Abstract

In recent years, public–private partnership (PPP), as an alternative strategy in the delivery of infrastructure services, has developed rapidly in China. However, the implementation of PPP projects differs significantly between provinces and municipalities. Using the implementation data of national PPP demonstration projects, this study employs spatial autoregression and a spatial Durbin model (SDM) to explore the spatial characteristics and driving factors of PPP projects across China. The results indicate that the PPP project implementation rate in China shows significant spatial clustering, which indicates a spatial spillover effect in the eastern, central, and western regions of the country. The fixed asset investment and infrastructure status exert a significant positive effect on the PPP project implementation rate in a certain region and aid in the implementation of PPP projects in the neighboring regions. Urbanization potentiality, the financial self-sufficiency rate, and regional openness do not have an impact on the local PPP project implementation rate, but they do inhibit the increase in this rate in the adjacent regions. Fiscal capacity, government credibility, and the level of social development do not affect the local PPP project implementation rate, but they do promote the implementation of the PPP projects of these neighboring regions. Local authorities should make additional efforts to build an inter-regional development environment for PPP and promote the implementation of PPP projects.

1. Introduction

Public–private partnership (PPP) has been adopted widely in the world in both developed and developing countries as an alternative way to deliver quality public goods and services by the government. PPP involves a long-term contractual arrangement between the public and private sectors for reciprocity and mutual benefit in which the collaborators mutually agree to share costs, benefits, and risks in the provision of public goods or services [1]. The practical experience around the world has shown that PPP can provide a wide range of benefits, including private financing, increased efficiency, value for money, and risk transfer, if properly formulated [2,3,4].

Since 1994, PPP has been introduced into the infrastructure sector in China and has been continuously promoted and adopted [5]. PPP projects further improve supply efficiency and quality by introducing social capital to participate in the supply of public goods and services. In the past two decades, the development of PPP in China has experienced many twists and turns. In 2014, due to the increased economic downturn and tight local finance, the Ministry of Finance (MOF) and the National Development and Reform Commission (NDRC) issued a series of documents to vigorously encourage private investment in public services and infrastructure, making it once again an important tool for the infrastructure financing and public service supply of local governments in China [6]. The number of Chinese PPP projects has soared in recent years.

PPP projects have witnessed a massive increase due to strong promotion by central and local governments, yet many PPP projects are still facing a series of difficulties in implementation and fail to be put into practice according to both partners’ wishes. For example, the China Public–Private Partnerships Center under MOF reported that the governments at all levels had initiated a total of 10,115 projects with a 15.9 trillion RMB (about USD 2.5 trillion) investment by the end of the third quarter of 2021. Only 78.2% of PPP projects have signed cooperative contracts, and only 45.2% of these signed projects have entered into the construction stage [7]. To cope with increasing issues regarding PPP implementation, MOF and other departments jointly issued a series of guidelines on promoting the regulated development of PPP, asking local governments at all levels to effectively attract social capital and efficiently improve the quality of supply. However, owing to the obvious imbalance between regional and industry development demand, there is significant spatial heterogeneity of implemented PPP projects in China across regions. The measure of dealing with implemented PPP projects has been brought to the forefront of the policy agenda. It requires a better understanding of implemented PPP projects, especially determinants of spatial heterogeneity of PPP projects.

In the past few decades, academics have been devoting more attention to the critical factors of PPP success or failure [8]. Some factors related to local political, economic, and institutional contexts have been considered as the determinants of PPP development [9]. Although the results of other studies in this field may contribute to our current understanding of the spatial distribution of PPP projects, few studies have sought to explore the spatial distribution characteristics and determinants of PPP projects [10,11]. These studies qualitatively describe the pattern of PPP projects but ignore the investigation of the spatial distribution of PPP projects in quantitative analysis, let alone from the perspective of the development environment. Thus, the purpose of this paper is to describe the distribution characteristics of PPP national demonstration projects in space and capture their driving factors.

The remainder of the paper proceeds as follows. Section 2 provides a systematic literature review of the related determinants of PPP development. Section 3 describes the methodology, including spatial autocorrelation and the spatial Durbin model, the analytical framework, and the data collection. Section 4 offers the results and discussion. Conclusions are provided in Section 5.

2. Literature Review

During the past few decades, many studies in various fields of PPP have been explored and conducted [12,13,14]. Among them, a major research area of PPP is the critical success factors (CSFs) for PPP. The terminology of CSFs is employed to enhance the understanding and ensure the best practice of implementing PPP policy for infrastructure projects [15]. For instance, scholars explored CSFs for PFI/PPP construction projects by a questionnaire survey. A strong and reputable private consortium, reasonable and effective risk allocation, and an available financial market were identified as the most important CSFs [16]. The CSFs during the tendering process in PPP projects were summarized as three components, namely a streamlined approval and negotiation process, a clear project brief and client outcomes, and increased competition [17]. One article identified five principal factors that contribute to PPP success in China, including a stable macroeconomic environment, shared responsibility, a transparent and efficient procurement process, a favorable political and social environment, and insightful government control [18]. A stable and favorable economic environment, financial attractiveness, public acceptance, and a supportive political framework are imperative when considering the adoption of the PPP approach [19]. The five most reported CSFs were risk allocation and sharing, a strong private consortium, political support, public support, and transparent procurement [9]. Moreover, in another study, Osei-Kyei and his colleagues argued that several factors contribute to PPP success, including effective risk management, a specification requirements meeting, reliable and quality service operations, project schedule adherence, public facility/service demand satisfaction, long-term relationships and partnerships, and project profitability [20]. Several studies have undertaken a comparative analysis of CSFs between the different economies [2,21,22]. Those authors pointed out that CSFs in PPP vary with economic, social, and policy contexts. On the contrary, numerous studies have been conducted to explore the drivers of PPP project failure. In these studies, determinants such as changes in regulations [23], an insufficient feasibility study [24], inadequate supervision [25,26], an inappropriate financing structure [27], and an inaccurate prediction of output performance [28] have been reported. These studies have significantly contributed to improving the performance of PPP projects.

Apart from PPP CSFs and failure factors, there are also critical factors related to the adoption of PPP projects [8,29,30]. Some findings have indicated that macroeconomic stability is essential for PPP in countries where aggregate demand and the market size are large, and GDP per capita has been positively associated with the number of PPP projects in general [31,32]. There was a positive relationship between GDP per capita and the number of PPP projects. Focusing on public finance conditions, scholars have found that a negative fiscal condition discourages private investment through the PPP route [33,34]. For example, some fiscally solid countries have been highly reluctant to adopt PPP in the public service sector [35].

PPP adoption depends on the institutional quality of the local governance capacity. There are multiple barriers to PPPs, including the distrust between the public and private sector, the lack of an enabling institutional environment, and the insufficiency of project preparation on the part of the public sector [36]. Trust is crucial for both PPP performance and cooperation between the public and private sectors [37,38]. In addition, appropriate policies, unambiguous regulations, transparent procurement procedures, and well-defined responsibilities between stakeholders contribute to the success of PPP [39]. The openness and transparency of the market environment are essential for maximizing the benefits from infrastructure and for guaranteeing optimal socio-economic outcomes. The information disclosure and its availability to the public and private sectors increase predictability, enhance public confidence, and ensure the consistency of private investments with the public interest. Transparency effectively strengthens governance institutions and regulations in PPP projects in many respects [40]. For example, information disclosure can promote the social and political support of PPP projects [41]. Similarly, transparency has also been pointed out as a major factor contributing to PPP success [42]. In developing countries, it is not unusual that investors withdraw due to the procurement process in transparency. Hence, the overall governance quality will influence the adoption and implementation of better PPP policies.

