Zombification and Industry 4.0—Directional Financialisation against Doomed Industrial Revolution

Abstract

:1. Introduction

2. Materials and Methods

3. Industry 4.0

3.1. Sweet Dreams?

3.2. Cumbersome Diffusion of I4.0: Dreaming No More

4. Financialisation and Its Landmines

4.1. General Landmines of Financialisation

- (i)

- Expanding markets for corporate and sovereign debts with shifting mindsets: Debts have always served as a kind of refuge for societies sometimes to survive, sometimes to develop further. With hyper-globalisation partly driven by the ICT revolution of the 1980s–1990s as well as the worldwide deregulation of financial markets in parallel, the market for corporate and sovereign debts has become solidified by feeding back to the rise of the international financial universe. In doing so, the prevailing credo changed course by shifting from the sentiment of “rescuing indebted countries” to ever-more preferring “saving (foreign) creditors’ portfolios” in stabilising the global market for sovereign debt. At another level, it is also true that with excessive financialisation in a time of continuous challenges, the tolerance level of financial markets (as well as regulators)33 of unsustainable sovereign public finances has softened, i.e., debt rates did not need to be strongly stabilized and moderated as it was the case previously; they could have reached higher levels without causing more serious economic vulnerability. The crisis of 2008, but also COVID-19, must be seen as a turning point in this respect, as debt service (interest payment) has not grown at the pace we expected in line with soaring debt levels. With the financial and real economic crisis of 2008, and especially with the aftermath of the eurozone crisis, developed countries sought to stimulate their economies by increasing debt and raising money in a “relatively coordinated manner” with the underlying aim of demonstrating their ability to act and control the processes, i.e., to legitimize their existence. The global financial crisis of 2008 reinforced the view that indebtedness does not necessarily lead to automatically escaping inflation, low interest rates and fiscal crises. We should not be surprised, then, that the public health emergency caused by the coronavirus epidemic, which began in 2019 and then became global, which in a sense can be apostrophized as a war for the survival of the present generation, has led to an increase in debt rates (e.g., eurozone’s average debt-to-GDP rate was above 100% of the GDP by 2021), with the world now collectively turning a blind eye over moral hazard (e.g., Germany has suspended the debt brake rule and reached a deficit of 4.2% in 2020). Economic history teaches us that financial crises were, by and large, followed by rises in debt-to-GDP ratios of at least 20% of GDP in the OECD countries (European Commission 2021) simply because of a learning process: future uncertainties required larger and larger fiscal space (buffer) to intervene and to calm the markets. The only question is whether the currently observable more permissive attitude towards increasing (public) debt will change (i.e., the number of insolvency proceedings has never been so low in Europe), whether inflation will skyrocket after the pandemic (but rather in the meantime), whether the historically exceptional low-interest-rate environment will end and whether the accumulation of debt mountains will start by triggering serious fiscal consolidations across the board (i.e., it would entail a shift from financialisation-driven growth to a more real-economy-led and often export-oriented growth).34 In other words, excessive financialisation acted as a Janus-faced phenomenon by prolonging the sustainability of welfare states, on the one hand, while by becoming an important landmine to them, on the other. The result has been a vicious cycle. If the stimulus is abandoned by returning to austerity, it is likely that many companies will go bankrupt, unemployment will soar, the hard-won demand side will succumb, and the already increasingly anti-inclusive economic feature of today would fall into deeper employment challenges (especially because COVID-19 has almost become a driver of automation and robotics in the era of the completion of Industry 4.0), which would result in non-negligible anomalies in public finances.

- (ii)

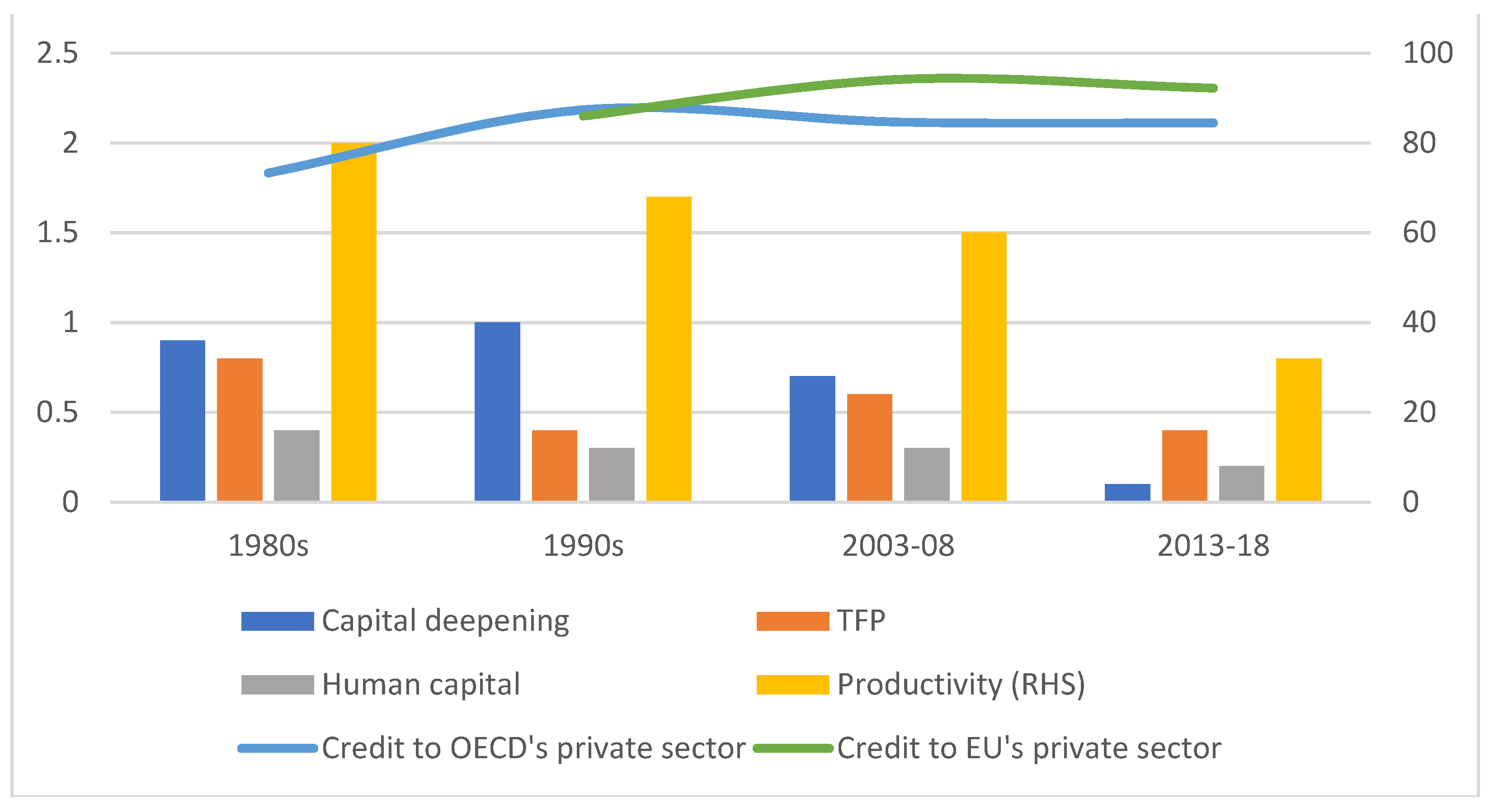

- Rising credit flow without spectacular productivity improvements: There was an underlying idea behind liberalising financial markets, namely reaching out infinite capital mobility in space and time; however, the financial system figured out that there is no need for the real economy to realise higher and higher profits in the short term, and it has therefore become a self-propelling mechanism.35 A relatively new stream of economic literature focuses on the issue of secular stagnation meaning the permanent deterioration observable in the growth trend of productivity and thus that of innovation performance in the advanced world (Teulings and Baldwin 2014). Secular stagnation is associated with increasing uncertainties leading to increasing instability of the socio-economic system. There is a growing body of evidence that increases in uncertainty are mainly associated with protracted negative impetus on economic activity (Baker et al. 2016; Bachmann et al. 2013); thus secular stagnation (a declining growth rate of labour productivity) is associated with increasing uncertainties. For instance, such uncertainties come from the fact that more and more entities started to function as those in the financial sector by circumventing the regulatory framework. Following the collapse of the Bretton Woods system, financial globalization was jumpstarted (e.g., decoupling of banking assets from GDP growth, steadily growing volume of loans, while productivity has barely improved, meaning that credit efficiency has conspicuously declined, etc.). And behind the curtains, non-bank financial institutions showed up in the shadow leading to bubbles and overvalued assets of EU banks (i.e., shadow banking entities delivering banking services are out of the eye of regulators). As many studies pointed out, shadow banking exposure has become very significant (see Abad et al. 2022),36 as if one is witnessing some sort of expulsion of the real economy from the consciousness of the financial sector by feeding back to secular stagnation. Importantly, one can emphasise that secular stagnation is one of the thorniest challenges advanced world faces today simply because it can be seen as a sort of failure of all economic policy initiatives (e.g., expensive R&D and innovation support measures) as well as financial system activity acting with the aim of dynamising the real economy in the last decades (i.e., by leading to distrust in economic governance and the financial sector in general on the side of the private sector). Paradoxically, one can recognise that we have never devoted as many (financial and other types of) resources to supporting productivity growth as in recent decades, but not only is the boom waiting, productivity growth rate has also been shrinking (see Figure 1). For instance, domestic credit flowing to the private sector provided by banks in OECD countries was 61.32% of GDP in 1981, while it has risen by almost 38% up to 84.48% by 2020 (in EU countries, 86% in 2001 was then followed by a rate of 92.20% in 2020).

