How Does Land Finance Influence Vegetation Dynamics in China?

Abstract

1. Introduction

2. Literature Review

2.1. Determinants of Vegetation Dynamics

2.2. Unfavorable Effects of Land Finance in Economic, Environmental and Social Aspects

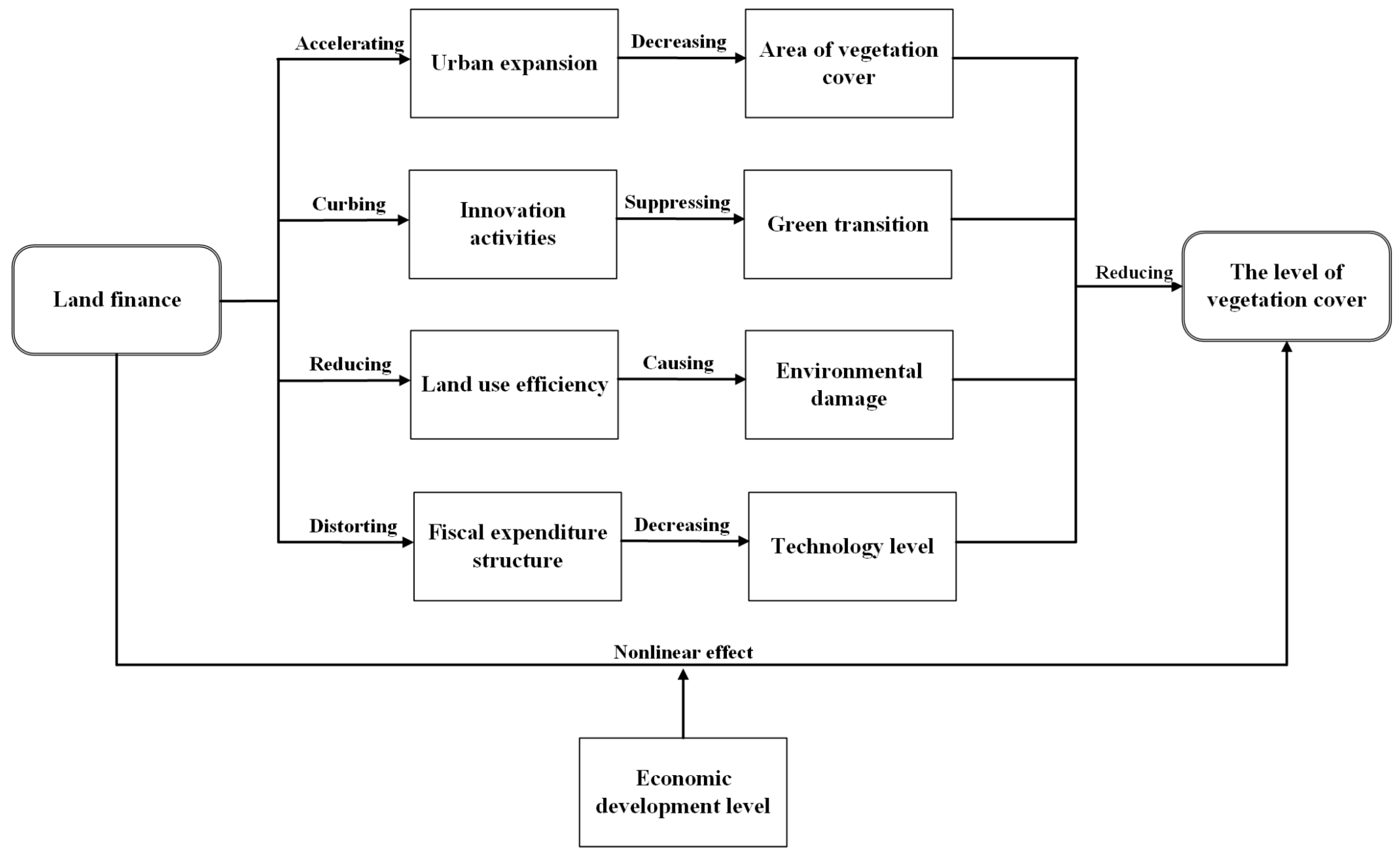

3. Theoretical Analysis and Hypotheses

3.1. Land Finance and Urban Expansion

3.2. Land Finance and Innovation

3.3. Land Finance and Land Use Efficiency

3.4. Land Finance and Fiscal Expenditure Structure

3.5. Nonlinear Effect at Different Levels of Economic Development

4. Methodology and Data

4.1. Model Specification

4.2. Methods for Robustness Tests

4.3. Variable Measurement

4.3.1. The Explained Variable

4.3.2. The Core Explanatory Variable

4.3.3. The Mechanism Variables and Threshold Variable

4.3.4. Control Variables

4.4. Study Areas and Data Sources

5. Results and Analysis

5.1. Measurement Results of Land Finance and Vegetation Status

5.2. Baseline Estimation Results

5.3. Robustness Tests

5.3.1. Replacing Variables and Samples

5.3.2. Spatial Econometric Analysis

5.4. Endogeneity Issues

5.5. Heterogeneity Analysis

5.6. Mechanism Analysis

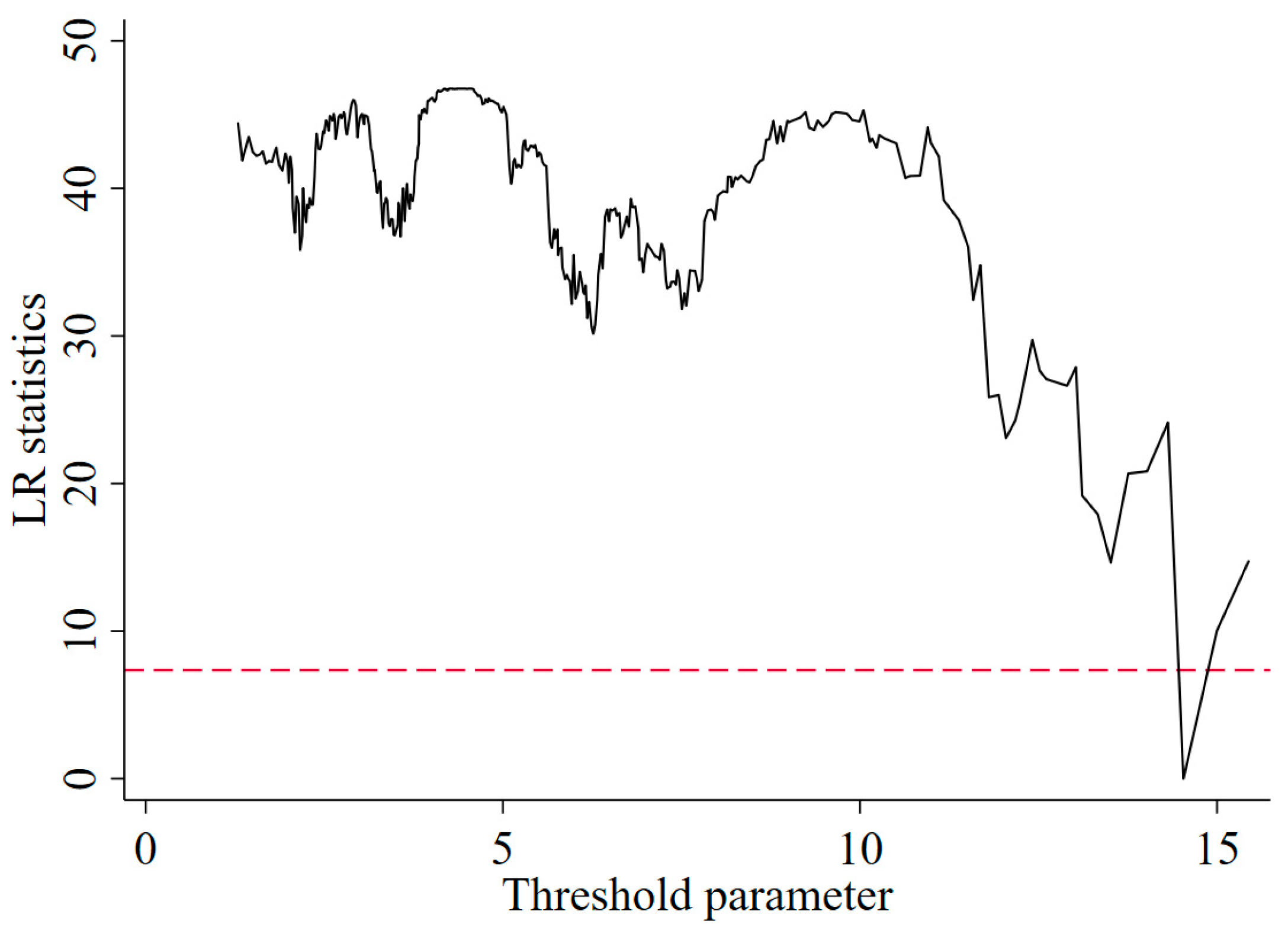

5.7. Analysis of Nonlinear Effects

6. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Shahfahad; Talukdar, S.; Naikoo, M.W.; Rahman, A. Urban Expansion and Vegetation Dynamics: The Role of Protected Areas in Preventing Vegetation Loss in a Growing Mega City. Habitat Int. 2024, 150, 103129. [Google Scholar] [CrossRef]

- Lindén, J.; Gustafsson, M.; Uddling, J.; Watne, Å.; Pleijel, H. Air Pollution Removal through Deposition on Urban Vegetation: The Importance of Vegetation Characteristics. Urban For. Urban Green. 2023, 81, 127843. [Google Scholar] [CrossRef]

- United Nations. The Sustainable Development Goals Report 2023; DESA Publications: New York, NY, USA, 2023. [Google Scholar]

- Vyas, I.; Vyas, H.N.; Mishra, A.K. Land-Based Financing of Cities in India: A Study of Bengaluru and Hyderabad and Directions for Reforms. J. Public Aff. 2022, 22, e2378. [Google Scholar] [CrossRef]

- Nguyen, T.B.; van der Krabben, E.; Musil, C.; Le, D.A. ‘Land for Infrastructure’ in Ho Chi Minh City: Land-Based Financing of Transportation Improvement. Int. Plan. Stud. 2018, 23, 310–326. [Google Scholar] [CrossRef]

- Chen, D.; Li, Y.; Zhang, C.; Zhang, Y.; Hou, J.; Lin, Y.; Wu, S.; Lang, Y.; Hu, W. Regional Coordinated Development Policy as an Instrument for Alleviating Land Finance Dependency: Evidence from the Urban Agglomeration Development. Land Use Policy 2024, 143, 107182. [Google Scholar] [CrossRef]

