Role of Conservation Adoption Premiums on Participation in Water Quality Trading Programs

Abstract

:1. Introduction

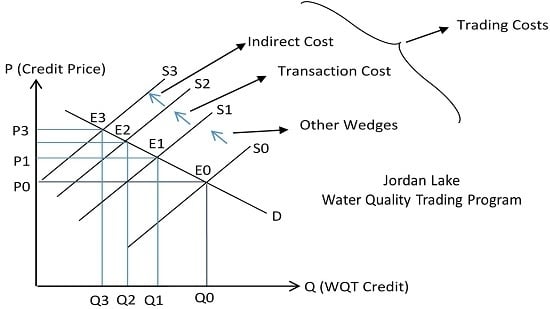

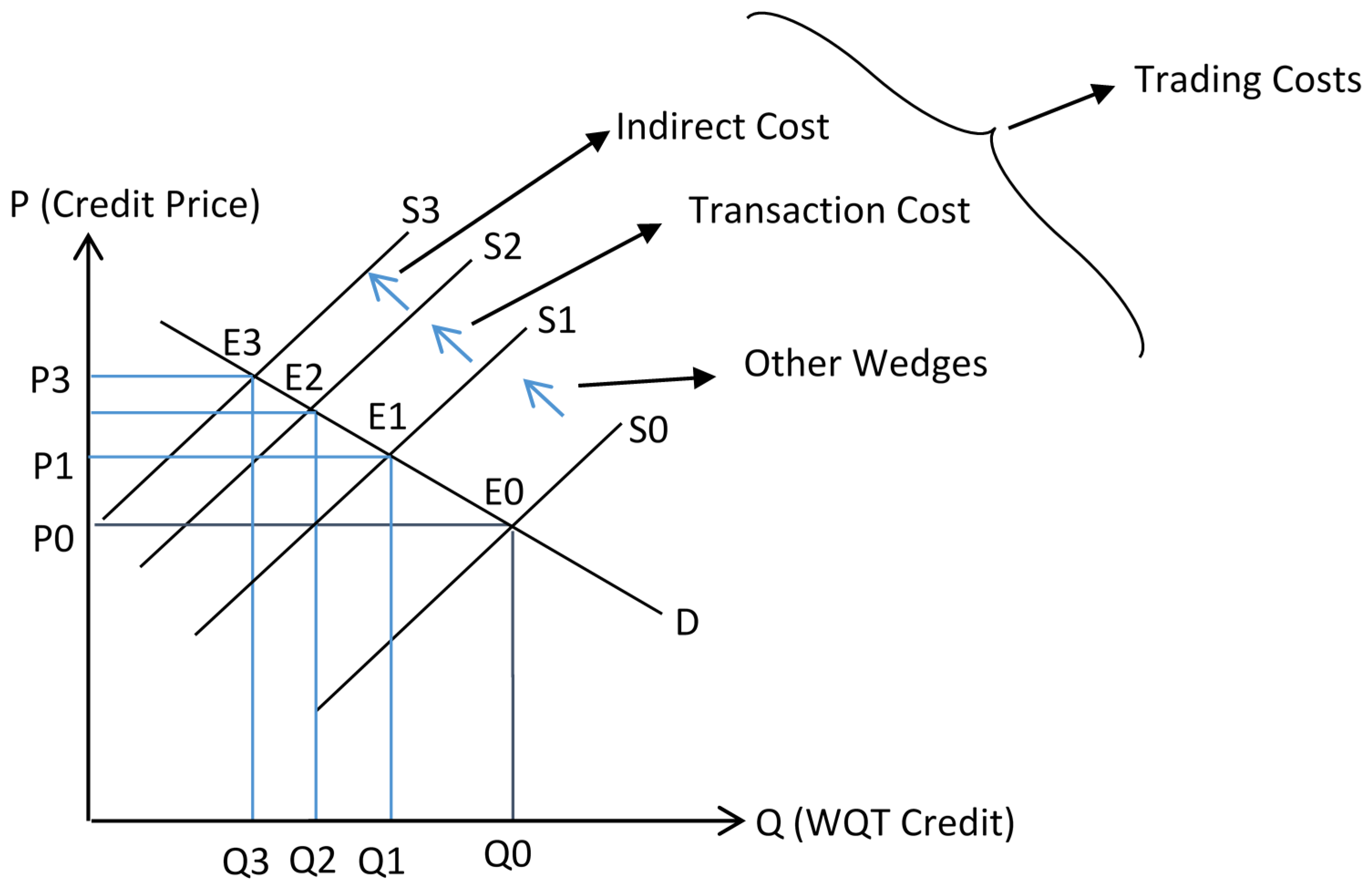

2. Materials and Methods

2.1. Case Study Background

“Experience shows that it would cost about $450 OR $2,200 (including fencing) per ac ($1,110 OR $5,400 (including fencing) per ha) to install permanent riparian buffers along streams. Given that developers could pay for part, all or more than your costs with the water quality trading, how much would be your willingness to accept to install riparian buffers? ______$/ac.”

“After thinking it a little more, are you confident with your earlier answer that you would be willing to accept $ X to install the permanent buffers?”

2.2. Computing the Adoption Premium

3. Results

3.1. The Adoption Premium

3.2. Profile of Farmers in the Jordan Lake Study

3.3. The Role of Information

3.4. Trading Cost

4. Farmer’s Willingness to Bear Some Costs

“In your opinion, why would other farmers be willing to accept less than the cost of installation (for the conservation practice)?”

“In your opinion, why would other farmers need to accept more than their cost of conservation practice installation?”

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Selman, M.; Greenhalgh, S.; Branosky, E.; Jones, C.; Guiling, J. Water Quality Trading Programs: An International Overview; World Resources Institute Issue Brief; WRI: Washington, DC, USA, 2009; Available online: http://www.wri.org/publication/water-quality-trading-programs-international-overview (accessed on 15 August 2013).

