Resource Opportunity in China’s Market Transition and Governance: Time Factor in Urban Housing Inequality

Abstract

:1. Introduction

2. Theory and Hypothesis

3. Research Methods

3.1. Methodology

3.2. Data Collection

3.3. Measures

- Education level: The education of the respondents is re-classified as elementary school and below, secondary school, high school, and university and above.

- Party membership: Membership includes Communist Party membership and membership in democratic parties. In China, democratic parties have their own political implications.

- Work unit type: Due to the joint-stock system reform in recent years, some state-owned enterprises and collective enterprises have begun to include private capital, and some public institutions are owned and run by individuals. Therefore, first, the work unit types offered in questionnaires are roughly classified. Next, the work unit types marked as enterprise are further classified as state-owned, collective, or privately owned in terms of ownership.

- Occupation and administration position: Occupation is a major factor affecting housing distribution. To better compare the variable of administration position to other occupations, respondents with an administration position are encoded into two professions: senior cadres with a title of section chief and above, and junior cadres with a title of section chief and below. These two professions are added to the variable of occupation. Additionally, samples that have both administration positions and other occupations are ruled out.

- Control variable: According to the literature, demographic variables are included as control variables to increase the accuracy of the model. These variables are age and the square of age, marital status, number of family members, province, and natural logarithm, taken as the total income of the previous year.

4. Analysis and Results

4.1. Housing Value Model

4.2. Housing Added-Value Model

5. Conclusions and Discussion

5.1. Conclusions

5.2. Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Wang, F.; Ma, L. Boundaries and Categories: Rising Inequality in Post-Socialist Chin; Zhejiang People’s Publishing House: Hangzhou, China, 2013. [Google Scholar]

- Reuters Beijing. The First Time the Bureau of Statistics Released Gini Coefficiet in China. Available online: http://cn.reuters.com/article/cn-gini-population-reform-idCNCNE90H04A20130118 (accessed on 25 October 2021).

- Davis, D.S. Urban Chinese homeowners as citizen-consumers. In The Ambivalent Consumer edited by Sheldon Garon and Patricia Maclachlan; Cornell University Press: Ithaca, NY, USA, 2006; pp. 281–299. [Google Scholar]

- Davis, D. Urban consumer culture. China Q. 2005, 183, 692–709. [Google Scholar] [CrossRef] [Green Version]

- Gan, L. China Household Finance Survey Report; Southwestern University of Finance and Economics Press: Chengdu, China, 2012. [Google Scholar]

- Merton, R.K. The matthew effect in science, ii: Cumulative advantage and the symbolism of intellectual property. Isis 1988, 79, 606–623. [Google Scholar] [CrossRef] [Green Version]

- Walder, A.G. Property rights and stratification in socialist redistributive economies. Am. Sociol. Rev. 1992, 57, 524–539. [Google Scholar] [CrossRef]

- Parish, W.L.; Ethan, M. Politics and markets: Dual transformations. Am. J. Sociol. 1996, 101, 1042–1059. [Google Scholar] [CrossRef]

- Gerber, T.P.; Hout, M. More shock than therapy: Market transition, employment, and income in russia, 1991–1995. Am. J. Sociol. 1998, 104, 1–50. [Google Scholar] [CrossRef]

- Bian, Y.; Logan, J.R. Market transition and the persistence of power: The changing stratification system in urban china. Am. Sociol. Rev. 1996, 61, 739–758. [Google Scholar] [CrossRef]

- Zhou, X.G. Economic transformation and income inequality in urban china: Evidence from panel data. Am. J. Sociol. 2000, 105, 1135–1174. [Google Scholar] [CrossRef]

- Bian, Y.J.; Zhang, Z.X. Marketization and income distribution in urban china, 1988 and 1995. Res. Soc. Strat. Mobil. 2002, 19, 377–415. [Google Scholar] [CrossRef]

- Walder, A.G. Communist Neo-Traditionalism; University of California Press: Auckland, CA, USA, 1988. [Google Scholar]

- Bian, Y.; Liu, Y. Social stratification, home ownership, and quality of living: Evidence from china’s fifth census. Sociol. Res. 2005, 3, 82–98. [Google Scholar]

- Liu, X. Market transition and social stratification: Theoretial debates and further research issues. Soc. Sci. China 2003, 5, 102–110. [Google Scholar]

- Liu, Z.; Hu, R. Urban housing stratification: An analysis based on cgss2006 data. Chin. J. Sociol. 2010, 30, 164–192. [Google Scholar]

- Nee, V. Social inequalities in reforming state socialism: Between redistribution and markets in china. Am. Sociol. Rev. 1991, 56, 267–282. [Google Scholar] [CrossRef] [Green Version]

- Nee, V. The emergence of a market society: Changing mechanisms of stratification in china. Am. J. Sociol. 1996, 101, 908–949. [Google Scholar] [CrossRef]

- Szelenyi, I. Social inequalities in state socialist redistributive economies. Int. J. Comp. Sociol. 1978, 19, 63–87. [Google Scholar] [CrossRef]

- Chen, Z. Market transition or power conversion: The wealth distribution and the regional disparity of urban residents in mainland china. In Market, Classes and Politics: Chinese Society during Transition; Liu, Z., Ed.; Hong Kong Institute of Asia-Pacific Studies, The Chinese University of Hong Kong: Hongkong, China, 2000. [Google Scholar]

- Walder, A.G. Local governments as industrial firms: An organizational analysis of china’s transitional economy. Am. J. Sociol. 1995, 101, 263–301. [Google Scholar] [CrossRef] [Green Version]

- Liu, X. Housing inequality in urban china. Sociol. Forum Fudan Univ. 2005, 1, 149–171. [Google Scholar]

- Xie, Y.; Hannum, E. Regional variation in earnings inequality in reform-era urban china. Am. J. Sociol. 1996, 101, 950–992. [Google Scholar] [CrossRef]

- Liu, Z.Q. The economic impact and determinants of investment in human and political capital in china. Econ. Dev. Cult. Change 2003, 51, 823–849. [Google Scholar] [CrossRef]

- Song, S.G. The delayed effect of power conversion-an explanation of the regeneration and circulation of elites in the process of transforming socialist countries to markets. Sociol. Res. 1998, 3, 26–36. [Google Scholar]

- Li, B.; Walder, A.G. Career advancement as party patronage: Sponsored mobility into the chinese administrative elite, 1949–1996. Am. J. Sociol. 2001, 106, 1371–1408. [Google Scholar] [CrossRef] [Green Version]

- Fan, G.; Wang, X. Marketization index for China’s provinces. Econ. Res. 2003, 3, 9–18. [Google Scholar]

- Li, S.; Wei, Z.; Ding, S. Empirical analysis on the inequality and the reason for china’s residents’ property distribution. Econ. Res. J. 2005, 6, 4–15. [Google Scholar]

- Zhang, J. Study on the Housing Inequality in China; Dongbei University of Finance and Economics: Dalian, China, 2013. [Google Scholar]

- Hu, R. Housing inequality during market transition: Analysis of housing value and housing quantity. J. Gansu Admin. Ins. 2014, 6, 108–116. [Google Scholar]

- Li, B. Housing Policies in Differentiatio; Social Sciences Academic Press: Beijing, China, 2009. [Google Scholar]

