Advancing Fair Division in Overseas Farmland Investment via Shapley Value

Abstract

1. Introduction

2. Literature Review

2.1. OFI May Be a Win–Win Solution

2.2. Fair Division in the OFI

3. Methodology

3.1. Cooperative Game

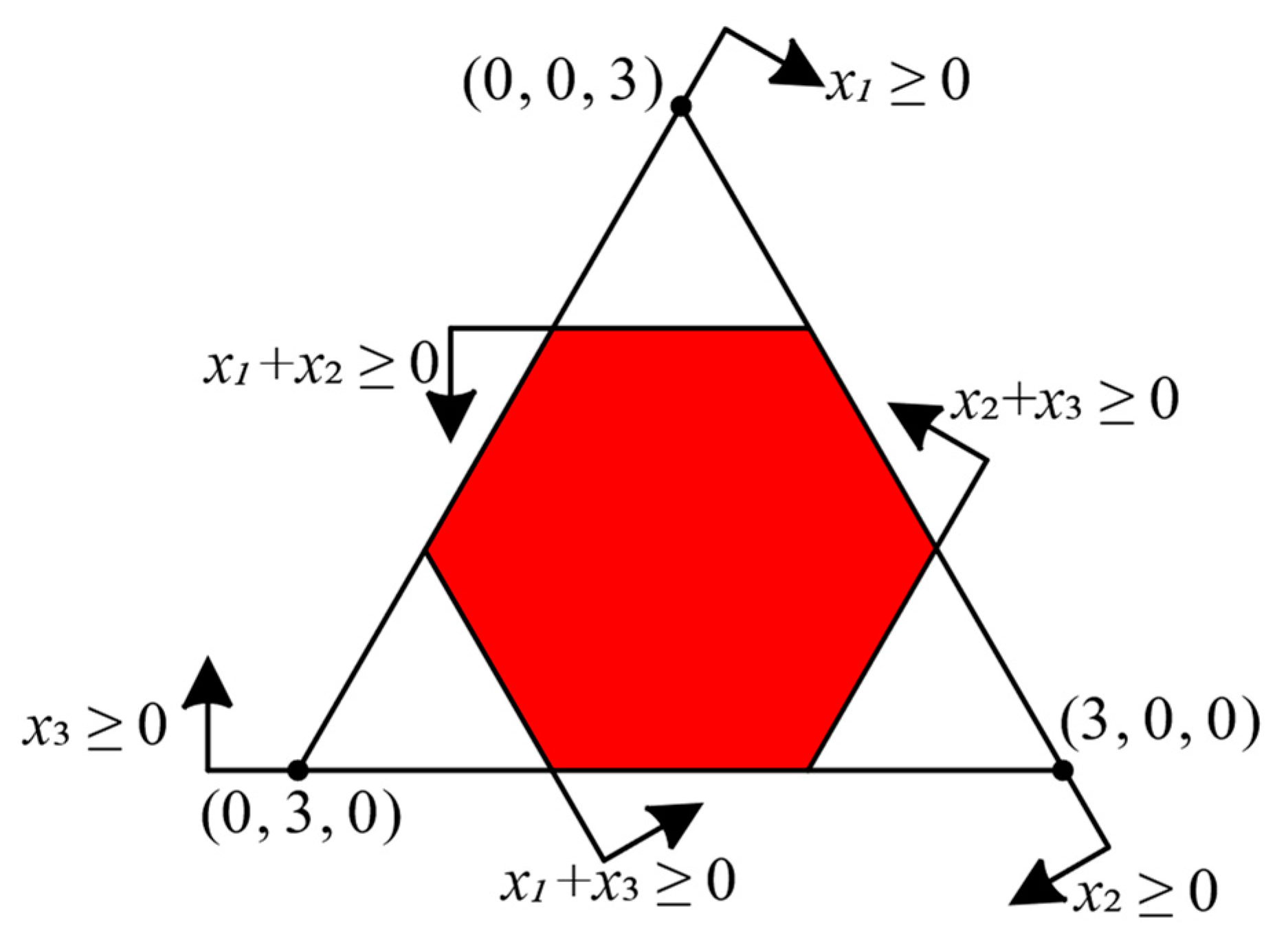

3.2. Core

3.3. Shapley Value

4. Results and Discussion

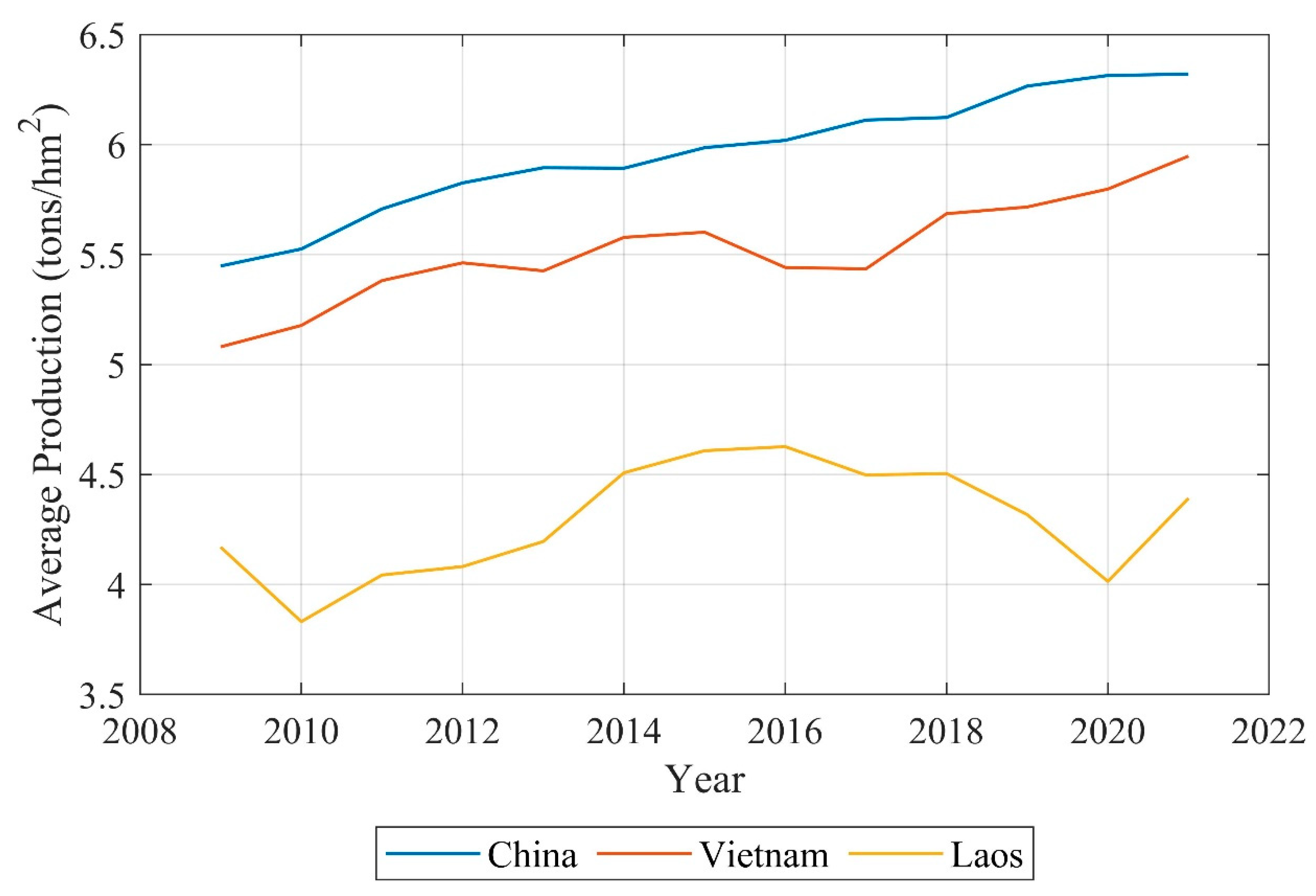

4.1. Case Study

4.2. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Rosegrant, M.W.; Cline, S.A. Global Food Security: Challenges and Policies. Science 2003, 302, 1917–1919. [Google Scholar] [CrossRef]

- Skaf, L.; Buonocore, E.; Dumontet, S.; Capone, R.; Franzese, P.P. Applying Network Analysis to Explore the Global Scientific Literature on Food Security. Ecol. Inform. 2020, 56, 101062. [Google Scholar] [CrossRef]

- WFP. A Global Food Crisis. Available online: https://www.wfp.org/global-hunger-crisis (accessed on 25 February 2025).