- (iii)

- Increasing socio-economic and political divergences: First, extensive deregulation of the financial markets in promoting financialisation not only meant that financial actors, which had hitherto been subject to strict supervisory rules, would continue to do the same but in greater volumes, but it also opened the door to new solutions by reflecting a completely new approach to lending.37 For instance, on the one hand, deregulation led to the so-called predatory lending, being pervaded by high-interest-rate credit cards with fees and penalties, payday loans and subprime mortgages, etc.; on the other hand, deregulation of capital markets put the richer in an easier position to avoid paying high taxes by forcing governments to go for public debts in a more voracious way. These all did contribute to increasing inequalities. Second, with the outbreak of the 2008 financial and economic crisis, rising inequality has become the defining challenge of our societies. There is therefore an inherent dynamic between financial development and inequality; up until a certain point, financial development seems to be conducive to growth and moderating inequalities, but after that point, the financial sphere becomes more cautious by turning away from riskier customers by preferring larger and less-risky companies having relatively higher net values (i.e., inequality rises).38 Wealth inequalities are ten times larger than inequalities in the flow category (Piketty 2017; Atkinson 2015). With the intensifying financialisation (i.e., together with the easier financing), as Favara and Imbs (2015) pointed out, house prices were exposed to rise in a very powerful way by limiting the room for the manoeuvre of younger households to buy a home (i.e., young households are not better off than a similar household was two decades ago)39 by presumably engendering disappointment in the ruling governments and elites. What is more, in OECD countries, it takes an average of 4.5 generations for a child born to a poor family to reach the middle class (even the corresponding German and French figures are 6); in practice, the growth rate of median household net income has been negligible since the mid-1970s. Komlos (2019) pointed out that the middle class has not only been shrinking but partly disappearing, and its income grew at almost zero rate between 1979 and 2011 (0.1% and 0.7% per year), while the top 1% has been realising an annual income of 3.4–3.9% during the 32 years studied. In addition, the proportion of the population living in households whose per capita consumption and income do not reach the poverty line (USD 3.2 per day), for example, in Germany, which has a significant impact on EU growth, has been stagnating or even declining (from 0.23% in 2000 to 0.24% in 2019).40 Moreover, the shrinkage of the middle class—most of which tend to slip towards lower-profit jobs—also means that this social stratum is losing its political importance (i.e., it has been empirically proven that people from the middle class are more likely to enter the political system and governance, thus supporting political stability).41 The thinning of this group is worrying from the development perspective because it is precisely the class that has the critical level of desire to move upwards, which is essential at the system level (for investment in research and development and innovation thanks to intellectual and other resources and savings, self-improvement/self-education), and the desire, in addition to its systemic importance, not to fall behind, and therefore it is the class supporting the healthy system of checks and balances; hence it is the refuge of democratic order (dampening inequality, corruption, etc.). The middle class is predominantly a believer in political stability and good governance (Birdsall 2016), helping to prevent excessive political polarization and fostering trade-offs within government. And if, in spite of all this, slippage and layer shrinkage take place, one can suspect that the configuration of the socio-economic system is in an evolutionary state that is incapable of providing “good jobs” in this form, both in quantity and quality. Illiberalism, populism and nationalism can then gain traction more easily as it happened across the board.42 Third, with shrinking middle-class and middle-income jobs, corporate giants are dominating by increasing and maintaining a large productivity dispersion across firms.43 As one of the greatest Hungarian economists, Janos Kornai, once emphasised, if a phenomenon can be detected in many places, it is not a disease. And still, the growing presence of divergences can be treated as a systemic pattern given by systemic tectonic movements such as the exuberance of the financial sector. A predominant part of scholars and economic practitioners have been considering inequality as mainly a national issue; now, it should be clear that it is internationally determined and interdependent.

- (iv)

