1. Introduction

In 1938, the Italian physicist Ettore Majorana stated the following [

1]: “Atom physics with which we will mainly have to deal, despite its numerous and important practical applications, and those of a wider and perhaps more revolutionary scope that the future may reserve for us, remains above all a science of speculative interest, due to the depth of its investigation which truly goes to the very last root of natural facts”.

With this point of view, Majorana insists on the need to use statistical laws in every scientific discipline. His considerations focus, in an innovative way, on the analogy between the quantum–statistical nature of nuclear phenomena and the formalization of economic models [

2]. His ideas led to the development over time of a sub-sector of econophysics, quantum econophysics, in which the concepts of quantum mechanics allow us to describe the behavior of economic processes. The numerous successes of quantum field physics have profoundly changed the study of phase transitions, studies which, through sophisticated computational techniques, have allowed us to investigate complex phenomena such as financial ones.

In 2022, scientists Alain Aspect, John F. Clauser and Anton Zeilinger were awarded for their research on quantum mechanics [

3]. Their studies have opened up a modern world of quantum information, through which it has been possible to develop the first quantum computers, which will be important in the not-too-distant future. Quantum computers will quickly solve a broad series of problems that we are yet unable to solve, and these very important technological developments have a series of yet unrevealed and unknown applications.

Currently, technology does not allow the application of quantum computers for individual uses, but it is possible to simulate its potentialities through quantum computing. Quantum programs are composed of sequences of instructions that are interpreted by classical computers to perform a specific task from a quantum system, i.e., one that follows the principles of quantum physics [

4]. The reality that we perceive can be described by Newtonian physics, but it is only an approximation of quantum physics. This is why quantum computing seeks to master the abstract mathematical models that are able to describe quantum mechanics, where the state space of a system is not a countable set, the states are not necessarily distinguishable from each other in totally unambiguously, and it is not possible to perform a measurement that leaves the system unperturbed, regardless of how this measurement is obtained.

Nonetheless, the creation of algorithms and programs that exploit the characteristics of quantum computers can be useful to analyze, in an innovative way, the dynamics of the real estate market or any other economic phenomenon.

Under the economic evaluation profile of housing value and income, the real estate market, especially the Italian one, is characterized by limited competitiveness, a lack of transparency and the absence of complete and systematic surveys of data concerning real estate characteristics and actual prices for sales and rents.

The available data often do not allow an exhaustive scientific, descriptive and interpretative analysis of urban and territorial real estate markets. With the data available, it is therefore necessary to carry out real estate analyses based on adequate and innovative estimation tools that allow the progressive construction of economic statistics to interpret existing markets and possibly forecast future real estate values.

From this point of view, the proposed approach implements a high-performance multidisciplinary model for real estate market analysis (interpretation of selling prices), derived from the characteristics of the demand, which can also be applied for administrative and tax purposes. The other main aims of this work are to show how quantum programming and genetic algorithms can be integrated and, at the same time, to show some potential uses of quantum programming tools with reference to the real estate sector. With the latter undertaking, the study is among the first at an international level regarding the application of quantum computing to real estate market analysis and the interpretation of selling prices.

The research initially starts with an overview of the literature on nature-inspired algorithms, and a more detailed review of genetic algorithms. The principles of quantum programming, necessary and fundamental to understand its logic and functioning, are subsequently presented. In this part, some basic concepts are described, including what a “qubit” is, what application potential it has, how to modify and measure it and how to use its characteristics for purposes related to real estate market analysis. We focus on the tools necessary to understand the idea behind the approach that is implemented in the case study. After a brief presentation of the context of the study and the real estate data sample, genetic algorithms are implemented to obtain the marginal prices of real estate characteristics considered for the data sample. The marginal prices constitute the quantum program inputs to provide, as results, the purchase probabilities corresponding to each real estate characteristic considered. The other main outcome of the quantum computing application is a comparison among the optimal quantities for each real estate characteristic as determined by the quantum program and the average amounts of the same characteristics but relative to the real estate data sampled, as well as the weights of the same obtained with the implementation of genetic algorithms. A discussion is finally presented with the formulation of critical considerations.

2. Literature Review

Algorithms and machine learning are having a significant impact on the real estate sector, as many of its activities are based on data and information that can be handled more efficiently and accurately by evolutionary algorithms.

The search for better-performing algorithms in real estate valuation is becoming an increasingly central topic in terms of real estate market issues, allowing us to analyze large amounts of data and to provide a more precise and reliable valuation of real estate properties.

From this point of view, nature-inspired algorithms represent techniques that are increasingly applied to analyze data relating to real estate properties, including their selling prices, their geographical positions, their physical characteristics and other relevant information. These data are then processed by machine learning algorithms, which use mathematical models to identify the factors that influence the value of a property, among which the most recent implementations of scientific research are mostly focused on genetic algorithms.

Artificial intelligence and quantum computing techniques can compensate for some information gaps arising from the application of a model based on genetic algorithms. This is because, in quantum computing, information is stored, transmitted and manipulated by physical means. Therefore, the concepts of information and computation—which are simply a particular form of the manipulation of information—can be formulated in the context of a physical theory, and the study of information ultimately requires the use of experiments. This seemingly simple and almost obvious fact has non-trivial consequences. It is now generally accepted that every physical theory supports a computational model whose power is limited only by the nature of the theory itself. Classical physics and quantum mechanics support a multitude of different implementations of the model of computation that we are accustomed to today.

Starting from this theoretical framework, we initially present an overview of the literature on nature-inspired algorithms applied to the real estate sector, and subsequently a more detailed review of genetic algorithms applied in the same field. The principles of quantum programming are treated separately, because studies of quantum computing closely applied to the real estate market are still lacking.

2.1. Overview of Nature-Inspired Algorithms Applied to the Real Estate Market: Developments and Comparative Studies

The literature review regarding nature-inspired algorithms specifically applied to the real estate sector was carried out using the Scopus platform. The research provided a total of 118 papers, later yielding 48 relevant items considering a period limited only to the last 13 years (2010–2023) and in correspondence to some selected keywords (real estate, real estate appraisal, property appraisal, property, property valuation, mass appraisal, house prices, house price prediction, price).