- Godfray, H.C.J.; Beddington, J.R.; Crute, I.R.; Haddad, L.; Lawrence, D.; Muir, J.F.; Pretty, J.; Robinson, S.; Thomas, S.M.; Toulmin, C. Food Security: The Challenge of Feeding 9 Billion People. Science 2010, 327, 812–818. [Google Scholar] [CrossRef] [PubMed]

- FAO. The State of Food Security and Nutrition in the World 2022. Available online: https://openknowledge.fao.org/items/c0239a36-7f34-4170-87f7-2fcc179ef064 (accessed on 25 February 2025).

- FAO. How to Feed the World in 2050. Available online: https://www.fao.org/fileadmin/templates/wsfs/docs/expert_paper/How_to_Feed_the_World_in_2050.pdf (accessed on 27 March 2023).

- Hall, D. The 2008 World Development Report and the Political Economy of Southeast Asian Agriculture. J. Peasant Stud. 2009, 36, 603–609. [Google Scholar] [CrossRef]

- Anseeuw, W.; Lay, J.; Messerli, P.; Giger, M.; Taylor, M. Creating a Public Tool to Assess and Promote Transparency in Global Land Deals: The Experience of the Land Matrix. J. Peasant Stud. 2013, 40, 521–530. [Google Scholar] [CrossRef]

- Schoneveld, G.C. The Politics of the Forest Frontier: Negotiating between Conservation, Development, and Indigenous Rights in Cross River State, Nigeria. Land Use Policy 2014, 38, 147–162. [Google Scholar] [CrossRef]

- Schoneveld, G.C. Host Country Governance and the African Land Rush: 7 Reasons Why Large-Scale Farmland Investments Fail to Contribute to Sustainable Development. Geoforum 2017, 83, 119–132. [Google Scholar] [CrossRef]

- Müller, M.F.; Penny, G.; Niles, M.T.; Ricciardi, V.; Chiarelli, D.D.; Davis, K.F.; Dell’Angelo, J.; D’Odorico, P.; Rosa, L.; Rulli, M.C.; et al. Impact of Transnational Land Acquisitions on Local Food Security and Dietary Diversity. Proc. Natl. Acad. Sci. USA 2021, 118, e2020535118. [Google Scholar] [CrossRef]

- Holmes, G. What Is a Land Grab? Exploring Green Grabs, Conservation, and Private Protected Areas in Southern Chile. J. Peasant Stud. 2014, 41, 547–567. [Google Scholar] [CrossRef]

- Herrmann, R.T. Large-Scale Agricultural Investments and Smallholder Welfare: A Comparison of Wage Labor and Outgrower Channels in Tanzania. World Dev. 2017, 90, 294–310. [Google Scholar] [CrossRef]

- Zoomers, E.B.; Otsuki, K. Addressing the Impacts of Large-Scale Land Investments: Re-Engaging with Livelihood Research. Geoforum 2017, 83, 164–171. [Google Scholar] [CrossRef]

- Davis, K.F.; Müller, M.F.; Rulli, M.C.; Tatlhego, M.; Ali, S.; Baggio, J.A.; Dell’Angelo, J.; Jung, S.; Kehoe, L.; Niles, M.T.; et al. Transnational Agricultural Land Acquisitions Threaten Biodiversity in the Global South. Environ. Res. Lett. 2023, 18, 024014. [Google Scholar] [CrossRef]

- Pearce, F. The Land Grabbers: The New Fight over Who Owns the Earth; Beacon Press: Boston, UK, 2012. [Google Scholar]

- Coscieme, L.; Pulselli, F.M.; Niccolucci, V.; Patrizi, N.; Sutton, P.C. Accounting for “Land-Grabbing” from a Biocapacity Viewpoint. Sci. Total Environ. 2016, 539, 551–559. [Google Scholar] [CrossRef]

- Deininger, K. Challenges Posed by the New Wave of Farmland Investment. J. Peasant Stud. 2011, 38, 217–247. [Google Scholar] [CrossRef]

- Love, D.; Twomlow, S.; Mupangwa, W.; van der Zaag, P.; Gumbo, B. Implementing the Millennium Development Food Security Goals—Challenges of the Southern African Context. Phys. Chem. Earth Parts A/B/C 2006, 31, 731–737. [Google Scholar] [CrossRef]

- Cotula, L.; Vermeulen, S.; Leonard, R.; Keeley, J. Land Grab or Development Opportunity? Agricultural Investment and International Land Deals in Africa; International Institute for Environment and Development: London, UK, 2009; Available online: https://iied.org/12561iied (accessed on 25 February 2025).