While previous studies contribute to significant growth in both the number of published articles and the diversity of research topics, domains, and methods [8,43], there have been few attempts to describe the spatial characteristics of PPP projects and examine the driving factors. One exception used samples from the unofficial PPP database and adopted the method of descriptive statistics to explore the spatial–temporal evolution in regional differentiation, sectors, investors, and contract types [10]. The factors related to this evolution mainly include the economic environment, national policies, local governments’ motivation, preference, competency, and reliability. Additionally, a few scholars have studied the spatial distribution of PPP in specific fields. For example, the spatial distribution of waste-to-energy PPP projects between 2005 and 2015 in China is imbalanced, and the distribution pattern can be described as gradually decreasing from east to west and from north to south [11]. The significant spatial disparities and policy implications of tourism PPP projects based on the PPP database of MOF in China have been analyzed [44]. Some factors within the wider political, economic, and institutional contexts should be considered as critical drivers that influence the processes of the rise and fall of PPP [45].

However, these studies have only described the spatial distribution characteristics of PPP from a dimension of descriptive statistics and lack a more comprehensive analysis of its spatial spillover effect, let alone a spatial perspective based on the data samples. To fill the research gaps, this study aims to investigate the spatial distribution of PPP projects using quantitative analysis and to detect its driving factors.

3. Methodology

3.1. Spatial Autocorrelation and the Spatial Durbin Model

According to Tobler’s first law, everything is related, but near things are more related than things further apart [46]. In spatial econometrics, almost all spatial data have spatial autocorrelation (spatial dependence) characteristics, which means a certain characteristic of a regional spatial unit is related to the same characteristic of a spatial unit of a neighboring region. Therefore, when exploring the driving factors of the spatial characteristics of PPP projects, we must first consider whether the PPP project implementation rate has spatial relevance. The PPP project implementation rate is used as a dependent variable to detect the spatial characteristics of PPP projects.

Exploratory spatial data analysis (ESDA) refers to the methods to analyze exploratory data by revealing the characteristics specific to spatial data, such as spatial autocorrelation and spatial heterogeneity [47,48]. The ESDA method can measure the correlations among neighboring observations, demonstrate spatial patterns of data, detect the levels of spatial clustering, and verify the hypotheses based on the geographical data [49,50,51]. The two frequently used methods for testing spatial autocorrelation are Moran’s I and Geary’s C statistics [52,53].

The Moran’s I index is analogous to the conventional correlation coefficient, with its values ranging from −1 (strong negative spatial autocorrelation) to 1 (strong positive spatial autocorrelation). It could be used to measure the spatial autocorrelation by ratio data [54]. The global Moran’s I statistic is calculated as follows:

where n is the number of the province-level unit, xi is the value of the PPP project implementation rate at location i, xj is the value of the PPP project implementation rate at neighboring location j, and wij is the weight that determines the relationship between i and j. Global Moran’s I statistic can clarify the degree of linear association between the vector of the PPP project implementation rate and the vector of spatially weighted averages of neighboring values but cannot reveal the regional structure of spatial autocorrelation [55].

Local Moran’s I is used to detect local spatial dependence about the high or low levels of local spatial clusters, identify the regions contributing more to the global Moran’s I, and conceal atypical localization [56]. Local indicators of spatial association (LISA), as the local Moran’s I statistic for each region i, is written as

Geary’s coefficient C index and global Moran’s I can be converted into each other. Geary’s coefficient is calculated with an analogy with the Durbin–Watson statistic [54].

In the ordinary panel model, different spatial units are considered as mutually independent homogeneous regions. In practice, however, the socio-economic phenomena in adjacent regional units will affect each other and produce spatial relevance. In this study, there may be a spatial correlation among the determinants of the PPP project implementation rate, so the spatial regression model is used to explore the spatial characteristics of PPP projects.

The spatial Durbin model (SDM) is a general form of spatial autoregressive model (SAR) and the spatial error model (SEM). It considers the influence of spatial lag explained variables and spatial lag explained variables on the explained variables, and can effectively capture the externalities and spillover effects produced by various sources [57]. The SDM is expressed in the following equation:

where yit represents the PPP project implementation rate in the period t in region i, wij is the spatial weight matrix, is the spatial lag term of the dependent variable, which represents the endogenous influence of implementation rate changes in surrounding regions, and the coefficient represents the average implementation rate of PPP projects in neighboring provinces in province i. xit is the explanatory variable about driving factors of implemented PPP projects, is the spatial lag term of explanatory variable, and the coefficient θ represents the influence of explanatory variables of neighboring regions on the PPP project implementation rate in region i. μi and λt are the space effect and time effect, respectively, which are used to reflect the heterogeneity in the space–time dimension. εit is a random error term.

3.2. Analytical Framework for Driving Factors of Implemented PPP Projects

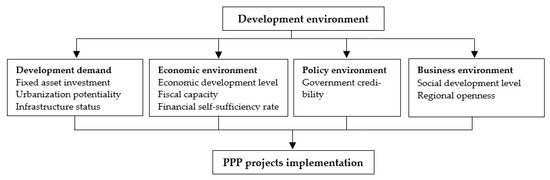

Due to the different social and economic environments in various provinces and cities, the adoption of PPP across regions is also different, showing significant heterogeneity. Many studies have suggested that the adoption of the PPP approach is greatly affected by the local social, economic, and institutional contexts [58,59]. It can then be assumed that the spatial characteristics of PPP projects across regions are closely related to these development environment factors, which comprehensively reflect whether and to what extent a region is suitable for the investment, construction, and operation of infrastructure and public services in the PPP mode [60]. From the economic growth theory and the findings of previous studies, these development environment factors can be divided into four categories: development demand, economic environment, policy environment, and business environment. We thus built the analytical framework of this study, shown in Figure 1.

Figure 1.

The analytical framework for driving factors of PPP project implementation.

The development demand mainly reflects the local development speed and urbanization potential, as well as the demand of local governments to provide public goods through the PPP mode. The greater demand for development means greater market space and investment opportunities. The economic environment mainly measures the level of economic development and the financial capacity of the local government. Many PPP projects need the support of local finance, and sound local finance will contribute to the sustainable development of PPP projects. The policy environment mainly reflects the credibility of the government. Good government capacity can help to build a good political and social cooperation relationship, enhance the trust of social capital in government partners, and strengthen the confidence of social capital to participate in PPP projects. The business environment mainly reflects the level of social development and openness and is the supporting environment to impact social capital to invest in the PPP model. A good business environment is conducive to the formation of steady and sustainable expectations for PPP projects.

To evaluate these variables, we specified the observed variable-related indicators based on literature and available statistics data. The observed variables are shown in Table 1.

Table 1.

Observed variable-related indicators (source: experts’ opinions).

