1. Introduction

The real estate sector has a significant impact on energy consumption and CO

2 emissions, making energy efficiency in buildings an important strategic tool in climate change mitigation policies [

1]. In the European Union (EU), around 75% of buildings are energy inefficient, making their renovation and retrofitting a key priority to reduce energy consumption and promote the transition to renewable energy sources [

2]. Initiatives such as the European Green Deal, the Renovation Wave, and the Energy Performance of Buildings Directive (EPBD) set standards for sustainable construction and renovation to reduce CO

2 emissions and, at the same time, promote investment in real estate [

3,

4].

The Nordic real estate market plays a crucial role in achieving these goals, as the region is particularly active in implementing energy-saving measures due to its climate conditions, high urbanization, and technological progress. Energy consumption trends in the real estate sector depend on various factors, such as demographic changes, economic growth, urbanization, and technological solutions [

5,

6,

7,

8,

9,

10].

This study focuses on the Nordic countries—Denmark, Estonia, Finland, Iceland, Ireland, Latvia, Lithuania, Norway, Sweden, and the United Kingdom—due to their strong commitments to energy efficiency and climate policies. These countries have implemented some of the most ambitious real estate sustainability regulations in Europe, including nearly zero-energy building (NZEB) standards and large-scale renovation programs. Furthermore, their diverse economic and political environments provide a favorable environment to assess how different regulatory models and investment trends affect CO2 emissions in the real estate sector. By analyzing the experiences of these countries, this study can also provide insights for other countries seeking to promote sustainable real estate development.

Globally, buildings are one of the main sources of energy consumption and carbon dioxide (CO

2) emissions, accounting for about 39% of global emissions. Of this amount, about 28% of the energy is used to operate buildings—for heating, cooling, lighting, and appliances—while the remaining 11% is related to so-called embodied emissions, which occur during the production and construction processes of building materials. Given the projected rapid growth of urban populations, especially in developing countries, the demand for buildings and their associated energy consumption may increase significantly in the future, further exacerbating environmental problems [

11,

12].

International agreements such as the Paris Climate Agreement and the United Nations Sustainable Development Goals highlight the crucial role of the building sector in reducing global CO

2 emissions [

13]. These goals encourage improvements in the energy efficiency of buildings and the increased use of renewable energy sources. Some countries outside Europe already have good examples of how to successfully reduce the environmental impact of buildings. For example, Singapore’s Green Mark scheme encourages the use of environmentally friendly solutions in the construction and renovation of buildings, thereby reducing energy consumption and pollution [

14]. The NABERS system in Australia also helps to reduce emissions by clearly assessing the energy efficiency of buildings and encouraging the choice of more sustainable solutions [

15]. These good examples show that the experience of Northern Europe could be useful for other countries in the world, but the specificities of each country, such as climate, economy, technological development, and population attitudes, should be taken into account.

This international experience shows that there is much scope for adopting and adapting policies and technological solutions that have worked well in Northern Europe and other parts of the world. However, differences in climate conditions, economic resources, technological infrastructure, regulatory systems, and public acceptance should be carefully considered. To successfully reduce emissions from the construction sector worldwide, it is crucial to understand which measures are universal and which should be adapted to specific regional conditions.

The real estate sector is a major energy consumer and CO2 emitter, and its role in mitigating climate change is becoming increasingly important. European Union policy initiatives, such as the “Renovation Wave” set ambitious goals, but there is still a lack of research that comprehensively examines the impact of real estate investments on long-term sustainability. This study provides new insights, using advanced quantitative methods, to better understand long-term investment trends and their impact on CO2 emissions.

This study examines the impact of real estate investments on energy efficiency and CO

2 emission reduction, but it is important to highlight how these results differ from previous research findings. Previous studies have focused on individual factors, such as energy efficiency improvements or policy impact assessments, but have not examined the complex effects of these interacting factors in the Nordic countries [

16,

17]. For example, Sweden’s green building regulations have had a significant impact on energy consumption trends, while Norway’s promotion of energy-saving renovations has long-term benefits [

18]. However, the existing literature still pays little attention to the long-term impact of real estate investments—both new construction and renovation—on CO

2 emissions at the regional level. Renovations likely provide greater benefits in terms of emission reduction than new construction projects (H1), and the share of renewable energy reduces the impact of real estate investments on emission reduction (H2). This study adds to the existing literature by applying a comprehensive quantitative combination of methods to determine how real estate investments work in the long term. It also examines economic and policy trade-offs that have often been underemphasized in previous studies.

Previous studies have mostly examined energy efficiency and emission reduction in isolation but have paid little attention to the complex interactions between real estate investment, economic growth, and sustainability. Studies show that energy-efficient buildings can significantly contribute to reducing emissions, but their impact depends on the national policies and market incentives in place (Pylsy et al., 2020) [

19]. Furthermore, Haarstad et al. (2021) highlight the main obstacles to sustainable urban development, emphasizing financial and regulatory challenges [

20]. This study aims to fill this gap by assessing the long-term relationships between these factors using panel regression and time series models.

The structure of this article is as follows:

Section 2 presents an analysis of the scientific literature, which includes the research hypotheses and reviews the most important previous studies.

Section 3 details the research methods, data sources used, and applied analysis procedures—panel regression, ARIMA, MCDA, and linear regression.

Section 4 presents the results of the empirical study.

Section 5 discusses the results obtained and clearly indicates which of the five research hypotheses were confirmed or rejected. Finally,

Section 6 presents the main conclusions, discusses the limitations of this study, and offers suggestions for further research.

2. Review of the Literature

2.1. The Role of the Real Estate Market and EU Policies in the Transition to Sustainability

European Union policy is a key driver of the real estate market in the area of energy efficiency and emission reduction [

21]. The Energy Efficiency Directive (EED), the Renewable Energy Directive (RED), and the Energy Performance of Buildings Directive (EPBD) set clear guidelines on how Member States should promote energy efficiency. The EPBD already obliged all EU countries in 2010 to build only nearly zero-energy buildings (NZEBs) from 2020, and the Renovation Wave Strategy envisages the renovation of at least 35 million buildings by 2030 in order not only to reduce energy costs but also to attract new investments in the real estate sector. In Northern Europe, these policy changes have a significant impact on the real estate market, as many countries have already established sustainable financing mechanisms to promote real estate modernization and investment in green solutions [

22].