- Gyourko, J.; Shen, Y.; Wu, J.; Zhang, R. Land Finance in China: Analysis and Review. China Econ. Rev. 2022, 76, 101868. [Google Scholar] [CrossRef]

- Lu, J.; Li, B.; Li, H. The Influence of Land Finance and Public Service Supply on Peri-Urbanization: Evidence from the Counties in China. Habitat Int. 2019, 92, 102039. [Google Scholar] [CrossRef]

- Jin, W.; Zhang, H.-Q.; Liu, S.-S.; Zhang, H.-B. Technological Innovation, Environmental Regulation, and Green Total Factor Efficiency of Industrial Water Resources. J. Clean. Prod. 2019, 211, 61–69. [Google Scholar] [CrossRef]

- Bleischwitz, R. International Economics of Resource Productivity—Relevance, Measurement, Empirical Trends, Innovation, Resource Policies. Int. Econ. Econ. Policy 2010, 7, 227–244. [Google Scholar] [CrossRef]

- Tang, X.; Wang, W.; Liu, W. Land Revenue and Government Myopia: Evidence from Chinese Cities. Cities 2024, 154, 105393. [Google Scholar] [CrossRef]

- Lu, Y.; Zhang, K.; Ouyang, J. Does Land Finance Hinder Regional Innovation? Based on the Data of 267 Prefectura—Level City in China. J. Financ. Res. 2018, 455, 101–119. [Google Scholar]

- Li, H.; Qin, Y. Land Financialization and Regional Innovation Dynamics: Evidence from China. Financ. Res. Lett. 2024, 64, 105474. [Google Scholar] [CrossRef]

