Abstract

As freshwater scarcity becomes increasingly severe under climate change, physical water risk has emerged as a critical financial concern for firms in water-intensive industries. This study explores whether and how physical water risk influences firms’ cost of equity, and whether corporate social responsibility (CSR)—both its overall level and structural differentiation—modulates this relationship. Using panel data from 849 Chinese listed companies in water-intensive sectors between 2011 and 2022, we find that physical water risk significantly elevates equity capital costs. While a strong CSR performance buffers this effect, CSR differentiation—reflected in uneven CSR engagement across different domains—undermines or even reverses this moderating role. Additional heterogeneity analyses show that these patterns are more pronounced in large and non-state-owned enterprises. These findings deepen our understanding of how environmental risks are priced in capital markets and offer strategic insights for firms seeking to manage sustainability-related financial exposures.

1. Introduction

Amid accelerating climate change, rapid urbanization, and intensifying industrial activity, water security has become a critical global concern. Water security issues stem not only from the insufficiency of physical supply but are also deeply influenced by poor management, institutional inefficiencies, and governance failures [1,2], and they have increasingly evolved into operational and financial risks for firms [3]. These risks are particularly acute in water-intensive industries such as energy, textiles, agriculture, and mining, where business continuity and supply chain resilience are heavily dependent on stable water access [4,5,6]. In recognition of this growing threat, the World Economic Forum has consistently ranked water crises among the top five global risks in terms of impact [7].

For corporations, water-related risks manifest in both direct and indirect forms—ranging from physical disruptions in production to regulatory penalties and reputational damage Zheng et al. et al. [3]. More importantly, as environmental, social, and governance (ESG) considerations become integrated into investor decision-making, water risk is now being priced into financial markets, particularly through its influence on a firm’s cost of capital [8]. However, empirical understanding of how physical water risk affects the cost of equity, especially in emerging markets, remains limited.

At the same time, corporate social responsibility (CSR) has gained prominence as a strategic tool to manage sustainability-related risks and reinforce stakeholder legitimacy [9,10]. Firms with strong CSR engagement often benefit from greater investor confidence, reduced information asymmetry, and improved access to capital [11]. Yet, CSR practices are not monolithic. Firms differ not only in the level of CSR commitment but also in the distribution and consistency of that commitment across different domains. This raises a critical but underexplored question: Does the structure of CSR matter in buffering the financial impacts of water risk?

This study investigates whether and how physical water risk affects the cost of equity capital, and whether overall CSR performance and its differentiation across CSR dimensions moderate this relationship. We focus on publicly listed firms in China’s water-intensive industries, using panel data from 2011 to 2022. China presents a particularly relevant setting, given its acute regional water stress, rapid industrial development, and increasing policy emphasis on green and sustainable finance. Our study makes three main contributions. First, we provide empirical evidence that physical water risk is financially material—investors do price water-related operational vulnerability into equity financing costs. Second, we demonstrate that CSR engagement mitigates this effect, highlighting its role as a risk-buffering mechanism. Third, and most importantly, we show that when CSR investments are unevenly distributed across different domains—what we refer to as CSR differentiation—the risk-mitigating benefit of CSR weakens or may even reverse, especially in larger and non-state-owned enterprises. By linking water risk, capital market pricing, and CSR strategy design, this research contributes to the interdisciplinary dialog between environmental management and financial economics.

2. Literature Review

2.1. Physical Water Risk

Physical water risk primarily refers to the direct impact on business operations caused by water scarcity, water quality deterioration, or extreme hydrological events such as droughts and floods [12]. In addition, governance failures, flawed institutional arrangements, and unequal power structures have also exacerbated the risk [1,2]. Early research on physical water risk primarily focused on its impacts at the macro socio-economic level [13]. Yang et al. found that water scarcity and declining water quality jointly exacerbate economic risks across countries, causing economic losses amounting to hundreds of millions of dollars in the agriculture and manufacturing sectors [14]. Wang et al. constructed a nested multi-regional input-output (MRIO) model and estimated that the economic risk from global water scarcity amounts to USD 11.1 trillion, with more than 55% of this risk being indirectly amplified through trade networks. The study emphasizes that physical water risk is not merely a local issue, but a systemic shock propagated through global trade chains [15]. In recent years, research has begun to focus on the micro-level effects of physical water risk, with scholars paying increasing attention to how water-related issues impact corporate sustainable development. Zhu et al. through bibliometric analysis, found that current empirical studies on water risk are primarily concentrated on the perspective of government regulation [16]. For example, studies have shown that the implementation of policies such as China’s River Chief Policy and the Ten Measures for Water has led to increased corporate water information disclosure [8,17]. Zheng et al. pointed out that water resource uncertainty can affect a firm’s financial performance and expectations through mechanisms such as production disruptions, rising operating costs, and fluctuations in raw material supply [3]. In terms of physical water risk measurement, the academic literature primarily adopts two approaches. The first involves constructing regional water risk indicators based on global databases such as WRI Aqueduct, and estimating firms’ water risk exposure by matching their geographic locations with regional risk data [18]. Second, the construction of enterprise-level water risk indicators based on factors such as the frequency of droughts and the water resources development and utilization rate in the region where the enterprise is located enhances the specificity and comparability of the measurement [19]. The above research lays the foundation for exploring the impact pathways of water risk on enterprises.

2.2. Factors Affecting the Cost of Equity Capital

In corporate financial decision-making, the cost of equity capital reflects the minimum required rate of return demanded by investors for bearing the uncertainty of a company’s future cash flows. It is a key parameter in business valuation and capital structure design. The academic community has long focused on various factors influencing the cost of equity capital for enterprises, primarily concentrating on areas such as corporate characteristics [20,21,22,23], corporate governance [24], information disclosure [25], and corporate ESG performance [26,27]. In recent years, resource constraints such as environmental risks have gradually been incorporated into the capital market evaluation system, with a primary focus on carbon risk, air pollution, and climate change risks. The study by Nasrallah et al. [28] shows that increased carbon risk raises the cost of equity capital for enterprises. The study by Lin et al. indicates that air pollution intensifies investor pessimism, leading to the issuance price of a company’s stock being lower than expected [29]. The study by Cepni et al. using data from U.S. companies found that climate risk exposure and increased financing costs coexist. However, the impact of physical risks is relatively weak, and the increase in the cost of equity capital primarily stems from climate transition risks [30]. Furthermore, Yue et al. found that climate risk can increase a company’s cost of equity capital by affecting its operational risks, financial constraints, and the government service environment [31]. As environmental factors become more deeply embedded in the operational risks of enterprises, water resource issues, particularly physical water risks, are gradually becoming an important exogenous variable influencing the cost of capital for enterprises. Water scarcity or unstable water supply can lead to production interruptions, idle equipment, increased water treatment costs, and other issues, making it difficult for companies to maintain normal input-output efficiency. Chen et al. found that water risk increases the cost of debt capital by affecting the scale of corporate financing [19]. Building on this research, Zheng et al. discovered that water resource vulnerability not only impacts a company’s cost of debt capital but also affects the cost of equity capital, primarily by increasing the company’s financing constraints, thereby raising financing costs [3].

3. Research Hypotheses

The survival and development of enterprises are inseparable from their ability to acquire and utilize natural resources [32]. In high water-consuming industries, water serves as a critical production input, and its availability, stability, and quality are directly linked to a firm’s operational efficiency and profitability [32,33,34,35]. According to the Natural Resource Dependence Theory [36], firms that are heavily dependent on key natural resources tend to face structural disadvantages in resource acquisition, cost control, and external relationship management, thereby increasing their exposure to survival risks [12]. Under conditions of increasing water scarcity, declining water quality, or growing volatility in supply and demand, firms that rely heavily on water resources are more likely to experience operational disruptions, rising input costs, and reputational damage. These factors collectively elevate the firm’s environmental vulnerability [34].

