Resource Intensity Trends in the South African Ferrochrome Industry from 2007 to 2020

Abstract

1. Introduction

1.1. Resource Intensity

1.2. The Ferrochrome Industry

1.3. Beneficiation

1.4. Smelting Processes

1.5. Developments in Ore Grades and Sources

2. Methods and Data

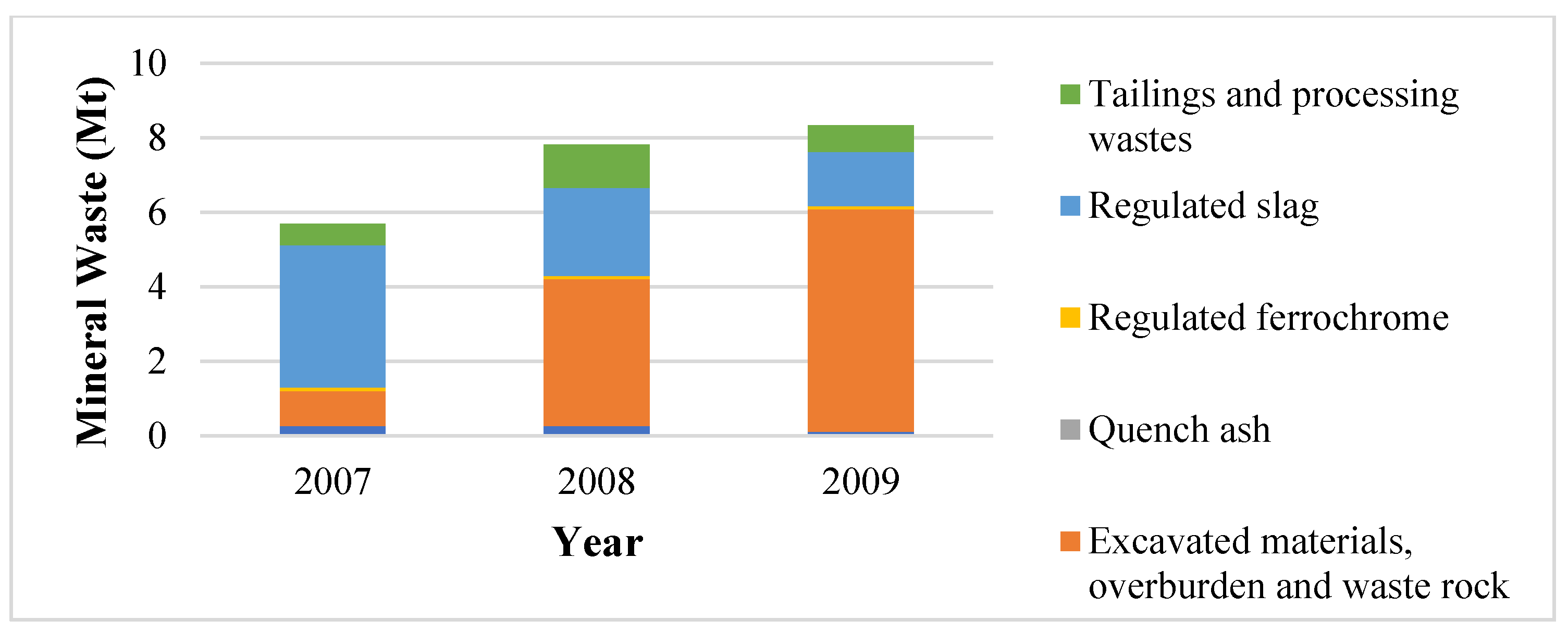

3. Results

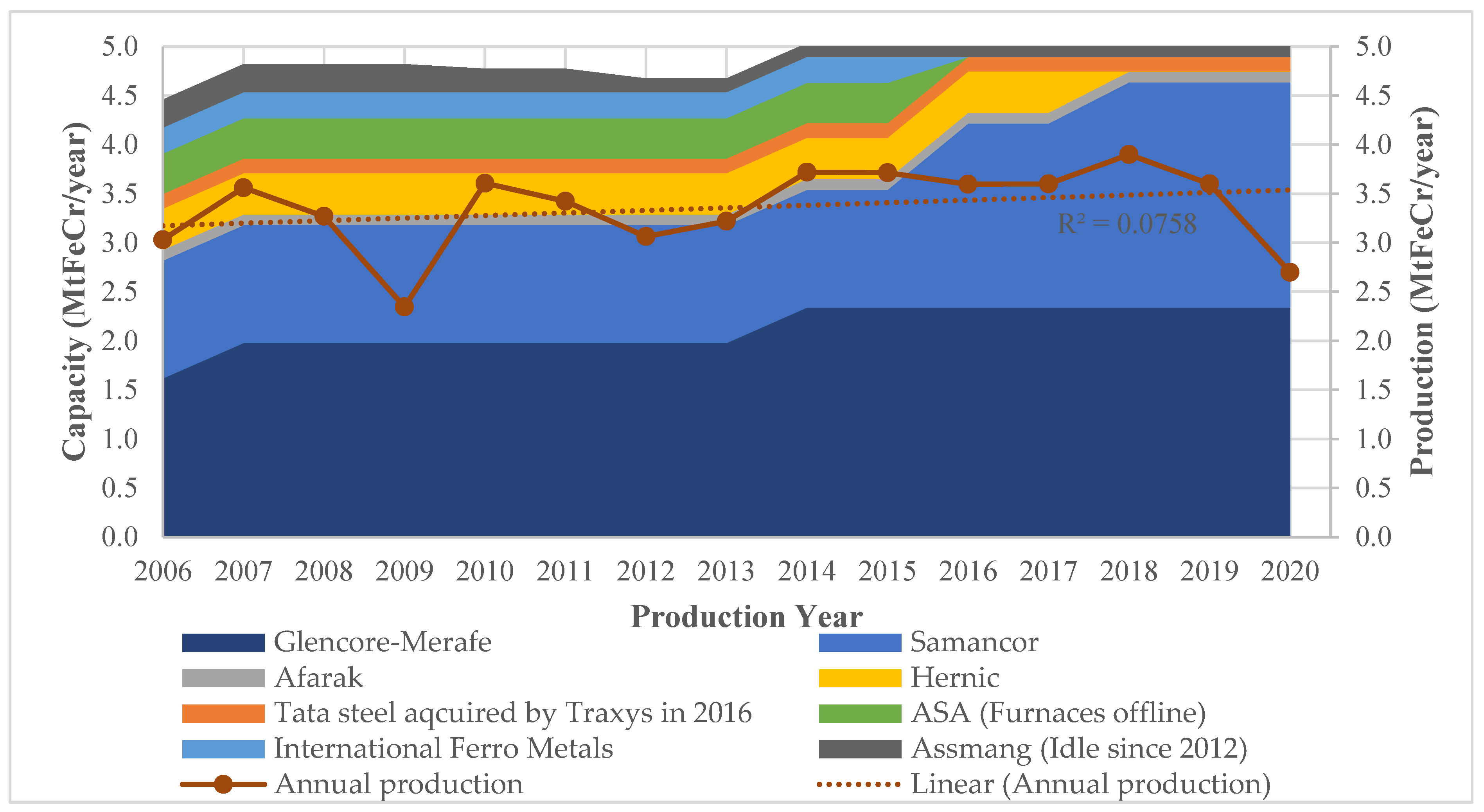

3.1. Production Trends

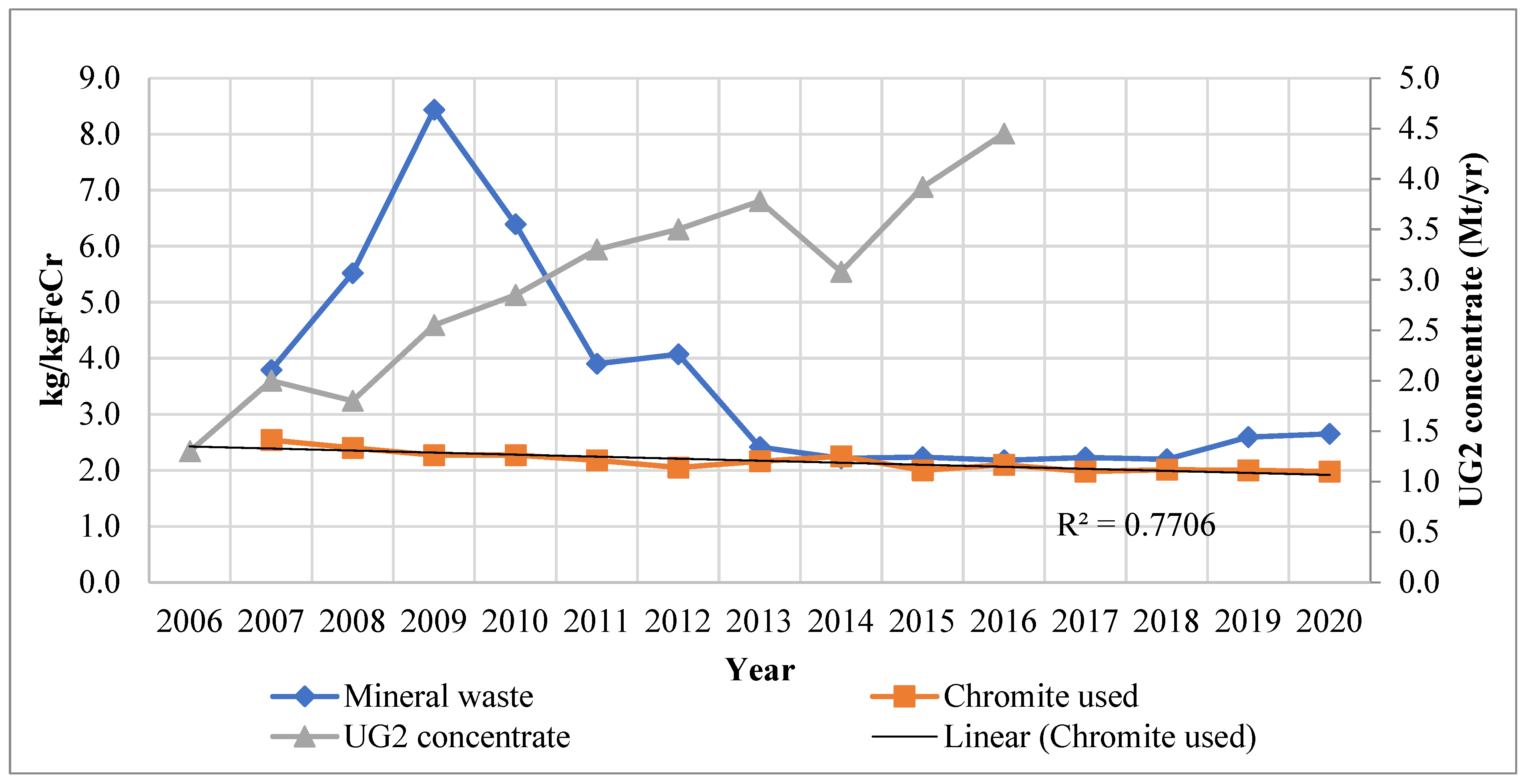

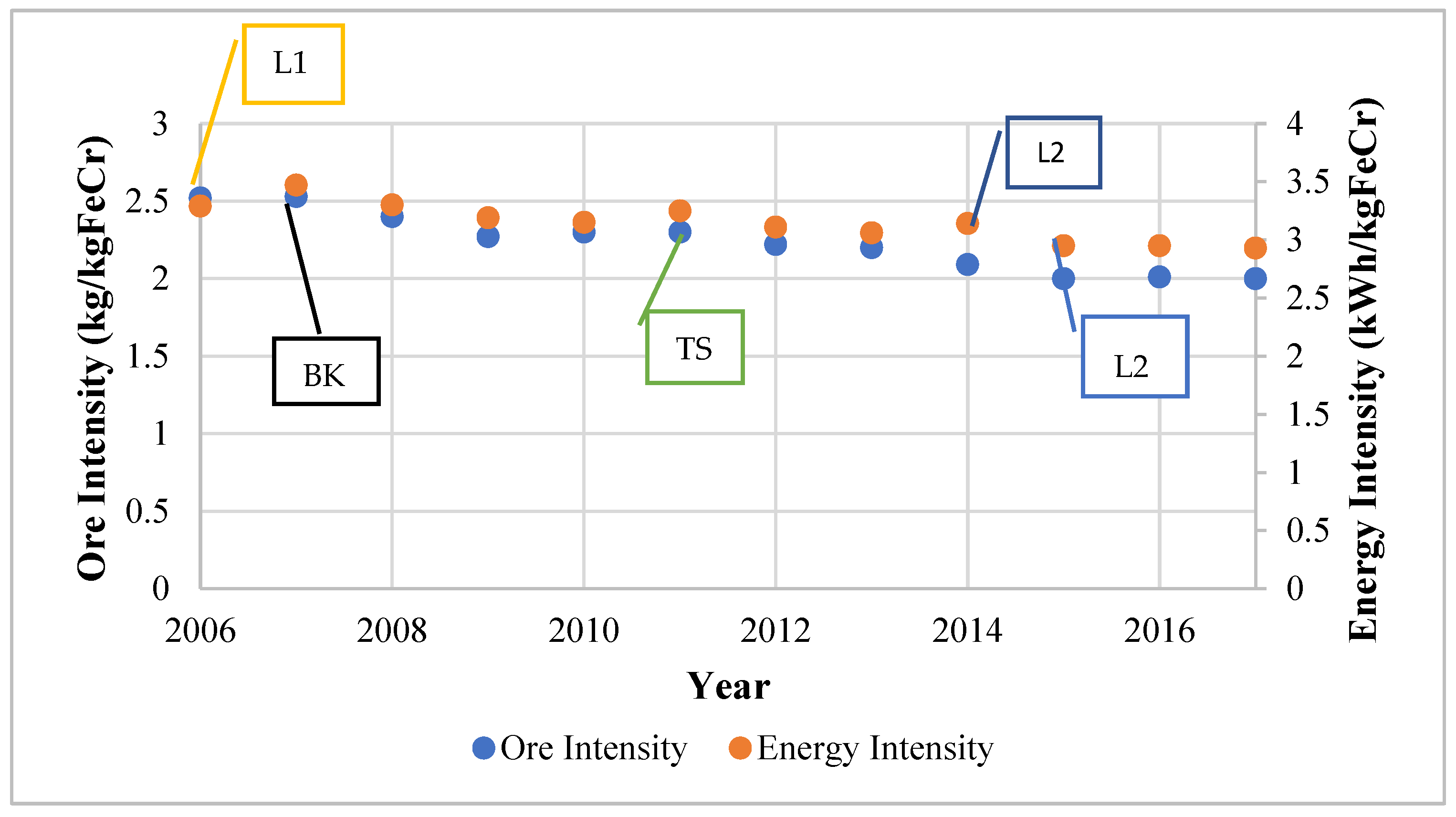

3.2. Ore intensity Trends

3.3. Energy Intensity Trends

