Contagion in the Euro Area Sovereign Bond Market

Abstract

:1. Introduction

2. Literature Review

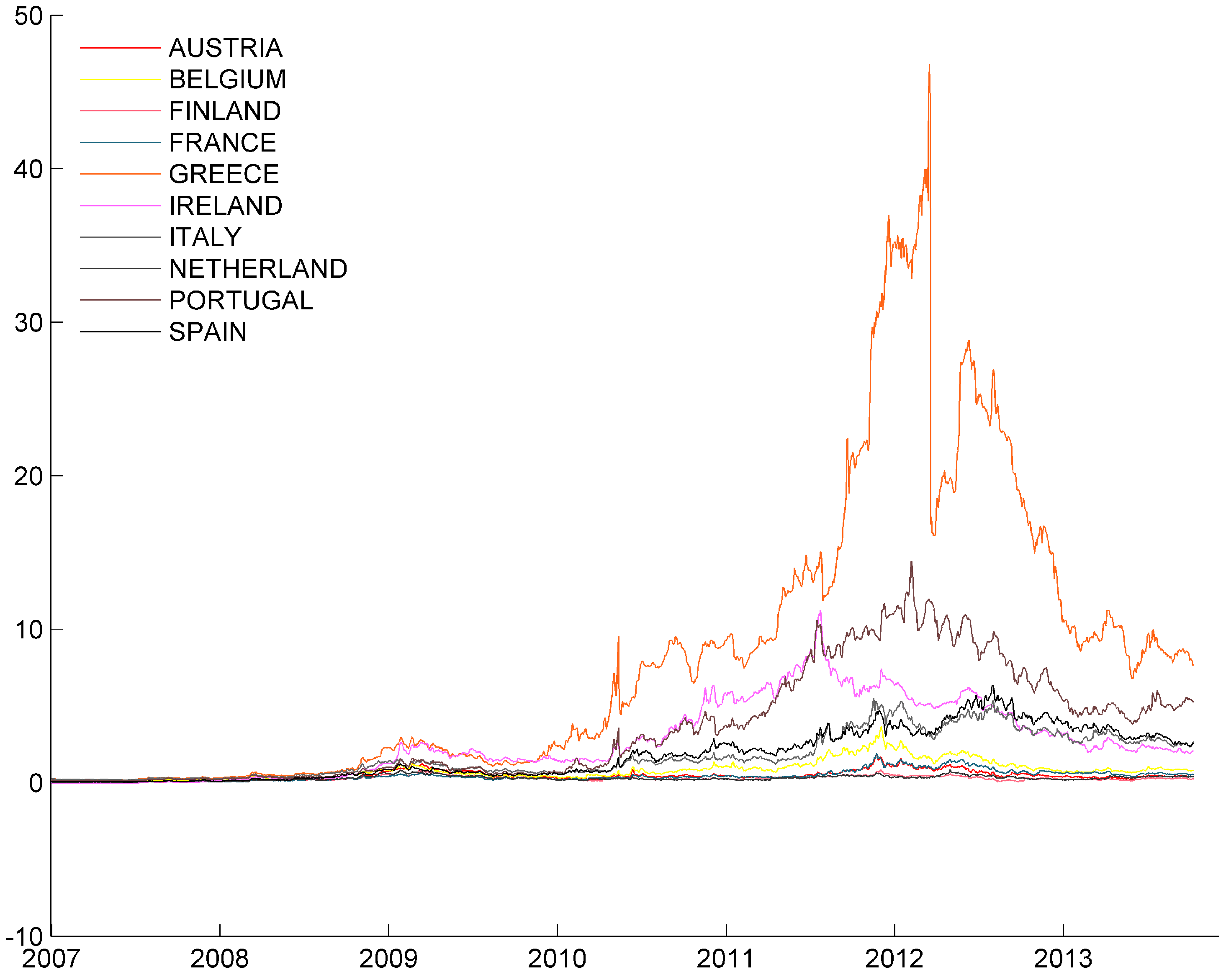

3. Stylized Facts about the Eurozone Crisis

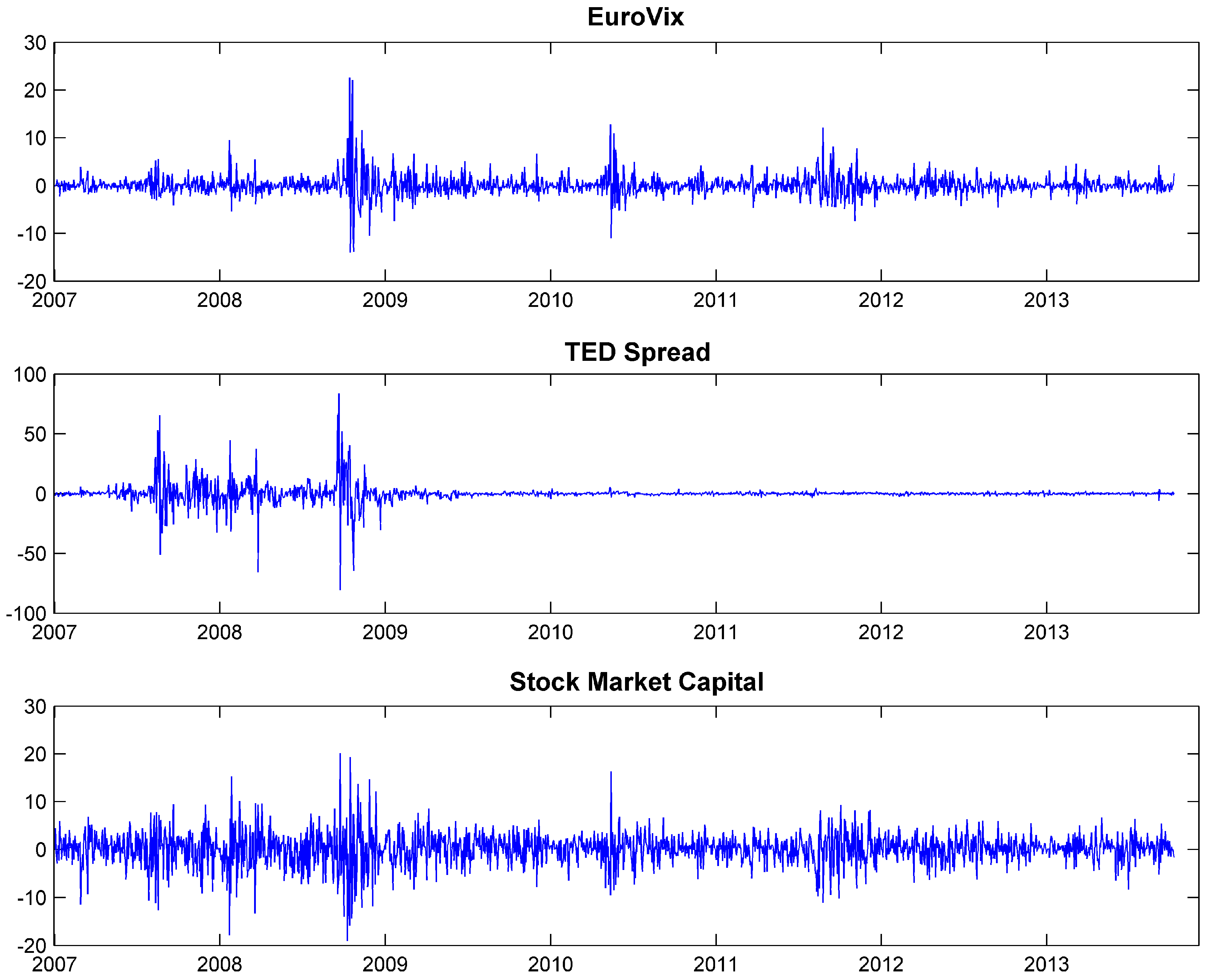

4. Model

5. Data

| All Countries | Highly Exposed | Low Exposed | |

|---|---|---|---|

| Entire Sample | |||

| Standard Deviation (%) | 13.31 | 23.6 | 3.02 |

| Autocorrelation | 0.16 | 0.21 | 0.12 |

| First Subsample | |||

| Standard Deviation (%) | 0.54 | 0.62 | 0.45 |

| Autocorrelation | –0.02 | –0.04 | –0.01 |

| Second Sub-sample | |||

| Standard Deviation (%) | 2.9 | 3.81 | 1.98 |

| Autocorrelation | 0.22 | 0.29 | 0.15 |

| Third Sub-sample | |||

| Standard Deviation (%) | 11.66 | 19.54 | 3.77 |

| Autocorrelation | 0.18 | 0.24 | 0.13 |

| Fourth Sub-sample | |||

| Standard Deviation (%) | 32.04 | 59.12 | 4.96 |

| Autocorrelation | 0.12 | 0.16 | 0.08 |

| Firth Sub-sample | |||

| Standard Deviation (%) | 7.89 | 13.4 | 2.37 |

| Autocorrelation | 0.12 | 0.2 | 0.03 |

6. Empirical Results

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Entire | I | II | III | IV | V | |

