Dose Land Negotiation Policy Promote or Suppress Hidden Debts of Local Governments?

Abstract

:1. Introduction

2. Theoretical and Policy Background

2.1. Policy Background

2.1.1. Land Policy Practices in Different Countries

2.1.2. Land Negotiation Policy with Chinese Characteristics

2.2. Theoretical Analysis

2.2.1. Land Negotiation and Local Government Hidden Debt

2.2.2. The Transmission of Land Negotiation to Local Governments’ Hidden Debt

2.2.3. The Impact Mechanism of Land Negotiation on Local Governments’ Hidden Debt

3. Empirical Analysis

3.1. Methodology

3.1.1. Model Construction

3.1.2. Measure of Variables

- Explained variable: hidden debt of local government(debt). Presently, there are two methods used to calculate the scale of such hidden debt: direct and indirect. The direct method primarily utilizes the total sum of local financing platform debts as a representation of the hidden debt of local governments [2] (p. 19). While the indirect method calculates from the perspective of investment direction, taking advantage of the feature that the hidden debt is mainly used for municipal construction. By measuring the amount of new investment in urban infrastructure construction of local governments in each year, and deducting the funds invested in the government budget and the funds obtained from public bond issuance, the new amount of implicit debt of local governments can be obtained. Since there are some differences in the definition of local financing platforms at the national level, in documents of various caliber such as the Ministry of Finance, the (former) CBRC, the National Audit Office, the wind database and the China Bond Standard [29] (p. 40) and the relevant functions of financing platform companies have been stripped after 2014.This paper mainly refers to the method of Guan Zhihua and Fan Yuxiang [26] (p. 148) and uses the indirect method to measure the scale of local government’s implicit debt. The specific formula is as follows: scale of hidden debt of local governments = investment in urban construction fixed assets completed this year—investment in urban construction fixed assets state budget funds—bonds for urban construction fixed assets investment.

- Explanatory variable: land negotiation policy(talk). We set the dummy variable of land negotiation policy, and the value is 1 during and after the city is interviewed, otherwise the value is 0.

- Mechanism variables: land finance (Tdc), budget soft constraint (tran), fiscal decentralization (dec) and government competition(compe).

- 4.

- Control variables: Considering the influence of other factors on the scale of local government hidden debt, this paper selects the following five control variables to ensure the robustness of the results by referring to existing studies: (1) Fixed asset investment ratio (invest), expressed as the ratio of completed investment in urban construction fixed assets to GDP this year, reflects the role of fixed assets investment in promoting the scale of hidden debt; (2) Urbanization rate (urban) is expressed by the proportion of urban population in the permanent resident population of a region at the end of the year. The process of urbanization requires the investment of local government funds and material resources and, thus, becomes a major incentive for the expansion of local implicit debt [26] (p. 148); (3) Openness, measured by the amount of foreign investment actually used in the year; (4) Population(pop), total population at the end of the year; (5) Economic development level (GDP), measured by regional gross domestic product. To pursue a certain economic growth, local governments will carry out certain debt investment and financing behaviors, thus promoting the increase of the scale of implicit debt [32].