- Gu, H.; Jie, Y. Escaping from “Dream City”? Housing Price, Talent, and Urban Innovation in China. Habitat Int. 2024, 145, 103015. [Google Scholar] [CrossRef]

- Chen, H.; Liang, Y. Population Agglomeration and Vegetation Restoration: An Empirical Study Based on Population Spatial Distribution. China Econ. Q. 2023, 23, 2025–2041. [Google Scholar]

- Shi, S.; Yu, J.; Wang, F.; Wang, P.; Zhang, Y.; Jin, K. Quantitative Contributions of Climate Change and Human Activities to Vegetation Changes over Multiple Time Scales on the Loess Plateau. Sci. Total Environ. 2021, 755, 142419. [Google Scholar] [CrossRef]

- Jin, H.; Chen, X.; Wang, Y.; Zhong, R.; Zhao, T.; Liu, Z.; Tu, X. Spatio-Temporal Distribution of NDVI and Its Influencing Factors in China. J. Hydrol. 2021, 603, 127129. [Google Scholar] [CrossRef]

- Allen, C.D.; Macalady, A.K.; Chenchouni, H.; Bachelet, D.; McDowell, N.; Vennetier, M.; Kitzberger, T.; Rigling, A.; Breshears, D.D.; Hogg, E.H.(T.); et al. A Global Overview of Drought and Heat-Induced Tree Mortality Reveals Emerging Climate Change Risks for Forests. Ecol. Manag. 2010, 259, 660–684. [Google Scholar] [CrossRef]

- Anderegg, W.R.L.; Trugman, A.T.; Badgley, G.; Konings, A.G.; Shaw, J. Divergent Forest Sensitivity to Repeated Extreme Droughts. Nat. Clim. Chang. 2020, 10, 1091–1095. [Google Scholar] [CrossRef]

- Emberson, L.D.; Ashmore, M.R.; Murray, F.; Kuylenstierna, J.C.I.; Percy, K.E.; Izuta, T. Impacts of Air Pollutants on Vegetation in Developing Countries. Water Air Soil Pollut. 2001, 130, 107–118. [Google Scholar] [CrossRef]

- Zhang, L.; Yang, L.; Zohner, C.M.; Crowther, T.W.; Li, M.; Shen, F.; Guo, M.; Qin, J.; Yao, L.; Zhou, C. Direct and Indirect Impacts of Urbanization on Vegetation Growth across the World’s Cities. Sci. Adv. 2022, 8, eabo0095. [Google Scholar] [CrossRef] [PubMed]

- Geist, H.J.; Lambin, E.F. Proximate Causes and Underlying Driving Forces of Tropical Deforestation. Bioscience 2002, 52, 143–150. [Google Scholar] [CrossRef]

- Brandt, M.; Rasmussen, K.; Peñuelas, J.; Tian, F.; Schurgers, G.; Verger, A.; Mertz, O.; Palmer, J.R.B.; Fensholt, R. Human Population Growth Offsets Climate-Driven Increase in Woody Vegetation in Sub-Saharan Africa. Nat. Ecol. Evol. 2017, 1, 0081. [Google Scholar] [CrossRef]

- Li, W.; Wang, W.; Chen, J.; Zhang, Z. Assessing Effects of the Returning Farmland to Forest Program on Vegetation Cover Changes at Multiple Spatial Scales: The Case of Northwest Yunnan, China. J. Environ. Manage. 2022, 304, 114303. [Google Scholar] [CrossRef] [PubMed]

- Nepstad, D.; Mcgrath, D.; Stickler, C.; Alencar, A.; Azevedo, A.; Swette, B.; Bezerra, T.; Digiano, M.; Shimada, J.; Seroa Da Motta, R.; et al. Slowing Amazon Deforestation through Public Policy and Interventions in Beef and Soy Supply Chains. Science 2014, 344, 1118–1123. [Google Scholar] [CrossRef] [PubMed]

- Naughton-Treves, L.; Holland, M.B.; Brandon, K. The Role of Protected Areas in Conserving Biodiversity and Sustaining Local Livelihoods. Annu. Rev. Env. Resour. 2005, 30, 219–252. [Google Scholar] [CrossRef]

