Has Austerity Succeeded in Ameliorating the Economic Climate? The Cases of Ireland, Cyprus and Greece

Abstract

:1. Introduction

2. Crisis Management Strategies

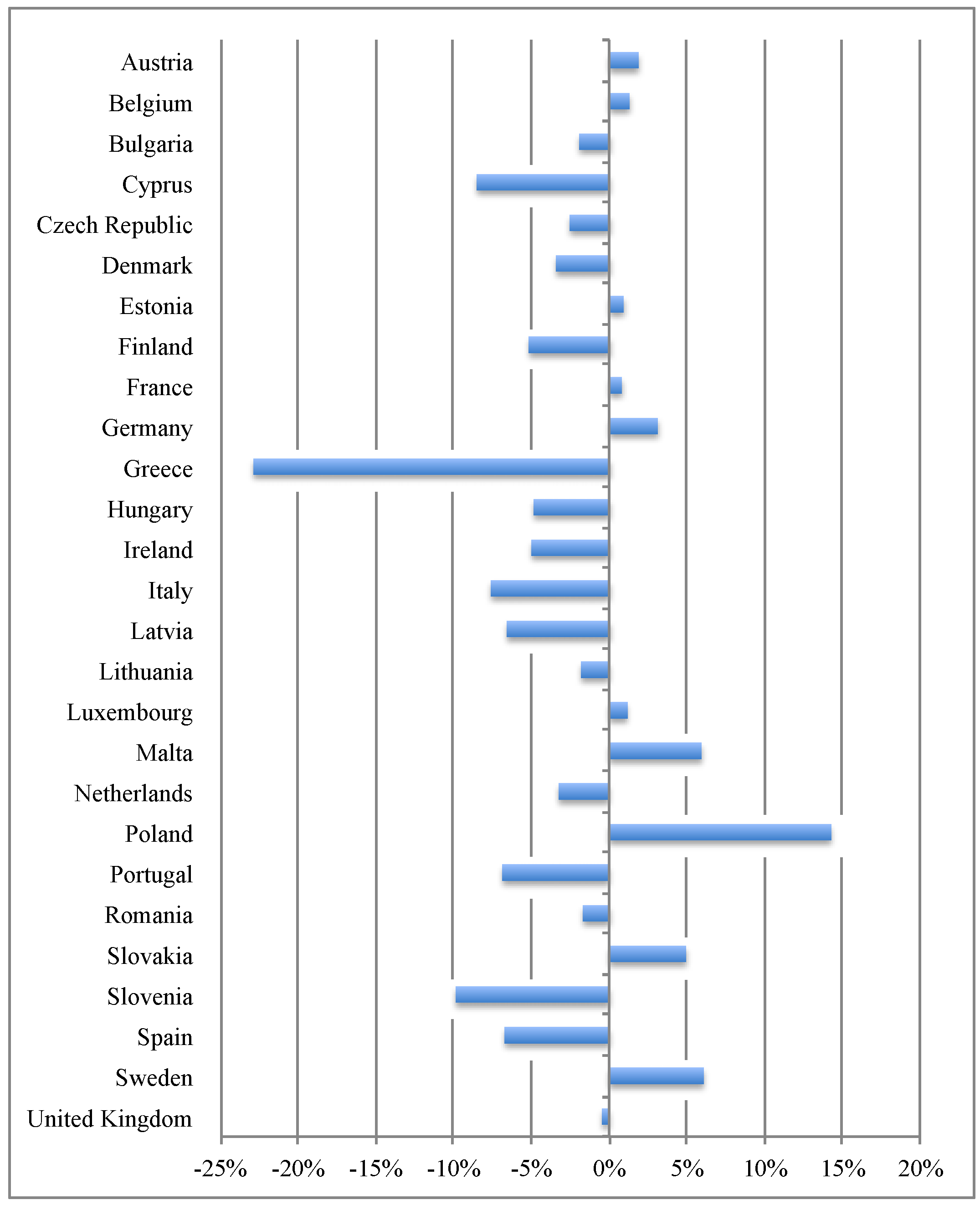

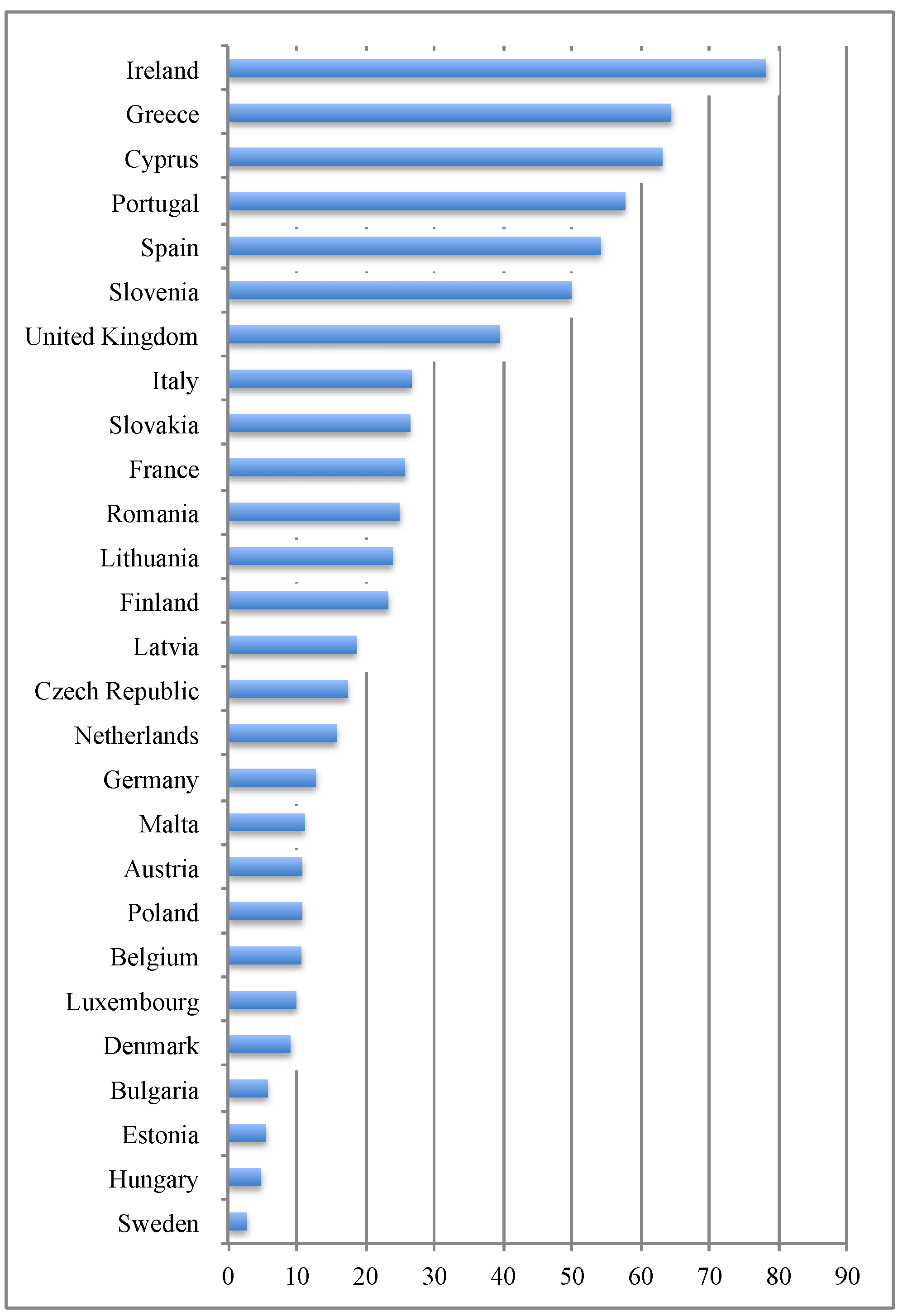

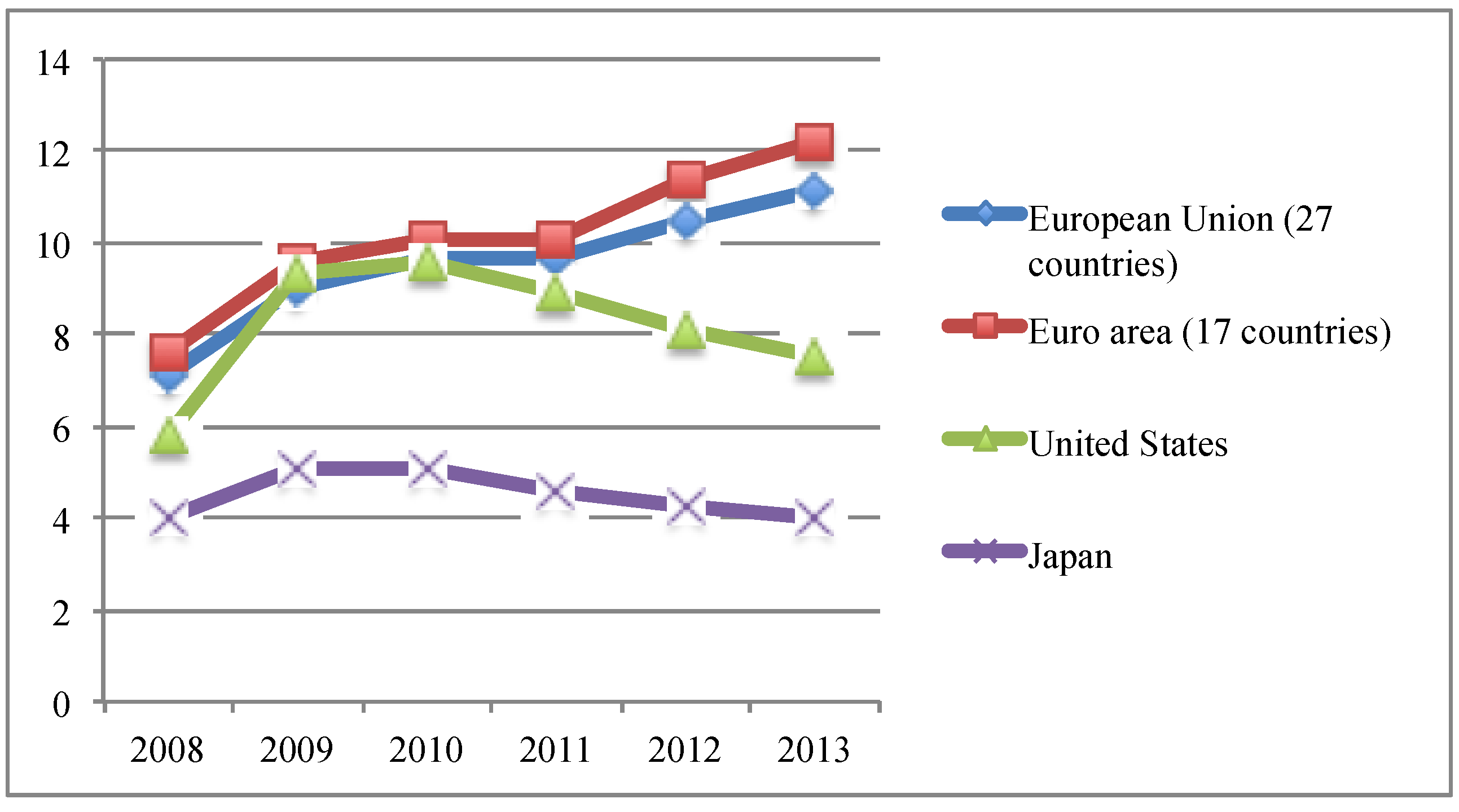

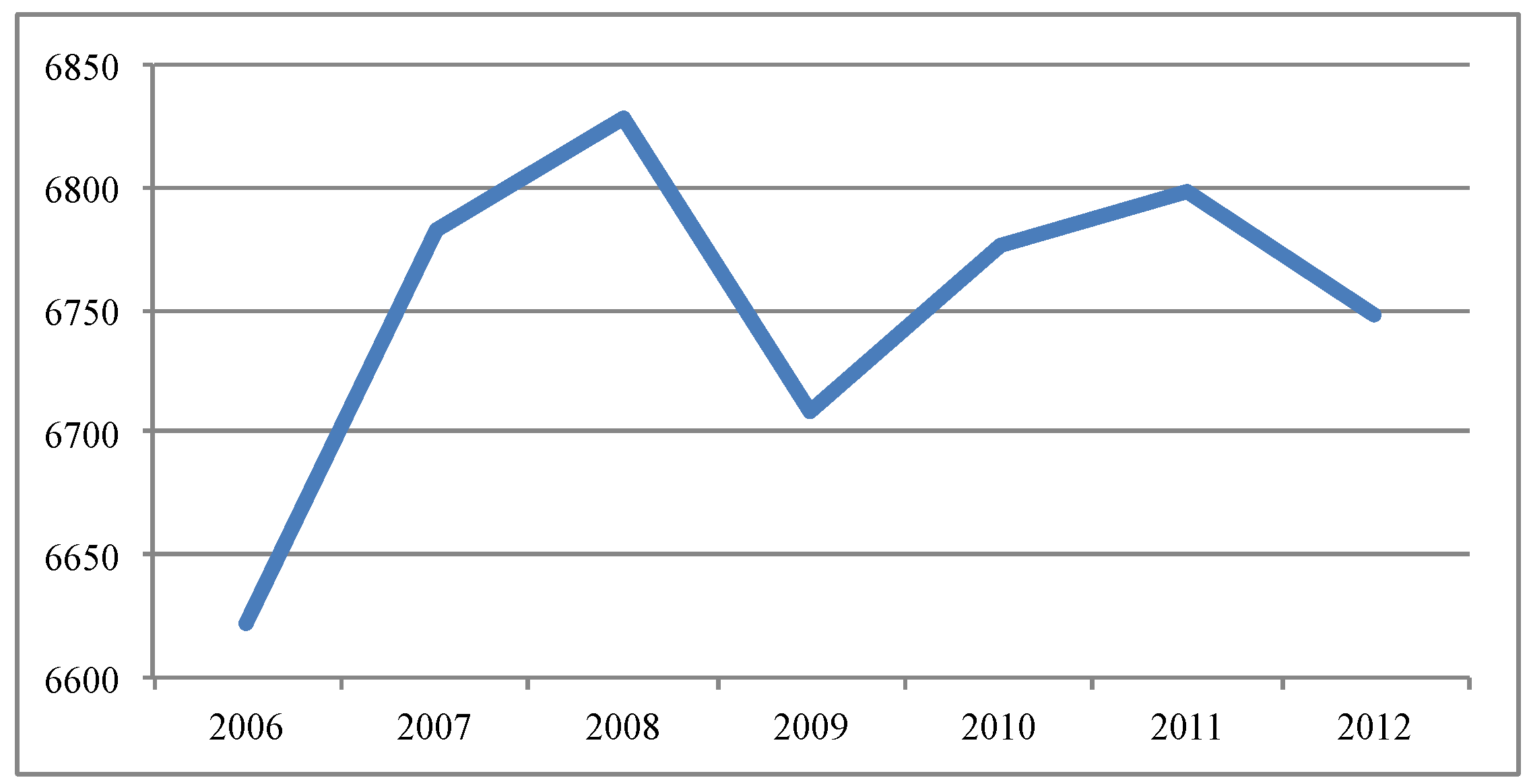

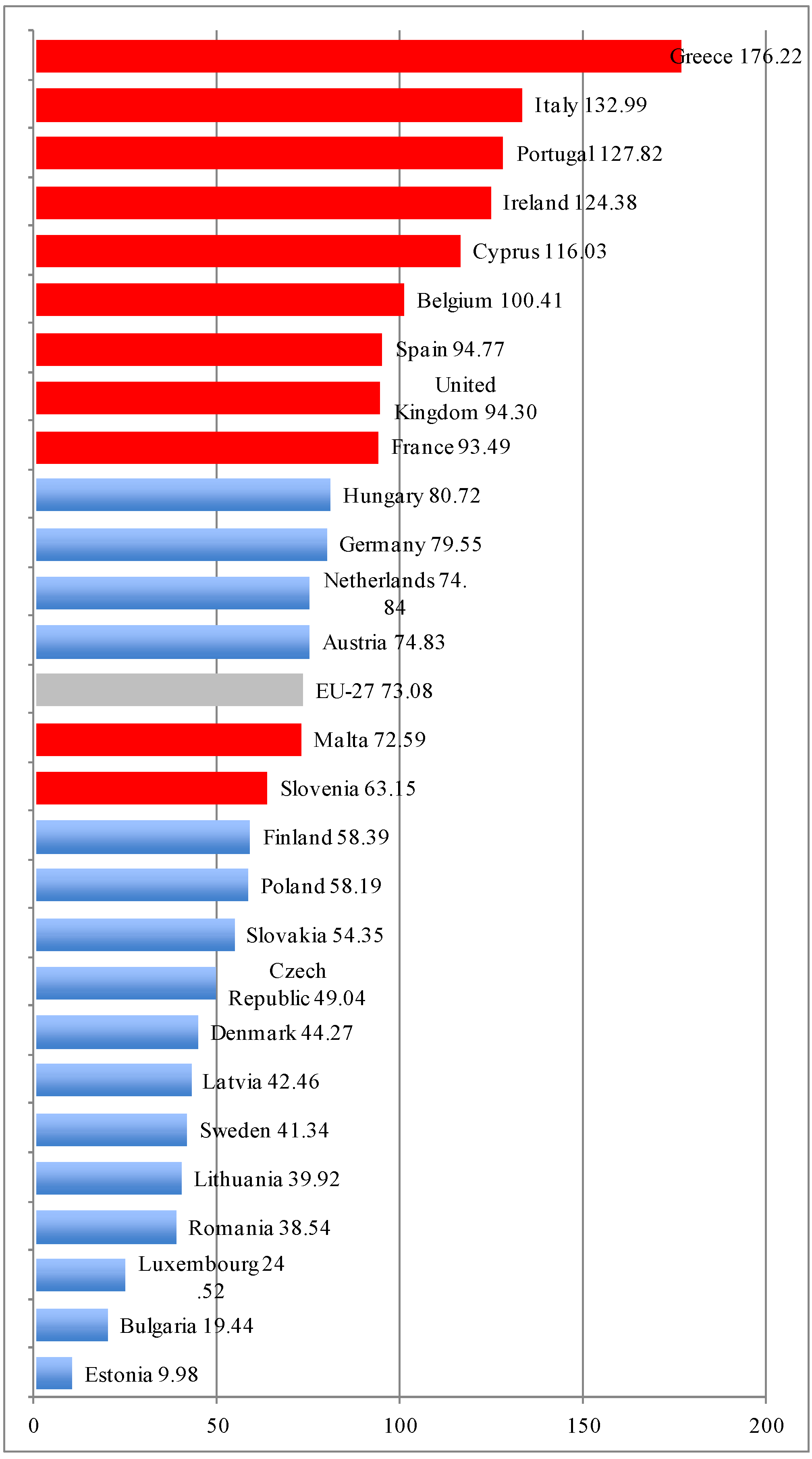

2.1. Emergence of the Crisis in the EU

