Abstract

Modern technologies have changed human life and created a generation of customers who have different needs compared to the past. Considering Industry 4.0 and its drivers, the implementation of digital banking (DB) has faced various challenges that are caused by emerging trends. Both Industry 4.0 and DB are contemporary concepts, and decision-makers are often faced with uncertainties in their decisions regarding the implementation of DB and its indicators. For this purpose, a novel multi-criteria group decision-making approach has been developed utilizing the best–worst method (BWM) and α-cut analysis as well as trapezoidal fuzzy numbers (TFNs). By reviewing the literature and using experts’ opinions, the DB implementation criteria are determined, and considering an uncertain environment, the criteria are prioritized using the proposed method. Then, the available DB models and alternatives are examined based on the decision criteria and the importance of each criterion. This research contributes to the existing literature by identifying and prioritizing the criteria necessary for the successful implementation of DB, taking into account emerging trends and technological advances driven by Industry 4.0. Subsequently, the study prioritizes the prevalent models of DB based on these criteria. This study proposes a decision-support framework for dealing with ambiguity, lack of information, insufficient knowledge, and uncertainty in decision-making. The framework uses TFNs to account for imprecision and doubt in decision-makers’ preferences. Additionally, the study presents a fuzzy multi-criteria group decision-making approach that enables a group of experts to arrive at more reliable results. The proposed approach can help improve the quality of decision-making in complex and uncertain situations. The results of this research show that human resources, rules and regulations, and customer satisfaction are the most important criteria for implementing DB. In addition, the open, blockchain, and social banking models are the crucial models that significantly cover the implementation criteria for DB.

Keywords:

multi-criteria decision-making (MCDM); best–worst method (BWM); trapezoidal fuzzy numbers (TFNs); Industry 4.0; digital banking; Banking 4.0; service quality (SERVQUAL) MSC:

90B50; 90C70; 91B06; 03B52

1. Introduction

Extensive technological changes brought about by Industry 4.0 have changed the behaviors and attitudes of customers and created new needs for them. Due to the emergence of technologies such as the Internet, broadband, social networks, data processing solutions, cloud computing, and digital transformations, these new customers have higher expectations of their bank and are looking for convenience, personalized products, and coverage of their daily needs [1]. With the widespread use of new digital technologies and the emergence of new malicious threats, service-oriented business models and processes have been evolved in all sectors and business rules have changed [2]. Digitalization does not necessarily mean that all companies must have high-level technologies, although it conveys the message that in the not-so-distant future, businesses that invest efficiently in digital services that create value for customers and improve the operational agility of customer services will be market leaders [3].

On the other hand, with the increase in the activities of banks, the emergence of new competitors in the industry, and the increase in the complexity of economic variables and society’s needs, the importance of defining goals and developing new banking programs has increased. Banks are customer-oriented organizations and deal with the general public, so they must have a comprehensive understanding of customers and adjust their business models accordingly. Digitalization of banking in the new era is very necessary in order to transform and adapt banks to environmental changes and the new requirements of the banking industry [4]. Considering the undeniable effects of new technologies, such as the development of the web and high-speed Internet, social networks, smart phones, and user-oriented platforms, and the emergence of a generation of customers with new needs and desires who want to carry out banking affairs, including payments, investment management, loans and the like, on new technological platforms, it is necessary to examine the impact of digitalization of the banking industry on the quality of its services [3]. The advent of digitalization, innovation, and new technologies is transforming conventional business models and processes. As a consequence, banks must modify their business models to alter their customer interactions, manage their middle- and back-office operations, enhance competitiveness, and prepare for the future [5].

The digital transformation of banking encompasses a wide range of services, such as document digitization, electronic signatures for transactions, e-learning, teleconferencing, online trading platforms, digital stores, e-statements, and mobile payments. As customers increasingly adopt these digital operations, new solutions are emerging in this sector. Consequently, the banking industry must develop new business models to emphasize all the major banking processes [6]. As many service sectors are driven to explore innovative technological methods to enhance customer service and streamline internal processes, adopting new business models through the digital transformation of banking operations is the most appropriate approach for banking institutions in today’s economic environment [7].

Adoption of digital banking (DB) is necessary and inevitable. Considering the fact that DB will become the dominant service-oriented business model in the future in this sector, banks should try to identify the necessary infrastructure and mechanisms for the design and implementation of this new business model. As technology becomes more widely available, people are increasingly using DB for their everyday transactions. While some may see this as beneficial, it disrupts the usual way of banking that customers are used to. Therefore, it is crucial to understand the successful DB implementation indicators when it comes to DB services and products [8]. Financial institutions that were previously hesitant to adopt or rely on DB models are now embracing them for their speed and convenience, which may result in a permanent shift in their behavior [9,10]. The impact of digitalization on banking extends beyond being just an innovative channel and a marketing strategy. This term has brought about a significant shift in how banks perceive and address their customers’ needs [11].

In this research, we try to identify the criteria for implementing DB using the experiences of experts as well as an extensive literature review, and we determine the importance of each of these criteria. Then, according to the importance of each criterion, possible alternatives are evaluated and the results are analyzed. For this purpose, by conducting an extensive and in-depth review of the previous literature and also establishing a panel of experts (holding a total of nine 1.5 h meetings with them over sixty days), the effective criteria for the implementation of DB are identified, and then, the significance of each indicator is calculated using the proposed method. In addition, the banking models affected by the emerging trends of Industry 4.0 are evaluated according to the importance of each criterion.

The best–worst method (BWM) is one of the newest and most accurate criteria evaluation methods, which provides more acceptable results than previous methods, including the analytical hierarchy process (AHP). The BWM is one of the multi-criteria decision-making (MCDM) techniques, and it was introduced by Rezaei [12]. With this method, the best and worst indicators are selected and the rest of the options are compared with them in a pairwise comparison. Then, a maximum–minimum problem is formulated and solved to obtain the weights of the indicators. With this method, the degree of consistency of decisions can be calculated with a specified formula. In this research, in order to evaluate the effective indicators for the implementation of DB, a new fuzzy decision-making model based on the BWM and α-cut analysis using TFNs is presented. With the proposed approach, the decision-maker is able to choose different values of the α parameter between 0.1 and 0.9 and to make decisions with high reliability by determining the level of uncertainty. The higher the value of the α parameter, the lower the level of uncertainty in the decision-making environment, and the lower the value of the α parameter, the higher the level of uncertainty in the decision-making environment. Some of the advantages of the proposed method include the possibility of making a definite decision in a fuzzy environment, taking into account more uncertainty compared to previous similar models, and the increased robustness of the results.

DB, like classical banking, has been formed with the aim of providing services to customers; however, in DB, we seek to improve processes and increase the efficiency and effectiveness of services provided to customers by using new technologies and concepts. To provide high-quality services and the integrated development of service delivery systems in the banking industry, it is essential to understand the customer’s attitudes and pay attention to their needs [13]. In addition, DB service quality dimensions, such as ease of use, efficiency, privacy/security and reliability, impact customers’ satisfaction and retention intentions [9]. The successful implementation of DB depends on the acceptance of DB by customers, and the mechanisms for persuading them to use DB are important. Therefore, when evaluating the DB implementation indicators, special attention should be paid to the quality of electronic services provided to customers.

