Evolving Green Premiums: The Impact of Energy Efficiency on London Housing Prices over Time

Abstract

1. Introduction

- a.

- How has the price premium associated with energy efficiency in London’s housing market evolved from 2013 to 2021?

- b.

- Has the market’s valuation of unrealized energy-saving potential changed over the same period?

2. Literature Review

2.1. Empirical Evidence of Green Premiums in Housing Markets

- Contextual Differences: Markets with higher baseline fuel costs or greater climate-driven energy needs tend to show stronger willingness-to-pay for efficiency. A study shows that Turin’s buyers paid close attention to the EPC label, reflecting the greater heating needs (higher heating degree days) and fuel use there, whereas Barcelona’s buyers placed more value on features like air conditioning and pools to cope with hot summers [20]. Additionally, evidence from the UK indicates higher relative premiums in regions where the house price-to-earnings ratio is higher or housing tenure is longer [21]. Property type also matters: flats and terraced homes, which are often associated with more budget-conscious buyers or tenants, show higher percentage premiums than detached houses in some studies [22]. However, in contexts where energy is cheap or incomes are high, the premium can shrink. A study in Oslo (Norway) found virtually no price effect from EPC ratings, concluding that homebuyers placed minimal weight on energy efficiency compared to location, size, and other attributes [23]. Similarly, research in Sweden’s housing market found no significant price premium attributable to the EPC label itself, aside from the value of specific efficiency-related attributes (like better insulation or windows) [24]. This null result contrasts with the notable premiums observed in other countries, and it underscores how abundant cheap energy, cost of retrofitting and other financial factors can neutralize the willingness to pay for efficiency [25,26].

- Influence of Information and Policy: Several studies highlight the role of disclosure and standards in unlocking the green premium. Ghosh et al., exploiting an “information shock” policy that made EPC ratings more salient at the point of sale, provide causal evidence that homebuyers will pay more for better-rated homes. They estimate a 1–3% price premium per EPC letter upgrade at the national level, and a somewhat higher 3–6% premium in the London market specifically [21]. Government policies can also create direct financial incentives: for example, from 2018 the UK’s Minimum Energy Efficiency Standards (MEES) regulation made it unlawful to rent out properties below EPC “E”, effectively penalizing the worst-rated homes and likely increasing investors’ attention to energy performance [27]. Such regulatory shifts are expected to be capitalized into prices. Inefficient properties facing mandatory retrofits or rent restrictions should sell at discounts, while efficient ones may enjoy enhanced demand. Correspondingly, when the policy was patchily enforced, early research found weaker or inconsistent effects. Early evidence on behavioral responses to MEES reveals that the early compliance was “too easy” and landlords could obtain exemptions or make minimal changes, so the policy’s immediate impact on the market was muted [28]. However, the study also found MEES beginning to change market practice, for instance, some landlords started adding clauses or seeking greater control over tenant behavior in leases to ensure compliance. These insights suggest that policy alone may not immediately transform market values without strong enforcement, but it has started to shift investor awareness and behavior. Indeed, industry observers have posited that the value attached to energy efficiency will rise over time as climate policies tighten, and that market premiums could grow if government incentives for green homes strengthen.