- Angelsen, A. REDD+ as Result-Based Aid: General Lessons and Bilateral Agreements of Norway. Rev. Dev. Econ. 2017, 21, 237–264. [Google Scholar] [CrossRef]

- Butchart, S.H.M.; Clarke, M.; Smith, R.J.; Sykes, R.E.; Scharlemann, J.P.W.; Harfoot, M.; Buchanan, G.M.; Angulo, A.; Balmford, A.; Bertzky, B.; et al. Shortfalls and Solutions for Meeting National and Global Conservation Area Targets. Conserv. Lett. 2015, 8, 329–337. [Google Scholar] [CrossRef]

- Wang, Y.; Hui, E.C.-M. Are Local Governments Maximizing Land Revenue? Evidence from China. China Econ. Rev. 2017, 43, 196–215. [Google Scholar] [CrossRef]

- Wang, P.; Shao, Z.; Wang, J.; Wu, Q. The Impact of Land Finance on Urban Land Use Efficiency: A Panel Threshold Model for Chinese Provinces. Growth Change 2021, 52, 310–331. [Google Scholar] [CrossRef]

- Zhang, X.; Geltner, D.; de Neufville, R. System Dynamics Modeling of Chinese Urban Housing Markets for Pedagogical and Policy Analysis Purposes. J. Real Estate Financ. Econ. 2018, 57, 476–501. [Google Scholar] [CrossRef]

- Lu, Y.; Zhang, J.; Mao, J.; Gao, S. Land Financialization and Debt Expansion: Evidence from City–County Mergers in China. Cities 2024, 146, 104679. [Google Scholar] [CrossRef]

- Tang, P.; Shi, X.; Gao, J.; Feng, S.; Qu, F. Demystifying the Key for Intoxicating Land Finance in China: An Empirical Study through the Lens of Government Expenditure. Land Use Policy 2019, 85, 302–309. [Google Scholar] [CrossRef]

- Hu, F.Z.Y.; Qian, J. Land-Based Finance, Fiscal Autonomy and Land Supply for Affordable Housing in Urban China: A Prefecture-Level Analysis. Land Use Policy 2017, 69, 454–460. [Google Scholar] [CrossRef]

- Guo, S.; Liu, L.; Zhao, Y. The Business Cycle Implications of Land Financing in China. Econ. Model 2015, 46, 225–237. [Google Scholar] [CrossRef]

- Wang, L.O.; Wu, H.; Hao, Y. How Does China’s Land Finance Affect Its Carbon Emissions? Struct. Change Econ. Dyn. 2020, 54, 267–281. [Google Scholar] [CrossRef]

- Yang, X.; Wang, W.; Su, X.; Ren, S.; Ran, Q.; Wang, J.; Cao, J. Analysis of the Influence of Land Finance on Haze Pollution: An Empirical Study Based on 269 Prefecture-Level Cities in China. Growth Change 2023, 54, 101–134. [Google Scholar] [CrossRef]

- Cao, J.; Law, S.H.; Wu, D.; Yang, X. Impact of Local Government Competition and Land Finance on Haze Pollution: Empirical Evidence from China. Emerg. Mark. Financ. Trade 2023, 59, 3877–3899. [Google Scholar] [CrossRef]

- Zhang, Y.; Liu, Y.; Yang, Q.; Yue, W. Assessing Performance and Disparities in China’s Land Finance Transition: Insights from Neo-Liberalism and Neo-Marxism. Land Use Policy 2024, 146, 107306. [Google Scholar] [CrossRef]

- Ong, L.H. State-Led Urbanization in China: Skyscrapers, Land Revenue and Concentrated Villages. China Q. 2014, 217, 162–179. [Google Scholar] [CrossRef]

- Chen, T.; Kung, J.K.S. Busting the Princelings: The Campaign against Corruption in China’s Primary Land Market. Q. J. Econ. 2019, 134, 185–226. [Google Scholar] [CrossRef]

- Wang, S.; Tan, S.; Yang, S.; Lin, Q.; Zhang, L. Urban-Biased Land Development Policy and the Urban-Rural Income Gap: Evidence from Hubei Province, China. Land Use Policy 2019, 87, 104066. [Google Scholar] [CrossRef]

