Governance and Efficiency in Brazilian Water Utilities: An Analysis Based on Revenue Collection Efficiency

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

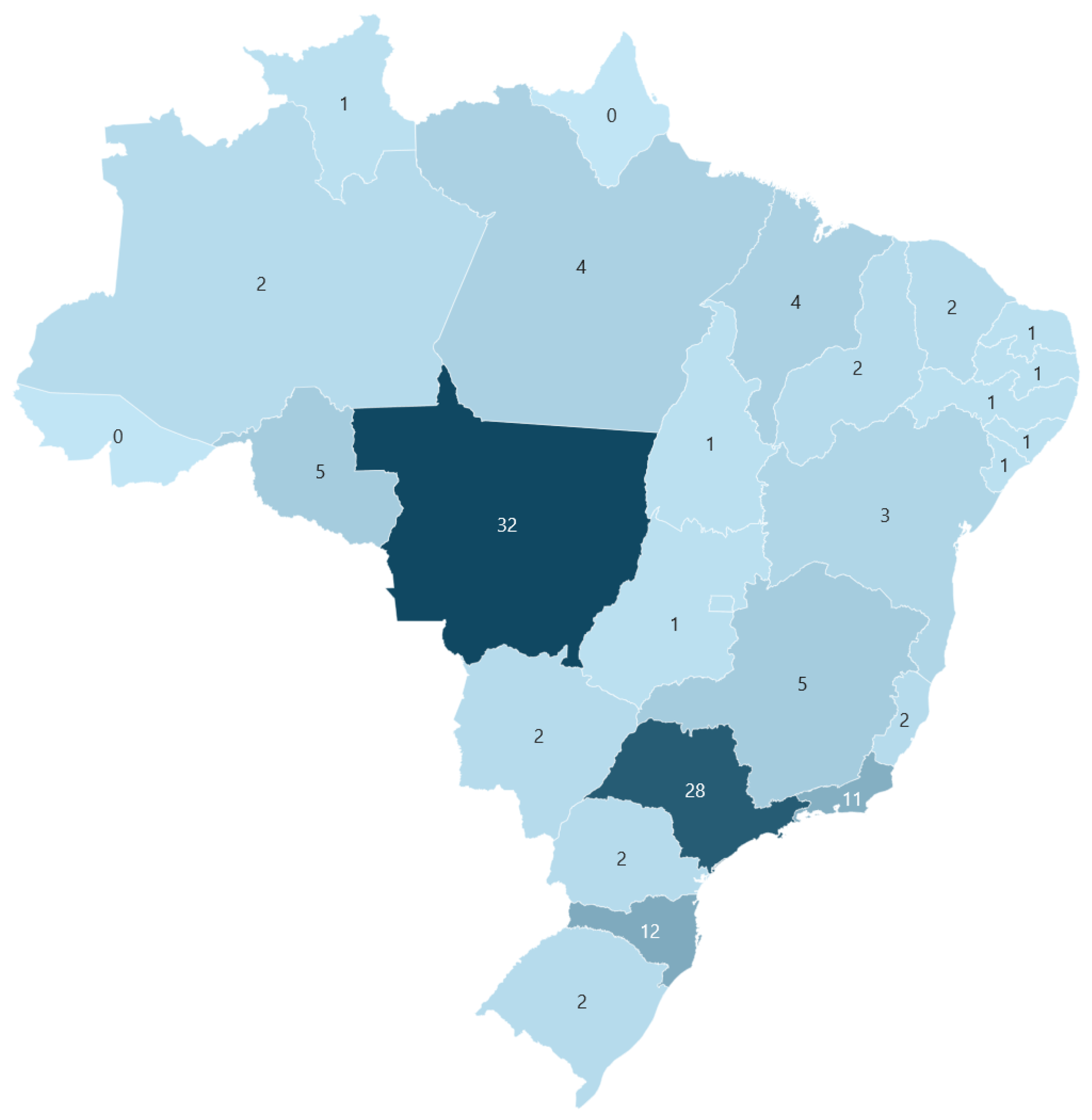

3.1. Data Collection

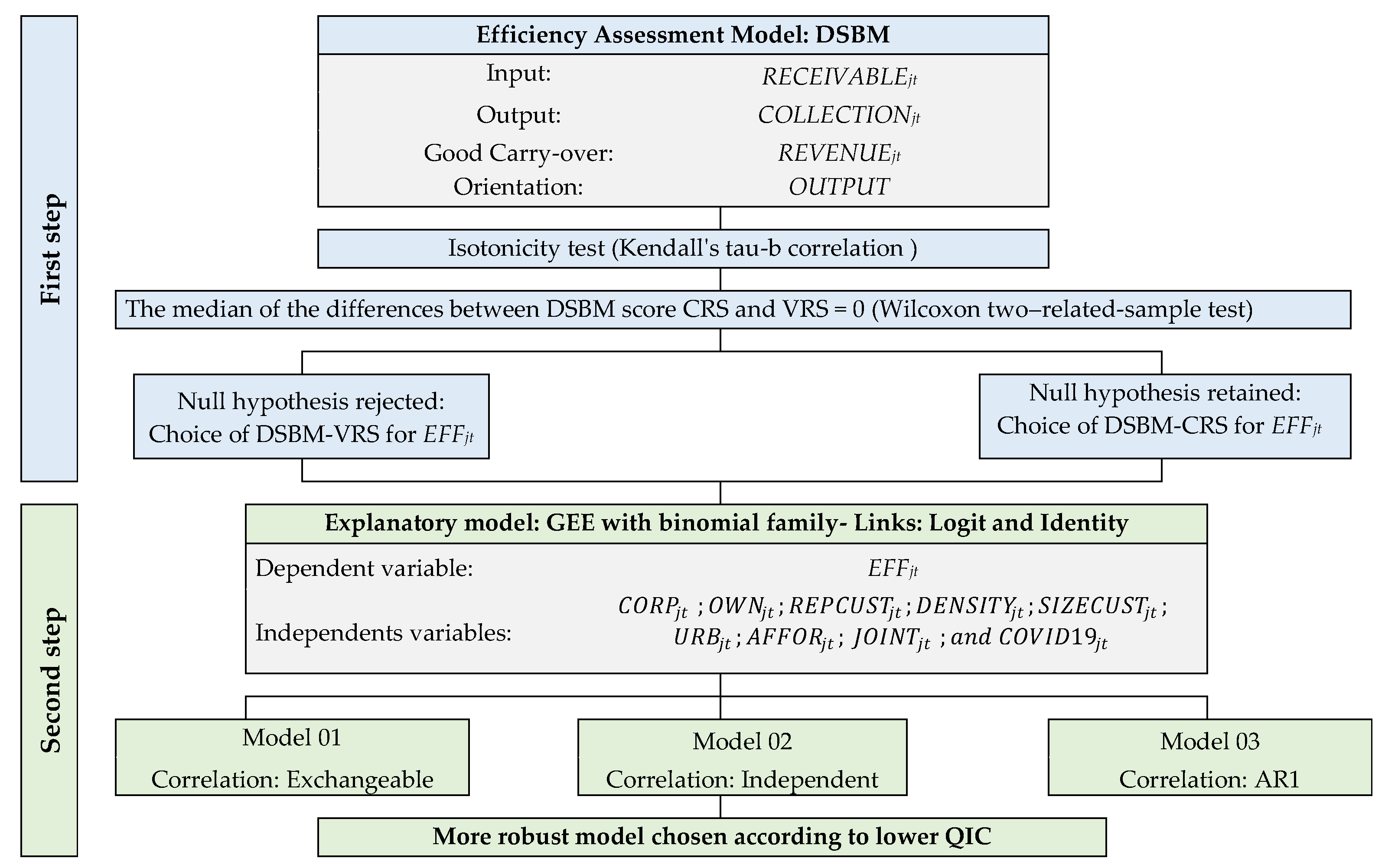

3.2. Model Specification for Efficiency Score Model