| Main | ||||||

| Lag Yields Spread | 0.10 | 0.03 | 0.16 *** | 0.20 ** | 0.07 | 0.22 *** |

| Risk | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.00 |

| TED Spread | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 * |

| Market Capitalization | 0.00 | 0.00 | 0.00 | 0.00 | –0.01 | 0.00 |

| Spatial ρ | 0.12 * | 0.50 *** | 0.61 *** | 0.41 *** | 0.02 | 0.44 *** |

| Observations | 8800 | 915 | 1730 | 3760 | 860 | 1510 |

| Number of Countries | 5 | 5 | 5 | 5 | 5 | 5 |

| RSquare | 0.01 | 0.01 | 0.09 | 0.06 | 0.01 | 0.07 |

| Pvalues LM-Test | 0.00 | 0.00 | 0.00 | 0.00 | 0.90 | 0.00 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Entire | I | II | III | IV | V | |

| Main | ||||||

| Lag Yields Spread | 0.12 *** | 0.00 | –0.05 | 0.16 *** | 0.08 ** | 0.03 |

| Risk | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 * |

| TED Spread | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Market Capitalization | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Spatial ρ | 0.54 *** | 0.46 *** | 0.58 *** | 0.55 *** | 0.56 *** | 0.54 *** |

| Observations | 8800 | 915 | 1730 | 3760 | 860 | 1510 |

| Number of Countries | 5 | 5 | 5 | 5 | 5 | 5 |

| RSquare | 0.03 | 0.01 | 0.01 | 0.05 | 0.02 | 0.01 |

| Pvalues LM-Test | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Entire | I | II | III | IV | V | |

| Main | ||||||

| Lag Yields Spread | 0.21 *** | –0.01 | 0.15 *** | 0.18 *** | 0.26 *** | 0.13 *** |

| Risk | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| TED Spread | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 ** |

| Market Capitalization | 0.00 * | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Spatial ρ | 0.43 *** | 0.39 *** | 0.57 *** | 0.47 *** | 0.28 *** | 0.50 *** |

| Observations | 7040 | 732 | 1384 | 3008 | 688 | 1208 |

| Number of Countries | 4 | 4 | 4 | 4 | 4 | 4 |

| RSquare | 0.06 | 0.01 | 0.08 | 0.07 | 0.07 | 0.05 |

| Pvalues LM-Test | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Entire | I | II | III | IV | V | |

| Main | ||||||

| Lag Yields Spread | 0.10 | 0.03 | 0.16 *** | 0.20 ** | 0.07 | 0.22 *** |

| Risk | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.00 |

| TED Spread | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 * |

| Market Capitalization | 0.00 | 0.00 | 0.00 | 0.00 | –0.01 | 0.00 |

| Spatial ρ | 0.12 * | 0.50 *** | 0.61 *** | 0.41 *** | 0.02 | 0.44 *** |

| Observations | 17,600 | 1830 | 3460 | 7520 | 1720 | 3020 |

| Number of Countries | 10 | 10 | 10 | 10 | 10 | 10 |

| RSquare | 0.01 | 0.01 | 0.06 | 0.06 | 0.01 | 0.06 |

| Pvalues LM-Test | 0.00 | 0.00 | 0.00 | 0.00 | 0.69 | 0.00 |

7. Conclusions

Acknowledgments

Conflicts of Interest

References

- Sebastian Keiler, and Armin Eder. “CDS spreads and systemic risk: A spatial econometric approach.” Discussion Papers 01/2013. Frankfurt am Main, Germany: Deutsche Bundesbank, Research Centre, 2013. [Google Scholar]

- Carmen Broto, and Gabriel Perez-Quiros. “Disentangling Contagion among Sovereign CDS Spreads during the European Debt Crisis.” Banco de Espana Working Papers 1314. Madrid, Spain: Banco de Espana, 2013. [Google Scholar]

