From Audits to Projects: Evaluating New York State Policy to Encourage Home Retrofit Projects

Abstract

:1. Introduction

1.1. Drivers and Barriers of Retrofits

1.2. Role of Intermediaries

1.3. Current Policy Landscape in New York State

1.4. Hypotheses

2. Materials and Methods

2.1. Research Site

2.2. Key Variables and Descriptive Statistics

2.3. Analytic Strategy

3. Results

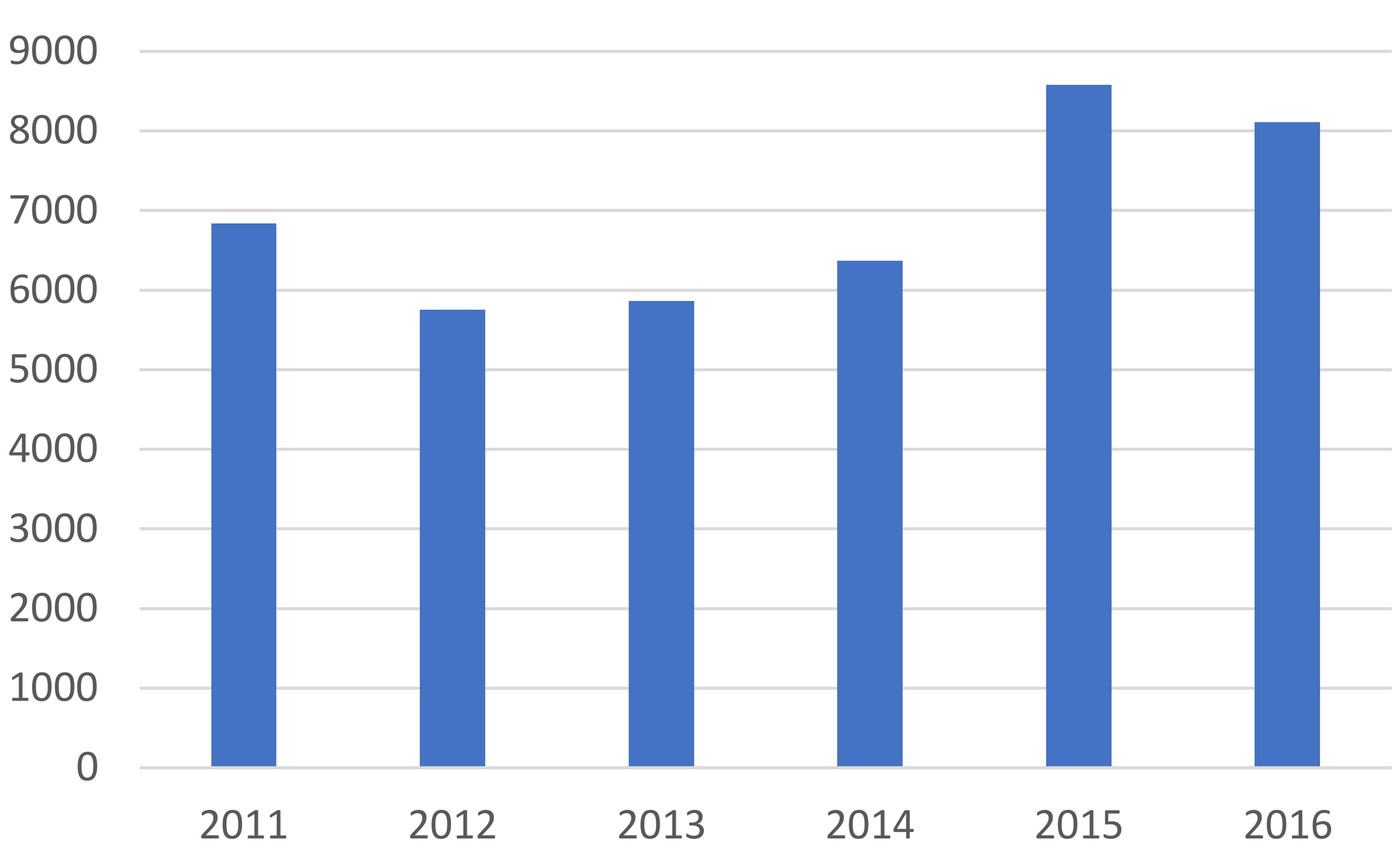

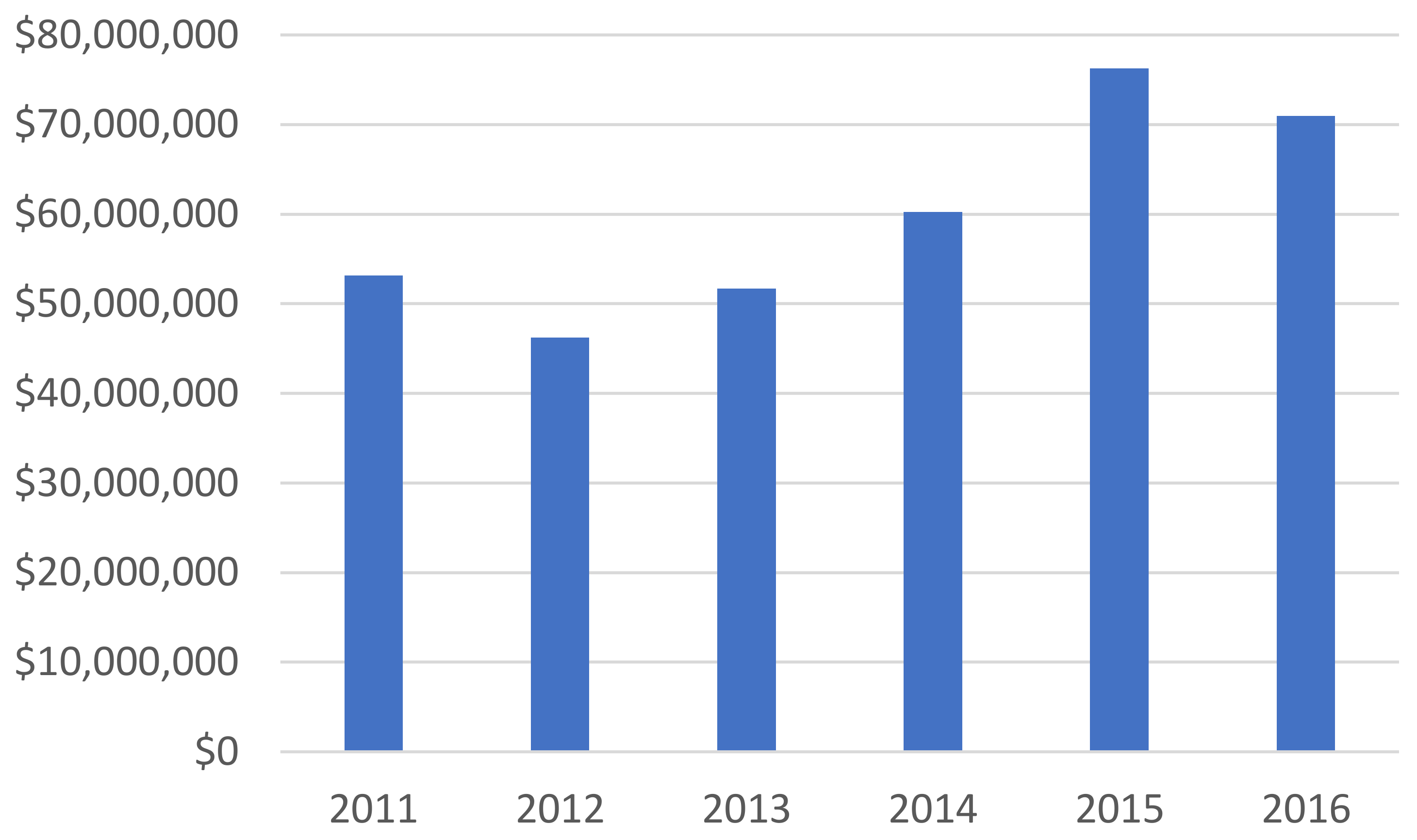

3.1. Descriptive Statistics

3.2. Regression Results

4. Discussion

4.1. Policy Implications

4.2. Limitations and Future Work

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Median Age | Median Income | % BA Degree or Higher | Pop. Density ppl/sq-ml | Ave. Household Size | Median Home Value | % Renter-Occupied Unit | Median Age of Structures | % Non-Hispanic Whites | Democratic Margin | % Undeclared Affiliation | % Limited English | Audits/cap × 10,000 | Projects/Capita |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Median income | 0.068 ** | |||||||||||||

| % BA degree or higher | 0.046 | 0.713 ** | ||||||||||||

| Pop. density ppl/sq-ml | −0.273 ** | 0.053 * | 0.276 ** | |||||||||||

| Ave. household size | −0.441 ** | 0.241 ** | −0.100 ** | −0.020 | ||||||||||

| Median home value | −0.056 * | 0.668 ** | 0.700 ** | 0.486 ** | 0.128 ** | |||||||||