In addition to policy initiatives, technological solutions such as smart energy management systems, heat pumps, and solar energy systems are having a significant impact on the sustainability of the real estate sector [

23,

24,

25,

26,

27].

These innovations not only help reduce energy consumption and CO

2 emissions, but also raise debates about their cost-effectiveness and initial return on investment [

28]. While energy-saving technologies reduce energy costs in the long run, their implementation often depends on government subsidies and the stability of the economic environment [

29].

2.2. Investors’ Attitudes Towards Sustainability in the Real Estate Market: Strategies, Opportunities, and Links to Energy Efficiency

Sustainability issues in the real estate sector are becoming increasingly important not only due to environmental requirements but also due to direct economic benefits [

30,

31]. Investors are increasingly choosing real estate projects that are characterized by higher energy efficiency, as such objects ensure lower operating costs and higher long-term property value [

32]. Research shows that real estate objects that meet high energy efficiency standards are valued more by buyers, tenants, and insurance companies, which often apply more favorable insurance conditions to such assets [

33]. This creates a double benefit for investors—both increased asset liquidity and lower operational risk [

34].

Due to the increasing volatility of energy prices, the impact of climate change on infrastructure, and increasingly stringent regulatory requirements, investors need to diversify their portfolios to protect themselves from long-term risks [

35]. Sustainable real estate projects offer an opportunity to reduce dependence on fossil fuels and ensure more stable building operating costs [

14]. For example, buildings powered by solar or geothermal energy are more resilient to market fluctuations and have more stable long-term costs [

36]. For these reasons, sustainable real estate projects are attractive to long-term investors, such as pension funds or insurance companies, who seek to secure stable income over a longer period [

37].

In recent years, more and more consumers and companies have chosen sustainable real estate solutions, which encourages market participants to invest even more in green technologies [

38]. This trend is especially pronounced among young people and start-ups, who emphasize their social responsibility and environmental commitments [

39]. As a result, sustainable investments in real estate are becoming not only a market requirement but also a strategic driver for the development of the real estate sector, which can ensure long-term economic stability and a lower environmental impact [

40,

41].

In light of these developments, this article analyzes the changes in energy consumption and CO2 emission reduction in Northern Europe from 2000 to 2022, assessing the development trends of the real estate sector and the implementation of EU policies. Based on previous research, it is assumed that real estate investment reviews are associated with an increase in CO2 emissions, as the construction process is often energy-intensive (H3). Thus, the implementation of stricter energy efficiency regulations could significantly reduce the negative CO2 impact (H4). Different analytical methods were used to implement the study: panel regression, MCDA, and ARIMA modeling. These methods allow us to understand past trends and plan future scenarios that are important for politicians, investors, and real estate market participants.

2.3. Research Questions

This study aims to assess the trade-offs between economic and environmental solutions in the Nordic real estate sector. While sustainable buildings reduce long-term operating costs and contribute to reducing CO

2 emissions, their initial investment is high, which can limit the pace of real estate development [

42]. In addition, strict energy efficiency regulations in some countries are hindering market growth by making construction processes more complex and expensive [

43]. Urbanization also poses challenges, as increasing demand for real estate may conflict with the preservation of green spaces [

44]. These factors reveal that the Nordic real estate sector is faced with the need to balance economic development and sustainability goals. One of the main aspects of this study is the analysis of the short-term and long-term costs of sustainable real estate investments. In the short term, the design and construction of green buildings require higher initial investments due to high technological requirements, strict certification standards, and the implementation of energy-saving systems [

45]. This can lead to slower returns on capital, especially during the financing phase of new projects. However, in the long term, sustainable real estate projects become more economically viable due to lower energy costs, greater property value stability, and increased tenant demand [

46]. In addition, policy solutions such as subsidies and preferential financing mechanisms can offset the initial costs and encourage the development of green real estate projects. In this context, several key questions are analyzed: How do real estate investments in the Nordic countries affect CO

2 emissions? What impact do strict energy efficiency regulations have on real estate market growth and investment profitability? Do urbanization processes significantly impact energy consumption and emission changes? How effectively do sustainable real estate solutions contribute to reducing CO

2 emissions, and are they economically sustainable in the long term? The results of this study will help answer these questions by analyzing the statistical relationships between real estate investments, energy consumption, urbanization, and the impact of sustainable solutions on emission reduction.

The selected variables reflect the main factors determining the impact of the real estate sector on CO2 emissions and energy consumption. Investments in real estate can increase emissions depending on the efficiency of buildings, and energy consumption directly affects the level of emissions. GDP per capita and the level of urbanization help to assess the impact of economic growth and urban development on the real estate sector. In addition, urbanization can have a significant impact on the efficiency of infrastructure and the effectiveness of applied policies, especially in addressing issues related to sustainability and CO2 emission reduction (H5). The share of renewable energy allows the assessment of the transition of countries to sustainable energy sources, while the EU policy index measures the impact of regulations on reducing emissions. These variables provides a comprehensive assessment of the interaction between real estate, the economy, and energy consumption.

3. Materials and Methods

This study analyzes the dynamics of energy consumption, CO2 emissions, and real estate investment in Northern Europe from 2000 to 2022. Four main methods were used to conduct the detailed analysis: panel regression analysis, ARIMA model, multi-criteria decision analysis (MCDA), and linear regression analysis. These methods allow for a detailed assessment of historical data, identification of key drivers, and recommendations for sustainable solutions in the real estate sector.

The main data source is the International Energy Agency (IEA) database, which provides information on energy consumption in residential and industrial buildings, the energy mix, and CO2 emission dynamics. National data on real estate investment, including renovation projects and new construction, are also used.

All collected data were processed and standardized using Microsoft Excel 17.0, SPSS 30, and RStudio R 3.6.0+ to ensure consistency and transparency of the analysis. Before applying the analytical models, data cleaning was performed to remove missing values and discrepancies. Energy consumption and CO2 emissions time series data were tested using the Shapiro–Wilk test, and in the case of normality (p > 0.05), one-way analysis of variance (ANOVA) was applied to compare the means of CO2 emissions across the Nordic countries.

The null hypothesis of the one-way analysis of variance states that the means of the compared groups are not statistically significantly different, as shown in Equation (1):

where H₀ is the null hypothesis, μ is the mean, and k is the sample size.