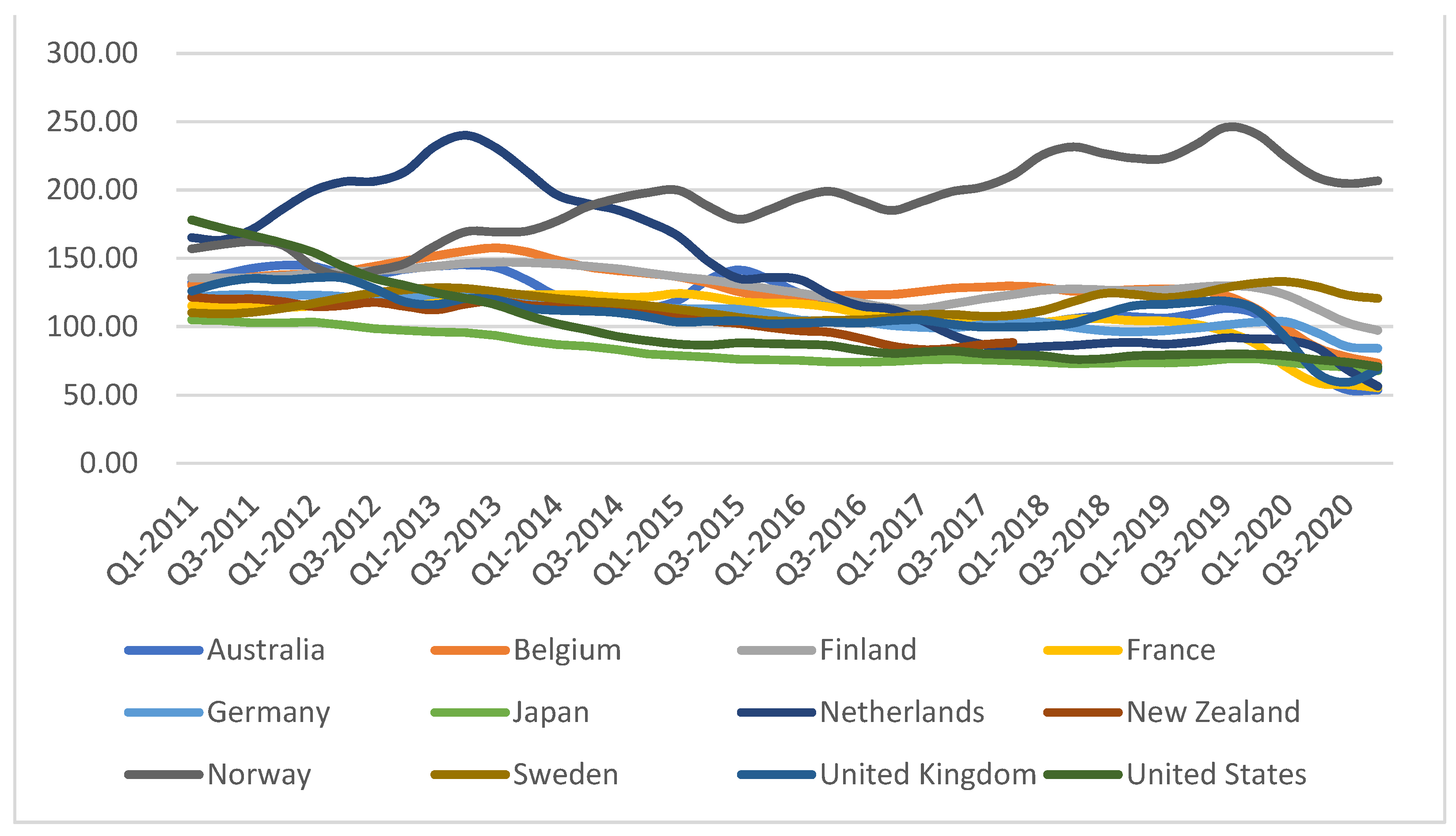

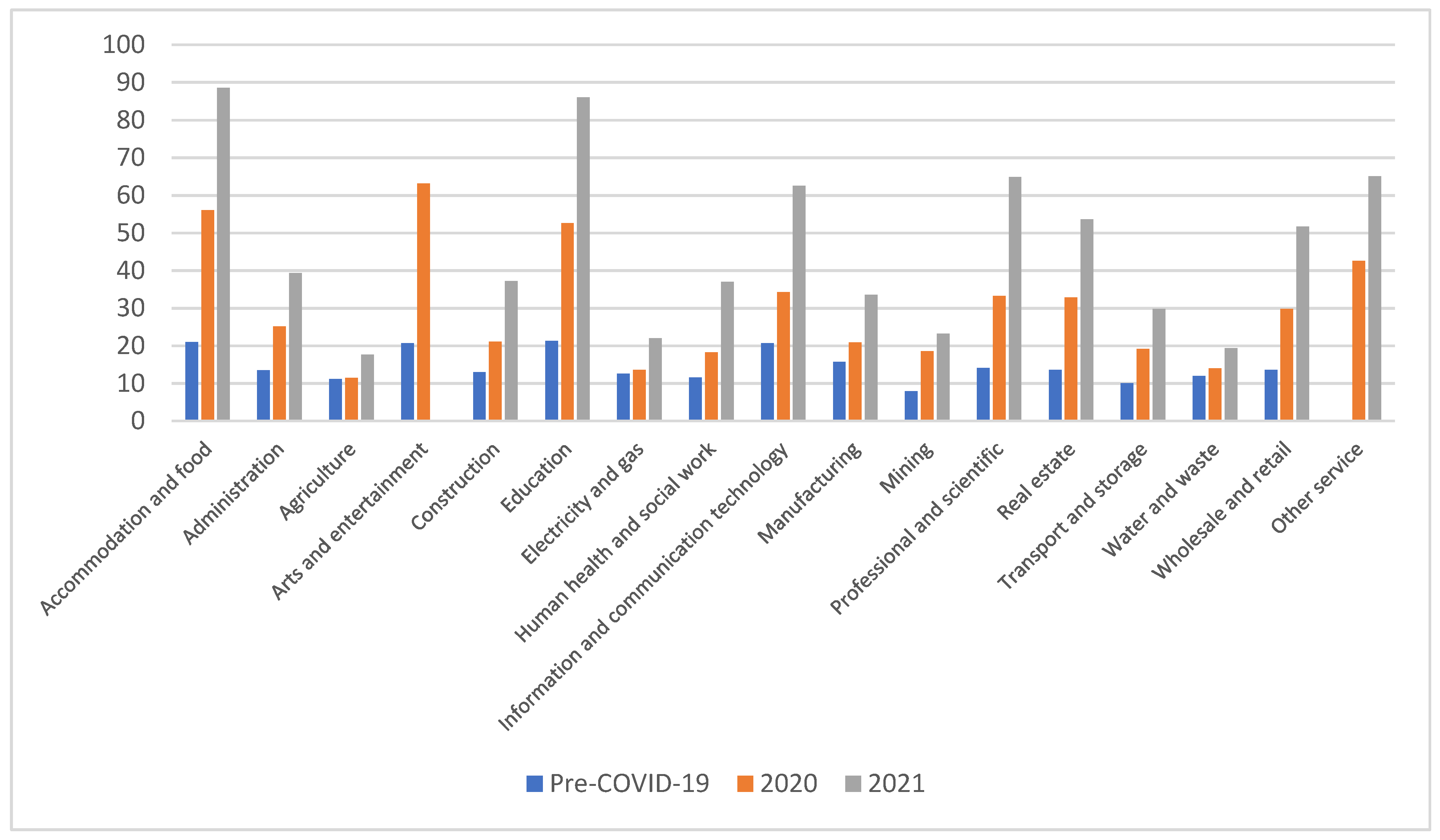

- Financial exuberance as a deceptive cushion in time of a black swan (COVID-19):44 With the runaway of the financial universe meaning the build-up of an ever-more blurring and lengthier bridge between the two sectors with all its repercussions (e.g., resulting in higher concentrations with larger dominating companies), COVID-19-induced economic crisis could not spread quickly to the financial sphere, which is often regarded as a positive development. Yet, there are at least three interlinked underlying phenomena injecting critical instability into the socio-economic system. (1) Big concentrations have become even more pronounced by exerting ever more influence and fuelling inequality across firms. Financial exuberance has led to a financial real economy configuration in which debt and equity financing are easily and widely available, and low-interest rates prevailed across the globe for a relatively unprecedented period when companies equipped with the necessary financial capacity started to intensify their mergers and acquisitions by maintaining their growth (even inorganic).45 It is true that this process, per se, served as a cushion for business players shaken by the new socio-economic context (excessive digitalisation, lockdown effect of COVID-19, etc.) in a way they could find a relatively easy way out (exit). Although a proxy for capturing this trend is the trajectory of non-performing loans across the European Union which, in spite of COVID-19, has continued to decline even along 2020–2021 together with the fall in bankruptcies as well (Figure 2);46 with the end of cheap money and governmental support, banks are facing a conspicuous deterioration in their asset quality due to the emergence of household and corporate defaults in a more vigorous way.This per se will hamper the banking sector to be an efficient contributor to the recovery later on.47 (2) Forced digitalisation, but no positive signs in plain sight. On the one hand, COVID-19 bolstered the usage and development of alternative smart, cheap and even digitalised payment methods by resulting in a higher risk of cybersecurity.48 On the other hand, the financial and banking sphere, as a major employer, did make a shift towards a more digitalised employment model with the introduction of remote work in the case of 40–60% of a working week whereby the labour market shock given by COVID-19 was limited to the real economy. It nurtured a misleading feeling of comfort by assuming positive impacts on productivity and business activity. Still, employment in the financial and banking sector has been declining further; plus, there is no clear-cut evidence whether the broad introduction of home office has had a positive impact on productivity, workers’ job satisfaction or innovation activity in general.49 (3) No healthy contraction, but a gathering inflation storm. There is also a widespread belief that since the financial and economic crisis of 2008, being uninterrupted by COVID-19, the banking sector, including the European one, has been going through a healthy contraction in the spirit of increasing efficiency and cultivating stability.50 However, there is underlying inertia for such contraction, namely that more and more workers have been intentionally leaving the financial/banking universe (as well) without even reappearing in the labour market by contributing to the so-called (and inflationary) Great Resignation (i.e., labour shortage is a ubiquitous phenomenon even in the financial system). Labour shortage, by its very nature, fuels scary inflation, especially in the aftermath of COVID-19 (i.e., hiring requirements have been lowered, and there is a pressure on increasing wages and salaries ever-more spectacularly).

- (v)

- Encoding critical instability and distrust via unresolved cybersecurity: excessive financialisation driven by digitalisation has triggered enormous cyberattacks in the broadened financial sector (financial sphere, banking sphere and the growing share of non-banking payment service providers and apps). Excessive digitalisation has increased the channels along which private and business customers are available and can be manipulated in many ways. It is hardly by chance that misinformation and disinformation were mentioned among one of the most intriguing and withering challenges of today’s democracies around the globe. Only during the first half of 2020, the number of cyberattacks targeting exclusively the financial universe rose surpassingly (a 238% increase was registered by VMware, and according to the calculation of IBM, the average cost of a data breach that happened to a financial institution accounted for approx. USD 5.7 million, while attacks geared towards apps also went up vehemently by 22% since 2020). In short, both the number of ways and the extent of potential (financial and confidence-related) damage have jumped significantly (i.e., think of phishing emails, ransomware attacks paralysing even public services and financial/banking actors51, SQL injections52, DDoS attacks, supply chain attacks53 or bank drops).

- (vi)

- Altered economic wisdom: First, according to the traditional monetarist theory, we should expect higher inflation in parallel with the increase in the money supply. Contrary to theory, however, one can recognise that high inflation did not emerge from the volatile but precisely the relatively stable money supply from the 1960s onwards, i.e., it did not emerge as a result of money-supply-increasing periods.54 What is more, it was not primarily a combination of monetary but other factors. This calls for a refinement in our theory since the old one may be only true if the financial system is an efficient intermediary system for the real economy. Currently, unfortunately, this is not the case. Importantly, mainly because of the distorted harmony between the financial universe and the real economy, stock market indices correlate more with money supply than traditional CPI metrics. Second, according to mainstream economics, a more intensive and deeper financial intermediation cultivates economic growth and development, i.e., credit growth feeds back into increasing economic growth in terms of GDP. Although with the shift from the Great Moderation to the Great Recession, due to the financial and economic crisis of 2008, there have been voices trying to rethink and refine that finance and growth narrative; those works are still remaining in the same paradigm in the sense that they tackle the financial universe as an immense part of the real economy without considering its runaway (as a disguised real sphere, as Bofinger et al. (2021) put it).55 And even though seemingly there is evidence of the strong positive relationship between credit growth and GDP growth, excessive credit growth is now treated as one of the most pivotal signals of a forthcoming decay. The Great Moderation (approx. 1992–2007) was pervaded by low fluctuations (i.e., moderated level of unemployment, inflation, stable GDP growth) giving a misleading feeling of comfort whereby people tended to go for more and more credit. It encoded a process of excessive indebtedness with an above-the-optimum boom cycle marching toward a below-the-necessary recession with full steam (the Great Recession). As a corollary, easing the external financing constraint for households and firms is neither good, as the basic literature suggested (Beck et al. 2000; Levine 2005), nor bad but can be both.56 Third, conventional theory postulates that credit (and leverage) is worthwhile for companies (i.e., net debt benefits the company). But, and by feeding back to growing concentrations, as mentioned earlier, in the configuration of the financial universe and real economy emerging, the business-as-usual way of bank lending started to contain an underlying preference over internal sources of funds in the case of small and medium companies as compared to more powerful giants. Unsurprisingly, there is a declining trend in leverage in the last decades by even approaching zero as well (also known as zero-leverage mystery).57 And fourth, economics theory on the nexus between technological advancement (technological revolutions leading to new techno-economic paradigms) and the financial sector seems to have been ill-based. The role of the financial sector in the technological-economic paradigm shift cannot be properly grasped by prevailing theories. One ruling economic theory assumes that innovations are the achievements of the real economy and the financial sector is responsible for the diffusion and widespread use of such innovations (Perez 2003, 2009); while the other theory emphasizes the primacy of liquidity-enhancing power in financial sector innovations leading to ones in the real economy (Minsky 1982, 1986, 2008; Wray 2018). The basic underlying assumption of both theories is the existence of a harmony between the two spheres, based on which we should see innovation dynamism one way or another, but this relationship no longer exists today. Insofar as the financial universe has outgrown the real economy (e.g., banks went beyond the sheer operation of lending by becoming qualitatively new players in town by asking to whom to sell the loan)58, that is to say, it does not function as an integral part of it, it suggests that the financial sector’s traditional liquidity-creating methods via financial innovations have lost their orientation. It also implies that the financial system as of today is not necessarily contributing to the deployment of Industry 4.0 and the real transition to the digital economy. What it has been producing is just side effects and unintended consequences of such liquidity creation (i.e., creating and preserving uncompetitive and stagnating zombie firms).

4.2. Zombies—Sunspots for Industry 4.0?

- Noisy expectations: When the volatility of trends becomes very low, people tend to consider moderated trends as a period of calmness which is very likely to continue in the future without significant interruptions.63 People are therefore filing for credit cards and using them in a good deal of quantity in those times by expecting the best. In other words, higher-risk-taking behaviour, from the side of both banks (i.e., in a form of poor risk management practices) and private/business sectors, is encoded in a time of moderation (e.g., 1992–2007) when abundant liquidity and relative calmness of financial and banking players instil zombification.64 And that leads to the fact that the boom phase of the business cycle is running even higher, while when the recession hits, the bust phase is falling even deeper (because there has been excessive indebtedness and credit consumerism viewed as systemic risk factors).

- Noisy lending: Even the same company’s credit rating (i.e., assessments of creditworthiness) may be subject to completely different assessments from different banks.65 And since banks more and more avoid writing down significant losses that would otherwise worsen the bank’s reputation, zombification is just a means to do so (not to mention the fact that banks could allow more and more indebted and non-viable zombie firms to live longer by offering them new loans to repay older debts due to loose monetary policies and increasing liquidity available), while financialisation is a means of pursuing more profits at the same time.66 All this happened in an environment pervaded by excessive liquidity; thereby, access to credits became ever-more simple and easy by resulting in zombification that entailed worsening average productivity performance.67

- Noisy institutional, regulatory and business incentives: Weak insolvency regimes contribute to the survival of zombie firms whereby zombie lending may continue;68 governmental support and loose monetary policy to prop up lending result in a behaviour change in the day-to-day operation of banks since the flood of liquidity increases their risk tolerance (i.e., riskier loans are soaring even towards less productive and probably unviable firms with a greater chance); and there might be a culturally driven zombification channel, i.e., increasing tolerance with respect to allowing less-productive firms to get credits if and when their market existence safeguards a more inclusive society pursued by economic policy (i.e., their employability becomes a priority when assessing their creditworthiness).69

- Noisy asymmetrical information: Zombie lending and zombification together build up a business environment pervaded not only by asymmetrical but also noisy information flow to be relied on when it comes to important decisions, i.e., it is harder to identify whether the partner company is creditworthy or actually a zombie which could be a malicious landmine in the future. Companies may become misinformed by zombie lending masking the creditworthiness of one or more of their suppliers by resulting in a business network soaked with a good deal of contagion risk that sprinkles the mourning among them (i.e., a large company prefers creditworthy suppliers who, due to the tendency of banks to zombie lending, are not necessarily proven to be zombies in advance). It is similar to what happened in George Akerlof’s famous “market for lemon” model: there will be an immanent tendency for companies of deteriorating quality and efficiency to dominate the market, which will feed back on zombification and zombie lending.70

