Research on Typical Market Mode of Regulating Hydropower Stations Participating in Spot Market

Abstract

1. Introduction

2. Issues and Challenges

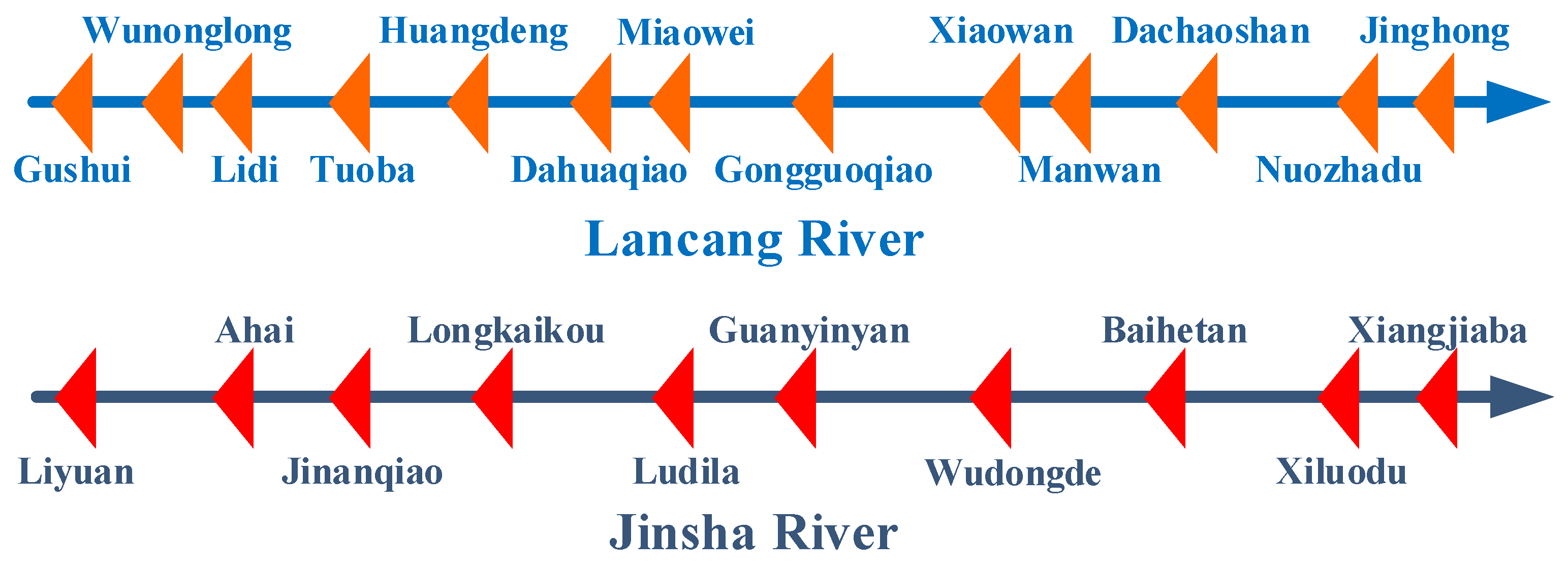

2.1. Upstream and Downstream Joint Clearing of Cascade Hydropower Stations

2.2. Different Types of Power Source Bidding on the Same Platform

2.3. Coordination Between Spot Market and Long-Term Planning

3. Mechanisms and Methods

