Malliavin Differentiability and Density Smoothness for Non-Lipschitz Stochastic Differential Equations

Abstract

1. Introduction

1.1. Research Background

1.2. Notation and Definitions

1.2.1. Probability Spaces and Stochastic Processes

- (Ω, , ℙ): Complete probability space.

- {Wt}t≥0: Standard one-dimensional Brownian motion.

- {t}t≥0: Natural filtration of the Brownian motion, augmented with ℙ-null sets.

- Xt: Solution process to the SDE under consideration.

- 𝔼[·]: Expectation with respect to measure ℙ.

1.2.2. Function Spaces

- C∞(ℝ): Space of infinitely differentiable functions on ℝ.

- L2(Ω): Space of square-integrable random variables.

- H1[0, T]: Sobolev space of absolutely continuous functions φ: [0, T] → ℝ with ∈ L2[0, T].

- AC [0, T]: Space of absolutely continuous functions on [0, T].

- k,p: k-th order Malliavin–Sobolev space with integrability exponent p.

1.2.3. Malliavin Calculus Notation

- D: Malliavin derivative operator.

- Ds: Malliavin derivative at time s.

- δ: Skorokhod integral operator (adjoint of D).

- H = L2([0, T]): Cameron–Martin space.

- ⟨·,·⟩h: Inner product in Cameron–Martin space.

- Ys,t: Variational process solution to linearized SDE.

1.2.4. Large Deviation Theory

- I(φ): Rate function (action functional) for path φ.

- LDP: Large deviation principle.

- ε: Small noise parameter in scaled SDE dXt(ε) = b(Xt(ε))dt + √ε σ(Xt(ε))dWt.

1.2.5. SDE Coefficients and Conditions

- b: ℝ → ℝ: Drift coefficient.

- σ: ℝ → ℝ: Diffusion coefficient.

- α: Hölder continuity exponent for σ.

- β: Growth exponent in Assumption (H4).

- γ: Exponent in moment estimates for Malliavin derivatives.

1.2.6. Model-Specific Notation

- CIR: Cox–Ingersoll–Ross model.

- CEV: Constant Elasticity of Variance model.

- SIR: Susceptible–Infected–Recovered epidemic model.

- rt: Interest rate in CIR model.

- St: Stock price in CEV model.

- Nt, It: Population size, infected individuals in biological models.

2. Comparison with Existing Research and Main Contributions

3. Materials and Basic Assumptions

3.1. Definition of Stochastic Differential Equations

3.2. Basic Assumptions

3.3. Existence and Uniqueness of Solutions

- When α = 1/2, ;

- When α > 1/2, du diverges at the lower limit.

4. Malliavin Calculus Fundamentals

- Treat diverse models (CIR, CEV, population dynamics) within a single framework;

- Transfer techniques between different application domains;

- Identify the minimal assumptions needed for each type of result;

- Provide explicit formulas suitable for numerical implementation.