| % Renter-occupied unit | −0.513 ** | −0.263 ** | 0.085 ** | 0.633 ** | −0.068 ** | 0.234 ** | ||||||||

| Median age of structures | −0.162 ** | −0.152 ** | −0.027 | 0.253 ** | −0.043 | 0.054 * | 0.328 ** | |||||||

| % Non-Hispanic Whites | 0.449 ** | 0.047 | −0.064 ** | −0.531 ** | −0.288 ** | −0.342 ** | −0.660 ** | −0.305 ** | ||||||

| Democratic margin | −0.371 ** | 0.004 | 0.258 ** | 0.581 ** | 0.058 * | 0.404 ** | 0.675 ** | 0.361 ** | −0.807 ** | |||||

| % Undeclared affiliation | 0.035 | 0.368 ** | 0.253 ** | −0.191 ** | 0.062 * | 0.198 ** | −0.200 ** | −0.197 ** | 0.179 ** | −0.124 ** | ||||

| % Limited English | −0.297 ** | −0.084 ** | 0.063 * | 0.555 ** | 0.245 ** | 0.346 ** | 0.578 ** | 0.250 ** | −0.696 ** | 0.592 ** | −0.078 ** | |||

| Audits/cap × 10,000 | 0.196 ** | 0.082 ** | 0.121 ** | −0.267 ** | −0.090 ** | −0.146 ** | −0.302 ** | −0.138 ** | 0.278 ** | −0.212 ** | 0.155 ** | −0.254 ** | ||

| Projects/capita | −0.012 | 0.014 | 0.037 | −0.155 ** | 0.010 | −0.124 ** | −0.037 | −0.130 ** | 0.112 ** | −0.094 ** | 0.115 ** | −0.137 ** | 0.462 ** | |

| Project costs/capita | 0.074 ** | 0.114 ** | 0.116 ** | −0.203 ** | 0.007 | −0.086 ** | −0.155 ** | −0.095 ** | 0.174 ** | −0.131 ** | 0.102 ** | −0.167 ** | 0.638 ** | 0.790 ** |

References

- Biggart, N.W. Constructing Green: The Social Structures of Sustainability; The MIT Press: Cambridge, MA, USA, 2013. [Google Scholar]

- Davis, H. The Culture of Building; Oxford University Press: Oxfordshire, UK, 2000. [Google Scholar]

- Karvonen, A. Towards systemic domestic retrofit: A social practices approach. Build. Res. Inf. 2013, 41, 563–574. [Google Scholar] [CrossRef] [Green Version]

- Arrigoni, A.; Zucchinelli, M.; Collatina, D.; Dotelli, G. Life cycle environmental benefits of a forward-thinking design phase for buildings: The case study of a temporary pavilion built for an international exhibition. J. Clean. Prod. 2018, 187, 974–983. [Google Scholar] [CrossRef]

- Zhang, L.; Wu, J.; Liu, H. Turning green into gold: A review on the economics of green buildings. J. Clean. Prod. 2018, 172, 2234–2245. [Google Scholar] [CrossRef]

- Hirst, E.; Brown, M. Closing the efficiency gap: Barriers to the efficient use of energy. Resour. Conserv. Recycl. 1990, 3, 267–281. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Stavins, R.N. The energy paradox and the diffusion of conservation technology. Resour. Energy Econ. 1994, 16, 91–122. [Google Scholar] [CrossRef]

- Thompson, P.B. Evaluating energy efficiency investments: Accounting for risk in the discounting process. Energy Policy 1997, 25, 989–996. [Google Scholar] [CrossRef]

- Owen, A.; Mitchell, G. Outside influence–Some effects of retrofit installers and advisors on energy behaviours in households. Indoor Built Environ. 2015, 24, 925–936. [Google Scholar] [CrossRef] [Green Version]

- Bardhan, A.; Jaffee, D.; Kroll, C.; Wallace, N. Energy efficiency retrofits for U.S. housing: Removing the bottlenecks. Reg. Sci. Urban Econ. 2014, 47, 45–60. [Google Scholar] [CrossRef] [Green Version]

- New York State Homes and Community Renewal. Weatherization Assistance Program. New York State. Available online: https://hcr.ny.gov/weatherization-assistance-program-0 (accessed on 9 September 2021).

