A Multifactor Fuzzy Time-Series Fitting Model for Forecasting the Stock Index

Abstract

1. Introduction

2. Related Work

2.1. Fuzzy Time Series

2.2. The Causality between Price and Volume

3. Proposed Model

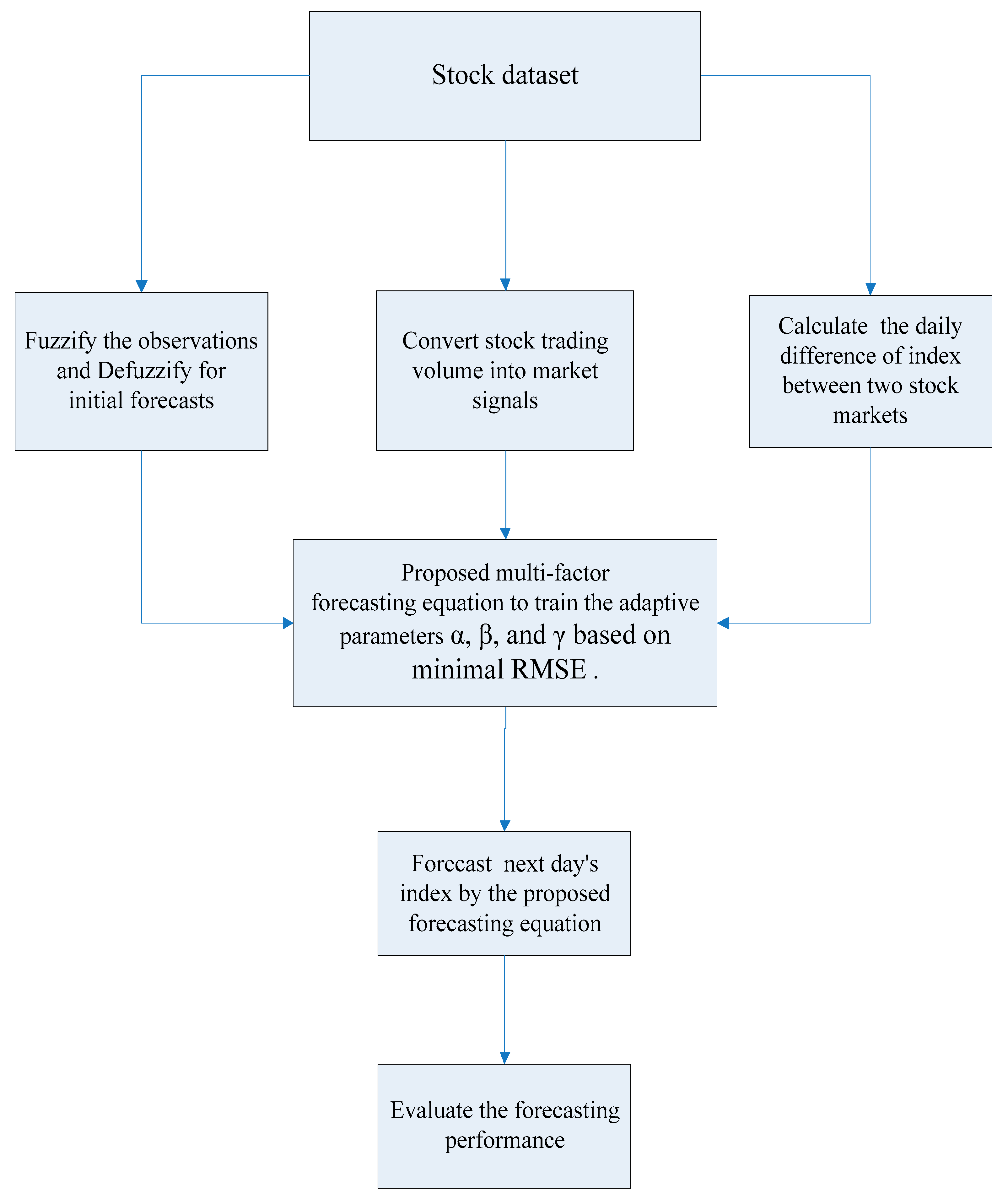

3.1. Proposed Computational Step

- (1)

- α represents the degree of influence of the F(t + 1) forecast from the market signals of trading volume and the actual stock index. Taiwan stock has is a volatility limitation of ±7%, whereas HSI has no such restriction; thus, to obtain accurate factors and better train the forecasting equation, we extend the range of α to between −0.15 and 0.15.