3.1.3. Data Source

3.2. Analysis of Empirical Results

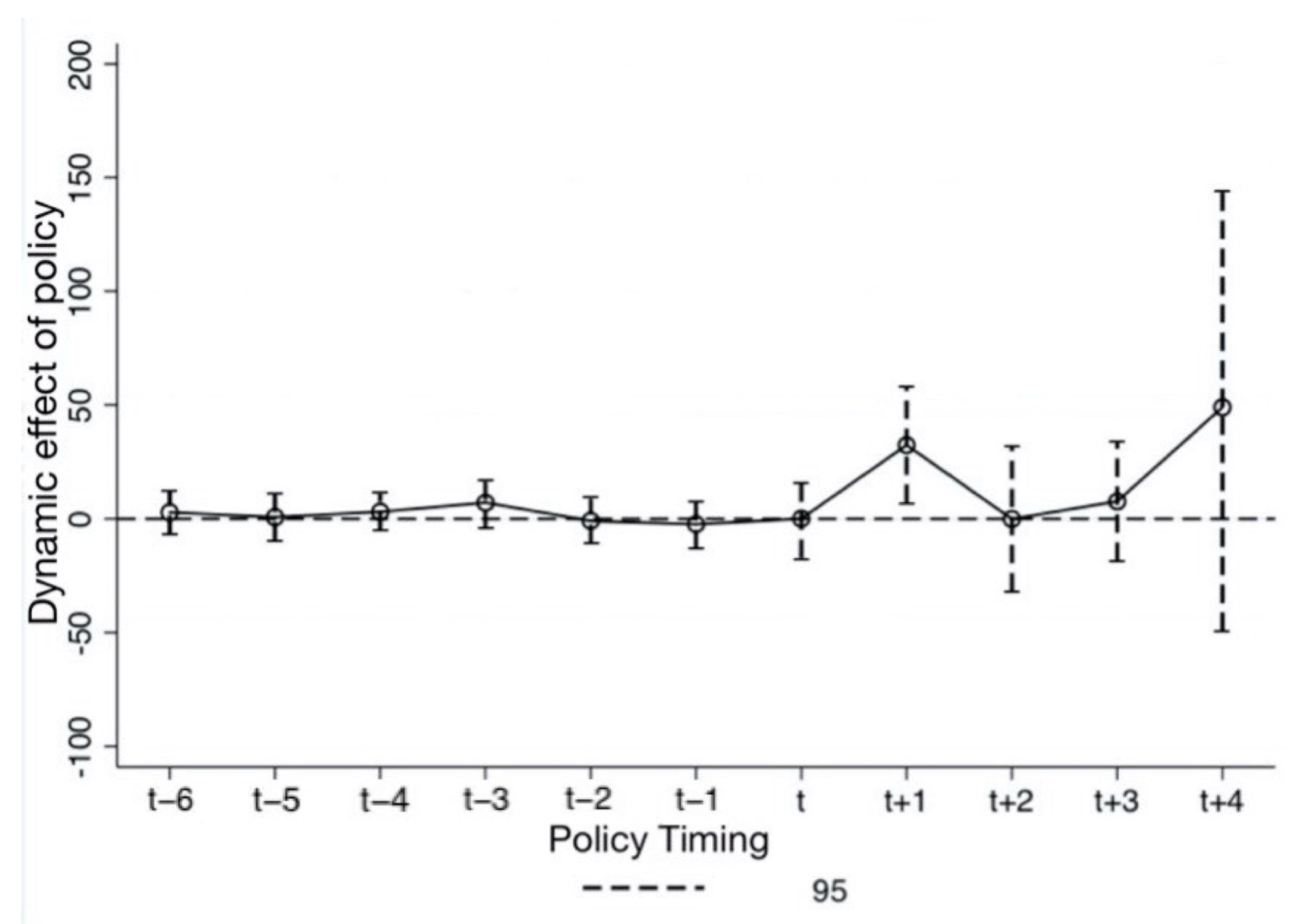

3.2.1. Parallel Trend Test

3.2.2. The Overall Impact of Land Negotiations on the Government Implicit Debt

3.2.3. Conduction Pathway

3.2.4. Influence Mechanism

- Soft constraint of budget

- 2.

- Fiscal decentralization

- 3.

