Why Did the “Missing Middle” Miss the Train? An Actors-In-Systems Exploration of Barriers to Intensified Family Housing in Waterloo Region, Canada

Abstract

:1. Introduction

2. Literature Background

2.1. How and Why Is “Missing Middle” Housing Missing?

2.2. Developer Decisions in a Planning and Market Context

3. Methods

3.1. Historical Supporting Research

3.2. Data Narrative

3.3. Semi-Structured Interviews

3.4. Systems Analysis

4. Knowledge Exchange with Partners

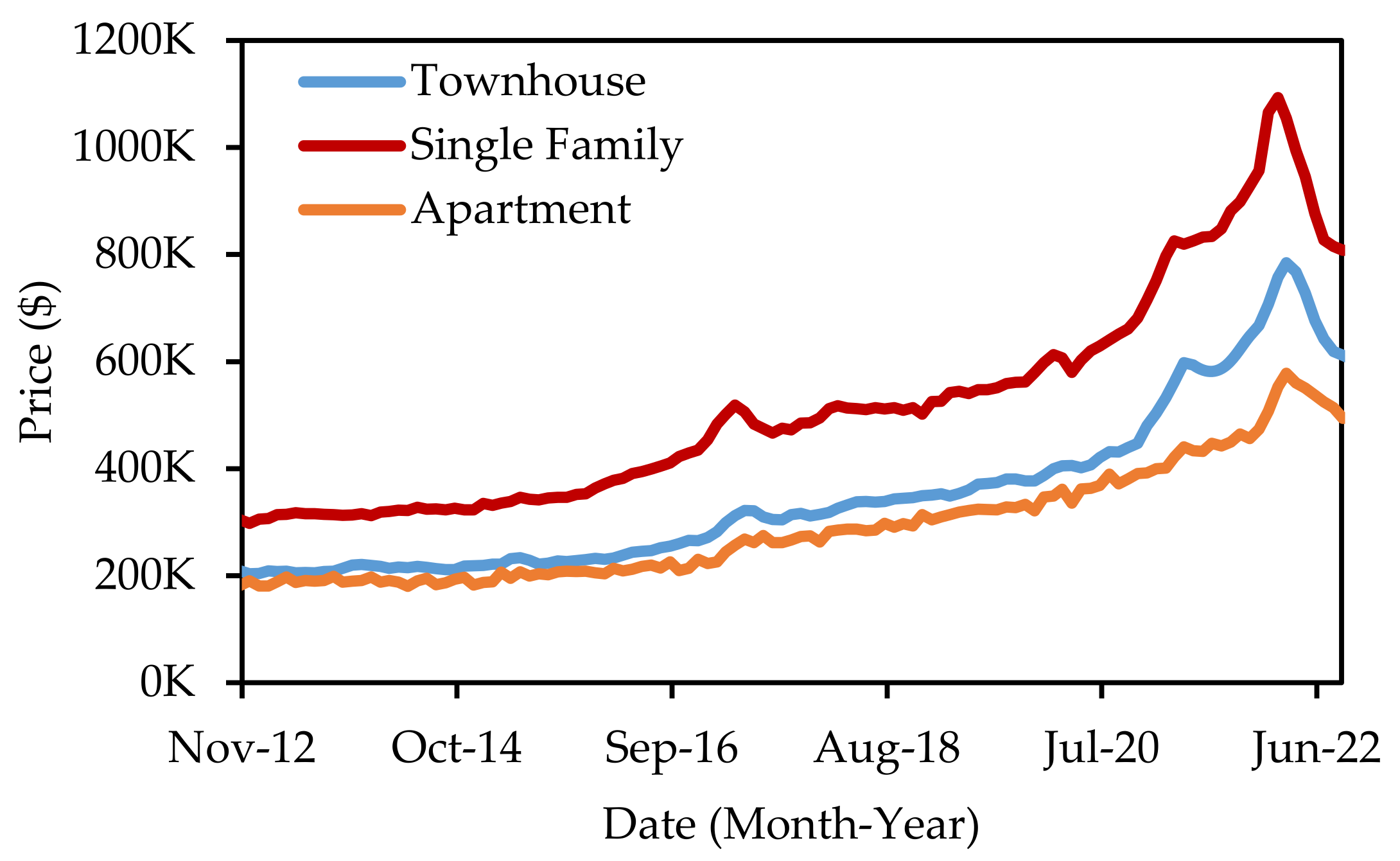

4.1. Local Trends and Economic Context

4.2. Previous MM Housing Demand Evidence

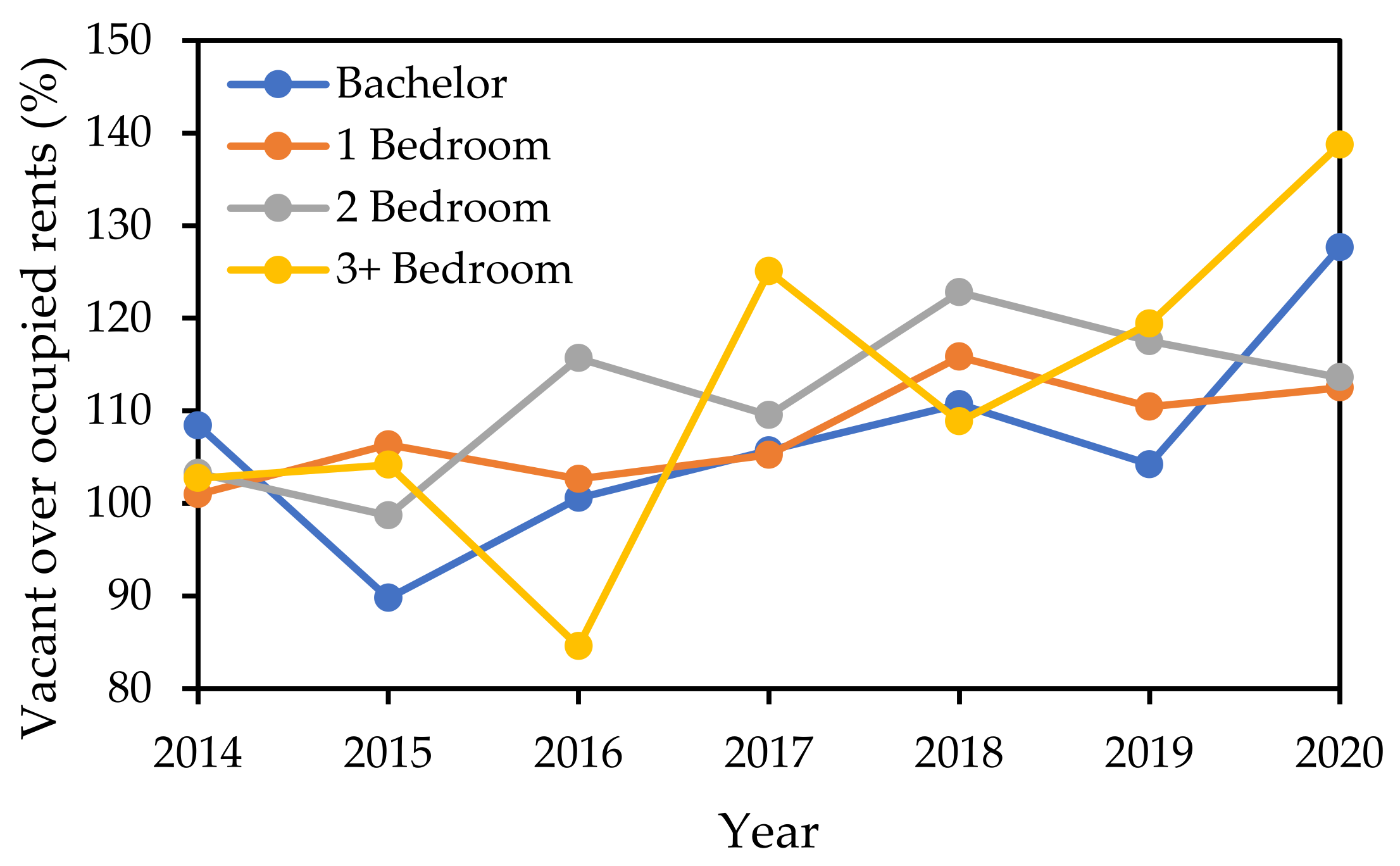

4.3. Data Narrative: Empirical Evidence of the Scarcity of Three-Bedroom Units

- Although there is clear scarcity of rentals with three or more bedrooms, they are not being constructed as part of new builds, most acutely not in Kitchener Central.

- With benchmark single-family homes selling for more than CAD 800,000, rents for units with three or more bedrooms should be very high, as so many family households cannot afford to buy a single-family home.

- There is very clear evidence from market research for strong demand for rentals with three or more bedrooms, not only for families with children living in the home, but also for downsizers.

- One explanatory hypothesis is that developer decisions are mostly shaped by investor demand, rather than that of potential residents. We need to ask both actors what barriers exist for the supply of three-bedroom units.

4.4. Results of Discussions with Real Estate Industry Stakeholders

5. Qualitative Systems Mapping of Development, Investment, and Planning Interactions

6. Conclusions and Implications for Planning

6.1. Concluding Recommendation for Planning and Housing Markets

- In areas targeted for MM housing that would otherwise be under pressure for land-value uplift reflecting potential high-rise development, limit this uplift by enforcing low-rise zoning (i.e., refusing development applications for higher height and density). This suggestion may contradict the belief by some planning and economic actors that markets allocate land to its highest and best social use. They do not, as land and housing markets incorrectly and incompletely incorporate