Abstract

This study examines the governance of building carbon markets in the context of China’s “dual-carbon strategy”, focusing specifically on the integration of Monitoring, Reporting, and Verification (MRV) systems. The study identifies critical challenges in China’s emissions-trading scheme (ETS), such as weak corporate compliance incentives, high regulatory costs, and concerns about third-party verification independence, which hinder the effectiveness of carbon pricing and technology adoption. Using a three-player evolutionary game model involving the government, carbon-emitting firms, and third-party verifiers, the study finds that moderate government supervision, performance-based incentives, and stronger penalties lead to long-term stability and optimal governance. Based on these findings, policy recommendations are made, including tiered penalties, targeted incentives for green technology adoption, and the strengthening of third-party verification mechanisms to enhance market governance and support China’s carbon-reduction goals in the building sector.

1. Introduction

The building sector is responsible for roughly 30% of global energy consumption and a significant share of carbon emissions across its life cycle [1,2]. Yet the central governance challenge is not only the scale of emissions but also the complexity of monitoring, reporting, and verification (MRV) in this sector [3]. Unlike power generation or manufacturing, where emissions are concentrated and measurable, buildings involve dispersed sources, heterogeneous ownership, and long life cycles. Data collection is costly, boundaries are difficult to standardize, and severe information asymmetries exist between regulators, operators, and verifiers. These features make MRV in buildings inherently more complex than in other industries and directly affect the credibility of carbon-market mechanisms [4,5].

Several jurisdictions have attempted to regulate building-related emissions through carbon pricing or rating systems, but their MRV practices differ widely [6]. The EU’s ETS 2 requires third-party verification of building fuel-use data [7], while Tokyo’s program combines annual reporting with flexible compliance options. Green building standards such as LEED, BREEAM, and Passive House also embed verification but apply it with different levels of stringency. These diverse practices highlight fragmented MRV governance in buildings, where variations in audit rigor, data granularity, and verifier involvement undermine comparability and enforcement. Such challenges underscore the need for analytical frameworks that can capture strategic interactions among governments, firms, and third-party verifiers [8]. Implementing carbon trading in buildings faces multiple institutional and execution challenges [9]. MRV is widely regarded as the foundation of carbon markets, ensuring the authenticity of allowances and credited reductions through data collection, reporting, and verification [10]. However, current MRV practice lacks authoritative, unified standards. Many specifications are issued by different organizations, enabling project developers to select relatively lenient rules. Inconsistencies in standards and interests across actors, combined with resource constraints and high MRV costs, can lead building operators to collect data incompletely, report inaccurately, or disclose selectively, making it difficult for regulators to assess true emissions. Limited regulatory resources and high enforcement costs hinder sustained high-intensity oversight, and in the absence of adequate incentives and accountability, third-party verifiers may relax verification criteria or even collude with firms. These issues depress the relative payoff to genuine compliance and blunt the incentive effects of carbon markets and building-sector mitigation policies [11].

In sum, effective mitigation through carbon trading and efficiency policy in buildings hinges on establishing a unified, transparent, and cost-efficient MRV system together with well-designed incentive and constraint mechanisms. On the one hand, requirements for monitoring and reporting of building energy use and emissions should be clarified, accounting boundaries unified, and sub-metering and data governance improved to raise the accuracy of energy data [12]. On the other hand, measures such as efficiency subsidies, green-certification premia, and financial incentives should increase the net benefits of genuine compliance for operators, complemented by information disclosure and credit records to discipline behavior [13]. Symmetric reputation pressures and legal penalties applied to both operators and verification bodies can deter misreporting and collusion, while risk-based tiering and random audits help reduce enforcement costs when regulatory resources are limited. Only when monitoring, incentives, and penalties reinforce one another can a building-sector carbon trading regime sustain positive feedbacks [14].

Because building carbon trading involves multiple actors—government agencies, building operators, and verification bodies—who adjust strategies under bounded rationality, evolutionary game theory provides a suitable framework to analyze dynamic interactions [15]. The theory emphasizes learning and adaptation over repeated interactions and can internalize regulatory costs, verification costs, reputational returns, and penalty strength into payoff functions, using replicator dynamics and Lyapunov stability to characterize strategy trajectories and equilibria [16]. This allows comparison of steady states under alternative policy parameter combinations and provides theoretical support for optimizing building-sector carbon trading policies [17].

This study focuses on three core challenges in the governance of building carbon markets, namely balancing regulatory intensity and administrative costs under limited regulatory resources, designing incentive and penalty mechanisms that can constrain both building operators and third-party verifiers to prevent misreporting and collusion arising from information asymmetries and misaligned interests, and translating model-based insights into actionable policy decisions. To address these challenges, we develop a tri-party evolutionary game model among government, emitting firms, and third-party verification agencies, analyzing how regulatory costs, compliance benefits, verifier incentives, and rent-seeking risks shape behavioral mechanisms and evolutionary paths. Using Lyapunov stability analysis and numerical simulations, we identify stable strategy states and sensitivity characteristics under different policy variables. The contributions are as follows: we explicitly incorporate third-party verification agencies into the evolutionary game framework, overcoming the limitation of prior work that focused only on government–firm dyads; we systematically examine the dynamic coupling among rent-seeking risk, regulatory cost, and penalty strength, and identify effective boundary conditions for policy tool combinations; and we combine theory with simulations to propose practically oriented recommendations for improving carbon-market supervision and verification mechanisms, thereby enhancing the operability of implementation.

The remainder of this paper is organized as follows: Section 2 reviews the literature, synthesizing the importance of carbon-market supervision and verification mechanisms and the literature on evolutionary games. Section 3 presents the methods: it constructs a tri-party evolutionary game model involving government, firms, and third-party verification agencies; specifies model assumptions; derives the replicator dynamics; solves for equilibrium points; and proposes and proves related propositions. Section 4 presents numerical analyses; under a baseline scenario, we examine regulatory costs, subsidy intensity, penalties imposed by the government on emitting firms and third-party verifiers, and firms’ payoffs under different conditions, and we use sensitivity analyses to identify how key factors shape stakeholder decisions. Section 5 concludes by summarizing the main findings and theoretical contributions and by offering actionable policy recommendations for building carbon markets and green-building rating systems.

2. Literature Review

2.1. The Importance of Research on Carbon-Market Oversight and Verification Mechanisms

Emissions trading is widely regarded by the global policy community as a pivotal instrument for tackling climate change: by harnessing market forces, it steers firms toward emissions abatement and guides economies onto low-carbon, efficient, and sustainable development pathways [18]. Although carbon-market architecture has improved worldwide in recent years, its practical performance is still constrained by information asymmetries, firms’ misreporting, and the high cost of supervision, all of which dilute policy effectiveness. Sound carbon-market governance therefore requires not only well-designed institutions and policy tools but also close coordination between regulatory systems and monitoring-reporting-verification (MRV) mechanisms [19]. How to foster a virtuous interaction among public regulators, compliant firms, and third-party verifiers—both in policy design and in implementation—has become a focal issue for scholars and policy-makers alike.

From the governmental perspective, the quality of regulatory oversight is decisive for the ultimate performance of an emissions-trading scheme [20]. Regulators must balance enforcement intensity, fiscal burden, and policy incentives: overly stringent oversight may inflate firms’ costs and dampen market vitality, whereas lax supervision invites under-reporting, fictitious abatement, and outright fraud, thereby undermining the seriousness and efficacy of the regime. Research increasingly shows that government alone cannot fully offset the regulatory failures caused by information asymmetry; effective collaboration with other market actors is indispensable [21].

From the vantage point of third-party verification agencies, which play a critical role in ensuring data integrity and easing information asymmetries, institutional credibility and market effectiveness hinge directly on verifier conduct. Although, in principle, such agencies should operate independently and objectively, in practice they face temptations arising from firms’ economic interests, incomplete regulatory frameworks, and cost constraints. These pressures can breed moral hazard and rent-seeking; when incentives are weak or penalties toothless, verifiers may align themselves with regulated firms, distorting data and nullifying oversight [22]. Existing studies note that incentive and restraint mechanisms for verifiers remain rudimentary, offering little reputational reward or dynamic punishment, which erodes their independence and blunts policy execution [14]. Devising stronger institutional arrangements that boost verifiers’ diligence and autonomy is therefore a pressing theoretical and practical task.