- Government competition

3.3. Robustness Test

3.3.1. Counterfactual Test

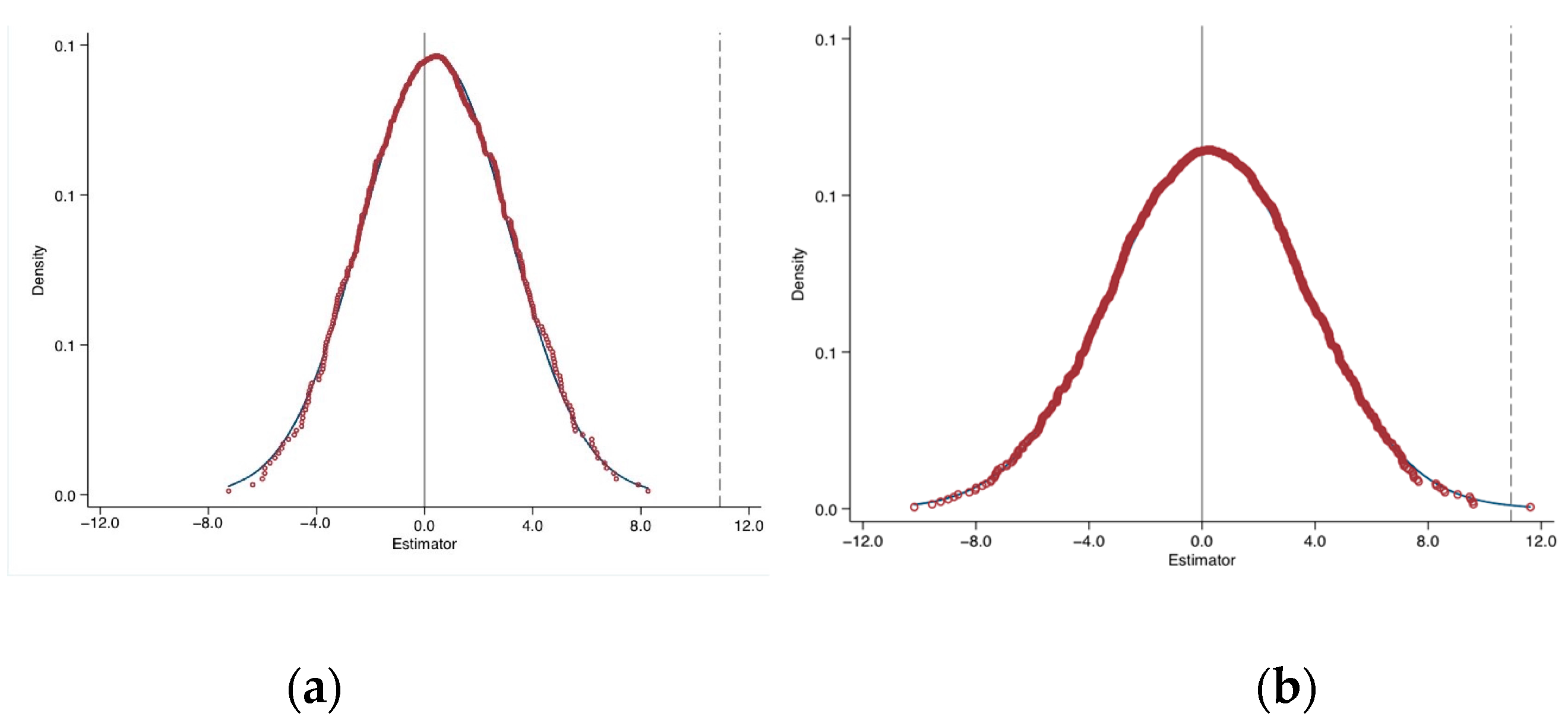

3.3.2. Placebo Test

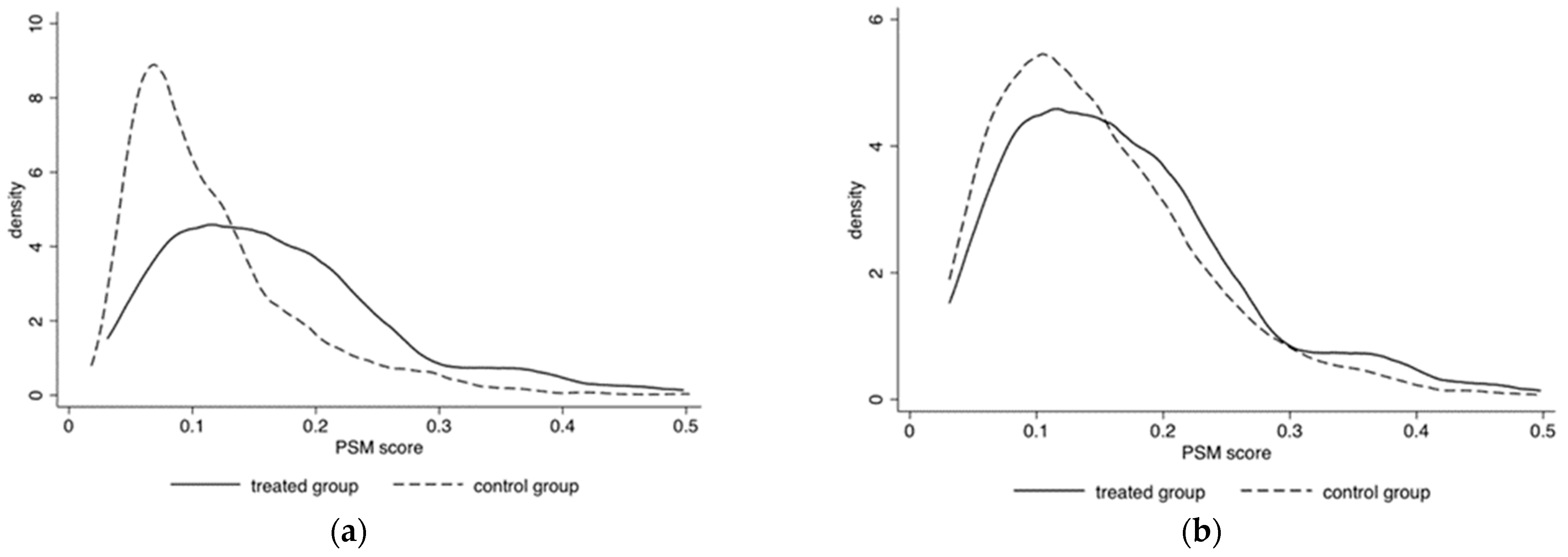

3.3.3. Propensity Matching Score Method

3.4. Heterogeneity Analysis

3.4.1. Regional Heterogeneity

3.4.2. Urban Size Heterogeneity

3.4.3. Economic Development Level Heterogeneity

4. Conclusions and Policy Suggestions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Liu, J.; Peng, J. Does land interview inhibit local government land finance?—An empirical analysis based on double difference method. China Land Sci. 2022, 7, 34–42. [Google Scholar]

- Shen, K.; Shi, Y. Manifestation, scale measurement and risk assessment of local government hidden debt. Econ. Dyn. 2022, 7, 16–30. [Google Scholar]

- Li, L.; Liu, J. The formation mechanism and governance mechanism of local government hidden debt--Based on the perspective of fiscal decentralization and land finance. Soc. Sci. 2019, 5, 59–71. [Google Scholar]

- Romano, B.; Zullo, F.; Fiorini, L.; Montaldi, C. Micromunicipality (MM) and Inner Areas in Italy: A Challenge for National Land Policy. Sustainability 2022, 14, 15169. [Google Scholar] [CrossRef]

- Wiegandt, C. Urban development in Germany: Perspectives for the future. Geo J. 2000, 50, 5–15. [Google Scholar]

- Zaborowski, T. It’s All about Details. Why the Polish Land Policy Framework Fails to Manage Designation of Developable Land. Land 2021, 10, 890. [Google Scholar] [CrossRef]

- Weber, C. Interaction model application for urban planning. Landsc. Urban Plan. 2003, 63, 49–60. [Google Scholar] [CrossRef]