3.3. Data Collection

The data of this study are drawn from the National PPP database released by the Chinese Ministry of Finance (MOF) and the National Development and Reform Commission (NDRC), respectively. From 2014 to 2018, MOF released a total of four batches of PPP national demonstration projects. These projects are selected and determined by MOF according to a set of requirements, including the competitiveness of project procurement procedures, the authenticity of social capital, the rationality of operation mode, the appropriateness of transaction structure, and the sustainability of financial affordability. Thus, these projects have strong demonstration effects. In case of data overlap or incomplete information in the two databases, the PPP project database of MOF is applied in priority. In these two databases, we exclude the PPP projects in the identification stage and only select implemented projects as valid samples.

There are 982 PPP national demonstration projects and only 895 implemented projects in which the relevant actors have signed the contracts and started construction by the end of 2020, involving 19 industries, including municipal engineering, transportation, water conservancy construction, energy, ecological construction, and environmental protection. Among them are 427 municipal engineering projects (accounting for 43.9%), 91 transportation projects (accounting for 10.2%), 86 ecological construction and environmental protection projects (accounting for 9.6%), and 325 other projects (accounting for 36.3%). The study area according to the implemented demonstration projects includes 30 provincial administrative regions, while Hong Kong, Macao, Taiwan, and Tibet were excluded.

In this study, the socio-economic data were derived from the China Statistical Yearbook, the China Regional Economic Statistical Yearbook, and the statistical yearbooks of provincial and municipal levels. The human development index was drawn from the China urban sustainable development report of the United Nations Development Program. The government financial transparency data were drawn from China’s financial transparency of the public policy research center of Shanghai University of Finance and Economics, while system and integrity culture data were collected from the report on the evaluation results of the financial ecological environment in China.

In the SDM, the specific form of the time effect and space effect can be expressed by fixed effect or random effect models, which can be detected by the Hausman test. In our study, the panel data of PPP projects in 30 provinces and municipalities from 2014 to 2018, which are short panel data, were used, but the SDM has a low requirement on the length of panel data [69,70,71]. Therefore, it is appropriate to select the SDM for estimation.

4. Results and Discussion

4.1. Spatial Autocorrelation Test of Spatial Characteristics

The results of Moran’s I and Geary’s C are reported in Table 2. The statistical results show that, to some extent, the PPP projects showed spatial correlation during the period from 2016 to 2018, but no spatial correlation was observed in 2015.

Table 2.

Moran’s I and Geary’s C statistics of the PPP project implementation rate from 2015 to 2018 (source: authors’ calculations).

Both the Moran’s I and Geary’s C statistics of PPP projects in 2015 were insignificant, which indicates that there was no spatial correlation in the PPP project implementation rate in 2015. There are two reasons for this. First, in 2015, when MOF and NDRC built the PPP information platform, there were relatively few qualified PPP projects, and the spatial correlation of those projects was not strong. Second, because of (1) the different statistical scope of the PPP rate in the initial stage of establishment on two ministries’ information platforms and (2) the lag of the PPP project data in some provinces, such as Hubei, Shanxi, and Qinghai, it was difficult for spatial correlation characteristics to appear.

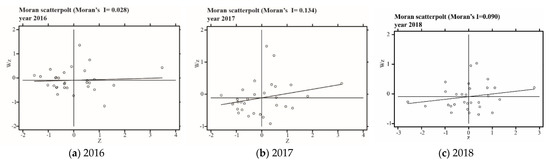

The Moran’s I in 2016 was not statistically significant, but the Geary’s C statistic was significant at the 10% significance level. The positive value indicates that the PPP project implementation rate in China showed a spatial clustering of high value, but the characteristics of positive spatial correlation were not significant.

The Moran’s I and Geary’s C statistics were all statistically significant in 2017 and 2018. Regarding Geary’s C statistics, a positive spatial autocorrelation was found, with the values ranging from 0 to 1, while a negative spatial autocorrelation was found between 1 and 2. Therefore, the judgment based on the results of Moran’s I and Geary’s C statistics is consistent. It indicates a significant tendency toward the geographical clustering of similar regions in terms of the PPP project implementation rate. In 2017, the Moran’s I index increased significantly compared with that in 2016. As Table 2 shows, Moran’s I increased from 0.028 to 0.134, indicating that the PPP project implementation rate in China began to show spatial clustering rapidly; that is, a region was surrounded by neighbors with similar values (either high or low), and the spatial clustering of the PPP rate became increasingly obvious. In 2018, Moran’s I and Geary’s C statistics of the PPP rate decreased compared with those in 2017, indicating that the spatial clustering characteristics in 2018 were weakened compared with those in 2017. This is because the government cleared some unqualified PPP projects and strictly supervised the PPP project implementation.

Figure 2 displays the Moran scatterplots of the PPP rates during the period from 2016 to 2018. A positive association was found between observations z of the PPP project implementation rate on the horizontal axis and observations wz of the spatially lagged factors indicated on the vertical axis, suggesting that the scalar parameter in Equation (3) is greater than zero. The linear slope equals the global Moran’s I. As shown in Figure 2, in Quadrant I (HH), the areas had a high PPP project implementation rate, and the neighboring areas had a high PPP project implementation rate, so this quadrant is defined as the HH quadrant. In Quadrant II (LH), the areas had low PPP project implementation rates, but they were surrounded by those areas with high PPP project implementation rates. In Quadrant III (LL), the PPP project implementation rates in the areas and their surrounding areas were relatively low. In Quadrant IV (HL), the areas had a high PPP project implementation rate, but the neighboring areas had a low one. Another way to perceive the strength of the positive association is to determine whether there are any points in Quadrants II and IV.

Figure 2.

Moran scatter chart of the PPP project implementation rate from 2016 to 2018 (source: authors’ calculations).

Table 3 reports the quadrant distribution of Moran’s I index of the PPP project implementation rate. As shown in Table 3, in 2016, 16 provinces and municipalities (53.33%) were located in Quadrant I (HH) and Quadrant III (LL), while, in 2017, 21 provinces and municipalities (70%) were located in the same quadrant. In 2018, the same quadrant included 19 provinces and municipalities (63.33%), which provides further evidence of the existence of the spatial correlation of the PPP rate in China.

Table 3.

Quadrant distribution of Moran’s I index of the PPP rate (source: authors’ calculations).

Points in Quadrant I (HH) represent regions where both their local and neighboring PPP project implementation rates were above average. These regions were mainly distributed in eastern coastal provinces and municipalities, such as Fujian, Jiangsu, Shandong, Shanghai, and Zhejiang. The distribution of Moran’s statistics is also consistent with the PPP status in these provinces and municipalities, indicating that there was a positive spatial spillover effect. Compared with the central and western regions, the eastern region enjoyed a good foundation for social and economic development, which made the spatial spillover effect of the PPP project more significant in the eastern region.

Nearly two-thirds of the provinces and municipalities showed a positive correlation, mainly distributed in the first (HH) and third (LL) quadrants. The major difference between the two quadrants is that the economically developed areas in the east were distributed in the first quadrant, while the less developed areas in the west were in the third quadrant. In the third quadrant, although the lack of infrastructure in these regions led to a large demand for PPP projects, the lack of their relatively low level of economic development hindered the investment and resulted in a low PPP project implementation rate.