- Boucher, J.L.; Araújo, K.; Hewitt, E. Do education and income drive energy audits? A socio-spatial analysis of New York State. Resour. Conserv. Recycl. 2018, 136, 355–366. [Google Scholar] [CrossRef]

- Risholt, B.; Berker, T. Success for energy efficient renovation of dwellings—Learning from private homeowners. Energy Policy 2013, 61, 1022–1030. [Google Scholar] [CrossRef] [Green Version]

- Bjørneboe, M.G.; Svendsen, S.; Heller, A. Initiatives for the energy renovation of single-family houses in Denmark evaluated on the basis of barriers and motivators. Energy Build. 2018, 167, 347–358. [Google Scholar] [CrossRef]

- Wilson, C.; Pettifor, H.; Chryssochoidis, G. Quantitative modelling of why and how homeowners decide to renovate energy efficiently. Appl. Energy 2018, 212, 1333–1344. [Google Scholar] [CrossRef]

- Kerr, N.; Gouldson, A.; Barrett, J. Holistic narratives of the renovation experience: Using Q-methodology to improve understanding of domestic energy retrofits in the United Kingdom. Energy Res. Soc. Sci. 2018, 42, 90–99. [Google Scholar] [CrossRef]

- Wilson, C.; Crane, L.; Chryssochoidis, G. Why do homeowners renovate energy efficiently? Contrasting perspectives and implications for policy. Energy Res. Soc. Sci. 2015, 7, 12–22. [Google Scholar] [CrossRef] [Green Version]

- Jaffe, A.B.; Stavins, R.N. The energy-efficiency gap What does it mean? Energy Policy 1994, 22, 804–810. [Google Scholar] [CrossRef]

- Cajias, M.; Fuerst, F.; Bienert, S. Tearing down the information barrier: The price impacts of energy efficiency ratings for buildings in the German rental market. Energy Res. Soc. Sci. 2019, 47, 177–191. [Google Scholar] [CrossRef]

- Cuadrado-Ballesteros, B.; Martínez-Ferrero, J.; García-Sánchez, I.M. Mitigating information asymmetry through sustainability assurance: The role of accountants and levels of assurance. Int. Bus. Rev. 2017, 26, 1141–1156. [Google Scholar] [CrossRef]

- Phillips, Y. Landlords versus tenants: Information asymmetry and mismatched preferences for home energy efficiency. Energy Policy 2012, 45, 112–121. [Google Scholar] [CrossRef]

- Fuerst, F.; Warren-Myers, G. Does voluntary disclosure create a green lemon problem? Energy-efficiency ratings and house prices. Energy Econ. 2018, 74, 1–12. [Google Scholar] [CrossRef]

- Carroll, J.; Aravena, C.; Denny, E. Low energy efficiency in rental properties: Asymmetric information or low willingness-to-pay? Energy Policy 2016, 96, 617–629. [Google Scholar] [CrossRef]

- Cayla, J.-M.; Maizi, N.; Marchand, C. The role of income in energy consumption behaviour: Evidence from French households data. Energy Policy 2011, 39, 7874–7883. [Google Scholar] [CrossRef]

- Haq, G.; Weiss, M. Time preference and consumer discount rates-Insights for accelerating the adoption of efficient energy and transport technologies. Technol. Forecast. Soc. Chang. 2018, 137, 76–88. [Google Scholar] [CrossRef]

- Ansar, J.; Sparks, R. The experience curve, option value, and the energy paradox. Energy Policy 2009, 37, 1012–1020. [Google Scholar] [CrossRef]

- Awerbuch, S.; Deehan, W. Do consumers discount the future correctly? A market-based valuation of residential fuel switching. Energy Policy 1995, 23, 57–69. [Google Scholar] [CrossRef]

- Hewitt, E.L.; Andrews, C.J.; Senick, J.A.; Wener, R.E.; Krogmann, U.; Allacci, M.S. Distinguishing between green building occupants’ reasoned and unplanned behaviours. Build. Res. Inf. 2016, 44, 119–134. [Google Scholar] [CrossRef]

- Ouellette, J.A.; Wood, W. Habit and intention in everyday life: The multiple processes by which past behavior predicts future behavior. Psychol. Bull. 1998, 124, 54–74. [Google Scholar] [CrossRef]

- Verplanken, B.; Wood, W. Interventions to Break and Create Consumer Habits. J. Public Policy Mark. 2006, 25, 90–103. [Google Scholar] [CrossRef] [Green Version]

- Boucher, J.L. Culture, Carbon, and Climate Change: A Class Analysis of Climate Change Belief, Lifestyle Lock-in, and Personal Carbon Footprint. Soc. Ekol. 2016, 25, 53–80. [Google Scholar] [CrossRef] [Green Version]