- (2)

- β represents the degree of influence of the F(t + 1) forecast based on the difference between the forecast stock index and the actual stock index. Moreover, given the volatility limitation of TAIEX (±7%) and the lack of a limit for the HSI stock, we plot the daily fluctuation of HSI as shown in Figure 2. From Figure 2, we see that the daily fluctuation is no greater than ±15%. Then, we can set the range of β from −0.15 to 0.15 to search for the optimal β.

- (3)

- γ represents the degree of influence of the F(t + 1) forecast from the daily difference of two stock indexes; the range of γ is [−1, 1], where −1 is an entire negative correlation, and 1 represents completely positive correlation.

| Algorithm 1: Multifactor FTS model |

| Input: double array , , , , , , and begin sum = 0 min RMSE = 999999999 // refer Equation (8) for i←−150 to 150 do for j←−150 to 150 do for k←−1000 to 1000 do for x←0 to length of factor1 do forecast train // refer Equation (7), and set α = , β = , and γ = square error sum = sum + square error end if (min RMSE > RMSE) best(i) = i best(j) = j best(k) = k min RMSE = RMSE end RMSE = 0 square error = 0 end end end Output: best i, best j, best k |

3.2. The Pseudocode of the Proposed Model

| : | stock index for training in the i-th year; |

| : | trading volume for training in the i-th year; |

| : | interaction between two stock markets for training in the i-th year; |

| : | closing price for training in the i-th year; |

| : | next half-year stock index for testing in the i-th year; |

| : | next half-year trading volume for testing in the i-th year; |

| : | next half-year interaction between two stock markets for testing in the i-th year; |

| : | next half-year closing price for testing in the i-th year. |

4. Verification and Comparison

5. Findings and Discussion

- (1)

- From the literature review, the selected attributes (trading volume, stock index, and interaction between two stock markets) have been proved to have an impact on the forecast of the stock market, and the results have a minimal RMSE, which will lead to a higher profits for investors.

- (2)

- Table 4 and Table 5 indicate that the TAIEX is less volatile than the HSI. This is because Taiwan limits the volatility of shares to ±7%, whereas Hong Kong has no limit. From Figure 2, the daily fluctuation of HSI can help us to set the search range for quickly obtaining the optimal parameters for α and β.

- (3)

- (4)

- From Table 2 and Table 3, the maximal parameter is β = 0.057 for TAIEX (1999/07~2000/06) and β = 0.065 for HSI (2000/01~2000/12). During this period (1999/07~2000/12), we searched “2000 crisis”. The results pertaining to the Dot-com bubble (2000–2002) and the year 2000 issues carry tremendous risks of disruption in the operations of financial institutions and in financial markets. Hence, we think that the “2000 crisis” has influenced the fluctuations of the stock market.

- (5)

- The comparative results (Table 4 and Table 5) and statistical test (Table 6) show that the proposed model outperforms other models in forecast accuracy (less RMSE) because the proposed linear multifactor forecasting equation with three optimized parameters (α, β, and γ) produces an optimal prediction to match past stock index patterns and generates a more accurate forecast.