3.1. Day-Ahead Spot Market Clearing Method for High-Proportion Hydropower Systems

3.1.1. Water Spillage Management Strategy

3.1.2. Settlement Compensation Mechanism

3.2. Bidding Mechanism for Hydropower and Thermal Power in a Unified Market

3.2.1. Electricity Markets Dominated by Hydropower

Separate Bidding Mechanism in the Medium- and Long-Term Market

Price Difference Subsidy Mechanism for Thermal Power

Capacity Cost Recovery Mechanism for Thermal Power

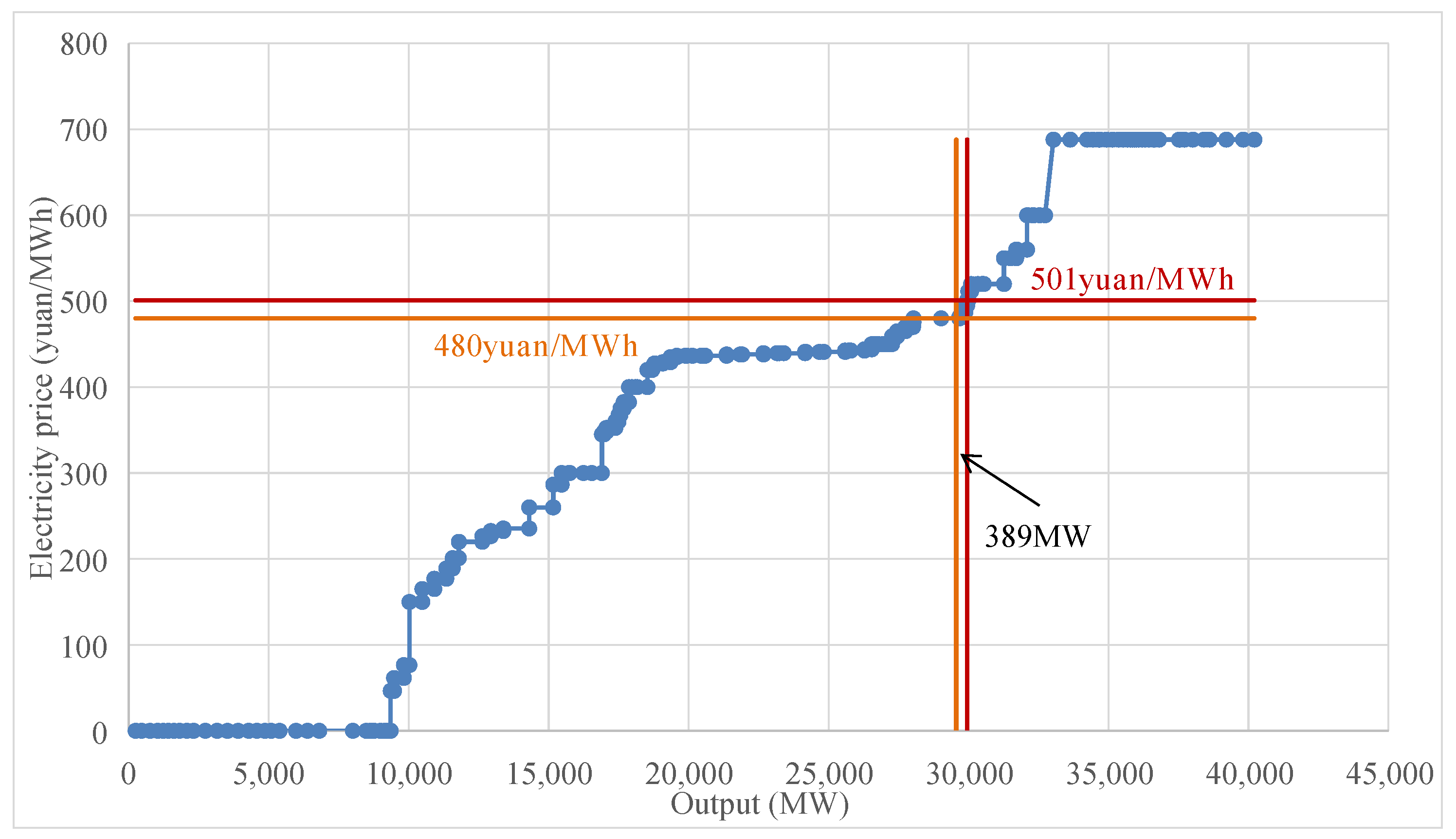

3.2.2. Electricity Markets Dominated by Thermal Power

Authorization Contract Mechanism with Peak Regulation Incentives

Excess Revenue Recovery Mechanism for Generation Resources

3.3. Coordination Method Between Spot Market and Long-Term Supply Security

3.3.1. Objective Function

3.3.2. Constraints

3.3.3. Solving Algorithm

4. Case Study