Given the limitations of traditional regression models in examining both cross-sectional and time series data, this study uses panel regression analysis [

47]. Panel data models allow for a more accurate assessment of how real estate investments and policy changes affect CO

2 emissions across countries over time. This panel regression model is applied (see Equation (2)).

Yit—CO2 emissions in country i at time t; Xit—key independent variables such as investment in real estate, energy consumption, GDP per capita; Zit—control variables, including the level of urbanization, the share of renewable energy, and the implementation of EU policies (dummy variable); ui—fixed country-specific effect; εit—error term.

To determine whether a fixed effects (FE) or random effects (RE) model is more appropriate, a Hausman test is performed. It assesses whether unspecified individual effects are correlated with the explanatory variables. The null hypothesis of the Hausman test assumes that the RE model is appropriate because individual effects are not related to the regressors and are therefore considered more efficient. However, if the null hypothesis is rejected, this indicates that the FE model is more appropriate because country-specific characteristics can affect the independent variables and lead to endogeneity problems. In this study, the results of the Hausman test supported the choice of the FE model, as the estimated coefficients showed that factors such as energy consumption, urbanization, and policy measures are correlated with country-specific characteristics. Therefore, the FE model was chosen to ensure more reliable and unbiased estimates, better control for country heterogeneity and more accurately identify the impact of real estate investments on CO2 emissions.

Autoregressive Integrated Moving Average Model (ARIMA) is used to analyze and forecast long-term trends in energy consumption and CO

2 emissions. This model effectively handles seasonal and noisy time series and has already been used to forecast carbon emissions [

48]. The model parameters are determined based on autocorrelation (ACF) and partial autocorrelation (PACF) plots, while the final model is optimized using Akai (AIC) and Bayesian (BIC) information criteria.

Multi-criteria decision analysis (MCDA) is used to assess the sustainability of energy resources in the real estate sector. Since the energy consumption of residential buildings depends largely on the choice of energy sources, the following alternatives are analyzed: solar, wind, geothermal, and natural gas.

The reliability of the MCDA method is often discussed in scientific studies, especially due to its sensitivity to the weight of the criteria [

49]. To make decisions as reliable as possible, studies recommend combining MCDA with real energy efficiency data, which allows for a better assessment of whether the chosen alternatives will actually bring long-term benefits [

50,

51].

The assessment is carried out using the Analytical Hierarchy Process (AHP), taking into account three main criteria: energy efficiency, CO2 emission intensity, and economic costs.

This method allows to identification of optimal energy alternatives for building renovation and new construction.

Linear regression is used to determine how key factors affect CO

2 emissions, which has already been used to predict in previous studies [

52]. The dependent variable is CO

2 emissions, and the independent variables include energy consumption in residential buildings, the share of renewable energy, economic growth, population change, and real estate investment (see Equation (3)).

Here, Y represents the dependent variable, X is the independent variable, a and b are the coefficients of the equation, and ε shows the error term in the equation.

Using panel regression, ARIMA forecasting, MCDA, and linear regression, this study aims to comprehensively assess the interaction between energy consumption, CO

2 emissions, and real estate investment. Panel regression helps to identify causal relationships, the ARIMA model is used to forecast future trends, the MCDA method is used to select optimal energy alternatives, and linear regression assesses the significance of key factors. Panel regression has been frequently employed to assess the relationship between investments and environmental indicators [

53].

However, each method has certain limitations. Panel regression can be affected by multicollinearity, which distorts the coefficient estimates. ARIMA forecasts may not capture long-term structural changes or policy reforms. The results of the MCDA method depend on the subjective weighting of the criteria, and linear regression may simplify complex interactions between the energy and RE sectors. Nevertheless, combining these methods allows for a more comprehensive assessment of the drivers of CO2 emissions and energy use in Northern Europe.

The results of this study will be important for investment strategies, sustainable policy-making, and long-term energy planning in Northern Europe. All data and methodological protocols will be available in a public database to ensure the transparency and replicability of this study.

4. Results

4.1. Correlation and Regression Analysis Between CO2 and Independent Variables

In order to gain a more detailed understanding of the trends in CO2 emissions in the Nordic countries, several statistical analysis methods were performed. The analysis started with a one-way ANOVA analysis to determine whether the average emissions varied significantly across countries. After checking for normality, it was found that emissions were fairly evenly distributed across the region, so further analysis focused on factors that could influence emissions changes over time.

The analysis next analyzed the main factors that could influence CO

2 emissions. Pearson correlation analysis allowed us to identify the relationship between energy consumption, the share of renewable energy sources, real estate investment, and CO

2 emissions. The results are presented in

Table 1, which shows that the largest negative correlation with emissions is the increase in the population, while real estate investment has the opposite effect in some countries. (see

Table 1).

Since strong correlations were found between some of the independent variables, additional multicollinearity analysis was required. Due to the multicollinearity problem (VIF > 16), linear regression analysis could not be successfully performed. This showed that energy consumption, GDP, and RE investments are closely related to each other. Therefore, panel regression was used to more accurately analyze the impact of these variables on CO2 emissions.

The correlation analysis revealed several different relationships between CO2 emissions and key independent variables—energy consumption, real estate investment, GDP per capita, and population—across all countries analyzed. Rather than discussing the results for each country separately, the analysis grouped countries according to observed trends and highlighted key differences.

Countries such as Ireland, Denmark, Sweden, and the United Kingdom have found a strong negative relationship between GDP per capita, population, and CO

2 emissions. This suggests that economic growth and urbanization in these countries are associated with the introduction of more advanced, efficient technologies and renewable energy sources. As a result, emissions are decreasing despite economic development and population growth. In these regions, higher GDP per capita often means greater investment in green infrastructure and sustainable transport solutions, and urbanization leads to more efficient use of resources, such as the development of district heating systems and public transport. This confirms previous research that highlights the ability of advanced regulatory countries to reduce CO

2 emissions as their economies grow [

54,

55,

56,

57].

A strong positive correlation between real estate investment and CO

2 emissions was found in Denmark, Lithuania, and Iceland. This suggests that in these countries, active real estate developments, especially new construction, remain a significant source of carbon emissions. Despite Denmark’s progress in implementing renewable energy sources, new construction still contributes to an increase in emissions. This effect remains significant in Lithuania and Iceland as the integration of renewable energy into the real estate sector is not yet sufficiently developed. This highlights the challenges that countries face in reconciling real estate market growth with sustainability goals [

58,

59,

60].

