Industrial Land Expansion as an Unintended Consequence of Housing Market Regulation: Evidence from China

Abstract

1. Introduction

2. Background and Hypothesis

2.1. Background

2.2. Hypothesis

3. Data and Empirical Strategy

3.1. Data

3.2. Constructing Policy Stringency Measure

3.3. Econometric Specification

4. Results

4.1. Baseline Results

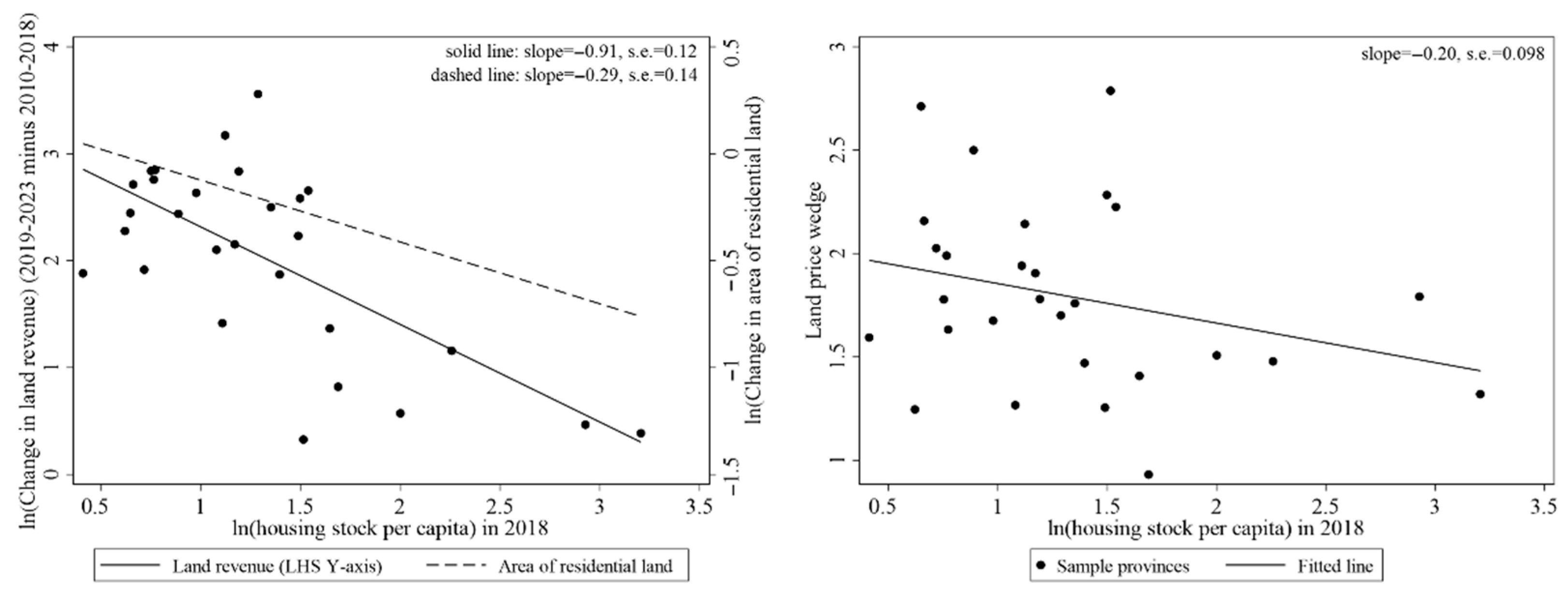

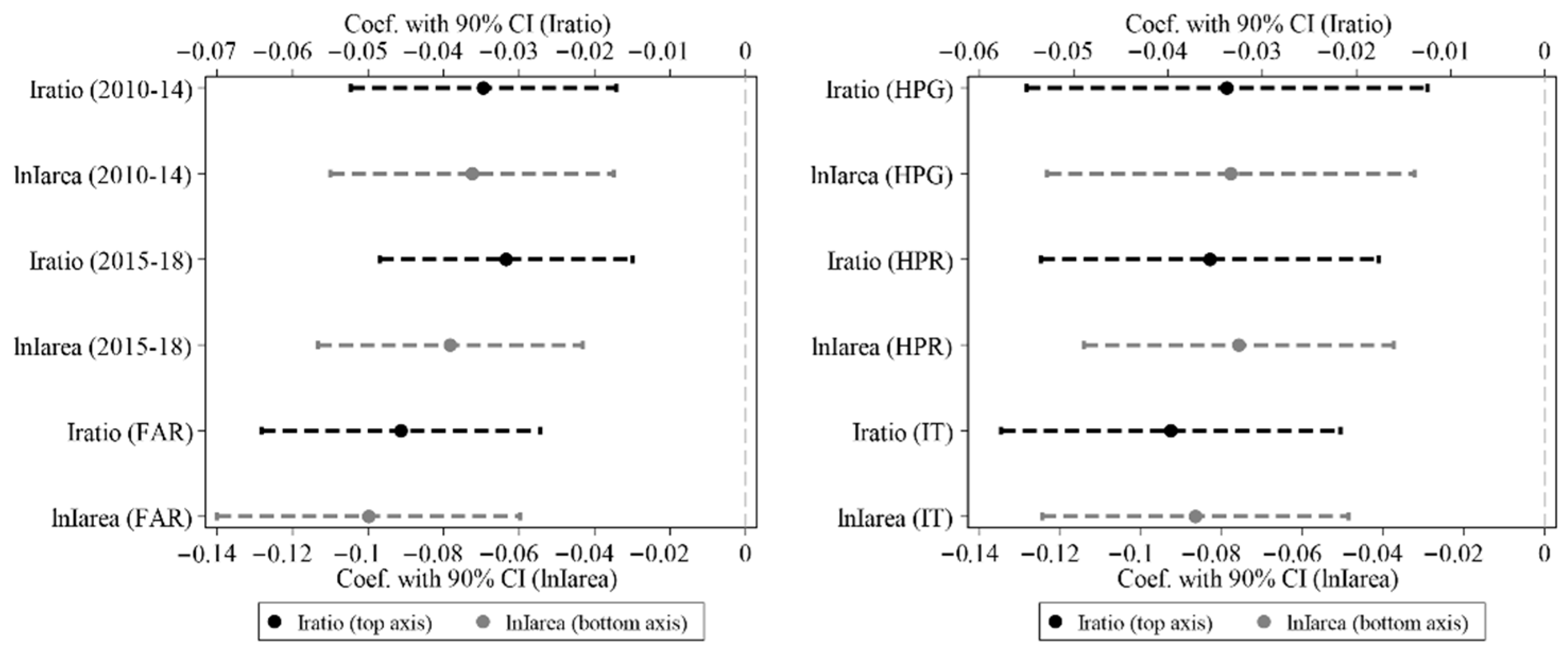

4.2. Robustness Checks

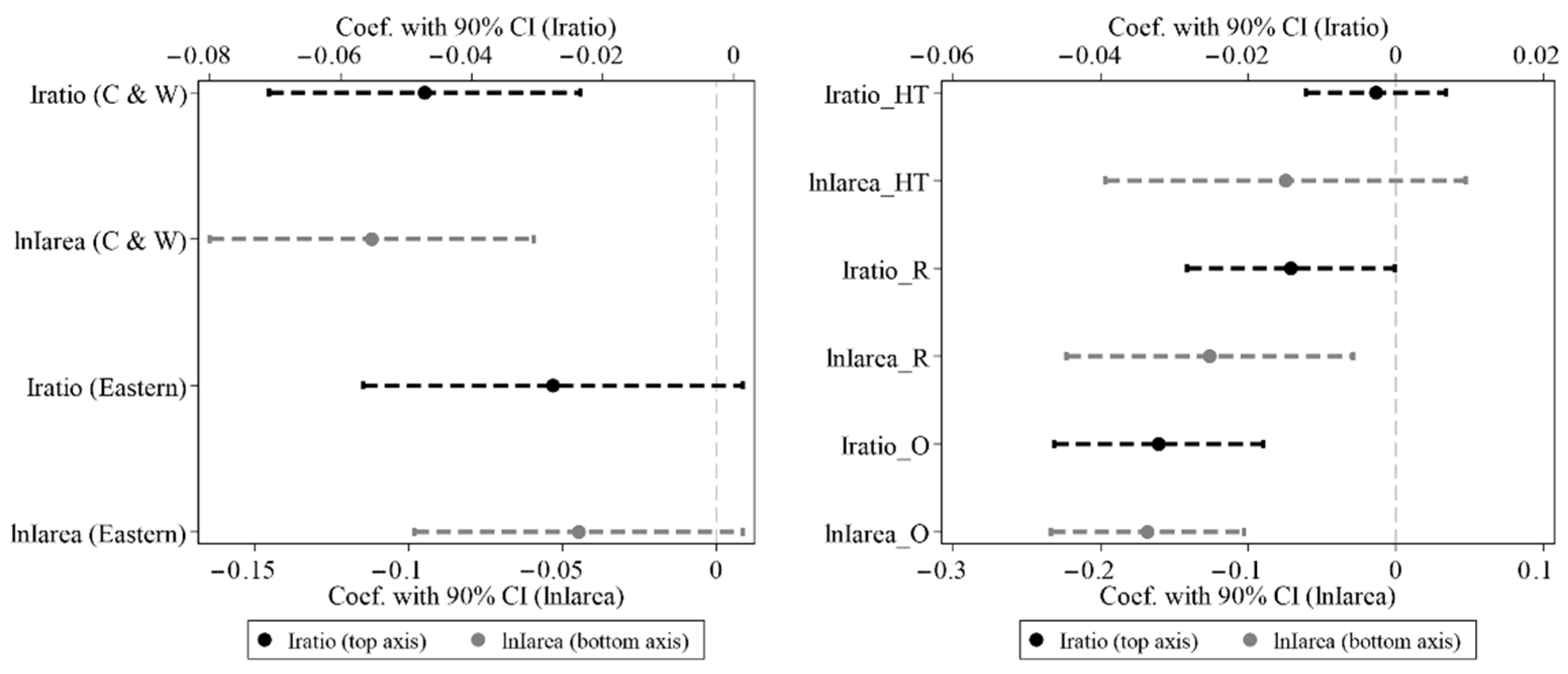

4.3. Heterogeneity Effects

4.4. Further Analysis

5. Concluding Remarks

Author Contributions

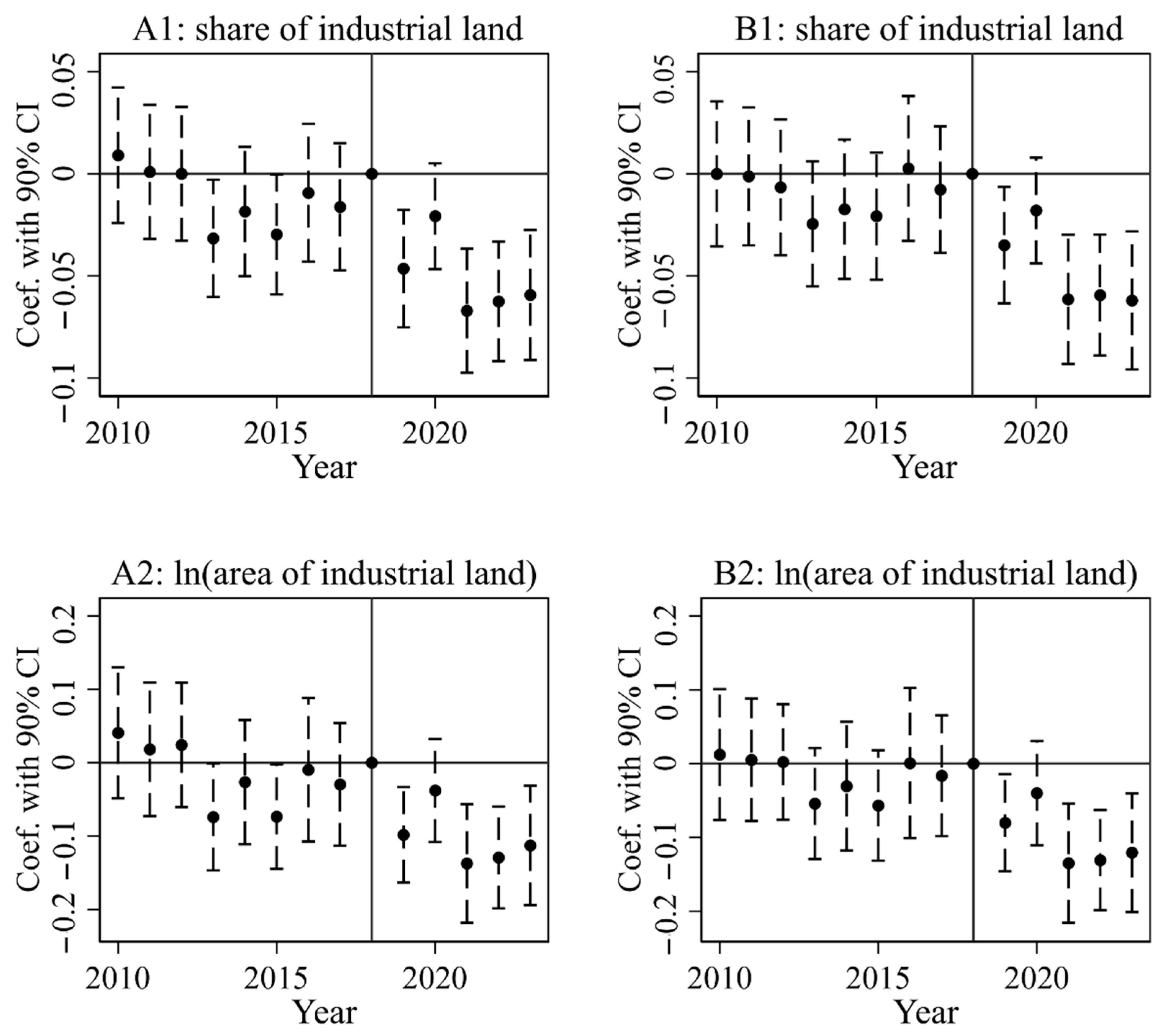

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Mean | S.D. | Min. | Max. | Obs. |

|---|---|---|---|---|---|

| Panel data | |||||

| Iratio | 0.523 | 0.160 | 0.006 | 0.976 | 3680 |

