1. Introduction

The growing concentrations of people and production in space has been one of the characteristics of economic growth in recent decades, hence, the renewed academic interest in urban phenomena. Populations and companies tend to prefer being located in places where physical proximity with other people and firms presents significant benefits, which are known as economies of agglomeration [

1,

2,

3,

4,

5,

6,

7]. This concept goes back to Marshall [

8], who observed that the location of firms in areas with a high concentration of firms in the same sector brought advantages, such as the availability of skilled labor, the availability of intermediate goods, and the ease of exchanging knowledge about products, processes, and innovations.

There is a broad consensus in the literature about the importance of agglomeration economies for productivity and economic growth [

9,

10,

11,

12,

13,

14,

15,

16,

17,

18,

19]. In fact, the heterogeneity of urban growth is interpreted as the result of different levels of productivity, which, in turn, are influenced by the size of cities. These cities, according to the World Bank [

20], are home to 54% of the world’s population and generate more than 80% of the world’s gross domestic product, which poses enormous challenges for cities, given that when the agglomeration economies emerge, spatial inequalities also emerge.

Traditionally, two types of agglomeration economies are distinguished: localization economies, which operate mainly within a specific sector; and urbanization economies, which operate through the whole of economic activity [

21]. The benefits (and costs) of localization and urbanization are collectively referred to as external economies (diseconomies), because they arise outside the company. This work only focuses on the benefits of external economies of scale or economies of agglomeration in manufacturing (localization economies and urbanization economies).

Based on the aforementioned typology, the most recent empirical analyzes estimate the impact of external economies on the local results of productivity and wages [

11,

22,

23,

24,

25]; however, studies related to employment and location decisions are also present. A large body of literature seeks to quantify such effects in different countries and geographic scales. The results support the presence of positive effects in urban growth of diversity (economic concentration of a market) and competition [

26,

27,

28,

29], while the results with respect to specialization are more ambiguous [

13,

30,

31,

32,

33].

In terms of employment as a measure of urban growth, the expected incidence of localization and urbanization externalities is strongly dependent on the context and sector of analysis. Regarding density, a positive impact is expected given that geographic proximity facilitates the presence of micro-fundamentals: sharing, matching, and learning [

34], that lead the economies of agglomeration. Regarding the average size of firms, this is also expected to explain employment positively given that these factors are inherent to internal economies of scale [

26]. However, regarding the developing countries, and Latin American countries in particular, the existing evidence is very limited, so this study is a significant contribution in this regard.