- Massimiliano Caporin, Loriana Pelizzon, Francesco Ravazzolo, and Roberto Rigobon. “Measuring Sovereign Contagion in Europe.” NBER Working Papers 18741. Cambridge, MA, USA: National Bureau of Economic Research, 2013. [Google Scholar]

- Ari Tjahjawandita, Tito Pradono, and Rullan Rinaldi. “Spatial Contagion of Global Financial Crisis.” Working Papers in Economics and Development Studies (WoPEDS) 200906. Bandung, Indonesia: Department of Economics, Padjadjaran University, August 2009. [Google Scholar]

- Morris Goldstein, and Geoffrey Woglom. “Market-Based Fiscal Discipline in Monetary Unions: Evidence from the U.S. Municipal Bond Market.” IMF Working Papers 91/89. Washington, DC, USA: International Monetary Fund, 1991. [Google Scholar]

- Maria-Grazia Attinasi, Cristina Checherita, and Christiane Nickel. “What Explains the Surge in Euro Area Sovereign Spreads during the Financial Crisis of 2007-09.” Working Paper Series 1131. Frankfurt am Main, Germany: European Central Bank, 2009. [Google Scholar]

- Salvador Barrios, Per Iversen, Magdalena Lewandowska, and Ralph Setzer. “Determinants of intra-euro area government bond spreads during the financial crisis.” European Economy-Economic Papers 388. Brussels, Belgium: Directorate General Economic and Monetary Affairs (DG ECFIN), European Commission, 2009. [Google Scholar]

- Christian Aßmann, and Jens Boysen-Hogrefe. “Determinants of government bond spreads in the Euro area: In good times as in bad.” Empirica 39 (2012): 341–56. [Google Scholar] [CrossRef]

- Niko Doetz, and Christoph Fischer. “What can EMU Countries’ Sovereign Bond Spreads Tell Us about Market Perceptions of Default Probabilities during the Recent Financial Crisis? ” Discussion Paper, Series 1: Economic Studies, No. 11/2010. Frankfurt am Main, Germany: Deutsche Bundesbank, Research Centre, 2010. [Google Scholar]

- Carlos Caceres, Vincenzo Guzzo, and Miguel Segoviano. “Sovereign Spreads: Global Risk Aversion, Contagion or Fundamentals? ” IMF Working Papers 10/120. Washington, DC, USA: International Monetary Fund, 2010. [Google Scholar]

- In-Mee Baek, Arindam Bandopadhyaya, and Chan Du. “Determinants of market-assessed sovereign risk: Economic fundamentals or market risk appetite? ” Journal of International Money and Finance 24 (2005): 533–48. [Google Scholar] [CrossRef]

- David Haugh, Patrice Ollivaud, and David Turner. “What Drives Sovereign Risk Premiums?: An Analysis of Recent Evidence from the Euro Area.” OECD Economics Department Working Papers 718. Paris, France: OECD Publishing, 2009. [Google Scholar]

- Paul De Grauwe, and Yuemei Ji. “Self-fulfilling crises in the Eurozone: An empirical test.” Journal of International Money and Finance 34 (2013): 15–36. [Google Scholar] [CrossRef]

- Patrick Bolton, and Olivier Jeanne. “Sovereign Default Risk and Bank Fragility in Financially Integrated Economies.” NBER Working Papers 16899. Cambridge, MA, USA: National Bureau of Economic Research, 2011. [Google Scholar]

- Paolo Canofari, Giovanni Di Bartolomeo, and Piersantii Giovanni. “Theory and practice of contagion in monetary unions. Domino effects in EU Mediterranean countries: The case of Greece, Italy and Spain.” International Advances in Economic Research 20 (2013): 259–67. [Google Scholar] [CrossRef]

- Michael Arghyrou, and Alexandros Kontonikas. “The EMU sovereign-debt crisis: Fundamentals, expectations and contagion.” Journal of International Financial Markets, Institutions and Money 22 (2012): 658–77. [Google Scholar] [CrossRef]

- Paul De Grauwe. “Governance of a fragile Eurozone.” CEPR Working Paper 346. Brussels, Belgium: Centre for European Policy Studies, 4 May 2011. [Google Scholar]