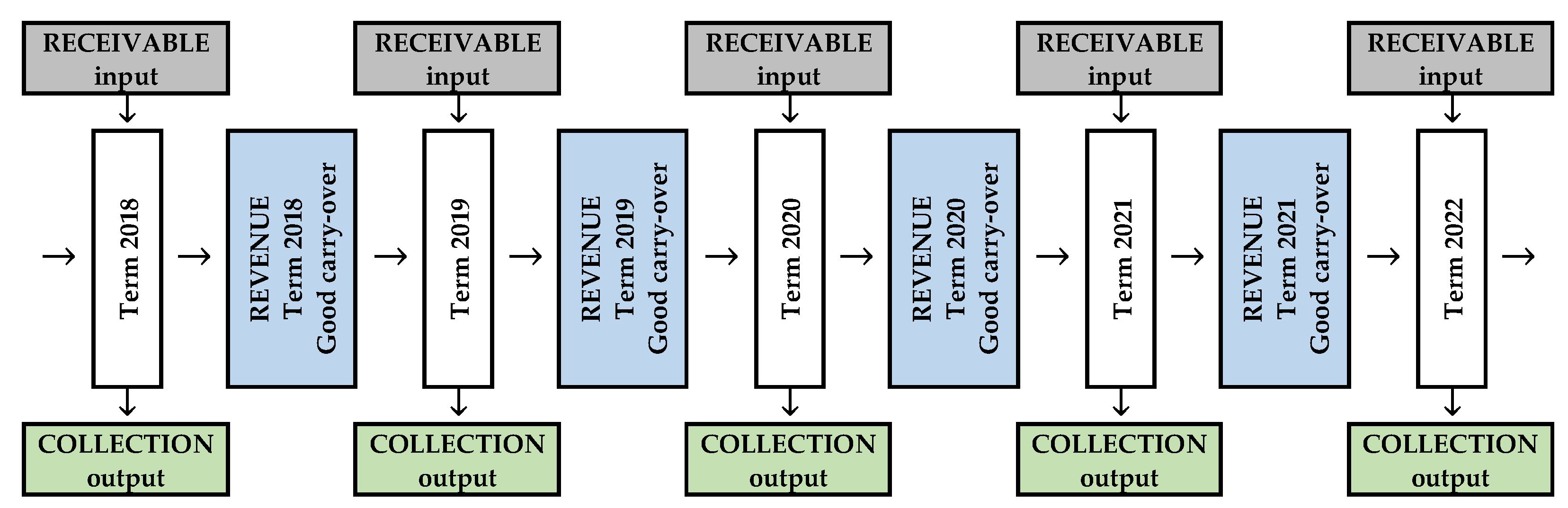

3.2.1. The Proposed Data Envelopment Analysis Model

3.2.2. Variable Selection for Efficiency Assessment

3.3. Explanatory Econometric Model Construction and Variable Measurement

4. Results and Discussion

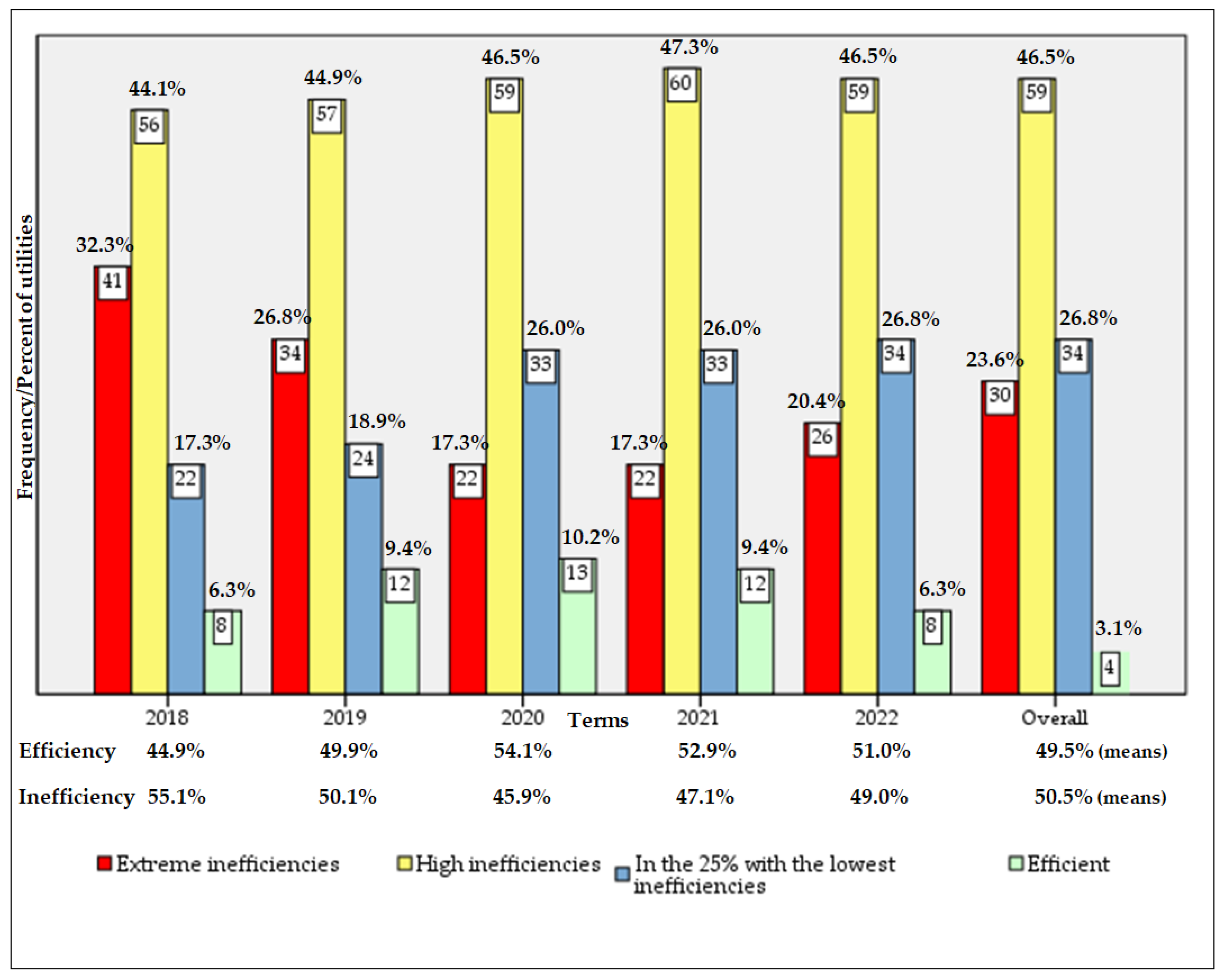