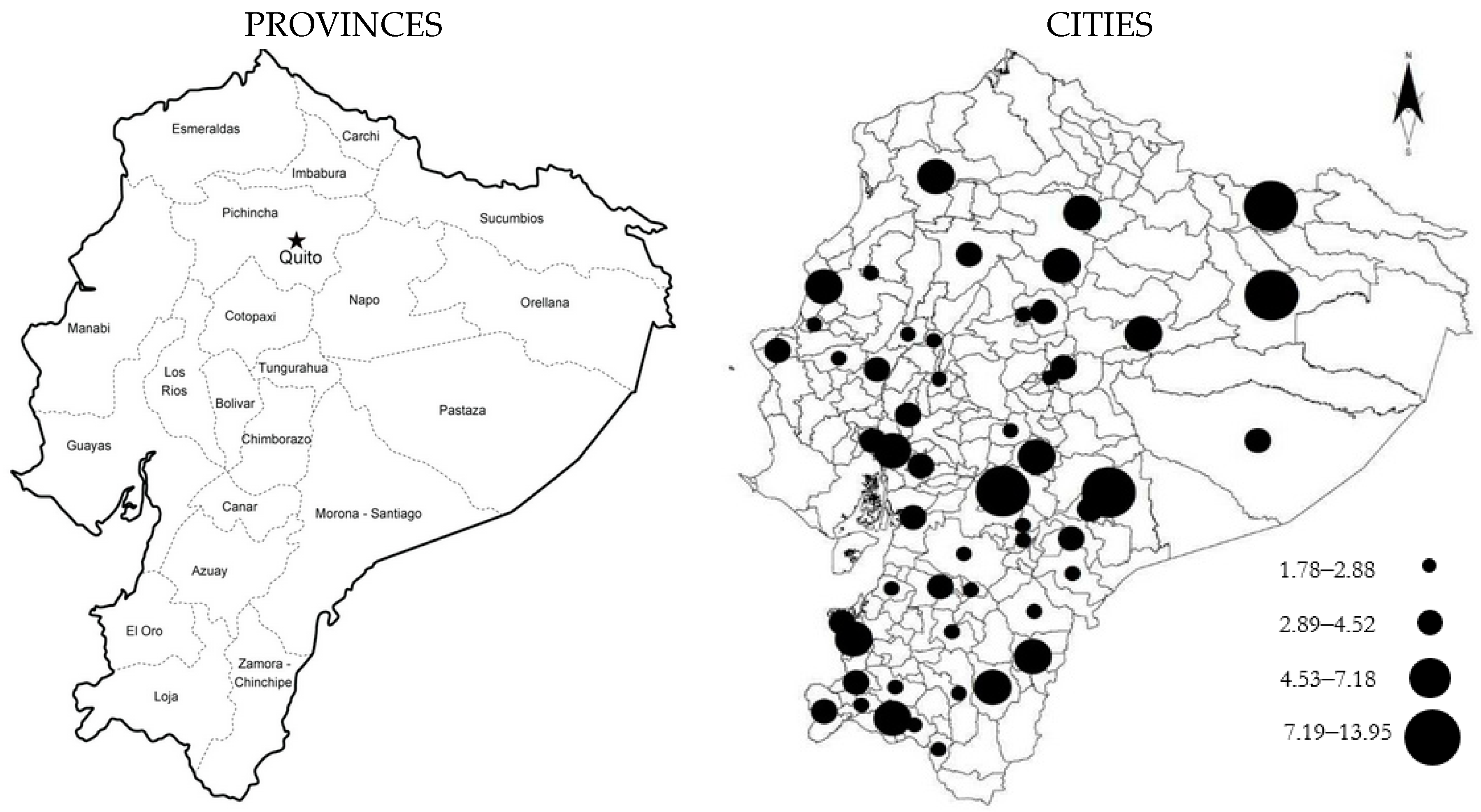

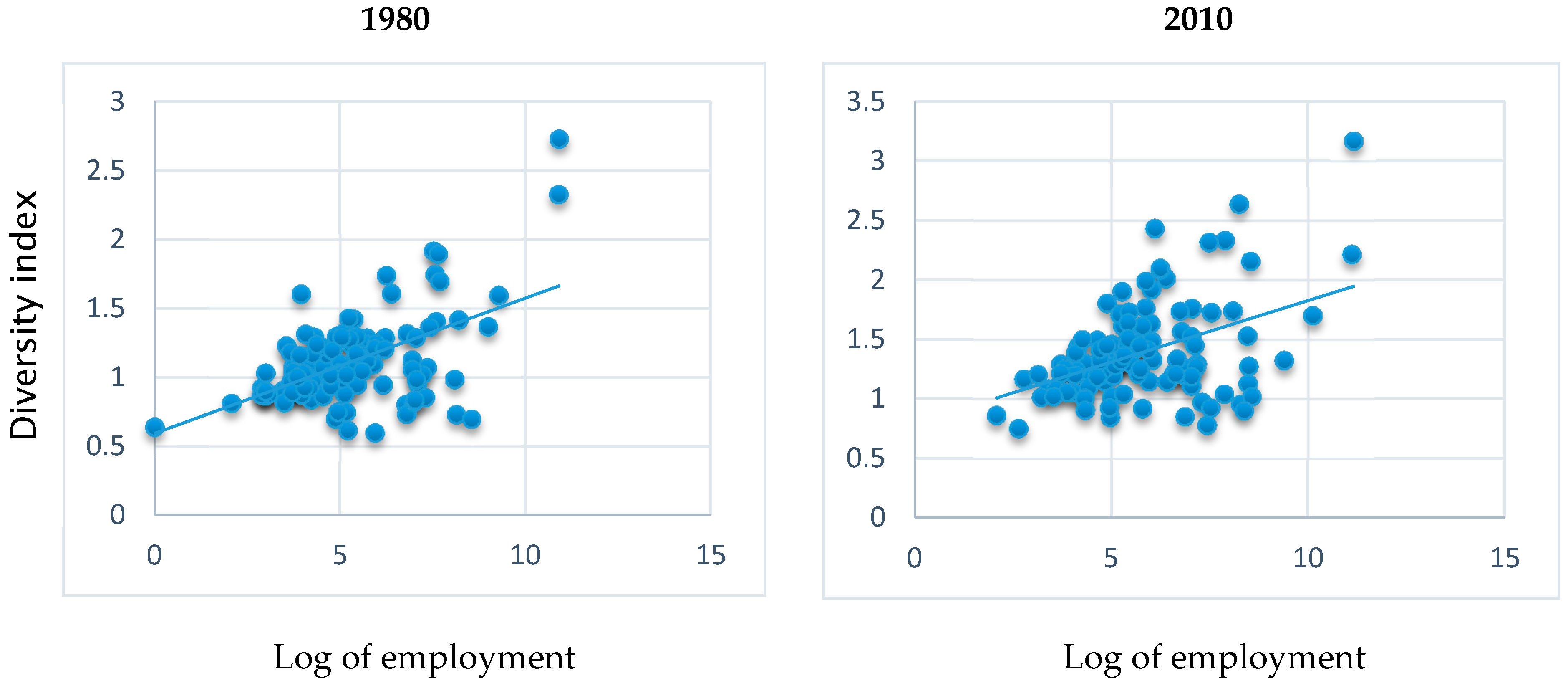

In this context, this study quantifies the impact of the localization and urbanization economies on the growth of employment, as a proxy for economic growth, in the cities of Ecuador between 1980 and 2010, years for which data are available by industry and cities from the Economic Census of this country. Localization economies are measured through the specialization index that captures productivity gains both when it is high, because total employment in a city is high, and when industry participation is high for the total employment given in a city. For urbanization economies, the Herfindahl index is a measure of the diversity, employed in economics, which indicates the economic concentration of a market; the inverse of the Herfindahl index a high index indicates a very concentrated and uncompetitive market. Density measures number of people living in an urbanized area. These results suggest that specialization affects employment growth throughout this period. Two purposes drive this research: first, to contrast the empirical results obtained by other studies carried out in developed countries [

26,

32,

35,

36,

37], with those obtained in this research conducted in Ecuador, a developing country. Second, provide guidance, based on empirical results, to political managers for development of economic policies related to employment and productivity in a country that seeks to reorient its strong agro-exporting sector (manufacturing) to diversify production and, through the generation of added value, to develop new industries.

It should be noted that the contribution of this paper is not only limited to Ecuador, but extends to other Latin American countries, given the characteristics it shares with most of them in terms of its industrial composition and urbanization process.

The work is organized as follows: the next section presents a review of the literature.

Section 3 contains the methodology and the empirical analysis. In

Section 4, the results obtained are detailed. Finally, in

Section 5 the most relevant conclusions are recorded.

2. Literature Review on Agglomeration Economies

Deepening the knowledge of the magnitude and causes of agglomeration economies has been a field of renewed interest in the economic literature from the seminal works of Smith [

38] and Marshall [

8] around the importance of economies of scale for agglomeration. Smith introduced the idea that scaling up allows firms and workers to specialize in specific activities, and that specialization and division of labor increase productivity. Marshall [

8] posits that industries specialize geographically because proximity favors the transmission of knowledge, the reduction of costs of transporting inputs and products, and greater efficiency in labor markets. Analogously, Duranton and Puga [

34] specify the mechanisms that lead to agglomeration: sharing, matching, and learning. The sharing mechanism includes the profits that come from the great variety of inputs and industrial specialization; matching involves better adjustments between employees and employers, and between buyers and suppliers or business pairs; and learning corresponds to the generation, diffusion, and accumulation of knowledge.