- Andersen, H.T.; van Kempen, R. New trends in urban policies in Europe: Evidence from the Netherlands and Denmark. Cities 2003, 20, 77–86. [Google Scholar] [CrossRef]

- Smedby, N.; Neij, L. Experiences in urban governance for sustainability: The Constructive Dialogue in Swedish municipalities. J. Clean. Prod. 2013, 50, 148–158. [Google Scholar] [CrossRef]

- Halleux, J.-M.; Nordahl, B.I.; Havel, M.B. Spatial Efficiency and Socioeconomic Efficiency in Urban Land Policy and Value Capturing: Two Sides of the Same Coin? Sustainability 2022, 14, 13987. [Google Scholar] [CrossRef]

- Burkardt, N.; Thomas, R.E.W. Navigating the Space between Policy and Practice: Toward a Typology of Collaborators in a Federal Land Management Agency. Soc. Nat. Resour. 2022, 35, 1333–1351. [Google Scholar] [CrossRef]

- Mizero, M.; Maniriho, A.; Bashangwa Mpozi, B.; Karangwa, A.; Burny, P.; Lebailly, P. Rwanda’s Land Policy Reform: Self-Employment Perspectives from a Case Study of Kimonyi Sector. Land 2021, 10, 117. [Google Scholar] [CrossRef]

- Hardiyanto, B. Politics of land policies in Indonesia in the era of President Susilo Bambang Yudhoyono. Land Use Policy 2021, 110, 105134. [Google Scholar] [CrossRef]

- Han, Z.; Liu, Y. The governance tool of rigidity and flexibility and its governance advantages—A case study of administrative interview. J. Gansu Inst. Adm. 2021, 1, 32–41. [Google Scholar] [CrossRef]

- Cai, S. The governance function, role logic and legal norms of administrative interview. Leadersh. Sci. 2022, 8, 119–122. [Google Scholar]