- Guo, J.; Zhao, Y.; Li, F.Y.; Mao, K.; He, J.; He, Q. Developing a Land Development Compensation Model for Returned Land in Tract Expropriation: Towards a Unified Urban-Rural Land Market in China. Land Use Policy 2024, 139, 107088. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, J.; Liu, Y.; Yue, W. Quantifying Multiple Effects of Land Finance on Urban Sprawl: Empirical Study on 284 Prefectural-Level Cities in China. Environ. Impact Assess. Rev. 2023, 101, 107156. [Google Scholar] [CrossRef]

- Tong, D.; Chu, J.; MacLachlan, I.; Qiu, J.; Shi, T. Modelling the Impacts of Land Finance on Urban Expansion: Evidence from Chinese Cities. Appl. Geogr. 2023, 153, 102896. [Google Scholar] [CrossRef]

- Tao, R.; Su, F.; Liu, M.; Cao, G. Land Leasing and Local Public Finance in China’s Regional Development: Evidence from Prefecture-Level Cities. Urban Stud. 2010, 47, 2217–2236. [Google Scholar] [CrossRef]

- Feng, C.; Tao, Y.; Zhang, Y.; Zhu, X. Local Land Regulatory Governance and Land Transaction Prices: Micro Evidence from Land Audits. Econ. Anal. Policy 2024, 83, 1133–1150. [Google Scholar] [CrossRef]

- Lee, C.W.; Park, S. Does Religious Similarity Matter in International Trade in Services? World Econ. 2016, 39, 409–425. [Google Scholar] [CrossRef]

- Du, J.; Peiser, R.B. Land Supply, Pricing and Local Governments’ Land Hoarding in China. Reg. Sci. Urban Econ. 2014, 48, 180–189. [Google Scholar] [CrossRef]

- Jia, R.; Kudamatsu, M.; Seim, D. Political Selection in China: The Complementary Roles of Connections and Performance. J. Eur. Econ. Assoc. 2015, 13, 631–668. [Google Scholar] [CrossRef]

- Zhang, R.; Sun, W.; Li, H.; Wu, J. Land Financing, Corporate Tax Subsidy, and Investment Attraction. China J. Econ. 2021, 8, 57–86. [Google Scholar]

- Ahmad, N.; Youjin, L.; Žiković, S.; Belyaeva, Z. The Effects of Technological Innovation on Sustainable Development and Environmental Degradation: Evidence from China. Technol. Soc. 2023, 72, 102184. [Google Scholar] [CrossRef]

- Miao, J.; Wang, P. Sectoral Bubbles, Misallocation, and Endogenous Growth. J. Math. Econ. 2014, 53, 153–163. [Google Scholar] [CrossRef]

- He, Z.; Xiao, L.; Guo, Q.; Liu, Y.; Mao, Q.; Kareiva, P. Evidence of Causality between Economic Growth and Vegetation Dynamics and Implications for Sustainability Policy in Chinese Cities. J. Clean. Prod. 2020, 251, 119550. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold Effects in Non-Dynamic Panels: Estimation, Testing, and Inference. J. Econ. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Zhang, S.; Chen, W.; Wang, Y.; Li, Q.; Shi, H.; Li, M.; Sun, Z.; Zhu, B.; Seyoum, G. Human Interventions Have Enhanced the Net Ecosystem Productivity of Farmland in China. Nat. Commun. 2024, 15, 10523. [Google Scholar] [CrossRef]

- Peng, S.; Chen, A.; Xu, L.; Cao, C.; Fang, J.; Myneni, R.B.; Pinzon, J.E.; Tucker, C.J.; Piao, S. Recent Change of Vegetation Growth Trend in China. Environ. Res. Lett. 2011, 6, 044027. [Google Scholar] [CrossRef]

- Li, M.; Cao, S.; Zhu, Z.; Wang, Z.; Myneni, R.B.; Piao, S. Spatiotemporally Consistent Global Dataset of the GIMMS Normalized Difference Vegetation Index (PKU GIMMS NDVI) from 1982 to 2022. Earth Syst. Sci. Data 2023, 15, 4181–4203. [Google Scholar] [CrossRef]

