Understanding the Impacts of Financial Flows in the Landscape

Abstract

:1. Introduction

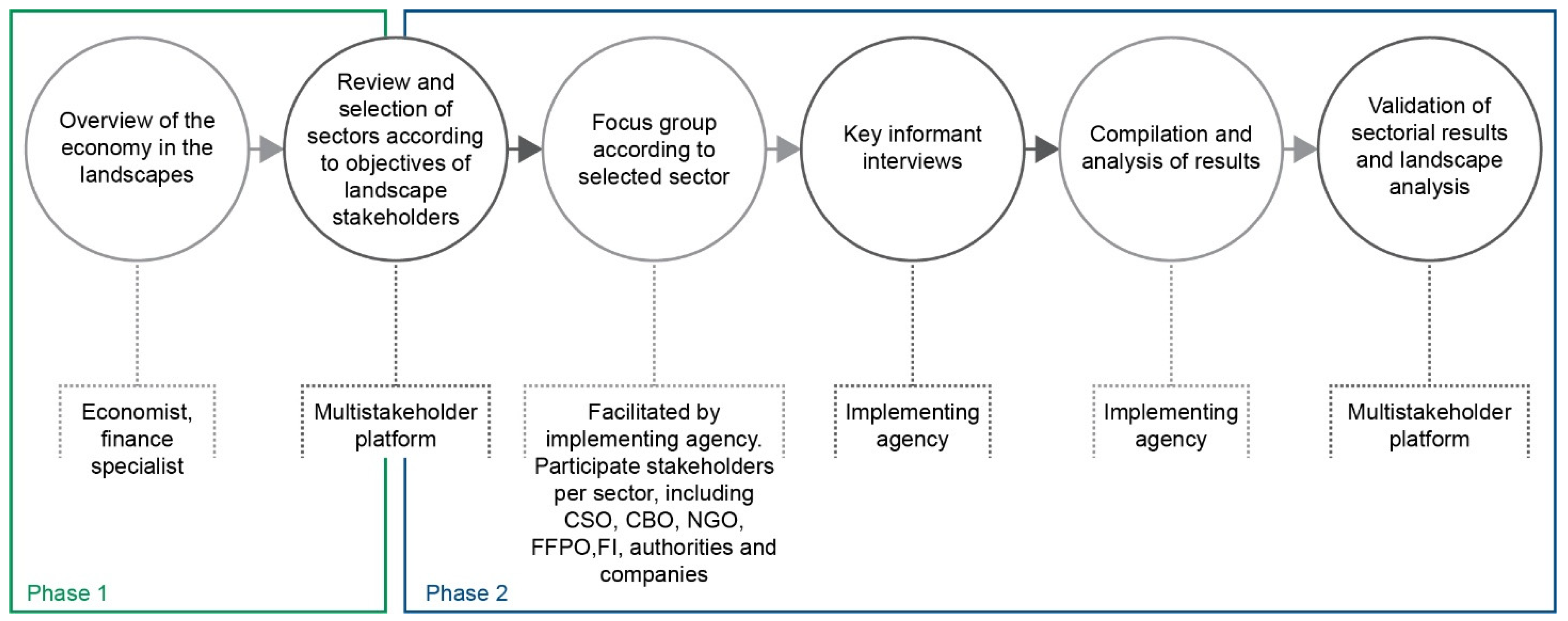

2. Methodology

2.1. Users

2.2. Implementation

2.3. Pilots in Ghana, Indonesia and Vietnam

3. Results

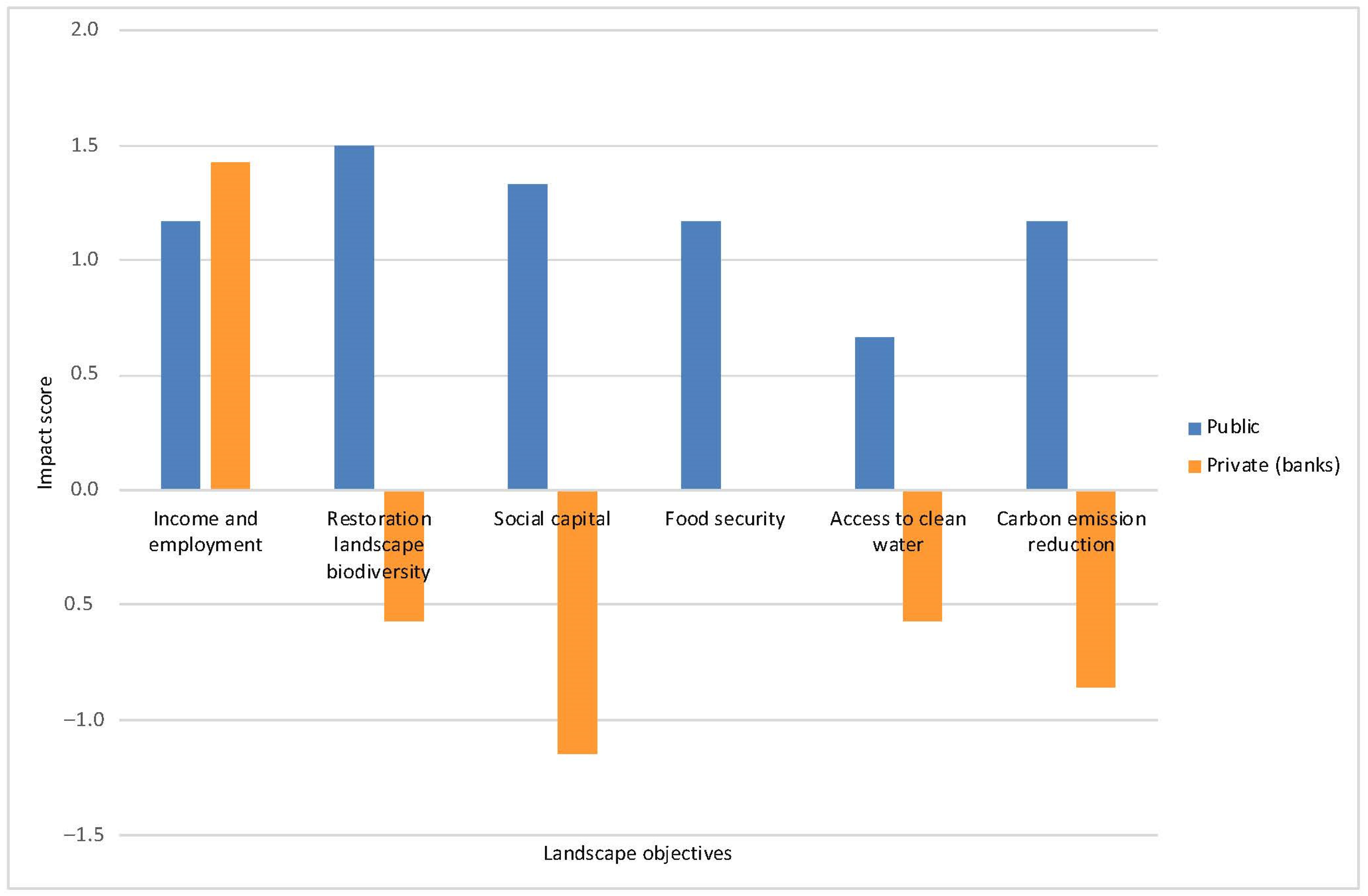

3.1. Ketapang-Kayong Utara (KKU) Landscape, Indonesia

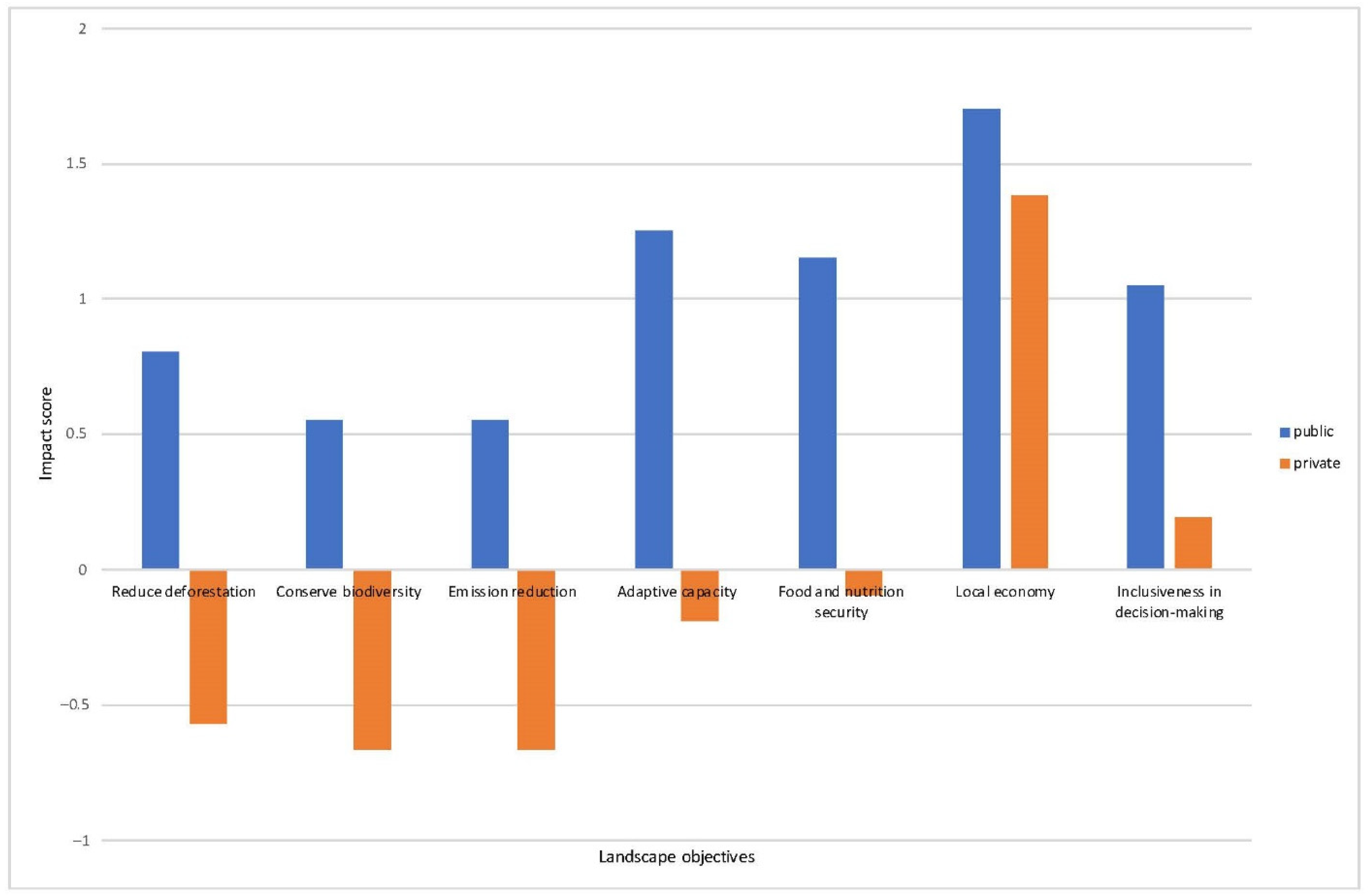

3.2. Juabeso-Bia and Sefwi-Wiawso (JBSW) Landscape, Ghana

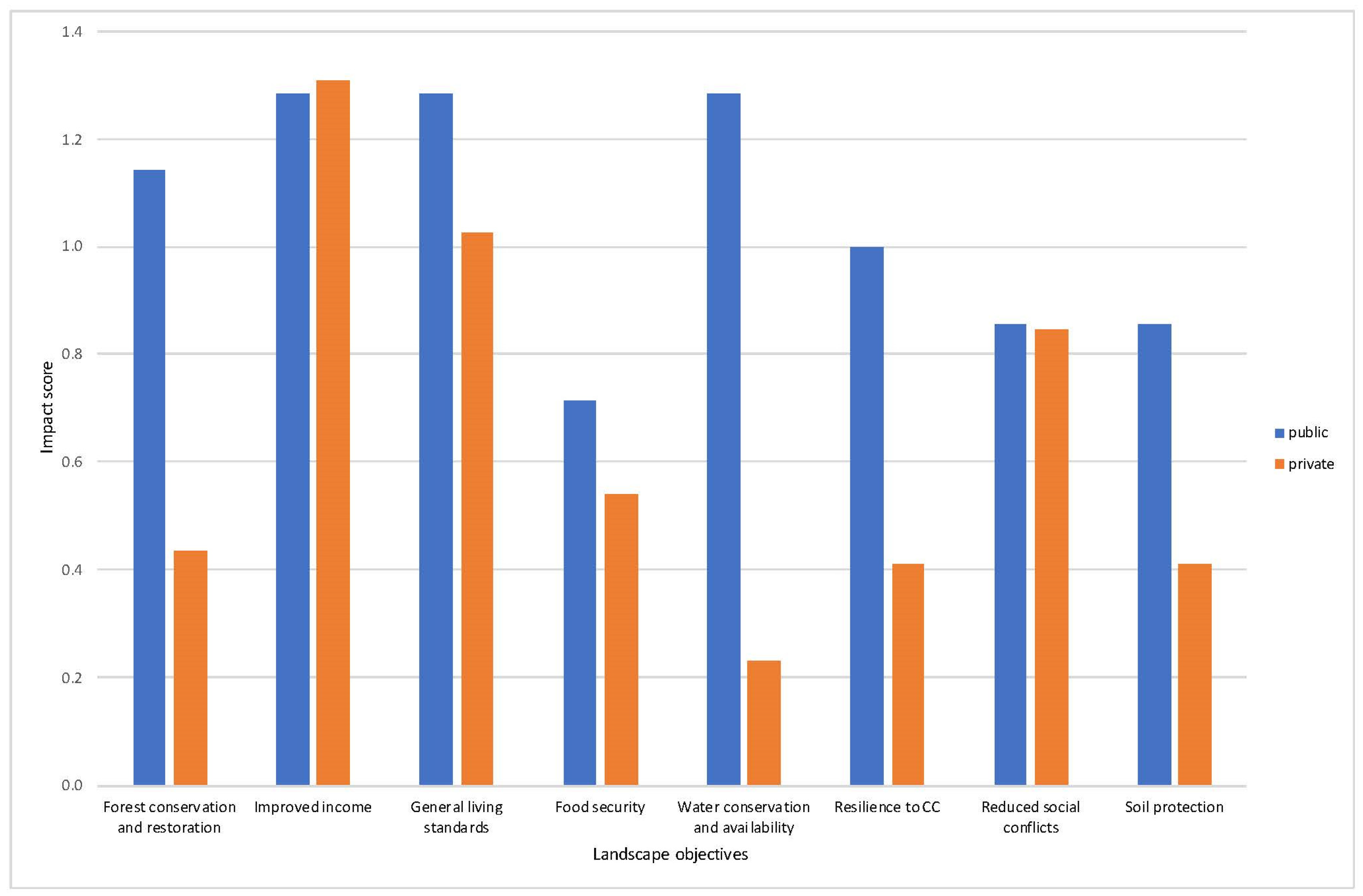

3.3. Srepok River Basin (SRB) Landscape, Vietnam

4. Discussion