Finally, firms—the primary actors within emissions-trading regimes—shape their compliance strategies under the combined influence of regulatory incentives, abatement costs, and market returns. Corporate decision-making is influenced not only by straightforward cost–benefit calculations but also by perceptions of regulatory credibility, the stringency of verification, and the risk of detection, all of which weigh heavily on strategic choices. If governmental enforcement is weak and third-party verification ineffective, firms tend to gravitate toward low-cost, high-gain misreporting strategies, sharply curtailing the market’s ability to deliver genuine emissions cuts. Unpacking the strategic interplay among corporate decisions, government oversight, and verifier behavior is thus essential for translating carbon-market policies into real-world outcomes.

2.2. MRV Research in the Building Sector

The building sector has become a focal area for MRV development due to its substantial and diverse carbon emissions [23]. Unlike power generation or heavy industry, building emissions are distributed across material production, on-site construction, and long-term operation. This dispersion increases the difficulty of establishing consistent accounting boundaries and ensuring data reliability. Operational emissions are influenced by climatic conditions and user behavior, while embodied emissions are embedded in products and supply chains, often with limited transparency. Existing studies generally agree that these characteristics make the building sector highly dependent on MRV systems that can integrate heterogeneous data sources and provide credible emission inventories [24].

Methodological studies have concentrated on improving the measurement of building emissions. Life-cycle assessment (LCA) remains the primary tool, and it has been supplemented by hybrid input–output methods, dynamic emission factors, and scenario analysis [25]. In parallel, digital tools such as Building Information Modeling (BIM), Internet of Things (IoT) devices, and blockchain-based traceability have been explored to enhance the accuracy, timeliness, and integrity of emission data [26]. While these approaches improve precision at the project level, research highlights persistent limitations in interoperability, data comparability, and scalability across regions. As a result, technological advances have not yet translated into standardized MRV frameworks applicable across diverse building contexts.

Institutional research has examined MRV practices in both certification and compliance settings. Green building certification schemes, such as LEED, BREEAM, and China’s Green Building Label, incorporate reporting and third-party review, but their primary function is market signaling rather than regulatory enforcement. By contrast, policy-driven MRV systems—such as Tokyo’s metropolitan cap-and-trade program and the EU’s forthcoming ETS 2—require periodic reporting and independent verification, but they also face high administrative costs, fragmented standards, and limited verifier independence. Comparative analyses indicate that operators may selectively disclose data, while verification agencies often lack strong incentives or sanctions to maintain audit rigor. These weaknesses reduce the credibility of MRV outcomes and limit their effectiveness in supporting building-sector carbon trading [27].

Overall, the literature shows that MRV research in the building sector has advanced in terms of methods and pilot systems but remains fragmented and incomplete. Standardization across regions is lacking, embodied emissions are often underrepresented, and verification practices are not sufficiently safeguarded against conflicts of interest. Most studies provide methodological or case-specific insights, but less attention has been given to integrating technical, institutional, and economic dimensions into a coherent MRV framework. These gaps suggest the need for further work to improve methodological consistency, enhance the independence and credibility of verification, and strengthen the connection between MRV practices and the effective functioning of carbon markets in the building sector.

2.3. Application of Evolutionary Game Theory

Classical game theory generally assumes that all players are perfectly rational and fully informed, capable of forecasting and evaluating every possible strategy profile in a game [28]. Such assumptions rarely capture the bounded rationality and interactive learning that characterize real-world decision-making. By contrast, evolutionary game theory posits that actors are only boundedly rational: instead of making a one-off, fully optimized choice, they experiment, learn, imitate, and adapt across repeated interactions, gradually converging on stable strategies [29]. Because this framework mirrors actual decision processes in economic and social systems, it has been widely employed in recent years to study public-policy design [30], resource-and-environment management [31], and other multi-actor governance issues [32], becoming a key methodological tool for analyzing the effectiveness of policy instruments and the strategic dynamics of stakeholders.

In the realms of green trading and environmental governance, evolutionary game theory has provided strong theoretical support for examining the policy-execution strategies of governments and firms. Existing studies show that, in environmental contexts, governments influence corporate compliance through subsidies, penalties, and information disclosure, yet firms’ actual behaviors emerge from the interplay of economic benefits, policy signals, and market feedback. Two-player evolutionary game models featuring governments and firms reveal a critical incentive band within which firms evolve towards long-run compliance [33]. Scholars have also incorporated public consumers or third-party regulators into such models to explore how additional actors reshape the strategic landscape and to demarcate the effective boundaries of policy incentives under multi-actor interaction [34].

Evolutionary game approaches are now being applied to the oversight and verification mechanisms of emissions-trading schemes. A carbon market is a complex governance system involving government regulators, emitting enterprises, and third-party verification agencies. Owing to information asymmetries, high regulatory costs, and diverse strategic options, traditional static-game analysis cannot fully illustrate how the three actors adjust their strategies over time or the conditions under which the system stabilizes. Several studies have attempted to employ three-player evolutionary game models to trace strategic evolution in related contexts, such as the green building market under carbon trading policy [35], the sustainable development of power construction projects [16], and the carbon emission trading mechanism in China [36]. These contributions demonstrate the potential of evolutionary dynamics in capturing adaptive behaviors among multiple stakeholders. However, their modeling designs often simplify or overlook the role of third-party verifiers, treating them implicitly as external conditions or embedding them in cost terms rather than recognizing them as independent actors. Furthermore, parameter specifications are usually stylized without empirical grounding, and stability analyses are frequently restricted to theoretical equilibria with limited numerical validation. Such shortcomings are particularly salient in the building sector, where the credibility of MRV systems depends heavily on the incentives and conduct of verification agencies. Against this backdrop, the present study explicitly incorporates third-party verification agencies as independent participants in a three-player evolutionary game framework tailored to the building sector’s MRV system, thereby addressing a critical gap in the literature and enhancing the explanatory power of existing models.

Against this backdrop, the present study adopts an evolutionary game framework centered on government regulators, carbon-emitting firms, and third-party verifiers. It constructs a dynamic model that jointly incorporates incentives, regulatory costs, rent-seeking risk, and penalty severity. Using replicator dynamics and Lyapunov stability analysis, the paper systematically derives the evolutionary trajectories and equilibrium conditions for all three actors, and then employs numerical simulation to elucidate how policy parameters influence behavior and institutional performance. The results not only enrich the theoretical foundation of carbon-market design and behavioral governance but also furnish a solid evidence base and policy guidance for improving China’s carbon-market oversight and verification mechanisms.

3. Method

3.1. Model Assumptions

To build the game-theoretic framework and analyze the stability of each actor’s strategies and equilibria—as well as the effects of key parameters—we adopt the following assumptions.

Assumption 1.

The carbon-market game involves three participants: Government regulators (Player 1), Carbon-Regulated Firms (Player 2), and Third-Party Verifiers (Player 3). All three are bounded-rational decision-makers whose strategies evolve through repeated interaction and gradually converge to an evolutionary–stable outcome. This approach is widely applied in environmental governance studies to capture adaptive learning and gradual adjustment under imperfect information [29,37].

Assumption 2.

The Government’s strategy space in supervising carbon-emissions data includes strict supervision and flexible governance. Let denote the probability that the Government adopts strict supervision; then is the probability of flexible governance, with . Such binary policy settings are commonly adopted in regulatory game models to reflect the real-world trade-off between intensive oversight and reduced enforcement costs. Similarly, the Carbon-Regulated Firms’ strategy space is (compliant reporting, opportunistic reporting). Let denote the probability that a firm chooses compliant (truthful) reporting; then is the probability of opportunistic reporting, with . The Third-Party Verifiers’ strategy space is (prudent verification, lax verification). Let denote the probability that a verifier conducts prudent verification; then is the probability of lax verification, with . This dichotomous representation captures the essential conflicts of interest while keeping the model analytically manageable, as in prior studies of auditing and compliance [38,39].

Assumption 3.

