1. Introduction

The technological advancements and proliferation of economic globalization have led to a marked exacerbation of environmental concerns, particularly with regard to pollution and energy consumption [

1,

2]. How to promote enterprises to efficiently fulfill their environmental responsibilities (here, environmental responsibility mainly refers to enterprises reducing pollutant emissions in production and other processes through green technology innovation) and solve the contradiction between economic expansion and environmental degradation have become global challenges [

3,

4]. Green design (also termed life-cycle design or environmental design) is a product-development paradigm that requires explicit consideration, at the design stage, of a product’s environmental attributes. This involves minimizing the use of resources and hazardous substances and reducing waste generation over the entire life cycle so as to mitigate adverse effects on producers, users, and other stakeholders [

5,

6]. By enabling firms to jointly evaluate resource-use efficiency and anticipated life-cycle environmental impacts early in product design, green design offers a practical pathway to mutually reinforcing environmental and economic outcomes [

7,

8].

In recent years, an increasing number of manufacturing enterprises have embedded green design into product development and production to control resource use and pollutant emissions from production [

6,

9,

10]. Many companies have demonstrated in practice the importance of green design in balancing production costs and environmental impacts [

6]. HP, as one of the early companies to launch green design initiatives, has not only reduced material use and environmental impacts at the manufacturing stage, but also improved energy efficiency at the use stage [

5]. Likewise, Canon, by incorporating green design into product planning, development, and production processes, has substantially reduced product energy consumption and pollutant emissions, thereby improving resource utilization and performance [

9]. Although green design is helpful for enhancing resource utilization efficiency and can improve the brand competitiveness of enterprises, it often requires huge investment in early research and development [

11,

12]. At the same time, manufacturing enterprises often bear the environmental responsibility costs in product greening, and investment in green design may make other participants more profitable [

11,

13]. Therefore, it will become very complex and difficult for manufacturers to make decisions on whether to carry out green design and how to decide on the optimal green design level, because they not only need to balance investments and incomes, but also ponder on the actions made by other members [

6,

13].

The difference in the supply chain channel power structure is one of the key factors affecting channel profit distribution [

14]. In different power structures, the specific order of decision-making varies, as does the impact on the optimal decision-making of other members [

15]. Due to their greater bargaining power, dominant enterprises frequently affect the economic and environmental decisions of relatively weaker participants, enabling themselves to make decisions first as leaders [

15,

16]. In fact, most research has shown that strong retailers in the supply chain are often able to obtain more marginal retail profits, which causes the wholesale profit of manufacturers to not be enough to offset the cost of carrying out green design [

11,

17]. A case in point is P&G’s USD 200 million investment aimed at reducing packaging material usage, while the majority of the economic gains from this initiative were appropriated by Wal-Mart [

11]. More broadly, dominant retailers often exert their positional advantage in the channel to diminish manufacturers’ pricing power and reduce their share of marginal profits, as observed in interactions involving firms such as Costco and Alibaba [

16].

In this case, some manufacturers believe that the more they invest in green design/sustainability, the more their competitiveness will be further weakened [

18]. The impact of channel power on manufacturers’ green design motivation and environmental performance is also a growing concern [

19,

20]. Therefore, shifts in channel power may hinder manufacturers from investing in green design [

13,

14]. When manufacturers lack sufficient channel power, they may be unable to secure adequate wholesale margins to offset the costs of green design investment [

11]. A corresponding real-world example is Amazon’s Frustration-Free Packaging program, which requires manufacturers to redesign green packaging at their own expense, while Amazon captures the majority of the benefits through improved customer experience. To the best of our knowledge, only a limited number of studies have explored the impact of channel power on supply chain performance and sustainability [

16,

18]. However, the existing literature has largely overlooked the multifaceted effects of green design—particularly its implications for cost structures, market demand, and environmental impact [

5,

9]. Specifically, there is a lack of research examining how channel power influences manufacturing enterprises’ green design investment strategies, as well as the resulting trade-offs in profitability and sustainability.

To address the gap in the existing literature regarding the interplay between channel power structures and green design decisions, this study aims to explore three core research questions. First, under three channel power structures, does the manufacturer consistently have sufficient economic or environmental motivation to invest in green design initiatives? Second, how do varying channel power configurations influence the manufacturer’s green design decisions, and what are the implications for firm-level profitability, supply chain operational performance, and environmental outcomes? Third, from an environmental perspective, does green design lead to a reduction in the total environmental impact of product? By answering these questions, we seek to uncover the conditions under which green design becomes both a sustainable and strategic choice for manufacturers operating under different power structures.