| Country | Public debt (% of the GDP) | Government balance (% of the GDP) | Country | Public debt (% of the GDP) | Government balance (% of the GDP) |

|---|---|---|---|---|---|

| Greece | 112.90 | –9.62 | Spain | 40.17 | –4.46 |

| Italy | 106.09 | –3.84 | Sweden | 38.80 | 1.51 |

| Belgium | 89.20 | –2.13 | Finland | 33.94 | 2.47 |

| Hungary | 72.98 | –4.63 | Denmark | 33.38 | 2.27 |

| Portugal | 71.69 | –4.49 | Czech Republic | 28.70 | –4.26 |

| France | 68.21 | –4.23 | Slovakia | 27.86 | –4.08 |

| Germany | 66.79 | –0.88 | Slovenia | 21.96 | –4.45 |

| Austria | 63.83 | –1.87 | Latvia | 19.78 | –5.60 |

| Malta | 60.91 | –6.23 | Lithuania | 15.52 | –5.31 |

| Netherlands | 58.46 | –0.67 | Luxembourg | 14.44 | 2.66 |

| United Kingdom | 52.30 | –5.01 | Bulgaria | 13.68 | –0.18 |

| Poland | 47.11 | –5.01 | Romania | 13.41 | –7.89 |

| Cyprus | 48.89 | –0.79 | Estonia | 4.54 | –4.50 |

| Ireland | 44.50 | –7.57 |

2.2. Reasons for the Crisis

2.3. Austerity Policies

2.4. Stimulus Policies

2.5. Debt-Friendly Stimulus

| Fiscal consolidation | Deficit spending | Debt-friendly stimulus | |

|---|---|---|---|

| Aim | Restore creditors’ confidence | Create jobs, stimulate consumption | Stimulate the economy without increasing in indebtedness |