In the second quadrant (LH), some provinces and municipalities, such as Heilongjiang, Henan, Jiangxi, and Tianjin, were steadily rising in the second quadrant, where the PPP project implementation rate was below average and that of the neighboring regions was above average. One possible reason is that, during the period of the PPP project’s vigorous development between 2016 and 2017, these provinces and municipalities were put in an unfavorable position by surrounding regions with a high-quality economic development and a strong ability to absorb economic factors. Consequently, the provinces and municipalities in the second quadrant became “low-lying land” of PPP projects.

In the fourth quadrant (HL), the spatial distribution of provinces and municipalities was considerably different. Their PPP project implementation rate was above average and that of their neighboring regions was below average. With the support of local policies, these provinces and municipalities made full use of the development elements of PPP projects, restricting the PPP project development in their neighboring areas. As such, a polarization connection mode with a high center and a low periphery was formed. Compared with the scatterplots for the PPP rate between 2017 and 2018, there was much more spatial instability. In particular, the characteristics of PPP projects in the national information platform changed in 2018. The characteristics of a large number of PPP projects with low implementation rates in the west and a small number of projects with high implementation rates in the east gradually disappeared, and the positive relationship between the number of PPP projects, investment, and the implementation rate became increasingly close. Provinces and municipalities originally in the second quadrant gradually moved to the first and third quadrants. At the same time, new provinces and municipalities appeared in the second quadrant.

4.2. Spatial Econometric Analysis of Spatial Characteristics

In this section, we first discuss which spatial econometric model is suitable for the collected panel data, and we then report the estimated results of the spatial panel model and discuss the impacts of various variables on the PPP project implementation rate.

In the spatial econometric model, both the LR test and the Wald test were employed to detect the applicability of the SDM, SAR, and SEM. The results suggested that the SDM is more suitable for spatial regression estimation than the SAR and SEM. Meanwhile, the Hausman test was conducted to detect the fixed and random effects of the SDM in model specifications. The Hausman test result indicates the appropriateness of the fixed effect. Table 4 reports the results of spatial panel data models with the spatial, temporal, and spatial–temporal fixed effects. The goodness of fit increases from 0.575 to 0.826. As indicated by various software packages, a higher value indicates a better model fit. Further work is required to discuss the impacts of various variables on the PPP project implementation rate according to the estimation result of the spatial panel data model with a spatial–temporal fixed effect.

Table 4.

Results of spatial panel data models with fixed effects (source: authors’ calculations).

As reported in Table 4, only a few variables have significant coefficients. From the perspective of development need, the coefficients of fixed asset investment and infrastructure status are significantly greater than zero, indicating their positive impacts on the PPP project implementation rate. The fixed asset investment mainly reflects the local development speed and the willingness of local governments to use the PPP mode to provide public goods, reflecting the objective and subjective needs of PPP development. The higher growth rate of fixed asset investment indicates a broader market space and greater investment opportunities, which is conducive to the implementation of PPP projects. Meanwhile, an excellent infrastructure system provides a fundamental condition for the development environment and contributes to the PPP project implementation rate. In the economic environment, the economic development level is significantly and negatively related to the PPP project implementation rate, which is consistent with our expectations. It is suggested that the low level of economic development means a greater demand for the PPP project and will promote investment in the PPP project.

The results for the spatial–temporal fixed effect in the SDM in Table 4 suggest that the coefficients of the spatial lag of almost all the variables are significant except for that of the economic development level. The inconsistent findings indicate that other variables may exert different influences on the PPP project implementation rate in addition to the above three variables. Since the impact of changes in an explanatory variable in the SDM would differ over all other regions, the desirable summation measure for total impact estimates with the SDM coefficient estimates would result in erroneous conclusions because of the omission of spatial spillover [57]. That is, the direct, indirect, and total effects are calculated based on regression coefficients in the SDM to reflect direct effects and capture the spatial spillover effects of various variables on the PPP project implementation rate.

Table 5 shows the results of the direct, indirect, and total effects calculated based on the regression coefficients of the SDM in Table 4. In the direct effects, the significance and signs of the coefficients of variables are completely consistent with these of the coefficients of variables in the SDM reported in Table 4. The coefficients of all the indirect and total effects are statistically significant at the 1% or 5% level, suggesting that the spillover and total effects exert profound impacts on the PPP project implementation rate in their own and nearby regions. Therefore, we focus on the discussion of spatial spillover (indirect) and total effects.

Table 5.

Direct, indirect, and total effects of the SDM with spatial–temporal fixed effects (source: authors’ calculations).

The direct, indirect, and total effects of fixed asset investment are positive and significantly different from zero using the t-statistic. Therefore, fixed asset investment presents a significant positive effect on the PPP rate. This finding is consistent with those of related studies, showing that fixed asset investment is essential for the economic environment to prosper and is imperative when considering the adoption of the PPP model [19]. The difference between the coefficient estimate of 0.982 in Table 4 and the direct effect estimate of 0.959 is 0.023, which represents feedback effects due to impacts passing through neighboring regions and back to the region itself. The negative discrepancy reflects some negative feedback since the impact estimate is less than the coefficient estimate. The general feedback effects are too weak to find economic significance. The direct effect estimate of fixed asset investment shows that a positive and significant impact arises from changes in the spatial lag of fixed asset investment. It is suggested that the increase in fixed asset investment in the local region will exert a favorable impact on the fixed asset investment in its neighboring regions and further improve the implementation rate of PPP projects in the surrounding areas. We can also interpret the total effect of fixed asset investment as elasticities since the model is specified using logged levels of fixed asset investment and the PPP project implementation rate. Based on the positive estimate of the total impact of fixed asset investment, we can conclude that a 10% increase in fixed asset investment would result in a 0.192% increase in the PPP project implementation rate. Nearly half of this impact comes from the direct effect magnitude of 0.959, and one half results from the indirect or spatial spillover impact based on its scalar impact estimate of 0.963.

The coefficient of the direct effect of the urbanization rate is not significant, while the coefficient of the indirect effect is negatively statistically significant, indicating its negative spillover effect. The total effect is significantly negative, while its absolute value is less than that of the indirect effect. It is indicated that the negative spillover effect of the urbanization rate on neighboring regions is significantly greater than the direct effect on one’s region. The urbanization rate harms the implementation of PPP projects [62]. Urbanization is important to and closely correlated with economic growth [61]. In China, high-level urbanization contributes to rapid economic development; on the contrary, low-level urbanization leads to slow economic growth [72]. In regions with low-level urbanization, local governments are eager to introduce PPP projects to improve the supply of public facilities and promote economic growth. Their failure to improve the urbanization level helps, conversely, to promote the PPP project implementation rate. Moreover, social capital has a higher expectation of the investment of public facilities in those regions, which is also conducive to the implementation of PPP projects.

Similar to the fixed asset investment, the direct effect of infrastructure status is positive and statistically significant, suggesting the positive effects on the PPP project implementation rate. However, the difference between the coefficient estimate of 0.181 in the SDM and the direct effect estimate of 0.176 is 0.005; in other words, the feedback effects are very small. The indirect effect estimate is 0.247, with a significance level of 1%. On average, an increase of 1% in infrastructure status will cause an increase of 0.025% in the PPP project implementation rate of all the neighboring regions. It is noteworthy that the indirect effect is greater than its direct effect, indicating that infrastructure status has a strong positive spatial spillover effect on the PPP project implementation rate. The better infrastructure status in one region will contribute to the implementation of PPP projects in the adjacent areas. This finding is consistent with the regional characteristics of the high PPP project implementation rate in the eastern coastal areas.