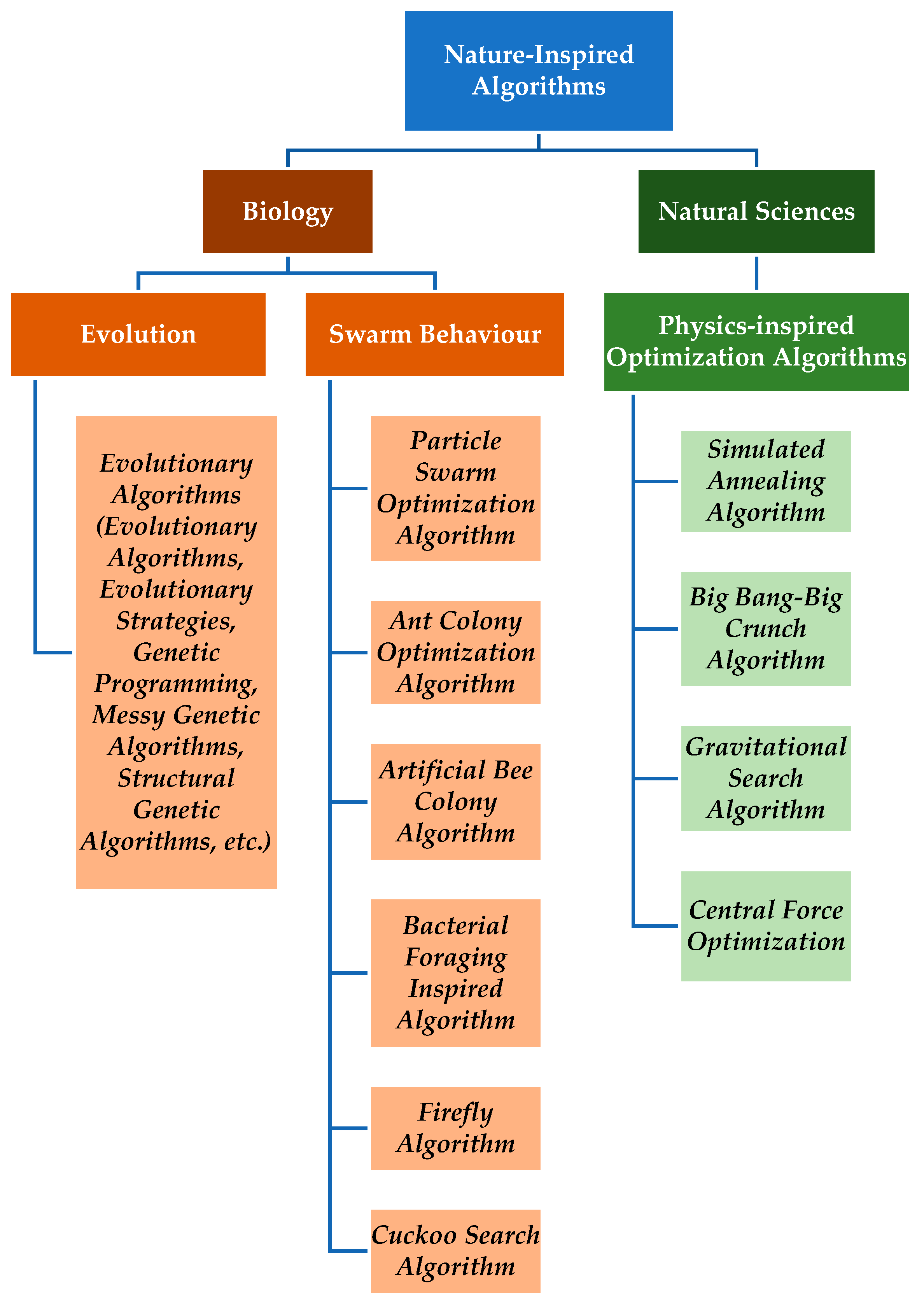

A summary of the nature-inspired algorithms divided by category, modified from the original scheme of Fister Jr. et al. [

5], is reported in

Figure 1.

The results for the different keywords used in this literature review, together with the selected papers from the total results produced by the Scopus database, are shown in

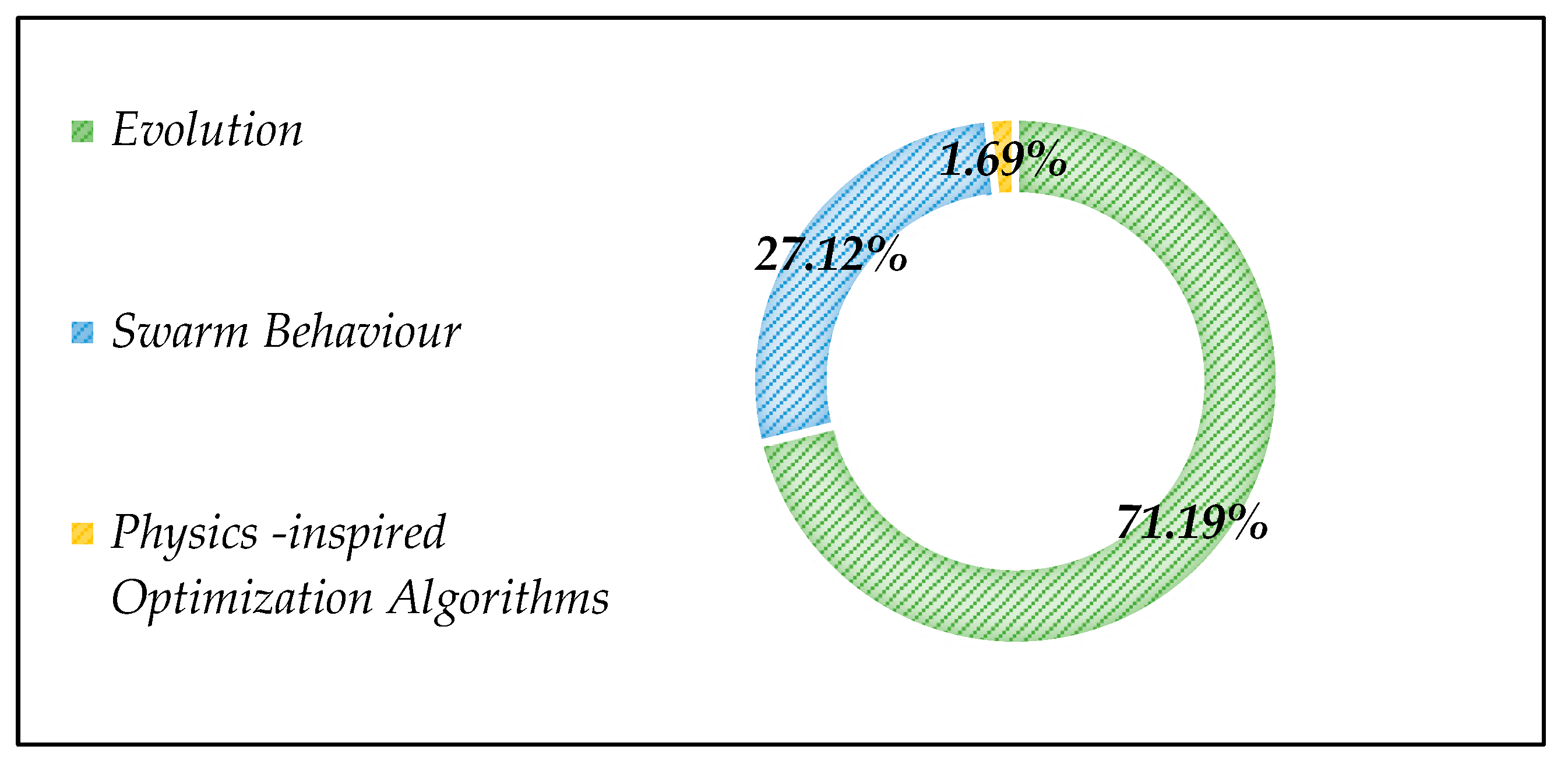

Table 1. By grouping the research results into three different macro-groups that refer to biology-inspired algorithms and other hybrid methodologies of optimization algorithms (physics-inspired), there is a clear preponderance of evolutionary algorithms in the literature (see

Figure 2).

Despite the increasing number of papers in the last few years, focused on these topics’ development, there is a clear preference for the use of genetic algorithms and evolutionary algorithms in general (71.19% total documents in the literature) and with reference to real estate markets, in clear contrast to other next-generation metaheuristic algorithms based on swarm behavior, which are mostly used for the purpose of optimizing input parameters and attributes and model comparison. Recent developments and comparative studies on optimization algorithms have shown little, if any, literature, as well as for the branch of algorithms inspired by the natural sciences (optimization inspired by physics), a sign that this field is still in the exploration phase. With reference to the research area covered, no results were obtained for the following algorithms: bacterial-foraging-inspired, firefly, big-bang or big-crunch, gravitational search and central force.