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Song, Q.; Chissom, B.S. Forecasting enrollments with fuzzy time series—Part I. Fuzzy Sets Syst. 1993, 54, 1–9. [Google Scholar] [CrossRef]

- Chen, S.-M.; Hsu, C.-C. A new method to forecast enrollments using fuzzy time series. Int. J. Appl. Sci. Eng. 2004, 2, 234–244. [Google Scholar] [CrossRef]

- Chen, S.-M.; Wang, N.-Y.; Pan, J.-S. Forecasting enrollments using automatic clustering techniques and fuzzy logical relationships. Expert Syst. Appl. 2009, 36, 11070–11076. [Google Scholar] [CrossRef]

- Chen, S.-M. Forecasting enrollments based on fuzzy time-series. Fuzzy Sets Syst. 1996, 81, 311–319. [Google Scholar] [CrossRef]

- Chen, S.-M. Forecasting enrollments based on high-order fuzzy time series. Cybern. Syst. 2002, 33, 1–16. [Google Scholar] [CrossRef]

- Yu, H.-K. Weighted fuzzy time-series models for TAIEX forecasting. Phys. A Stat. Mech. Its Appl. 2005, 349, 609–624. [Google Scholar] [CrossRef]

- Chen, T.-L.; Cheng, C.-H.; Teoh, H.-J. High-order fuzzy time-series based on multi-period adaptation model for forecasting stock markets. Phys. A Stat. Mech. Its Appl. 2008, 387, 876–888. [Google Scholar] [CrossRef]

- Hadavandi, E.; Shavandi, H.; Ghanbari, A. Integration of genetic fuzzy systems and artificial neural networks for stock price forecasting. Knowl.-Based Syst. 2010, 23, 800–808. [Google Scholar] [CrossRef]

- Huarng, K.; Yu, H.-K. A type 2 fuzzy time series model for stock index forecasting. Phys. A Stat. Mech. Its Appl. 2005, 353, 445–462. [Google Scholar] [CrossRef]

- Park, J.-I.; Lee, D.-J.; Song, C.-K.; Chun, M.-G. TAIFEX and KOSPI 200 forecasting based on two-factors high-order fuzzy time series and particle swarm optimization. Expert Syst. Appl. 2010, 37, 959–967. [Google Scholar] [CrossRef]

- Chen, S.-M.; Hwang, J.-R. Temperature prediction using fuzzy time series. IEEE Trans. Syst. Man Cybern. Part B (Cybern.) 2000, 30, 263–275. [Google Scholar] [CrossRef] [PubMed]

- Li, S.-T.; Kuo, S.-C.; Cheng, Y.-C.; Chen, C.-C. Deterministic vector long-term forecasting for fuzzy time series. Fuzzy Sets Syst. 2010, 161, 1852–1870. [Google Scholar] [CrossRef]

- Cheng, C.-H.; Wei, L.-Y. Volatility model based on multi-stock index for TAIEX forecasting. Expert Syst. Appl. 2009, 36, 6187–6191. [Google Scholar] [CrossRef]

- Lee, L.-W.; Wang, L.-H.; Chen, S.-M.; Leu, Y.-H. Handling forecasting problems based on two-factors high-order fuzzy time series. IEEE Trans. Fuzzy Syst. 2006, 14, 468–477. [Google Scholar] [CrossRef]

- Dickinson, D.G. Stock market integration and macroeconomic fundamentals: An empirical analysis, 1980–1995. Appl. Financ. Econ. 2000, 10, 261–276. [Google Scholar] [CrossRef]

- Kanas, A.; Yannopoulos, A. Comparing linear and nonlinear forecasts for stock returns. Int. Rev. Econ. Financ. 2001, 10, 383–398. [Google Scholar] [CrossRef]

- Rashid, A. Stock prices and trading volume: An assessment for linear and nonlinear Granger causality. J. Asian Econ. 2007, 18, 595–612. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Grossman, S.J.; Wang, J. Trading volume and serial correlation in stock returns. Q. J. Econ. 1993, 108, 905–939. [Google Scholar] [CrossRef]

- Chu, H.-H.; Chen, T.-L.; Cheng, C.-H.; Huang, C.-C. Fuzzy dual-factor time-series for stock index forecasting. Expert Syst. Appl. 2009, 36, 165–171. [Google Scholar] [CrossRef]

- Hiemstra, C.; Jones, J.D. Testing for linear and nonlinear Granger causality in the stock price-volume relation. J. Financ. 1994, 49, 1639–1664. [Google Scholar] [CrossRef]