- Luo, C.L. Housing area inequality in urban residents: An analysis based on 2000 and 2005 census in chin. Acad. Bras. 2014, 1, 80–90. [Google Scholar]

- Hu, R. Housing inequality during the market transition: Evidence from the data of cgss2006. Soc. Chin. J. Sociol. Shehui 2012, 32, 126–151. [Google Scholar]

- Wu, X.B. Gains and Losses of Economic Reform in the Course of History; Zhejiang University Press: Hangzhou, China, 2013. [Google Scholar]

- Zhou, F.Z. Fiscal Relations and Local Governance; Shanghai SDX Joint Publishing Company: Shanghai, China, 2012. [Google Scholar]

- Xie, Y.; Wu, X. Danwei profitability and earnings inequality in urban china. China Q. 2008, 195, 558–581. [Google Scholar] [CrossRef] [Green Version]

- Liu, X. Market transformation and social stratification: The focus of theoretical debate and problems to be studied. Chin. Soc. Sci. 2003, 102–110. [Google Scholar]

- Giddens, A. The Class Structure of the Advanced Society; Hutchinson: London, UK, 1973. [Google Scholar]

- Goldthorpe, J. Social Mobility and Class Structure in Modern Britain; Clarendon: Oxford Shire, UK, 1987. [Google Scholar]

- Szelnyi, I.; Manchin, R. Social policy under state socialism: Market, redistribution, and social inequalities in East European socialist societies. In Stagnation and Renewal in Social Policy; Rein, M., Esping-Anderson, G., Rainwater, L., Eds.; M.E. Sharpe: White Plains, NY, USA, 1986; pp. 102–139. [Google Scholar]

| Continuous Variable | ||||||

|---|---|---|---|---|---|---|

| Variables | Sample Numbers | Mean | Gini Coefficient | Standard Deviation | Minimum Value | Maximum Value |

| The market value of property 1 (CNY 10,000) | 2791 | 80.67 | 0.59332 | 128.46 | 0.01 | 3000 |

| The added value of property (CNY 10,000) | 1931 | 55.88 | 0.57414 | 70.977 | −49 | 990 |

| Income (CNY) | 3165 | 44,700 | 0.58174 | 534,295 | 300 | 3 × 107 |

| Number of properties | 2860 | 1.203 | —— | 0.5986 | 1 | 15 |

| Year of purchase or construction | 1998 | 2000 | —— | 9.6015 | 1812 | 2013 |

| Age | 3263 | 42.54 | —— | 14.224 | 17 | 70 |

| Discrete variable 2 | ||||||

| Variables | Sample numbers | Frequency | Percentage (%) | Standard deviation | Minimum value | Maximum value |

| Time of Purchase or Construction | ||||||

| Before 1998 | 1998 | 659 | 32.983 | 0.4703 | 0 | 1 |

| 1999–2003 | 1998 | 555 | 27.7778 | 0.448 | 0 | 1 |

| 2004–2008 | 1998 | 479 | 23.974 | 0.427 | 0 | 1 |

| After 2009 | 1998 | 305 | 15.2653 | 0.3597 | 0 | 1 |

| Work Unit Types | ||||||

| Party and government organs | 2891 | 94 | 3.25147 | 0.1774 | 0 | 1 |

| Public institutions | 2891 | 426 | 14.7354 | 0.3545 | 0 | 1 |

| State-owned enterprises | 2891 | 669 | 23.1408 | 0.4218 | 0 | 1 |

| Collective enterprises | 2891 | 142 | 4.9118 | 0.2162 | 0 | 1 |

| Private enterprises | 2891 | 969 | 33.51781 | 0.4721 | 0 | 1 |

| Self-employed business | 2891 | 591 | 20.44275 | 0.4034 | 0 | 1 |

| Education Level | ||||||

| Elementary school | 3261 | 477 | 14.62741 | 0.3534 | 0 | 1 |

| Secondary school | 3261 | 869 | 26.64827 | 0.4422 | 0 | 1 |

| High school | 3261 | 908 | 27.84422 | 0.4483 | 0 | 1 |

| University and above | 3261 | 1007 | 30.8801 | 0.4621 | 0 | 1 |

| Occupation | ||||||

| Senior cadre | 2904 | 145 | 4.99311 | 0.2178 | 0 | 1 |

| Junior cadre | 2904 | 130 | 4.47658 | 0.2068 | 0 | 1 |

| Senior management | 2904 | 49 | 1.68733 | 0.1288 | 0 | 1 |

| Junior management | 2904 | 117 | 4.02893 | 0.1967 | 0 | 1 |

| Intermediate and senior technician | 2904 | 125 | 4.30441 | 0.203 | 0 | 1 |

| Ordinary technician | 2904 | 327 | 11.26033 | 0.3162 | 0 | 1 |

| Organization clerk | 2904 | 215 | 7.40358 | 0.2619 | 0 | 1 |

| Salesman of enterprises and institutions | 2904 | 147 | 5.06198 | 0.2193 | 0 | 1 |

| Business service personnel | 2904 | 466 | 16.04683 | 0.3671 | 0 | 1 |

| Skilled worker | 2904 | 154 | 5.30303 | 0.2241 | 0 | 1 |

| Ordinary worker | 2904 | 630 | 21.69421 | 0.4122 | 0 | 1 |

| Self-employed entrepreneur | 2904 | 363 | 12.5 | 0.3308 | 0 | 1 |

| Worker after retirement 3 | 2904 | 36 | 1.23967 | 0.1107 | 0 | 1 |

| Others | 2904 | 4 | 0.00138 | 0.03712 | 0 | 1 |

| Party member (Yes = 1, No = 0) | 3263 | 510 | 15.62979 | 0.3632 | 0 | 1 |

| Marriage status (Yes = 1, No = 0) | 3258 | 2536 | 77.83917 | 0.4154 | 0 | 1 |

| Family member number | 3260 | 7564 | 232.0245 | 1.2309 | 0 | 9 |

| Gender (Male = 1, Female = 0) | 3263 | 1602 | 49.09592 | 0.5 | 0 | 1 |

| Province | ||||||

| Shanghai Municipality | 3263 | 837 | 25.6512 | 0.43677 | 0 | 1 |

| Yunnan Province | 3263 | 368 | 11.278 | 0.31637 | 0 | 1 |

| Jilin Province | 3263 | 575 | 17.6218 | 0.38106 | 0 | 1 |

| Guangdong Province | 3263 | 735 | 22.5253 | 0.41781 | 0 | 1 |

| Henan Province | 3263 | 392 | 12.0135 | 0.32517 | 0 | 1 |

| Gansu Province | 3263 | 356 | 10.9102 | 0.31181 | 0 | 1 |

| Model Type/Quantiles | OLS | 0.1 | 0.25 | 0.5 | 0.75 | 0.9 |

|---|---|---|---|---|---|---|

| Age | −0.0183 | −0.0388 ! | −0.0253 | −0.0117 | −0.0104 | −0.00454 |

| Square of age | 0.000303 * | 0.000538 * | 0.000384 * | 0.000215 | 0.000182 | 0.000135 |

| Marriage status | −0.0088 | 0.00175 | 0.00708 | 0.000983 | 0.0423 | −0.00369 |

| Number of family members | 0.0535 *** | 0.0253 | 0.0532 ** | 0.0537 *** | 0.0526 ** | 0.0493 * |