For the economic development level, the direct effect estimate is negatively significant at the 1% confidence level, while the indirect effect coefficient is positive and significant at the 5% confidence level. These results indicate that the economic development level in one particular region has a spatial spillover effect on the PPP project implementation rate in the neighboring regions but an inhibitory effect on its own PPP project implementation rate. In general, in the provinces or municipalities with a well-developed economy, the infrastructure services are relatively adequate. The local governments have abundant financial resources and less demand for PPP projects, so they are less likely to adopt the PPP project mode. For example, according to the national PPP information platform, the number of PPP projects in Tianjin was equal to zero in 2016, and the number of PPP projects in Beijing was relatively small.

Both the direct and indirect effect estimates of fiscal capacity are positive, but the coefficient of the direct effect is not significant based on the t-statistic. This suggests that fiscal capacity has a positive spatial spillover effect on the PPP project implementation rate in the neighboring regions, and, concurrently, it exerts a negative feedback effect on the PPP project implementation rate in its region, but the feedback impact is not significant. One possible reason is that most PPP projects need the financial support of local governments. The strong financial capacity helps to raise sufficient funds to support PPP projects and contributes to the implementation of PPP projects. Some scholars have also identified that a developed fiscal capacity is critical to the success of project procurement under the PPP model [10,15,63,73]. In contrast to the effects of the fiscal capacity, the direct and indirect effect estimates of the financial self-sufficiency rate are negative. Similar to fiscal capacity, the direct effect of the financial self-sufficiency rate is also not statistically significant. The coefficients indicate that an increase in the financial self-sufficiency rate would reduce the PPP project implementation rate of both its province and neighboring provinces. It is more likely that provinces and municipalities with high financial self-sufficiency rates are less keen on conducting PPP projects. Some previous studies have also indicated that more fiscally solid governments are highly reluctant to use PPP in the infrastructure service sector [9,33]. Moreover, due to the negative spatial spillover effect, the implementation rate of PPP projects in surrounding provinces and municipalities is also reduced.

The direct and indirect effect estimates of government credibility are positive [74], but the direct effect is not statistically significant. PPP as a public policy has a direct relation with the political setting of the local government [16]. Without the essential support from the local government, approval for public expenditure on public projects would not be granted [65], so it is understandable that government credibility is considered essential to PPP implementation and success. This result further verifies the findings of Casady et al. [1]. They argued that the utilization of PPP often signals a certain level of local governments’ credibility as a critical variable of PPP success. In recent years, local departments at all levels have always been committed to promoting PPP development, following the principles of “standardized operation, strict supervision, openness and transparency, and honest fulfillment of agreement” to create a good policy environment. The transparent and honest policy environment further enhances the long-term investment confidence of social capital, and the PPP project implementation rate rises steadily as a result.

The estimates of the social development level are consistent with the results of government credibility as the significance and confidence levels are similar. The social development level creates a positive and significant spillover effect on the PPP project implementation rate of the neighboring regions while exerting an insignificant and negative feedback effect on its own region. By contrast, the estimates of indirect and total effects are negative and statistically significant at the 1% confidence level. The impact of regional openness is consistent with the influence of the financial self-sufficiency rate. The results indicate that the spatial spillover and feedback effects bring about the impeding effects both on its region and on its surrounding regions.

4.3. Further Analysis of Regional Spatial Characteristics

Although the determinants of the PPP project implementation rate and its spillover effect have been investigated on a nationwide scale, the mechanisms in the eastern, central, and western regions are still not clear. In China, there are striking differences in geographical space and socio-economic development between provinces and municipalities, and the PPP project implementation rate in various regions is also different. Therefore, the impact mechanism of the PPP project implementation rate may also share different drivers in various regions. To further reveal the different influence mechanisms of the PPP rate in the eastern, central, and western regions, the first step is to synthesize nine secondary indicators into four primary indicators, namely development demand, the economic environment, the policy environment, and the business environment. We thus employed the spatial–temporal fixed effect to estimate the spatial Durbin model. The results are reported in Table 6.

Table 6.

Results of spatial panel data models in the eastern, central, and western regions of China (source: authors’ calculations).

As for the development demand, it has a significant impact on the PPP rate in the eastern and central regions, while the impact on the western region is not significant. The economic environment exerts a significant influence on the implementation rate of PPP in the central and western regions but not in the eastern region. In terms of coefficient estimates, the impact on the western region is greater than that on the central region. Most of the negative effects of the policy environment are not significant. The business environment harms the central region, whereas it plays a positive role in promoting the implementation rate of PPP in the western region. The results reported in Table 5 suggest that all four variables exert various impacts on the PPP project implementation rate in the three regions. To further explore these differences, we also calculated the direct, indirect, and total effects to reflect direct effects and capture the spatial spillover effects of various variables on the PPP project implementation rate. The direct, indirect, and total effects of SDM in the eastern, central, and western regions are reported in Table 7.

Table 7.

Direct, indirect, and total effects of the SDM in the eastern, central, and western regions of China (source: authors’ calculations).

As shown in Table 7, in the eastern region, there are obvious differences between the coefficients in the estimates of the direct effect and those in the spatial Durbin model. This is mainly because the direct effect takes the feedback effect into account. For instance, the direct effect of development demand is 0.172, and its coefficient estimate is 0.273, so the feedback effect is −0.101. The indirect effect of the policy environment is positive and statistically significant, while both the direct and indirect effects of the economic environment and business environment are not significant. In the central area, only the direct effect of the economic environment is positive and significant at the 10% confidence level, while the direct, indirect, and total effects of the other three variables are not significant. Furthermore, the effects of all four variables are not significant in the western region.

From the perspective of the national level, the results reported in Table 4 and Table 5 indicate that we should not ignore the feedback and spillover effects of many variables on the PPP project implementation rate within three regions. However, compared to the results in Table 4 and Table 5, some variables with statistical significance in the regional SDM become less significant in their direct and indirect effect estimates and are not likely to be of economic significance, especially in the central and western regions. First, within the central and western regions, the level of socio-economic development of all the provinces and municipalities is mostly similar and significantly lower than that of the eastern region, resulting in the insignificant direct and indirect effects of regions with high PPP project implementation rates. Second, we built the effect analysis model according to the geographical space and artificially split the direct and indirect effects between the eastern, central, and western regions. As a result, the results suggest that the size of some direct and spatial spillover effects is not likely to be economically meaningful with respect to the central and western regions. Admittedly, according to the results of the national model reported in Table 4 and Table 5, the PPP project implementation rates between the three regions are closely related.

5. Conclusions

Around the world, PPP is a popular alternative procurement tool for public goods and services. Since it was introduced into China, PPP has flourished in infrastructure services. Especially between 2014 and 2018, China witnessed a dramatic increase in PPP development in the context of strong promotion by governments at all levels. Owing to the great regional differences in social and economic development, the development of PPP is highly unbalanced. Many PPP projects are facing a series of difficulties and have failed to be implemented. In recent years, the mechanisms of PPP development and PPP determinants have received increasing attention from scholars, policymakers, and the media. Unlike some previous Chinese studies focusing on the spatial patterns of PPP development, this study found it necessary to investigate the spatial characteristics of PPP and its determinants from the perspective of the environment. Taking advantage of the national implemented PPP demonstration project data, we developed an analytical framework to capture the influencing factors of the PPP development environment and employed spatial autoregression and the SDM to explore the spatial characteristics and driving factors for PPP projects across China.