To incentivize carbon-regulated firms to report emissions truthfully and actively undertake abatement, the government may provide financial support or subsidies

[40]. Since all such funds ultimately originate from public finance, a social-welfare cost factor

is introduced based on the concept of the marginal cost of public funds in public economics [41]. Here,

represents the government’s marginal fiscal cost, implying that spending one unit of public funds results in a social-welfare loss of

units. When the Government subsidizes a firm’s compliant reporting, it may raise the opportunity cost for certain industries or social groups, causing an additional welfare loss denoted by

. Under strict supervision, the Government must assemble dedicated inspection teams to conduct on-site checks of firms’ emission sources and abatement measures, incurring a regulatory cost denoted by

. If strict supervision uncovers opportunistic reporting or similar misconduct, the Government rescinds any previously granted subsidies. Under flexible governance, by contrast, the Government organizes only irregular spot checks on both firms and Third-Party Verifiers. In this looser regime, all related incentives and penalties are proportionally reduced by a factor

, with

. This reduced-strength supervision mechanism captures real-world practices of flexible regulation, in which enforcement intensity is adjusted downward but continuous monitoring is preserved under fiscal and administrative limitations [42,43].

Assumption 4.

The benefit a carbon-emitting firm receives from compliant reporting is

, and the associated cost is

; the benefit from flexible (opportunistic) reporting is

, and its cost is

. To satisfy basic rationality, we assume the benefit from either reporting choice exceeds its cost ( and

); the benefit of compliant reporting is greater than that of flexible reporting (); and, because active compliance typically requires more resources—such as higher-quality monitoring equipment, regular maintenance, and genuine abatement—its cost is usually higher (). When a firm submits compliant emissions data, it qualifies for government subsidies; if it opts for flexible reporting, rent-seeking arises only when the Third-Party Verifier loosens its audit, at which point the firm may seek “collaboration” with the verifier to defraud the government of compliance subsidies. The rent-seeking cost is denoted

.

Assumption 5.

The income of Third-Party Verifiers is drawn chiefly from the verification service fees and technical-support charges they levy on Carbon-Regulated Firms, together with the value-added revenue obtained from services such as data-management consulting, staff training, and system upgrades. A fixed proportion of the firm’s compliance benefit—captured by the coefficient

—is collected by the verifier as a commission. This revenue-sharing arrangement is aligned with principal–agent theory and is frequently applied in auditing and certification studies [44,45]. When a verifier chooses to optimize its verification service, it must incur a higher-quality audit cost, denoted

. Under this choice, the improved audit quality and more standardized procedures raise the level of trust that both firms and the Government place in the data, thereby boosting all related revenues; this enhancement effect is represented by the coefficient

. Moreover, a verifier that adopts the optimized service path will refuse any improper requests from firms (e.g., assistance in concealing emissions or tampering with data). If, instead, the verifier provides only a general verification service, the corresponding cost is

, while

is the laxity coefficient. A smaller value of

indicates that lax verification requires substantially fewer resources than prudent verification, whereas a larger

implies that the cost reduction is marginal. This formulation captures the trade-off between audit rigor and cost, consistent with prior research on auditing and principal–agent theory [46]. In this setting, the agency may tacitly permit—or even help—the firm to “massage” its data so that the firm can secure Government subsidies. In return, the verifier extracts rent-seeking income, that is, an extra payment offered by the firm as a side benefit.

Assumption 6.

When Carbon-Regulated Firms opt for compliant reporting, they are effectively responding to the Government’s call for a green, low-carbon transition. This choice helps the Government advance nationwide emission-reduction goals, fulfill its environmental responsibilities to the public, and—at the macro level—contribute to carbon-market stability and sustainable socio-economic development; the resulting social benefit is denoted

. Through compliant reporting, firms can accumulate green reputation capital

, with

representing the firm’s reputation-premium coefficient. The reputation of Third-Party Verifiers is likewise affected, and their reputation-premium coefficient is

. The inclusion of reputation effects is consistent with studies showing that credibility and professional trust are essential drivers of verifier behavior in carbon markets [47,48]. Moreover, rent-seeking between firms and verifiers is more likely to be detected only when the Government exercises strict supervision; the penalties imposed on the firm and the verifier are denoted

and

, respectively. Once misconduct is confirmed, sanctions may include revocation of subsidies, monetary fines, entry into the carbon-market misconduct register, downgrading of credit ratings, and other punitive measures.

The detailed parameters are presented in Table 1.

Table 1.

Model parameters and their meanings.

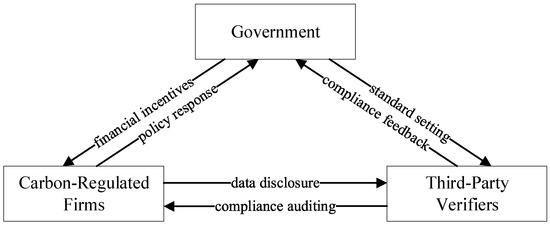

The three-party evolutionary game framework is shown in Figure 1.

Figure 1.

Three-party evolutionary-game framework for MRV governance in building carbon markets.

3.2. Model Building

Building on the preceding assumptions, we obtain the three-party evolutionary game payoff matrix for the Government, Carbon-Regulated Firms, and Third-Party Verifiers, as shown in Table 2.

Table 2.

Three-party evolutionary game payoff matrix.

3.3. Stability Analysis of the Evolutionary Game Model

3.3.1. Stability Analysis of Government Regulatory Strategies

The expected payoff under strict supervision is denoted as , the expected payoff under moderate governance is denoted as , and the average expected payoff of the government’s regulatory strategy is denoted as , given, respectively, by:

The replicator-dynamic equation for the Government’s regulatory-strategy choice is:

Let

setting , yields three solutions: , , and .

Further, the following is obtained:

Taking the first derivative of with respect to gives:

Proposition 1.

The probability decreases as

and

increase. This means that when carbon-regulated firms demonstrate stronger compliance in reporting and third-party verifiers adopt more prudent verification, the marginal necessity of intensive government supervision is reduced. In this favorable context, the government is inclined to adopt moderate governance rather than maintaining high-intensity intervention.

Proof.

Let , then . Because , is a decreasing function of . According to the stability theory of differential equations, the probability that the Government’s regulatory strategy is at a stable state must satisfy and . When , and always hold, the government is, therefore, indifferent between its strategic choices. When , is decreasing, so . Hence, and . Under these conditions, the government tends to adopt strict supervision; is the stable point. When , . Hence and . In this case, the government tends to adopt moderate governance, is the stable point. Thus, proposition 1 is proved. □

This proposition indicates that when firms increasingly adopt compliant reporting strategies and third-party verifiers strengthen their auditing diligence, the government can rationally reduce its probability of adopting strict supervision. From an economic perspective, this reflects the substitution between external monitoring and internal compliance: higher levels of voluntary compliance lower the marginal utility of costly enforcement. Practically, this suggests that governments can reallocate scarce regulatory resources by adopting risk-based or tiered supervision, focusing on high-risk actors while relaxing oversight of compliant ones. Such adaptive governance not only reduces fiscal burdens but also enhances overall market efficiency by fostering trust-based mechanisms.

Corollary 1.1.

The probability that the government adopts strict supervision is negatively correlated with its regulatory cost.

Proof.

Taking the first partial derivative of with respect to gives . Thus, as increases, gradually decreases; the interval in which holds becomes smaller, and the probability that the government opts for moderate governance correspondingly becomes larger. □

Corollary 1.2.

The probability that the government will adopt strict supervision is not unilaterally positive or negative in relation to the level of fiscal incentives or subsidies; its trend depends on both the severity of the penalties the government imposes on potential shirking by other stakeholders during the game and the government’s overall trade-off with respect to regulatory costs.

Proof.

Taking the first partial derivative of with respect to yields . This expression shows that the impact of is governed chiefly by . Only when does , the probability that then increases, indicating that the government, in light of penalty costs, is more likely to adopt strict supervision. Conversely, when the inequality is not satisfied, the probability that the government chooses moderate governance becomes larger. □

3.3.2. Stability Analysis of Carbon-Regulated Firms’ Participation Strategies

The expected payoff from compliant reporting , the expected payoff from flexible reporting , and the average expected payoff of the firm’s participation strategy , are given, respectively, by:

The replicator-dynamic equation for carbon-regulated firms’ strategy choice is:

Let

Setting , gives , , and .

Further,

Taking the first derivative of with respect to yields:

Proposition 2.

The probability

rises with

. In other words, when the Government adopts stricter supervision, carbon-regulated firms tend to choose compliant reporting, since stronger oversight increases the expected cost of opportunistic behavior and shifts the firms’ cost–benefit balance in favor of compliance. This reflects the deterrent effect of credible enforcement, where the risk of detection and punishment makes compliance the rational strategic choice.