| Gender | −0.120 *** | −0.125 ! | −0.139 ** | −0.125 *** | −0.0472 | −0.0695 |

| Province | ||||||

| Yunnan Province | −1.126 *** | −1.306 *** | −1.244 *** | −1.110 *** | −1.076 *** | −1.070 *** |

| Jilin Province | −1.618 *** | −1.924 *** | −1.615 *** | −1.449 *** | −1.463 *** | −1.467 *** |

| Guangdong Province | −0.479 * | −0.801 ** | −0.637 * | −0.498 | −0.328 | −0.0866 |

| Henan Province | −1.057 *** | −0.988 *** | −1.031 *** | −1.046 *** | −1.147 *** | −1.223 *** |

| Gansu Province | −1.391 *** | −1.473 *** | −1.416 *** | −1.321 *** | −1.379 *** | −1.376 *** |

| Constant term | 1.923 *** | 0.6 | 1.469 ! | 1.580 ** | 2.792 *** | 3.493 *** |

| Number of cases | 1648 | 1648 | 1648 | 1648 | 1648 | 1648 |

| R2 | 0.577 | 0.3503 | 0.3589 | 0.3807 | 0.3959 | 0.3866 |

| Model Type/Quantiles | OLS | 0.1 | 0.25 | 0.5 | 0.75 | 0.9 |

|---|---|---|---|---|---|---|

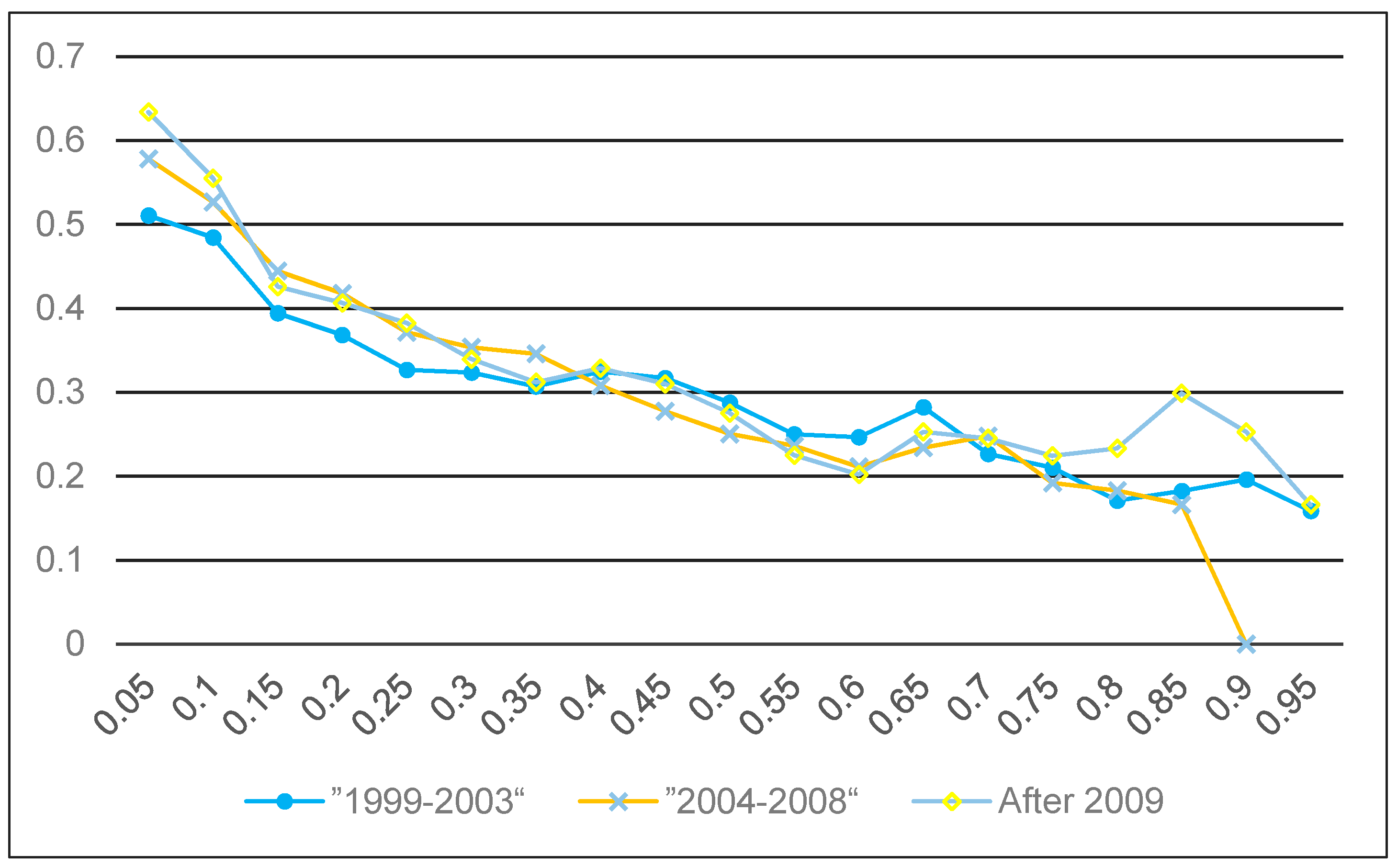

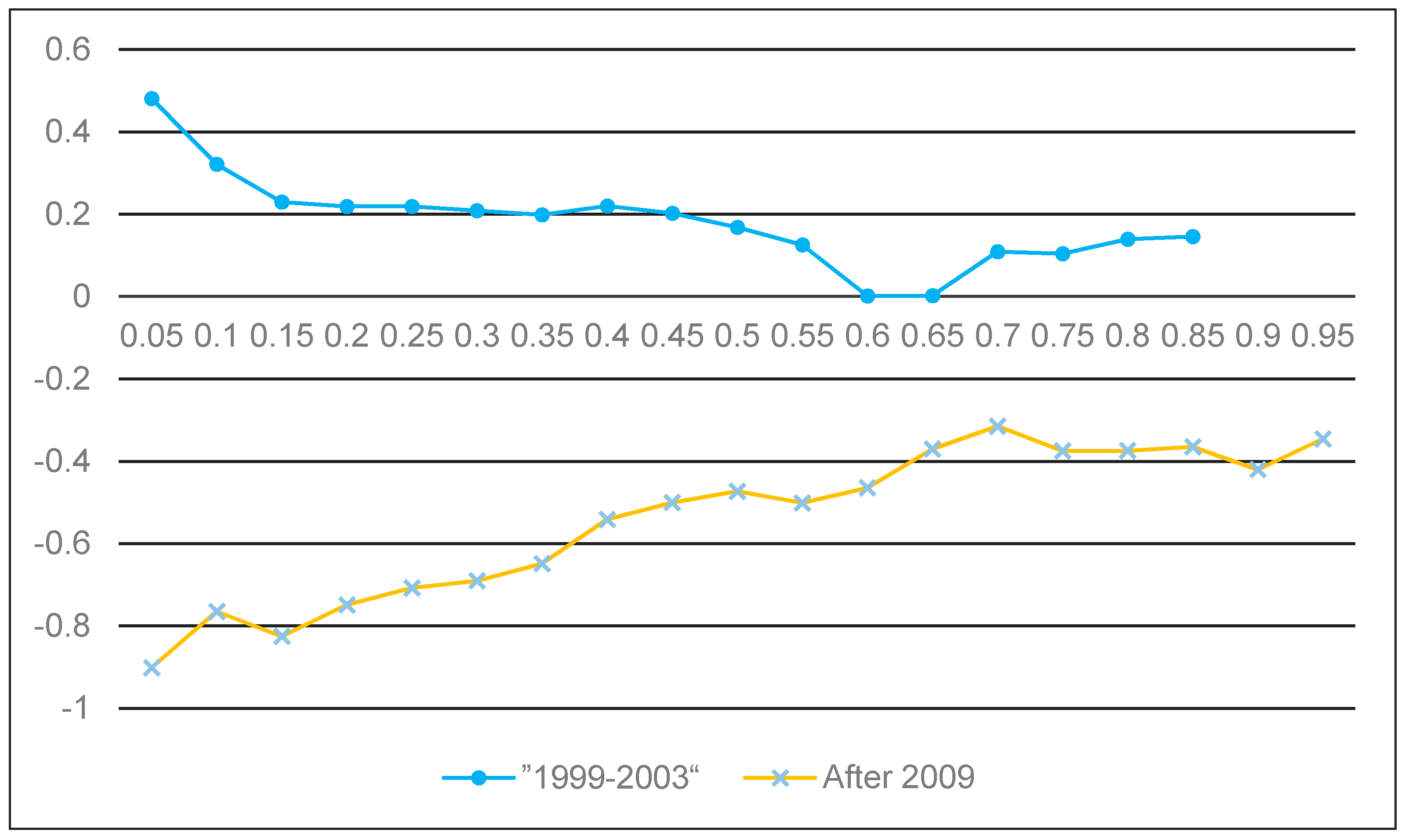

| Time of Purchase or Construction | ||||||

| Reference Group: Before 1998 | ||||||

| 1999–2003 | 0.329 *** | 0.485 *** | 0.327 *** | 0.288 *** | 0.211 *** | 0.197 * |