- United States Environmental Protection Agency (USEPA). Water Quality Trading Toolkit for Permit Writers. Available online: http://water.epa.gov/type/watersheds/trading/WQTToolkit.cfm (accessed on 10 September 2013).

- King, D.M.; Kuch, P.J. Will nutrient credit trading ever work? An assessment of supply and demand problems and institutional obstacles. In The Environmental Law Reporter; Environmental Law Institute: Washington, DC, USA, 2003; pp. 10352–10368. [Google Scholar]

- Willamette Partnership; World Resources Institute; The National Network on Water Quality. Building a Water Quality Trading Program: Options and Considerations. Available online: http://willamettepartnership.org/wp-content/uploads/2015/06/BuildingaWQTProgram-NNWQT.pdf (accessed on 18 June 2015).

- Newburn, D.A.; Woodward, R.T. An ex post evaluation of the Great Miami water quality trading program. J. Am. Water Resour. Assoc. 2012, 48, 156–169. [Google Scholar] [CrossRef]

- Shortle, J. Economics and environmental markets: Lessons from water quality trading. Agric. Resour. Econ. Rev. 2013, 42, 57–74. [Google Scholar]

- Nowak, P.; O’Keefe, G.; Bennett, C.; Anderson, S.; Trumbo, C. Communication and Adoption Evaluation of USDA Water Quality Demonstration Projects. Plant and Animal Science Production and Protection and Processing, CSREES/USDA: Washington, DC, USA, 1997; Available online: https://archive.org/details/CAT10844774 (accessed on 1 August 2013).

- Lichtenberg, E.; Parker, D.; Lane, S. Best Management Practice Use and Nutrient Management in Maryland: A 2010 Snapshot; University of Maryland Center for Agricultural and Natural Resource Policy: College, MD, USA, 2010; p. 23. Available online: https://agresearch.umd.edu/sites/default/files/_docs/2010PolicyAnalysisReport_BMP.pdf (accessed on 1 August 2013).

