Research on the Evaluation of Real Estate Inventory Management in China

Abstract

1. Introduction

1.1. Background

1.2. Literature Review

1.2.1. Research on Technology Innovation and Application of Inventory Management

1.2.2. Research on Multi-Scenario Inventory Management Strategies

1.2.3. Research on Inventory Management of Specific Enterprises and Products

1.2.4. Research on Inventory Management in Real Estate Market

1.3. Aim and Question

2. Research Design

2.1. Study Area: China

2.2. Research Methods

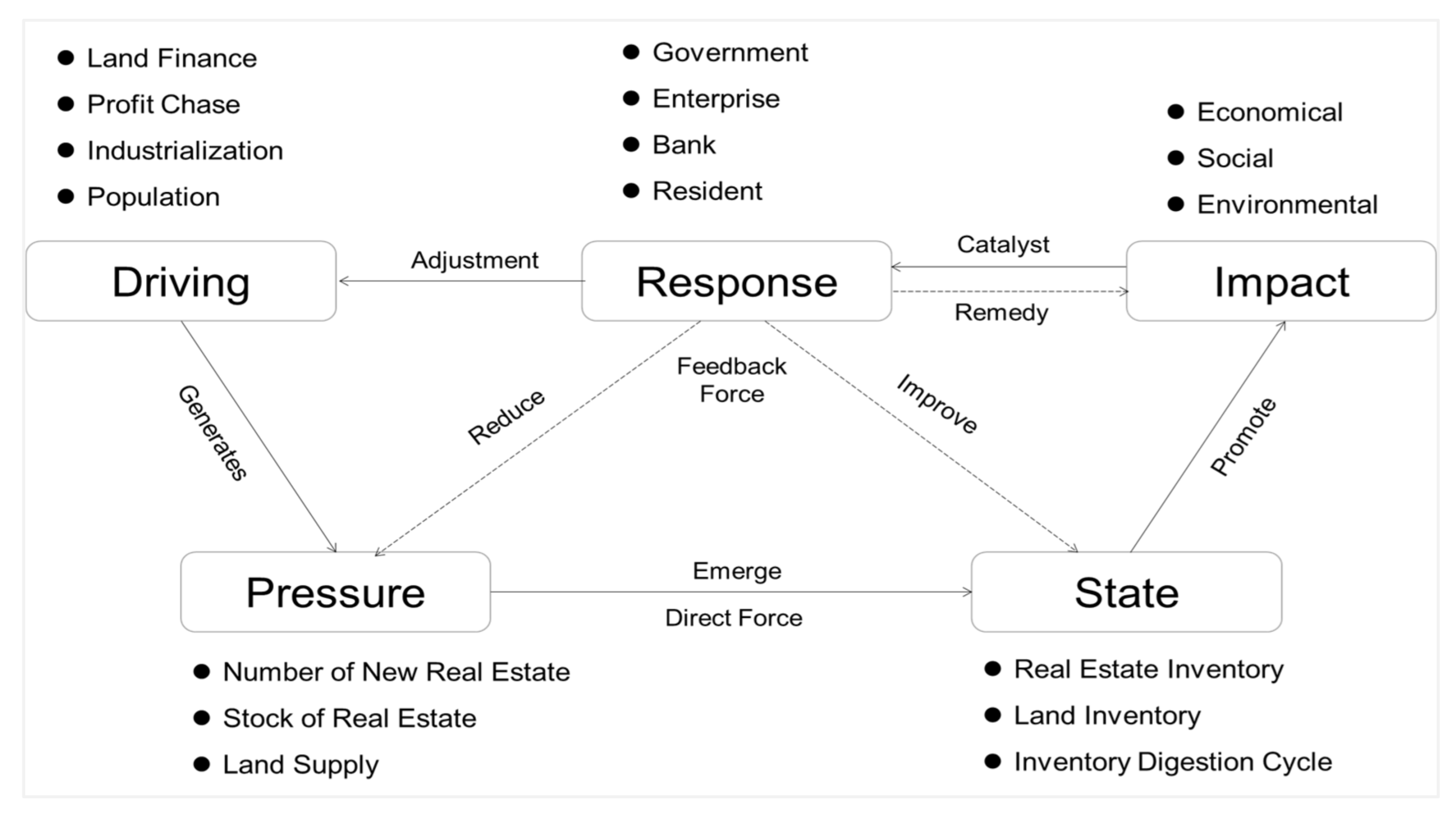

2.2.1. DPSIR Model

2.2.2. Obstacle Factor Diagnosis

2.3. Index Selection

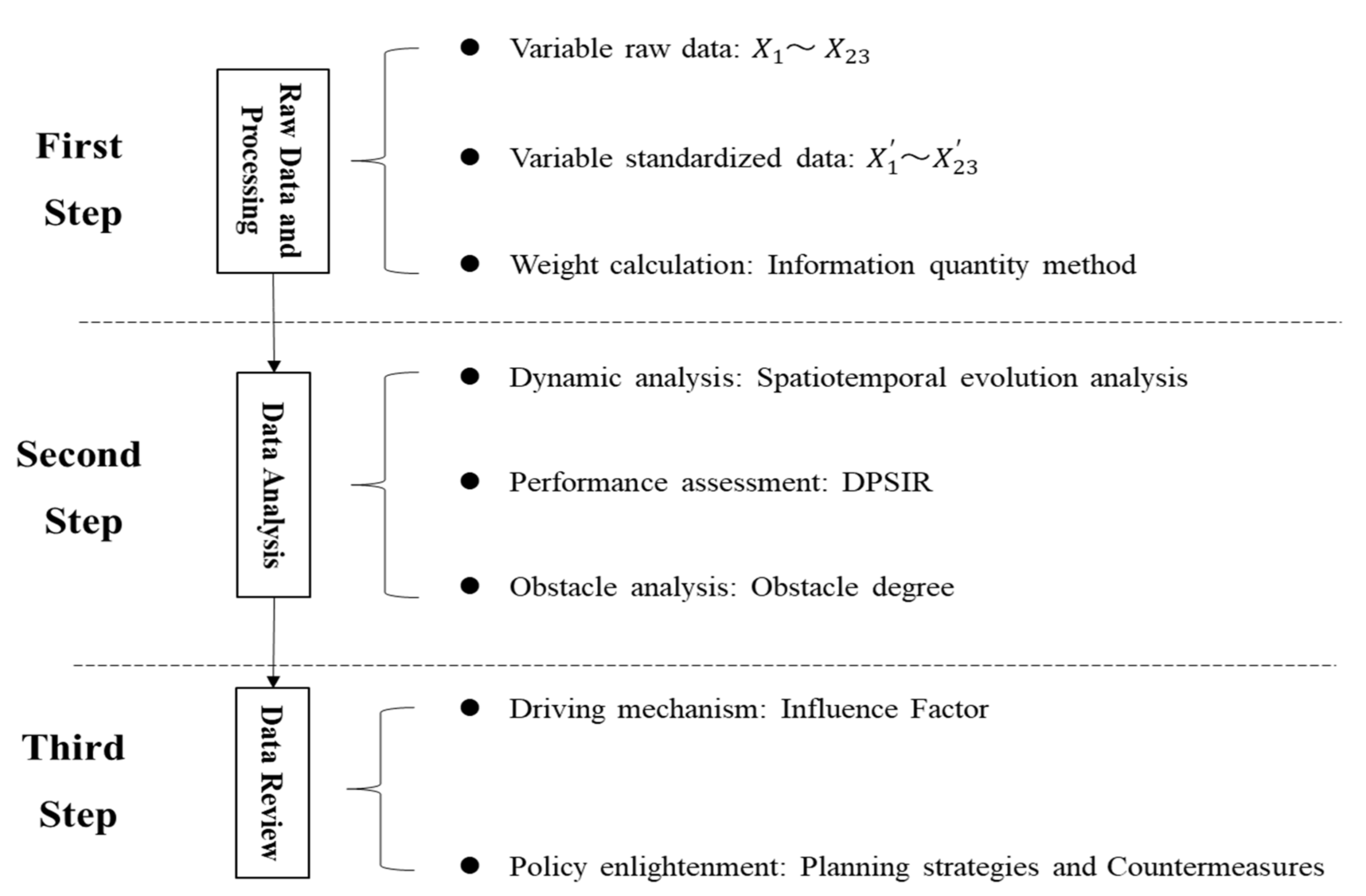

2.4. Research Steps and Data Sources

3. Results

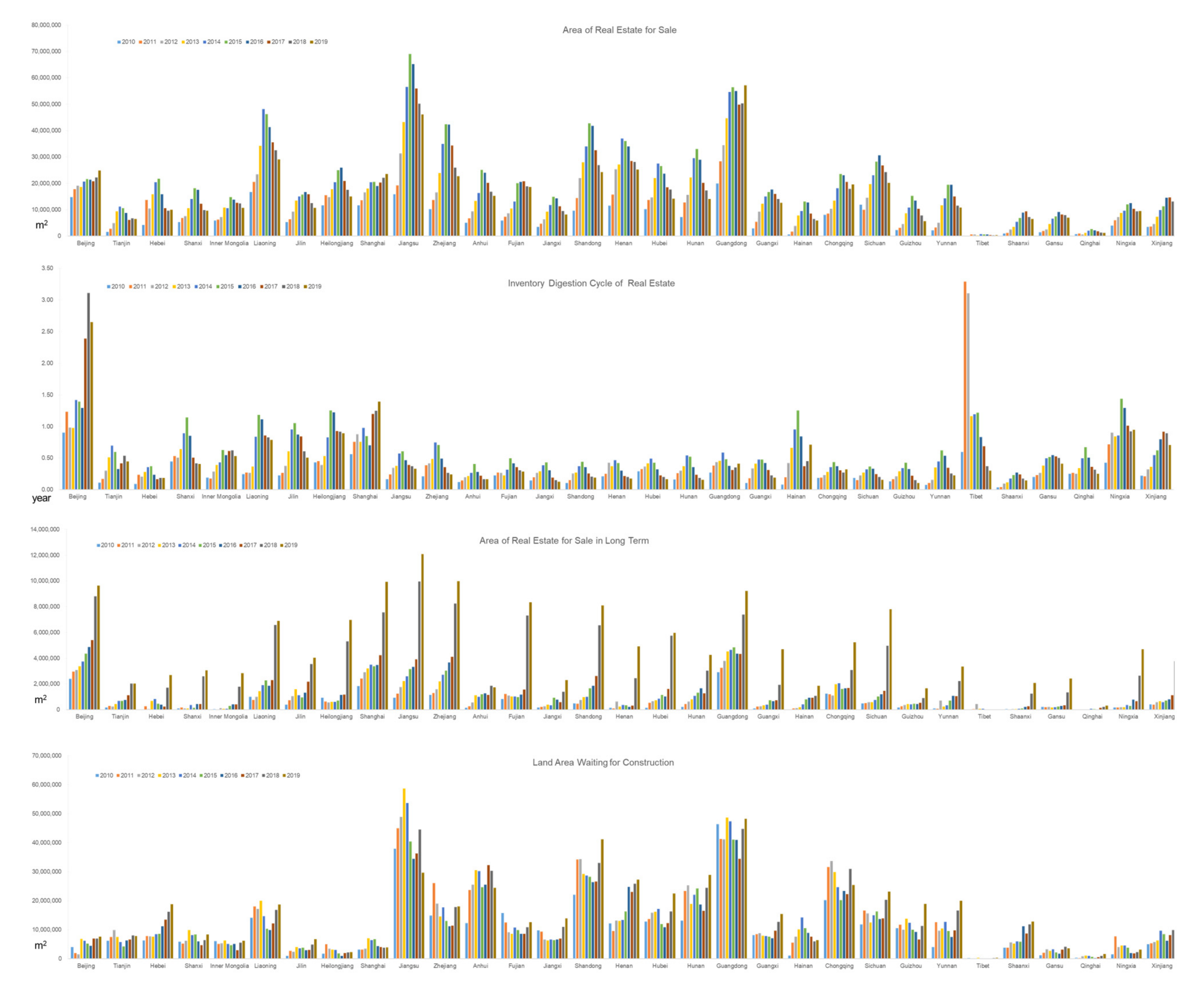

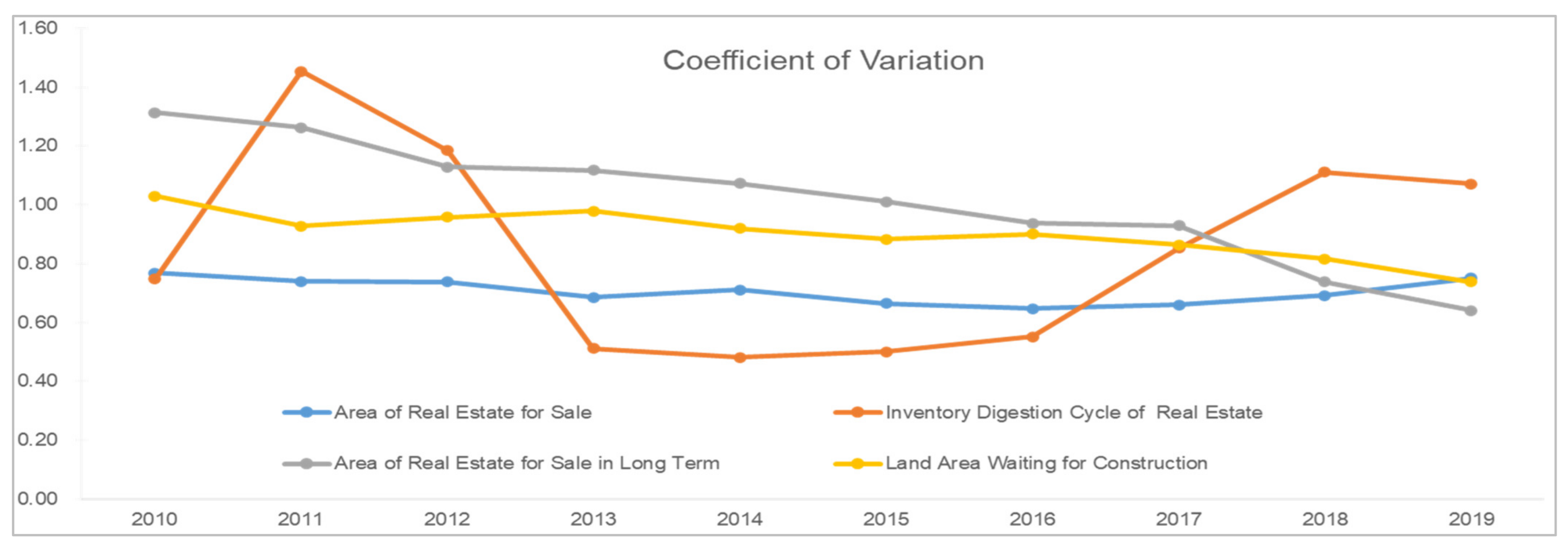

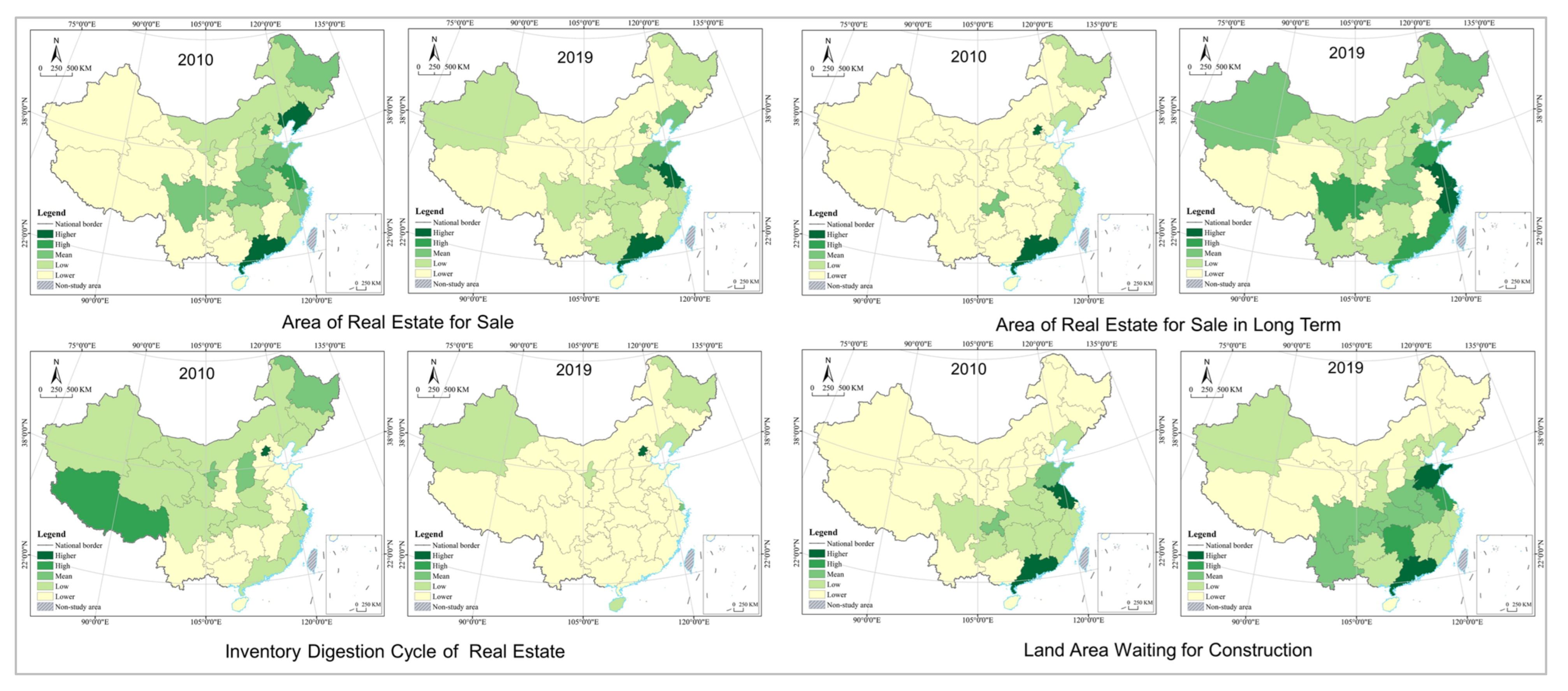

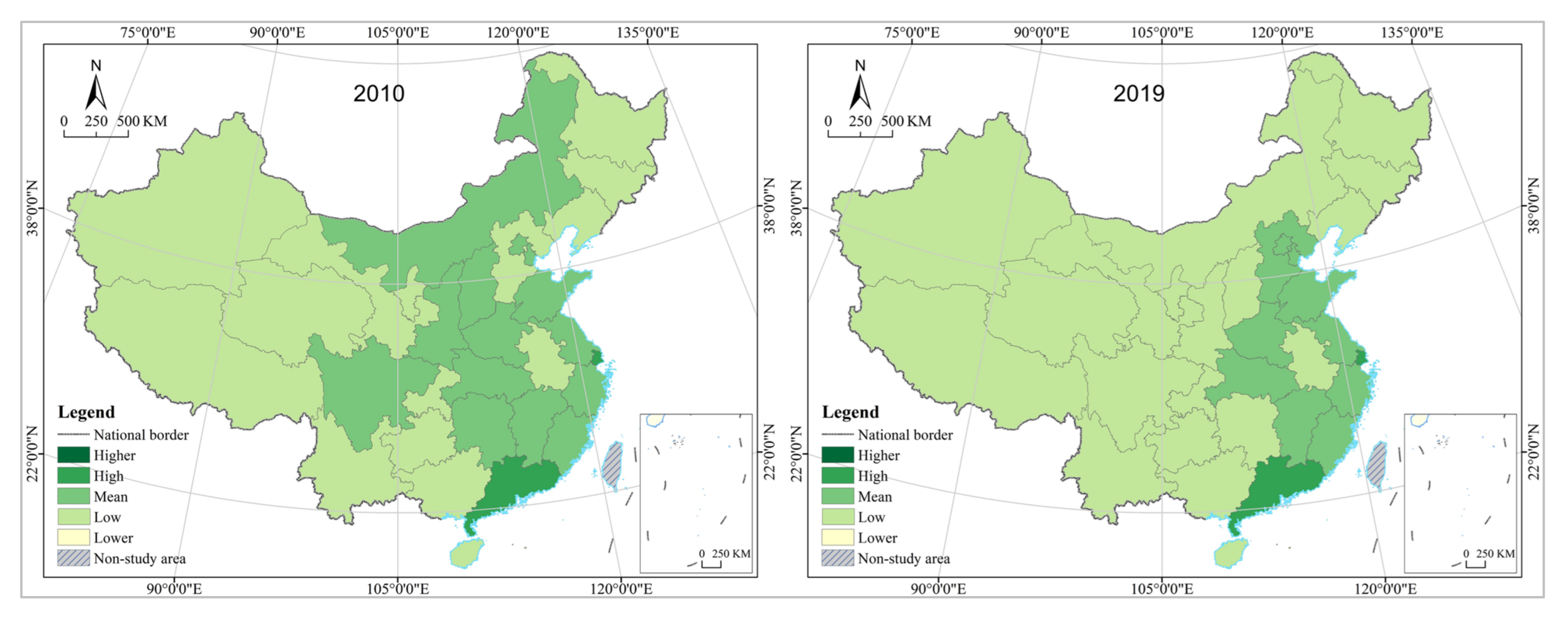

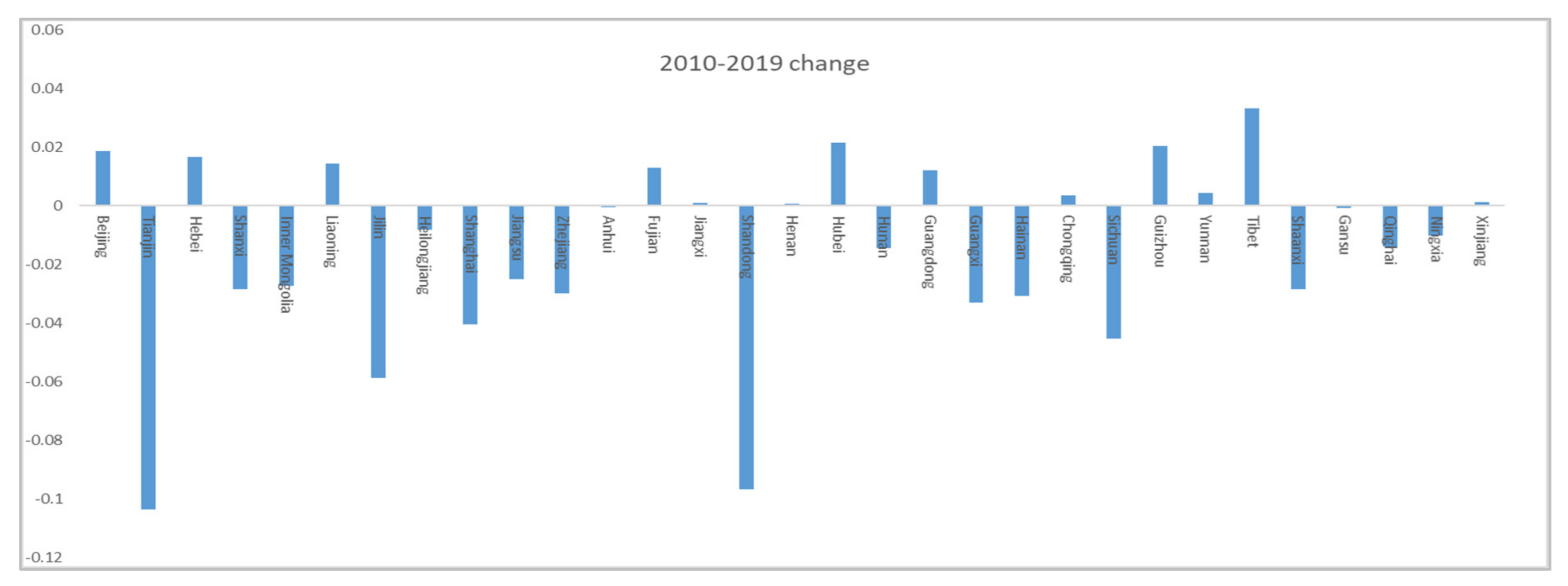

3.1. Spatial and Temporal Dynamic Analysis

3.2. Performance and Obstacle Analysis

4. Discussion

4.1. Influence Factor

4.2. Policy Suggestion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Beijing | 0.09 | 0.22 | 0.00 | 0.10 | 0.00 | 0.01 | 0.01 | 0.00 | 0.01 | 0.04 | 0.06 | 0.01 | 0.10 | 0.02 | 0.10 | 0.00 | 0.07 | 0.01 | 0.08 | 0.00 | 0.01 | 0.05 | 0.01 |

| Tianjin | 0.10 | 0.18 | 0.07 | 0.08 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.01 | 0.01 | 0.10 | 0.03 | 0.10 | 0.09 | 0.07 | 0.01 | 0.09 | 0.00 | 0.01 | 0.01 | 0.01 |