The studies highlight two main thematic areas: the forecasting and analysis of real estate prices [

6,

7,

11,

14,

16,

17,

23,

24,

28,

39,

50] and the optimization of the real estate portfolio with all the related valorization interventions for the evaluation/feasibility of possible investments for real estate project management. Although these thematic areas are interconnected, for the first topic, the mass appraisal techniques have been strategically used for the definition of policies on the management and enhancement of public and private real estate assets, in the case of technical re-functionalization investments and economic issues and for the sales of buildings no longer suitable for public needs [

13,

22,

25,

31,

35]. The use of new-generation metaheuristic algorithms to estimate the building demand on territories also serves as support for this specific problem [

8,

41,

49]. Regarding the issue of land management, to support decision making in urban planning and for the efficient management of landed properties and real estate management, one of the objectives is to determine the suitability of locations by also making use of the interpretation of relationships between real estate rental prices and the geographical locations of the housing units themselves [

10,

18]. The issues relating to the real estate portfolio’s optimization also address problems inherent to the risk preferences or risk levels of investors, such as the proposition of a semi-variance model of a real estate investment portfolio based on the risk preference coefficient using the Artificial Bee Colony algorithm [

42,

43].

The discussion of the Artificial Bee Colony (ABC) and Ant Colony Optimization (ACO) algorithms, based on swarm behavior, is controversial: ABC can generate a better solution than genetic algorithms and can be considered a useful approach to solving problems related to real estate portfolios [

42]; regarding the ACO algorithms, with variance as a risk measurement index, it is better than the basic ACO and the basic genetic algorithm of the real estate portfolio [

41].

2.2. Focus on Genetic Algorithms Applied to Real Estate Market

Genetic algorithms (GA) have been investigated over the time as an alternative to multiple regression analysis and artificial neural networks. The most relevant difficulties in real estate price forecasting have always been the dependence on subjective judgement to precess in order to obtain reliable real estate values. For this reason, multiple regression analysis and artificial neural networks have been considered for a long time as the most flexible techniques, able to provide reliable predictions and information on real estate values and facilitate market analysis [

54,

55,

56,

57,

58,

59,

60,

61].

GA are stochastic search techniques that may explore wide and complex spaces based on Charles Darwin’s evolutionary principle [

62,

63,

64,

65]. Multi-parameter optimization problems, characterized by objective functions subject to constraints, are the main operating areas suitable for GA. Initialization, selection, crossover and mutation are the four stages of the search process developed by GA [

66].

The history of GA began with the first computer simulations of evolution; the latter began to spread in the 1950s. In the 1960s, Rechenberg [

67] introduced the “evolutionary strategy”, and the topic was further expanded by Schwefel [

68]. Then, Fogel, Owen and Walsh [

69] developed “evolutionary programming”, a particular technique whose possible solutions were finite state machines. During these years, other studies were carried out on automatic learning and algorithms inspired by evolution and genetics [

70].

However, only with Holland [

63], and later with Goldberg [

62], have GA experienced wider use in many scientific fields, mainly thanks to the improvements in the power of computational machines, making the wider practical application of these methods possible.

Holland’s original idea, citing Mitchell [

71], “was not to design algorithms to solve specific problems, but rather to formally study the phenomenon of adaptation as it occurs in nature and to develop ways in which the mechanisms of natural adaptation might be imported into computer systems”.

Holland’s GA, as presented in his book [

63], is a technique that is useful to pass from an initial population of chromosomes to a new one, with a better fit to the environment, using a natural selection mechanism and the genetic operations of crossover, mutation and inversion.

GA applications are very limited in the real estate field. In the international literature, Lertwachara [

72] presents a GA method to identify attractive stocks and to measure the performance of profitable investment strategies. Ahn et al. [

13] use ridge regression with GA to enhance real estate appraisal forecasting in the Korean real estate market. Ma et al. [

73] propose an approach characterized by the combination of a hierarchical genetic algorithm and the least squares method to optimize a particular neural network, with the aim of predicting the real estate price index. In the Italian literature, only two works can be found on the use of GA in real estate appraisal: Manganelli et al. [

74] test GA to interpret the relationship between real estate prices and property locations; De Mare et al. [

75] use GA verify the economic and territorial impacts of high-speed railways; and Del Giudice et al. study the interpretation of the relationships existing between real estate rental prices and the geographical locations of housing units in a central urban area of Naples [

18].

Nowadays, the diffusion of GA is broad and they are used to solve a wide range of problems, such as scheduling, data fitting, trend spotting and budgeting problems.

3. Quantum Computing

3.1. Quantum Computing between Hype and Revolution

Since the 1980s, quantum computers have transformed from a concept in a few scientists’ minds to real-world applications that are expected to revolutionize the way that we solve computationally complex tasks.

Quantum computers have already completed calculations that are beyond the capabilities of even the most powerful current supercomputers. Four years ago, Google had already claimed in a study that it had achieved “quantum supremacy”, or the ability of a quantum processor to solve a calculation that a traditional computer would require an unreasonable time to perform. Sycamore, the 54-qubit machine built by Google, proved that a sequence of random numbers was truly random through a complex mathematical operation by generating random numbers. This was achieved in only 200 s, while a traditional supercomputer would have completed the same calculation in 10,000 years [

76].

It has now been demonstrated that quantum computers are able to reason faster than classical calculators, but we are still far from having a universal quantum computer. For this reason, many researchers have shifted their attention to a less ambitious task, thus effectively moving from the problem of “quantum supremacy” to the “quantum advantage”, i.e., algorithm design to be carried out by future quantum computers [

77].

The quantum advantage refers to the ability to solve a problem more efficiently than classical computation, usually in terms of speed. Quantum solutions are based on quantum algorithms, multi-level instructions used to operate a quantum computer. Quantum algorithms can be designed, tested and refined using quantum computer emulators. Research in recent years has been particularly oriented towards quantum computing combined with machine learning techniques, which exploit hybrid approaches to increase the precision of quantum solutions (“quantum machine learning”, QML) [

4].

In general, machine learning (ML) is a subset of artificial intelligence (AI) that deals with the creation of systems that learn or improve performance based on the data that they use. Artificial intelligence is a generic term and refers to systems or machines that mimic human intelligence. The terms ML and AI are often used together and interchangeably, but they do not have the same meaning. An important distinction is that while all aspects related to machine learning fall within artificial intelligence, artificial intelligence is not merely machine learning. With ML techniques, it is possible to analyze large amounts of data for the purpose of real estate estimation and the scheduling of property maintenance. The innovations in real estate valuation are closely linked to the development of automatic valuation methods (AVMs) based on ML. Almost all AVMs implemented in the literature refer to the market value valuation of residential units. Among the main AVMs that can be recognized are the following: regression trees and random forests, artificial neural networks, evolutionary algorithms, nearest neighbor algorithms and support vector machines [

78].

With reference to QML, there are currently a wide range of quantum development libraries that can be used with standard programming languages to compose and test quantum circuits. Some libraries are specialized in ML applications and offer the possibility to integrate such quantum circuits with ML libraries, giving full control over the hybrid quantum–classical algorithms, which are currently the most promising research candidates. This makes it easy for users to discover the best algorithm for their respective use case and the best hardware to run it. Such hybrid approaches to quantum computing combine the stability of classical computers with the benefits of quantum effects such as superposition and entanglement properties [

4].

To date, with reference to the real estate sector, only a single quantum algorithm has been developed and applied for the prediction of house price trends. The Finnish OP Financial Group’s innovation unit OP Lab and CSC, together with the National Research and Education Network (NREN) of Finland, processed data from the previous decade and estimated the average house price in Helsinki in 2021 with an error of approximately 0.24%. This result had no direct implications, as the prediction was developed only for the implemented quantum tool’s verification [

79].

3.2. Principles of Quantum Computing

The distinction between classical and quantum computers is analogous to the one present between classical and quantum physics. The main difference regards the scale: our everyday experience mostly involves objects with dimensions and qualities for which the quantum effects generally are not relevant. The physics behind quantum computers is a fascinating topic, but knowledge of physics is not needed in order to learn to program and operate quantum devices. Until quantum computers are widespread, classical computer science will remain in use and will be the means by which we operate, communicate and interact, although it will be joined by quantum hardware [

4].