The theory of agglomeration economies postulates that companies enjoy positive externalities of the spatial concentration of economic activities [

8]. Such benefits may arise within an industry or between them, which are referred to as localization and urbanization economies, respectively. According to the MAR (Marshall-Arrow-Romer) model [

8,

39,

40], formalized as such by Glaeser et al. [

9], the concentration of an industry in a region promotes and facilitates the spillover of knowledge and innovation between firms within the region. However, knowledge externalities between firms only occur between firms from the same industry or similar industries, and therefore are generated only by geographical concentrations of firms in the same or similar sector. In this sense, the MAR model assumes the monopoly as the best form of market competition since it protects the ideas and allows the rents of the innovation to be appropriated by the firms. The spatial concentration of economic activities can therefore positively influence the productivity and growth of these firms, and consequently of the cities that contain them. This intra-industry external effect is known as localization economies.

In contrast, Jacobs [

41] indicates that cities are a source of innovation and states that the most important sources of knowledge spillover are external to the industry in which they develop their activity. In fact, he argues that diversity of industries within a region favors knowledge externalities driving innovative activities and economic growth. The foundation is that a more diverse and closer industrial fabric fosters opportunities to imitate, share, and recombine ideas and practices. Therefore, Jacobs [

41] sees diversity rather than specialization as the main mechanism of economic growth; that is, a diversified local productive structure gives rise to urbanization economies.

In line with Jacobs [

41], a third type of externality is recognized, rising from Porter’s [

42] argument that competition is better for growth. This author argues that strong competition in the same market encourages innovation and accelerates the rate of technological progress and, therefore, the growth of productivity. Regarding spillovers of knowledge, it indicates that these occur primarily within a vertically integrated industry, which corresponds to the postulate by Marshall that specialization leads to spillovers of knowledge within industries. However, according to Combes [

26], the impact of competition on information spillovers is ambiguous, as corroborated by Sutton [

43] (p. 334) who “… shows that empirical studies do not succeed in establishing that competition has a positive effect on innovations”.

The empirical literature has established that the spatial concentration of industrial activity improves productivity and innovation, as well as economic growth through different approaches. In these approaches, the common denominator is the analysis of the localization–urbanization dichotomy [

2,

10,

44]. In this paper, the first of these is addressed; therefore, empirical works whose performance measures are employment growth as a proxy for economic growth are discussed, on which the incidence of agglomeration economies is evaluated [

22,

26,

27,

29,

30,

36,

37]. An alternative measure of economic growth is the number of new businesses. Rosenthal and Strange [

45]; Van Soest et al. [

29], Jofre-Monseny [

46], and Mota and Brandão [

47] find positive effects of localization and urbanization economies in the birth of new firms.

In line with this work, two pioneering works correspond to Glaeser et al. [

9] and Henderson et al. [

10], who use a dynamic perspective to estimate the impact of numerous local determinants on employment growth at the industry and city level for the United States. Similarly, Combes [

26] establishes that for France the size of the local market has a negative effect on employment growth in the services sector, however, the effect is positive in manufacturing industries. Viladecans-Marsal [

27] demonstrates for Spain that agglomeration economies influence the location of manufacturing activity (the influence of urbanization economies predominates in most sectors). For Germany, Blien et al. [

36] determine that the size of the local market has a positive impact on the growth of industrial employment and the service sector. For Italy, Mameli et al. [

37] find that localization economies have a negative effect, and urbanization economies have a positive effect on employment growth; however, their results are sensitive to the sectoral disaggregation used. Marrocu et al. [

48] find that in old urban European areas, positive effects of diversity are particularly noticeable in the service sector. On the other hand, in the “new” Europe, specialization affects the low-tech manufacturing sectors positively. In general, positive results are expected mainly from urbanization economies, since economic growth depends strongly on the level of local demand. Therefore, diversified regions with strong local demand and several intermediaries in the supply chain should function better economically [

31].

