Abstract

In order to improve the market competitiveness of suppliers and their resilience to emergencies, it is of great significance to discuss the investment decision making of suppliers in developing new products under uncertain and competitive environments. In this paper, with the background of knowledge spillover, absorptive capacity, initial R&D investment, and innovation efficiency asymmetry, the uncertainty of price, sales, and cost are incorporated into the evaluation system as three important risk factors. On the basis of the existing real option investment evaluation model, a real option game model of R&D investment of supplier enterprises based on multiple random variables is established. The sensitivity analysis of parameters is carried out with an example of one enterprise’s monitor R&D project. The results depict that the probability of R&D success has a great impact on the value of enterprise options, which depends on the R&D investment, innovation efficiency, and R&D performance of enterprises. Secondly, the drift rate of price, sales, and cost also has a significant impact on improvement in enterprise option value.

1. Introduction

With the implementation of the “Fourteenth Five-Year Plan” in China, policies for the development of various medical institutions continue to be issued. The rapid construction of hospitals across the country has driven the development of the medical device industry. According to “the Blue Book of Medical Device Industry: Annual Report on the Development Medical Device Industry in China (2021)” [1], China’s medical device industry has developed rapidly amid COVID-19 prevention and control. The number of medical device manufacturers increased from 18,070 at the end of 2019 to 26,465 at the end of 2020, with a growth rate of 46%. Especially in the post-pandemic period, the demand of the medical device industry is rigid. To gain competitive advantages, domestic medical device enterprises must accelerate R&D and innovation and continue to improve product technology and quality while reducing costs.

According to “the Blue Book of Medical Device Industry: Annual Report on the Development Medical Device Industry in China (2019)” [2], more than 90% of China’s medical device manufacturers are small- and medium-sized enterprises. Their average annual main revenue is CNY 30 to 40 million; compared with the average annual main revenue of CNY 300 to 400 million of domestic pharmaceutical industry enterprises, there is still a huge gap. However, enterprises have certain R&D capabilities, often limited by factors such as talent, technology, experience, or capital. Thus, they cannot carry the risks of developing new products alone. At the same time, considering the recurrence of the epidemic, there are unknown risks, like unstable raw materials prices, factory closures, worker shortages, transport disruptions, and uncertain output. How to choose the R&D investment strategy to enhance enterprise income and market share is particularly important.

Therefore, in the face of increasingly competitive markets, enterprises form joint ventures and collaborative R&D through R&D alliances based on the lack of their own resources or capabilities, combined with their own resources and technology to jointly bear the cost and risk required for R&D to innovate and develop new products and improve their market competitiveness. In this paper, the real option theory is applied, and the uncertainty of price, sales, and cost are included in the evaluation system as three important risk factors under the asymmetry of two medical device suppliers. Further, a real option game model for R&D investment of medical device suppliers is established based on multiple random variables. The expected investment value and investment critical value expressions of medical device suppliers in following investment, leading investment, and cooperative R&D investment are derived. The investment strategies and their applicable conditions of waiting investment, sequential investment, preemptive investment, and cooperative investment are provided. The influence of uncertainty of price, cost, one-time R&D investment, and R&D success probability on investment value is emphatically analyzed, enabling investors to better grasp investment opportunities according to market dynamics, determine the investment opportunity in a timely manner, and improve their market share.

Literature Review

At present, the method of discounted cash flow (DCF) is commonly used by Chinese enterprises when investing in venture projects. The methodology takes into account the time value of capital, but cash flows may differ from the initial expectation due to changes in demand, uncertainty, and competition in the actual market. DCF ignores the impact of management flexibility, such as the uncertainty of value, the selection of discount rate, which inevitably incorporates subjective factors, and the delayed investment by the project. It tends to make the investors underestimate the project value, thus losing good investment opportunities [3]. The work of Black and Scholes (1973) [4] in the field of financial options revealed a new way to solve this problem. Since then, the evaluation method of real option investment has become a hot topic in the theory and business circles in recent years.

Myers (1977) [5] and Ross (1978) [6] first put forward the concept of “real option”, which innovatively regarded potential investment opportunities in venture capital projects as a kind of option for pricing. This provided support for investment decision making of R&D projects. Keste (1984) [7] discussed the concept of growth opportunity on the basis of Myers (1977). He estimated that the option value of an enterprise exceeded half of the owner’s equity, even reached 70–80% in industries with high uncertainty. Carr (1988) [8] analyzed the pricing of compound options, which can be used to price sequential investment opportunities in theory. In terms of real option theory of R&D projects, Sahlman (1988) [9] and Trigeorgis (1993) [3] discussed the characteristics of enterprise staged options. Kolbe et al. (1991) [10] analyzed the option factors contained in R&D projects. Copeland and Weiner (1990) [11] believed that, when uncertainty can be identified, enterprises can flexibly manage it by real options in order to gain a competitive advantage.

In terms of real option value evaluation, Newton and Pearson (1994) [12] evaluated the value of R&D projects through Black–Scholes real option model. In addition to the classic Black–Scholes model, Merton (1976) [13] derived the real option model under jump diffusion. Geske (1979) [14] discussed the single-stage and two-stage compound option models, which are used to evaluate the value of investment opportunities with only one asset object and only one market uncertainty. Schwartz and Moon (2000) [15] established the continuous time model and discrete time model of real options and calculated the numerical solution of compound options through Monte Carlo simulation. In addition, Schwartz (2004) [16] evaluated the value of the patent right with the real option method and considered the uncertainty of the investment cost and profits after the commercialization of the project. Andergassen and Sereno (2012) [17] added jumping factors to the compound real options, which could assess the sudden risk. However, this did not discuss other risks in R&D projects. The study of Alvarez and Stenbacka (2001) [18] found that, with an increase in market uncertainty, the value of growth options would greatly increase. According to the method and model of real options, the critical value of investment or not can be obtained in multi-stage project investment.