| Tools | Augmentation of taxes, cutting social spending | Investments and the augmentation of redistribution | Proportional tax increases and government spending |

| Consequence | Economic growth | Public debt increase | Balanced budget |

| Effect on balance | Positive | Negative | Neutral |

3. The Cases of Ireland, Cyprus and Greece

3.1. General Lessons from Crisis Management

| Ireland (2008–2009) | Cyprus (2008–2009) | Greece (2008–2009) | Ireland (2010–2011) | Cyprus (2010–2011) | Greece (2010–2011) | |

|---|---|---|---|---|---|---|

| Making significant cuts in government spending | ✓ | ✓ | ✓ | ✓ | ||

| Raising taxes and customs | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Decreasing taxes and customs | ✓ | ✓ | ||||

| Taking significant loans for the running expenses from markets | ✓ | |||||

| Taking significant loans from international organizations | ✓ | ✓ | ||||

| Conducing extra taxation on the service sector | ✓ | |||||

| Conducing bank bailouts | ✓ | |||||

| Enacting interventions in the job market | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Creating stimulus programs on consumption | ✓ | |||||

| Taking other unique measures, such as privatization | ✓ | ✓ | ||||

| Changing the regulation of public finances | ✓ | ✓ | ✓ | ✓ |

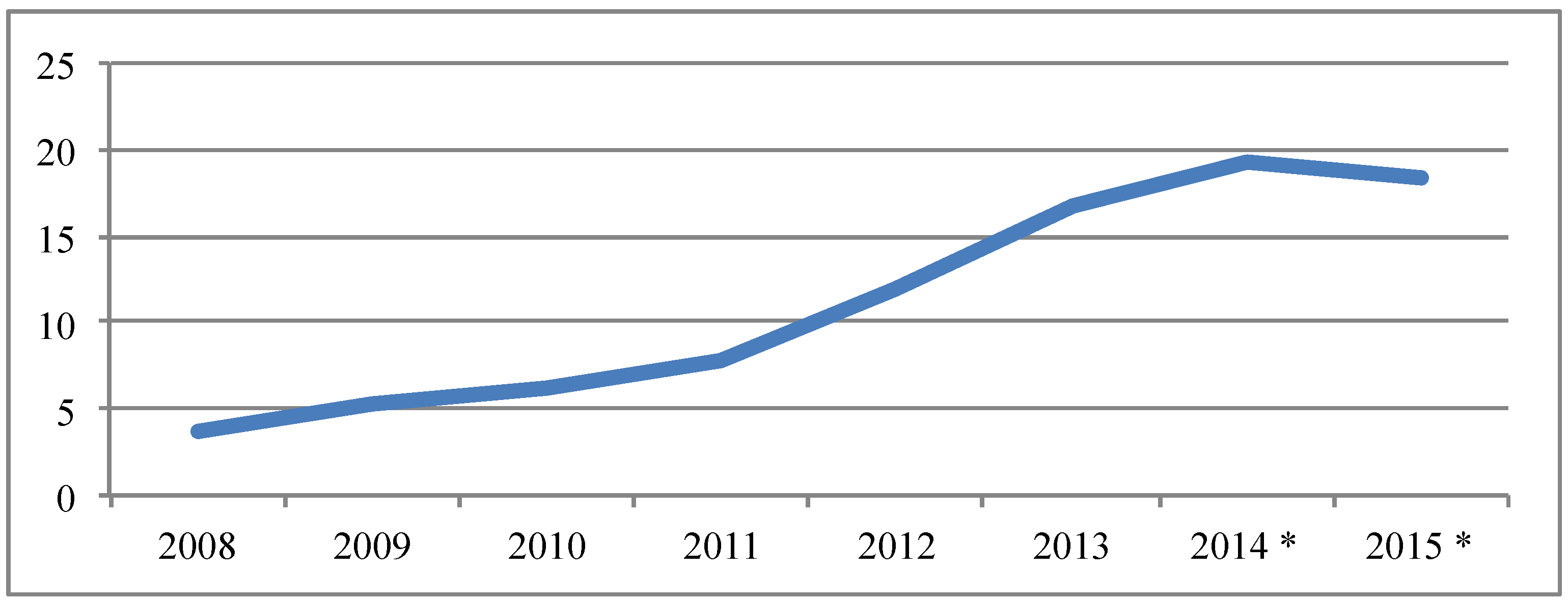

3.2. Ireland, the First Member State in Crisis

3.3. The Case of Cyprus

3.4. The Recession in Greece

4. Summary and Conclusions

Acknowledgments

Conflicts of Interest

References

- Eurostat. “Key Figures on Europe 2012.” In Eurostat Pocketbooks. Brussels: Commission of European Communities, 2012. [Google Scholar]

- “Ameco Database.” Available online: http://ec.europa.eu/economy_finance/ameco/user/serie/SelectSerie.cfm (accessed on 1 June 2014).

