1. Introduction

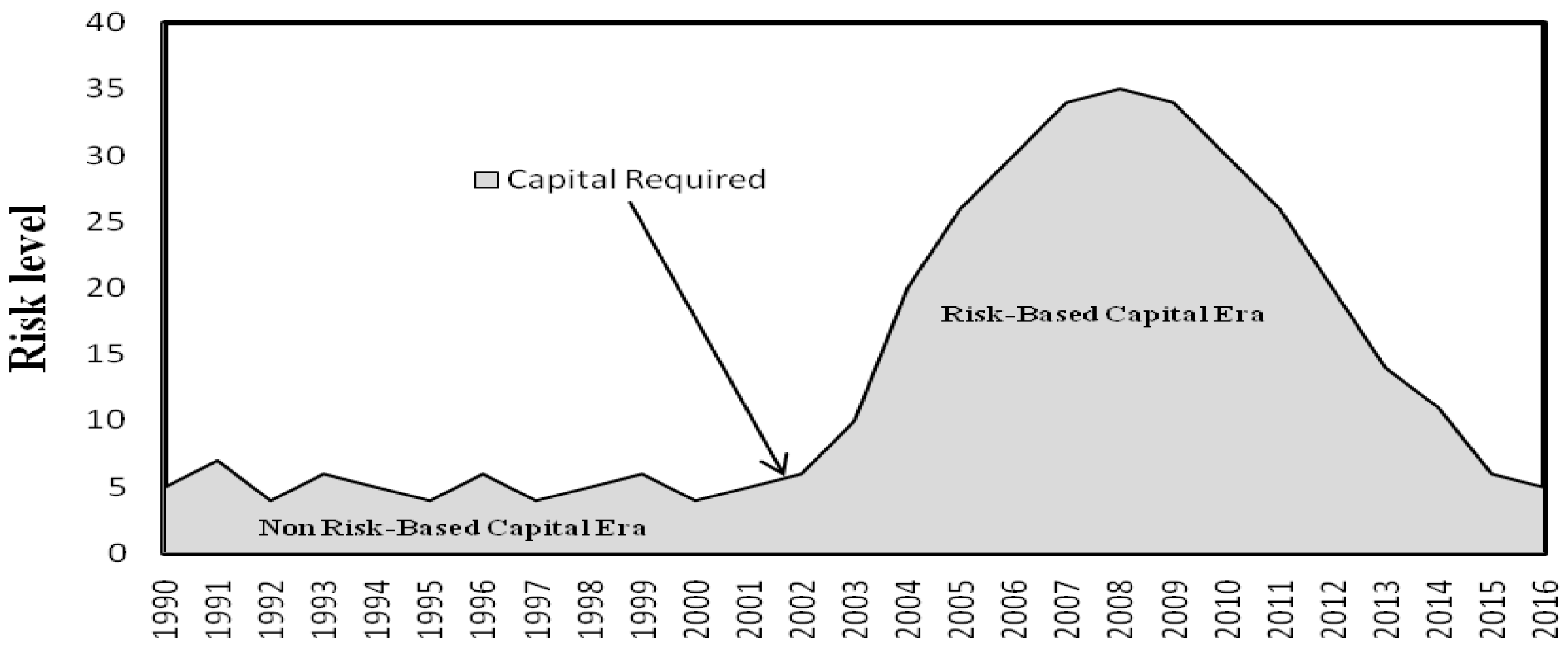

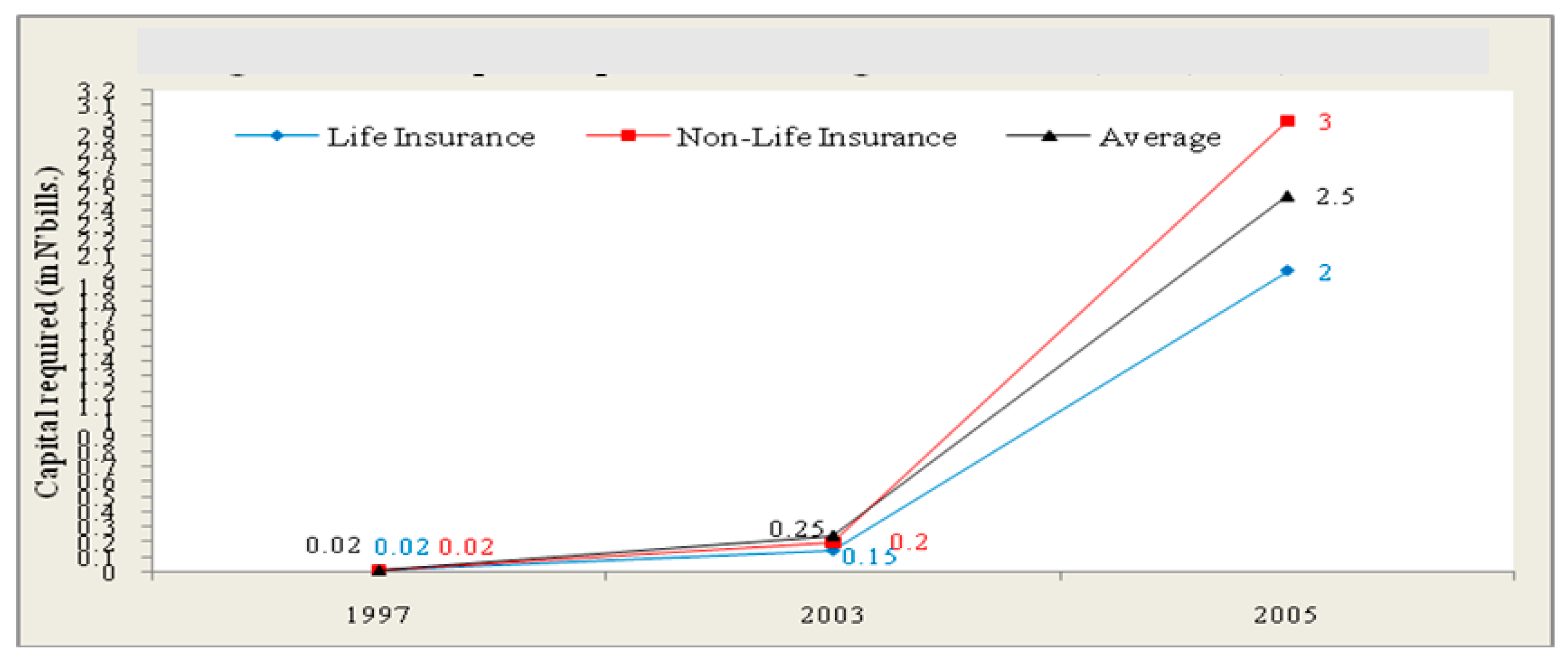

The practice of predicting future organizational behaviour and decision making based on historical information and past performance indices is commonplace in social and management sciences. One of the areas with increased interest is capital structure and firm performance. Capital structure is considered the foundation of corporate existence and has been studied extensively in corporate finance and related fields (

Dhaene et al. 2015). Consequently, it has become an important area where policies and regulations are targeted. The current risk-based capital (RBC) policy is one of such policies that have attracted attentions and criticisms. RBC basically focuses on capital structure manipulations to achieve desired performance. But critics doubt the anticipated efficacy of RBC at guaranteeing insurers’ solvency and ultimately, better performance (

Yusof et al. 2016). Under RBC policy, insurers are required to hold higher capital in line with the level of risk assumed, whereas under non risk-based capital (NRBC) regime, they are not. Thus, in either regime, capital structure is affected; and because capital and its allocation are linked to insurance […] and performance management (

Zec 2012), there is reasonable justification for investigating measures of capital structure in relation to performance under these different policy regimes

Capital structure theories and empirical evidences describe capital structure as principally comprising of equity and debt. However, capital structure of insurance firms comprises equity and technical provisions (

Florio and Leoni 2017;

Eling and Marek 2014). Equity is ownership contribution whereas technical provision is the combination of interest-bearing liabilities (financial debt or insurance funds) and non interest-bearing liabilities (creditors, accruals and, outstanding claims) (