- Druckman, A.; Jackson, T. The carbon footprint of UK households 1990–2004: A socio-economically disaggregated, quasi-multi-regional input–output model. Ecol. Econ. 2009, 68, 2066–2077. [Google Scholar] [CrossRef] [Green Version]

- Gatersleben, B.; Steg, L.; Vlek, C. Measurement and Determinants of Environmentally Significant Consumer Behavior. Environ. Behav. 2002, 34, 335–362. [Google Scholar] [CrossRef]

- Klöckner, C.A.; Nayum, A. Psychological and structural facilitators and barriers to energy upgrades of the privately owned building stock. Energy 2017, 140, 1005–1017. [Google Scholar] [CrossRef]

- Ingle, A.; Moezzi, M.; Lutzenhiser, L.; Hathaway, Z.L.; Lutzenhiser, S.; Van Clock, J.; Peters, J.; Smith, R.; Heslam, D.; Diamond, R. Behavioral Perspectives on Home Energy Audits: The Role of Auditors, Labels, Reports, and Audit Tools on Homeowner Decision-Making (LBNL-5715E); Lawrence Berkeley National Lab: Berkeley, CA, USA, 2012.

- Palmer, K.; Walls, M.; O’Keeffe, L. Putting information into action: What explains follow-up on home energy audits? Resour. Future Discuss. Pap. 2015, 15–34. [Google Scholar] [CrossRef]

- Van de Grift, S.; Schauer, L. A Hand to Hold: A Holistic Approach to Addressing Barriers in the Home Retrofit Market; ACEEE Summer Study on Energy Efficiency in Buildings: Washington, DC, USA, 2010; Available online: https://www.aceee.org/files/proceedings/2010/data/papers/2298.pdf (accessed on 22 March 2020).

- Aspeteg, J.; Mignon, I. Intermediation services and adopter expectations and demands during the implementation of renewable electricity innovation–Match or mismatch? J. Clean. Prod. 2019, 214, 837–847. [Google Scholar] [CrossRef]

- Gliedt, T.; Hoicka, C.E.; Jackson, N. Innovation intermediaries accelerating environmental sustainability transitions. J. Clean. Prod. 2018, 174, 1247–1261. [Google Scholar] [CrossRef]

- Kivimaa, P.; Boon, W.; Hyysalo, S.; Klerkx, L. Towards a typology of intermediaries in sustainability transitions: A systematic review and a research agenda. Res. Policy 2019, 48, 1062–1075. [Google Scholar] [CrossRef]

- Owen, A.; Mitchell, G.; Gouldson, A. Unseen influence—The role of low carbon retrofit advisers and installers in the adoption and use of domestic energy technology. Energy Policy 2014, 73, 169–179. [Google Scholar] [CrossRef]

- Wade, F.; Hitchings, R.; Shipworth, M. Understanding the missing middlemen of domestic heating: Installers as a community of professional practice in the United Kingdom. Energy Res. Soc. Sci. 2016, 19, 39–47. [Google Scholar] [CrossRef] [Green Version]

- Wade, F.; Shipworth, M.; Hitchings, R. Influencing the central heating technologies installed in homes: The role of social capital in supply chain networks. Energy Policy 2016, 95, 52–60. [Google Scholar] [CrossRef] [Green Version]

- De Wilde, M. The sustainable housing question: On the role of interpersonal, impersonal and professional trust in low-carbon retrofit decisions by homeowners. Energy Res. Soc. Sci. 2019, 51, 138–147. [Google Scholar] [CrossRef]

- NYSERDA. Homes and Residents. Albany, NY. 2019. Available online: https://www.nyserda.ny.gov/residents-and-homeowners (accessed on 9 September 2021).

- Neuman, W. Big Buildings Hurt the Climate. New York City Hopes to Change That. The New York Times. 17 April 2019. Available online: https://www.nytimes.com/2019/04/17/nyregion/nyc-energy-laws.html (accessed on 9 September 2021).

- New York City Mayor’s Office of Sustainability/ Greener, Greater Buildings Plan. 2018. Available online: http://www.nyc.gov/html/gbee/html/plan/plan.shtml (accessed on 9 September 2021).