| 2004–2008 | 0.341 *** | 0.526 *** | 0.373 *** | 0.252 *** | 0.195 ** | 0.133 |

| After 2009 | 0.398 ** | 0.556 ** | 0.383 *** | 0.276 ** | 0.224 * | 0.255 * |

| Model Type/Quantile | OLS | 0.1 | 0.25 | 0.5 | 0.75 | 0.9 |

|---|---|---|---|---|---|---|

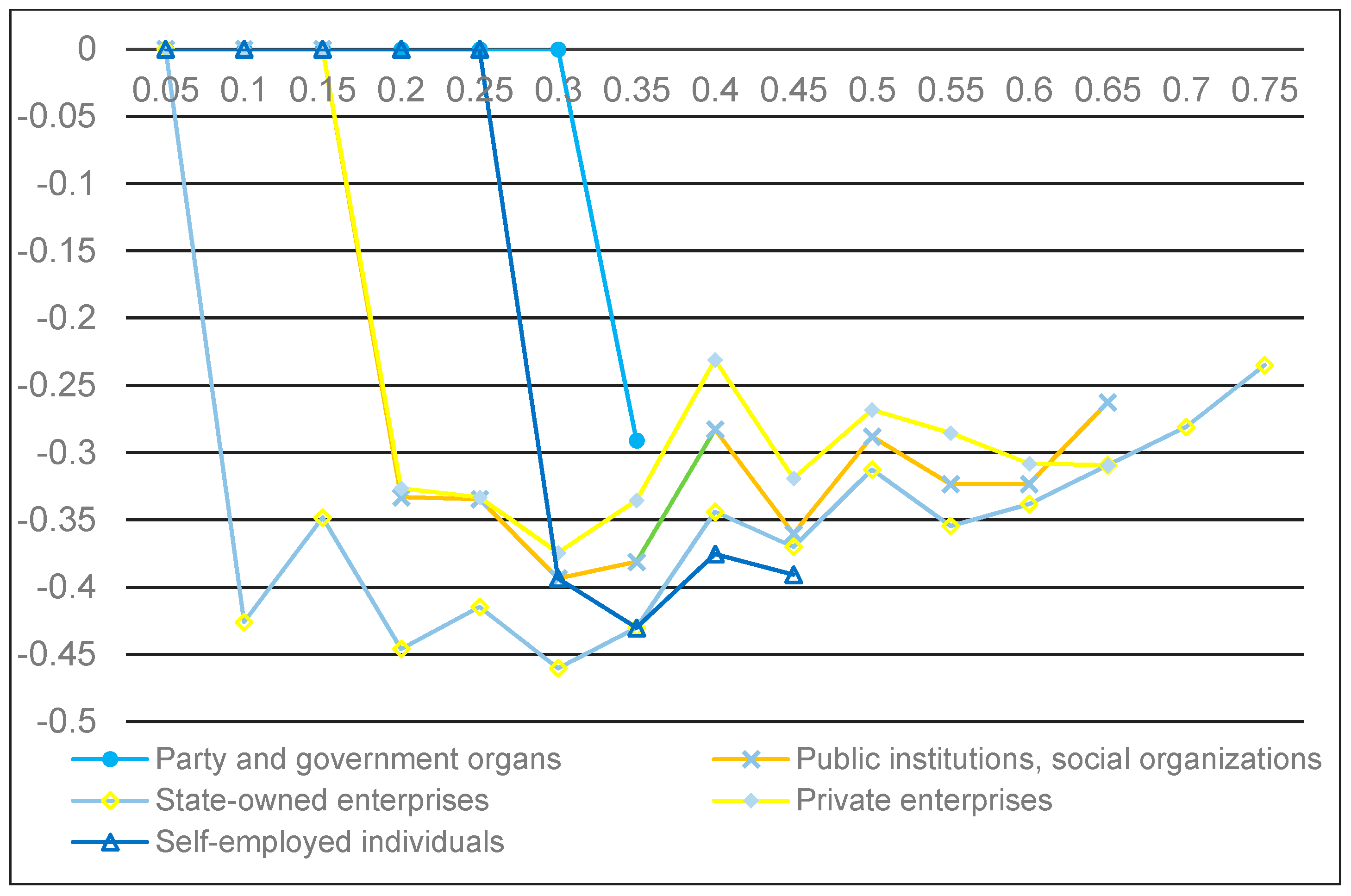

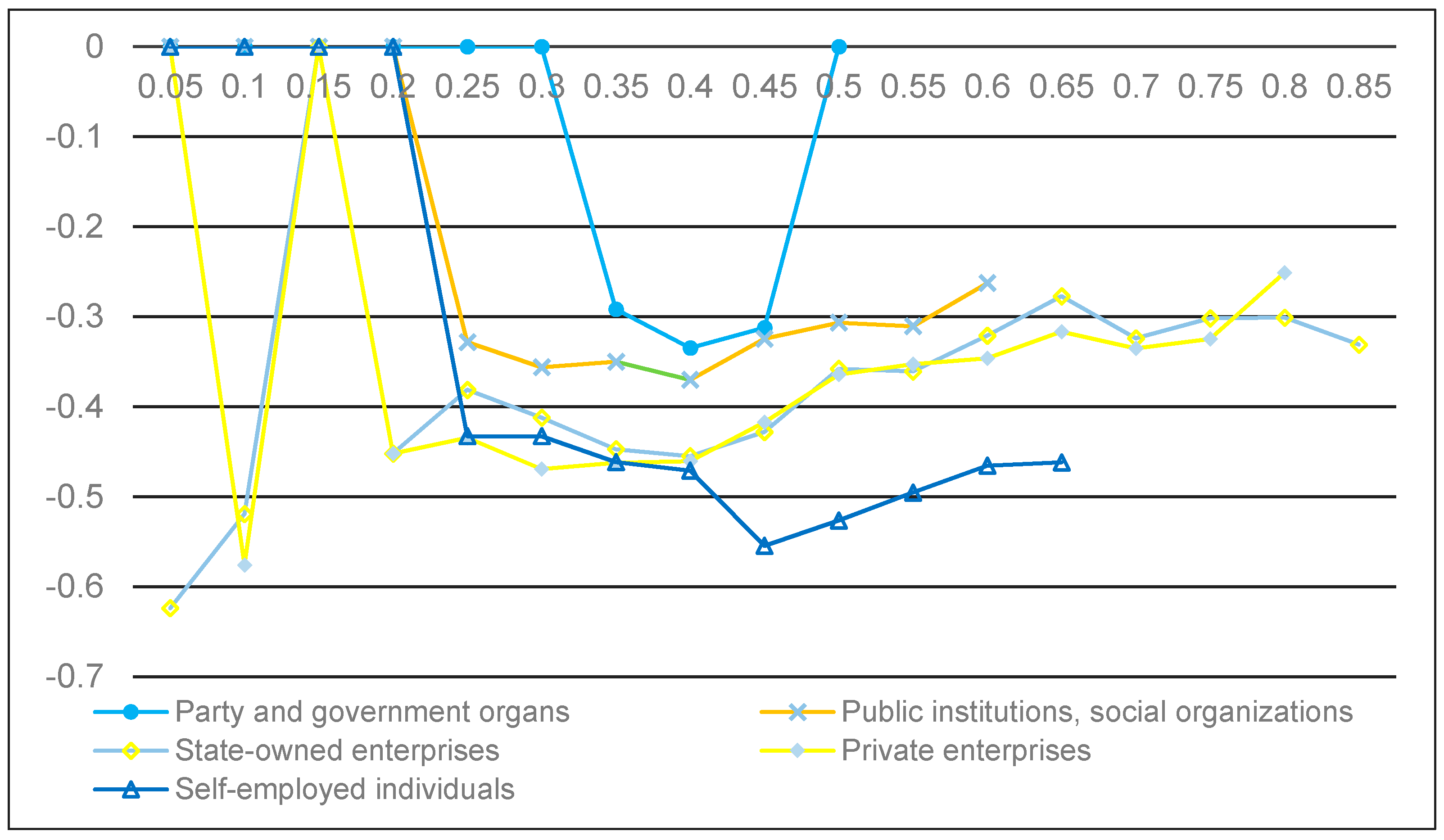

| Work Unit Type | ||||||

| Reference Group: Collective Enterprises | ||||||

| Party and government organs | −0.196 | −0.128 | −0.206 | −0.276 ! | −0.169 | −0.045 |

| Public institutions, social organizations | −0.291 ** | −0.261 | −0.335 * | −0.289 ** | −0.220 * | −0.181 |

| State-owned enterprises | −0.330 ** | −0.427! | −0.414 ** | −0.312 ** | −0.235 * | −0.15 |

| Private enterprises | −0.281 ** | −0.304 | −0.332 ** | −0.269 ** | −0.224 * | −0.194 |

| Self-employed individuals | −0.275 | −0.0655 | −0.304 | −0.299 ! | −0.229 | −0.299 |