2.2. Gaps in Research: Temporal Dynamics and Policy Context

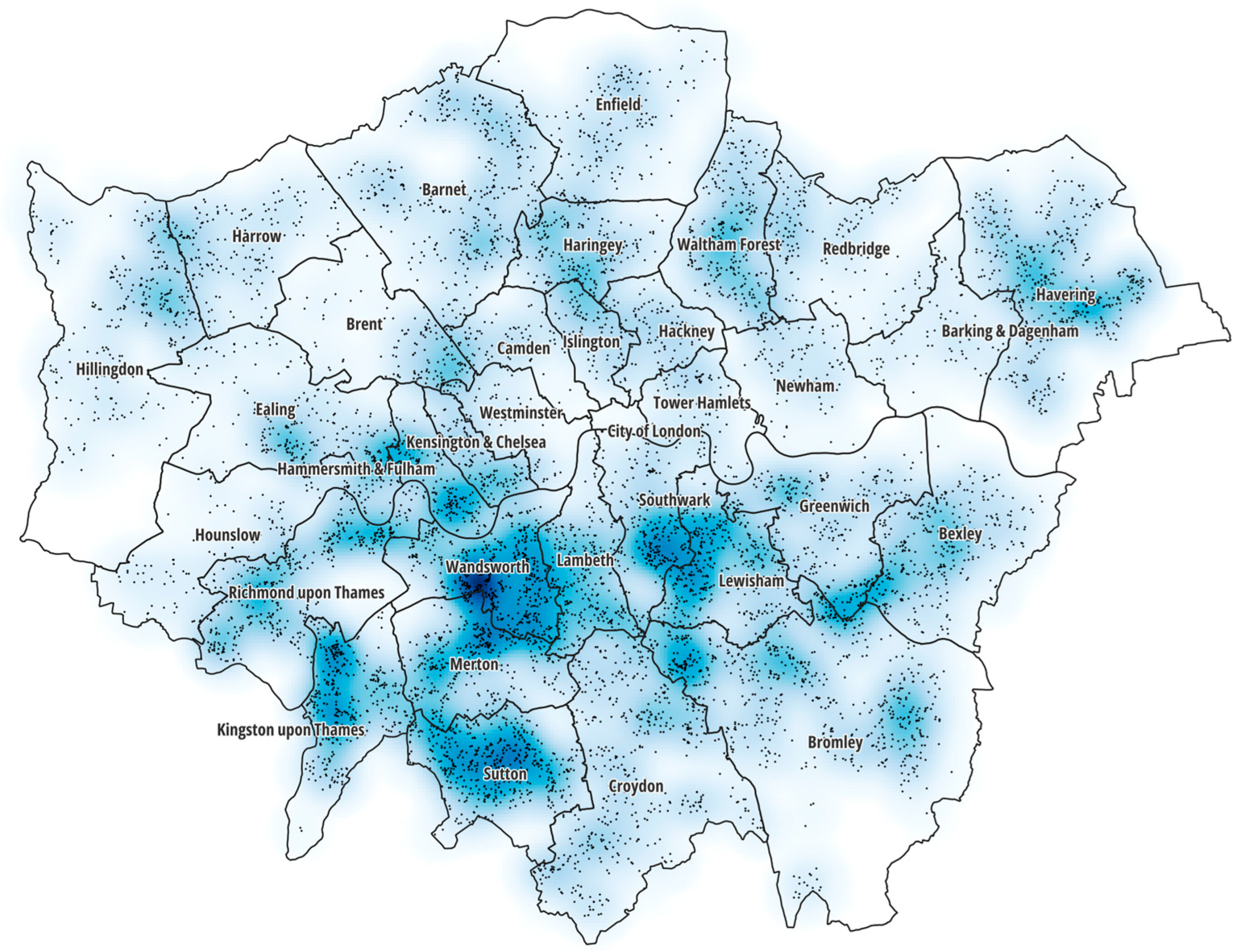

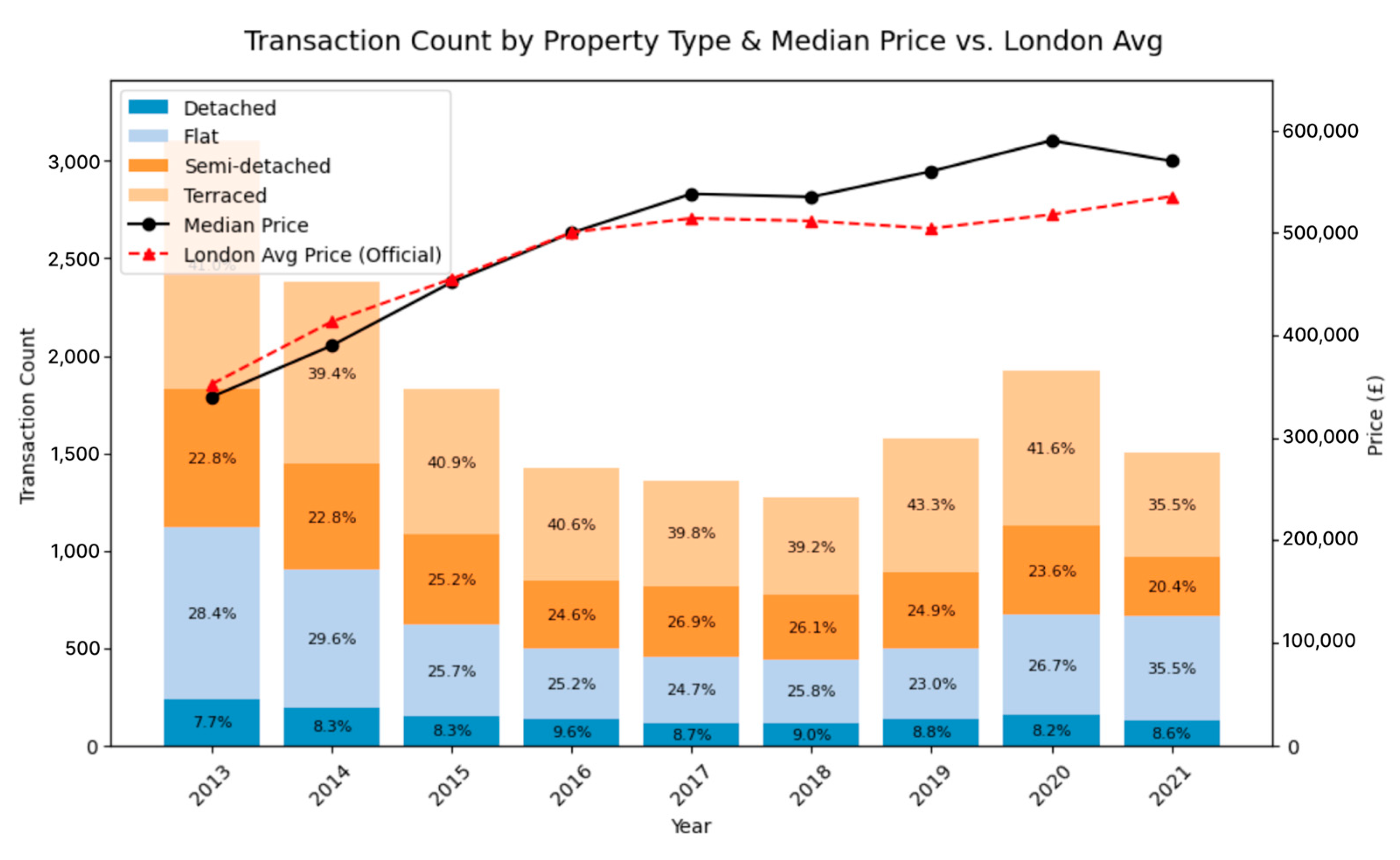

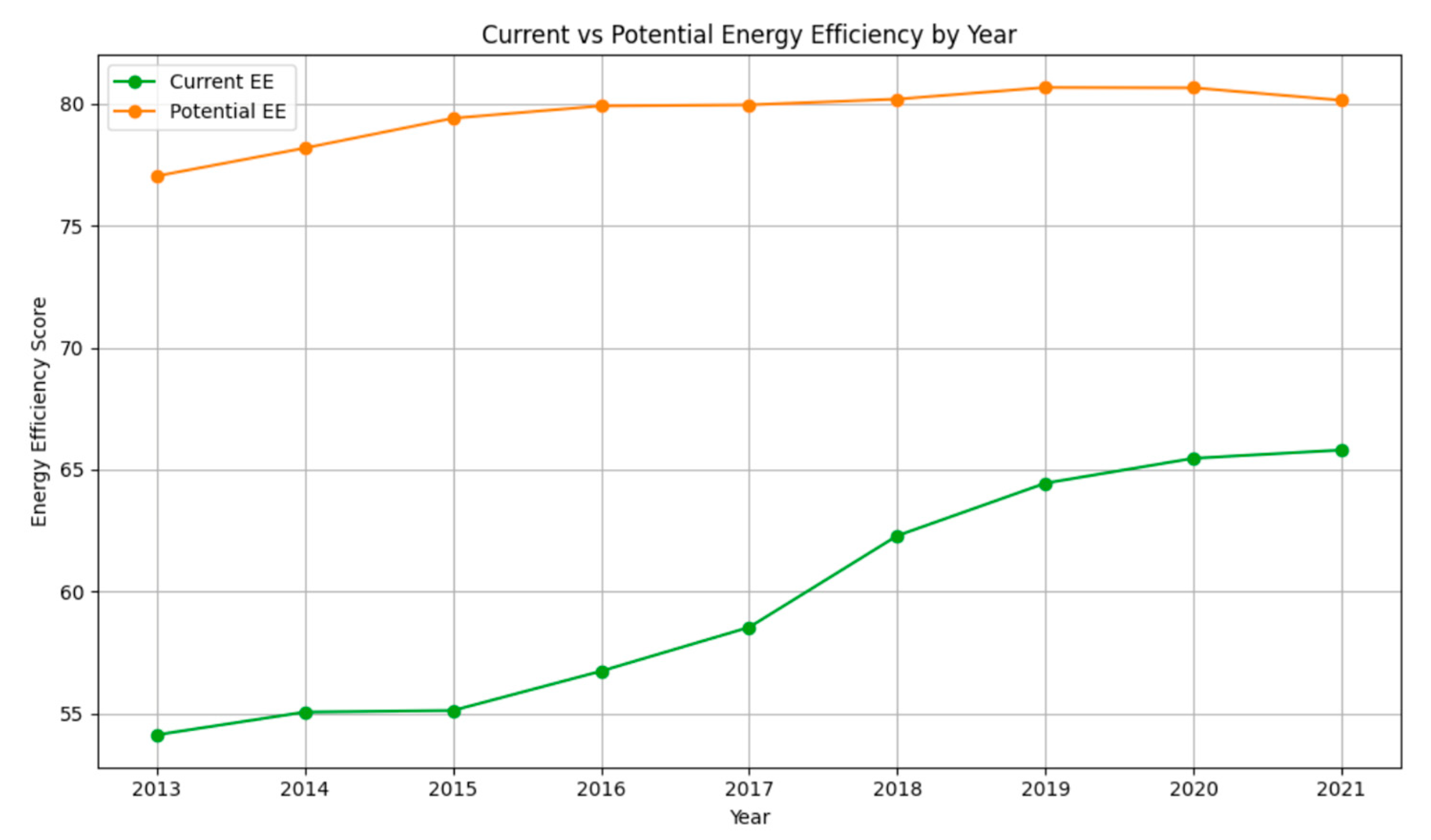

3. Methodology and Data

3.1. Theoretical Framework: Hedonic Pricing and Energy Efficiency

3.2. First-Difference Repeat-Sales Model Specification

3.3. Data Sources and Variable Definitions

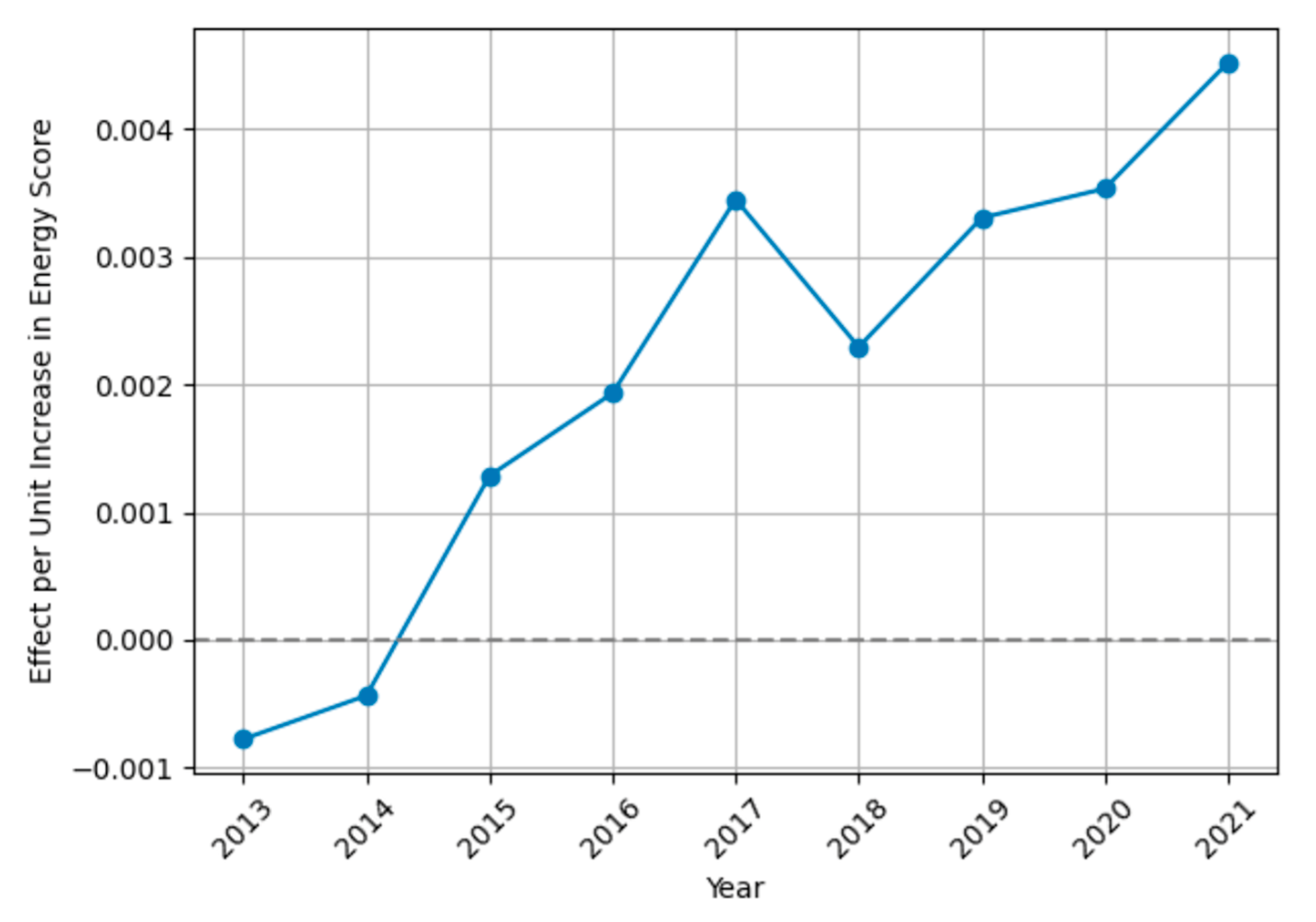

4. Results

4.1. Model and Result

- Energy efficiency score—the change in actual EPC rating (1–100 scale) between two repeat sales.

- Energy efficiency gap—the change in the difference between potential and current EPC scores, capturing unrealized efficiency potential.

- Interaction terms between these variables and year dummies—to capture time-varying effects in their impacts.

4.2. Robustness Check Result

- (a)

- Restricting the sample to repeat sales within three years: In this specification, we only include pairs of transactions that occurred within roughly three years of each other. This tests whether our results are influenced by very long holding periods, during which macroeconomic shifts, major renovations, or neighborhood changes could occur. Focusing on shorter intervals between sales helps isolate the price effect of energy efficiency improvements by minimizing confounding from long-horizon factors.

- (b)

- Using categorical EPC ratings instead of numeric scores: Our baseline model uses the numeric EPC score (1–100). However, buyers are often more familiar with the letter grade (A–G). In this alternative model, we use the EPC rating bands as the measure of energy performance. This tests whether our observed effects are robust to a coarser but more salient representation of energy efficiency.

- (c)

- Excluding transactions with no change in energy efficiency: In the repeat-sales sample, some properties show no change in their EPC score between sales. These cases might reflect measurement noise or truly no efficiency improvements. We remove these observations to ensure we focus on homes with actual performance shifts, making the estimated premium for efficiency gains more credible.

- (d)

- Controlling for borough-by-year fixed effects: To address potential geographic compositional shifts in the repeat-sales sample over time, we include interaction terms between borough and year indicators. This accounts for borough-specific price trends that could confound our temporal estimates if, for instance, later-year transactions disproportionately occur in gentrifying or more affluent areas.

5. Discussion

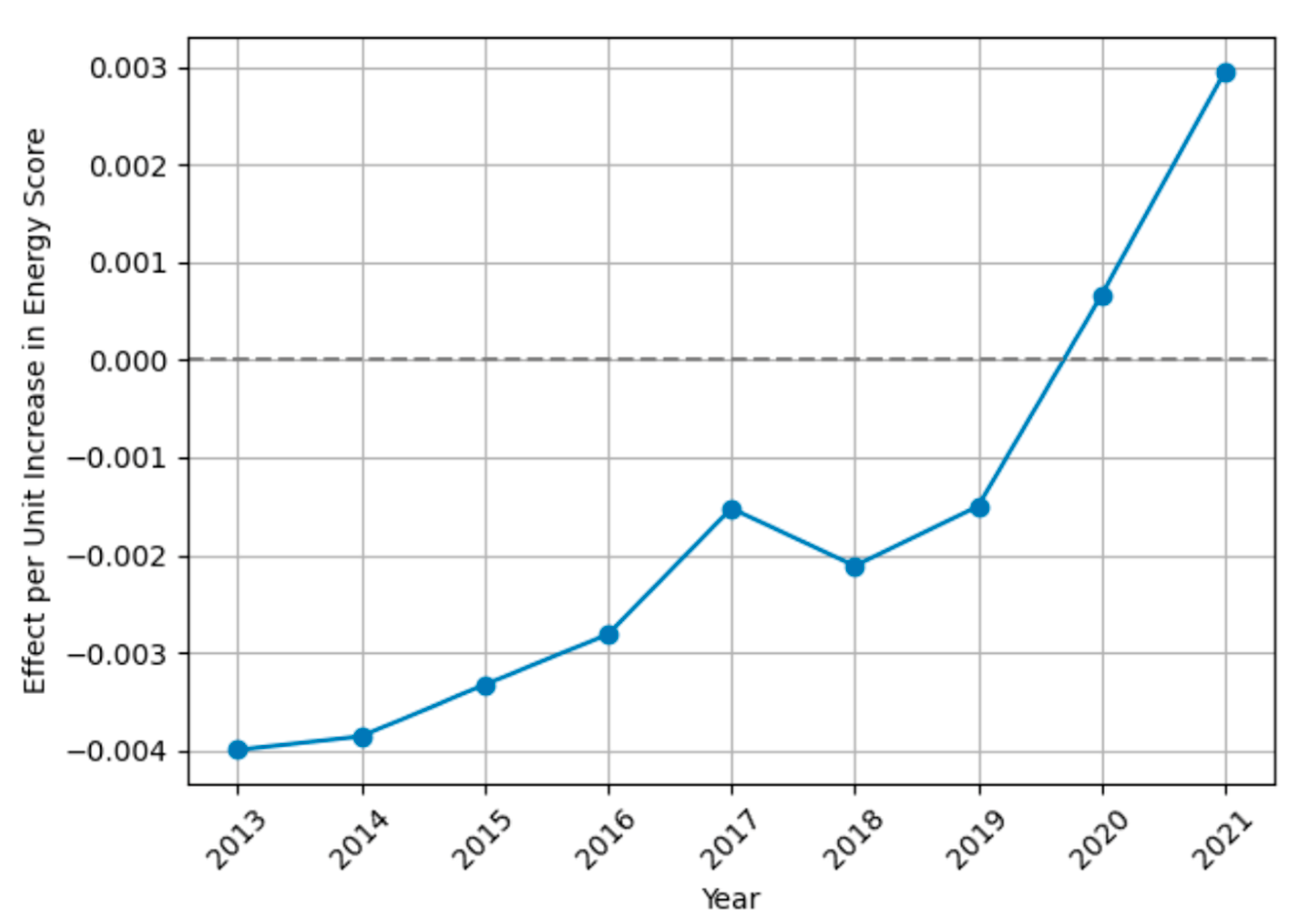

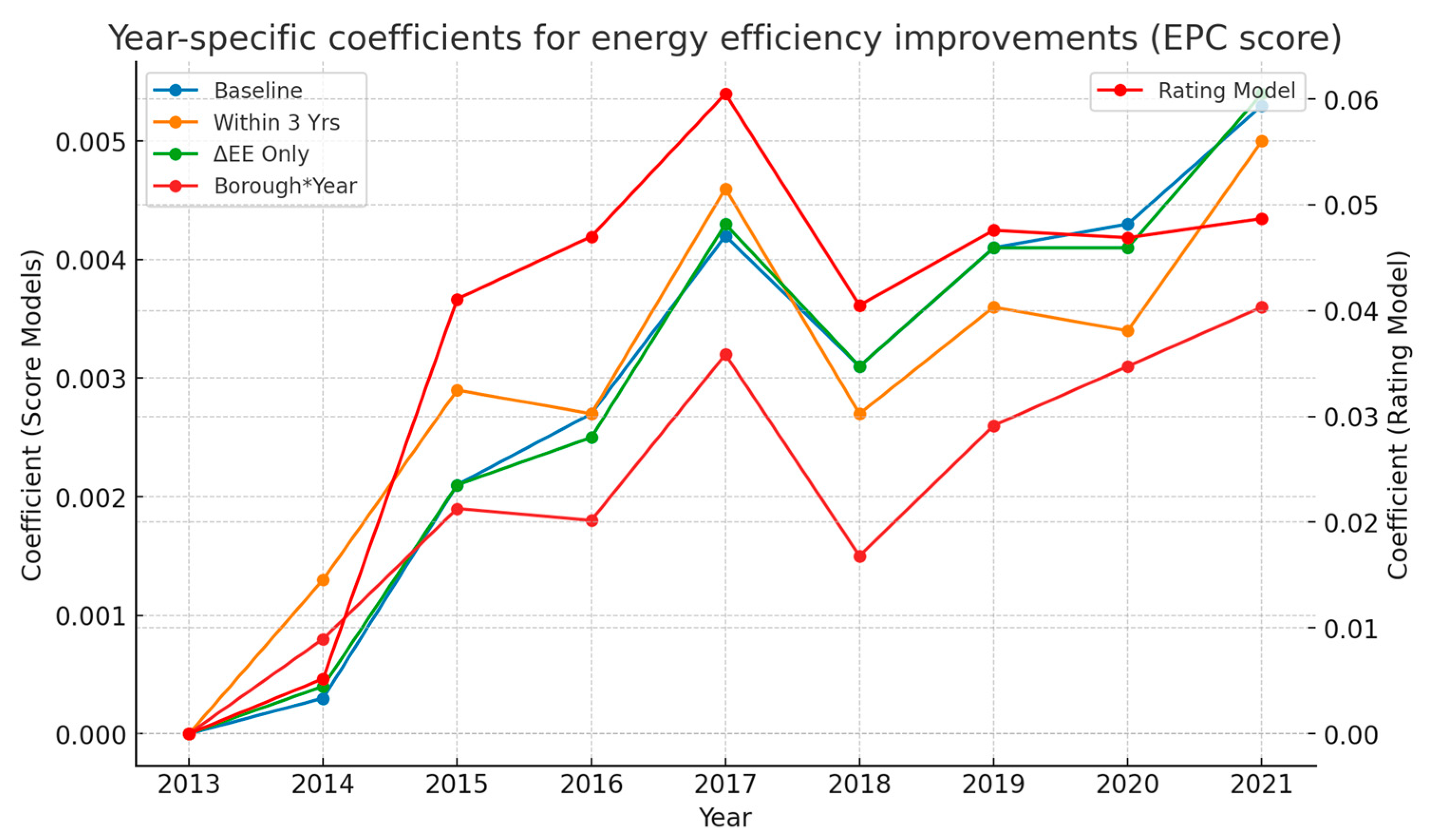

5.1. Growing Time-Varying Premiums

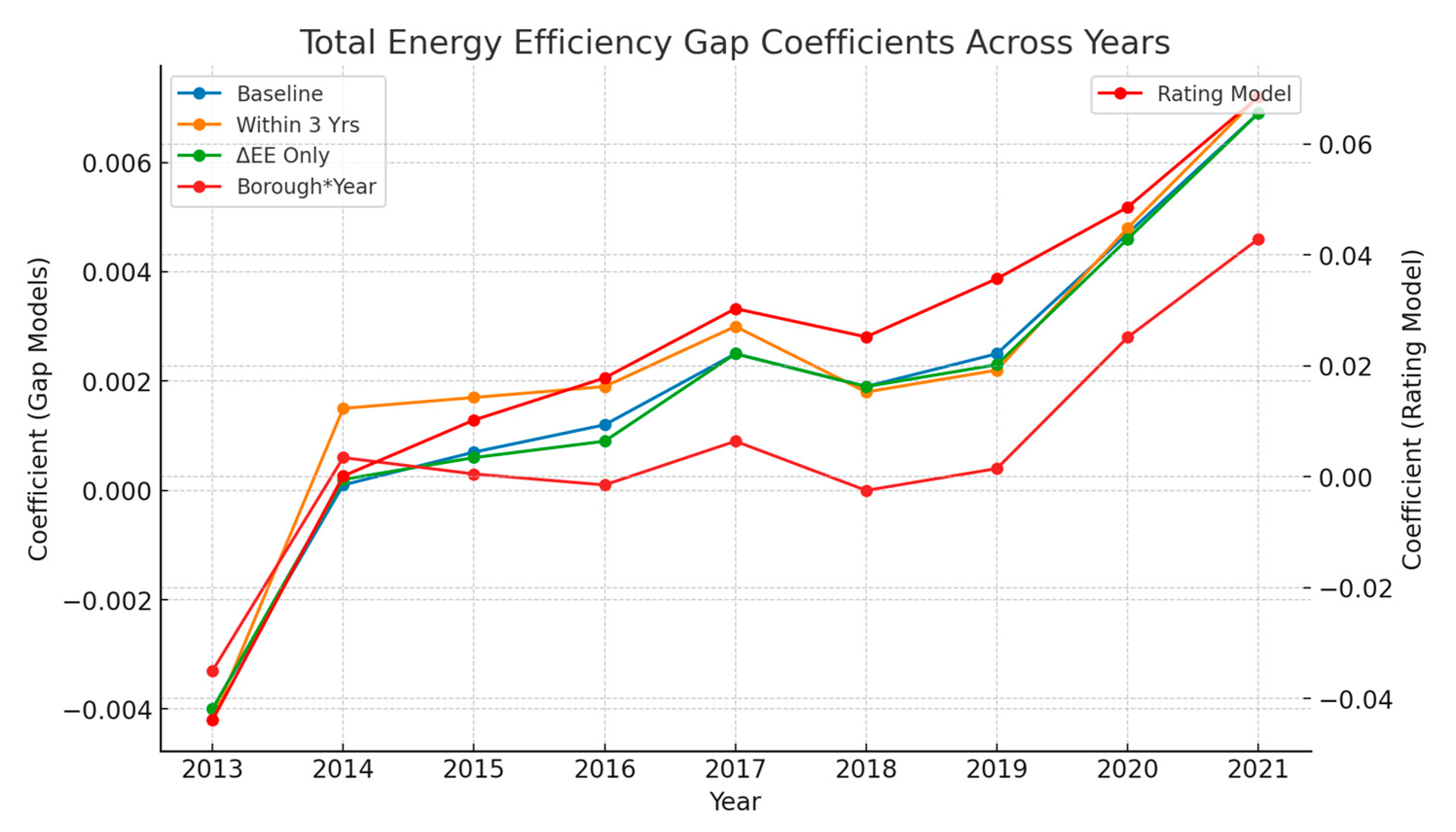

5.2. Reframing the Energy Efficiency Gap

5.3. Robustness and Sensitivity: Confirming Temporal Dynamics

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Metric | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|