- Lizhen, L.; Xiumei, A. Local Government Implicit Debt Under China’s Public Private Partnerships: Scope, Formation and Governance. J. Invest. Manag. 2018, 5, 133. [Google Scholar]

- Pang, C. The Development of Implicit Debt of Local Government and the Countermeasures of Financial Institutions. In Proceedings of the 2020 4th International Conference on Economics, Toronto, ON, Canada, 3–5 June 2020. [Google Scholar]

- Thomas, W.; Xueying, Z.; Aoran, Z.; Yulin, W. Fact or fiction: Implicit government guarantees in China’s corporate bond market. J. Int. Money Financ. 2021, 116, 102414. [Google Scholar]

- Zijun, W.; Rettenmaier, A.J. Deficits, Explicit Debt, Implicit Debt, and Interest Rates: Some Empirical Evidence. South. Econ. J. 2008, 1, 208–222. [Google Scholar]

- Zdenek, D.; Schneider, O. Size of the Public Sector, Contingent Liabilities, and Structural and Cyclical Deficits in the Czech Republic. Post-Sov. Geogr. Econ. 2000, 5, 311–340. [Google Scholar]

- Zhao, Y.; Li, Y.; Feng, C.; Gong, C.; Tan, H. Early Warning of Systemic Financial Risk of Local Government Implicit Debt Based on BP Neural Network Model. Systems 2022, 6, 207. [Google Scholar] [CrossRef]

- Wang, J.; Lei, P. A new tool for environmental regulation? The connection between environmental administrative talk policy and the market disciplinary effect. J. Clean. Prod. 2020, 275, 124–162. [Google Scholar] [CrossRef]

- Ya, C.; Yankun, Z. Analysis of the Effectiveness of the Administrative Talk to Environmental Supervision in China. Open J. Bus. Manag. 2016, 4, 716–730. [Google Scholar]

- Shapiro, S.P. Agency theory. Annu. Rev. Sociol. 2005, 31, 263–284. [Google Scholar] [CrossRef]

- Pan, J.N.; Huang, J.T.; Chiang, T.F. Empirical study of the local government deficit, land finance and real estate markets in China. China Econ. Rev. 2015, 32, 57–67. [Google Scholar] [CrossRef]

- Guan, Z.; Fan, Y. Soft budget constraints, economic growth and the scale of local government hidden debt. J. Anhui Univ. (Philos. Soc. Sci.) 2020, 3, 143–156. [Google Scholar]

- Xu, J.; Zhang, X. China’s sovereign debt: A balance-sheet perspective. China Econ. Rev. 2014, 31, 55–73. [Google Scholar] [CrossRef]

- Spieth, P.; Lerch, M. Augmenting innovation project portfolio management performance: The mediating effect of management perception and satisfaction. RD Manag. 2014, 5, 498–515. [Google Scholar] [CrossRef]

- Xu, J.; Mao, J.; Guan, X. Re-understanding of Local Government Hidden Debt—Based on the Precise Definition of Financing Platform Companies and the Perspective of Financial Potential Energy. Manag. World 2020, 9, 37–59. [Google Scholar]

- Erik, L.; Chengri, D. Local officials as land developers: Urban spatial expansion in China. J. Urban Econ. 2009, 1, 57–64. [Google Scholar]

- Hu, H.; Li, J. Fiscal competition, soft budget constraints and corporate tax burden. Econ. Manag. 2022, 6, 153–171. [Google Scholar]

- He, W.; Hou, J. Fiscal decentralization, public service supply and inclusive growth. Financ. Econ. 2023, 1, 61–69. [Google Scholar]

- Wu, M.; Zhou, L. Promotion Incentives and Urban Construction: From the Perspective of Public Goods Visibility. Econ. Res. J. 2018, 12, 97–111. [Google Scholar]

- Wang, J.; Feng, Y.; Wu, Q. Does the “Three Land” Reform Affect Local Government Land Financial Revenue. Rural Econ. 2022, 2, 25–36. [Google Scholar]

- Wang, J.; Skimore, M.; Wu, Q.; Wang, S. The impact of a tax cut reform on land finance revenue: Constrained by the binding target of construction land. J. Urban Aff. 2022, 44, 1311–1340. [Google Scholar] [CrossRef]

- Hildreth, W.B.; Miller, G.J. Debt and the Local Economy: Problems in Benchmarking Local Government Debt Affordability. Public Budg. Financ. 2002, 4, 99–113. [Google Scholar] [CrossRef]