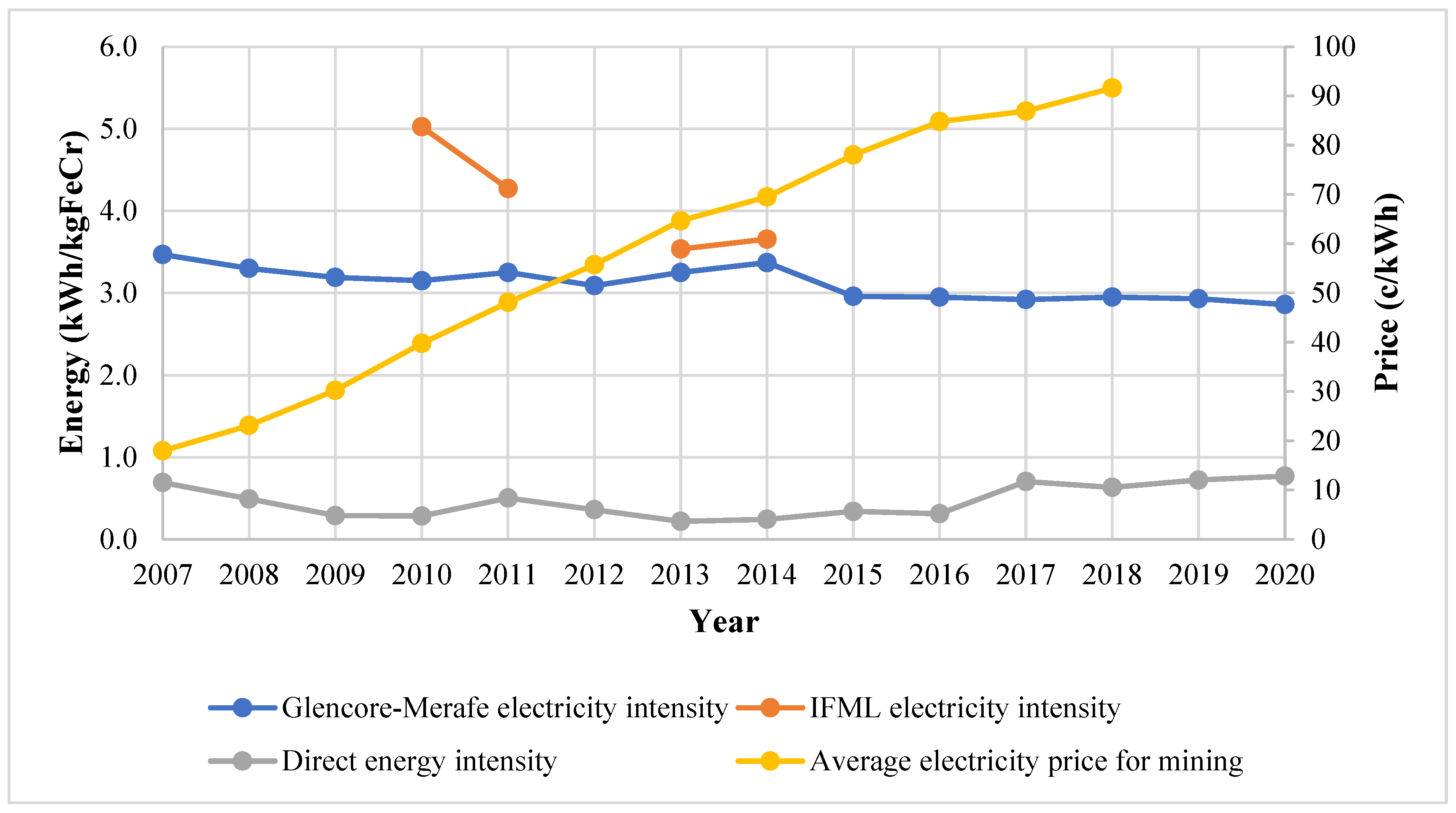

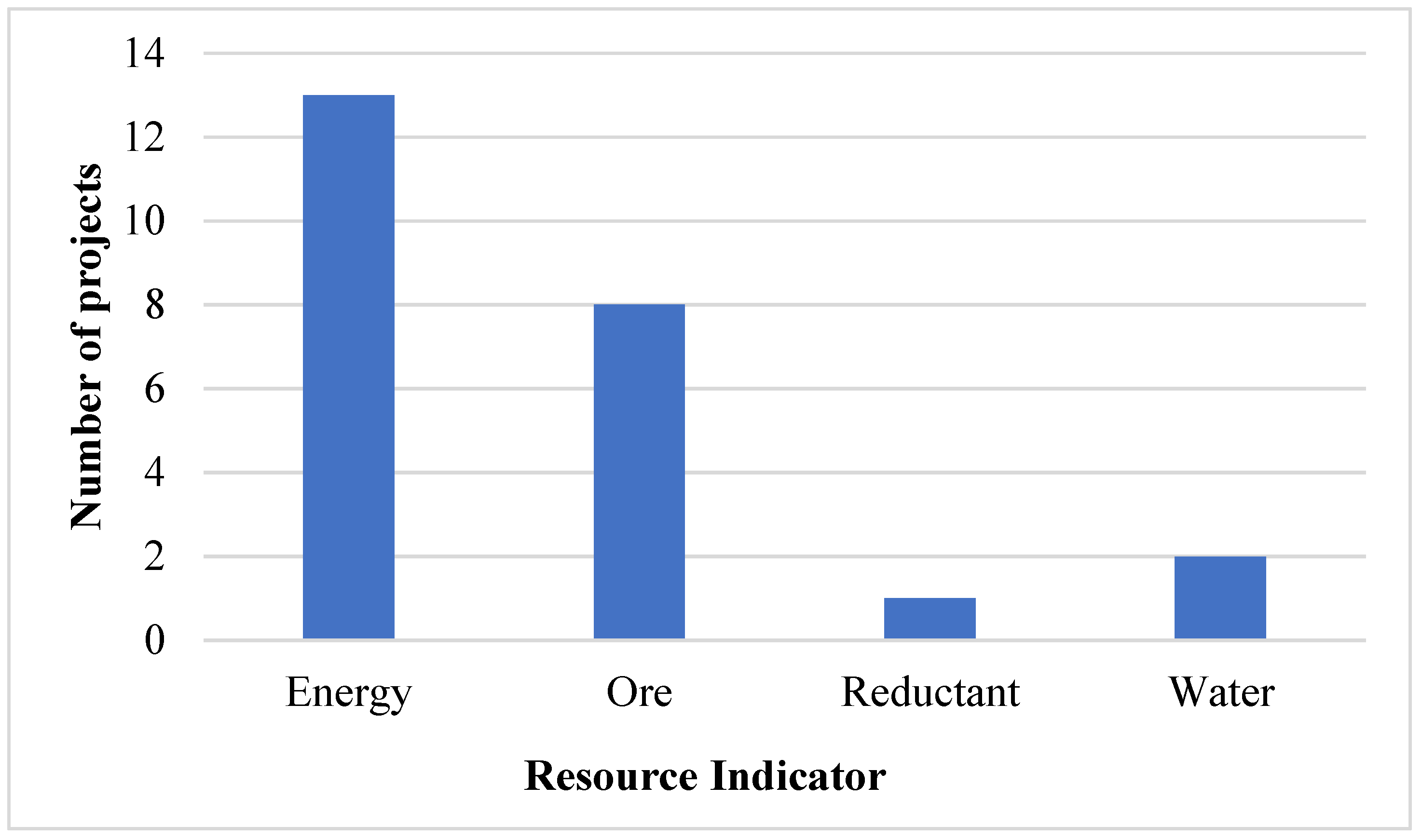

3.4. Industry Projects

3.5. Ore Intensity

4. Discussion

4.1. Ore Grade and Its Relation to Ore Intensity

4.2. Energy Intensity

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Gasik, M.I. Technology of chromium and its ferroalloys. In Handbook of Ferroalloys; Butterworth-Heinemann: Oxford, UK, 2013; pp. 267–316. [Google Scholar]

- Azapagic, A. Developing a framework for sustainable development indicators for the mining and minerals industry. J. Clean. Prod. 2004, 12, 639–662. [Google Scholar] [CrossRef]