Regarding the identification and prioritization of appropriate criteria for the successful implementation of DB, many research gaps remain. Indicators that take into account various aspects of DB, from customer behavior to technological infrastructure, require a comprehensive literature review, past practical experiences, emerging trends affected by Industry 4.0, expert opinions, and the like. For example, many efforts have been made in India, such as digital marketing campaigns and customer education, to drive customers toward DB, but due to the lack of identification of appropriate criteria for DB implementation and their accurate evaluation, these programs have failed [14]. It is worth noting that the responsibility for implementing DB lies with banks, financial institutions, and policymakers, while the adoption of DB lies with customers and users. While numerous studies have focused on evaluating users’ acceptance of DB, limited research has been conducted to identify and evaluate appropriate criteria for successful DB implementation. To ensure that banks can switch to the DB business model, it is necessary to study the factors affecting the implementation of DB [15]. This study aims to comprehensively identify and evaluate suitable indicators for DB implementation to promote its acceptance among users. Banks and customers view electronic banking services as more convenient and cost-effective than traditional branch-based services, leading banks to move toward providing all services electronically in the future [16]. As a result, identifying and evaluating comprehensive indicators for the implementation of DB and examining efficient models is a crucial research area. This study evaluates these indicators and models based on a literature review, trends influenced by Industry 4.0, service quality theory, and experts’ opinions. The proposed approach considers uncertainty in the decision-making environment and decision-makers’ preferences when evaluating the DB implementation indicators and conventional models.

Generally, the research and development, marketing, and digital transformation departments of banks are struggling with problems such as the lack of knowledge and information resources needed to design a road map for the switch to DB, and the publication of scientific research on this issue is of great importance. The contributions of this research can be summarized as follows:

- Development of a best–worst multi-criteria decision-making method based on an α-cut analysis and TFNs to obtain the importance of the DB implementation criteria and prioritization of DB trends in an uncertain environment.

- Providing a decision-support framework in a trapezoidal fuzzy environment in order to deal with ambiguity in information, lack of information, insufficient knowledge and doubt in the preferences of decision-makers.

- Providing a fuzzy multi-criteria group decision-making approach that can be used by a group of experts and lead to more reliable results.

- Identifying and ranking the criteria and sub-criteria for DB implementation according to emerging trends and technological advances affected by Industry 4.0, service quality theory, a DB literature review, and experts’ opinions.

- Prioritization of omni-channel, cognitive, social, blockchain, and open DB trends according to the importance of the DB implementation criteria.

The rest of this paper is structured as follows. Section 2 reviews the literature, including the theoretical background and a summary of research related to service quality and DB and the identification of DB implementation indicators and models as research alternatives. The research methodology, including a description of the BWM and the proposed approach, can be seen in Section 3. In Section 4, the research results, including the final prioritization of the criteria and alternatives, are analyzed and discussed. Finally, concluding remarks are presented in Section 5.

2. Literature Review

This section begins with an overview of the theoretical background of DB and service quality in Section 2.1, followed by a summary of studies related to DB and service quality theory from different perspectives in Section 2.2. Next, the DB implementation indicators are explained in Section 2.3, and the trends and conventional models of DB implementation are discussed in Section 2.4.

2.1. Theoretical Background

Banks are basically service organizations, and their final outputs are the services they provide to customers. DB tries to increase the quality of the services provided by banks and thus increase the efficiency and effectiveness of the banking industry.

The theory of service quality examines customer satisfaction and states that the quality level of services provided to customers affects their satisfaction and has a direct relationship with the company’s profit. Service quality is considered a leading factor in the service industry that affects consumer satisfaction [17]. A comprehensive and widely used approach to measure service quality in various industries is the service quality (SERVQUAL) model [18]. The SERVQUAL model is a framework that records and measures the quality of services provided to customers and evaluates customers’ experience of receiving services. In other words, the SERVQUAL model measures the difference between the actual services provided and the services expected by customers. The five main dimensions of the service quality model are tangibility (the physical appearance of the service and the customer’s understanding of the service delivery environment), reliability (reliability of service results and performance), empathy (willingness and enthusiasm to provide services), responsiveness (willingness to address appropriate and timely feedback), and assurance (specialized skills and increasing trust and confidence) [19]. On the other hand, measuring the quality of electronic services has become an important issue in relation to understanding the value of customers in the context of online service transactions. Service quality plays an important role in customer satisfaction, which can be directly evaluated and managed [17]. Service quality has different results regarding user satisfaction. If the service provided to customers is less than their expectations, customers will be dissatisfied; if the service provided is equal to the expectations of customers, they will be satisfied; and if the service provided exceeds the expectations of customers, they will be highly satisfied [20]. Banking services are moving from an interactive and traditional approach to a digital approach, and the concept of electronic service quality in DB is used to measure and manage digital services such as online shopping, delivery, and ordering. From the user’s point of view, the quality of electronic services is defined as how online systems and various electronic portals can improve the efficiency of transactions and activities and meet the customer’s needs [21,22]. Electronic service quality is classified into two categories: technical performance quality and service performance quality. Technical performance quality refers to websites and systems that provide electronic services to users, and service performance quality refers to the efficiency and effectiveness of electronic service delivery processes [23].

Considering predictions of the future of banking in the world, it becomes clear that it is necessary to improve the quality of DB services, especially in the field of retail banking [24]. Parasuraman et al. [25] believed that service quality is an externally perceived attitude based on the customer’s experience of the service. Parasuraman et al. [26] used a factor analysis to correct the service quality model provided in the past and named it the SERQUAL model, which includes 5 measurement aspects and 22 evaluation indicators. The quality of service is examined from two perspectives as follows [27]:

- Interaction perspective: Service quality is a sign of the inherent excellence of services and the fulfillment of high-level standards in providing services. This view is often used in performing and visual arts. It is argued that people perceive quality only through repeated experience.

- User-centered view: This view is based on the hypothesis that the quality of a service depends on the user’s opinion about it. This definition considers the level of service quality to be equivalent to the level of user satisfaction. This mental perspective and demand-oriented perspective specifies that every customer has different and unique demands and needs.

In the following, some of the studies conducted in the field of service quality are reviewed, along with the theories used in them, so that the variety of theories used in the field of service quality becomes more palpable.

Omarini [28] investigated the transformation of banking from traditional to digital and, finally, open banking. He pointed to the opportunities and possibilities of creating value through the use of new banking approaches in the form of open banking. Bouwman et al. [29] examined the effect of digitalization, the internal capabilities of the organization and the ecosystem, and the external environment of the organization as influential factors in the use of new business models in the digital era and Industry 4.0. Sousa and Rocha [30] examined the skills needed by employees to use and manage emerging technologies such as artificial intelligence, Internet of things, etc., in an organization.

Liu et al. [31] investigated the experiences of the CBC e-banking project and how to integrate two important management theories, namely resource-based theory and resource-fit, in order to exploit e-banking. They developed a framework with four main dimensions: external resource fit, internal resource fit, external capability fit, and internal capability fit. Additionally, they examined the eight critical factors necessary for the successful implementation of an electronic banking project through a real case study. Mbama and Ezepue [32] examined the components of the customer experience of digital services in VK Bank. In their research, they proposed 15 hypotheses about the relationship between the quality of bank services and the experience, satisfaction, and loyalty of customers and the positive effects of DB on them. Khanboubi and Boulmakoul [33] investigated the effects of DB on various aspects of people’s personal and professional lives. They showed that digital transformations have dramatic effects on lifestyles. They suggested some ways to improve organizations in the digital era. Kumar et al. [34] investigated the challenges of creating ethical and sustainable operations in Indian manufacturing units using soft operational research methods, especially the decision-making trial and evaluation laboratory (DEMATEL). They first identified 15 challenges to sustainability in operations in manufacturing industries, and they then investigated the cause-and-effect relationships between them. A summary of research related to the theories and concepts used in DB can be seen in Table 1.

Table 1.

Research related to theories and concepts used in DB.

2.2. Survey of Service Quality and Digital Banking

In this section, various aspects of the service quality theory in different industries are examined. In addition, some studies related to the quality of services will be reviewed from the perspective of Industry 4.0 and its drivers, and finally, various trends in DB will be described by reviewing the studies conducted in this field.