- Gao, Y. Local Government Implicit Guarantees in China’ s Farmland Financial System. Academia 2015, 5, 6. [Google Scholar]

| Classification | Name | Specification |

|---|---|---|

| explained variable | debt | investment in urban construction fixed assets completed this year—investment in urban construction fixed assets state budget funds—bonds for urban construction fixed assets investment. |

| explanatory variable | talk | 0 before the interview, 1 during the year and after the interview |

| mechanism variables | Tdc | amount of land transfer fee |

| tran | ln(general transfer payment income + special transfer payment income + restitution tax) | |

| dec | 3× urban fiscal expenditure/(urban fiscal expenditure + provincial administrative fiscal expenditure + national fiscal expenditure) | |

| compe | highest per capita GDP of cities in the same province/per capita GDP of cities× highest per capita GDP of the country/per capita GDP of cities/100 | |

| control variables | fixinvest | investment in urban construction fixed assets completed this year investment/GDP |

| urban | urban population/area permanent population at the end of the year | |

| openness | amount of foreign capital actually used in that year | |

| pop | total population at the end of the year | |

| GDP | Regional gross domestic product |

| Variables | Observations | Mean | Std | Min | Max |

|---|---|---|---|---|---|

| debt | 4331 | 25.37 | 69.04 | −176.52 | 1106.01 |

| talk | 4331 | 0.12 | 0.32 | 0.00 | 1.00 |

| Tdc | 4331 | 1.83 | 32.05 | 0.00 | 1620.18 |

| tran | 4331 | −0.65 | 1.40 | −7.10 | 3.10 |

| dec | 4331 | 30.78 | 53.76 | 0.32 | 1122.44 |

| compe | 4331 | 0.03 | 1.83 | 0.00 | 120.40 |

| fixinvest | 4331 | 0.04 | 0.04 | 0.00 | 0.49 |

| urban | 4331 | 0.68 | 0.32 | 0.05 | 1.00 |

| openness | 4331 | 5.96 | 12.13 | 0.00 | 140.05 |

| pop | 4331 | 130.82 | 116.21 | 5.10 | 954.00 |

| GDP | 4331 | 915.77 | 1848.31 | 12.22 | 26,927.00 |

| (1) | (2) | |

|---|---|---|

| VARIABLES | Debt | Debt |

| talk | 36.870 *** (2.68) | 11.536 ** (5.70) |

| fixinvest | 388.775 *** (50.63) | |

| urban | 14.60 ** (6.55) | |

| openness | 1.518 ** (0.74) | |

| pop | 0.057 (0.15) | |

| GDP | 0.020 *** (0.01) | |

| Constant | 20.190 *** (3.02) | −35.226 *** (16.75) |

| time fix effect | no control | control |

| individual fix effect | no control | control |

| Observations | 4331 | 4331 |

| R-squared | 0.055 | 0.456 |

| Number of id | 275 | 275 |

| Path | Talk→Debt | Tdc→Debt | Talk→Tdc→Debt |

|---|---|---|---|

| VARIABLES | (3) | (4) | (5) |

| debt | Tdc | debt | |

| talk | 20.839 *** (2.13) | 3.934 *** (1.42) | 20.103 *** (2.26) |

| Tdc | 0.187 *** (0.02) | ||

| Indirect effect | 0.736 *** (0.28) | ||

| controls | control | control | control |

| (6) | (7) | (8) | |

|---|---|---|---|

| VARIABLES | Debt | Debt | Debt |

| talk | 19.970 ** (9.24) | 8.489 ** (4.21) | 11.500 ** (5.71) |

| c_tran talk | −10.490 ** (5.33) | ||

| c_dec talk | 5242.000 ** (2250.00) | ||

| c_ talk | −0.947 *** (0.26) | ||

| tran | −2.984 (3.13) | ||

| dec | 28.010 (455.90) | ||

| Constant | −39.030 *** (14.32) | −34.390 ** (15.24) | −35.210 ** (16.75) |

| controls | control | control | control |

| time fix effect | control | control | control |

| individual fix effect | control | control | control |

| Observations | 4331 | 4331 | 4331 |

| R-squared | 0.459 | 0.490 | 0.456 |

| Number of id | 275 | 275 | 275 |

| (9) | (10) | |