external and public good values [102]. We also remind the reader of the dual market for housing as both a use and investment good. Investors will push land allocation to its profit-maximizing use as an investment good, not a use good. Thus, planning and zoning have important roles to play in correcting market failures. Planning interventions may have the capacity to create successful “balancing loops” if they limit land-value uplift.

- Simplify the planning and approvals process by modifying single-family zoning to allow multiple units on all residential parcels “as-of-right” (i.e., without submitting an Official Planning or Zoning By-law Amendment application). This widely supported planning measure has been implemented in various jurisdictions around North America to differing extents, including Kitchener (duplex plus two additional units) [90]; Minneapolis (three units) [103]; Grand Rapids, MI (four units) [104,105]; Portland (multiplexes) [106]; California (four units) [107]; and to geographically limited extents in Atlanta, GA [104], and Saint Paul, MN [17].

- Simplify the planning and approvals process by creating easily approved standardized MM typologies. Our future research in the RoW is focused on this goal. In the RoW, site plan applications are currently required for residential builds of three units or more, but not for duplexes, incentivizing duplex builds over higher-density MM. While existing examples of this approach are scarce, the City of Edmonton held a contest to create MM architectural typologies [108]. Moreover, Saint Paul, Minnesota, facilitated the housing permission by including MM housing types such as duplexes, triplexes, townhomes, small-scale multifamily, and accessory dwelling units [109].

- Provide non-profit finance to create reasonably affordable MM builds, allowing for support by broad evidence of potential demand. For example, a joint project between the City of Minneapolis and the Minnesota Housing and Land Bank Twin Cities provides MM finance of up to USD 70,000 to USD 95,000 per affordable unit, with higher subsidies for larger units [17,110]. The State of Michigan has provided no-interest construction and rehabilitation loans for MM homes for moderate-income residents [111].