| Iarea (in hectare) | 476.896 | 434.788 | 1.120 | 4118.252 | 3680 |

| Rratio | 0.355 | 0.138 | 0.006 | 0.856 | 3680 |

| Rarea (in hectare) | 328.263 | 336.127 | 0.085 | 4315.099 | 3680 |

| Cratio | 0.122 | 0.081 | 0 | 0.747 | 3680 |

| Carea (in hectare) | 106.481 | 116.13 | 0 | 1553.889 | 3680 |

| Allarea (in hectare) | 911.641 | 797.719 | 14.551 | 7800.331 | 3680 |

| FisPre | 0.453 | 0.223 | 0.056 | 2.144 | 3680 |

| GDPGrowth | 0.082 | 0.084 | −0.632 | 0.479 | 3680 |

| SecRatio | 0.450 | 0.112 | 0.107 | 0.897 | 3680 |

| POP (in thousand) | 45,459.929 | 35,453.542 | 2318.530 | 321,334 | 3680 |

| SecTerRatio | 1.183 | 0.630 | 0.157 | 9.196 | 3402 |

| NFirm | 1315.706 | 1631.613 | 20 | 13,844 | 3155 |

| SVApc (thousand Yuan/person) | 26.144 | 19.130 | 1.451 | 179.202 | 3680 |

| Cross-sectional data | |||||

| LandPriceWedge | 1.217 | 0.520 | −0.319 | 2.618 | 266 |