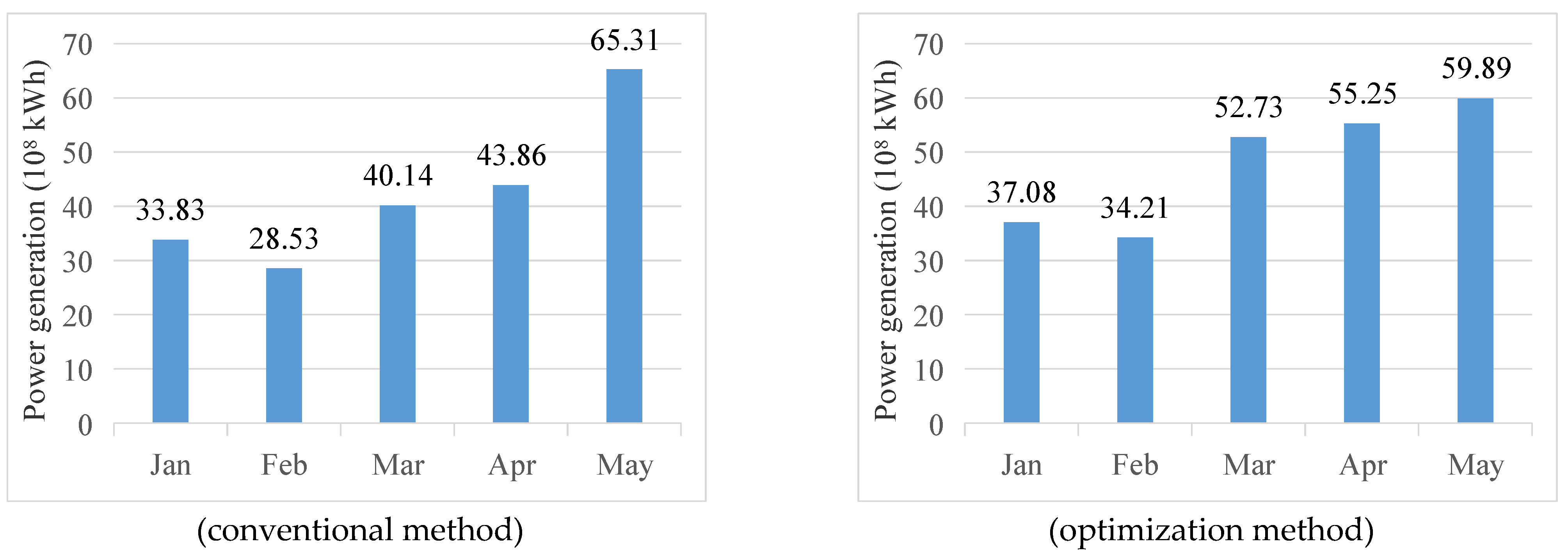

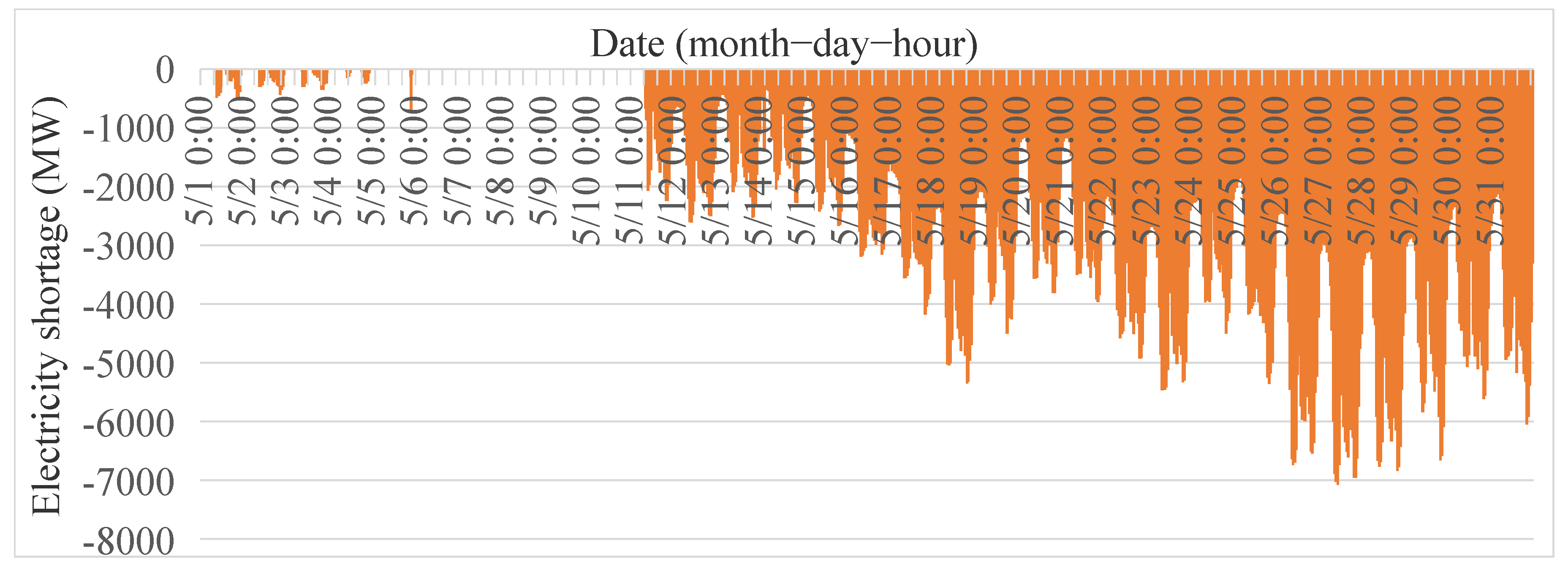

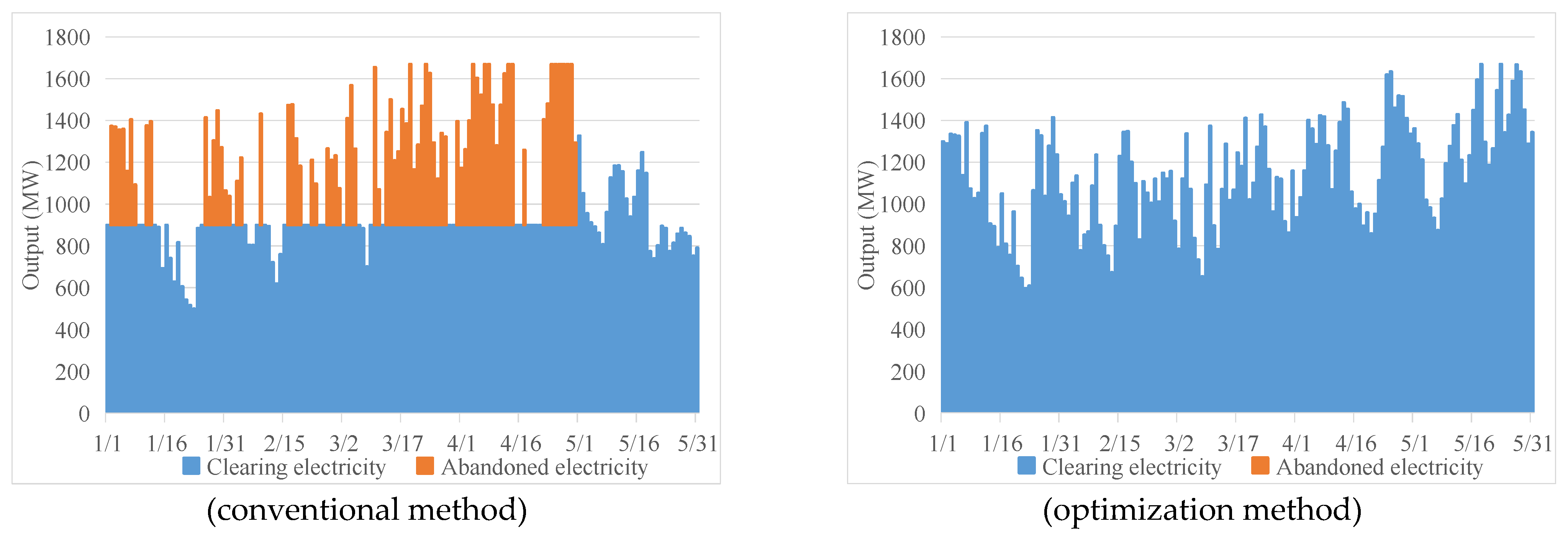

4.1. Conventional Method

4.2. Optimization Method

4.3. Comparison of Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Cheng, C.; Yan, L.; Mirchi, A.; Madani, K. China’s Booming Hydropower: Systems Modeling Challenges and Opportunities. J. Water Res. Plan. Manag. 2017, 143, 5. [Google Scholar] [CrossRef]

