Main Features of the Timber Structure Building Industry Business Models

Abstract

1. Introduction

1.1. Defining a Business Model

Business Model Innovation

1.2. Business Models in the Construction Industry

1.3. Business Models in the Timber Structure Building Industry

2. Materials and Methods

2.1. Methodological Tool 1: Use of Secondary Data

2.2. Methodological Tool 2: Semi-Structured Interviews

2.3. Methodological Tool 3: Participant Observation

2.4. Qualitative Analysis

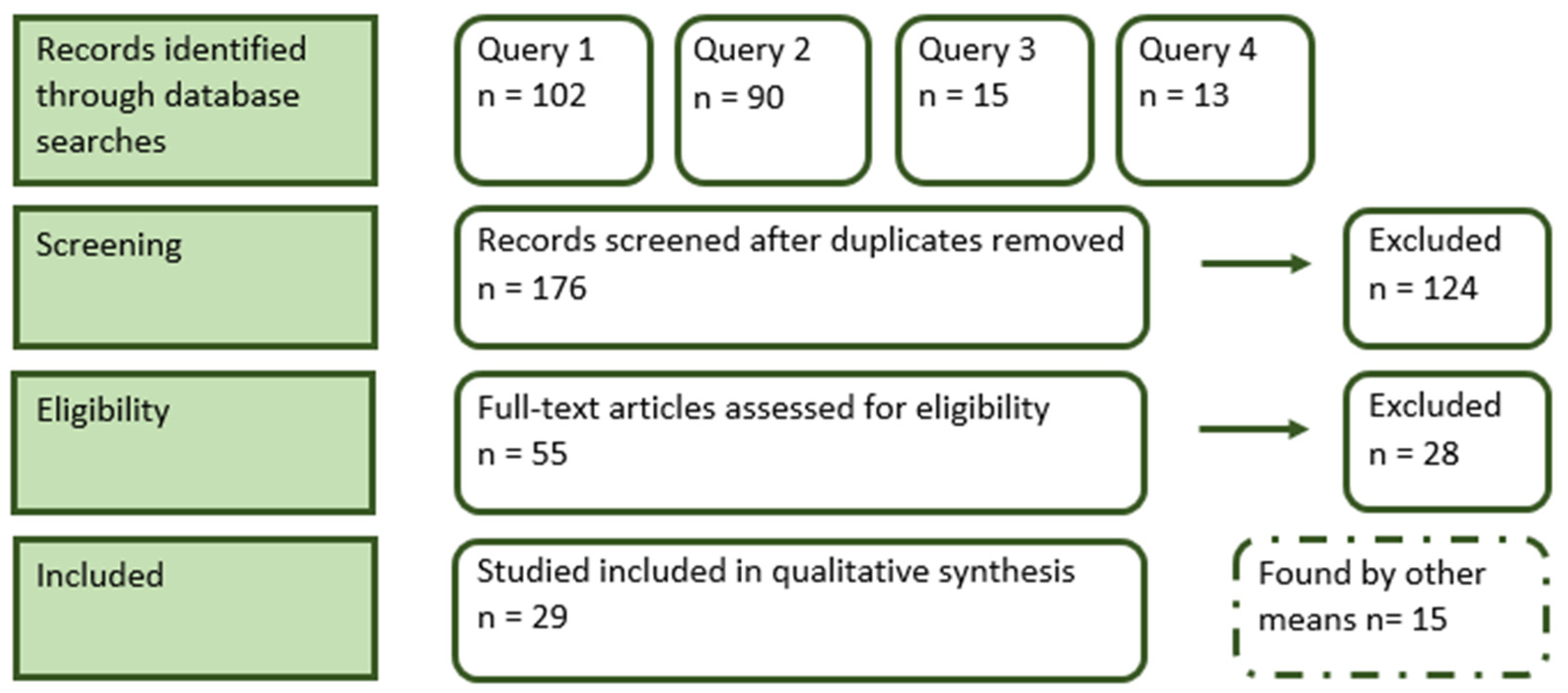

2.5. Literature Review

- “construction”

- AND “building”

- AND “business models”