In classical programming, the term “bit” can generally denote any physical system that can be completely described by answering a question that expects only true or false as an answer—the information stored in this physical system.

As “bits” are the simplest units of information in classical programming, “qubits” are the basic units of information in a quantum computer. They can be physically implemented by systems that have two states, as with classical bits, but behave according to the laws of quantum mechanics, with additional properties that classical bits do not have.

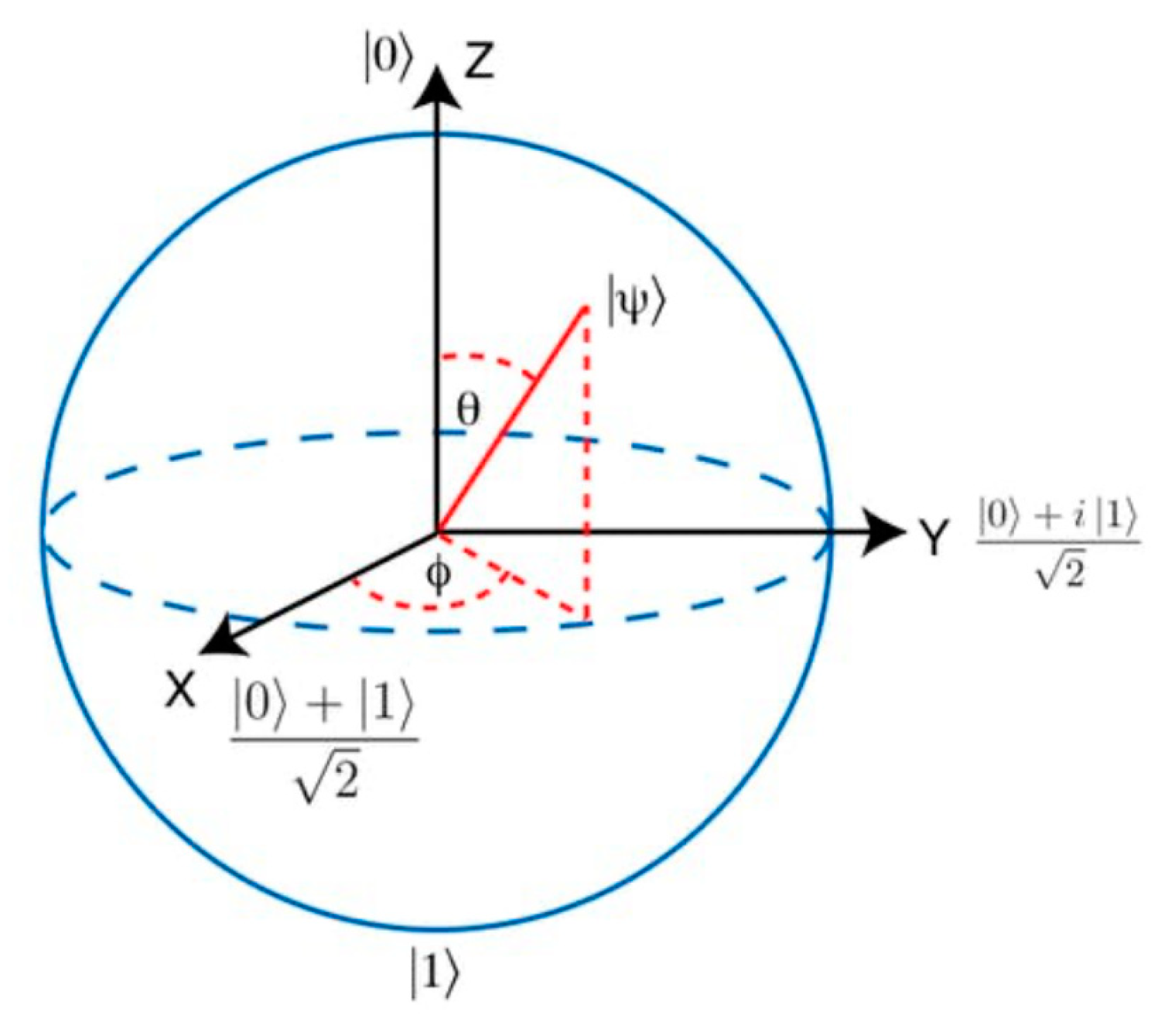

The most similar qubit states to the classic 0- and 1-bit states are “|0⟩” and “|1⟩” (“ket 0” and “ket 1”). The state of a qubit can be represented as a point on a circle that has two states labeled at the poles: |0⟩ and |1⟩. Classical bits can be recorded as values on a line because the only operation that can be performed on them is inversion (or 180° rotation). Quantum mechanics allows more types of operations to be applied to qubits, including rotations of less than 180°. Therefore, qubits also differ from classical bits in terms of the operations that we can perform on them. While classical bit operations are logical operations that can be performed by combining the operators “NOT”, “AND” and “OR” in various ways, quantum operations consist of rotations. This feature gives the qubit a fundamental property: reversibility. Rotating a qubit by 90° in both directions, we obtain two states, which are marked with the symbols |+⟩ and |–⟩. They are, respectively, “ket plus” (clockwise rotation) and “ket less” (counterclockwise rotation): they represent the two states, which have a 50% chance of returning 1 or 0 from a measurement. Dirac notation is used to represent qubits. Quantum states can also use complex numbers, where, using the “Bloch sphere”, the state of a qubit is any point on this sphere (see

Figure 3).

When the considered system has more than one qubit, it is not possible to describe each single qubit, but it is necessary to describe the whole system through a qubit register. The amount of data grows exponentially as the number of qubits in the register increases.

Quantum mechanics is often based on the concept of energy, where energy is described by a Hamiltonian matrix. In this case, the properties of the eigenstates are exploited (the “eigenstate” with respect to an opmnvmxxmeration is defined as the state that does not undergo variations other than that of the global phase subjected to this operation). Each eigenstate of a Hamiltonian matrix represents a constant energy state, but the phases of the states evolve over time. The Schrödinger Equation (1) demonstrates this, stating that, as a quantum system evolves, each eigenstate of the Hamiltonian matrix accumulates a phase proportional to its energy [

4]:

The time derivative (j/jt) of the Schrödinger equation indicates that the way in which qubits rotate is completely described by the energy associated with each state.

Mathematically, Born’s rule is used to measure a quantum state and calculate its probability: the probability is the square of the amount of the inner product of the measurement and the state.

The Hadamard transformation is a qubit rotation that maps the basic states |0〉 and |1〉 to an overlapping of the two states with equal weight. Usually, the phases are chosen as follows [

4]:

The notation (2) corresponds to the transformation matrix [

4]

An application of Hadamard’s transformation to a 0 qubit, or 1 qubit, will produce a quantum state that, if observed, will be 0 or 1 with equal probability. This precisely resembles the flipping of a coin in the probabilistic standard model of computation. Many quantum algorithms use the Hadamard transform as an initial step, as it maps

m qubits initialized with |0〉 to an overlapping of all

2m orthogonal states in the base |0〉, |1〉 with equal weight [

80]. Increasing the dimension of the quantum register forces the vector to use exponential amplitudes (coefficients of computational basis). To express the state of a 60-qubit register, we would require approximately 1.15 × 10

18 numbers in the vector (equivalent to the number of grains of sand on Earth).

4. Materials and Methods

4.1. Context of the Study

The real estate data sample consisted of 45 housing units offered for sale in 2022 and located in a central urban area of Naples (Chiaia district). Chiaia is a district that, together with the Posillipo and San Ferdinando districts, forms Municipality n. 1 of Naples.