| Hebei | 0.08 | 0.18 | 0.10 | 0.03 | 0.02 | 0.02 | 0.01 | 0.01 | 0.02 | 0.00 | 0.01 | 0.02 | 0.07 | 0.01 | 0.08 | 0.12 | 0.05 | 0.01 | 0.08 | 0.03 | 0.01 | 0.00 | 0.02 |

| Shanxi | 0.09 | 0.17 | 0.10 | 0.06 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.01 | 0.01 | 0.09 | 0.02 | 0.09 | 0.12 | 0.06 | 0.00 | 0.09 | 0.02 | 0.00 | 0.00 | 0.01 |

| Inner Mongolia | 0.10 | 0.18 | 0.08 | 0.07 | 0.01 | 0.01 | 0.00 | 0.01 | 0.01 | 0.00 | 0.01 | 0.01 | 0.09 | 0.03 | 0.10 | 0.10 | 0.06 | 0.01 | 0.10 | 0.02 | 0.00 | 0.00 | 0.01 |

| Liaoning | 0.09 | 0.17 | 0.09 | 0.06 | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.03 | 0.02 | 0.08 | 0.02 | 0.08 | 0.11 | 0.06 | 0.00 | 0.08 | 0.02 | 0.01 | 0.00 | 0.01 |

| Jilin | 0.09 | 0.16 | 0.09 | 0.06 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.02 | 0.01 | 0.09 | 0.04 | 0.09 | 0.12 | 0.06 | 0.01 | 0.09 | 0.02 | 0.00 | 0.00 | 0.01 |

| Heilongjiang | 0.10 | 0.17 | 0.10 | 0.06 | 0.00 | 0.01 | 0.01 | 0.00 | 0.01 | 0.01 | 0.03 | 0.00 | 0.09 | 0.03 | 0.09 | 0.13 | 0.06 | 0.01 | 0.06 | 0.02 | 0.00 | 0.00 | 0.01 |

| Shanghai | 0.08 | 0.18 | 0.01 | 0.11 | 0.01 | 0.01 | 0.02 | 0.00 | 0.01 | 0.02 | 0.07 | 0.01 | 0.11 | 0.03 | 0.11 | 0.00 | 0.07 | 0.01 | 0.07 | 0.00 | 0.02 | 0.04 | 0.02 |

| Jiangsu | 0.05 | 0.12 | 0.05 | 0.04 | 0.04 | 0.05 | 0.06 | 0.03 | 0.08 | 0.00 | 0.07 | 0.04 | 0.01 | 0.02 | 0.02 | 0.10 | 0.03 | 0.06 | 0.03 | 0.02 | 0.04 | 0.01 | 0.04 |

| Zhejiang | 0.06 | 0.15 | 0.06 | 0.06 | 0.03 | 0.03 | 0.03 | 0.03 | 0.05 | 0.00 | 0.06 | 0.02 | 0.06 | 0.02 | 0.05 | 0.05 | 0.05 | 0.03 | 0.04 | 0.02 | 0.03 | 0.01 | 0.04 |