Büyüközkan et al. [36] argued that today, transformation is an important factor for the competitiveness and performance of organizations. Using integrated MCDM approaches, they investigated companies’ sustainability components in the aviation industry and the effects of digital transformation in the era of Industry 4.0. Büyüközkan et al. [37] debated that since air transportation is one of the most important modes of transportation, customers are constantly looking for the best quality of airline services. By using fuzzy models based on cognitive maps, they tried to reconstruct the structure and scenario according to the uncertainties in order to improve the airline service quality.

Li et al. [38] investigated the inflight service quality perceived by customers using the integrated approach of fuzzy blind and fuzzy AHP. They finally identified five criteria and eighteen sub-criteria and evaluated them using MCDM approaches. Aydemir and Gerni [39] investigated the service quality in export credit agencies in Turkey. By sending a questionnaire to 127 companies, they analyzed the gap between the perceived service quality and their expectations in the field of exports. Using statistical tests, they showed that the perceived and expected quality in these agencies were higher than the average values. Al-Neyadi et al. [40] assessed the quality of health sector services in UAE. They examined the components of reassurance, empathy, accountability, and tangible structures among 127 patients and, using statistical models, showed that the quality of the services was appropriate. Kargari [41] studied the dimensions of service quality of the hotel industry using hybrid models by combining the DEMATEL and an analytic network process (ANP). The dimensions he studied in his research were accountability, empathy, and confidence.

Jun and Cai [42] investigated service quality in Internet banking. They investigated 17 components of service quality in 4 clusters, namely online banking system quality, perceived customer service quality, product quality, and banking packages, using the content analysis method. Sari et al. [43] investigated service quality in boat and small ship services. Using statistical modelling approaches, they investigated the opinions of fishermen and yachtsmen regarding the quality of services provided in marinas. Ten hypotheses were tested to calculate the final satisfaction of customers with these services. Caro and Garcia [44] proposed a comprehensive model of service quality in the travel industry. Agents were surveyed using a qualitative approach and in-depth interviews. Then, a model with three components (performance, physical environment, interactions between people) and seven sub-components was tested. Finally, the level of customer satisfaction was determined by surveying users of travel agencies. Miranda et al. [45] investigated the impacts of different components of service quality on customer satisfaction. By developing a basic model of service quality and by adding the three dimensions of convenience, comfort, and connection, which are specific to the railway industry, they examined the correlation between these dimensions and finally modelled a multiple regression. Table 2 provides a summary of the research conducted in the field of service quality in various service-oriented industries.

Table 2.

Some applications of service quality theory in different industries.

The service quality theory has been expanded due to emerging trends under the influence of Industry 4.0. A number of studies have been conducted on the theory of service quality and the impacts of the emerging trends of Industry 4.0. In the following, some of them will be reviewed, and a summary of these studies can be seen in Table 3.

Table 3.

Service-quality-based studies considering the emerging trends of Industry 4.0.

Santos [46] examined service quality in e-commerce and its implementation on the Internet. A service quality model was proposed based on the determinants of service quality in the Internet world. Corradini [47] examined the quality of services in public administrations in Italy. The author introduced a comprehensive model using effective components of government service quality and, finally, implemented a mathematical model. Hartwig and Billert [48] examined the impact of digital transformation on industry, society and services. They reviewed various studies, and by reviewing the literature presented on this topic, they investigated the differences and gaps among the presented models. Benlian et al. [49] investigated customers’ views about software-as-a-service solutions through the lens of perceived quality and the decision to adopt and use them. They extracted and ranked the effective factors by reviewing the literature. At the end, they presented a conceptual model of SaaS. Wu et al. [50] investigated the development of service quality in e-banking according to the cultural requirements of Taiwan. They proposed a new model based on the scale-development approach and the opinions of managers and evaluations made by customers.

Hizam and Ahmed [51] examined the emerging trends of the digital world as an important element of providing Internet of Things services by considering the four dimensions of privacy, efficiency, functionality, and infrastructure in order to empower the organization in evaluating the opinions of customers regarding the service provided on the Internet of Things platform. Ardagna et al. [52] investigated the application of cloud computing in service quality management. After reviewing the literature on the subject and formulating effective components to improve the quality of services based on cloud computing, they provided recommendations for the efficient allocation of resources. Ahmad and Abawajy [53] examined service quality in digital libraries. Instead of paying attention to users’ perception of service quality, they examined this issue through the lens of providers. At the end, they tested the service quality evaluation model based on two clusters (internal and external) and five hypotheses. Al-Hader et al. [54] investigated the service quality and smart city architecture in various dimensions of daily urban life. By proposing some models, they examined how to design a smart city to increase the quality of services and reduce costs. Tate et al. [55] reviewed the concepts of service quality provided in various articles and studies. With a critical view, they proposed a new research method to understand the concept of digital service quality. Tam and Van Thuy [56] examined the service quality of Vietnamese banks in the Industry 4.0 era. Through structured and semi-structured interviews, they formulated assumptions regarding the problem and evaluated the impacts of the components of Industry 4.0 on the service quality of Vietnamese banks using statistical tests.

Due to the increasing growth of technological tools and digital transformation, various digital payment methods and, subsequently, DB have led to various changes in the banking and financial industry [57]. Therefore, various types of DB approaches and various methods derived from them have emerged in the banking industry. These approaches cover digital payment methods, including wallets, mobile banking, Internet banking, and payment using cryptocurrencies, and they are based on technology brought about by Industry 4.0, i.e., DB [58].

According to the high growth rate of DB and the types of digital payment approaches, the focus on providing quality services and the optimal use of these trends has attracted the attention of researchers and managers of financial organizations.

In the following, some studies in the field of new banking trends are mentioned.

Behbood et al. [59] examined the speed of digital transformation and its effects on DB. They assessed one of the most important new trends in banking, namely machine learning. Finally, using fuzzy expert system approaches, they proposed an algorithm for data-driven forecasting in DB. Mahdiraji et al. [60] discussed the evolution of the digital world and one of its important aspects, i.e., big data. Using decision approaches, they clustered the influential and important components of big data in banking, and finally, by examining the proposed clusters, they proposed a strategic document for the development of DB. Zhao et al. [61] identified and ranked the components related to the evaluation of financial service innovation strategies using decision-making approaches, considering the developments in DB and the cooperation of banks with fin-techs and start-ups. Kahveci and Wolfs [62] investigated DB in the Turkish banking industry. Using the DEA approach, they analyzed the effects of DB services on the performance and efficiency of the Turkish banking industry. After examining seven banks, they showed that DB had positive effects in five banks and had no special effect in two banks. Sharma et al. [63] investigated the barriers to adopting mobile banking in the Omani banking industry. Using the structural modelling approach, they determined the relationships and effects of each of the barriers on other components and, finally, presented a model of the key components effective in accepting the mobile wallet approach. Veríssimo [64] examined the barriers to using mobile banking. He first identified the important barriers and then ranked them using fuzzy set methodology. Ondrus et al. [65] discussed the rapid changes in the digital world and the willingness of users to adapt their needs to those changes. By identifying the input components, they evaluated alternatives based on integrated FSS and MCDM approaches.

Ali and Kaur [66] investigated various business models to face the challenges of using mobile banking. First, they created a hierarchical structure for the criteria based on the factors related to the organization and the factors related to the service. Then, using MCDM approaches, they ranked the business models based on the obtained priorities. Hu and Liao [67] investigated the quality of internet banking services. First, they identified the main criteria using the literature and then extracted the relevant sub-criteria by reviewing different articles. Finally, by applying MCDM approaches, they weighted the criteria and sub-criteria. Liang et al. [68] examined the quality of internet banking in Ghana. They first identified criteria and alternatives. They considered five criteria and, finally, ranked five options or alternatives, which were internet banking providers. Sayyadi Tooranloo and Ayatollah [69] focused on identifying and evaluating the important factors for success in Internet banking. They first identified the factors of Internet banking failure and then ranked and weighted the factors using fuzzy decision-making approaches. Arias-Oliva et al. [70] investigated and identified the effective variables in the development of cryptocurrency banking. They first identified the key variables and then ranked the variables using fuzzy approaches. Gupta et al. [71] investigated the reasons and motives behind the decision to use cryptocurrencies in banking and investment. They first identified different factors and then prioritized them using fuzzy analysis frameworks. Chen et al. [72] evaluated blockchain-based businesses in the banking sector by using a hybrid approach, including BWM and modified VIKOR methods. Their findings indicated that due to the importance of policy and regulations, a circumspect government should lay an adaptable foundation for fostering fin-tech innovations. In Table 4, the trends mentioned above and the papers related to them are summarized.