| Transactions (count) | 3105 | 2381 | 1830 | 1428 | 1363 | 1272 | 1575 | 1926 | 1503 |

| Total Volume (£) | 1.48 × 109 | 1.27 × 109 | 1.08 × 109 | 9 × 108 | 9.24 × 108 | 8.5 × 108 | 1.18 × 109 | 1.46 × 109 | 1.16 × 109 |

| Avg Price (£) | 477,594.8 | 531,925.6 | 590,433.6 | 630,157.3 | 677,983.4 | 668,314.8 | 748,864.8 | 756,918.5 | 774,908.6 |

| Median Price (£) | 339,950 | 390,000 | 451,755 | 500,000 | 538,000 | 535,000 | 560,000 | 590,000 | 570,000 |

| Price SD (£) | 520,719.1 | 554,555.1 | 485,139.2 | 434,919 | 562,285.7 | 480,114.7 | 715,964.7 | 632,340.6 | 796,041.4 |

| P10 Price (£) | 195,000 | 220,000 | 260,000 | 295,700 | 315,000 | 310,000 | 320,000 | 337,000 | 315,000 |

| P25 Price (£) | 248,000 | 284,000 | 325,000 | 365,000 | 395,000 | 386,000 | 405,000 | 425,000 | 403,750 |

| P50 Price (£) | 339,950 | 390,000 | 451,755 | 500,000 | 538,000 | 535,000 | 560,000 | 590,000 | 570,000 |

| P75 Price (£) | 524,000 | 595,000 | 670,000 | 740,000 | 755,000 | 760,625 | 845,000 | 850,000 | 843,000 |

| P90 Price (£) | 835,000 | 930,000 | 1,055,750 | 1,100,000 | 1,190,000 | 1,175,000 | 1,295,000 | 1,300,000 | 1,350,000 |

| Mean Price Per Unit (£/m2) | 4904.693 | 5552.447 | 5935.583 | 6284.202 | 6417.528 | 6287.13 | 6471.953 | 6727.176 | 6907.218 |

| Median Price Per Unit (£/m2) | 4241.071 | 4788.136 | 5248.239 | 5714.286 | 5774.648 | 5844.757 | 5824.176 | 6170.012 | 6283.784 |

| Current EE Score (score) | 54.13366 | 55.0651 | 55.12951 | 56.743 | 58.54072 | 62.29245 | 64.44444 | 65.46366 | 65.8024 |

| Potential EE Score (0–100) | 77.02963 | 78.17682 | 79.39836 | 79.90196 | 79.94571 | 80.18082 | 80.65841 | 80.64486 | 80.13307 |

| Avg Rooms (count) | 4.458615 | 4.440151 | 4.610383 | 4.597339 | 4.735877 | 4.709906 | 4.84254 | 4.790758 | 4.638723 |

| Median Rooms (count) | 4 | 4 | 5 | 4 | 5 | 5 | 5 | 5 | 4 |

| Avg Area (m2) | 92.39929 | 92.1884 | 97.45342 | 99.28901 | 104.3183 | 105.5987 | 111.8255 | 110.1423 | 107.0971 |

| Median Area (m2) | 83 | 83 | 87 | 87 | 91 | 92 | 99 | 100 | 90 |

| Ptype D Share (%) | 7.697262 | 8.315834 | 8.251366 | 9.593838 | 8.657373 | 8.962264 | 8.761905 | 8.15161 | 8.582834 |

| Ptype F Share (%) | 28.438 | 29.56741 | 25.68306 | 25.21008 | 24.6515 | 25.78616 | 23.04762 | 26.68744 | 35.46241 |

| Ptype S Share (%) | 22.83414 | 22.76354 | 25.19126 | 24.57983 | 26.85253 | 26.10063 | 24.88889 | 23.57217 | 20.42582 |

| Ptype T Share (%) | 41.0306 | 39.35321 | 40.87432 | 40.61625 | 39.83859 | 39.15094 | 43.30159 | 41.58879 | 35.52894 |

| Age England And Wales 1900–1929 Share (%) | 28.82448 | 27.76144 | 28.19672 | 30.88235 | 27.73294 | 29.16667 | 31.11111 | 32.39875 | 31.20426 |

| Age England And Wales 1930–1949 Share (%) | 28.21256 | 28.47543 | 30.16393 | 28.08123 | 33.30888 | 30.58176 | 31.04762 | 28.92004 | 26.67997 |

| Age England And Wales 1950–1966 Share (%) | 8.824477 | 8.609828 | 9.945355 | 9.943978 | 11.0785 | 10.61321 | 7.809524 | 8.982347 | 8.715902 |

| Age England And Wales 1967–1975 Share (%) | 5.120773 | 5.333893 | 5.027322 | 6.442577 | 4.328687 | 5.188679 | 4.888889 | 5.192108 | 6.254158 |

| Age England And Wales 1976–1982 Share (%) | 2.254428 | 2.225955 | 1.584699 | 1.540616 | 1.980924 | 1.965409 | 2.095238 | 2.336449 | 2.661344 |

| Age England And Wales 1983–1990 Share (%) | 3.220612 | 3.653927 | 3.114754 | 3.081232 | 2.934703 | 3.301887 | 3.428571 | 2.803738 | 4.25815 |

| Age England And Wales 1991–1995 Share (%) | 1.15942 | 1.637967 | 1.36612 | 0.910364 | 1.247249 | 1.493711 | 1.460317 | 1.557632 | 2.39521 |

| Age England And Wales 1996–2002 Share (%) | 1.674718 | 1.805964 | 1.256831 | 1.330532 | 2.054292 | 1.493711 | 2.222222 | 1.505711 | 2.59481 |

| Age England And Wales 2003–2006 Share (%) | 1.223833 | 1.259975 | 0.983607 | 0.70028 | 0.880411 | 1.022013 | 1.206349 | 0.674974 | 1.596806 |

| Age England And Wales 2007–2011 Share (%) | 0.57971 | 0.671987 | 0.437158 | 0.35014 | 0.513573 | 0.157233 | 0.126984 | 0.778816 | 0.665336 |

| Age England And Wales Before 1900 Share (%) | 18.90499 | 18.56363 | 17.9235 | 16.73669 | 13.93984 | 15.01572 | 14.60317 | 14.84943 | 12.97405 |

| Month 01 (% of transactions) | 7.149758 | 9.533809 | 8.63388 | 9.383754 | 6.236244 | 7.704403 | 6.793651 | 6.490135 | 15.03659 |

| Month 02 (% of transactions) | 6.795491 | 8.98782 | 6.994536 | 7.492997 | 6.896552 | 7.54717 | 6.349206 | 5.399792 | 14.23819 |

| Month 03 (% of transactions) | 6.859903 | 8.441831 | 7.26776 | 15.19608 | 7.923698 | 7.54717 | 6.730159 | 6.542056 | 19.76048 |

| Month 04 (% of transactions) | 7.665056 | 8.48383 | 8.087432 | 6.232493 | 6.749817 | 6.996855 | 6.920635 | 3.686397 | 7.850965 |

| Month 05 (% of transactions) | 8.792271 | 8.147837 | 8.032787 | 6.862745 | 7.410125 | 6.446541 | 7.047619 | 3.167186 | 5.256154 |

| Month 06 (% of transactions) | 7.665056 | 8.357833 | 9.180328 | 9.243697 | 9.170946 | 8.569182 | 7.428571 | 5.451713 | 16.96607 |

| Month 07 (% of transactions) | 9.243156 | 9.071819 | 11.31148 | 8.543417 | 9.757887 | 8.883648 | 10.47619 | 7.632399 | 1.929474 |

| Month 08 (% of transactions) | 11.01449 | 8.609828 | 9.453552 | 7.983193 | 9.97799 | 10.84906 | 10.22222 | 8.047767 | 3.592814 |

| Month 09 (% of transactions) | 8.373591 | 7.391852 | 7.704918 | 7.633053 | 10.93177 | 8.726415 | 9.333333 | 10.85151 | 6.786427 |

| Month 10 (% of transactions) | 8.856683 | 8.651827 | 8.961749 | 7.352941 | 7.997065 | 8.962264 | 10.4127 | 13.75909 | 2.927478 |

| Month 11 (% of transactions) | 9.822866 | 7.139857 | 6.939891 | 6.932773 | 9.170946 | 10.14151 | 9.396825 | 14.07061 | 2.59481 |

| Month 12 (% of transactions) | 7.761675 | 7.181856 | 7.431694 | 7.142857 | 7.776963 | 7.625786 | 8.888889 | 14.90135 | 3.060546 |

| Borough Bromley Share (%) | 7.536232 | 8.567829 | 7.978142 | 7.703081 | 9.904622 | 8.726415 | 8.698413 | 8.203531 | 7.451763 |

| Dorough Wandsworth Share (%) | 7.181965 | 5.543889 | 5.191257 | 5.812325 | 4.915627 | 6.053459 | 5.396825 | 6.697819 | 6.320692 |

| Dorough Havering Share (%) | 5.217391 | 6.257875 | 5.519126 | 6.582633 | 6.969919 | 6.289308 | 6.285714 | 6.022845 | 4.99002 |

| Dorough Sutton Share (%) | 5.507246 | 5.459891 | 5.68306 | 6.232493 | 6.896552 | 5.974843 | 6.285714 | 5.867082 | 5.655356 |

| Dorough Croydon Share (%) | 5.47504 | 5.921882 | 6.284153 | 6.302521 | 4.988995 | 6.053459 | 4.825397 | 5.192108 | 5.189621 |

| Dorough Richmond Upon Thames Share (%) | 5.507246 | 4.535909 | 5.519126 | 4.481793 | 4.548789 | 4.323899 | 4.825397 | 4.932503 | 4.25815 |

| Dorough Barnet Share (%) | 4.541063 | 5.039899 | 4.590164 | 5.112045 | 4.84226 | 4.08805 | 4.698413 | 3.478712 | 4.657352 |

| Dorough Kingston Upon Thames Share (%) | 3.671498 | 4.745905 | 4.754098 | 5.252101 | 4.548789 | 4.559748 | 4.31746 | 4.361371 | 4.99002 |

| Dorough Lewisham Share (%) | 4.154589 | 4.157917 | 4.043716 | 3.571429 | 3.961849 | 3.852201 | 4.571429 | 5.244029 | 4.99002 |

| Dorough Merton Share (%) | 3.89694 | 4.283914 | 4.644809 | 5.042017 | 4.108584 | 3.066038 | 3.746032 | 4.413292 | 4.25815 |

| Dorough Other Share (%) | 47.31079 | 45.48509 | 45.79235 | 43.90756 | 44.31401 | 47.01258 | 46.34921 | 45.58671 | 47.23886 |

Appendix B

| Model Statistics | ||||||

|---|---|---|---|---|---|---|

| Observations | 5167 | |||||

| R2 | 0.759 | Adjusted R2 | 0.757 | |||

| F-statistic | 358.7 | p(F-stat) | 0.000 | |||

| Variable | Coefficient | Std. Error | t-Statistic | p-Value | 95% CI Lower | 95% CI Upper |

| Constant | 0.0195 | 0.0036 | 5.443 | 0.000 | 0.013 | 0.027 |

| Energy efficiency × 2014 | 0.0013 | 0.0007 | 1.844 | 0.065 | −0.0001 | 0.0030 |

| Energy efficiency × 2015 | 0.0029 | 0.0009 | 3.409 | 0.001 | 0.0012 | 0.0046 |

| Energy efficiency × 2016 | 0.0027 | 0.0009 | 2.879 | 0.004 | 0.0009 | 0.0046 |

| Energy efficiency × 2017 | 0.0046 | 0.0010 | 4.496 | 0.000 | 0.0026 | 0.0065 |

| Energy efficiency × 2018 | 0.0027 | 0.0012 | 2.274 | 0.023 | 0.0004 | 0.0050 |

| Energy efficiency × 2019 | 0.0036 | 0.0012 | 3.101 | 0.002 | 0.0013 | 0.0059 |

| Energy efficiency × 2020 | 0.0034 | 0.0012 | 2.810 | 0.005 | 0.0010 | 0.0058 |

| Energy efficiency × 2021 | 0.0050 | 0.0013 | 3.927 | 0.000 | 0.0025 | 0.0075 |

| Year 2014 dummy | 0.0657 | 0.0534 | 1.230 | 0.219 | −0.0389 | 0.1704 |

| Year 2015 dummy | 0.0909 | 0.0649 | 1.401 | 0.161 | −0.0363 | 0.2180 |

| Year 2016 dummy | 0.2081 | 0.0726 | 2.864 | 0.004 | 0.0656 | 0.3506 |

| Year 2017 dummy | 0.1081 | 0.0797 | 1.356 | 0.175 | −0.0481 | 0.2643 |

| Year 2018 dummy | 0.2360 | 0.0915 | 2.579 | 0.010 | 0.0567 | 0.4153 |

| Year 2019 dummy | 0.1633 | 0.0915 | 1.785 | 0.074 | −0.0160 | 0.3427 |

| Year 2020 dummy | 0.1766 | 0.0929 | 1.900 | 0.058 | −0.0058 | 0.3591 |

| Year 2021 dummy | 0.0609 | 0.0994 | 0.612 | 0.540 | −0.1341 | 0.2558 |

| Energy efficiency score | −0.0010 | 0.0007 | −1.388 | 0.165 | −0.0023 | 0.0004 |

