Comparison of the World’s Best Pension Systems: The Lesson for Indonesia

Abstract

1. Introduction

2. Literature Review

2.1. Defined Benefit Pension System

2.2. Defined Contribution Pension System

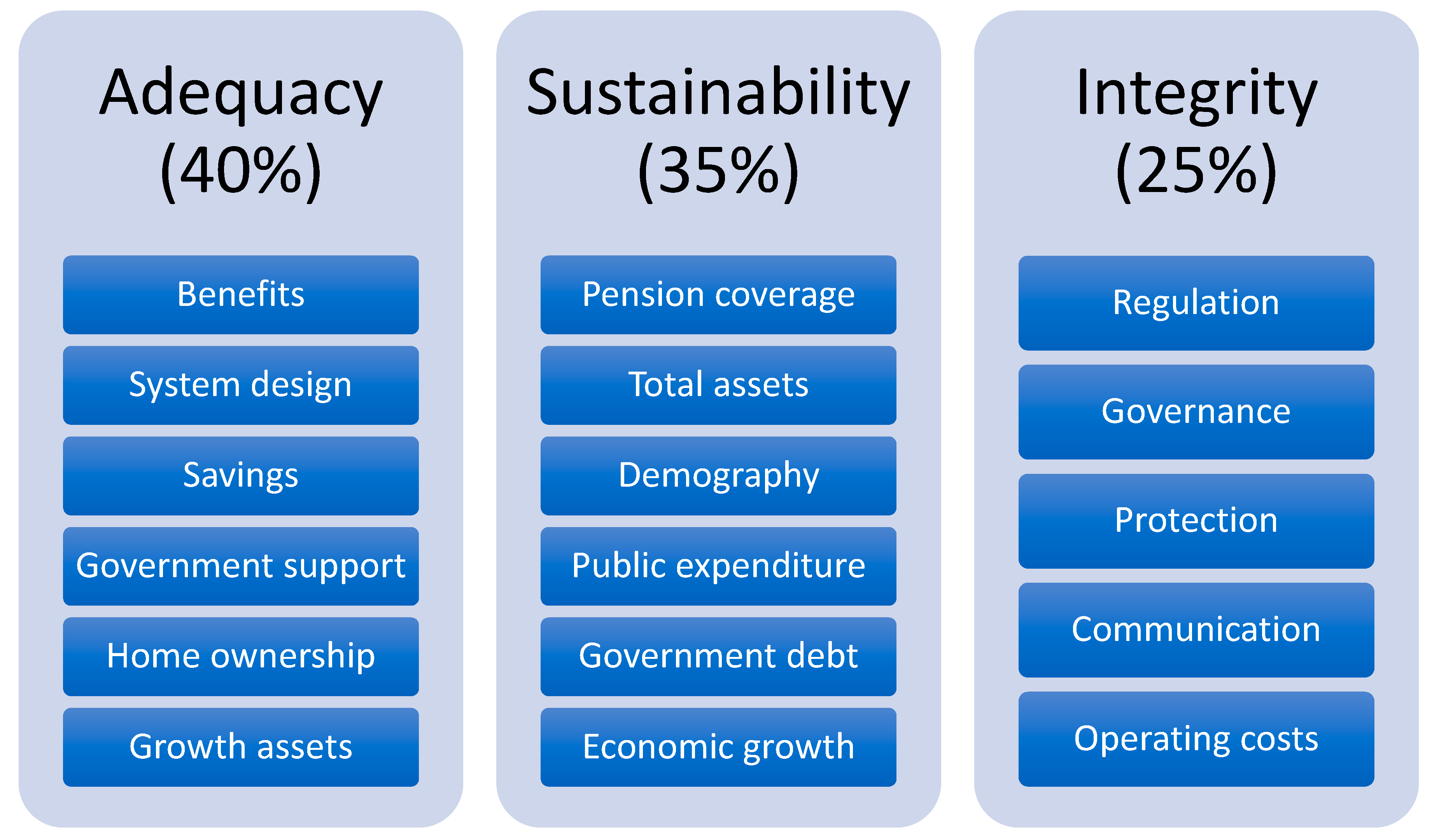

2.3. Adequacy and Sustainability of Pension System

2.4. Automatic Adjustment Mechanism

2.5. Automatic Balance Management

3. Comparison of Iceland, The Netherlands, and Indonesia Pension Systems

3.1. Structure of Pension Systems

3.2. Adequacy and Sustainability of Pension System

3.2.1. Benefits