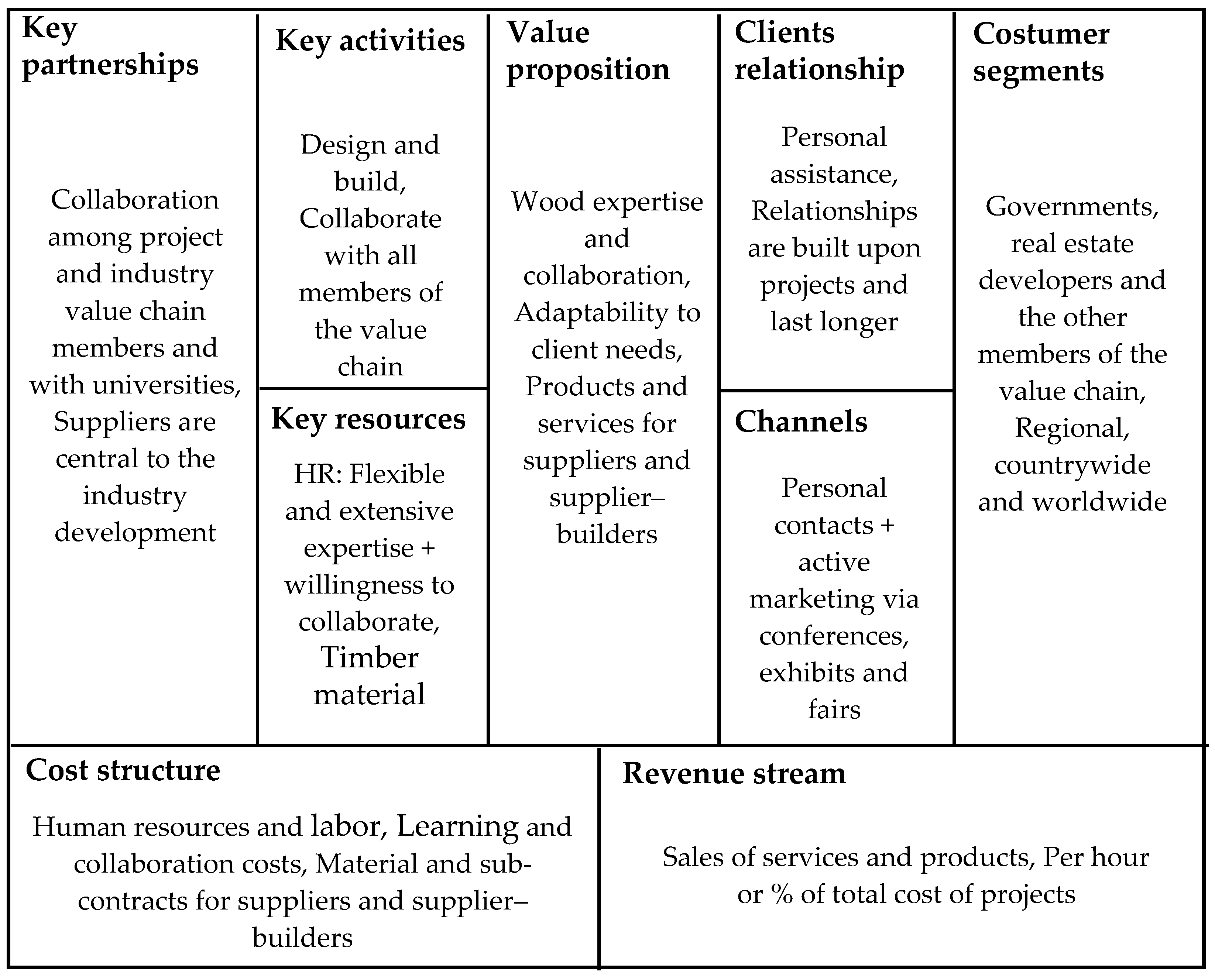

3. Results

3.1. Value Proposition

3.1.1. Architects

3.1.2. Engineers

3.1.3. Builders

3.1.4. Suppliers

3.1.5. Supplier–Builders

3.2. Customer Segments

3.2.1. Architects

3.2.2. Engineers

3.2.3. Builders

3.2.4. Suppliers

3.2.5. Supplier–Builders

3.3. Customer Relationships

3.4. Channels

3.4.1. Architects

3.4.2. Engineers

3.4.3. Builders

3.4.4. Suppliers

3.4.5. Supplier–Builders

3.5. Revenue Streams

3.5.1. Architects

3.5.2. Engineers

3.5.3. Builders

3.5.4. Suppliers and Supplier–Builders

3.6. Key Activities

3.6.1. Architects

3.6.2. Engineers

3.6.3. Builders

3.6.4. Suppliers

3.6.5. Supplier–Builders

3.7. Key Resources

3.7.1. Architects

3.7.2. Engineers

3.7.3. Builders

3.7.4. Suppliers

3.7.5. Supplier–Builders

3.8. Key Partnerships

3.8.1. Architects

3.8.2. Engineers

3.8.3. Builders

3.8.4. Suppliers

3.8.5. Supplier–Builders

3.9. Cost Structure

3.9.1. Architects and Engineers

3.9.2. Builders

3.9.3. Suppliers and Supplier–Builders

4. Discussions

4.1. Features of the Timber Structure Building Industry

4.1.1. Similarities and Distinctions among Stakeholder’s Business Models

4.1.2. Early Stage of Maturity: Mostly Small Businesses for Now

4.1.3. Sustainability Is a Strong Motivation, Especially for Architects

4.1.4. The Suppliers Are the Industry Development Leaders

4.1.5. The Structural Timber Building Industry Is Not Mass Standardized