- Hoag, D.L.K.; Luloff, A.E.; Osmond, D.L. Socioeconomic analysis: National institute of food and agriculture—Conservation Effects Assessment. In How to Build Better Agricultural Conservation Programs to Protect Water Quality: The National Institute of Food and Agriculture—Conservation Effects Assessment Project Experience, 1st ed.; Deanna, L., Osmond, D.L., Meals, D.W., Hoag, D.L.K., Arabi, M., Eds.; Soil and Water Conservation Society: Ankeny, IA, USA, 2012; pp. 120–137. [Google Scholar]

- Center for Agriculture in the Environment. The Adoption of Conservation Practices in Agriculture; American Farmland Trust: Washington, DC, USA, 2013; Available online: https://4aa2dc132bb150caf1aa-7bb737f4349b47aa42dce777a72d5264.ssl.cf5.rackcdn.com/Adoption-of-Conservation-Practices-in-Agriculture.pdf (accessed on 10 September 2013).

- USDA Economic Research Service. Some Conservation Practices Are More Widely Adopted than Others. Available online: http://www.ers.usda.gov/data-products/chart-gallery/detail.aspx?chartId=53856 (accessed on 21 September 2015).

- Ball, A.G.; Heady, E.O.; Baumann, R.V. Economic Evaluation of the Use of Soil Conservation and Improvement Practices in Western Iowa. No. 157185, Technical Bulletins. United States Department of Agriculture, Economic Research Service, 1957. Available online: http://ageconsearch.umn.edu/bitstream/157185/2/tb1162.pdf (accessed on 1 September 2013).

- Fang, F.; Easter, K.W.; Brezonik, P.L. Point-nonpoint source water quality trading: A case study in the Minnesota River basin. J. Am. Water Resour. Assoc. 2005, 41, 645–657. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.S. Investment under Uncertainty, 1st ed.; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Hoag, D.; Hughes-Popp, J. Theory and practice of pollution credit trading in water quality management. Rev. Agric. Econ. 1997, 19, 252–262. [Google Scholar] [CrossRef]

- Shortle, J.S.; Horan, R.D. The economics of water quality trading. Int. Rev. Environ. Resour. Econ. 2008, 2, 101–133. [Google Scholar] [CrossRef]

- Ghosh, G.; Ribaudo, M.; Shortle, J. Baseline requirements can hinder trades in water quality trading programs: Evidence from the Consetoga Watershed. J. Environ. Manag. 2011, 92, 2076–2084. [Google Scholar] [CrossRef] [PubMed]

- Suter, J.; Spraggon, J.; Poe, G.L. Thin and lumpy: An experimental investigation of water quality trading. Water Res. Econ. 2013, 1, 36–60. [Google Scholar] [CrossRef]

- Peterson, J.M.; Smith, C.M.; Leatherman, J.C.; Hendricks, N.P.; Fox, J.A. Transaction costs in payment for environmental service contracts. Am. J. Agric. Econ. 2015, 97, 219–238. [Google Scholar] [CrossRef]

- Breetz, H.L.; Fisher-Vanden, K.; Jacobs, H.; Schary, C. Trust and communication: Mechanisms for increasing farmers’ participation in water quality trading. Land Econ. 2005, 81, 170–190. [Google Scholar] [CrossRef]

- Peterson, J.M.; Fox, J.A.; Leatherman, J.C.; Smith, C.M. Choice experiments to assess farmers, willingness to participate in a water quality trading market. In Proceedings of the American Agricultural Economics Association Annual Meeting, Portland, OR, USA, 29 July–1 August 2007; Available online: http://ageconsearch.umn.edu/bitstream/9726/1/sp07pe03.pdf (accessed on 1 October 2015).

- Mariola, M.J. Farmers, trust, and the market solution to water pollution: The role of social embeddedness in water quality trading. J. Rural Stud. 2012, 28, 577–589. [Google Scholar] [CrossRef]

- Morgan, C.; Woverton, A. Water Quality Trading in the United States; NCEE Working Paper Series 200507; EPA National Center for Environmental Economics: Washington, DC, USA, 2005. Available online: https://www.epa.gov/home/pdf-files (accessed on 10 October 2014).