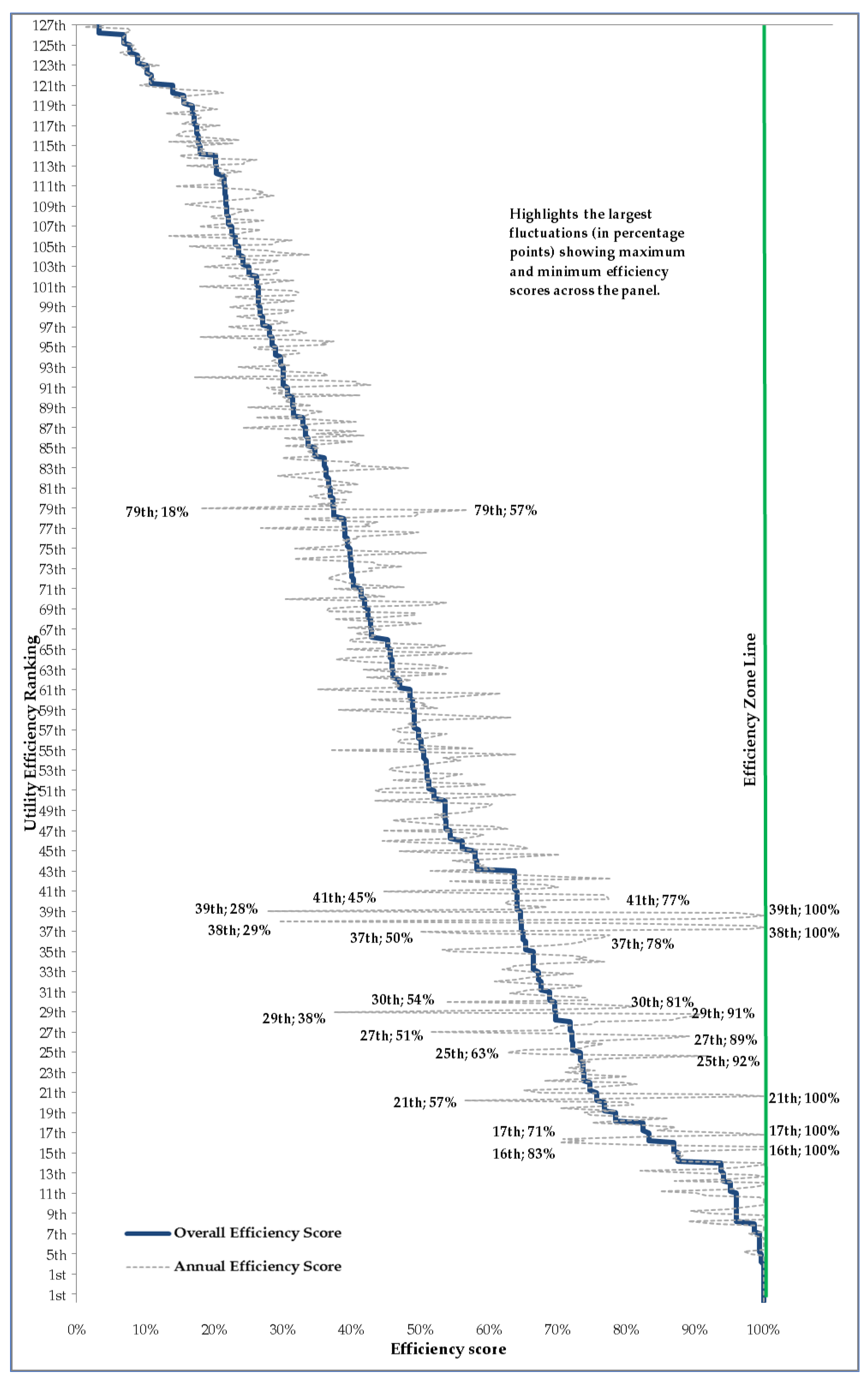

4.1. Revenue Collection Efficiency Assessment

4.2. Econometric Explanatory Model

4.3. Explanatory Econometric Analysis

5. Conclusions

- The overall average inefficiency in revenue collection is 50.47%, with at least 17% of the water utilities being extremely inefficient.