- Noisy crisis management: The financial and real economic crisis of 2008 and its ensuing eurozone crisis have brought a “relatively coordinated” stimulus to life. Through this, nation states could demonstrate their ability to act. The crisis of 2008 reinforced the view that indebtedness does not necessarily lead to automatically escaping inflation, low interest rates and a fiscal crisis. What is more, authoritative studies argued that fiscal policy offers the best policy response (Baldwin and Weder di Mauro 2020a, 2020b). Rescuing weaker banks is equivalent to creating and maintaining their competitive advantage (i.e., fending off their exit) by presumably destabilising the entire financial system since such unviable zombie banks may crowd out real competitors too.71 Importantly, there was a belief that such intervention increases competition by incentivising lending to the real economy (i.e., to be materialised in a form of more real investment entailing positive impetus on growth and innovation).72 But once the financial sector shows a runaway described in this paper, such effect can be nothing else but a phantasmagory. Then we should not be surprised that the public health emergency caused by the coronavirus epidemic that started in 2019 has led to an increase in debt ratios without any more serious consequences (e.g., Germany has suspended the debt brake rule and reached a deficit of 4.2% in 2020). However, with the help of the ECB (Single Supervisory Mechanism, SSM), the classification rules for non-performing loans were also relaxed during the pandemic. Initially, this was only a recommendation up until more specific guidance/regulation came out from the European Commission and the European Banking Authority. Importantly, bankruptcies have been suspended in many cases, and a moratorium has been also launched together with other direct state support and guarantees. All this opened the way for zombification, especially in countries where interventions were not adequately addressed and/or banks do not have sufficient capital buffers to write off losses.73

5. Discussion

Funding

Conflicts of Interest

| 1 | Ranging from the long-lasting and to some extent still unresolved consequences of the 2008 financial and economic crisis including the eurozone crisis such as flaring populism, secessionism and nationalism across the board (today, one in four nations is governed by a populist leader/party) by endangering the sustainability of the European integration process as a whole, the escalating trade war between the United States and China affecting many other countries, the migration and COVID-19 crises, creeping military conflicts, the ever-more deciphered and publicly discussed business scandals (Wirecard, security fraud by Chinese-based companies such as Luckin, Archegos Capital, etc.), etc. |

| 2 | |

| 3 | For instance, Blais et al. (2020) illustrated that fact exquisitely. The rates were as follows: Austria (1962: 93.77%, 1995: 85.98%; 2019: 75.59%); Belgium (1961: 92.34%; 1995: 91.15%; 2019: 88.38%); France (1967: 81.12%; 1997: 67.96%; 2017: 48.70%); Germany (1972: 91.11%; 1994: 78.97%; 2021: 76.57%); Italy (1963: 92.88%; 1996: 82.91%; 2018: 72.93%). |

| 4 | […] sucht den ruhenden Pol in der Erscheinungen Flucht” by Schiller, Der Spaziergang. |

| 5 | Many papers admitted that available data, which might be of interest pertaining to non-financial firms, have many shortcomings in this respect (since we are dealing with a more secular phenomenon, and the available time series for 10 years at best do not seem to be as conducive as it would be required), and we are at the very beginning of such new research avenue to be complemented by reasonable econometric or basic regression analyses, for instance, later on (e.g., building partly on CompNet as well as Compustat to carry out correlation analysis, regression analysis, using VAR model or panel database analysis as GMM to see the extent to which policies and initiatives over excessive and zombified financialisation influence the complex process of Industry 4.0 and its unfolding). |

| 6 | The first industrial revolution dates back to the 18th century when power generation started to gain momentum (e.g., facilities with water power and steam engine), the second appeared in the 19th century with the discovery of electricity and assembly line (mass) production (e.g., automotive industry), and the third one entered the world stage with the fast diffusion of information and communication technologies from the 1970s based on smart chipsets (e.g., Internet, robots, automation opportunities). |

| 7 | Despite the lack of convincing empirical backing (Baldassarre and Ricciardi 2017), improved productivity via Industry-4.0-related technologies (e.g., robotics) and nontechnological solutions in the real economy and the financial sector alike is widely expected in the literature. See: Aichholzer et al. (2015); Vaidya et al. (2018); World Economic Forum (2018); Zambon et al. (2019). For the case of the financial sector, see: Mehdiabadi et al. (2020). |

| 8 | |

| 9 | A survey conducted by Chapman University in 2016 showed that, after corruption, what Americans fear the most is cyberterrorism. Available: http://www.usatoday.com/story/news/nation-now/2016/10/12/survey-top-10-things-americans-fear-most/91934874/ (Accessed on 2 April 2022). It is hardly by chance that Piggin (2016) documented that not only the number of reported industrial control incidents but also the number of cyberattacks against manufacturing firms have been conspicuously growing, initiated by ransomware, malware and various types of phishing activities, engendering smaller-scale and also full disruptions (e.g., in public services as well). |

| 10 | Not surprisingly, IBM stopped two years of experimenting with telecommuting in 2017, before the coronavirus pandemic began, because telework had a negative impact on work efficiency. |

| 11 | For more on the reallocation channel, see: Martin and Scarpetta (2012). Of course, not only the tangible (salaries/wages, bonuses, etc.) but also the intangible (e.g., autonomy, space for self-realisation, increased responsibility) part of the incentive regime matters (See: Beck-Krala et al. 2017), whose power can be curbed in the case of extensive ICT-based monitoring and control, encoding the culture of anxiety mentioned above. For instance, UPS follows every move of its drivers via ICT devices, or, at Amazon, harrowing work conditions have been revealed as an undercover journalist reported after visiting an Amazon warehouse where workers are using bottles when they have to pee because fulfilment demands are too high at the company. |

| 12 | |

| 13 | |

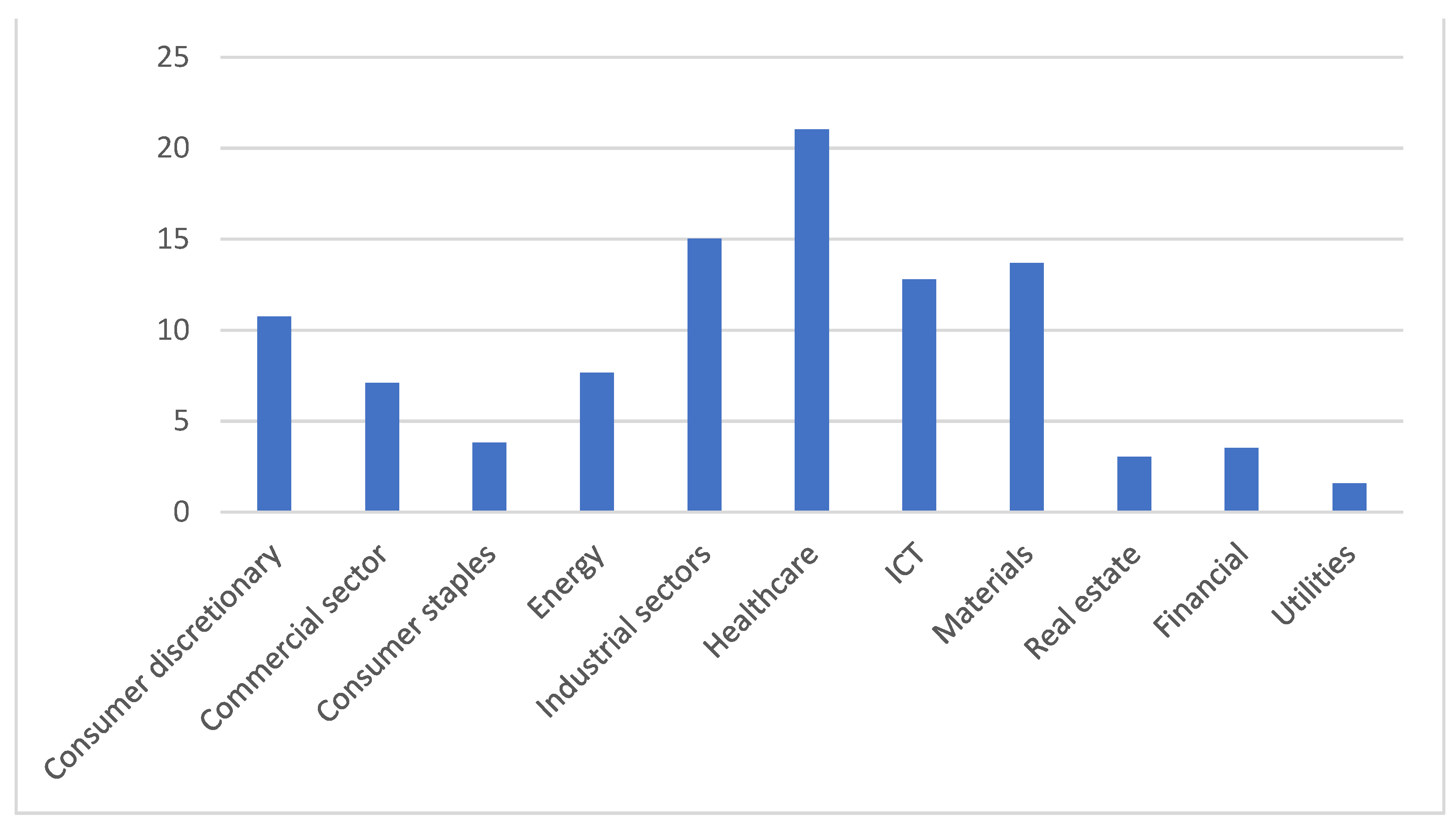

| 14 | Source: Statista, Citigroup, World Bank. For more on the negative association between adopting robots and manufacturing employment in the OECD countries, see: Calì and Presidente (2022). |

| 15 | In a survey carried out by Capgemini Research Institute, 58% of company respondents reported that the positive impetus of automation on productivity was actually invisible. Available: https://www.capgemini.com/wp-content/uploads/2018/11/Report-%E2%80%93-Upskilling-your-people-for-the-age-of-the-machine.pdf (Accessed on 2 April 2022). |

| 16 | The growing importance of ageing and its multifaceted consequences have become a deeply researched topic today when life expectancy has reached 70 years in the world (and has even exceeded it in many countries), and for the first time in the history of mankind, the number of individuals aged 60 or older has eclipsed that of the number of children under the age of five. On the increasing European awareness over the issue of inclusion, see: Europe2020 Strategy or the Annual Convention for Inclusive Growth. |

| 17 | See: OECD Inclusive Growth Initiative. Not to mention the Sustainable Development Goals of the United Nations accentuating the promotion of sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all. Recent work, among others, offers work–life balance in a more dedicated and flexible way, which is required more and more by generation Y. See: Robak (2017). |