In Estonia, Norway, and Finland, weak or statistically insignificant relationships were observed between most of the independent variables and CO

2 emissions. In Estonia, this can be explained by the effective implementation of EU climate policy measures (e.g., CO

2 trading system and energy efficiency directives), which have decoupled economic activity from changes in emissions. In Norway, almost all electricity is produced by hydroelectric power plants, so CO

2 emissions are not dependent on normal economic growth rates or population changes. In Finland, despite a growing economy, emissions levels remain stable due to a diversified renewable energy portfolio and strict environmental policies [

18,

61,

62]

In Latvia and Lithuania, contrasting results are observed. In Latvia, GDP per capita and real estate investment show a small correlation with CO

2 emissions, but this relationship is not as strong as in other groups. This can be explained by the increasing development of renewable energy sources, which reduces the potential growth of emissions. In Lithuania, the relationship between GDP per capita, population and energy consumption, and CO

2 emissions is stronger, indicating that economic growth and urbanization are still closely linked to higher energy demand and higher emissions. These countries are currently entering the renewable energy phase, but the transformation of the real estate sector is not yet fully implemented [

8,

40,

58,

59,

61,

63].

While the analysis confirms a significant relationship between real estate investment and CO2 emissions, it does not clearly distinguish between the effects of new construction and renovation. However, previous research suggests that new construction projects generally emit more emissions due to the energy-intensive production of building materials and site preparation, while renovation, which requires energy to renovate buildings, reduces emissions over time due to improved energy efficiency. Future research would be useful to further disaggregate the types of investment to more accurately assess their impact on emission levels.

4.2. Panel Regression Analysis

Panel regression is a suitable method for identifying long-term structural relationships between CO2 emissions and their determinants. This analysis allows for controlling for both country-specific effects and time variations and can therefore yield more accurate results than using simple correlation or linear regression alone.

This study presents both fixed effects (FE) and random effects (RE) models, as they allow for the assessment of different assumptions about country differences (

Table 2). The fixed effects model (FE) is appropriate when country-specific factors are related to the independent variables and remain constant over time, allowing for the separation of the net effects of these variables on CO

2 emissions. Meanwhile, the random effects model (RE) allows for inferences about common patterns across countries but relies on the assumption that country-specific effects are not correlated with the explanatory variables. To determine which of these models is more appropriate, a Hausman test was performed—the results showed that the fixed effects model better captures the structure of the data, but the RE model is also presented as an additional robustness test to assess the overall stability of the relationships. This comparative analysis of the two models provides a more detailed understanding of how real estate investments and other factors determine CO

2 emissions in different macroeconomic and political contexts.

The panel regression results show that real estate investment significantly increases CO

2 emissions (β = 0.078,

p < 0.01), indicating that real estate development is associated with higher energy consumption and the environmental impact of the construction sector. Meanwhile, the growth of the share of renewable energy is significantly associated with a decrease in CO

2 emissions (β = −0.126,

p < 0.01), confirming that the use of clean energy is one of the most effective ways to reduce emissions. The level of urbanization and GDP per capita does not have a statistically significant impact on emissions, which may indicate that CO

2 levels are more determined by the specific energy use and nature of real estate investment, rather than economic growth or urban development itself. The EU Policy Implementation Index is also not statistically significant, indicating that regulatory measures have an indirect or delayed effect on emissions changes. This shows that to reduce the real estate sector’s impact on climate change, targeted investments in green buildings, financial incentives for the integration of renewable energy, and stricter regulations that encourage low-carbon real estate development practices are needed (see

Figure 1).