- Ownership is relevant to efficiency; however, privately controlled water utilities are more likely to face inefficiency in revenue collection, challenging the prevailing belief that private management is more productive and efficient than public management;

- Corporatization is also relevant to efficiency in revenue collection, with water utilities with shares on the stock exchange being more likely to achieve greater efficiency.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variable | Description | Expectation a priori and Hypothesis | Reference Literature |

|---|---|---|---|

| The revenue collection efficiency score of utility j in year t, calculated using the DSBM under the premises of VRS and input-oriented considering customer accounts receivables (input), revenue collections (output), and revenue (good carry-over). Source: DSBM score. | Dependent Variable | ||

| The ownership structure of utility j in year t. Was collected through the SNIS platform using the information of “Natureza juridica”; 1 for the utilities with private control (“Empresa Privada” and “Sociedade de economia mista com gestão privada”), and 0 for the utilities with public control (“Empresa Pública” and “Sociedade de economia mista com gestão pública”). | + (H1) | [43,45] | |

| The corporatization of utility j in year t. This variable captures whether a utility is publicly listed; 1 for utilities listed with the CVM, 0 otherwise. Source: CVM. | + (H2) | [45] | |

| The proportion of residential customers per economies of utility j in year t. Thus, the number of active residential water (AG013 of the SNIS) and wastewater (ES008 of the SNIS) units that were fully operational on the last day of the reference year proportional to active water (AG003 of the SNIS) and wastewater (ES003 of the SNIS) economies. This refers to the number of units connected to the water supply network and provided with water for user consumption in the reference year. | + | [41,91] | |

| The density of the service area of utility j in year t. Therefore, the total population served with water (AG001 of the SNIS) and wastewater (ES001 of the SNIS) services by the service provider on the last day of the reference year proportional to active water (AG003 of the SNIS) and wastewater (ES003 of the SNIS) economies. This refers to the number of units connected to the water supply network and provided with water for user consumption in the reference year. | −/+ | [41,46] | |

| Average per capita consumption (IN022 from the SNIS) multiplied by the average applied tariff (IN004) divided by GDP per capita. On this portal, the GDP per municipality, the population attended per municipality, and the GDP per capita per municipality can be found. For this work, the GDPs per municipality were summed to calculate the GDP per company. Then, the GDP per capita per company was obtained by dividing this total by the sum of the total population served per company. Average tariff and GDP were adjusted using the Brazilian price index IPCA/IBGE. | − | [36,43] | |

| The size of utility j in year t. Total assets relative to the number of economies served. Thus, the annual value of the sum of current assets, long-term receivables, and permanent assets (BL002 of the SNIS) divided by active water (AG003 of the SNIS) and wastewater (ES003 of the SNIS) economies. This refers to the number of units connected to the water supply network and provided with water for user consumption in the reference year. Then, the number is adjusted using the Brazilian price index IPCA/IBGE (measured in BR/Econ). | − | [45] | |

| The proportion of the urban population served in relation to the total active economies of utility j in year t. It represents the value of the urban population served with water supply by the service provider on the last day of the reference year in proportion to the total population served with water (AG001 from the SNIS) and wastewater (ES001 from the SNIS) services by the service provider on the last day of the reference year. | + | [8] | |

| The joint provision of water and wastewater of utility j in year t. Was collected through the SNIS platform using the information of “Tipo de serviço”; 1 for the utilities providing both water and wastewater services (“Água e Esgoto”), and 0 for the utilities providing either water or wastewater services (“Água”; “Esgoto”). | −/+ | [45] | |

| Effect of COVID-19 on utility j in year t 2020 onwards. | −/+ | [104] |

Appendix B

| DMU | Overall Score | 2018 | 2019 | 2020 | 2021 | 2022 | DMU | Overall Score | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 35503000-SABESP(1st) | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 35298011-AMT(65th) | 0.457 | 0.392 | 0.463 | 0.574 | 0.499 | 0.400 |

| 51055811-AMA(1st) | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 35284011-SM(66th) | 0.453 | 0.399 | 0.398 | 0.452 | 0.536 | 0.513 |

| 43149000-CORSAN(1st) | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 23044000-CAGECE(67th) | 0.429 | 0.444 | 0.430 | 0.407 | 0.436 | 0.433 |

| 51083011-AUS(1st) | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 35407011-BRK(68th) | 0.428 | 0.375 | 0.418 | 0.501 | 0.474 | 0.395 |

| 51013011-AA(5th) | 0.996 | 0.982 | 1.000 | 1.000 | 1.000 | 1.000 | 35467011-BRK(69th) | 0.424 | 0.366 | 0.364 | 0.493 | 0.493 | 0.443 |

| 51062511-SETAE(6th) | 0.994 | 1.000 | 1.000 | 1.000 | 1.000 | 0.971 | 35385011-AP(70th) | 0.419 | 0.305 | 0.424 | 0.539 | 0.512 | 0.404 |

| 31062000-COPASA(7th) | 0.994 | 0.979 | 0.990 | 1.000 | 1.000 | 1.000 | 50027011-AG(71st) | 0.414 | 0.376 | 0.417 | 0.410 | 0.423 | 0.450 |

| 33033011-CAN(8th) | 0.986 | 0.935 | 1.000 | 1.000 | 1.000 | 1.000 | 42125012-AP(72nd) | 0.403 | 0.366 | 0.384 | 0.395 | 0.413 | 0.477 |

| 35334011-CODEN(9th) | 0.961 | 0.925 | 1.000 | 1.000 | 1.000 | 0.891 | 41182011-PS(73rd) | 0.401 | 0.425 | 0.430 | 0.400 | 0.385 | 0.372 |

| 41069000-SANEPAR(10th) | 0.960 | 1.000 | 1.000 | 0.968 | 0.949 | 0.894 | 51026711-ACV(74th) | 0.399 | 0.317 | 0.374 | 0.432 | 0.439 | 0.474 |

| 52087000-SANEAGO(11th) | 0.960 | 0.901 | 0.916 | 0.994 | 1.000 | 1.000 | 35177011-GUARA(75th) | 0.398 | 0.318 | 0.390 | 0.508 | 0.428 | 0.390 |