Table 4.

Studies of emerging trends of Industry 4.0 in the field of banking.

As can be seen from the results, several theories have contributed to the development and implementation of DB. Open innovation, the resource-based view, corporate strategy, organizational learning, and social responsibility are the advantageous theories used in the development of DB. On the other hand, service quality and electronic service quality theories have made a major contribution to the development of DB, and since banks are inherently service organizations, key indicators of the development, implementation, and evaluation of DB are derived from these theories. A review of studies related to the application of service quality theory showed that this theory has been used in various service fields and industries, such as transportation, financial institutions, travel agencies, and similar cases. Most of the studies in this field have evaluated and measured the quality of services provided to customers by considering the basic service quality model or its expanded models using specific indicators and MCDM approaches. Additionally, the review of studies related to the application of service quality theory in relation to the emerging trends of Industry 4.0 showed the wide application of this theory in innovative and modern concepts. In addition, the review of related works on the development of the banking industry affected by the drivers of Industry 4.0 showed that the digital, mobile, electronic, internet, and cryptocurrency banking models are prominent models, and researchers mostly used MCDM approaches to evaluate models and indicators in this field. In this research, by reviewing the literature on DB in various dimensions, comprehensive indicators of DB implementation and evaluation were identified according to the emerging trends and drivers of Industry 4.0. Moreover, in this study, a new fuzzy MCDM approach was proposed to prioritize the indicators and alternatives for DB implementation. DB services have become the main trend in the financial industry in today’s modern era [80]. Due to the novelty of concepts related to DB development, there is limited practical experience in the field, leading researchers to encounter uncertainty in the decision-making process. To address this, the proposed approach in this study utilizes TFNs to effectively handle a significant portion of the uncertainty in the decision-making environment. This enables decision-makers to express their preferences more reliably.

2.3. Digital Banking Implementation Criteria

2.3.1. Human Resources

It refers to selection, training, performance evaluation, providing rewards and financial and non-financial benefits, increasing productivity, and taking care of intra- and extra-organizational relations [81]. Human resources are among the main resources of the organization that empower the organization in developing the skills, capabilities, behaviors and attitudes of its employees to achieve its goals [82]. This component includes a workforce familiar with the characteristics of the era of the Industry 4.0. This workforce has characteristics such as collaboration and participation anywhere and anytime, instant feedback, an open and innovative culture, and data-driven decisions [83].

Compensation

This refers to promotions and rewards to employees according to the evaluation of their participation in key performance components and without relying solely on their position and seniority [83]. Of course, benefits include different types, such as benefits that are paid in cash and non-cash. In addition, the design of benefit systems according to different levels of performance is one of the most important components in e-HR departments [84].

HR Technical Qualification

Having a workforce familiar with IT knowledge and skills, IT management, professional computer coding and programming, ability to analyze data, and ability in security topics and the like is an important prerequisite for entering the digital age [85]. Additionally, the workforce of the digital age needs to have general knowledge about new technologies [86]. Another required technical condition is the familiarization of the workforce with the new interfaces of the digital age in order to exploit a variety of emerging technological trends [87].

Training

Hiring and training a highly capable workforce is very important when facing the new trends of Industry 4.0, including artificial intelligence, social networks, and cognitive systems [83]. Therefore, human resource training is a necessity for the digital ecosystem and various organizational levels, and planned and documented training is a key component of the workforce improvement cycle [88]. As a result, education in the era of Industry 4.0 will be different from the past, and due to the rapid development of technologies in this era, continuous education is very important for organizations [89].

Personal Skills

Due to the growing technological changes in Industry 4.0, human resources need skills such as teamwork, social communication, as well as continuous improvement and long-term learning [85]. Long-term learning ability in the face of emerging technologies and adaptability are significant individual skills in Industry 4.0 [86]. Having a workforce with effective and talented skills will lead to increased productivity and competitive advantages for the organization [90].

2.3.2. Digital Strategy

Digital strategy refers to how to use digital technology as a tool to achieve the organization’s goals [2]. Digital strategy is not a separate tool from other business processes but rather helps to rebuild all kinds of organizational relationships with business agents, including personnel, customers, and the ecosystem. Digitization by itself does not lead to digital transformation, although digital strategy is the core of this transformation [91].

Digital Preparation

This refers to the level of the organization’s expectations of the workforce to prepare for the transformational changes related to the new processes of Industry 4.0 era. In addition, the redesign of tasks in this era is one of the key factors. Reaching the end point of the value chain requires preparation and provision of effective conditions and a road map [92]. One approach to digital preparation is to involve all stakeholders (shareholders, managers, etc.). Paying attention and focusing on services and their efficient provision has a significant role in achieving organizational goals [93].

Agility

Agility refers to quick and easy movement and quick and intelligent thinking [94]. In the digital age, it is critical to respond in a timely manner to customer feedback [37]. In the era of digital transformation, the integration and redesign of technological trends for setting contracts, managing assets, obtaining licenses and ensuring transparent financial transactions will lead to advantages such as high agility and increased data security [95]. Technological changes and smart services require organizational agility and especially operational agility. This agility will lead to the effective regulation of processes related to data and interfaces, which will consequently facilitate data exchange and improve the efficiency of the value chain [96].

Digital Culturalization

It refers to the cultural changes of Industry 4.0 era and the changes in training needed to face those changes, as well as providing general information about the benefits of the new generation of Banking 4.0 to customers [97]. A suitable organizational culture can lead to the effective sharing of knowledge in the organization’s environment [98]. Moreover, in the organizations of Industry 4.0 era, choosing the right type of culture for the organization to properly implement the trends related to this era and digital transformation is of great importance [99].

Partnership with Third-Party

It refers to cooperation and partnership with start-ups and fin-techs and other technology-based financial companies in order to improve organizational performance [100]. Resource sharing and asset exchange can lead to effective service development. Today, companies are increasingly forming coalitions for a specific purpose and service [101]. As a result, due to the rapid changes in technologies, the creation of alliances in order to meet the needs of customers and exploit the capabilities of technology-based financial companies leads to an increase in organizational agility [102]. The assessment of third-party providers can be considered an MCDM issue. In this evaluation procedure, the experts usually express their judgments with uncertainty [103]. In addition, by outsourcing activities to third-party providers, organizations can focus on their core functions to improve competitive advantages [104].

Investment

It refers to the development of future banks by investing in new digital transformation trends such as artificial intelligence, blockchain, cyberspace security and robotics [105]. In the future, companies will invest in new digital trends to redesign processes, optimize distribution, reduce costs through tracking the transport fleet and the like [106]. Reducing costs and increasing revenues can be achieved by making the right decisions in relation to digital investment. Therefore, determining investment priorities and the components of the digitization of banks is of great importance [107].

Strategic Management

It refers to the redesign of business according to digital transformation trends in order to gain competitive advantages [108]. By applying the strategic management approach, companies seek to create opportunities through the development of new business models [109]. By properly applying digital transformation and organizational resources and capabilities, competitive advantages will be achieved [31].

Leadership

Leadership qualities in the age of Industry 4.0 include cognitive ability, interpersonal skills, business skills, strategic skills, agile leadership, ability to analyze data and functions, ability to identify problems, and intelligent leadership [110]. Paying attention to cultural changes and having a creative and learning spirit are the requirements of Leadership 4.0 [83]. Therefore, the way of leadership in the era of Industry 4.0 plays an important role in the intelligent behavior and success of the organization [111].