In this context, capital markets are likely to perceive water-related uncertainty as a form of environmental fragility or operational constraint [19], which in turn influences investor risk assessments and corporate capital pricing. When a firm is in a region with high water stress or when its operations are highly water-intensive, investors tend to anticipate greater volatility in its future cash flows and demand a higher risk premium. This risk compensation mechanism manifests in an increase in the cost of equity capital—that is, firms face higher financing costs and reduced access to external equity funding.

This relationship is particularly salient in China, where water resource distribution is highly uneven across regions [37]. In such an environment, firms in water-intensive industries face structural challenges in accessing reliable water resources. If these firms fail to effectively reduce their water dependence or lack strategies to mitigate water-related risks, they are more likely to be perceived by investors as high-risk entities and subjected to valuation discounts in capital markets [19].

Based on the theoretical logic of natural resource dependence, this study proposes the following hypothesis:

H1:

Physical water risk is positively associated with a firm’s cost of equity capital

Against the backdrop of increasing natural resource scarcity and escalating environmental risks, how firms effectively respond to external environmental uncertainty and enhance their risk-buffering capacity has become a focal point of attention in capital markets [38]. Corporate Social Responsibility (CSR)—as a strategic practice reflecting a firm’s active engagement with environmental, social, and stakeholder-related concerns—has increasingly been regarded as an important tool for addressing sustainability challenges and strengthening risk management [39]. Prior research suggests that CSR engagement can help enhance corporate reputation [40], build stakeholder trust, and reduce negative investor expectations regarding environmental risks, thereby partially alleviating firms’ financing constraints [41]. From the perspectives of natural resource dependence theory and legitimacy theory, firms that are highly reliant on critical natural resources must construct legitimacy and reputational capital to secure stable access to resources and external financing [42]. CSR implementation signals a firm’s commitment to sustainability, particularly when substantial efforts are made in areas such as environmental protection, water resource management, and green production. These signals indicate a firm’s environmental awareness, risk sensitivity, and willingness to fulfill social obligations, all of which can strengthen investors’ confidence in the firm’s long-term operational stability.

In the context of physical water risk, firms that consistently and comprehensively fulfill their CSR responsibilities—especially in environmentally relevant areas—may be perceived by investors as having stronger capabilities in identifying, monitoring, and responding to water-related risks. These capabilities can not only reduce the likelihood of actual operational disruptions but also help stabilize investors’ expectations of future cash flows, thereby lowering the required risk premium.

Therefore, CSR engagement may not only reduce a firm’s overall cost of capital but also moderate the relationship between physical water risk and the cost of equity. When a firm exhibits a high level of CSR performance, the capital market may be less likely to assign a high-risk premium, even in the presence of significant water-related challenges. Conversely, firms with poor CSR performance may experience an amplification of water risk pricing by the market.

Based on the above logic, we propose the following hypothesis:

H2:

Overall CSR performance negatively moderates the relationship between physical water risk and the cost of equity capital.

As corporate social responsibility has become an increasingly important strategic tool for firms to address environmental uncertainty and gain recognition from capital markets, academic attention has expanded beyond the overall level of CSR engagement to focus on how CSR is implemented. One key dimension of this emerging focus is CSR differentiation [43,44,45], which captures structural imbalances or strategic emphasis in how firms allocate CSR resources across various domains such as environmental protection, employee welfare, and community engagement [44]. Some firms adopt a strategic focus approach, concentrating their CSR investments in a limited number of areas while allocating fewer resources to others. In contrast, other firms pursue a more balanced approach, distributing efforts more evenly across CSR dimensions. The presence of such differentiation adds complexity to the CSR signals that firms send to external stakeholders, particularly investors, which may in turn lead to divergent interpretations regarding a firm’s risk profile and strategic intentions.

From the perspective of strategic focus and resource allocation efficiency, a moderate level of CSR differentiation may be perceived positively by investors—as a sign of strategic intent and prioritization. If the differentiation is concentrated in areas directly related to water risk, such as environmental initiatives and water stewardship, it may reinforce the firm’s capability to manage water-related challenges. This perception may reduce investor concerns and, therefore, weaken the positive effect of physical water risk on the cost of equity capital.

However, from the perspectives of legitimacy theory and the greenwashing risk framework, CSR differentiation may also give rise to investor skepticism about the credibility and consistency of a firm’s CSR commitments. Specifically, when a firm allocates limited CSR resources to water-related environmental concerns, while emphasizing more symbolic or public-facing initiatives—such as philanthropy or branding [43]—such imbalances may be interpreted as selective disclosure or greenwashing [46]. This could intensify investor sensitivity to water-related risks and diminish trust in the firm’s long-term sustainability management. As a result, CSR differentiation may not mitigate, but instead amplify, the market penalties associated with physical water risk [47].

In summary, the moderating effect of CSR differentiation on the pricing of water risk is theoretically ambiguous and empirically open to debate. Whether such differentiation is viewed by capital markets as a sign of strategic prioritization or inconsistent commitment may determine its impact on investor behavior. Accordingly, we propose the following competing hypotheses:

H3:

CSR differentiation negatively moderates the relationship between physical water risk and the cost of equity capital.

H4:

CSR differentiation positively moderates the relationship between physical water risk and the cost of equity capital.

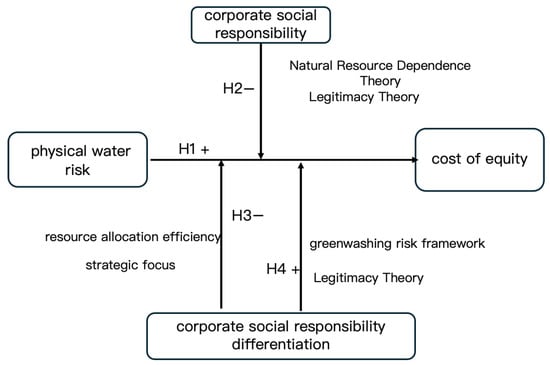

Based on the above content, we have developed the theoretical framework of this study, as shown in Figure 1.

Figure 1.

Theoretical framework.

4. Research Design

4.1. Samples and Data

This study selects A-share listed companies in water-intensive industries on the Shanghai and Shenzhen stock exchanges from 2011 to 2022 as the research sample. The starting year of 2011 is chosen because China’s No. 1 Central Document of that year proposed implementing the strictest water resource management system, which introduced the “Three Red Lines” policy—total water use control, water use efficiency control, and pollution restriction in water function zones—laying the foundation for the study of physical water risk. Meanwhile, the identification of water-intensive industries is based on the 13th Five-Year Plan for the Development of a Water-Saving Society, issued by the National Development and Reform Commission and other ministries. Specific industry classifications are determined with reference to the Guidelines on Industry Classification of Listed Companies (2012) issued by the China Securities Regulatory Commission, as shown in Table 1.

Table 1.

Industry distribution of sample companies.

To ensure the completeness and reliability of the data, this study excludes ST and PT companies, as well as firms with severe data omissions. To enhance the scientific validity of the empirical results and reduce the influence of outliers, continuous variables are minorized at the 1% level. Ultimately, the study obtains a panel dataset comprising 10,194 firm-year observations from 849 listed companies.

The data on physical water risk are based on the cities in which sample firms are registered, covering 256 cities across China. The water resource carrying capacity of each city is calculated and used as a proxy variable to measure physical water risk. Relevant data on physical water risk are obtained from provincial and municipal statistical yearbooks, while data on capital cost and control variables are drawn from the CSMR database [39,48]. Information on corporate social responsibility and its differentiation comes from https://www.Hexun.com/.