3.2.2. Poverty Rate of Pensioners

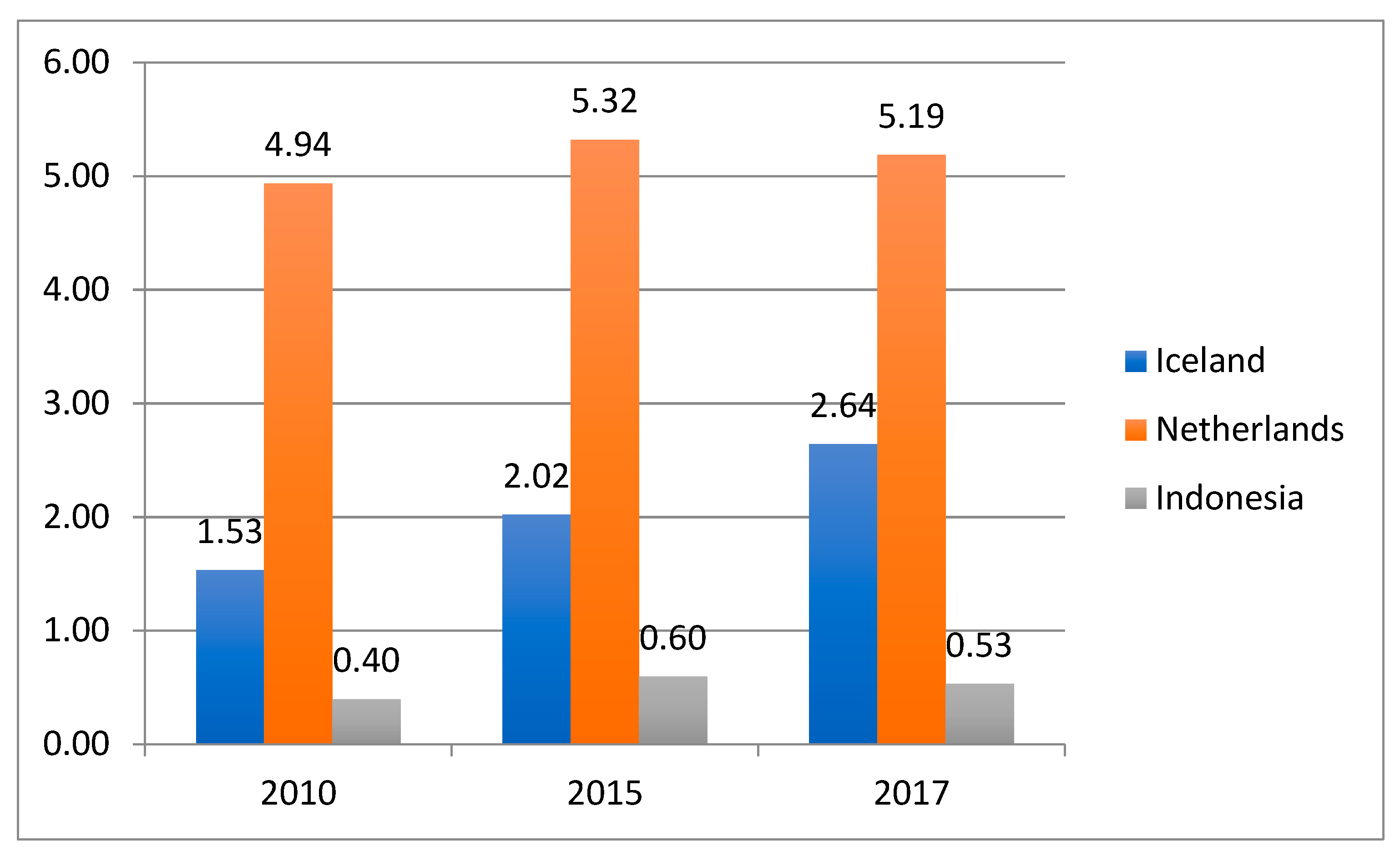

3.2.3. Pension Assets

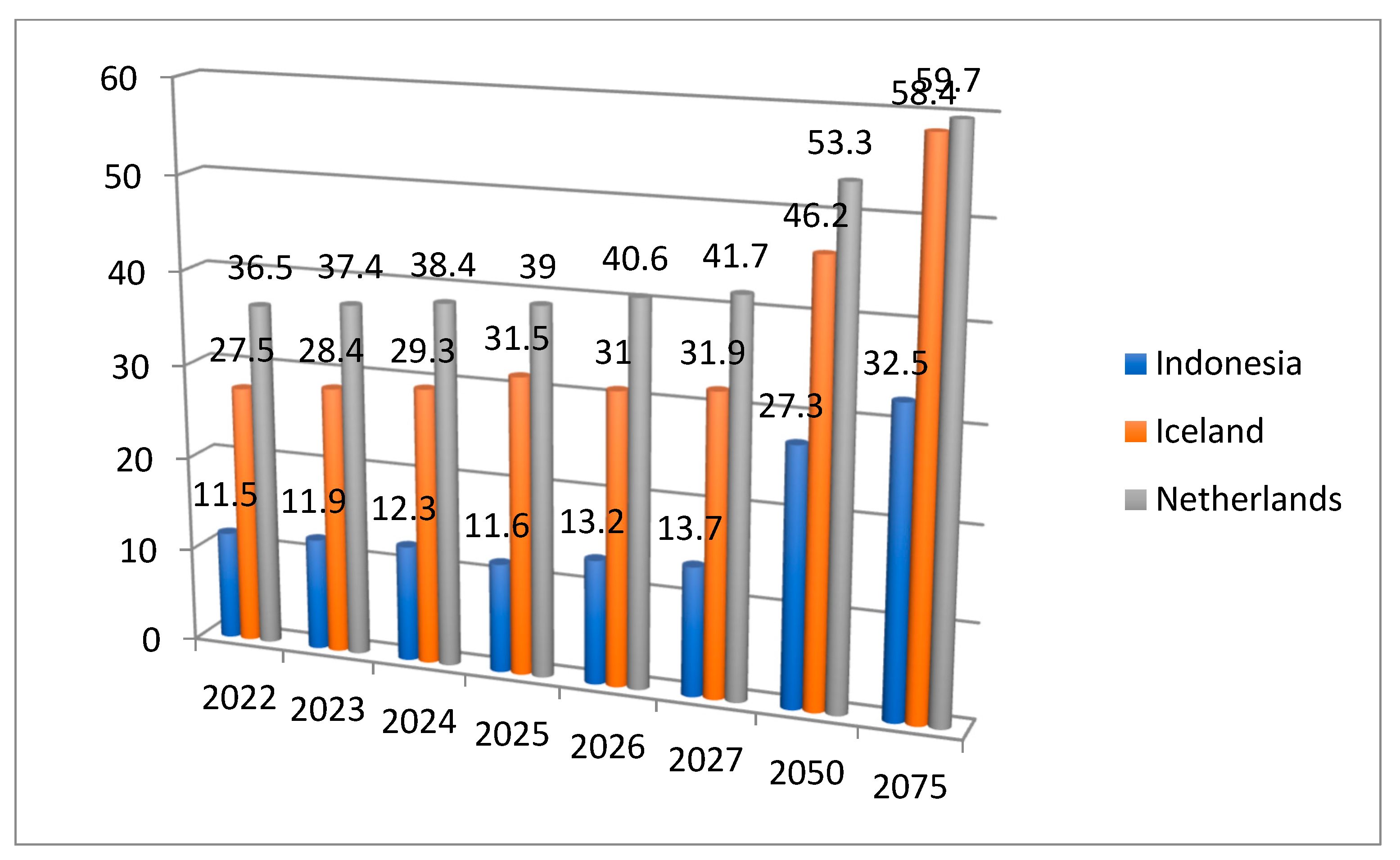

3.2.4. Demography

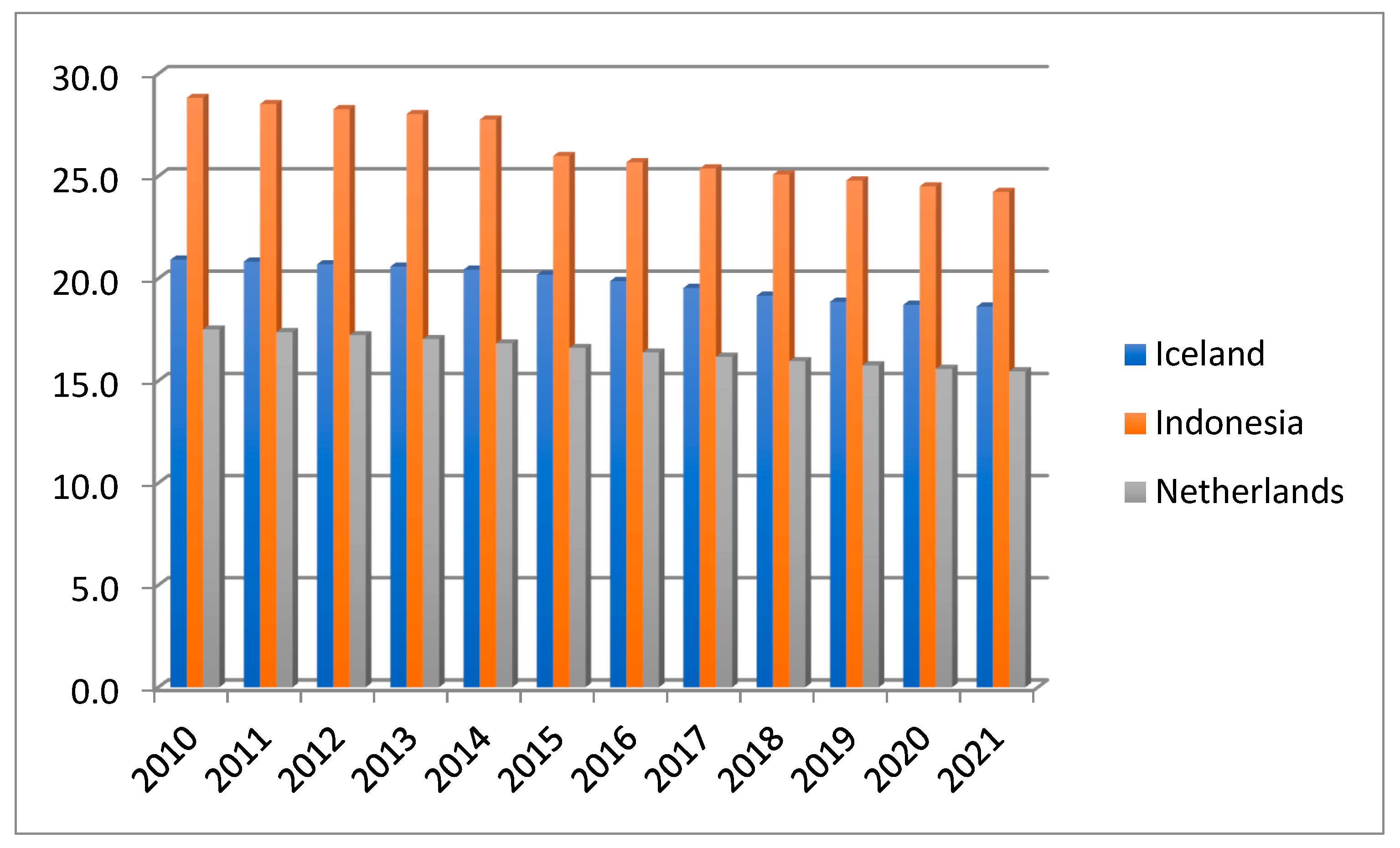

3.2.5. Old-Age Dependency Ratio

3.2.6. Public Pension Expenditure

4. Future Challenge of Adequacy and Sustainability of Pension System in Iceland and The Netherlands

5. Future Direction of Indonesia Pension System (The Lesson Learned from Iceland and The Netherlands to Indonesia)

5.1. The Mandatory Public Pension System