Proof.

Setting yields . Because , is an increasing function of . The proof proceeds analogously to Proposition 1. When , and always hold, firms are indifferent between their strategy options. When and , then and . In this case, firms favor flexible reporting, and is the stable point. When and , then and . Firms now favor compliant reporting, proving Proposition 2. □

The result shows that stricter governmental supervision increases the likelihood that firms will engage in truthful reporting. Economically, this is consistent with deterrence theory: as the expected penalty for misreporting rises, opportunistic behavior becomes less attractive, and compliance emerges as a dominant strategy. The managerial implication is that policy tools must go beyond financial subsidies, as subsidies alone may not shift firms’ incentives. Instead, combining credible monitoring with sanctions ensures that the payoff structure favors long-term compliance over short-term opportunism.

Corollary 2.1.

In a carbon-mitigation setting, the structure of a firm’s pa-offs is decisive for its abatement decisions; at the same time, the marginal effect of government penalty intensity on corporate behavior is nonlinear—neither a purely positive incentive nor a constant negative deterrent, but a bidirectional adjustment mechanism that depends on the underlying parameter trade-offs.

Proof.

Taking the first partial derivatives of with respect to , , and gives , . Hence, as increases, the probability that falls, and carbon-regulated firms become more inclined to file compliant reports; conversely, as rises, the region expands, and firms tend toward flexible reporting. Because is not strictly monotonic, its sign depends on a balance of several parameters. Only when , does , in which case firms are more likely to choose compliant reporting. □

3.3.3. Stability Analysis of Third-Party Verifiers’ Participation Strategies

The expected payoff from prudent verification is , the expected payoff from lax verification is , and the average expected payoff of the verifier’s strategy is , given, respectively, by:

The replicator-dynamic equation for third-party verifiers’ strategy choice is:

Let

Setting , gives , , and .

Further,

Taking the first derivative of with respect to yields:

Proposition 3.

The probability

rises with

. That is, when the Government tightens supervision, Third-Party Verifiers tend to carry out prudent verification because stronger regulatory oversight increases the expected risk and cost of collusion or lenient auditing. As government scrutiny becomes more credible, verifiers find that maintaining diligence is the rational strategy to safeguard both institutional credibility and their own reputational interests.

Proof.

Set . This yields . Because , is an increasing function of . When , and hold simultaneously, so the verifier is indifferent between its two strategies. When , . Hence, and , under these conditions verifiers prefer lax verification, and is the stable point. When , . Hence, and , verifiers now favor prudent verification, and is the stable point. Proposition 3 is thereby proved. □

This proposition highlights the dependency of verifier behavior on governmental oversight. Stronger penalties and accountability mechanisms increase the expected cost of lax verification, thereby pushing verifiers toward prudent auditing as the rational strategy. From an institutional economics perspective, this finding underscores the principal–agent problem inherent in verification: without sufficient external discipline, verifiers may collude with firms to capture private rents. Effective governance therefore requires not only market-based incentives but also regulatory instruments such as credit rating systems, public disclosure of audit quality, and strict sanctioning of collusion.

Corollary 3.1.

When the Government’s penalty on third-party verifiers is sufficiently strong, those verifiers are induced to choose prudent verification.

Proof.

Taking the first partial derivative of with respect to the penalty parameter gives . Only when , does ; in that case, the probability that shrinks, and the likelihood that third-party verifiers opt for lax verification rises. Otherwise, the probability that verifiers choose prudent verification increases. □

3.3.4. Stability Analysis of the Equilibrium Points in the Three-Party Game System

To solve the three-dimensional dynamical system, set , , and . Eight pure-strategy equilibrium points are obtained: , , , , , , , and . The analysis herein focuses solely on these pure-strategy points. According to Lyapunov stability theory, the system is asymptotically stable if all eigenvalues of its Jacobian matrix possess negative real parts. Based on this three-dimensional system, the Jacobian matrix is constructed as follows:

where,

By substituting each equilibrium point into the Jacobian matrix in turn, the corresponding eigenvalues can be obtained; the results are summarized in Table 3. Based on the degree of participation of the REIT’s stakeholders, the evolutionary outcomes are ranked by desirability as follows: least desirable, undesirable, desirable, and most desirable.

Table 3.

Equilibrium point stability analysis.

Proposition 4.

In this three-party game system, only

and

satisfy the conditions for stable equilibria. Since

, , and

, constitutes the most desirable state for the current game participants. Within this equilibrium, governmental regulators exercise moderate supervision to balance governance costs, regulated firms pursue compliant reporting to accumulate reputation and market returns, and third-party verifiers conduct prudent audits that strengthen data accuracy and institutional credibility.

Proof.

Under Lyapunov stability theory, an equilibrium in a three-party evolutionary game system is unstable if the Jacobian matrix at that point contains at least one eigenvalue with a positive real part. Any small perturbation will then drive the system away along the corresponding eigenvector rather than back to the equilibrium, meaning the associated strategy mix cannot remain stable over time. The system will instead drift toward some alternative configuration. From the stability results summarized in Table 3: Because , the points and are unstable. Because , the points and are unstable. Because and , the points and are unstable. Thus, in this three-party system only and remain asymptotically stable. From a governmental perspective, state is usually viewed as the most desirable outcome. It achieves incentive compatibility and behavioral coordination among all three actors: the government selects moderate supervision, containing governance costs; firms engage in compliant reporting, gaining long-term reputation and market returns; and third-party verifiers perform prudent audits, enhancing data accuracy and credibility. □

4. Numerical Simulation

To complement the formal stability analysis and provide intuitive insights into the model’s practical significance, this section conducts numerical simulations of the replicator-dynamic system. The purpose is not only to verify the analytical derivations but also to illustrate how different policy instruments—such as subsidies, penalties, and regulatory costs—shape the strategic evolution of government, firms, and third-party verifiers. In this way, the simulation clarifies the economic and managerial implications of the model.

The setting of parameters follows the principle of relative normalization, a practice widely adopted in evolutionary game simulations [49,50]. Monetary or payoff-related parameters are scaled to values within the 0–10 range in order to reflect the relative magnitudes of costs and benefits, while probability-type and behavioral coefficients are constrained within the 0–1 interval to preserve their interpretation as ratios. This approach avoids arbitrary numerical substitution and ensures that the values retain empirical plausibility.

Based on this principle, the social benefit of compliance is fixed as the benchmark unit . Firms’ payoff from truthful reporting is set higher than from opportunistic reporting , reflecting the observation that compliance yields greater cumulative returns despite higher cost [17,51]. Government regulatory cost and subsidy intensity are placed at moderate levels to capture the trade-off between administrative burden and incentive strength [17]. Penalties for firms and verifiers follow the deterrence ranges discussed in emissions-trading regulations [52], while the rent-seeking cost represents the additional risks associated with collusion. For verifiers, the efficiency factor , commission rate , and audit cost reflect the balance between operational inputs and service revenues. The reputation coefficients for firms and verifiers are selected as mid-range values based on empirical behavioral studies [53]. The governance relaxation factor represents the reduced intensity of government supervision under flexible governance, while the laxity coefficient reflects the reduced supervision when third-party verifiers adopt more lenient verification practices. Additionally, the marginal fiscal cost coefficient is used to account for the increasing administrative burden as supervision becomes more stringent. Moreover, Section 4.2 presents sensitivity analysis to verify that the qualitative dynamics and equilibrium outcomes remain robust under different parameter settings, ensuring that the results are meaningful and not influenced by arbitrary assumptions.

It is worth noting that the parameter settings are not arbitrary but draw on established practices in the literature. Some parameters follow conventional norms in evolutionary game modeling to ensure standardization and comparability, while others are determined according to their economic meaning and conceptual interpretation, such as assigning the compliance payoff higher than the opportunistic payoff, using moderate values for regulatory cost and subsidy intensity to capture trade-offs, and selecting medium penalty levels to represent typical sanction strength. In addition, typical numerical settings adopted in related studies were consulted to maintain consistency with prior research. This layered approach ensures that the parameterization reflects both methodological norms and conceptual rationality, thereby enhancing the transparency and reproducibility of the simulations.