| 18 | Let us note that these readiness-related analyses have a predilection to concentrate primarily on the technology side of Industry 4.0 potential in the case of countries/companies. For more on such bias in Industry 4.0 assessment methods, see: Hizam-Hanafiah et al. (2020). |

| 19 | |

| 20 | |

| 21 | See: https://www.interreg-central.eu/Content.Node/4STEPS.html (Accessed on 2 April 2022). |

| 22 | To name a few more spectacular efforts, and beyond the level of communication and visionary narratives (For a European Industrial Renaissance of 2014, Task Force on Advanced Manufacturing for Clean Production of 2013, Strategic Policy Forum on Digital Entrepreneurship, Grand Coalition for Digital Jobs, EC’s Digital Single Market Strategy), S3P-Industry initiative, or the more general Horizon 2020, offered more than EUR 80 billion for supporting industrial leadership between 2014 and 2020; more than EUR 100 billion were also available via European Structural and Investment Funds for the Member States to reinvigorate innovation in line with smart specialisation. For more on EU policies towards Industry 4.0, see: Dosso (2020). |

| 23 | See: https://www.wipo.int/edocs/pubdocs/en/wipo_pub_gii_2020/at.pdf (Accessed on 2 April 2022). |

| 24 | Sometimes seriously stepping, sometimes jumping. |

| 25 | |

| 26 | See more on the Gerschenkronian great spurts in Gerschenkron (1962). Of course, diligent readers of how financialisation has developed can observe that the literature on the interaction between growth and financialisation has shifted with the 2008 financial and economic crisis. After the Great Recession, voices about the more negative impact of financialisation on economic growth started to gain traction. For instance, Stockhammer (2012) and Cecchetti and Kharroubi (2015) did also emphasise the crucial importance of excessive global financialisation in the slowing down of economic growth becoming ever more fragile. |

| 27 | By updating the version of In God We Trust! that has prevailed primarily in the US. |

| 28 | |

| 29 | See: https://www.multpl.com/shiller-pe (Accessed on 2 April 2022). |

| 30 | See: https://www.currentmarketvaluation.com/models/buffett-indicator.php Accessed on (Accessed on 2 April 2022). |

| 31 | See: https://www.forbes.com/sites/stephenmcbride1/2021/02/08/millennials-will-propel-stocks-higher-for-years/?sh=187a97506e5d (Accessed on 2 April 2022). |

| 32 | Although there were approaches in the US and Europe in diametrical opposition to each other, programmes now seem to have been worthwhile. For instance, in the US, where the government allowed workers to lose their jobs, jobless aid was offered for more than 56 million workers between January and August of 2020. The European Union and the Member States did also start their furlough programs with the aim of preserving the workers as much as possible. See: https://www.bloomberg.com/graphics/2021-furlough-jobs-unemployment-europe-united-states/ (Accessed on 2 April 2022). |

| 33 | Note that in Europe, the institutionalised fiscal rules and regulations have not been sufficiently followed and, most importantly, noncompliance has been the rule rather than the exception. See: European Fiscal Board (2019); Gaspar and Amaglobeli (2019). |

| 34 | For an example, see the case of Iceland. See: Gudmundsson (2015) and Raza et al. (2016). Let us note that putting European debt-to-GDP rates altogether on a more sustainable path is of crucial importance since high discrepancies in Member States’ indebtedness does also mean differing fiscal spaces deployable in mitigating shocks and to dynamise structural transformation (i.e., into green, inclusive and more sustainable growth/development). |

| 35 | The parasitic-like nature of the financial universe unleashed new systemic patterns: (i) the share of capital in national income has been rising, while that of the labour share has been declining since the 1970s (see Milanovic 2019, pp. 24–25); (ii) it can be captured by looking at the growing trends in share buy-backs; thereby, the players are to boost the stock market artificially. It implies that they are not looking for riskier but productivity-enhancing investments in the real economy (40% of S&P 500 firms bought back shares in 1990; their proportion was 60% in 1997–2003, while 85% today). It is hardly by chance that a global saving glut of the rich has become a well-researched field (i.e., over more than 40 years, top earners have been accumulating savings instead of seeking out financing investments in the real economy; see Mian et al. (2021)). It also generates a bias towards larger companies at the expense of the middle ones (Andrews et al. 2016). |

| 36 | According to comprehensive research of the European Banking Authority on the exposure of European banks to shadow banking entities, German institutions, serving an economy driving the European growth potential substantially, reported the second largest exposure. See: European Banking Authority (2015, p. 13). |

| 37 | |

| 38 | See: La Porta et al. (1999) or Kang-Kook and Md Abu Bakkar (2021). Owing to the fact that cash flows are risky in a competitive industrial environment, banks take competition risks into consideration when making lending decisions (Gaspar and Massa 2006; Irvine and Pontiff 2009). Thus, banks prefer less risky companies with big net value. |

| 39 | |

| 40 | See: http://iresearch.worldbank.org/PovcalNet/povDuplicateWB.aspx (Accessed on 2 April 2022). |

| 41 | In this respect, Putnam and Garrett (2020) offered a sensitive account, while the the book by Tankersley (2020) did also join this line of thinking. |

| 42 | For instance, see the emergence of the Donald J. Trump administration in the United States, the case of the Brexit in the European Union or other populist-leaders-led economic governance show up in a more dedicated way. More on illiberalism, see: Sajo et al. (2021). |

| 43 | Larger companies are much better able to design vertical restraints and use their patents to reduce the risk of their often very costly R&D and innovation activities (see Sovinsky et al. (2016)). This is also the reason why, after five years, a maximum of 8 out of 100 micro-enterprises entering the market will be able to have more than 10 employees, while 26–56% of them no longer exist. See: Kovács (2020a, 2020b). |

| 44 | A black swan is an event with a very low probability to happen but having a tremendous impact afterwards. |

| 45 | For more on the possible outlook of the M&As in the post-pandemic world, see: Kooli and Lock Son (2021). |

| 46 | As the OECD (2022) mentioned, some core European countries did suspend the obligation to file for bankruptcy for part of 2020 as a reaction to COVID-19 by allowing entrepreneurs and SMEs to defend their market existence despite the pandemic (i.e., insolvency started to decline along 2020 and 2021 as compared to 2019). |

| 47 | In Q4 2014, the average gross non-performing loans and advances in percentage of total gross loans and advances in the EU was 6.7%, while it was merely 2.3 by Q2 of 2021. See: ECB, CBD2.Q.B0.W0.11._Z._Z.A.F.I3632._Z._Z._Z._Z._Z._Z.PC. Still, a growing trend in corporate and household defaults has been out there as OECD (2021) documented. |

| 48 | See: https://home.kpmg/xx/en/blogs/home/posts/2020/07/payments-deals-soar-despite-covid-19.html (Accessed on 2 April 2022). |

| 49 | |

| 50 | According to The European Banking Federation, the total number of credit institutions continues to decline: since 2008, the number of credit institutions has fallen by one-third. Compared to 2019, the number of branches decreased by almost 8% as banks intensify the use of digital banking. Nevertheless, the number of branches of non-EU banks has increased by 20%. Meanwhile, employment in the sector is decreasing at a slower pace. The sector employed over 2.2 million people in the European Union by the end of 2020. See: https://www.ebf.eu/facts-and-figures-2021/ (Accessed on 2 April 2022). |

| 51 | The banking sector experienced an outstanding increase in ransomware attacks since that number increased by more than 1318% in the first half of 2021 compared to the same period of 2020. See: TrendMicro (2021). |

| 52 | Cybercriminals started to focus more on application programming interfaces (APIs). See: https://www.prnewswire.com/news-releases/akamai-security-research-apis-are-now-target-of-choice-for-cybercriminals-attacking-financial-services-organizations-301007128.html (Accessed on 2 April 2022). |

| 53 | Meaning that a victim is attacked (breached) in an almost completely unnoticed way via a compromised third-party vendor in their supply chain. European Union Agency for Cybersecurity (2021) reported that more than 66% of compromised suppliers either did not know or failed to recognise in time the fact of the breach. |

| 54 | |

| 55 | Of course, there are dissonant voices to it; see: Mian et al. (2021). |

| 56 | |

| 57 | See: Haddad and Lotfaliei (2019). Leverage, measured as debt-to-equity, has been on a decreasing trend. In the EU27, corporate debt increased from 97.7 per cent of GDP to 99.8% in the period 2009–2019, while EU27 corporate financial leverage fell significantly from 73.6% to 53.3% during the same period. |

| 58 | See: Kregel (2012). Let us mention that the aspect of becoming has not been addressed at all by mainstream economics, either. It refers to irreversible processes emerging as a result of far-from-equilibrium systems, such as the open, adaptive and complex socio-economic innovation ecosystem. See more: Kovács (2022a). |

| 59 | |

| 60 | For instance, as Joseph E. Gagnon, senior fellow at The Peterson Institute for International Economics, articulated that “[…] Some economists are concerned that these “zombie” firms will drain resources from the healthy parts of the US economy, slow the recovery, and inhibit productivity growth. These fears are fundamentally misguided. Zombies are a consequence of a weak economy, not a cause.” Available: https://www.piie.com/blogs/realtime-economic-issues-watch/whos-afraid-zombie-firms (Accessed on 2 April 2022). Meanwhile, for instance, Schivardi et al. (2020) argued that the correlation between healthy firm performance and zombies is a mechanical consequence of an increase in the fraction of zombies with no causal meaning. |

| 61 | Noisier in the sense that zombification makes it more difficult to make a decision without errors (e.g., misinformation leading to wrong decisions when choosing suppliers that are, in turn, zombies, etc.). For a comprehensive account of noise, see: Kahneman et al. (2021). |

| 62 | On the complex nature of being zombie see Banerjee and Hofmann (2021) showing that a non-negligible share of zombies may be able to exit from the zombie status, in the case of Germany, Bittner et al. (2021) offered an account. |

| 63 | Because of shared norms and the ruling narrative over how the socio-economic system works, which was presented confidently by respect-experts in a way as Kahneman et al. (2021) suggested, people tended to assume that such moderating period will continue in the near future. For more on how such economics narrative backfired by neglecting underlying phenomena resulting in noise, see Kovács (2022a). |

| 64 | More nuanced views over zombification can be seen in a generalised manner or in a country-specific way (Duval et al. 2020; Blattner et al. 2019; Storz et al. 2017; Schivardi et al. 2020; Acharya et al. 2019; Peek and Rosengren 2005). |