From a real estate point of view, it represents approximately 7% of all real estate transactions in Naples. The average price of apartments in the Chiaia area is around 4375 €/sqm, much higher than the average city price, which is around 2735 €/sqm. The price of apartments in the Chiaia area of Naples is less uniform than the average, but around 60% of the units are offered at a price between € 2785/sqm and € 5615/sqm [

81].

4.2. Methodology

4.2.1. Genetic Algorithms

GA are adaptive techniques, particularly suitable in the resolution of optimization problems, able to seek—for a complex and prefixed fitness function—the maximum or minimum point. In these circumstances, other traditional analytical techniques are not usable due to the impossibility of exploring the spaces of possible random solutions.

More generally, GA are adaptive heuristic search techniques based on the ideas of natural selection and genetic evolution initially postulated by Charles Darwin with his theory on survival [

18,

71,

72,

73,

74,

75,

82].

Thus, GA represent, in other terms, the clever utilization of a random search within a preset search space in order to solve a prearranged problem.

GA have been applied in a wide number of ways, but their effective representation and selection of a fitness function are key parameters in their applications. The relevance of GA in applications is due to the possibility of using them easily, and they are, at the same time, reliable and adaptable algorithms that are able to search for better solutions quickly and in complex multidimensional problems. Three specific conditions, if verified, suggest the use of GA in operational applications:

the space of the solution is complex and wide or its knowledge is very poor;

the knowledge about a domain is poor or it is not possible to decode or restrict the space of the solution;

traditional tools or techniques for mathematical analysis are unavailable.

In analogy with a biological system, it is possible to assume that also the built environment is characterized by a given issue to be solved and it is constituted by subjects of the population that are the solvers of the problem to be addressed. On the individuals of the population, the environment exerts a pressure that is continuously in evolution, pressure identifiable as a specific fitness function able to provide, for each person, a high-accuracy solution, proposed by the same people, for the problem under investigation.

Derived from biology, crossover and mutation are the main genetic operations considered in study cases. Referring to the concepts of natural selection, the best individuals of a given generation, if coupled together, will produce better subsequent and future generations of new individuals that can provide an entire population of possible solutions for the problem of interest. In this way, there is a continuous improvement in the genetic characteristics and in the number of individuals compared with previous generations. Thus, the better features are crossed and exchanged in the course of future generations.

Exploring in detail the most suitable research areas, the optimal solution is identified by the best individuals generated in the time.

Generally, five domains can be distinguished where GA are usefully applied, even if these domains do not have clearly defined boundaries: control; design; simulation and identification; planning; and classification, modeling and machine learning. For the latter domain, the use of GA is directed towards the construction of models able to interpret an underlying phenomenon or for forecasting purposes.

The implementation of GA in this work is performed by a Matlab tools extension [

83].

4.2.2. Quantum Programming

The quantum program implemented in this work concerns the presence of two operators (buyer and offerer), one of which decides a “hidden” angle (sales or purchase price) that the other manages to identify through various considerations and properties of the qubits. To achieve his goal, the second operator multiplies the hidden angle by a random and known value

x, and then measures several times the state that emerges from the rotation of a qubit (initially in the initial state

ket_plus) of the quantity given by the multiplication. The ability of the qubit to rotate in infinite positions on a circle (although we well know that everything takes place in three dimensions considering the Bloch sphere) and to represent, for each of these positions (states), a measurement probability (for example, measure 0) allows us, through a formula that activates the hidden angle and the value chosen to multiply it with the probability of measurement, to determine the angle [

4]:

Our case study tries to exploit the plotting of the resulting probability variation. The application relates the variation in the probability of measuring a value to the probability of purchase by the real estate market protagonist, based on the variation in the property’s characteristic.

To better explain the concept, reference is made to a simple regression model, where the property market (

Vx) represents an output that can be defined in a very simple way through the product of the amount of a single real estate characteristic considered with its marginal price:

where

α is the marginal price and

y the amount of the real estate characteristic. We can see how the previously written equation is simply the representation of a straight line with an angular coefficient equal to the marginal price of the real estate characteristic. By setting a range of constant values for

y, the market value can be varied according to the variation in only the marginal price—therefore, graphically, by rotating the straight line. In this simple case, and with all other conditions being equal, the probability of purchase in the real estate market depends on the marginal price and the quantity of the characteristic considered. By setting the

α parameter to be constant, we make the marginal price and therefore the rotation of the representative line of the regression model the only factor regarding the variation in utility.

The aspects described so far can be transposed in terms of a qubit.

The state of a qubit is simply the position of the latter on a circumference (2D Boch sphere) and this state can be changed by rotating its position by an arbitrary angle. We can compare the rotation that we apply to the state of a qubit with the variation in the real estate marginal price, i.e., with the line rotation of the regression model. If we rotate the qubit concerned infinitely and measure it (several times, sufficient to determine a probability) at each instant, graphing the probabilities of measuring 1 or 0 (depending on the axis chosen for the measurement and the state of the bracket <status|measurement>), we can observe that the graph will have a sinusoidal trend.

A doubt could arise about the usefulness of this method as these operations could also be performed with classical programming. The advantage of using quantum programming consists in obtaining the general/generated function, not through equations of the type y = asin(x), which would then have to be modified from time to time to specialize them according to the chosen parameter, but through a physics operation that consists of waiting for a time t (the time in which the physical qubit evolves and varies its state) and performing a measurement of the physical state of our qubit.

By changing the waiting time to allow the qubit to evolve in the various states and then measuring them (several times) to obtain the probability, the general function can be specialized; this indicates that in order to consider different variables (property characteristics), it is sufficient to vary the time t. This is a simplification in terms of calculations because we use physical properties and not simply mathematical equations, so we can use this approach to process much more information.

The simulation of the quantum program is performed by a Python application [

84].

4.3. Research Design

After a preliminary overview of the context of study, the research phases can be summarized as follows.

Representation of the real estate data sample belonging to the same market segment and identification of the relevant real estate characteristics.

Genetic algorithm implementation to obtain the marginal prices of real estate characteristics considered for the data sample: definition of the fitness function (sum of squared residuals); iteration cycles’ changing constraints and model key parameters, directing the process to the minimization of the fitness function; determination of the vector of coefficients that directly expresses the average unit price for each single real estate characteristic.

Quantum computing application based on the marginal prices of real estate characteristics determined by genetic algorithms, and preliminarily defining the rotation angle and scale factor (2D Boch sphere).

Findings of quantum computing application: purchase probability for each real estate characteristic; comparison between the optimal quantities for each real estate characteristic as determined by the quantum program and the average amounts of the same characteristics but relative to the real estate data sampled, as well as the weights of the same characteristics obtained with the implementation of genetic algorithms.

4.4. Data Specification

The proposed multidisciplinary approach focuses on the interpretation of selling prices as the result of a multicriteria choice process.

The criteria of selection may be expressed by the characteristics of the housing units, which are fundamental in the mechanism of formation of real estate value. To determine the marginal price of some relevant characteristics that contribute to defining real estate selling prices, the original sample (initial population) has been defined with the detection of real estate selling prices that refer to the recent past (year 2022) and to housing units with a similar building type and located in a central urban area of Naples (n. 45 housing units located in Chiaia district).

Regarding the real estate sample size, Green [

85] used statistical power analysis to compare the performance of several rules of thumb regarding how many subjects are required for a regression analysis. Marks et al. [

86] specified a minimum of 200 subjects for any regression analysis. Tabachnick and Fidell [

87] suggested that although 20 subjects per variable would be preferable, the minimum number of required subjects should be five. Harris [

88] argued that the number of subjects should exceed the sum of 50 and the number of predictor variables. Schmidt [

89] determined that the minimum number of subjects per variable lies in the range of 15 to 20. Meanwhile, Harrell [

90] suggested that 10 subjects per variable was the minimum required sample size for linear regression models to ensure accurate prediction in subsequent areas. Finally, Simonotti [

91] argued that the required sample size minimum is equal to 4–5 subjects per independent variable. As reported, also considering the opacity of the Italian real estate market as in the present case, the reduced real estate sample used in this work does not prejudice the operational usability of GA models.