- Shortle, J. Water Quality Trading in Agriculture. Report to the Organization for Economic Cooperation and Development, Directorate for Trade and Agriculture, OECD Publishing. 2010. Available online: https://www.oecd.org/tad/sustainable-agriculture/49849932.pdf (accessed on 5 April 2012).

- Feather, P.M.; Amacher, G.S. Role of information in the adoption of best management practices for water quality improvement. Agric. Econ. 1994, 11, 159–170. [Google Scholar] [CrossRef]

- O’Connell, C.; Motallebi, M.; Osmond, D.L.; Hoag, D. Trading on Risk: The moral logics and economic reasoning of North Carolina farmers in water quality trading markets. Econ. Anthropol. 2017. accepted. [Google Scholar]

- Natural Resources Conservation Service (NRCS). Practice Payment. Available online: http://www.nrcs.usda.gov/wps/portal/nrcs/main/national/technical/econ/costs/ (accessed on 1 December 2012).

- Baker, R.; Bartczak, A.; Chilton, S.; Metcalf, H. Did people “buy” what was “sold”? A qualitative evaluation of a contingent valuation survey information set for gains in life expectancy. J. Environ. Manag. 2014, 133, 94–103. [Google Scholar] [CrossRef] [PubMed]

- Schenk, A.; Hunziker, M.; Kienast, F. Factors influencing the acceptance of nature conservation measures—A qualitative study in Switzerland. J. Environ. Manag. 2007, 83, 66–79. [Google Scholar] [CrossRef] [PubMed]

- Bernard, H.R. Research Methods in Anthropology: Qualitative and Quantitative Approaches, 5th ed.; AltaMira Press: Lanham, MD, USA, 2011. [Google Scholar]

- Fontana, A.; Frey, J.H. The interview: From neutral stance to political involvement. In The SAGE Handbook of Qualitative Research, 3rd ed.; Denzin, N.K., Lincoln, Y.S., Eds.; SAGE Publications: London, UK, 2005; pp. 695–727. [Google Scholar]

- Pagiola, S. Economic Analysis of Investment in Cultural Heritage: Insights from Environmental Economics; World Bank: Washington, DC, USA, 1996; Available online: https://www.elaw.org/system/files/Economic.Analysis.Investments.Cultural.Heritage_0.pdf (accessed on 10 October 2014).

- Freeman, A.M. The Measurement of Environmental and Resource Values. In Theory and Methods; Resource for the Future: Washington, DC, USA, 1993. [Google Scholar]

- Loomis, J.; Kent, P.; Strange, L.; Faush, K.; Covich, A. Measuring the total economic value of restoring ecosystem services in an impaired in river basin: Result from a contingent valuation survey. Ecol. Econ. 2000, 33, 103–117. [Google Scholar] [CrossRef]

- Carson, R.T.; Flores, N.E.; Meade, N.F. Contingent valuation: Controversies and evidence. Environ. Resour. Econ. 2001, 19, 173–210. [Google Scholar] [CrossRef]

- Dupraz, P.; Vermersch, D.; Henry, D.F.B.; Delvaux, L. The environmental supply of farm households: A flexible willingness to accept model. Environ. Resour. Econ. 2003, 25, 171–189. [Google Scholar] [CrossRef]

- Buckley, C.; Stephen, H.; Sarah, M. Operating or not Operating at the Margin: Farmers Willingness to Adopt a Riparian Buffer Zone. Working Paper No. 148830. 2012. Available online: https://www.nuigalway.ie/semru/documents/12wpsemru03.pdf (accessed on 10 February 2016).