| Total floor area (m2) | 0.0024 | 0.0001 | 22.063 | 0.000 | 0.0022 | 0.0026 |

| Number of rooms | 0.0187 | 0.0026 | 7.292 | 0.000 | 0.0136 | 0.0238 |

| Energy efficiency gap | −0.0042 | 0.0008 | −5.495 | 0.000 | −0.0058 | −0.0027 |

| EE gap × 2014 | 0.0015 | 0.0007 | 2.158 | 0.031 | 0.0001 | 0.0029 |

| EE gap × 2015 | 0.0017 | 0.0008 | 2.052 | 0.040 | 0.0001 | 0.0033 |

| EE gap × 2016 | 0.0019 | 0.0009 | 2.002 | 0.045 | 0.0000 | 0.0037 |

| EE gap × 2017 | 0.0030 | 0.0010 | 2.901 | 0.004 | 0.0010 | 0.0051 |

| EE gap × 2018 | 0.0018 | 0.0012 | 1.532 | 0.126 | −0.0005 | 0.0040 |

| EE gap × 2019 | 0.0022 | 0.0012 | 1.873 | 0.061 | −0.0001 | 0.0045 |

| EE gap × 2020 | 0.0048 | 0.0012 | 3.859 | 0.000 | 0.0024 | 0.0072 |

| EE gap × 2021 | 0.0072 | 0.0013 | 5.461 | 0.000 | 0.0046 | 0.0099 |

| Month 10 dummy | 0.0494 | 0.0088 | 5.612 | 0.000 | 0.0321 | 0.0666 |

| Month 11 dummy | 0.0653 | 0.0088 | 7.417 | 0.000 | 0.0480 | 0.0825 |

| Month 12 dummy | 0.0658 | 0.0090 | 7.303 | 0.000 | 0.0479 | 0.0838 |

| Month 2 dummy | −0.0017 | 0.0092 | −0.189 | 0.850 | −0.0196 | 0.0162 |

| Month 3 dummy | 0.0007 | 0.0092 | 0.078 | 0.938 | −0.0173 | 0.0187 |

| Month 4 dummy | 0.0035 | 0.0094 | 0.368 | 0.713 | −0.0150 | 0.0220 |

| Month 5 dummy | 0.0219 | 0.0093 | 2.367 | 0.018 | 0.0037 | 0.0401 |

| Month 6 dummy | 0.0333 | 0.0087 | 3.831 | 0.000 | 0.0161 | 0.0505 |

| Month 7 dummy | 0.0478 | 0.0087 | 5.489 | 0.000 | 0.0307 | 0.0650 |

| Month 8 dummy | 0.0490 | 0.0087 | 5.624 | 0.000 | 0.0318 | 0.0663 |

| Month 9 dummy | 0.0623 | 0.0088 | 7.087 | 0.000 | 0.0449 | 0.0797 |

| Flat × EE score | 0.0004 | 0.0007 | 0.531 | 0.595 | −0.0010 | 0.0017 |

| Semi-detached × EE score | 0.0016 | 0.0006 | 2.491 | 0.013 | 0.0003 | 0.0029 |

| Terraced × EE score | 0.0011 | 0.0006 | 1.762 | 0.078 | −0.0001 | 0.0023 |

| Flat × EE gap | −0.0007 | 0.0007 | −0.905 | 0.365 | −0.0021 | 0.0008 |

| Semi-detached × EE gap | 0.0003 | 0.0007 | 0.397 | 0.692 | −0.0011 | 0.0017 |

| Terraced × EE gap | −0.0003 | 0.0007 | −0.364 | 0.716 | −0.0017 | 0.0012 |

| Model Statistics | ||||||

|---|---|---|---|---|---|---|

| Observations | 8205 | |||||

| R2 | 0.819 | Adjusted R2 | 0.818 | |||

| F-statistic | 819.2 | p(F-stat) | 0.000 | |||

| Variable | Coefficient | Std. Error | t-Statistic | p-Value | 95% CI Lower | 95% CI Upper |

| Constant | 0.0008 | 0.0020 | 0.396 | 0.692 | −0.0030 | 0.0046 |

| Energy efficiency rating × 2014 | 0.0052 | 0.0070 | 0.745 | 0.456 | −0.0084 | 0.0188 |

| Energy efficiency rating × 2015 | 0.0411 | 0.0079 | 5.208 | 0.000 | 0.0256 | 0.0566 |

| Energy efficiency rating × 2016 | 0.0470 | 0.0089 | 5.302 | 0.000 | 0.0296 | 0.0644 |

| Energy efficiency rating × 2017 | 0.0605 | 0.0092 | 6.562 | 0.000 | 0.0424 | 0.0786 |

| Energy efficiency rating × 2018 | 0.0405 | 0.0102 | 3.960 | 0.000 | 0.0205 | 0.0605 |

| Energy efficiency rating × 2019 | 0.0476 | 0.0097 | 4.896 | 0.000 | 0.0286 | 0.0666 |

| Energy efficiency rating × 2020 | 0.0369 | 0.0093 | 3.962 | 0.000 | 0.0189 | 0.0549 |

| Energy efficiency rating × 2021 | 0.0487 | 0.0100 | 4.855 | 0.000 | 0.0290 | 0.0684 |

| Year 2014 dummy | 0.1529 | 0.0334 | 4.572 | 0.000 | 0.0873 | 0.2185 |

| Year 2015 dummy | 0.1069 | 0.0392 | 2.726 | 0.006 | 0.0299 | 0.1839 |

| Year 2016 dummy | 0.1805 | 0.0450 | 4.015 | 0.000 | 0.0922 | 0.2688 |

| Year 2017 dummy | 0.1350 | 0.0471 | 2.866 | 0.004 | 0.0429 | 0.2271 |

| Year 2018 dummy | 0.2154 | 0.0521 | 4.132 | 0.000 | 0.1128 | 0.3180 |

| Year 2019 dummy | 0.1624 | 0.0497 | 3.271 | 0.001 | 0.0649 | 0.2599 |

| Year 2020 dummy | 0.2225 | 0.0469 | 4.742 | 0.000 | 0.1306 | 0.3144 |

| Year 2021 dummy | 0.1762 | 0.0506 | 3.482 | 0.001 | 0.0769 | 0.2755 |

| Energy efficiency rating | −0.0043 | 0.0071 | −0.599 | 0.549 | −0.0182 | 0.0096 |

| Total floor area (m2) | 0.0023 | 0.0001 | 28.209 | 0.000 | 0.0021 | 0.0025 |

| Number of rooms | 0.0179 | 0.0020 | 8.985 | 0.000 | 0.0140 | 0.0218 |

| Energy efficiency rating gap | −0.0439 | 0.0074 | −5.971 | 0.000 | −0.0584 | −0.0294 |

| Gap × 2014 | 0.0001 | 0.0063 | 0.023 | 0.981 | −0.0122 | 0.0124 |

| Gap × 2015 | 0.0102 | 0.0073 | 1.406 | 0.160 | −0.0041 | 0.0245 |

| Gap × 2016 | 0.0178 | 0.0084 | 2.132 | 0.033 | 0.0014 | 0.0342 |

| Gap × 2017 | 0.0303 | 0.0088 | 3.438 | 0.001 | 0.0130 | 0.0476 |

| Gap × 2018 | 0.0252 | 0.0094 | 2.680 | 0.007 | 0.0069 | 0.0435 |

| Gap × 2019 | 0.0357 | 0.0089 | 3.988 | 0.000 | 0.0183 | 0.0531 |

| Gap × 2020 | 0.0486 | 0.0084 | 5.788 | 0.000 | 0.0320 | 0.0652 |

| Gap × 2021 | 0.0685 | 0.0090 | 7.608 | 0.000 | 0.0508 | 0.0862 |

| Month 10 dummy | 0.0400 | 0.0068 | 5.887 | 0.000 | 0.0267 | 0.0533 |

| Month 11 dummy | 0.0547 | 0.0068 | 8.009 | 0.000 | 0.0414 | 0.0680 |

| Month 12 dummy | 0.0575 | 0.0069 | 8.282 | 0.000 | 0.0440 | 0.0710 |

| Month 2 dummy | −0.0085 | 0.0070 | −1.213 | 0.225 | −0.0222 | 0.0052 |

| Month 3 dummy | −0.0130 | 0.0066 | −1.955 | 0.051 | −0.0260 | 0.0000 |

| Month 4 dummy | 0.0036 | 0.0072 | 0.496 | 0.620 | −0.0106 | 0.0178 |

| Month 5 dummy | 0.0119 | 0.0071 | 1.666 | 0.096 | −0.0021 | 0.0259 |

| Month 6 dummy | 0.0281 | 0.0067 | 4.176 | 0.000 | 0.0150 | 0.0412 |

| Month 7 dummy | 0.0395 | 0.0068 | 5.831 | 0.000 | 0.0262 | 0.0528 |

| Month 8 dummy | 0.0367 | 0.0067 | 5.450 | 0.000 | 0.0236 | 0.0498 |

| Month 9 dummy | 0.0554 | 0.0068 | 8.128 | 0.000 | 0.0421 | 0.0687 |

| Flat × Rating | 0.0022 | 0.0069 | 0.324 | 0.746 | −0.0114 | 0.0158 |

| Semi-detached × Rating | 0.0229 | 0.0067 | 3.409 | 0.001 | 0.0098 | 0.0360 |

| Terraced × Rating | 0.0160 | 0.0065 | 2.446 | 0.014 | 0.0032 | 0.0288 |

| Flat × Gap | 0.0010 | 0.0081 | 0.121 | 0.904 | −0.0149 | 0.0169 |

| Semi-detached × Gap | 0.0056 | 0.0074 | 0.753 | 0.452 | −0.0091 | 0.0203 |

| Terraced × Gap | 0.0031 | 0.0072 | 0.427 | 0.669 | −0.0110 | 0.0172 |

| Model Statistics | ||||||

|---|---|---|---|---|---|---|

| Observations | 7950 | |||||

| R2 | 0.823 | Adjusted R2 | 0.822 | |||

| F-statistic | 815.5 | p(F-stat) | 0.000 | |||

| Variable | Coefficient | Std. Error | t-Statistic | p-Value | 95% CI Lower | 95% CI Upper |

| Constant | 0.0001 | 0.0020 | 0.043 | 0.966 | −0.0040 | 0.0042 |

| Energy efficiency × 2014 | 0.0004 | 0.0005 | 0.711 | 0.477 | −0.0006 | 0.0014 |

| Energy efficiency × 2015 | 0.0021 | 0.0007 | 3.212 | 0.001 | 0.0008 | 0.0033 |

| Energy efficiency × 2016 | 0.0025 | 0.0008 | 3.204 | 0.001 | 0.0009 | 0.0040 |

| Energy efficiency × 2017 | 0.0043 | 0.0008 | 5.344 | 0.000 | 0.0027 | 0.0058 |

| Energy efficiency × 2018 | 0.0031 | 0.0009 | 3.356 | 0.001 | 0.0013 | 0.0048 |

| Energy efficiency × 2019 | 0.0041 | 0.0009 | 4.629 | 0.000 | 0.0023 | 0.0059 |

| Energy efficiency × 2020 | 0.0041 | 0.0009 | 4.762 | 0.000 | 0.0024 | 0.0059 |

| Energy efficiency × 2021 | 0.0054 | 0.0009 | 5.915 | 0.000 | 0.0036 | 0.0071 |

| Year 2014 dummy | 0.1450 | 0.0402 | 3.610 | 0.000 | 0.0658 | 0.2242 |

| Year 2015 dummy | 0.1453 | 0.0500 | 2.904 | 0.004 | 0.0470 | 0.2436 |

| Year 2016 dummy | 0.2209 | 0.0618 | 3.574 | 0.000 | 0.0998 | 0.3420 |

| Year 2017 dummy | 0.1106 | 0.0635 | 1.741 | 0.082 | −0.0138 | 0.2350 |

| Year 2018 dummy | 0.1853 | 0.0732 | 2.531 | 0.011 | 0.0419 | 0.3287 |

| Year 2019 dummy | 0.1088 | 0.0694 | 1.568 | 0.117 | −0.0269 | 0.2446 |

| Year 2020 dummy | 0.0972 | 0.0676 | 1.439 | 0.150 | −0.0354 | 0.2299 |

| Year 2021 dummy | 0.0103 | 0.0706 | 0.146 | 0.884 | −0.1289 | 0.1496 |

| Energy efficiency score | −0.0008 | 0.0005 | −1.514 | 0.130 | −0.0019 | 0.0003 |

| Total floor area (m2) | 0.0022 | 0.0001 | 26.645 | 0.000 | 0.0021 | 0.0024 |

| Number of rooms | 0.0184 | 0.0020 | 9.151 | 0.000 | 0.0144 | 0.0224 |

| Energy efficiency gap | −0.0040 | 0.0006 | −6.879 | 0.000 | −0.0051 | −0.0029 |

| EE gap × 2014 | 0.0002 | 0.0006 | 0.348 | 0.728 | −0.0009 | 0.0013 |

| EE gap × 2015 | 0.0006 | 0.0006 | 0.966 | 0.334 | −0.0006 | 0.0018 |

| EE gap × 2016 | 0.0009 | 0.0008 | 1.142 | 0.254 | −0.0006 | 0.0024 |

| EE gap × 2017 | 0.0025 | 0.0008 | 3.029 | 0.002 | 0.0009 | 0.0041 |

| EE gap × 2018 | 0.0019 | 0.0009 | 2.038 | 0.042 | 0.0001 | 0.0037 |

| EE gap × 2019 | 0.0023 | 0.0009 | 2.489 | 0.013 | 0.0005 | 0.0041 |

| EE gap × 2020 | 0.0046 | 0.0009 | 5.114 | 0.000 | 0.0028 | 0.0064 |

| EE gap × 2021 | 0.0069 | 0.0010 | 7.188 | 0.000 | 0.0050 | 0.0088 |

| Month 10 dummy | 0.0407 | 0.0069 | 5.923 | 0.000 | 0.0272 | 0.0542 |

| Month 11 dummy | 0.0569 | 0.0069 | 8.239 | 0.000 | 0.0434 | 0.0704 |

| Month 12 dummy | 0.0567 | 0.0070 | 8.094 | 0.000 | 0.0430 | 0.0704 |

| Month 2 dummy | −0.0086 | 0.0070 | −1.223 | 0.221 | −0.0222 | 0.0050 |

| Month 3 dummy | −0.0116 | 0.0068 | −1.718 | 0.086 | −0.0249 | 0.0017 |

| Month 4 dummy | 0.0031 | 0.0072 | 0.434 | 0.664 | −0.0111 | 0.0173 |

| Month 5 dummy | 0.0125 | 0.0072 | 1.736 | 0.083 | −0.0016 | 0.0266 |

| Month 6 dummy | 0.0290 | 0.0068 | 4.268 | 0.000 | 0.0156 | 0.0424 |

| Month 7 dummy | 0.0391 | 0.0068 | 5.715 | 0.000 | 0.0257 | 0.0525 |

| Month 8 dummy | 0.0375 | 0.0068 | 5.523 | 0.000 | 0.0241 | 0.0509 |

| Month 9 dummy | 0.0544 | 0.0069 | 7.912 | 0.000 | 0.0408 | 0.0680 |

| Flat × EE score | 0.0002 | 0.0005 | 0.358 | 0.720 | −0.0008 | 0.0012 |

| Semi-detached × EE score | 0.0015 | 0.0005 | 2.967 | 0.003 | 0.0005 | 0.0025 |

| Terraced × EE score | 0.0010 | 0.0005 | 1.963 | 0.050 | 0.0000 | 0.0020 |

| Flat × EE gap | 0.0000 | 0.0006 | −0.009 | 0.993 | −0.0011 | 0.0011 |

| Semi-detached × EE gap | 0.0006 | 0.0006 | 0.984 | 0.325 | −0.0006 | 0.0018 |

| Terraced × EE gap | 0.0003 | 0.0006 | 0.449 | 0.654 | −0.0009 | 0.0015 |

| Model Statistics | ||||||

|---|---|---|---|---|---|---|

| Observations | 8205 | |||||

| R2 | 0.850 | Adjusted R2 | 0.845 | |||

| F-statistic | 152.9 | p(F-stat) | 0.000 | |||

| Variable | Coefficient | Std. Error | t-Statistic | p-Value | 95% CI Lower | 95% CI Upper |