5.2. The Civil Service Pension System

5.2.1. Strengthening the Current PAYG and DB System

5.2.2. Increasing Pension Eligibility Age

5.2.3. Increasing Contribution Rates

5.2.4. Implementing Cost of Living Adjustments

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ádám, Zoltán, and András Simonovits. 2019. From Democratic to Authoritarian Populism: Comparing Pre-and Post-2010 Hungarian Pension Policies. Acta Oeconomica 69: 333–55. [Google Scholar] [CrossRef]

- Ananta, Aris, Ahmad Irsan, A. Moeis, Hendro TryWidianto, Heri Yulianto, and Evi Nurvidya Arifin. 2021. Pension and Active Ageing: Lessons Learned from Civil Servants in Indonesia. Social Sciences 10: 436. [Google Scholar] [CrossRef]

- Barr, Nicholas. 2000. Reforming Pensions: Myths, Truths, and Policy Choices. IMF Working Paper: WP/00/139. Washington, DC: IMF. [Google Scholar]

- Barr, Nicholas, and Peter Diamond. 2006. The Economics of Pensions. Oxford Review of Economic Policy 22: 15–39. [Google Scholar] [CrossRef]

- Central Statistics Agency. 2021. Statistik Penduduk Lanjut Usia 2021; Jakarta: Central Statistics Agency.