4.1.6. Labor Competition Explained by Lack of Specialists and of Timber Trained Employees

4.1.7. A Strong and Absolute Collaboration between Stakeholders Is Needed

4.1.8. Participating to Conferences or Shows Is a Must

4.1.9. Collaborative Procurement Modes Are Better Suited to Timber Structural Building Industry

4.1.10. Partnerships with Universities Are a Common Feature within the Industry

4.1.11. Prefabrication Is an Important Part of the Structural Timber Industry’s Future

4.1.12. Strongly Regulated Work Environment

4.1.13. Fragmented

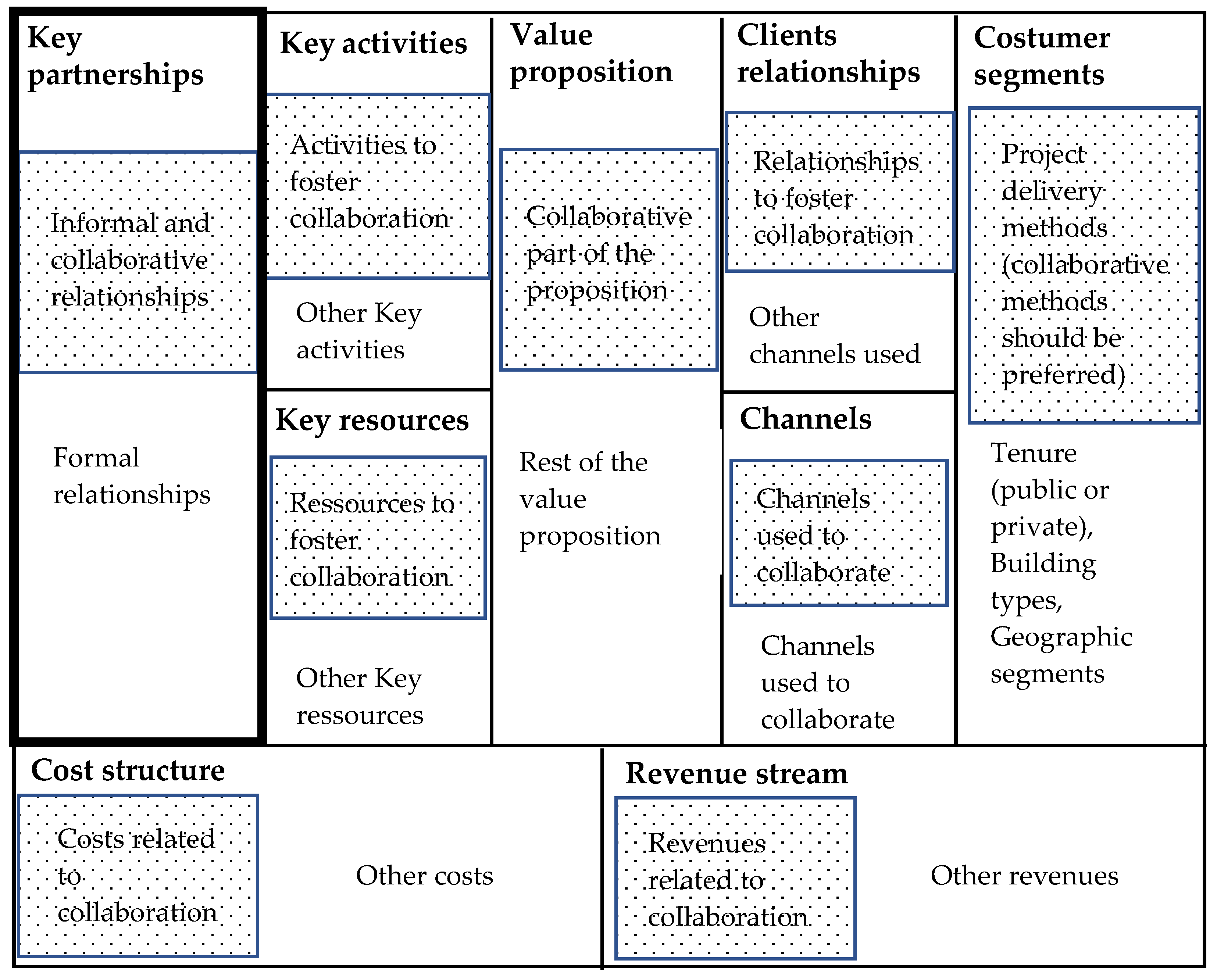

4.2. Rethinking the Business Model Canvas for the Structural Timber Construction Industry

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

- Could you briefly tell me about your company’s history?

- What is the size of the company? (No. of employees, annual turnover)

- 3.

- In your opinion, what are its main strengths, what distinguishes your organization from its competitors?

- 4.

- Can you tell me about the company’s main activities? In your opinion, what are the main reasons why customers decide to work with you?

- 5.

- What expertise are they seeking?

- 6.

- What are your missions?

- a.

- Types of projects

- b.

- Types of contracts

- 7.

- Who are your most important clients?

- 8.

- What kind of relationships do you have with your clients?

- 9.

- How do you start a relationship?

- 10.