Dhaene et al. 2015). The non interest-bearing liabilities have enormous opportunity costs such as loss of business, loss of premium, loss of profit, loss of credit worthiness, loss of investible fund and high rental costs. These have important performance implications for insurance firms and deserve empirical investigation especially, in the face of the divergent arguments in past empirical studies. For instance, recent study explicitly stated that these liabilities are capable of influencing insurance performance negatively (

Akpan et al. 2017a). This goes in agreement with some authors who have argued that capital structure affect firm performance negatively (

Avci 2016;

Foo et al. 2015). On the contrary, other scholars said capital structure and firm performance shares a positive relationship (

Fosu 2013;

Majumdar and Sen 2010). Still, there are those who argued that there is no relationship (

Chaudhuri et al. 2016;

Davydov 2016;

Chadha and Sharma 2015). As insurers’ capital structure differs, its effect on performance is largely uncertain, particularly under different capital regimes, hence this investigation.

The scope of this study thus covers capital structure, measured by technical provision ratio (TPR), and performance of insurance firms measured by return on asset (ROA) and earnings per share (EPS). TPR demonstrates the relationship between total liabilities and total assets (

Shim 2010;

De Haan and Kakes 2010). The choice of TPR is informed by the fact that it is different from the conventional measurement of capital structure in past studies as well as from theoretical explanations. Again, we assume that the observed inconclusiveness in past studies may either relate to inappropriate measurement or omission of some other important variables. ROA represent how efficient the management of insurance firm have been at managing the firm’s asset while EPS represent how much profit a share has generated with shareholders’ fund and its consideration is important in many fronts. Aside from the fact that EPS is the least examined performance measure in empirical studies, scholars describe it as the linchpin that undergirds strategic decision-making in the areas of share valuations, incentive schemes and Mergers and Acquisitions (M&As) negotiations (

Berger and Di Patti 2006;

Margaritis and Psillaki 2007).

From the perspective of tradeoff theory, a firm’s capital structure influences its performance (

Abdeljawad et al. 2013;

Dang et al. 2012; etc.). Past studies concentrates on non insurance firms in developed markets (

Pervan and Kramarić 2010); few focused on emerging markets (

Pervan et al. 2012;

Kyereboah-Coleman 2007;

Zeitun and Tian 2014;

Abor 2005,

2007). Generally, studies involving insurers capital structure are particularly limited, but results from a few studies suggest a positive link between capital structure (measured conventionally) and insurance performance (

Cheng and Weiss 2012a,

2012b;

Lai 2011). We argue that such link is conjectural under different measurement as well as different capital regimes, hence the need for further investigation. Based on the proposition that borrowed capital (TPR inclusive) can create wealth and that, higher capital requirements are important to small insurers (

Muhlnickel et al. 2016;

Muscettola 2013), we expect a positive association between TPR and insurance performance. On this basis the following hypotheses will be tested in this study:

H1a. There is a positive relationship between TPR and EPS of insurance firms in NRBC era in Nigeria.

H1b. There is a positive relationship between TPR and EPS of insurance firms in RBC era in Nigeria.

H2a. There is a positive relationship between TPR and ROA of insurance firms in NRBC era in Nigeria.

H2b. There is a positive relationship between TPR and ROA of insurance firms in RBC era in Nigeria.

Nevertheless, it is noteworthy that the above hypothesized relationships may change due to regional factors (developed or emerging market), or types of firms (insurance or non insurance) (

Shyu 2013). It is also on record “[…] that global, regional and national financial structures are complex, which by intuition, would be inaccurate to characterize financial markets ‘analogously’ with other simple markets” (

Khan 2004). This informed the choice of Nigeria and her insurance firms as the setting and relevant sector respectively for this study. As part of the characteristics of developing market which Nigeria is,

Khan (

2004) further explained that volatility and crisis in financial markets are eminent due most likely to nonlinear structures, asymmetric information, fundamental uncertainties and, different types of risk among other market frictions. Apart from the fact that these features present better ground for testing the validity of some fundamental theories in finance, they make it cautionary that in any phenomenal investigation, these factors must be considered within specific settings or country to avoid spuriousness in empirical outcome. The primary objective is to determine which capital-based policy regime favours profitable insurance operation in Nigeria. This study contributes markedly to: (i) Defining capital structure of insurance firms beyond interest-bearing liabilities (financial debt) to other non-interest bearing liabilities; (ii) Theory extension by applying the theory of risk capital to explain if the transition to a higher capital era results in higher performance; (iii) ascertaining if capital-based regulations have less desired subtle consequences on insurance performance. The paper is presented in five sections namely: introduction, literature review, methodology, results and discussion and finally concluding remarks.