4.1. Basic Concepts of Malliavin Calculus

4.2. Basic Properties of Malliavin Derivatives

4.3. Skorokhod Integral

5. Malliavin Differentiability of Solutions

5.1. Main Result on Malliavin Differentiability

5.2. Detailed Proof of Theorem 3

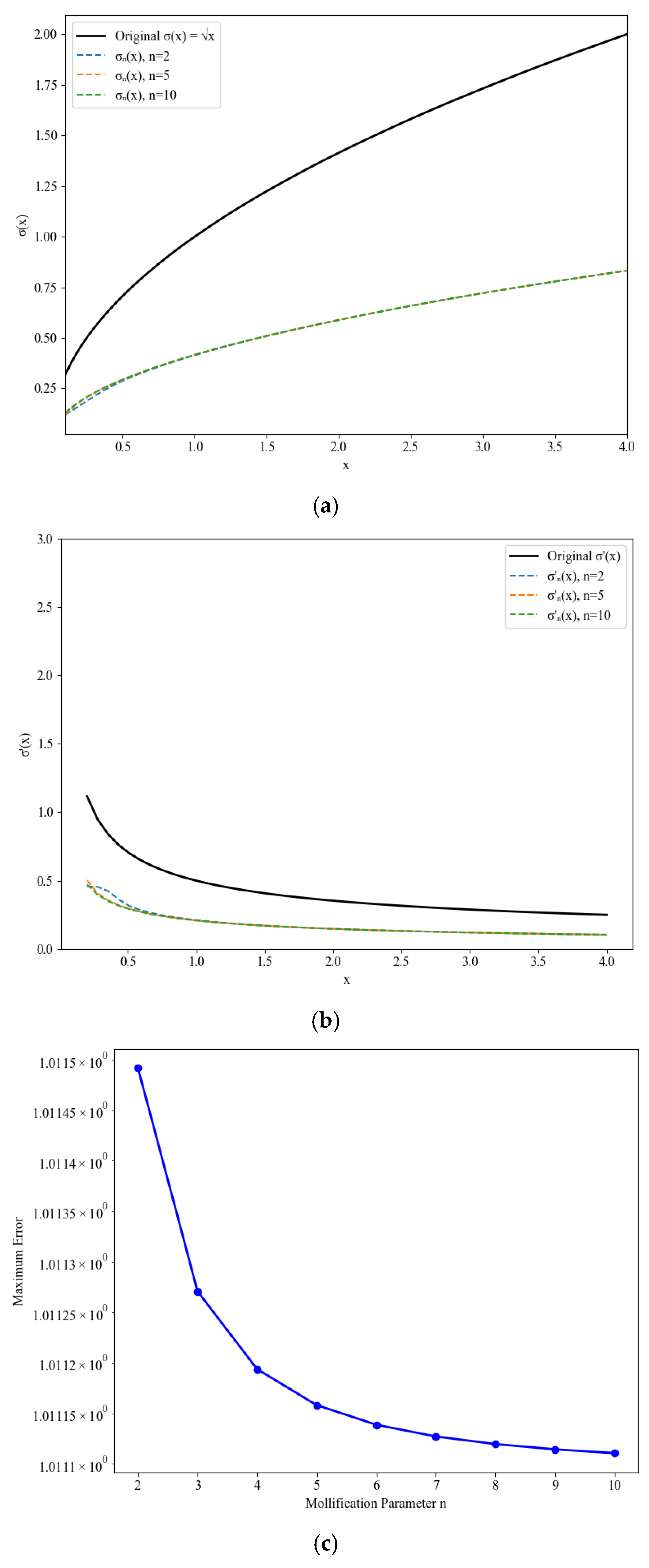

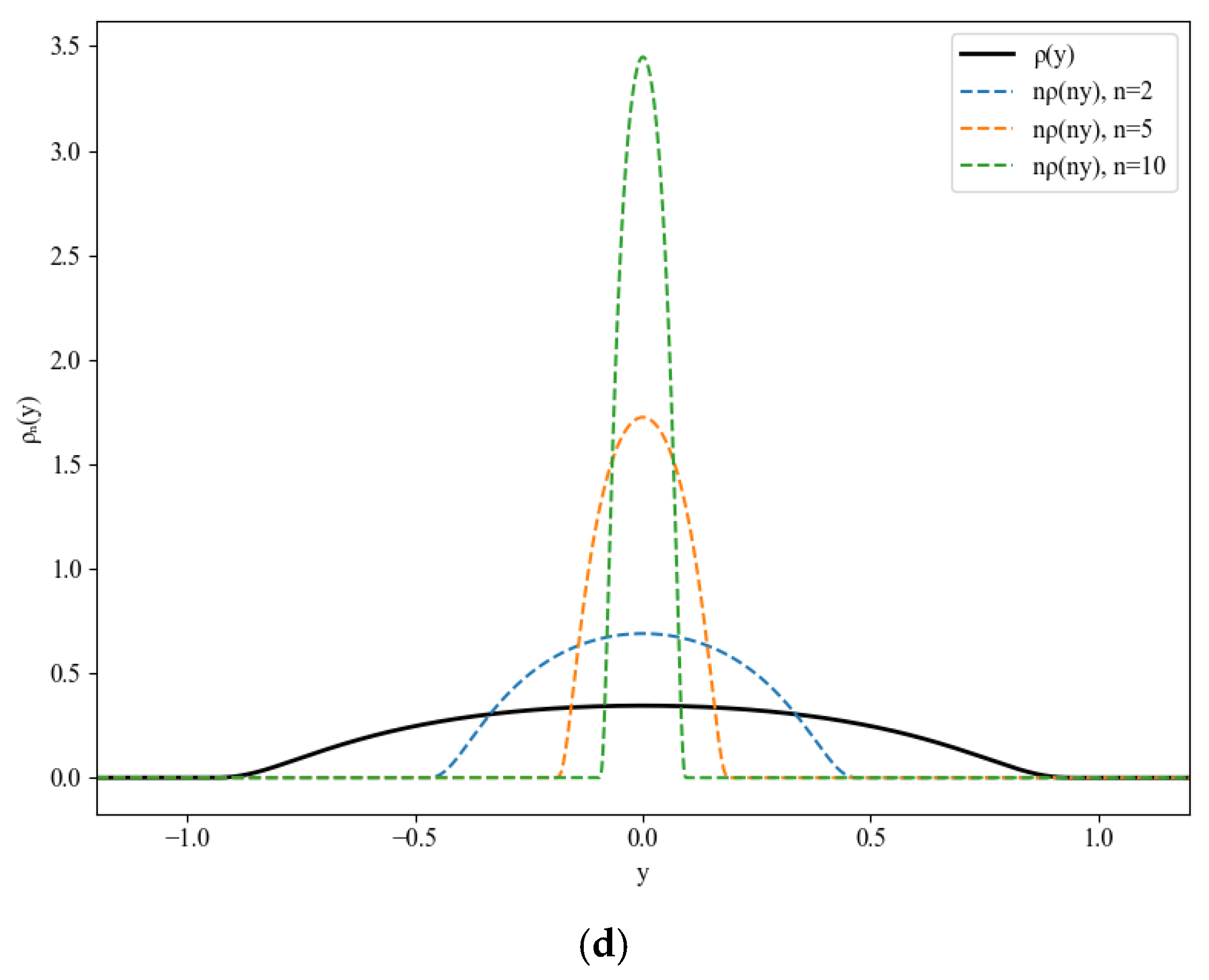

- (1)

- bn, σn ∈ C∞(ℝ);

- (2)

- |bn(x)| + |σn (x)| ≤ K(1 + |x|) uniformly in n;

- (3)

- bn → b and σn → σ uniformly on compact sets as n → ∞.