- Edwards, S.; Anderson, G. Overlooked biases in contingent valuation surveys. Land Econ. 1987, 63, 168–178. [Google Scholar] [CrossRef]

- Loomis, J.; Gonzalez-Caban, A.; Gregory, R. Do reminders of substitutes and budget constraints influence contingent valuation estimates? Land Econ. 1994, 70, 499–506. [Google Scholar] [CrossRef]

- Neill, H.R.; Cummings, R.G.; Ganderton, R.G.; Harrison, G.W.; McGuckin, T. Hypothetical surveys and real economic commitments. Land Econ. 1994, 70, 145–154. [Google Scholar] [CrossRef]

- List, J.; Berrens, R.; Bohara, A.; Kerkvliet, J. Examining the role of social isolation on stated preferences. Am. Econ. Rev. 2004, 94, 741–752. [Google Scholar] [CrossRef]

- List, J.A.; Gallet, C.A. What experimental protocol influence disparities between actual and hypothetical stated values? Environ. Resour. Econ. 2001, 20, 241–254. [Google Scholar] [CrossRef]

- Mitchell, R.; Carson, T. Using Surveys to Value Public Goods: The Contingent Valuation Method; Resources for the Future: Washington, DC, USA, 1989. Available online: http://www.waterboards.ca.gov/waterrights/water_issues/programs/bay_delta/wq_control_plans/1995wqcp/admin_records/part05/380.pdf (accessed on 1 August 2013).

- Fisher, R.J. Social desirability bias and the validity of indirect questioning. J. Consum. Res. 1993, 20, 303–315. [Google Scholar] [CrossRef]

- Natural Resources Conservation Service (NRCS). Rate for Federal Water Projects. Available online: http://www.economics.nrcs.usda.gov/cost/priceindexes/rates.html (accessed on 1 August 2013).

- North Carolina Division of Water Resources (NCDEQ). Jordan Lake Rules. Available online: http://portal.ncdenr.org/web/jordanlake/tmdl (accessed on 1 February 2013).

- United States Department of Agriculture. National Agricultural Statistics Services. Available online: http://www.nass.usda.gov/ (accessed on 2 May 2014).

- NC State University and A&T State University Cooperative Extension. Field Crops Publications. 2014. Available online: http://www.ces.ncsu.edu/publications-on-field-crops/ (accessed on 20 December 2014).

- Van Houtven, G.; Loomis, R.; Baker, J.; Beach, R.; Casey, S. Nutrient Credit Trading for the Chesapeake Bay: An Economic Study: Prepared for Chesapeake Bay Commission. RTI International: Research Triangle Park, NC, USA. Available online: http://www.chesbay.us/Publications/nutrient-trading-2012.pdf (accessed on 1 May 2012).

- Motallebi, M. Water Quality Trading In Jordan Lake, North Carolina: Economic, Hydrological, Behavioral, and Ecological Aspects. Ph.D. Thesis, Colorado State University, Fort Collins, CO, USA, 2015. [Google Scholar]

- Taylor, B.M.; Van Grieken, M. Local institutions and farmer participation in agri-environmental schemes. J. Rural Stud. 2015, 37, 10–19. [Google Scholar] [CrossRef]

- Jones, C.; Hesterly, W.S.; Borgatti, S.P. A general theory of network governance: Exchange conditions and social mechanisms. Acad. Manag. Rev. 1997, 22, 911–945. [Google Scholar]

- Van Winsen, F.; De Mey, Y.; Lauwers, L.; Van Passel, S.; Vancauteren, M.; Wauters, E. Cognitive mapping: A method to elucidate and present farmers’ risk perception. Agric. Syst. 2013, 122, 42–52. [Google Scholar] [CrossRef]

- Blackstock, K.L.; Richards, C. Evaluating stakeholder involvement in river basin planning: A Scottish case study. Water Policy 2007, 9, 493–512. [Google Scholar] [CrossRef]

- Bryant, L.; Garnham, B. Beyond discourses of drought: The micro-politics of the wine industry and the mental health of farmers. J. Rural Stud. 2013, 32, 1–9. [Google Scholar] [CrossRef]

- Mettepenningen, E.; Vandermeulen, V.; Delaet, K.; Van Huylenbroeck, G.; Wailes, E.J. Investigating the influence of the institutional organization of agri-environmental schemes on scheme adoption. Land Use Policy 2011, 33, 20–30. [Google Scholar] [CrossRef]