- Baumgartner, P.; von Braun, J.; Abebaw, D.; Müller, M. Impacts of Large-Scale Land Investments on Income, Prices, and Employment: Empirical Analyses in Ethiopia. World Dev. 2015, 72, 175–190. [Google Scholar] [CrossRef]

- Friis, C.; Nielsen, J.Ø. Small-Scale Land Acquisitions, Large-Scale Implications: Exploring the Case of Chinese Banana Investments in Northern Laos. Land Use Policy 2016, 57, 117–129. [Google Scholar] [CrossRef]

- Santangelo, G.D. The Impact of FDI in Land in Agriculture in Developing Countries on Host Country Food Security. J. World Bus. 2018, 53, 75–84. [Google Scholar] [CrossRef]

- Lu, X.; Ke, S.; Cheng, T.; Chen, T. The Impacts of Large-Scale OFI on Grains Import: Empirical Research with Double Difference Method. Land Use Policy 2018, 76, 352–358. [Google Scholar] [CrossRef]

- Vermeulen, S.; Cotula, L. Over the Heads of Local People: Consultation, Consent, and Recompense in Large-Scale Land Deals for Biofuels Projects in Africa. J. Peasant Stud. 2010, 37, 899–916. [Google Scholar] [CrossRef]

- Rieple, A.; Singh, R. A Value Chain Analysis of the Organic Cotton Industry: The Case of UK Retailers and Indian Suppliers. Ecol. Econ. 2010, 69, 2292–2302. [Google Scholar] [CrossRef]

- Aha, B.; Ayitey, J.Z. Biofuels and the Hazards of Land Grabbing: Tenure (in)Security and Indigenous Farmers’ Investment Decisions in Ghana. Land Use Policy 2017, 60, 48–59. [Google Scholar] [CrossRef]

- Regassa, A.; Hizekiel, Y.; Korf, B. ‘Civilizing’ the Pastoral Frontier: Land Grabbing, Dispossession and Coercive Agrarian Development in Ethiopia. J. Peasant Stud. 2019, 46, 935–955. [Google Scholar] [CrossRef]

- Sändig, J. Contesting Large-Scale Land Acquisitions in the Global South. World Dev. 2021, 146, 105581. [Google Scholar] [CrossRef]

- De Maria, M.; Robinson, E.J.Z.; Zanello, G. Fair Compensation in Large-Scale Land Acquisitions: Fair or Fail? World Dev. 2023, 170, 106338. [Google Scholar] [CrossRef]

- Steinhaus, H. The Problem of Fair Division. Econometrica 1948, 16, 101–104. [Google Scholar]

- Shapley, L.S. A Value for N-Person Games. In Contributions to the Theory of Games (AM-28), Volume II; Kuhn, H.W., Tucker, A.W., Eds.; Princeton University Press: Princeton, NJ, USA, 1953; pp. 307–318. ISBN 978-1-4008-8197-0. [Google Scholar]

- Byerlee, D.; Deininger, K. Growing Resource Scarcity and Global Farmland Investment. Annu. Rev. Resour. Econ. 2013, 5, 13–34. [Google Scholar] [CrossRef]

- Eidt, R.C. Japanese Agricultural Colonization: A New Attempt at Land Opening in Argentina. Econ. Geogr. 1968, 44, 1–20. [Google Scholar] [CrossRef]

- Hall, D. Land Grabs, Land Control, and Southeast Asian Crop Booms. J. Peasant Stud. 2011, 38, 837–857. [Google Scholar] [CrossRef]

- Kinda, S.R.; Kere, N.E.; Yogo, T.U.; Simpasa, M.A. Do Land Rushes Really Improve Food Security in Sub-Saharan Africa? Food Policy 2022, 113, 102285. [Google Scholar] [CrossRef]