In this empirical analysis, the results of the Moran’s I and Geary’s C statistics indicate that the PPP project implementation rate in China shows significant spatial clustering. The findings of the Moran scatterplot show that over half of the 30 provinces and municipalities are located in Quadrants I (HH) and III (LL), which provides further evidence for the existence of spatial clustering. The degree of spatial clustering is increased when the central government pays more attention to the “low-lying land” of PPP projects, such as Hainan and Heilongjiang. From the SDM, we find that fixed asset investment and infrastructure status exert a significant positive effect on the PPP project implementation rate in a certain region and contribute to the implementation of PPP projects in the neighboring areas. Several factors, such as urbanization potentiality, the financial self-sufficiency rate, and regional openness, do not affect the local PPP project implementation rate but inhibit the increase in the PPP project implementation rate in the adjacent areas. We also found that such variables as fiscal capacity, government credibility, and the level of social development do not play significant roles in improving the local PPP project implementation rate, but they do promote the implementation of PPP projects in neighboring regions.

Our findings suggest four measures that local authorities could use to promote PPP project implementation and to exert the functions of social capital. First, due to the significant differences between provinces and municipalities, local governments should plan rationally and adopt PPP projects according to the economic environment of the local region and its neighboring regions [10], which is still an important foundation for the development of the PPP model. In particular, the local governments with large fiscal deficits should prudently use PPP to boost infrastructure services. Second, local governments should focus on the key infrastructure service sectors when adopting PPP projects. For example, local governments may give priority to PPP projects that help to strengthen the weakness in infrastructure and to the public welfare projects that produce benefits in the field of basic public service equalization, such as healthcare, pension, sports, and tourism. Moreover, the government can also provide some preferential policies to such projects, including improving fiscal and tax preferences and financing support. Third, to promote the implementation of the projects, policymakers at all levels should stabilize expectations on social capital investment, establish strong confidence in government credibility, and create a set of standardized and transparent procurement processes for PPP projects—specifically, strengthening information disclosure, accepting social supervision, and promoting the standardized and orderly implementation of the projects. Lastly, some regions can make full use of the spillover effect released by the surrounding areas with better PPP adoption and can seize the opportunity to promote the implementation of PPP projects [44,75].

With this study, we contribute to the body of knowledge on PPP development and, by providing empirical evidence on the spatial characteristics of PPP projects from the perspective of the development environment, can help local authorities promote the implementation of PPP projects by spatial governance in China [44]. However, there are several limitations to this research. The drivers of PPP development are diverse and complex. In the selection of driving indicators, we only include some representative factors. The indicators adopted in this study may not be sufficient to reflect the development environment of PPP projects. In addition, within the limitations of the PPP demonstration projects data released by MOF, the data herein were collected over a relatively short period, although they meet the requirements of the panel data model. Subsequent research is needed to include more indicator variables and to expand the period of the sample data, which would help to illustrate a more comprehensive picture of PPP spatial–temporal evolution and driving factors.

Author Contributions

Conceptualization, F.Y. and J.L.; methodology, Y.W., F.Y. and J.L.; data curation, Y.W. and S.G.; software, Y.W. and J.L.; writing—original draft preparation, F.Y. and Y.W.; writing—review and editing, F.Y., H.L. and J.L.; project administration, F.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This study was financially supported by the MOE (Ministry of Education of China) Project of Humanities and Social Sciences Research (Grant Number 19YJA630035) and Fundamental Research Funds for the Central Universities, Huazhong Agricultural University (grant number 2662022GGYJ002, 2662020GGPY004) and China University of Geosciences (Wuhan) (grant number CUGESIW1801).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Casady, C.B.; Eriksson, K.; Levitt, R.E.; Scott, W.R.; Casady, C.B.; Eriksson, K.; Levitt, R.E.; Richard, W. (Re)defining public-private partnerships (PPPs) in the new public governance (NPG) paradigm: An institutional maturity perspective. Public Manag. Rev. 2022, 22, 161–183. [Google Scholar] [CrossRef]

- Muhammad, Z.; Johar, F. Critical success factors of public–private partnership projects: A comparative analysis of the housing sector between Malaysia and Nigeria. Int. J. Constr. Manag. 2019, 19, 257–269. [Google Scholar] [CrossRef]

- Wall, A.; Connolly, C.J. The Private Finance Initiative. Public Manag. Rev. 2014, 11, 707–724. [Google Scholar] [CrossRef]

- Moskalyk, A. Public-Private Partnerships in Housing and Urban Development; UN-HABITAT: Nairobi, Kenya, 2011; ISBN 9789211320275. [Google Scholar]

- Ministry of Commerce of the People’s Republic of China. Guidelines on Attracting Foreign Investment in the Form of BOT. Available online: http://www.mofcom.gov.cn/article/swfg/swfgbl/gfxwj/201304/20130400092593.shtml (accessed on 16 January 2020). (In Chinese)

- National Development and Reform Commission. Guidelines on Implementation Public-Private Partnerships. Available online: https://www.ndrc.gov.cn/fggz/gdzctz/tzfg/201412/t20141204_1197597.html?code=&state=123 (accessed on 2 December 2019). (In Chinese)

- China Public Private Partnerships Center. Quarterly Report of National PPPs Projects Development. Available online: https://www.cpppc.org/jb/1001093.jhtml (accessed on 29 February 2022). (In Chinese).

- Cui, C.; Liu, Y.; Hope, A.; Wang, J. Review of studies on the public–private partnerships (PPP) for infrastructure projects. Int. J. Proj. Manag. 2018, 36, 773–794. [Google Scholar] [CrossRef]

- Rosell, J.; Saz-carranza, A. Determinants of public–private partnership policies. Public Manag. Rev. 2020, 22, 1171–1190. [Google Scholar] [CrossRef]

- Cheng, Z.; Ke, Y.; Lin, J.; Yang, Z.; Cai, J. Spatio-temporal dynamics of public private partnership projects in China. Int. J. Proj. Manag. 2016, 34, 1242–1251. [Google Scholar] [CrossRef]

- Liang, C.; Jingchun, F.; Song, X.; Ke, Z. Spatial-temporal Analysis for PPP Waste-to-energy Projects in China. J. Residuals Sci. Technol. 2017, 14, S71–S78. [Google Scholar] [CrossRef][Green Version]

- Osei-Kyei, R.; Chan, A.P.C. Review of studies on the critical success factors for public-private partnership (PPP) projects from 1990 to 2013. Int. J. Proj. Manag. 2015, 33, 1335–1346. [Google Scholar] [CrossRef]

- Simon, L.; Jefferies, M.; Davis, P.; Newaz, M.T. Developing a theoretical success factor framework for the tendering phase of social infrastructure PPPs. Int. J. Constr. Manag. 2020, 20, 613–627. [Google Scholar] [CrossRef]

- Tang, L.; Shen, G.Q.; Skitmore, M.; Wang, H. Procurement-Related Critical Factors for Briefing in Public-Private Partnership Projects: Case of Hong Kong. J. Manag. Eng. 2015, 31, 04014096. [Google Scholar] [CrossRef]