- How do you maintain them over time?

- 11.

- The CIRCERB Chair was created especially to promote the wooden building, something you are already doing brilliantly. How did you come to value wood constructions? How important is the use of wood as a structural material for non-residential buildings within your company today?

- 12.

- What other markets does your business occupy?

- 13.

- In your opinion, are they complementary or rather dominant compared to wood? (% wood vs. steel)

- 14.

- What are the motivations that lead your company to work on projects with wooden structures?

- 15.

- What is the level of expertise and training of your employees with wood? Professionals, technicians?

- 16.

- Are your employees comfortable to work on buildings with wooden structures upon hiring? How they develop the skills that allow them to work with wood?

- 17.

- Could I get a copy of the Operation “flowchart”?

- 18.

- Can you describe the company’s human resources?

- 19.

- In your wooden structure projects such as ____________, what type of business relationships was established?

- 20.

- Who gets to know about your services and how do they learn about them? How do you reach your customers? What main visibility elements is the business using to be known/to improve its notoriety?

- 21.

- Do you have some examples of project that reflect your core business? Are projects your business card?

- 22.

- What are the main cost sources for your business? What are the drivers of these costs (client requests, supplier issues, unforeseen difficulties on a technical level, etc.)?

- 23.

- What are the main revenue sources?

- 24.

- Was the ______________ building an exceptional or routine project for your business?

- 25.

- Why was wood chosen as structural material for this/these buildings?

- 26.

- What were the positive elements for you company about working on this/these building(s)?

- 27.

- What were difficulties or challenges faced when working on this/these building(s)?

- 28.

- If your company had to do this/these project(s) over again, what would you do differently?

- 29.

- Would you like to share something else related to this/these project(s)?

- 30.

- Do you have anything to add?

References

- Robichaud, F.; Kozak, R.; Richelieu, A. Wood use in nonresidential construction: A case for communication with architects. For. Prod. J. 2009, 59, 57–65. [Google Scholar]

- Drouin, M. Étude de Marché Pour les bois de Structure dans la Construction non Résidentielle au Québec; 301010000; FPInnovations: Montréal, QC, Canada, 2015; p. 28. [Google Scholar]

- Robichaud, F. L’utilisation du bois en Construction non Résidentielle au Québec: Enquête Auprès des Ingénieurs en Structure; 2001001474; FPInnovations: Montréal, QC, Canada, 2010; p. 25. [Google Scholar]

- Chamberland, V.; Robichaud, F. Le Marché pour les bois de Structure dans la Construction non Résidentielle au Québec; 30107433; 30107433; FPInnovations: Montréal, QC, Canada, 2013; p. 25. [Google Scholar]

- O’Connor, J.; Gaston, C. Potential for Increased Wood-Use in the N. A” Non-Residential Markets—Part II (Builder/Owner Survey); 3917; Forintek Cananda Corop: Vancouver, BC, Canada, 2004; p. 89. [Google Scholar]

- Gaston, C.; Kozak, R.; O’Connor, J.; Fell, D. Potential for Increased Wood-Use in N.A. Non-Residential Markets; 2711; Forinteck Canada Corp: Vancouver, BC, Canada, 2001; p. 106. [Google Scholar]

- Guy-Plourde, S.; Robichaud, F. Enquête sur la Construction non Résidentielle et Multifamiliale en Bois en 2020; Forest Economics Advisors: Port Coquitlam, BC, Canada, 2020; p. 14. [Google Scholar]

- Michaelsen, J.; Tran, E. Analyse du Flux du Bois Pour la Scierie St-Roch de Kruger Avec L’utilisation de Parc de Transfert et de Camions hor Normes; Rapport de contrat confidentiel RC-0387-1; Feric: Toronto, ON, Canada, 2008. [Google Scholar]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Mathison, S. Why Triangulate? Educ. Res. 1988, 17, 13–17. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y.; Tucci, C.L. Clarifying Business Models: Origins, Present, and Future of the Concept. Commun. Assoc. Inf. Syst. 2005, 16, 1. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R.; Massa, L. The Business Model: Recent Developments and Future Research. J. Manag. 2011, 37, 1019–1042. [Google Scholar] [CrossRef]

- Timmers, P. Business Models for Electronic Markets; 98-21; European Commission, Directorate-general III: Palo Alto, CA, USA, 1998. [Google Scholar]

- Amit, R.; Zott, C. Value creation in E-business. Strat. Manag. J. 2001, 22, 493–520. [Google Scholar] [CrossRef]

- Chesbrough, H. The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’s technology spin-off companies. Ind. Corp. Chang. 2002, 11, 529–555. [Google Scholar] [CrossRef]

- Magretta, J. Why Business Models Matter. Available online: https://hbr.org/2002/05/why-business-models-matter (accessed on 1 March 2019).