Consistent with prior research, this study focuses on supply chains composed of a manufacturer and a retailer, particularly in the context of durable consumer goods such as consumer electronics, household appliances, and small-scale durable products [

6,

7]. In these types of supply chains, the manufacturer and retailer are the principal decision-makers, while other potential participants are often regarded as exogenous or passive players [

7,

8]. Green design is typically a prominent and certifiable product attribute in such settings [

11,

13]. The decision to center the analysis on manufacturer–retailer supply chains is grounded in both theoretical tractability and practical relevance [

12,

13]. In practice, manufacturers are generally the key actors responsible for product development and green design investment—examples include leading firms in the home appliance industry such as Midea and Samsung. After production, manufacturers set the wholesale price and supply products to retailers [

13,

14]. Retailers, in turn, serve as intermediaries who interact directly with end consumers—such as GOME or JD.com in the home appliance market—and determine the final retail prices offered to the market.

This study adopts a game-theoretic modeling approach to capture the strategic interactions among key supply chain participants and to reflect the multifaceted impact of green design on cost, demand, and environmental outcomes [

16,

17]. Specifically, we develop six supply chain decision models under three distinct channel power structures—manufacturer-led (e.g., Huawei, Apple, who typically dominate their supply chains [

21]), retailer-led (e.g., Amazon, Tmall, which often act as dominant players [

22]), and Nash game (e.g., GOME and Gree, where both parties possess comparable bargaining power [

23]). In these models, the manufacturer determines the level of green design and wholesale pricing, while the retailer sets the retail price [

13,

14]. This structure mirrors real-world settings in which manufacturers like Huawei integrate green design into their production processes to reduce material and energy consumption from the source [

9] and subsequently sell the products at a wholesale price to platforms such as JD.com. In order to facilitate the analysis of the economic and environmental performance generated by green design, we use the profit of the enterprise as the economic indicator, and the higher the profit, the more significant the economic performance [

3,

4]. We also use the environmental impact of the product as an environmental indicator, where lower environmental impact signifies greater environmental performance [

7,

9].

Compared to the existing literature on supply chain greening behavior consideration [

13,

16], our research both confirms the previous findings in a broader environment and expands the research perspective to provide new findings and management insights. Specifically, our research shows that under the multiple influences of green design, the following conclusions are still valid: Firstly, the enhancement of the manufacturer’s capacity to generate revenue is a possible consequence of increased power, but it is not necessarily aligned with enhancing the collective financial gains of the supply chain as a whole (here, the supply chain as a whole refers to all the participating firms within the supply chain, most commonly the manufacturer and the retailer) [

16,

17]. In contrast, strategies that promote green development have the potential to yield enhanced profits for the supply chain [

20]. Secondly, an increase in consumer environmental awareness (CEA) consistently facilitates an increase in the market demand and the overall profits of the supply chain [

12]. Finally, the increase in green design cost coefficient is likely to lower the market demand and the overall profits [

1]. However, given the multifaceted nature of green design, our research results diverge as follows: Firstly, the green design behavior of the manufacturer may not always lead to higher product prices; that is, greening may not always lead to higher prices. Secondly, balanced channel power may not yield a greater capacity to augment the overall supply chain profitability when compared with that dominated by the retailer. Last but not least, an increase in both CEA and the manufacturer’s green design behavior may not contribute to a reduction in the total environmental impact, making green design the least advantageous for retailer-led power structures with regard to total environmental impact.

The subsequent sections are structured as follows.

Section 2 presents a review of the relevant literature.

Section 3 introduces the problem at hand.

Section 4 constructs and solves the decision-making models under diverse channel power structures.

Section 5 discusses the equilibrium results.

Section 6 validates the findings through numerical simulation. Finally,

Section 7 summarizes the research conclusions of this paper and explores potential future research directions. The proofs of the Propositions are provided in

Appendix A.

3. Problem Description and Assumptions

In this paper, we consider a supply chain comprising a manufacturer and a retailer, assuming symmetric information between them [

12,

13]. The manufacturer is responsible for product development and production, with the opportunity to implement green design in the early stages to reduce energy consumption and the unit product’s environmental impact. The retailer is responsible for product sales. Although our model focuses on the manufacturer–retailer dyad, this structure captures the core strategic interface in many durable goods supply chains—such as consumer electronics and home appliances—where decisions on green design and pricing are predominantly driven by these two parties [

16,

17]. Such modeling assumptions have been widely adopted in the existing literature to capture the essential dynamics of supply chain operation [

16,

17,

18,

19,

20].

