The Two-Way Impact Between Economic Policy Uncertainty and Housing Prices in China: Sub-Sample Time-Varying Causality Analysis

Abstract

1. Introduction

2. Literature Review

3. General Equilibrium Model

4. Methodology

4.1. Bootstrap Full-Sample Technique

4.2. Parameter Stability Test

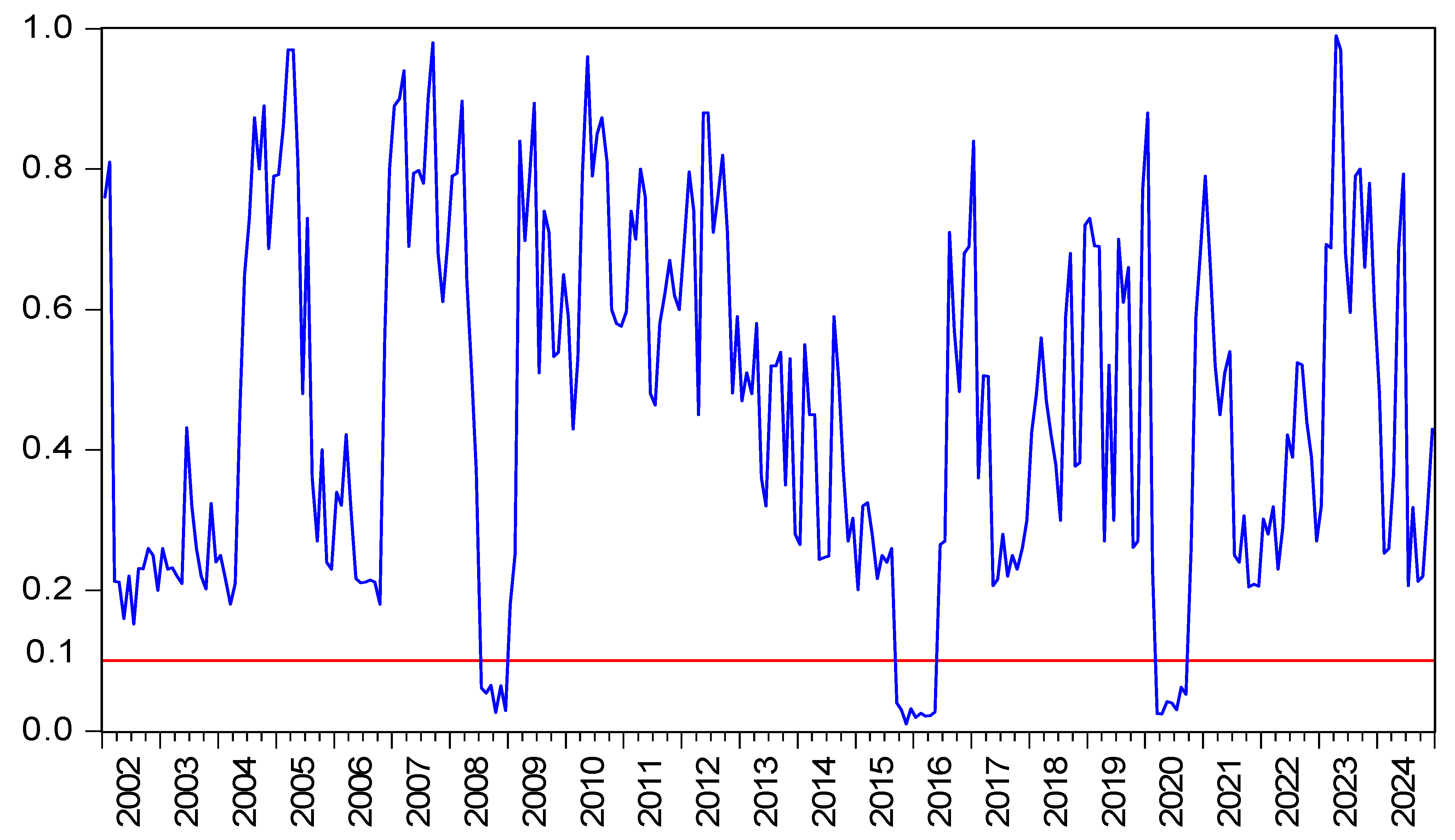

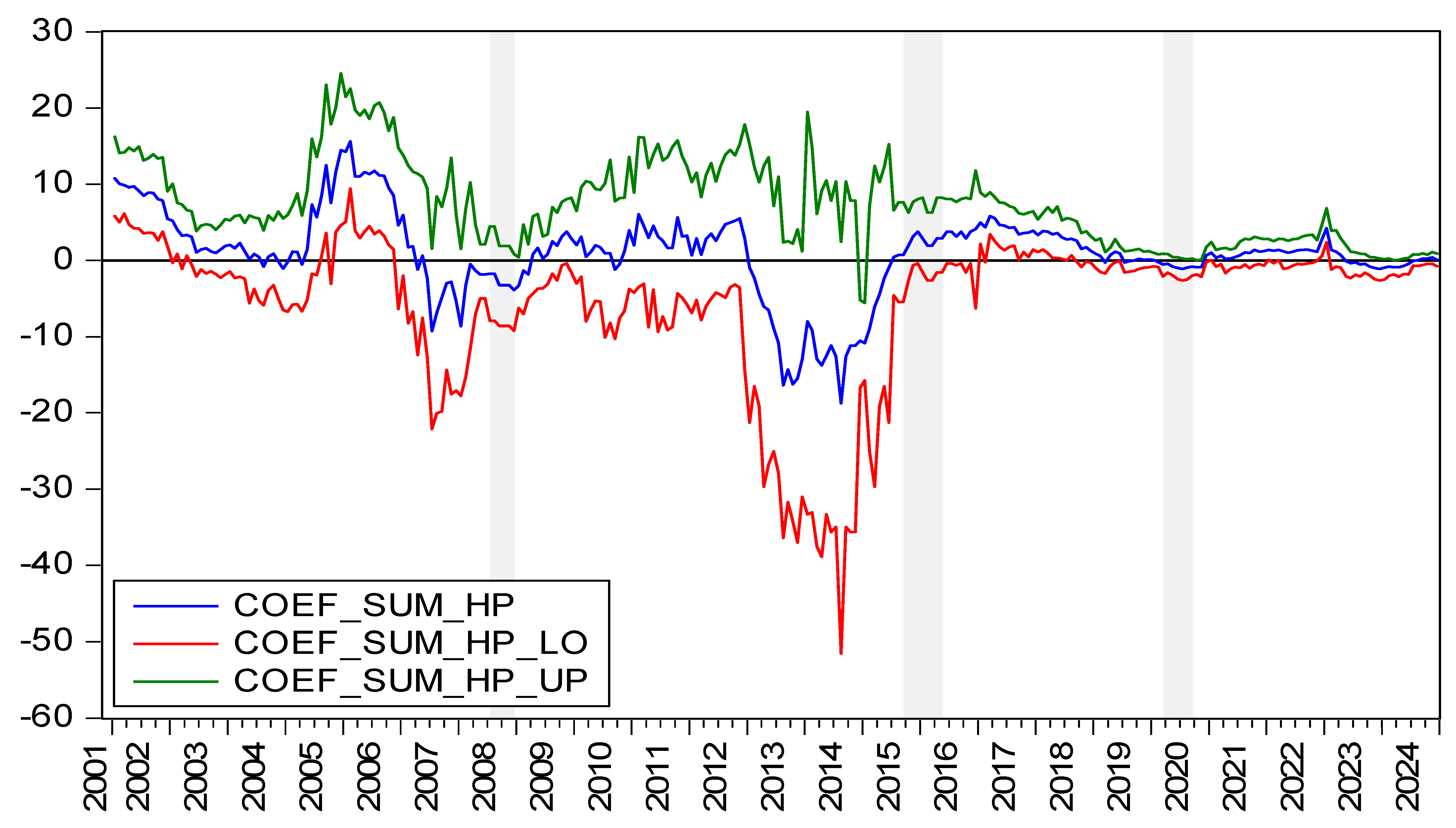

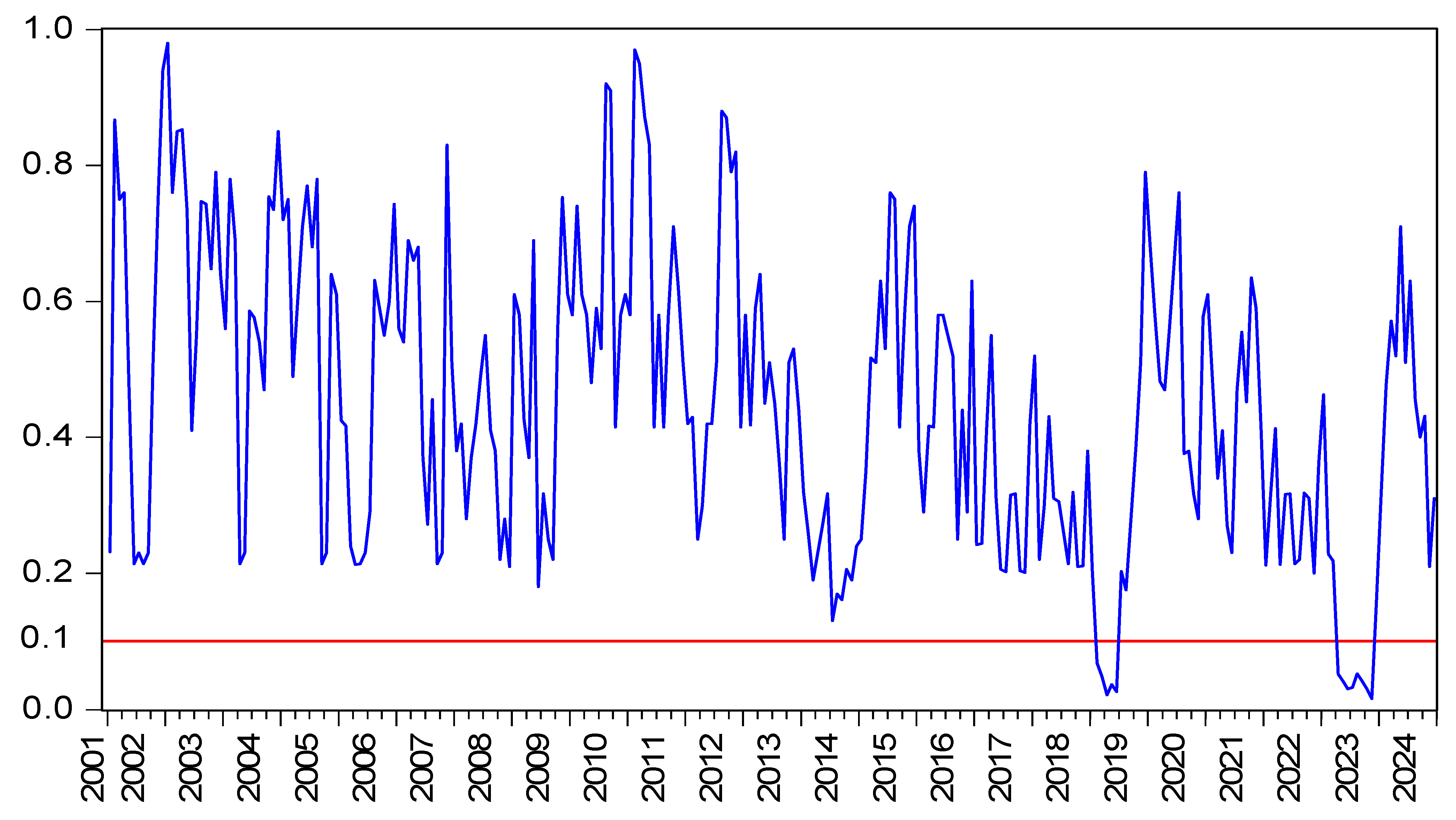

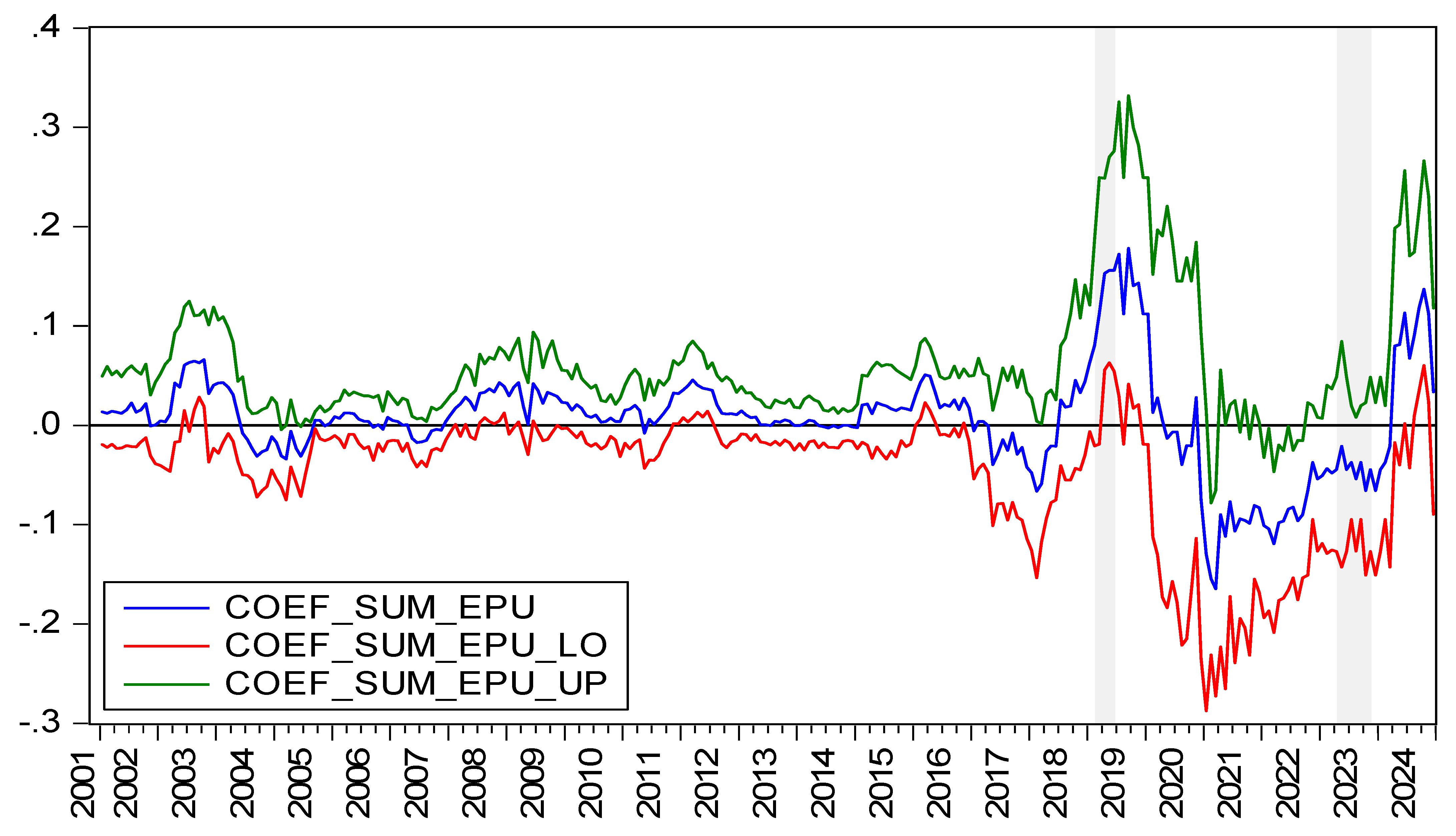

4.3. Bootstrap Sub-Sample Rolling-Window Causality Test

5. Data Source and Descriptive Analysis