2.3.3. Regulations and Rules

Regulations related to technologies facilitate the appropriate response of the organization to the changes and trends of the digital world. Therefore, technology regulation is an essential tool to adapt to changes [112]. Overall, the purpose of regulation is to protect investors, consumers, competitions, innovations, and transactions in the digital age [113].

Third-Party Operational Law

In the Banking 4.0 environment, third-party service providers are continuously growing and developing through partnerships with various companies; therefore, creating standard rules and regulations for third-party service providers is important, especially in the fields of cloud computing and data services in affiliated companies [113].

Cooperative Regulation

In the Banking 4.0 environment, each banking method and process requires its own regulations. Therefore, the cooperation of technology-oriented companies in the financial area and legislators and the use of others’ experiences result in reduced divergence and island activities (independent activities without considering the beneficiaries) in this industry [113]. Additionally, the coordination of regulations and cooperation between the parties and the agreement of all countries regarding a set of common standards is one of the vital requirements of cooperative regulation [114].

Updated Regulation

In the Banking 4.0 era, the regulators should be able to modify the regulations related to each banking method in an agile way if needed and quickly react to changes in the financial business environment. Governments are facing increasing challenges in establishing and amending regulations in this changing environment. These challenges exist not only in managing the issues caused by disruptive digital trends but also in the methods of guaranteeing, identifying and distributing the opportunities and benefits of digital marketing [115].

2.3.4. Technologies

It refers to all technological facilities and infrastructures and related processes and their performances [18]. In the era of Industry 4.0, interfaces are embedded in the form of codes and computing kits in artifacts and other objects so that it is possible to display and present information to users in different digital forms [116].

Functional Ability

It refers to the suitability and quality of digital channels and their services [117]. What is important from the viewpoint of functional ability is that customers or other stakeholders should be efficiently guided from one process to another or from one stage to the next [118]. Customers and users have expectations of any service. It is important to fulfill their needs at each stage and to pay attention to their behaviors in order to improve the functional ability of the service [119].

Efficiency

It refers to responding to several users in the shortest time and with the most appropriate product and experience. When inputs and data are effectively converted into reliable outputs, efficiency approaches its ideal state [120]. Therefore, the efficient use of organizational resources, such as human resources and infrastructure, can ultimately lead to financial and non-financial advantages for service providers [121].

Technology Architecture

It refers to processes and continuous sequences of new technological trends. Its improvement and coordination can lead to better service delivery to stakeholders and the workforce of the organization. Therefore, the convenience for customers of using digital services and the appropriate and agile implementation of technology by the organization are characteristics of efficient technology architecture [37].

Service-Providing Platforms

It refers to the delivery of services to customers and users and their interactions with the organization through new platforms [37]. Today, banks provide services to their customers using their own APIs. Instead of developing their own APIs, many banks collaborate with third parties and provide them with their customer data to improve the bank’s platforms [122].

Suitability

It refers to the operationality and compatibility of service processes with service channels and platforms. One of the important components that organizations should pay attention to when providing services is correct and appropriate responses to users’ needs. The organization should focus on the suitability of its services. If customers think that their needs are met by the service provided by the platform or application, they will find it suitable [123].

Usability

It refers to the easy performance of transactions through channels and platforms by the user [117]. A service has usability when it is efficient, satisfactory, easily learnable, and has minimal errors. When the perceived satisfaction of the user reaches a high level, he interacts with the content and service to fulfill his goals and needs. Therefore, usability is very important for user satisfaction with the platform and application, and it allows users to easily fulfill their needs through the channel or platform provided [124].

2.3.5. Trust

It refers to providing services based on transparency, respecting privacy and focusing on secure transactions. In general, trust is dependent on confidence in the other party to the transaction, and when the customer is transacting online, factors such as expected performance and competence and availability lead to an increase in trust [125].

Virtual Security

It indicates that the system or platform is reliable and efficient to the extent that it has the ability to deal with virtual threats and the transaction data of customers are securely protected [37]. Therefore, privacy, strict control over financial transactions and people’s assets, and finally, increasing security should be considered when applying the new trends of digital transformation in every industry [126].

Privacy

It refers to the protection of the privacy and non-distributable data of customers [37]. In the era of digital transformation, providers encrypt data. This approach is performed by using the specific architecture and rules and policies of each of the digital trends. Therefore, in the era of digital transformation, each platform needs a special mechanism to apply privacy policies. By improving privacy in financial transactions, security will be strengthened [127].

Recognizability

It refers to the possibility of identifying and recognizing a service provider, whether it is an internal provider or a third party [126]. In addition, by focusing on privacy and security, it is possible to create platforms with embedded recognizability. As a result, everyone can perform their transactions with confidence in the digital environment. This means that there is no need to refer to the central core, there is no need to monitor the transaction and ensure the identity of the participants and there is no need for third-party intervention [128].

2.3.6. Customer Satisfaction

Customers always have needs, and meeting those needs with efficient online services will lead to their satisfaction. Customer satisfaction depends a lot on the performance of the organization and the usefulness of the service provided. The structure of the service and the way the service is provided are among the factors that make the user inclined to use the service [129].

Access

It refers to the possibility of continuous provision of the service without any technical problems and under suitable and efficient technical conditions. Accessibility is affected by various factors, including the technology and network architecture, platform design, servers and processes [130]. Therefore, before designing any service or platform, it is necessary to check the composition of the platform or service in detail and determine the availability [131].

Accountability

It refers to the responsibility of the service provider to solve the problems and take corrective actions on the information and services provided to the customers [132].

Availability

It refers to the ability of the customers to communicate with the organization at any time and in any place, and in addition, the ability to choose any of the service provider channels by the customers according to their interests [37]. Therefore, the digital service provider should make it possible for users to have equal access to their favorite services. Since the users of the service are from different spectrums of society in terms of education and age, and they may even have physical disabilities, it is very important to pay attention to the functionality and usability of the service delivery channels [133].

Self-Service Capability

It refers to the possibility of using and installing new applications and platforms without the need for an IT specialist. Nowadays, due to the increasing growth of technology trends, banks are seriously trying to provide self-service applications so that customers can easily perform their transactions at any time and in any place using the capabilities of banking channels. Therefore, paying attention to remote self-service capabilities can lead to the increased satisfaction and trust of customers and users [134].

Customer Participation

It refers to the participation of customers in promoting the organization’s services and recommending it to other users on social networks, the web, etc. [135]. It is also possible to track users’ opinions on the web and social media and use them in decisions related to the organization’s marketing.

Customer Insight

It refers to the organization’s ability to use the data obtained from the analysis of customers and users in the virtual space and the online world in order to provide its services and products based on their preferences and interests. Such information and data are very important for designing services and products. Therefore, due to the rapid growth and development of the digital world and information technology as well as the large volume of customer data, paying attention to customer opinions, interests, and reactions can greatly help designers to better meet customer expectations and requirements [136]. As a result, the application of information obtained from customer analysis in products and services is the value that companies and organizations will gain through paying attention to customer insight.

2.4. Digital Banking Implementation: Key Trends and Alternatives

After identifying appropriate criteria, appropriate alternatives were also determined according to the experts’ opinions, research literature, and existing infrastructure, which are presented in Table 5. These alternatives will be ranked using the proposed approach and the results will be analyzed. When identifying and evaluating DB models, it is necessary to pay attention to the technologies required in DB. In addition to identifying and evaluating the criteria for the implementation of DB, the technologies required for the implementation, growth, and development of DB should also be considered. Digital electronic technologies are widely used to switch classical banks to modern digital banks, some of which are computers, computer networks, digital communications, the Internet, and information and communication technologies with the appropriate software. Fin-techs, cloud computing, big data, and APIs have been considered facilitating technologies in relation to DB. The use of such technologies increases the speed, security and efficiency of all banking operations and services [137].