With the basic establishment of a real option investment evaluation model, the research in this field has gradually matured. By integrating the strategic behavior of competitors into the real option method [19], the research of enterprise investment decision making under competitive and uncertain environments promoted the development of the option game theory [20]. Smets (1993) [21] established a symmetric continuous time duopoly option game model. Dixit and Pindyck (1994) [22] extended the Smets model by discussing the leader and follower exogenous and endogenous cases. They argued that external uncertainty could improve the value of waiting for new information. Therefore, enterprises need to wait for more new information when investing to avoid the impact of external uncertainty on investment returns. Huisman and Kort (1999) [23] considered three competitive scenarios, preemptive equilibrium, common equilibrium, and Pareto equilibrium, and analyzed the mutual influence of the leader’s strategy and the follower’s strategy, while the model of Dixit and Pindyck [22] did not consider the impact of a leader’s strategy on followers. Wu and Xuan (2004) [24] and Yang and Da (2005) [25] expanded the model by adding operating cost and investment cost, respectively, to the model of Huisman and Kort [23]. Thijssen (2010) [26] analyzed the first mover advantage in the game between both competitors. The game model followed Brownian motion and modified the model of Huisman and Kort.

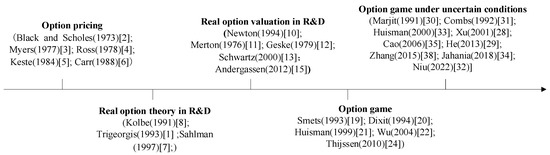

In recent years, scholars have shifted their focus from the application of the option model to the expansion of the option model. Among them, the uncertainty analysis of project value is one of the important directions of model expansion. They began to consider the impact of fluctuations in price, sales, cost, technology, and environment on the investment value [27,28,29]. Xu and Zhang (2001) [30] and He et al. (2013) [31] proposed a real option investment evaluation model for R&D projects based on multiple random variables. Marjit (1991) [32] and Combs (1992) [33] studied the effect of uncertainty on cooperation incentive, showing that cooperation is worthwhile only when the probability of success is relatively high. Niu (2022) [34] considered the investment in the supply chain process with innovation uncertainty and concluded that the investment strategy depends on the intensity of knowledge spillover if the success probability of innovation is high. Huisman (2001) [35] explored the investment decision making of both enterprises under the uncertainty of investment cost. In the context of real options, Jahani et al. (2018) [36] redesigned the supply chain network to meet corporate objectives, taking into account the uncertainty of demand and price. Cao et al. (2006) [37] and Zhang et al. (2008) [38] analyzed the investment option game equilibrium of duopoly enterprises under the conditions of symmetry and asymmetry of R&D cost and construction time, respectively. Wang et al. (2011) [39] and Zhang et al. (2015) [40] considered the option game model of investment decision making of both enterprises in different environments under the conditions of limited investment project time and different options, respectively. They analyzed the investment value and investment critical value of enterprises. Zheng and Li (2003) [41] and Li (2007) [42] emphasized the importance of the spillover effect on the evaluation of the value of R&D projects when studying the investment decision making of R&D projects under uncertain conditions. Nishihara (2018) [43] established an R&D investment evaluation and optimization model considering duration, growth opportunity, technology, and preemptive uncertainty. He analyzed the degree of influence of various uncertain factors on R&D investment decisions. Xie (2021) [44] considered the uncertainty of demand and R&D level as well as R&D competition and constructed geometric Brownian motion with random jumps of demand obedience. He used real option and Stackelberg game to establish a leader and follower R&D investment decision model to explore the influence of demand and R&D success probability on game strategy. Figure 1 briefly introduces the development course of R&D investment under the competitive environment of an option game model, including the stages of option pricing, application of real option theory in R&D projects, and value evaluation of real option, option game, and option game under uncertain environments. Several representative papers are listed in each stage.

Figure 1.

The development course of R&D investment under the competitive environment of option game model.

Although scholars have pointed out various uncertain factors affecting the investment value of development projects, respectively (such as R&D cost, demand, and spillover effect, etc.) [45,46], most of their evaluation models can only reflect one of them and ignore other factors. Our main contribution is that, in the context of real options, two suppliers whose innovation may fail due to their inherent uncertainty are considered. The stochastic process of price, cost, and sales of products in the market is simulated through three related geometric Brownian motion (GBM) processes. In addition, knowledge spillovers created by suppliers benefit each other. However, they differ in the use of knowledge due to different absorptive capacities. In this context, we attempt to incorporate several salient features of manufacturing into our model to discuss how they affect the incentives of suppliers to invest in R&D innovation. In particular, the model captures a series of factors that have a key impact on suppliers’ knowledge stock, including absorptive capacity, innovation uncertainty, and spillover effect, etc. This paper also provides the degree of influence of different factors on the option value, especially the importance of price, cost, sales, and R&D success probability on the investment value of suppliers. Moreover, this research analyzes how they choose investment opportunities and investment strategies, which makes this paper different from previous studies.

2. Construction of Investment Model

Most innovation plans are usually based on forecast data. However, it is very difficult to predict the real-world demand. There are always random changes, so some prediction errors may occur, which may have a negative impact on suppliers. How to control the R&D investment and production cost and set the selling price is crucial for suppliers to cooperate and innovate new products.