In Latin America, empirical literature in this field is scarce. Saito and Gopinath [

49] for Chile, Da Silva Catela et al. [

50] for Brazil, Pereira and Soloaga [

51] for Mexico, and Guevara et al. [

52] in Ecuador, analyze the incidence of agglomeration economies on the growth of labor productivity. In contrast, only Escobar-Méndez [

53] and Cota [

54] analyze the incidence of agglomeration economies on the growth of manufacturing employment for Mexico. Escobar-Méndez [

55] analyzes the main metropolitan areas and cities of Mexico during the period 1980–2003, showing that specialized environments have a negative effect on the growth of manufacturing employment, while the results of the study by Cota [

54] in the cities near the northern border of Mexico revealed that the externalities caused by industrial specialization constitute one of the explanatory factors of the growth of manufacturing employment in the period 1988−1993.

As expected, the results obtained differ according to the sector analyzed, the territorial unit, the availability of data, and the methodology used. Regarding this last aspect, it should be noted that the measurement of the agglomeration economies entails aspects of endogeneity that, according to Combes and Gobillon [

32], can occur both individually and at the local level. The literature has mainly pointed out aspects of endogeneity at the local level, proposing some strategies related to fixed effects at a local level—primarily the use of instrumental variables and of delayed variables (to expand on this topic, review Combes and Gobillon [

32]).

This paper approaches this problem with the use of instrumental variables, as is discussed below. Along this line, the most common approach according to Grahman et al. [

55] consists of instrumentalizing the current levels of agglomeration using long delays of the population or population density, within which the work of Moomaw [

35], Henderson et al. [

10], Ciccone and Hall [

11], Combes et al. [

23], and Duranton [

56], among others, fall. In these studies, the recurrent argument is that the densities observed at present are determined by previous patterns of population concentration, which in themselves are not correlated with contemporary levels of productivity.

In contrast, instruments based on contemporary data are also used; among others, Viladecans-Marsal [

27] uses the average of the size of firms or taxes on economic activities, and Nakaruma [

57] and Combes et al. [

23] use the surface of the geographical units under analysis. Rosenthal and Strange [

46] and Combes et al. [

58] use geological variables related to the subsoil of industrial sites as instruments.

Finally, it should be noted that specialization and urbanization are not mutually exclusive, since specialization is a particular feature of a certain sector within an industry, while diversity is a characteristic of a total area. Consequently, both hypotheses are tested appropriately with the use of different indicators.

4. Results

The estimate of Equation (9) was derived by OLS. However, these results were not entirely correct given the presence of selection bias and the endogeneity of the model. Therefore, it was necessary to apply two additional estimation strategies. Next, the specificities of each of these were explained for the measures of productivity of the variable of interest: employment.

The first column of

Table 5 shows the results obtained when the estimates were made by OLS. In this case, the localization economies measured by the specialization index and the density of employment explain the decrease in employment between 1980 and 2010, while the urbanization economies measured by the diversity index explain employment growth positively.

In order to correct the selection bias, the analysis proceeded with maximum likelihood estimations through a Tobit Type II model whose results were quite similar to those obtained by OLS. In column two, the statistical significance of 1% is shown for these same variables in the growth of employment, but with a size of coefficients relatively higher than those obtained in column one. For all regressors, except for the size of the firms, which in this case has a negative sign, the signs of the coefficients of the significant variables are maintained.

Finally, column 3 of

Table 5 shows the results of the estimations with instrumental variables (2SLS) that allow the endogeneity of the model to be treated. Employment growth approaches the instrumental variables: specialization index, diversity index, 1974 population density squared, the urbanization index of 1980, the centrality index, and a geological variable, which leads to results that diverge from those obtained in the previous estimates. In this case, it is evident that a 1% greater specialization of the industries in the cities in 1980 leads to 0.287% employment growth in the following 30 years. Such a positive effect of specialization in employment growth is consistent with Nakaruma [

57], Henderson et al. [

10], Henderson [

67] (these authors only find evidence of urbanization economies for the new high-tech sectors), Blien et al. [

36], and Choi and Choi [

68]. However, diversity had a non-significant effect on employment growth, which was the same result as González-Val and Marcén [

69].