- Create programs to facilitate co-op builds, where three or more households collaborate to finance, design, and build an MM housing build, as undertaken by the City of Vancouver in low-density neighborhoods targeted for MM housing [22]. The Government of Canada has also initiated a new Co-operative Housing Development Program to expand co-op housing in Vancouver and across Canada to stimulate a new generation of co-op housing [112].

- Acknowledging the potential bias by condo investors against renting to families with children, implement planning requirements for unit mix (including three-bedroom units), minimum sizes (1200–1500 square feet), and adequate provision of on-site private and proximate public greenspace and playgrounds. Unit-mix requirements and recommendations have been implemented in Grand Rapids, MI [104]; Montreal [113,114]; and Toronto [115].

- Facilitate non-profit or municipal pre-purchase of three-bedroom condo units to bridge the gap between end-user resident demand and the financing need for condo pre-sales. We have not found previous examples of this “bridging broker” role for non-profit or municipal entities.

- Facilitate MM demonstration projects to demonstrate financial feasibility and market uptake, reducing uncertainty for both the for-profit and non-profit housing supply sectors. Ideally, these demonstration projects should be co-designed with end-users to ensure their market viability. Such demonstrations may be particularly important given the finding by the authors of [23] that new MM builds are more likely in neighborhoods with existing MM housing.

6.2. Recapping our Complex Systems Lens

6.3. Limitations and Future Work

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Region of Waterloo. Monitoring Change in the CTC: 2020 Report; Region of Waterloo: Kitchener, ON, Canada, 2022; Available online: https://www.regionofwaterloo.ca/en/regional-government/resources/LandUse_BuildingActivity/3868173-PDL-CPL-22-02_Attachment_1_Monitoring_Change_in_the_CTC_2020_Report.ACCESS.pdf (accessed on 5 December 2022).

- Thompson, C. Construction in Region Continues at a Breakneck Pace. 2021. Available online: https://www.therecord.com/news/council/2021/11/05/construction-in-waterloo-region-continues-at-breakneck-pace.html (accessed on 5 December 2022).

- Parker, D.C.; Casello, J.; Dean, J. Monitoring and modelling the causes and consequences of urban intensification in Waterloo Region. In Housing Market Insights; Kitchener Waterloo Association of Realtors: Kitchener, ON, Canada, 2018. [Google Scholar]

- KWAR. Home Price Index Dashboard; Kitchener-Waterloo Association of Realtors: Kitchener, ON, Canada, 2021; Available online: https://kwar.ca/hpi-dashboard/ (accessed on 5 December 2022).

- Van der Merwe, J.; Doucet, B. Housing challenges, mid-sized cities and the COVID-19 pandemic. Can. Plan. Policy/Amenage. Et Polit. Au Can. 2021, 2021, 70–90. [Google Scholar] [CrossRef]

- KWCF. Waterloo Region’s Vital Signs; Kitchener Waterloo Community Foundation: Kitchener, ON, Canada, 2021; Available online: https://www.wrcf.ca/s/KWCF-2021-Waterloo-Region-Vital-Signs-Report-Affordable-Housing.pdf (accessed on 5 December 2022).

- Moffatt, M. Baby Needs a New Home; Smart Prosperity Institute: Ottawa, ON, Canada, 2021; Available online: https://institute.smartprosperity.ca/publications/growing-number-households (accessed on 5 December 2022).

- Ontario. Housing Affordability Task Force Report; Ontario: Ottawa, ON, Canada, 2022; Available online: https://www.ontario.ca/page/housing-affordability-task-force-report (accessed on 5 December 2022).

- Moffatt, M.; Dudu, A.; Hosseini, M. Ontario’s Need for 1.5 Million More Homes; Smart Prosperity Institute: Ottawa, ON, Canada, 2022; Available online: https://institute.smartprosperity.ca/1.5MillionMoreHomes (accessed on 5 December 2022).

- CMHC. Canada’s Housing Supply Shortages: Estimating What is Needed to Solve Canada’s Housing Affordability Crisis by 2030; Canadian Mortgage and Housing Corporation: Ottawa, ON, Canada, 2022; Available online: https://assets.cmhc-schl.gc.ca/sites/cmhc/professional/housing-markets-data-and-research/housing-research/research-reports/2022/housing-shortages-canada-solving-affordability-crisis-en.pdf?rev=88308aef-f14a-4dbb-b692-6ebbddcd79a0 (accessed on 5 December 2022).

- Statistics Canada. Dictionary, Census of Population, 2021: Structural Type of Dwelling; Statistics Canada: Ottawa, ON, Canada, 2021; Available online: https://www12.statcan.gc.ca/census-recensement/2021/ref/dict/az/definition-eng.cfm?ID=dwelling-logements013 (accessed on 5 December 2022).

- Canada Mortgage and Housing Corporation. National Occupancy Standard; Canada Mortgage and Housing Corporation: Ottawa, ON, Canada, 2022; Available online: https://www.cmhc-schl.gc.ca/en/professionals/industry-innovation-and-leadership/industry-expertise/affordable-housing/provincial-territorial-agreements/investment-in-affordable-housing/national-occupancy-standard (accessed on 5 December 2022).