2.1. Model Assumptions

Suppose that the medical device industry is composed of two asymmetric supplier enterprises in a certain region ( and ). Both enterprises have different absorptive capacity, technology spillover level, and innovation capacity. Their own R&D investment level and initial R&D investment are also different, but the products produced by both enterprises are homogeneous. In order to reduce the spillover of innovation achievements and the risk of independent R&D, both supplier enterprises will decide the R&D investment strategy according to market demand and price fluctuations. Assuming that the enterprise is flexible in operation, can determine production based on sales, production without lag, and is not overstocked, it can be considered that the output is equal to the sales.

Suppose that , and are stochastic processes defined in the full probability space , representing the stochastic processes of price, sales, and unit production cost, respectively. Set as the initial time and as the terminal time. For simple symbols, set , , and then is the time set. This paper assumes the total period is divided into equal interval with length , . Then, price, sales, and unit production cost are controlled by the following stochastic processes:

where , , , and are the drift terms, representing the growth rate, , , and are the diffusion terms, representing the volatility, and they are constants. In addition, , , and are three related standard Brownian motions in the full probability space , representing the uncertainty of price, sales, and cost, respectively.

where is the correlation coefficient of two Brownian motions. For any value , Equations (1)–(3) are three lognormal random variables.

According to Itö integral, stochastic differential Equations (1)–(3) have the following solutions:

where , , and are the initial values of , , and , respectively.

According to the properties of geometric Brownian motion, the expected values of product price, sales, and cost are , , .

2.2. Investment Model

The net cash flow (NCF) of a project at time can be summarized as a function that generally defines sales, price, cost, and time. The project value is the expectation of the profit flow in continuous time.

The expected profit of enterprise is

where is the risk-free annual interest rate, and the expected income of the project is

The innovation cost, initial R&D investment, and effective R&D level of enterprise are independent of time and one-time investment, . Record as .

The investment cost of innovation R&D of enterprise is

where is the innovation efficiency coefficient of enterprise , , is the R&D investment level of enterprise .

Considering the ability to learn and absorb knowledge outside the industry and the degree of technology spillover, the effective R&D investment level of enterprise is

where is the absorptive capacity of enterprise , is the knowledge outside the industry, is the technology spillover degree of the opposite enterprise , is the R&D investment level of enterprise , .

After the investment of enterprise , in the time period, the expected sales function of enterprise is

where , is the industry average discount rate, assuming .

Expected cost amount function of enterprise is

where .

In the time period, the expected investment profit function of enterprise is

Let to represent the instantaneous profit of the unit product. The Itö theorem shows that follows geometric Brownian motion:

where is the drift term, representing the instantaneous profit growth rate of per unit product, is the diffusion term, representing the instantaneous profit volatility of per unit product. And they are constants. In addition, represents the standard Brownian motion with uncertainty.

Let denote the instantaneous cash flow, , and obtain the Itö differential:

And , , ; is the correlation coefficient of two Brownian motions, so we have

Because of , then

The instantaneous cash flow follows geometric Brownian motion. Where , , . is the drift term, representing the instantaneous profit growth rate, is the diffusion term, representing the instantaneous profit volatility. And they are constants. represents the standard Brownian motion with uncertainty. comprehensively reflects the growth trend and uncertainty of instantaneous profit and instantaneous sales of per unit product, while comprehensively reflects the market risk faced by enterprises. Then, the expected investment income of enterprise is

Since the enterprise cannot obtain profits from the product endlessly, that is, cannot be infinite, then .

Known , and then can be solved:

According to the interchangeability of integral and expectation, first calculate the expectation for the random variable of integral term; that is

And , so we can obtain

It can be obtained from the Itö formula:

where , . The above formula shows that the expected cash flow income follows geometric Brownian motion. is the drift term, indicating the expected income growth rate, and is the diffusion term, indicating the expected income volatility. And they are constants. represents the standard Brownian motion with uncertain expected income.

Because of , it can be seen that the expectation of is a minus function of time . After entering the expansion period, the venture enterprise will continuously and steadily obtain positive cash flow, so is always positive, consistent with the non-negative characteristics of geometric Brownian motion.

2.3. Enterprise Option Value

If the patent value is regarded as the option value and the expected income is regarded as the price of the underlying asset, investment option value is the function of income and time , namely . According to Itö lemma and no arbitrage theory, satisfies the following equation:

The above formula is a stochastic partial differential equation that satisfies the value of real options, where return shortage rate is similar to the dividend rate of financial options, and .

In addition, at , from the value matching condition and smooth pasting condition, the equation also needs to meet the following boundary conditions:

where represents the critical value of monopoly investment of enterprise . The general solution of the investment value of enterprise can be derived from Formula (27) as follows:

is the solution to the equation , where one of the solutions is less than 0, so it was discarded.

Substituting from Equation (31) into the boundary conditions (29) and (30), we can obtain

Simultaneously, Equations (29), (31) and (33) obtain the solution of parameter A:

When the expiration date of the option is , the corresponding call option boundary condition is . In the time period , the expected value of the patent call option can be obtained by Black–Scholes pricing method as follows:

where is the current time, and then is the time from the due date. is the cumulative probability distribution function of normal distribution variables.

Technology has a life cycle. The R&D process of technology cannot be infinite. There is a certain maximum. Assuming that the R&D success time is the Weber distribution, the maximum R&D allowable time is set as , and the minimum R&D necessary time is set as . Its probability density function is , . indicates the influence of other factors on the R&D success time, reflecting the arrival speed of the enterprise’s R&D success time, and is set as a constant. Then, the probability of enterprise technology R&D success is .