4.2. Variable Measurement

4.2.1. Physical Water Risk

Water Resource Carrying Capacity refers to the maximum amount of water resources that a region or enterprise can sustainably utilize within a given period. It considers not only the natural availability of water resources but also their distribution, sustainable usability, and related socio-economic demands. This capacity directly reflects whether the water resources relied upon by a region or enterprise are sufficient to support its production needs and future development. When the carrying capacity approaches or reaches its critical threshold, the risk of water scarcity for the enterprise rises significantly. This may lead to production constraints, increased costs, and even long-term impacts on business viability.

Therefore, this study uses water resource carrying capacity as a proxy variable for water risk. The relevant data are obtained from the China Statistical Yearbook and the statistical yearbooks of various provinces, cities, and districts.

For the measurement of water resource carrying capacity, this paper refers to the study by Wang et al. [48] and constructs an indicator system as shown in Table 2. The entropy method is used to determine the weights of each indicator. The standardized value of each indicator is then multiplied by its corresponding weight to calculate the water resource carrying capacity of a given region. The final values range between 0 and 1, where values closer to 1 indicate stronger water resource carrying capacity, and values closer to 0 indicate weaker capacity. The specific steps are as follows:

Table 2.

Water resources carrying capacity indicator system.

(1) Indicator Standardization

In Equation (1), yij denotes the standardized value of the j-th indicator for the i-th region. If the standardized value calculated by Equation (1) equals zero, it is replaced with 0.00001; xij represents the actual value of the j-th indicator in the i-th region.

(2) Calculate the weight of each indicator using the entropy method.

Entropy value of indicator j:

Weight of indicator j:

(3) Measurement of Water Resources Carrying Capacity

It is important to note that a higher water resources carrying capacity indicates a better overall water resource condition in a region, which corresponds to lower water risk. To ensure consistency in the direction of interpretation, we multiply the final calculated value of water resources carrying capacity by –1 when using it as a proxy for water risk. As a result, the water risk values range from –1 to 0, where values closer to 0 indicate higher water risk.

4.2.2. Cost of Equity

Regarding the measurement of the cost of equity capital, existing research suggests that ex-post forecast data are often subject to random disturbances and contain considerable “noise.” Therefore, estimating the cost of equity capital using ex-ante models is considered more accurate [49]. Following the study by Radwan et al. (2025) [50], this study adopts an ex-ante estimation approach and employs the classical PEG model for calculation. The calculation method is shown in Equation (5), where PEG denotes the cost of equity capital (COE) estimated using the PEG model, EPS represents the forecasted earnings per share at the end of the period, and P refers to the company’s stock price at the end of the period. The EPS forecasts are primarily based on analysts’ estimates, and the relevant data are obtained from the CSMAR database. In addition, since the OJ model is subject to fewer restrictions and adopts a more scientific estimation method, this study also uses the OJ model as an alternative proxy variable for robustness analysis.

4.2.3. CSR

Following the study by Xie et al. [51], this paper measures the level of corporate social responsibility (CSR) using the logarithm of the CSR scores published by Hexun.com for Chinese firms. Drawing on Wang and Choi [52], this study calculates the standard deviation of a firm’s scores across five CSR dimensions to capture the degree of CSR differentiation. A larger standard deviation indicates that the firm allocates its CSR efforts unevenly among different stakeholder groups and issues, implying a higher level of CSR differentiation.

4.2.4. Control Variables

Referring to the studies by Chen et al. and Zheng et al. [19,53], we selected the following control variables: company size (Size), return on assets (ROA), leverage (Lev), firm age (Age), ownership concentration (TOP1), board size (Board), and gross regional product per capita (PGDP) and so on. The measurement methods and data sources for these control variables are specified in Table 2.

4.3. Model

To examine the impact of physical water risk on the cost of equity capital for water-intensive enterprises, we draw on the findings from related studies [19,53] and construct the following model to test our hypothesis.

To study the impact of corporate social responsibility (CSR) on the relationship between physical water risk and the cost of equity capital, we extend model (6) by incorporating CSR and its interaction term with physical water risk. The models (7) and (8) are constructed for testing, as outlined below:

In the above models, COE represents the cost of equity capital, WR represents water risk, and CSR and CSRSD represent corporate social responsibility and CSR differentiation, respectively. Controls represent a set of control variables, as detailed in Table 3. Industrialfixed denotes industry-fixed effects, and Yearfixed denotes year-fixed effects. Additionally, the Hausman test indicates that a fixed effects model should be used in this analysis.

Table 3.

Definition and measurement of variables.

5. Empirical Analysis

5.1. Descriptive Statistics

From Table 4, it can be observed that the cost of equity (COE) has a maximum value of 0.600, a minimum value of 0.015, a mean of 0.109, and a median of 0.036, indicating a right-skewed distribution. This suggests that the equity capital cost is relatively high for most of the sample firms. In contrast, physical water risk shows significant geographical variation, with a minimum value of −0.670, a maximum value of −0.090, and an average of −0.221. The large gap between the maximum and minimum values indicates considerable spatial heterogeneity in physical water risk, and overall, it remains at a relatively high level.

Table 4.

Descriptive statistical results of each variable.

5.2. Hypothesis Testing

Table 5 reports the regression results of the impact of physical water risk on the cost of equity capital for high water-consuming firms. In column (1), the regression coefficient of physical water risk is 0.037 and is significant at the 1% level. After adding control variables, the coefficient increases to 0.041 and remains statistically significant, indicating that a one-unit increase in physical water risk leads to a 4.1% increase in the cost of equity capital. Therefore, Hypothesis 1 is supported, suggesting that the capital market has already recognized the direct impact of physical water risk on firms—that is, a physical water risk can directly affect a firm’s cost of equity capital.

Table 5.

Regression Results of Physical Water Risk on Cost of Equity Capital.

5.3. Robustness and Endogeneity Tests

- (1)

- Robustness Test

To ensure the robustness of the estimation results of Model (6), this study conducts two robustness tests. First, to eliminate the potential impact of the COVID-19 pandemic on corporate operations, the study modifies the sample period to test the reliability of the baseline regression results. Specifically, the sample period is adjusted to 2011–2019. As shown in Column (1) of Table 6, the regression coefficient of physical water risk remains consistent in sign with the baseline regression and is statistically significant, indicating that the baseline results are robust. Second, we conduct another robustness check by replacing the dependent variable. Specifically, the cost of equity capital is recalculated using the OJ model. As presented in Column (2) of Table 6, the regression coefficient of physical water risk is 0.049 and statistically significant at the 5% level, again confirming the robustness of the estimation results of Model (6). Third, this study uses the inverse of regional water resource carrying capacity as a proxy for physical water risk, which may introduce a potential ecological fallacy. To verify the robustness of our results, we draw on the idea proposed by Bartik and construct an alternative proxy variable (WR_1) by interacting with the inverse of regional water resource carrying capacity with the proportion of revenue derived from water-intensive core business for each firm. This variable reflects the firm’s dependency on water resources. The rationale behind this approach is that our sample consists of water-intensive enterprises whose core operations are closely tied to water usage. Therefore, the higher the proportion of revenue from core business, the greater the firm’s reliance on water, and the higher its exposure to physical water risk. The regression results using this alternative proxy are reported in Column (3) of Table 6. The coefficient of WR_1 is 0.008 and is statistically significant at the 10% level, confirming the robustness of the baseline regression results in Model (6).

Table 6.

Robustness Tests.