- Wu, Y.; Su, C.; Liu, S.; Guo, H.; Sun, Y.; Jiang, Y.; Shao, Q. Optimal Decomposition for the Monthly Contracted Electricity of Cascade Hydropower Plants Considering the Bidding Space in the Day-Ahead Spot Market. Water 2022, 14, 2347. [Google Scholar] [CrossRef]

- Zhang, X.; Lu, W.; Li, T.; Wang, C. A High Proportion of New Energy Participates in the Design of the Day-Ahead Market Clearing Mechanism. In Proceedings of the 11th International Conference on Power and Energy Systems, Shanghai, China, 18–20 December 2021; pp. 620–625. [Google Scholar]

- Liu, Y.; Zhang, H.; Guo, P.; Li, C.; Wu, S. Optimal Scheduling of a Cascade Hydropower Energy Storage System for Solar and Wind Energy Accommodation. Energies 2024, 17, 2734. [Google Scholar] [CrossRef]

- Song, Y.; Shen, C.; Wang, Y. Multi-objective optimal reservoir operation considering algal bloom control in reservoirs. J. Environ. Manag. 2023, 344, 118436. [Google Scholar] [CrossRef] [PubMed]

- Jia, Z.; Shen, J.; Cheng, C.; Zhang, Y.; Lyu, Q. Optimum day-ahead clearing for high proportion hydropower market considering complex hydraulic connection. Int. J. Electr. Power Energy Syst. 2022, 141, 20. [Google Scholar] [CrossRef]

- Li, Z.Y.; Wang, S.J. Market Risk Analysis to Hydropower Project Based on Monte Carlo Method—Case Study of Xiluodu Hydropower Station in Sichuan Province. Adv. Mater. Res. 2012, 472–475, 1437–1440. [Google Scholar] [CrossRef]

- Cheng, C.; Chen, F.; Li, G.; Ristic, B.; Mirchi, A.; Qiyu, T.; Madani, K. Reform and renewables in China: The architecture of Yunnan’s hydropower dominated electricity market. Renew. Sustain. Energy Rev. 2018, 94, 682–693. [Google Scholar] [CrossRef]

- Liu, S.; Yang, Q.; Cai, H.; Yan, M.; Zhang, M.; Wu, D.; Xie, M. Market reform of Yunnan electricity in southwestern China: Practice, challenges and implications. Renew. Sustain. Energy Rev. 2019, 113, 109265. [Google Scholar] [CrossRef]

- Yuan, W.; Sun, Y.; Su, C.; Wu, Y.; Guo, H.; Tang, Y. Day-ahead optimal scheduling of hydropower-dominated power grids under a spot market environment. J. Clean. Prod. 2024, 446, 141350. [Google Scholar] [CrossRef]

- Yuksel, I.; Demirel, I.H. Investigation of the optimal method for determining hydropower potential of small streams: A case study Batman Basin in Turkey. Arab. J. Geosci. 2021, 14, 580–581. [Google Scholar] [CrossRef]

- Cai, Z.; Zhang, C.; Zhang, C.; Sun, Y.; Zhang, G.; Zhang, D. Market Clearing with Participation of Cascade Hydropower Stations Based on Variable Dimension Reduction. In Proceedings of the 2021 3rd Asia Energy and Electrical Engineering Symposium (AEEES), Chengdu, China, 26–29 March 2021; pp. 1080–1086. [Google Scholar]

- Shen, J.J.; Cheng, C.T.; Jia, Z.B.; Zhang, Y.; Lv, Q.; Cai, H.X.; Wang, B.C.; Xie, M.F. Impacts, challenges and suggestions of the electricity market for hydro-dominated power systems in China. Renew. Energy 2022, 187, 743–759. [Google Scholar] [CrossRef]

- Costa, L.; Neto, J.A. Proposal for a water resource management strategy model using the water footprint concept. Assoc. Bras. Eng. Prod.—Abepro 2017, 14, 371–380. [Google Scholar] [CrossRef]

- Schaffer, L.E.; Adeva-Bustos, A.; Bakken, T.H.; Helseth, A.; Korpas, M. Modelling of Environmental Constraints for Hydropower Optimization Problems—A Review. In Proceedings of the 2020 17th International Conference on the European Energy Market, Stockholm, Sweden, 16–18 September 2020; pp. 1–7. [Google Scholar] [CrossRef]