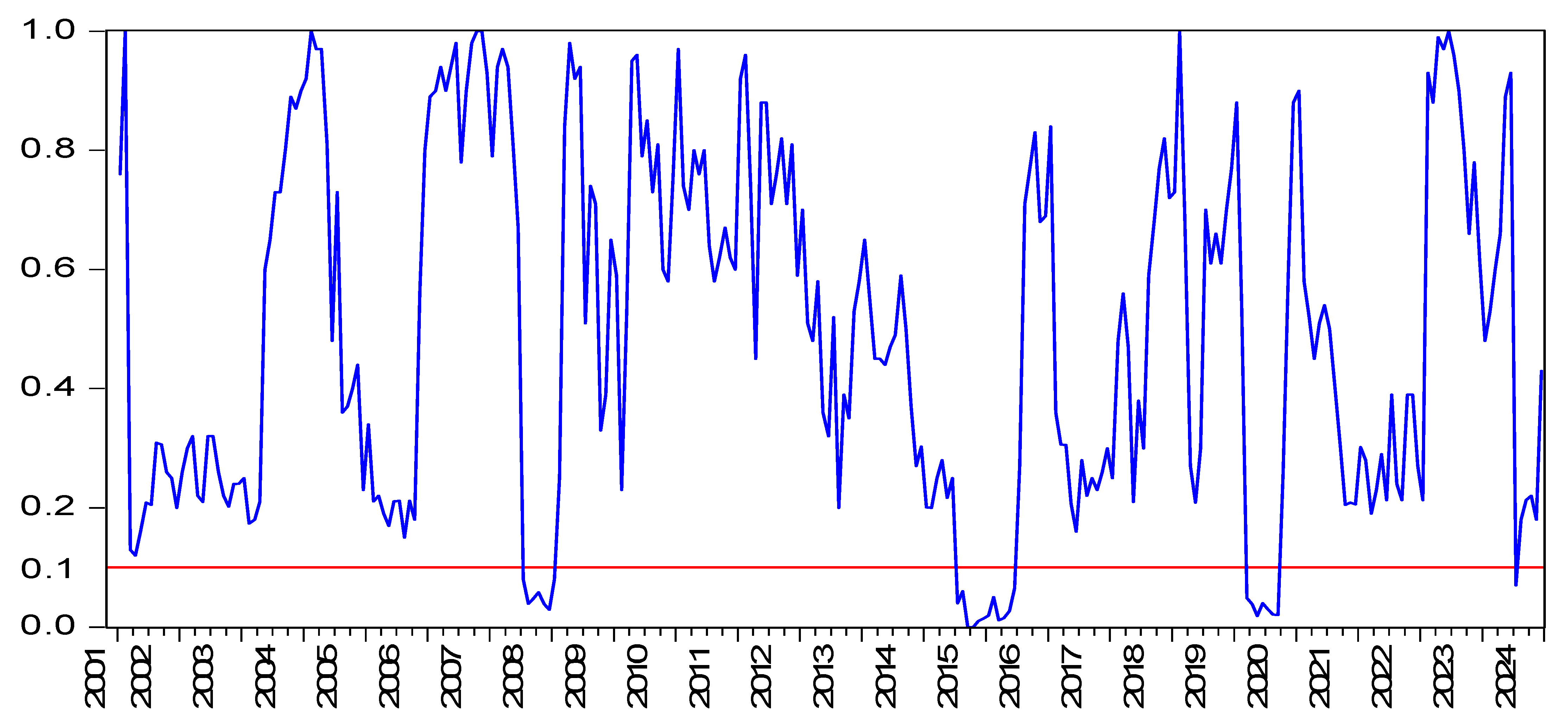

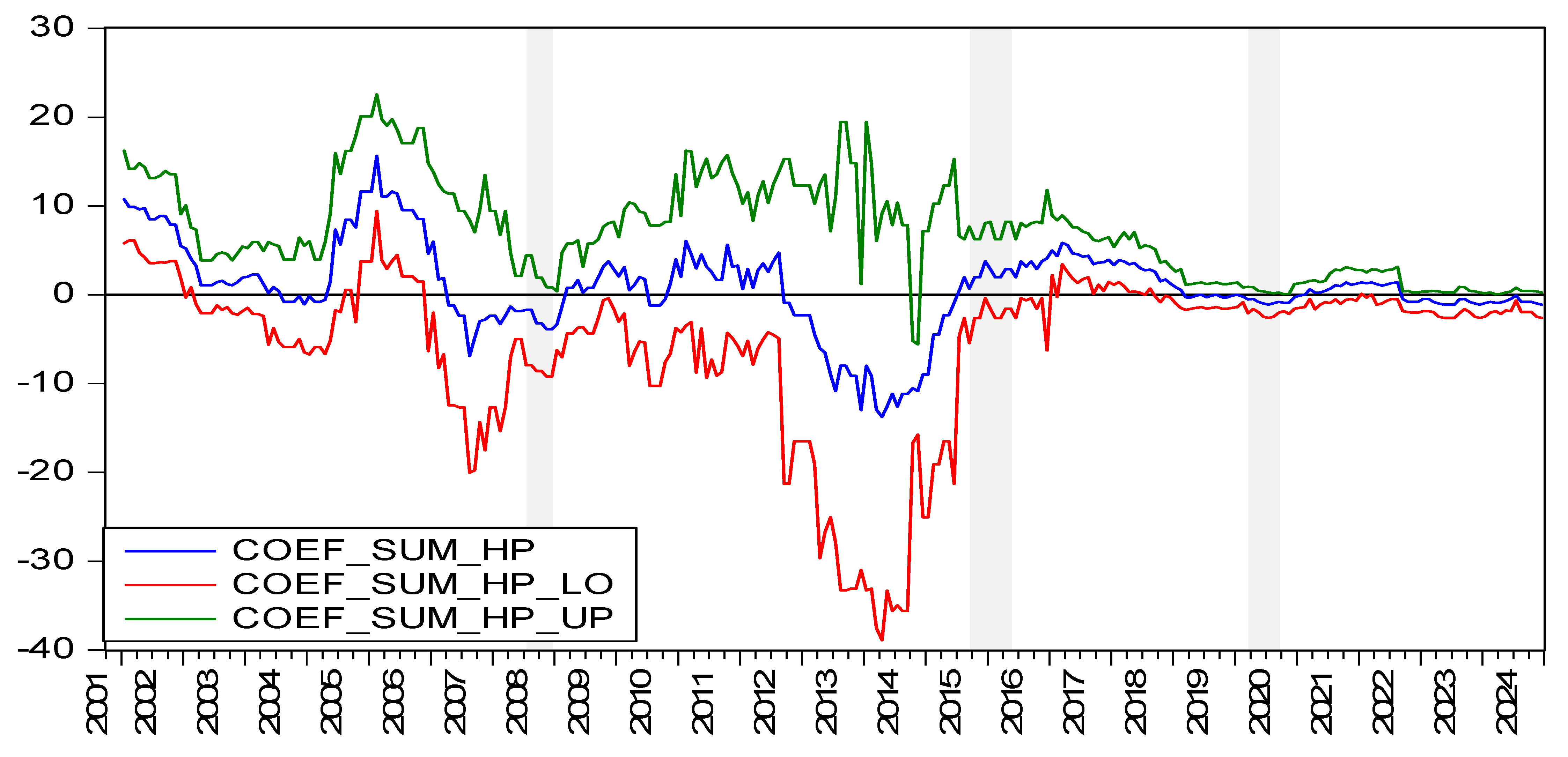

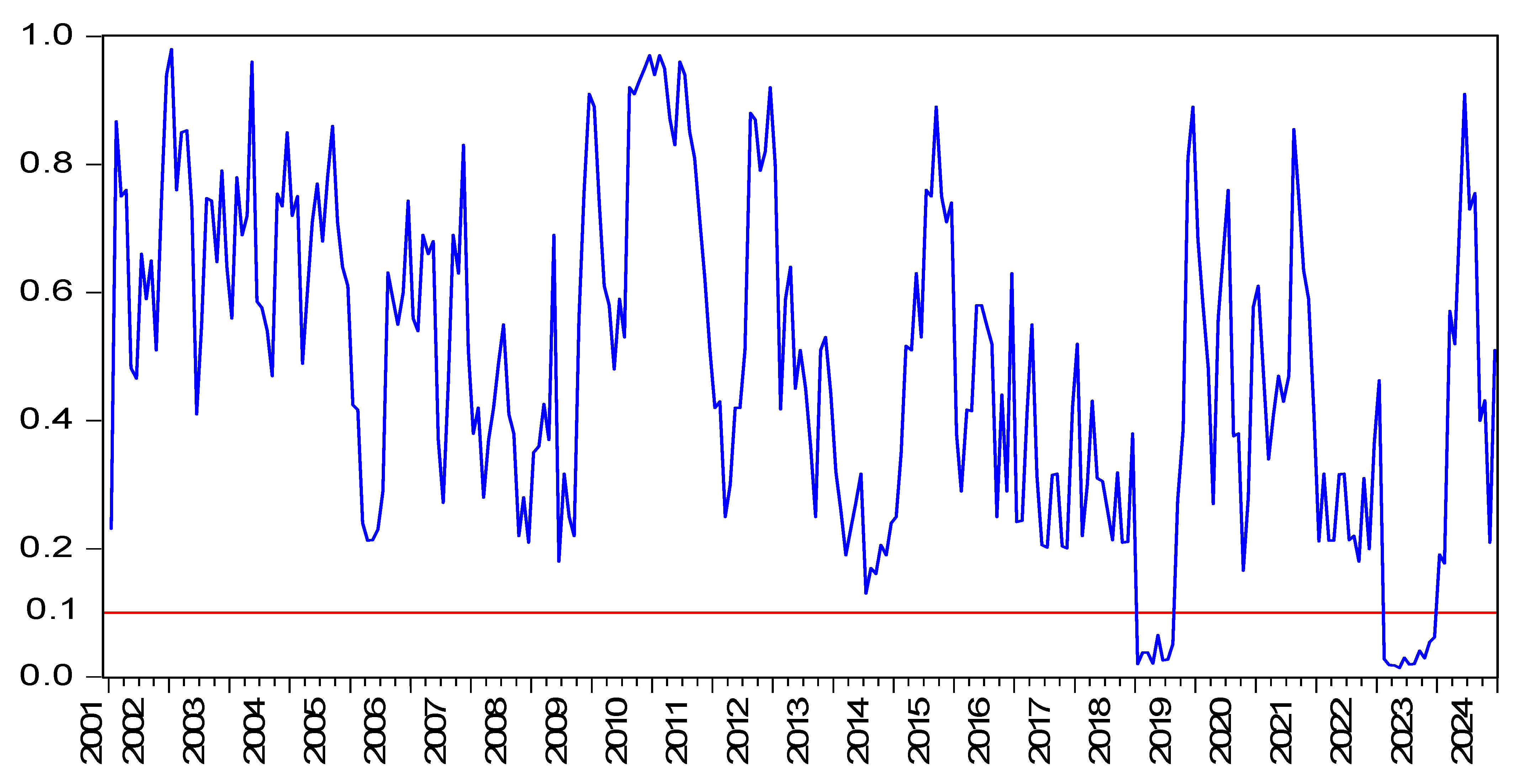

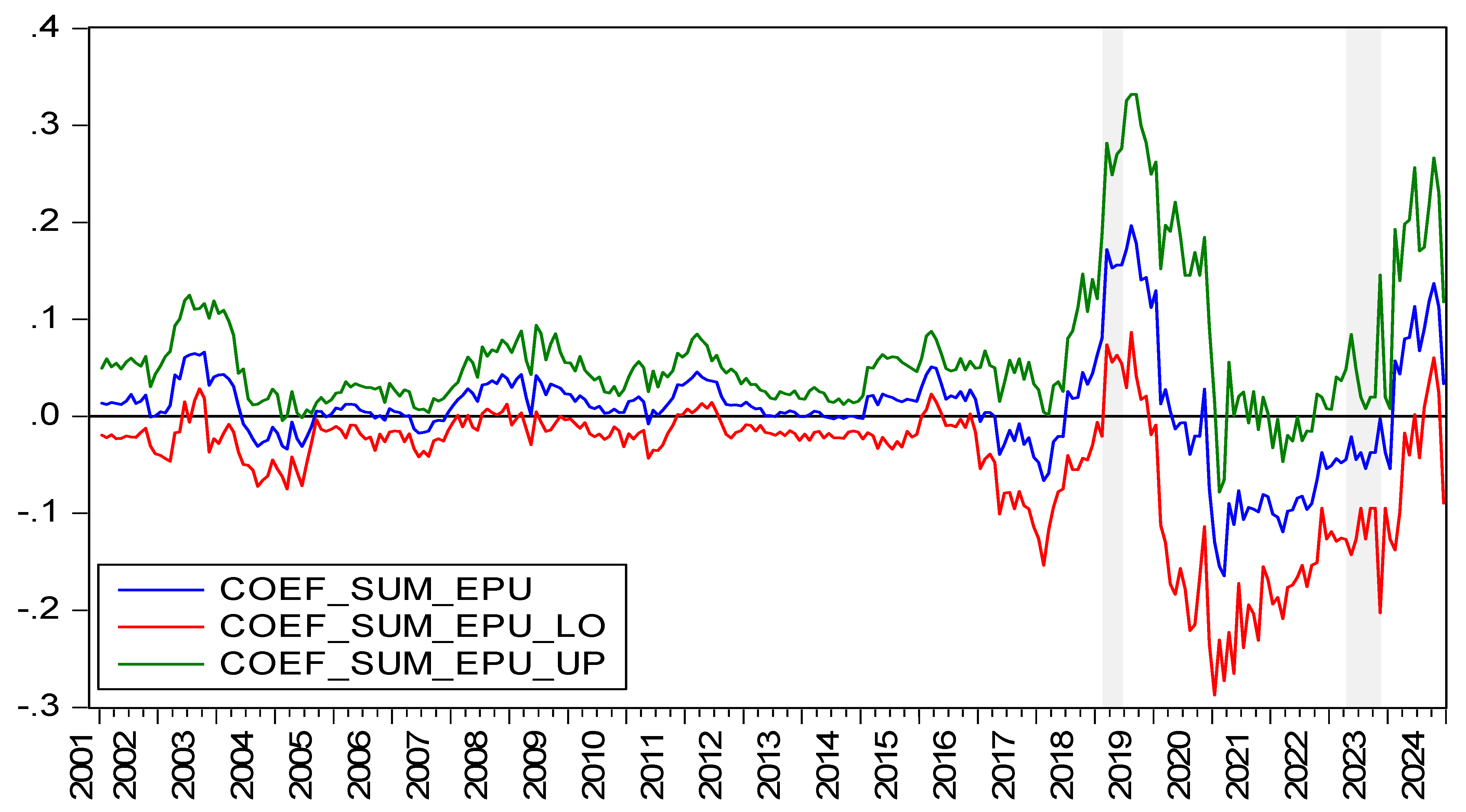

6. Empirical Results

7. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Wadud, I.M.; Bashar, O.H.M.N.; Ali Ahmed, H.J.; Dimovski, W. Property price dynamics and asymmetric effects of economic policy uncertainty: New evidence from the Australian capital cities. Account. Financ. 2022, 62, 4359–4380. [Google Scholar] [CrossRef]

- António, M.; Cunha, R.L. Housing price dynamics and elasticities: Portugal’s conundrum. Natl. Account. Rev. 2024, 6, 75–94. [Google Scholar]

- Liu, F.; Ren, H.; Liu, C. Housing price fluctuations and financial risk transmission: A spatial economic model. Appl. Econ. 2019, 51, 5767–5780. [Google Scholar] [CrossRef]