- Clemens, Jason, and Sasha Parvani. 2017. The Age of Eligibility for Public Retirement Programs in the OECD. Montreal: Fraser Research Bulletin. [Google Scholar]

- Dekkers, Gijs J. M. 1998. The Pension Income of the Elderly: A Comparison between Belgium and the Netherlands. LIS Working Paper Series, No. 186. Luxembourg: Luxembourg Income Study (LIS). [Google Scholar]

- European Commission. 2017. European Semester Thematic Factsheet: Adequacy and Sustainability of Pension. Brussels: European Commission. [Google Scholar]

- European Commission. 2021. Iceland Population: Demographic Situation, Languages and Religions. Available online: https://eacea.ec.europa.eu/national-policies/eurydice/content/population-demographic-situation-languages-and-religions-36_en (accessed on 3 June 2022).

- Fouejieu, Armand, Alvar Kangur, Samuel Romero Martinez, and Mauricio Soto. 2021. Pension Reforms in Europe: How Far Have We Come and Gone? Washington, DC: International Monetary Fund. [Google Scholar]

- Gannon, Frédéric, Florence Legros, and Vincent Touzé. 2015. Automatic Adjustment Mechanisms and Budget Balancing of Pension Schemes. OFCE Working Paper, 2014-24. Paris: OFCE. [Google Scholar]

- Guardiancich, Igor, R. Kent Weaver, Gustavo Demarco, and Mark C. Dorfman. 2019. The Politics of NDC Pension Scheme Diffusion: Constraints and Drivers. Social Protection & Jobs Discussion Papers, No. 1927. Washington, DC: World Bank. [Google Scholar]

- Hallmark, Bill. 2016. When Is Solvency Important, and How Can Plan Sponsors Adjust over Time to Maintain Sustainability? Contingencies (September/October 2016). p. 39. Available online: http://contingencies.org/wp-content/uploads/2017/06/Contingencies20160910.pdf (accessed on 27 February 2022).

- Karam, Philippe, Dirk Muir, Joana Pereira, and Anita Tuladhar. 2010. Macroeconomic Effects of Public Pension Reforms. IMF Working Paper. Washington, DC: IMF. [Google Scholar]

- Mercer CFA Institute. 2021. Mercer CFA Institute Global Pension Index 2021. Pension Reform in Challenging Times. Melbourne: Mercer CFA Institute. Available online: www.mercer.com/globalpensionindex (accessed on 10 August 2022).

- OECD. 2007. Pension Reforms and Private Pensions, in Pensions at a Glance 2007: Public Policies across OECD Countries. Paris: OECD Publishing, Paris. [Google Scholar]

- OECD. 2021a. Pensions at a Glance 2021: OECD and G20 Indicators. Paris: OECD Publishing. [Google Scholar]

- OECD. 2021b. Pensions at a Glance 2021: Country Profiles–Iceland. Paris: OECD Publishing. [Google Scholar]

- OECD. 2021c. Pensions at a Glance 2021: Country Profiles–Netherlands. Paris: OECD Publishing. [Google Scholar]

- OECD. 2021d. Pension Funds in Figures. Paris: OECD Publishing. [Google Scholar]

- OECD. 2022. OECD Labour Force Statistics 2021. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Ofori-Abebrese, Grace, Robert Becker Pickson, and Sherifatu Abubakari. 2017. Assessing The Impact of Macroeconomic Variables on Pension Benefits in Ghana: A Case of Social Security and National Insurance Trust. South African Journal of Economic and Management Sciences 20: 1–10. [Google Scholar] [CrossRef]

- Ólafsson, Stefán. 2017. ESPN Thematic Report: Assessment of Pension Adequacy in Iceland. Brussels: European Commission. [Google Scholar]

- PT Asabri. 2018. Integrated Annual Report of 2018. Jakarta: PT Asabri. [Google Scholar]

- PT Taspen. 2018. Annual Report of 2018. Jakarta: PT Taspen. [Google Scholar]

- The World Bank Pension Conceptual Framework. 2008. World Bank Pension Reform Primer Series Number 45728. Washington, DC: World Bank. [Google Scholar]

- The World Bank. 2022. Old-Age Dependency Ratio (% of Working-Age Population). Available online: https://data.worldbank.org/indicator/SP.POP.DPND (accessed on 13 September 2022).

