1. Introduction

Climate change and the subsequent climate emergency, finite resources and the environmental impact of winning them from the earth’s crust, and increased emphasis on sustainability through the UN Sustainable Development Goals (UN SDGs) have led to a rethinking of the linear economic model, where the ultimate end product is the waste heap. The circular economy, as advocated by the Ellen McArthur Foundation (EMF), brings us back to an approach to resources that global society abandoned in a race for profit, efficiency, and convenience. The built environment is a major consumer of resources globally. In the EU, 5.5 tonnes of material per capita are consumed during construction [

1]. In the UK, construction and demolition waste (CDW) accounted for 62% of the material sent to landfills in 2018 [

2]. However, landfills have become an issue for local governments across the EU with the introduction of landfill taxes. Between 2008 and 2012, it was estimated that the construction sector in England paid approximately £1000 million in landfill taxes. At the same time, dedicated efforts to divert construction, demolition, and excavation (CD&E) waste from landfills saved the industry £144 million [

3].

The application of a circular approach to resource management in the built environment is gaining increasing attention. The EMF has been leading the way since 2012 [

4]. In conjunction with EMF, Arup, the multinational engineering consultancy, published a Circular Buildings Toolkit in 2022 [

5]. An EU COST Action (CircularB) was also established in 2022 to investigate how to implement a circular economy in the built environment [

6].

The transition to a circular built environment (CBE) is essential for addressing sustainability challenges, yet it faces significant market barriers rooted in stakeholder dynamics. The CBE promotes resource efficiency by integrating the principles of reduce, reuse, and recycle into construction and urban planning. However, the construction sector’s entrenched linear models and associated cultural norms hinder its adoption. These barriers include fragmented responsibilities among stakeholders, regulatory misalignments, and the perceived financial risks of innovative circular solutions. As part of the CircularB network [

6], a multi-national questionnaire was launched in 2024 to gather opinions on the technological, regulatory, political, cultural, societal, economic, and market barriers to circular economy from built environment professionals.

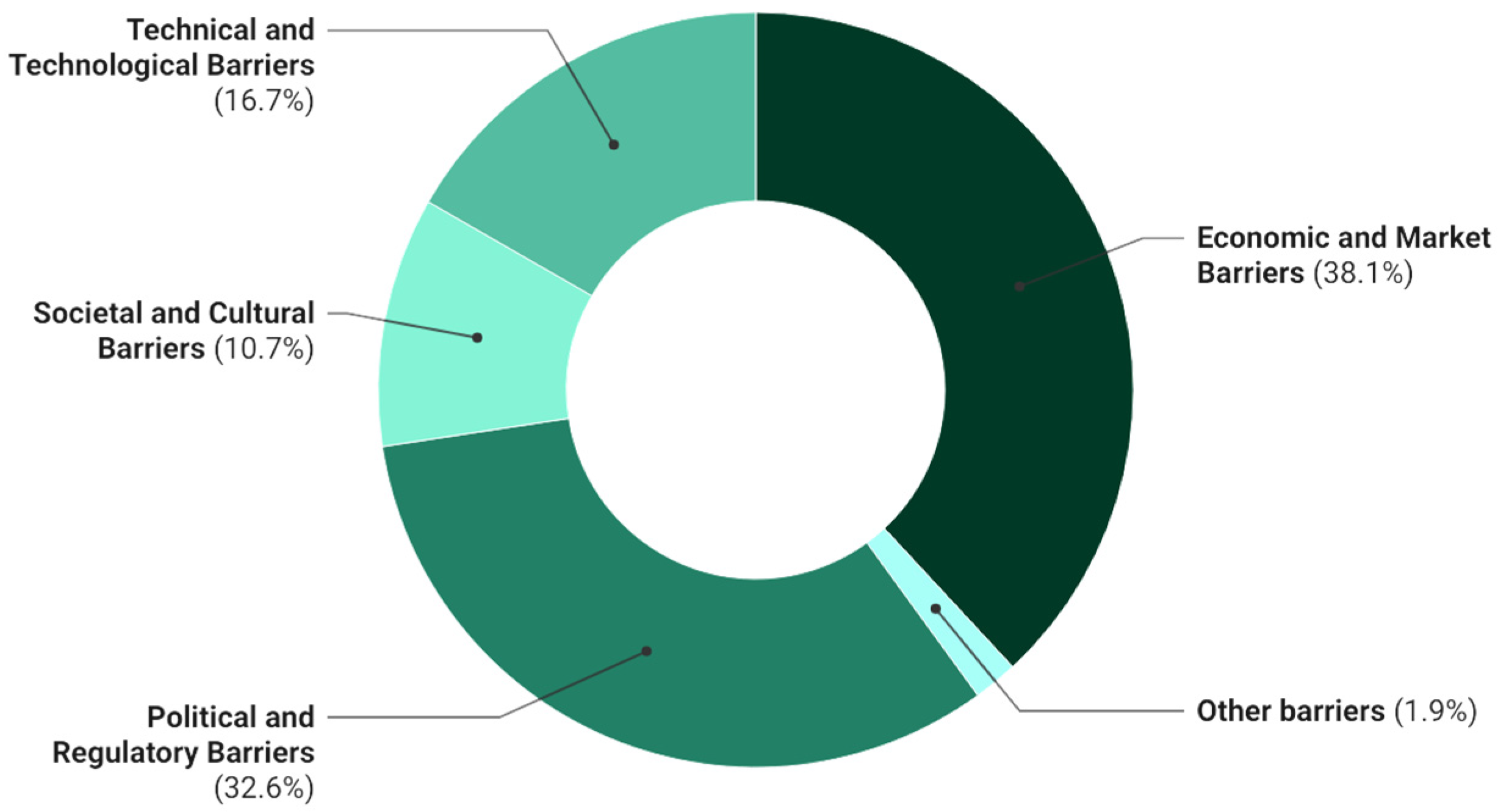

Economic and market barriers received the greatest attention from respondents in terms of their importance (38%), rated by 270 stakeholders ranging from academia, architects, engineers, professionals engaged in investment, development, and insurance, manufacturers of building/construction products, consultants, environmental specialists, and project managers, to building and construction professionals. Although this paper focuses on market barriers, they cannot be observed in isolation as they are deeply interrelated with other barriers that need to be addressed to achieve more circularity in the construction industry. Almost one-third of the respondents found policy and regulatory barriers to be critical factors hindering the upscaling of circular practices, while 17% of respondents perceived technical and technological barriers as a significant concern. Cultural and societal hurdles were prioritised by nearly 11% of survey participants, while five participants indicated that some other barriers play a crucial role in impeding the implementation of circular economy principles.

Considering the profit-oriented nature of companies in the construction ecosystem, the market barriers deserve special attention, and a deeper understanding can support policy interventions to facilitate the transition toward a CBE. For instance, developers and investors often prioritise short-term returns, deterring investments in long-term sustainable practices [

7,

8]. When examining the development of theories reflected in the literature, it is most often mentioned that “Market barriers” are most often attributed to competitive product prices, exaggeratedly high investment costs, or insufficient compensation for social and environmental benefits, hence small or non-existent profit margins, which prevent companies from successfully transitioning to new markets, including the introduction of a circular economy. The elimination of market barriers will also solve organisational and cultural problems as obstacles [

9].

Regulatory frameworks and policy incentives play a critical role in enabling or obstructing the CBE. Policymakers face challenges in harmonising legislation across regions, often resulting in fragmented market conditions that discourage innovation. Stakeholders, including architects, contractors, and municipalities, cite the lack of standardised criteria for circular materials and unclear financial incentives as barriers. Moreover, the absence of robust digital tools to track material lifecycles exacerbates inefficiencies in the transition. Strengthening regulatory incentives and fostering public–private partnerships can catalyse systemic changes, as highlighted by the Circular Cities and Regions Initiative [

10].

Various studies have considered the barriers to a CBE. Nordby [

11] considered the barriers to material reuse in the construction industry in Norway. She found that the time to demolish buildings in a manner to recover materials was a barrier, along with the lack of documentation of these resources. She also noted that not knowing what materials will be available in the future limits the designers’ decision-making processes. She also cited a lack of professionals with the right skills as a market barrier. Charef and Lu [

12] considered how a circular economy could be facilitated in the built environment. They point out that there is a lack of infrastructure for processing and storing materials and systems, which leads to a lack of materials that meet circular economy principles. The available resources also often lack the certification and product information required by designers. They also raised the issue of approval by insurance bodies and how the current procurement method hinders a circular economy. However, they envisage that the digitisation of buildings and the use of that information by the demolition/refurbishment industry will stimulate the market and provide the relevant information and certification needed for the reuse of materials.