- Morris, M.; Schindehutte, M.; Allen, J. The entrepreneur’s business model: Toward a unified perspective. J. Bus. Res. 2005, 58, 726–735. [Google Scholar] [CrossRef]

- Johnson, M.W.; Christensen, C.M.; Kagermann, H. Reinventing Your Business Model. Available online: https://hbr.org/2008/12/reinventing-your-business-model (accessed on 1 December 2019).

- Teece, D.J. Business Models, Business Strategy and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- George, G.; Bock, A.J. The Business Model in Practice and its Implications for Entrepreneurship Research. Entrep. Theory Pract. 2011, 35, 83–111. [Google Scholar] [CrossRef]

- Casadesus-Masanell, R.; Ricart, J.E. How to Design a Winning Business Model. Available online: https://hbr.org/2011/01/how-to-design-a-winning-business-model (accessed on 1 January 2020).

- Gulati, R. Silo Busting—How to Execute on the Promise of Customer Focus. Available online: https://hbr.org/2007/05/silo-busting-how-to-execute-on-the-promise-of-customer-focus (accessed on 1 January 2020).

- Joyce, A.; Paquin, R.L. The triple layered business model canvas: A tool to design more sustainable business models. J. Clean. Prod. 2016, 135, 1474–1486. [Google Scholar] [CrossRef]

- Franceschelli, M.V.; Santoro, G.; Candelo, E. Business model innovation for sustainability: A food start-up case study. Br. Food J. 2018, 120, 2483–2494. [Google Scholar] [CrossRef]

- Dijkman, R.; Sprenkels, B.; Peeters, T.; Janssen, A. Business models for the Internet of Things. Int. J. Inf. Manag. 2015, 35, 672–678. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Advantage: Creating and Sustaining Superior Performance; The Free Press: New York, NY, USA, 1985; p. 557. [Google Scholar]

- Demil, B.; Lecocq, X. Business Model Evolution: In Search of Dynamic Consistency. Long Range Plan. 2010, 43, 227–246. [Google Scholar] [CrossRef]

- Linder, J.C.; Cantrell, S. Five business-model myths that hold companies back. Strat. Lead. 2001, 29, 13–18. [Google Scholar] [CrossRef]

- Doz, Y.L.; Kosonen, M. Embedding Strategic Agility. Long Range Plan. 2010, 43, 370–382. [Google Scholar] [CrossRef]

- Euchner, J.; Ganguly, A. Business Model Innovation in Practice. Res. Technol. Manag. 2014, 57, 33–39. [Google Scholar] [CrossRef]

- Spieth, P.; Schneider, S. Business model innovativeness: Designing a formative measure for business model innovation. J. Bus. Econ. 2016, 86, 671–696. [Google Scholar] [CrossRef]

- Foss, N.J.; Saebi, T. Fifteen Years of Research on Business Model Innovation. J. Manag. 2016, 43, 200–227. [Google Scholar] [CrossRef]

- Cosenz, F.; Bivona, E. Fostering growth patterns of SMEs through business model innovation. A tailored dynamic business modelling approach. J. Bus. Res. 2020, 1–12. [Google Scholar] [CrossRef]

- Pekuri, A.; Pekuri, L.; Haapasalo, H. The role of business models in Finnish construction companies. Constr. Econ. Build. 2013, 13, 13–23. [Google Scholar] [CrossRef]

- Pekuri, A.; Pekuri, L.; Haapasalo, H. Business models and project selection in construction companies. Constr. Innov. 2015, 15, 180–197. [Google Scholar] [CrossRef]

- Mokhlesian, S.; Holmén, M. Business model changes and green construction processes. Constr. Manag. Econ. 2012, 30, 761–775. [Google Scholar] [CrossRef]

- Pan, W.; Gibb, A.G.F.; Dainty, A.R.J. Perspectives of UK housebuilders on the use of offsite modern methods of construction. Constr. Manag. Econ. 2007, 25, 183–194. [Google Scholar] [CrossRef]

- Pan, W.; Gibb, A.G.; Dainty, A.R. Leading UK housebuilders’ utilization of offsite construction methods. Build. Res. Inf. 2008, 36, 56–67. [Google Scholar] [CrossRef]

- Pan, W.; Goodier, C.I. House-Building Business Models and Off-Site Construction Take-Up. J. Arch. Eng. 2012, 18, 84–93. [Google Scholar] [CrossRef]

- Andersson, N.; Lessing, J. Industrialization of construction: Implications on standards, business models and project orientation. Organ. Technol. Manag. Constr. Int. J. 2020, 12, 2109–2116. [Google Scholar] [CrossRef]

- Goulding, J.; Pour Rahimian, F.; Arif, M.; Sharp, M. New offsite production and business models in construction: Priorities for the future research agenda. Arch. Eng. Des. Manag. 2015, 11, 163–184. [Google Scholar] [CrossRef]

- Lessing, J.; Brege, S. Industrialized Building Companies’ Business Models: Multiple Case Study of Swedish and North American Companies. J. Constr. Eng. Manag. 2018, 144, 05017019. [Google Scholar] [CrossRef]