- Zoomers, A. Globalisation and the Foreignisation of Space: Seven Processes Driving the Current Global Land Grab. J. Peasant Stud. 2010, 37, 429–447. [Google Scholar] [CrossRef]

- Fairhead, J.; Leach, M.; Scoones, I. Green Grabbing: A New Appropriation of Nature? J. Peasant Stud. 2012, 39, 237–261. [Google Scholar] [CrossRef]

- Balestri, S.; Maggioni, M.A. This Land Is My Land! Large-Scale Land Acquisitions and Conflict Events in Sub-Saharan Africa. Def. Peace Econ. 2021, 32, 427–450. [Google Scholar] [CrossRef]

- De Maria, M. Understanding Land in the Context of Large-Scale Land Acquisitions: A Brief History of Land in Economics. Land 2019, 8, 15. [Google Scholar] [CrossRef]

- Sosa Varrotti, A.P.; Gras, C. Network Companies, Land Grabbing, and Financialization in South America. Globalizations 2021, 18, 482–497. [Google Scholar] [CrossRef]

- Chen, Y.; Li, X.; Wang, L.; Wang, S. Is China Different from Other Investors in Global Land Acquisition? Some Observations from Existing Deals in China’s Going Global Strategy. Land Use Policy 2017, 60, 362–372. [Google Scholar] [CrossRef]

- Michael, M.; Eilon, S.; Shmuel, Z. Game Theory; Cambridge University Press: New York, NY, USA, 2013. [Google Scholar]

- Chakravarty, S.R.; Mitra, M.; Sarkar, P. A Course on Cooperative Game Theory; Cambridge University Press: New York, NY, USA, 2014. [Google Scholar]

- Thomson, W. The Fair Division of a Fixed Supply Among a Growing Population. Math. Oper. Res. 1983, 8, 319–326. [Google Scholar] [CrossRef]

- Chen, Y.; Lai, J.K.; Parkes, D.C.; Procaccia, A.D. Truth, Justice, and Cake Cutting. Games Econ. Behav. 2013, 77, 284–297. [Google Scholar] [CrossRef]

- Robertson, B.; Pinstrup-Andersen, P. Global Land Acquisition: Neo-Colonialism or Development Opportunity? Food Secur. 2010, 2, 271–283. [Google Scholar] [CrossRef]

- Toft, K.H. Are Land Deals Unethical? The Ethics of Large-Scale Land Acquisitions in Developing Countries. J. Agric. Environ. Ethics 2013, 26, 1181–1198. [Google Scholar] [CrossRef]

- Liu, Y.; Li, J.; Yang, Y. Strategic Adjustment of Land Use Policy under the Economic Transformation. Land Use Policy 2018, 74, 5–14. [Google Scholar] [CrossRef]

- Mills, E.N. Framing China’s Role in Global Land Deal Trends: Why Southeast Asia Is Key. Globalizations 2018, 15, 168–177. [Google Scholar] [CrossRef]

- FAO. The State of Food and Agriculture: Investing in Agriculture for a Better Future. Available online: https://lib.icimod.org/record/27723 (accessed on 25 February 2025).

- Borras, S.M.; Kay, C.; Gómez, S.; Wilkinson, J. Land Grabbing and Global Capitalist Accumulation: Key Features in Latin America. Can. J. Dev. Stud./Rev. Can. D’études Dév. 2012, 33, 402–416. [Google Scholar] [CrossRef]

- Kolstad, I.; Wiig, A. Better the Devil You Know? Chinese Foreign Direct Investment in Africa. J. Afr. Bus. 2011, 12, 31–50. [Google Scholar] [CrossRef]

- Cubukcu, K.M. The Problem of Fair Division of Surplus Development Rights in Redevelopment of Urban Areas: Can the Shapley Value Help? Land Use Policy 2020, 91, 104320. [Google Scholar] [CrossRef]

- Rao, N. Land Rights, Gender Equality and Household Food Security: Exploring the Conceptual Links in the Case of India. Food Policy 2006, 31, 180–193. [Google Scholar] [CrossRef]