- Ekins, P.; Hughes, N.; Brigenzu, S.; Arden Clark, C.; Fischer-Kowalski, M.; Graedel, T.; Hajer, M.; Hashimoto, S. Resource Efficiency: Potential and Economic Implications; Report of the International Resource Panel; United Nations Environment Program (UNEP): Paris, France, 2016. [Google Scholar]

- IIED. Breaking New Ground: Mining, Minerals, and Sustainable Development; Earthscan: London, UK, 2002. [Google Scholar]

- Laurence, D. Establishing a sustainable mining operation: An overview. J. Clean. Prod. 2011, 19, 278–284. [Google Scholar] [CrossRef]

- Spuerk, S.; Drobe, M.; Lottermoser, B.G. Evaluating resource efficiency at major copper mines. Miner. Eng. 2017, 107, 27–33. [Google Scholar] [CrossRef]

- Mudd, G. Global trends in gold mining: Towards quanitifying and resource sustainability? Resour. Policy 2007, 32, 42–56. [Google Scholar] [CrossRef]

- Calvo, G.; Mudd, G.; Valero, A.; Valero, A. Decreasing ore grades in global metallic mining: A theoretical issue or a global reality? Resources 2016, 5, 36. [Google Scholar] [CrossRef]

- Mudd, G.M. Sustainability and mine waste management—A snapshot of mining waste issues. In Proceedings of the Waste Management & Infrastructure Conference, Melbourne, Australia, 25 February–1 March 2007. [Google Scholar]

- Glaister, B.J.; Mudd, G.M. The environmental costs of platinum–PGM mining and sustainability: Is the glass half-full or half-empty? Miner. Eng. 2010, 23, 438–450. [Google Scholar] [CrossRef]

- Mudd, B.G.M. Sustainability reporting and the platinum group metals: A global mining industry leader? Platin. Met. Rev. 2012, 56, 2–19. [Google Scholar] [CrossRef]

- Northey, S.; Haque, N.; Mudd, G. Using sustainability reporting to assess the environmental footprint of copper mining. J. Clean. Prod. 2013, 40, 118–128. [Google Scholar] [CrossRef]

- Murthy, Y.R.; Tripathy, S.K.; Kumar, C.R. Chrome ore benenficiation challenges & Opportunities—A review. Miner. Eng. 2011, 24, 375–380. [Google Scholar]

- Nafziger, N.H. A review of the deposits and beneficiation of lower-grade chromite. J. S. Afr. Inst. Min. Metall. 1982, 82, 205–226. [Google Scholar]