| Constant | 0.0021 | 0.0019 | 1.117 | 0.264 | −0.0016 | 0.0058 |

| Energy efficiency × 2014 | 0.0008 | 0.0005 | 1.620 | 0.105 | −0.0002 | 0.0018 |

| Energy efficiency × 2015 | 0.0019 | 0.0006 | 3.060 | 0.002 | 0.0007 | 0.0031 |

| Energy efficiency × 2016 | 0.0018 | 0.0007 | 2.510 | 0.012 | 0.0004 | 0.0032 |

| Energy efficiency × 2017 | 0.0032 | 0.0008 | 4.128 | 0.000 | 0.0017 | 0.0047 |

| Energy efficiency × 2018 | 0.0015 | 0.0009 | 1.702 | 0.089 | −0.0002 | 0.0032 |

| Energy efficiency × 2019 | 0.0026 | 0.0009 | 3.070 | 0.002 | 0.0009 | 0.0043 |

| Energy efficiency × 2020 | 0.0031 | 0.0008 | 3.840 | 0.000 | 0.0015 | 0.0046 |

| Energy efficiency × 2021 | 0.0036 | 0.0009 | 4.170 | 0.000 | 0.0019 | 0.0053 |

| Year 2014 dummy | 0.0917 | 0.0600 | 1.527 | 0.127 | −0.0261 | 0.2095 |

| Year 2015 dummy | 0.2371 | 0.0676 | 3.509 | 0.000 | 0.1046 | 0.3696 |

| Year 2016 dummy | 0.3417 | 0.0739 | 4.619 | 0.000 | 0.1968 | 0.4866 |

| Year 2017 dummy | 0.2936 | 0.0816 | 3.600 | 0.000 | 0.1336 | 0.4536 |

| Year 2018 dummy | 0.4427 | 0.0822 | 5.385 | 0.000 | 0.2816 | 0.6038 |

| Year 2019 dummy | 0.3234 | 0.0843 | 3.836 | 0.000 | 0.1582 | 0.4886 |

| Year 2020 dummy | 0.2706 | 0.0825 | 3.280 | 0.001 | 0.1089 | 0.4323 |

| Year 2021 dummy | 0.3227 | 0.1043 | 3.093 | 0.002 | 0.1184 | 0.5270 |

| Energy efficiency score | −0.0009 | 0.0005 | −1.776 | 0.076 | −0.0019 | 0.0001 |

| Total floor area (m2) | 0.0025 | 0.0001 | 32.022 | 0.000 | 0.0023 | 0.0026 |

| Number of rooms | 0.0156 | 0.0019 | 8.320 | 0.000 | 0.0119 | 0.0193 |

| Energy efficiency gap | −0.0033 | 0.0005 | −6.048 | 0.000 | −0.0043 | −0.0023 |

| Gap × 2014 | 0.0006 | 0.0005 | 1.233 | 0.218 | −0.0004 | 0.0016 |

| Gap × 2015 | 0.0003 | 0.0006 | 0.403 | 0.687 | −0.0009 | 0.0015 |

| Gap × 2016 | 0.0001 | 0.0007 | 0.088 | 0.930 | −0.0013 | 0.0015 |

| Gap × 2017 | 0.0009 | 0.0008 | 1.066 | 0.286 | −0.0008 | 0.0026 |

| Gap × 2018 | 0.0000 | 0.0009 | 0.047 | 0.963 | −0.0018 | 0.0019 |

| Gap × 2019 | 0.0004 | 0.0008 | 0.474 | 0.635 | −0.0011 | 0.0019 |

| Gap × 2020 | 0.0028 | 0.0009 | 3.196 | 0.001 | 0.0011 | 0.0045 |

| Gap × 2021 | 0.0046 | 0.0009 | 4.944 | 0.000 | 0.0028 | 0.0064 |

| Month 10 dummy | 0.0422 | 0.0064 | 6.620 | 0.000 | 0.0296 | 0.0548 |

| Month 11 dummy | 0.0575 | 0.0064 | 8.950 | 0.000 | 0.0449 | 0.0701 |

| Month 12 dummy | 0.0602 | 0.0065 | 9.264 | 0.000 | 0.0474 | 0.0730 |

| Month 2 dummy | −0.0108 | 0.0065 | −1.656 | 0.098 | −0.0236 | 0.0020 |

| Month 3 dummy | −0.0109 | 0.0062 | −1.750 | 0.080 | −0.0230 | 0.0012 |

| Month 4 dummy | 0.0039 | 0.0068 | 0.573 | 0.567 | −0.0095 | 0.0173 |

| Month 5 dummy | 0.0168 | 0.0067 | 2.513 | 0.012 | 0.0037 | 0.0299 |

| Month 6 dummy | 0.0336 | 0.0063 | 5.309 | 0.000 | 0.0211 | 0.0461 |

| Month 7 dummy | 0.0408 | 0.0064 | 6.415 | 0.000 | 0.0282 | 0.0534 |

| Month 8 dummy | 0.0409 | 0.0063 | 6.484 | 0.000 | 0.0285 | 0.0533 |

| Month 9 dummy | 0.0567 | 0.0064 | 8.860 | 0.000 | 0.0441 | 0.0693 |

| Flat × EE score | 0.0009 | 0.0005 | 1.870 | 0.062 | 0.0000 | 0.0018 |

| Semi-detached × EE score | 0.0018 | 0.0005 | 3.723 | 0.000 | 0.0009 | 0.0027 |

| Terraced × EE score | 0.0017 | 0.0005 | 3.588 | 0.000 | 0.0007 | 0.0027 |

| Flat × Gap | −0.0003 | 0.0006 | −0.585 | 0.558 | −0.0015 | 0.0008 |

| Semi-detached × Gap | 0.0006 | 0.0006 | 1.094 | 0.274 | −0.0005 | 0.0017 |

| Terraced × Gap | 0.0002 | 0.0006 | 0.343 | 0.732 | −0.0009 | 0.0013 |

| Variable (Borough × Year fixed effects) | Coefficient | Std. Err. | t-stat | p-value | 95% CI (Lower) | 95% CI (Upper) |

| borough_Barnet × year_2014 | −0.0073 | 0.049 | −0.149 | 0.882 | −0.103 | 0.088 |

| borough_Barnet × year_2015 | −0.0828 | 0.051 | −1.615 | 0.106 | −0.183 | 0.018 |

| borough_Barnet × year_2016 | −0.1421 | 0.048 | −2.965 | 0.003 | −0.236 | −0.048 |

| borough_Barnet × year_2017 | −0.1335 | 0.057 | −2.324 | 0.02 | −0.246 | −0.021 |

| borough_Barnet × year_2018 | −0.1782 | 0.052 | −3.397 | 0.001 | −0.281 | −0.075 |

| borough_Barnet × year_2019 | −0.1364 | 0.055 | −2.499 | 0.012 | −0.243 | −0.029 |

| borough_Barnet × year_2020 | −0.1176 | 0.056 | −2.105 | 0.035 | −0.227 | −0.008 |

| borough_Barnet × year_2021 | −0.2239 | 0.081 | −2.755 | 0.006 | −0.383 | −0.065 |

| borough_Bexley × year_2014 | 0.0148 | 0.049 | 0.302 | 0.763 | −0.081 | 0.111 |

| borough_Bexley × year_2015 | −0.0195 | 0.052 | −0.376 | 0.707 | −0.122 | 0.082 |

| borough_Bexley × year_2016 | −0.0134 | 0.051 | −0.264 | 0.792 | −0.113 | 0.086 |

| borough_Bexley × year_2017 | −0.0154 | 0.058 | −0.267 | 0.79 | −0.129 | 0.098 |

| borough_Bexley × year_2018 | 0.0018 | 0.052 | 0.035 | 0.972 | −0.1 | 0.103 |

| borough_Bexley × year_2019 | 0.0343 | 0.055 | 0.621 | 0.535 | −0.074 | 0.143 |

| borough_Bexley × year_2020 | 0.0508 | 0.055 | 0.93 | 0.352 | −0.056 | 0.158 |

| borough_Bexley × year_2021 | −0.0315 | 0.082 | −0.383 | 0.701 | −0.193 | 0.13 |

| borough_Brent × year_2014 | 0.1079 | 0.058 | 1.858 | 0.063 | −0.006 | 0.222 |

| borough_Brent × year_2015 | 0.02 | 0.06 | 0.334 | 0.738 | −0.097 | 0.137 |

| borough_Brent × year_2016 | −0.0743 | 0.064 | −1.157 | 0.247 | −0.2 | 0.052 |

| borough_Brent × year_2017 | −0.0743 | 0.066 | −1.129 | 0.259 | −0.203 | 0.055 |

| borough_Brent × year_2018 | −0.1263 | 0.059 | −2.156 | 0.031 | −0.241 | −0.011 |

| borough_Brent × year_2019 | −0.0026 | 0.062 | −0.041 | 0.967 | −0.125 | 0.12 |

| borough_Brent × year_2020 | −0.022 | 0.065 | −0.34 | 0.734 | −0.149 | 0.105 |

| borough_Brent × year_2021 | −0.1376 | 0.087 | −1.581 | 0.114 | −0.308 | 0.033 |

| borough_Bromley × year_2014 | 0.0251 | 0.047 | 0.533 | 0.594 | −0.067 | 0.118 |

| borough_Bromley × year_2015 | −0.0599 | 0.049 | −1.215 | 0.224 | −0.157 | 0.037 |

| borough_Bromley × year_2016 | −0.0301 | 0.046 | −0.651 | 0.515 | −0.121 | 0.061 |

| borough_Bromley × year_2017 | −0.065 | 0.055 | −1.182 | 0.237 | −0.173 | 0.043 |

| borough_Bromley × year_2018 | −0.1005 | 0.049 | −2.04 | 0.041 | −0.197 | −0.004 |

| borough_Bromley × year_2019 | −0.0539 | 0.053 | −1.019 | 0.308 | −0.157 | 0.05 |

| borough_Bromley × year_2020 | −0.0263 | 0.053 | −0.497 | 0.619 | −0.13 | 0.077 |

| borough_Bromley × year_2021 | −0.1185 | 0.08 | −1.477 | 0.14 | −0.276 | 0.039 |

| borough_Camden × year_2014 | −0.0534 | 0.065 | −0.819 | 0.413 | −0.181 | 0.074 |

| borough_Camden × year_2015 | −0.1183 | 0.069 | −1.722 | 0.085 | −0.253 | 0.016 |

| borough_Camden × year_2016 | −0.2534 | 0.069 | −3.693 | 0 | −0.388 | −0.119 |

| borough_Camden × year_2017 | −0.3096 | 0.072 | −4.33 | 0 | −0.45 | −0.169 |

| borough_Camden × year_2018 | −0.2911 | 0.075 | −3.895 | 0 | −0.438 | −0.145 |

| borough_Camden × year_2019 | −0.245 | 0.067 | −3.648 | 0 | −0.377 | −0.113 |

| borough_Camden × year_2020 | −0.2585 | 0.064 | −4.014 | 0 | −0.385 | −0.132 |

| borough_Camden × year_2021 | −0.4137 | 0.093 | −4.472 | 0 | −0.595 | −0.232 |

| borough_City of London × year_2014 | 0 | 0 | −1.991 | 0.047 | 0 | 0 |

| borough_City of London × year_2015 | 0.1023 | 0.092 | 1.117 | 0.264 | −0.077 | 0.282 |

| borough_City of London × year_2016 | 0 | 0 | −1.326 | 0.185 | 0 | 0 |

| borough_City of London × year_2017 | 0 | 0 | 1.44 | 0.15 | 0 | 0 |

| borough_City of London × year_2018 | 0 | 0 | 1.429 | 0.153 | 0 | 0 |

| borough_City of London × year_2019 | 0 | 0 | 1.439 | 0.15 | 0 | 0 |

| borough_City of London × year_2020 | 0 | 0 | −2.042 | 0.041 | 0 | 0 |

| borough_City of London × year_2021 | −0.1023 | 0.092 | −1.117 | 0.264 | −0.282 | 0.077 |

| borough_City of Westminster × year_2014 | −0.1872 | 0.069 | −2.699 | 0.007 | −0.323 | −0.051 |

| borough_City of Westminster × year_2015 | −0.1987 | 0.065 | −3.041 | 0.002 | −0.327 | −0.071 |

| borough_City of Westminster × year_2016 | −0.1585 | 0.072 | −2.211 | 0.027 | −0.299 | −0.018 |

| borough_City of Westminster × year_2017 | −0.3131 | 0.075 | −4.16 | 0 | −0.461 | −0.166 |

| borough_City of Westminster × year_2018 | −0.3481 | 0.071 | −4.932 | 0 | −0.486 | −0.21 |

| borough_City of Westminster × year_2019 | −0.3218 | 0.077 | −4.184 | 0 | −0.473 | −0.171 |

| borough_City of Westminster × year_2020 | −0.2858 | 0.07 | −4.063 | 0 | −0.424 | −0.148 |

| borough_City of Westminster × year_2021 | −0.323 | 0.095 | −3.415 | 0.001 | −0.508 | −0.138 |

| borough_Croydon × year_2014 | 0.0177 | 0.048 | 0.368 | 0.713 | −0.077 | 0.112 |

| borough_Croydon × year_2015 | −0.0398 | 0.05 | −0.799 | 0.425 | −0.137 | 0.058 |

| borough_Croydon × year_2016 | −0.027 | 0.047 | −0.574 | 0.566 | −0.119 | 0.065 |

| borough_Croydon × year_2017 | −0.036 | 0.057 | −0.634 | 0.526 | −0.147 | 0.075 |

| borough_Croydon × year_2018 | −0.0936 | 0.05 | −1.855 | 0.064 | −0.192 | 0.005 |

| borough_Croydon × year_2019 | −0.0465 | 0.054 | −0.855 | 0.393 | −0.153 | 0.06 |

| borough_Croydon × year_2020 | −0.0437 | 0.054 | −0.808 | 0.419 | −0.15 | 0.062 |