| DevLandpc2010 (in sq.m) | 2531.297 | 6721.257 | 94.800 | 83,740.540 | 266 |

| ExpDependency2016 | 0.016 | 0.029 | 0 | 0.202 | 266 |

| ImpDependency2016 | 0.004 | 0.010 | 0 | 0.074 | 266 |

| SIVApu2010–18 (billion Yuan/hectare) | 0.197 | 0.125 | 0.022 | 1.206 | 266 |

| Variable | Mean | S.D. | Min. | Max. | Obs. |

|---|---|---|---|---|---|

| Panel data | |||||

| IratioProv | 0.509 | 0.124 | 0.052 | 0.862 | 392 |

| IareaProv (in hectare) | 4477.060 | 3533.843 | 16.298 | 19,582.678 | 392 |

| AllareaProv (in hectare) | 8532.506 | 6679.777 | 176.851 | 35,968.719 | 392 |

| FisPreProv | 0.499 | 0.197 | 0.184 | 1.294 | 392 |

| GDPGrowthProv | 0.084 | 0.074 | −0.308 | 0.297 | 392 |

| SecRatioProv | 0.430 | 0.099 | 0.149 | 0.673 | 392 |

| POPProv (in thousand) | 423,945.920 | 279,184.810 | 27,315.781 | 1,270,600 | 392 |