| Model Type/Quantile | OLS | 0.1 | 0.25 | 0.5 | 0.75 | 0.9 |

|---|---|---|---|---|---|---|

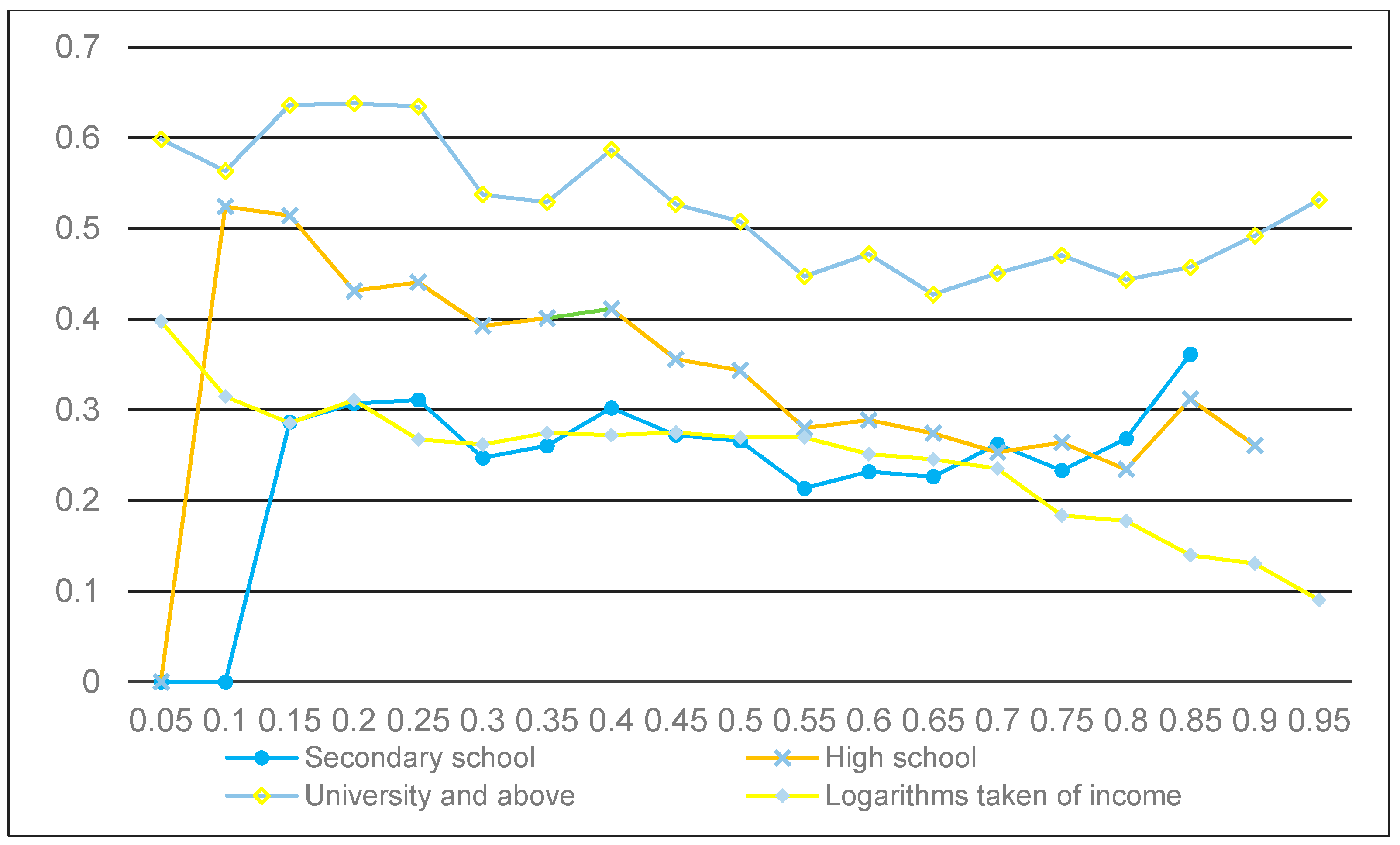

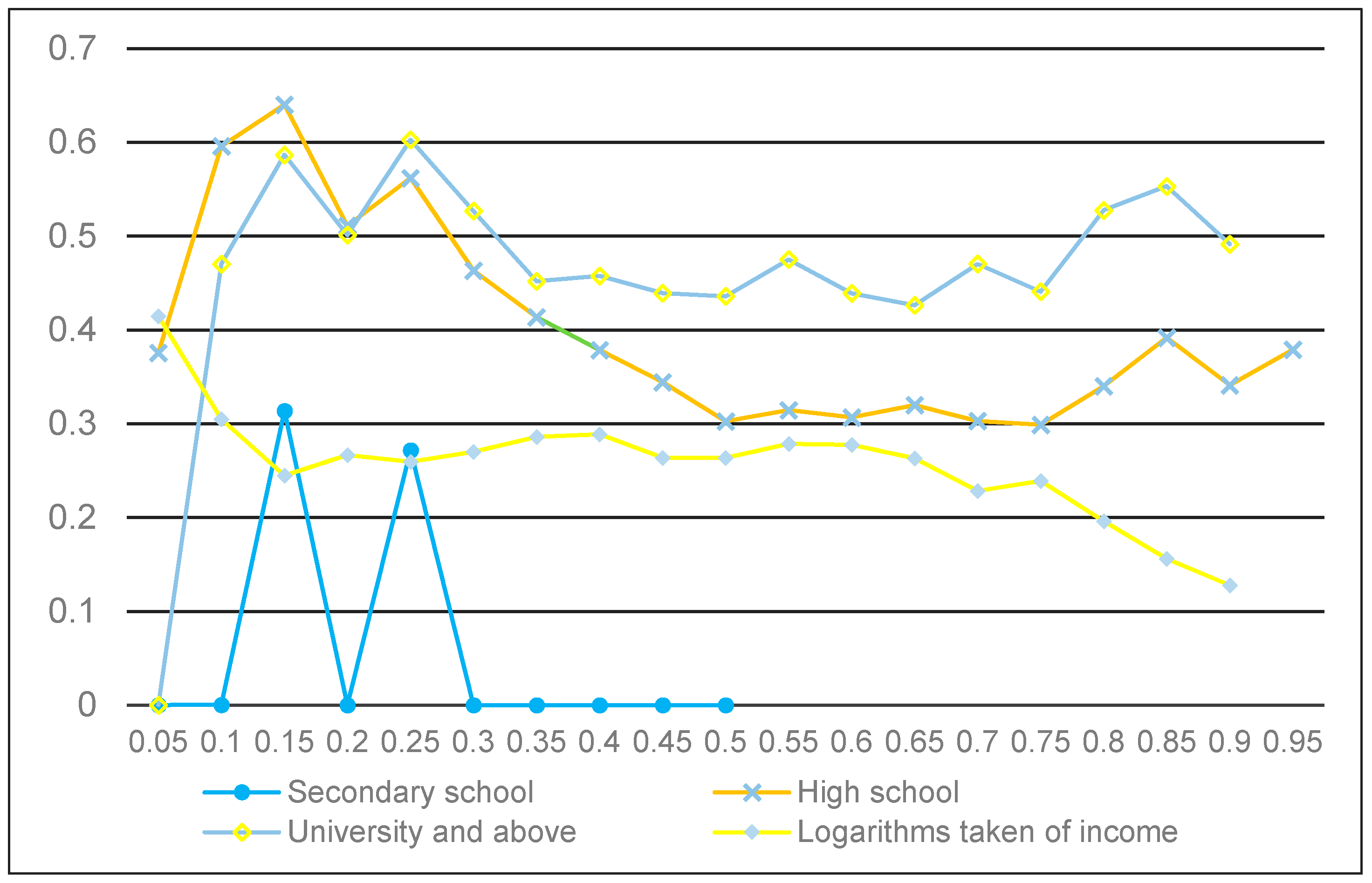

| Education Level | ||||||

| Reference Group: Elementary School and Below | ||||||

| Secondary school | 0.325 ** | 0.283 | 0.311 * | 0.266 ** | 0.233 ** | 0.296 ** |

| High school | 0.412 *** | 0.524 * | 0.440 ** | 0.345 ** | 0.263 ** | 0.261 * |

| University and above | 0.584 *** | 0.564 * | 0.633 *** | 0.507 *** | 0.471 *** | 0.493 *** |

| Logarithms taken of income | 0.233 *** | 0.316 *** | 0.268 *** | 0.270 *** | 0.184 *** | 0.131 ** |