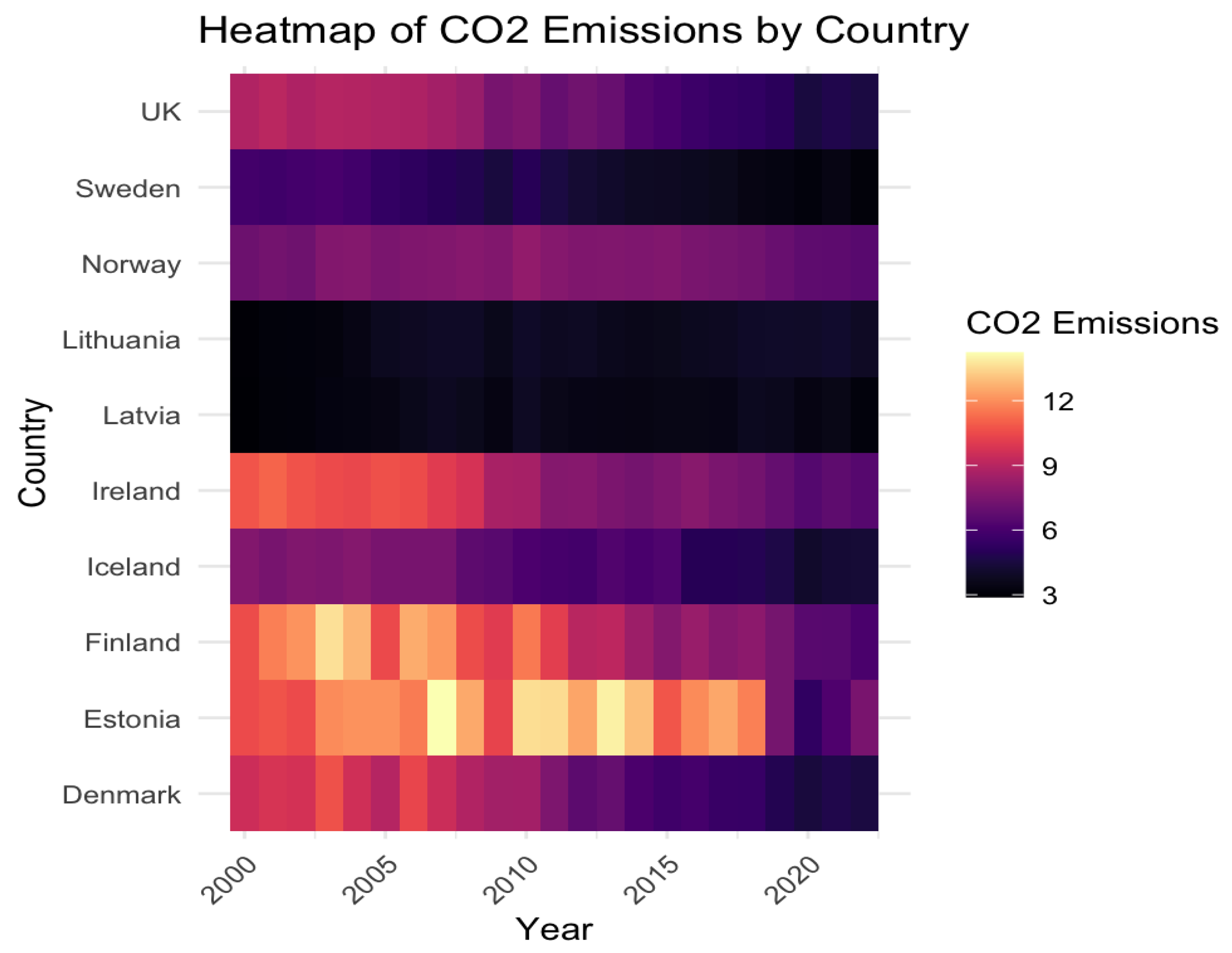

To visually compare changes in CO

2 emissions across the Nordic and Baltic countries, a heat map was created reflecting the dynamics of emissions in 2000–2022 (see

Figure 2).

The figure allows us to assess the trends in CO2 changes over the study period, highlighting differences between countries with different energy policies, economic indicators, and real estate investments. We can see that in Sweden, Norway, and the United Kingdom, regulatory policies have paid off, as CO2 levels have decreased significantly. Meanwhile, in Estonia and Ireland, high CO2 emissions remain, which may be related to the use of fossil fuels and a relatively slow transition to sustainable renewable energy sources. In the case of Finland and Estonia, large fluctuations in emissions are observed, which may indicate a dependence on certain energy sectors, such as the oil and gas industry or coal-fired power plants. In Lithuania and Latvia, CO2 emissions have remained stably low, but this may be due not only to active climate policies but also to the smaller overall size of the economy and the limited impact of the industrial sector. These results show that CO2 emissions are decreasing at different rates in different countries and that effective regulatory mechanisms and investments in clean technologies are key factors in achieving long-term emission reductions.

4.3. Multi-Criteria Decision Analysis (MCDA)—TOPSIS

This study uses the TOPSIS (Technique for Order Preference by Likelihood to Ideal Solution) method to objectively evaluate energy alternatives in ten Nordic countries based on several important criteria: energy efficiency, CO2 emission intensity, and economic costs.

The TOPSIS method allows for adjusting the weights of criteria, which is particularly useful when assessing aspects of different importance in the energy sector. Energy efficiency was given the highest weight (0.5), as it directly reduces energy consumption and emissions. CO2 emission intensity was given a score of 0.3, emphasizing the importance of sustainability, and economic costs, although significant, were given a score of 0.2, as the economic factor is important but should not dominate over ecological priorities.

Using this method, four energy alternatives were evaluated in each country: solar energy, wind energy, natural gas, and geothermal energy. For each alternative, a closeness coefficient was calculated, which shows how close a given alternative is to the ideal value. The results of the analysis revealed large differences between countries due to different energy structures and policy priorities. For example, in countries such as Ireland and Denmark, where there is a lot of investment in renewable energy sources, wind and solar energy achieved the highest ratings. Meanwhile, in Lithuania and Latvia, natural gas achieved a higher rating due to lower economic costs, despite its higher CO2 emission intensity. This shows that in countries that are just starting to transition to renewable energy, the economic factor remains decisive.

Other countries, such as Sweden and Norway, which already have developed renewable energy technologies, have given priority to alternatives with minimal environmental impact, such as geothermal or wind energy. The TOPSIS method allowed not only to determine the suitability of each alternative but also to reveal the specifics of the energy policies and infrastructure of the countries. This method is particularly useful for evaluating alternatives in regions with different economic and ecological conditions, as it helps to make decisions that meet the needs and goals of a particular country. In addition, the results of this study can be used as a basis for further planning of sustainable solutions and directing investments towards sustainable energy (see

Table 3).

The TOPSIS method showed that wind and solar energy were rated as the most effective in reducing emissions and ensuring the long-term sustainability of the RE sector. On the other hand, natural gas was considered a less efficient alternative, but still an important intermediate solution in the transition to a full transition to renewable energy sources.