- Oliveira, A.M.; Melo, A.; Souza, R.C. Optimum price bidding strategy in the short-term market of hydro-dominated systems. In Proceedings of the 2004 International Conference on Probabilistic Methods Applied to Power Systems, Ames, IA, USA, 12–16 September 2004; pp. 373–379. [Google Scholar]

- Nycander, E.; Soder, L. Modelling Prices in Hydro Dominated Electricity Markets. In Proceedings of the 2022 18th International Conference on the European Energy Market, Ljubljana, Slovenia, 13–15 September 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Kleiven, A.; Risanger, S.; Fleten, S. Co-movements between forward prices and resource availability in hydro-dominated electricity markets. Energy Syst.-Optim. Model. Simul. Econ. Asp. 2023, 1–34. [Google Scholar] [CrossRef]

- Niessen, S.; Krasenbrink, B.; Haubrich, H.J.; Reuter, A. Unit commitment and planning of electricity trading for a hydro dominated generation system in decentral electricity markets. IFAC Proc. Vol. 2000, 33, 245–250. [Google Scholar]

- Qiu, Y.; Zhou, S.; Gu, W.; Zhang, X.P. Analysis of China’s Electricity Price and Electricity Burden of Basic Industries Under the Carbon Peak Target Before 2030. CSEE J. Power Energy Syst. 2024, 10, 481–491. [Google Scholar] [CrossRef]

- Cai, Z.; Cui, H.; Han, B.; Zhang, G.; Lu, Y.; Dai, Y. Analysis and Outlook of Future Chinese Electricity Spot Market Model. In Proceedings of the 2020 Asia Energy and Electrical Engineering Symposium (AEEES), Chengdu, China, 29–31 May 2020; pp. 875–880. [Google Scholar] [CrossRef]

- Xia, W.; Wang, Z.; Yang, T.; Gao, C.; Ming, H. Research on Electricity Selling Pricing of Electricity Retailers Considering the Independent Choice of Users. In Proceedings of the 2022 IEEE 6th Conference on Energy Internet and Energy System Integration (EI2), Chengdu, China, 11–13 November 2022; pp. 3274–3279. [Google Scholar] [CrossRef]

- Shi, J.; Guo, Y.; Tong, L.; Wu, W.; Sun, H. A Scenario-Oriented Approach to Energy-Reserve Joint Procurement and Pricing. IEEE Trans. Power Syst. 2023, 38, 411–426. [Google Scholar] [CrossRef]

- Huang, M.; Wei, Z.; Ju, P.; Wang, J.; Chen, S. Incentive-Compatible Market Clearing for a Two-Stage Integrated Electricity-Gas-Heat Market. IEEE Access 2019, 7, 120984–120996. [Google Scholar] [CrossRef]

- Zhang, Q.; Wang, M.; Wang, X.; Tian, S. Mid-long term optimal dispatching method of power system with large-scale wind-photovoltaic-hydro power generation. In Proceedings of the 2017 IEEE Conference on Energy Internet and Energy System Integration (EI2), Beijing, China, 26–28 November 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Ge, X.L.; Zhang, L.Z.; Shu, J.; Fu, N.N. A Multi-Scenario Model for Mid-Long Term Hydro-Thermal Optimal Scheduling. In Proceedings of the 2012 Asia-Pacific Power and Energy Engineering Conference, Shanghai, China, 27–29 March 2012; pp. 1–4. [Google Scholar] [CrossRef]

- Liu, S.; Xie, M. Modeling the daily generation schedules in under-developed electricity markets with high-share renewables: A case study of Yunnan in China. Energy 2020, 201, 117677. [Google Scholar] [CrossRef]

- Xu, B.; Zhong, P.-A.; Du, B.; Chen, J.; Liu, W.; Li, J.; Guo, L.; Zhao, Y. Analysis of a Stochastic Programming Model for Optimal Hydropower System Operation under a Deregulated Electricity Market by Considering Forecasting Uncertainty. Water 2018, 10, 885. [Google Scholar] [CrossRef]