5.3. Estimates for Malliavin Derivatives

6. Existence and Smoothness Analysis of Density Functions

6.1. Existence of Density Functions

6.2. Smoothness of Density Functions

6.3. Application of Norris Lemma

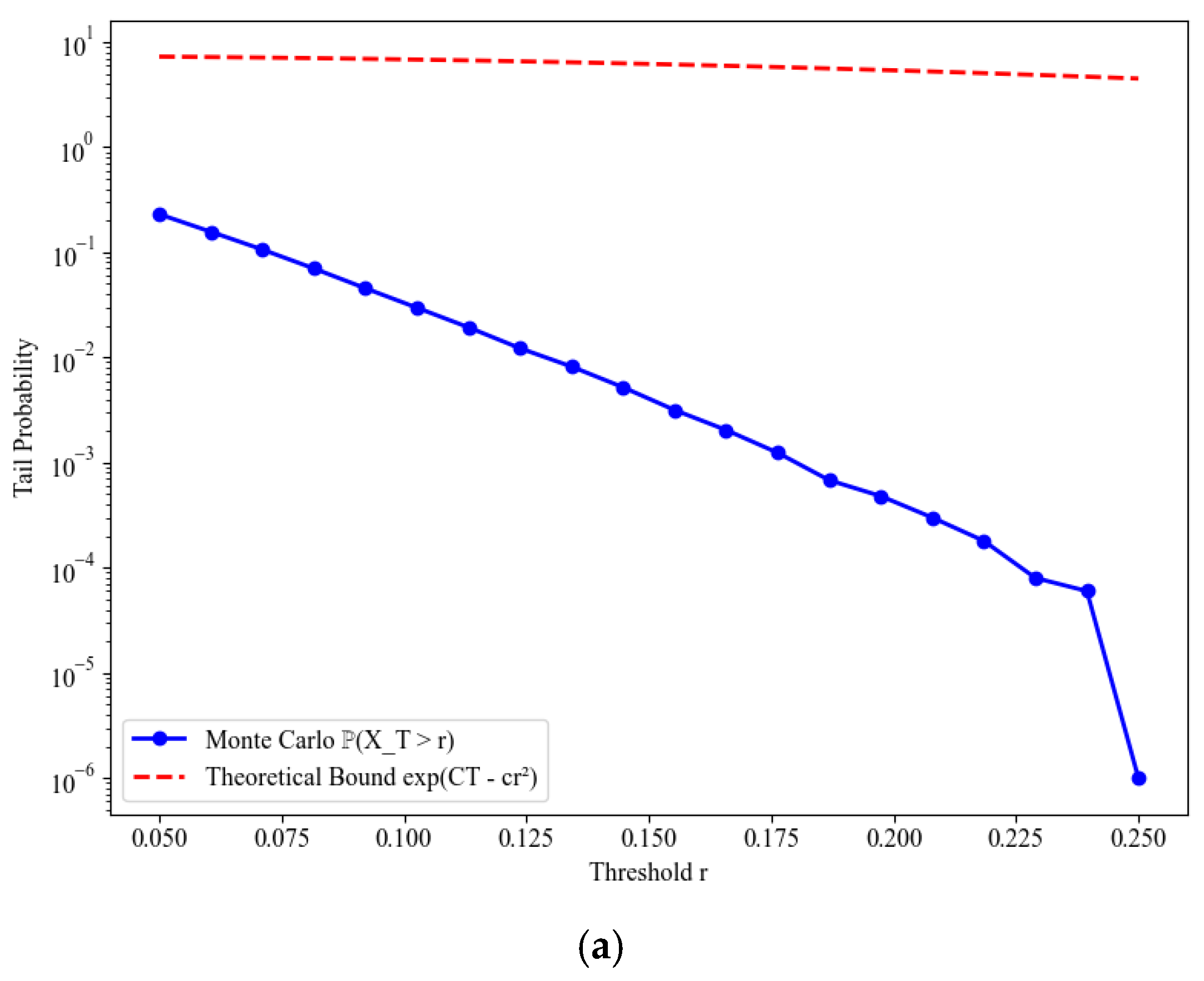

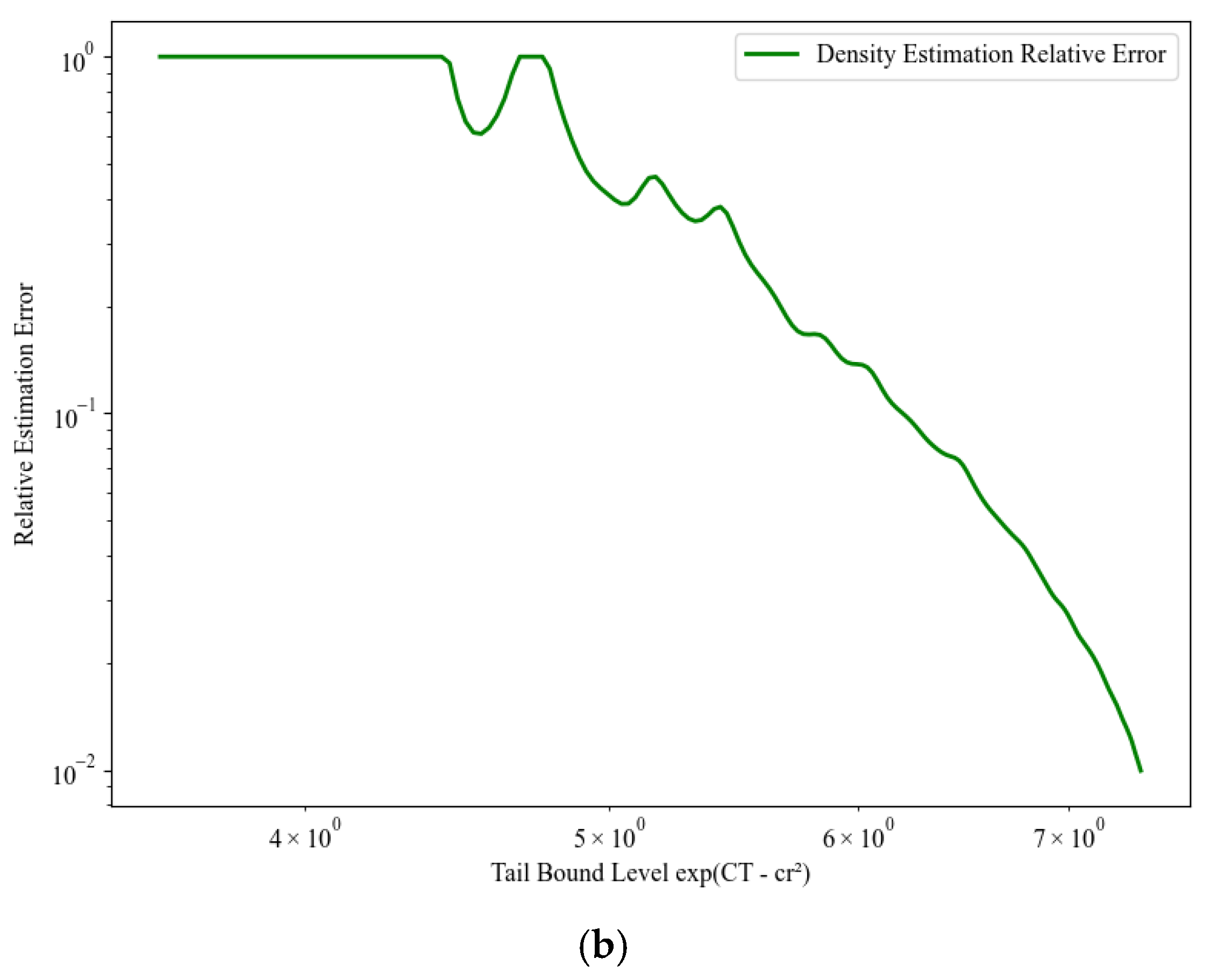

7. Large Deviation Theory and Density Large Deviations

- Time scaling: Small noise asymptotics uses fixed time T with ε → 0, while density asymptotics considers t → ∞ with fixed noise intensity.

- Rate functions: The small noise rate function I(φ) is path-dependent and measures deviation from deterministic dynamics over [0, T], while It(x) is endpoint-dependent and measures the cost to reach x at time t.

- Mathematical techniques: Small noise analysis employs Girsanov transformation and weak convergence methods, while density asymptotics use Varadhan’s integral lemma and heat kernel estimates.

- Applications: Small noise results are crucial for understanding metastability and rare transitions, while density asymptotics provide tail estimates essential for risk management and extreme value analysis.