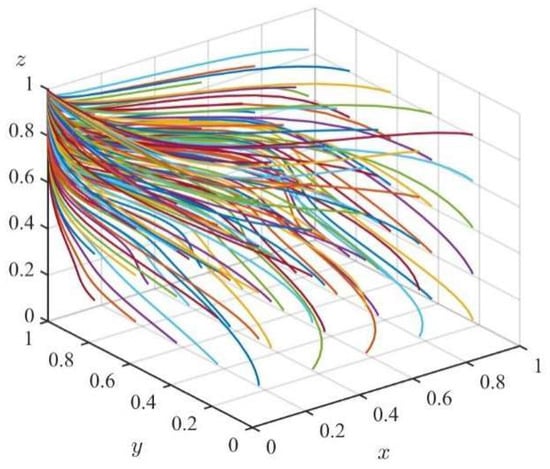

4.1. Simulation Path Analysis of the Three-Party Game System

To further verify the theoretical conclusions derived earlier, the calibrated parameters are substituted into the three-party evolutionary game model. By solving the replicator-dynamic equations, the strategy-evolution processes of the three actors are simulated across time. The resulting evolutionary trajectories are plotted in Figure 2, which illustrates the dynamics under Condition 2. The x-axis represents the government’s probability of adopting strict supervision , the y-axis represents the firms’ probability of choosing compliant reporting , and the z-axis represents the verifiers’ probability of conducting prudent auditing . Each curve corresponds to a different initial state. In this simulation, 125 groups of initial conditions are generated to comprehensively trace the system’s dynamic processes, and all trajectories gradually converge to a stable equilibrium. This indicates that, under Condition 2, firms evolve toward compliance, verifiers toward prudent auditing, and governments reduce their reliance on strict supervision. From the standpoint of numerical simulation, this finding not only confirms the analytical stability results but also highlights the effectiveness of the proposed model in capturing the interaction mechanisms among carbon-market actors and the regularities of their strategy evolution.

Figure 2.

Evolutionary trajectories of the three-party system under Condition 2. Note: x = government strict supervision probability; y = firms’ compliance probability; z = verifiers’ prudent auditing probability. 125 initial points are simulated. Axis definitions are the same for subsequent figures and will not be repeated.

4.2. Influence of Key Parameters on Behavioral Evolution

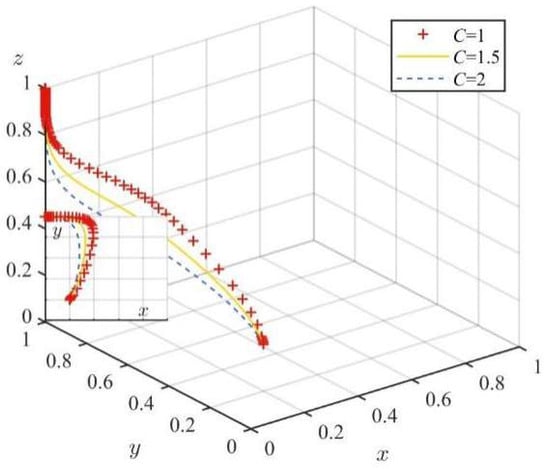

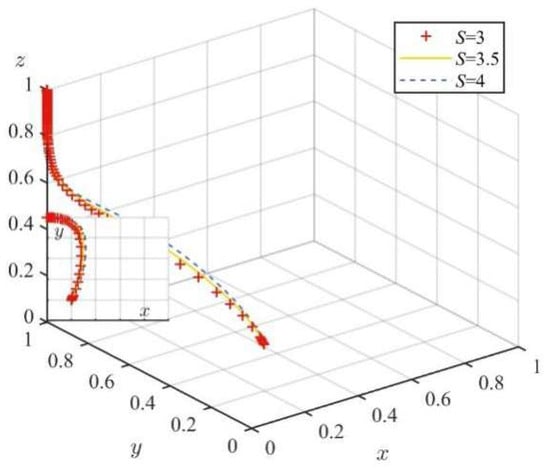

To further investigate how the government can steer carbon-emitting firms and third-party verifiers toward a compliance-oriented, stable strategy mix in the carbon market by tuning key policy parameters, this study conducts numerical simulations using the following: the government’s regulatory cost ; fiscal-subsidy intensity ; the penalties imposed on carbon-emitting firms and third-party verifiers ; and the firms’ payoffs under different reporting choices and . For a clearer comparison of the actors’ dynamic strategy trajectories, the initial strategy probabilities of the government, carbon-emitting firms, and third-party verifiers are uniformly set to .

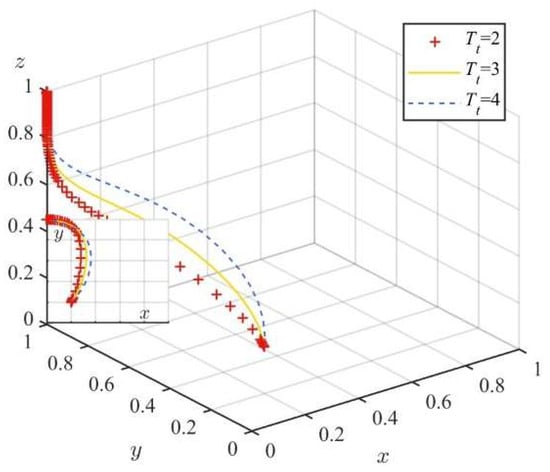

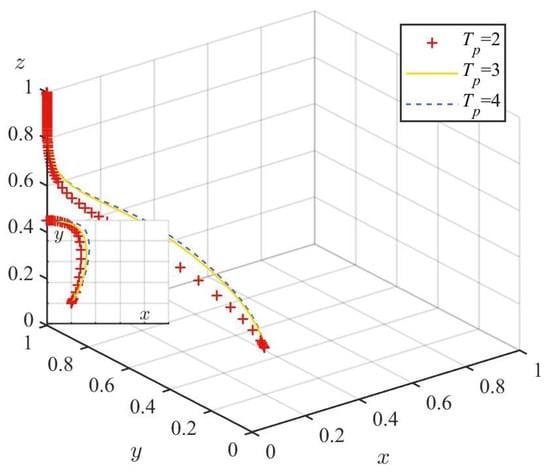

The government’s incentive cost for adopting strict supervision is set at 1, 1.5, and 2, with the results shown in Figure 3. The x-axis represents the probability of government strict supervision, the y-axis the probability of firms’ compliance reporting, and the z-axis the probability of verifiers’ prudent auditing. As regulatory cost rises, the peak probability of strict supervision decreases and trajectories converge more quickly to zero on the x-axis, indicating that higher costs weaken the government’s willingness to sustain strict oversight and drive the system toward the equilibrium, where firms comply, verifiers audit prudently, and governments adopt moderate supervision. In Figure 4, the fiscal-subsidy intensity was set at 3, 3.5, and 4. Larger subsidies accelerate convergence toward the same equilibrium: firms’ compliance and verifiers’ prudent auditing increase more rapidly, while strict supervision declines earlier, showing that stronger subsidies reinforce compliance and auditing incentives and allow governments to withdraw from intensive supervision sooner while maintaining coordination. From a practical perspective, these findings reflect the governance challenges of building carbon markets: in the MRV process, numerous monitoring points, long accounting chains, and fragmented data drive regulatory costs upward and limit the feasibility of prolonged strict oversight; meanwhile, subsidies—commonly applied to green building promotion and energy-efficiency retrofits—can strengthen firms’ compliance incentives and improve verification quality, but if poorly designed, may create fiscal burdens or induce dependency. Effective governance therefore requires reducing regulatory costs while carefully calibrating subsidies and integrating credible penalties to achieve long-term compliance stability.

Figure 3.

Evolutionary trajectories of the three-party system under different regulatory costs .

Figure 4.

Evolutionary trajectories of the three-party system under different subsidy intensities .