Although information is symmetric, power asymmetry still exists due to differences in market position, brand influence, and bargaining ability between supply chain members [

16]. For instance, electronic product manufacturers such as Lenovo and HUAWEI often lead supply chains through technological or brand dominance [

21], while retailers such as Wal-Mart and Suning exert control through extensive distribution networks [

22]. Additionally, in some vertically integrated or closely coordinated systems (e.g., Gome–Gree partnerships), power is more balanced [

23]. To capture the influence of channel power structure on green design decisions and environmental outcomes, we consider three game structures: a manufacturer-led Stackelberg game, a retailer-led Stackelberg game, and a Nash game representing a balanced power structure. From the perspective of environmental responsibility, we explore how shifts in channel power affect manufacturers’ incentives to invest in green design, and how these changes influence the economic and environmental performance of the supply chain.

To clarify the problem, the symbol definitions are shown in

Table 1, and the relevant assumptions are as follows.

Assumption 1. When the manufacturer does not carry out green design, referring to Shi et al. [

39], the product market demand function is

.

A global survey conducted by Accenture reveals that over 80% of consumers consider the green attributes of a product when making purchasing decisions [

7]. In practice, many companies in the electronics and home appliance industries have begun to implement green design strategies to cater to growing CEA and to expand their market share. For example, Huawei has reduced CO

2 emissions by more than 30,000 tons through green design investments, while also significantly improving its product market share [

9]. Therefore, green design investments can effectively meet rising CEA and enhance market demand [

11,

13]. Drawing on Yenipazarli [

11], the product market demand function when the manufacturer carries out green design is

. The manufacturer’s green investment cost is

, where

denotes the green design cost coefficient [

4,

16].

Assumption 2. The manufacturer’s green design is capable of cutting down the production cost and the unit environmental impact [

5,

9]. In the consumer electronics supply chain, HP has adopted green design strategies that not only reduce material usage during the production process but also significantly lower pollutant emissions [

5]. In the electric vehicle sector, BYD has continuously invested in green design research and development, which has reduced the production cost of new energy vehicles by 30%, improved their energy efficiency, and decreased emissions during both the production and usage stages [

9]. Therefore, in the case of manufacturer’s green design, the unit production cost is

, and the unit environmental impact is

.

Assumption 3. To ensure that all profit functions are concave and that related expressions are economically feasible, in line with prior research [

13,

34], the scale parameter satisfies

.

5. Equilibrium Result Analyses

This study considers a supply chain consisting of a single manufacturer and a single retailer, which is a common structure in durable goods industries such as electronics and home appliances. Under this supply chain type, we first investigate whether the manufacturer has the incentive to adopt green design under different channel power structures, as well as the impact of green design implementation on supply chain decisions and environmental performance. Second, we explore how different power structures influence the manufacturer’s green design investment level, firm profitability, and environmental performance. Finally, we analyze how key cost parameters affect the optimal level of green design and the resulting supply chain decisions. All proofs of propositions are provided in the

Appendix A.

5.1. The Impact of Green Design on the Operation of the Supply Chain and Environmental Performance Under Three Channel Power Structures

Proposition 1. (1) In the case of the manufacturer-led structure, (a) when , , and when , ; (b) when , , and when , . (2) In the case of the retailer-led structure, (a) when , , and when , ; (b) when , , and when , . (3) In the case of the Nash game structure, (a) when , , and when , ; (b) when , , and when , .

Proposition 1 shows that, regardless of the channel power structure, the adoption of green design by a manufacturer does not inevitably result in increased wholesale and retail prices of products. Specifically, the manufacturer and retailer will charge higher prices for green design only if consumers are more sensitive to green design than to product price (i.e., consumers pay more attention to the environmental level of products). Conversely, both manufacturer and retailer will adopt a lower price strategy. Actually, diverse enterprises will also comprehensively deliberate the price sensitivity and CEA level of prospective consumers when formulating price strategies for ordinary products and environment-friendly products based on green design. Prospective consumers of high-end car brands such as BMW and Mercedes Benz are usually less sensitive to product prices, and the prices of the electric versions of the same series of models are much higher than those of the gasoline versions (for example, the price of the gasoline version of the BMW X5 is CNY 700,000, while the price of the electric version of the same series is CNY 860,000). The prospective consumers of Wuling Hongguang pay more attention to product price, so the price of the new electric car launched by Wuling Hongguang is only CNY 28,800, far lower than its previous gasoline car price (about CNY 50,000).