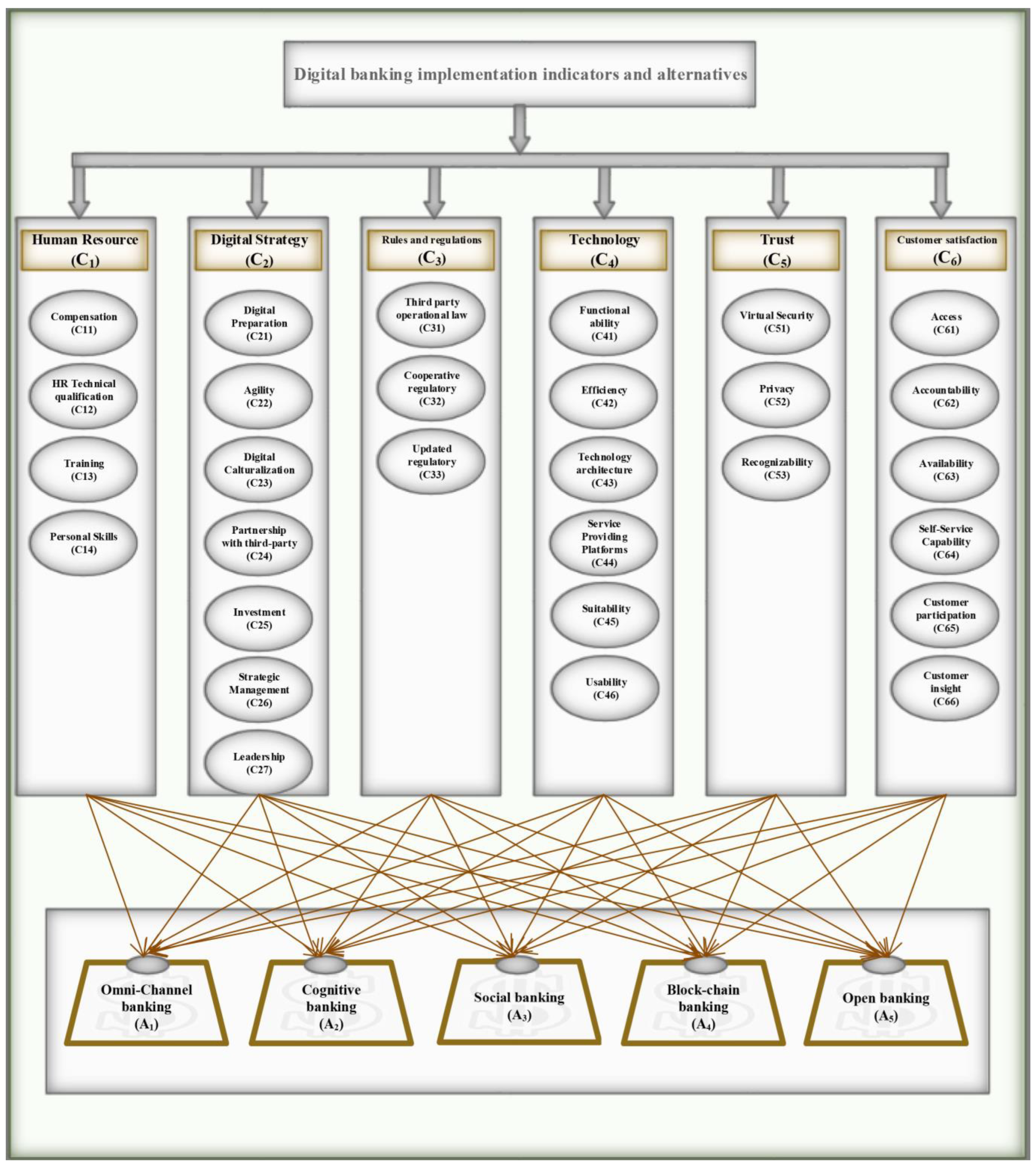

Melnychenko et al. [138] reviewed the important technological trends used in DB. According to the field of application of these technologies in the analysis of customer behavior, supervision of financial transactions, fraud management, and other areas related to modern banking services, they consider four technological trends, namely big data, artificial intelligence, biometrics and blockchain, as effective technologies in DB. In another study, the destructive trends affecting the increasing growth of DB were investigated. The results of the research showed that the important and vital infrastructures for the effective use of DB that lead to customer satisfaction are data protection regulation, APIs, data sharing, artificial intelligence, big data and fin-techs [139]. Managers and policymakers in the banking industry should pay special attention to the existing infrastructure and widely used concepts in Industry 4.0, such as artificial intelligence, in line with the implementation of DB [140]. Before evaluating the implementation criteria for DB, it is necessary to examine the existing infrastructures and the possibility of their development to drive the transformation from classical banking to DB. The hierarchical structure of the research, including the decision criteria and alternatives, can be seen in Figure 1.

Figure 1.

Hierarchical structure of decision criteria and alternatives.

Table 5.

Digital banking alternatives.

Table 5.

Digital banking alternatives.

| Alternative | Explanation | Source |

|---|---|---|

| Omni-channel banking | In omni-channel banking, communication with the customer is conducted uniformly at any time, in any place and on all channels. The customer and the activities he performs are the focus of how to provide the services that are provided to him. Accordingly, the way of serving each customer is personalized based on the activities performed in all portals. With this method, not only the explicit requests of the customer are answered but also his implicit interests and needs are guessed. | [141] |

| Cognitive banking | Cognitive banking begins with the development of the big data platform by collecting, integrating, and extracting structured and unstructured customer data and other useful data, and it incorporates artificial intelligence and advanced data-based analytics. It is worth noting that with the maturity of systems and algorithms based on artificial intelligence, cognitive banking, as a new generation of advanced analytics with learning capabilities, will replace smart banking. | [142] |

| Social banking | Social networks can be used as one of the important platforms for promoting and even selling the products and services of various businesses. This platform creates a good opportunity for banks to, on the one hand, be on the path to transition to a social business model and coordinate with emerging markets, and on the other hand, by analyzing large volumes of customer data and measuring customer behavior, provide better, personalized and new products and services. | [143] |

| Blockchain banking | Due to its nature, blockchain technology can provide the financial system with the tools needed to develop and improve services and products and to facilitate and accelerate the process of DB. Therefore, the use of this technology in the country’s banking industry has advantages such as transparency, security and control, no need for intermediaries, uncertainty of the system, integration and immutability, and reduced costs. According to an international analysis of emerging technologies, disrupting technologies such as blockchain technology are moving beyond unrealistic expectations and gradually entering a large implementation phase. | [144] |

| Open banking | In this model, banking data and information are shared through APIs between different members of the banking ecosystem with the customer’s permission according to specific standards, and this creates various opportunities and threats for the traditional banking system. Based on the transformation caused by the open banking model, banks transfer part of their activities in the banking value chain to other actors and change the situation from the position of bank management to the position of ecosystem management. | [145] |

3. Proposed Approach

In this section, the proposed method to determine the importance of each of the implementation criteria for DB is explained. Industry 4.0 and DB are modern concepts, and scientists have not yet fully mastered them scientifically so as to be able to offer definitive opinions about them. Uncertainty in decision-making in new fields has always been a problem for decision-makers and experts in different fields. The fuzzy BWM uses human preferences and judgments as fuzzy numbers in an uncertain environment to solve decision-making problems [146].

In this research, we try to weigh the DB criteria by considering the uncertain environment that governs them and to determine the importance of each of them correctly and as close to reality as possible. Sometimes, in pairwise comparisons between criteria or options, decision-makers use fuzzy judgments instead of accurate judgments. A fuzzy programming model is more applicable and flexible than a deterministic model because it allows decision-makers to use imprecise and ambiguous data in the model [147]. The α-cut method is one of the ways to consider inaccurate data in the model [148]. By applying α-cut operations on the fuzzy membership functions, the membership functions will be limited to closed intervals and mathematical calculations will be performed on them [149]. In the following, the BWM will be explained, and then the proposed method based on TFNs will be described.