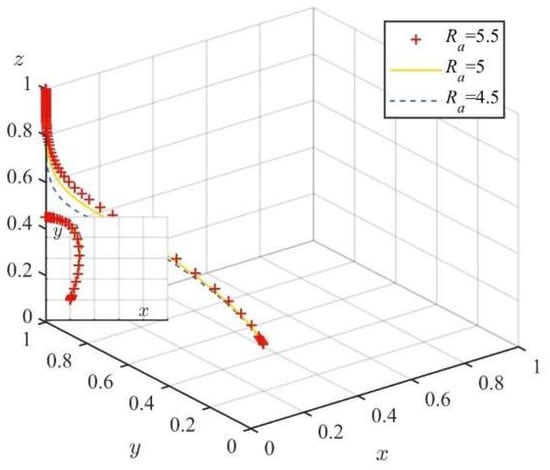

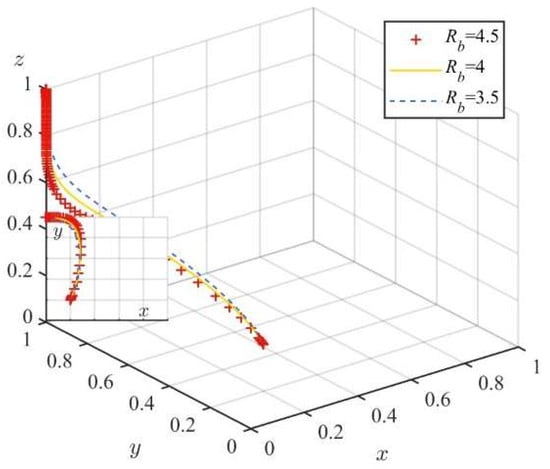

Setting the Government’s penalties on carbon-emitting firms and third-party verifiers sequentially to 2, 3, and 4 yields the time-evolution simulations shown in Figure 5 and Figure 6. In Figure 5, the trajectories correspond to different values of the penalty intensity on firms: the red line represents , the blue line represents , and the yellow line represents . The comparison shows that stronger penalties make the trajectories bend downward more steeply and converge more quickly to the equilibrium. This indicates that higher penalties substantially raise the expected cost of opportunistic reporting, thereby accelerating the dominance of compliance as the rational strategy for firms. In Figure 6, a similar pattern is observed for the penalties on verifiers. As the penalty intensity increases, the trajectories also converge more rapidly to the cooperative equilibrium, reflecting that prudent auditing becomes the rational choice once lax auditing carries higher risks. From a practical perspective, these results highlight that in building carbon markets, stronger penalties not only accelerate the emergence of compliance but also reinforce the credibility of MRV governance by reducing incentives for misconduct and weak auditing.

Figure 5.

Evolutionary trajectories of the three-party system under different penalty intensities on carbon-emitting firms .

Figure 6.

Evolutionary trajectories of the three-party system under different penalty intensities on third-party verifiers .

When the compliance-reporting payoff for carbon-emitting firms is set to 5.5, 5, and 4.5, the time-evolution of the replicator-dynamic equations is plotted in Figure 7. The different curves correspond to the different payoff levels, and the comparison shows that as decreases, the trajectories converge more rapidly to a “moderate-governance” state. This indicates that when the payoff from compliance reporting becomes insufficient, the government’s marginal return from strict supervision declines, reducing its incentive to maintain high-intensity oversight, while the rise of prudent auditing among verifiers also slows down noticeably. When the opportunistic-reporting payoff is set to 4.5, 4, and 3.5, the corresponding simulation is shown in Figure 8. The curves illustrate that lower values of accelerate convergence to the cooperative equilibrium. In this case, the scope for firms to gain private benefits from opportunistic reporting is curtailed, their incentive to violate is effectively suppressed, verifiers rapidly adopt prudent auditing, and the government’s supervisory burden is eased. The system thus evolves toward a more flexible and stable governance path. These findings demonstrate that the payoff structure attached to reporting strategies strongly guides the system’s evolutionary trajectory. Changes in reporting payoffs generate incentive effects that are transmitted across firms, verifiers, and the government, thereby shaping the effective range and stability of institutional constraints.

Figure 7.

Evolutionary trajectories of the three-party system under different compliance-reporting payoffs for firms .

Figure 8.

Evolutionary trajectories of the three-party system under different opportunistic-reporting payoffs for firms .

5. Conclusions

Against the backdrop of China’s “dual-carbon” strategy and the rapid expansion of its carbon market, the tension between institutional enforceability and market-mechanism effectiveness has become increasingly pronounced. Although the top-level design of China’s emissions-trading scheme (ETS) has been progressively refined, the system still faces practical challenges such as weak corporate compliance incentives, high regulatory costs, and doubts about the independence of third-party verification. These issues not only erode the price signal’s allocative role but also hinder low-carbon technology diffusion and the equitable sharing of abatement responsibilities. Clarifying the dynamic game relationships among multiple actors and probing the incentive–constraint logic of carbon-market oversight and verification are therefore of significant theoretical and practical value for enhancing institutional performance and strengthening the market’s intrinsic resilience.

Drawing on evolutionary game theory, this paper constructs a three-player model involving the government, carbon-emitting firms, and third-party verifiers. Focusing on key parameters—regulatory intensity, fiscal subsidies, violation penalties, compliance costs, and compliance benefits—the model traces the strategy-evolution paths of bounded-rational actors. Numerical simulations yield the following four main findings: (1) The ideal evolutionarily stable state features moderate government supervision, firm compliance, and prudent third-party verification; this tripartite coordination delivers long-run stability and optimal governance performance. (2) Higher governmental incentive costs reduce the adaptive value of strict supervision; excessive subsidies can actually dampen regulatory willingness and slow the system’s evolution toward high-governance states. (3) Raising firms’ compliance payoffs and lowering their compliance costs substantially increase the attractiveness of the compliant strategy and foster a convergent, stable structure during evolution. (4) Stronger penalties on both firms and verifiers markedly enhance institutional deterrence and accelerate convergence to the ideal strategy profile. Collectively, these results indicate that effective oversight and verification design should balance incentives and sanctions structurally and improve feedback coupling among the actors.

In comparison with existing studies in other sectors, such as energy and manufacturing, the findings of this study offer new insights into the application of three-party evolutionary game theory across industries with differing regulatory environments. In the energy sector, research has consistently shown that government sanctions and market incentives are crucial in driving firm compliance with emissions regulations, with studies emphasizing the need for a balanced mix of regulatory measures and market-based mechanisms. In manufacturing, studies have explored the effectiveness of fiscal penalties and subsidies in shaping firms’ compliance behavior, demonstrating that a nuanced policy mix is essential for encouraging sustainable production practices. These studies align with the findings of this study, particularly in terms of the importance of balancing incentives and penalties. However, the building sector presents distinct challenges. The fragmented market structure, high transaction costs, and heavy reliance on third-party certification in the building industry create specific barriers to compliance that are not as pronounced in the energy or manufacturing sectors. The findings of this study underscore the need for more tailored regulatory approaches to the building sector, where third-party verification plays a critical role in ensuring the accuracy and credibility of carbon emissions data.

To address these sector-specific challenges, this study proposes several policy recommendations for improving the effectiveness of carbon-market governance in the building sector: First, government supervision should adopt a flexible and adaptable management model by establishing a dynamic regulatory framework that adjusts based on market conditions and firm behaviors. This would not only enhance the adaptability of the policy but also introduce a graduated penalty system that applies different levels of sanctions depending on the severity of violations, preventing a “one-size-fits-all” penalty approach that burdens the market. By imposing higher fines on severe violations and lighter penalties or warnings on minor infractions, firms are encouraged to comply proactively with carbon reduction regulations. Second, the design of fiscal subsidies should be precisely calibrated to avoid over-reliance on government incentives. To address the issue of excessive subsidies potentially diminishing regulatory willingness, the government should implement performance-based incentive mechanisms that reward firms for achieving specific environmental milestones or carbon reduction targets. Additionally, long-term incentive measures, such as rewards for obtaining green building certifications, could drive firms to make sustainable investments beyond the regulatory requirements. This approach will stimulate technological innovation and the adoption of low-carbon technologies, without undermining the effectiveness of regulatory oversight. Third, policies should focus on reducing firms’ compliance costs by providing initial financial support, such as tax exemptions, green loans, or subsidies for adopting energy-efficient and low-carbon technologies in construction. Additionally, the government could introduce incentive programs specifically encouraging early adoption of green building technologies, offering extra rewards to firms that take the lead in implementing sustainable practices. These measures will not only reduce the initial compliance burden on firms but also ensure steady progress towards long-term low-carbon goals in the building sector. Finally, improving third-party verification mechanisms is crucial. It is essential to enhance the independence and transparency of third-party verifiers by offering performance-based incentives that ensure their impartiality and accuracy. By linking verifiers’ compensation to their performance and ensuring that they are not swayed by potential conflicts of interest, the quality and reliability of the verification process can be significantly improved. Strengthening third-party verification mechanisms will increase the trust and transparency of the carbon market, ensuring that compliance processes are fair and credible.