| Anhui | 0.08 | 0.14 | 0.09 | 0.04 | 0.02 | 0.02 | 0.03 | 0.04 | 0.04 | 0.00 | 0.01 | 0.02 | 0.07 | 0.01 | 0.06 | 0.11 | 0.05 | 0.04 | 0.08 | 0.03 | 0.02 | 0.00 | 0.02 |

| Fujian | 0.10 | 0.16 | 0.05 | 0.06 | 0.01 | 0.02 | 0.02 | 0.01 | 0.03 | 0.00 | 0.04 | 0.01 | 0.07 | 0.01 | 0.07 | 0.10 | 0.07 | 0.01 | 0.09 | 0.02 | 0.02 | 0.01 | 0.02 |

| Jiangxi | 0.09 | 0.16 | 0.10 | 0.05 | 0.01 | 0.01 | 0.01 | 0.01 | 0.03 | 0.00 | 0.01 | 0.01 | 0.08 | 0.00 | 0.08 | 0.12 | 0.06 | 0.02 | 0.09 | 0.03 | 0.01 | 0.00 | 0.01 |

| Shandong | 0.06 | 0.15 | 0.08 | 0.01 | 0.05 | 0.04 | 0.05 | 0.04 | 0.06 | 0.00 | 0.04 | 0.04 | 0.04 | 0.02 | 0.03 | 0.10 | 0.03 | 0.03 | 0.06 | 0.02 | 0.02 | 0.00 | 0.04 |

| Henan | 0.08 | 0.14 | 0.09 | 0.01 | 0.03 | 0.03 | 0.03 | 0.01 | 0.06 | 0.00 | 0.02 | 0.03 | 0.05 | 0.01 | 0.05 | 0.13 | 0.04 | 0.01 | 0.08 | 0.03 | 0.02 | 0.00 | 0.04 |

| Hubei | 0.09 | 0.15 | 0.08 | 0.05 | 0.02 | 0.02 | 0.01 | 0.01 | 0.04 | 0.00 | 0.03 | 0.02 | 0.07 | 0.01 | 0.06 | 0.12 | 0.05 | 0.02 | 0.09 | 0.03 | 0.01 | 0.00 | 0.02 |

| Hunan | 0.09 | 0.16 | 0.09 | 0.04 | 0.02 | 0.02 | 0.02 | 0.02 | 0.04 | 0.00 | 0.02 | 0.03 | 0.07 | 0.01 | 0.07 | 0.11 | 0.05 | 0.01 | 0.08 | 0.03 | 0.01 | 0.00 | 0.02 |

| Guangdong | 0.00 | 0.00 | 0.10 | 0.00 | 0.06 | 0.08 | 0.08 | 0.03 | 0.11 | 0.01 | 0.07 | 0.08 | 0.00 | 0.03 | 0.00 | 0.14 | 0.00 | 0.04 | 0.00 | 0.02 | 0.07 | 0.02 | 0.08 |

| Guangxi | 0.09 | 0.16 | 0.09 | 0.05 | 0.01 | 0.01 | 0.01 | 0.01 | 0.03 | 0.00 | 0.02 | 0.01 | 0.08 | 0.02 | 0.08 | 0.11 | 0.05 | 0.02 | 0.08 | 0.03 | 0.01 | 0.00 | 0.01 |