Only non-homogeneous real estate characteristics were detected for each sampled unit and, in particular (see

Table 2), the following:

real estate sale price expressed in euros (PRICE);

commercial area expressed in square meters (AREA);

number of floor levels of housing unit (FLOOR);

maintenance status (MAIN) expressed on a scale: 2 if the housing unit is in optimal condition, 1 if maintenance status is good, 0 otherwise (mediocre status);

number of parking spaces associated with housing unit (PARK);

presence of car box associated with housing unit (BOX), expressed with binary scale: 1 if present, 0 if absent;

historical quality of housing unit (HIST), expressed with binary scale: 1 if present, 0 if absent;

architectural quality of housing unit (ARCH), expressed with binary scale: 1 if present, 0 if absent;

panoramic view of sea for housing unit (SEA), expressed with binary scale: 1 if present, 0 if absent.

Other real estate characteristics, manifesting in the same modalities in all the sampled units, were excluded from the analysis.

4.5. Research Process

For GA implementation, the constitution of an initial population (random or derived by heuristic rules) is the first step; then, an evolutionary cycle must be generated, and, in correspondence to each iteration, we must produce a new population using genetic operations on the previous population.

GA focus on the identification of a maximum or minimum point for a default fitness function. Therefore, the best solutions must be selected with subsequent iterations and then we must recombine them, so that continuous evolution towards the optimal state occurs. Every individual generated from the previous population is assigned a specific value that depends on the quality of the solution. Subsequently, more suitable individuals are recombined to produce new generations, until there is convergence to the value attributable to the best individual.

Residual sum of squares (

RSS) is the fitness function adopted for the proposed model, so as to obtain residuals as a difference between the sampled real estate sale prices and fitted values provided by the model [

18,

71,

72,

73,

74,

75]:

where

yi is the observed sale prices,

is the fitted values,

xi is the measure of the

i-th real estate characteristic selected,

b0 is the statistical error (or constant, assumed equal to zero in this case study) and

bi is the coefficient of the

i-th real estate characteristic (marginal price with which the

i-th real estate characteristic contributes to the selling price).

Determining, in this way, the marginal prices of the real estate characteristics with GA, the input data of the quantum program must then be defined, i.e., the rotation angle and scale factor.

The marginal prices of real estate characteristics vary considerably, so it is necessary to verify how many complete revolutions the qubit would make in the Bloch sphere (in 2D) if subjected to a rotation equal to the value of the marginal price. Each marginal price must therefore be divided by 360, excluding all the revolutions that the qubit would make without a load, and using the remainder of division to represent the angle expressed as a percentage with respect to the value of 100% (corresponding to 360 degrees). To obtain the angle of rotation expressed in degrees, it will then be necessary to multiply the remainder of the division by 360. Finally, to obtain the equivalent in radians (the program uses radians to express rotations), it will be sufficient to set a simple geometric proportion.

4.6. Results of Data Analysis

Regarding the GA implementation, in the Matlab software, numerous iterations were performed, changing in several iterative cycles, one by one, the constraints and model key parameters, directing the process towards the minimization of the sum of squared residuals. Data processing allowed us to determine the genetic code able to generate the optimal solution.

Solver: genetic algorithm (GA);

Number of variables: 8;

Population type: double vector;

Population size: 45;

Mutation: constraint-dependent;

Selection: selection function as stochastic uniform;

Reproduction: elite count equal to 1, crossover fraction equal to 0.3;

Crossover: heuristic function;

Migration: both;

Evaluate fitness and constraint functions: in serial;

Stopping criterion: maximum number of generations equal to 1000;

Plot function: best fitness, stopping.

Table 3 shows the values of the

bi coefficients.

The vector of coefficients directly expresses the average unit price for each single real estate characteristic. The sale price function is additive as follows (

Kj denotes the marginal contributions of real estate characteristics) [

18,

71,

72,

73,

74,

75]:

The block in

Figure 2 synthetically shows the results of the model.

The optimal run involved 710 iterations (with a maximum of 1000 prefixed iterations) and the best objective function value was equal to 4.0079 × 10

12 (see

Figure 4).

The real estate characteristics’ marginal prices all have positive signs, showing an increase in the price in correspondence to the single characteristic with respect to the final sales price. This outcome is in line with the normal dynamics of the housing market.

Commercial area (AREA): €/sqm 3919.78 (average unit price/sqm, for period and territorial context of reference, equal to €/sqm 4450 based on the indications of web portal specialized in real estate advertisements [

92]).

Floor level (FLOOR): €/floor 53,476.42, amount that corresponds to a percentage incidence of approximately 4.73% if compared to the average price of the real estate sample.

Maintenance status (MAIN): €/point 40,015.54, amount that corresponds—with respect to the average commercial area of the real estate sample—to approximately € 203.95/sqm (€ 407.90/sqm for the complete building’s renovation per surface unit).

Parking spaces (PARK): €/parking space 105,454.97, amount that corresponds to a percentage incidence of approximately 9.33% if compared to the average price of the real estate sample.

Car box (BOX): €/car box 188,372.87, amount that corresponds to a percentage incidence of approximately 16.66% if compared to the average price of the real estate sample.

Historical quality (HIST): €/point 215,985.69, amount that corresponds to a percentage incidence of approximately 19.11% if compared to the average price of the real estate sample.

Architectural quality (ARCH): 121,793.39, amount that corresponds to a percentage incidence of approximately 10.77% if compared to the average price of the real estate sample.

Panoramic view of sea (SEA): €/point 117,808.20, amount that corresponds to a percentage incidence of approximately 10.42% if compared to the average price of the real estate sample.

After determining the marginal prices of the real estate characteristics, as shown in

Table 3, the rotation angle and scale factor must be defined for their elaboration with the quantum program.

With reference to the scale factor, the intervals between small numbers must be varied. In some cases, the problem arises of having to represent quantities of real estate characteristics of the order of hundreds, necessitating an adequate scale with which to represent the characteristic considered (see

Table 4).