Previous studies have generally believed that when carrying out green research and development (R&D), enterprises usually increase the price of products to make up for their own investment in green R&D [

1,

11]. However, we show that whether enterprises will set higher product prices after adopting green design depends on the consumption concept of prospective consumers. If prospective consumers emphasize the environmentally friendly level of products more, enterprises should set higher product prices. On the contrary, in order to retain consumers, enterprises should adopt a lower product price strategy.

Proposition 2. Under the three channel power structures, , , , and , where and .

Proposition 2 shows that, whatever the channel power structure, compared with the case in which the manufacturer does not carry out green design, the manufacturer’s green design behavior contributes to higher product sales and increased profits for supply chain members and overall. In fact, product sales determine whether an enterprise can quickly attract consumers and occupy the market, which is also the key to the survival and profitability of the enterprise. The products produced by manufacturers after carrying out the green design strategy are more efficient and energy-saving, which can not only effectively cater to increasing CEA but also lower the use cost of consumers’ products. Therefore, compared with traditional products, consumers exhibit a greater propensity to purchase environmentally friendly and energy-efficient products based on green design. For example, GREE has always been committed to the independent R&D of green, low-carbon, and environment-friendly air conditioners, providing rosy future prospects regarding air conditioners and improving their energy efficiency by more than 10%, thereby achieving the effect of not damaging the ozone layer or contributing to the greenhouse effect, which has also been widely praised by consumers. According to the sales data of various brands of air conditioners published by HUATAI Securities Research Institute in 2020, GREE ranks first in the industry with a share of 36.9% and continues to maintain its leading position.

In combination with Propositions 1 and 2, when green design is applied, enterprises should not only consider their own investments in green design when formulating product price strategies but do so in combination with the consumption preferences of prospective consumer groups, so as to better cater to consumers and occupy the market.

Proposition 3. (1) In the case of the manufacturer-led structure, when , , and when , . (2) In the case of the retailer-led structure, when , , and when , . (3) In the case of the Nash game structure, when , , and when , .

Proposition 3 shows that, notwithstanding the prevailing channel power structure, the manufacturer’s adoption of green design does not invariably result in a diminution of products’ aggregate environmental impact compared with that in the absence of such design. Specifically, manufacturers’ green design behavior can only be efficacious in reducing the total environmental impact if green design can significantly minimize the unit environmental impact. This is due to the fact that the total environmental impact of a product is contingent upon two factors: the sales volume of the product and unit environmental impact. Despite the manufacturer’s efforts to mitigate the unit environmental impact through green design, there is a concomitant augmentation in product sales. Consequently, it is only when the manufacturer significantly lowers the unit environmental impact to a large extent through green design that this can offset the adverse environmental impact of increased product sales due to green design. At this time, the manufacturer’s green design can serve as a pivotal factor in diminishing the collective environmental impact.

Comprehensively, as shown by Propositions 1–3, a change in channel power structure has no influence on whether the manufacturer adopts green design strategies. Under the three channel power structures, a manufacturer’s green design behavior will continue to increase profits for her and the entire supply chain. However, it may not necessarily lower the total environment impact of products. Therefore, for manufacturing enterprises, when carrying out green transformation through green design, they prioritize not only the reduction of products’ production cost and the augmentation of market demand through green design but also make more green investment to lower the total environmental impact. For example, as mentioned in its 2020 Environmental Progress Report, Apple is actively working to lower the carbon footprint of its products while reducing product material and energy consumption through green design.