| Cross-sectional data | |||||

| HousingStockpc2018 (sq.m/person) | 0.489 | 0.513 | 0.151 | 2.467 | 28 |

| LandPriceWedgeProv | 1.795 | 0.451 | 0.931 | 2.788 | 28 |

| (1) | (2) | (3) | |

|---|---|---|---|

| PTratio | lnPTarea | lnAllareaPT | |

| LandPriceWedge × Post2018 | −0.020 | −0.052 | 0.015 |

| (0.012) | (0.038) | (0.040) | |

| Controls | Y | Y | Y |

| City and Year FEs | Y | Y | Y |

| Observations | 3680 | 3680 | 3680 |

| R-squared | 0.352 | 0.678 | 0.170 |

| (5) | (6) | |

|---|---|---|

| Iratio | lnIarea | |

| LandPriceWedge × Post2018 | −0.038 *** | −0.085 *** |

| (0.013) | (0.027) | |

| LandPriceWedge | 0.0024 | 0.0060 |

| × Year2016 | (0.018) | (0.045) |

| LandPriceWedge | −0.0045 | −0.014 |

| × Year2017 | (0.018) | (0.043) |

| LandPriceWedge | 0.012 | 0.015 |

| × Year2018 | (0.015) | (0.041) |

| Controls | Y | Y |

| City and Year FEs | Y | Y |

| Observations | 3680 | 3680 |

| R-squared | 0.181 | 0.734 |

| (1) | (2) | |

|---|---|---|

| Iratio | lnIarea | |

| LandPriceWedge × Post2018 | −0.032 *** | −0.071 *** |

| (0.012) | (0.026) | |

| CR_SRP intensity × Post2018 | 0.00086 | 0.012 |

| (0.0052) | (0.011) | |

| Controls | Y | Y |

| City and Year FEs | Y | Y |

| Observations | 2940 | 2940 |

| R-squared | 0.191 | 0.737 |

| (1) | |

|---|---|

| Iarea_HT | |

| LandPriceWedge × Post2018 | −0.0084 |

| (0.062) | |

| Controls | Y |

| City and Year FEs | Y |

| Observations | 3680 |

| Pseudo R-squared | 0.786 |

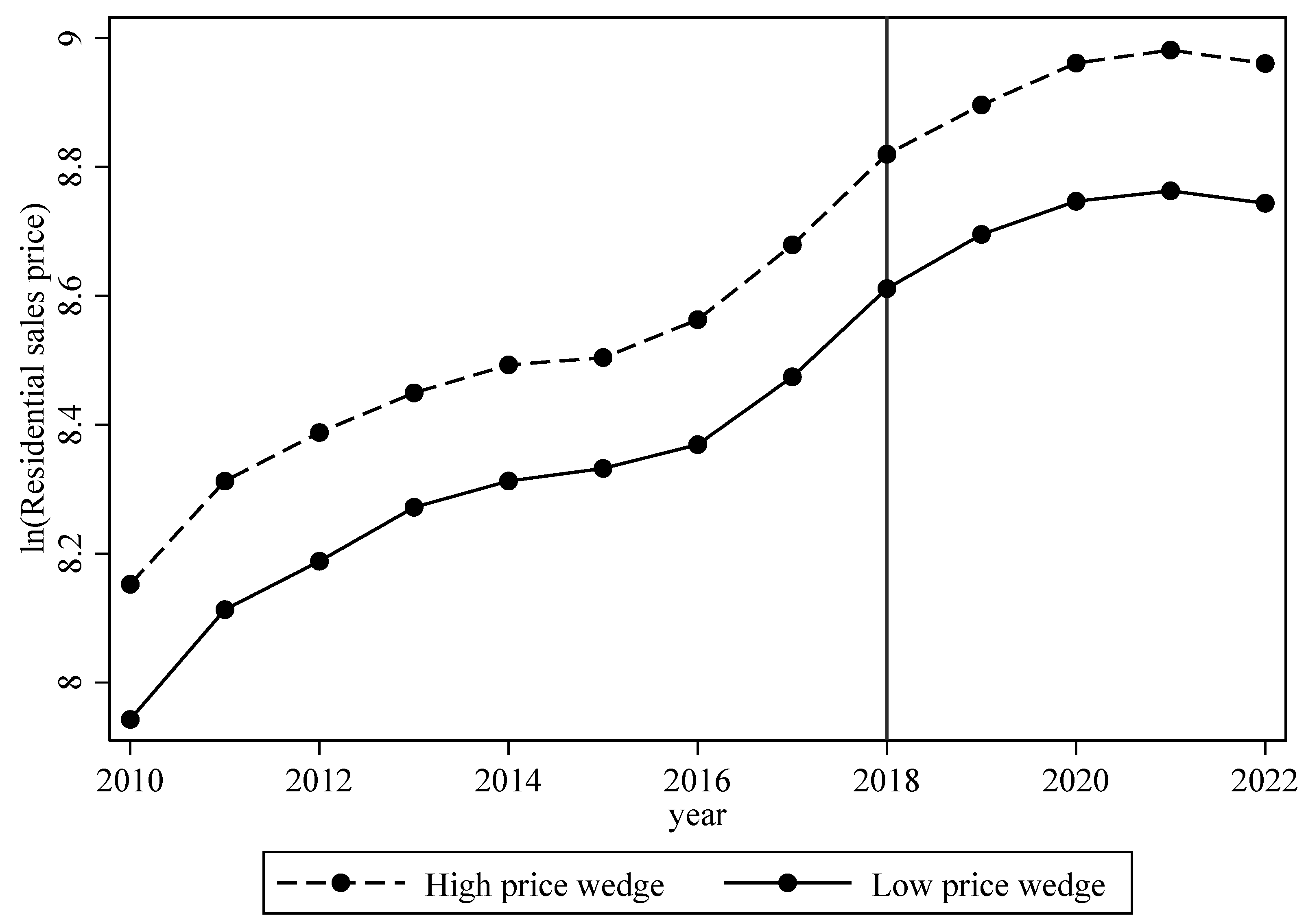

| 1. | Housing prices maintained an upward trend with no notable shift around 2018 (Figure A1 of Appendix A), implying that the regulation policy induced simultaneous leftward shifts in both the demand and supply curves for residential property. |

| 2. | Housing regulations were also applied to cities experiencing rapid price appreciation, which is specifically designed to curb excessive growth. Our baseline results remain robust to the exclusion of these cities (detailed in Section 4.2). |