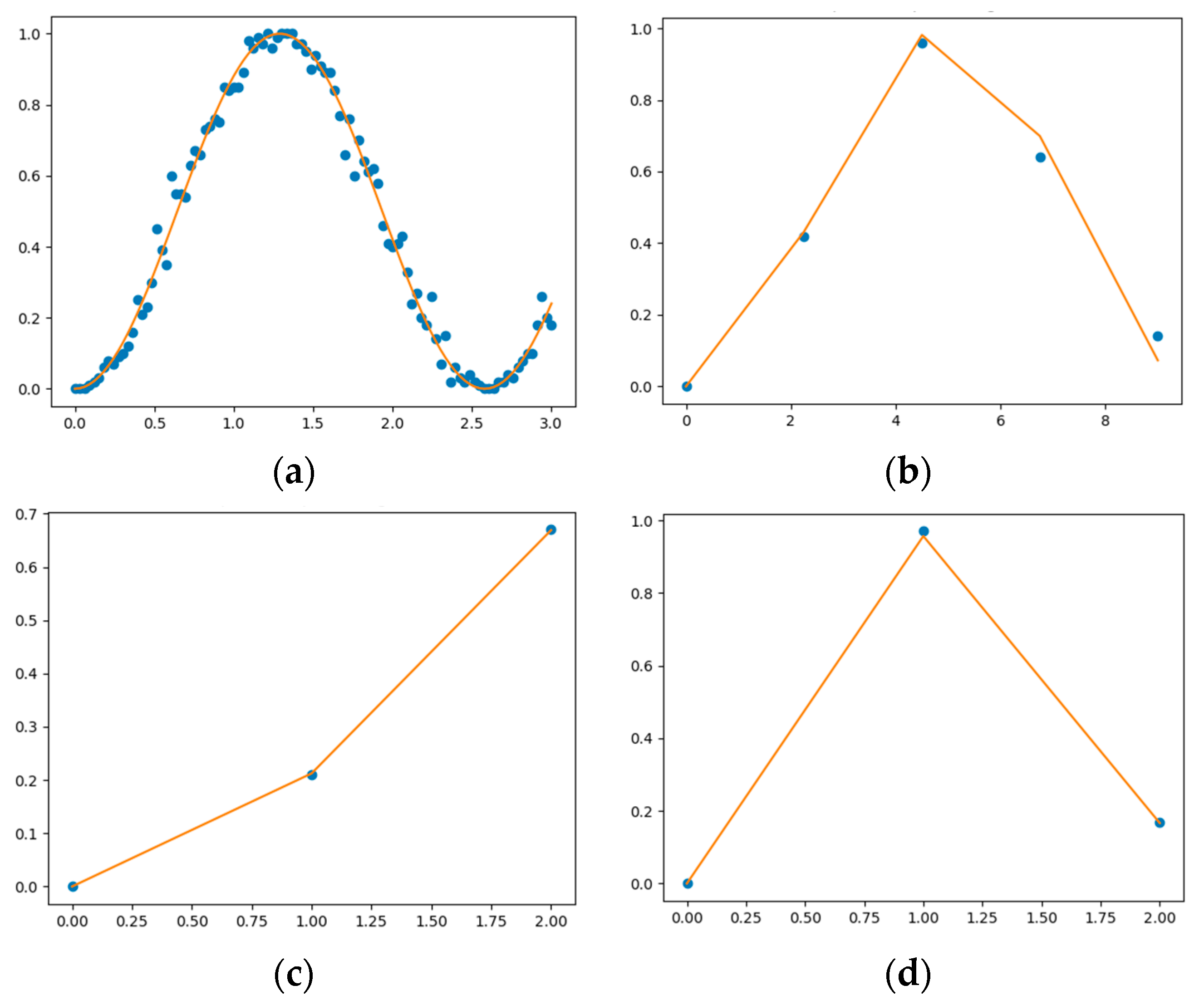

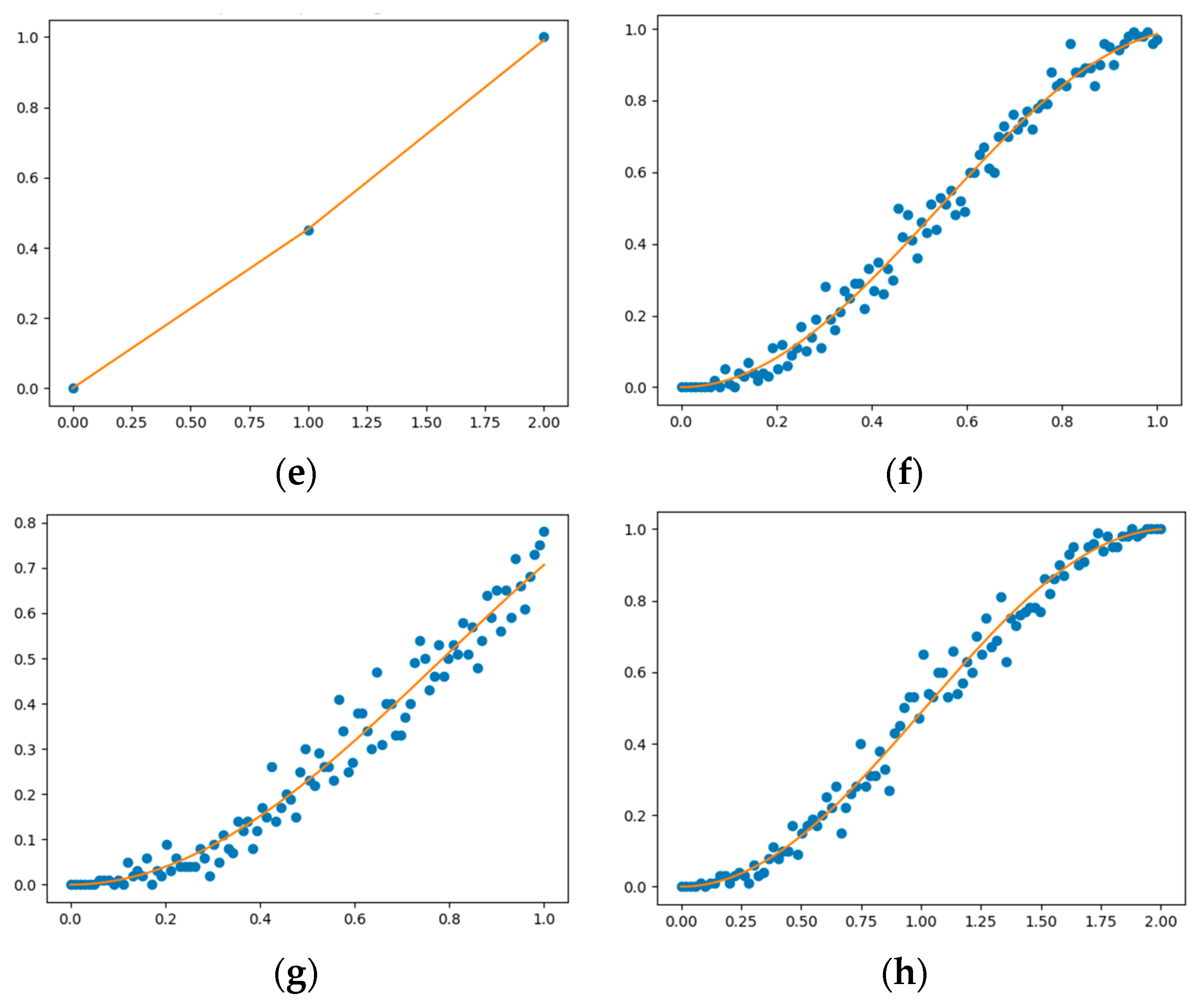

The graphs in

Figure 5 show the results of the quantum program, where the purchase probabilities in correspondence to each property characteristic (

x axes) are represented on the

y axes.

4.7. Research Findings

The quantum program works particularly well for the commercial area variable, providing useful information that is logically matched by the knowledge of the local real estate market.

Figure 5a shows that the most attractive surface area in the local real estate market, in terms of purchase probability, ranges from approximately 100 to 175 sqm (at least 80% probability). The purchase probability function tends again to grow significantly over 300 sqm, considering the possibility to create two houses with optimal surfaces over this amount.

Figure 5b indicates that the purchase probability approaches 100% for intermediate floors, with less preference for lower or penthouse floors. In the latter case, the phenomenon is to be reconnected to the major maintenance problems for roofs and terraces. The result must then be linked to panoramic views, understood as views towards the sea (a higher floor level does not necessarily correspond, in the case of interest, to the characteristic of panoramic views towards the sea).

As regards the state of use and maintenance, the quantum program provides information indicating that the market is more inclined to buy properties with an excellent state of maintenance (see

Figure 5c).

For parking spaces and car boxes, the quantum program provides information indicating that the real estate market is more inclined to purchase properties with a single space available (see

Figure 5d), thereby showing a greater preference for appurtenant garages that can be used also as storage areas or, in some cases, for craft/commercial activities (see

Figure 5e).

For the remaining three qualitative variables (historical quality, architectural quality, panoramic view of sea), the results indicate increasing purchase probabilities as these variables increase (see

Figure 5f–h). The quantum program provides detailed results considering that the variables taken into consideration may not be fully evaluated using binary scales (for example, for the panoramic view variable, there is the possibility of great variability in the sampled houses: only 1, 2 or more views).