| Model Type/Quantile | OLS | 0.1 | 0.25 | 0.5 | 0.75 | 0.9 |

|---|---|---|---|---|---|---|

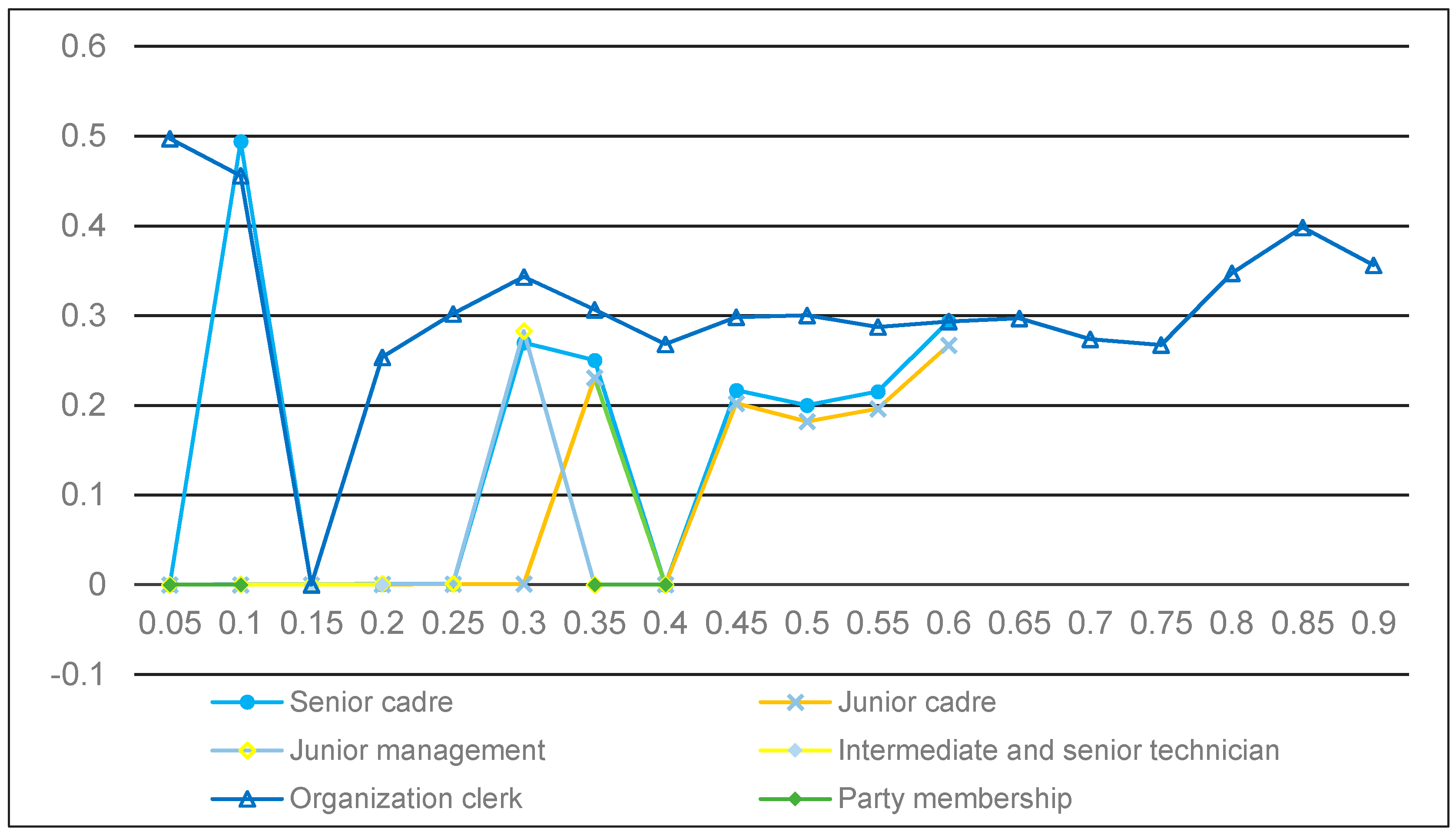

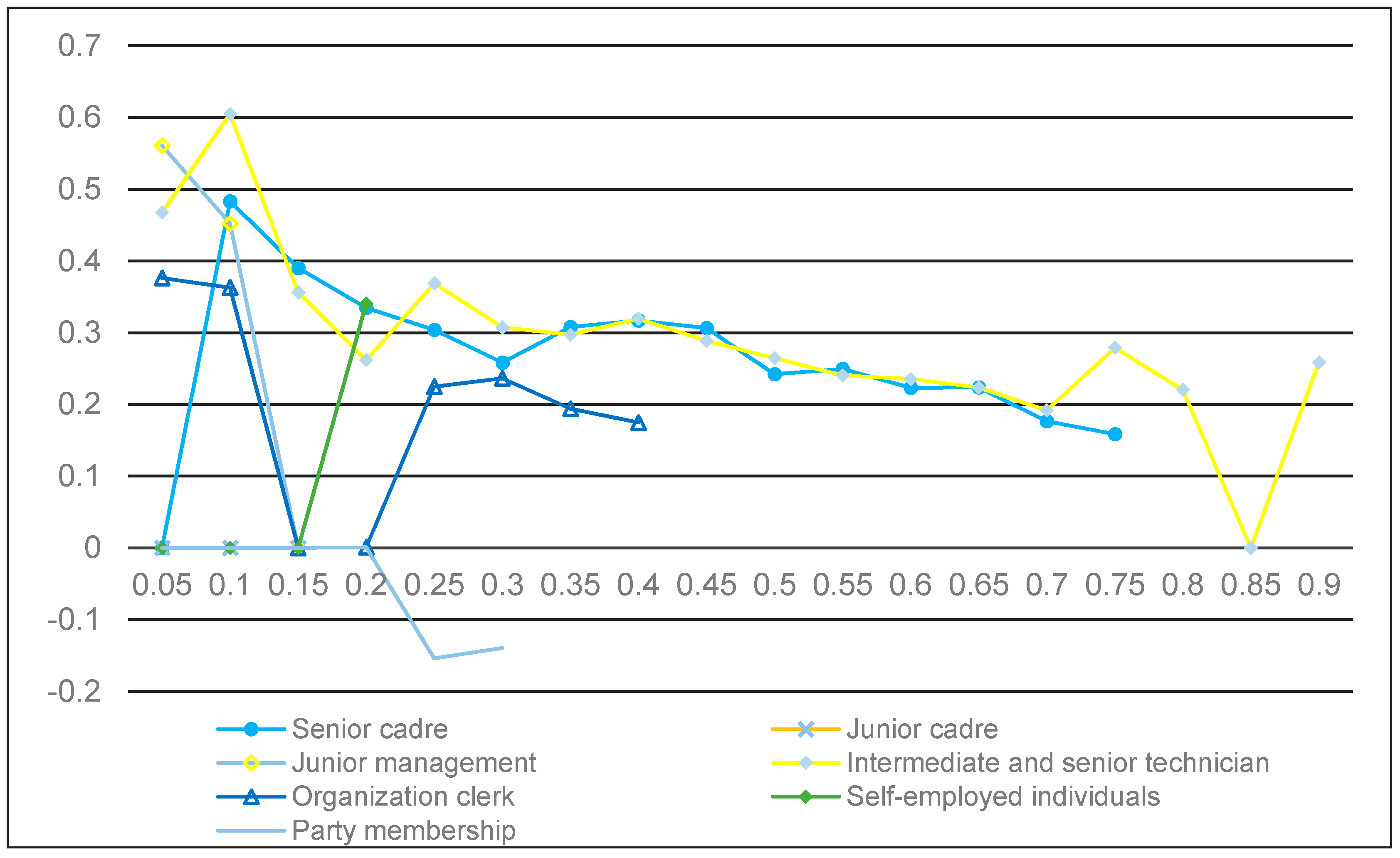

| Occupation | ||||||

| Reference Group: Ordinary Workers | ||||||

| Senior cadre | 0.278 * | 0.494 * | 0.203 | 0.200 ! | 0.236 ** | 0.158 |

| Junior cadre | 0.231 ! | 0.41 | 0.134 | 0.182 ! | 0.176 ! | 0.250 ** |

| Senior management | 0.226 ! | 0.155 | −0.158 | 0.161 | 0.223 | 0.537 * |

| Junior management | 0.245 * | 0.236 | 0.231 | 0.219 * | 0.179 ! | 0.247 |

| Intermediate and senior technician | 0.144 ! | 0.273 | 0.0567 | 0.139 ! | 0.0942 | 0.0203 |

| Ordinary technician | 0.0382 | −0.0529 | −0.0257 | 0.0389 | 0.0635 | 0.0896 |

| Organization clerk | 0.365 ** | 0.455 * | 0.301 * | 0.301 ** | 0.267 * | 0.356 ** |

| Salesman of enterprises and institutions | 0.0868 | 0.161 | −0.0476 | 0.0701 | 0.0754 | 0.241 |

| Business service personnel | 0.118 ! | 0.362 * | 0.0763 | 0.0648 | 0.0316 | 0.0173 |

| Skilled worker | 0.147 ! | 0.299 | −0.0214 | −0.0241 | 0.222 * | 0.214 ! |

| Self-employed entrepreneur | 0.168 | 0.121 | 0.0945 | 0.135 | 0.184 | 0.261 |

| Others | −0.126 | −0.212 | −0.393 | 0.323 | 0.068 | −0.205 |

| Party membership | −0.0928 | −0.0499 | −0.126 * | −0.092 | −0.0467 | −0.0422 |

| Model Type/Quantile | OLS | 0.1 | 0.25 | 0.5 | 0.75 | 0.9 |

|---|---|---|---|---|---|---|

| Age | −0.00913 | −0.013 | −0.0041 | −0.018 | 0.00834 | −0.00282 |

| Square of age | 0.000226 | 0.000309 | 0.000216 | 0.000305 ! | 0.000017 | 9.27 × 10−5 |