| 33034011-CANF(12th) | 0.952 | 1.000 | 1.000 | 0.985 | 0.943 | 0.850 | 43224011-BRK(76th) | 0.394 | 0.411 | 0.388 | 0.400 | 0.391 | 0.383 |

| 17210000-SANEATINS(13th) | 0.941 | 0.912 | 0.987 | 1.000 | 0.947 | 0.871 | 31039011-SANARJ(77th) | 0.391 | 0.269 | 0.396 | 0.497 | 0.479 | 0.408 |

| 24081000-CAERN(14th) | 0.938 | 1.000 | 1.000 | 0.967 | 0.926 | 0.821 | 51041011-AG(78th) | 0.389 | 0.330 | 0.356 | 0.439 | 0.419 | 0.426 |

| 32053000-CESAN(15th) | 0.875 | 0.867 | 0.883 | 0.879 | 0.868 | 0.878 | 33024012-BRK(79th) | 0.374 | 0.181 | 0.569 | 0.492 | 0.497 | 0.493 |

| 35475012-COMASA(16th) | 0.869 | 0.703 | 0.826 | 1.000 | 1.000 | 0.892 | 21122013-AT(80th) | 0.373 | 0.355 | 0.393 | 0.392 | 0.351 | 0.381 |

| 35184011-SAEG(17th) | 0.834 | 0.958 | 1.000 | 0.840 | 0.709 | 0.739 | 51070411-APL(81st) | 0.370 | 0.371 | 0.380 | 0.401 | 0.363 | 0.340 |

| 33042011-CAAN(18th) | 0.824 | 0.751 | 0.805 | 0.872 | 0.860 | 0.846 | 33038011-CAPY(82nd) | 0.367 | 0.337 | 0.362 | 0.385 | 0.410 | 0.351 |

| 42024012-BRK(19th) | 0.785 | 0.739 | 0.749 | 0.803 | 0.860 | 0.786 | 35294012-BRK(83rd) | 0.363 | 0.483 | 0.411 | 0.362 | 0.323 | 0.293 |

| 35095011-SANASA(20th) | 0.769 | 0.799 | 0.811 | 0.756 | 0.704 | 0.784 | 51002511-AAF(84th) | 0.360 | 0.300 | 0.320 | 0.403 | 0.412 | 0.399 |

| 35144011-EMDAEP(21st) | 0.756 | 0.676 | 0.951 | 1.000 | 0.764 | 0.565 | 25075000-CAGEPA(85th) | 0.347 | 0.353 | 0.345 | 0.336 | 0.349 | 0.352 |

| 33039011-CAI(22nd) | 0.747 | 0.794 | 0.815 | 0.760 | 0.737 | 0.651 | 35110011-EAC(86th) | 0.337 | 0.302 | 0.334 | 0.403 | 0.361 | 0.303 |

| 35028011-SAMAR(23rd) | 0.738 | 0.711 | 0.749 | 0.802 | 0.758 | 0.681 | 51056011-AM(87th) | 0.334 | 0.243 | 0.318 | 0.406 | 0.349 | 0.417 |

| 42054000-CASAN(24th) | 0.737 | 0.747 | 0.730 | 0.740 | 0.717 | 0.754 | 51064211-APA(88th) | 0.330 | 0.261 | 0.342 | 0.406 | 0.353 | 0.322 |

| 35452012-SANESALTO(25th) | 0.733 | 0.627 | 0.678 | 0.919 | 0.773 | 0.732 | 51030511-AC(89th) | 0.316 | 0.249 | 0.325 | 0.358 | 0.342 | 0.333 |

| 50027000-SANESUL(26th) | 0.723 | 0.728 | 0.767 | 0.742 | 0.734 | 0.653 | 33007011-PROLAGOS(90th) | 0.314 | 0.300 | 0.309 | 0.303 | 0.321 | 0.342 |

| 35356012-CAEPA(27th) | 0.721 | 0.515 | 0.714 | 0.892 | 0.864 | 0.763 | 15014000-COSANPA(91st) | 0.307 | 0.277 | 0.283 | 0.307 | 0.287 | 0.413 |

| 29274000-EMBASA(28th) | 0.718 | 0.756 | 0.750 | 0.702 | 0.697 | 0.691 | 11002812-ARM(92nd) | 0.300 | 0.172 | 0.279 | 0.407 | 0.406 | 0.427 |

| 42062012-GS(29th) | 0.697 | 0.375 | 0.908 | 0.902 | 0.876 | 0.867 | 42187012-TBSSA(93rd) | 0.300 | 0.236 | 0.282 | 0.299 | 0.358 | 0.366 |

| 29148011-EMASA(30th) | 0.696 | 0.538 | 0.723 | 0.815 | 0.791 | 0.688 | 51034011-CBA(94th) | 0.297 | 0.305 | 0.292 | 0.284 | 0.293 | 0.310 |

| 33002011-CAJ(31st) | 0.689 | 0.647 | 0.631 | 0.693 | 0.744 | 0.744 | 35293011-AM(95th) | 0.290 | 0.259 | 0.262 | 0.319 | 0.324 | 0.299 |

| 35570011-CAV(32nd) | 0.677 | 0.609 | 0.672 | 0.736 | 0.725 | 0.657 | 11000212-AA(96th) | 0.284 | 0.180 | 0.261 | 0.374 | 0.357 | 0.364 |

| 53001000-CAESB(33rd) | 0.673 | 0.667 | 0.723 | 0.685 | 0.655 | 0.639 | 15050311-PMNP/ANP(97th) | 0.281 | 0.221 | 0.254 | 0.320 | 0.335 | 0.307 |

| 35269011-BRKL(34th) | 0.665 | 0.768 | 0.686 | 0.636 | 0.635 | 0.620 | 11001812-APB(98th) | 0.271 | 0.233 | 0.266 | 0.287 | 0.307 | 0.275 |

| 31471011-CAPAM(35th) | 0.664 | 0.545 | 0.631 | 0.722 | 0.742 | 0.727 | 51067511-APL(99th) | 0.267 | 0.223 | 0.250 | 0.315 | 0.302 | 0.265 |