Oluleye et al. [

13] considered barriers to CE in the built environment in both developed and developing countries. They point out that the costs of information technology and the development of secondary markets may be barriers to the adoption of a circular economy. They also noted that the perception that circular materials were inferior also acted as a market barrier. Their survey highlighted that the cheaper cost of virgin material was a significant market barrier for circular materials. They also found that market barriers were more prevalent in developing countries. Hassan et al. [

14] identified 12 barriers that they considered related to the market, including labour supply, lack of synchronisation, perceived risks, lack of innovation capacity, past technological failures and a lack of external stakeholder involvement. They used a Fuzzy Delphi Method to analyse the results of their survey of 30 individuals with a minimum of five years of experience. The skills barrier was identified as a significant market barrier. Bajare et al. [

15] advocated that the simplification of design processes, manufacturing, retrofitting and renovation to incorporate circular economy principles and practices was required, and again, data and building information were seen as key in overcoming market barriers.

2. Materials and Methods

To establish the literature in this field, six keyword phrases related to sustainability and resource management were chosen: “Circular Built Environment”, “Circular Construction”, “Circular Economy”, “Construction Ecosystem”, “Market Barriers”, and “Stakeholders”. These keywords were used to search for relevant research papers in the SCOPUS database, an extensive collection of academic publications. The materials were selected from 2014 to 2024, with a regional focus on Europe.

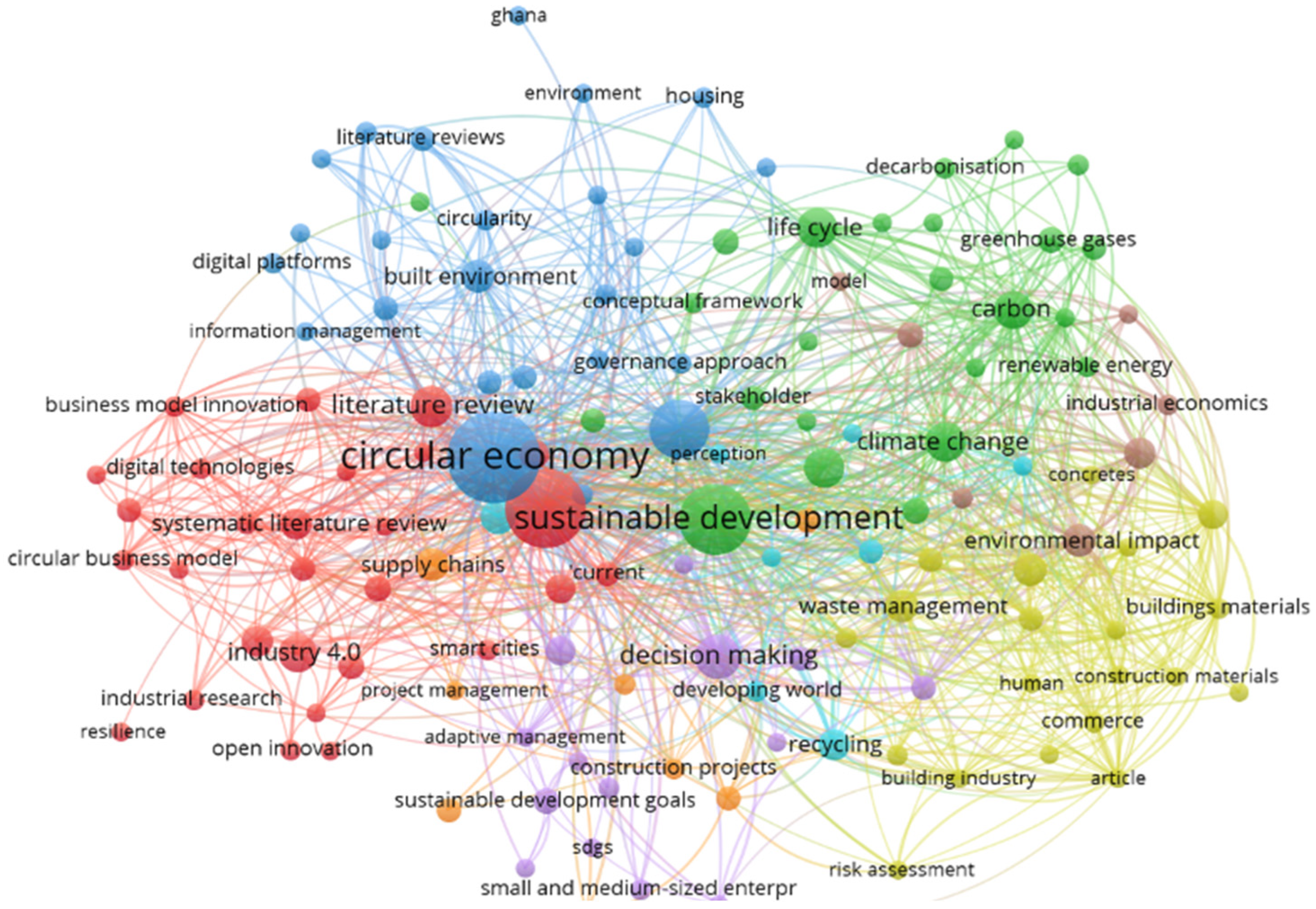

The search results were filtered to identify the most relevant studies, providing 209 documents which were selected and analysed to gather information about when and where the research was conducted. The data was exported into a CSV file and then visualised using a software called VOSviewer 1.6.20 to create a visual representation of the research trends. By visualising this data, the researchers can gain a better understanding of the current state of research and identify potential gaps or areas for future study.

Figure 1 shows significant connections across the circular economy field. The relationship between the circular economy and sustainable development is evident, connecting with other aspects like climate change, SDGs, carbon, and greenhouse gases. Literature reviews are dominant, resulting in the development of conceptual frameworks and models. Digital platforms and technologies, new business models, and supply chain optimisations often present required solutions to address the barriers. Decision-making and governance approaches by stakeholders are also vital for effective adoption.

Working with the knowledge obtained from published literature on barriers to the implementation of a circular economy, a workshop was held amongst members of the CircularB network to develop a survey for professionals to consider (1) economic and market barriers, (2) technical barriers in circular systems, (3) societal and cultural barriers, and (4) political and regulatory barriers.

Participants were asked to identify any barriers that had not been presented in the questionnaire. The survey was placed in the field and overseen by the European Joint Research Centre in the late spring/summer of 2024. The CircularB network members translated the survey created in English into 11 languages to widen its reach. Finally, a total of 270 respondents participated in the survey. The analysis of the survey on cultural values has been reported by Rajčić et al. [

16].

Seven specific questions related to market barriers were asked. Respondents were asked to rate their responses in terms of absolute importance, very important, average importance, or little importance, or to note if they did not know. The market barriers to be considered are listed in

Table 1. At the end, the respondents were asked to name other market barriers.