- Haan, M. The residential crowding of immigrants in Canada, 1971–2001. J. Ethn. Migr. Stud. 2011, 37, 443–465. [Google Scholar] [CrossRef]

- Statistics Canada. Table 98-10-0238-01: Housing Suitability by Tenure, with Household Type Including Census Family Structure: Canada, Provinces and Territories, Census Divisions and Census Subdivisions; Statistics Canada: Ottawa, ON, Canada, 2022. [Google Scholar] [CrossRef]

- Moos, M.; Revington, N.; Wilkin, T. Is there suitable housing near work? The impact of housing suitability on commute distances in Montreal, Toronto, and Vancouver. J. Urban. Int. Res. Placemaking Urban Sustain. 2018, 11, 436–459. [Google Scholar] [CrossRef]

- Bimm, A.J.; Chesquin, A.F.; Xu, C.; Atencio-Malixi, A.; Oliveira, K. The City-Builder’s Guide to Building the Missing Middle; School of Cities, University of Toronto: Toronto, ON, Canada, 2021; Available online: https://smartdensity.com/wp-content/uploads/2021/05/Tour-Guide-_Building-the-Missing-Middle.pdf (accessed on 5 December 2022).

- Parolek, D.G. Missing Middle Housing: Thinking Big and Building Small to Respond to Today’s Housing Crisis; Island Press: Washington, DC, USA, 2020. [Google Scholar]

- Haines, G.; Aird, B. Finding the Missing Middle in the GTHA An Intensification Case Study of Mississauga; Ryerson City Building Institute: Toronto, ON, Canada, 2018. [Google Scholar]

- Urban Strategies Inc. The “Missing Middle”: An Answer to Toronto’s Housing Shortages? Toronto Regional Real Estate Board: Toronto, ON, Canada, 2020; Available online: https://trreb.ca/hlfiles/pdf/2021.01.04-TRREB_Missing_Middle.pdf (accessed on 5 December 2022).

- Parker, D.C.; Filatova, T. A conceptual design for a bilateral agent-based land market with heterogeneous economic agents. Comput. Environ. Urban Syst. 2008, 32, 454–463. [Google Scholar] [CrossRef]

- Zellner, M.; Campbell, S.D. Planning for deep-rooted problems: What can we learn from aligning complex systems and wicked problems? Plan. Theory Pract. 2015, 16, 457–478. [Google Scholar] [CrossRef]

- Popal, A. Filling in the Housing Gaps: Planning for Missing Middle Housing in Toronto’s Yellowbelt; York Space: Denver, CO, USA, 2020; Available online: http://hdl.handle.net/10315/38331 (accessed on 5 December 2022).

- Kuhlmann, D.; Rodnyansky, S. Search of the Missing Middle: Historical Trends in and Contemporary Correlates of Small Multifamily Development; Daniel Kuhlmann; Tucson, AZ, USA. 2022. Available online: https://www.dankuhlmann.com/publication/working-paper-missing-middle/ (accessed on 5 December 2022).

- Statistics Canada. Canada at a Glance. Statistics Canada Catalogue No. 12-581-X; Statistics Canada: Ottawa, ON, Canada, 2018; Available online: https://www150.statcan.gc.ca/n1/pub/12-581-x/12-581-x2018000-eng.htm (accessed on 5 December 2022).

- Clayton, F.; Petramala, D.; Zaduban, A. A Strategy for Significantly Increasing the Supply of “Missing Middle” Housing in the City of Toronto; CUR/Ryerson University: Toronto, ON, Canada, 2019; Available online: https://www.torontomu.ca/content/dam/centre-urban-research-land-development/pdfs/TREB/CUR_TREB_Presentation_Feb.6.pdf (accessed on 5 December 2022).

- Evenson, J.; Cancelli, A.; Matthews-Hunter, K.; German, M.; Fader, J. What is the Missing Middle? A Toronto Housing Challenge Demystified. 2018. Available online: https://canurb.org/publications/what-is-the-missing-middle-a-toronto-housing-challenge-demystified/ (accessed on 5 December 2022).

- Clayton, F.; Paton, G. Missing in Action: New Low-Rise Apartments in the Greater Golden Horseshoe; Toronto Metropolitan University: Toronto, ON, Canada, 2022; Available online: https://www.torontomu.ca/centre-urban-research-land-development/blog/blogentry72/ (accessed on 5 December 2022).

- Maharaj, S.H.O. Factors Affecting the Supply of “Missing Middle” Housing Types in Walkable Urban Core Neighborhoods. Muma Bus. Rev. 2020, 4, 001–015. [Google Scholar] [CrossRef]

- Yeoman, R.; Akehurst, G. The Housing We’d Choose: A Study of Housing Preferences, Choices and Trade-offs in Auckland; Market Economics Ltd.: Annapolis, MD, USA, 2015. [Google Scholar]

- Babin, R. Estimating Homebuyer Preferences Under Intensification: Hedonic Modelling of Open Space and Multimodal Transit Amenities Preceding Light Rail in Kitchener-Waterloo; University of Waterloo, UWSpace: Waterloo, ON, Canada, 2016; Available online: http://hdl.handle.net/10012/10936 (accessed on 5 December 2022).

- Opit, S.; Kearns, R.; Witten, K.; Fergusson, E. Density in the Suburbs: Families with Children Adapting to Living in a Medium Density Social Housing Development. Urban Policy Res. 2021, 39, 397–413. [Google Scholar] [CrossRef]

- The Canadian Centre for Economic Analysis. Understanding the Forces Driving the Shelter Affordability Issue; Residential Construction Council of Ontario (RESCON): Concord, ON, Canada, 2017; Available online: https://www.rccao.com/research/files/Affordability-Phase2-report.pdf (accessed on 5 December 2022).

- Burda, C.; Collins-Williams, M. Make Way for Mid-Rise.; Pembina Institute: Ottawa, ON, Canada, 2015; Available online: https://www.pembina.org/pub/make-way-for-mid-rise (accessed on 5 December 2022).