| 3. | |

| 4. | City-level housing stock The baseline results remain robust if public land is included (detailed in Section 4.2) statistics with official coverage are not available in China. Related reporting can be found at: https://news.sina.cn/2022-08-14/detail-imizmscv6127707.d.html?utm_source=chatgpt.com, accessed on 14 August 2022 and https://kandian.ke.com/detail/MjY3MjM4NzI=.html?beikefrom=pc_kd_index, accessed on 5 August 2022. |

| 5. | The baseline results remain robust if public land is included (detailed in Section 4.2). |

| 6. | Local governments tend to prioritize industrial land because of its perceived role in attracting investment and fostering growth, whereas they take a more cautious stance toward commercial land. Industrial parcels are often subsidized or allocated strategically to attract firms, while commercial land is subject to stricter market discipline and administrative oversight, reflecting concerns about speculative activity and inefficient land use. |

| 7. | Details on the estimation of the land price wedge are provided in Section 3.2. |

| 8. | In 2018, the Ministry of Housing and Urban-Rural Development pointed out that in hotspot cities, the share of residential land in total urban construction land should be increased, with residential land accounting for no less than 25 percent. |

| 9. | Our analysis uses the prefecture-level city as the primary spatial unit, consistent with extensive prior research on China’s urban and regional economies [17,41,42,43]. In China, a prefecture-level city encompasses a central urban core (typically composed of several urban districts (shiqu)) as well as surrounding rural counties and towns. While this administrative definition differs from the functional definition of “city” often employed in the context of other countries, it aligns with the level of government that makes land-supply decisions central to our analysis. |

| 10. | This pattern is consistent with substantial disparity in land transaction prices across uses, as industrial land is generally transacted at considerably lower prices than those for residential and commercial uses [39]. Accordingly, we estimate price wedges for residential and commercial land relative to industrial land. |

| 11. | For each parcel in our sample, we calculate the distance to municipal government building, which is typically located in the traditional central business district. |

| 12. | Due to the absence of city-level housing stock data, specifications involving housing stock per capita are estimated at the province level. |

| 13. | ExpDependency2016 and ImpDependency2016 are based on each city’s imports and exports to the US in 2016, relative to the city’s GDP in that year. We can only access it from China’s 2016 customs data and assume that these two trade dependence variables to be relatively stable between 2010 and 2018. |

| 14. | Table A2 presents summary statistics at the province level. |

| 15. | Upper-level governments reward jurisdictions that fully utilize their annual land quotas with additional allocations in the following year. |

| 16. | Due to substantial missing data on FAR, the baseline estimates of price wedges do not control for this variable. |

| 17. | In addition, the government first introduced the principle that “houses are for living in, not for speculation” in 2016, which may have shaped market expectations. The event study analysis in Figure 4 helps alleviate this concern. As an additional check, we control for the interaction between the land price wedge and time dummies for 2016, 2017 and 2018. The results, reported in Table A4 of the Appendix A, show that the main results remain robust. |

| 18. | The coefficient of industrial land use efficiency is not statistically significant in panel B of Table 2 (coefficients of controls are not reported and results are available upon request). |

| 19. | Core cities are defined as those that either demonstrate exceptional performance in advanced manufacturing (according to a report by the China Center for Information Industry Development, a public institution under China’s Ministry of Industry and Information Technology, in 2018) or hold a higher administrative status than the typical prefecture-level city, including provincial cities (ZhiXiaShi), cities granted independent planning status (JiHuaDanLieShi) at the subprovincial level, and provincial capitals (ShengHui). This classification yields 56 core cities and 210 peripheral cities. |

| 20. | The count of resettlement units is hand-collected from Statistical Bulletins on National Economic and Social Development, government work reports, and official releases by provincial and municipal agencies (Housing and Urban-Rural Development; Planning and Natural Resources). Because systematic disclosure largely ceased after 2016, we use the 2016 intensity as a proxy for overall program intensity during 2015–2019. |

| 21. | “High-tech” refers to industrial land used for pharmaceutical manufacturing, transportation equipment manufacturing, electronic equipment manufacturing, instrumentation manufacturing, and special equipment manufacturing. “Restricted” pertains to sectors identified as high-pollution or suffering from overcapacity, as specified by the State Environmental Protection Administration (2008) and the State Council of the People’s Republic of China (2013), which include sugar and food product manufacturing; beverage production; textile manufacturing; leather tanning and dressing; paper and paperboard manufacturing; refined petroleum production; basic chemicals, fertilizers, pesticides, cleaning products, and pharmaceutical manufacturing; rubber tire and tube manufacturing; metal treatment and coating; nonmetallic mineral product manufacturing; iron and steel casting; precious and other nonferrous metal manufacturing; and ship building. |

| 22. | With over 200 zeros in high-tech industrial land area, an average treatment effect in logs is not well-defined. We therefore re-estimate the specification from the second line of the right panel in Figure 7 using Poisson pseudo-maximum likelihood model [54] and results remain largely unchanged (Table A6 of the Appendix A). |

| 23. | Industrial enterprise above designated size refers to those industrial enterprises with annual main business income of more than 20 million Chinese Yuan. |

| 24. | Such a metric facilitates an assessment of the alignment between land allocation and local economic structure. In industrialized cities, this ratio would be expected to approximate one. Conversely, in cities oriented towards services or agriculture, a value significantly greater than one would indicate an excessive allocation of industrial land relative to economic fundamentals, suggesting potential resource misallocation. |

References

- Lucas, R.E.; Rossi-Hansberg, E. On the internal structure of cities. Econometrica 2002, 70, 1445–1476. [Google Scholar] [CrossRef]

- De Vor, F.; De Groot, H.L. The impact of industrial sites on residential property values: A hedonic pricing analysis from the Netherlands. Reg. Stud. 2011, 45, 609–623. [Google Scholar] [CrossRef]

- Koster, H.R.; Rouwendal, J. The impact of mixed land use on residential property values. J. Reg. Sci. 2012, 52, 733–761. [Google Scholar] [CrossRef]