Despite these contributions, several limitations remain in the study. First, the model does not incorporate firm reputation accumulation, verifier heterogeneity, or carbon-price volatility, which could significantly influence compliance behavior over time. Second, the calibration of model parameters is based on theoretical assumptions, which may limit the external validity of some of the results. Future research could integrate multi-source empirical data, including real-world data on carbon-price volatility, verifier performance, and market segmentation, to develop a more comprehensive, multi-agent model. Furthermore, incorporating sector-specific factors, such as building regulations, technology adoption, and market incentives for green construction, would provide more accurate insights into the challenges and opportunities in the building sector.

In conclusion, the findings of this study offer valuable insights into the design of more effective and tailored regulatory frameworks for the building sector. By addressing the sector’s unique challenges and adopting more targeted policy interventions, China’s carbon market can achieve more effective governance and contribute to the country’s carbon reduction goals.

Author Contributions

Conceptualization, S.Z. and Q.S.; Methodology, S.Z., Q.S. and J.L.; Data curation, Q.S.; Formal analysis, Q.S. and J.L.; Investigation, Q.S. and J.L.; Resources, S.Z.; Writing—original draft preparation, Q.S.; Writing—review and editing, S.Z. and J.L.; Visualization, J.L.; Supervision, S.Z.; Project administration, S.Z.; Funding acquisition, S.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China, grant number 72204127.

Data Availability Statement

The original contributions presented in this study are included within this article. Further inquiries can be directed to the corresponding author.

Acknowledgments

The authors would like to express their sincere gratitude to all individuals and organizations who contributed to this research but are not listed as authors.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Geng, Y.; Xu, Y.; Ma, K.; Li, Y.; Zhang, Z. Exploring the Driving Factors for Low-Carbon Development of the Construction Industry in China. Buildings 2024, 15, 71. [Google Scholar] [CrossRef]

- Song, Y.; Park, M.; Joo, J. Study on the Calculation Method of Carbon Emissions in the Construction Industry: Targeting Small River Maintenance Projects in Korea. Water 2023, 15, 3608. [Google Scholar] [CrossRef]

- Cheng, J.; Li, L.; Zhang, R.; Tian, L.; Liu, Y. Identification of Key Drivers and Path Transmission of Carbon Emissions from Prefabricated Buildings: Based on System Dynamics. Buildings 2025, 15, 562. [Google Scholar] [CrossRef]

- Yu, Y.; You, K.; Cai, W.; Feng, W.; Li, R.; Liu, Q.; Chen, L.; Liu, Y. City-Level Building Operation and End-Use Carbon Emissions Dataset from China for 2015–2020. Sci. Data 2024, 11, 138. [Google Scholar] [CrossRef] [PubMed]

- Du, J.; Zhao, M.; Zhu, J. The Impact of Carbon Quota Benchmark Allocation on Cement Company Competitiveness: A System Dynamics Approach. Buildings 2022, 12, 1599. [Google Scholar] [CrossRef]

- Hu, Y.-J.; Li, X.-Y.; Tang, B.-J. Assessing the Operational Performance and Maturity of the Carbon Trading Pilot Program: The Case Study of Beijing’s Carbon Market. J. Clean. Prod. 2017, 161, 1263–1274. [Google Scholar] [CrossRef]

- Braungardt, S.; der Wieden, M.B.; Kranzl, L. EU Emissions Trading in the Buildings Sector—An Ex-Ante Assessment. Clim. Policy 2025, 25, 208–222. [Google Scholar] [CrossRef]

- Luo, Y.; Shen, J.; Liang, H.; Sun, L.; Dong, L. Supporting Building Life Cycle Carbon Monitoring, Reporting and Verification: A Traceable and Immutable Blockchain-Empowered Information Management System and Application in Hong Kong. Resour. Conserv. Recycl. 2024, 208, 107736. [Google Scholar] [CrossRef]

- Mikulenas, M.; Seduikyte, L. Circularity and Decarbonization Synergies in the Construction Sector: Implications for Zero-Carbon Energy Policy. Energies 2025, 18, 1164. [Google Scholar] [CrossRef]

- Jiang, J.; Ye, B. A Comparative Analysis of Chinese Regional Climate Regulation Policy: ETS as an Example. Environ. Geochem. Health 2020, 42, 819–840. [Google Scholar] [CrossRef]

- Chen, L.; Xie, M. How Do Hard Regimes Absorb, Overlap, and Squeeze out Soft Regimes? Insights from Global Carbon Markets. Glob. Public Policy Gov. 2023, 3, 60–85. [Google Scholar] [CrossRef]

- Jin, X.; Zhang, C.; Xiao, F.; Li, A.; Miller, C. A Review and Reflection on Open Datasets of City-Level Building Energy Use and Their Applications. Energy Build. 2023, 285, 112911. [Google Scholar] [CrossRef]

- Lee, W.L.; Yik, F.W.H. Regulatory and Voluntary Approaches for Enhancing Building Energy Efficiency. Prog. Energy Combust. Sci. 2004, 30, 477–499. [Google Scholar] [CrossRef]

- Su, Y.; Zhang, Z. Evolutionary Game Analysis on the Promotion of Green Buildings in China Under the “Dual Carbon” Goals: A Multi-Stakeholder Perspective. Buildings 2025, 15, 1392. [Google Scholar] [CrossRef]

- Song, X.; Shen, M.; Lu, Y.; Shen, L.; Zhang, H. How to Effectively Guide Carbon Reduction Behavior of Building Owners under Emission Trading Scheme? An Evolutionary Game-Based Study. Environ. Impact Assess. Rev. 2021, 90, 106624. [Google Scholar] [CrossRef]

- Li, L.; Song, K.; Zhu, R.; Zhang, O.; Jiang, X. Promoting the Sustainable Development of Power Construction Projects through Stakeholder Participant Mechanisms: An Evolutionary Game Analysis. Buildings 2024, 14, 663. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, L.; Zhuang, J. Research on ESG Investment Efficiency Regulation from the Perspective of Reciprocity and Evolutionary Game. Comput. Econ. 2024, 64, 1665–1695. [Google Scholar] [CrossRef]

- Campiglio, E. Beyond Carbon Pricing: The Role of Banking and Monetary Policy in Financing the Transition to a Low-Carbon Economy. Ecol. Econ. 2016, 121, 220–230. [Google Scholar] [CrossRef]

- Lippert, I. Failing the Market, Failing Deliberative Democracy: How Scaling up Corporate Carbon Reporting Proliferates Information Asymmetries. Big Data Soc. 2016, 3, 2053951716673390. [Google Scholar] [CrossRef]

- Yu, X.; Shi, J.; Wan, K.; Chang, T. Carbon Trading Market Policies and Corporate Environmental Performance in China. J. Clean. Prod. 2022, 371, 133683. [Google Scholar] [CrossRef]

- Qian, J.; Zhou, Y. Environmental Regulation and Green Technology Innovation: An Evolutionary Game Analysis Between Government and High Energy Consuming Enterprises. Comput. Econ. 2025, 1–31. [Google Scholar] [CrossRef]

- Zhang, X.; Zhou, H.; bin Mohd Nasir, M.H.; Bt, S.N.H.J.N.; Huang, C. Warming Planet and Expanding Wallets: Climate Risk and Managerial Moral Hazard. Int. Rev. Econ. Financ. 2024, 95, 103475. [Google Scholar] [CrossRef]

- Ojo, L.D.; Chan, A.P.C.; Sing, M.C.P. Impact of Integrity-Based Approach to Ethics Management on the Integrity of Construction Professionals in a Developing Economy. J. Eng. Des. Technol. 2025. [Google Scholar] [CrossRef]

- Zhu, R.; Li, L.; Guo, C. Research on the Stable Operation Strategy of Carbon Emission Trading System Under Dual Carbon Goals: An Evolutionary Game Analysis from the Mrv Perspective. SSRN, 2025; in press. [Google Scholar]