Finally, to further test the temporal robustness of our findings and to respond to concerns regarding the potential evolution of investor perceptions and regulatory policies over time, we divide the sample period (2011–2022) into two sub-periods: 2011–2016 and 2017–2022. This division is based on a critical institutional development—namely, the China Securities Regulatory Commission’s 2016 initiative to promote the establishment of a green financial system. This year marks a significant turning point in China’s environmental regulatory framework and the maturation of its green finance policies, making it an appropriate boundary for assessing institutional shifts in the capital market.

We conduct separate regressions for the two periods to examine whether the relationships among key variables differ over time. The results, presented in Table 7, show that during the 2011–2016 period, the coefficient of physical water risk (WR) on the cost of equity (COE) is 0.017 and statistically significant at the 10% level. This suggests that even in the earlier stage, water risk had begun to be recognized by capital markets as a source of financial risk. In the 2017–2022 period, the coefficient increases to 0.069 and is significant at the 5% level, indicating that with the development of ESG frameworks, the evolution of investor risk awareness, and improvements in disclosure practices, capital markets have become significantly more sensitive to water-related risks.

Table 7.

Regression results across different periods.

These findings demonstrate a strong degree of temporal consistency and an increasing trend in the capitalization of water risk, thereby reinforcing our central conclusion that physical water risk significantly influences firms’ capital costs and that this relationship remains robust under evolving institutional conditions.

- (2)

- Endogeneity Test

First, to avoid endogeneity issues arising from sample selection bias and omitted variables, this study uses propensity score matching for in-depth analysis. We classify firms located in areas with physical water risk above the average as the treatment group, and firms located in areas with physical water risk below the average as the control group. The control variables from previous sections are used as covariates for 1:1 matching. Column (1) of Table 7 reports the regression results after matching, showing that the regression result for physical water risk remains significantly positive, indicating that after addressing sample selection bias, physical water risk still has a positive impact on firms’ equity capital costs.

Next, considering that capital costs may be influenced by their past levels, and to address the omitted variable issue, this study follows the approach of Jo and Na [54] by introducing the lagged term of equity capital costs (COEt-1) as a control variable for re-estimation. The regression results are shown in column (2) of Table 7, where the lagged equity capital cost is significantly positively related to the equity capital cost. Other regression results are generally consistent with previous conclusions, suggesting that the model does not suffer from endogeneity issues.

Finally, to address the endogeneity problem from reverse causality, this study tests the lagged physical water risk. As shown in column (3) of Table 8, the test results are consistent with previous findings.

Table 8.

Results of endogeneity test.

5.4. Channel Analysis

In the previous analysis, this study confirmed the significant impact of physical water risk on the equity capital cost of high water-consuming enterprises. Going a step further, we argue that when firms are in regions facing water scarcity, usage restrictions, or extreme drought events, their production and operations are often directly affected. These effects may manifest as production interruptions, reduced capacity, increased energy consumption, and surging water costs. Such disruptions not only lead to short-term declines in production efficiency but may also reduce the firm’s overall operating efficiency.

Investors generally regard operating efficiency as a reflection of a firm’s intrinsic quality and long-term profitability. Once a decline in operating efficiency is observed, capital markets may respond by raising risk premium expectations, demanding higher expected returns, and thus increasing the cost of equity capital. Therefore, we posit that physical water risk increases the equity capital cost of high water-consuming enterprises by reducing their operating efficiency. Following Hu et al. [55], we use Total Asset Turnover (TAT) as a measure of a firm’s operating efficiency. Referring to the study by Weng and Ye, we construct models (9) to (11) to test the mediating effect of operating efficiency.

Table 9 presents the results of the mediating effect of operating efficiency. Model (9) primarily tests the impact of physical water risk on the cost of equity capital, which corresponds to the estimation results of our Model (6). The coefficient α1\alpha_1α1 indicates a significant positive correlation between physical water risk and the cost of equity capital. Column (2) of Table 8 shows the impact of physical water risk on firms’ operating efficiency, with a regression coefficient of −0.035 that is significant at the 5% level, indicating a negative relationship—higher physical water risk is associated with lower operating efficiency. In Column (3), both the coefficients of physical water risk and operating efficiency are statistically significant, and the coefficient of operating efficiency is significantly negative. This suggests that operating efficiency plays a partial mediating role in the relationship between physical water risk and the cost of equity capital—physical water risk increases capital costs by reducing firms’ operating efficiency.

Table 9.

Mediating Effect Test Results.

5.5. Moderating Effects

The moderating effects of corporate social responsibility (CSR) and CSR differentiation are presented in Table 10 Column (1) of Table 9 shows that the coefficient of the interaction term between WR (Water Risk) and CSR is negative and statistically significant at the 5% level. This indicates that CSR negatively moderates the relationship between physical water risk and the cost of equity capital, suggesting that CSR helps to alleviate the positive impact of physical water risk on the cost of equity capital. This finding supports Hypothesis 2. In column (2), the coefficient of the interaction term between CSR differentiation and the cost of equity capital is positive and statistically significant at the 1% level. This indicates that CSR differentiation positively moderates the relationship between physical water risk and capital costs, confirming Hypothesis 3 of this study, while disproving Hypothesis 4. Our findings suggest that uneven and strategic CSR investments undermine the risk-buffering function of corporate social responsibility. This is consistent with the view of Oikonomou et al., who argue that CSR can only effectively reduce risk premiums in capital markets when it is coordinated as a whole [56].

Table 10.

Moderating effects of corporate social responsibility and its differentiation.

To further address potential endogeneity issues—particularly those arising from omitted variable bias and reverse causality—we employ an instrumental variable (IV) approach as a robustness check. Specifically, we use the industry-average CSR score as the instrument for firm-level CSR performance, and the average CSR differentiation of other firms in the same industry (excluding the focal firm) as the instrument for CSR differentiation. The rationale behind this choice is that a firm’s CSR behavior is often influenced by prevailing CSR norms and practices within its industry; however, the industry-level average CSR score and CSR differentiation are unlikely to directly affect the firm’s cost of capital, thus satisfying the relevance and exogeneity requirements for valid instruments.

We conduct a two-stage least squares (2SLS) estimation. The results, reported in Table 11, show that the IV estimates are consistent with our baseline regression outcomes, thereby confirming the robustness of the moderating effects of CSR and mitigating potential endogeneity bias in our causal inference.

Table 11.

Instrumental variable (IV) estimation.

To further examine the moderating effects of corporate social responsibility (CSR) and CSR differentiation (CSRD) on the relationship between water risk and the cost of capital across different periods, we divide the sample into two sub-periods: 2011–2016 and 2017–2022. Interaction terms are constructed for each period, and the regression results are presented in Table 12.

Table 12.

Moderating effects of CSR and CSRSD on water risk and capital cost across different periods.

During the 2011–2016 period, the interaction term between CSR and physical water risk is −0.014 and not statistically significant. This suggests that in the earlier stage, CSR did not play a significant role in mitigating water-related financial risks—possibly due to limited investor responsiveness to CSR information and the underdevelopment of CSR strategies. However, in the 2017–2022 period, the coefficient becomes −0.058 and is significant at the 5% level, indicating that under improved institutional conditions and deepened ESG awareness, corporate CSR efforts more effectively alleviated the negative financial impact of water risk, with a strengthened moderating effect.

The moderating effect of CSR differentiation also demonstrates a clear temporal divergence. In the 2011–2016 period, the coefficient for the interaction term WR × CSRD is 0.034 and statistically insignificant. In contrast, in the 2017–2022 period, the coefficient increases to 0.093 and is significant at the 1% level. This indicates that as capital markets matured, they became increasingly capable of identifying firms’ structural inconsistencies in CSR performance and used such differentiation as a signal when assessing CSR effectiveness. A more unbalanced CSR structure may weaken the credibility of CSR signaling and amplify the extent to which water risk is priced into firms’ capital costs.