4.1. The Value of Understanding the Impacts of Financial Flows in the Landscape

4.2. Balancing Trade-offs between Participation and Level of Detail

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Borras, S.M., Jr.; Hall, R.; Scoones, I.; White, B.; Wolford, W. Towards a Better Understanding of Global Land Grabbing: An Editorial Introduction. J. Peasant. Stud. 2011, 38, 209–216. [Google Scholar] [CrossRef] [Green Version]

- FAO. The State of the World’s Forests 2018—Forest Pathways to Sustainable Development; FAO: Rome, Italy, 2018. [Google Scholar]

- HLPE. Sustainable Forestry for Food Security and Nutrition; The High Level Panel of Experts on Food Security and Nutrition (HLPE), Food and Agriculture Organization on the United Nations (FAO): Rome, Italy, 2017. [Google Scholar]

- Sethi, T.; Custer, S.; Turner, J.; Sims, J.; DiLorenzo, M.; Latourell, R. Realizing Agenda 2030: Will Donor Dollars and Country Priorities Align with Global Goals; AidData at William & Mary: Williamsburg, VA, USA, 2017. [Google Scholar]

- Macqueen, D.; Benni, N.; Boscolo, M.; Zapata, J. Access to Finance for Forest and Farm Producer Organisations (FFPOs); FAO/IIED: Rome, Italy; London, UK, 2018. [Google Scholar]

- Guarnaschelli, S.; Limketkai, B.; Vandeputte, P. Financing Sustainable Land Use. Unlocking Business Opportunities in Sustainable Land Use with Blended Finance; Kois Invest: Brussels, Belgium, 2018. [Google Scholar]

- Shames, S.; Clarvis, M.H.; Kissinger, G. Financing Strategies for Integrated Landscape Investment: Synthesis Report; EcoAgriculture Partners, on behalf of the Landscapes for People, Food and Nature Initiative: Washington, DC, USA, 2014. [Google Scholar]