- Das, R.C.; Chatterjee, T.; Ivaldi, E. Nexus between Housing Price and Magnitude of Pollution: Evidence from the Panel of Some High- and Low Polluting Cities of the World. Sustainability 2022, 14, 9283. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Hussain, R.Y.; Bajaj, N.K.; Kumari, S.; Al-Faryan, M.A.S. Does Economic Policy Uncertainty Affect Foreign Remittances? Linear and Non-linear ARDL Approach in BRIC Economies. Cogent Econ. Financ. 2023, 11, 2183642. [Google Scholar] [CrossRef]

- Amin, A.; Dogan, E. The role of economic policy uncertainty in the energy-environment nexus for China: Evidence from the novel dynamic simulations method. J. Environ. Manag. 2021, 292, 112865. [Google Scholar] [CrossRef]

- Al-Thaqeb, S.A.; Algharabali, B.G. Economic policy uncertainty: A literature review. J. Econ. Asymmetries 2019, 20, e00133. [Google Scholar] [CrossRef]

- Rodrik, D. Policy uncertainty and private investment in developing countries. J. Dev. Econ. 1991, 36, 229–242. [Google Scholar] [CrossRef]

- Wang, S.; Zeng, Y.; Yao, J.; Zhang, H. Economic policy uncertainty, monetary policy and housing price in China. J. Appl. Econ. 2020, 23, 235–252. [Google Scholar] [CrossRef]

- Shi, X.; He, Z.; Lu, X. The effect of home equity on the risky financial portfolio choice of Chinese households. Emerg. Mark. Financ. Trade 2018, 56, 543–561. [Google Scholar] [CrossRef]

- Yin, X.-C.; Li, X.; Wang, M.-H.; Qin, M.; Shao, X.-F. Do economic policy uncertainty and its components predict China’s housing returns? Pac.-Basin Financ. J. 2021, 68, 101575. [Google Scholar] [CrossRef]

- Huang, Y.; Luk, P. Measuring economic policy uncertainty in China. China Econ. Rev. 2020, 59, 101367. [Google Scholar] [CrossRef]

- Li, N.; Li, R.Y.M. A bibliometric analysis of six decades of academic research on housing prices. Int. J. Hous. Mark. Anal. 2024, 17, 307–328. [Google Scholar] [CrossRef]

- Ali, M.; Samour, A.; Joof, F.; Tursoy, T. Oil prices and gold prices on housing market in China: Novel findings from the bootstrap approach. Int. J. Hous. Mark. Anal. 2022, 17, 591–610. [Google Scholar] [CrossRef]

- Chien, M.-S.; Setyowati, N. The effects of uncertainty shocks on global housing markets. Int. J. Hous. Mark. Anal. 2021, 14, 218–242. [Google Scholar] [CrossRef]

- Balcilar, M.; Roubaud, D.; Uzuner, G.; Wohar, M.E. Housing sector and economic policy uncertainty: A GMM panel VAR approach. Int. Rev. Econ. Financ. 2021, 76, 114–126. [Google Scholar] [CrossRef]

- Fan, T.; Khaskheli, A.; Raza, S.A.; Shah, N. The role of economic policy uncertainty in forecasting housing prices volatility in developed economies: Evidence from a GARCH-MIDAS approach. Int. J. Hous. Mark. Anal. 2023, 16, 776–791. [Google Scholar] [CrossRef]

- Anoruo, E.; Akpom, U.N.; Nwoye, Y.D. Dynamic relationship between economic policy uncertainty and housing market returns in Japan. J. Int. Bus. Econ. 2017, 5, 28–37. [Google Scholar] [CrossRef]

- Ghosh, S. Housing price volatility: Uncertainty, an asymmetric econometric analysis-some European country experiences. Int. J. Hous. Mark. Anal. 2021, 14, 1004–1026. [Google Scholar] [CrossRef]

- Choudhry, T. Economic policy uncertainty and house prices: Evidence from geographical regions of England and Wales. Real Estate Econ. 2020, 48, 504–529. [Google Scholar] [CrossRef]

- Balcilar, M.; Uzuner, G.; Bekun, F.V.; Wohar, M.E. Housing price uncertainty and housing prices in the UK in a time-varying environment. Empirica 2023, 50, 523–549. [Google Scholar] [CrossRef]

- Soon, C.C. Impact of domestic economic policy uncertainty on the volatility of housing sale price and joense price, land price. Asia-Pac. J. Converg. Res. Interchange 2022, 8, 165–175. [Google Scholar]

- André, L.; Bonga-Bonga, R.; Gupta, J.W. Economic policy uncertainty, US real housing returns and their volatility: A nonparametric approach. J. Real Estate Res. 2017, 39, 493–513. [Google Scholar] [CrossRef]

- Antonakakis, N.; Gupta, R.; André, C. Dynamic co-movements between economic policy uncertainty and housing market returns. J. Real Estate Portf. Manag. 2015, 21, 53–60. [Google Scholar] [CrossRef]

- Bahmani-Oskoee, M.; Ghodsi, S.H. Policy uncertainty and housing prices in the United States. J. Real Estate Portf. Manag. 2017, 23, 73–85. [Google Scholar] [CrossRef]

- Jeon, J.H. The impact of Asian economic policy uncertainty: Evidence from Korean housing market. J. Asian Financ. Econ. Bus. 2018, 5, 43–51. [Google Scholar] [CrossRef]

- Sreenu, N. Dynamics of property prices and asymmetrical impacts of economic policy uncertainty: New evidence from Indian cities. Int. J. Hous. Mark. Anal. 2023. ahead of print. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Gokmenoglu, K.; Hesami, S. Economic policy uncertainty and house prices in Germany: Evidence from GSADF and wavelet coherence techniques. Int. J. Hous. Mark. Anal. 2021, 14, 842–859. [Google Scholar] [CrossRef]

- Alola, A.A.; Uzuner, G. The housing market and agricultural land dynamics: Appraising with economic policy uncertainty index. Int. J. Financ. Econ. 2020, 25, 274–285. [Google Scholar] [CrossRef]

- Su, C.W.; Li, X.; Tao, R. How does economic policy uncertainty affect prices of housing? Evidence from Germany. Argum. Oeconomica 2019, 42, 131–153. [Google Scholar] [CrossRef]