Considering the uncertainty of R&D success, the expected total value of R&D investment and innovation of enterprises can be expressed as follows:

2.4. Investment Models under Different Investment Strategies

When making R&D investment decisions, both enterprises will not only consider independent investment strategies but also consider whether to cooperate with competitors to innovate. Influenced by many factors, such as initial R&D investment, absorptive capacity, spillover effect, and innovation efficiency, both enterprises will make R&D investment decisions based on the comparison between the project profit of R&D investment as a partner and the project profit of independent R&D investment.

Suppose that two enterprises occupy the whole market and become a duopoly. The market share of enterprise is ; enterprise accounts for . In the previous section, the expected investment profits when enterprises invest separately have been discussed. Next, the backward induction method is applied to derive the expected investment profit of enterprises when they follow the investment and lead the investment. This paper also analyzes the investment critical values of both enterprises under different investment models.

2.4.1. Waiting for Investment Strategy

When the investment income of both enterprises fails to meet the requirements of leading investment critical values, that is, or , the profit obtained from the investment is not enough to compensate the cost of the enterprise. Instead of investing, the enterprise should continue to wait to form the waiting investment equilibrium. At this time, the investment probability of both enterprises is 0.

2.4.2. Follow Investment Strategy

For rational followers, the optimal investment strategy is to make decisions on the premise that they recognize themselves as followers. When the enterprise satisfies , it will make investment at time , , and is the critical value of the following investment of the enterprise.

When enterprise invests as a follower, enterprise determines the investment effort to maximize its own expected profits before . Due to the leading R&D investment, enterprise can not only absorb knowledge outside the industry but also enhance its own effective R&D investment level through the technology spillovers of competitors. Assume its market share ; after , the expected investment profit function is

When , there is . Then, the following investment critical value of enterprise is

2.4.3. Leading Investment Strategy

When enterprises satisfy , the leading investment value of both enterprises is greater than the following investment value; that is, . Both enterprises have leading investment motives and adopt preemptive investment strategies. As long as the competitors do not invest, they will invest immediately to form the preemptive investment balance. Because of the existence of the optimal investment time, the investment strategy of the enterprise is uncertain. Therefore, the investment strategy adopted by both enterprises constitutes a mixed strategy Nash equilibrium.

In the leading R&D investment stage, the enterprise determines the investment effort to maximize its own expected profits. As only knowledge outside the industry can be absorbed and utilized, the effective R&D investment level of the enterprise changes. After the time point when the follower is completed and put into production, the follower goes into production and obtains the same product demand as the leader. Then, before , the product demand of the leader is and . To sum up, when enterprise invests as a leader, its expected investment profit function is

When both enterprises have the motivation of preemptive investment, becoming a leader not only depends on the investment cost, their own R&D capability, and innovation efficiency but also depends on the investment critical value required by the two enterprises when they are leading the investment. The critical value of investment for enterprise to become a leader is determined by its expected investment profit . The critical value of investment for enterprise to become a leader is determined by its expected investment profit . Namely:

Equation (42) has no analytic solution to the leading investment critical value of enterprise . If the leader does not have a follower, it can be assumed that the leading investment value of the enterprise is equal to the monopoly investment value of the enterprise, meeting the following conditions:

The leading investment critical value of enterprise is

2.4.4. Cooperative R&D Investment Strategy

When the enterprise satisfies , the investment value of both enterprises is greater than the leading investment value and the following investment value; that is, , . At this time, no enterprise has a leading investment motivation. Both enterprises may adopt cooperative R&D investment strategies and share R&D results.

At this time, the information of cooperative R&D between both enterprises is disclosed. They can reduce costs not only through the direct effect of their process investment but also through the indirect effect of the use of external knowledge. Enterprise will make investment efforts in the investment stage, and will maximize its joint expected profits. It can be assumed that both enterprises obtain the same proportion of the market at this time, and then the joint expected profit function of enterprise and enterprise is

3. Case Analysis

This section mainly takes the medical product monitor of Biolight as an example to further explain the above models and applies MATLAB to analyze the investment strategy and sensitivity of the above models.

3.1. Case of Biolight

Guangdong Biolight Medical Technology Co., Ltd. is a private listed enterprise engaged in the R&D, manufacturing, and sale of medical equipment and software. It is committed to the R&D and manufacturing of clinical medical equipment. Its business segments cover life information and support, nephrotic medicine, and general health medicine. One of its main products, the monitor, is mainly used to monitor the physiological parameters of patients for 24 h, detect the change trend, and point out emergencies. Throughout the development of the company in recent years, the growth in revenue scale has been flat, and the growth rate has declined significantly. However, the outbreak of the epidemic made the monitor market demand surge, and the company’s performance multiplied. On the whole, the market scale of monitors continues to expand, but Biolight mainly focuses on middle- and low-end products. The proportion of the company’s investment in R&D is not very outstanding. In recent years, the proportion of R&D investment is only about 5%, and the competitiveness is relatively weak. Because the explosive growth of the epidemic is not sustainable, the market will return to the new normal of strengthening epidemic prevention and medical construction in countries around the world. The overall competitiveness of the company is still weak. In addition, some of the technical patents of the company’s monitor will expire in a few years, so Biolight plans to develop and research new technologies and carry out systematic and modular design of medical monitors, which can more effectively meet the professional requirements of various departments of the hospital. At the same time, according to the proposed new national infrastructure, wireless, information, and 5G telemedicine also impact the development direction of the medical monitoring system. Only in this way can we achieve intelligence and meet the needs of hospitals and patients.

Take the data of sales, average unit cost, and average unit selling price of Biolight monitor from 2015 to 2021 as samples for estimation, as shown in Table 1.

Table 1.

2015–2021 sales, cost, and price of Biolight monitor.