4.4. Interaction Between Energy Consumption and Real Estate Investment

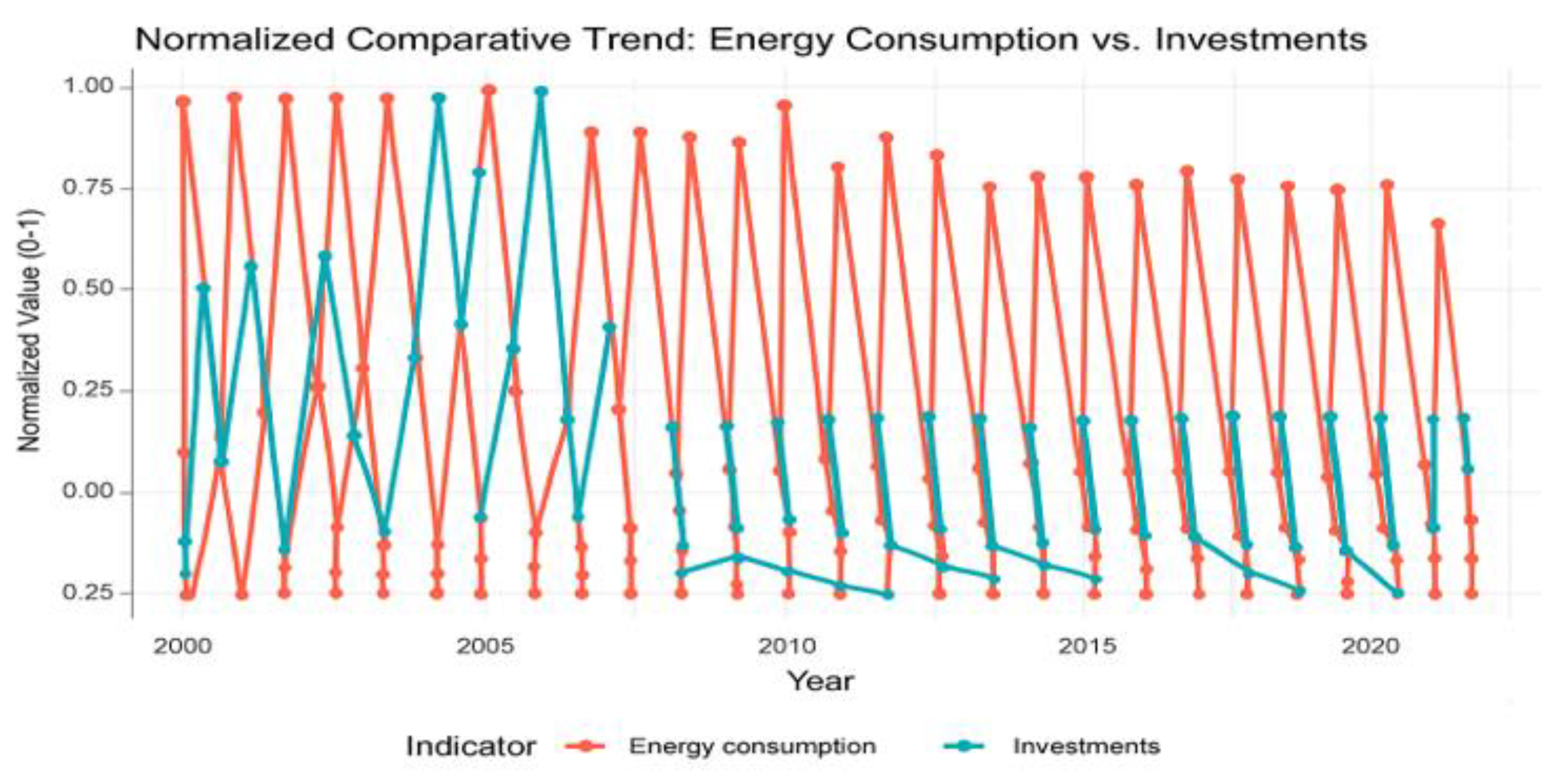

To assess the interaction between real estate investment and energy consumption over time, a normalized trend analysis was performed.

Figure 3 shows how these two indicators have changed from 2000 to 2022, using a scale from 0 to 1. The results show that the dynamics of real estate investment and energy consumption are not fully synchronized—in some periods they move together and in other periods they move in opposite directions. This may mean that real estate investment does not always directly lead to an increase in energy consumption, but its impact depends on various macroeconomic, technological, and policy factors (see

Figure 3).

The large fluctuations observed indicate that economic cycles, financial crises, and the boom or bust of the real estate market can affect changes in both investment and energy consumption. Furthermore, in some countries, a greater focus on energy efficiency measures may lead to lower growth in energy consumption even during periods of real estate expansion [

62]. These results highlight the need for a deeper analysis of policy and investment directions to ensure the sustainability of the RE sector’s impact on energy consumption.

4.5. Time Series Analysis Using the ARIMA Model

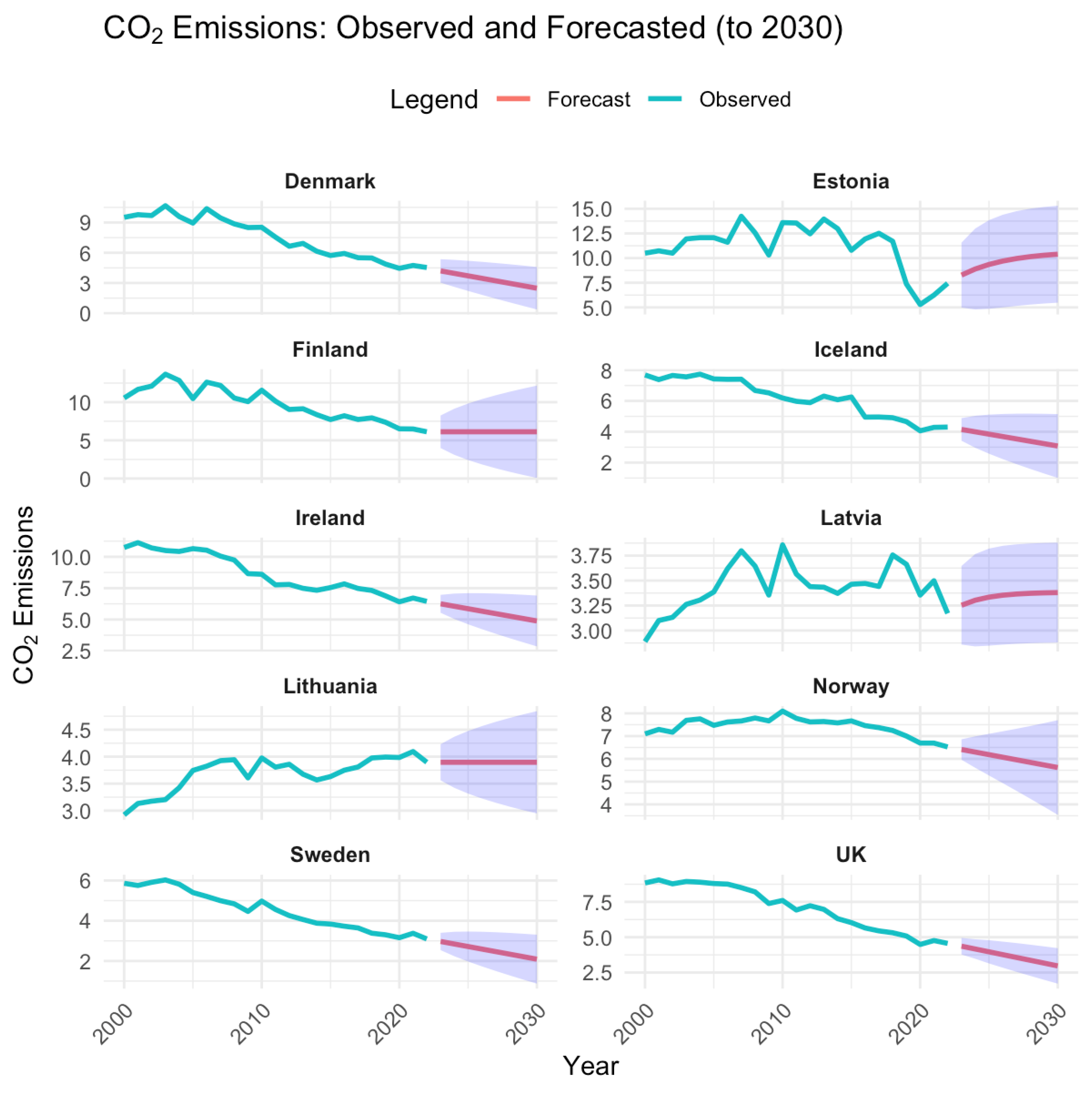

To perform a short-term forecast for CO

2 emissions in the analyzed data, the ARIMA (0, 1, 0) model was used. The forecast indicated a decrease in CO

2 emissions for several countries—Ireland, Denmark, Estonia, Iceland, Norway, Finland, Sweden, and the United Kingdom—while Latvia and Lithuania were expected to experience an increase (see

Figure 4).