5.6. Further Analysis

This study examines how firm heterogeneity—specifically ownership structure and firm size—affects the relationship between physical water risk and the cost of equity capital.

- (1)

- Ownership Structure

The impact of water risk on the cost of capital varies across firms with different ownership structures. State-owned enterprises (SOEs) typically have stronger access to policy resources and government endorsements [57], which enable them to receive government bailouts, credit support, or policy subsidies. As a result, their financing channels tend to be more stable, and their risk resilience is generally stronger. Private enterprises lack policy support and resource guarantees. When crises occur, they must independently bear the operational risks and financial pressures caused by production disruptions, rising costs, and supply chain disorder. Given the higher market competition pressure and external financing constraints faced by private firms [58,59], capital markets respond more sensitively to their operational risks. Therefore, under the impact of physical water risk, this study argues that capital markets are more responsive to the risks faced by non-state-owned enterprises compared to state-owned ones. Therefore, under the impact of physical water risk, this study argues that capital markets are more sensitive to the risks faced by non-state-owned enterprises compared to state-owned ones. Column (1) of Table 13 presents the heterogeneity test results based on ownership type. The findings are consistent with our analysis: under the impact of physical water risk, non-state-owned enterprises experience a higher equity cost of capital than state-owned enterprises. Specifically, a 1% increase in physical water risk leads to a 2.2% increase in the equity cost of capital for non-state-owned firms. As shown in Column (3) of Table 10, the moderating effect of CSR differentiation is also significant in the group of non-state-owned enterprises. The possible reason is that non-state-owned firms, due to stronger financing constraints, are more sensitive to market trust and capital market reactions [60]. Once CSR differentiation causes the market to question a firm’s ability to manage environmental risks, investors’ negative sentiment and risk expectations escalate quickly, leading to a rapid and significant increase in the cost of equity capital.

Table 13.

Heterogeneity test results based on ownership structure.

- (2)

- Firm Size

Firm size, as an important indicator reflecting a company’s resource endowment, risk resilience, and market position, may significantly influence the relationship between physical water risk and the cost of equity capital. Referring to the studies by Inrawan et al. and Muhammad et al. [61,62], this study classifies firms with total assets above the average as large-scale enterprises and those with total assets below the average as small-scale enterprises. A group-based test is conducted accordingly, and the results are presented in Table 11. In column (1) of Table 12, the regression coefficients of physical water risk on the cost of equity capital are statistically significant at the 5% level in both groups, indicating that physical water risk affects the cost of equity capital for both large- and small-scale enterprises. In column (2), the interaction term between CSR and physical water risk is significant at the 5% level in the large-scale enterprise group, but not in the small-scale enterprise group, suggesting that the moderating effect of CSR is only present among large-scale enterprises. We speculate that this result may be because large-scale enterprises are typically the focus of public attention, and their CSR disclosures tend to be more standardized and transparent. Capital market participants (such as investors and rating agencies) are more sensitive to the CSR performance of such firms, which enhances the signaling effect of CSR and helps reduce the cost of capital. In contrast, investors pay relatively less attention to the CSR activities of small-scale enterprises, whose disclosures are often insufficient. Even if these firms engage in some CSR initiatives, it is difficult for such actions to generate a strong signaling effect in the market, thereby weakening the moderating effect. As previously discussed, we also find that CSR differentiation may undermine the consistency and strategic coherence of corporate social responsibility efforts.

Column (3) of Table 14 presents the moderating effect of CSR differentiation across firms of different sizes. The moderating effect of CSR differentiation is statistically significant in the large-scale enterprise group but not in the small-scale enterprise group, indicating that firm size plays a fundamental role in shaping this mechanism. This result may stem from the fact that large firms are generally subject to higher levels of public scrutiny and investor attention. Their CSR differentiation behaviors are more easily detected by rating agencies, the media, and ESG investors, and any inconsistency in their CSR structure tends to be magnified by capital markets as a signal of strategic ambiguity or imbalance in responsibility fulfillment, thereby reinforcing the financialization pathway of physical water risk. In contrast, small firms typically have limited resources, underdeveloped CSR systems, and lower levels of information disclosure, making their CSR differentiation less likely to be recognized by capital markets as a credible risk signal. In most cases, investors are relatively more tolerant of small firms’ CSR performance and focus more on their basic profitability and cash flow than on the complexity of their CSR structures. As a result, CSR differentiation is less likely to be interpreted as a warning signal by the market in small firms, and no significant moderating effect is observed in the small-firm sample.

Table 14.

Heterogeneity test results based on firm size.

6. Discussion and Conclusions

Natural resources are becoming an important factor limiting organizational development [63]. This study focuses on high-water-consuming enterprises in China, exploring the impact mechanism of physical water risk on corporate capital costs and introducing Corporate Social Responsibility (CSR) and its differentiation as moderating variables, constructing a strategic influence path between “water risk—capital cost.”

First, our research results indicate that physical water risks significantly increase the equity capital costs of enterprises. Environmental issues such as water scarcity and water pollution introduce production uncertainties that affect operational efficiency, thus raising the risk evaluation in the capital market. This conclusion addresses a frontier issue in sustainable finance research, namely the financialization of natural resource risks [3], which aligns with the findings of Daddi et al. [64] and Sun et al. [65].

It is noteworthy that although water risk has attracted attention in the capital market, its impact on corporate capital costs is limited. This may be because the effect of water risk on business operations is long-term, and it has received limited attention in the short term [54].

Secondly, the research results indicate that Corporate Social Responsibility (CSR) can effectively mitigate the adverse impact of physical water risk on the cost of equity capital. As a vital component of a firm’s sustainability strategy, CSR strengthens environmental governance capabilities, enhances corporate reputation, and improves relationships with investors, thereby increasing trust in the company within capital markets. When firms demonstrate consistent and ongoing investment in areas such as environmental protection, regulatory compliance, and social engagement, the capital market’s response to environmental risks tends to be significantly weakened [66]. This suggests that the “financial buffering” role of CSR in managing resource risks is increasingly being recognized by market mechanisms. These findings also echo the strategic value positioning of CSR emphasized in the Resource-Based View (RBV) and Stakeholder Theory [54,58,64].

Moreover, although previous studies suggest that differentiated CSR investment across various domains can lead to optimal resource allocation and improved firm performance [43], the present study does not focus on financial performance per se. Instead, it examines the moderating role of CSR differentiation under the condition of physical water risk on the cost of capital. The findings reveal that, in high water-consuming industries, the imbalance in CSR investment weakens the signal of consistent environmental governance, thereby lowering the capital market’s expectations regarding firms’ water risk management capabilities. As a result, the negative impact of water risk on capital cost is amplified. This outcome suggests that under environmentally sensitive conditions, CSR differentiation may not be interpreted as a sign of “better resource allocation” but rather as a potential risk signal of strategic inconsistency and unbalanced responses by the capital market. Especially when firms face major environmental uncertainties, the structural coherence of CSR becomes a key factor in building market trust. Therefore, this study offers a new perspective: while CSR differentiation may carry motivational and efficiency advantages in some contexts, its role in risk moderation and market signaling mechanisms may, in fact, be adverse.

Finally, to further explore the boundary conditions of the impact mechanism between physical water risk and the cost of equity capital, and to test the robustness of the moderating effects of corporate social responsibility (CSR) and its differentiation, this study conducted heterogeneity analyses using ownership type and firm size as grouping variables. The results reveal that both ownership structure and firm size play a significant role in shaping the differentiated mechanisms through which CSR operates.