7.1. Large Deviation Principle for Solutions

7.2. Density Asymptotics: Short-Time and Long-Time Behavior

7.3. Kusuoka–Stroock Inequality and Applications

8. Results and Discussion

8.1. Summary of Main Theoretical Results

8.2. Applications in Financial Mathematics

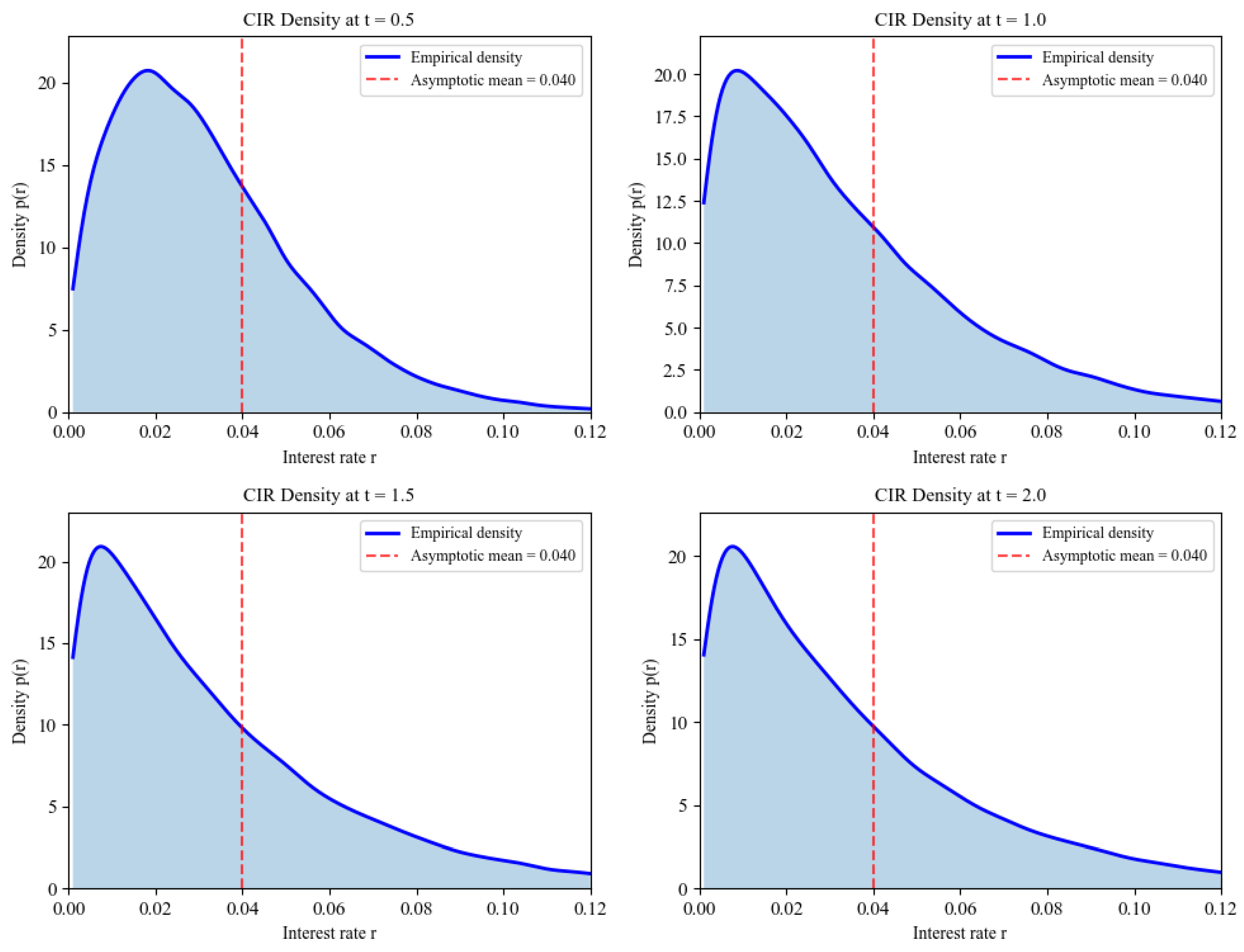

8.2.1. Cox–Ingersoll–Ross Interest Rate Model

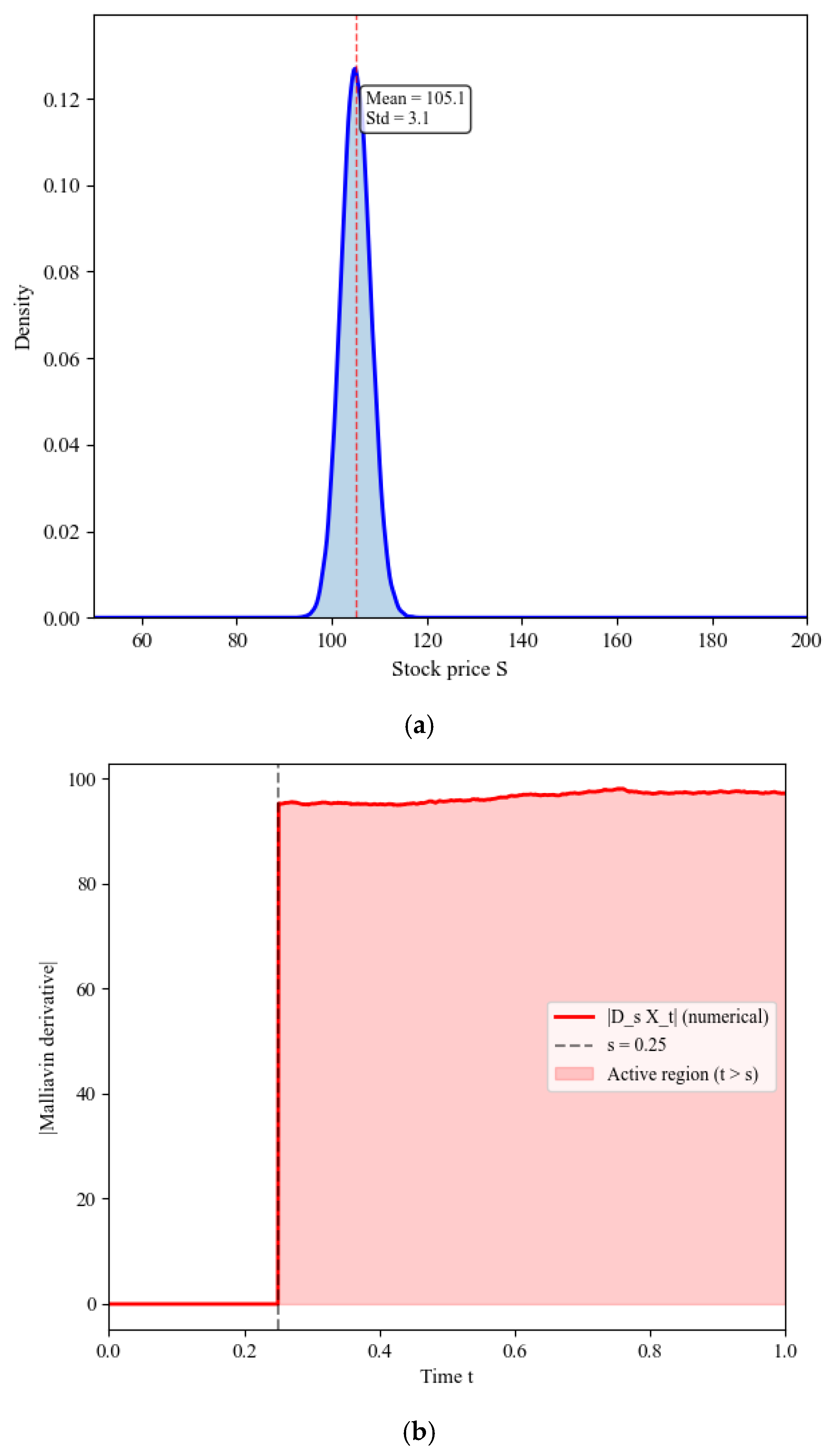

8.2.2. Constant Elasticity of Variance (CEV) Model

8.3. Applications in Biological System Modeling

8.3.1. Population Growth with Environmental Stochasticity

8.3.2. Epidemic Spreading with Spatial Heterogeneity

8.4. Computational and Numerical Implications

8.5. Extension to Multidimensional SDEs: Challenges and Perspectives

- Yamada–Watanabe Conditions: The multidimensional Yamada–Watanabe theorem requires careful analysis of the interaction between different components, particularly when different components have different Hölder exponents.

- Norris Lemma: The multidimensional version requires controlling the determinant of the Malliavin covariance matrix, which involves subtle estimates on the interaction of different diffusion directions.

- Large Deviations: The rate function becomes more complex, involving matrix operations:

- Optimal Hölder exponents for each component in systems with mixed regularity;

- Sharp constants in the multidimensional polynomial decay estimates;

- Efficient numerical schemes that preserve the Malliavin differentiability structure in high dimensions.

9. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Oksendal, B. Stochastic Differential Equations: An Introduction with Applications; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Karatzas, I.; Shreve, S. Brownian Motion and Stochastic Calculus; Springer: Berlin/Heidelberg, Germany, 2014; Volume 113. [Google Scholar]