Based on the above data, after estimation, , , , , , , , . It is known that, due to the impact of COVID-19, the sales in 2019–2020 fluctuate greatly, resulting in a large variance in the sample sales and a large deviation in data. In order to ensure the accurate estimation of the expected investment value in the future, this group of values will be removed. It can be obtained that the growth rate and volatility of the new sample sales are , . When multiple uncertain factors are affected by the market environment at the same time, there is high correlation. This paper argues that there are high correlation coefficients between sales and cost, sales and selling price, selling price and cost, and cost and unit instantaneous profit. According to the above sample, , , , . The risk-free interest rate is taken from the annual interest rate of the short-term loan of the People’s Bank of China at 4.35%.

According to the data of the annual report of Biolight, it is assumed that the initial R&D investment of the monitor is CNY 30 million, and the enterprise’s own R&D level, the absorptive learning capacity coefficient, and innovation efficiency are , , and , respectively. The R&D level, technology spillover degree, and knowledge level outside the industry of competitors are , , and , respectively. The initial sale of the product is 700,000 units, the initial unit cost is CNY 300, the initial unit selling price is CNY 520, and the production cycle is 5 years.

Based on the estimation of the above sample parameters, the drift rate and volatility of the product’s instantaneous cash flow are first calculated, , . Then, the drift rate and volatility of the expected investment income can be obtained, , . Then, the return shortage rate is calculated, . The expected income of the Biolight monitor within 5 years is CNY 601.9439 million.

Import the above results into Equations (32)–(37) to obtain parameters , , the monopoly investment critical value , and the investment option value of the patent right . , , , .

As can be seen from the above evaluation results, the expected return of the Biolight monitor is CNY 601.9439 million, and the investment circle value obtained by the option pricing model is CNY 80.0468 million. This result indicates that it is feasible to invest in the project immediately due to the high demand under the current pandemic. However, the project value is highly uncertain. At a certain point in the future, the market will reach saturation, and the project value may decrease, making the investment infeasible. When the future investment income is lower than the optimal investment critical value, it is not advisable to invest in the industry. Considering the possibility of reducing the project value falling to the critical value during the postponement period, the real option model provides the investment opportunity value of the venture project to be CNY 2222.7 million. This result reveals that the project has a larger investment value in a short time after giving the investor the management flexibility to choose investment time.

3.2. Investment Strategy Analysis

Suppose that, in the medical device industry, in addition to Biolight (recorded as enterprise ), there is another risk-neutral enterprise Mindray (recorded as enterprise ) that also mainly sells health monitoring devices, such as monitors. There is a certain gap between the strength of both enterprises. Suppose that both enterprises invest in a new type of monitor, . In order to reduce the impact of data errors on investment decision making, most of the data are collected from the annual reports of both enterprises, and some of the data are industry averages.

Take the data of sales, average unit cost, and average unit selling price of Mindray monitor from 2015 to 2018 as samples for estimation, as shown in Table 2.

Table 2.

2015–2018 sales, cost, and price of Mindray monitor.

The relevant data of enterprise are analyzed by the example in the previous section. After calculation, the specific parameters of enterprise are as follows: , , , , , , , , million, , , . By calculation, , , . According to Equations (40) and (44), the critical value of the following investment of enterprise is CNY 150.486 million, and the critical value of the leading investment is CNY 133.413 million. The critical value of following investment of enterprise is CNY 274.7754 million, and the critical value of leading investment is CNY 121.5153 million.

When , both enterprises adopt the waiting investment strategy and do not invest, forming the waiting investment equilibrium. When , enterprise has the first mover advantage and can take the sequential investment strategy to become the leader. Enterprise continues to wait, forming the sequential investment equilibrium. When , the leading investment value of both enterprises is greater than the following investment. They all adopt the preemptive investment strategy. As long as the competitive enterprises do not invest, they will immediately invest, forming the preemptive investment equilibrium. When , enterprise with the first mover advantage starts to invest, and enterprise continues to wait, forming the sequential investment equilibrium. When , both enterprises make immediate investment. Considering that, the higher the value is, the greater the risk is, the cooperative investment equilibrium may be formed.

According to the data of two enterprises, enterprise has a higher following investment value than enterprise . At present, there are many mature monitor products in the market, and the enterprise basically enters the monitor investment market as a follower. However, due to large initial R&D investment and limited product demand, enterprises tend to be more wait-and-see. Therefore, if the enterprise wants to invest in a monitor project under the limited market environment and uncertain R&D success probability, it must enhance the core strength of the enterprise, reduce production costs, and improve the R&D success probability to reduce the critical investment value of the enterprise.

4. Sensitivity Analysis

From the enterprise’s investment value model, it can be seen that product sales, cost, price, initial R&D investment, absorptive capacity, technology spillover, innovation efficiency, and R&D success time and probability all have an impact on R&D innovation investment decision making of the supplier. In this section, the control variable method will be used to simulate and analyze the impact of these factors on the investment value through MATLAB. During the simulation, the main parameters in the model are based on the estimated values in the case analysis, and other parameters are assumed to be , .

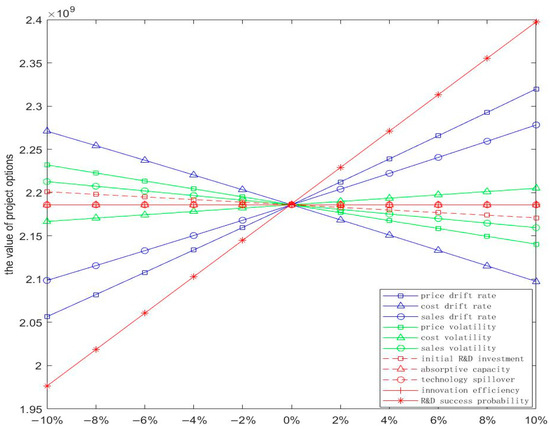

First, the changes in each factor within the range of [−10%, 10%] are analyzed, and one may observe the degree of influence of different values of the main parameters on the expected option profit of the project investment. The specific results are shown in Figure 2.