| 31367011-CESAMA(36th) | 0.654 | 0.740 | 0.720 | 0.691 | 0.632 | 0.533 | 51063711-SBPP(100th) | 0.264 | 0.231 | 0.247 | 0.317 | 0.280 | 0.261 |

| 42084512-IS(37th) | 0.650 | 0.500 | 0.574 | 0.775 | 0.765 | 0.739 | 51033511-ACO(101sh) | 0.264 | 0.180 | 0.252 | 0.316 | 0.323 | 0.319 |

| 51072411-ASC(38th) | 0.647 | 0.295 | 0.770 | 0.985 | 1.000 | 0.978 | 51073011-ASJ(102th) | 0.261 | 0.222 | 0.240 | 0.315 | 0.287 | 0.262 |

| 42020712-GS(39th) | 0.646 | 0.279 | 0.961 | 1.000 | 0.978 | 0.913 | 51085011-AVE(103th) | 0.250 | 0.185 | 0.237 | 0.295 | 0.292 | 0.284 |

| 42091012-CAJ(40th) | 0.641 | 0.629 | 0.624 | 0.637 | 0.684 | 0.635 | 51035012-ADI(104th) | 0.242 | 0.212 | 0.218 | 0.294 | 0.275 | 0.233 |

| 51027011-AC(41st) | 0.641 | 0.448 | 0.592 | 0.767 | 0.774 | 0.775 | 15013012-ASF(105th) | 0.236 | 0.165 | 0.194 | 0.277 | 0.291 | 0.340 |

| 35253012-CAJA(42nd) | 0.637 | 0.544 | 0.615 | 0.681 | 0.701 | 0.671 | 51027911-AGUASCAR(106th) | 0.231 | 0.135 | 0.244 | 0.313 | 0.291 | 0.284 |

| 14001000-CAER(43rd) | 0.637 | 0.515 | 0.594 | 0.653 | 0.710 | 0.779 | 51049011-SBJ(107th) | 0.226 | 0.178 | 0.225 | 0.268 | 0.243 | 0.235 |

| 35259011-DAE Jundiaí(44th) | 0.583 | 0.548 | 0.582 | 0.592 | 0.587 | 0.609 | 51063012-APA(108th) | 0.222 | 0.197 | 0.195 | 0.272 | 0.248 | 0.214 |

| 31472011-COSÁGUA(45th) | 0.580 | 0.470 | 0.535 | 0.704 | 0.635 | 0.612 | 51065011-APO(109th) | 0.219 | 0.181 | 0.206 | 0.257 | 0.237 | 0.227 |

| 42032012-AC(46th) | 0.561 | 0.445 | 0.502 | 0.622 | 0.650 | 0.658 | 15061312-BRK(110th) | 0.217 | 0.287 | 0.257 | 0.228 | 0.202 | 0.158 |

| 35190512-AH(47th) | 0.544 | 0.448 | 0.563 | 0.592 | 0.582 | 0.562 | 51050011-AJ(111th) | 0.216 | 0.144 | 0.210 | 0.256 | 0.273 | 0.262 |

| 42162012-ASFS(48th) | 0.538 | 0.460 | 0.503 | 0.530 | 0.606 | 0.627 | 28003000-DESO(112th) | 0.214 | 0.220 | 0.215 | 0.204 | 0.217 | 0.216 |

| 32012011-BRK(49th) | 0.537 | 0.577 | 0.561 | 0.522 | 0.541 | 0.490 | 23042011-SAAEC(113th) | 0.203 | 0.161 | 0.205 | 0.218 | 0.239 | 0.210 |

| 51079211-AS(50th) | 0.536 | 0.433 | 0.512 | 0.605 | 0.599 | 0.574 | 29307711-EMSAE(114th) | 0.202 | 0.150 | 0.164 | 0.262 | 0.245 | 0.243 |

| 35029011-CAA(51st) | 0.520 | 0.435 | 0.445 | 0.638 | 0.603 | 0.546 | 13026011-MA(115th) | 0.180 | 0.161 | 0.174 | 0.187 | 0.177 | 0.205 |

| 35021011-AA(52nd) | 0.513 | 0.461 | 0.527 | 0.596 | 0.564 | 0.448 | 51068211-APE(116th) | 0.177 | 0.145 | 0.188 | 0.237 | 0.135 | 0.227 |

| 51032011-AC(53rd) | 0.511 | 0.455 | 0.482 | 0.561 | 0.538 | 0.532 | 33018511-FSSG(117th) | 0.175 | 0.208 | 0.181 | 0.188 | 0.158 | 0.152 |

| 35524012-BRK(54th) | 0.508 | 0.559 | 0.536 | 0.516 | 0.484 | 0.459 | 11002000-CAERD(118th) | 0.170 | 0.179 | 0.181 | 0.174 | 0.167 | 0.154 |

| 35350011-ESAP(55th) | 0.505 | 0.370 | 0.493 | 0.640 | 0.581 | 0.533 | 27043000-CASAL(119th) | 0.168 | 0.178 | 0.187 | 0.205 | 0.162 | 0.130 |

| 42083011-CIA de Águas(56th) | 0.501 | 0.472 | 0.468 | 0.493 | 0.509 | 0.578 | 21112012-BRK(120th) | 0.156 | 0.169 | 0.141 | 0.161 | 0.159 | 0.152 |

| 51018012-ABG(57th) | 0.498 | 0.461 | 0.472 | 0.539 | 0.520 | 0.507 | 11004512-ABU(121st) | 0.139 | 0.092 | 0.114 | 0.152 | 0.200 | 0.214 |

| 33010011-CAP(58th) | 0.491 | 0.504 | 0.501 | 0.482 | 0.492 | 0.478 | 51060011-ANOR(122th) | 0.109 | 0.110 | 0.107 | 0.114 | 0.106 | 0.108 |

| 51079011-AS(59th) | 0.491 | 0.382 | 0.445 | 0.508 | 0.568 | 0.632 | 22110000-AGESPISA(123th) | 0.102 | 0.120 | 0.095 | 0.098 | 0.099 | 0.103 |

| 22110011-AT(60th) | 0.489 | 0.428 | 0.496 | 0.509 | 0.501 | 0.525 | 21075012-BRK(124th) | 0.089 | 0.073 | 0.096 | 0.099 | 0.092 | 0.089 |