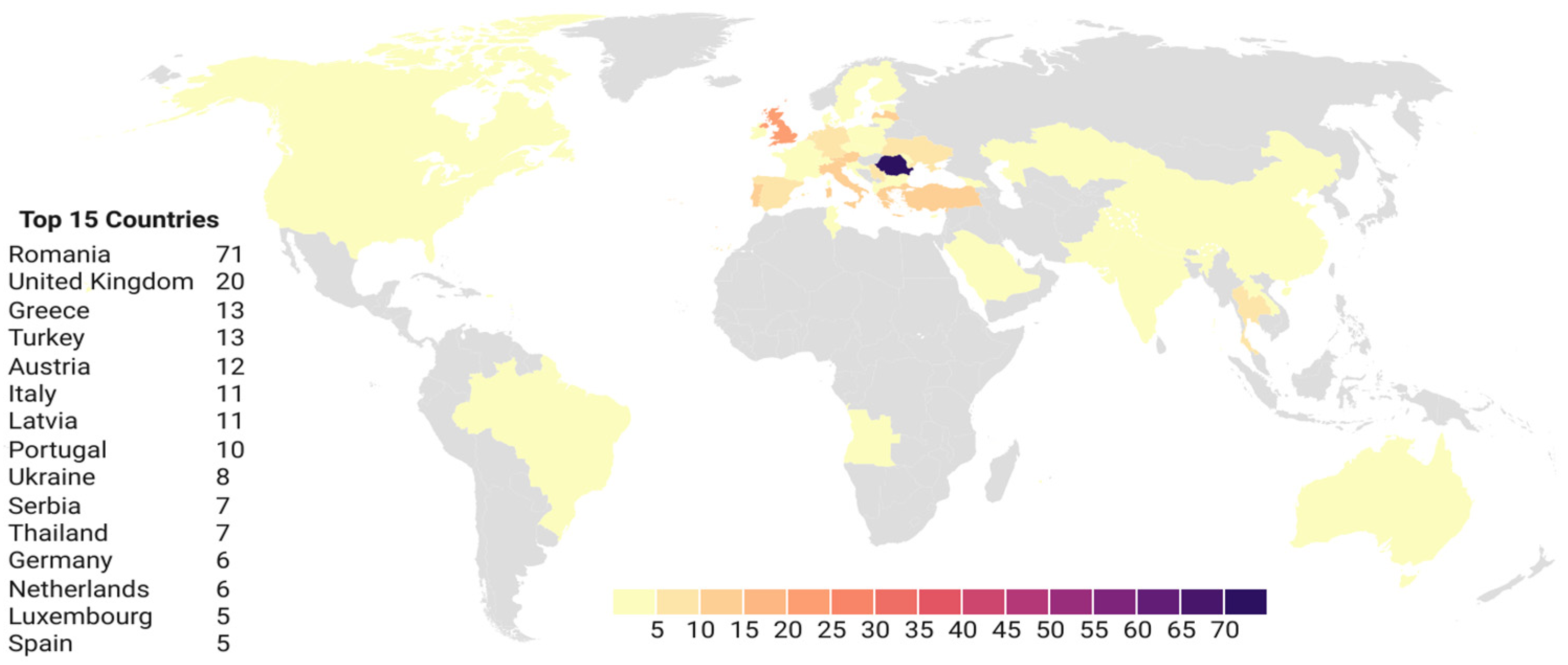

Figure 2 shows the geographical distribution of the respondents. Social media, such as LinkedIn, X (Twitter), and Instagram, were used to promote the survey along with articles in newsletters, direct emails to members of professional bodies, and through word-of-mouth. Concern was raised when the survey was closed that there was a significant response from one country. Rajčić et al. [

16] undertook a sensitivity analysis of the data and found that there was no bias as a result of the significant response from Romania, and hence, the data was considered to be valid.

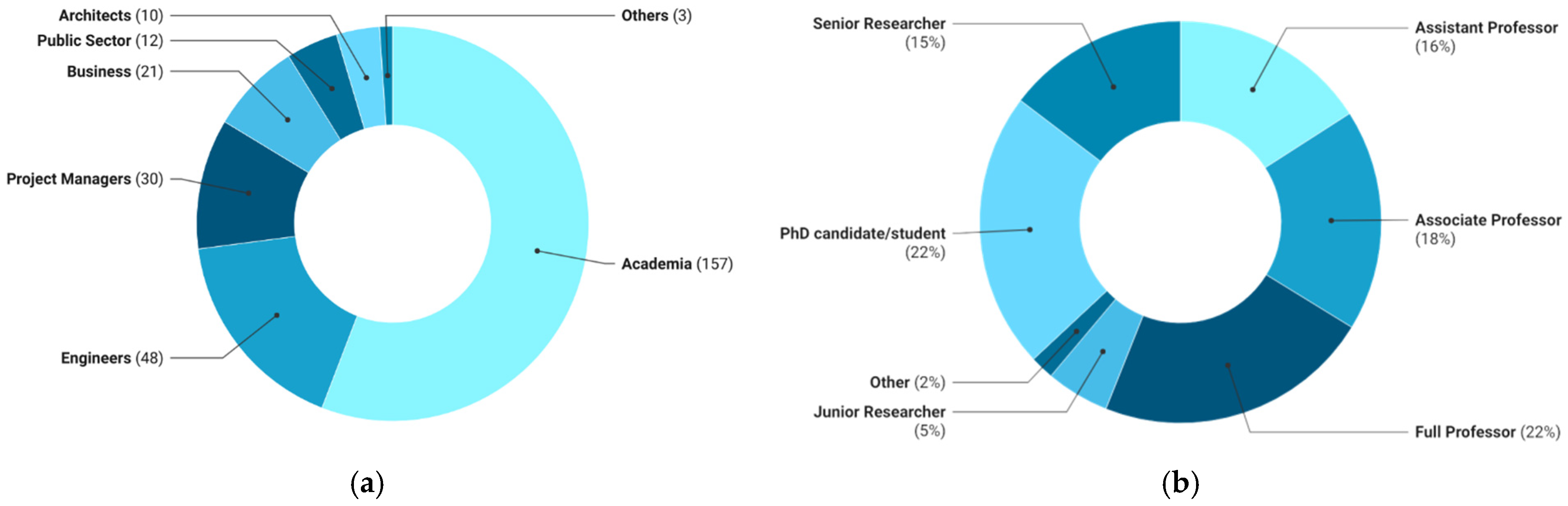

The respondents were first asked about their profession, with a majority being from academia, see

Figure 3a,b. This is not surprising, considering that the social media accounts and outreach originated from academics, and it was within their networks that the survey was most seen. The academics’ professional areas were drawn from across the spectrum of the built environment. Once academics’ professional area is mapped, a good representation is noted from across the built environment professionals, from architects, consulting engineers, project managers and the public sector. So, the survey can be said to be a good representation of the industry.

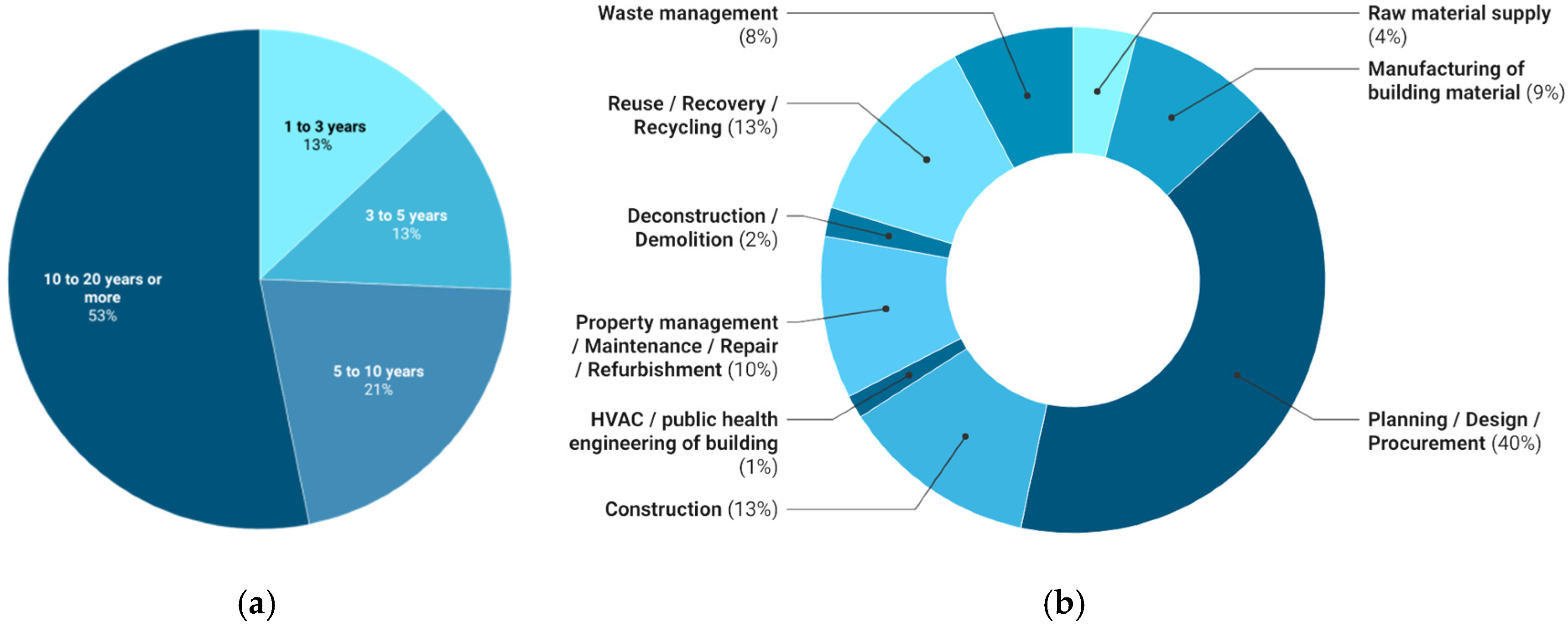

When asked how much experience they had as a professional, the responses, shown in

Figure 4a, indicated that the majority of respondents had 10 to 20 years of experience or more. Respondents also indicated the life cycle stage of buildings that they mainly influence, as depicted in

Figure 4b. The most rated was the planning, design, and procurement stage (40%), which aligns with the ideology that design represents the vital stage for embedding the circular economy principles, particularly regarding decisions with material selection, project specification, and collaboration. The construction (13%) and reuse/recovery/recycling (13%) were also rated high. Despite the essential requirement for enabling circularity, raw material supply (4%) and deconstruction/demolition (2%) have a minimal representation. It is also significant that there is an insufficient representation of HVAC/public health engineering (1%) professionals, aligning with recent research that this industry segment is often overlooked in circular economy efforts [

17]. The moderate involvement of other professionals from manufacturing (9%), maintenance (10%), and waste management (8%) is essential for ensuring circularity across the building life cycle of manufactured components.