- Reimer, A.P.; Weinkauf, D.K.; Prokopy, L.S. The influence of perceptions of practice characteristics: An examination of agricultural best management practice adoption in two Indiana watersheds. J. Rural Stud. 2012, 28, 118–128. [Google Scholar] [CrossRef]

| Before Stated Installation Cost | After Stated Installation Cost | ||||

|---|---|---|---|---|---|

| Answer | Frequency | Percent | Answer | Frequency | Percent |

| Yes | 24 | 27 | Yes | 84 | 93 |

| No | 25 | 28 | No | 5 | 6 |

| Maybe | 39 | 43 | Maybe | - | - |

| No Answer | 2 | 2 | No Answer | 1 | 1 |

| Sum | 90 | 100 | Sum | 90 | 100 |

| Variable | Coefficient | Std. Error | t-Test |

|---|---|---|---|

| Constant | −1.17 | 0.805 | −1.46 |

| Years of Residency | −0.017 | 0.008 | −2.12 ** |

| Education | 0.27 | 0.14 | 1.96 * |

| Type of Buffer | 0.37 | 0.16 | 2.37 ** |

| Size of Farm | −0.00042 | 0.0004 | −1.05 |

| Experience | −0.089 | 0.26 | −0.34 |

| Stated Installation Cost (dummy variable) | 2.083 | 0.26 | 8.12 ** |

| Pseudo R 2 | 0.4 | LR Chi-Square | 20.5 |

| Log Likelihood | −68.78 | Prob > Chi-Square | 0.000 |

| Rate | Frequency | Percentage |

|---|---|---|

| 0–1 | 24 | 29 |

| 1 | 2 | 2 |

| 1–2 | 19 | 23 |

| 2–3 | 15 | 18 |

| 3–4 | 3 | 4 |

| 4–5 | 5 | 6 |

| 5–6 | 3 | 4 |

| 6–7 | 4 | 5 |

| 7–8 | 2 | 2 |

| 8–9 | 2 | 2 |

| 9–10 | 2 | 2 |

| 10–11 | 1 | 1 |

| 20< | 2 | 2 |

| Livestock Farming * | ||||

|---|---|---|---|---|

| WTA ($) | Trading Cost ($) | Trading Cost Rate | Adoption Premium ($) | Adoption Premium Rate |

| 28,858 per ha (11,757 per ac) | 20,802 per ha (8,475 per ac) | 2.59 | 18,912 per ha (7,705 per ac) | 2.35 |

| Crop Farming ** | ||||

| WTA ($) | Trading Cost ($) | Trading Cost Rate | Adoption Premium ($) | Adoption Premium Rate |

| 12,920 per ha (5,264 per ac) | 9,190 per ha (3,744 per ac) | 2.46 | 8,802 per ha (3,586 per ac) | 2.36 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Motallebi, M.; O’Connell, C.; Hoag, D.L.; Osmond, D.L. Role of Conservation Adoption Premiums on Participation in Water Quality Trading Programs. Water 2016, 8, 245. https://doi.org/10.3390/w8060245

Motallebi M, O’Connell C, Hoag DL, Osmond DL. Role of Conservation Adoption Premiums on Participation in Water Quality Trading Programs. Water. 2016; 8(6):245. https://doi.org/10.3390/w8060245

Chicago/Turabian StyleMotallebi, Marzieh, Caela O’Connell, Dana L. Hoag, and Deanna L. Osmond. 2016. "Role of Conservation Adoption Premiums on Participation in Water Quality Trading Programs" Water 8, no. 6: 245. https://doi.org/10.3390/w8060245

APA StyleMotallebi, M., O’Connell, C., Hoag, D. L., & Osmond, D. L. (2016). Role of Conservation Adoption Premiums on Participation in Water Quality Trading Programs. Water, 8(6), 245. https://doi.org/10.3390/w8060245