- Kitt, R.; Kalda, J. Scaling analysis of multi-variate intermittent time-series. Phys. A Stat. Mech. Its Appl. 2005, 353, 480–492. [Google Scholar] [CrossRef]

- Zhu, X.; Wang, H.; Xu, L.; Li, H. Predicting stock index increments by neural networks: The role of trading volume under different horizons. Expert Syst. Appl. 2008, 34, 3043–3054. [Google Scholar] [CrossRef]

- Le, V.; Zurbruegg, R. The role of trading volume in volatility forecasting. J. Int. Financ. Mark. Inst. Money 2010, 20, 533–555. [Google Scholar] [CrossRef]

- Wang, X.; Phua, P.K.H.; Lin, W. Stock market prediction using neural networks: Does trading volume help in short-term prediction? Proc. Int. Jt. Conf. Neural Netw. 2003, 4, 2438–2442. [Google Scholar] [CrossRef]

- Su, C.-H.; Cheng, C.-H. A hybrid fuzzy time series model based on ANFIS and integrated nonlinear feature selection method for forecasting stock. Neurocomputing 2016, 205, 264–273. [Google Scholar] [CrossRef]

- Stefanakos, C. Fuzzy time series forecasting of nonstationary wind and wave data. Ocean Eng. 2016, 121, 1–12. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Song, Q.; Chissom, B.S. Forecasting enrollments with fuzzy time series—Part II. Fuzzy Sets Syst. 1994, 62, 1–8. [Google Scholar] [CrossRef]

- Bose, M.; Mali, K. Designing fuzzy time series forecasting models: A survey. Int. J. Approx. Reason. 2019, 111, 78–99. [Google Scholar] [CrossRef]

- Chen, S.-M.; Zou, X.-Y.; Gunawan, G.C. Fuzzy time series forecasting based on proportions of intervals and particle swarm optimization techniques. Inf. Sci. 2019, 500, 127–139. [Google Scholar] [CrossRef]

- Panigrahi, S.; Behera, H.S. A computationally efficient method for high order Fuzzy time series forecasting. J. Theor. Appl. Inf. Technol. 2018, 96, 7215–7226. [Google Scholar] [CrossRef]

- Bas, E.; Grosan, C.; Egrioglu, E.; Yolcu, U. High order fuzzy time series method based on pi-sigma neural network. Eng. Appl. Artif. Intell. 2018, 72, 350–356. [Google Scholar] [CrossRef]

- Avazbeigi, M.; Doulabi, S.H.H.; Karimi, B. Choosing the appropriate order in fuzzy time series: A new N-factor fuzzy time series for prediction of the auto industry production. Expert Syst. Appl. 2010, 37, 5630–5639. [Google Scholar] [CrossRef]

- Vapnik, V.N. The Nature of Statistical Learning Theory; Springer: Berlin/Heidelberg, Germany, 2000. [Google Scholar]

- Specht, D. F A general regression neural network. IEEE Trans. Neural Netw. 1991, 2, 568–576. [Google Scholar] [CrossRef] [PubMed]

- Chen, C.-D.; Chen, S.-M. A New Method to Forecast the TAIEX Based on Fuzzy Time Series. In Proceedings of the 2009 IEEE International Conference on Systems, Man, and Cybernetics, San Antonio, TX, USA, 11–14 October 2009. [Google Scholar]

- Huarng, K.-H.; Yu, T.H.-K.; Hsu, Y.W. A multivariate heuristic model for fuzzy time-series forecasting. IEEE Trans. Syst. Man Cybern. Part B Cybern. 2007, 37, 836–846. [Google Scholar] [CrossRef] [PubMed]

- Tsai, I.-C. Dynamic price–volume causality in the American housing market: A signal of market conditions. North Am. J. Econ. Financ. 2019, 48, 385–400. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Shen, C.-H.; Wang, L.-R. Daily serial correlation, trading volume and price limit: Evidence from the Taiwan stock market. Pac. Basin Financ. J. 1998, 6, 251–273. [Google Scholar] [CrossRef]