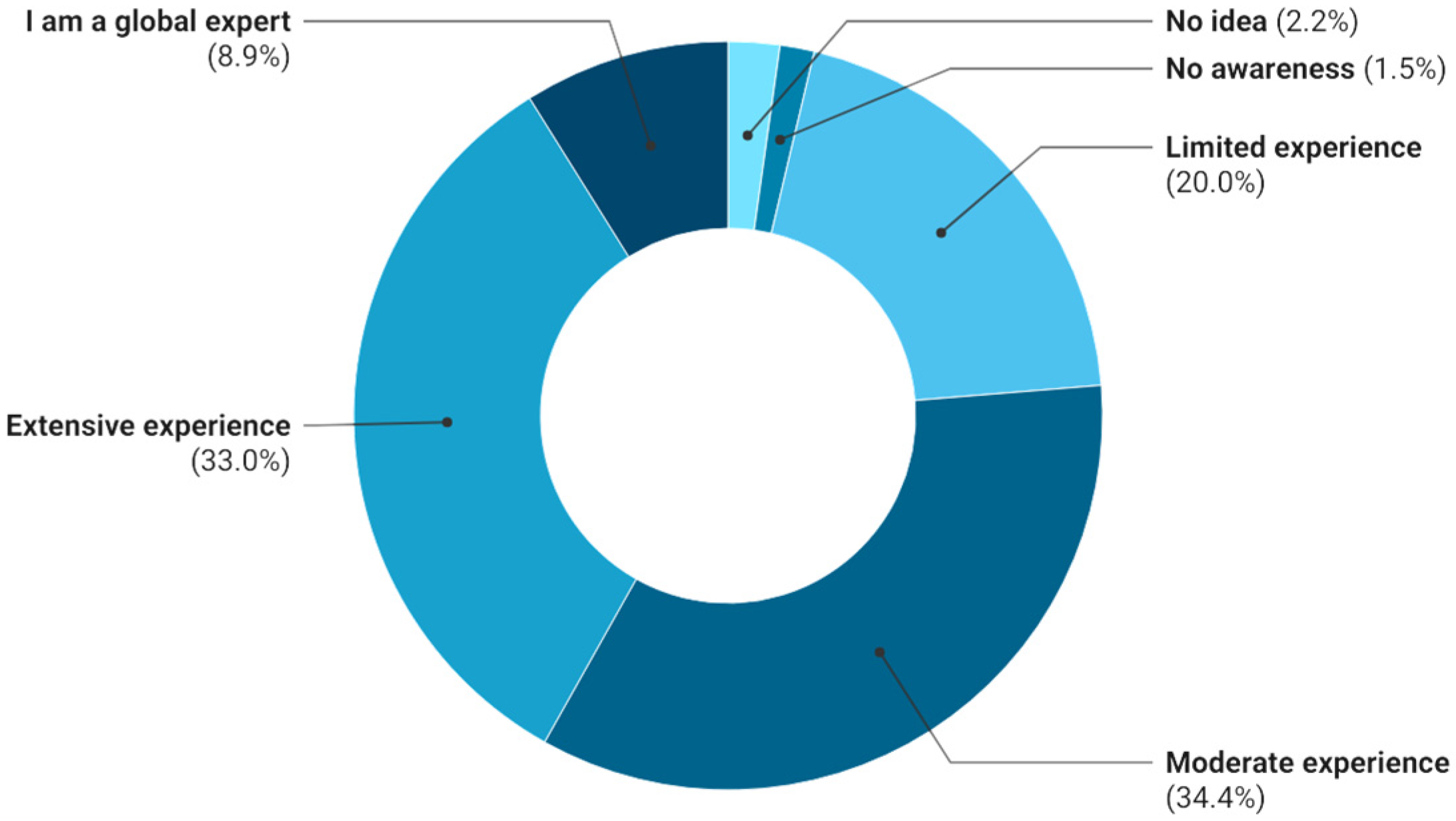

The level of awareness of circular economy principles was also measured to ensure the quality of contributions, see

Figure 5. Most of the respondents have moderate (34%) to extensive (33%) experience, and about 9% are global experts, reflecting a solid foundation and expertise in the research area. A small proportion indicated limited experience (20%), and a very small proportion of respondents had no awareness (1%) or no idea (2%). This implies that the results of the survey rely on the opinions of stakeholders with a high level of awareness of circular economy principles, particularly in the built environment.

3. Results

Among the various barriers to the implementation of a circular economy, market, and economic barriers ranked the highest in the survey, see

Figure 6. This is interesting as other surveys, for example, Oluleye et al. [

13], did not consider the market to be the highest. However, the literature did indicate that by removing/lowering market barriers, cultural and organisational barriers could be reduced.