5.2. The Impact of Channel Power Structure on Green Design and Environment

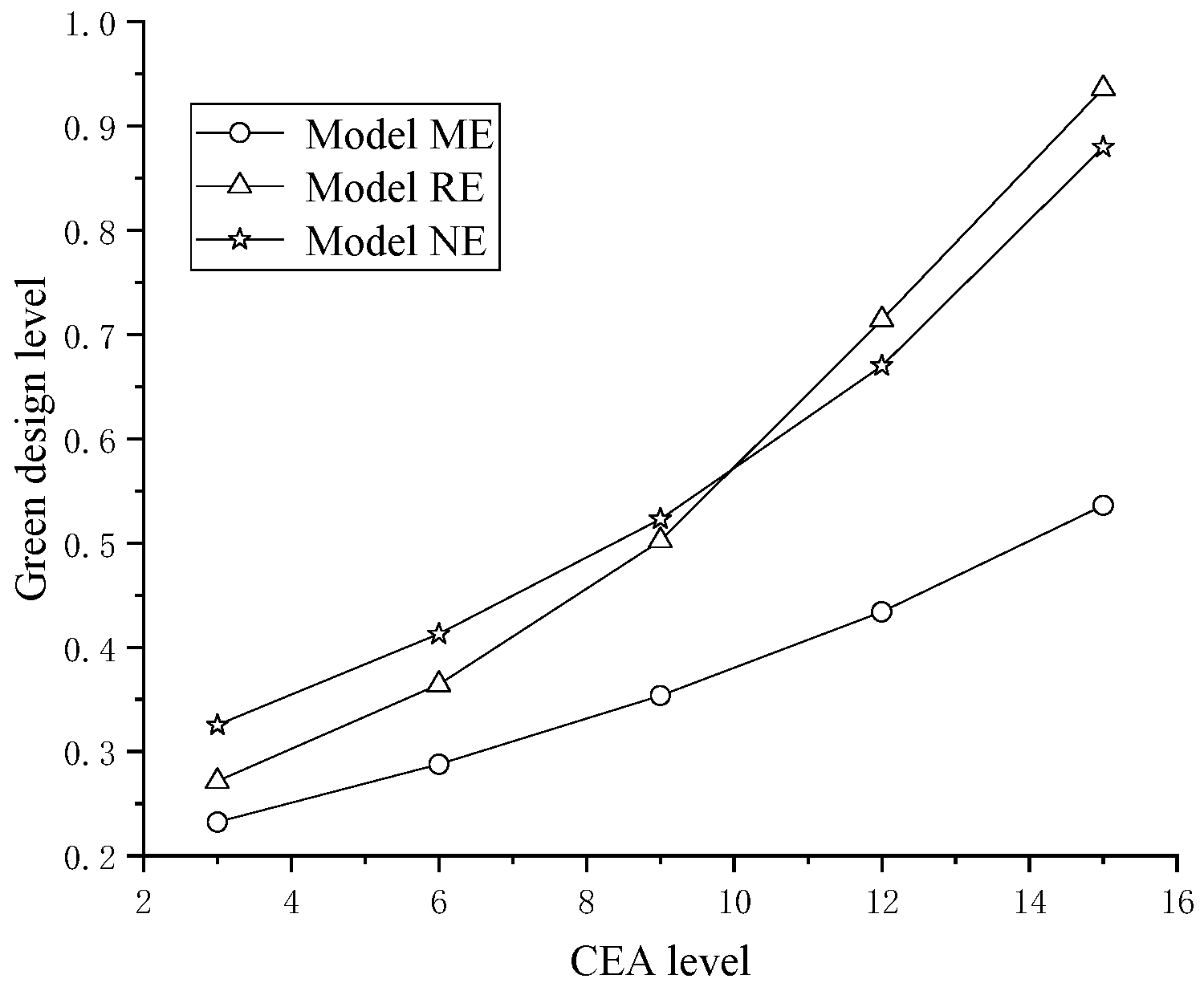

Proposition 4. In the case that the manufacturer carries out green design, under three distinct channel power structures, (1) when , and . (2) When , and .

Proposition 4 shows that Nash game and retailer-dominated structures are more useful in lowering wholesale prices and producing higher levels of green design than manufacturer-dominated ones. Specifically, in circumstances where the green investment coefficient is comparatively minimal in relation to the retailer-led channel power structure, the capacity for the enhancement of green design and market demand is more pronounced. However, this configuration tends to impede the process of wholesale price reduction. On the contrary, when the coefficient of green investment is relatively high, the Nash game structure promotes green design improvement while hindering wholesale price reduction.

In fact, the manufacturer tends to maximize profits by raising wholesale prices and at the same time balance green design investments through adjustments to the green design level. Under manufacturer-dominated channel power structures, where the manufacturer holds stronger bargaining power, this results in consistently higher wholesale prices and lowered green design levels. Conversely, under retailer-led structures, the manufacturer’s weaker bargaining power drives a focus on green design improvements when investments are low. Therefore, when the investment coefficient of green design is relatively low, the manufacturer prioritizing enhanced green design lowers production costs, stimulates market demand, and ultimately increases profits.