| borough_Croydon × year_2021 | −0.0997 | 0.081 | −1.229 | 0.219 | −0.259 | 0.059 |

| borough_Ealing × year_2014 | 0.0629 | 0.052 | 1.215 | 0.224 | −0.039 | 0.164 |

| borough_Ealing × year_2015 | −0.0155 | 0.054 | −0.285 | 0.776 | −0.122 | 0.091 |

| borough_Ealing × year_2016 | −0.0438 | 0.052 | −0.848 | 0.397 | −0.145 | 0.057 |

| borough_Ealing × year_2017 | −0.1112 | 0.059 | −1.871 | 0.061 | −0.228 | 0.005 |

| borough_Ealing × year_2018 | −0.1091 | 0.055 | −1.969 | 0.049 | −0.218 | 0 |

| borough_Ealing × year_2019 | −0.1577 | 0.058 | −2.708 | 0.007 | −0.272 | −0.044 |

| borough_Ealing × year_2020 | −0.1058 | 0.058 | −1.839 | 0.066 | −0.219 | 0.007 |

| borough_Ealing × year_2021 | −0.2135 | 0.083 | −2.577 | 0.01 | −0.376 | −0.051 |

| borough_Enfield × year_2014 | −0.0544 | 0.054 | −1.009 | 0.313 | −0.16 | 0.051 |

| borough_Enfield × year_2015 | −0.0706 | 0.056 | −1.271 | 0.204 | −0.179 | 0.038 |

| borough_Enfield × year_2016 | −0.0716 | 0.054 | −1.32 | 0.187 | −0.178 | 0.035 |

| borough_Enfield × year_2017 | −0.0875 | 0.064 | −1.37 | 0.171 | −0.213 | 0.038 |

| borough_Enfield × year_2018 | −0.1394 | 0.061 | −2.292 | 0.022 | −0.259 | −0.02 |

| borough_Enfield × year_2019 | −0.1073 | 0.059 | −1.814 | 0.07 | −0.223 | 0.009 |

| borough_Enfield × year_2020 | −0.1266 | 0.058 | −2.175 | 0.03 | −0.241 | −0.012 |

| borough_Enfield × year_2021 | −0.1919 | 0.085 | −2.258 | 0.024 | −0.358 | −0.025 |

| borough_Greenwich × year_2014 | 0.0681 | 0.051 | 1.346 | 0.178 | −0.031 | 0.167 |

| borough_Greenwich × year_2015 | 0.0033 | 0.053 | 0.062 | 0.95 | −0.1 | 0.107 |

| borough_Greenwich × year_2016 | 0.0317 | 0.051 | 0.621 | 0.535 | −0.069 | 0.132 |

| borough_Greenwich × year_2017 | 0.0309 | 0.059 | 0.528 | 0.598 | −0.084 | 0.146 |

| borough_Greenwich × year_2018 | −0.0059 | 0.054 | −0.109 | 0.913 | −0.111 | 0.1 |

| borough_Greenwich × year_2019 | −0.0191 | 0.057 | −0.334 | 0.738 | −0.131 | 0.093 |

| borough_Greenwich × year_2020 | −0.0025 | 0.056 | −0.044 | 0.965 | −0.112 | 0.107 |

| borough_Greenwich × year_2021 | −0.0877 | 0.082 | −1.066 | 0.286 | −0.249 | 0.074 |

| borough_Hackney × year_2014 | 0.0243 | 0.061 | 0.4 | 0.689 | −0.095 | 0.143 |

| borough_Hackney × year_2015 | −0.0999 | 0.064 | −1.558 | 0.119 | −0.226 | 0.026 |

| borough_Hackney × year_2016 | −0.199 | 0.063 | −3.139 | 0.002 | −0.323 | −0.075 |

| borough_Hackney × year_2017 | −0.0891 | 0.076 | −1.171 | 0.242 | −0.238 | 0.06 |

| borough_Hackney × year_2018 | −0.1921 | 0.064 | −3.017 | 0.003 | −0.317 | −0.067 |

| borough_Hackney × year_2019 | −0.0353 | 0.068 | −0.521 | 0.603 | −0.168 | 0.098 |

| borough_Hackney × year_2020 | −0.0823 | 0.063 | −1.305 | 0.192 | −0.206 | 0.041 |

| borough_Hackney × year_2021 | −0.1727 | 0.087 | −1.977 | 0.048 | −0.344 | −0.001 |

| borough_Hammersmith & Fulham × year_2014 | 0.0324 | 0.054 | 0.6 | 0.548 | −0.073 | 0.138 |

| borough_Hammersmith & Fulham × year_2015 | −0.0498 | 0.055 | −0.905 | 0.366 | −0.158 | 0.058 |

| borough_Hammersmith & Fulham × year_2016 | −0.1185 | 0.056 | −2.126 | 0.034 | −0.228 | −0.009 |

| borough_Hammersmith & Fulham × year_2017 | −0.2211 | 0.063 | −3.492 | 0 | −0.345 | −0.097 |

| borough_Hammersmith & Fulham × year_2018 | −0.319 | 0.06 | −5.353 | 0 | −0.436 | −0.202 |

| borough_Hammersmith & Fulham × year_2019 | −0.294 | 0.059 | −4.968 | 0 | −0.41 | −0.178 |

| borough_Hammersmith & Fulham × year_2020 | −0.2206 | 0.06 | −3.647 | 0 | −0.339 | −0.102 |

| borough_Hammersmith & Fulham × year_2021 | −0.3374 | 0.086 | −3.925 | 0 | −0.506 | −0.169 |

| borough_Haringey × year_2014 | 0.083 | 0.054 | 1.537 | 0.124 | −0.023 | 0.189 |

| borough_Haringey × year_2015 | −0.0542 | 0.056 | −0.967 | 0.334 | −0.164 | 0.056 |

| borough_Haringey × year_2016 | −0.0266 | 0.054 | −0.495 | 0.621 | −0.132 | 0.079 |

| borough_Haringey × year_2017 | −0.0303 | 0.062 | −0.485 | 0.628 | −0.153 | 0.092 |

| borough_Haringey × year_2018 | −0.0882 | 0.057 | −1.56 | 0.119 | −0.199 | 0.023 |

| borough_Haringey × year_2019 | −0.0939 | 0.06 | −1.578 | 0.115 | −0.211 | 0.023 |

| borough_Haringey × year_2020 | −0.0954 | 0.059 | −1.611 | 0.107 | −0.212 | 0.021 |

| borough_Haringey × year_2021 | −0.1025 | 0.085 | −1.21 | 0.226 | −0.268 | 0.063 |

| borough_Harrow × year_2014 | −0.0058 | 0.054 | −0.108 | 0.914 | −0.111 | 0.1 |

| borough_Harrow × year_2015 | −0.0663 | 0.056 | −1.184 | 0.236 | −0.176 | 0.043 |

| borough_Harrow × year_2016 | −0.0424 | 0.054 | −0.791 | 0.429 | −0.148 | 0.063 |

| borough_Harrow × year_2017 | −0.0865 | 0.063 | −1.382 | 0.167 | −0.209 | 0.036 |

| borough_Harrow × year_2018 | −0.1871 | 0.06 | −3.132 | 0.002 | −0.304 | −0.07 |

| borough_Harrow × year_2019 | −0.1117 | 0.059 | −1.904 | 0.057 | −0.227 | 0.003 |

| borough_Harrow × year_2020 | −0.1357 | 0.063 | −2.162 | 0.031 | −0.259 | −0.013 |

| borough_Harrow × year_2021 | −0.1404 | 0.084 | −1.665 | 0.096 | −0.306 | 0.025 |

| borough_Havering × year_2014 | 0.0055 | 0.048 | 0.115 | 0.908 | −0.089 | 0.1 |

| borough_Havering × year_2015 | −0.0765 | 0.051 | −1.51 | 0.131 | −0.176 | 0.023 |

| borough_Havering × year_2016 | −0.0171 | 0.047 | −0.364 | 0.716 | −0.109 | 0.075 |

| borough_Havering × year_2017 | −0.003 | 0.056 | −0.053 | 0.958 | −0.113 | 0.107 |

| borough_Havering × year_2018 | −0.0517 | 0.05 | −1.025 | 0.305 | −0.15 | 0.047 |

| borough_Havering × year_2019 | −0.0048 | 0.054 | −0.089 | 0.929 | −0.11 | 0.101 |

| borough_Havering × year_2020 | 0.0072 | 0.054 | 0.134 | 0.893 | −0.099 | 0.113 |

| borough_Havering × year_2021 | −0.0387 | 0.081 | −0.477 | 0.633 | −0.198 | 0.12 |

| borough_Hillingdon × year_2014 | −0.0382 | 0.051 | −0.745 | 0.456 | −0.139 | 0.062 |

| borough_Hillingdon × year_2015 | −0.097 | 0.052 | −1.852 | 0.064 | −0.2 | 0.006 |

| borough_Hillingdon × year_2016 | −0.0931 | 0.051 | −1.835 | 0.067 | −0.193 | 0.006 |

| borough_Hillingdon × year_2017 | −0.0891 | 0.058 | −1.527 | 0.127 | −0.203 | 0.025 |

| borough_Hillingdon × year_2018 | −0.1264 | 0.052 | −2.415 | 0.016 | −0.229 | −0.024 |

| borough_Hillingdon × year_2019 | −0.1147 | 0.056 | −2.043 | 0.041 | −0.225 | −0.005 |

| borough_Hillingdon × year_2020 | −0.0806 | 0.056 | −1.438 | 0.15 | −0.191 | 0.029 |

| borough_Hillingdon × year_2021 | −0.1666 | 0.083 | −2.013 | 0.044 | −0.329 | −0.004 |

| borough_Hounslow × year_2014 | 0.0026 | 0.055 | 0.047 | 0.962 | −0.104 | 0.11 |

| borough_Hounslow × year_2015 | −0.1166 | 0.058 | −2.01 | 0.044 | −0.23 | −0.003 |

| borough_Hounslow × year_2016 | −0.0574 | 0.056 | −1.023 | 0.306 | −0.168 | 0.053 |

| borough_Hounslow × year_2017 | −0.1422 | 0.067 | −2.138 | 0.033 | −0.273 | −0.012 |

| borough_Hounslow × year_2018 | −0.212 | 0.06 | −3.53 | 0 | −0.33 | −0.094 |

| borough_Hounslow × year_2019 | −0.173 | 0.064 | −2.684 | 0.007 | −0.299 | −0.047 |

| borough_Hounslow × year_2020 | −0.1681 | 0.06 | −2.819 | 0.005 | −0.285 | −0.051 |

| borough_Hounslow × year_2021 | −0.205 | 0.086 | −2.392 | 0.017 | −0.373 | −0.037 |

| borough_Islington × year_2014 | 0.0305 | 0.06 | 0.504 | 0.614 | −0.088 | 0.149 |

| borough_Islington × year_2015 | −0.1031 | 0.066 | −1.572 | 0.116 | −0.232 | 0.025 |

| borough_Islington × year_2016 | −0.1079 | 0.064 | −1.686 | 0.092 | −0.233 | 0.018 |

| borough_Islington × year_2017 | −0.3481 | 0.082 | −4.243 | 0 | −0.509 | −0.187 |

| borough_Islington × year_2018 | −0.1938 | 0.069 | −2.813 | 0.005 | −0.329 | −0.059 |

| borough_Islington × year_2019 | −0.1654 | 0.068 | −2.432 | 0.015 | −0.299 | −0.032 |

| borough_Islington × year_2020 | −0.1954 | 0.062 | −3.158 | 0.002 | −0.317 | −0.074 |

| borough_Islington × year_2021 | −0.223 | 0.092 | −2.425 | 0.015 | −0.403 | −0.043 |

| borough_Kensington & Chelsea × year_2014 | 0.0382 | 0.057 | 0.675 | 0.5 | −0.073 | 0.149 |

| borough_Kensington & Chelsea × year_2015 | −0.3271 | 0.064 | −5.138 | 0 | −0.452 | −0.202 |

| borough_Kensington & Chelsea × year_2016 | −0.2633 | 0.063 | −4.199 | 0 | −0.386 | −0.14 |

| borough_Kensington & Chelsea × year_2017 | −0.1328 | 0.066 | −2.005 | 0.045 | −0.263 | −0.003 |

| borough_Kensington & Chelsea × year_2018 | −0.2615 | 0.073 | −3.587 | 0 | −0.404 | −0.119 |

| borough_Kensington & Chelsea × year_2019 | −0.2438 | 0.06 | −4.03 | 0 | −0.362 | −0.125 |

| borough_Kensington & Chelsea × year_2020 | −0.3025 | 0.063 | −4.822 | 0 | −0.425 | −0.18 |

| borough_Kensington & Chelsea × year_2021 | −0.438 | 0.087 | −5.045 | 0 | −0.608 | −0.268 |

| borough_Kingston upon Thames × year_2014 | 0.0305 | 0.049 | 0.618 | 0.536 | −0.066 | 0.127 |

| borough_Kingston upon Thames × year_2015 | −0.0945 | 0.051 | −1.836 | 0.066 | −0.195 | 0.006 |

| borough_Kingston upon Thames × year_2016 | −0.1295 | 0.048 | −2.673 | 0.008 | −0.224 | −0.035 |

| borough_Kingston upon Thames × year_2017 | −0.1344 | 0.058 | −2.33 | 0.02 | −0.247 | −0.021 |

| borough_Kingston upon Thames × year_2018 | −0.1532 | 0.052 | −2.927 | 0.003 | −0.256 | −0.051 |

| borough_Kingston upon Thames × year_2019 | −0.1116 | 0.056 | −2.011 | 0.044 | −0.22 | −0.003 |

| borough_Kingston upon Thames × year_2020 | −0.1371 | 0.055 | −2.475 | 0.013 | −0.246 | −0.029 |

| borough_Kingston upon Thames × year_2021 | −0.2087 | 0.081 | −2.562 | 0.01 | −0.368 | −0.049 |

| borough_Lambeth × year_2014 | 0.0634 | 0.051 | 1.234 | 0.217 | −0.037 | 0.164 |

| borough_Lambeth × year_2015 | −0.0521 | 0.053 | −0.983 | 0.325 | −0.156 | 0.052 |

| borough_Lambeth × year_2016 | −0.0202 | 0.051 | −0.392 | 0.695 | −0.121 | 0.081 |

| borough_Lambeth × year_2017 | −0.0462 | 0.059 | −0.777 | 0.437 | −0.163 | 0.07 |

| borough_Lambeth × year_2018 | −0.1208 | 0.055 | −2.189 | 0.029 | −0.229 | −0.013 |

| borough_Lambeth × year_2019 | −0.0799 | 0.056 | −1.427 | 0.154 | −0.19 | 0.03 |

| borough_Lambeth × year_2020 | −0.0819 | 0.056 | −1.472 | 0.141 | −0.191 | 0.027 |

| borough_Lambeth × year_2021 | −0.1523 | 0.082 | −1.857 | 0.063 | −0.313 | 0.008 |