4. Results and Discussions

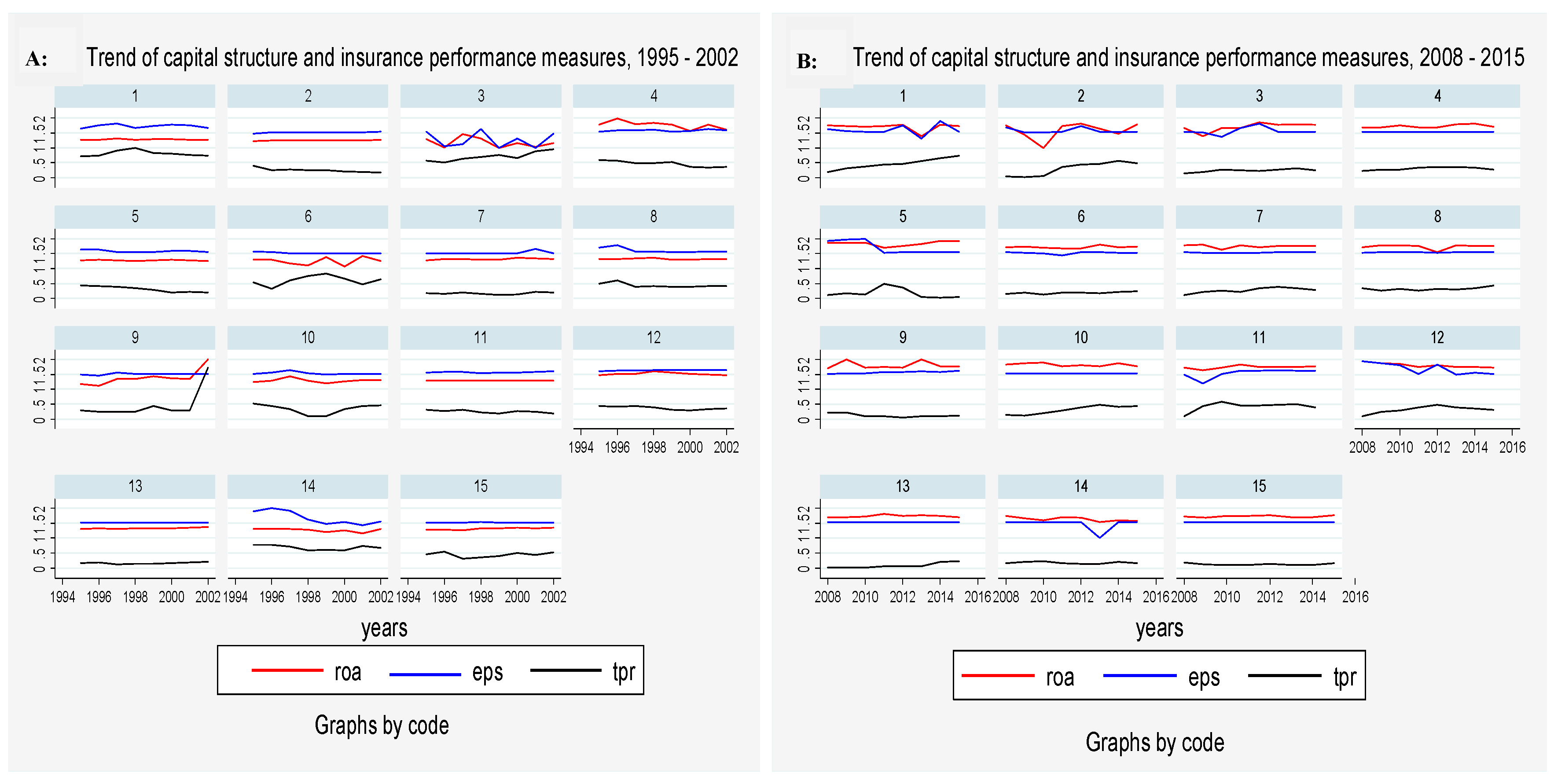

4.1. The Effect of Insurance Performance on Capital Structure

Regression result model 2, which tests the above relationship is not part of the objectives of this study, but it reported in