| 65 | For instance, large and small banks may judge creditworthiness differently. By the same token, rating agencies are more prone to assign positive ratings to larger banks—especially because those banks often ask them to provide securities rating businesses as well. See: Hau et al. (2012). |

| 66 | Bank health and insolvency regime play an important role in the process as Andrews and Petroulakis (2019) documented. |

| 67 | See the inverted U-shaped relationship between credit access and productivity growth by Aghion et al. (2018). |

| 68 | See: OECD (2017). Many European core countries did change and ease insolvency laws in coping with COVID-19; see: https://www.squirepattonboggs.com/-/media/files/insights/publications/2020/04/global-impact-of-covid19-on-insolvency-laws/global-impact-of-covid19-on-insolvency-laws.pdf (accessed on 2 April 2022). |

| 69 | See: Kovács (2022b). When pursuing inclusive growth entails zombification, see the pivotal case of China by Zhang et al. (2020). |

| 70 | As Storz et al. (2017) documented, weaker banks, primarily in the Mediterranean region, typically have business relations with more zombie firms, who in turn are more likely to be sub-optimally indebted, making the bank even weaker. |

| 71 | |

| 72 | A more interventionist state is likely to be associated witrh a higher share of zombie bank presence as it was the result of Calderon and Schaeck (2016). |

| 73 | Although the ECB (SSM) has increased banks’ loss-absorbing capacity (trying to incentivise banks not to delay their write-offs) by significantly easing their capital requirements, so far, it has not counteracted enough the zombification effects of these steps mentioned. |

| 74 | A fine insights is advocated by Goto and Wilbur (2019) namely that total elimination of zombie firms can be as problematic as letting them flourishing. |

| 75 | Competitive release happens in living systems such as the socio-economic innovation ecosystem. For instance, in cancer research, we know that when treatment-sensitive cells die en masse due to intensive chemotherapy, the resistant subpopulations, that were previously controlled begin to explode rapidly, and the end result will be much worse than without treatment. See, for instance, Seton-Rogers (2016). |

| 76 | As Eurostat data suggest on annual enterprise statistics by size class for special aggregates of activities (NACE Rev. 2), the number of large companies (employing 250 employees or more) has been increasing since 2011 across the EU27. Regulation on insolvency regime was changed in Greece, Italy and Spain in an effort to dampen the number of zombies since 2010, and the data imply that as certain zombies were taken out from the system, medium and even larger companies could dominate in a more conspicuous way. For example, the number of large companies in manufacturing in 2011 was as follows: Greece (120), Italy (1269), Spain (814) and EU27 (14,600); meanwhile, it rose by 2019: Greece (138), Italy (1431), Spain (981) and EU27 (15,800). It is all the more telling that the number of medium-sized enterprises has been dwindling (that number was 102,000 in the EU27 in 2011, while it declined to 100,000 by 2019). See: Eurostat (SBS_SC_SCA_R2). |

| 77 | As Brig. Gen. Gavin got the answer to his question “What’s the best way to take a bridge?” in the classical movie ‘A Bridge Too Far’, the best way is to take both ends at once. |

| 78 | Of course, applying Industry-4.0-related technologies is also of the essence in the financial system itself. See: Mehdiabadi et al. (2020). |

References

- Acharya, Viral V., Tim Eisert, Christian Eufinger, and Christian Hirsch. 2019. Whatever It Takes: The Real Effects of Unconventional Monetary Policy. The Review of Financial Studies 32: 3366–411. [Google Scholar] [CrossRef]

- Abad, Jorge, Marco D’Errico, Neill Killeend, Vera Luze, Tuomas Peltonen, Richard Portes, and Teresa Urbano. 2022. Mapping Exposures of EU Banks to the Global Shadow Banking System. Journal of Banking & Finance 134: 106168. [Google Scholar] [CrossRef]

- Aghion, Philippe, Antonin Bergeaud, Gilbert Cette, Rémy Lecat, and Héléne Maghin. 2018. The inverted-U Relationship between Credit Access and Productivity Growth. CEP Discussion Papers No. 1588. London: Centre for Economic Performance, LSE. [Google Scholar]

- Aichholzer, Georg, Wolfram Rhomberg, Niklas Gudowsky, Florian Saurwein, and Matthias Weber. 2015. Industry 4.0—Background Paper on the Pilot Project: ‘Industry 4.0: Foresight & Technological Assessment on the Social Dimension of the Next Industrial Revolution’. Institute of Technology Assessment, Austrian Institute of Technology. Project Report Nr.: ITA-AIT-1en. Available online: https://www.researchgate.net/publication/322340882_Industry_40_Background_Paper_on_the_pilot_project_’Industry_40_Foresight_Technology_Assessment_on_the_social_dimension_of_the_next_industrial_revolution’ (accessed on 2 April 2022).

- Andrews, Dan, and Filippos Petroulakis. 2019. Breaking the Shackles: Zombie Firms, Weak Banks and Depressed Restructuring in Europe. ECB Working Paper No. 2240. Frankfurt: ECB. [Google Scholar]

- Andrews, Dan, Chiara Criscuolo, and Peter N. Gal. 2016. The Best versus the Rest: The Global Productivity Slowdown, Divergence across Firms and the Role of Public Policy. OECD Productivity Working Papers No. 5. Paris: OECD Publishing. [Google Scholar]

- Atkinson, Anthony B. 2015. Inequality: What Can Be Done, 1st ed. Harvard: Harvard University Press, p. 400. [Google Scholar]

- Bachmann, Rüdiger, Steffen Elstner, and Eric R. Sims. 2013. Uncertainty and economic activity: Evidence from business survey data. American Economic Journal: Macroeconomics 5: 217–49. [Google Scholar] [CrossRef] [Green Version]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Baldassarre, Fabrizio, and Francesca Ricciardi. 2017. The Additive Manufacturing in the Industry 4.0 Era: The Case of an Italian FabLab. Journal of Emerging Trends in Marketing and Management 1: 105–15. [Google Scholar]

- Baldwin, Richard, and Beatrice Weder di Mauro. 2020a. Economics in the Time of COVID-19. Washington, DC: CEPR Press, pp. 31–36. [Google Scholar]

- Baldwin, Richard, and Beatrice Weder di Mauro. 2020b. Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes. Washington, DC: CEPR Press. [Google Scholar]

- Banerjee, Ryan, and Boris Hofmann. 2021. Corporate Zombies: Anatomy and Life Cycle. BIS Working Paper No. 882. Basel: BIS. [Google Scholar]

- Beck, Thorsten, Ross Levine, and Norman Loayza. 2000. Finance and the Sources of Growth. Journal of Financial Economics 58: 261–300. [Google Scholar] [CrossRef] [Green Version]

- Beck-Krala, Ewa, Elzbieta Tarczoń, and Tomasz Masłyk. 2017. Employee Satisfaction with Tangible and Intangible Rewards in Health Care Sector. Polish Journal of Management Studies 16: 17–27. [Google Scholar] [CrossRef]

- Birdsall, Nancy. 2016. Middle-class heroes: The best guarantee of good governance. Foreign Affairs 95: 25–32. [Google Scholar]

- Bittner, Christian, Falko Fecht, and Co-Pierre Georg. 2021. Contagious Zombies. SUERF Policy Brief No. 178. September. Available online: https://www.suerf.org/suer-policy-brief/32629/contagious-zombies (accessed on 2 April 2022).

- Blais, André, Ruth Dassonneville, and Filip Kostelka. 2020. Political Equality and Turnout. In The Oxford Handbook of Political Representation in Liberal Democracies. Edited by Robert Rohrschneider and Jacques Thomassen. Oxford: Oxford University Press, pp. 396–412. [Google Scholar] [CrossRef]

- Blattner, Laura, Luisa Farinha, and Francisca Rebelo. 2019. When Losses Turn Into Loans: The Cost of Undercapitalized Banks. ECB Working Paper No. 2228. Frankfurt: European Central Bank. [Google Scholar]

- Bofinger, Peter, Lisa Geißendörfer, Thomas Haas, and Fabian Mayer. 2021. Discovering the True Schumpeter—New Insights into the Finance and Growth Nexus. CEPR Discussion Paper No. 16851. London: CEPR. [Google Scholar]

- Caballero, Ricardo J., Takeo Hoshi, and Anil K. Kashyap. 2008. Zombie Lending and Depressed Restructuring in Japan. American Economic Review 98: 1943–77. [Google Scholar] [CrossRef] [Green Version]

- Calderon, Cesar, and Klaus Schaeck. 2016. The Effects of Government Interventions in the Financial Sector on Banking Competition and the Evolution of Zombie Banks. Cambridge: Cambridge University Press. [Google Scholar]

- Calì, Massimiliano, and Giorgio Presidente. 2022. Robots for Economic Development. Working Paper. Kiel, Hamburg: ZBW-Leibniz Information Centre for Economics. Available online: http://hdl.handle.net/10419/242497 (accessed on 2 April 2022).

- Cecchetti, Stephen G., and Enisse Kharroubi. 2015. Why Does Financial Sector Growth Crowd Out Real Economic Growth? BIS Working Papers No 490. Basel: Bank for International Settlements. [Google Scholar]

- Cella, Cristina. 2020. Zombie Firms in Sweden: Implications for the Real Economy and Financial Stability. Staff Memo, Sveriges Riksbank. Available online: https://www.riksbank.se/globalassets/media/rapporter/staff-memo/engelska/2020/zombie-firms-in-sweden_implications-for-the-real-economy-and-financial-stability.pdf (accessed on 2 April 2022). Staff Memo, Sveriges Riksbank.

- Cette, Gilbert, Jimmy Lopez, and Jacques Mairesse. 2016. Labour Market Regulations and Capital Intensity; NBER Working Papers, No. 22603. Cambridge, MA: NBER. Available online: https://www.nber.org/system/files/working_papers/w22603/w22603.pdf (accessed on 2 April 2022).

- Claessens, Stijn. 2009. The Financial Crisis and Financial Nationalism. In Effective Crisis Response and Openness: Implications for the Trading System. Edited by Simon J. Evenett, Bernard M. Hoekman and Olivia Cattaneo. Washington, DC: CEPR. [Google Scholar]

- Colantone, Italo, Gianmarco Ottaviano, and Piero Stanig. 2022. The Backlash of Globalization. CEPR Discussion Paper 16521. In Handbook of International Economics 5. Edited by Gita Gopinath, Elhanan Helpman and Kenneth S. Rogoff. Cambridge, MA: Elsevier, forthcoming. [Google Scholar]

- Davis, Leila E. 2018. Financialization and the Non-Financial Corporation: An Investigation of Firm-Level Investment Behavior in the United States. Metroeconomica 69: 270–307. [Google Scholar] [CrossRef] [Green Version]

- Deloitte. 2019. Success Personified in the Fourth Industrial Revolution. Deloitte Insights. Available online: https://www2.deloitte.com/content/dam/insights/us/articles/GLOB1948_Success-personified-4th-ind-rev/DI_Success-personified-fourth-industrial-revolution.pdf (accessed on 2 April 2022).