- Gediga, J.; Russ, M. Life Cycle Inventory (LCI) Update of Primary Ferrochrome Production; International Chromium Development Association: Leinfelden-Echterdingen, Germany, 2007. [Google Scholar]

- Cramer, L.A.; Basson, J.; Nelson, L.R. The impact of platinum production from UG2 ore on ferrochrome production in South Africa. J. S. Afr. Inst. Min. Metall. 2004, 104, 517–527. [Google Scholar]

- Pan, X. Effect of South Africa chrome ores on ferrochrome production. In Proceedings of the International Conference on Mining, Mineral Processing and Metallurgical Engineering, Johannesburg, South Africa, 15–16 April 2013; pp. 106–110. [Google Scholar]

- Basson, J.; Curr, T.R.; Gericke, W.A. South Africa’s Ferro Alloys Industry-Present Status and Future Outlook; Macmillan India: New Delhi, India, 2007. [Google Scholar]

- Basson, J.; Daavittila, J. High carbon ferrochrome technology. In Handbook of Ferroalloys; Butterworth-Heinemann: Oxford, UK, 2013; pp. 317–363. [Google Scholar]

- Neizel, B.W.; Beakes, J.P.; van Zyl, P.G. Alteration of Chrome-to-Iron in Chromite Ore by Chlorination; North-West University: Potchefstroom, South Africa, 2010. [Google Scholar]

- Mc Dougall, I. Ferroalloys processing equipment. In Handbook of Ferroalloys; Butterworth-Heinemann: Oxford, UK, 2013; pp. 83–138. [Google Scholar]

- Dawson, N.F.; Edwards, R.I. Factors affecting the reduction rate of chromite. MINTEK 1987, 6, 12–19. [Google Scholar]

- Steele, F. Event History Analysis; Centre for Multilevel Modelling, Graduate School of Education, University of Bristol: Bristol, UK, 2005. [Google Scholar]

- Moorcroft, M. Tata Steel KZN to Pay Back the Money; Zululand Observer: Empangeni, South Africa, 2016. [Google Scholar]

- Pastour, D. Chrome and Ferrochrome Markets Recent Trends & Challenges; UNICHROME: Paris, France, 2018. [Google Scholar]

- IFML. Annual Financial Report of the Year Ended 30 June 2015. 2015. Available online: https://www.ifml.com/_/media/Files/I/International-Ferro-Metals/results-and-presentations/ifm-fy2015-annual-report.pdf (accessed on 16 April 2017).

- Merafe Resources. Integrated Annual Report 2009. 2009. Available online: http://www.meraferesources.co.za/pdf/reports/2009/ar_2009.pdf (accessed on 16 April 2017).

- Merafe Resources. Integrated Annual Report 2011. 2011. Available online: http://www.meraferesources.co.za/pdf/reports/2011/ar_2011.pdf (accessed on 16 April 2017).

- IFML. International Ferro Metals Limited Annual Report. 2011. Available online: http://files.investis.com/ifl/investor_centre/res_pres/ar_2011.pdf (accessed on 16 April 2017).

- IFML. Annual Report 2014. 2014. Available online: https://ifml.com/_/media/Files/I/International-Ferro-Metals/results-and-presentations/30-oct-2014-results.pdf (accessed on 16 April 2017).

- Merafe Resources. Integrated Annual Report 2014. 2014. Available online: http://www.meraferesources.co.za/reports/ir_2014/pdf/integrated-full-new.pdf (accessed on 4 April 2017).

- Merafe Resources. Integrated Annual Report 2015. 2015. Available online: http://www.meraferesources.co.za/reports/ir_2015/pdf/full-integrated.pdf (accessed on 16 April 2017).

- Merafe Resources. Integrated Annual Report 2017. 2017. Available online: http://www.meraferesources.co.za/reports/ir_2017/pdf/full-iar.pdf (accessed on 23 September 2017).

- Merafe Resources. Integrated Annual Report 2020. 2020. Available online: https://www.meraferesources.co.za/reports/ir-2020/pdf/full-integrated.pdf (accessed on 15 May 2021).

- Merafe Resources. Integrated Annual Report 2012. 2012. Available online: http://www.meraferesources.co.za/pdf/reports/2012/ar_2012.pdf (accessed on 16 April 2017).