- George Soros. “Angela Merkel’s Pyrrhic Victory.” Project Syndicate. 7 October 2013. Available online: http://www.project-syndicate.org/commentary/george-soroson-angela-merkel-s-pyrrhic-victory (accessed on 1 February 2014).

- European Commission. “European Economic Forecast, Autumn 2013.” Commission of European Communities. 2013. Available online: http://ec.europa.eu/economy_finance/publications/european_economy/2013/pdf/ee7_en.pdf (accessed on 1 June 2014).

- International Monetary Fund (IMF). “Is the Tide Rising? ” Intetnational Monetary Fund. 21 January 2014. Available online: http://www.imf.org/external/pubs/ft/weo/2014/update/01/pdf/0114.pdf (accessed on 1 June 2014).

- Paul Krugman. “The State of the Euro, In One Graph.” New York Times. 1 January 2014. Available online: http://krugman.blogs.nytimes.com/2014/01/01/the-state-of-the-euro-in-one-graph (accessed on 1 June 2014).

- Paul Krugman. End This Depression Now! New York: W. W. Norton & Company, 2012. [Google Scholar]

- Klaus Schwab. The Re-Emergence of Europe. Geneva: World Economic Forum, 2012. [Google Scholar]

- Joseph Stiglitz. The Price of Inequality: How Today’s Divided Society Endangers Our Future. New York: W. W. Norton & Company, 2013. [Google Scholar]

- Marcell Zoltán Végh. “Válságkezelés Innovatív Módszerekkel—Közép-Európa EU-tagállamai Példáin keresztül megközelítve.” In Innováció: A Vállalati Stratégiától a Társadalmi Stratégiáig. Edited by Bajmócy Zoltán and Elekes Zoltán. Szeged: JATE Press, 2013, pp. 109–29. (In Hungarian) [Google Scholar]

- Seppo Honkapohja. “The euro crisis: A view from the North.” Bank of Finland Research Discussion Papers 2013/12; Helsinki, Finland: Bank of Finland, 2013, Available online: http://www.suomenpankki.fi/fi/julkaisut/tutkimukset/keskustelualoitteet/Documents/BoF_DP_1312.pdf (accessed on 1 June 2014).

- Rainer Masera. “Reforming financial systems after the crisis: A comparison of EU and USA.” PSL Quarterly Review 63 (2010): 297–360. [Google Scholar]

- European Commission. “A European Economic Recovery Plan.” Available online: http://ec.europa.eu/economy_finance/publications/publication13504_en.pdf (accessed on 1 June 2014).

- Paul Krugman. “A model of balance-of-payments crisis.” Journal of Money, Credit and Banking 11 (1979): 311–25. [Google Scholar] [CrossRef]

- Maurice Obstfeld. “Rational and Self-Fulfilling Balance-of-Payments Crises.” The American Economic Review 76 (1986): 72–81. [Google Scholar]

- Daniel Gros. “How Fit are the Candidates for EMU? ” The World Economy 23 (2000): 1367–77. [Google Scholar] [CrossRef]

- Giuseppe Bertola. “EMU and inequality: The facts.” VOXEU. 11 October 2007. Available online: http://www.voxeu.org/article/emu-and-inequality-facts (accessed on 1 June 2014).

- Giancarlo Corsetti. “Has austerity gone too far? ” VOXEU. 2 April 2012. Available online: http://www.voxeu.org/article/has-austerity-gone-too-far-new-vox-debate (accessed on 1 June 2014).

- Hans-Michael Trautwein, and Finn Marten Körner. “German Economic Models, Transnationalization and European Imbalances.” ZenTra Working Papers in Transnational Studies No. 28/2014. Bremen, Germany: Center for Transnational Studies, University of Bremen, 12 January 2014. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2378178 (accessed on 1 June 2014).

- Farkas Beata. “The necessity of a renewed European economic integration concept.” In Paper presented at the 43rd Annual UACES Conference, University of Leeds, Leeds, United Kingdom, 2–4 September 2013.

- Ugo Panizza, and Andrea F. Presbitero. “Is high public debt harmful for economic growth? ” VOXEU. 22 April 2012. Available online: http://www.voxeu.org/article/high-public-debt-harmful-economic-growth-new-evidence (accessed on 1 June 2014).

- Olli Rehn. “Europe must stay the austerity course.” Financial Times. 10 December 2012. Available online: http://www.ft.com/intl/cms/s/0/35b77c12-42d6-11e2-a3d2-00144feabdc0.html#axzz2sFlEAd (accessed on 1 June 2014).

- Joseph Stiglitz. “Five Years in Limbo.” Project Syndicate. 8 October 2013. Available online: http://www.project-syndicate.org/commentary/joseph-e--stiglitzthe-sluggish-pace-of-post-crisis-financial-reform (accessed on 1 June 2014).