- Duranton, G.; Puga, D. Urban land use. In Handbook of Regional and Urban Economics; Elsevier: Amsterdam, The Netherlands, 2015; Volume 5, pp. 467–560. [Google Scholar]

- Shertzer, A.; Twinam, T.; Walsh, R.P. Zoning and the economic geography of cities. J. Urban Econ. 2018, 105, 20–39. [Google Scholar] [CrossRef]

- Djankov, S.; Glaeser, E.; Perotti, V.; Shleifer, A. Property rights and urban form. J. Law Econ. 2022, 65, S35–S64. [Google Scholar] [CrossRef]

- Xu, H. Commercial-to-residential land-use conversion and residential recentralization in large cities. Can. J. Econ. 2023, 56, 306–338. [Google Scholar] [CrossRef]

- Xu, C. The fundamental institutions of China’s reforms and development. J. Econ. Lit. 2011, 49, 1076–1151. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, Q.; Zhou, L.A. Career incentives of city leaders and urban spatial expansion in China. Rev. Econ. Stat. 2020, 102, 897–911. [Google Scholar] [CrossRef]

- Fu, S.; Xu, X.; Zhang, J. Land conversion across cities in China. Reg. Sci. Urban Econ. 2021, 87, 103643. [Google Scholar] [CrossRef]

- Chen, T.; Kung, J.S. Do land revenue windfalls create a political resource curse? Evidence from China. J. Dev. Econ. 2016, 123, 86–106. [Google Scholar] [CrossRef]

- He, Z.; Nelson, S.T.; Su, Y.; Zhang, A.L.; Zhang, F. Zoning for profits: How public finance shapes land supply in China. Natl. Bur. Econ. Res. 2022, w30504. [Google Scholar] [CrossRef]

- Zhang, L.; Lu, M.; Liu, Y. Tax incentives and supply structure of commercial and residential land. China Econ. Q. 2022, 22, 1425–1446. (In Chinese) [Google Scholar]

- Tian, W.; Wang, Z.; Zhang, Q. Land allocation and industrial agglomeration: Evidence from the 2007 reform in China. J. Dev. Econ. 2024, 171, 103351. [Google Scholar] [CrossRef]

- Lin, G.C. Reproducing spaces of Chinese urbanisation: New city-based and land-centred urban transformation. Urban Stud. 2007, 44, 1827–1855. [Google Scholar] [CrossRef]

- Jiang, S.; Miao, J.; Zhang, Y. China’s housing bubble, infrastructure investment, and economic growth. Int. Econ. Rev. 2022, 63, 1189–1237. [Google Scholar] [CrossRef]

- Henderson, J.V.; Su, D.; Zhang, Q.; Zheng, S. Political manipulation of urban land markets: Evidence from China. J. Public Econ. 2022, 214, 104730. [Google Scholar] [CrossRef]

- Tang, M. Industrialize with tax structure change: Agricultural tax abolition and local industrial growth in China. China Econ. Rev. 2025, 90, 102339. [Google Scholar] [CrossRef]

- Xiao, J.; Zhang, Q.; Knight, B.; Gong, L. Political budget cycles, government size, and the allocation of public funds: Evidence from prefectures in China. China Econ. Rev. 2025, 94, 102542. [Google Scholar] [CrossRef]

- Sun, W.; Song, Z.; Xia, Y. Government-enterprise collusion and land supply structure in Chinese cities. Cities 2020, 105, 102849. [Google Scholar] [CrossRef]

- Xu, G.; Shen, Z.; Si, R. Anti-corruption shocks, political incentives, and regional economic development in a developmental state. J. Dev. Econ. 2025, 179, 103606. [Google Scholar] [CrossRef]

- Zhang, J.; Fan, J.; Mo, J. Government intervention, land market, and urban development: Evidence from Chinese cities. Econ. Inq. 2017, 55, 115–136. [Google Scholar] [CrossRef]

- Glaeser, E. Triumph of the City; Penguin Press: New York, NY, USA, 2011. [Google Scholar]

- Du, Z.; Zhang, L. Home-purchase restriction, property tax and housing price in China: A counterfactual analysis. J. Econom. 2015, 188, 558–568. [Google Scholar] [CrossRef]

- Glaeser, E.; Huang, W.; Ma, Y.; Shleifer, A. A real estate boom with Chinese characteristics. J. Econ. Perspect. 2017, 31, 93–116. [Google Scholar] [CrossRef]

- Li, V.J.; Cheng, A.W.W.; Cheong, T.S. Home purchase restriction and housing price: A distribution dynamics analysis. Reg. Sci. Urban Econ. 2017, 67, 1–10. [Google Scholar] [CrossRef]

- Sun, W.; Zheng, S.; Geltner, D.M.; Wang, R. The housing market effects of local home purchase restrictions: Evidence from Beijing. J. Real Estate Financ. Econ. 2017, 55, 288–312. [Google Scholar] [CrossRef]

- Somerville, T.; Wang, L.; Yang, Y. Using purchase restrictions to cool housing markets: A within-market analysis. J. Urban Econ. 2020, 115, 103189. [Google Scholar] [CrossRef]

- Gan, J. Housing wealth and consumption growth: Evidence from a large panel of households. Rev. Financ. Stud. 2010, 23, 2229–2267. [Google Scholar] [CrossRef]

- Hau, H.; Ouyang, D. Can real estate booms hurt firms? Evidence on investment substitution. J. Urban Econ. 2024, 144, 103695. [Google Scholar] [CrossRef]

- Lin, J.; Li, X.; Shen, J. Industrial Land Protection and Allocation Efficiency: Evidence from Guangdong, China. Land 2024, 13, 2081. [Google Scholar] [CrossRef]

- Zhou, J.; Lu, Y. Land market cooling and local government debt risk: Evidence from county-level data. J. Quant. Technol. Econ. 2024, 41, 28–48. (In Chinese) [Google Scholar]

- Zheng, X.; Chen, X.; Yuan, Z. Exploring the spatial spillover effect of home purchase restrictions on residential land prices based on the difference-in-differences approach: Evidence from 195 Chinese cities. Land Use Policy 2021, 102, 105236. [Google Scholar] [CrossRef]