- Cox, J.C.; Ingersoll, J.E.; Ross, S.A. A theory of the term structure of interest rates. Econometrica 1985, 53, 385–407. [Google Scholar] [CrossRef]

- Heston, S.L. A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 1993, 6, 327–343. [Google Scholar] [CrossRef]

- Yamada, T.; Watanabe, S. On the uniqueness of solutions of stochastic differential equations. J. Math. Kyoto Univ. 1971, 11, 155–167. [Google Scholar] [CrossRef]

- Malliavin, P. Stochastic calculus of variation and hypoelliptic operators. In Stochastic Analysis, Proceedings of the International Conference on Stochastic Analysis, Northwestern University, Evanston, IL, USA, 10–14 April 1978; Kinokuniya: Tokyo, Japan, 1978; pp. 195–263. [Google Scholar]

- Bismut, J.M. Martingales, the Malliavin calculus and hypoellipticity under general Hörmander’s conditions. Z. Wahrscheinlichkeitstheorie Verwandte Geb. 1981, 56, 469–505. [Google Scholar] [CrossRef]

- Nualart, D. The Malliavin Calculus and Related Topics; Springer: Berlin/Heidelberg, Germany, 2006. [Google Scholar]

- Norris, J. Simplified malliavin calculus. In Séminaire de Probabilités XX 1984/85: Proceedings; Springer: Berlin/Heidelberg, Germany, 2006; pp. 101–130. [Google Scholar]

- Kusuoka, S.; Stroock, D. Applications of the Malliavin calculus, Part I. In North-Holland Mathematical Library; Elsevier: Amsterdam, The Netherlands, 1984; Volume 32, pp. 271–306. [Google Scholar]

- Röckner, M.; Zhang, X. Well-posedness of distribution dependent SDEs with singular drifts. Bernoulli 2021, 27, 1131–1158. [Google Scholar] [CrossRef]

- Hayashi, M.; Kohatsu-Higa, A.; Yûki, G. Local Hölder continuity property of the densities of solutions of SDEs with singular coefficients. J. Theor. Probab. 2013, 26, 1117–1134. [Google Scholar] [CrossRef][Green Version]