| 51033011-AC(61st) | 0.486 | 0.350 | 0.455 | 0.617 | 0.577 | 0.530 | 21113000-CAEMA(125th) | 0.077 | 0.084 | 0.080 | 0.086 | 0.077 | 0.063 |

| 26116000-COMPESA(62nd) | 0.470 | 0.486 | 0.474 | 0.461 | 0.471 | 0.460 | 33045511-FABZO(126th) | 0.069 | 0.072 | 0.068 | 0.069 | 0.068 | 0.068 |

| 35303011-SANESSOL(63rd) | 0.460 | 0.418 | 0.453 | 0.540 | 0.489 | 0.423 | 13026000-COSAMA(127th) | 0.033 | 0.039 | 0.012 | 0.075 | 0.079 | 0.072 |

| 42024511-AB(64th) | 0.458 | 0.378 | 0.420 | 0.477 | 0.519 | 0.540 |

References

- Tourinho, M.; Santos, P.R.; Pinto, F.T.; Camanho, A.S. Performance assessment of water services in Brazilian municipalities: An integrated view of efficiency and access. Socio-Econ. Plan. Sci. 2022, 79, 101139. [Google Scholar] [CrossRef]

- Muriithi, J.M.; Ochieng, I.; Nzioki, P.M. The Effect of Improved Revenue-Collection Efficiency Strategy on the Performance of Wsps in Kenya: A Case Nyahururu Water And Sanitation Company, Nyahururu, Kenya. Strateg. J. Bus. Chang. Manag. 2019, 6, 1335–1341. [Google Scholar] [CrossRef]

- Ngotho, J.; Kerongo, F. Determinants of revenue collection in developing countries: Kenya’s tax collection perspective. J. Manag. Bus. Adm. 2014, 1, 1–9. [Google Scholar]

- Nekemia, A.; Atukunda, G.; Nuwagaba, A. On-spot billing system, cost of water, revenue collection mechanism & revenue collection performance of public utility entities evidence from NWSC Mbarara Centre. J. Dev. Educ. Technol. 2023, 1, 29–54. [Google Scholar]

- Murrar, A.; Paz, V.; Yerger, D.; Batra, M. Enhancing financial efficiency and receivable collection in the water sector: Insights from structural equation modeling. Util. Policy 2024, 87, 101723. [Google Scholar] [CrossRef]

- Brazil. Conselho Nacional do Ministério Público. Revista do CNMP: Água, vida e Direitos Humanos/Conselho Nacional do Ministério Público.—N. 7. 2018. Brasília: CNMP. 2018. Available online: https://www.cnmp.mp.br/portal/images/revista_final.pdf (accessed on 27 February 2024).

- Nauges, C.; Whittington, D. Evaluating the performance of alternative municipal water tariff designs: Quantifying the tradeoffs between equity, economic efficiency, and cost recovery. World Dev. 2017, 91, 125–143. [Google Scholar] [CrossRef]

- Barbosa, A.; Brusca, I. Governance structures and their impact on tariff levels of Brazilian water and sanitation corporations. Util. Policy 2015, 34, 94–105. [Google Scholar] [CrossRef]

- Romano, G.; Guerrini, A.; Vernizzi, S. Ownership, investment policies and funding choices of Italian water utilities: An empirical analysis. Water Resour. Manag. 2013, 27, 3409–3419. [Google Scholar] [CrossRef]

- Pereira, J.M. Defesa da concorrência e regulação econômica no Brasil. RAM. Rev. De Adm. Mackenzie 2022, 5, 35–55. [Google Scholar] [CrossRef]

- Leibenstein, H. Allocative efficiency vs.”X-efficiency”. Am. Econ. Rev. 1966, 56, 392–415. [Google Scholar]

- Brazil. Lei nº. 11.445, de 5 de janeiro de 2007. Diário Oficial da União, Brasília, DF. 5 jan. 2007. Available online: https://www.planalto.gov.br/ccivil_03/_ato2007-2010/2007/lei/l11445.htm (accessed on 28 February 2024).

- Brazil. Lei n. 14.026, de 15 de julho DE 2020. Diário Oficial da União, 16 de julho de 2020. Available online: https://www.planalto.gov.br/ccivil_03/_ato2019-2022/2020/lei/l14026.htm#:~:text=%E2%80%9CEstabelece%20as%20diretrizes%20nacionais%20para,11%20de%20maio%20de%201978.%E2%80%9D (accessed on 28 February 2024).

- Berg, S.V. Seven elements affecting governance and performance in the water sector. Util. Policy 2016, 43, 4–13. [Google Scholar] [CrossRef]

- Beecher, J.A. What matters to performance? Structural and institutional dimensions of water utility governance. Int. Rev. Appl. Econ. 2013, 27, 150–173. [Google Scholar] [CrossRef]

- Estrin, S.; Pelletier, A. Privatization in developing countries: What are the lessons of recent experience? World Bank Res. Obs. 2018, 33, 65–102. [Google Scholar] [CrossRef]

- Gonçalves, M.B.V.B. Privatização da Cedae: Na Contramão do Movimento Mundial de Remunicipalização dos Serviços de Saneamento. Geo UERJ 2017, 31, 81–103. [Google Scholar]

- Ferreira, J.G.; Gomes, M.F.B.; Dantas, M.W.d.A. Challenges and controversies of the new legal framework for basic sanitation in Brazil. Braz. J. Dev. 2021, 7, 65449–65468. [Google Scholar] [CrossRef]

- Kishimoto, S.; Petitjean, O. Cómo Ciudades y Ciudadanía Están Escribiendo el Futuro de los Servicios Públicos. The Transnational Institute. Available online: https://www.tni.org/es/publicaci%C3%B3n/remunicipalizacion-el-futuro-de-los-servicios-p%C3%BAblicos (accessed on 2 March 2024).