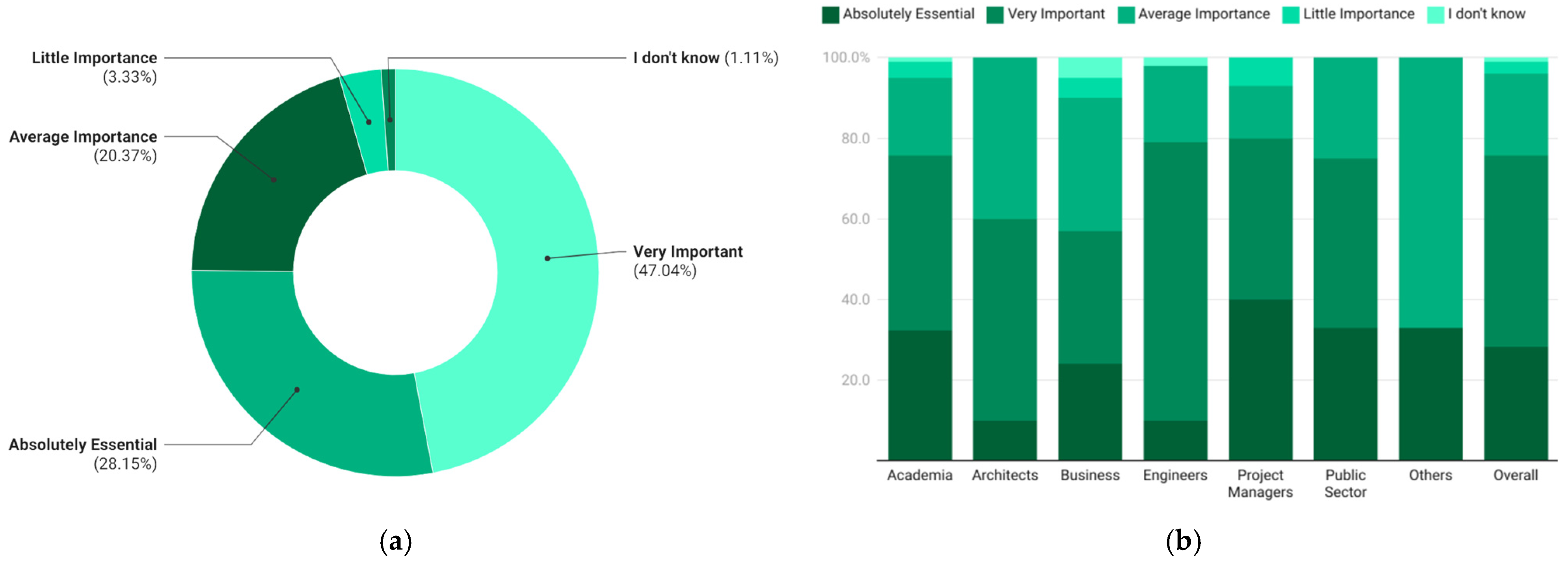

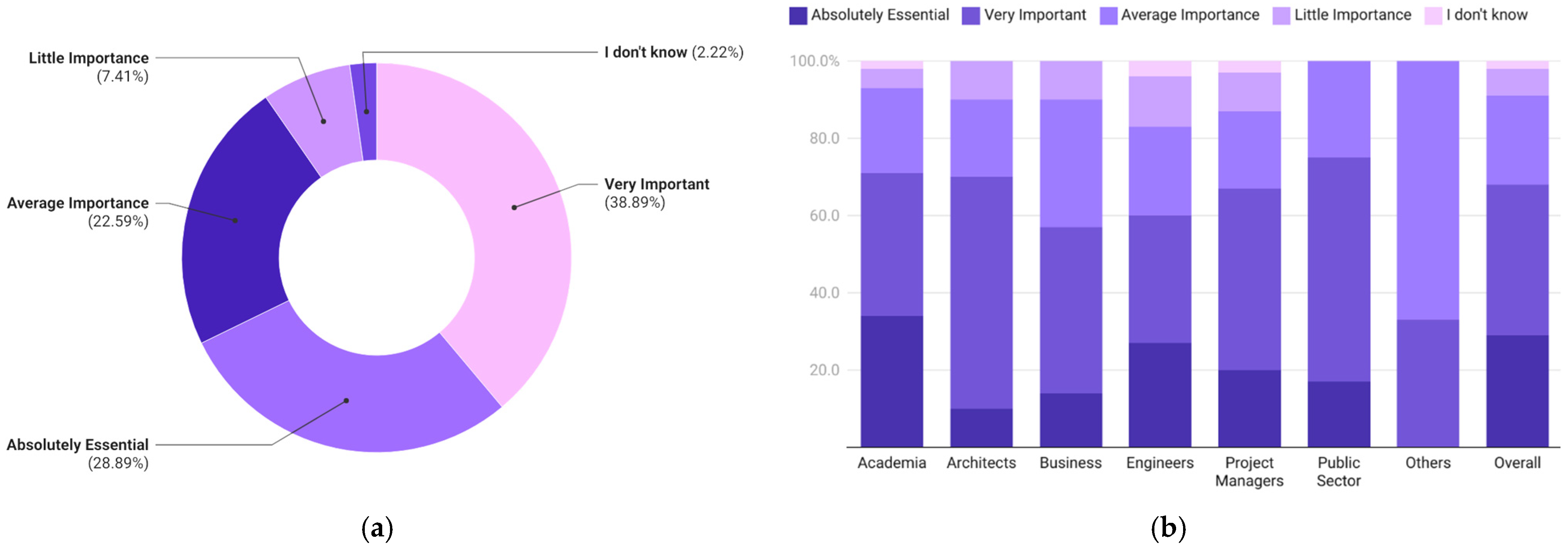

Respondents were asked to rate the importance of the extra costs of building insurance and/or professional indemnity when using recycled materials.

Figure 7a shows the overall response to the question, and

Figure 7b shows how the data was broken down according to the respondent’s job role.

To assess whether there was a significant difference between responses according to the job role, a pairwise chi-squared test was performed on the data, comparing the data for each job role with each other. The results suggested that there was no significant difference or dependencies between the results according to the job role; see

Table 2 below.

Overall, 62% of respondents considered insurance and professional indemnity to be a significant barrier. When investigating this barrier, there is concern that re-used products do not have certification/product guarantees. Also, professionals are concerned that their professional indemnity will not cover them when specifying reused/remanufactured materials/equipment. Among engineers, academia, and architects, there was a high concern about this.

The liability for reused construction products is one of the most significant concerns when considering the implementation of a circular approach in the built environment. Companies are interested in reused materials and equipment, provided there is a warranty covering them. The need to guarantee the specific properties of reused products and to transfer liability led to the development of insurance for reclaimed building materials. For example, a German start-up, Concular, partnered with the country’s largest insurance company, boasting a 150-year tradition, to level the playing field in terms of warranty and insurance between new and reclaimed construction materials. By creating this insurance for reclaimed materials, their second life was enabled, and their warranty was even better than that of new materials. Furthermore, the cost of insurance did not make reclaimed materials more expensive; they remained 20–30% cheaper than new ones [

18].

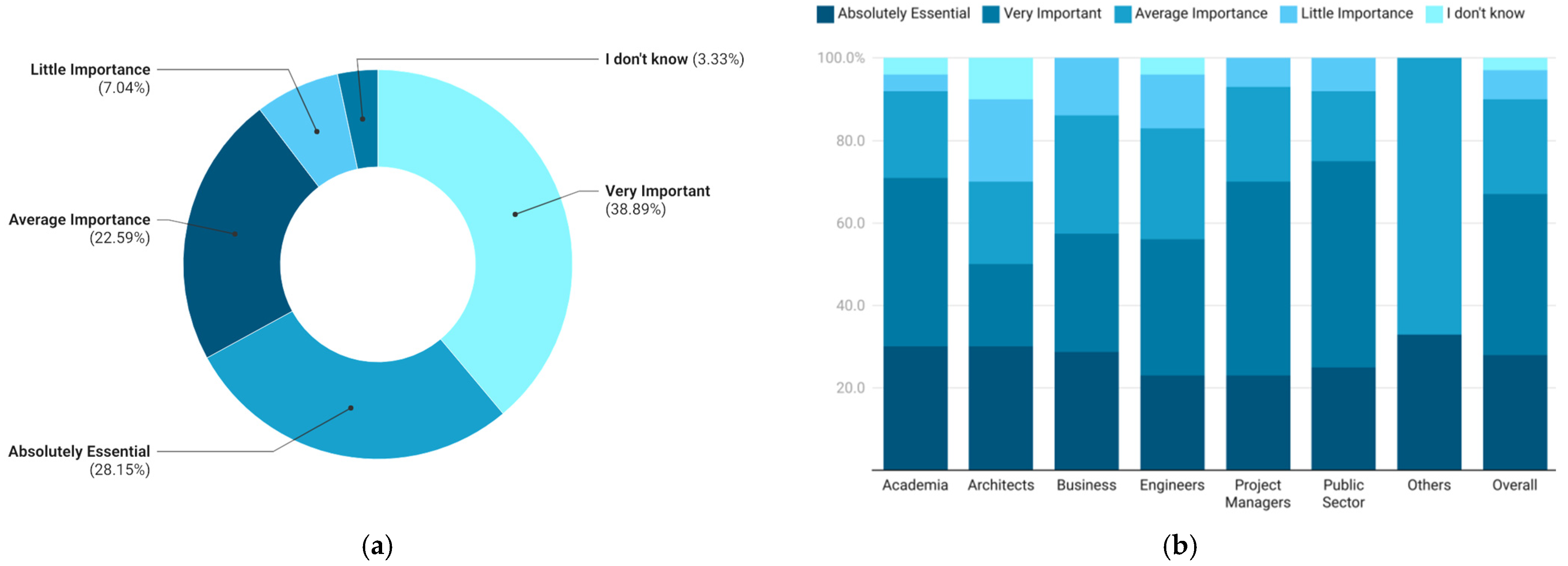

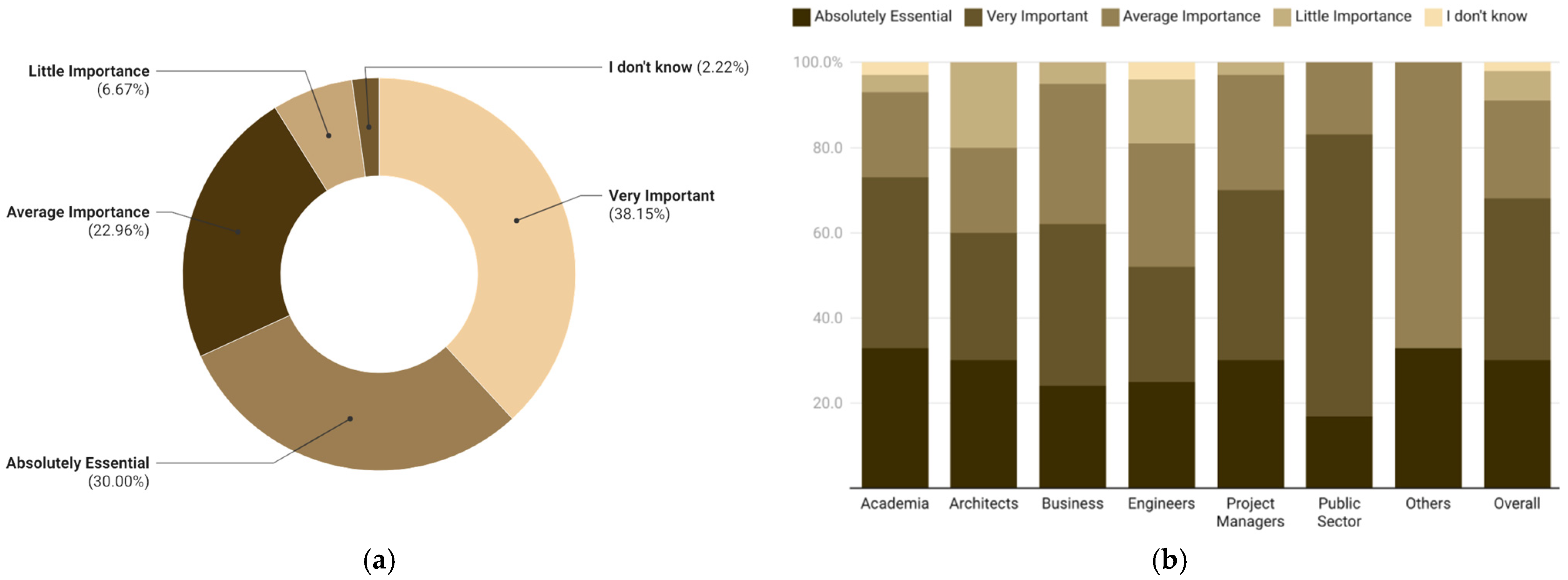

Next, the respondents were asked to rate the importance of inadequate collaboration between stakeholders and everyone involved in the value chain in the transition to a circular economy.