- Burgess, M. Personal carbon allowances: A revised model to alleviate distributional issues. Ecol. Econ. 2016, 130, 316–327. [Google Scholar] [CrossRef]

- Wilson, J.; Tyedmers, P.; Spinney, J.E.L. An Exploration of the Relationship between Socioeconomic and Well-Being Variables and Household Greenhouse Gas Emissions. J. Ind. Ecol. 2013, 17, 880–891. [Google Scholar] [CrossRef]

- (NYSERDA) New York State Energy and Research Development Authority. Albany, NY, “Data,” 2017. Available online: https://www.nyserda.ny.gov/about/publications/program-planning-status-and-evaluation-reports/evaluation-contractor-reports/2017-reports (accessed on 9 September 2021).

- (American Community Survey) ACS. US Census Bureau, American Community Survey, 5-Year Estimates, 2011–2015. United States Census Bur. 2016. Available online: https://www.census.gov/programs-surveys/acs/technical-documentation/table-and-geography-changes/2015/5-year.html (accessed on 15 May 2019).

- (New York Department of Motor Vehicles) NYDMV. Vehicle, Snowmobile, and Boat Registrations | Open Data NY. Available online: https://data.ny.gov/Transportation/Vehicle-Snowmobile-and-Boat-Registrations/w4pv-hbkt (accessed on 2 January 2017).

- (New York State Board of Elections) NYSBE. Foil Requests. 2016. Available online: https://www.elections.ny.gov/FoilRequests.html (accessed on 25 July 2017).

- Gillingham, K.; Sweeney, J. Barriers to Implementing Low-Carbon Technologies. Clim. Chang. Econ. 2012, 3, 1. [Google Scholar] [CrossRef]

- Davis, L.W. Evaluating the Slow Adoption of Energy Efficient Investments: Are Renters Less Likely to have Energy Efficient Appliances? In The Design and Implementation of US Climate Policy; Fullerton, D., Wolfram, C., Eds.; University of Chicago Pres: Chicago, IL, USA, 2011; pp. 301–316. [Google Scholar]

- Portes, A. The Two Meanings of Social Capital. Sociol. Forum 2000, 15, 1. [Google Scholar] [CrossRef]

- Portes, A.; Sensenbrenner, J. Embeddedness and Immigration: Notes on the Social Determinants of Economic Action. Am. J. Sociol. 1993, 98, 1320–1350. [Google Scholar] [CrossRef]

- Grubesic, T.H. Zip codes and spatial analysis: Problems and prospects. Socioecon. Plann. Sci. 2008, 42, 129–149. [Google Scholar] [CrossRef]

- Grubesic, T.H.; Matisziw, T.C. On the use of ZIP codes and ZIP code tabulation areas (ZCTAs) for the spatial analysis of epidemiological data. Int. J. Health Geogr. 2006, 5, 58. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- GeoDa. GeoDa: An Introduction to Spatial Data Analysis. GeoDa on Github. 2019. Available online: https://geodacenter.github.io/ (accessed on 28 November 2019).

- ACS. US Census Bureau, American Community Survey, 5-Year Estimates, 2006–2010, TIGER/Line® with Data. 2015. Available online: https://www.census.gov/geo/maps-data/data/tiger-data.html (accessed on 15 October 2014).

- Csutora, M. One More Awareness Gap? The Behaviour–Impact Gap Problem. J. Consum. Policy 2012, 35, 145–163. [Google Scholar] [CrossRef]

- Shahan, Z. Tesla Model 3 Outsold BMW, Mercedes, Audi, & Lexus Competitors In 2nd Quarter In USA—By A Landslide! CleanTechnica. 10 August 2019. Available online: https://cleantechnica.com/2019/08/10/tesla-model-3-outsold-bmw-mercedes-audi-lexus-competitors-in-2nd-quarter-in-usa-by-a-landslide/ (accessed on 22 October 2021).

| Variable | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| Square miles | 28.0 | 36.5 | 0.0 | 453.4 |