Specifically, in the ownership-based grouping, the findings show that physical water risk significantly increases the cost of equity capital for non-state-owned enterprises, whereas the effect is not significant for state-owned enterprises. Moreover, the moderating effects of CSR and CSR differentiation are only observed in non-state-owned firms.

In the firm-size-based grouping, the results indicate that physical water risk has a significant direct impact on the cost of equity capital for both large and small firms. However, the moderating effects of CSR and its differentiation are only significant among large enterprises. These findings suggest that CSR’s risk-buffering function is primarily effective in non-state-owned and large enterprises. This aligns with Su et al. [67], who argue that the institutional advantages of state-owned enterprises may obscure CSR signals in capital markets, and it also extends the research scope of CSR–market mechanism interactions discussed by Chen et al. [68].

7. Policy Recommendations and Future Directions

7.1. Policy Recommendations

The findings of this study indicate that physical water risk significantly increases the cost of equity capital for water-intensive companies. However, corporate social responsibility (CSR) practices can alleviate this negative financial effect to some extent. On the other hand, when CSR exhibits high differentiation across various dimensions, its risk-mitigating role may be weakened or even reversed. Furthermore, the ownership structure and size of a company exhibit significant heterogeneity in the mechanism’s effectiveness. Therefore, to better harness CSR’s governance and financial adjustment functions in the context of high environmental risks and enhance corporate sustainability, this study proposes the following policy recommendations.

Firstly, strengthen the regulation and classification management mechanisms for water risks in water-intensive industries. Establish a classification and evaluation system for water risk exposure, incorporating factors such as water usage intensity, water source sustainability, and water environmental risks into the national green industry classification and regulatory list. For industries with high exposure, implement differentiated regulation and risk alerts, encouraging companies to integrate water resource management into their core strategic planning. Additionally, use financial incentives such as subsidies and tax deductions to encourage companies to increase investments in water-saving technology research, the construction of water recycling systems, and intelligent water resource monitoring systems, thereby building technology-driven water resource risk management capabilities to reduce financial risks caused by water resource uncertainties. Furthermore, support the establishment of an industry-specific water risk fund to promote the development of cross-company collaborative water management platforms.

Secondly, current corporate social responsibility (CSR) performance evaluations mainly focus on the overall level of responsibility investment, overlooking the coordination and balance among different CSR domains. It is recommended that regulatory authorities promote the establishment of a CSR structural coordination evaluation system to guide and standardize the reasonable allocation of responsibility resources across environmental, social, and governance dimensions. For industries highly dependent on water resources, it is essential to strengthen companies’ continuous investment and systematic governance capabilities in water risk-related areas to enhance their resilience to risks in the capital market.

Finally, to improve the efficiency of capital markets in recognizing companies’ environmental risk management capabilities, it is recommended to incorporate the degree of water resource dependence, water governance strategies, and actual performance into mandatory environmental information disclosure. Additionally, efforts should be made to establish an ESG rating model centered around water resource risk. By enhancing information transparency and the responsiveness of ratings, investors can be guided to make more accurate capital pricing based on the quality of CSR performance, thereby strengthening the positive moderating effect of CSR on companies’ capital costs.

7.2. Potential Limitations and Future Directions

Although this study systematically explores the impact mechanism of physical water risk on the cost of equity capital for water-intensive companies through theoretical analysis and empirical testing, and further analyzes the moderating effects of corporate social responsibility and its differentiation, there are still several limitations that warrant further expansion and refinement in future research:

Firstly, this study focuses on A-share listed companies in high water-intensive industries in China. Given the availability of data and the contextual relevance, the sample is representative and provides valuable insights into how environmental information can be integrated into capital market decision-making processes in developing economies—offering a “China experience.” However, we also acknowledge that the external generalizability of the findings is subject to certain limitations. China’s capital market is characterized by centralized regulatory control, an ESG framework that is still evolving, and an underdeveloped water governance system. These institutional features may jointly shape corporate behavior and market responses in ways that differ from other contexts. Therefore, future research could incorporate cross-country comparative samples or firm-level data from varied institutional environments to further examine whether the moderating role of CSR under water risk holds consistently across different governance systems.

Secondly, this study measures physical water risk based on the water resource carrying capacity of the region in which each firm is located. To test the robustness of our findings, we construct an interaction term between the proportion of revenue from water-intensive core business and the inverse of regional water resource carrying capacity as an alternative proxy for physical water risk. This approach enables a partial micro-level mapping of traditional region-level indicators, aiming to better reflect the actual resource constraints faced by individual firms. However, we acknowledge that this method still falls short of fully capturing the multidimensional heterogeneity in firm-level water dependency, operational exposure, and internal water governance capacity. Even within the same industry and region, firms may differ significantly in terms of water usage intensity, supply chain vulnerability, and investments in water management systems. Therefore, future research could incorporate firm-level micro data—such as disclosed water consumption, water-related expenditures, or environmental risk reports—to develop more refined measures of physical water risk, thereby enhancing the accuracy and applicability of risk identification.

Third, following prior studies, we measure CSR differentiation using the standard deviation of a firm’s scores across five key CSR dimensions. This approach provides a proxy for the degree of heterogeneity in a firm’s CSR performance across stakeholder groups. However, we acknowledge that this measure may not fully account for contextual variations in CSR strategies. Firms operating in high-risk environments—such as water-intensive sectors—may rationally prioritize certain dimensions (e.g., environmental performance), leading to higher standard deviation without implying incoherence or greenwashing. Therefore, while this metric allows for empirical comparison, we interpret the results with caution and call for future research to construct more nuanced and strategy-sensitive indicators of CSR differentiation.

Author Contributions

Conceptualization, M.W.; Data curation, L.Z.; Formal analysis, M.W.; Writing—original draft, M.W.; Writing—review and editing, Y.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This article received financial support from the Special Fund for Basic Scientific Research Operating Expenses of Central Universities: Research on Water Risk Challenges and Governance Mechanisms in the Construction of the “Belt and Road” Initiative (No. B240207115).

Data Availability Statement

The data presented in this study are available on request from the corresponding author due to the ongoing status of the research project.

Conflicts of Interest

The authors declare no competing interests.

References

- Mehta, L. The Politics and Poetics of Water: The Naturalisation of Scarcity in Western India; Orient Blackswan: Hyderabad, India, 2005. [Google Scholar]

- Hussein, H. Lifting the Veil: Unpacking the Discourse of Water Scarcity in Jordan. Environ. Sci. Policy 2018, 89, 385–392. [Google Scholar] [CrossRef]

- Zheng, L.; Ye, L.; Wang, M.; Wang, Y.; Zhou, H. Does Water Matter? The Impact of Water Vulnerability on Corporate Financial Performance. Int. J. Environ. Res. Public Health 2022, 19, 11272. [Google Scholar] [CrossRef]

- Bhat, V.N. Water and Its Effect on Business Productivity: A Cross-Country Analysis. Water Resour. Manag. 2015, 29, 4007–4020. [Google Scholar] [CrossRef]

- Sánchez-Hernández, M.; Robina-Ramírez, R.; De Clercq, W. Water Management Reporting in the Agro-Food Sector in South Africa. Water 2017, 9, 830. [Google Scholar] [CrossRef]

- Kurland, N.B.; Zell, D. Water and Business: A Taxonomy and Review of the Research. Organ. Environ. 2010, 23, 316–353. [Google Scholar] [CrossRef]

- Evans, J.; Allan, N.; Cantle, N. A New Insight into the World Economic Forum Global Risks. Econ. Pap. A J. Appl. Econ. Policy 2017, 36, 185–197. [Google Scholar] [CrossRef]