Figure 8a,b show the results, with the latter broken down according to their job role. Nearly half (47%) of respondents agreed that this was very important, with 28% agreeing that this was absolutely important, giving an overall score of 75%. Again, when looking at the individual responses across the job roles, few responded that this was of little importance. Again, statistical analysis did not highlight any significant differences between the professions in their answer to this question; however, it is noteworthy that architects and business professionals (if you exclude others) had the lowest response to collaboration.

To scale up circular solutions, it is essential to establish a circular construction ecosystem. Collaboration is needed between the public and private sectors, as well as within the private sector, to enable stakeholders to partner and build a network that promotes the implementation of closed-loop systems. The transfer of knowledge, along with making skills and resources accessible to partnering companies, fosters innovative approaches and resource-efficient practices. Within the individual responses of job roles, project managers ranked inadequate collaboration as a crucial hurdle, considering their responsibility for ensuring stakeholder management.

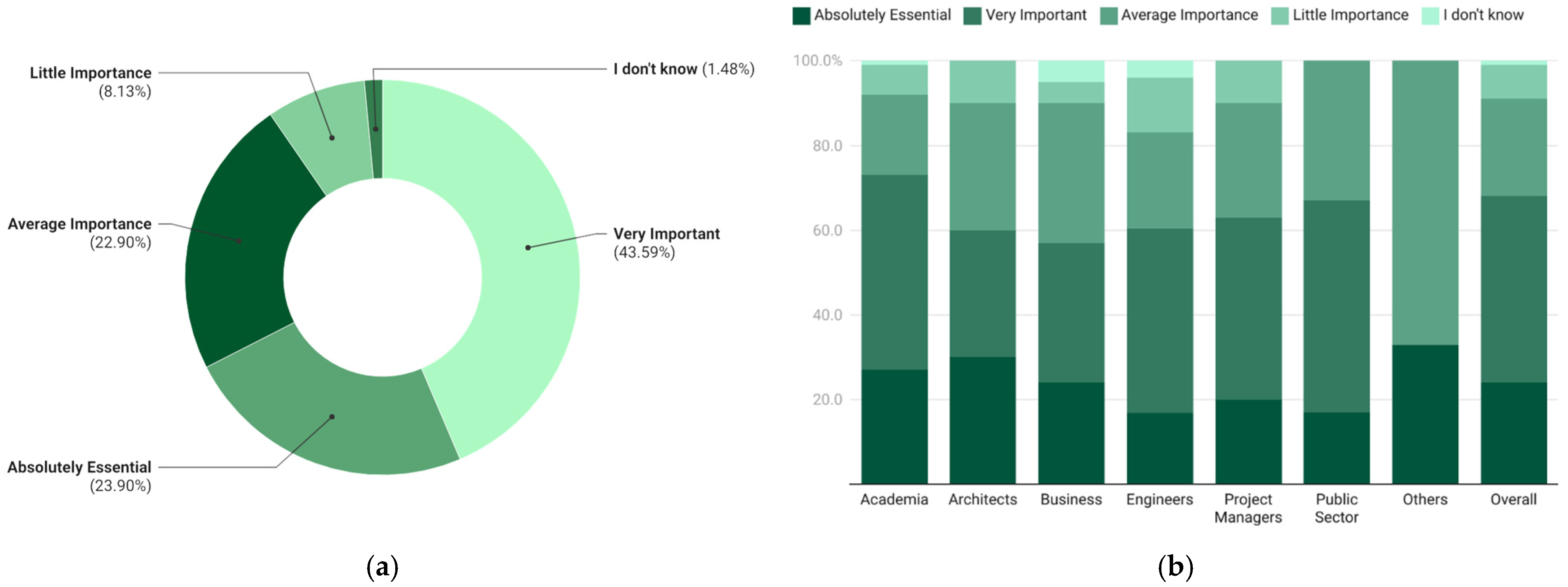

Respondents were asked to rate if an important market and economic barrier to the advancement of a circular economy is that public procurement currently supports linear business models.

Figure 9a,b outline the results, with a total of 67% of respondents agreeing that this was essential and very important.

Public authorities own and manage large amounts of building stock. Yet, the adoption of the EU Green Public Procurement (GPP) criteria—an important driver of sustainability and decarbonisation in building and infrastructure construction—remains voluntary. Recently, a handbook was designed for the public sector by over 40 industry experts in collaboration with renowned law firms in Germany, ensuring that the guidelines and templates for circular public procurement in construction are legally compliant. The handbook showcases successful pilot projects and includes strategies for reusing materials and optimising processes with standards for pre-demolition audits. It focuses on reducing emissions, managing costs, and highlighting the public sector’s role in leading the transition to circular construction [

19]. Since 2022, the Scottish Government has required annual reporting of the prioritisation of the circular economy in all public procurements under policy note SPPN 3/2022 [

20].

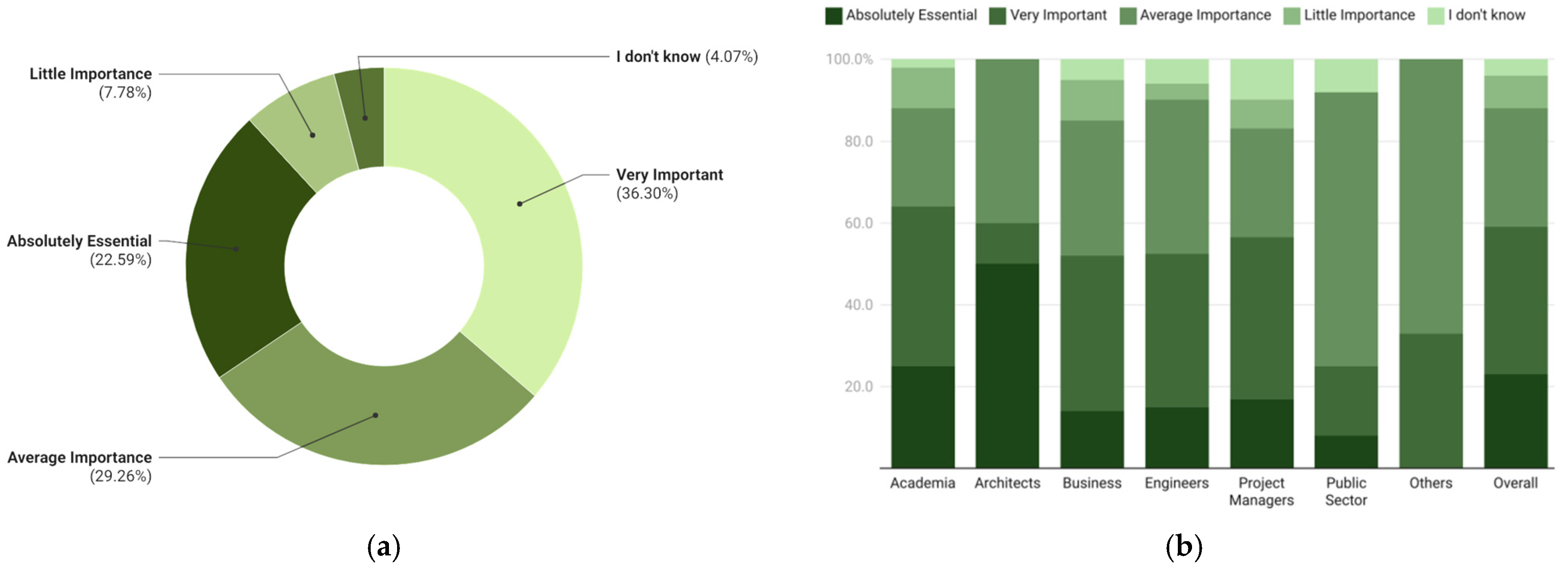

Next, the respondents were asked to rate the lack of technologies and infrastructure for promoting circular buildings and construction projects as necessary and whether there are insufficient procurement strategies for CE-based materials requirements, see

Figure 10. This highlights the role that BIM and other such tools could have in enabling a CBE.