- Bremer, M.; Hiraki, T. Volume and individual security returns on the Tokyo Stock Exchange. Pac. Basin Financ. J. 1999, 7, 351–370. [Google Scholar] [CrossRef]

- Wang, C.; Chin, S. Profitability of return and volume-based investment strategies in China’s stock market. Pac. Basin Financ. J. 2004, 12, 541–564. [Google Scholar] [CrossRef]

- Hodgson, A.; Masih, A.M.M.; Masih, R. Futures trading volume as a determinant of prices in different momentum phases. Int. Rev. Financ. Anal. 2006, 15, 68–85. [Google Scholar] [CrossRef]

- Kim, M.-J.; Min, S.-H.; Han, I. An evolutionary approach to the combination of multiple classifiers to predict a stock price index. Expert Syst. Appl. 2006, 31, 241–247. [Google Scholar] [CrossRef]

- Lee, B.-S.; Rui, O.M.; Wang, S.S. Information transmission between the NASDAQ and Asian second board markets. J. Bank. Financ. 2004, 28, 1637–1670. [Google Scholar] [CrossRef]

- Yang, S.H. Dynamic Conditional Correlation Analysis of NASDAQ and Taiwan Stock Market. Master’s Thesis, Business Administration, National Chiao Tung University, Hsinchu, Taiwan, 2009. [Google Scholar]

- Savva, C.S. International stock markets interactions and conditional correlations. J. Int. Financ. Mark. Inst. Money 2009, 19, 645–661. [Google Scholar] [CrossRef]

- Kim, S.; In, F. The influence of foreign stock markets and macroeconomic news announcements on Australian financial markets. Pac. Basin Financ. J. 2002, 10, 571–582. [Google Scholar] [CrossRef]

- Cheng, C.-H.; Liu, J.-W.; Lin, T.-H. Multi-factor fuzzy time series model based on stock volatility for forecasting Taiwan stock index. Adv. Mater. Res. 2011, 211–212, 1119–1123. [Google Scholar] [CrossRef]

- Miller, G.A. The magical number seven, plus or minus two: Some limits on our capacity for processing information. Psychol. Rev. 1994, 63, 81–97. [Google Scholar] [CrossRef]

- Cheng, C.-H.; Chen, T.-L.; Chiang, C.-H. Trend-weighted fuzzy time-series model for TAIEX forecasting. Lect. Note Comput. Sci. 2006, 4234, 469–477. [Google Scholar]

- Wilcoxon, F. Individual comparisons by ranking methods. Biom. Bull. 1945, 1, 80–83. [Google Scholar] [CrossRef]

- Ahmed, A.; Khalid, M. A review on the selected applications of forecasting models in renewable power systems. Renew. Sustain. Energy Rev. 2019, 100, 9–21. [Google Scholar] [CrossRef]