- Aye, G.C. Causality between economic policy uncertainty and real housing returns in emerging economies: A cross-sample validation approach. Cogent Econ. Financ. 2018, 6, 1473708. [Google Scholar] [CrossRef]

- El-Montasser, G.; Ajmi, A.N.; Chang, T.; Simo-Kengne, B.D.; André, C.; Gupta, R. Cross-country evidence on the causal relationship between policy uncertainty and housing prices. J. Hous. Res. 2016, 25, 195–211. [Google Scholar] [CrossRef]

- Xia, T.; Yao, C.X.; Geng, J.B. Dynamic and frequency-domain spillover among economic policy uncertainty, stock, and housing markets in China. Int. Rev. Financ. Anal. 2020, 67, 101427. [Google Scholar] [CrossRef]

- Chow, S.C.; Cunado, J.; Gupta, R.; Wong, W.K. Causal relationships between economic policy uncertainty and housing market returns in China and India: Evidence from linear and nonlinear panel and time series models. Stud. Nonlinear Dyn. Econom. 2018, 22, 20160121. [Google Scholar] [CrossRef]

- Zhao, H.M.H. Essays on Economic Uncertainty and Housing Market in China. Ph.D. Thesis, CUNY Academic Works, The City University of New York (CUNY), New York, NY, USA, 2021. p. 28539775. [Google Scholar]

- Hu, C.C.; Chen, X. Economic policy uncertainty, macroeconomic and asset price fluctuation: Based on TVAR model and spillover index. Chin. J. Manag. Sci. 2020, 28, 61–70. [Google Scholar]

- Huang, W.L.; Lin, W.Y.; Nin, S.L. The effect of economic policy uncertainty on China’s housing market. N. Am. J. Econ. Financ. 2020, 54, 100850. [Google Scholar] [CrossRef]

- Qu, Y.; Md Kassim, A.A. The impact of economic policy uncertainty on investment in real estate corporations based on sustainable development: The mediating role of house prices. Sustainability 2023, 15, 15318. [Google Scholar] [CrossRef]

- Pastor, L.; Veronesi, P. Uncertainty about government policy and stock prices. J. Financ. 2012, 67, 1219–1264. [Google Scholar] [CrossRef]

- Pastor, L.; Veronesi, P. Political uncertainty and risk premia. J. Financ. Econ. 2013, 110, 520–545. [Google Scholar] [CrossRef]

- André, C.; Gabauer, D.; Gupta, R. Time-varying spillovers between housing sentiment and housing market in the United States. Financ. Res. Lett. 2021, 42, 101925. [Google Scholar] [CrossRef]

- Li, X. Economic Policy Uncertainty and Corporate Cash Policy: International Evidence. J. Account. Public Policy 2019, 38, 106694. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J.; Terry, S.J. COVID-Induced Economic Uncertainty; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Hu, S.; Gong, D. Economic policy uncertainty, prudential regulation and bank lending. Financ. Res. Lett. 2019, 29, 373–378. [Google Scholar] [CrossRef]

- Toda, H.Y.; Phillips, P.C.B. Vector autoregression and causality. Econometrica 1993, 61, 1367–1393. [Google Scholar] [CrossRef]

- Shukur, G.; Mantalos, P. A simple investigation of the Granger-causality test in integrated-cointegrated VAR systems. J. Appl. Stat. 2000, 27, 1021–1031. [Google Scholar] [CrossRef]

- Shukur, G.; Mantalos, P. Size and power of the RESET test as applied to systems of equations: A bootstrap approach. J. Mod. Appl. Stat. Methods 2004, 3, 370–385. [Google Scholar] [CrossRef]

- Park, J.B.; Lee, T.R.; Oh, M.J. An empirical study on the contribution of interest rates to housing prices. Korean Assoc. Hous. Policy Stud. 2021, 29, 75–100. [Google Scholar] [CrossRef]

- Lee, C.; Park, J. The time-varying effect of interest rates on housing prices. Land 2022, 11, 2296. [Google Scholar] [CrossRef]

- Martin, C.; Schmitt, N.; Westerhoff, F. Housing markets, expectations formation and interest rates. Macroecon. Dyn. 2022, 26, 491–532. [Google Scholar] [CrossRef]

- De Mansilla, G.R.B. Interest rates, prices and housing transactions in Spain. Rev. Estud. Empres. 2023, 2, 5–26. [Google Scholar]

- McDonald, J.F.; Stokes, H.H. Monetary policy and the housing bubble. J. Real Estate Financ. Econ. 2013, 46, 437–451. [Google Scholar] [CrossRef]

- Hartzmark, S.M. Economic uncertainty and interest rates. Rev. Asset Pricing Stud. 2016, 6, 179–220. [Google Scholar] [CrossRef]

- Hsieh, Y.S.; Yang, C.W. The dominant risks in the interest rate channel: Evidence from the urban housing market. Appl. Econ. 2023, 56, 8091–8111. [Google Scholar] [CrossRef]

- Xin, B.; Jiang, K. Economic uncertainty, central bank digital currency, and negative interest rate policy. J. Manag. Sci. Eng. 2023, 8, 430–452. [Google Scholar] [CrossRef]

- Andrews, D.W.K. Tests for parameter instability and structural change with unknown change point. Econometrica 1993, 61, 821–856. [Google Scholar] [CrossRef]

- Andrews, D.W.K.; Ploberger, W. Optimal tests when a nuisance parameter is present only under the alternative. Econometrica 1994, 62, 1383–1414. [Google Scholar] [CrossRef]

- Nyblom, J. Testing for the constancy of parameters over time. J. Am. Stat. Assoc. 1989, 84, 223–230. [Google Scholar] [CrossRef]

- Hansen, B.E. Tests for parameter instability in regressions with I(1) processes. J. Bus. Econ. Stat. 1992, 20, 45–59. [Google Scholar] [CrossRef]

- Balcilar, M.; Ozdemir, Z.A.; Arslanturk, Y. Economic growth and energy consumption causal nexus viewed through a bootstrap rolling window. Energy Econ. 2010, 32, 1398–1410. [Google Scholar] [CrossRef]

- Su, C.W.; Lv, S.; Qin, M.; Norena-Chavez, D. Uncertainty and Credit: The Chicken or the Egg Causality Dilemma. Emerg. Mark. Financ. Trade 2024, 60, 2560–2578. [Google Scholar] [CrossRef]