- Liu, G.; Li, K.; Zhao, D.; Mao, C. Business Model Innovation and Its Drivers in the Chinese Construction Industry during the Shift to Modular Prefabrication. J. Manag. Eng. 2017, 33, 04016051. [Google Scholar] [CrossRef]

- Thuesen, C.; Hvam, L. Rethinking the Business Model in Construction by the Use of Off-Site System Deliverance: Case of the Shaft Project. J. Arch. Eng. 2013, 19, 279–287. [Google Scholar] [CrossRef]

- Zhang, R.; Zhou, A.S.J.; Tahmasebi, S.; Whyte, J. Long-standing themes and new developments in offsite construction: The case of UK housing. Proc. Inst. Civ. Eng. Civ. Eng. 2019, 172, 29–35. [Google Scholar] [CrossRef]

- Pardalis, G.; Mahapatra, K.; Mainali, B. Swedish construction MSEs: Simply renovators or renovation service innovators? Build. Res. Inf. 2019, 48, 67–83. [Google Scholar] [CrossRef]

- Abuzeinab, A.; Arif, M.; Kulonda, D.J.; Awuzie, B.O. Green business models transformation: Evidence from the UK construction sector. Built Environ. Proj. Asset Manag. 2016, 6, 478–490. [Google Scholar] [CrossRef]

- Abuzeinab, A.; Arif, M.; Qadri, M.A. Barriers to MNEs green business models in the UK construction sector: An ISM analysis. J. Clean. Prod. 2017, 160, 27–37. [Google Scholar] [CrossRef]

- Duarte, S.; Cruzmachado, V. Modelling lean and green: A review from business models. Int. J. Lean Six Sigma 2013, 4, 228–250. [Google Scholar] [CrossRef]

- Wang, L.; Toppinen, A.; Juslin, H. Use of wood in green building: A study of expert perspectives from the UK. J. Clean. Prod. 2014, 65, 350–361. [Google Scholar] [CrossRef]

- Aho, I. Value-added business models: Linking professionalism and delivery of sustainability. Build. Res. Inf. 2013, 41, 110–114. [Google Scholar] [CrossRef][Green Version]

- Zhao, X.; Hwang, B.-G.; Lu, Q. Typology of business model innovations for delivering zero carbon buildings. J. Clean. Prod. 2018, 196, 1213–1226. [Google Scholar] [CrossRef]

- Zhao, X.; Pan, W. Delivering Zero Carbon Buildings: The Role of Innovative Business Models. Procedia Eng. 2015, 118, 404–411. [Google Scholar] [CrossRef]

- Zhao, X.; Pan, W. Co-productive interrelations between business model and zero carbon building. Built Environ. Proj. Asset Manag. 2017, 7, 353–365. [Google Scholar] [CrossRef]

- Zhao, X.; Pan, W.; Lu, W. Business model innovation for delivering zero carbon buildings. Sustain. Cities Soc. 2016, 27, 253–262. [Google Scholar] [CrossRef]

- Adams, K.T.; Osmani, M.; Thorpe, T.; Thornback, J. Circular economy in construction: Current awareness, challenges and enablers. Proc. Inst. Civ. Eng. Waste Resour. Manag. 2017, 170, 15–24. [Google Scholar] [CrossRef]

- Munaro, M.R.; Tavares, S.F.; Bragança, L. Towards circular and more sustainable buildings: A systematic literature review on the circular economy in the built environment. J. Clean. Prod. 2020, 260, 121134. [Google Scholar] [CrossRef]

- Górecki, J.; Núñez-Cacho, P.; Corpas-Iglesias, F.A.; Molina, V. How to convince players in construction market? Strategies for effective implementation of circular economy in construction sector. Cogent Eng. 2019, 6, 1–22. [Google Scholar] [CrossRef]

- Brege, S.; Stehn, L.; Nord, T. Business models in industrialized building of multi-storey houses. Constr. Manag. Econ. 2013, 32, 208–226. [Google Scholar] [CrossRef]

- Mayo, J. Solid Wood: Case Studies in Mass Timber Architecture, Technology and Design; Routeledge; Taylor & Francis: New York, NY, USA, 2015; p. 346. [Google Scholar]

- Höök, M.; Stehn, L.; Brege, S. The development of a portfolio of business models: A longitudinal case study of a building material company. Constr. Manag. Econ. 2015, 33, 334–348. [Google Scholar] [CrossRef]

- Hurmekoski, E.; Jonsson, R.; Nord, T. Context, drivers, and future potential for wood-frame multi-story construction in Europe. Technol. Soc. Chang. 2015, 99, 181–196. [Google Scholar] [CrossRef]

- Carmines, E.G.; Zeller, R.A. Reliability and Validity Assessment; Sage Publications: Beverly Hills, CA, USA, 1979. [Google Scholar]

- Cooper, H.; Hedges, L.V.; Valentine, J.C. The Handbook of Research Synthesis and Meta-Analysis; Russell Sage Foundation: New York, NY, USA, 2009; p. 632. [Google Scholar]