| Hainan | 0.10 | 0.16 | 0.09 | 0.08 | 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 | 0.10 | 0.02 | 0.10 | 0.11 | 0.07 | 0.00 | 0.10 | 0.02 | 0.00 | 0.01 | 0.01 |

| Chongqing | 0.09 | 0.14 | 0.07 | 0.06 | 0.01 | 0.01 | 0.02 | 0.01 | 0.03 | 0.00 | 0.02 | 0.02 | 0.08 | 0.02 | 0.08 | 0.11 | 0.06 | 0.02 | 0.09 | 0.02 | 0.01 | 0.00 | 0.01 |

| Sichuan | 0.08 | 0.15 | 0.09 | 0.02 | 0.03 | 0.03 | 0.02 | 0.01 | 0.06 | 0.00 | 0.04 | 0.02 | 0.06 | 0.01 | 0.05 | 0.12 | 0.04 | 0.04 | 0.07 | 0.03 | 0.02 | 0.00 | 0.02 |

| Guizhou | 0.09 | 0.17 | 0.10 | 0.06 | 0.01 | 0.01 | 0.00 | 0.01 | 0.02 | 0.00 | 0.01 | 0.02 | 0.09 | 0.00 | 0.09 | 0.12 | 0.06 | 0.00 | 0.09 | 0.03 | 0.01 | 0.00 | 0.01 |

| Yunnan | 0.09 | 0.17 | 0.10 | 0.05 | 0.02 | 0.01 | 0.01 | 0.01 | 0.02 | 0.00 | 0.01 | 0.02 | 0.08 | 0.00 | 0.08 | 0.11 | 0.05 | 0.01 | 0.09 | 0.03 | 0.01 | 0.00 | 0.01 |

| Tibet | 0.11 | 0.17 | 0.09 | 0.08 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.00 | 0.10 | 0.11 | 0.07 | 0.00 | 0.10 | 0.05 | 0.00 | 0.00 | 0.00 |

| Shaanxi | 0.09 | 0.17 | 0.08 | 0.06 | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.00 | 0.01 | 0.01 | 0.08 | 0.02 | 0.08 | 0.12 | 0.06 | 0.01 | 0.09 | 0.02 | 0.01 | 0.00 | 0.01 |

| Gansu | 0.10 | 0.17 | 0.10 | 0.06 | 0.01 | 0.01 | 0.00 | 0.00 | 0.01 | 0.00 | 0.01 | 0.00 | 0.09 | 0.02 | 0.09 | 0.12 | 0.06 | 0.01 | 0.09 | 0.03 | 0.00 | 0.00 | 0.01 |

| Qinghai | 0.11 | 0.17 | 0.09 | 0.08 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.02 | 0.10 | 0.12 | 0.08 | 0.00 | 0.10 | 0.03 | 0.00 | 0.00 | 0.00 |

| Ningxia | 0.10 | 0.17 | 0.09 | 0.08 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.02 | 0.00 | 0.10 | 0.01 | 0.10 | 0.11 | 0.08 | 0.00 | 0.10 | 0.02 | 0.00 | 0.00 | 0.00 |

| Xinjiang | 0.09 | 0.17 | 0.09 | 0.06 | 0.01 | 0.01 | 0.00 | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.09 | 0.02 | 0.09 | 0.12 | 0.06 | 0.01 | 0.10 | 0.03 | 0.00 | 0.00 | 0.01 |

| Beijing | 0.07 | 0.09 | 0.00 | 0.10 | 0.02 | 0.02 | 0.01 | 0.02 | 0.01 | 0.05 | 0.04 | 0.00 | 0.10 | 0.09 | 0.09 | 0.02 | 0.06 | 0.01 | 0.07 | 0.00 | 0.05 | 0.04 | 0.04 |

| Tianjin | 0.10 | 0.17 | 0.01 | 0.10 | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.00 | 0.00 | 0.01 | 0.11 | 0.00 | 0.12 | 0.06 | 0.09 | 0.01 | 0.11 | 0.01 | 0.01 | 0.02 | 0.01 |

| Hebei | 0.08 | 0.14 | 0.08 | 0.03 | 0.04 | 0.03 | 0.02 | 0.06 | 0.02 | 0.00 | 0.00 | 0.00 | 0.06 | 0.05 | 0.07 | 0.10 | 0.04 | 0.01 | 0.08 | 0.04 | 0.03 | 0.00 | 0.03 |

| Shanxi | 0.09 | 0.16 | 0.08 | 0.06 | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.02 | 0.00 | 0.00 | 0.09 | 0.03 | 0.09 | 0.11 | 0.06 | 0.00 | 0.10 | 0.04 | 0.01 | 0.00 | 0.02 |

| Inner Mongolia | 0.09 | 0.14 | 0.05 | 0.07 | 0.03 | 0.02 | 0.01 | 0.04 | 0.02 | 0.01 | 0.00 | 0.00 | 0.08 | 0.02 | 0.09 | 0.10 | 0.06 | 0.00 | 0.10 | 0.03 | 0.01 | 0.00 | 0.02 |

| Liaoning | 0.06 | 0.12 | 0.06 | 0.05 | 0.05 | 0.04 | 0.02 | 0.06 | 0.04 | 0.01 | 0.01 | 0.01 | 0.06 | 0.03 | 0.06 | 0.09 | 0.04 | 0.03 | 0.07 | 0.03 | 0.04 | 0.00 | 0.04 |

| Jilin | 0.09 | 0.15 | 0.07 | 0.06 | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.01 | 0.01 | 0.00 | 0.09 | 0.03 | 0.09 | 0.11 | 0.06 | 0.01 | 0.10 | 0.03 | 0.01 | 0.00 | 0.01 |

| Heilongjiang | 0.09 | 0.14 | 0.08 | 0.05 | 0.02 | 0.01 | 0.01 | 0.02 | 0.01 | 0.02 | 0.01 | 0.00 | 0.08 | 0.04 | 0.08 | 0.11 | 0.05 | 0.01 | 0.10 | 0.03 | 0.01 | 0.00 | 0.02 |

| Shanghai | 0.07 | 0.00 | 0.00 | 0.12 | 0.02 | 0.03 | 0.01 | 0.01 | 0.02 | 0.04 | 0.04 | 0.00 | 0.11 | 0.12 | 0.12 | 0.00 | 0.06 | 0.02 | 0.06 | 0.00 | 0.04 | 0.05 | 0.05 |

| Jiangsu | 0.01 | 0.05 | 0.06 | 0.03 | 0.08 | 0.07 | 0.05 | 0.05 | 0.07 | 0.01 | 0.02 | 0.04 | 0.01 | 0.06 | 0.03 | 0.08 | 0.01 | 0.06 | 0.00 | 0.04 | 0.07 | 0.01 | 0.07 |

| Zhejiang | 0.06 | 0.09 | 0.06 | 0.06 | 0.04 | 0.05 | 0.02 | 0.05 | 0.03 | 0.01 | 0.02 | 0.02 | 0.06 | 0.07 | 0.06 | 0.04 | 0.05 | 0.03 | 0.01 | 0.04 | 0.05 | 0.02 | 0.07 |

| Anhui | 0.08 | 0.13 | 0.09 | 0.04 | 0.03 | 0.02 | 0.01 | 0.04 | 0.02 | 0.00 | 0.00 | 0.01 | 0.07 | 0.03 | 0.08 | 0.10 | 0.05 | 0.02 | 0.09 | 0.04 | 0.03 | 0.00 | 0.03 |

| Fujian | 0.09 | 0.14 | 0.07 | 0.06 | 0.02 | 0.02 | 0.01 | 0.03 | 0.01 | 0.01 | 0.01 | 0.01 | 0.08 | 0.04 | 0.08 | 0.07 | 0.07 | 0.01 | 0.09 | 0.03 | 0.02 | 0.01 | 0.03 |

| Jiangxi | 0.09 | 0.15 | 0.09 | 0.05 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.01 | 0.08 | 0.03 | 0.09 | 0.11 | 0.06 | 0.00 | 0.10 | 0.04 | 0.01 | 0.00 | 0.02 |

| Shandong | 0.05 | 0.13 | 0.07 | 0.01 | 0.06 | 0.05 | 0.03 | 0.06 | 0.06 | 0.00 | 0.01 | 0.02 | 0.02 | 0.06 | 0.02 | 0.09 | 0.03 | 0.02 | 0.05 | 0.05 | 0.05 | 0.00 | 0.06 |

| Henan | 0.07 | 0.14 | 0.09 | 0.01 | 0.03 | 0.03 | 0.02 | 0.05 | 0.03 | 0.01 | 0.00 | 0.01 | 0.05 | 0.05 | 0.06 | 0.10 | 0.03 | 0.01 | 0.08 | 0.05 | 0.03 | 0.00 | 0.04 |

| Hubei | 0.09 | 0.14 | 0.08 | 0.04 | 0.02 | 0.02 | 0.01 | 0.03 | 0.02 | 0.01 | 0.00 | 0.01 | 0.07 | 0.03 | 0.07 | 0.11 | 0.05 | 0.02 | 0.09 | 0.04 | 0.02 | 0.00 | 0.03 |

| Hunan | 0.08 | 0.15 | 0.09 | 0.03 | 0.03 | 0.02 | 0.01 | 0.02 | 0.02 | 0.01 | 0.00 | 0.01 | 0.07 | 0.03 | 0.07 | 0.10 | 0.05 | 0.01 | 0.09 | 0.05 | 0.02 | 0.00 | 0.03 |

| Guangdong | 0.00 | 0.06 | 0.09 | 0.00 | 0.06 | 0.07 | 0.04 | 0.05 | 0.06 | 0.02 | 0.06 | 0.06 | 0.00 | 0.08 | 0.00 | 0.09 | 0.00 | 0.03 | 0.01 | 0.04 | 0.07 | 0.02 | 0.09 |

| Guangxi | 0.09 | 0.14 | 0.09 | 0.05 | 0.02 | 0.02 | 0.01 | 0.02 | 0.01 | 0.00 | 0.00 | 0.01 | 0.08 | 0.03 | 0.09 | 0.09 | 0.06 | 0.02 | 0.09 | 0.05 | 0.01 | 0.00 | 0.03 |

| Hainan | 0.10 | 0.14 | 0.09 | 0.08 | 0.00 | 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.10 | 0.01 | 0.10 | 0.10 | 0.08 | 0.00 | 0.11 | 0.04 | 0.01 | 0.01 | 0.00 |