On the other hand, the density of total employment in cities also has a positive impact. In this case, an increase of 1% in the density of cities in 1980 generates employment growth in the order of 0.097% in the subsequent 30 years. In several studies, when density and specialization were simultaneously introduced, it was found that both have a positive effect on the measure of productivity used [

32,

70,

71].

The average size of the firms has a negative impact, with an elasticity of −0.294, almost coincident with that obtained by Combes [

26] in the global regressions for industry in France; Combes [

26] interprets this result as the effect of the life cycle of an industry. Other similar results regarding this variable are obtained by Glaeser et al. [

9], O’Huallachain and Satterthwaite [

72], and Badr et al. [

73]. In the estimates using OLS and 2SLS, fixed effects of the regions, provinces, and industries are considered.

In the estimations of

Table 5, the value of the F statistic that is recorded corresponds to the statistic of the minimum own value (minimum eigenvalue), which is considered an analogous measure of the F statistic defined by Stock and Yogo [

66] when the estimates are conducted with more than one endogenous regressor, as in this case [

74]. As before, this value is greater than 10, which indicates that the instruments are not weak. The value of F in this case represents the joint statistical significance of the endogenous regressors of employment growth, at a maximum tolerance level of 10% relative bias, as measured by the Wald statistic based on the parameters given by Stock and Yogo [

66].

In general, the findings fully validate the proposal of MAR-type externalities.

Table 1 previously showed the specialization of the cities of Ecuador, mainly around the sectors related to the natural resources of wood and leather. This suggests reinforcement within the industries and between firms of individual and collective learning.

Robustness of Results

In order to verify the robustness of the results described above, it was first necessary to verify that the instruments used comply with the second condition of exogeneity suggested in Equation (8). The orthogonality of the error term, which in the presence of a greater number of instruments than endogenous regressors (m < k), can be evaluated with the Sargan over-identification test in 2SLS estimates.

This statistic, like others used in models other than 2SLS, evaluates not only the non-correlation of the instruments with the error term, but also that the equation is incorrectly specified and that one or more of the excluded exogenous variables should be included in the base Equation (9) as appropriate to the employment. The values reported for this statistic in

Table 5 suggest that the instruments that have been defined to deal with the endogeneity of the model of Equation (9) are exogenous, since in neither case are their

p values significant. A significant statistical test could represent either of the two cases, that is, not only the non-correlation of the instruments with the error term, but also that the equation is incorrectly specified. In other words, the Sargan test allows rejection of the hypothesis of restriction of over identification, which suggests the joint exogeneity of the instruments.

Another robustness test, a strategy for estimating the growth of employment less sensitive to weak instruments, was applied, namely, the limited-information maximum likelihood (LIML) estimator. According to Cameron and Trivedi [

75], in the presence of weak instruments, asymptotic theory may provide poor guidance for the actual distributions of finite samples. LIML considers the estimation of the structural parameters of our equations, taking into account only the likelihood function of the endogenous variables of Equation (9) and the identification constraints corresponding to the equation to be estimated.

Table 6 shows these results in the first stage of the estimates by LIML.

The results of the partial correlations between the endogenous regressor and their respective instruments are very similar to those obtained in the 2SLS estimations, particularly regarding the value of the coefficients, although a modification in the values of the errors is evidenced as standard, but small. The values of the F statistic are exactly the same for all the endogenous returns of employment. This suggests an equal relevance of the instruments to those obtained by 2SLS.

Finally, the results obtained from the regression of employment growth ratify those previously mentioned using 2SLS, albeit with some differences to note.