- Shen, J.; Cheng, C.; Zhang, X.; Zhou, B. Coordinated operations of multiple-reservoir cascaded hydropower plants with cooperation benefit allocation. Energy 2018, 153, 509–518. [Google Scholar] [CrossRef]

| Power Plant | Parameter | Stage 1 | Stage 2 | Stage 3 | Stage 4 | Stage 5 |

|---|---|---|---|---|---|---|

| Xiaowan | Output (MW) | 0–840 | 840–1680 | 1680–2520 | 2520–3360 | 3360–4200 |

| Quotation (CNY/MWh) | 220 | 260 | 300 | 400 | 470 | |

| Manwan | Output (MW) | 0–300 | 300–600 | 600–900 | 900–1200 | 1200–1670 |

| Quotation (CNY/MWh) | 300 | 400 | 450 | 550 | 600 | |

| Thermal A | Output (MW) | 360–400 | 400–450 | 450–500 | 500–550 | 550–600 |

| Quotation (CNY/MWh) | 0 | 520 | 560 | 600 | 688 | |

| Wind B | Output (MW) | 0–20 | 20–40 | 40–60 | 60–80 | 80–100 |

| Quotation (CNY/MWh) | 0 | 0 | 0 | 0 | 0 | |

| Photovoltaic C | Output (MW) | 0–30 | 30–60 | 60–90 | 90–120 | 120–150 |

| Quotation (CNY/MWh) | 0 | 0 | 0 | 0 | 0 |

| Power Plant | Dead Water Level (m) | Highest Water Level (m) | Minimum Discharge (m3/s) | Minimum Output (MW) | Installed Capacity (MW) |

|---|---|---|---|---|---|

| Wunonglong | 1901 | 1906 | 130 | 99 | 990 |

| Lidi | 1814 | 1818 | 140 | 60 | 420 |

| Tuoba | 1725 | 1735 | 150 | 158 | 1400 |

| Huangdeng | 1586 | 1619 | 160 | 312 | 1900 |

| Dahuaqiao | 1472 | 1477 | 160 | 103 | 920 |

| Miaowei | 1398 | 1408 | 170 | 141 | 1400 |

| Gongguoqiao | 1303 | 1307 | 170 | 160 | 900 |

| Xiaowan | 1166 | 1240 | 120 | 120 | 4200 |

| Manwan | 988 | 994 | 130 | 90 | 1670 |

| Dachaoshan | 889 | 899 | 150 | 93 | 1350 |

| Nuozhadu | 765 | 812 | 170 | 655 | 5850 |

| Jinghong | 591 | 602 | 500 | 430 | 1750 |

| Liyuan | 1605 | 1618 | 300 | 420 | 2400 |

| Ahai | 1492 | 1504 | 350 | 560 | 2000 |

| Jinanqiao | 1398 | 1418 | 350 | 40 | 2400 |

| Longkaikou | 1289 | 1298 | 380 | 270 | 1800 |

| Ludila | 1212 | 1223 | 400 | 165 | 2160 |

| Guanyinyan | 1122 | 1134 | 350 | 1200 | 3000 |

| Wudongde | 945 | 975 | 1160 | 1432 | 10,200 |

| Baihetan | 765 | 825 | 1180 | 1900 | 16,000 |

| Xiluodu | 540 | 600 | 1200 | 2317 | 13,860 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xie, M.; Liu, X.; Cai, H.; Wu, D.; Xu, Y. Research on Typical Market Mode of Regulating Hydropower Stations Participating in Spot Market. Water 2025, 17, 1288. https://doi.org/10.3390/w17091288

Xie M, Liu X, Cai H, Wu D, Xu Y. Research on Typical Market Mode of Regulating Hydropower Stations Participating in Spot Market. Water. 2025; 17(9):1288. https://doi.org/10.3390/w17091288

Chicago/Turabian StyleXie, Mengfei, Xiangrui Liu, Huaxiang Cai, Dianning Wu, and Yanhe Xu. 2025. "Research on Typical Market Mode of Regulating Hydropower Stations Participating in Spot Market" Water 17, no. 9: 1288. https://doi.org/10.3390/w17091288

APA StyleXie, M., Liu, X., Cai, H., Wu, D., & Xu, Y. (2025). Research on Typical Market Mode of Regulating Hydropower Stations Participating in Spot Market. Water, 17(9), 1288. https://doi.org/10.3390/w17091288