| Population | 11,580 | 17,716 | 17 | 109,931 |

| Median age | 42.6 | 7.3 | 16 | 82 |

| % BA degree or higher | 29.5 | 17.1 | 0 | 100 |

| Median income ($US) | 64,100 | 26,911 | 10,675 | 216,250 |

| % Non-Hispanic Whites | 80.9 | 23.8 | 0.6 | 100 |

| % Hispanic | 7.8 | 11.8 | 0 | 74.5 |

| % Black | 5.8 | 12.9 | 0 | 89.4 |

| % Asian | 3.2 | 6.7 | 0 | 73.3 |

| % Other race | 2.2 | 3.7 | 0 | 90.1 |

| Pop. density people/sq-ml | 5657 | 16,894 | 0.43 | 146,388 |

| Median home value | 253,859 | 219,161 | 28,200 | 1,718,800 |

| Avg. household size | 2.6 | 0.4 | 1.2 | 5.1 |

| % Renter-occupied units | 28.2 | 20.8 | 0 | 100 |

| Median age of structures | 57.0 | 13.6 | 14.0 | 80.0 |

| % Limited English | 2.8 | 5.6 | 0 | 53.6 |

| Democrat affiliation | 35.8 | 15.5 | 9.6 | 100 |

| Republican affiliation | 33.7 | 13.4 | 0 | 75.0 |

| Democratic margin | 2.1 | 28.3 | −58.1 | 100 |

| % Undeclared affiliation | 22.5 | 4.9 | 0 | 45.4 |

| % Green affiliation | 0.29 | 0.28 | 0 | 3.8 |

| % Other | 8.0 | 2.6 | 0 | 22.9 |

| Installed solar kW/capita × 10,000 | 404 | 718 | 0 | 12,846.6 |

| Registered Elec cars/cap × 10,000 | 8.7 | 13.3 | 0 | 146.3 |

| # of audits/capita | 0.0078 | 0.0079 | 0 | 0.075 |

| Contractors/county pop × 10,000 | 0.15 | 0.12 | 0 | 0.49 |

| # of projects/capita | 0.0029 | 0.0051 | 0 | 0.134 |

| Cost of projects/capita ($US) | 26.8 | 35.2 | 0 | 465.9 |

| Projects/audit ratio | 0.354 | 0.664 | 0 | 20.3 |

| Cost of projects/audit ratio ($US) | 3348.18 | 2783.72 | 0 | 69,180.58 |

| Variables | Model 1 Zip Code Characteristics 2 | Model 2 Zip Code and Autocorrelation 2 |

|---|---|---|

| (Constant) | -- *** | -- *** |

| Median age | 0.050 ** | 0.024 |

| % BA degree or higher | 0.189 *** | 0.102 *** |

| Median income | 0.001 | −0.030 |

| Population density ppl/sq-ml | −0.404 *** | −0.263 *** |

| Average household size | 0.055 ** | 0.027 |

| Median home value | −0.268 *** | −0.062 ** |

| % Renter-occupied unit | −0.192 *** | −0.160 *** |

| Median age of structures | 0.053 *** | 0.046 *** |

| % Non-Hispanic Whites | 0.011 | 0.098 *** |

| Democratic margin | −0.039 | 0.015 |

| % Undeclared affiliation | 0.043 ** | −0.031 * |

| % Green affiliation | 0.048 *** | −0.007 |

| % Other | −0.067 *** | 0.010 |

| % Limited English | −0.108 *** | −0.045 ** |

| Contractors/County Pop | 0.118 *** | 0.106 *** |

| Total installed solar kW/cap | 0.079 *** | 0.098 *** |

| Total adopted 2017 EV/cap | 0.104 *** | 0.009 |

| Lambda | 0.757 *** | |

| R2 | 0.667 | 0.817 |

| Akaike info criterion | 2939.4 | 2189.9 |

| Moran’s I | 0.444 *** | −0.084 *** |

| Number of Observations | 1670 | 1667 |

| Count of Projects 2 | Cost of Projects 2 | |||

|---|---|---|---|---|

| Variable | Model 3 Base Model | Model 4 Spatial Auto-Correlation | Model 5 Base Model | Model 6 Spatial Auto-Correlation |

| (Constant) | -- | -- * | -- | -- |

| Median age | 0.039 ** | 0.039 ** | −0.026 | −0.017 |

| % BA degree or higher | 0.040 | 0.002 | 0.062 | 0.076 * |

| Median income | 0.105 *** | 0.065 ** | 0.112 ** | 0.094 ** |

| Population density ppl/sq-ml | −0.362 *** | −0.303 *** | −0.314 *** | −0.279 *** |