3.1. The Best–Worst Method (BWM)

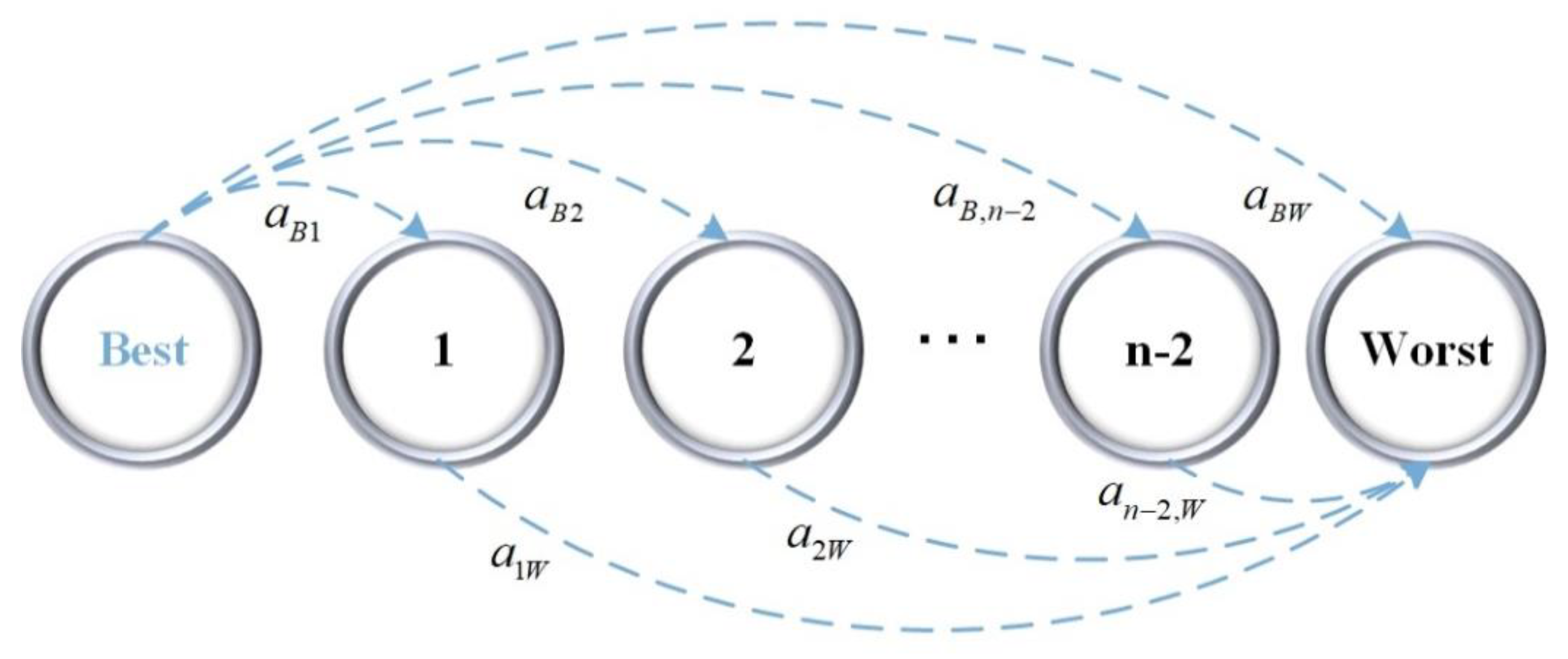

The BWM is one of the newest and most accurate criteria evaluation methods introduced by Rezaei [12]. With this method, the best and worst indicators are selected and the rest of the options are compared with them in a pairwise comparison manner (Figure 2). Then, a maximum–minimum problem is formulated and solved to obtain the weights of the indicators. With this method, the consistency rate of decisions can be calculated with a certain formula. The BWM requires fewer pairwise comparisons than the AHP method [150].

Figure 2.

Reference comparisons in the BWM.

The steps of the best–worst method (BWM):

Step 1: Determining the decision criteria: In this step, the decision criteria are defined as .

Step 2: Determining the best and the worst criteria: The best (most important or most desirable) and the worst (least important or least desirable) criteria are selected. No comparison will be made in this step.

Step 3: In this step, the priority of the best criterion over each of the other criteria is determined as a number between 1 and 9, which is expressed as , where is the priority of the best criterion over the j-th criterion and .

Step 4: In this step, the priority of each criterion over the worst criterion is determined as a number between 1 and 9, which is expressed as , where is the priority of the j-th criterion over the worst criterion and .

Step 5: Calculating the optimal weights of the criteria : To obtain the optimal weight of each criterion, we form the pairs and ; then, we try to minimize the maximum of and for each j.

Given that the weights and the sum of the weights are non-negative, the model can be written as follows:

The above model can also be written as follows:

The linear form of the BWM presented in [151] is as follows:

Calculating the consistency ratio (CR) when using the BWM: Using the value of obtained from the expressions and the consistency index (CI) [12], the CR is calculated. The higher the value, the higher the CR.

3.2. The Fuzzy BWM

In this paper, the BWM is developed based on the α-cut for an uncertain condition where the parameters of the problem are TFNs. The proposed method is based on the study conducted by [152], with the difference being that in the current study, the model is developed using trapezoidal numbers, which makes it possible to consider more uncertainty in the model. Using the proposed method, the importance of each criterion and sub-criterion, as well as the preference of each alternative over each criterion, will be calculated.

Definition 1.

A trapezoidal fuzzy number is written as . For a TFN, the membership function is defined as μ_τ ˜ (x):R → [0.1] [153], where

Definition 2.

The fuzzy set τ ˜ with a degree of membership at least as large as α (α > 0) is called the α-cut set of τ, which is defined by Equation (5) [154]:

Suppose that we have a trapezoidal fuzzy number in the form of , its α-cut is then obtained from Equation (6) [155]:

The steps of the proposed method are as follows:

Step 1: Determining the decision criteria: The required criteria for the selection and evaluation of suppliers are defined as by the decision-maker (DM).

Step 2: Determining the best and the worst criteria: The best and the worst criteria are selected by the DM. No comparison will be made in this step.

Step 3: In this step, the priority of the best criterion over each of the other criteria is determined by experts as a TFN. The linguistic terms and trapezoidal fuzzy scales used in this paper are provided in Table 6.

Table 6.

Linguistic terms for criteria/alternatives comparison.

The priority of the best criterion over the j-th criterion is expressed as and .

Step 4: In this step, the priority of each criterion over the worst criterion (OW) is determined by the DM as the TFNs provided in Table 6. The priority of the j-th criterion over the worst criterion is expressed as , and

Step 5: Calculating the optimal weights of the criteria : Given that the weights are non-negative, the model can be formulated as follows:

The above relationship can be rewritten as follows:

The consistency index in the fuzzy BWM is obtained with respect to the value of the priority of the best criterion over the worst criterion [156], and its values are provided in Table 7.

Table 7.

Consistency index (CI) in the fuzzy BWM.

Given the value obtained from the model and the consistency index provided in Table 7, the CR is calculated from Equation (9) [12].

Definition 3.

In a pairwise comparison, preferences are fully consistent when . When , it means that has a lower or higher value than the above value and there is inconsistency in the pairwise comparisons. It is also clear that and considering that the highest inequality occurs when and are maximum, the value of ξ must be subtracted from and and added to .

The maximum inconsistency occurs when , so we have:

To calculate the consistency index value, it is enough to substitute the value of in Equation (11) and calculate the maximum value of ξ [12].

To calculate the consistency index of fuzzy numbers, the upper limit value of the fuzzy number or instead of can be substituted in Equation (11) to obtain Equation (12) [157].