- Deloitte. 2020. Industry 4.0 Readiness Report. Industry 4.0: At the Intersection of Readiness and Responsibility Deloitte Global’s Annual Survey on Business’s Preparedness for a Connected Era. Deloitte. Available online: https://www2.deloitte.com/content/dam/Deloitte/za/Documents/about-deloitte/2020%20Industry%204.0%20Readiness%20Report%20-%20web%20version.pdf (accessed on 2 April 2022).

- de Pleijt, Alexandra, and Jacob L. Weisdorf. 2017. Human Capital Formation from Occupations: The ‘Deskilling Hypothesis’ Revisited. Cliometrica 11: 1–30. [Google Scholar] [CrossRef] [Green Version]

- Dosso, Mafini. 2020. Technological readiness in Europe: EU Policy Perspectives on Industry 4.0. In Industry 4.0 and Regional Transformations, 1st ed. Edited by Lisa De Propris and David Bailey. London: Routledge, p. 24. [Google Scholar]

- Duval, Romain, A., Gee Hee Hong, and Yannick Timmer. 2020. Financial Frictions and the Great Productivity Slowdown. Review of Financial Studies 33: 475–503. [Google Scholar] [CrossRef] [Green Version]

- European Banking Authority. 2015. Report on Institutions Exposures to Shadow Banking Entities. European Banking Authority. Available online: https://www.eba.europa.eu/sites/default/documents/files/documents/10180/950548/9cec3aa1-9205-4b97-8ec1-f0f26bf991b4/Report%20on%20institutions%20exposures%20to%20shadow%20banking%20entities.pdf?retry=1 (accessed on 2 April 2022).

- European Commission. 2021. Debt Sustainability Monitor 2020. Economic and Financial Affairs, Institutional Paper No. 143. Available online: https://ec.europa.eu/info/sites/default/files/economy-finance/ip143_en.pdf (accessed on 2 April 2022).

- European Fiscal Board. 2019. Assessment of EU Fiscal Rules. European Fiscal Board, September 11. Available online: https://ec.europa.eu/info/sites/default/files/2019-09-10-assessment-of-eu-fiscal-rules_en.pdf (accessed on 2 April 2022).

- European Parliament. 2021. Did the Pandemic Lead to Structural Changes in the Banking Sector? European Parliament, IPOL|Economic Governance Support Unit. Available online: https://www.europarl.europa.eu/RegData/etudes/IDAN/2021/689460/IPOL_IDA (accessed on 2 April 2022).

- European Union Agency for Cybersecurity. 2021. Understanding the Increase in Supply Chain Security Attacks. Report. Available online: https://www.enisa.europa.eu/news/enisa-news/understanding-the-increase-in-supply-chain-security-attacks (accessed on 2 April 2022).

- Fasianos, Apostolos, Diego Guevara, and Christos Pierros. 2018. Have we been here before? Phases of Financialization within the twentieth century in the US. Review of Keynesian Economics 6: 34–61. [Google Scholar] [CrossRef] [Green Version]

- Favara, Giovanni, Camelia Minoiu, and Ander U. S. Perez-Orive. 2021. FEDS Notes, Board of Governors of the Federal Reserve System. Available online: https://www.federalreserve.gov/econres/notes/feds-notes/us-zombie-firms-how-many-and-how-consequential-20210730.htm (accessed on 2 April 2022).

- Favara, Giovanni, and Jean Imbs. 2015. Credit supply and the price of housing. American Economic Review 105: 958–92. [Google Scholar] [CrossRef] [Green Version]

- Frank, Alejandro German, Glauco Henrique de Sousa Mendes, Néstor Fabián Ayala, and Antonio Ghezzi. 2019. Servitization and Industry 4.0 Convergence in the Digital Transformation of Product Firms: A Business Model Innovation Perspective. Technological Forecasting & Social Change 141: 341–51. [Google Scholar] [CrossRef]

- Gaspar, José-Miguel, and Massimo Massa. 2006. Idiosyncratic Volatility and Product Market Competition. The Journal of Business 79: 3125–52. [Google Scholar] [CrossRef]

- Gaspar, Vitor, and David Amaglobeli. 2019. Fiscal Rules. The European Money and Finance Forum, SUERF Policy Note, Issue No. 60. Available online: https://www.suerf.org/docx/f_096ffc299200f51751b08da6d865ae95_4731_suerf.pdf (accessed on 2 April 2022).

- Gerschenkron, Alexander. 1962. Economic Backwardness in Historical Perspective. Cambridge, MA: Belknap Press, p. 456. [Google Scholar]

- Goto, Yasuo, and Scott Wilbur. 2019. Unfinished Business: Zombie Firms Among SME in Japan’s Lost Decades. Japan and the World Economy 49: 105–12. [Google Scholar] [CrossRef]

- Gudmundsson, Björn Rúnar. 2015. Financialisation and Financial Crisis in Iceland. Working Paper No. 55. Berlin: Institute for International Political Economy Berlin. [Google Scholar]

- Haddad, Kamal, and Babak Lotfaliei. 2019. Trade-off Theory and Zero Leverage. Finance Research Letters 31: 165–70. [Google Scholar] [CrossRef]

- Hau, Harald, Sam Langfield, and David Marques-Ibanez. 2012. Bank Ratings—What Determines Their Quality? ECB Working Paper No. 1484. Frankfurt: ECB. [Google Scholar]

- Hizam-Hanafiah, Mohd, Mansoor Ahmed Soomro, and Nor Liza Abdullah. 2020. Industry 4.0 Readiness Models: A Systematic Literature Review of Model Dimensions. Information 11: 364. [Google Scholar] [CrossRef]

- Irvine, Paul J., and Jeffrey Pontiff. 2009. Idiosyncratic Return Volatility, Cash Flows, and Product Market Competition. Review of Financial Studies 22: 1149–77. [Google Scholar] [CrossRef]

- Kahneman, Daniel, Olivier Sibony, and Cass R. Sunstein. 2021. Noise: A Flaw in Human Judgement. New York: Little, Brown Spark, May 18, p. 464. [Google Scholar]

- Kang-Kook, Lee, and Siddique Md Abu Bakkar. 2021. Financialization and Income Inequality: An Empirical Analysis. The Japanese Political Economy 47: 121–45. [Google Scholar] [CrossRef]

- Komlos, John. 2019. Growth of Welfare and its Distribution in the U.S., 1979–2013. Journal of Income Distribution 28: 1–19. [Google Scholar] [CrossRef]

- Kooli, Chokri, and Melanie Lock Son. 2021. Impact of COVID-19 on Mergers, Acquisitions & Corporate Restructuring. Businesses 1: 102–14. [Google Scholar] [CrossRef]

- Kovács, Olivér. 2019. Big IFs in Productivity-Enhancing Industry 4.0. Social Sciences 8: 37. [Google Scholar] [CrossRef] [Green Version]

- Kovács, Olivér. 2020a. Gazellák az iparpolitika tükrében I. Közgazdasági Szemle 67: 54–87. [Google Scholar] [CrossRef]

- Kovács, Olivér. 2020b. Gazellák az iparpolitika tükrében II. Közgazdasági Szemle 67: 181–205. [Google Scholar] [CrossRef]

- Kovács, Olivér. 2022b. Complexity Economics. Economic Governance, Science and Policy. London and New York: Routledge, p. 432, forthcoming. [Google Scholar]

- Kovács, Olivér. 2022b. Inclusive Industry 4.0 in Europe—Japanese Lessons on Socially Responsible Industry 4.0. Social Sciences 11: 29. [Google Scholar] [CrossRef]

- Kregel, Jan. 2012. Financial Experimentation, Technological Paradigm Revolutions and Financial Crises. In Techno-Economic Paradigms. Essays in Honour of Carlota Perez. Edited by Wolfgang J. Drechsler, Rainer Kattel and Erik S. Reinert. Cambridge: Cambridge University Press, Chap. 12. pp. 203–20. [Google Scholar] [CrossRef]

- Krzywdzinski, Martin, Ulrich Jürgens, and Sabine Pfeiffer. 2016. The Fourth Revolution: The Transformation of Manufacturing Working the Age of Digitalization. WZB, Report. Available online: https://www.researchgate.net/publication/311575975_The_Fourth_Revolution_The_Transformation_of_Manufacturing_Work_in_the_Age_of_Digitalization (accessed on 2 April 2022).

- Kurz, Heinz D. 2017. Auf der Schwelle zur ’Vierten Industriellen Revolution’. Wirtschaftsdienst 97: 785–92. [Google Scholar] [CrossRef] [Green Version]

- Lapavitsas, Costas, and Jeff Powell. 2013. Financialisation Varied: A Comparative Analysis of Advanced Economies. Cambridge Journal of Regions, Economy and Society 6: 359–79. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-De-Silanes, and Andrei Shleifer. 1999. Corporate Ownership Around the World. The Journal of Finance 54: 471–517. [Google Scholar] [CrossRef]

- Levine, Ross. 2005. Finance and Growth: Theory and Evidence. In Handbook of Economic Growth. Edited by Philippe Aghion and Steven N. Durlauf. vol. 1A, Chap. 12. pp. 865–934. [Google Scholar]

- Levine, Ross. 2021. Finance, Growth, and Inequality. IMF Working Paper No. 21/164. Washington, DC: IMF. [Google Scholar]

- Machkour, Badr, and Ahmed Abriane. 2020. Industry 4.0 and its Implications for the Financial Sector. Procedia Computer Science 177: 496–502. [Google Scholar] [CrossRef]

- Martin, John P., and Stefano Scarpetta. 2012. Setting It Right: Employment Protection, Labour Reallocation and Productivity. De Economist 60: 89–116. [Google Scholar] [CrossRef] [Green Version]

- McGowan, Müge Adalet, Dan Andrews, and Valentine Millot. 2017. Insolvency Regimes, Zombie Firms And Capital Reallocation. OECD Economics Department Working Papers No. 1399. Paris: OECD Publishing. [Google Scholar]

- Mehdiabadi, Amir, Mariyeh Tabatabeinasab, Cristi Spulbar, Amir Karbassi Yazdi, and Ramona Birau. 2020. Are We Ready for the Challenge of Banks 4.0? Designing a Roadmap for Banking Systems in Industry 4.0. International Journal of Financial Studies 8: 32. [Google Scholar] [CrossRef]

- Mian, Atif, Ludwig Straub, and Amir Sufi. 2021. The Saving Glut of the Rich. Cambridge, MA: NBER Working Paper No. 26941. [Google Scholar] [CrossRef] [Green Version]

- Milanovic, Branco. 2019. Capitalism, Alone. The Future of the System That Rules the World. Cambridge and London: Belknap Press, Harvard University Press, p. 287. [Google Scholar]

- Minsky, Hyman P. 1982. Central Banking and Money Market Changes. Reprinted in Can ‘It’ Happen Again? Armonk and New York: Sharpe. [Google Scholar] [CrossRef]

- Minsky, Hyman P. 1986. Stabilizing an Unstable Economy. New Haven: Yale University Press, p. 372. [Google Scholar]

- Minsky, Hyman P. 2008. Securitization. Handout Econ 335A. Fall 1987. Reprinted as Levy Economics Institute Policy Note No. 2. Available online: https://digitalcommons.bard.edu/hm_archive/15/ (accessed on 2 April 2022).