- Wicaksono, A.P.; Setiawan, D. Water Disclosure in the Agriculture Industry: Does Stakeholder Influence Matter? J. Clean. Prod. 2022, 337, 130605. [Google Scholar] [CrossRef]

- Vo, X.V. Corporate Social Responsibility and Sustainable Development: A Literature Review and Future Research Directions. Papers SSRN 2025. preprint. [Google Scholar]

- Godfrey, P.C.; Merrill, C.B.; Hansen, J.M. The Relationship between Corporate Social Responsibility and Shareholder Value: An Empirical Test of the Risk Management Hypothesis. Strateg. Manag. J. 2009, 30, 425–445. [Google Scholar] [CrossRef]

- Prasad, K.; Kumar, S.; Devji, S.; Lim, W.M.; Prabhu, N.; Moodbidri, S. Corporate Social Responsibility and Cost of Capital: The Moderating Role of Policy Intervention. Res. Int. Bus. Financ. 2022, 60, 101620. [Google Scholar] [CrossRef]

- Ortas, E.; Burritt, R.L.; Christ, K.L. The Influence of Macro Factors on Corporate Water Management: A Multi-Country Quantile Regression Approach. J. Clean. Prod. 2019, 226, 1013–1021. [Google Scholar] [CrossRef]

- Distefano, T.; Kelly, S. Are We in Deep Water? Water Scarcity and Its Limits to Economic Growth. Ecol. Econ. 2017, 142, 130–147. [Google Scholar] [CrossRef]

- Yang, J.; Li, J.; Van Vliet, M.T.H.; Jones, E.R.; Huang, Z.; Liu, M.; Bi, J. Economic Risks Hidden in Local Water Pollution and Global Markets: A Retrospective Analysis (1995–2010) and Future Perspectives on Sustainable Development Goal 6. Water Res. 2024, 252, 121216. [Google Scholar] [CrossRef]

- Wang, C.; Shuai, C.; Chen, X.; Sun, J.; Zhao, B. Linking Local and Global: Assessing Water Scarcity Risk through Nested Trade Networks. Sustain. Dev. 2025, 33, 1–18. [Google Scholar] [CrossRef]

- Zhu, Y.; Zhang, C.; Wang, T.; Miao, Y. Corporate Water Risk: A New Research Hotspot under Climate Change. Sustain. Dev. 2024, 32, 2623–2637. [Google Scholar] [CrossRef]

- Zhang, L.; Tang, Q.; Huang, R.H. Mind the Gap: Is Water Disclosure a Missing Component of Corporate Social Responsibility? Br. Account. Rev. 2021, 53, 100940. [Google Scholar] [CrossRef]

- Mueller, S.A.; Carlile, A.; Bras, B.; Niemann, T.A.; Rokosz, S.M.; McKenzie, H.L.; Chul Kim, H.; Wallington, T.J. Requirements for Water Assessment Tools: An Automotive Industry Perspective. Water Resour. Ind. 2015, 9, 30–44. [Google Scholar] [CrossRef]

- Chen, F.; Liu, J.; Yang, Z.; Dusengemungu, D.-R.; Zhang, H. Does Water Risk Increase Corporate Debt Financing Capacity? Evidence from Listed Companies in High-Water Sensitive Industries in China. J. Clean. Prod. 2023, 415, 137858. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. The Cross-Section of Expected Stock Returns. J. Financ. 1992, 47, 427–465. [Google Scholar] [CrossRef]

- Chen, F.; Hope, O.-K.; Li, Q.; Wang, X. Financial Reporting Quality and Investment Efficiency of Private Firms in Emerging Markets. Account. Rev. 2011, 86, 1255–1288. [Google Scholar] [CrossRef]

- Yang, J.; Cai, G.; Zheng, G.; Gu, Q. Firm Internationalization and Cost of Equity: Evidence from China. China J. Account. Res. 2022, 15, 100237. [Google Scholar] [CrossRef]

- Nukala, V.B.; Prasada Rao, S.S. Role of Debt-to-Equity Ratio in Project Investment Valuation, Assessing Risk and Return in Capital Markets. Future Bus. J. 2021, 7, 13. [Google Scholar] [CrossRef]

- Jang, S.; Choi, H.; Kim, H. Managerial Ability and Cost of Equity Capital. Adv. Account. 2024, 65, 100681. [Google Scholar] [CrossRef]

- Gerged, A.M.; Matthews, L.; Elheddad, M. Mandatory Disclosure, Greenhouse Gas Emissions and the Cost of Equity Capital: UK Evidence of a U-shaped Relationship. Bus. Strategy Environ. 2021, 30, 908–930. [Google Scholar] [CrossRef]

- Chen, Y.; Li, T.; Zeng, Q.; Zhu, B. Effect of ESG Performance on the Cost of Equity Capital: Evidence from China. Int. Rev. Econ. Financ. 2023, 83, 348–364. [Google Scholar] [CrossRef]

- Mathath, N.; Kumar, V.; Balasubramanian, G. ESG Disclosure and Cost of Equity: Do Big 4 Audit Firms Matter? J. Emerg. Mark. Financ. 2025, 24, 87–108. [Google Scholar] [CrossRef]

- Nasrallah, N.; El Khoury, R.; Atayah, O.F.; Marashdeh, H.; Najaf, K. The Impact of Carbon Awareness, Country-Governance, and Innovation on the Cost of Equity: Evidence from Oil and Gas Firms. Res. Int. Bus. Financ. 2025, 73, 102640. [Google Scholar] [CrossRef]

- Han, L.; Cheng, X.; Chan, K.C.; Gao, S. Does Air Pollution Affect Seasoned Equity Offering Pricing? Evidence from Investor Bids. J. Financ. Mark. 2022, 59, 100657. [Google Scholar] [CrossRef]

- Cepni, O.; Şensoy, A.; Yılmaz, M.H. Climate Change Exposure and Cost of Equity. Energy Econ. 2024, 130, 107288. [Google Scholar] [CrossRef]

- Yue, X.; Kong, X.; Zhao, Q.; Ho, K.-C. Impact of Climate Change Risks on Equity Capital: Evidence-Based on Chinese Markets. Pac.-Basin Financ. J. 2024, 88, 102541. [Google Scholar] [CrossRef]

- Debaere, P.; Kapral, A. The Potential of the Private Sector in Combating Water Scarcity: The Economics. Water Secur. 2021, 13, 100090. [Google Scholar] [CrossRef]

- Afrin, R.; Peng, N.; Bowen, F. The Wealth Effect of Corporate Water Actions: How Past Corporate Responsibility and Irresponsibility Influence Stock Market Reactions. J. Bus. Ethics 2021, 180, 105–124. [Google Scholar] [CrossRef]

- Kumar Kanike, U. Factors Disrupting Supply Chain Management in Manufacturing Industries. J. Supply Chain. Manag. Sci. 2023, 4, 1–24. [Google Scholar] [CrossRef]

- Skouloudis, A.; Leal Filho, W.; Deligiannakis, G.; Vouros, P.; Nikolaou, I.; Evangelinos, K. Coping with Floods: Impacts, Preparedness and Resilience Capacity of Greek Micro-, Small- and Medium-Sized Enterprises in Flood-Affected Areas. Int. J. Clim. Change Strateg. Manag. 2023, 15, 81–103. [Google Scholar] [CrossRef]

- Zhong, S.; Geng, Y.; Liu, W.; Gao, C.; Chen, W. A Bibliometric Review on Natural Resource Accounting during 1995–2014. J. Clean. Prod. 2016, 139, 122–132. [Google Scholar] [CrossRef]