- Cooper, D.R.; Schindler, P.S. Business Research Methods, 6th ed.; Irwin/McGraw-Hill: New York, NY, USA, 1998. [Google Scholar]

- Ghauri, P.; Grønhaug, K.; Strange, R. Research Methods in Business Studies; FT Prentice Hall: Harlow, UK, 2005. [Google Scholar]

- Heckathorn, D.D. Comment: Snowball versus respondent-driven sampling. Soc. Methodol. 2011, 41, 355–366. [Google Scholar] [CrossRef]

- Poupart, J.; Deslauriers, J.-P.; Groulx, L.H.; Mayer, R.; Pires, A. La Recherche Qualitative: Enjeux Épistémologiques et Méthodologiques; Gaëtan Morin: Montréal, QC, Canada, 1997. [Google Scholar]

- Mucchielli, A. Dictionnaire des Méthodes Qualitatives en Sciences Humaines et Sociales; Colin: Paris, France, 1996. [Google Scholar]

- Bryman, A.; Bell, E. Business Research Methods, 4th ed.; Oxford University Press: Oxford, UK, 2015; p. 778. [Google Scholar]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for business Students; Pearson Education Limited: Harlow, UK, 2012; p. 696. [Google Scholar]

- Lessard-Hébert, M.; Goyette, G.; Boutin, G. La Recherche Qualitative, Fonde ments et Pratiques; Éditions Nouvelles: Montréal, QC, Canada, 1995; p. 124. [Google Scholar]

- Tedlock, B. Ethnography and Ethographic Representation. In Handbook of Qualitative Research, 2nd ed.; Denzin, N.K., Lincoln, Y.S., Eds.; SAGE Publications Inc.: Thousand Oaks, CA, USA, 2000; pp. 455–486. [Google Scholar]

- Fortin, A. L’observation Participante: Au Cœur de L’altérité. In Les Méthodes de la Recherche Qualitative; Deslauriers, J.-P., Ed.; Presses de L’université du Québec: Quebec City, QC, Canada, 1987; pp. 23–33. [Google Scholar]

- Mintzberg, H. An Emerging Strategy of "Direct" Research. Adm. Sci. Q. 1979, 24, 582. [Google Scholar] [CrossRef]

- L’Écuyer, R. Méthodologie de L’analyse Développementale de Contenu: Mé Thode GPS et Concept de Soi; Presses de l’Université du Québec: Quebec City, QC, Canada, 1990; p. 472. [Google Scholar]

- Herbert, J. Using Unpublished Data: Error and Remedies; SAGE Publications: Newbury Park, CA, USA, 1984; p. 65. [Google Scholar]

- Lincoln, Y.S.; Guba, E.G. Paradigmatic controversies, contradictions, and emerging confluencies. In Handbook of Qualitative Reasearch, 2nd ed.; Denzin, N.K., Lincoln, Y.S., Eds.; SAGE Publications Ltd.: Thousand Oaks, CA, USA, 2008; pp. 163–188. [Google Scholar]

- Silverman, D. Analysing Talk and Text. In Handbook of Qualitative Research, 2nd ed.; Denzin, N.K., Lincoln, Y.S., Eds.; SAGE Publications Inc.: Thousand Oaks, CA, USA, 2000; pp. 821–834. [Google Scholar]

- Barratt, M. Understanding the meaning of collaboration in the supply chain. Supply Chain Manag. Int. J. 2004, 9, 30–42. [Google Scholar] [CrossRef]

- Johnston, M.P. Secondary Data Analysis: A Method of which the Time Has Come. Qual. Quant. Methods Libr. 2014, 3, 619–626. [Google Scholar]

- Miles, M.B.; Huberman, A.M. Qualitative Data Analysis, 2nd ed.; SAGE Publications: Thousand Oaks, CA, USA, 1994; p. 408. [Google Scholar]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G. The PRISMA Group. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Med. 2009, 6, e1000097. [Google Scholar] [CrossRef]

- Booth, A. Unpacking your literature search toolbox: On search styles and tactics. Health Inf. Libr. J. 2008, 25, 313–317. [Google Scholar] [CrossRef]

- Nelson, J. Using conceptual depth criteria: Addressing the challenge of reaching saturation in qualitative research. Qual. Res. 2017, 17, 554–570. [Google Scholar] [CrossRef]

- Gosselin, A.; Blanchet, P.; Lehoux, N.; Cimon, Y. Collaboration Enables Innovative Timber Structure Adoption in Construction. Buildings 2018, 8, 183. [Google Scholar] [CrossRef]

- Abuzeinaba, A.; Arifa, M. Stakeholder engagement: A green business model indicator. In Proceedings of the 4th International Conference on Building Resilience, Salford Quays, UK, 8–10 September 2014; pp. 505–512. [Google Scholar]

- Churkina, G.; Organschi, A.; Reyer, C.P.O.; Ruff, A.; Vinke, K.; Liu, Z.; Reck, B.K.; Graedel, T.E.; Schellnhuber, H.J. Buildings as a global carbon sink. Nat. Sustain. 2020, 3, 269–276. [Google Scholar] [CrossRef]