- Liu, J.; Love, P.E.D.; Smith, J.; Regan, M.; Davis, P.R. Life Cycle Critical Success Factors for Public-Private Partnership Infrastructure Projects. J. Manag. Eng. 2015, 31, 04014073. [Google Scholar] [CrossRef]

- Li, B.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. Critical success factors for PPP/PFI projects in the UK construction industry. Constr. Manag. Econ. 2005, 23, 459–471. [Google Scholar] [CrossRef]

- Jefferies, M. Critical success factors of public private sector partnerships: A case study of the Sydney SuperDome. Eng. Constr. Archit. Manag. 2006, 13, 451–462. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Lam, P.T.I.; Chan, D.W.M.; Cheung, E.; Ke, Y. Critical Success Factors for PPPs in Infrastructure Developments: Chinese Perspective. J. Constr. Eng. Manag. 2010, 136, 484–494. [Google Scholar] [CrossRef]

- Ng, S.T.; Wong, Y.M.W.; Wong, J.M.W. Factors influencing the success of PPP at feasibility stage—A tripartite comparison study in Hong Kong. Habitat Int. 2012, 36, 423–432. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P.C. Implementing public–private partnership (PPP) policy for public construction projects in Ghana: Critical success factors and policy implications. Int. J. Constr. Manag. 2017, 17, 113–123. [Google Scholar] [CrossRef]

- Ahmadabadi, A.A.; Heravi, G. The effect of critical success factors on project success in Public-Private Partnership projects: A case study of highway projects in Iran. Transp. Policy 2019, 73, 152–161. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Lam, P.T.I.; Chan, D.W.M.; Cheung, E.; Ke, Y. Drivers for Adopting Public Private Partnerships—Empirical Comparison between China and Hong Kong Special Administrative Region. J. Constr. Eng. Manag. 2009, 135, 1115–1124. [Google Scholar] [CrossRef]

- Fayard, A.; Gaeta, F.; Quinet, E. French motorways: Experience and assessment. Res. Transp. Econ. 2005, 15, 93–105. [Google Scholar] [CrossRef]

- Meunier, D.; Quinet, E. Tips and Pitfalls in PPP design. Res. Transp. Econ. 2010, 30, 126–138. [Google Scholar] [CrossRef]

- Galilea, P.; Medda, F. Does the political and economic context influence the success of a transport project? An analysis of transport public-private partnerships. Res. Transp. Econ. 2010, 30, 102–109. [Google Scholar] [CrossRef]

- Willoughby, C. How much can public private partnership really do for urban transport in developing countries? Res. Transp. Econ. 2013, 40, 34–55. [Google Scholar] [CrossRef]

- Heravi, G.; Ilbeigi, M. Development of a comprehensive model for construction project success evaluation by contractors. Eng. Constr. Archit. Manag. 2012, 19, 526–542. [Google Scholar] [CrossRef]

- Jeerangsuwan, T.; Said, H.; Kandil, A.; Ukkusuri, S. Financial Evaluation for Toll Road Projects Considering Traffic Volume and Serviceability Interactions. J. Infrastruct. Syst. 2014, 20, 04014012. [Google Scholar] [CrossRef]

- Song, J.; Zhang, H.; Dong, W. A review of emerging trends in global PPP research: Analysis and visualization. Scientometrics 2016, 107, 1111–1147. [Google Scholar] [CrossRef]

- Zhang, S.; Chan, A.P.C.; Feng, Y.; Duan, H.; Ke, Y. Critical review on PPP Research—A search from the Chinese and International Journals. Int. J. Proj. Manag. 2016, 34, 597–612. [Google Scholar] [CrossRef]

- Yehoue, E.B.; Hammami, M.; Ruhashyankiko, J.-F. Determinants of Public-Private Partnerships in Infrastructure. IMF Work. Pap. 2006, 6, 1. [Google Scholar] [CrossRef]

- Sharma, C. Determinants of PPP in infrastructure in developing economies. Transform. Gov. People Process Policy 2012, 6, 149–166. [Google Scholar] [CrossRef]

- van den Hurk, M.; Brogaard, L.; Lember, V.; Helby Petersen, O.; Witz, P. National Varieties of Public–Private Partnerships (PPPs): A Comparative Analysis of PPP-Supporting Units in 19 European Countries. J. Comp. Policy Anal. Res. Pract. 2016, 18, 1–20. [Google Scholar] [CrossRef]

- Greve, C.; Hodge, G. Public-Private Partnerships: A Comparative Perspective on Victoria and Denmark. In Transcending New Public Management; Christensen, T., Lægreid, P., Eds.; Ashgate: Farnham, UK, 2007; pp. 179–201. ISBN 0754670716. [Google Scholar]

- Widén, K.; Lember, V.; Olander, S.; Petersen, O.H.; Scherrer, W. Institutional Reasons for not Implementing PPPs in the Transport Sector. In Public Private Partnership in Transport: Trends and Theory; Roumboutsos, A., Carbonara, N., Eds.; COST office, European Science Foundation: Lund, Sweden, 2012. [Google Scholar]

- Mahalingam, A. PPP Experiences in Indian Cities: Barriers, Enablers, and the Way Forward. J. Constr. Eng. Manag. 2010, 136, 419–429. [Google Scholar] [CrossRef]

- Warsen, R.; Nederhand, J.; Klijn, E.H.; Grotenbreg, S.; Koppenjan, J. What makes public-private partnerships work? Survey research into the outcomes and the quality of cooperation in PPPs. Public Manag. Rev. 2018, 20, 1165–1185. [Google Scholar] [CrossRef]

- Warsen, R.; Klijn, E.H.; Koppenjan, J. Mix and match: How contractual and relational conditions are combined in successful public-private partnerships. J. Public Adm. Res. Theory 2019, 29, 375–393. [Google Scholar] [CrossRef]

- Jooste, S.F.; Levitt, R.; Scott, D. Beyond ‘one size fits all’: How local conditions shape PPP-enabling field development. Eng. Proj. Organ. J. 2011, 1, 11–25. [Google Scholar] [CrossRef]

- Domingues, S.; Zlatkovic, D. Renegotiating PPP Contracts: Reinforcing the ‘P’ in Partnership. Transp. Rev. 2015, 35, 204–225. [Google Scholar] [CrossRef]

- Boyer, E.J. How does public participation affect perceptions of public–private partnerships? A citizens’ view on push, pull, and network approaches in PPPs. Public Manag. Rev. 2019, 21, 1464–1485. [Google Scholar] [CrossRef]

- Roumboutsos, A. Public Private Partnerships in Transport: Trends and Theory; Routledge: London, UK, 2015. [Google Scholar]

- de Castro e Silva Neto, D.; Cruz, C.O.; Rodrigues, F.; Silva, P. Bibliometric Analysis of PPP and PFI Literature: Overview of 25 Years of Research. J. Constr. Eng. Manag. 2016, 142, 06016002. [Google Scholar] [CrossRef]

- Cheng, Z.; Yang, Z.; Gao, H.; Tao, H.; Xu, M. Does PPP matter to sustainable tourism development? An analysis of the spatial effect of the tourism PPP policy in China. Sustainability 2018, 10, 4058. [Google Scholar] [CrossRef]