- Alonso, W. Location and Land Use; Harvard University Press: Cambridge, MA, USA, 1964. [Google Scholar]

- Muth, R.F. The derived demand for urban residential land. Urban Stud. 1971, 8, 243–254. [Google Scholar] [CrossRef]

- Witte, A.D. The determination of interurban residential site price differences: A derived demand model with empirical testing. J. Reg. Sci. 1975, 15, 351–364. [Google Scholar] [CrossRef]

- Lin, Y.; Qin, Y.; Yang, Y.; Zhu, H. Can price regulation increase land-use intensity? Evidence from China’s industrial land market. Reg. Sci. Urban Econ. 2020, 81, 103501. [Google Scholar] [CrossRef]

- Van der Kamp, D.; Lorentzen, P.; Mattingly, D. Racing to the bottom or to the top? Decentralization, revenue pressures, and governance reform in China. World Dev. 2017, 95, 164–176. [Google Scholar] [CrossRef]

- Bhatt, V.; Liao, M.; Zhao, M.Q. Government policy and land price dynamics: A quantitative assessment of China’s factor market reforms. Reg. Sci. Urban Econ. 2023, 98, 103854. [Google Scholar] [CrossRef]

- Xu, H.; Li, S.; Yang, X. City Population size and government land supply structure: A new perspective of land use for public facilities. Econ. Res. J. 2025, 60, 124–140. (In Chinese) [Google Scholar]

- Roberts, M.; Deichmann, U.; Fingleton, B.; Shi, T. Evaluating China’s road to prosperity: A new economic geography approach. Reg. Sci. Urban Econ. 2012, 42, 580–594. [Google Scholar] [CrossRef]

- Rogoff, K.S.; Yang, Y. A tale of tier 3 cities. J. Int. Econ. 2024, 152, 103989. [Google Scholar] [CrossRef]

- Wang, Q.; Wu, J.; Wu, S. Export slowdown and increasing land supply: Local government’s responses to export shocks in China. J. Urban Econ. 2025, 149, 103796. [Google Scholar] [CrossRef]

- Saiz, A. The geographic determinants of housing supply. Q. J. Econ. 2010, 125, 1253–1296. [Google Scholar] [CrossRef]

- Yang, J.; Huang, B.; Yang, Q.; Zhou, Y. Impact of the US-China trade war on resource allocation: Evidence from China’s land supply. China Econ. Rev. 2022, 76, 101854. [Google Scholar] [CrossRef]

- Ju, J.; Ma, H.; Wang, Z.; Zhu, X. Trade wars and industrial policy competitions: Understanding the US-China economic conflicts. J. Monet. Econ. 2024, 141, 42–58. [Google Scholar] [CrossRef]

- Gu, Q.; He, J.; Qian, W.; Ren, Y. Housing booms and shirking. J. Urban Econ. 2025, 149, 103793. [Google Scholar] [CrossRef]

- Dingel, J.I.; Miscio, A.; Davis, D.R. Cities, lights, and skills in developing economies. J. Urban Econ. 2021, 125, 103174. [Google Scholar] [CrossRef]

- Li, F.; Xiao, J.J. Losing the future: Household wealth from urban housing demolition and children’s human capital in China. China Econ. Rev. 2020, 63, 101533. [Google Scholar] [CrossRef]

- Luo, Q. From demolition to business: How compensation method influences New Ventures. Asian Dev. Rev. 2025, 1–25. [Google Scholar] [CrossRef]

- Xu, H.; Zheng, W. Growth-driven shantytown redevelopment and housing market dynamics in the low-tier cities of China. MPRA Working Paper Series No. 124326. Available online: https://mpra.ub.uni-muenchen.de/124326/ (accessed on 8 November 2025).