- Yao, Y.; Zhang, B. Life Cycle Assessment in the Monitoring, Reporting, and Verification of Land-Based Carbon Dioxide Removal: Gaps and Opportunities. Environ. Sci. Technol. 2025, 59, 11950–11963. [Google Scholar] [CrossRef]

- Woo, J.; Fatima, R.; Kibert, C.J.; Newman, R.E.; Tian, Y.; Srinivasan, R.S. Applying Blockchain Technology for Building Energy Performance Measurement, Reporting, and Verification (MRV) and the Carbon Credit Market: A Review of the Literature. Build. Environ. 2021, 205, 108199. [Google Scholar] [CrossRef]

- Luo, Y.; Shen, J.; Liang, H.; Sun, L.; Dong, L. Carbon Monitoring, Reporting and Verification (MRV) for Cleaner Built Environment: Developing a Solar Photovoltaic Blockchain Tool and Applications in Hong Kong’s Building Sector. J. Clean. Prod. 2024, 471, 143456. [Google Scholar] [CrossRef]

- Li, X.; Wang, C.; Kassem, M.A.; Liu, Y.; Ali, K.N. Study on Green Building Promotion Incentive Strategy Based on Evolutionary Game between Government and Construction Unit. Sustainability 2022, 14, 10155. [Google Scholar] [CrossRef]

- Chu, Z.; Bian, C.; Yang, J. How Can Public Participation Improve Environmental Governance in China? A Policy Simulation Approach with Multi-Player Evolutionary Game. Environ. Impact Assess. Rev. 2022, 95, 106782. [Google Scholar] [CrossRef]

- Wei, G.; Li, G.; Sun, X. Evolutionary Game Analysis of the Regulatory Strategy of Third-Party Environmental Pollution Management. Sustainability 2022, 14, 15449. [Google Scholar] [CrossRef]

- Shan, S.; Zhang, Z.; Ji, W.; Wang, H. Analysis of Collaborative Urban Public Crisis Governance in Complex System: A Multi-Agent Stochastic Evolutionary Game Approach. Sustain. Cities Soc. 2023, 91, 104418. [Google Scholar] [CrossRef]

- Cui, B.; Shui, Z.; Yang, S.; Lei, T. Evolutionary Game Analysis of Green Technology Innovation under the Carbon Emission Trading Mechanism. Front. Environ. Sci. 2022, 10, 997724. [Google Scholar] [CrossRef]

- Wu, X.; Liu, P.; Yang, L.; Shi, Z.; Lao, Y. Impact of Three Carbon Emission Reduction Policies on Carbon Verification Behavior: An Analysis Based on Evolutionary Game Theory. Energy 2024, 295, 130926. [Google Scholar] [CrossRef]

- Li, H.; Liu, D.; Han, Z.-J.; Sun, Y.-P.; Wang, L.; Zhang, J.-S. Simulation Analysis of the Three-Party Evolutionary Game of Green Building Market Players under Carbon Trading Policy. Environ. Sci. Pollut. Res. 2023, 30, 117591–117608. [Google Scholar] [CrossRef] [PubMed]

- Chang, P.; Liao, B.-Y. Evolutionary Game Analysis of Low-Carbon Transformation of Multi-Subject Construction Enterprises under Government Involvement. Environ. Ecol. Res. 2023, 11, 676–688. [Google Scholar] [CrossRef]

- Chen, N.; Zhao, Y.; He, H.; Ma, X.; Xu, X.; Li, L.; Gang, S.; Xue, B. Stability Analysis of Carbon Emission Trading Mechanism in China Based on a Tripartite Evolutionary Game. Sci. Rep. 2025, 15, 7304. [Google Scholar] [CrossRef]

- Cao, W.; Yu, J. Evolutionary Game Analysis of Factors Influencing Green Innovation in Enterprises under Environmental Governance Constraints. Environ. Res. 2024, 248, 118095. [Google Scholar] [CrossRef]

- Hao, X.; Tian, T.; Dong, L.; Wong, C.W.Y.; Lai, K. Unmasking Greenwashing in ESG Disclosure: Insights from Evolutionary Game Analysis. Ann. Oper. Res. 2025, 1–29. [Google Scholar] [CrossRef]

- Luo, J.; Feng, W. Promoting Green Transformation of Enterprises in China to Adapt to Climate Change: An Evolutionary Game Analysis. Front. Clim. 2025, 7, 1504615. [Google Scholar] [CrossRef]

- Li, B.; Geng, Y.; Xia, X.; Qiao, D. The Impact of Government Subsidies on the Low-Carbon Supply Chain Based on Carbon Emission Reduction Level. Int. J. Environ. Res. Public Health 2021, 18, 7603. [Google Scholar] [CrossRef]

- Wen, Y.; Wei, Y.; Liu, L. Comparative Study on Government Subsidy Models for Competitive Drug Supply Chains under Centralized Procurement Policy. Front. Public Health 2025, 13, 1542858. [Google Scholar] [CrossRef] [PubMed]

- Wu, J.; Yu, Z.; Wang, B.; Ma, C. Environmental Regulations and Carbon Intensity: Assessing the Impact of Command-and-Control, Market-Incentive, and Public-Participation Approaches. Carbon Manag. 2025, 16, 2499091. [Google Scholar] [CrossRef]

- Bai, J.; Ma, W.; Wang, Y.; Jiang, J. Political Incentives in Market-Based Environmental Regulation: Evidence from China’s Carbon Emissions Trading Scheme. Heliyon 2024, 10, e25730. [Google Scholar] [CrossRef] [PubMed]

- Meng, L.; Yuan, G.X.; Wang, H. Dynamic Incentive Strategies for Principal-Agent Coopetition: A Stochastic Approach to Managing Risks and Performance. Manag. Decis. Econ. 2025, 46, 3976–3997. [Google Scholar] [CrossRef]

- Li, C.; Gu, X.; Li, Z.; Lai, Y. Government-enterprise Collusion and Public Oversight in the Green Transformation of Resource-based Enterprises: A Principal-agent Perspective. Syst. Eng. 2024, 27, 417–429. [Google Scholar] [CrossRef]

- Wang, Y.; Zhuang, J.; Lai, R.; Chen, L. A Tripartite Governance Strategy for Infrastructure REITs Considering Tax Incentives and Antiavoidance Regulations. J. Constr. Eng. Manag. 2024, 150, 04024162. [Google Scholar] [CrossRef]

- Zhu, C.; Su, Y.; Fan, R.; Xu, R.; Li, B. Research on the Optimal Incentive and Constraint Mechanisms for Corporate Carbon Information Disclosure Considering Different Market Contexts: A Network-Based Evolutionary Game Analysis. Energy Econ. 2025, 142, 108207. [Google Scholar] [CrossRef]

- Zhou, M.; Qian, L. Evolutionary Game Analysis of Carbon Emission Reduction of Internet Enterprises under Multiple Constraints. PLoS ONE 2024, 19, e0296918. [Google Scholar] [CrossRef]

- Pingkuo, L.; Jiahao, W. Study on the Diffusion of CCUS Technology under Carbon Trading Mechanism: Based on the Perspective of Tripartite Evolutionary Game among Thermal Power Enterprises, Government and Public. J. Clean. Prod. 2024, 438, 140730. [Google Scholar] [CrossRef]

- Yong, X.; Tao, Y.; Wu, Y.; Chen, W. Rent-Seeking Analysis of Carbon Emission Verification Based on Game Theory and Prospect Theory from the Perspective of Multi-Participation. J. Clean. Prod. 2024, 438, 140784. [Google Scholar] [CrossRef]

- Li, J.; Liu, J.; Yi, Y.; Chen, Y. The Influence of Opportunism on the Cooperation Modes of Carbon Emission Reduction. J. Syst. Sci. Syst. Eng. 2024, 33, 736–758. [Google Scholar] [CrossRef]

- Hu, J.; Wang, T. Strategies of Participants in the Carbon Trading Market—An Analysis Based on the Evolutionary Game. Sustainability 2023, 15, 10807. [Google Scholar] [CrossRef]

- Li, Y.; Zhu, Y. Analysis of the Tripartite Evolutionary Game Among Third-Party Verification Agencies, Emission Control Enterprises, and Government Driven by Carbon Trading-the Case of Beijing Carbon Market. SSRN, 2024; in press. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).