| Chongqing | 0.08 | 0.13 | 0.08 | 0.06 | 0.02 | 0.02 | 0.01 | 0.02 | 0.02 | 0.01 | 0.02 | 0.02 | 0.09 | 0.00 | 0.09 | 0.09 | 0.06 | 0.01 | 0.09 | 0.03 | 0.02 | 0.00 | 0.02 |

| Sichuan | 0.07 | 0.13 | 0.10 | 0.02 | 0.03 | 0.03 | 0.02 | 0.02 | 0.04 | 0.01 | 0.01 | 0.01 | 0.07 | 0.02 | 0.07 | 0.11 | 0.02 | 0.02 | 0.08 | 0.05 | 0.03 | 0.00 | 0.04 |

| Guizhou | 0.09 | 0.13 | 0.10 | 0.05 | 0.01 | 0.01 | 0.00 | 0.02 | 0.01 | 0.00 | 0.00 | 0.01 | 0.09 | 0.04 | 0.09 | 0.11 | 0.06 | 0.00 | 0.10 | 0.05 | 0.01 | 0.00 | 0.01 |

| Yunnan | 0.08 | 0.14 | 0.10 | 0.05 | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.00 | 0.00 | 0.00 | 0.09 | 0.05 | 0.09 | 0.10 | 0.05 | 0.02 | 0.09 | 0.05 | 0.01 | 0.00 | 0.02 |

| Tibet | 0.10 | 0.14 | 0.09 | 0.08 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.02 | 0.00 | 0.00 | 0.09 | 0.04 | 0.10 | 0.10 | 0.07 | 0.00 | 0.11 | 0.06 | 0.00 | 0.00 | 0.00 |

| Shaanxi | 0.09 | 0.15 | 0.09 | 0.06 | 0.01 | 0.02 | 0.00 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.09 | 0.03 | 0.09 | 0.11 | 0.06 | 0.01 | 0.10 | 0.04 | 0.01 | 0.00 | 0.01 |

| Gansu | 0.09 | 0.15 | 0.09 | 0.06 | 0.01 | 0.00 | 0.00 | 0.01 | 0.00 | 0.01 | 0.00 | 0.00 | 0.09 | 0.05 | 0.09 | 0.11 | 0.06 | 0.00 | 0.10 | 0.05 | 0.00 | 0.00 | 0.01 |

| Qinghai | 0.10 | 0.15 | 0.08 | 0.08 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | 0.10 | 0.02 | 0.10 | 0.11 | 0.08 | 0.00 | 0.11 | 0.04 | 0.00 | 0.00 | 0.00 |

| Ningxia | 0.10 | 0.15 | 0.08 | 0.08 | 0.01 | 0.00 | 0.00 | 0.01 | 0.00 | 0.01 | 0.00 | 0.00 | 0.09 | 0.04 | 0.10 | 0.10 | 0.08 | 0.00 | 0.10 | 0.04 | 0.00 | 0.00 | 0.00 |

| Xinjiang | 0.09 | 0.14 | 0.08 | 0.07 | 0.01 | 0.01 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.09 | 0.06 | 0.09 | 0.11 | 0.06 | 0.00 | 0.10 | 0.04 | 0.00 | 0.00 | 0.01 |

References

- Song, J.S.; van Houtum, G.J.; Van Mieghem, J.A. Capacity and Inventory Management: Review, Trends, and Projections. Manuf. Serv. Oper. Manag. 2020, 22, 36–46. [Google Scholar] [CrossRef]

- Gutierrez, V.; Vidal, C.J. Inventory management models in supply chains: A literature review. Rev. Fac. Ing. Univ. Antioquia 2008, 43, 134–149. [Google Scholar]

- Zhao, Y.; Wei, R.; Zhong, C.W. Research on Spatial Spillover Effects and Regional Differences of Urban Housing Price in China. Econ. Comput. Econ. Cybern. Stud. Res. 2021, 55, 211–228. [Google Scholar] [CrossRef]

- Jang, H.; Song, Y.; Sohn, S.; Ahn, K. Real Estate Soars and Financial Crises: Recent Stories. Sustainability 2018, 10, 4559. [Google Scholar] [CrossRef]

- Chen, K.; Song, Y.Y.; Pan, J.F.; Yang, G.L. Measuring destocking performance of the Chinese real estate industry: A DEA-Malmquist approach. Soc. Econ. Plan. Sci. 2020, 69, 100691. [Google Scholar] [CrossRef]

- Ye, Y.; Ge, Y.Q. A bibliometric analysis of inventory management research based on knowledge mapping. Electron. Libr. 2019, 37, 127–154. [Google Scholar] [CrossRef]

- Lopez, J.A.; Mendoza, A.; Masini, J. A Classic and Effective Approach to Inventory Management. Int. J. Ind. Eng. Theory Appl. Pract. 2013, 20, 372–386. [Google Scholar]

- Yan, B.; Wu, J.W.; Liu, L.F.; Chen, Q.Q. Inventory Management Models in Cluster Supply Chains Based on System Dynamics. Rairo Oper. Res. 2017, 51, 763–778. [Google Scholar] [CrossRef]

- Melikov, A.Z.; Shahmaliyev, M.O. Markov Models of Inventory Management Systems with a Positive Service Time. J. Comput. Syst. Sci. Int. 2018, 57, 766–783. [Google Scholar] [CrossRef]

- Preil, D.; Krapp, M. Artificial intelligence-based inventory management: A Monte Carlo tree search approach. Ann. Oper. Res. 2021, 19, 1–25. [Google Scholar] [CrossRef]

- Drakaki, M.; Tzionas, P. A Colored Petri Net-based modeling method for supply chain inventory management. Simul. Trans. Soc. Model. Simul. Int. 2021, 00375497211038755. [Google Scholar] [CrossRef]

- Mamani, H.; Nassiri, S.; Wagner, M.R. Closed-Form Solutions for Robust Inventory Management. Manag. Sci. 2017, 63, 1625–1643. [Google Scholar] [CrossRef]

- Borgonovo, E.; Peccati, L. Global sensitivity analysis in inventory management. Int. J. Prod. Econ. 2007, 108, 302–313. [Google Scholar] [CrossRef]

- Hill, A.V.; Hang, W.Y.; Urch, G.F. Forecasting the forecastability quotient for inventory management. Int. J. Forecast. 2015, 31, 651–663. [Google Scholar] [CrossRef]

- Subramanian, K.; Rawlings, J.B.; Maravelias, C.T. Economic model predictive control for inventory management in supply chains. Comput. Chem. Eng. 2014, 64, 71–80. [Google Scholar] [CrossRef]

- Perez, H.D.; Hubbs, C.D.; Li, C.; Grossmann, I.E. Algorithmic Approaches to Inventory Management Optimization. Processes 2021, 9, 102. [Google Scholar] [CrossRef]

- Borgonovo, E. Differential importance and comparative statics: An application to inventory management. Int. J. Prod. Econ. 2008, 111, 170–179. [Google Scholar] [CrossRef]

- Almaktoom, A.T. Stochastic Reliability Measurement and Design Optimization of an Inventory Management System. Complexity 2017, 1460163. [Google Scholar] [CrossRef]

- Jonsson, P.; Mattsson, S.A. An inherent differentiation and system level assessment approach to inventory management: A safety stock method comparison. Int. J. Logist. Manag. 2019, 30, 663–680. [Google Scholar] [CrossRef]

- Lei, T.F.; Li, R.Y.M.; Fu, H.Y. Dynamics Analysis and Fractional-Order Approximate Entropy of Nonlinear Inventory Management Systems. Math. Probl. Eng. 2021, 2021, 5516703. [Google Scholar] [CrossRef]

- Rahaman, M.; Mondal, S.P.; Alam, S.; Goswami, A. Synergetic study of inventory management problem in uncertain environment based on memory and learning effects. Sadhana Acad. Proc. Eng. Sci. 2021, 46, 39. [Google Scholar] [CrossRef]

- Bendavid, I.; Herer, Y.T.; Yucesan, E. Inventory management under working capital constraints. J. Simul. 2017, 11, 62–74. [Google Scholar] [CrossRef]

- Steinker, S.; Pesch, M.; Hoberg, K. Inventory management under financial distress: An empirical analysis. Int. J. Prod. Res. 2016, 54, 5182–5207. [Google Scholar] [CrossRef]

- Katehakis, M.N.; Melamed, B.; Shi, J. Cash-Flow Based Dynamic Inventory Management. Prod. Oper. Manag. 2016, 25, 1558–1575. [Google Scholar] [CrossRef]

- Sharma, S.; Abouee-Mehrizi, H.; Sartor, G. Inventory Management under Storage and Order Restrictions. Prod. Oper. Manag. 2020, 29, 101–117. [Google Scholar] [CrossRef]

- Fu, K.; Gong, X.T.; Hsu, V.N.; Xue, J.Y. Dynamic Inventory Management with Inventory-based Financing. Prod. Oper. Manag. 2021, 30, 1313–1330. [Google Scholar] [CrossRef]

- Buzacott, J.A.; Zhang, R.Q. Inventory management with asset-based financing. Manag. Sci. 2004, 50, 1274–1292. [Google Scholar] [CrossRef]

- Herrmann, S.; Muhle-Karbe, J.; Shang, D.P.; Yang, C. Inventory Management for High-Frequency Trading with Imperfect Competition. Siam J. Financ. Math. 2020, 11, 1–26. [Google Scholar] [CrossRef]

- Xu, C.; Duan, Y.R.; Huo, J.Z. Joint pricing and inventory management under servitisation. J. Oper. Res. Soc. 2019, 71, 893–909. [Google Scholar] [CrossRef]

- Chen, Y.W.; Shi, C. Joint Pricing and Inventory Management with Strategic Customers. Oper. Res. 2019, 67, 1610–1627. [Google Scholar] [CrossRef]

- Mokhtari, H. Joint ordering and reuse policy for reusable items inventory management. Sustain. Prod. Consum. 2018, 15, 163–172. [Google Scholar] [CrossRef]

- Guo, S.; Choi, T.M.; Shen, B.; Jung, S.J. Inventory Management in Mass Customization Operations: A Review. IEEE Trans. Eng. Manag. 2019, 66, 412–428. [Google Scholar] [CrossRef]

- Chen, X.; Hu, P.; Shum, S.; Zhang, Y.H. Dynamic Stochastic Inventory Management with Reference Price Effects. Oper. Res. 2016, 64, 1529–1536. [Google Scholar] [CrossRef]

- Xiao, G.; Yang, N.; Zhang, R.Y. Dynamic Pricing and Inventory Management Under Fluctuating Procurement Costs. Manuf. Serv. Oper. Manag. 2015, 17, 321–334. [Google Scholar] [CrossRef]