|---|---|---|

| VARIABLES | Debt | Debt |

| talkpre2 | 5.487 (3.87) | |

| talkpre4 | 3.207 (2.97) | |

| Constant | −35.020 ** (17.00) | −35.020 ** (16.92) |

| controls | control | control |

| time fix effect | control | control |

| individual fix effect | control | control |

| Observations | 4331 | 4331 |

| R-squared | 0.453 | 0.454 |

| Number of id | 275 | 275 |

| Reference Regression | Conduction Pathway | ||||

|---|---|---|---|---|---|

| VARIABLES | (11) Debt | (12) Debt | (13) Debt | (14) Tdc | (15) Debt |

| talk | 35.82 *** (2.788) | 11.15 ** (5.461) | 20.617 *** (2.20) | 4.031 *** (1.47) | 19.866 *** (2.18) |

| Tdc | 0.186 *** (0.02) | ||||

| Constant | 20.91 *** (3.134) | −35.93 * (18.58) | −36.211 *** (2.32) | −1.061 (1.55) | −36.013 *** (2.31) |

| controls | control | control | control | control | control |

| time fix effect | no control | control | control | control | control |

| individual fix effect | no control | control | control | control | control |

| Observations | 4062 | 4062 | 4062 | 4062 | 4062 |

| R-squared | 0.054 | 0.448 | 0.614 | 0.028 | 0.621 |

| Number of id | 275 | 275 | 275 | 275 | 275 |

| Influence Mechanism | |||

|---|---|---|---|

| VARIABLES | (16) Debt | (17) Debt | (18) Debt |

| talk | 18.930 ** (8.92) | 8.362 ** (4.16) | 11.120 ** (5.47) |

| c_tranxtalk1 | −9.672 * (5.20) | ||

| c_decxtalk1 | 5034.000 ** (2170.00) | ||

| c_compextalk1 | −0.736 *** (0.26) | ||

| Constant | −39.080 ** (15.95) | −35.350 ** (16.87) | −35.910 * (18.59) |

| controls | control | control | control |

| time fix effect | control | control | control |

| individual fix effect | control | control | control |

| Observations | 4062 | 4062 | 4062 |

| R-squared | 0.451 | 0.480 | 0.448 |

| Number of id | 275 | 275 | 275 |

| Region | Urban Size | Economic Development Level | |||||

|---|---|---|---|---|---|---|---|

| VARIABLES | (19) East | (20) Center | (21) West | (22) Small | (23) Large | (24) Low | (25) High |

| talk | 9.732 ** (4.35) | −6.780 ** (3.13) | 1.138 (3.27) | 1.198 (0.98) | 26.225 *** (6.00) | 0.945 (0.78) | 34.496 *** (7.74) |

| Constant | −58.075 *** (8.95) | 29.860 *** (6.21) | −29.773 *** (7.47) | −4.687 *** (1.05) | −88.256 *** (14.29) | −13.461 *** (1.62) | −135.392 *** (17.83) |

| time fix effect | control | control | control | control | control | control | control |

| individual fix effect | control | control | control | control | control | control | control |

| Observations | 1559 | 1617 | 1155 | 2924 | 1407 | 3301 | 1030 |

| R-squared | 0.615 | 0.562 | 0.828 | 0.504 | 0.615 | 0.477 | 0.659 |

| Number of id | 95 | 98 | 82 | 189 | 86 | 212 | 63 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, Y.; Xu, J.; Feng, C.; Gong, C. Dose Land Negotiation Policy Promote or Suppress Hidden Debts of Local Governments? Land 2023, 12, 985. https://doi.org/10.3390/land12050985

Zhao Y, Xu J, Feng C, Gong C. Dose Land Negotiation Policy Promote or Suppress Hidden Debts of Local Governments? Land. 2023; 12(5):985. https://doi.org/10.3390/land12050985

Chicago/Turabian StyleZhao, Yinglan, Jingwen Xu, Chen Feng, and Chi Gong. 2023. "Dose Land Negotiation Policy Promote or Suppress Hidden Debts of Local Governments?" Land 12, no. 5: 985. https://doi.org/10.3390/land12050985

APA StyleZhao, Y., Xu, J., Feng, C., & Gong, C. (2023). Dose Land Negotiation Policy Promote or Suppress Hidden Debts of Local Governments? Land, 12(5), 985. https://doi.org/10.3390/land12050985