At this point, the optimal quantities for each real estate characteristic are compared, as can be obtained from the quantum program implementation, with the average and median amounts of the same characteristics but relative to the real estate data sampled (see

Table 5 and

Figure 5).

From

Table 5, it can be observed that, in all cases, the optimal quantity does not correspond to the average or median one derived from the analysis of the sampled properties.

Subsequently, an attempt was made to study the other information that the quantum program could provide through the analysis of the maximum purchase probabilities for each real estate characteristic, if compared with the incidence of the same obtained with the implementation of genetic algorithms. Therefore,

Table 6 shows the maximum probability for each real estate characteristic compared with the weight of the corresponding real estate characteristic on the real estate average sale price.

By comparing the maximum probabilities with the weight ranking attributable to the real estate characteristics’ marginal prices, one would expect that a greater probability always coincides with a greater weight. However, it must be highlighted that this analysis has no absolute value but is a simple comparison analysis between two or more characteristics. Thus, a maximum probability of 100% does not necessarily correspond to the best ranking of marginal prices. Comparing two characteristics, on the other hand, one can see a correspondence between the difference in probability and that in economic weight. The limit of the information that we can obtain from the graphs derived from the quantum program emerges when we compare characteristics that have close maximum probabilities; in this case, we are in fact unable to understand which of the two has greater relevance to the real estate values.

5. Discussion

In recent years, genetic algorithms have gained increasing attention in the context of the real estate market. With advancements in technology and the availability of data, GA are emerging as powerful tools to optimize real estate research and investment. GA are inspired by the processes of natural selection and biological evolution. By combining concepts from genetics and mathematics, these algorithms can generate optimal solutions to complex optimization problems.

In the context of the real estate market, GA can be used for various applications. For instance, they can be employed to identify the best real estate investments based on specific criteria such as profitability, risk and portfolio diversification. By processing a large amount of real estate data, GA can uncover patterns and trends that might be challenging to detect using traditional methods. Additionally, GA can be utilized to optimize urban planning and real estate development. Considering factors such as the housing demand, accessibility to public services and environmental constraints, these algorithms can generate development proposals that maximize social utility and reduce negative environmental impacts [

18,

71,

72,

73,

74,

75,

82].

However, despite significant progress in research on GA in the real estate context, there are still challenges to overcome. The quality and accuracy of real estate data are crucial for the success of such algorithms, and accessing reliable data can be difficult. Moreover, the complexity of the factors influencing the real estate market requires careful algorithm design and proper parameter calibration.

Some information gaps that arise with GA may be overcome by quantum computing.

Currently, quantum computing is still in its early stages of development, and many of its potential uses are yet to be fully explored. However, some ideas and potential applications are emerging for quantum computing in the context of the real estate market. One area where quantum computing could have a significant impact is in optimizing real estate portfolios. The efficient allocation of financial resources in a real estate portfolio is a complex challenge that requires the consideration of various factors, such as risk, profitability, diversification and regulatory restrictions. Quantum computers may be able to perform complex and simultaneous calculations, enabling the identification of optimal combinations of real estate investments that maximize returns and mitigate risks. Furthermore, quantum computing could be used to enhance market forecasting and data analysis in real estate. Through the use of quantum algorithms, it might be possible to perform more in-depth analyses of real estate data, uncover hidden patterns, identify complex correlations and improve price and demand predictions. This could provide investors and market operators with a greater understanding and better adaptability to market dynamics [

4,

79].

With respect to the current situation of knowledge, our research findings represent a first step in overcoming the information gap associated with GA use, through QC. However, it is important to note that QC is still in development, and its practical application in the real estate market will require further technological advancements and a better understanding of its capabilities and limitations. At the same time, there are significant challenges to overcome, such as quantum bit stability, quantum errors and the scalability of quantum systems. QC offers great potential for the real estate market, but further research and development will be necessary to fully realize these possibilities.

Of course, though, flexibility and adaptation of use are among the main aspects that favor the use of the proposed multidisciplinary approach. This is because, in quantum computing, information is stored, transmitted and manipulated by physical means. Therefore, the concepts of information and computation—which are simply a particular form of manipulation of information—can be formulated in the context of a physical theory and the study of information ultimately requires the use of experiments. This seemingly simple and almost obvious fact has non-trivial consequences. It is now generally accepted that every physical theory supports a computational model whose power is limited only by the nature of the theory itself. Classical physics and quantum mechanics support a multitude of different implementations of the model of computation that we are accustomed to today.

6. Conclusions

This study developed a multidisciplinary approach based on the integration of quantum computing and genetic algorithms for the interpretation of housing prices in a local real estate market segment of Naples.

A demonstration has been provided of how quantum programming and genetic algorithms can be integrated, and how quantum programming tools have high and still unexplored potential for use with reference to the real estate sector. While genetic algorithms can now be considered as consolidated tools for the marginal price determination of real estate characteristics, quantum programs can provide the optimal quantity corresponding to each real estate characteristic considered (in terms of purchase probability).

In future research, the combination of quantum computing and advanced optimization algorithms for the decision problem treated represents the current frontier.

Advanced optimization algorithms (e.g., hybrid heuristic and metaheuristic algorithms, adaptive algorithms, self-adaptive algorithms, island algorithms, etc.), applied to challenging decision problems, are currently used in many different domains as solution approaches for online learning, scheduling, multi-objective optimization, transportation, medicine, data classification and others [

93,

94,

95]. Genetic algorithms are included within the evolutionary algorithms and are derived from the natural evolution and selection processes. They are recognized as a metaheuristic technique. The study has revealed that with the advancements in computing power, researchers can develop various methods to solve real-world problems. Metaheuristics and heuristics are emerging study areas for the handling of a variety of problems in the real estate sector. The main advantage of heuristic and metaheuristic algorithms is the use of search populations that simultaneously explore the search space for possible solutions, sharing information among systems, to obtain a better solution. Future management approaches must deal with a variety of challenges that may occur as a result of high nonlinearities; a larger range of uncertainties; real-life challenges; continuous, discrete, complex, stochastic, multi-reservoir, multi-objective problems; and the integration of huge system components. The main question that arises regards which algorithm to use. For real-world challenges involving multi-modal functions, evolutionary algorithms provide significant benefits. Each of the metaheuristic algorithms has its advantages and limitations. The major advantages of genetic algorithms lie in their ability to manage non-linear, non-convex and diverse positions, as well as in their multimodal strategies and ability to solve the given problems with optimal or near-optimal solutions. However, they also require the correct tuning of algorithm-specific parameters, such as mutation, crossover and reproduction [

96].

As reported for heuristic and metaheuristic algorithms, in the coming years, quantum computing will also lead to profound changes in all sectors of the economy.

Quantum technologies are innovative and transversal across several fundamental sectors of social and economic life—health, the environment, real estate, innovation, IT security, telecommunications and financial markets, to name only a few fields. Thus, it would be unwise not to consider them at the center of strategies and investments for the next few years. Real estate investment strategies are constantly evolving as investors seek to maximize returns and minimize risks. Quantum computing will transform into quantum machine learning, serving to further optimize these objectives. In the real estate sector, these tools can be used to identify optimal investment strategies. For example, they can analyze market trends and identify properties that are likely to increase in value. They can also analyze the financial aspects of potential investments and identify those with the highest potential returns. The use of quantum machine learning can also help investors to make better decisions about when to buy and sell properties. By analyzing market trends and historical data, we can identify the optimal time to buy or sell a property.

The use of quantum algorithms in real estate is still in its infancy. However, it has the potential to revolutionize the way that investors approach real estate investing. By harnessing the power of quantum computing, investors can make more informed decisions and maximize their returns. Thus far, the goals of quantum computing outweigh its real potential, but quantum computing is moving from hype to reality.