- Louman, B.; Meybeck, A.; Mulder, G.; Brady, M.; Fremy, L.; Savenije, H.; Gitz, V.; Trines, E. Innovative Finance for Sustainable Landscapes; CIFOR: Bogor, Indonesia, 2020. [Google Scholar]

- Milder, J.C.; Hart, A.K.; Dobie, P.; Minai, J.; Zaleski, C. Integrated Landscape Initiatives for African Agriculture, Development, and Conservation: A Region-Wide Assessment. World Dev. 2014, 54, 68–80. [Google Scholar] [CrossRef]

- Estrada-Carmona, N.; Hart, A.K.; DeClerck, F.A.; Harvey, C.A.; Milder, J.C. Integrated Landscape Management for Agriculture, Rural Livelihoods, and Ecosystem Conservation: An Assessment of Experience from Latin America and the Caribbean. Landsc. Urban Plan. 2014, 129, 1–11. [Google Scholar] [CrossRef] [Green Version]

- Hart, A.K.; Milder, J.C.; Estrada-Carmona, N.; DeClerck, F.A.J.; Dobie, P. Integrated landscape initiatives in practice: Assessing experiences from 191 landscapes in Africa and Latin America. In Climate-Smart Landscapes: Multifunctionality in Practice; Minang, P.A., Van Noordwijk, M., Freeman, O.E., Mbow, C., De Leeuw, J., Catacutan, D., Eds.; World Agroforestry Centre (ICRAF): Nairiobi, Kenya, 2015. [Google Scholar]

- Sayer, J.; Campbell, B.; Petheram, L.; Aldrich, M.; Perez, M.R.; Endamana, D.; Dongmo, Z.-L.N.; Defo, L.; Mariki, S.; Doggart, N. Assessing Environment and Development Outcomes in Conservation Landscapes. Biodivers. Conserv. 2007, 16, 2677–2694. [Google Scholar] [CrossRef]

- Shames, S.; Louman, B.; Scherr, S. The Landscape Assessment of Financial Flows: A Methodology; Tropenbos International and EcoAgriculture Partners: Wageningen, The Netherlands, 2017. [Google Scholar]

- Minang, P.; Van Noordwijk, M.; Freeman, O.E.; Mbow, C.; De Leeuw, L.; Catacutan, D. ClimateSmart Landscapes: Multifunctionality in Practice; World Agroforestry Centre (ICRAF): Nairobi, Kenya, 2015. [Google Scholar]

- Scherr, S.J.; Shames, S.; Friedman, R. From Climate-Smart Agriculture to Climate-Smart Landscapes. Agric. Food Secur. 2012, 1, 12. [Google Scholar] [CrossRef] [Green Version]

- Kusters, K. Climate-Smart Landscapes and the Landscape Approach: An Exploration of the Concepts and Their Practical Implications; Tropenbos International: Wageningen, The Netherlands, 2015. [Google Scholar]

- Pamerneckyte, G.; Sekyere, K.; Louman, B. Report on Implementation of the Landscape Assessment of Financial Flows (LAFF) in the Juabeso–Bia and Sefwi–Wiawso Landscape; Tropenbos International: Wageningen, The Netherlands, 2020. [Google Scholar]

- Rossanda, D.; Pamerneckyte, G.; Koesoetjahjo, I.; Louman, B. Report on Implementation of the Landscape Assessment of Financial Flows (LAFF) in Gunung Tarak Landscape, Indonesia; Tropenbos International: Wageningen, The Netherlands, 2020. [Google Scholar]

- Tropenbos Viet Nam. Report on Implementation of the Landscape Assessment of Financial Flows (LAFF) in Srepok River Basin in the Dak Lak Region, Vietnam; Tropenbos International: Ede, The Netherlands, forthcoming.