Figure 2.

Cobweb analysis diagram.

As shown in Figure 2:

(1) The values of cost drift rate, price volatility, sales volatility, initial R&D investment, and innovation efficiency in the figure are negatively correlated with the profit of option investment, while other parameters are positively correlated with the profit of project investment. It can be seen from this that larger project volatility will result in higher investment value with other conditions unchanged.

(2) This model considers multiple uncertain factors, and there are many parameters that need to be valued. Excessive parameter valuation may affect the accuracy of the evaluation of the project model results. Therefore, this paper analyzes the sensitivity of multiple uncertain factors to the project option profit. It can be seen from Figure 2 that the R&D success probability, cost drift, price drift rate, and sales drift rate have a relatively significant impact on the option profit results, while changes in other parameters have a weak impact on the evaluation results. This also guarantees the stability of the model to a large extent.

(3) The probability of R&D success is the most significant factor affecting the option profit. This factor implies the enterprise’s own R&D level, learning absorption capacity, and innovation efficiency. It is the estimated value of the project R&D success rate by experienced investors. Therefore, this factor can be seen as the reaction of investors to the subjective preference of the project. A high probability of R&D success indicates that investors are optimistic about the project, while a low probability of R&D success indicates that investors are cautious. Only when the expected return of the project is at a high level can they invest in the project.

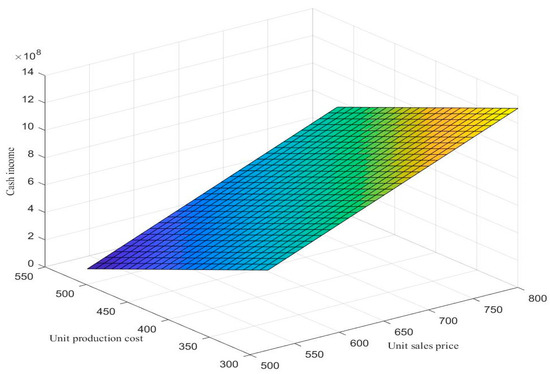

4.1. Impact of Changes in Selling Price and Cost on Expected Income

It can be seen from the cobweb diagram that the price and cost of products have a significant impact on the value of project investment options. The example analysis in the previous section shows that price and cost are highly correlated. The joint effect of both factors on investment income was analyzed and the trend of investment income was discussed.

It can be seen from Figure 3 that the expected income increases with the increase in the selling price and decreases with the increase in the production cost. On the contrary, the higher the price and the lower the cost, the more they play a positive role in promoting project research and development.

Figure 3.

Cash income under different sales and production costs.

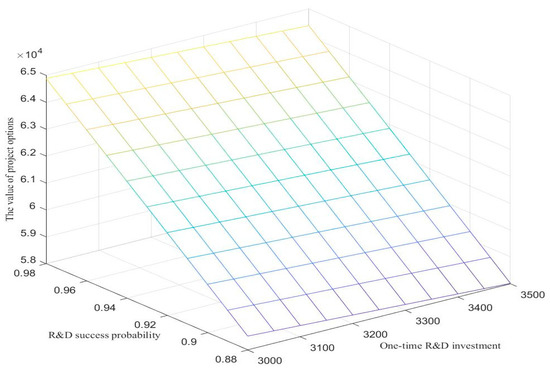

4.2. Impact of Changes in R&D Success Probability and One-Time R&D Investment on Project Option Value

It can be seen from the cobweb diagram that the probability of R&D success of a product has the greatest impact on the value of project investment options and is an important driving factor for investment, while the probability of R&D success depends on the enterprise’s own R&D level, learning and absorption capacity, innovation efficiency, talent reserve, and other factors, and is also affected to some extent by one-time R&D investment.

It can be seen from Figure 4 that the project option value is proportional to the probability of R&D success and inversely proportional to the one-time R&D investment. The lowest value is obtained at high R&D investment and low R&D success probability, and the highest value is obtained at low R&D investment and high R&D success probability. However, the option value is also high at high R&D investment and high R&D success probability. Therefore, the probability of R&D success is an important factor affecting the value of options.

Figure 4.

Project option value under different R&D investment and R&D success probabilities.

It can be seen from the above analysis that, to make product R&D have high investment value, projects with high cash income and R&D success probability and low production costs and investment costs should be selected.

5. Conclusions

Based on the real option evaluation model, this paper establishes an investment evaluation game model based on multiple random variables for the investment model and value influencing factors of medical device suppliers’ R&D of new products. The influence of uncertainty of price, cost, one-time R&D investment, and R&D success probability on investment value is analyzed emphatically. In this paper, the analytical solution of the model is provided, and the price, cost, sales, and their respective drift rate and volatility are analyzed with an example of an enterprise’s monitor product development project.