| TAIEX’s Rule for Consecutive Trading Day | FLR |

|---|---|

| 8763.27 (t = 2000/03/17)→8536.05 (t + 1 = 2000/03/20) | B6 (t)→B5 (t + 1) |

| 8536.05 (t = 2000/03/20)→9004.48 (t + 1 = 2000/03/21) | B5 (t)→B6 (t + 1) |

| 9004.48 (t = 2000/03/21)→9069.39 (t + 1 = 2000/03/22) | B6 (t)→B6 (t + 1) |

| 9069.39 (t = 2000/03/22)→9533.87 (t + 1 = 2000/03/23) | B6 (t)→B7 (t + 1) |

| Training | Testing | α | β | γ | RMSE |

|---|---|---|---|---|---|

| 1997/01~1997/12 | 1998/01~1998/06 | −0.004 | 0.002 | 0.002 | 112 |

| 1997/07~1998/06 | 1998/07~1998/12 | −0.006 | 0.005 | 0.002 | 104 |

| 1998/01~1998/12 | 1999/01~1999/06 | −0.008 | −0.001 | 0.002 | 97 |

| 1998/07~1999/06 | 1999/07~1999/12 | −0.008 | 0.001 | 0.003 | 122 |

| 1999/01~1999/12 | 2000/01~2000/06 | −0.009 | 0.049 | 0.003 | 168 |

| 1999/07~2000/06 | 2000/07~2000/12 | 0.0 | 0.057 | −0.001 | 147 |

| 2000/01~2000/12 | 2001/01~2001/06 | −0.006 | −0.003 | −0.002 | 94 |

| 2000/07~2001/06 | 2001/07~2001/12 | −0.01 | 0.016 | −0.003 | 91 |

| 2001/01~2001/12 | 2002/01~2002/06 | −0.013 | −0.003 | 0.001 | 98 |

| 2001/07~2002/06 | 2002/07~2002/12 | −0.009 | 0.007 | 0.001 | 82 |

| 2002/01~2002/12 | 2003/01~2003/06 | −0.005 | 0.024 | 0.0 | 71 |

| 2002/07~2003/06 | 2003/07~2003/12 | −0.008 | −0.002 | 0.002 | 61 |

| 2003/01~2003/12 | 2004/01~2004/06 | −0.005 | −0.01 | 0.003 | 112 |

| 2003/07~2004/06 | 2004/07~2004/12 | −0.006 | −0.004 | 0.002 | 59 |

| Training | Testing | α | β | γ | RMSE |

|---|---|---|---|---|---|

| 1997/01~1997/12 | 1998/01~1998/06 | −0.013 | −0.021 | −0.001 | 226 |

| 1997/07~1998/06 | 1998/07~1998/12 | 0.0 | −0.07 | −0.003 | 228 |

| 1998/01~1998/12 | 1999/01~1999/06 | −0.019 | 0.024 | −0.001 | 192 |

| 1998/07~1999/06 | 1999/07~1999/12 | 0.0 | −0.014 | 0.002 | 208 |

| 1999/01~1999/12 | 2000/01~2000/06 | −0.013 | 0.017 | 0.0 | 329 |

| 1999/07~2000/06 | 2000/07~2000/12 | −0.014 | 0.041 | −0.001 | 238 |

| 2000/01~2000/12 | 2001/01~2001/06 | −0.016 | 0.065 | −0.001 | 217 |

| 2000/07~2001/06 | 2001/07~2001/12 | 0.0 | −0.015 | −0.001 | 199 |

| 2001/01~2001/12 | 2002/01~2002/06 | −0.01 | 0.013 | 0.0 | 116 |

| 2001/07~2002/06 | 2002/07~2002/12 | −0.009 | 0.012 | 0.0 | 119 |

| 2002/01~2002/12 | 2003/01~2003/06 | −0.008 | −0.003 | 0.0 | 88 |

| 2002/07~2003/06 | 2003/07~2003/12 | −0.009 | 0.017 | 0.001 | 115 |

| 2003/01~2003/12 | 2004/01~2004/06 | 0.0 | 0.006 | 0.001 | 153 |

| 2003/07~2004/06 | 2004/07~2004/12 | −0.01 | −0.017 | 0.0 | 106 |

| Testing | RMSE | |||||

|---|---|---|---|---|---|---|

| [4] | [9] | [7] | SVR | GRNN | Proposed | |

| 1998/01~1998/06 | 209 | 139 | 207 | 275 | 1208 | 112 a |

| 1998/07~1998/12 | 339 | 160 | 361 | 393 | 1964 | 104 a |

| 1999/01~1999/06 | 324 | 211 | 352 | 897 | 2381 | 97 a |

| 1999/07~1999/12 | 195 | 162 | 205 | 919 | 1624 | 122 a |