| borough_Lewisham × year_2014 | 0.0539 | 0.05 | 1.083 | 0.279 | −0.044 | 0.151 |

| borough_Lewisham × year_2015 | −0.0438 | 0.052 | −0.847 | 0.397 | −0.145 | 0.058 |

| borough_Lewisham × year_2016 | 0.0031 | 0.05 | 0.063 | 0.95 | −0.095 | 0.101 |

| borough_Lewisham × year_2017 | −0.0554 | 0.058 | −0.953 | 0.341 | −0.169 | 0.059 |

| borough_Lewisham × year_2018 | −0.0713 | 0.052 | −1.359 | 0.174 | −0.174 | 0.032 |

| borough_Lewisham × year_2019 | −0.0115 | 0.055 | −0.209 | 0.834 | −0.119 | 0.096 |

| borough_Lewisham × year_2020 | −0.0322 | 0.054 | −0.592 | 0.554 | −0.139 | 0.074 |

| borough_Lewisham × year_2021 | −0.1072 | 0.082 | −1.313 | 0.189 | −0.267 | 0.053 |

| borough_Merton × year_2014 | 0.044 | 0.05 | 0.888 | 0.374 | −0.053 | 0.141 |

| borough_Merton × year_2015 | −0.0385 | 0.051 | −0.749 | 0.454 | −0.139 | 0.062 |

| borough_Merton × year_2016 | −0.0495 | 0.049 | −1.019 | 0.308 | −0.145 | 0.046 |

| borough_Merton × year_2017 | −0.0879 | 0.058 | −1.512 | 0.131 | −0.202 | 0.026 |

| borough_Merton × year_2018 | −0.1622 | 0.054 | −2.981 | 0.003 | −0.269 | −0.056 |

| borough_Merton × year_2019 | −0.1128 | 0.056 | −2.022 | 0.043 | −0.222 | −0.003 |

| borough_Merton × year_2020 | −0.0993 | 0.055 | −1.814 | 0.07 | −0.207 | 0.008 |

| borough_Merton × year_2021 | −0.1759 | 0.082 | −2.154 | 0.031 | −0.336 | −0.016 |

| borough_Newham × year_2014 | 0.1522 | 0.06 | 2.516 | 0.012 | 0.034 | 0.271 |

| borough_Newham × year_2015 | −0.0908 | 0.068 | −1.337 | 0.181 | −0.224 | 0.042 |

| borough_Newham × year_2016 | 0.025 | 0.065 | 0.382 | 0.703 | −0.103 | 0.153 |

| borough_Newham × year_2017 | 0.0697 | 0.075 | 0.934 | 0.35 | −0.077 | 0.216 |

| borough_Newham × year_2018 | 0.0853 | 0.07 | 1.216 | 0.224 | −0.052 | 0.223 |

| borough_Newham × year_2019 | 0.1037 | 0.068 | 1.53 | 0.126 | −0.029 | 0.237 |

| borough_Newham × year_2020 | 0.0773 | 0.067 | 1.148 | 0.251 | −0.055 | 0.209 |

| borough_Newham × year_2021 | −0.0587 | 0.094 | −0.622 | 0.534 | −0.244 | 0.126 |

| borough_Redbridge × year_2014 | −0.009 | 0.053 | −0.171 | 0.865 | −0.112 | 0.094 |

| borough_Redbridge × year_2015 | −0.0986 | 0.058 | −1.702 | 0.089 | −0.212 | 0.015 |

| borough_Redbridge × year_2016 | −0.0148 | 0.052 | −0.283 | 0.777 | −0.117 | 0.087 |

| borough_Redbridge × year_2017 | −0.0061 | 0.062 | −0.097 | 0.922 | −0.128 | 0.116 |

| borough_Redbridge × year_2018 | −0.097 | 0.057 | −1.711 | 0.087 | −0.208 | 0.014 |

| borough_Redbridge × year_2019 | −0.0631 | 0.059 | −1.069 | 0.285 | −0.179 | 0.053 |

| borough_Redbridge × year_2020 | −0.0601 | 0.059 | −1.01 | 0.313 | −0.177 | 0.057 |

| borough_Redbridge × year_2021 | −0.1005 | 0.089 | −1.133 | 0.257 | −0.275 | 0.073 |

| borough_Richmond upon Thames × year_2014 | −0.0001 | 0.049 | −0.003 | 0.998 | −0.096 | 0.095 |

| borough_Richmond upon Thames × year_2015 | −0.112 | 0.05 | −2.229 | 0.026 | −0.21 | −0.013 |

| borough_Richmond upon Thames × year_2016 | −0.1539 | 0.048 | −3.182 | 0.001 | −0.249 | −0.059 |

| borough_Richmond upon Thames × year_2017 | −0.1727 | 0.057 | −3.022 | 0.003 | −0.285 | −0.061 |

| borough_Richmond upon Thames × year_2018 | −0.2375 | 0.052 | −4.585 | 0 | −0.339 | −0.136 |

| borough_Richmond upon Thames × year_2019 | −0.2008 | 0.054 | −3.693 | 0 | −0.307 | −0.094 |

| borough_Richmond upon Thames × year_2020 | −0.1969 | 0.054 | −3.631 | 0 | −0.303 | −0.091 |

| borough_Richmond upon Thames × year_2021 | −0.242 | 0.081 | −2.972 | 0.003 | −0.402 | −0.082 |

| borough_Southwark × year_2014 | 0.0723 | 0.052 | 1.391 | 0.164 | −0.03 | 0.174 |

| borough_Southwark × year_2015 | −0.042 | 0.053 | −0.794 | 0.427 | −0.146 | 0.062 |

| borough_Southwark × year_2016 | −0.0371 | 0.052 | −0.707 | 0.48 | −0.14 | 0.066 |

| borough_Southwark × year_2017 | −0.0528 | 0.061 | −0.87 | 0.384 | −0.172 | 0.066 |

| borough_Southwark × year_2018 | −0.1168 | 0.054 | −2.151 | 0.032 | −0.223 | −0.01 |

| borough_Southwark × year_2019 | −0.051 | 0.057 | −0.892 | 0.373 | −0.163 | 0.061 |

| borough_Southwark × year_2020 | −0.0109 | 0.056 | −0.196 | 0.844 | −0.12 | 0.098 |

| borough_Southwark × year_2021 | −0.1174 | 0.083 | −1.408 | 0.159 | −0.281 | 0.046 |

| borough_Sutton × year_2014 | −0.0044 | 0.048 | −0.091 | 0.927 | −0.099 | 0.09 |

| borough_Sutton × year_2015 | −0.0876 | 0.05 | −1.738 | 0.082 | −0.186 | 0.011 |

| borough_Sutton × year_2016 | −0.0733 | 0.047 | −1.549 | 0.121 | −0.166 | 0.019 |

| borough_Sutton × year_2017 | −0.0736 | 0.056 | −1.32 | 0.187 | −0.183 | 0.036 |

| borough_Sutton × year_2018 | −0.1269 | 0.051 | −2.505 | 0.012 | −0.226 | −0.028 |

| borough_Sutton × year_2019 | −0.0936 | 0.054 | −1.743 | 0.081 | −0.199 | 0.012 |

| borough_Sutton × year_2020 | −0.0801 | 0.054 | −1.486 | 0.137 | −0.186 | 0.026 |

| borough_Sutton × year_2021 | −0.1615 | 0.081 | −1.998 | 0.046 | −0.32 | −0.003 |

| borough_Tower Hamlets × year_2014 | 0.0123 | 0.064 | 0.191 | 0.849 | −0.114 | 0.138 |

| borough_Tower Hamlets × year_2015 | −0.1471 | 0.068 | −2.178 | 0.029 | −0.279 | −0.015 |

| borough_Tower Hamlets × year_2016 | −0.0105 | 0.071 | −0.147 | 0.883 | −0.15 | 0.129 |

| borough_Tower Hamlets × year_2017 | −0.2379 | 0.083 | −2.859 | 0.004 | −0.401 | −0.075 |

| borough_Tower Hamlets × year_2018 | −0.1448 | 0.087 | −1.67 | 0.095 | −0.315 | 0.025 |

| borough_Tower Hamlets × year_2019 | −0.1632 | 0.075 | −2.169 | 0.03 | −0.311 | −0.016 |

| borough_Tower Hamlets × year_2020 | −0.1394 | 0.066 | −2.103 | 0.035 | −0.269 | −0.009 |

| borough_Tower Hamlets × year_2021 | −0.2135 | 0.086 | −2.473 | 0.013 | −0.383 | −0.044 |

| borough_Waltham Forest × year_2014 | 0.136 | 0.05 | 2.731 | 0.006 | 0.038 | 0.234 |

| borough_Waltham Forest × year_2015 | 0.0056 | 0.053 | 0.105 | 0.916 | −0.098 | 0.109 |

| borough_Waltham Forest × year_2016 | 0.1144 | 0.049 | 2.328 | 0.02 | 0.018 | 0.211 |

| borough_Waltham Forest × year_2017 | 0.0963 | 0.059 | 1.635 | 0.102 | −0.019 | 0.212 |

| borough_Waltham Forest × year_2018 | 0.0566 | 0.052 | 1.086 | 0.278 | −0.046 | 0.159 |

| borough_Waltham Forest × year_2019 | 0.1304 | 0.057 | 2.29 | 0.022 | 0.019 | 0.242 |

| borough_Waltham Forest × year_2020 | 0.1132 | 0.058 | 1.966 | 0.049 | 0 | 0.226 |

| borough_Waltham Forest × year_2021 | 0.0565 | 0.083 | 0.683 | 0.495 | −0.106 | 0.219 |

| borough_Wandsworth × year_2014 | −0.0109 | 0.048 | −0.226 | 0.821 | −0.105 | 0.083 |

| borough_Wandsworth × year_2015 | −0.1351 | 0.05 | −2.683 | 0.007 | −0.234 | −0.036 |

| borough_Wandsworth × year_2016 | −0.1656 | 0.047 | −3.509 | 0 | −0.258 | −0.073 |

| borough_Wandsworth × year_2017 | −0.2157 | 0.057 | −3.8 | 0 | −0.327 | −0.104 |

| borough_Wandsworth × year_2018 | −0.2654 | 0.05 | −5.285 | 0 | −0.364 | −0.167 |

| borough_Wandsworth × year_2019 | −0.2347 | 0.054 | −4.359 | 0 | −0.34 | −0.129 |

| borough_Wandsworth × year_2020 | −0.2121 | 0.053 | −3.971 | 0 | −0.317 | −0.107 |

| borough_Wandsworth × year_2021 | −0.3142 | 0.08 | −3.904 | 0 | −0.472 | −0.156 |

References

- Brounen, D.; Kok, N. On the economics of energy labels in the housing market. J. Environ. Econ. Manag. 2011, 62, 166–179. [Google Scholar] [CrossRef]

- Hyland, M.; Lyons, R.C.; Lyons, S. The value of domestic building energy efficiency—Evidence from Ireland. Energy Econ. 2013, 40, 943–952. [Google Scholar] [CrossRef]

- de Ayala, A.; Galarraga, I.; Spadaro, J.V. The price of energy efficiency in the Spanish housing market. Energy Policy 2016, 94, 16–24. [Google Scholar] [CrossRef]

- Kholodilin, K.; Mense, A.; Michelsen, C. The market value of energy efficiency in buildings and the mode of tenure. Urban Stud. 2017, 54, 3218–3238. [Google Scholar] [CrossRef]

- Aydin, E.; Brounen, D.; Kok, N. The capitalization of energy efficiency: Evidence from the housing market. J. Urban Econ. 2020, 117, 103243. [Google Scholar] [CrossRef]

- Copiello, S.; Donati, E. Is investing in energy efficiency worth it? Evidence for substantial price premiums but limited profitability in the housing sector. Energy Build. 2021, 251, 111371. [Google Scholar] [CrossRef]

- McCord, M.; Davis, P.; McCord, J.; Haran, M.; Davison, K. An exploratory investigation into the relationship between energy performance certificates and sales price: A polytomous universal model approach. J. Financ. Manag. Prop. Constr. 2020, 25, 247–271. [Google Scholar] [CrossRef]

- Massimo, D.E.; De Paola, P.; Musolino, M.; Malerba, A.; Del Giudice, F.P. Green and gold buildings? Detecting real estate market premium for green buildings through evolutionary polynomial regression. Buildings. 2022, 12, 621. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Does energy efficiency matter to home-buyers? An investigation of EPC ratings and transaction prices in England. Energy Econ. 2015, 48, 145–156. [Google Scholar] [CrossRef]

- Fuerst, F.; Haddad, M.F.C.; Adan, H. Is there an economic case for energy-efficient dwellings in the UK private rental market? J. Clean. Prod. 2020, 245, 118642. [Google Scholar] [CrossRef]

- Onishi, J.; Deng, Y.; Shimizu, C. Green premium in the Tokyo office rent market. Sustainability. 2021, 13, 12227. [Google Scholar] [CrossRef]

- Aroul, R.; Hansz, J.A. The value of “Green”: Evidence from the first mandatory residential green building program. J. Real Estate Res. 2012, 34, 27–50. [Google Scholar] [CrossRef]

- Zhang, L.; Liu, H.; Wu, J. The price premium for green-labelled housing: Evidence from China. Urban Stud. 2017, 54, 3524–3541. [Google Scholar] [CrossRef]

- Dell’Anna, F.; Bottero, M. Green premium in buildings: Evidence from the real estate market of Singapore. J. Clean. Prod. 2021, 286, 125327. [Google Scholar] [CrossRef]

- Kahn, M.E.; Kok, N. The capitalization of green labels in the California housing market. Reg. Sci. Urban Econ. 2014, 47, 25–34. [Google Scholar] [CrossRef]

- Mesthrige Jayantha, W.; Sze Man, W. Effect of green labelling on residential property price: A case study in Hong Kong. J. Facil. Manag. 2013, 11, 31–51. [Google Scholar] [CrossRef]

- Li, Q.; Qian, T.; Long, R.; Chen, H.; Wang, J.; Chen, M. An experimental study on premium measurement in response to residents' willingness to pay for green housing in urban areas. Resour. Conserv. Recycl. 2024, 211, 107870. [Google Scholar] [CrossRef]

- Wilkinson, S.J.; Sayce, S. Decarbonising real estate. J. Eur. Real Estate Res. 2020, 13, 387–408. [Google Scholar] [CrossRef]

- Copiello, S.; Coletto, S. The price premium in green buildings: A spatial autoregressive model and a multi-criteria optimization approach. Buildings 2023, 13, 276. [Google Scholar] [CrossRef]

- Dell’Anna, F.; Bravi, M.; Marmolejo-Duarte, C.; Bottero, M.C.; Chen, A. EPC Green Premium in Two Different European Climate Zones: A Comparative Study between Barcelona and Turin. Sustainability 2019, 11, 5605. [Google Scholar] [CrossRef]

- Ghosh, A.; McConnell, B.; Millán-Quijano, J. Do Homebuyers Value Energy Efficiency? Evidence From an Information Shock. SSRN 2024, 4774498. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P.M.; Nanda, A.; Wyatt, P. Is Energy Efficiency Priced in the Housing Market? Some Evidence from the United Kingdom. SSRN 2013, 2225270. [Google Scholar] [CrossRef]