The work of this paper has the following significance: (1) the key factors that affect the value of medical device suppliers’ R&D investment projects are analyzed, and the impact of the drift rate and volatility of price, cost, and sales on the option value of R&D projects is clarified. It is of great significance to improve the market competitiveness of medical device suppliers and enhance the resilience of medical device suppliers in the face of public health emergencies. (2) This paper breaks through the limitation of the single variable of traditional real option models, derives the option model pricing method under multiple uncertain factors, and has certain universality. (3) The expected investment value expression and investment critical value expression of enterprises in following investment, leading investment, and cooperative R&D investment are derived by using the backward induction method. It helps enterprises to grasp the changing trend of market dynamics and make timely investment choices. On this basis, the investment strategies and their applicable conditions that enterprises should adopt are provided, such as the waiting for investment, sequential investment, preemptive investment, and cooperative investment. (4) Through the analysis of the simulation results of the model, the fluctuation of different influencing factors has varying degrees of impact on the value of project options, enabling investors to determine the investment opportunity in time and determine the investment opportunity based on the market dynamic changes, investment critical value, and expected investment value. This provides a decision making basis for medical device suppliers to increase their market share.

In practical application, if an enterprise wants to gain greater benefits, it should consider that the investment in R&D in advance may lose the option value of future uncertainty, especially the option value of demand uncertainty, but also consider that the delay may lose the “first advantage” or even the exclusivity of the R&D results invested by competitors and lose the whole market. On the basis of the evaluation model of real options established in this paper, the critical value of investment under different investment strategies can be provided to grasp the investment opportunity in time in line with the changes in market dynamics. In addition, sensitivity analysis shows that, although there are many factors affecting project option value, the most significant one is R&D success probability. Enterprises can focus on increasing the investment in the R&D success probability to improve the value of project options. This includes enhancing their own R&D level, learning and absorption capacity, and innovation efficiency. Specific measures can be taken to improve the educational and experience requirements of research and development personnel, regular training and learning, and the introduction of advanced hardware equipment.

The research object of this paper is two asymmetrical medical device suppliers, and the strength of both is quite different. When the strength of the leader and the follower is equal, the roles of both may change due to some subtle factors, thus affecting the R&D strategy and changing the timing of R&D investment. At this time, dynamic game theory should be applied to study this kind of change, which is also a problem to address in terms of further research in the future.

Author Contributions

Methodology, Supervision, Y.S.; Conceptualization, Methodology, Software, Formal analysis, Validation, Visualization, Writing—original draft, Writing—review and editing, X.S.; Conceptualization, Methodology, Formal analysis, Visualization, Writing—original draft, Writing—review, Z.W.; Methodology, Writing—review and editing, H.X. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by The National Social Science Fund of China (Grant number: 21&ZD127), Humanities and Social Sciences Youth Foundation, Ministry of Education of the People’s Republic of China (Grant number: 20YJC630154), and the Fundamental Research Funds for the Central Universities (Grant number: WUT2020-YB-043).

Institutional Review Board Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Baoting, W.; Hongwu, G. The Blue Book of Medical Device Industry: Annual Report on the Development Medical Device Industry in China (2021); Social Sciences Academic Press (CHINA): Beijing, China, 2021. [Google Scholar]

- Baoting, W.; Hongwu, G. The Blue Book of Medical Device Industry: Annual Report on the Development Medical Device Industry in China (2019); Social Sciences Academic Press (CHINA): Beijing, China, 2019. [Google Scholar]

- Trigeorgis, L. Real Options and Interaction with Financial Flexibility. Financ. Manag. 1993, 22, 202–224. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The Pricing of Options and Corporate Liabilities. J. Polit. Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Myers, S.C.; Turnbull, S.M. Capital Budgeting and the Capital Asset Pricing Model: Good News and Bad News. J. Financ. 1977, 32, 321–333. [Google Scholar] [CrossRef]

- Ross, S.A. A Simple Approach to the Valuation of Risky Streams. J. Bus. 1978, 51, 453–475. [Google Scholar] [CrossRef]

- Kester, W.C. Today’s Options for Tomorrow’s Growth. Harv. Bus. Rev. 1984, 62, 153–160. [Google Scholar] [CrossRef]

- Carr, P. The Valuation of Sequential Exchange Opportunities. J. Financ. 1988, 43, 1235–1256. [Google Scholar] [CrossRef]

- Shalman, W.A. How to Write a Great Business Plan. Harv. Bus. Rev. 1997, 75, 98–108. [Google Scholar]

- Morris, P.A.; Teisberg, E.O.; Kolbe, A.L. When Choosing R&D Projects, Go with Long Shots. Res. Technol. Manag. 1991, 34, 35–40. [Google Scholar] [CrossRef]

- Copeland, T.; Weiner, J. Proactive Management of Uncertainty. Mckinsey Q. 1990, 4, 133–152. [Google Scholar]

- Newton, D.P.; Pearson, A.W. Application of Option Pricing Theory to R&D. RD Manag. 1994, 24, 083–089. [Google Scholar] [CrossRef]

- Merton, R.C. Option Pricing When Underlying Stock Returns Are Discontinuous. J. Financ. Econ. 1976, 3, 125–144. [Google Scholar] [CrossRef]

- Geske, R. The Valuation of Compound Options. J. Financ. Econ. 1979, 7, 63–81. [Google Scholar] [CrossRef]

- Schwartz, E.S.; Moon, M. Rational Pricing of Internet Companies. Financ. Anal. J. 2000, 56, 62–75. [Google Scholar] [CrossRef]

- Schwartz, E.S. Patents and R&D As Real Options. Econ. Notes 2004, 33, 23–54. [Google Scholar] [CrossRef]

- Andergassen, R.; Sereno, L. Valuation of N-Stage Investments under Jump-Diffusion Processes. Comput. Econ. 2012, 39, 289–313. [Google Scholar] [CrossRef]

- Alvarez, L.H.R.; Stenbacka, R. Adoption of Uncertain Multi-Stage Technology Projects: A Real Options Approach. J. Math. Econ. 2001, 35, 71–97. [Google Scholar] [CrossRef]