| Average household size | 0.054 *** | 0.062 *** | 0.102 *** | 0.072 ** |

| Median home value | −0.183 *** | −0.142 *** | −0.121 *** | −0.120 *** |

| % Renter-occupied unit | 0.046 * | 0.020 | −0.016 | 0.000 |

| Median age of structures | 0.053 *** | 0.040 *** | 0.058 ** | 0.019 ** |

| Audits/cap × 10,000 | 0.381 *** | 0.339 *** | 0.355 *** | 0.334 *** |

| % Non-Hispanic Whites | 0.093 *** | 0.138 *** | −0.193 *** | −0.144 *** |

| Democratic margin | 0.000 | 0.029 | −0.043 | −0.036 |

| % Undeclared affiliation | −0.026 | −0.014 | 0.039 | 0.054 * |

| % Green affiliation | −0.029 ** | −0.026 ** | −0.017 | −0.017 |

| % Other | 0.034 * | 0.035 * | 0.059 * | 0.048 |

| % Limited English | −0.148 *** | −0.101 *** | 0.031 | 0.053 |

| Contractors/County Pop | 0.131 *** | 0.108 *** | 0.061 *** | 0.043 |

| Total installed solar kW/cap | 0.008 | 0.039 *** | −0.030 | −0.041 * |

| Total adopted 2017 EV/cap | 0.042 *** | 0.016 | 0.006 | −0.011 |

| Lambda | 0.523 *** | 0.318 *** | ||

| R2 | 0.735 | 0.785 | 0.320 | 0.361 |

| Akaike info criterion | 2561.5 | 2311.6 | 4133.2 | 4061.9 |

| Moran’s I | 0.258 *** | −0.036 ** | 0.129 *** | −0.018 * |

| Number of Observations | 1670 | 1667 | 1670 | 1667 |

| Variable | Count of Projects per Audit 2 | Cost of Projects per Audit 2 | ||

|---|---|---|---|---|

| Model 7 Base Model | Model 8 Spatial Auto-Correlation | Model 9 Base Model | Model 10 Spatial Auto-Correlation | |

| (Constant) | -- | -- | -- | -- |

| Median age | −0.091 *** | −0.084 ** | −0.061 * | −0.056 |

| % BA degree or higher | 0.073 | 0.069 | 0.076 * | 0.093 ** |

| Median income | 0.039 | 0.016 | 0.077 | 0.062 |

| Pop. density ppl/sq-ml | −0.165 *** | −0.144 *** | −0.201 *** | −0.179 *** |

| Ave. household size | 0.035 | 0.026 | 0.089 ** | 0.057 |

| Median home value | −0.090 * | −0.104 ** | −0.074 | −0.079 |

| % Renter-occupied unit | 0.002 | −0.009 | −0.056 | −0.038 |

| Median age of structures | 0.017 | −0.001 | 0.063** | 0.028 |

| Audits/cap × 10,000 | 0.066 ** | 0.060 ** | 0.230 *** | 0.221 *** |

| % Non-Hispanic Whites | −0.002 | 0.013 | −0.219 *** | −0.188 *** |

| Democratic margin | 0.102 ** | 0.110 ** | −0.014 | −0.017 |

| % Undeclared affiliation | −0.076 *** | −0.046 | 0.014 | 0.030 |

| % Green affiliation | −0.073 *** | −0.058 ** | −0.024 | −0.025 |

| % Other | 0.085 ** | 0.061 | 0.087 ** | 0.066 * |

| % Limited English | 0.034 | 0.050 | 0.100 *** | 0.109 *** |

| Contractors/County Pop | 0.150 *** | 0.117 *** | 0.038 | 0.020 |

| Total installed solar kW/cap | −0.081 *** | −0.064 ** | −0.045 * | −0.058 ** |

| Total adopted 2017 EV/cap | −0.002 | −0.008 | −0.008 | −0.020 |

| Lambda | 0.310 *** | 0.276 *** | ||

| R2 | 0.084 | 0.144 | 0.141 | 0.180 |

| Akaike info criterion | 4629.3 | 4549.6 | 4523.2 | 4471.1 |

| Moran’s I | 0.148 *** | −0.008 | 0.110 *** | −0.013 |

| Number of Observations | 1670 | 1667 | 1670 | 1667 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hewitt, E.L.; Boucher, J.L. From Audits to Projects: Evaluating New York State Policy to Encourage Home Retrofit Projects. Buildings 2021, 11, 631. https://doi.org/10.3390/buildings11120631

Hewitt EL, Boucher JL. From Audits to Projects: Evaluating New York State Policy to Encourage Home Retrofit Projects. Buildings. 2021; 11(12):631. https://doi.org/10.3390/buildings11120631

Chicago/Turabian StyleHewitt, Elizabeth L., and Jean Léon Boucher. 2021. "From Audits to Projects: Evaluating New York State Policy to Encourage Home Retrofit Projects" Buildings 11, no. 12: 631. https://doi.org/10.3390/buildings11120631

APA StyleHewitt, E. L., & Boucher, J. L. (2021). From Audits to Projects: Evaluating New York State Policy to Encourage Home Retrofit Projects. Buildings, 11(12), 631. https://doi.org/10.3390/buildings11120631