The respondents were next asked to rank the unwillingness of companies or stakeholders to take back used components or materials.

During the procurement process, procurers can include extended contractor responsibility as a criterion. This ensures that the contractor or material supplier is accountable for maintenance over a specified period after project delivery and/or the take-back of materials at the end of their use. This approach encourages the selection of durable and recoverable materials [

21]. However, the reluctance of manufacturers or contractors to take back used components or materials remains a significant barrier to enabling a second life for recovered construction products, as shown in

Figure 11a. A few notable examples have demonstrated the potential for this to advance a CBE. The take-back programme by an HVAC pump manufacturer, Grundfos, has contributed to reducing landfill waste [

17].

Respondents next rated the importance of the lack of knowledge about the availability of ‘second-hand materials’ companies and/or exchange marketplaces, such as the Material Reuse Portal [

22], see

Figure 12.

Exchange marketplaces for second-hand construction materials are required. For example, to develop a circular economy, reduce the amount of construction waste generated, and ensure its reuse, a new construction waste sorting and recycling centre, “Nomales”, was established in Latvia [

23]. It is the only place in the country that provides and meets all environmental requirements. The exchange point for construction waste, building materials, and repair items is open to everyone. It offers free drop-off, pick-up, or exchange of reusable building materials, repair items, interior furnishings, and usable electrical appliances. At the exchange point, you can also exchange construction waste of a certain quality for recycled soil or chips. However, the lack of awareness of these marketplaces exists, hindering widespread use.

Where companies are talking to each other, CE principles are being delivered. A recent article in New Civil Engineer explored the reuse of steel in construction projects [

24]. Large-scale projects in London require the calculation of embodied carbon and whole-life carbon emissions, for which the CE can be beneficial. The article highlighted a recent case of ‘urban mining’ where 40 tonnes of steel from a former department store on Oxford Street were reused in an office retrofit in the City of London. It was enabled through the collaboration of like-minded consultancies. Another scheme involved two buildings owned by the same property company where the contractor reused 1800 tonnes of steel.

The last question asked respondents to rate the importance of market disconnection due to significant transport distances or additional demand for material processing before reuse, see

Figure 13.

There can be a time lag between the deconstruction or demolition of buildings and the sale of recovered materials, necessitating the storage of reclaimed building materials. In Germany, for example, the concept of the Urban Mining Hub was developed to serve as a storage facility where materials can be refurbished and stored [

18], representing a crucial component in the value chain for professional reuse. The Hub serves as a bridge between the period after dismantling and before subsequent use, ensuring components are not prematurely discarded as waste due to lack of use [

25]. Reclaimed materials and components from hundreds of projects are available for purchase through an online shop (

https://shop.concular.de/). The first Hub was established in Berlin with the support of local government as part of the Re-Use Initiative of the Berlin Senate Department for Mobility, Transport, Climate Protection and the Environment (ger.

Senatsverwaltung für Mobilität,

Verkehr,

Klimaschutz und Umwelt—SenMVKU) in collaboration with recycling and waste management company Alba and circular construction company Concular [

26] and will serve as a role model for further hubs to be established in other large cities [

18]. In the meantime, a warehouse in the underground car park has been established to store, clean, and refurbish the materials and give them a second life by returning them to the office spaces or selling them on the open market [

27].

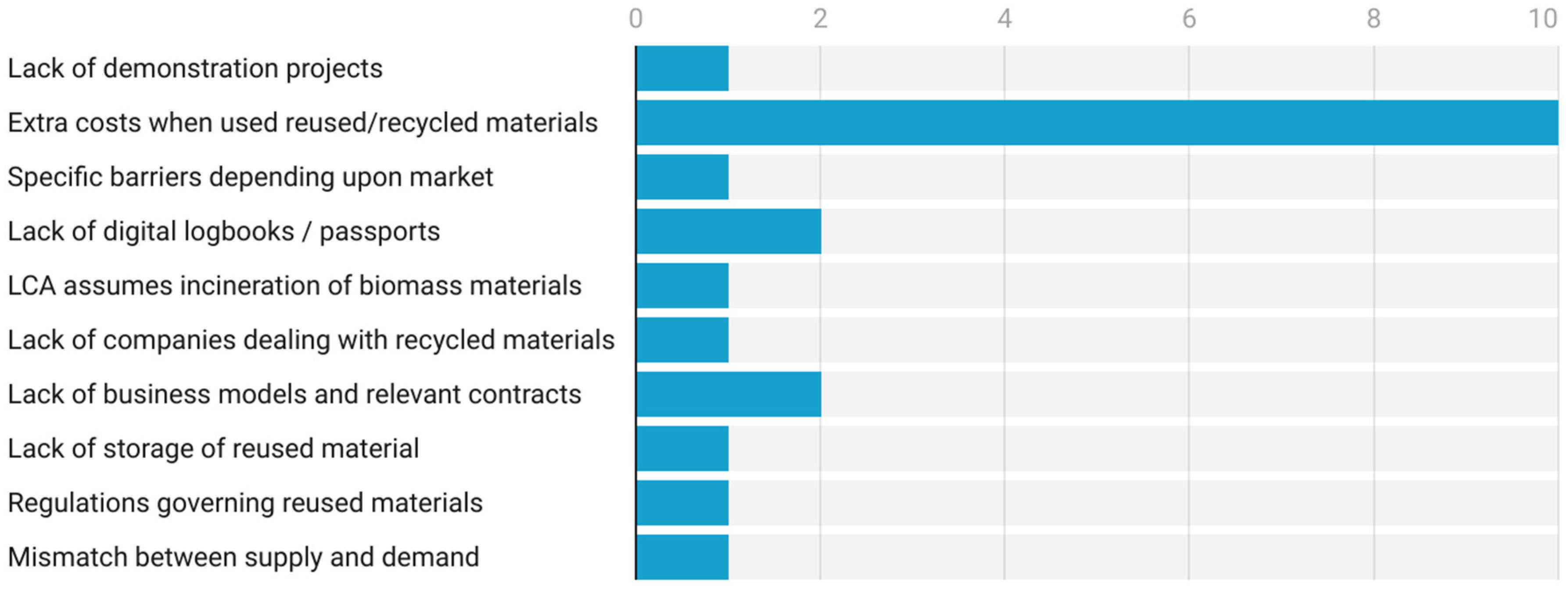

Finally, the questionnaire asked whether there were market barriers not included in the previous questions that hindered the implementation of the circular economy in the built environment. There were 21 individual replies, as depicted in

Figure 14 below. The most common missing barrier was the extra cost incurred with reused/recycled materials, with 10 responses. The lack of digital information, such as material passports, was cited by two persons. Other barriers cited included a lack of demonstration projects, different barriers between countries/regions, a lack of business models, and especially a lack of relevant contracts that are able to deal specifically with reused materials. A lack of storage space for material when taken off a deconstructed building was noted, and this is something that the authors are well aware of, as it is an issue regularly mentioned in professional forums. One barrier mentioned was timing. The authors are aware of a UK project where a company wanted to use metal beams from a building under deconstruction to erect temporary works to support a building façade. After which, the temporary works would have been used to erect a portal frame building. However, the timing of the three projects was altered, and it was not possible to use the materials in this way.

The barriers discussed are crucial to advancing circular construction, and companies are working to overcome them. Interestingly, many of these barriers are addressed in the Handbook for Circular Planning and Construction, developed for the public sector in Germany. This handbook also serves as a valuable resource for other stakeholders in circular construction [

19].

4. Discussion

The investigation of these economic and market hurdles to a CBE represents a new perspective. The current political, economic and environmental situation in the world requires immediate and radical actions to ensure sustainability for future generations. A bibliographical analysis of the literature showed that when talking about economic and market barriers, they should not be viewed as a problem, but rather enablers should be found that turn problems into opportunities. The term built environment denotes conditions shaped by human intervention and is frequently used in fields such as architecture, landscape architecture, urban planning, public health, sociology, and anthropology, among others. These designed environments serve as the backdrop for human actions and were developed to meet human wants and requirements. One of the most important directions is the implementation of circular economy principles to the construction and demolition waste cycle, as construction waste is a vital stream of untapped resources [

28]. Over the past year, the number of publications on the role of stakeholders in the built environment, specifically in mitigating climate change, has increased rapidly. This resonates with the relevance of the survey the authors conducted and demonstrates the problem’s global nature [

28,

29,

30].