- He, Y.; Wang, Y.; Chen, X. Spatial Patterns and Regional Differences of Inequality in Water Resources Exploitation in China. J. Clean. Prod. 2019, 227, 835–848. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kim, H.; Park, K. Corporate Environmental Responsibility and the Cost of Capital: International Evidence. J. Bus. Ethics 2018, 149, 335–361. [Google Scholar] [CrossRef]

- Wang, H.; Niu, X.; Xing, H. Regional Climate Risk and Corporate Social Responsibility: Evidence from China. Emerg. Mark. Financ. Trade 2025, 61, 21–43. [Google Scholar] [CrossRef]

- Le, T.T. Corporate Social Responsibility and SMEs’ Performance: Mediating Role of Corporate Image, Corporate Reputation and Customer Loyalty. Int. J. Emerg. Mark. 2023, 18, 4565–4590. [Google Scholar] [CrossRef]

- Liu, Q.; Wu, J. Financial Regulation and Corporate Social Responsibility: Evidence from China. Pac.-Basin Financ. J. 2025, 89, 102599. [Google Scholar] [CrossRef]

- Weber, O.; Saunders-Hogberg, G. Water Management and Corporate Social Performance in the Food and Beverage Industry. J. Clean. Prod. 2018, 195, 963–977. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, H.; Zhou, X. Dare to Be Different? Conformity Versus Differentiation in Corporate Social Activities of Chinese Firms and Market Responses. Acad. Manag. J. 2020, 63, 717–742. [Google Scholar] [CrossRef]

- Zhou, J.; Lu, Y.; Wu, Z.; Wang, H. Optimally Distinctive Corporate Social Responsibility Strategy: How Strategic Conformity and Differentiation Contribute to Entrepreneurial Firm Performance. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 3693–3710. [Google Scholar] [CrossRef]

- Barlow, M.A.; Verhaal, J.C.; Angus, R.W. Optimal Distinctiveness, Strategic Categorization, and Product Market Entry on the Google Play App Platform. Strateg. Manag. J. 2019, 40, 1219–1242. [Google Scholar] [CrossRef]

- Gorovaia, N.; Makrominas, M. Identifying Greenwashing in Corporate-social Responsibility Reports Using Natural-language Processing. Eur. Financ. Manag. 2025, 31, 427–462. [Google Scholar] [CrossRef]

- Xu, M.; Tse, Y.K.; Geng, R.; Liu, Z.; Potter, A. Greenwashing and Market Value of Firms: An Empirical Study. Int. J. Prod. Econ. 2025, 284, 109606. [Google Scholar] [CrossRef]

- Wang, M.; Xu, X.; Zheng, L.; Xu, X.; Zhang, Y. Analysis of the Relationship between Economic Development and Water Resources–Ecological Management Capacity in China Based on Nighttime Lighting Data. Int. J. Environ. Res. Public Health 2023, 20, 1818. [Google Scholar] [CrossRef]

- Bhuiyan, M.d.B.U.; Hu, Y. Do Corporate Donations Affect the Cost of Equity? International Evidence. J. Account. Lit. 2025, ahead-of-print. [Google Scholar] [CrossRef]

- Radwan, S.R.A.; Xiongyuan, W.; Abdelall, M.A.A.; Abdelgawad, H.N.M. The Impact of Integrated Reporting Quality on the Cost of Equity Capital: Evidence from Asia. J. Financ. Report. Account. 2025, ahead-of-print. [Google Scholar] [CrossRef]

- Xie, X.; Zhang, W. Impacts of CSR on the Efficiency of Chinese Enterprises’ Outward FDI. Financ. Res. Lett. 2023, 57, 104252. [Google Scholar] [CrossRef]

- Wang, H.; Choi, J. A New Look at the Corporate Social–Financial Performance Relationship: The Moderating Roles of Temporal and Interdomain Consistency in Corporate Social Performance. J. Manag. 2013, 39, 416–441. [Google Scholar] [CrossRef]

- Zheng, L.; Gao, P.; Wang, M. The Economic Impact of Water Vulnerability on Corporate Sustainability: A Perspective of Corporate Capital Cost. Water 2024, 16, 2560. [Google Scholar] [CrossRef]

- Jo, H.; Na, H. Does CSR Reduce Firm Risk? Evidence from Controversial Industry Sectors. J. Bus. Ethics 2012, 110, 441–456. [Google Scholar] [CrossRef]

- Hu, C.; Li, Y.; Zheng, X. Data Assets, Information Uses, and Operational Efficiency. Appl. Econ. 2022, 54, 6887–6900. [Google Scholar] [CrossRef]

- Oikonomou, I.; Brooks, C.; Pavelin, S. The Impact of Corporate Social Performance on Financial Risk and Utility: A Longitudinal Analysis. Financ. Manag. 2012, 41, 483–515. [Google Scholar] [CrossRef]

- Wang, Y.; Llasat, M.C.; Randin, C.; Coppola, E. Climate Change Impacts on Water Resources in the Mediterranean. Reg. Environ. Change 2020, 20, 83. [Google Scholar] [CrossRef]

- Boardman, A.E.; Vining, A.R. Ownership and Performance in Competitive Environments: A Comparison of the Performance of Private, Mixed, and State-Owned Enterprises. J. Law Econ. 1989, 32, 1–33. [Google Scholar] [CrossRef]

- Huang, M.; Jiang, H.; Ning, Z.; Tu, J. Institutional Ownership and Cost of Equity of Chinese Firms. China Financ. Rev. Int. 2024, ahead-of-print. [Google Scholar] [CrossRef]

- Nguyen, V.H.; Agbola, F.W.; Choi, B. Does Corporate Social Responsibility Reduce Information Asymmetry? Empirical Evidence from Australia. Aust. J. Manag. 2019, 44, 188–211. [Google Scholar] [CrossRef]

- Inrawan, A.; Sembiring, L.D.; Loist, C. The Moderating Role of Liquidity in the Relationship between Leverage, Firm Size, and Profitability. Int. J. Bus. Law Educ. 2025, 6, 54–68. [Google Scholar] [CrossRef]

- Muhammad, H.; Migliori, S.; Consorti, A. Corporate Governance and R&D Investment: Does Firm Size Matter? Technol. Anal. Strateg. Manag. 2024, 36, 518–532. [Google Scholar] [CrossRef]

- Tashman, P. A Natural Resource Dependence Perspective of the Firm: How and Why Firms Manage Natural Resource Scarcity. Bus. Soc. 2021, 60, 1279–1311. [Google Scholar] [CrossRef]

- Daddi, T.; Todaro, N.M.; De Giacomo, M.R.; Frey, M. A Systematic Review of the Use of Organization and Management Theories in Climate Change Studies: A Review of Management Theories in Climate Change Studies. Bus. Strategy Environ. 2018, 27, 456–474. [Google Scholar] [CrossRef]

- Sun, Y.; Yang, Y.; Huang, N.; Zou, X. The Impacts of Climate Change Risks on Financial Performance of Mining Industry: Evidence from Listed Companies in China. Resour. Policy 2020, 69, 101828. [Google Scholar] [CrossRef]

- Havlinova, A.; Kukacka, J. Corporate Social Responsibility and Stock Prices After the Financial Crisis: The Role of Strategic CSR Activities. J. Bus. Ethics 2023, 182, 223–242. [Google Scholar] [CrossRef]

- Su, W.; Peng, M.W.; Tan, W.; Cheung, Y.-L. The Signaling Effect of Corporate Social Responsibility in Emerging Economies. J. Bus. Ethics 2016, 134, 479–491. [Google Scholar] [CrossRef]

- Chen, T.; Dong, H.; Lin, C. Institutional Shareholders and Corporate Social Responsibility. J. Financ. Econ. 2020, 135, 483–504. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).