Proposition 5. In the case that the manufacturer carries out green design, under three distinct channel power structures, (1) . (2) When , , and when , .

Proposition 5 shows that, in the context of economic analysis, it has been demonstrated that the Nash game invariably results in a higher contribution to product prices, with the contributions from the manufacturer-led and retailer-led games following in sequence. If the green design investment coefficient of the manufacturer is lower than a certain critical value, the adoption of the retailer-led model will be more conducive to expanding the product market demand. When the green investment coefficient is relatively large, the Nash game structure contributes more to product market demand. Under the manufacturer-led structure, the product demand is always the least favorable.

Propositions 4 and 5 reveal that the manufacturer-led channel power structure consistently hinders improvements in green design levels and market demand. Whether green design is promoted in the context of a retailer-led or Nash game structure is contingent upon the investment coefficient. Regarding green design and market demand improvements, if the green investment coefficient is low, the retailer-led structure is better. If the opposite is the case, the Nash game structure is better.

Proposition 6. In the case that the manufacturer carries out green design, under three distinct channel power structures, (1) . (2) . (3) When , , and when , .

Proposition 6 indicates that both the manufacturer and the retailer always earn higher profits when they act as the channel leader and obtain lower profits when they act as the follower. When the cost coefficient of the manufacturer’s green design investment is relatively low, the retailer-led power structure is more conducive to improving the overall performance of the supply chain. Conversely, when the green design investment is costly, the Nash game structure is more favorable for enhancing overall supply chain performance. Moreover, under the manufacturer-led structure, the total profit of the supply chain is always the lowest. The results show that when the green investment coefficient is low, the retailer-led supply chain structure can improve the overall performance of the supply chain more efficiently. On the contrary, if the green investment coefficient is high, the Nash game model has more advantages. It is worth noting that in the manufacturer-led supply chain structure, its total profit is always at the lowest level.

Chen et al. [

17] showed that the total profits of supply chain under the Nash game structure is greater than that under the channel power structure dominated by manufacturers or retailers. We further reveal that in the context of green design, when the green design investment cost coefficient is relatively small, the total profits of the supply chain under the retailer-led channel power structure is greater.

Proposition 7. In the case that the manufacturer carries out green design, under three distinct channel power structures, (1) when , ; (2) when , ; (3) when , ; (4) when , .

Proposition 7 shows that, when the unit green design level is small, which means the reduction of the unit environmental impact can only be achieved to a minor degree, the channel power structure dominated by the manufacturer contributes more to the total environmental impact, while the Nash game channel power structure performs the worst. With an increase in , the channel power structure that is most useful to the reduction of the total environment impact will gradually change from a manufacturer-led to a Nash game structure. The channel power structure that is most unfavorable to reducing the total environment impact will gradually change from a Nash game to a retailer-led structure, and finally to a manufacturer-led structure. This occurs because total impact hinges on two factors: product sales volume () and per-unit environmental impact under green design. Consequently, when is small, product sales volume exerts a more pronounced influence on total environmental impact. When increases, the unit environmental impact reduces, and exerts a more pronounced influence on the total environmental impact.

Based on the assumption that the manufacturer increases product greenness through product design, Hong et al. [

7] stated that the retailer-led channel power structure is more effective in enhancing supply chain environmental performance. However, we further reveal that the retailer-led channel power structure does not really allow for a greater reduction in the product’s overall environmental impact than the manufacturer-led channel power structure.

Proposition 7 reveals that, from the perspective of reducing the total environmental impact, the channel power structure dominated by the manufacturer is better when enterprises can only lower the unit environmental impact to a small extent through green design. The opposite is true for the Nash game structure.

Table 5 presents a comparative summary of the key findings under three distinct channel power structures: manufacturer-led, retailer-led, and Nash game. The comparison integrates and synthesizes the results derived from the formal propositions (Proposition 1–Proposition 7) and provides a clear and intuitive understanding of how power dynamics affect supply chain decisions, economic outcomes, and environmental performance.

First, it is evident that the manufacturer always has an incentive to implement green design regardless of the power structure, as it enhances overall supply chain profit (Propositions 1 and 2). Second, the adoption of green design may not necessarily result in a significant increase in product prices under any of the three structures, which helps alleviate concerns about green premium pricing (Proposition 1).