- Marta Gomez-Puig, and Simon Sosvilla-Rivero. “Causality and contagion in peripheral EMU public debt markets: A dynamic approach.” Working Papers 11-06. Valladolid, Spain: Asociacion Espanola de Economia y Finanzas Internacionales, 2011. [Google Scholar]

- Norbert Metiu. “Sovereign risk contagion in the Eurozone.” Economics Letters 117 (2012): 35–38. [Google Scholar] [CrossRef]

- Mark Mink, and Jakob de Haan. “Contagion during the Greek sovereign debt crisis.” Journal of International Money and Finance 34 (2013): 102–13. [Google Scholar] [CrossRef]

- Jurgen Von Hagen, Ludger Schuknecht, and Guido Wolswijk. “Government bond risk premiums in the EU revisited: The impact of the financial crisis.” European Journal of Political Economy 27 (2011): 36–43. [Google Scholar] [CrossRef]

- Roberto De Santis. “The Euro Area Sovereign Debt Crisis: Identifying Flight-to-Liquidity and the Spillover Mechanisms.” Journal of Empirical Finance 26 (2014): 150–70. [Google Scholar] [CrossRef]

- Matteo Falagiarda, and Stefan Reitz. “Announcements of ECB Unconventional Programs: Implications for the Sovereign Risk of Italy.” Kiel Working Papers 1866. Kiel, Germany: Institute for the World Economy, 2013. [Google Scholar]

- Philip R. Lane. “The European Sovereign Debt Crisis.” Journal of Economic Perspectives 26 (2012): 49–68. [Google Scholar] [CrossRef]

- J. Paul Elhorst. “Spatial panel data models.” In Handbook of Applied Spatial Analysis. Edited by Fischer Manfred and Getis Arthur. New York: Springer, 2010, pp. 377–407. [Google Scholar]

- Luc Anselin, Raymond Florax, and Sergio J. Rey. Advances in Spatial Econometrics: Methodology, Tools and Applications. New York: Springer, 2004. [Google Scholar]

- Stefan Gerlach, Alexander Schulz, and Wolff B. Guntram. “Banking and sovereign risk in the euro area.” Discussion Paper, Series 1: Economic Studies, No. 9/2010. Frankfurt am Main, Germany: Deutsche Bundesbank, Research Centre, 2010. [Google Scholar]

- Valerie De Bruyckere, Maria Gerhardt, Glenn Schepens, and Rudi Vander Vennetb. “Bank/sovereign risk spillovers in the European debt crisis.” Working Paper Research 232. Brussels, Belgium: National Bank of Belgium, 2012. [Google Scholar]

- Luc Anselin, Julie Le Gallo, and Hubert Jaynet. Spatial Panel Econometric. New York: Springer, 2008. [Google Scholar]

- 3For an extensive discussion on these issue, see [5].

- 6The authors assume that pricing of bonds was fundamental. However, on may argue that pricing was also driven by overconfidence.

- 7For a detailed analysis of the ECB unconventional monetary policy measures and the impact of the ECB announcements, see [23].

- 8For a detailed analysis of the issues concerning the EMU, see [24].

- 9The weight matrix will be standardized to guarantee a stationary spatial model and the main diagonal is set equal to zero.

- 10The author provides the calculations for the weight matrix on request.

- 11The author provides the results of the tests on request.

- 13Five country members of the EMU are excluded from the investigation. Luxembourg is excluded because the financial outstanding and the government debt are very small as well as all countries that joint in the Union in 2008 or after (Cyprus, Slovakia, Slovenia, Malta, Estonia and recently Latvia).

- 14The calculated Lagrangian Multiplier test is the extention to the pooled case of the cross-sectional test. For additional reference on this issue, see [29].

© 2014 by the author; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Muratori, U. Contagion in the Euro Area Sovereign Bond Market. Soc. Sci. 2015, 4, 66-82. https://doi.org/10.3390/socsci4010066

Muratori U. Contagion in the Euro Area Sovereign Bond Market. Social Sciences. 2015; 4(1):66-82. https://doi.org/10.3390/socsci4010066

Chicago/Turabian StyleMuratori, Umberto. 2015. "Contagion in the Euro Area Sovereign Bond Market" Social Sciences 4, no. 1: 66-82. https://doi.org/10.3390/socsci4010066

APA StyleMuratori, U. (2015). Contagion in the Euro Area Sovereign Bond Market. Social Sciences, 4(1), 66-82. https://doi.org/10.3390/socsci4010066