- Westerhout, Ed, Eduard Ponds, and Peter Zwaneveld. 2021. Completing Dutch Pension Reform. CPB Background Document. Den Haag: CPB Netherlands Bureau for Economic Policy Analysis. Available online: https://www.cpb.nl/sites/default/files/omnidownload/CPB-Background-Document-Completing-Dutch-pension-reform.pdf (accessed on 22 February 2022).

- Whitehouse, Edward. 2014. Earnings Related Schemes: Design, Options and Experience. Washington, DC: World Bank Core Course. [Google Scholar]

- Widjaja, Muliadi, and Robert A. Simanjuntak. 2010. Social Protection in Indonesia: How Far Have We Reached? In Social Protection in East Asia—Current State and Challenges. Edited by Mukul G. Asher, Sothea Oum and Friska Parulian. ERIA Research Project Report 2009-9. Jakarta: ERIA, pp. 157–81. [Google Scholar]

| Indicators | Iceland | The Netherlands | Indonesia |

|---|---|---|---|

| Ranking | 1 | 2 | 35 |

| Adequacy Sub-Index | 82.7 (1st) | 82.3 (2nd) | 44.7 (37th) |

| Sustainability Sub-Index | 84.6 (1st) | 81.6 (3rd) | 43.6 (30th) |

| Integrity Sub-Index | 86.0 (7th) | 87.9 (3rd) | 69.2 (29th) |

| Compare to 2020 index | The index for 2021 is 84.2. | The index increased from 82.6 in 2020 to 83.5 in 2021. | The index decreased from 51.4 in 2020 to 50.4 in 2021. |

| Country | Zero Pillar | First Pillar | Second Pillar | Third Pillar |

|---|---|---|---|---|

| Iceland | X | PAYG and DB- income-tested benefits | DC | DC |

| The Netherlands | X | PAYG and DB | DC | DC |

| Indonesia | X | X |

| DC |

| Country | Pension Age | Benefit | Contribution |

|---|---|---|---|

| Iceland |

|

|

|

| The Netherlands |

|

| The AOW: 18%. The mandatory occupational pension system: varies depending on the employee’s age and income level. |

| Indonesia (Civil Service Pension System) | 58 years, 60 years, or 65 years based on the job position. |

| Civil servants: 4.75%; The Indonesian government does not contribute monthly |

| Indonesia (Civil Service Old-Age Savings System) | Participants: civil servants. Their membership ends when pension ends, dies, or they resign | The benefits include Dwiguna insurance and Life insurance | Civil servants: 3.25% of their monthly salary to their private savings accounts |

| Iceland | The Netherlands | Indonesia | |

|---|---|---|---|

| Basic benefit | ISK 3,081,468 (EUR 21,860) per year (EUR 1821/month) | EUR 1302.28/month for singles and EUR 1770.76/month for couples |

|

| Average income of active workers (per year) | ISK 9,250,000 (EUR 65,619 or USD 68,284) | EUR 54,843 (USD 62,641) | IDR 28,774,200 (USD 1973) |

| Benefit/Average income | 33% | Single: 28.49% Couple: 38.74% | Minimum: 5.42% * Maximum: 15.37% ** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hadi, A.; Bruder, E.; Setioningtyas, W.P. Comparison of the World’s Best Pension Systems: The Lesson for Indonesia. Soc. Sci. 2022, 11, 435. https://doi.org/10.3390/socsci11100435

Hadi A, Bruder E, Setioningtyas WP. Comparison of the World’s Best Pension Systems: The Lesson for Indonesia. Social Sciences. 2022; 11(10):435. https://doi.org/10.3390/socsci11100435

Chicago/Turabian StyleHadi, Abdul, Emese Bruder, and Widhayani Puri Setioningtyas. 2022. "Comparison of the World’s Best Pension Systems: The Lesson for Indonesia" Social Sciences 11, no. 10: 435. https://doi.org/10.3390/socsci11100435

APA StyleHadi, A., Bruder, E., & Setioningtyas, W. P. (2022). Comparison of the World’s Best Pension Systems: The Lesson for Indonesia. Social Sciences, 11(10), 435. https://doi.org/10.3390/socsci11100435