- Cox, W.; He, A. Canada’s Middle-Income Housing Affordability Crisis; Frontier Centre for Public Policy: Winnipeg, MB, USA, 2016. [Google Scholar]

- Green, K.P.; Filipowicz, J.; Lafleur, S.; Herzog, I. The Impact of Land-Use Regulation on Housing Supply in CANADA; Fraser Institute Vancouver: Vancouver, BC, Canada, 2016. [Google Scholar]

- Donner, C. Housing Agents and Housing Submarkets. In International Encyclopedia of Housing and Home; Smith, S.J., Ed.; Elsevier: San Diego, CA, USA, 2012; pp. 265–272. [Google Scholar]

- Geva, Y.; Rosen, G. The regeneration deal: Developers, homeowners and new competencies in the development process. Geoforum 2018, 96, 10–20. [Google Scholar] [CrossRef]

- Prochorskaite, A.; Couch, C.; Malys, N.; Maliene, V. Housing stakeholder preferences for the “Soft” features of sustainable and healthy housing design in the UK. Int. J. Environ. Res. Public Health 2016, 13, 111. [Google Scholar] [CrossRef]

- Mohd Thas Thaker, H.; Ariff, M. Supply-side drivers of residential price in Malaysia: A qualitative analysis from developers’ perspectives. Prop. Manag. 2020, 38, 543–564. [Google Scholar] [CrossRef]

- Coiacetto, E. Diversity in real estate developer behaviour: A case for research. Urban Policy Res. 2001, 19, 43–59. [Google Scholar] [CrossRef]

- Maruani, T.; Amit-Cohen, I. Characteristics of developers and their relations to open space conservation. Land Use Policy 2011, 28, 887–897. [Google Scholar] [CrossRef]

- Ruming, K.J. Developer typologies in urban renewal in Sydney: Recognising the role of informal associations between developers and local government. Urban Policy Res. 2010, 28, 65–83. [Google Scholar] [CrossRef]

- Lai, N.; Wang, K. Land-supply restrictions, developer strategies and housing policies: The case in Hong Kong. Int. Real Estate Rev. 1999, 2, 143–159. [Google Scholar] [CrossRef] [PubMed]

- Li, F.; Guo, Z. How Does an Expansion of Mandatory Inclusionary Housing Affect Housing Supply? Evidence From London (UK). J. Am. Plan. Assoc. 2021, 88, 83–96. [Google Scholar] [CrossRef]

- Ontario. O. Reg. 329/22: Zonning Order—City of Toronto; Ontario: Ottawa, ON, Canada, 2022; Available online: https://www.ontario.ca/laws/regulation/220329 (accessed on 5 December 2022).

- Altus Group. 2020 Canadian Cost Guide.; Altus Group: Toronto, ON, Canada, 2020; Available online: https://www.altusgroup.com/services/reports/2020-canadian-cost-guide/ (accessed on 5 December 2022).

- Benjamin, L.; Rubin, J.S.; Zielenbach, S. Community development financial institutions: Current issues and future prospects. J. Urban Aff. 2004, 26, 177–195. [Google Scholar] [CrossRef]

- Follain, J.R. Some possible directions for research on multifamily housing. Hous. Policy Debate 1994, 5, 533–568. [Google Scholar] [CrossRef]

- Federal Reserve Bank of Dallas. Breaking Ground-Beginner’s Guide for Non-Profit; Federal Reserve Bank of Dallas: Dallas, TX, USA, 2004; Available online: https://community-wealth.org/sites/clone.community-wealth.org/files/downloads/tool-breaking-ground.pdf (accessed on 5 December 2022).

- Getter, D.E. Multifamily Housing Finance and Selected Policy Issue; Congressional Research Service: Washington, DC, USA, 2020; Available online: https://www.everycrsreport.com/files/2020-08-07_R46480_7d415ecff917f1c33e9e4f9fe81a7e8bc3a8187d.pdf (accessed on 5 December 2022).

- Ignatova, I.; Rabenhorst, S. Condominium Housing and Mortgage Lending in Emerging Markets Constraints and Opportunities: IDG Working Paper No. 2009-04; Urban Institute Center on International Development and Governance: Washingrton, DC, USA, 2009. [Google Scholar]

- Levitin, A.J.; Wachter, S.M. The public option in housing finance. UCDL Rev. 2012, 46, 1111. [Google Scholar]

- Brill, F. Governing investors and developers: Analysing the role of risk allocation in urban development. Urban Stud. 2021, 59, 1499–1517. [Google Scholar] [CrossRef]

- Winarso, H. Developer’s Behaviour in Residential Land Development in Jabothek, Indonesia; University of London: London, UK, 2000; Available online: https://discovery.ucl.ac.uk/id/eprint/1348854 (accessed on 5 December 2022).

- Magliocca, N.R.; Brown, D.G.; McConnell, V.D.; Nassauer, J.I.; Westbrook, S.E. Effects of Alternative Developer Decision-Making Models on the Production of Ecological Subdivision Designs: Experimental Results from an Agent-Based Model. Environ. Plan. B Plan. Des. 2014, 41, 907–927. [Google Scholar] [CrossRef]

- Mohamed, R. The psychology of residential developers: Lessons from behavioral economics and additional explanations for satisficing. J. Plan. Educ. Res. 2006, 26, 28–37. [Google Scholar] [CrossRef]

- Rowley, S.; Gilbert, C.; Gurran, N.; Leishman, C.; Phelps, C. The uneven distribution of housing supply 2006–2016. AHURI Final Report No. 334; Australian Housing and Urban Research Institute Limited: Melbourne, VI, Canada, 2020. [Google Scholar] [CrossRef]

- DeFields, E. Property Size Preferences and the Value of Private and Public Outdoor Spaces amid a Shift to High-Density Residential Development: A Case Study of Kitchener-Waterloo, Ontario. University of Waterloo, UWSpace: Waterloo, ON, Canada, 2013; Available online: http://hdl.handle.net/10012/7778 (accessed on 5 December 2022).