- Farnsworth, C.B.; Beveridge, S.; Miller, K.R.; Christofferson, J.P. Application, Advantages, and Methods Associated with Using BIM in Commercial Construction. Int. J. Constr. Educ. Res. 2014, 11, 1–19. [Google Scholar] [CrossRef]

- Georgiadou, M.C. An overview of benefits and challenges of building information modelling (BIM) adoption in UK residential projects. Constr. Innov. 2019, 19, 298–320. [Google Scholar] [CrossRef]

- Toppinen, A.; Miilumäki, N.; Vihemäki, H.; Toivonen, R.; Lähtinen, K. Collaboration and shared logic for creating value-added in three Finnish wooden multi-storey building projects. Wood Mater. Sci. Eng. 2019, 14, 269–279. [Google Scholar] [CrossRef]

- Uusitalo, P.; Lavikka, R. Technology transfer in the construction industry. J. Technol. Transf. 2020, 1–30. [Google Scholar] [CrossRef]

- Lavikka, R.; Seppänen, O.; Peltokorpi, A.; Lehtovaara, J. Fostering process innovations in construction through industry–university consortium. Constr. Innov. 2020, 20, 569–586. [Google Scholar] [CrossRef]

- Pelli, P.; Lähtinen, K. Servitization and bioeconomy transitions: Insights on prefabricated wooden elements supply networks. J. Clean. Prod. 2020, 244, 118711. [Google Scholar] [CrossRef]

- Brady, T.; Davies, A.; Gann, D. Can integrated solutions business models work in construction? Build. Res. Inf. 2005, 33, 571–579. [Google Scholar] [CrossRef]

- Branco Pedro, J.; Meijer, F.; Visscher, H. Comparison of building permit procedures in European Union countries. In Proceedings of the COBRA 2011—RICS Construction and Property, Salford, Manchester, UK, 12–13 September 2011. [Google Scholar]

- Egan, J. Rethinking Construction; Department of the Environment, Transport and the Regions: London, UK, 1998; p. 38.

- Nawi, M.N.M.; Baluch, N.; Bahauddin, A.Y. Impact of Fragmentation Issue in Construction Industry: An Overview. In Proceedings of the MATEC Web of Conferences, Perak, Malaysia, 27 August 2014; EDP Sciences: Les Ulis, Île-de-France, France, 2014; Volume 15, p. 1009. [Google Scholar]

| Expert Categories | Number of Interviews | Countries |

|---|---|---|

| Architects | 9 | Austria, Denmark, England, Germany, Italy, Sweden, Switzerland |

| Structural engineers | 5 | Austria, England, Norway, Switzerland |

| Builders | 3 | Austria, England, Norway |

| Suppliers-Builders | 3 | Austria, Germany |

| Engineered timber product suppliers | 3 | Austria, Norway, Scotland |

| Wood board supplier | 1 * | Sweden |

| Timber building technology developers | 2 * | Scotland |

| Academics | 3 * | Austria, Germany, Scotland |

| Total | 29 | 9 countries |

| Building Blocks | Subdividing a search query in multiple variants and combining them using Boolean operators |

| Citation Pearl Growing | Scanning relevant article to find additional relevant terms to add to the search strategy |

| Successive Fractions | Searching databases using relevant terms found in relevant articles with the AND operator |

| Berry Picking | Scanning articles for relevant references, citations, authors and journals |

| Primary Keywords | Secondary Keywords | Tertiary Keywords | Quaternary Keywords |

|---|---|---|---|

| Construction | Building | Business models | Value proposition |

| Timber building | Collaboration | Clients | |

| Wood building | Collaborative business model | Costumers | |

| Shared business model | Channels | ||

| Value co-creation | Revenue | ||

| Innovation network | Resources | ||

| Innovation ecosystem | Activities | ||

| Value generating | Cost | ||

| Co-creation | Partnerships |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gosselin, A.; Cimon, Y.; Lehoux, N.; Blanchet, P. Main Features of the Timber Structure Building Industry Business Models. Buildings 2021, 11, 170. https://doi.org/10.3390/buildings11040170

Gosselin A, Cimon Y, Lehoux N, Blanchet P. Main Features of the Timber Structure Building Industry Business Models. Buildings. 2021; 11(4):170. https://doi.org/10.3390/buildings11040170

Chicago/Turabian StyleGosselin, Annie, Yan Cimon, Nadia Lehoux, and Pierre Blanchet. 2021. "Main Features of the Timber Structure Building Industry Business Models" Buildings 11, no. 4: 170. https://doi.org/10.3390/buildings11040170

APA StyleGosselin, A., Cimon, Y., Lehoux, N., & Blanchet, P. (2021). Main Features of the Timber Structure Building Industry Business Models. Buildings, 11(4), 170. https://doi.org/10.3390/buildings11040170