- ICDA. Activity Report 2016. 2016. Available online: https://www.icdacr.com/download/ICDAActivityReport2016.pdf (accessed on 4 June 2018).

- Merafe Resources. Merafe Resource: Stakeholder Communication. 2017. Available online: https://www.meraferesources.co.za/pdf/presentations/2017/lion-site-visit.pdf (accessed on 16 April 2021).

- Cramer, M. Ferrochrome Commits to 750 MW Self-Generation, Junior Mining Support. 2020. Available online: https://www.engineeringnews.co.za/article/ferrochrome-industry-commits-to-750-mw-self-generation-junior-mining-support-2020-11-09/rep_id:4136 (accessed on 19 April 2021).

- Steyn, L. Business Day. 2021. Available online: https://www.businesslive.co.za/bd/companies/energy/2021-03-11-swedish-clean-tech-pilot-plant-opens-at-samancor-chrome/ (accessed on 19 April 2021).

- Google Maps. K1 and K1.5 Facilities, Rustenburg. 2019. Available online: https://www.google.com/maps/place/Kroondal+Mine/@-25.715034,27.3389868,779m/data=!3m1!1e3!4m5!3m4!1s0x0:0x8d6fb0233c94c1cb!8m2!3d-25.7136399!4d27.3193362 (accessed on 19 February 2019).

- Anglo-American Platinum. 2019. Available online: https://www.angloamericanplatinum.com/~/media/Files/A/Anglo-American-Group/Platinum/sustainability/platinum-tailings-storage-facilities-angloamerican-new.pdf (accessed on 20 January 2020).

- Nel, E.; Martin, C.; Raabe, H.; Theron, J. SGS Mineral Services: Media. 2004. Available online: https://www.sgs.com/-/media/global/documents/technical-documents/sgs-technical-papers/sgs-min-tp2004-02-pgm-ore-processing-at-ug-2-concentrator-in-south-africa.pdf (accessed on 4 April 2020).

- Jacobson, N.B. Industrial Symbiosis in Kalundborg, Denmark: A quantitative assessment of economic and environmental aspects. J. Ind. Ecol. 2006, 10, 239–255. [Google Scholar] [CrossRef]

- Reuters. 2020. Available online: Reuters.com/article/safrica-chrome-idUKL8N2HD30Y (accessed on 18 July 2021).

| Participant(s) | Organisation Type | Role |

|---|---|---|

| FP1-EM and FP1-WM | Ferrochrome Producer 1 | Group Environmental Manager and General Works Manager |

| FP2-SS | Ferrochrome Producer 2 | Safety and Sustainable Development Head |

| FP2-WM | Ferrochrome Producer 2 | Production Manager |

| CF1-Dir | Consulting Firm 1 | Director |

| CF2-Dir | Consulting Firm 2 | Director |

| Company | 2006 Capacity (kt/Year) | 2020 Capacity (kt/Year) |

|---|---|---|

| Glencore Merafe (Xstrata) | 1620 | 2340 |

| Samancor Chrome Limited (Samancor) | 1200 | 2300 |

| Tata KZN | 150 | 150 |

| Afarak Includes Mogale alloys processing plant | 110 | 110 |

| Hernic Ferrochrome | 420 | Acquired by Samancor |

| International Ferro Metals (IFML) | 267 | Acquired by Samancor |

| ASA Metals (Newco) | 410 | Acquired by Samancor |

| Assmang Chrome | 300 | Idle since 2012 |

| Total South African capacity | 4174 | 4895 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dlamini, R.; von Blottnitz, H. Resource Intensity Trends in the South African Ferrochrome Industry from 2007 to 2020. Minerals 2023, 13, 44. https://doi.org/10.3390/min13010044

Dlamini R, von Blottnitz H. Resource Intensity Trends in the South African Ferrochrome Industry from 2007 to 2020. Minerals. 2023; 13(1):44. https://doi.org/10.3390/min13010044

Chicago/Turabian StyleDlamini, Reuben, and Harro von Blottnitz. 2023. "Resource Intensity Trends in the South African Ferrochrome Industry from 2007 to 2020" Minerals 13, no. 1: 44. https://doi.org/10.3390/min13010044

APA StyleDlamini, R., & von Blottnitz, H. (2023). Resource Intensity Trends in the South African Ferrochrome Industry from 2007 to 2020. Minerals, 13(1), 44. https://doi.org/10.3390/min13010044