- Lei, X.; Li, L. Research of R&D Investment under Competition Based on Option Games. J. Manag. S. 2004, 17, 85–89. [Google Scholar]

- Huang, X.; Wu, C. Option Game Model on R&D Investment Decision under Uncertainty. Chin. J. Manag. Sci. 2006, 14, 33–37. [Google Scholar] [CrossRef]

- Smets, F.R. Essays on Foreign Direct Investment. Ph.D. Thesis, Yale University, New Haven, CT, USA, 1993. [Google Scholar]

- Dixit, A.K.; Pindyck, S. Investment under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Huisman, K.J.M.; Kort, P.M. Effects of Strategic Interactions on the Option Value of Waiting; Working Paper; Tilburg University: Tilburg, The Netherlands, 1999. [Google Scholar]

- Wu, J.; Xuan, H. The Impact of Operating Costs on Firms’ R&D Investment Decision: A Real Option and Game-Theoretic Approach. Syst. Eng. 2004, 22, 30–34. [Google Scholar]

- Yang, Y.; Da, Q. Study on Investment in Technology Innovation of Asymmetric Duopoly. Chin. J. Manag. Sci. 2005, 13, 95–99. [Google Scholar] [CrossRef]

- Thijssen, J.J.J. Preemption in a Real Option Game with a First Mover Advantage and Player-Specific Uncertainty. J. Econ. Theory 2010, 145, 2448–2462. [Google Scholar] [CrossRef]

- Shibata, T. The Impacts of Uncertainties in a Real Options Model under Incomplete Information. Eur. J. Oper. Res. 2008, 187, 1368–1379. [Google Scholar] [CrossRef]

- Won, C. Valuation of Investments in Natural Resources Using Contingent-Claim Framework with Application to Bituminous Coal Developments in Korea. Energy 2009, 34, 1215–1224. [Google Scholar] [CrossRef]

- An, F.; Liu, G. Two-sided Beneficial Value-Added Service Investment and Pricing Strategies in Asymmetric/Symmetric Investment Scenarios. Symmetry 2023, 15, 1246. [Google Scholar] [CrossRef]

- Xu, M.; Zhang, Z. Application of Real Options Theory to R&D Project Evaluation. Syst. Eng. 2001, 19, 10–14. [Google Scholar]

- He, M.; Liu, J.; Gao, Q. An Investment Evaluation Model for Natural Resource Development Project under Multiple Uncertainties. J. Manag. Sci. China 2013, 16, 46–55. [Google Scholar]

- Marjit, S. Incentives for Cooperative and Non-Cooperative R and D in Duopoly. Econ. Lett. 1991, 37, 187–191. [Google Scholar] [CrossRef]

- Combs, K.L. Cost Sharing vs. Multiple Research Projects in Cooperative R&D. Econ. Lett. 1992, 39, 353–357. [Google Scholar] [CrossRef]

- Niu, W.; Shen, H. Investment in Process Innovation in Supply Chains with Knowledge Spillovers under Innovation Uncertainty. Eur. J. Oper. Res. 2022, 302, 1128–1141. [Google Scholar] [CrossRef]

- Huisman, K.J.M. Technology Investment: A Game Theoretic Real Options Approach; Springer: New York, NY, USA, 2001. [Google Scholar]

- Jahania, H.; Abbasia, B.; Alavifard, F.; Talluri, S. Supply Chain Network Redesign with Demand and Price Uncertainty. Int. J. Prod. Econ. 2018, 205, 287–312. [Google Scholar] [CrossRef]

- Cao, G.; Pan, Q. Investment Option-Game Equilibrium Strategy Analyses Based on Time-to-Build. Chinese. J. Manag. Sci. 2006, 14, 135–141. [Google Scholar] [CrossRef]

- Zhang, G.; Guo, J.; Liu, D. An Asymmetric Duopoly Option Game Model under Time-to-Build and Investment Cost. J. Manag. Sci. 2008, 21, 75–81. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, S. Option Games in Finite Investment Project Life. Syst. Eng. Theory Pract. 2011, 31, 247–251. [Google Scholar] [CrossRef]

- Zhang, G.; Gao, X.; Wang, Y. An Asymmetric Duopoly Investment Decision-Making Model Based on Difference of Option. Syst. Eng. Theory Pract. 2015, 35, 751–762. [Google Scholar]

- Zheng, D.; Li, Z. Study on Compound Option Model Based on Asymmetric Volatilities. Syst. Eng. Theory Pract. 2003, 2, 14–18. [Google Scholar]

- Li, Z.W. Impact of Spillover Effects on Corporate R&D Behaviors. J. Xiamen Univ. (Arts Soc. Sci.) 2007, 3, 55–62. [Google Scholar]

- Nishihara, M. Valuation of R&D Investment under Technological, Market, and Rival Preemption Uncertainty. Manag. Decis. Econ. Int. J. Res. Prog. Manag. Econ. 2018, 39, 200–212. [Google Scholar] [CrossRef]

- Xie, B. Stackelberg Game R&D Investment Decision under Uncertainty of Demand and R&D Level. Sci. Technol. Manag. Res. 2021, 41, 7. [Google Scholar] [CrossRef]

- Li, W.; Liu, Y.; Chen, Y. Modeling a Two-Stage Supply Contract Problem in a Hybrid Uncertain Environment. Comput. Ind. Eng. 2018, 123, 289–302. [Google Scholar] [CrossRef]

- Song, Z.; He, S.; An, B. Decision and Coordination in a Dual-Channel Three-Layered Green Supply Chain. Symmetry 2018, 10, 549. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).