- Transchel, S. Inventory management underprice-based and stockout-based substitution. Eur. J. Oper. Res. 2017, 262, 996–1008. [Google Scholar] [CrossRef]

- Park, S.; Huh, W.T.; Kim, B.C. Optimal inventory management with buy-one-give-one promotion. IISE Trans. 2021. [Google Scholar] [CrossRef]

- Xie, C.; Wang, L.Q.; Yang, C.L. Robust inventory management with multiple supply sources. Eur. J. Oper. Res. 2021, 295, 463–474. [Google Scholar] [CrossRef]

- Muharremoglu, A.; Yang, N. Inventory Management with an Exogenous Supply Process. Oper. Res. 2010, 58, 111–129. [Google Scholar] [CrossRef]

- Mascle, C.; Gosse, J. Inventory management maximization based on sales forecast: Case study. Prod. Plan. Control. 2014, 25, 1039–1057. [Google Scholar] [CrossRef]

- Nenes, G.; Panagiotidou, S.; Tagaras, G. Inventory management of multiple items with irregular demand: A case study. Eur. J. Oper. Res. 2010, 205, 313–324. [Google Scholar] [CrossRef]

- Cao, Y.; Shen, Z.J.M. Quantile forecasting and data-driven inventory management under nonstationary demand. Oper. Res. Lett. 2019, 47, 465–472. [Google Scholar] [CrossRef]

- Zhang, S.; Huang, K.; Yuan, Y.F. Spare Parts Inventory Management: A Literature Review. Sustainability 2021, 13, 2460. [Google Scholar] [CrossRef]

- Muniz, L.R.; Conceicao, S.V.; Rodrigues, L.F.; Almeida, J.F.D.; Affonso, T.B. Spare parts inventory management: A new hybrid approach. Int. J. Logist. Manag. 2020, 32, 40–67. [Google Scholar] [CrossRef]

- Turrini, L.; Meissner, J. Spare parts inventory management: New evidence from distribution fitting. Eur. J. Oper. Res. 2019, 273, 118–130. [Google Scholar] [CrossRef]

- Kranenburg, A.A.; Van Houtum, G.J. Service differentiation in spare parts inventory management. J. Oper. Res. Soc. 2008, 59, 946–955. [Google Scholar] [CrossRef]

- Dendauw, P.; Goeman, T.; Claeys, D.; De Turck, K.; Fiems, D.; Bruneel, H. Condition-based critical level policy for spare parts inventory management. Comput. Ind. Eng. 2021, 157, 107369. [Google Scholar] [CrossRef]

- Zhang, F.; Guan, Z.L.; Zhang, L.; Cui, Y.Y.; Yi, P.X.; Ullah, S. Inventory management for a remanufacture-to-order production with multi-components (parts). J. Intell. Manuf. 2019, 30, 59–78. [Google Scholar] [CrossRef]

- Aviles-Sacoto, S.V.; Aviles-Gonzalez, J.F.; Garcia-Reyes, H.; Bermeo-Samaniego, M.C.; Canizares-Jaramillo, A.K.; Izquierdo-Flores, S.N. A Glance of Industry 4.0 At Supply Chain and Inventory Management. Int. J. Ind. Eng. Theory Appl. Pract. 2019, 26, 486–506. [Google Scholar]

- Fang, X.D.; Chen, H.C. Using vendor management inventory system for goods inventory management in IoT manufacturing. Enterp. Inf. Syst. 2021. [Google Scholar] [CrossRef]

- Shan, J.; Zhu, K.J. Inventory Management in China: An Empirical Study. Prod. Oper. Manag. 2013, 22, 302–313. [Google Scholar] [CrossRef]

- Swaminathan, A.M. Structural reforms and inventory management: Evidence from Indian industries. Int. J. Prod. Econ. 2001, 71, 67–78. [Google Scholar] [CrossRef]

- Jaksic, M.; Fransoo, J.C. Optimal inventory management with supply backordering. Int. J. Prod. Econ. 2015, 159, 254–264. [Google Scholar] [CrossRef]

- Agrawal, N.; Smith, S.A. Optimal inventory management for a retail chain with diverse store demands. Eur. J. Oper. Res. 2013, 225, 393–403. [Google Scholar] [CrossRef]

- Ehrenthal, J.C.F.; Honhon, D.; Van Woensel, T. Demand seasonality in retail inventory management. Eur. J. Oper. Res. 2014, 238, 527–539. [Google Scholar] [CrossRef]

- Turgut, O.; Taube, F.; Minner, S. Data-driven retail inventory management with backroom effect. Spectrum 2018, 40, 945–968. [Google Scholar] [CrossRef]

- Saputro, T.E.; Figueira, G.; Almada-Lobo, B. Integrating supplier selection with inventory management under supply disruptions. Int. J. Prod. Res. 2020, 59, 3304–3322. [Google Scholar] [CrossRef]

- Sarkar, S.; Kumar, S. A behavioral experiment on inventory management with supply chain disruption. Int. J. Prod. Econ. 2015, 169, 169–178. [Google Scholar] [CrossRef]

- DeCroix, G.A. Inventory Management for an Assembly System Subject to Supply Disruptions. Manag. Sci. 2013, 59, 2079–2092. [Google Scholar] [CrossRef]

- Hasan, M.R.; Daryanto, Y.; Roy, T.C.; Feng, Y. Inventory management with online payment and preorder discounts. Ind. Manag. Data Syst. 2020, 120, 2001–2023. [Google Scholar] [CrossRef]

- Raviv, T.; Kolka, O. Optimal inventory management of a bike-sharing station. IIE Trans. 2013, 45, 1077–1093. [Google Scholar] [CrossRef]

- Swaszek, R.M.A.; Cassandras, C.G. Receding Horizon Control for Station Inventory Management in a Bike-Sharing System. IEEE Trans. Autom. Sci. Eng. 2020, 17, 407–417. [Google Scholar] [CrossRef]

- Chuang, C.H.; Zhao, Y.B. Demand stimulation in finished-goods inventory management: Empirical evidence from General Motors dealerships. Int. J. Prod. Econ. 2019, 208, 208–220. [Google Scholar] [CrossRef]

- Mostafaei, H.; Castro, P.M.; Relvas, S.; Harjunkoski, I. A holistic MILP model for scheduling and inventory management of a multiproduct oil distribution system. Omega Int. J. Manag. Sci. 2021, 98, 102110. [Google Scholar] [CrossRef]

- Siddiqui, A.; Verma, M.; Verter, V. An integrated framework for inventory management and transportation of refined petroleum products: Pipeline or marine? Appl. Math. Model. 2018, 55, 224–247. [Google Scholar] [CrossRef]

- Dimas, D.; Murata, V.V.; Neiro, S.M.S.; Relvas, S.; Barbosa-Povoa, A.P. Multiproduct pipeline scheduling integrating for inbound and outbound inventory management. Comput. Chem. Eng. 2018, 115, 377–396. [Google Scholar] [CrossRef]

- Toyasaki, F.; Arikan, E.; Silbermayr, L.; Sigala, I.F. Disaster Relief Inventory Management: Horizontal Cooperation between Humanitarian Organizations. Prod. Oper. Manag. 2017, 26, 1221–1237. [Google Scholar] [CrossRef]

- Loree, N.; Aros-Vera, F. Points of distribution location and inventory management model for Post-Disaster Humanitarian Logistics. Transp. Res. Part E Logist. Transp. Rev. 2018, 116, 1–24. [Google Scholar] [CrossRef]

- Natarajan, K.V.; Swaminathan, J.M. Inventory Management in Humanitarian Operations: Impact of Amount, Schedule, and Uncertainty in Funding. Manuf. Serv. Oper. Manag. 2014, 16, 595–603. [Google Scholar] [CrossRef]

- Paam, P.; Berretta, R.; Heydar, M.; Garcia-Flores, R. The impact of inventory management on economic and environmental sustainability in the apple industry. Comput. Electron. Agric. 2019, 163, 104848. [Google Scholar] [CrossRef]

- Golas, Z. The effect of inventory management on profitability: Evidence from the Polish food industry: Case study. Agric. Econ. Zemed. Ekon. 2020, 66, 234–242. [Google Scholar] [CrossRef]

- Geman, H.; Tunaru, R. Commercial Real-Estate Inventory and Theory of Storage. J. Futures Mark. 2013, 33, 675–694. [Google Scholar] [CrossRef]

- Pham, T.H.V.; Nguyen, M.H.V. Impact of Inventory Size, Staging, and Financing Policies on Sales Growth of Real Estate Companies in Vietnam . J. Glob. Econ. Bus. Financ. 2021, 3. [Google Scholar] [CrossRef]

- Bian, X.; Waller, B.D.; Turnbull, G.K.; Wentland, S.A. How many listings are too many? Agent inventory externalities and the residential housing market. J. Hous. Econ. 2015, 28, 130–143. [Google Scholar] [CrossRef]

- Caplin, A.; Leahy, J. Trading Frictions and House Price Dynamics. J. Money Credit Bank. 2011, 43, 283–303. [Google Scholar] [CrossRef]

- Ott, S.H.; Hughen, W.K.; Read, D.C. Optimal Phasing and Inventory Decisions for Large-Scale Residential Development Projects. J. Real Estate Financ. Econ. 2012, 45, 888–918. [Google Scholar] [CrossRef]

- Wen, X.Q.; Xu, C.; Hu, Q.Y. Dynamic capacity management with uncertain demand and dynamic price. Int. J. Prod. Econ. 2016, 175, 121–131. [Google Scholar] [CrossRef]

- Kwoun, M.J.; Lee, S.H.; Kim, J.H. Dynamic cycles of unsold new housing stocks, investment in housing, and housing supply-demand. Math. Comput. Model. 2013, 57, 2094–2105. [Google Scholar] [CrossRef]

- Morales, M.; Moraga, G.; Kirchheim, A.P.; Passuello, A. Regionalized inventory data in LCA of public housing: A comparison between two conventional typologies in southern Brazil. J. Clean. Prod. 2019, 238, 117869. [Google Scholar] [CrossRef]

- Jiang, Y.X.; Zheng, L.Y.; Wang, J.Z. Research on external financial risk measurement of China real estate. Int. J. Financ. Econ. 2020, 26, 5472–5484. [Google Scholar] [CrossRef]

- Muczynski, A. Financial flow models in municipal housing stock management in Poland. Land Use Policy 2020, 91, 104429. [Google Scholar] [CrossRef]