| 2000/01~2000/06 | 404 | 231 | 496 | 469 | 2508 | 168 a |

| 2000/07~2000/12 | 319 | 293 | 563 | 742 | 4159 | 147 a |

| 2001/01~2001/06 | 245 | 418 | 368 | 468 | 2813 | 94 a |

| 2001/07~2001/12 | 368 | 823 | 536 | 441 | 2032 | 91 a |

| 2002/01~2002/06 | 215 | 264 | 186 | 657 | 1797 | 98 a |

| 2002/07~2002/12 | 155 | 237 | 157 | 672 | 2077 | 82 a |

| 2003/01~2003/06 | 160 | 150 | 157 | 159 | 1582 | 71 a |

| 2003/07~2003/12 | 150 | 459 | 246 | 733 | 1473 | 61 a |

| 2004/01~2004/06 | 188 | 534 | 314 | 360 | 1924 | 112 a |

| 2004/07~2004/12 | 106 | 166 | 96 | 392 | 1357 | 59 a |

| Average | 241 | 303 | 303 | 541 | 2064 | 101a |

| Testing | RMSE | |||||

|---|---|---|---|---|---|---|

| [4] | [9] | [7] | SVR | GRNN | Proposed | |

| 1998/01~1998/06 | 620 | 491 | 1506 | 591 | 10192 | 226 a |

| 1998/07~1998/12 | 434 | 294 | 776 | 251 | 3844 | 228 a |

| 1999/01~1999/06 | 415 | 327 | 1197 | 758 | 6546 | 192 a |

| 1999/07~1999/12 | 728 | 357 | 856 | 729 | 8309 | 208 a |

| 2000/01~2000/06 | 678 | 460 | 924 | 353 | 5975 | 329 a |

| 2000/07~2000/12 | 372 | 304 | 503 | 726 | 3703 | 238 a |

| 2001/01~2001/06 | 589 | 466 | 662 | 504 | 4422 | 217 a |

| 2001/07~2001/12 | 626 | 415 | 1099 | 994 | 9973 | 199 a |

| 2002/01~2002/06 | 318 | 172 | 402 | 230 | 2761 | 116 a |

| 2002/07~2002/12 | 232 | 192 | 225 | 496 | 3380 | 119 a |

| 2003/01~2003/06 | 261 | 157 | 284 | 433 | 2091 | 88 a |

| 2003/07~2003/12 | 325 | 256 | 329 | 509 | 7329 | 115 a |

| 2004/01~2004/06 | 376 | 212 | 596 | 393 | 7913 | 153 a |

| 2004/07~2004/12 | 313 | 159 | 262 | 119 | 2572 | 106 a |

| Average | 449 | 304 | 687 | 506 | 5644 | 181a |

| TAIEX | [4] | [9] | [7] | SVR | GRNN |

| Proposed | + * | + * | + * | + * | + * |

| GRNN | − * | − * | − * | − * | |

| SVR | − * | − * | − * | ||

| [7] | − * | + | |||

| [9] | − * | ||||

| HSI | [4] | [9] | [7] | SVR | GRNN |

| Proposed | + * | + * | + * | + * | + * |

| GRNN | − * | − * | − * | − * | |

| SVR | − | − * | + | ||

| [7] | − * | − * | |||

| [9] | + |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsai, M.-C.; Cheng, C.-H.; Tsai, M.-I. A Multifactor Fuzzy Time-Series Fitting Model for Forecasting the Stock Index. Symmetry 2019, 11, 1474. https://doi.org/10.3390/sym11121474

Tsai M-C, Cheng C-H, Tsai M-I. A Multifactor Fuzzy Time-Series Fitting Model for Forecasting the Stock Index. Symmetry. 2019; 11(12):1474. https://doi.org/10.3390/sym11121474

Chicago/Turabian StyleTsai, Ming-Chi, Ching-Hsue Cheng, and Meei-Ing Tsai. 2019. "A Multifactor Fuzzy Time-Series Fitting Model for Forecasting the Stock Index" Symmetry 11, no. 12: 1474. https://doi.org/10.3390/sym11121474

APA StyleTsai, M.-C., Cheng, C.-H., & Tsai, M.-I. (2019). A Multifactor Fuzzy Time-Series Fitting Model for Forecasting the Stock Index. Symmetry, 11(12), 1474. https://doi.org/10.3390/sym11121474