- Nota, Giancarlo, Francesco Davit Nota, Domenico Peluso, and Alonso Toro Lazo. 2020. Energy Efficiency in Industry 4.0: The Case of Batch Production Processes. Sustainability 12: 6631. [Google Scholar] [CrossRef]

- OECD. 2004. OECD Employment Outlook 2004. Employment Protection Regulation and Labour Market Performance. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- OECD. 2017. Insolvency Regimes, Zombie Firms and Capital Reallocation. Economics Department Working Papers No. 1399. Paris: OECD Publishing. [Google Scholar]

- OECD. 2021. The COVID-19 Crisis and Banking System Resilience. Simulation of Losses on Non-performing Loans and Policy Implications; Paris: OECD Publishing. Available online: https://www.oecd.org/daf/fin/financial-markets/COVID-19-crisis-and-banking-system-resilience.pdf (accessed on 2 April 2022).

- OECD. 2022. Global Economy. Bankruptcy Rates Fall During COVID-19; Paris: OECD. Available online: https://www.oecd.org/coronavirus/en/data-insights/bankruptcy-rates-fall-during-covid-19 (accessed on 2 April 2022).

- Orhangazi, Özgür. 2008. Financialisation and Capital Accumulation in the Non-financial Corporate Sector. A Theoretical and Empirical Investigation on the US Economy: 1973–2003. Cambridge Journal of Economics 32: 863–86. [Google Scholar] [CrossRef] [Green Version]

- Palley, Thomas I. 2013. Financialization. The Economics of Finance Capital Dominance. London: Palgrave, Macmillan, p. 234. [Google Scholar]

- Paz-Pardo, Gonzalo. 2021. Homeownership and Portfolio Choice over the Generations. European Central Bank. ECB Working Paper Series No. 2522. Frankfurt: ECB. [Google Scholar]

- Peek, Joe, and Eric S. Rosengren. 2005. Unnatural Selection: Perverse Incentives and the Misallocation of Credit in Japan. American Economic Review 95: 1144–66. [Google Scholar] [CrossRef] [Green Version]

- Perez, Carlota. 2003. Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. Cheltenham: Edward Elgar Pub, p. 224. [Google Scholar]

- Perez, Carlota. 2009. Technological Revolutions and Techno-economic Paradigms. The Other Canon Foundation and Tallinn University of Technology Working Papers in Technology Governance and Economic Dynamics 20. Tallinn: TUT Ragnar Nurkse Department of Innovation and Governance. [Google Scholar]

- Piggin, Richard. 2016. Risk in the Fourth Industrial Revolution. ITNOW. Oxford: Oxford University Press, vol. 58, pp. 34–35. [Google Scholar]

- Piketty, Thomas. 2017. Capital in the Twenty-First Century, Reprint ed. Cambridge, MA: The Belknap Press of Harvard University Press, p. 816. [Google Scholar]

- Putnam, Robert D., and Shaylyn Romney Garrett. 2020. The Upswing: How America Came Together a Century Ago and How We Can Do It Again. New York: Simon & Schuster, p. 480. [Google Scholar]

- Rajan, Raghuram G. 2005. Has Financial Development Made the World Riskier? In Proceedings—Economic Policy Symposium—Jackson Hole. Kansas: Federal Reserve Bank of Kansas City, pp. 313–69. [Google Scholar]

- Raza, Hamid, Bjorn Gudmundsson, Gylfi Zoega, and Stephen Kinsella. 2016. Two thorns of experience: Financialisation in Iceland and Ireland. International Review of Applied Economics 30: 1–19. [Google Scholar] [CrossRef]

- Robak, Elżbieta. 2017. Expectations of Generation Y Connected with Shaping the Work-life Balance. The Case of Poland. Oeconomia Copernicana 8: 569–84. [Google Scholar] [CrossRef] [Green Version]

- Sajo, Andras, Renáta Uitz, and Stephen Holmes, eds. 2021. Routledge Handbook of Illiberalism. London and New York: Routledge, p. 1024. [Google Scholar]

- Sawyer, Malcolm. 2017. The Processes of Financialisation and Economic Performance. Economic and Political Studies 5: 5–20. [Google Scholar] [CrossRef]

- Schivardi, Fabiano, Enrico Sette, and Guido Tabellini. 2020. Identifying the Real Effects of Zombie Lending. The Review of Corporate Finance Studies 9: 569–92. [Google Scholar] [CrossRef]

- Seton-Rogers, Sarah. 2016. Preventing competitive release. Nature Reviews Cancer 16: 199. [Google Scholar] [CrossRef] [PubMed]

- Sharma, Priya. 2019. Digital Revolution of Education 4.0. International Journal of Engineering and Advanced Technology 9: 3558–64. [Google Scholar] [CrossRef]

- Soener, Matthew. 2021. Did the ‘Real’ Economy Turn Financial? Mapping the Contours of Financialisation in the Non-Financial Corporate Sector. New Political Economy 26: 817–31. [Google Scholar] [CrossRef]

- Sovinsky, Michelle, Alon Elzenberg, and Andras Pechy. 2016. Technology Adoption, Vertical Restraints and Partial Foreclosure: Changing the Structure of an Industry. In Annual Conference, Augsburg. Demographic Change, No. 145680. Frankfurt: Verein für Socialpolitik/German Economic Association. [Google Scholar]

- Stockhammer, Engelbert. 2012. Financialization, Income Distribution and the Crisis. Investigación Económica 71: 39–70. [Google Scholar] [CrossRef]

- Storz, Manuela, Michael Koetter, Ralph Setzer, and Andreas Westphal. 2017. Do We Want These Two to Tango? On Zombie Firms and Stressed Banks in Europe. ECB Working Paper No. 2104. Frankfurt: ECB. [Google Scholar]

- Tankersley, Jim. 2020. The Riches of This Land. New York: PublicAffairs, p. 320. [Google Scholar]

- 2014. Secular Stagnation: Facts, Causes and Cures. VoxEU, CEPR eBook. Available online: https://voxeu.org/system/files/epublication/Vox_secular_stagnation.pdf (accessed on 2 April 2022).

- TrendMicro. 2021. Attacks from All Angles: 2021 Midyear Security Roundup. TrendMicro. Available online: https://newsroom.trendmicro.com/2021-09-14-Attacks-Surge-in-1H-2021-as-Trend-Micro-Blocks-41-Billion-Cyber-Threats (accessed on 2 April 2022).

- Vague, Richard. 2021. Rapid Money Supply Growth Does Not Cause Inflation. Institute for New Economic Thinking, Article, Macroeconomics. 2 December 2016. Available online: https://www.ineteconomics.org/perspectives/blog/rapid-money-supply-growth-does-not-cause-inflation (accessed on 2 April 2022).

- Vaidya, Saurabh, Prashant Ambad, and Santosh Bhosle. 2018. Industry 4.0—A Glimpse. Procedia Manufacturing 20: 233–38. [Google Scholar] [CrossRef]

- Vuong, Quan-Hoang. 2018. The (ir)rational consideration of the cost of science in transition economies. Nature Human Behavior 2: 5. [Google Scholar] [CrossRef]

- Vuong, Quan-Hoang. 2021. The Semiconducting Principle of Monetary and Environmental Values Exchange. Economics and Business Letters 10: 284–90. [Google Scholar] [CrossRef]

- World Economic Forum. 2018. The Next Economic Growth Engine. Scaling Fourth Industrial Revolution Technologies in Production. World Economic Forum, McKinsey & Company, White Paper. Available online: https://www.weforum.org/whitepapers/the-next-economic-growth-engine-scaling-fourth-industrial-revolution-technologies-in-production (accessed on 2 April 2022).

- Wray, L. Randall. 2018. Why Minsky Matters. An Introduction to the Work of a Maverick Economist. Princeton: Princeton University Press, p. 288. [Google Scholar] [CrossRef]

- Zambion, Ilaria, Massimo Cecchini, Gianluca Egidi, Maria Grazia Saporito, and Andrea Colantoni. 2019. Revolution 4.0: Industry vs. Agriculture in a Future Development for SMEs. Processes 7: 36. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Chenyan, Yongqiao Chen, and Huiyu Zhou. 2020. Zombie Firms and Soft Budget Constraints in the Chinese Stock Market. Asian Economic Journal 34: 51–77. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kovács, O. Zombification and Industry 4.0—Directional Financialisation against Doomed Industrial Revolution. Soc. Sci. 2022, 11, 218. https://doi.org/10.3390/socsci11050218

Kovács O. Zombification and Industry 4.0—Directional Financialisation against Doomed Industrial Revolution. Social Sciences. 2022; 11(5):218. https://doi.org/10.3390/socsci11050218

Chicago/Turabian StyleKovács, Olivér. 2022. "Zombification and Industry 4.0—Directional Financialisation against Doomed Industrial Revolution" Social Sciences 11, no. 5: 218. https://doi.org/10.3390/socsci11050218

APA StyleKovács, O. (2022). Zombification and Industry 4.0—Directional Financialisation against Doomed Industrial Revolution. Social Sciences, 11(5), 218. https://doi.org/10.3390/socsci11050218