Countries such as Ireland, Denmark, Estonia, Iceland, Norway, Finland, Sweden, and the United Kingdom are likely to experience a decrease in CO

2 emissions in the near future for several main reasons. First, these countries are actively switching to renewable energy sources, such as wind, solar, and hydropower, thereby reducing their use of fossil fuels [

62]. Second, they are implementing strong climate change policies that promote energy efficiency and emission reductions, such as building renovation programs and industrial modernization. Third, these countries are active participants in EU or global climate agreements, such as the Paris Agreement, and are therefore investing in green technologies and low-carbon infrastructure. Finally, the growing awareness of climate change among society and businesses is encouraging further emission reductions through long-term sustainable solutions [

64].

Latvia and Lithuania show that CO

2 emissions may increase soon for several reasons. First, these countries still use a large share of energy production from fossil fuels, and the transition to renewable energy sources is proceeding more slowly than in other countries in the region [

58]. Second, economic growth, expressed in GDP growth, and the related activity of the industrial and transport sectors, increases energy demand, which in turn increases emissions. Third, the development of the real estate sector, including the construction of new buildings and infrastructure projects, is often not based on high energy efficiency solutions. Finally, investments in emission reduction technologies and political commitments in the field of climate change are less developed in these countries compared to other countries in the region, which limits the pace of emission reductions [

59].

This study used four main analytical methods—correlation, panel regression, ARIMA model, and MCDA method. Each of them provided different insights. Panel regression allowed to reveal long-term structural relationships and control for country differences. The ARIMA model helped to predict future changes and showed long-term trends. Correlation analysis provided an initial understanding of the relationships between factors, but without in-depth analysis. The MCDA method helped to evaluate the best energy alternatives for the RE sector according to different criteria.

5. Discussion

The results of this study confirmed that investment in real estate in the Nordic countries has a significant impact on CO2 emissions, especially in countries where new construction rather than renovation predominates. Panel regression analysis showed that the growth of investment in the real estate sector is directly related to increasing emissions, but in countries with high energy efficiency measures, this effect is reduced. Energy efficiency regulations, although limiting short-term market growth, create a more stable real estate sector in the long term, characterized by lower operating costs and higher property values. Urbanization processes are uneven—in densely urbanized areas, such as Stockholm or Copenhagen, energy consumption per capita is decreasing due to centralized energy systems, but in less urbanized countries, such as Estonia and Ireland, urbanization development is still dependent on fossil fuels, which increases emissions. Sustainable real estate solutions, such as integrating wind and solar energy into building systems, have proven to be the most effective in reducing CO2 emissions, but their economic sustainability depends on government subsidies and financial incentives. This study shows that in the long term, green real estate projects are economically beneficial as they reduce dependence on increasingly expensive fossil fuel energy sources, stabilize the real estate market, and reduce investor risk. Therefore, although the short-term costs may be high, the long-term benefits for both the environment and the economy are significant, and therefore, investments in sustainable real estate solutions should be a priority in strategic planning documents. The long-term benefits of this entire process—lower building operating costs, greater asset value stability, and lower investment risk—justify these costs. This is especially important for long-term investors, such as pension funds or insurance companies, who seek a stable stream of returns.

Moreover, the results show that in almost all the countries studied, energy consumption is one of the main factors with a significant impact on emissions [

65]. This is in line with the findings of previous studies, which have shown that energy consumption, especially from fossil fuels, is directly related to emissions. Therefore, countries whose energy sectors are still dependent on fossil fuels are recommended to combine energy-saving measures with investments in renewable energy sources to achieve significant pollution reduction results. However, in countries such as Finland and Norway, where energy production is almost entirely based on renewable sources, the impact of energy consumption on emissions is smaller or depends on specific sectors, such as industry. These results show that energy consumption is not equally important in all countries, and its impact depends on the structure of energy production.

The impact of real estate investments on emissions was also significant in many countries, especially where infrastructure development or renewal processes are underway, such as in Denmark and Ireland. Such results are not unexpected, as the real estate sector is one of the largest energy consumers and sources of pollution in the world [

66]. If renovation and new construction processes are not supported by high-energy efficiency technologies, they can increase emissions [

67]. In addition, investments in energy-efficient renovation can not only reduce emissions but also increase the market value of buildings and attract more conscious tenants or buyers for whom sustainability criteria are important. This aspect is particularly relevant for Lithuania and Latvia, where real estate investments are still not sufficiently oriented towards sustainability, which may lead to a risk of increasing pollution in the future. Therefore, it is necessary to develop public-private partnerships that would allow the financing of large-scale renovation projects and promote the transition to low-carbon building solutions.

The most unexpected finding was the negative impact of population on emissions, which was observed in all countries. This result can be interpreted as the effect of urbanization and energy efficiency. In cities, energy consumption per capita can decrease due to centralized energy supply systems, the development of public transport, and other efficient infrastructure solutions [

68,

69,

70,

71,

72,

73].

However, in the Baltic countries, the opposite pattern is observed—here, emissions are more correlated with energy consumption, population size, and economic activity. These results show that the energy sectors of these countries are still highly dependent on fossil fuels, and the transition to renewable energy sources is proceeding more slowly than in other Nordic countries. Lithuania and Latvia, despite their emission reduction targets, still face challenges in increasing energy efficiency and implementing green policies.

The results of this study show that policy measures can have a significant impact on reducing emissions, but their effectiveness depends on the country’s policies regarding sustainability. For example, direct subsidies for building renovation and energy efficiency measures have been shown to be effective in reducing long-term energy consumption. Countries’ sustainability policies, stricter building regulations, and higher energy efficiency standards also play a role. This leads to the conclusion that sustainable investments, together with clearly defined policies, are key elements in achieving CO2 emission reductions in the real estate sector.