Table 5 to confirm if our key variables are endogenoue. In the table, the Hausman test shows that RE model is more relevant in NRBC and FE in RBC regime given an insignificant value of 1.15 and a significant value of 5952.79 respectively. The diagnostic tests return VIF value of 1.73, which ndicates lack of multicollinearity. Based on RE model, ROA significantly influences TPR in NRBC with a coefficient of 0.712. Although EPS is insignificant in the model, it has, however, shown a theoretically expected negative sign with TPR in both eras, and so has ROA in RBC era. We thus conclude that insurance performance and capital structure are endogenous as foud in many other studies (

Oino and Ukaegbu 2015;

Nakhaei and Jafari 2015). Therefore, the predicted TPR was obtained and used as explanatory variable in the second stage regression analysis. This way, the problem of endogeneity is resolved.

4.2. The Effect of Capital Structure on Earnings per Share (EPS)

Table 6 and

Table 7 contain results of regression model 3, which is TPR regression on EPS. FE corrected model is used for NRBC given a statistically significant Hausman Chi2 (10) value of 52.70 and Wald chi2 (15) value of 3566.75, which indicates the presence of heteroscedasticity while RE model is appropriate for RBC era. Both models have no autocorrelation and multicollinearity problems and their F-test/Wald

X2 (10) values are significant, thus indicating goodness of fit. From the table, the FE model shows that TPR is positively related to EPS at a significant coefficient of 0.453 during NRBC, thus we fail to reject the hypothesis (H1a) that there is a positive relationship between TPR and EPS of insurance firms in NRBC era in Nigeria. This finding is in line with empirical findings (

Fosu 2013;

Majumdar and Sen 2010).

During RBC period, the RE model reveals a negative coefficient value of −0.002, which is not significant. So, we do not accept the hypothesis (H1b) that there is a positive relationship between TPR and EPS of insurance firms in RBC era in Nigeria. Though insignificant, we would however, deduce that the deployment of technical provision fund leads to a marginal decrease in EPS and this finding is supported by tradeoff theory and other empirical studies. Holding the controlled factors constant, we interpret that under RBC, it does not pay to finance projects with technical provision fund. Therefore, this represents a scenario where borrowed capital, as a major component of TPR, destroys wealth especially when firms have high TPR financing with insufficient income (

Muscettola 2013). Such financing exposes the firm to bankruptcy and ultimately failure (

Nadaraja et al. 2011).

4.3. The Effect of Capital Structure on Returns on Assets (ROA)

The result of the above relationship is presented in

Table 7. The model diagnostic results return Wald chi2 (15) values of 3553.31 and 827.61 for NRBC and RBC regimes respectively. These values are statistically significant at 0.01 level. Again the presence of heteroscedasticity in our model is confirmed while there are no autocorrelation and multicollinearity problems. Thus, a FE model corrected for heteroscedasticity was estimated as the final regression result for TPR and ROA in both regimes. In all, the F-test/Wald

X2(10) are significant, which indicate that the models are good. In relation to ROA, the model shows that TPR is positively and significantly related to ROA with a coefficient of 1.513 during NRBC regime. We thus refuse to reject the hypothesis (H2a) that there is a positive relationship between TPR and ROA of insurance firms in NRBC era in Nigeria. The finding is supported by empirical studies (

Muhlnickel et al. 2016;

Muscettola 2013), although it goes against the prediction of the dynamic tradeoff theory.

Considering the result for RBC regime, the FE-robust model returns a positive and insignificant coefficient of 1.084. This means that in RBC, technical provision has not contributed to ROA although both variables relate positively. Majority of the controlled variables have reasonable coefficients with expected signs but none is significant. Based on the expected sign of the coefficient, though insignificant, we do not reject the corresponding hypothesis (H2b) that there is a positive relationship between TPR and ROA of insurance firms in RBC era in Nigeria. However, when compared with NRBC regime, it is assumed that under RBC period, technical provision fund has not contributed to ROA, but it does under NRBC period.