- Organisation for Economic Co-operation and Development (OECD). “Economic Surveys.” Available online: http://www.oecd.org/economy/surveys/ (accessed on 1 June 2014).

- European Commission. “Employment and Social Developments.” Available online: http://ec.europa.eu/social/BlobServlet?docId=9604&langId=en (accessed on 1 June 2014).

- Vivien A. Schmidt. “The Eurozone Crisis and the Challenges for Democracy.” In The State of the Union(s): The Eurozone Crisis, Comparative Regional Integration and the EU Model. Miami: Jean Monnet Chair, 2012, pp. 103–16. [Google Scholar]

- Nitika Bagaria, Dawn Holland, and John Van Reenen. “Fiscal Consolidation during a Depression.” Special Paper No. 27; London, UK: Centre of Economic Performance, August 2012, Available online: http://cep.lse.ac.uk/pubs/download/special/cepsp27.pdf (accessed on 1 June 2014).

- George Stigler. Piac és állami szabályozás. Budapest: Közgazdasági és Jogi Kiadó, 1989. (In Hungarian) [Google Scholar]

- J. Bradford DeLong. “Spending cuts to improve confidence? No, the arithmetic goes the wrong way.” VOXEU. 6 April 2012. Available online: http://www.voxeu.org/article/spending-cuts-improve-confidence-no-arithmetic-goes-wrong-way (accessed on 1 June 2014).

- Paul R. Krugman. The Return of Depression Economics and the Crisis of 2008. New York: W. W. Norton & Company, 2009. [Google Scholar]

- Pelle Anita. “The European Social Market Model in Crisis: At a Crossroads or at the End of the Road? ” Social Sciences 2 (2013): 131–46. [Google Scholar]

- European Commission. “Business and Consumer Surveys.” Available online: http://ec.europa.eu/economy_finance/db_indicators/surveys/index_en.htm (accessed on 1 June 2014).

- Charles Wyplosz. “The eurozone in the current crisis.” ADBI working paper series; No. 207. Tokyo, Japan: Asian Developement Bank Institute, 2010. Available online: http://www.adbi.org/files/2010.03.26.wp207.eurozone.current.crisis.pdf (accessed on 1 June 2014).

- European Commission. “One trillion euro to invest in Europe’s future—The EU’s budget framework 2014–2020.” Available online: http://europa.eu/rapid/press-release_IP-13-1096_en.htm (accessed on 1 June 2014).

- Robert J. Schiller. “Debt-Friendly Stimulus.” Project Syndicate. 20 March 2013. Available online: http://www.project-syndicate.org/commentary/balanced-budgets-without-austerity-by-robert-j--shiller (accessed on 1 June 2014).

- Paul Krugman. “When good things happen to bad ideas.” New York Times. 14 September 2013. Available online: http://krugman.blogs.nytimes.com/2013/09/14/when-good-things-happen-to-bad-ideas-2 (accessed on 1 June 2014).

- European Council. “Conclusions—19/20 December 2013.” Available online: http://www.consilium.europa.eu/uedocs/cms_Data/docs/pressdata/en/ec/140245.pdf (accessed on 1 June 2014).

- European Commission. “Javaslat az Európai Parlament és a Tanács Rendelete a Közérdeklődésre Számot Tartó Jogalanyok Jog Szerinti Könyvvizsgálatára Vonatkozó Egyedi Követelményekről.” (In Hungarian)Available online: http://ec.europa.eu/internal_market/auditing/docs/reform/regulation_hu.pdf (accessed on 1 June 2014).

- Árpád Kovács, and Péter Halmosi. “Azonosságok és Különbségek az Európai Válságkezelésben.” Pénzügyi Szemle, 2012, 9–26. (In Hungarian)[Google Scholar]

- Sebastian Dellepiane, Niamh Hardiman, and Jon Las Heras. “Building on easy money: The political economy of housing bubbles in Ireland and Spain.” UCD Geary Institute Working Papers 2013/18; Dublin, Ireland: Geary Institute, University College Dublin, 2013, Available online: http://www.ucd.ie/geary/static/publications/workingpapers/gearywp201318.pdf (accessed on 1 June 2014).

- Udvari Beáta. “A Kelta Tigris bukása—Okok és következmények.” In Válság és Válságkezelés az Európai Unió Kohéziós Országaiban. Edited by Farkas Beáta, Voszka Éva and Mező Júlia. Szeged: Szegedi Tudományegyetem Gazdaságtudományi Kar Műhelytanulmányok, 2012, pp. 9–24. (In Hungarian) [Google Scholar]

- Samuel Brazys, and Niamh Hardiman. “From Tiger to PIIGS: Ireland and the use of heuristics in comparative political economy.” UCD Geary Institute Working Papers 2013/16; Dublin, Ireland: Geary Institute, University College Dublin, 2013, Available online: http://www.ucd.ie/geary/static/publications/workingpapers/gearywp201316.pdf (accessed on 1 June 2014).