- Grube, S. Strong solutions to McKean–Vlasov SDEs with coefficients of Nemytskii-type. Electron. Commun. Probab. 2023, 28, 1–13. [Google Scholar] [CrossRef]

- Xie, L.; Zhang, X. Sobolev differentiable flows of SDEs with local Sobolev and super-linear growth coefficients. Ann. Probab. 2016, 44, 3661–3687. [Google Scholar] [CrossRef]

- Hairer, M.; Mattingly, J. The strong Feller property for singular stochastic PDEs. Ann. De L’institut Henri Poincaré Probab. Et Stat. 2018, 54, 1314–1340. [Google Scholar] [CrossRef]

- Wang, F.Y. Distribution dependent SDEs for Landau type equations. Stoch. Process. Their Appl. 2018, 128, 595–621. [Google Scholar] [CrossRef]

- Flandoli, F.; Russo, F.; Wolf, J. Some SDEs with distributional drift Part I: General calculus. Osaka J. Math. 2003, 40, 493–542. [Google Scholar]

- Zhu, J. A simple and accurate simulation approach to the Heston model. J. Deriv. 2011, 18, 26–36. [Google Scholar] [CrossRef]

- Dembo, A. Large Deviations Techniques and Applications; Springer: Berlin/Heidelberg, Germany, 2009. [Google Scholar]

- Budhiraja, A.; Dupuis, P. Analysis and Approximation of Rare Events. Representations and Weak Convergence Methods; Probability Theory and Stochastic Modelling; Springer: New York, NY, USA, 2019; Volume 94, p. 8. [Google Scholar]

- Thomée, V. Galerkin Finite Element Methods for Parabolic Problems; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2007; Volume 25. [Google Scholar]

- Ikeda, N.; Watanabe, S. Stochastic Differential Equations and Diffusion Processes; Elsevier: Amsterdam, The Netherlands, 2014; Volume 24. [Google Scholar]

- Murray, J.D. Mathematical Biology: I. An Introduction; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2007; Volume 17. [Google Scholar]

- Delbaen, F.; Shirakawa, H. A Note of Option Pricing for Constant Elasticity of Variance Model. 1996. Available online: https://people.math.ethz.ch/~delbaen/ftp/preprints/CEV.pdf (accessed on 31 August 2025).

- Alòs, E.; Lorite, D.G. Malliavin Calculus in Finance: Theory and Practice; Chapman and Hall/CRC: Boca Raton, FL, USA, 2024. [Google Scholar]

- Bally, V.; Talay, D. The Law of the Euler Scheme for Stochastic Differential Equations: II. Convergence Rate of the Density; De Gruyter Brill: Berlin, Germany, 1996. [Google Scholar]

- Kohatsu-Higa, A.; Ogawa, S. Weak Rate of Convergence for an Euler Scheme of Nonlinear SDE’s; De Gruyter Brill: Berlin, Germany, 1997. [Google Scholar]

- Delbaen, F.; Shirakawa, H. An interest rate model with upper and lower bounds. Asia-Pac. Financ. Mark. 2002, 9, 191–209. [Google Scholar] [CrossRef]

- Aït-Sahalia, Y. Maximum likelihood estimation of discretely sampled diffusions: A closed-form approximation approach. Econometrica 2002, 70, 223–262. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qu, Z.; Sun, Y.; Zhang, L. Malliavin Differentiability and Density Smoothness for Non-Lipschitz Stochastic Differential Equations. Axioms 2025, 14, 676. https://doi.org/10.3390/axioms14090676

Qu Z, Sun Y, Zhang L. Malliavin Differentiability and Density Smoothness for Non-Lipschitz Stochastic Differential Equations. Axioms. 2025; 14(9):676. https://doi.org/10.3390/axioms14090676

Chicago/Turabian StyleQu, Zhaoen, Yinuo Sun, and Lei Zhang. 2025. "Malliavin Differentiability and Density Smoothness for Non-Lipschitz Stochastic Differential Equations" Axioms 14, no. 9: 676. https://doi.org/10.3390/axioms14090676

APA StyleQu, Z., Sun, Y., & Zhang, L. (2025). Malliavin Differentiability and Density Smoothness for Non-Lipschitz Stochastic Differential Equations. Axioms, 14(9), 676. https://doi.org/10.3390/axioms14090676