- Pi, X. Exploring Rental Housing Market in Kitchener-Waterloo, Ontario; University of Waterloo, UWSpace: Waterloo, ON, Canada, 2017; Available online: http://hdl.handle.net/10012/12431 (accessed on 5 December 2022).

- Tran, J. Understanding Developer’s Decision Making in the Region of Waterloo; University of Waterloo, UWSpace: Waterloo, ON, Canada, 2017; Available online: http://hdl.handle.net/10012/11163 (accessed on 5 December 2022).

- Cook, J. Light Rail Transit in the Region of Waterloo: A Qualitative Examination of Urban Rail’s Effects on Real Estate, Development and Urban Identities; University of Waterloo, UWSpace: Waterloo, ON, Canada, 2019; Available online: http://hdl.handle.net/10012/14345 (accessed on 5 December 2022).

- Huang, Y. Analyzing Housing Market Dynamics and Residential Location Choices Concurrent with Light-Rail Transit Investment in Kitchener-Waterloo, Canada; University of Waterloo, UWSpace: Waterloo, ON, Canada, 2020; Available online: http://hdl.handle.net/10012/15801 (accessed on 5 December 2022).

- El Outa, F.; Francia, M.; Marcel, P.; Peralta, V.; Vassiliadis, P. Towards a Conceptual Model for Data Narratives. In Proceedings of the Conceptual Modeling: 39th International Conference, ER 2020, Vienna, Austria, 3–6 November 2020; pp. 261–270. [Google Scholar]

- Dillon Consulting. Long-Term Population and Housing Growth Analysis; Dillon Consulting Ltd.|Watson & Associates Economists Ltd.: Mississauga, ON, Canada, 2020; Available online: https://www.engagewr.ca/8710/widgets/42728/documents/46361 (accessed on 5 December 2022).

- Longhurst, R. Semi-structured interviews and focus groups. Key Methods Geogr. 2003, 3, 143–156. [Google Scholar]

- Kallio, H.; Pietilä, A.-M.; Johnson, M.; Kangasniemi, M. Systematic methodological review: Developing a framework for a qualitative semi-structured interview guide. J. Adv. Nurs. 2016, 72, 2954–2965. [Google Scholar] [CrossRef]

- Blee, K.M.; Taylor, V. Semi-structured interviewing in social movement research. Methods Soc. Mov. Res. 2002, 16, 92–117. [Google Scholar]

- Sterman, J. System Dynamics: Systems Thinking and Modeling for a Complex World; McGraw-Hill Higher Education: New York, NY, USA, 2002. [Google Scholar]

- Forrester, J.W. Learning through system dynamics as preparation for the 21st century. Syst. Dyn. Rev. 2016, 32, 187–203. [Google Scholar] [CrossRef]

- Ghosh, A. Thinking in Systems. In Dynamic Systems for Everyone; Springer: Berlin/Heidelberg, Germany, 2015; pp. 1–17. [Google Scholar]

- Page, S.E. The Model Thinker: What You Need to Know to Make Data Work for You; Basic Books: New York, NY, USA, 2018. [Google Scholar]

- Olaya, C. Cows, agency, and the significance of operational thinking. Syst. Dyn. Rev. 2015, 31, 183–219. [Google Scholar] [CrossRef]

- Kubanza, N.S.; Das, D.K.; Simatele, D. Some happy, others sad: Exploring environmental justice in solid waste management in Kinshasa, The Democratic Republic of Congo. Local Environ. 2017, 22, 595–620. [Google Scholar] [CrossRef]

- Macmillan, A.; Davies, M.; Shrubsole, C.; Luxford, N.; May, N.; Chiu, L.F.; Trutnevyte, E.; Bobrova, Y.; Chalabi, Z. Integrated decision-making about housing, energy and wellbeing: A qualitative system dynamics model. Environ. Health 2016, 15, 23–34. [Google Scholar] [CrossRef]

- Luna-Reyes, L.F.; Andersen, D.L. Collecting and analyzing qualitative data for system dynamics: Methods and models. Syst. Dyn. Rev. J. Syst. Dyn. Soc. 2003, 19, 271–296. [Google Scholar] [CrossRef]

- Guest, J.; Skerlos, S.; Daigger, G.; Corbett, J.; Love, N. The use of qualitative system dynamics to identify sustainability characteristics of decentralized wastewater management alternatives. Water Sci. Technol. 2010, 61, 1637–1644. [Google Scholar] [CrossRef]

- Haji Gholam Saryazdi, A.; Rajabzadeh Ghatari, A.; Mashayekhi, A.; Hassanzadeh, A. Designing a qualitative system dynamics model of crowdfunding by document model building. Qual. Res. Financ. Mark. 2019, 12, 197–224. [Google Scholar] [CrossRef]

- Shoar, S.; Payan, S. A qualitative system dynamics approach to modeling the causes and effects of design deficiencies in construction projects. J. Facil. Manag. 2022, 20, 558–569. [Google Scholar] [CrossRef]

- Schwab, J.D.; Kühlwein, S.D.; Ikonomi, N.; Kühl, M.; Kestler, H.A. Concepts in Boolean network modeling: What do they all mean? Comput. Struct. Biotechnol. J. 2020, 18, 571–582. [Google Scholar] [CrossRef]

- Weimer-Jehle, W. Cross-impact balances: A system-theoretical approach to cross-impact analysis. Technol. Forecast. Soc. Chang. 2006, 73, 334–361. [Google Scholar] [CrossRef]