- Widayati, A.; Louman, B.; Mulyoutami, E.; Purwanto, E.; Kusters, K.; Zagt, R. Communities’ Adaptation and Vulnerability to Climate Change: Implications for Achieving a Climate-Smart Landscape. Land 2021, 10, 816. [Google Scholar] [CrossRef]

- Meyfroidt, P.; Vu, T.P.; Hoang, V.A. Trajectories of Deforestation, Coffee Expansion and Displacement of Shifting Cultivation in the Central Highlands of Vietnam. Glob. Environ. Chang. 2013, 23, 1187–1198. [Google Scholar] [CrossRef]

- Shames, S.; Scherr, S.J. Integrated Landscape Investment and Finance: A Primer. Technical Background Document for the Landscape Investment and Finance Tool (LIFT); EcoAgriculture Partners and IUCN NL: Washington, DC, USA, 2017. [Google Scholar]

- Besacier, C. Local Financing Mechanisms for Forest and Landscape Restoration: A Review of Local-Level Investment Mechanisms; Forestry Working Paper; FAO: Rome, Italy, 2021. [Google Scholar]

- Ros-Tonen, M.A.; Reed, J.; Sunderland, T. From Synergy to Complexity: The Trend toward Integrated Value Chain and Landscape Governance. Environ. Manag. 2018, 62, 1–14. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Falcone, P.M. Green Investment Strategies and Bank-Firm Relationship: A Firm-Level Analysis. Econ. Bull 2018, 38, 2225–2239. [Google Scholar]

- Fan, H.; Peng, Y.; Wang, H.; Xu, Z. Greening through Finance? J. Dev. Econ. 2021, 152, 102683. [Google Scholar] [CrossRef]

- Maguire-Rajpaul, V.A.; Sandbrook, C.; McDermott, C.; Hirons, M.A. Climate-Smart Cocoa Governance Entrenches Old Hegemonies in Côte d’Ivoire and Ghana: A Multiple Environmentality Analysis. Geoforum 2021, in press. [Google Scholar] [CrossRef]

- Mc Culloch-Jones, S.; Novellie, P.; Roux, D.J.; Currie, B. Thematic Section: Conservation Implications of Social-Ecological Change in Southern Africa Exploring the Alignment between the Bottom-up and Top-down Objectives of a Landscape-Scale Conservation Initiative. Environ. Conserv. 2021, 1–9. [Google Scholar] [CrossRef]

- Damnyag, L. Finance for Integrated Landscape Management: A Value Chain Based Landscape Approach towards Climate Smart Cocoa in the Juabeso-Bia Landscape, Ghana; Tropenbos International: Ede, The Netherlands, forthcoming.

- Mawesti, D.; Aryanto, T.; Louman, B. Finance for Integrated Landscape Management: The Potential of Credit Unions in Indonesia as Catalyzers of Local Rural Development. The Case of Semandang Jaya Credit Union; Tropenbos International: Ede, The Netherlands, forthcoming.

- Jachnik, R.; Mirabile, M.; Dobrinevski, A. Tracking Finance Flows towards Assessing Their Consistency with Climate Objectives; OECD: Paris, France, 2019. [Google Scholar]

- Buchner, B.; Herve-Mignucci, M.; Trabacchi, C.; Wilkinson, J.; Stadelmann, M.; Boyd, R.; Mazza, F.; Falconer, A.; Micale, V. Global Landscape of Climate Finance 2015. Clim. Policy Initiat. 2014, 32, 1–38. [Google Scholar]

- Micale, V.; Tonkonogy, B.; Mazza, F. Understanding and Increasing Finance for Climate Adaptation in Developing Countries; Climate Policy Initiative: San Francisco, CA, USA, 2018. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Louman, B.; Shames, S.; Pamerneckyte, G.; Owusu Ansah, M.; Koesoetjahjo, I.; Nghi, T.H.; Kusters, K. Understanding the Impacts of Financial Flows in the Landscape. Land 2021, 10, 1261. https://doi.org/10.3390/land10111261

Louman B, Shames S, Pamerneckyte G, Owusu Ansah M, Koesoetjahjo I, Nghi TH, Kusters K. Understanding the Impacts of Financial Flows in the Landscape. Land. 2021; 10(11):1261. https://doi.org/10.3390/land10111261

Chicago/Turabian StyleLouman, Bas, Seth Shames, Gabija Pamerneckyte, Mercy Owusu Ansah, Irene Koesoetjahjo, Tran Huu Nghi, and Koen Kusters. 2021. "Understanding the Impacts of Financial Flows in the Landscape" Land 10, no. 11: 1261. https://doi.org/10.3390/land10111261

APA StyleLouman, B., Shames, S., Pamerneckyte, G., Owusu Ansah, M., Koesoetjahjo, I., Nghi, T. H., & Kusters, K. (2021). Understanding the Impacts of Financial Flows in the Landscape. Land, 10(11), 1261. https://doi.org/10.3390/land10111261