- Mu, R.; de Jong, M.; Koppenjan, J. The rise and fall of Public-Private Partnerships in China: A path-dependent approach. J. Transp. Geogr. 2011, 19, 794–806. [Google Scholar] [CrossRef]

- Tobler, W.R. Geographical Filters and their Inverses. Geogr. Anal. 1969, 1, 234–253. [Google Scholar] [CrossRef]

- Anselin, L.U.C.; Sridharan, S.; Gholston, S. Using exploratory spatial data analysis to leverage social indicator databases: The discovery of interesting patterns. Discovery 2007, 82, 287–309. [Google Scholar] [CrossRef]

- Qiu, Y.; Zhu, Z.; Huang, H.; Bing, Z. Study on the evolution of B&Bs spatial distribution based on exploratory spatial data analysis (ESDA) and its influencing factors—with Yangtze River Delta as an example. Eur. J. Remote Sens. 2021, 54, 296–308. [Google Scholar] [CrossRef]

- Yang, W.; Jin, F.; Wang, C.; Lv, C. Industrial eco-efficiency and its spatial-temporal differentiation in China. Front. Environ. Sci. Eng. China 2012, 6, 559–568. [Google Scholar] [CrossRef]

- Li, Z.; Liu, Y. Research on the Spatial Distribution Pattern and Influencing Factors of Digital Economy Development in China. IEEE Access 2021, 9, 63094–63106. [Google Scholar] [CrossRef]

- Rao, H.X.; Zhang, X.; Zhao, L.; Yu, J.; Ren, W.; Zhang, X.L.; Ma, Y.C.; Shi, Y.; Ma, B.Z.; Wang, X.; et al. Spatial transmission and meteorological determinants of tuberculosis incidence in Qinghai Province, China: A spatial clustering panel analysis. Infect. Dis. Poverty 2016, 5, 45. [Google Scholar] [CrossRef] [PubMed]

- Anselin, L. A Local Indicator of Multivariate Spatial Association: Extending Geary’s c. Geogr. Anal. 2019, 51, 133–150. [Google Scholar] [CrossRef]

- Li, H.; Calder, C.A.; Cressie, N. Beyond Moran’s I: Testing for spatial dependence based on the spatial autoregressive model. Geogr. Anal. 2007, 39, 357–375. [Google Scholar] [CrossRef]

- Chen, Y. An analytical process of spatial autocorrelation functions based on Moran’s index. PLoS ONE 2021, 16, e0249589. [Google Scholar] [CrossRef]

- Gallo, J.; Ertur, C. Exploratory spatial data analysis of the distribution of regional per capita GDP in Europe, 1980–1995. Pap. Reg. Sci. 2003, 82, 175–201. [Google Scholar] [CrossRef]

- Anselin, L. Local Indicators of Spatial Association—LISA. Geogr. Anal. 1995, 27, 93–115. [Google Scholar] [CrossRef]

- Lesage, J.P.; Pace, R.K. Introduction to Spatial Econometrics; CRC Press: Boca Raton, FL, USA, 2009. [Google Scholar]

- Pu, W.; Xu, F.; Marques, R.C. A bibliometric and meta-analysis of studies on public–private partnership in China. Constr. Manag. Econ. 2021, 39, 773–789. [Google Scholar] [CrossRef]

- Castelblanco, G.; Guevara, J.; Mesa, H.; Sanchez, A. Semantic Network Analysis of Literature on Public-Private Partnerships. J. Constr. Eng. Manag. 2021, 147, 04021033. [Google Scholar] [CrossRef]

- Tariq, S.; Zhang, X. Socioeconomic, Macroeconomic, and Sociopolitical Issues in Water PPP Failures. J. Manag. Eng. 2021, 37, 04021047. [Google Scholar] [CrossRef]

- Liddle, B. The energy, economic growth, urbanization nexus across development: Evidence from heterogeneous panel estimates robust to cross-sectional dependence. Energy J. 2013, 34, 223–244. [Google Scholar] [CrossRef]

- Qu, Y. The study of development situation and influence factor of PPP in China. Master’s Thesis, Shandong University, Jinan, China, 2018. (In Chinese). [Google Scholar]

- Jefferies, M.; Gameson, R.; Rowlinson, S. Critical success factors of the BOOT procurement system: Reflections from the Stadium Australia case study. Eng. Constr. Archit. Manag. 2002, 9, 352–361. [Google Scholar] [CrossRef]

- Chen, C.; Li, D.; Man, C. Toward Sustainable Development? A Bibliometric Analysis of PPP-Related Policies in China between 1980 and 2017. Sustainability 2019, 11, 142. [Google Scholar] [CrossRef]

- Jacobson, C.; Choi, S.O. Success factors: Public works and public-private partnerships. Int. J. Public Sect. Manag. 2008, 21, 637–657. [Google Scholar] [CrossRef]

- Yi-Dong, W.U.; Chen, Z.; Chen, J. The Credibility of Local Government and the Scale of PPP Project:Based on the Data of the PPP Project Database of the Ministry of Finance. Mod. Financ. Econ. Tianjin Univ. Financ. Econ. 2019, 39, 3–13. (In Chinese) [Google Scholar] [CrossRef]

- Guoguang, Z.; Chunxia, J. Analysis on failure factors of PPP project of transportation infrastructure. J. Technol. Econ. Manag. 2015, 11, 8–13. (In Chinese) [Google Scholar]

- Yang, L.; Wang, Z. The Analysis of the Influence Factors for Private Assets Participating in the PPP Projects on the Background of AIIB. Asia-Pac. Econ. Rev. 2018, 1, 51–61+146. (In Chinese) [Google Scholar] [CrossRef]

- Tao, C.Q. The Frontier Theory and Applications of Spatial Econometric; Science Press: Beijing, China, 2016. (In Chinese) [Google Scholar]

- Chen, Z.; Shu, W.; Guo, H.; Pan, C. The spatial characteristics of sustainable development for agricultural products e-commerce at county-level: Based on the empirical analysis of china. Sustainability 2021, 13, 6557. [Google Scholar] [CrossRef]

- Sun, X.; Lian, W.; Duan, H.; Wang, A. Factors affecting wind power efficiency: Evidence from provincial-level data in china. Sustainability 2021, 13, 2759. [Google Scholar] [CrossRef]

- Liu, Y.; Yan, B.; Zhou, Y. Urbanization, economic growth, and carbon dioxide emissions in China: A panel cointegration and causality analysis. J. Geogr. Sci. 2016, 26, 131–152. [Google Scholar] [CrossRef]

- Jie, T.; Jianxing, Y.; Zhirong, Z. Explaining PPP Speed: Local Government Capacity, Leadership, and Project Characteristics: A Continuous-Time Event History Analysis. J. Public Manag. 2019, 16, 72–82. [Google Scholar] [CrossRef]

- Jamali, D. Success and failure mechanisms of public private partnerships (PPPs) in developing countries. Insights from the Lebanese context. Int. J. Public Sect. Manag. 2004, 17, 414–430. [Google Scholar] [CrossRef]

- Brinkerhoff, D.W.; Brinkerhoff, J.M. Public-private partnerships: Perspectives on purposes, publicness, and good governance. Public Adm. Dev. 2011, 31, 2–14. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).