Regarding green design level, market demand, and profit, the retailer-led structure performs best when the green design cost coefficient is small, while the Nash game structure shows the best performance when the cost coefficient is large (Propositions 4 and 5). In terms of improving supply chain profit, both the retailer-led and Nash game structures outperform the manufacturer-led structure under high green design costs (Proposition 6).

Finally, when evaluating total environmental impact, the power structure’s effectiveness varies with the parameter , which denotes the reduction rate of unit product impact through green design. Specifically, when is large, the Nash game structure is most effective in reducing total environmental impact, whereas when is small, the manufacturer-led structure performs better (Proposition 7). This reveals that while green design is broadly beneficial, the environmental outcome depends critically on both the marginal effect of green design and the underlying power structure.

This table consolidates theoretical insights into a managerial framework, facilitating better decision-making and highlighting the conditions under which each power structure is preferable from economic and environmental perspectives.

5.3. The Impact of Cost Parameters on Green Design and Supply Chain Performance

Proposition 8. In the case that the manufacturer carries out green design, under three different distinct power structures, , , , , , , and , where .

Proposition 8 shows that, whatever the channel power structure, an increase in not only lowers wholesale and retail prices, enhances green design levels and market demand, but is also conducive to increasing the profits of supply chain members and the supply chain as a whole. This is because with an increase in , improved per-unit green design efficiency more effectively lowers product production costs, motivating the manufacturer to cut wholesale prices and elevate green design levels. Meanwhile, the reduction of wholesale price and the improvement of green design level will also encourage the retailer to further increase market demand by reducing the retail price in response to the manufacturer’s efforts to increase the green design level. Finally, as the market demand grows, the manufacturer, the retailer, and the whole supply chain will benefit accordingly.

Proposition 8 reveals that when green design is carried out, the manufacturer can aim to minimize raw material usage without compromising product quality and performance, enabling more efficient production cost reduction through green design. This approach not only elevates their own profits but also strengthens overall supply chain performance. For example, by means of green design, Chrysler lowered material consumption and eradicated inefficient and redundant processes in manufacturing, thereby saving billions of dollars.

Proposition 9. (1) In the case of the manufacturer-led structure, (a) when , , and when , ; (b) when , , and when , . (2) In the case of the retailer-led structure, when , , , and when , , . (3) In the case of the Nash game structure, (a) when , , and when , ; (b) when , , and when , . (4) Whatever the channel power structure, , , , , and .

Proposition 9 shows that, no matter what the channel power structure, the green design level, market demand, and either the profitability of the supply chain members or the overall supply chain are decreasing. However, counterintuitively, the wholesale and retail prices may not necessarily rise accordingly. In fact, when the green investment coefficient rises, the manufacturer directly lowers the green design level, which in turn indirectly restrains market demand. The profits of the manufacturer and the retailer are more dependent on market demand, which is subject to product price and green design level. Therefore, the manufacturer and retailer will counter the loss of market demand caused by the decline in green design level through price reduction strategies when CEA is stronger. On the contrary, when CEA is relatively weak, the reduction in market demand caused by the decline in green design level is limited. This time, the manufacturer and retailer benefit themselves by increasing prices appropriately.

Proposition 9 reveals that increased investment in green design by the manufacturer will lead to a reduction in green design level, thereby reducing product demand and the overall profits of the supply chain. Therefore, the government, as regulator of the market, should create a better environment for manufacturers to innovate green design, so as to encourage manufacturers to improve green design level and thus better enhance the overall performance of supply chain.

7. Conclusions, Management Insights, and Future Research

7.1. Conclusions

With the increasingly stringent environmental laws and regulations and the enhancement of CEA, more and more manufacturing enterprises reduce their resource consumption in the production process through green design to fulfill the environmental responsibility of green and low-carbon development and realize the transformation from traditional manufacturing to green manufacturing.