| Political status | −0.0973 | −0.0939 | −0.155 * | −0.0935 | −0.0736 | 0.0206 |

| Marriage status | −0.0108 | −0.00724 | −0.0281 | −0.0275 | 0.0245 | 0.0134 |

| Family member number | 0.0551 ** | 0.0415 | 0.0640 ** | 0.0467 * | 0.0536 ** | 0.0615 * |

| Gender | −0.0787 * | −0.195 * | −0.112 ! | −0.0898 * | −0.0268 | 0.0177 |

| Province | ||||||

| Reference Group: Shanghai Municipality | ||||||

| Yunnan Province | −1.371 *** | −1.970 *** | −1.526 ** | −1.273 *** | −1.212 *** | −1.088 ** |

| Jilin Province | −1.751 *** | −1.854 *** | −1.777 *** | −1.693 *** | −1.697 *** | −1.629 *** |

| Guangdong Province | −0.648 * | −0.945 ** | −0.906 ** | −0.766 ! | −0.461 | −0.28 |

| Henan Province | −1.279 *** | −1.203 *** | −1.241 *** | −1.315 *** | −1.235 *** | −1.357 *** |

| Gansu Province | −1.568 *** | −1.665 *** | −1.674 *** | −1.492 *** | −1.514 *** | −1.572 *** |

| Logarithms taken of income | 0.229 *** | 0.307 *** | 0.260 *** | 0.264 *** | 0.239 *** | 0.128 ** |

| Constant term | 1.713 ** | −0.0158 | 0.822 | 1.848 ** | 1.851 ** | 3.495 *** |

| Number of cases | 1.560 | 1.560 | 1.560 | 1.560 | 1.560 | 1.560 |

| R2 | 0.533 | 0.3002 | 0.3242 | 0.3623 | 0.3859 | 0.3728 |

| Model Type/Quantile | OLS | 0.1 | 0.25 | 0.5 | 0.75 | 0.9 |

|---|---|---|---|---|---|---|

| The Time of Purchase or Construction | ||||||

| Reference Group: Before 1998 | ||||||

| 1999–2003 | 0.195 ** | 0.320 * | 0.218 ** | 0.165 * | 0.102 ! | 0.123 ! |

| 2004–2008 | −0.00078 | 0.155 | −0.0199 | −0.0915 | −0.082 | −0.0658 |

| After 2009 | −0.478 ** | −0.772 ** | −0.711 *** | −0.476 *** | −0.376 ** | −0.424 *** |

| Model Type/Quantile | OLS | 0.1 | 0.25 | 0.5 | 0.75 | 0.9 |

|---|---|---|---|---|---|---|

| Work Unit Type | ||||||

| Reference Group: Collective Enterprises | ||||||

| Party and government organs | −0.275 ! | −0.0186 | −0.204 | −0.251 | −0.255 * | −0.293 * |

| Public institutions | −0.324 * | −0.266 | −0.329 ! | −0.307 * | −0.244 ! | −0.212 |

| State-owned enterprises | −0.393 ** | −0.521 * | −0.382 * | −0.358 ** | −0.303 ** | −0.257 ! |

| Private enterprises | −0.409 ** | −0.576 * | −0.434 ** | −0.365 ** | −0.325 ** | −0.269 ! |

| Self-employed individuals | −0.446 * | −0.372 | −0.433 ! | −0.526 * | −0.470 * | −0.423 |

| Model Type/Quantile | OLS | 0.1 | 0.25 | 0.5 | 0.75 | 0.9 |

|---|---|---|---|---|---|---|

| Education Level | ||||||

| Reference Group: Elementary School and Below | ||||||

| Secondary school | 0.291 * | 0.215 | 0.270 ! | 0.189 | 0.327 ** | 0.370 ** |

| High school | 0.460 *** | 0.596 ** | 0.562 ** | 0.302 * | 0.298 ** | 0.342 ** |

| University and above | 0.521 *** | 0.470 * | 0.604 ** | 0.436 ** | 0.441 *** | 0.493 *** |

| Senior cadre | 0.301 * | 0.482 ! | 0.303 * | 0.243 * | 0.158 ! | 0.117 |

| Junior cadre | 0.148 | 0.248 | 0.194 | 0.109 | 0.048 | −0.0077 |

| Logarithms taken of income | 0.229 *** | 0.307 *** | 0.260 *** | 0.264 *** | 0.239 *** | 0.128 ** |

| Model Type/Quantile | OLS | 0.1 | 0.25 | 0.5 | 0.75 | 0.9 |

|---|---|---|---|---|---|---|

| Occupation | ||||||

| Reference Group: Ordinary Worker | ||||||

| Senior management | 0.255 | 0.339 | 0.269 | 0.101 | 0.198 | 0.33 |

| Junior management | 0.214 | 0.412 | 0.270 ! | 0.11 | 0.0392 | 0.0763 |

| Intermediate and senior technician | 0.176 ! | 0.452 * | 0.0507 | 0.178 | 0.103 | −0.0691 |

| Ordinary technician | 0.0294 | 0.119 | −0.0687 | 0.083 | 0.0638 | −0.0609 |

| Organization clerk | 0.372 ** | 0.604 ** | 0.368 ** | 0.265 * | 0.278 * | 0.256 * |

| Salesman of enterprises and institutions | 0.138 | 0.28 | 0.0814 | 0.133 | 0.0808 | −0.0676 |

| Business service personnel | 0.157 ** | 0.363 ! | 0.224 * | 0.118 ! | 0.0847 | −0.0145 |

| Skilled worker | 0.126 | 0.351 | −0.162 | 0.0261 | 0.0939 | 0.0748 |

| Self-employed entrepreneur | 0.214 | 0.341 | 0.321 * | 0.237 | 0.119 | 0.122 |

| Others | 0.195 | 1.059 ** | 0.48 | 0.329 | 0.152 | −0.118 |

| Party membership | −0.0973 | −0.0939 | −0.155 * | −0.0935 | −0.0736 | 0.0206 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, J.; Xiong, J. Resource Opportunity in China’s Market Transition and Governance: Time Factor in Urban Housing Inequality. Land 2021, 10, 1331. https://doi.org/10.3390/land10121331

Zhou J, Xiong J. Resource Opportunity in China’s Market Transition and Governance: Time Factor in Urban Housing Inequality. Land. 2021; 10(12):1331. https://doi.org/10.3390/land10121331

Chicago/Turabian StyleZhou, Jiawen, and Jing Xiong. 2021. "Resource Opportunity in China’s Market Transition and Governance: Time Factor in Urban Housing Inequality" Land 10, no. 12: 1331. https://doi.org/10.3390/land10121331

APA StyleZhou, J., & Xiong, J. (2021). Resource Opportunity in China’s Market Transition and Governance: Time Factor in Urban Housing Inequality. Land, 10(12), 1331. https://doi.org/10.3390/land10121331