- Voinov, A. Systems Science and Modeling for Ecological Economics: Amsterdam; Elsevier: Amsterdam, The Netherlands, 2008; ISBN 978-0-12-372593-7. [Google Scholar]

- Valaei Sharif, S.; Habibi Moshfegh, P.; Morshedi, M.A.; Kashani, H. Modeling the impact of mitigation policies in a pandemic: A system dynamics approach. Int. J. Disaster Risk Reduct. 2022, 82, 103327. [Google Scholar] [CrossRef]

- Kashani, H.; Valaei Sharif, S.; Hosseini, S.; Hekmatian, M.A. Dynamical Modeling of Outbreak and Control of Pandemics: Assessing the Resilience of Healthcare Infrastructure Under Mitigation Policies. In The Science behind the COVID Pandemic and Healthcare Technology Solutions; Springer: Berlin/Heidelberg, Germany, 2022; pp. 329–351. [Google Scholar]

- Innocenti, E.; Detotto, C.; Idda, C.; Parker, D.C.; Prunetti, D. An iterative process to construct an interdisciplinary ABM using MR POTATOHEAD: An application to Housing Market Models in touristic areas. Ecol. Complex. 2020, 44, 100882. [Google Scholar] [CrossRef]

- Filatova, T.; Parker, D.; Van der Veen, A. Agent-based urban land markets: Agent’s pricing behavior, land prices and urban land use change. J. Artif. Soc. Soc. Simul. 2009, 12, 3. [Google Scholar]

- Kaimowitz, D.; Angelsen, A. Economic Models of Tropical Deforestation: A Review; Center for International Forestry Research: Kota Bogor, Indonesia, 1998. [Google Scholar]

- KWAR. “Housing Market Insights” Event; Kitchener-Waterloo Association of Realtors: Kitchener, ON, Canada, 2018. [Google Scholar]

- Region of Waterloo. Draft Regional Official Plan for the Region of Waterloo; Region of Waterloo: Kitchener, ON, Canada, 2022; Available online: https://www.engagewr.ca/regional-official-plan (accessed on 5 December 2022).

- Huang, Y.; Parker, D.; Minaker, L. Identifying latent demand for transit-oriented development neighbourhoods: Evidence from a mid-sized urban area in Canada. J. Transp. Geogr. 2021, 90, 102940. [Google Scholar] [CrossRef]

- City of Kitchener. City of Kitchener Zonign Bylaw; City of Kitchener: Kitchener, ON, Canada, 2019; Available online: https://www.kitchener.ca/en/development-and-construction/zoning-bylaw.aspx (accessed on 5 December 2022).

- Nicholson, W.; Snyder, C.M. Microeconomic Theory: Basic Principles and Extensions; Cengage Learning: Boston, MA, USA, 2012. [Google Scholar]

- Daly, H.E.; Farley, J. Ecological Economics: Principles and Applications; Island press: Washington, DC, USA, 2011. [Google Scholar]

- Hackett, S.; Dissanayake, S.T.M. Environmental and Natural Resources Economics: Theory, Policy, and the Sustainable Society, 4th ed.; Routledge: London, UK, 2011. [Google Scholar]

- CMHC. Rental Market Survey 2014–2020; Canadian Mortgage and Housing Corporation: Ottawa, ON, Canada, 2022; Available online: https://www.cmhc-schl.gc.ca/en/professionals/housing-markets-data-and-research/housing-data/data-tables/rental-market/rental-market-report-data-tables (accessed on 5 December 2022).

- Statistics Canada. Kitchener—Cambridge—Waterloo [Census Metropolitan Area], Ontario and Ontario [Province] (Table). Census Profile. 2016 Census; Catalogue no. 98-316-X2016001; Statistics Canada: Ottawa, ON, Canada, 2017; Available online: https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/index.cfm?Lang=E (accessed on 5 December 2022).

- Statistics Canada. Canadian Income Survey: Population Rebasing, 2012 to 2019; Income Research Paper Series; Statistics Canada: Ottawa, ON, Canada, 2022. [Google Scholar]

- Statistics Canada. Survey of Labour and Income Dynamics; Statistics Canada: Ottawa, ON, Canada, 2022; Available online: https://www150.statcan.gc.ca/n1/en/catalogue/75F0026X (accessed on 5 December 2022).

- CMHC. Rental Market Report: Kitchener-Cambridge-Waterloo CMA; Canadian Mortgage and Housing Corporation: Ottawa, ON, Canada, 2020; Available online: https://publications.gc.ca/collections/collection_2020/schl-cmhc/NH12-72-2020-eng.pdf (accessed on 5 December 2022).

- Relator.ca Website. 2021. Available online: Realtor.ca (accessed on 14 June 2021).

- Higgins, C.D.; Kanaroglou, P.S. Forty years of modelling rapid transit’s land value uplift in North America: Moving beyond the tip of the iceberg. Transp. Rev. 2016, 36, 610–634. [Google Scholar] [CrossRef]

- Nabi, S. Learning from 20 Years of High-Density Development in Kitchener; Sam Nabi: Kitchener, ON, Canada, 2022; Available online: https://samnabi.com/blog/how-do-we-build-from-here?fbclid=IwAR0wnrURClgjAr009jTrsmCIdUeMf5oRrLSziNIjOJuxsxEISYlt9PoVGnc (accessed on 5 December 2022).

- Parker, D.C. Revealing “space” in spatial externalities: Edge-effect externalities and spatial incentives. J. Environ. Econ. Manag. 2007, 54, 84–99. [Google Scholar] [CrossRef]

- City of Minneapolis. Minneapolis, Minnesota—Code of Ordinances; City of Minneapolis: Minneapolis, MN, USA, 2020. Available online: https://www2.minneapolismn.gov/business-services/planning-zoning/zoning-maps/about-the-zoning-code/ (accessed on 5 December 2022).