- Ye, L.; Wu, A.M. Urbanization, Land Development, and Land Financing: Evidence from Chinese Cities. J. Urban Aff. 2014, 36, 354–368. [Google Scholar] [CrossRef]

- Chen, W.; Shen, Y.; Wang, Y.; Wu, Q. The Effect of Industrial Relocation on Industrial Land Use Efficiency in China: A Spatial Econometrics Approach. J. Clean. Prod. 2018, 205, 525–535. [Google Scholar] [CrossRef]

| Variable | Variable | Mean | S. D. | Min | Max |

|---|---|---|---|---|---|

| Veg | Average growing-season NDVI | 0.623 | 0.126 | 0.157 | 0.820 |

| Lf | Land sales revenue/local public budget revenue | 0.682 | 0.488 | 0.009 | 6.081 |

| Urexp | Built-up area/the total area of the city | 0.020 | 0.043 | 0.000 | 0.486 |

| Innov | Quantity of patents granted per capita | 11.190 | 16.172 | 0.063 | 157.891 |

| Lue | Land use efficiency (ten thousand yuan/km2) | 56,572.07 | 95,432.21 | 2243 | 139,782 |

| St | Share of public expenditure on science and technology | 0.0173 | 0.0178 | 0.0005 | 0.2068 |

| Rain | Precipitation (mm) | 1155.611 | 562.511 | 54 | 3234 |

| Tem | Annual average temperature (°C) | 14.843 | 5.153 | 0.000 | 25.877 |

| SO | Industrial SO2 emissions (t) | 31,732.900 | 42,933.070 | 0.470 | 531,340 |

| Ed | Per capita GDP (ten thousand yuan) | 5.832 | 3.546 | 0.697 | 28.219 |

| Pop | Population/the total area of the city(ten thousand persons/km2) | 0.049 | 0.065 | 0.001 | 0.885 |

| Gov | Local public budget expenditure/GDP | 0.204 | 0.105 | 0.043 | 1.129 |

| Fin | Loan balance of financial institutions/GDP | 1.075 | 0.632 | 0.132 | 6.707 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Lf | −0.003 *** | −0.005 *** | −0.003 *** | −0.004 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| Rain | 0.033 *** | 0.032 *** | ||

| (0.002) | (0.002) | |||

| Tem | −0.001 | −0.001 | ||

| (0.003) | (0.003) | |||

| SO | −0.005 *** | 0.000 | ||

| (0.001) | (0.001) | |||

| Ed | 0.041 *** | −0.007 | ||

| (0.004) | (0.008) | |||

| Pop | 0.016 ** | −0.001 | ||

| (0.008) | (0.008) | |||

| Gov | 0.021 *** | 0.022 *** | ||

| (0.004) | (0.004) | |||

| Fin | −0.014 *** | −0.021 *** | ||

| (0.003) | (0.003) | |||

| Constant | −0.503 *** | −0.539 *** | −0.654 *** | −0.714 *** |

| (0.001) | (0.002) | (0.034) | (0.034) | |

| City fixed effects | Yes | Yes | Yes | Yes |

| Time fixed effects | No | Yes | No | Yes |

| Number of observations | 3432 | 3432 | 3432 | 3432 |

| Variables | Total NDVI as Explained Variable | NEP as Explained Variable | Removing Municipalities | Trimming Variables |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Lf | −0.004 *** | −0.005 *** | −0.004 *** | −0.003 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| Constant | 4.253 *** | −0.501 *** | −0.712 *** | −0.518 *** |

| (0.035) | (0.007) | (0.034) | (0.048) | |

| Control variables | Yes | Yes | Yes | Yes |

| City fixed effects | Yes | Yes | Yes | Yes |

| Time fixed effects | Yes | Yes | Yes | Yes |

| Number of observations | 3432 | 3432 | 3384 | 3432 |

| Variables | Regression Coefficient | Direct Effect | Indirect Effect | Total Effect |