4.4. Discussion of Findings

From the results, the use of technical provision has a significant positive effect on insurance performance during NRBC when compared with RBC regime. In fact, the technical provision fund has a positive but marginal contribution to insurance performance during the RBC regime. It thus follows that the transition to the RBC regime with focus on technical provision results in a less desired outcome in terms of ROA in particular. This means that the policy led insurers to holding less capital in terms of TPR. Recall that during RBC, the descriptive statistics showed that the technical provision fund makes up only 25.48% of the capital structure against 43.06% during the NRBC regime. Thus, the marginal contribution of TPR during RBC should not be surprising because by risk capital theory that should be expected. On the contrary, the positive association found during NRBC means that insurers generated more returns and this is against the tradeoff theory. Invariably, the high returns could have led to low speed of adjustment (SoA) and its associated cost, hence more returns. Our finding is supported by other empirical studies (

Avci 2016;

Nwude et al. 2016;

Shyu 2013), and is contrary to others (

Bandyopadhyay and Barua 2016;

Vătavu 2015;

Fosu 2013).

However, while we may not attribute poor EPS under the RBC regime to the negative effect of factors like inflation and risk taking, we could hold such reason for ROA since other variables like age, growth and tax rate all influence ROA negatively along with inflation and risk taking. This means that low profits, in terms of ROA, may be caused by high inflation, tax, poor growth and age of the firm. Overall, when compared with the volume of technical fund in the capital structure during NRBC and RBC eras, this finding is supported by risk capital theory, that holding large capital vide technical provision (as it is in NRBC rather than in RBC regime) does preclude the firm from bankruptcy. Therefore, the assumption that a high technical provision fund increases the likelihood of bankruptcy may only be valid where there are more such funds without commensurate profit, in which case, it increases the liability and risk that the firms face.

5. Concluding Remarks

In this paper, we have investigated the effect of capital structure measured by technical provision ratio on insurance performance under two policy regimes of NRBC and RBC. During the NRBC regime insurers were more profitable in both ROA and EPS than during RBC. In the RBC regime insurers significantly recorded losses in EPS while there was no significant improvement in ROA. Comparatively therefore, we conclude based on our results that insurers in Nigeria performed better during NRBC than the RBC regime with technical provision being the preferred funding option. The poor performance during the RBC regime is probably due to the negative influence of some firm specific and macroeconomic factors like age, poor growth, inflation and tax. Unfortunately, RBC is an unavoidable regulatory policy and its implementation would be difficult to halt. Thus, it is imperative to look at various implications of this study for available strategic options for profitable compliance.

Theoretically, analysis and decision on an insurer’s capital structure should transcend beyond interest-bearing to non-interest-bearing liabilities, in which case technical provision could be considered adequate measure. This way, an alternative theoretical analysis is necessary as tradeoff predictions have failed. Therefore, when linking capital structure to insurance performance, a combination of capital structure theories could holistically explain such relationships better. Practically, financial decisions of insurance managers would involve an insightful analysis of the opportunity costs associated with the non-interest-bearing liability component of the capital structure for better tradeoffs. As our result reveals, insurers seem to benefit more in terms of EPS and ROA when using technical provision under a less regulated regime. Practically, it does appear that as their career depends on operating the company in regular conditions (probably in the NRBC scenario), managers prefer not to use the technical fund under RBC during which the operational condition is irregular and greater control makes it difficult for them to pursue their own interest. This may also account for why performance is poor during the RBC regime. The use of incentives and compensation could dissuade managers from such aptitude and encourage them to work effortlessly under irregular conditions for the growth of the firm. The policy implication is the need to integrate the technical provision fund with a focus on non-interest-bearing proportion into further capital-based related reform.

For future studies, it would be expedient to explore other measures of capital structure variables like equity ratio in relation to insurance performance, especially as our models exhibit marginal explanatory power. This indicates that our variable of interest may not be a key determinant of ROA in an RBC scenario. The sample size used for this study is relatively small due to data unavailability; future studies should consider, where possible, the inclusion of more firms.