- Podbielski, T. Finding the Suburban “Missing Middle”: Case Study Analysis of Housing Supply Trends and Needs in Buda, Kyle and San Marcos, Texas. Ph.D. Thesis, The University of Texas at Austin, Austin, TX, USA, 2021. [Google Scholar]

- City of Grand Rapids. City of Grand Rapids Zonign Ordinance; City of Grand Rapids: Grand Rapids, MI, USA, 2018. Available online: https://www.grandrapidsmi.gov/Government/Programs-and-Initiatives/Zoning-Ordinance (accessed on 5 December 2022).

- City of Portland. City of Portland Planning & Zoning Code; City of Portland: Portland, OR, USA, 2022. Available online: https://www.portland.gov/code/33#toc-zoning-code (accessed on 5 December 2022).

- California Legislative Information. California Goverment Code; California Legislative Information: California City, CA, USA, 2022; Available online: https://www.planning.org/knowledgebase/resource/9138404/#enabling (accessed on 5 December 2022).

- City of Edmonton. ‘Missing Middle’ Infill Design Competition; City of Edmonton: Edmonton, AB, Canada, 2019; Available online: https://www.edmonton.ca/programs_services/recognition_awards/infill-design-competition (accessed on 5 December 2022).

- City of Saint Paul. Zonning Permits and Land Uses; City of Saint Paul: Saint Paul, MN, USA, 2022. Available online: https://www.stpaul.gov/departments/safety-inspections/building-and-construction/construction-permits-and-inspections/zoning-permits-land-uses (accessed on 5 December 2022).

- Dill, E. City Program Promotes ‘Missing Middle’ Affordable Housing; The Minnesota Daily: Minneapolis, MN, USA, 2019; Available online: https://mndaily.com/224551/news/ctmiddlehousing/ (accessed on 5 December 2022).

- MSHDA. Missing Middle Housing Program; Michigan State Housing Development Authority: Detroit, MI, USA, 2022. Available online: https://www.michigan.gov/mshda/-/media/Project/Websites/mshda/developers/missing-middle/MM-Housing-Program-Plan.pdf?rev=c7a12e72fa6d4792bd23b1f493ae2474&hash=A8EC277F4004EF2CB26B7BEF8F9F8EA9 (accessed on 5 December 2022).

- CMHC. Canada Supports Co-Ops in Vancouver and across Canada; CMHC: Ottawa, ON, Canada, 2022; Available online: https://www.newswire.ca/news-releases/canada-supports-co-ops-in-vancouver-and-across-canada-887949021.html (accessed on 5 December 2022).

- Raymer, E. Montreal’s 20-20-20 Housing Development Bylaw Comes into Effect; Canadian Lawyer: Canmore, AB, Canada, 2021; Available online: https://www.canadianlawyermag.com/practice-areas/real-estate/montreals-20-20-20-housing-development-bylaw-comes-into-effect/355075 (accessed on 5 December 2022).

- City of Montreal. Diverse Metropolis: An Overview of the by-Law; City of Montreal: Montreal, QC, Canada, 2022; Available online: https://montreal.ca/en/articles/diverse-metropolis-overview-law-7816 (accessed on 5 December 2022).

- City of Toronto. Toronto Affordable Rental Housing Design Guidelines; City of Toronto: Toronto, ON, Canada, 2015; Available online: https://www.toronto.ca/wp-content/uploads/2017/11/8fea-AFFORDABLE-HOUSING-DESIGN-GUIDELINES.FINAL_.07.06.2017.pdf (accessed on 5 December 2022).

- Garber, P.M. Famous First Bubbles. J. Econ. Perspect. 1990, 4, 35–54. [Google Scholar] [CrossRef]

- Parker, D.C.; Valaei Sharif, S.; Waddel, P.; Tsiakopoulis, T. Incorporating price expectations into agent-based representations of land developer decision models. In Proceedings of the Social Simulation Conference: Promoting Social Simulation and Computational Social Science, Milan, Italy, 14 September 2022. [Google Scholar]

| Year | Bachelor | 1 BR | 2 BR | 3+ BR |

|---|---|---|---|---|

| 2015 | 2.6% | 32.0% | 60.5% | 4.8% |

| 2020 | 2.3% | 31.4% | 60.3% | 6.0% |

| Net increase in units between 2015 and 2020 | 61 | 1971 | 4097 | 759 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Parker, D.C.; Valaei Sharif, S.; Webber, K. Why Did the “Missing Middle” Miss the Train? An Actors-In-Systems Exploration of Barriers to Intensified Family Housing in Waterloo Region, Canada. Land 2023, 12, 434. https://doi.org/10.3390/land12020434

Parker DC, Valaei Sharif S, Webber K. Why Did the “Missing Middle” Miss the Train? An Actors-In-Systems Exploration of Barriers to Intensified Family Housing in Waterloo Region, Canada. Land. 2023; 12(2):434. https://doi.org/10.3390/land12020434

Chicago/Turabian StyleParker, Dawn Cassandra, Shahab Valaei Sharif, and Kaitlin Webber. 2023. "Why Did the “Missing Middle” Miss the Train? An Actors-In-Systems Exploration of Barriers to Intensified Family Housing in Waterloo Region, Canada" Land 12, no. 2: 434. https://doi.org/10.3390/land12020434

APA StyleParker, D. C., Valaei Sharif, S., & Webber, K. (2023). Why Did the “Missing Middle” Miss the Train? An Actors-In-Systems Exploration of Barriers to Intensified Family Housing in Waterloo Region, Canada. Land, 12(2), 434. https://doi.org/10.3390/land12020434