- Yoo, H.; Yoon, H. The Effect of Green Characteristics in Reducing the Inventory of Unsold Housing in New Residential Developments-A Case of Gyeonggi Province, in South Korea. Land 2021, 10, 377. [Google Scholar] [CrossRef]

- Nam, J.; Han, J.; Lee, C. Factors Contributing to Residential Vacancy and Some Approaches to Management in Gyeonggi Province, Korea. Sustainability 2016, 8, 367. [Google Scholar] [CrossRef]

- Chen, C.; Wang, K.; Feng, M. Research on China’s Industrial Green Development based on the Pressure-State-Response Model. J. Sci. Ind. Res. 2020, 79, 541–546. [Google Scholar]

- Tscherning, K.; Helming, K.; Krippner, B.; Sieber, S.; Paloma, S.G.Y. Does research applying the DPSIR framework support decision making? Land Use Policy 2012, 29, 102–110. [Google Scholar] [CrossRef]

- Sekovski, I.; Newton, A.; Dennison, W.C. Megacities in the coastal zone: Using a driver-pressure-state-impact-response framework to address complex environmental problems. Estuar. Coast. Shelf Sci. 2012, 96, 48–59. [Google Scholar] [CrossRef]

- Malekmohammadi, B.; Jahanishakib, F. Vulnerability assessment of wetland landscape ecosystem services using driver-pressure-state-impact-response (DPSIR) model. Ecol. Indic. 2017, 82, 293–303. [Google Scholar] [CrossRef]

- Borji, M.; Nia, A.M.; Malekian, A.; Salajegheh, A.; Khalighi, S. Comprehensive evaluation of groundwater resources based on DPSIR conceptual framework. Arab. J. Geosci. 2018, 11, 158. [Google Scholar] [CrossRef]

- Gupta, J.; Scholtens, J.; Perch, L.; Dankelman, I.; Seager, J.; Sander, F.; Stanley-Jones, M.; Kempf, I. Re-imagining the driver-pressure-state-impact-response framework from an equity and inclusive development perspective. Sustain. Sci. 2020, 15, 503–520. [Google Scholar] [CrossRef]

- Carr, E.R.; Wingard, P.M.; Yorty, S.C.; Thompson, M.C.; Jensen, N.K.; Roberson, J. Applying DPSIR to sustainable development. Int. J. Sustain. Dev. World Ecol. 2007, 14, 543–555. [Google Scholar] [CrossRef]

- Pan, W.Y.; Gulzar, M.A.; Hassan, W. Synthetic Evaluation of China’s Regional Low-Carbon Economy Challenges by Driver-Pressure-State-Impact-Response Model. Int. J. Environ. Res. Public Health 2020, 17, 5463. [Google Scholar] [CrossRef]

- Padash, A.; Vahidi, H.; Fattahi, R.; Nematollahi, H. Analyzing and Evaluating Industrial Ecology Development Model in Iran Using FAHP-DPSIR. Int. J. Environ. Res. 2021, 15, 615–629. [Google Scholar] [CrossRef]

- Liu, L.; Zhang, Q.; Wang, C.L.; Zhang, K.; Zhang, X. Comprehensive Eco-Environmental Impact Assessment of Urban Planning Based on Pressure-State-Response Model. Appl. Ecol. Environ. Res. 2019, 17, 14455–14463. [Google Scholar] [CrossRef]

- Wang, D.; Shen, Y.; Zhao, Y.Y.; He, W.; Liu, X.; Qian, X.Y.; Lv, T. Integrated assessment and obstacle factor diagnosis of China’s scientific coal production capacity based on the PSR sustainability framework. Resour. Policy 2020, 68, 101794. [Google Scholar] [CrossRef]

- Xie, X.; Fang, B.; Li, X.; He, S.S. Urban ecosystem health assessment and obstacle factor diagnosis using a comprehensive assessment model for Nanjing, China. Growth Chang. 2021, 52, 1938–1954. [Google Scholar] [CrossRef]

- Cui, X.F.; Yang, S.; Zhang, G.H.; Liang, B.; Li, F. An Exploration of a Synthetic Construction Land Use Quality Evaluation Based on Economic-Social-Ecological Coupling Perspective: A Case Study in Major Chinese Cities. Int. J. Environ. Res. Public Health 2020, 17, 3663. [Google Scholar] [CrossRef]

- Wang, H.N.; Zhang, M.Y.; Cui, L.J.; Guo, Z.L.; Wang, D.A. Evaluation of Ecological Environment Quality of Hengshui Lake Wetlands based on DPSIR Model. Wetl. Sci. 2019, 17, 193–198. [Google Scholar] [CrossRef]

- Yang, J.S. An Empirical Study on The Relationship Between Taizhou’s Economic Development and Water Environment Pollution Based on the PSR Framework. J. Environ. Prot. Ecol. 2020, 21, 1146–1155. [Google Scholar]

- Upreti, B.R.; Breu, T.; Ghale, Y. New Challenges in Land Use in Nepal: Reflections on the Booming Real-estate Sector in Chitwan and Kathmandu Valley. Scott. Geogr. J. 2017, 133, 69–82. [Google Scholar] [CrossRef]

- Fernandez, M.D.; Marron, M.L.; Rodriguez, P.M. Does the population determine the dynamics of the real estate activity? An analysis of cointegration for the Spanish case. Investig. Econ. 2016, 75, 103–124. [Google Scholar] [CrossRef][Green Version]

- Klett, I.R.G. Urban land market and financial reserve of land for housing production in the Metropolitan Area of Santiago. Rev. Geogr. Norte Gd. 2020, 76, 71–94. [Google Scholar]

- Chinloy, P.; Wu, Z.H. The Inventory-Sales Ratio and Homebuilder Return Predictability. J. Real Estate Financ. Econ. 2013, 46, 397–423. [Google Scholar] [CrossRef]

- Pan, J.N.; Huang, J.T.; Chiang, T.F. Empirical study of the local government deficit, land finance and real estate markets in China. China Econ. Rev. 2015, 32, 57–67. [Google Scholar] [CrossRef]

- Sinai, T. Feedback Between Real Estate and Urban Economics. J. Reg. Sci. 2010, 50, 423–448. [Google Scholar] [CrossRef]

- Zhang, P.; Li, W.; Zhao, K.; Zhao, S. Spatial Pattern and Driving Mechanism of Urban–Rural Income Gap in Gansu Province of China. Land 2021, 10, 1002. [Google Scholar] [CrossRef]

- Zhang, C.C.; Jia, S.; Yang, R.D. Housing affordability and housing vacancy in China: The role of income inequality. J. Hous. Econ. 2016, 33, 4–14. [Google Scholar] [CrossRef]

- Hu, F.Z.Y.; Qian, J.W. Land-based finance, fiscal autonomy and land supply for affordable housing in urban China: A prefecture-level analysis. Land Use Policy 2017, 69, 454–460. [Google Scholar] [CrossRef]

- Su, X.; Qian, Z. State Intervention in Land Supply and Its Impact on Real Estate Investment in China: Evidence from Prefecture-Level Cities. Sustainability 2020, 12, 1019. [Google Scholar] [CrossRef]

- Wang, L.; Li, S.W.; Wang, J.N.; Meng, Y. Real estate bubbles in a bank-real estate loan network model integrating economic cycle and macro-prudential stress testing. Phys. A Stat. Mech. Appl. 2020, 542, 122576. [Google Scholar] [CrossRef]

- Liu, T.Y.; Su, C.W.; Chang, H.L.; Chu, C.C. Is urbanization improving real estate investment? A cross-regional study of China. Rev. Dev. Econ. 2018, 22, 862–878. [Google Scholar] [CrossRef]

- Guan, X.Y.; Wang, S.L.; Gao, Z.Y.; Lv, Y.; Fu, X.J. Spatio-temporal variability of soil salinity and its relationship with the depth to groundwater in salinization irrigation district. Acta Ecol. Sin. 2012, 32, 198–206. [Google Scholar]

- Zhang, R.F. Theory and Application of Spatial Variability; Science Press: Beijing, China, 2005; pp. 13–14. [Google Scholar]

- Ruan, B.Q.; Xu, F.R.; Jiang, R.F. Analysis on spatial and temporal variability of groundwater level based on spherical sampling model. J. Hydraul. Eng. 2008, 39, 573–579. [Google Scholar]

- Liu, X.N.; Huang, F.; Wang, P. Spatial Analysis Principle and Method of GIS; Science Press: Beijing, China, 2008; pp. 199–206. [Google Scholar]

- Miyamoto, S.; Chacon, A.; Hossain, M.; Martinez, L. Soil salinity of urban turf areas irrigated with saline water I. Spatial variability. Landsc. Urban Plan. 2005, 71, 233–241. [Google Scholar]

- She, D.L.; Shao, M.A.; Yu, S.G. Spatial Variability of Soil Water Content on a Cropland-grassland Mixed Slope Land in the Loess Plateau, China. Trans. Chin. Soc. Agric. Mach. 2010, 41, 57–63. [Google Scholar]

- Zhao, S.; Yan, Y.; Han, J. Industrial Land Change in Chinese Silk Road Cities and Its Influence on Environments. Land 2021, 10, 806. [Google Scholar] [CrossRef]

- Zhao, S.; Zhang, P.; Li, W. A Study on Evaluation of Influencing Factors for Sustainable Development of Smart Construction Enterprises: Case Study from China. Buildings 2021, 11, 221. [Google Scholar] [CrossRef]

- Zhao, S.D.; Li, W.W.; Zhao, K.X.; Zhang, P. Change Characteristics and Multilevel Influencing Factors of Real Estate Inventory-Case Studies from 35 Key Cities in China. Land 2021, 10, 928. [Google Scholar] [CrossRef]

- Shen, X.Y.; Huang, X.J.; Li, H.; Li, Y.; Zhao, X.F. Exploring the relationship between urban land supply and housing stock: Evidence from 35 cities in China. Habitat Int. 2018, 77, 80–89. [Google Scholar] [CrossRef]

- Barreca, A.; Curto, R.; Rolando, D. Is the Real Estate Market of New Housing Stock Influenced by Urban Vibrancy? Complexity 2020, 2020, 1908698. [Google Scholar] [CrossRef]

- Li, M.; Shen, K.R. Population Aging and Housing Consumption: A Nonlinear Relationship in China. China World Econ. 2013, 21, 60–77. [Google Scholar] [CrossRef]