The results show that this variable is significant in the random effects (RE) model, but its effect is negative. This result may seem unexpected, but it is consistent with some previous studies that have shown that in certain markets, higher real estate investment can be associated with emission reductions due to modernization effects and stricter regulatory measures (e.g., energy efficiency standards) [

74,

75]. In addition, in some countries, real estate investment is directed towards renovation projects that reduce energy consumption and emissions in buildings over the long term [

76]. These factors suggest that the negative impact of the RE model may be related to structural market changes, energy efficiency improvements, and sustainability policies [

77]. However, further analysis should be carried out to better understand the reasons for this result, comparing it with the experience of other countries and including additional variables.

The findings indicate that the energy efficiency and emission reduction strategies applied in the Nordic countries in buildings could be useful in other countries of the world. However, it should be noted that the development of the construction sector in different regions is determined by unequal economic opportunities, technological progress, climate conditions, and local policy characteristics [

78]. For example, in developing countries, where the construction of new buildings is rapidly growing, it is important not only to renovate but also to ensure the energy efficiency of new buildings from the beginning [

14].

To successfully adapt the Nordic experience in other countries, it is important to take into account regional differences, such as different climate types, the development of energy infrastructure, and financial opportunities. For example, in hot climate zones, it is particularly important to ensure efficient cooling of buildings and the use of solar energy, while in temperate climate zones, more attention may be paid to the efficiency of insulation and heating [

79].

It is also worth emphasizing that economic and social differences between countries are no less important. Countries that are not fully developed or prosperous economically may need financial incentives—such as soft loans or subsidies—to facilitate the transition to green policies. Additionally, public–private cooperation in Northern Europe in finding sustainable solutions could serve an example for the world in its efforts to reduce CO

2 emissions in this sector [

80,

81,

82].

Summarizing the results of this empirical study, it can be stated that renovation leads to a greater reduction in CO2 emissions in the long term than the construction of new buildings. Therefore, hypothesis H1 was confirmed. Hypothesis H2 was also confirmed—it was found that a higher share of renewable energy effectively reduces the impact of investments in real estate on emissions. Hypothesis H3, stating that investments in real estate correlate with increasing emissions was also clearly confirmed by the panel regression results. Hypothesis H4, stating that stricter energy efficiency regulation significantly reduces the negative impact of CO2, was only partially confirmed—the direct effect of EU policy regulation was not statistically significant, but a significant indirect effect was found through the promotion of renewable energy sources. Finally, hypothesis H5, stating that urbanization significantly affects energy consumption and emissions, was also partially confirmed—in the panel regression results, the level of urbanization did not have a statistically significant direct effect, but a significant indirect effect was found through centralized energy solutions.

The results of this study allow for the formulation of several policy recommendations. To reduce CO2 emissions, it is important to promote building renovation, as it provides better sustainability outcomes in the long term than new construction. It is also necessary to strengthen the integration of renewable energy into the real estate sector and optimize urbanization processes by ensuring more efficient infrastructure. In countries where new construction remains high, it is necessary to set strict energy efficiency requirements for new buildings. The implementation of zero-energy building (NZEB) standards should become mandatory to ensure that new buildings have a minimal carbon footprint throughout their life cycle. Moreover, to attract more private capital to sustainable real estate projects, it is necessary to develop green financing mechanisms: green bonds, public–private partnerships (PPPs), and green mortgage solutions. Such financing would reduce investment risk and create the prerequisites for the long-term sustainability of the real estate sector. Additionally, properly managed urbanization processes can significantly contribute to reducing emissions. Urban development plans must include the implementation of energy-efficient solutions, promoting compact urban development, the development of public transport, and the integration of renewable energy sources into urban infrastructure. Lastly, since the study data show that in some countries, EU policy implementation indicators have not had a significant impact on emission reductions, this indicates the need to strengthen the monitoring and evaluation of policy implementation, ensuring that the set goals are realistically achievable and the measures are effective.

The study findings may be useful for policymakers, investors, and urban planners seeking to balance economic and environmental goals. However, the analysis was limited to the Nordic countries, so future studies could broaden the geographical context and assess the impact of specific policy measures in more detail.

6. Conclusions

In summary, changes in CO2 emissions directly depend on the energy structure, economic development, and policy decisions of each country. The results of this study showed that there is no universal solution to reduce emissions—each country has its specific assumptions and obstacles. For example, in countries with a high share of renewable energy (e.g., Norway or Finland), emissions are lower even when energy consumption is growing, or the real estate sector is developing intensively. Meanwhile, in Lithuania or Latvia, where the energy sector is still dependent on fossil fuels, there is a higher risk that investments in real estate, especially new construction projects, will increase emissions.

This study also showed that the real possibilities for reducing emissions depend on the measures chosen by policymakers. If the focus is on promoting renovation, higher energy efficiency standards, and supporting the deployment of renewable energy sources in the real estate sector, long-term emission reductions are realistic. Otherwise, if investments are directed toward traditional solutions, emissions may continue to grow, especially in rapidly developing real estate segments.

Another important observation is that the economic level and population density of different countries also affect the level of emissions. In countries where urbanization has already reached a high level, it is often easier to apply centralized energy supply solutions and optimize infrastructure, which contributes to lower CO2 emissions. Conversely, in smaller or less populated regions, the efficiency of investments may be lower, so more incentives and special programs are needed.

Although this study provides valuable insights into the impact of real estate investments on CO2 emissions, it has some limitations. The analysis is limited to Nordic countries, so the generalizability of the results to other regions with different economic and political environments may be limited. In addition, data availability and quality may have affected some of the model estimates, and additional variables may have shed light on the research topic. It is also worth noting that only the main variables were selected for the analysis: GDP per capita, population, energy consumption, and investment in the real estate sector. The analysis could be even more comprehensive by including additional factors such as energy prices, the carbon footprint of building materials, environmental taxes, or the effectiveness of specific environmental policy measures.

Future research should assess the impact of energy efficiency in the real estate sector in more detail, taking into account country-specific policy measures, macroeconomic indicators, and financial aspects. It is also worth including more quantitative methods that could reduce multicollinearity issues that limit the application of regression analysis to obtain more accurate insights. In the real estate sector, multicollinearity may cause difficulties in separately assessing the impact of investment, energy consumption, and urbanization on CO2 emissions. Therefore, it is necessary to use diagnostic studies and create alternative models to ensure the reliability of the results.