4. Results

After reviewing previous studies and holding several meetings with experts, a total of six criteria (each of which had a number of sub-criteria) were selected and approved. The expert panel consisted of five members, two of whom were managers with experience in the banking industry and the other three were professors of finance and accounting with full professor degrees. A total of nine 1.5 h meetings were held with the panel of experts over a two-month period, during which the decision-making criteria, research alternatives, and experts’ preferences regarding each of the criteria and alternatives were collected. To determine the importance of each criterion, the opinions of all five experts were used, and the preferences of the two experts with experience of banking models were used to rank the alternatives. Profiles of the experts are provided in Table 8.

Table 8.

Profiles of the experts.

Section 4.1 presents the final importance of the digital banking implementation criteria and sub-criteria as determined using the proposed approach. Following this, Section 4.2 displays the outcomes of the final prioritization of the digital banking implementation models as research alternatives.

4.1. Calculating the Importance of Each Criterion and Sub-Criterion

In many decision-making scenarios, the decision of a group rather than of an individual should be relied on, since decisions made by a group are usually more reliable [158]. Therefore, in this research, the opinions of the group of experts have been used to weight and prioritize the criteria and alternatives. In Equation (8), trapezoidal fuzzy membership functions are converted into numbers in a closed interval using the DM satisfaction level. The preferences determined by the experts are also converted into numbers in a closed interval. Then, the optimal weights of the criteria and alternatives are calculated using Equation (7) or (8). For example, for the comparisons of the main criteria, Equation (8) is solved once for each of the decision-makers. In this study, the value of α is considered 0.5 and 0.9 as determined by experts. Decision-makers can choose a value between 0.1 and 0.9 for α according to their level of satisfaction with the decision-making process and the level of uncertainty in the decision-making space. The higher the amount of α, the higher the level of satisfaction of the decision-maker, and this means that the uncertainty in the decision-making process is lower, although the lower the amount of α, the higher the level of uncertainty.

The consistency rate (CR) is an important index with which to check the correctness of the pairwise comparisons made by a DM. The BWM calculations are based on the initial judgments of the DMs, which appear in the form of the priority of the best option over each of the other options and the priority of each option over the worst option in the pairwise comparisons. Therefore, any error and inconsistency in the comparisons will affect the final result. In addition, at the time of interviewing the experts and receiving their preferences, an attempt was made to review the comparisons that had high consistency rates, and in many cases, the process of receiving preferences from the experts was repeated in order to obtain a lower consistency rate (and, as a result, higher reliability of the results).

The experts’ preferences, the local and global weights of the criteria and decision-making sub-criteria, the amount of the objective function and the consistency rate of the comparisons can be seen in Table 9, Table 10, Table 11, Table 12, Table 13, Table 14 and Table 15. Additionally, the final weight of the sub-criteria will be obtained by calculating the mean of the global weights (MGW).

Table 9.

Experts’ preferences and final weights for the main decision criteria.

Table 10.

Experts’ preferences and final weights for the human resources sub-criteria.

Table 11.

Experts’ preferences and final weights for the digital strategy sub-criteria.

Table 12.

Experts’ preferences and final weights for the rules and regulations sub-criteria.

Table 13.

Experts’ preferences and final weights for the technology sub-criteria.

Table 14.

Experts’ preferences and final weights for the trust sub-criteria.

Table 15.

Experts’ preferences and final weights for the customer satisfaction sub-criteria.

According to the opinions of the participants and experts, the final prioritization of the main criteria for DB implementation was obtained as C1 > C3 = C6 > C5 > C4 > C2. Human resources was considered the most important criterion for implementing and improving the quality of DB services. The role of human resources has changed in the era of digital transformation so that it is mentioned as the main element in the digital solution. Therefore, attention should be paid to HR technical qualification and training in the majority of digital skills and also to familiarizing them with standard methods, simulations, and big data technology. This is one of the main challenges facing financial organizations in the digital era. The personal skills of personnel can be improved in any place and at any time through virtual training. Organizations can improve HR technical qualification through virtual training, benchmarking, continuous control of capabilities, and updating training protocols. Approaches such as awarding certificates to employees for digital courses, promotion of positions, awarding rewards for their optimal performance in the digital transformation of the organization, and improving compensation processes and reward management are among the effective and useful methods to increase the performance of the organization’s human resources [159].

Another important issue is digital rules and regulations. Shaikh et al. [160] emphasized the importance of regulatory and digital laws to prevent threats, risk of fraud, hacking, and cyber-attacks. On the other hand, third-party operational law and cooperative regulation (to respect privacy and prevent data disclosure) will definitely lead to greater economic security for users and financial organizations. In addition, it is very important to pay attention to the updated regulatory controls, since this reduces costs, facilitates cooperation, removes obstacles and legal pressures on banks’ innovation, and improves the quality of services [161]. Certainly, digital transformation will lead to increased flexibility in providing services in any place and at any time, reducing costs for users, and as a result, increasing customer satisfaction [162]. In addition, having easy and convenient access to account information in any place and at any time can lead to the improvement of the digital experience of customers and consequently improve the relationship between customers and banks. Therefore, customizing banking platforms and portals so that customers can meet their financial needs through self-service capability will increase customer satisfaction [163]. Moreover, customer participation has benefits for the organization because customers feel that they have the ability to influence the organization. In addition, customer participation can lead to an increase in organizational profitability, customer loyalty, and customer satisfaction [164].

4.2. Ranking of Alternatives according to the Importance of Criteria

After identifying and determining the criteria for implementing DB and obtaining the importance of each of them, the identified alternatives are prioritized based on the importance of the criteria. Research questionnaires designed to obtain the experts’ preferences for each alternative are provided in Table A1, Table A2, Table A3, Table A4, Table A5 and Table A6 in Appendix A. For prioritizing the alternatives, the opinions of experts 4 and 5 have been used, since they had more knowledge about the alternatives. After receiving the experts’ preferences and analyzing them, the items with a high consistency rate were returned to them for modification. After corrections, their comments were re-evaluated. Finally, the research alternatives were prioritized using the proposed approach described in Section 4, and the results are provided in Table 16 and Table 17. To calculate and aggregate the final weight of the sub-criteria (), the final importance of the alternatives () and the final rank of each alternative (), Equations (13)–(15) are used, respectively. The higher the value of , the greater the importance of the alternative.

Table 16.

Decision matrix and final values of alternatives.

Table 17.

Final prioritization of DB alternatives.

To successfully implement DB, banks must ensure that their customers are willing to use it for their daily transactions, and success cannot be achieved by investing heavily in technology alone [165]. For this purpose, comprehensive identification of suitable indicators for the implementation of DB and paying attention to all its aspects should be taken into consideration by policymakers. Banks should recognize that a return on their investment in technology will only occur in the long run if a significant portion of their customers switch to digital channels, which can only be achieved through transformation of the banking model [166].

The implementation of DB is the responsibility of banks, financial institutions, policymakers, and regulators, while its acceptance rate is determined by customers and users. This study focuses on the indicators for DB implementation and examines this issue from the perspective of policymakers and regulators. The results of this study can provide valuable insights for policymakers seeking to make informed decisions about the implementation of DB. However, it is also important to consider the factors that affect the acceptance of DB by customers.

Based on the findings of this research, open banking emerged as the most favored DB model among the other models examined. A prior study [167] noted that the progression of open banking originated in the United Kingdom before spreading to various countries. This development allows consumers and businesses to conveniently and securely access a wide range of innovative financial services and products. However, it is important to acknowledge that open banking also brings forth risks and challenges that affect consumers, financial institutions, and regulators alike. However, despite numerous factors facilitating the implementation of open banking in the UK, there are still challenges that impact customers and third parties. These challenges may necessitate a fundamental reconsideration of the appropriate indicators for implementing open banking, especially in the dimensions of customer and their authentication [168].