- Hoekstra, M.S.; Hochstenbach, C.; Bontje, M.A.; Musterd, S. Shrinkage and housing inequality: Policy responses to population decline and class change. J. Urban Aff. 2020, 42, 333–350. [Google Scholar] [CrossRef]

- Wang, Y.; Zhou, Y.; Yu, X.X.; Liu, X. Is domestic consumption dragged down by real estate sector? -Evidence from Chinese household wealth. Int. Rev. Financ. Anal. 2021, 75, 101749. [Google Scholar] [CrossRef]

- Hui, E.C.M.; Dong, Z.Y.Z.; Jia, S.H. Housing Price, Consumption, and Financial Market: Evidence from Urban Household Data in China. J. Urban Plan. Dev. 2018, 144, 06018001. [Google Scholar] [CrossRef]

- Coskun, E.A.; Apergis, N.; Coskun, Y. Threshold effects of housing affordability and financial development on the house price-consumptionnexus. Int. J. Financ. Econ. 2020. [Google Scholar] [CrossRef]

- Cai, Z.Y.; Liu, Q.; Cao, S.X. Real estate supports rapid development of China’s urbanization. Land Use Policy 2020, 95, 104582. [Google Scholar] [CrossRef]

- Hidalgo, R.; Arenas, F.; Santana, D. Utopolis or distopolis? real estate production and urbanization in the central coast of Chile (1992–2012). Eure Rev. Latinoam. Estud. Urbano Reg. 2016, 42, 27–54. [Google Scholar] [CrossRef]

- Wu, J.; Gyourko, J.; Deng, Y.H. Evaluating the risk of Chinese housing markets: What we know and what we need to know. China Econ. Rev. 2016, 39, 91–114. [Google Scholar] [CrossRef]

- Lazear, E.P. Why Do Inventories Rise When Demand Falls in Housing and Other Markets? Singap. Econ. Rev. 2012, 57, 1250007. [Google Scholar] [CrossRef]

- Yan, S.Q.; Ge, X.J.; Wu, Q. Government intervention in land market and its impacts on land supply and new housing supply: Evidence from major Chinese markets. Habitat Int. 2014, 44, 517–527. [Google Scholar] [CrossRef]

- Zhang, D.Y.; Cai, J.; Liu, J.; Kutan, A.M. Real estate investments and financial stability: Evidence from regional commercial banks in China. Eur. J. Financ. 2018, 24, 1388–1408. [Google Scholar] [CrossRef]

- Wen, C.; Wallace, J.L. Toward Human-Centered Urbanization? Housing Ownership and Access to Social Insurance Among Migrant Households in China. Sustainability 2019, 11, 3567. [Google Scholar] [CrossRef]

- Bao, H.J.; Chong, A.Y.L.; Wang, H.D.; Wang, L.Y.; Huang, Y.K. Quantitative Decision Making in Land Banking: A Monte Carlo Simulation for China’s Real Estate Developers. Int. J. Strateg. Prop. Manag. 2012, 16, 355–369. [Google Scholar] [CrossRef]

- Wang, R.; Hou, J. Land finance, land attracting investment and housing price fluctuations in China. Int. Rev. Econ. Financ. 2021, 72, 690–699. [Google Scholar] [CrossRef]

- Deng, L.; Chen, J. Market development, state intervention, and the dynamics of new housing investment in China. J. Urban Aff. 2019, 41, 223–247. [Google Scholar] [CrossRef]

- Han, L.B.; Lu, M. Housing prices and investment: An assessment of China’s inland-favoring land supply policies. J. Asia Pac. Econ. 2017, 22, 106–121. [Google Scholar] [CrossRef]

- Jin, C.; Choi, M.J. The causal structure of land finance, commercial housing, and social housing in China. Int. J. Urban Sci. 2019, 23, 286–299. [Google Scholar] [CrossRef]

- Agunbiade, M.E.; Rajabifard, A.; Bennett, R. Land administration for housing production: An approach for assessment. Land Use Policy 2014, 38, 366–377. [Google Scholar] [CrossRef]

- Hui, E.C.M.; Leung, B.Y.P.; Yu, K.H. The impact of different land-supplying channels on the supply of housing. Land Use Policy 2014, 39, 244–253. [Google Scholar] [CrossRef]

- Agunbiade, M.E.; Rajabifard, A.; Bennett, R. Land administration for housing production: Analysis of need for interagency integration. Surv. Rev. 2014, 46, 66–75. [Google Scholar] [CrossRef]

- Fan, J.S.; Zhou, L.; Yu, X.F.; Zhang, Y.J. Impact of land quota and land supply structure on China’s housing prices: Quasi-natural experiment based on land quota policy adjustment. Land Use Policy 2021, 106, 105452. [Google Scholar] [CrossRef]

- Lewis, P.G.; Marantz, N.J. What Planners Know Using Surveys About Local Land Use Regulation to Understand Housing Development. J. Am. Plan. Assoc. 2019, 85, 445–462. [Google Scholar] [CrossRef]

- Haque, A.; Asami, Y. Optimizing urban land use allocation for planners and real estate developers. Comput. Environ. Urban Syst. 2014, 46, 57–69. [Google Scholar] [CrossRef]

| Code | Name | Attribute | |

|---|---|---|---|

| Driving | Financial Revenue | + | |

| Profits of Real Estate Enterprises | + | ||

| Per Capita GDP | + | ||

| Resident Population | + | ||

| Pressure | New Construction Area of House | - | |

| Building Construction Area of House | - | ||

| Completed Construction Area of House | - | ||

| Land Area Purchased by Real Estate Enterprises | - | ||

| State | Area of Real Estate for Sale | - | |

| Inventory Digestion Cycle of Real Estate | - | ||

| Area of Real Estate for Sale in Long Term | - | ||

| Land Area Waiting for Construction | - | ||

| Impact | Gross Domestic Product | + | |

| GDP Growth Rate | + | ||

| Total Retail Sales of Social Consumer Goods | + | ||

| Disposable Income of Urban Residents | + | ||

| Response | Financial Expense | + | |

| Area of Land Requisitioned | - | ||

| Loans Balance of Financial Institutions | + | ||

| Urbanization Rate of Population | + | ||

| Investment of Real Estate Enterprises | - | ||

| Average House Price | - | ||

| Number of Real Estate Enterprises | - | ||

| 2010 | 2019 | ||||||

|---|---|---|---|---|---|---|---|

| Code | Name | Index | Ranking | Light | Index | Ranking | Light |

| 1 | Beijing | 0.5456 | 5 | Yellow | 0.5641 | 26 | Yellow |

| 2 | Tianjin | 0.5276 | 6 | Yellow | 0.4238 | 29 | Yellow |

| 3 | Hebei | 0.3957 | 17 | Orange | 0.4122 | 25 | Yellow |

| 4 | Shanxi | 0.4057 | 14 | Yellow | 0.3772 | 27 | Orange |

| 5 | Inner Mongolia | 0.4257 | 11 | Yellow | 0.3982 | 13 | Orange |

| 6 | Liaoning | 0.3822 | 21 | Orange | 0.3966 | 23 | Orange |

| 7 | Jilin | 0.3954 | 18 | Orange | 0.3367 | 20 | Orange |

| 8 | Heilongjiang | 0.3806 | 22 | Orange | 0.3724 | 22 | Orange |

| 9 | Shanghai | 0.6519 | 1 | Blue | 0.6115 | 17 | Blue |

| 10 | Jiangsu | 0.5750 | 3 | Yellow | 0.5500 | 18 | Yellow |

| 11 | Zhejiang | 0.5569 | 4 | Yellow | 0.5270 | 28 | Yellow |

| 12 | Anhui | 0.3671 | 26 | Orange | 0.3666 | 30 | Orange |

| 13 | Fujian | 0.4391 | 8 | Yellow | 0.4521 | 1 | Yellow |

| 14 | Jiangxi | 0.4027 | 15 | Yellow | 0.4034 | 14 | Yellow |

| 15 | Shandong | 0.4992 | 7 | Yellow | 0.4025 | 7 | Yellow |

| 16 | Henan | 0.4025 | 16 | Yellow | 0.4031 | 11 | Yellow |

| 17 | Hubei | 0.4224 | 12 | Yellow | 0.4438 | 12 | Yellow |

| 18 | Hunan | 0.4130 | 13 | Yellow | 0.3984 | 10 | Orange |

| 19 | Guangdong | 0.6350 | 2 | Blue | 0.6470 | 6 | Blue |

| 20 | Guangxi | 0.3784 | 23 | Orange | 0.3454 | 24 | Orange |

| 21 | Hainan | 0.3852 | 19 | Orange | 0.3544 | 5 | Orange |

| 22 | Chongqing | 0.3835 | 20 | Orange | 0.3871 | 4 | Orange |

| 23 | Sichuan | 0.4340 | 9 | Yellow | 0.3885 | 2 | Orange |

| 24 | Guizhou | 0.3520 | 30 | Orange | 0.3724 | 21 | Orange |

| 25 | Yunnan | 0.3717 | 25 | Orange | 0.3759 | 31 | Orange |

| 26 | Tibet | 0.3351 | 31 | Orange | 0.3683 | 16 | Orange |

| 27 | Shaanxi | 0.4277 | 10 | Yellow | 0.3991 | 15 | Orange |

| 28 | Gansu | 0.3572 | 27 | Orange | 0.3563 | 19 | Orange |

| 29 | Qinghai | 0.3759 | 24 | Orange | 0.3618 | 9 | Orange |

| 30 | Ningxia | 0.3566 | 28 | Orange | 0.3462 | 8 | Orange |

| 31 | Xinjiang | 0.3563 | 29 | Orange | 0.3576 | 3 | Orange |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, W.; Weng, L.; Zhao, K.; Zhao, S.; Zhang, P. Research on the Evaluation of Real Estate Inventory Management in China. Land 2021, 10, 1283. https://doi.org/10.3390/land10121283

Li W, Weng L, Zhao K, Zhao S, Zhang P. Research on the Evaluation of Real Estate Inventory Management in China. Land. 2021; 10(12):1283. https://doi.org/10.3390/land10121283

Chicago/Turabian StyleLi, Weiwei, Lisheng Weng, Kaixu Zhao, Sidong Zhao, and Ping Zhang. 2021. "Research on the Evaluation of Real Estate Inventory Management in China" Land 10, no. 12: 1283. https://doi.org/10.3390/land10121283

APA StyleLi, W., Weng, L., Zhao, K., Zhao, S., & Zhang, P. (2021). Research on the Evaluation of Real Estate Inventory Management in China. Land, 10(12), 1283. https://doi.org/10.3390/land10121283