|---|---|---|---|---|

| Lf | −0.004 *** | −0.004 *** | −0.001 *** | −0.005 *** |

| (0.001) | (0.001) | (0.000) | (0.001) | |

| 0.227 *** | ||||

| (0.027) | ||||

| Control variables | Yes | |||

| City fixed effects | Yes | |||

| Time fixed effects | Yes | |||

| Number of observations | 3432 |

| Variables | The First-Stage Regression | The Second-Stage Regression |

|---|---|---|

| (1) | (2) | |

| Lf | Veg | |

| Sland × L.Lf | −0.134 *** | |

| (0.014) | ||

| Lf | −0.013 *** | |

| (0.005) | ||

| Control variables | Yes | Yes |

| City fixed effects | Yes | Yes |

| Time fixed effects | Yes | Yes |

| Kleibergen–Paaprk LM | 84.847 | |

| Kleibergen–Paaprk Wald F | 88.567 | |

| Number of observations | 3146 | 3146 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Eastern China | Central China | Western China | Northeast China | Secondary Industry-led Cities | Tertiary Industry-led Cities | |

| Lf | −0.003 ** | −0.004 * | −0.005 ** | −0.003 | −0.005 *** | −0.001 |

| (0.002) | (0.002) | (0.002) | (0.002) | (0.001) | (0.002) | |

| Constant | −0.052 | 0.287 ** | −0.950 *** | −0.620 *** | −0.605 *** | −1.009 *** |

| (0.123) | (0.137) | (0.122) | (0.114) | (0.049) | (0.070) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| City fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Number of observations | 1032 | 960 | 1032 | 408 | 1887 | 1545 |

| Variables | Urban Expansion | Innovation | Land Use Efficiency | Science and TechnologyExpense | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Urexp | Veg | Innov | Veg | Lue | Veg | St | Veg | |

| Lf | 0.008 * | −0.004 *** | −0.031 ** | −0.004 *** | −0.009 *** | −0.003 *** | −0.056 *** | −0.004 *** |

| (0.005) | (0.001) | (0.015) | (0.001) | (0.003) | (0.001) | (0.017) | (0.001) | |

| Urexp | −0.013 *** | |||||||

| (0.004) | ||||||||

| Innov | 0.007 *** | |||||||

| (0.001) | ||||||||

| Lue | 0.062 *** | |||||||

| (0.007) | ||||||||

| St | 0.001 *** | |||||||

| (0.000) | ||||||||

| Constant | −2.768 *** | −0.751 *** | 0.905 ** | −0.721 *** | 11.109 *** | −0.029 | −0.292 | −0.714 *** |

| (0.138) | (0.036) | (0.442) | (0.034) | (0.083) | (0.087) | (0.519) | (0.034) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| City fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Number of observations | 3432 | 3432 | 3432 | 3432 | 3432 | 3432 | 3432 | 3432 |

| Threshold Effect Test | F Statistics | p Value |

|---|---|---|

| Single threshold | 47.040 | 0.000 *** |

| Double threshold | 11.030 | 0.280 |

| Variables | (1) | (2) |

|---|---|---|

| −0.004 *** | −0.003 *** | |

| (0.001) | (0.001) | |

| −0.029 *** | −0.026 *** | |

| (0.004) | (0.004) | |

| Constant | −0.539 *** | −0.717 *** |

| (0.002) | (0.034) | |

| Control variables | No | Yes |

| Threshold value | 14.530 | 14.530 |

| City fixed effects | Yes | Yes |

| Time fixed effects | Yes | Yes |

| Number of observations | 3432 | 3432 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yan, S.; Wang, J. How Does Land Finance Influence Vegetation Dynamics in China? Land 2025, 14, 466. https://doi.org/10.3390/land14030466

Yan S, Wang J. How Does Land Finance Influence Vegetation Dynamics in China? Land. 2025; 14(3):466. https://doi.org/10.3390/land14030466

Chicago/Turabian StyleYan, Siqi, and Jian Wang. 2025. "How Does Land Finance Influence Vegetation Dynamics in China?" Land 14, no. 3: 466. https://doi.org/10.3390/land14030466

APA StyleYan, S., & Wang, J. (2025). How Does Land Finance Influence Vegetation Dynamics in China? Land, 14(3), 466. https://doi.org/10.3390/land14030466

_Cheung.jpeg)