- Manfred Gärtner, Björn Griesbach, and Giulia Mennillo. “The near-death experience of the Celtic Tiger: A model-driven narrative from the European sovereign debt crisis.” Universität St. Gallen Discussion Paper No. 2013-21; St. Gallen, Switzerland: Universität St.Gallen, 2013, Available online: http://www1.vwa.unisg.ch/RePEc/usg/econwp/EWP-1321.pdf (accessed on 1 June 2014).

- Tim Callan, Brian Nolan, Claire Keane, Michael Savage, and John R. Walsh. “Crisis, Response and Distributional Impact: The Case of Ireland.” ESRI Working Paper 456; ESRI Series; Dublin, Ireland: University College Dublin, 2013, Available online: http://www.iza.org/conference_files/FutureOfLabor_2013/callan_t3757.pdf (accessed on 1 June 2014).

- The Ecomomist. “Dead cat bounce.” 15 December 2013. Available online: http://www.economist.com/blogs/freeexchange/2013/12/irish-bailout-exit (accessed on 1 June 2014).

- Joseph E. Stiglitz. “An Agenda to Save the Euro.” Project Syndicate. 4 December 2013. Available online: http://www.project-syndicate.org/commentary/joseph-e--stiglitz-says-that-the-europe-will-not-recover-unless-and-until-the-eurozone-is-fundamentally-reformed (accessed on 1 June 2014).

- Iulia Monica Oehler-Sincai. “Financial contagion reloaded: The case of Cyprus.” MPRA Papers, Paper No. 48214; Munich, Germany: Munich Personal RePec Archive, 2013, Available online: http://mpra.ub.uni-muenchen.de/48214/1/MPRA_paper_48214.pdf (accessed on 1 June 2014).

- John H. Makin. “The extreme dangers of a deposit tax.” American Enterprise Institute. 24 March 2013. Available online: http://www.aei.org/outlook/the-extreme-dangers-of-a-deposit-tax (accessed on 1 June 2014).

- Heather D. Gibson, Stephen G. Hall, and George S. Tavlas. “Fundamentally Wrong: Market Pricing of Sovereigns and the Greek Financial Crisis.” University of Leicester Working Paper Series 13/20; Leicester, UK: University of Leicester, 2013, Available online: http://ies.fsv.cuni.cz/default/file/download/id/25323 (accessed on 1 June 2014).

- C.J. Polychroniou. “A Failure by Any Other Name: The International Bailouts.” Levy Economic Institute of Bard College, Policy Note 2013/06; New York, NY, USA: Levy Economic Institute, Annandale-on-Hudson, 2013, Available online: http://www.levyinstitute.org/pubs/pn_13_6.pdf (accessed on 1 June 2014).

- Demetrios Argyriades. “Greek Exit from the Crisis—A Pressing and Much-Needed Public Service Reform.” Social Sciences 2 (2013): 78–90. [Google Scholar] [CrossRef]

- Michalis Nikiforos, Laura Carvalho, and Christian Schoder. “Foreign and Public Deficits in Greece: In Search of Causality.” Levy Economic Institute of Bard College Working Paper Series; Working Paper No. 771; New York, NY, USA: Levy Economic Institute, Annandale-on-Hudson, 2013, Available online: http://www.levyinstitute.org/pubs/wp_771.pdf (accessed on 1 June 2014).

- Francesco Pappadà, and Yanos Zylberberg. “Tax evasion and austerity-plan failure.” VOXEU. 3 February 2014. Available online: http://www.voxeu.org/article/tax-evasion-and-austerity-plan-failure (accessed on 1 June 2014).

- Alberto Alesina, and Francesco Giavazzi. “The austerity question: ‘How’ is as important as ‘how much’.” VOXEU. 3 April 2012. Available online: http://www.voxeu.org/article/austerity-question-how-important-how-much (accessed on 1 June 2014).

- Andy Dabilis. “Samaras Says The End (Of Crisis) Is Near, But Skeptics Abound.” Greek Reporter. 11 April 2014. Available online: http://greece.greekreporter.com/2014/04/11/samaras-says-the-end-of-crisis-is-near/ (accessed on 1 June 2014).

- 1Fitch Ratings, Moody’s, Standard & Poor’s.

- 2Awarded the Nobel Memorial Prize in Economics (2013).

© 2014 by the author; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Végh, M.Z. Has Austerity Succeeded in Ameliorating the Economic Climate? The Cases of Ireland, Cyprus and Greece. Soc. Sci. 2014, 3, 288-307. https://doi.org/10.3390/socsci3020288

Végh MZ. Has Austerity Succeeded in Ameliorating the Economic Climate? The Cases of Ireland, Cyprus and Greece. Social Sciences. 2014; 3(2):288-307. https://doi.org/10.3390/socsci3020288

Chicago/Turabian StyleVégh, Marcell Zoltán. 2014. "Has Austerity Succeeded in Ameliorating the Economic Climate? The Cases of Ireland, Cyprus and Greece" Social Sciences 3, no. 2: 288-307. https://doi.org/10.3390/socsci3020288

APA StyleVégh, M. Z. (2014). Has Austerity Succeeded in Ameliorating the Economic Climate? The Cases of Ireland, Cyprus and Greece. Social Sciences, 3(2), 288-307. https://doi.org/10.3390/socsci3020288