- Olaussen, J.O.; Oust, A.; Solstad, J.T. Energy performance certificates—Informing the informed or the indifferent? Energy Policy 2017, 111, 246–254. [Google Scholar] [CrossRef]

- Wahlström, M.H. Doing good but not that well? A dilemma for energy conserving homeowners. Energy Econ. 2016, 60, 197–205. [Google Scholar] [CrossRef]

- Olaussen, J.O.; Oust, A.; Solstad, J.T.; Kristiansen, L. Energy Performance Certificates—The Role of the Energy Price. Energies 2019, 12, 3563. [Google Scholar] [CrossRef]

- Sieger, L. Investigating inefficiencies in the German rental housing market: The impact of disclosing total costs on energy efficiency appreciation. Energy Build. 2024, 312, 114183. [Google Scholar] [CrossRef]

- Ferentinos, K.; Gibberd, A.; Guin, B. Stranded houses? The price effect of a minimum energy efficiency standard. Energy Econ. 2023, 120, 106555. [Google Scholar] [CrossRef]

- Sayce, S.L.; Hossain, S.M. The initial impacts of Minimum Energy Efficiency Standards (MEES) in England. J. Prop. Investig. Finance 2020, 38, 435–447. [Google Scholar] [CrossRef]

- Marmolejo-Duarte, C.; Chen, A. The evolution of energy efficiency impact on housing prices. An analysis for Metropolitan Barcelona. Rev. Construcción 2019, 18, 145–155. [Google Scholar] [CrossRef]

- Chegut, A.; Eichholtz, P.; Holtermans, R.; Palacios, J. Energy efficiency information and valuation practices in rental housing. J. Real Estate Financ. Econ. 2020, 60, 181–204. [Google Scholar] [CrossRef]

- Cespedes-Lopez, M.-F.; Mora-Garcia, R.-T.; Perez-Sanchez, V.R.; Perez-Sanchez, J.-C. Meta-Analysis of Price Premiums in Housing with Energy Performance Certificates (EPC). Sustainability 2019, 11, 6303. [Google Scholar] [CrossRef]

- Ou, Y.; Bailey, N.; McArthur, D.P.; Zhao, Q. The price premium of residential energy performance certificates: A scoping review of the European literature. Energy Build. 2025, 332, 115377. [Google Scholar] [CrossRef]

- Davis, P.T.; McCord, J.A.; McCord, M.; Haran, M. Modelling the effect of energy performance certificate rating on property value in the Belfast housing market. Int. J. Hous. Mark. Anal. 2015, 8, 292–317. [Google Scholar] [CrossRef]

- McCord, M.; Lo, D.; Davis, P.T.; Hemphill, L.; McCord, J.; Haran, M. A spatial analysis of EPCs in The Belfast Metropolitan Area housing market. J. Prop. Res. 2019, 37, 25–61. [Google Scholar] [CrossRef]

- French, N. The impact of Minimum Energy Efficiency Standards on the UK investment market: One year on. J. Prop. Invest. Financ. 2019, 37, 416–423. [Google Scholar] [CrossRef]

- Lancaster, K.J. A New Approach to Consumer Theory. J. Political Econ. 1966, 74, 132–157. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Taruttis, L.; Weber, C. Estimating the impact of energy efficiency on housing prices in Germany: Does regional disparity matter? Energy Econ. 2022, 105, 105750. [Google Scholar] [CrossRef]

- Fuerst, F.; Oikarinen, E.; Harjunen, O. Green signalling effects in the market for energy-efficient residential buildings. Appl. Energy 2016, 180, 560–571. [Google Scholar] [CrossRef]

- Bailey, M.J.; Muth, R.F.; Nourse, H.O. A Regression Method for Real Estate Price Index Construction. J. Am. Stat. Assoc. 1963, 58, 933–942. [Google Scholar] [CrossRef]

- Clapp, J.M.; Giaccotto, C. Estimating Price Indices for Residential Property: A Comparison of Repeat Sales and Assessed Value Methods. J. Am. Stat. Assoc. 2019, 87, 300–306. [Google Scholar] [CrossRef]

- Case, K.E.; Shiller, R.J. Prices of Single Family Homes Since 1970: New Indexes for Four Cities; National Bureau of Economic Research: Cambridge, MA, USA, 1987; pp. 45–56. [Google Scholar] [CrossRef]

- Evangelista, R.; Ramalho, E.A.; de Silva, J.A. On the use of hedonic regression models to measure the effect of energy efficiency on residential property transaction prices: Evidence for Portugal and selected data issues. Energy Econ. 2020, 86, 104699. [Google Scholar] [CrossRef]

- Li, Y.; Kubicki, S.; Guerriero, A.; Rezgui, Y. Review of building energy performance certification schemes towards future improvement. Renew. Sustain. Energy Rev. 2019, 113, 109244. [Google Scholar] [CrossRef]

- Coyne, B.; Denny, E. Mind the energy performance gap: Testing the accuracy of building energy performance certificates in Ireland. Energy Effic. 2021, 14, 57. [Google Scholar] [CrossRef] [PubMed]

- Ngai, L.R.; Tenreyro, S. Hot and Cold Seasons in the Housing Market. Am. Econ. Rev. 2014, 104, 3991–4026. [Google Scholar] [CrossRef]

| Variable | Data Source | Definition | Sample Value |

|---|---|---|---|

| Number of habitable rooms | EPC | Count of habitable rooms (living rooms, dining rooms, bedrooms, studies, and similar spaces, including large kitchen-diners and non-separated conservatories). Excludes kitchens, bathrooms, utility rooms, hallways, etc. | 2 |

| Total useful floor area (m2) | EPC | Total enclosed floor area measured to internal walls (gross internal area, in square meters). | 70 |

| Current energy efficiency score | EPC | The EPC energy efficiency score on a 0–100 scale, based on the estimated annual energy cost (fuel usage for heating, hot water, lighting) per unit area. Higher = more efficient. | 83 |

| Potential energy efficiency score | EPC | The EPC potential score (0–100) that the property could achieve if recommended cost-effective improvements are implemented. | 92 |

| Current energy efficiency rating | EPC | The letter grade (A–G) corresponding to the current efficiency score (A = most efficient, G = least efficient). For example: A > 92, B = 81–91, C = 69–80, D = 55–68, etc. | B |

| Potential energy efficiency rating | EPC | The letter grade (A–G) corresponding to the potential efficiency score (using the same thresholds as above). | B |

| Transaction price (£) | PPD | Sale price of the property (at transaction date, nominal GBP). | 450,000 |

| Transaction year | PPD | Year of sale (derived from the transaction date). | 2014 |

| Transaction month | PPD | Month of sale (derived from the transaction date). | 10 |

| Property type | PPD | The property type code indicating the structural form of the dwelling: F = Flat/Maisonette, D = Detached, S = Semi-Detached, T = Terraced. | D |

| Borough | PPD | The borough in which the property is located, based on administrative boundaries. | Kensington and Chelsea |

| Energy efficiency gap | Derived | Difference between the potential and current energy efficiency scores (i.e., unrealized efficiency points). | 12 |

| Variable | Coefficient | Std. Err. | t-Stat | p-Value | Signif. |

|---|---|---|---|---|---|

| (A) | |||||

| Energy Efficiency Score (base) | –0.0008 | 0.001 | –1.451 | 0.147 | |

| Year 2014 × EE Score | 0.0003 | 0.001 | 0.639 | 0.523 | |

| Year 2015 × EE Score | 0.0021 | 0.001 | 3.204 | 0.001 | *** |

| Year 2016 × EE Score | 0.0027 | 0.001 | 3.557 | 0.000 | *** |

| Year 2017 × EE Score | 0.0042 | 0.001 | 5.263 | 0.000 | *** |

| Year 2018 × EE Score | 0.0031 | 0.001 | 3.317 | 0.001 | *** |

| Year 2019 × EE Score | 0.0041 | 0.001 | 4.710 | 0.000 | *** |

| Year 2020 × EE Score | 0.0043 | 0.001 | 5.033 | 0.000 | *** |

| Year 2021 × EE Score | 0.0053 | 0.001 | 5.928 | 0.000 | *** |

| Energy Efficiency Gap (base) | –0.0040 | 0.001 | –6.925 | 0.000 | *** |

| Year 2014 × EE Gap | 0.0001 | 0.001 | 0.260 | 0.795 | |

| Year 2015 × EE Gap | 0.0007 | 0.001 | 1.027 | 0.305 | |

| Year 2016 × EE Gap | 0.0012 | 0.001 | 1.510 | 0.131 | |

| Year 2017 × EE Gap | 0.0025 | 0.001 | 2.978 | 0.003 | *** |

| Year 2018 × EE Gap | 0.0019 | 0.001 | 2.002 | 0.045 | ** |

| Year 2019 × EE Gap | 0.0025 | 0.001 | 2.767 | 0.006 | *** |

| Year 2020 × EE Gap | 0.0047 | 0.001 | 5.207 | 0.000 | *** |

| Year 2021 × EE Gap | 0.0069 | 0.001 | 7.380 | 0.000 | *** |

| (B) | |||||

| Year 2014 | 0.1490 | 0.040 | 3.760 | 0.000 | *** |

| Year 2015 | 0.1459 | 0.049 | 2.953 | 0.003 | *** |

| Year 2016 | 0.2048 | 0.060 | 3.440 | 0.001 | *** |

| Year 2017 | 0.1176 | 0.063 | 1.868 | 0.062 | * |

| Year 2018 | 0.1900 | 0.072 | 2.624 | 0.009 | *** |

| Year 2019 | 0.1054 | 0.068 | 1.549 | 0.121 | |

| Year 2020 | 0.0847 | 0.067 | 1.274 | 0.203 | |

| Year 2021 | 0.0157 | 0.069 | 0.226 | 0.821 | |

| February | –0.0089 | 0.007 | –1.287 | 0.198 | |

| March | –0.0128 | 0.007 | –1.940 | 0.052 | * |

| April | 0.0038 | 0.007 | 0.529 | 0.597 | |

| May | 0.0132 | 0.007 | 1.863 | 0.062 | * |

| June | 0.0280 | 0.007 | 4.198 | 0.000 | *** |

| July | 0.0387 | 0.007 | 5.753 | 0.000 | *** |

| August | 0.0372 | 0.007 | 5.567 | 0.000 | *** |

| September | 0.0544 | 0.007 | 8.050 | 0.000 | *** |

| October | 0.0412 | 0.007 | 6.106 | 0.000 | *** |

| November | 0.0559 | 0.007 | 8.254 | 0.000 | *** |

| December | 0.0574 | 0.007 | 8.336 | 0.000 | *** |

| (C) | |||||

| Floor Area (sqm) | 0.0022 | 0.00008 | 27.299 | 0.000 | *** |

| Number of Rooms | 0.0178 | 0.002 | 8.977 | 0.000 | *** |

| Flat × EE Score | 0.0002 | 0.001 | 0.318 | 0.751 | |

| Semi-detached × EE Score | 0.0014 | 0.001 | 2.848 | 0.004 | *** |

| Terraced × EE Score | 0.0010 | 0.000 | 1.994 | 0.046 | ** |

| Flat × EE Gap | –0.0001 | 0.001 | –0.166 | 0.868 | |

| Semi-detached × EE Gap | 0.0004 | 0.001 | 0.780 | 0.435 | |

| Terraced × EE Gap | 0.0002 | 0.001 | 0.415 | 0.678 | |

| Energy Efficiency Variable | Baseline Model | Within 3 Years | ΔEE Only | Rating Model | Borough–Year |

|---|---|---|---|---|---|

| energy_efficiency_score | −0.0008 | −0.0010 | −0.0008 | - | −0.0009 * |

| energy_efficiency_rating | - | - | - | −0.0043 | |

| year_2014_energy_efficiency | 0.0003 | 0.0013 * | 0.0004 | 0.0052 | 0.0008 |

| year_2015_energy_efficiency | 0.0021 *** | 0.0029 *** | 0.0021 *** | 0.0411 *** | 0.0019 *** |

| year_2016_energy_efficiency | 0.0027 *** | 0.0027 *** | 0.0025 *** | 0.0470 *** | 0.0018 ** |

| year_2017_energy_efficiency | 0.0042 *** | 0.0046 *** | 0.0043 *** | 0.0605 *** | 0.0032 *** |

| year_2018_energy_efficiency | 0.0031 *** | 0.0027 ** | 0.0031 *** | 0.0405 *** | 0.0015 * |

| year_2019_energy_efficiency | 0.0041 *** | 0.0036 *** | 0.0041 *** | 0.0476 *** | 0.0026 *** |

| year_2020_energy_efficiency | 0.0043 *** | 0.0034 *** | 0.0041 *** | 0.0469 *** | 0.0031 *** |

| year_2021_energy_efficiency | 0.0053 *** | 0.0050 *** | 0.0054 *** | 0.0487 *** | 0.0036 *** |

| energy_efficiency_score_gap | −0.0040 *** | −0.0042 *** | −0.0040 *** | −0.0439 *** | −0.0033 *** |

| year_2014_energy_efficiency _gap | 0.0001 | 0.0015 ** | 0.0002 | 0.0001 | 0.0006 |

| year_2015_energy_efficiency _gap | 0.0007 | 0.0017 ** | 0.0006 | 0.0102 | 0.0003 |

| year_2016_energy_efficiency _gap | 0.0012 | 0.0019 ** | 0.0009 | 0.0178 ** | 0.0001 |

| year_2017_energy_efficiency _gap | 0.0025 *** | 0.0030 *** | 0.0025 *** | 0.0303 *** | 0.0009 |

| year_2018_energy_efficiency _gap | 0.0019 ** | 0.0018 | 0.0019 ** | 0.0252 *** | 0.0000 |

| year_2019_energy_efficiency _gap | 0.0025 *** | 0.0022 * | 0.0023 ** | 0.0357 *** | 0.0004 |

| year_2020_energy_efficiency _gap | 0.0047 *** | 0.0048 *** | 0.0046 *** | 0.0486 *** | 0.0028 *** |

| year_2021_energy_efficiency _gap | 0.0069 *** | 0.0072 *** | 0.0069 *** | 0.0685 *** | 0.0046 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wei, J.; Peiser, R. Evolving Green Premiums: The Impact of Energy Efficiency on London Housing Prices over Time. Land 2025, 14, 2053. https://doi.org/10.3390/land14102053

Wei J, Peiser R. Evolving Green Premiums: The Impact of Energy Efficiency on London Housing Prices over Time. Land. 2025; 14(10):2053. https://doi.org/10.3390/land14102053

Chicago/Turabian StyleWei, Jiabin, and Richard Peiser. 2025. "Evolving Green Premiums: The Impact of Energy Efficiency on London Housing Prices over Time" Land 14, no. 10: 2053. https://doi.org/10.3390/land14102053

APA StyleWei, J., & Peiser, R. (2025). Evolving Green Premiums: The Impact of Energy Efficiency on London Housing Prices over Time. Land, 14(10), 2053. https://doi.org/10.3390/land14102053