From the perspective of environmental responsibility, this study examines three types of channel power structures—manufacturer-led, retailer-led, and Nash game—and develops six supply chain decision-making models under scenarios with and without green design implementation. We investigate whether the manufacturer has incentives to engage in green design under different power structures and analyze the resulting impacts on supply chain decisions and environmental outcomes. The main conclusions are as follows: (1) Regardless of the channel power structure, the manufacturer always has the incentive to implement green design to increase both the profits of supply chain members and the supply chain as a whole. (2) Compared with the manufacturer-led structure, the retailer-led and Nash game structures are more conducive to improving the green design level, market demand, and the overall profits of the supply chain. (3) When the investment cost coefficient of green design is large, the Nash game channel power structure is more conducive to improving the green design level and the overall performance of the supply chain. When the opposite is the case, the channel power structure dominated by the retailer is better. (4) Although a large green design investment cost coefficient may not lead to higher product prices, it will reduce the enthusiasm of the manufacturer to engage in green design and thus reduce the overall profits of the supply chain. The enhancement of CEA is conducive to encouraging the manufacturer to improve her green design level, expand market demand, and increase the overall profits of the supply chain, but it may not always be conducive to reducing the total environmental impact of products. (5) Only when green design can significantly reduce the environmental impact of unit products can the manufacturer reduce the total environmental impact through implementing green design. (6) When green design can only reduce the environmental impact of unit products to a small extent, the manufacturer-led structure is more conducive to reducing the total environmental impact of products. When the opposite is the case, the Nash game channel power structure is better.

7.2. Management Insights

Based on the above theoretical insights and numerical results, we derive several practical implications for governments, enterprises, and consumers to jointly promote the efficiency and sustainability of green supply chains:

Governments play a pivotal role in shaping green supply chain practices. On one hand, they should reduce the cost of green innovation for manufacturers through targeted policy tools such as green subsidies, low-interest green credits, and tax incentives. For example, China’s Green Credit Guidelines have already facilitated financing for eco-friendly manufacturing upgrades in the home appliance and electronics sectors. On the other hand, regulatory authorities must ensure environmental effectiveness by setting minimum thresholds for green design performance and enforcing stricter eco-labeling standards. To avoid superficial green labeling, policies should encourage or mandate the disclosure of unit-level emission reduction data. This will enhance transparency and enable consumers to distinguish between genuinely sustainable products and those driven merely by green marketing.

At the firm level, manufacturers—regardless of their position in the channel power structure—should proactively fulfill environmental responsibilities by investing in authentic green design innovations. Real-world examples such as Huawei and BYD demonstrate the tangible benefits of such strategies: Huawei’s eco-design efforts reduced CO2 emissions by over 30,000 tons while boosting market share, while BYD lowered NEV production costs by 30% and improved energy efficiency. Through sustained innovation, firms can build a strong green brand image, improve supply chain performance, and enhance their competitive position in environmentally conscious markets.

However, increasing green demand also brings risk. Our analysis reveals the potential for a “green consumption trap”, in which rising CEA stimulates demand, but if per-unit environmental impact is not significantly reduced, the total environmental burden may actually increase. For instance, the Autohome New Energy Vehicle Consumption Insight Blue Book finds that NEV users drive more frequently and longer daily distances than traditional vehicle users. Similarly, consumers using energy-efficient appliances often extend usage time, offsetting energy savings. To address this issue, governments should direct subsidies toward technologies that deliver real emission reductions, while consumers must be educated to avoid overconsumption of green products and make informed, rational purchasing decisions based on verified environmental data.

7.3. Future Research

While this study offers valuable theoretical insights, it has several limitations that suggest promising avenues for future research. First, the model adopts a simplified dyadic supply chain structure involving a single manufacturer and a single retailer. Although this captures key strategic interactions in many durable goods industries, real-world supply chains often involve more-complex, multi-tiered networks comprising suppliers, distributors, and logistics providers. Extending the analysis to multi-echelon or networked supply chains would enhance the generalizability of the findings. Second, the model is based on a static game framework, which limits its ability to capture dynamic strategic decisions over time—particularly relevant in the context of green design, where investment and regulatory responses evolve gradually. Future work could explore dynamic Stackelberg or differential game formulations to account for time-dependent decision-making and long-term environmental impacts. Third, the assumption of a linear demand function may oversimplify consumer behavior, which is often nonlinear and subject to uncertainty due to trends, media influence, and market volatility. Incorporating stochastic demand models or nonlinear functional forms, such as those based on random utility theory or robust optimization, could yield more-nuanced results. Lastly, while this study is grounded in analytical modeling, it lacks empirical validation. Future research should seek to calibrate the model using firm-level or industry-level data—such as from Huawei, BYD, or HP—or employ simulation-based case studies to assess the robustness of the theoretical conclusions and their relevance in real-world green supply chain practices.