- Maxwell, D.; Webb, P.; Coates, J.; Wirth, J. Fit for Purpose? Rethinking Food Security Responses in Protracted Humanitarian Crises. Food Policy 2010, 35, 91–97. [Google Scholar] [CrossRef]

- Zaehringer, J.G.; Messerli, P.; Giger, M.; Kiteme, B.; Atumane, A.; Da Silva, M.; Rakotoasimbola, L.; Eckert, S. Large-Scale Agricultural Investments in Eastern Africa: Consequences for Small-Scale Farmers and the Environment. Ecosyst. People 2021, 17, 342–357. [Google Scholar] [CrossRef]

- Adams, E.A.; Kuusaana, E.D.; Ahmed, A.; Campion, B.B. Land Dispossessions and Water Appropriations: Political Ecology of Land and Water Grabs in Ghana. Land Use Policy 2019, 87, 104068. [Google Scholar] [CrossRef]

| Scenario | A | B | C | D | E |

|---|---|---|---|---|---|

| Coalition | {1} {2} {3} | {1, 2} {3} | {1, 3} {2} | {1} {2, 3} | {1, 2, 3} |

| Target area (hm2) | 2.8 × 105 3.9 × 105 4.5 × 105 | 6.7 × 105 4.5 × 105 | 7.3 × 105 3.9 × 105 | 2.8 × 105 8.3 × 105 | 1.1 × 106 |

| Production level (tons/hm2) | 5.96 4.29 5.52 | 5.96 5.52 | 5.96 4.29 | 5.96 5.52 | 5.96 |

| S | 1 | 1 + 2 | 1 + 3 | 1 + 2 + 3 |

| 1.7 × 106 | 4.0 × 106 | 4.3 × 106 | 6.6 × 106 | |

| 0 | 1.7 × 106 | 2.5 × 106 | 4.6 × 106 | |

| 1 | 2 | 2 | 3 | |

| 1/3 | 1/6 | 1/6 | 1/3 | |

| 5.6 × 105 | 3.9 × 105 | 3.1 × 105 | 6.8 × 105 | |

| 5.6 × 105 + 3.9 × 105 + 3.1 × 105 + 6.8 × 105 = 1.9 × 106 | ||||

| S | 2 | 1 + 2 | 2 + 3 | 1 + 2 + 3 |

| 1.7 × 106 | 4.0 × 106 | 4.6 × 106 | 6.6 × 106 | |

| 0 | 1.7 × 106 | 2.5 × 106 | 4.3 × 106 | |

| 1 | 2 | 2 | 3 | |

| 1/3 | 1/6 | 1/6 | 1/3 | |

| 5.5 × 105 | 3.8 × 105 | 3.5 × 105 | 7.7 × 105 | |

| 5.5 × 105 + 3.8 × 105 + 3.5 × 105 + 7.7 × 105 = 2.1 × 106 | ||||

| S | 3 | 1 + 3 | 2 + 3 | 1 + 2 + 3 |

| 2.5 × 106 | 4.3 × 106 | 4.6 × 106 | 6.6 × 106 | |

| 0 | 1.7 × 106 | 1.7 × 106 | 4.0 × 106 | |

| 1 | 2 | 2 | 3 | |

| 1/3 | 1/6 | 1/6 | 1/3 | |

| 8.2 × 105 | 4.4 × 105 | 4.9 × 105 | 8.8 × 105 | |

| 8.2 × 105 + 4.4 × 105 + 4.9 × 105 + 8.8 × 105 = 2.6 × 106 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, C.; Du, M.; Lu, X. Advancing Fair Division in Overseas Farmland Investment via Shapley Value. Land 2025, 14, 767. https://doi.org/10.3390/land14040767

Yang C, Du M, Lu X. Advancing Fair Division in Overseas Farmland Investment via Shapley Value. Land. 2025; 14(4):767. https://doi.org/10.3390/land14040767

Chicago/Turabian StyleYang, Chuan, Meng Du, and Xinhai Lu. 2025. "Advancing Fair Division in Overseas Farmland Investment via Shapley Value" Land 14, no. 4: 767. https://doi.org/10.3390/land14040767

APA StyleYang, C., Du, M., & Lu, X. (2025). Advancing Fair Division in Overseas Farmland Investment via Shapley Value. Land, 14(4), 767. https://doi.org/10.3390/land14040767