The lack of adequate insurance coverage for reclaimed building materials has been a significant barrier to achieving a CBE. However, cooperation between a construction company and a leading insurance provider in Germany showcases a solution that encourages the greater use of reclaimed construction materials while ensuring compliance with regulatory requirements. This example underscores the importance of stakeholder collaboration in developing an insurance product that provides the same coverage for reclaimed materials as for new materials, aligning with industry standards and legal requirements [

31].

The extra costs of using recycled or reused materials often emerge as an obstacle to upscaling circular practice. However, we must stress that the costs taken into account are mainly the cost of the material acquisition, and the environmental costs are usually neglected. The benefits of savings in terms of reduced CO2 emissions and lower waste generation are often overlooked as the buyers are primarily concerned about the costs they need to bear during the construction process. Nevertheless, successful circular construction companies serve as living proof that those benefits can be achieved along with the profit and that changing from the business as usual to circular practices, can make a massive difference for the environment, paving the way towards a sustainable future.

Stakeholders are at the nexus of the built environment transition to circularity. This is because engaging many stakeholders, including architects, contractors, facility managers, waste treatment companies, insurance providers and policymakers, is vital in tackling the systemic hurdles they come across. Stakeholders are often active members of dispersed networks with different degrees of circular economy knowledge, making cooperation and alignment difficult [

32,

33], as shown by the survey results.

Incorporating a pre-demolition audit into future construction processes and recording the reuse potential of building products through digital tools would benefit all stakeholders in the construction industry. This approach can assist legislators in drafting new regulations and provide standardised data on construction products for the private sector. Standards need to be developed to establish uniform and standardised processes within the industry, enabling the recording of building materials as a basis for evaluating their potential for high-quality reuse prior to demolition or renovation work. DIN SPEC 91484, developed by the German Institute for Standardization in collaboration with 30 leading construction companies, represents a notable example of good practice [

34].

Most often, when talking about the circular economy, waste management is mentioned first. The reduction of waste through the adoption of circular economy practices could result in cost savings in the long term. However, investing in infrastructure, training, and technology raises economic issues that become a barrier to the successful adoption of circular economy practices [

35]. In addition, attracting more involvement of firms that would be financially motivated to engage in circular practices is about addressing the bottom line [

36]. However, this is too narrow a view, as circularity should be ensured throughout the entire construction cycle, which additionally requires talking about quality requirements and guarantees [

14,

15,

28,

35].

Stakeholders require design for circularity and actionable implementation across building life cycles. On the contrary, inconsistent quality and quantity of recovered materials prevent equilibrium between supply and demand. Such ambiguity calls for reliable information systems that would enable real-time monitoring and matching of aggregated materials. Furthermore, from the perspective of demolition contractors, additional functional capabilities that go beyond traditional responsibilities are needed, which can help facilitate resource diversion for new projects [

30,

32,

34].

A paradigm shift in stakeholder collaboration is pivotal for overcoming these barriers. Stakeholders must move beyond isolated actions to adopt holistic, multi-disciplinary approaches. Collaborative business models that align incentives for all players—developers, suppliers, and end-users—can unlock value in circular practices. For example, flexible leasing models for building components and integrating circularity into procurement criteria have proven effective in pilot projects. Education and awareness campaigns can further empower stakeholders to align their strategies with circular economy principles, fostering a culture of innovation and sustainability [

7,

17,

37].

Cooperation sets the stage for the practical application of a circular economy. Industrial Symbiosis, where one project’s waste becomes another’s resource, illustrates the interconnectivity of projects with material pools. The involvement of public and private actors can increase such efforts. For example, resources can be organised worldwide if there are inter-institutional cooperation policies that encourage collaboration between the sectors. All such ecosystems are embedded in frameworks like the Circular Construction Ecosystems, which highlight the role of digital collaboration platforms in managing complex material flows. Thus, Industrial Urban Symbiosis enables all parties to pursue their objectives across urban and industrial landscapes, increasing resource economy and minimising pollution [

28,

38,

39].

The implementation of digital technologies could help reduce these issues from within. Digitisation and solutions on various platforms will be important in building cooperation, starting with a materials register, stakeholder networking and collaboration, and education solutions. Objectives like circularity not only demand extensive information but also necessitate significant alterations across all related sectors. These traits indicate that circularity is intrinsically linked to the digital transformation of the entire system, similar to how digitalisation has revolutionised communication, entertainment, social interactions, and more. Circularity must incorporate fully integrated digital information of the built environment and weave it into the core of its processes, acting as the connective framework among various elements, stakeholders, and actors. This would represent a vital focus area for subsequent studies, serving as a logical progression from this survey and its findings [

40,

41,

42].

In reflecting upon the outcomes of this research study, the authors acknowledge that the vocabulary used in some of the questions may have limited/directed the responses given in the survey. For example, in the first question—“Extra costs of building insurance and/or professional indemnity when using recycled materials”—the use of the term recycled may have limited responses to materials that were being sent for significant reprocessing. However, in an open-ended question regarding additional barriers, the respondents used the term “reused materials” to refer to the extra costs of such materials, confirming their awareness of the difference. It may have been better to use terms developed by Potting et al. [

43], such as reused, repurposed, remanufactured, etc. This highlights the need for the adoption of Potting’s 10R language in the CBE.

The survey was conducted within a clearly defined scope, focusing specifically on economic, market, technical, and cultural barriers to the implementation of circular practices in the built environment. While the research draws on insights from a broad range of stakeholders, its reliance on self-reported data introduces potential limitations related to respondent interpretation. Furthermore, the study does not explore regulatory or environmental barriers in-depth, nor does it assess circularity from a design or life-cycle analysis perspective. Broader urban sustainability themes, such as long-term spatial adaptability and flexibility or the role of cities as dynamic material reservoirs, are acknowledged as highly relevant but lie outside the focus of this research. These dimensions, while important, merit separate inquiry to fully capture their systemic implications. Future research could build upon the present findings by integrating cross-disciplinary perspectives that address the regulatory, architectural, and ecological aspects of circular urbanism.

5. Conclusions

Although the authors had planned to focus on market barriers in this article, they cannot be observed in isolation. They are closely linked to other hurdles that need to be addressed to achieve greater circularity in the construction sector by initiating digitalisation processes and promoting collaboration with stakeholders.

The survey results demonstrate the urgency of the problem, highlight its relevance, and show the different attitudes of different regions. A selection of the scientific literature shows that too little has been demonstrated regarding the analysis of the opinions and practices of built environment stakeholders, the risks of market barriers, and possible solutions. Lack of previous experience and fear of additional costs hinder circularity in all sectors. Successful achievements are based on stakeholder identification and engagement at all levels.

The research highlighted that market barriers were considered to have the most significant impact. The main means to overcome these barriers is by turning them into enablers and opportunities, some of which may involve new market approaches. Amongst the market barriers, the liability of reused products and related warranties and insurance for reused materials/systems raised significant concerns. The reliance on a linear model in public procurement was also considered significant. However, EU and national governments are working to develop guidelines and templates for circular procurement.

This research has highlighted knowledge of material availability and actual resource flows. Companies already exist that act as banks of circular materials. Not all construction materials suit such banks and are best removed from one site for immediate reuse elsewhere. For urban mining to be successful, better knowledge and collaboration are required across the industry to counter systemic problems like supply chain fragmentation and resource waste. There are opportunities for new entrants to join this field as factors facilitating material flows.

Materials costs tend to neglect environmental costs. Hence, while new materials can sometimes be cheaper than circular materials, the embodied carbon and environmental degradation linked to material extraction are not factored into new materials. If the environmental impact of all materials were factored into material costs, this would reduce the attractiveness of new materials. The EU circular economy action plan and national and international standards which are being developed will establish uniform processes across industry and, where practical, international borders to enable a CBE market.

Technology can be an enabler in overcoming these barriers. Material passports delivered through BIM tools and pre-demolition/pre-retrofit audits should be mandatory for all buildings, building up a database of resources in the urban landscape. Flexible leasing and new ownership models will drive manufacturers/construction companies to retain responsibility for the maintenance of products they produce across the lifespan.

Policy dimensions and economic sustainability are essential parameters for addressing the market aspects in a CBE. High startup costs in the development of infrastructure and technology appear to be a burden, but in the long run, the returns and environmental impacts are worthwhile. Subsidies and tax exemptions, coupled with favourable policies, help bring high-level circular economy aims into practical form. With proper assistance, satellite actors can practice the circular economy, thereby working towards the aggregate goal of a built environment that is resource-efficient and environmentally friendly.