Table 7 shows that a 1% increase in the specialization of industries contained in a city in 1980 favours the growth of employment in these industries to the order of 0.309% in the following decade, which represents an additional 0.02% compared to the estimates using 2SLS (

Table 6). Similarly, a 1% increase in the employment density of cities in 1980 determined employment growth of 0.102%, in this case only 0.005% additional to that obtained using 2SLS in

Table 5. Regarding the average size of firms, the estimate by LIML attributes −0.303% employment growth, 0.009% more than before.

In summary, it was assumed that the estimates of employment growth between 1980 and 2010 were consistent in terms of the coefficients obtained.

5. Conclusions, Policy Implications, and Research Limitations

5.1. Conclusions

This research examined the effects of agglomeration economies (location and urbanization) on the growth of urban employment in the secondary sector in Ecuador between 1980 and 2010. The results obtained suggest the following conclusions:

1. Localization economies promote employment growth in industries and, consequently, in the cities of Ecuador. In this sense, the benefits of spatial concentration are internalized by companies that belong to the same industry in a given area that generate savings through greater research cooperation and lower transport rates, such as in the consumption of supplies or special services provided by others.

2. In most countries, specialized and diversified cities co-exist; however, in Ecuador they do not. In Ecuador, cities are predominantly specialized in sectors largely dependent on natural resources, and of long tradition for the country. The absence of diversity suggests the disadvantages of less innovation and the inability to imitate, share, and recombine ideas and practices between industries, as well as between companies in the same industry.

3. The significant effect of the total employment density in cities indicates the importance of the size of the economy of a city for employment growth. The results show that this variable has a positive effect on the measure of productivity used in this research, namely, employment growth.

4. Finally, the results show a negative effect of the average size of companies within the local industry on employment growth. However, this effect is not important, in the sense that it was incorporated into the estimates as an additional determinant of localization economies.

5.2. Policy Implications

The results obtained have political implications. These results suggest that in the cities of Ecuador it is necessary to strengthen diversified local production structures as a source of innovation and economic growth; that is, to promote more diverse and competitive industrial fabrics. The intervention of political managers in the proper functioning of transport and communication infrastructure, and the proximity of markets and access to specialized services is essential. In the last decade, the country has made progress in creating conditions and factors necessary to initiate a process of productive transformation. However, its growth continues to depend on the extraction of non-renewable natural resources and the production of raw materials that, in both cases, are marketed in markets with great price instability, thereby affecting the terms of trade and making the country’s trade balance vulnerable.

Secondly, it is desirable that public interventions and the state’s action in the face of the presented territorial disparities revolve around incentive and disincentive policies for the installation of new industries. Therefore, it is necessary to: (1) generate incentives (economic, financial, and fiscal) for the implementation of public and private companies in cities with few industries; (2) invest in the improvement of city infrastructure, taking into account the new demands of the global environment; (3) incentivize via taxes and restrictions, and the installation of new industries in congested metropolitan agglomerations; and (4) transfer competencies (functions and financial resources) to city governments to design their own economic and industrial development strategies.

5.3. Research Limitations

Regarding the limitations of this study, it can be mentioned, as noted by Quintana-Romero, Mendoza and Correa-Quezada [

75] that reference studies are scarce due to lack of information, restrictions in the official data series, and the weak tradition of conducting spatial analysis in Ecuador.

Likewise, we recognize that the proxies used to measure agglomeration economies are imperfect. In line with the literature, the degree of specialization was used as a better representation of the potential of Marshall’s externalities because it better captures the intensity and density of interactions between companies. Other indicators, such as the location quotient, are also widely used for this purpose; however, the location quotient has received criticism because it is highly sensitive to the size of the region [

76], and because corrections of the errors of its calculation significantly reverse the sign of the effect of relative concentration on local growth [

23]. Regarding the measurement of Jacobs-type externalities, the Hirschman-Herfindahl index is the most common. Its various applications include those based on employment, as used in this work due to the availability of data, but also those based on patents or industrial value added. An alternative measure is the Gini index.