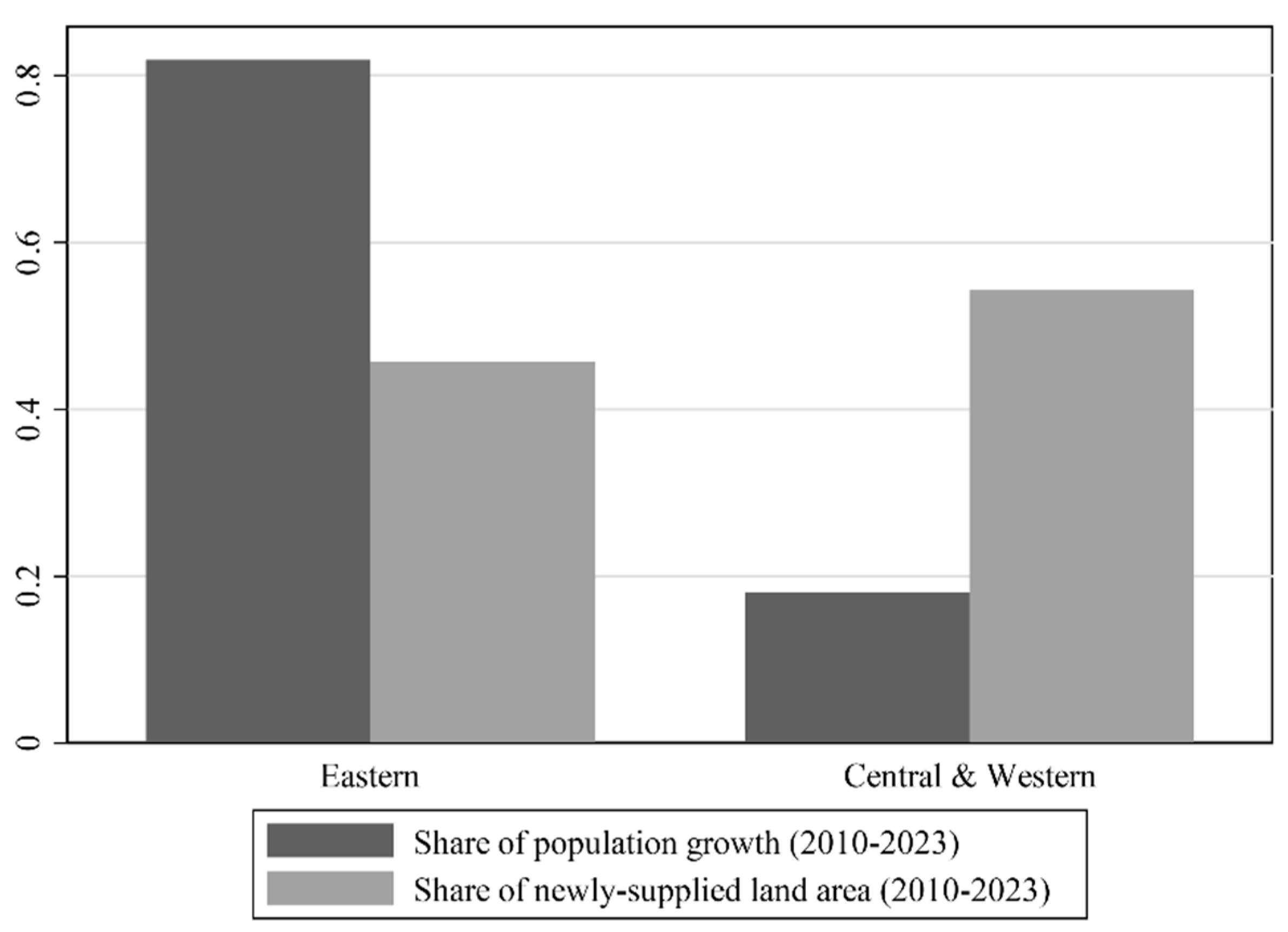

- Lu, M.; Zhang, Q.; Liang, W. How the bias toward central/western land supplies boosts wages in the east. Soc. Sci. China 2015, 5, 59–83. (In Chinese) [Google Scholar]

- Lu, M. Great State Needs Bigger City; Shanghai People’s Press: Shanghai, China, 2016. (In Chinese) [Google Scholar]

- Chen, J.; Roth, J. Logs with zeros? Some problems and solutions. Q. J. Econ. 2024, 139, 891–936. [Google Scholar] [CrossRef]

- Xie, T.; Zhang, J. Land Supply Constraints, Optimization of Industrial Land Allocation and Enterprise Efficiency: Evidence from Farmland Protection Policies. Econ. Res. J. 2024, 59, 190–208. (In Chinese) [Google Scholar]

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| IratioProv | lnIareaProv | IratioProv | lnIareaProv | Iratio | lnIarea | Iratio | lnIarea | |

| lnHousingStockpc2018 × Post2018 | 0.030 ** | 0.11 * | 0.046 *** | 0.093 *** | ||||

| (0.012) | (0.064) | (0.011) | (0.027) | |||||

| LandPriceWedgeProv × Post2018 | −0.064 *** | −0.11 *** | −0.077 *** | −0.16 *** | ||||

| (0.018) | (0.036) | (0.014) | (0.030) | |||||

| Controls | Y | Y | Y | Y | Y | Y | Y | Y |

| Province and Year FEs | Y | Y | Y | Y | N | N | N | N |

| City and Year FEs | N | N | N | N | Y | Y | Y | Y |

| Observations | 392 | 392 | 392 | 392 | 3680 | 3680 | 3680 | 3680 |

| R-squared | 0.447 | 0.823 | 0.459 | 0.819 | 0.182 | 0.738 | 0.187 | 0.740 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Iratio | lnIarea | Rratio | lnRarea | Cratio | lnCarea | lnAllarea | |

| Panel A | |||||||

| LandPriceWedge | −0.039 *** | −0.086 *** | 0.042 *** | 0.14 *** | −0.0027 | −0.021 | 0.050 |

| × Post2018 | (0.011) | (0.023) | (0.011) | (0.039) | (0.0061) | (0.059) | (0.041) |

| D × Post2018 | N | N | N | N | N | N | N |

| Observations | 3680 | 3680 | 3680 | 3680 | 3680 | 3675 | 3680 |

| R-squared | 0.181 | 0.738 | 0.167 | 0.596 | 0.096 | 0.407 | 0.237 |

| Panel B | |||||||

| LandPriceWedge | −0.035 *** | −0.080 *** | 0.039 *** | 0.12 *** | −0.0033 | −0.031 | 0.051 |

| × Post2018 | (0.011) | (0.023) | (0.010) | (0.037) | (0.0058) | (0.057) | (0.039) |

| D × Post2018 | Y | Y | Y | Y | Y | Y | Y |

| Controls | Y | Y | Y | Y | Y | Y | Y |

| City and Year FEs | Y | Y | Y | Y | Y | Y | Y |

| Observations | 3666 | 3666 | 3666 | 3666 | 3666 | 3666 | 3666 |

| R-squared | 0.195 | 0.736 | 0.181 | 0.608 | 0.099 | 0.412 | 0.271 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, S.; Xu, H.; Zheng, W. Industrial Land Expansion as an Unintended Consequence of Housing Market Regulation: Evidence from China. Land 2025, 14, 2228. https://doi.org/10.3390/land14112228

Li S, Xu H, Zheng W. Industrial Land Expansion as an Unintended Consequence of Housing Market Regulation: Evidence from China. Land. 2025; 14(11):2228. https://doi.org/10.3390/land14112228

Chicago/Turabian StyleLi, Sixuan, Hangtian Xu, and Wenzhuo Zheng. 2025. "Industrial Land Expansion as an Unintended Consequence of Housing Market Regulation: Evidence from China" Land 14, no. 11: 2228. https://doi.org/10.3390/land14112228

APA StyleLi, S., Xu, H., & Zheng, W. (2025). Industrial Land Expansion as an Unintended Consequence of Housing Market Regulation: Evidence from China. Land, 14(11), 2228. https://doi.org/10.3390/land14112228