- Fan, H.; Gao, X.; Zhang, L. How China’s accession to the WTO affects global welfare? China Econ. Rev. 2021, 69, 101688. [Google Scholar] [CrossRef]

- Jiang, Y.; Wang, Y. Price dynamics of China’s housing market and government intervention. Appl. Econ. 2020, 53, 1212–1224. [Google Scholar] [CrossRef]

- Yin, D.; Zhang, J.; Yu, X.; Xin, L. Causality between economic policy uncertainty and exchange rate in China with considering quantile differences. Theor. Appl. Econ. 2017, 24, 29–38. [Google Scholar]

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.C.B.; Schmidt, P.; Shin, Y. Testing the null hypothesis of stationarity against the alternative of a unit root. J. Econom. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Timmermann, A. Small sample properties of forecasts from autoregressive models under structural breaks. J. Econom. 2005, 129, 183–217. [Google Scholar] [CrossRef]

- Hu, C.; Chen, X. Economic policy uncertainty, property market and macroeconomic fluctuations—A study of regional differences based on GVAR model. Explor. Econ. Issues 2019, 8, 11. [Google Scholar]

- Zhang, Q.; Chen, K.; Zhang, F. Risk spillover effect of resident leverage on corporate debt. Financ. Res. Lett. 2024, 65, 105551. [Google Scholar] [CrossRef]

- Hu, Z.Y.; Qian, J. The impact of housing price on entrepreneurship in Chinese cities: Does the start-up motivation matter? Cities 2022, 131, 104045. [Google Scholar] [CrossRef]

- Fan, W.; He, Y.; Hao, L.; Wu, F. Do high house prices promote the development of China’s real economy? Empirical evidence based on the decomposition of real estate price. PLoS ONE 2024, 19, e0295311. [Google Scholar] [CrossRef] [PubMed]

- Kuang, D.; Liu, P. Inflation and House Prices: Theory and Evidence from 35 Major Cities in China. Int. Real Estate Rev. 2015, 18, 217–240. [Google Scholar] [CrossRef]

- Zhang, P.; Sun, L.; Zhang, C. Understanding the role of homeownership in wealth inequality: Evidence from urban China (1995–2018). China Econ. Rev. 2021, 69, 101657. [Google Scholar] [CrossRef]

- Aizenman, J.; Jinjarak, Y.; Zheng, H. Housing Bubbles, Economic Growth, and Institutions. Open Econ. Rev. 2019, 30, 655–674. [Google Scholar] [CrossRef]

- Su, C.W.; Cai, X.Y.; Qin, M.; Tao, R. Can bank credit withstand falling house price in China? Int. Rev. Econ. Financ. 2021, 71, 257–267. [Google Scholar] [CrossRef]

- Yii, K.J.; Tan, C.T.; Ho, W.K.; Kwan, X.H.; Shim, N.F.; Tan, Y.Y.; Wong, K.H. Land availability and housing price in China: Empirical evidence from nonlinear autoregressive distributed lag (NARDL). Land Use Policy 2022, 113, 105888. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, M.; Ghodsi, H.; Hadzic, M.; Marfatia, H. Asymmetric relationship between money supply and house prices in states across the U.S. Appl. Econ. 2023, 55, 3580–3608. [Google Scholar] [CrossRef]

- Ampudia, M.; Mayordomo, S. Borrowing constraints and housing price expectations in the euro area. Econ. Model. 2018, 72, 410–421. [Google Scholar] [CrossRef]

- Dias, D.A.; Duarte, J.B. Monetary policy, housing rents, and inflation dynamics. J. Appl. Econ. 2019, 34, 673–687. [Google Scholar] [CrossRef]

- Hong, Y.; Li, Y. House price and the stock market prices dynamics: Evidence from China using a wavelet approach. Appl. Econ. Lett. 2020, 27, 971–976. [Google Scholar] [CrossRef]

| Mean | Median | Maximum | Minimum | Standard Deviation | Skewness | Kurtosis | Jarque-Bera | |

|---|---|---|---|---|---|---|---|---|

| EPU | 270.154 | 151.865 | 970.830 | 9.007 | 251.284 | 1.208 | 3.218 | 70.132 *** |

| HP | 5785.667 | 5586.270 | 11970.208 | 1984.140 | 2770.182 | 0.271 | 1.783 | 21.142 *** |

| IR | 4.010 | 4.050 | 5.220 | 3.100 | 0.643 | 0.040 | 1.705 | 20.043 *** |

| Tests | H0: EPU Does Not Granger Cause HP | H0: HP Does Not Granger Cause EPU | ||

|---|---|---|---|---|

| Statistics | p-Values | Statistics | p-Values | |

| Bootstrap LR test | 2.872744 | 0.05 | 4.134696 | 0.08 |

| Tests | EPU | HP | VAR System | |||

|---|---|---|---|---|---|---|

| Statistics | p-Value | Statistics | p-Value | Statistics | p-Value | |

| Sup-F | 27.810 *** | 0.000 | 34.422 *** | 0.000 | 45.565 *** | 0.000 |

| Ave-F | 20.194 *** | 0.000 | 12.199 *** | 0.000 | 21.331 *** | 0.000 |

| Exp-F | 11.772 *** | 0.000 | 12.406 *** | 0.000 | 18.175 *** | 0.000 |

| Lc | 2.926 *** | 0.000 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guan, Y.; Wang, Y.; Su, C. The Two-Way Impact Between Economic Policy Uncertainty and Housing Prices in China: Sub-Sample Time-Varying Causality Analysis. Buildings 2025, 15, 1550. https://doi.org/10.3390/buildings15091550

Guan Y, Wang Y, Su C. The Two-Way Impact Between Economic Policy Uncertainty and Housing Prices in China: Sub-Sample Time-Varying Causality Analysis. Buildings. 2025; 15(9):1550. https://doi.org/10.3390/buildings15091550

Chicago/Turabian StyleGuan, Yumei, Yunfeng Wang, and Chiwei Su. 2025. "The Two-Way Impact Between Economic Policy Uncertainty and Housing Prices in China: Sub-Sample Time-Varying Causality Analysis" Buildings 15, no. 9: 1550. https://doi.org/10.3390/buildings15091550

APA StyleGuan, Y., Wang, Y., & Su, C. (2025). The Two-Way Impact Between Economic Policy Uncertainty and Housing Prices in China: Sub-Sample Time-Varying Causality Analysis. Buildings, 15(9), 1550. https://doi.org/10.3390/buildings15091550