- Berg, S. Water Utility Benchmarking: Measurement, Methodologies and Performance Incentives, 9th ed.; International Water Association Publishing: London, UK, 2010. [Google Scholar]

- Baker, S.R.; Bloom, N.; Davis, S.J.; Terry, S.J. Covid-Induced Economic Uncertainty; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Oliveira, G.; Marcato, F.S.; Scazufca, P.; Ferreira, A.V. Estudo Técnico: Remunicipalização dos Serviços de Saneamento Básico. estudos de caso e debate 2018. Available online: https://goassociados.com.br/wpcontent/uploads/2018/11/Parecer-remunicipaliza%C3%A7%C3%A3o-saneamento.pdf (accessed on 2 March 2024). [CrossRef]

- Vieira, A.C. O direito Humano à água; Imprenta: Arraes Belo Horizonte, Brazil, 2016; pp. 1–128. [Google Scholar]

- Wichman, C.J. Perceived price in residential water demand: Evidence from natural experiment. J. Econ. Behav. Organ. 2014, 107, 308–323. [Google Scholar] [CrossRef]

- Namaliya, N.G. Strategies for Maximizing Revenue Collection in Public Water Utility Companies. Doctoral Dissertations, Walden University, Minneapolis, MN, USA, 2017. [Google Scholar]

- Martínez-Espiñeira, R.; García-Valiñas, M.A.; González-Gómez, F. Does private management of water supply services really increase prices? An empirical analysis in Spain. Urban Stud. 2009, 46, 923–945. [Google Scholar] [CrossRef]

- García-Valiñas, M.d.L.; González-Gómez, F.; Picazo-Tadeo, A.J. Is the price of water for residential use related to provider ownership? Empirical evidence from Spain. Util. Policy 2013, 24, 59–69. [Google Scholar] [CrossRef]

- Guerrini, A.; Romano, G.; Campedelli, B. Factors affecting the performance of water utility companies. Int. J. Public Sect. Manag. 2011, 24, 543–566. [Google Scholar] [CrossRef]

- Romano, G.; Guerrini, A.; Masserini, L. Endogenous and Environmental Determinants of Water Pricing Policy in Italy. 2013. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2331391 (accessed on 2 March 2024).

- Chong, E.; Huet, F.; Saussier, S.; Steiner, F. Public-private partnerships and prices: Evidence from water distribution in France. Rev. Ind. Organ. 2006, 29, 149–169. [Google Scholar] [CrossRef]

- Ruester, S.; Zschille, M. The impact of governance structure on firm performance: An application to the German water distribution sector. Util. Policy 2010, 18, 154–162. [Google Scholar] [CrossRef]

- Bitrán, G.A.; Valenzuela, E.P. Water Services in Chile: Comparing Private and Public Performance. 2003. Available online: https://documents1.worldbank.org/curated/pt/455861468769468006/pdf/261260viewpoint.pdf (accessed on 2 March 2024).

- Marin, P. Public Private Partnerships for Urban Water Utilities: A Review of Experiences in Developing Countries; n° 8; The world Bank: Washington, DC, USA, 2009; pp. 1–177. [Google Scholar]

- Estache, A.; Trujillo, L. Efficiency effects of “privatization” in argentina’s water and sanitation services. Water Policy 2003, 5, 369–380. [Google Scholar] [CrossRef]

- Zaki, S.; Amin, A.N. Does basic services privatisation benefit the urban poor? Some evidence from water supply privatisation in Thailand. Urban Stud. 2009, 46, 2301–2327. [Google Scholar] [CrossRef]

- Oliveira, A.R. Private Provision of Water Service in Brazil: Impacts on Access and Affordability. MPRA paper 11149. University Library of Munich, Germany. 2008. Available online: https://mpra.ub.uni-muenchen.de/11149/1/MPRA_paper_11149.pdf (accessed on 2 March 2024).

- Berg, S.; Marques, R. Quantitative studies of water and sanitation utilities: A benchmarking literature survey. Water Policy 2011, 13, 591–606. [Google Scholar] [CrossRef]

- Abbott, M.; Cohen, B. Productivity and efficiency in the water industry. Util. Policy 2009, 17, 233–244. [Google Scholar] [CrossRef]

- Carvalho, P.; Marques, R.C.; Berg, S. A meta-regression analysis of benchmarking studies on water utilities market structure. Util. Policy 2012, 21, 40–49. [Google Scholar] [CrossRef]

- Worthington, A.C. A review of frontier approaches to efficiency and productivity measurement in urban water utilities. Urban Water J. 2014, 11, 55–73. [Google Scholar] [CrossRef]

- Barbosa, A.; de Lima, S.C.; Brusca, I. Governance and efficiency in the Brazilian water utilities: A dynamic analysis in the process of universal access. Util. Policy 2016, 43, 82–96. [Google Scholar] [CrossRef]

- Sabbioni, G. Efficiency in the Brazilian sanitation sector. Util. Policy 2008, 16, 11–20. [Google Scholar] [CrossRef]

- da Motta, R.S.; Moreira, A. Efficiency and regulation in the sanitation sector in Brazil. Util. Policy 2006, 14, 185–195. [Google Scholar] [CrossRef]

- Cetrulo, T.B.; Marques, R.C.; Malheiros, T.F. An analytical review of the efficiency of water and sanitation utilities in developing countries. Water Res. 2019, 161, 372–380. [Google Scholar] [CrossRef] [PubMed]

- Ferro, G.; Lentini, E.J.; Mercadier, A.C.; Romero, C.A. Efficiency in Brazil’s water and sanitation sector and its relationship with regional provision, property and the independence of operators. Util. Policy 2014, 28, 42–51. [Google Scholar] [CrossRef]

- Tupper, M. Resende Efficiency and regulatory issues in the brazilian water and sewage sector: An empirical study. Util. Policy 2004, 12, 29–40. [Google Scholar] [CrossRef]

- Carmo, C.M.; Tavora, J.L., Jr. Avaliação da eficiência Técnica das Empresas de Saneamento Brasileiras Utilizando a Metodologia DEA. In National Meeting on Economics of the Anpec; Porto Seguro: São Paulo, Brazil, 2003; Volume 31, Available online: http://www.anpec.org.br/encontro2003/artigos/D32.pdf (accessed on 5 March 2024).

- Grigolin, R. Setor de água e saneamento no Brasil: Regulamentação e eficiência. Doctoral Dissertations, São Paulo: FGV. Mestrado Dissertação, Escola de Economia de São Paulo, Fundação Getúlio Vargas, São Paulo, Brazil, 2007. [Google Scholar]

- Sampaio, B.; Sampaio, Y. Influências políticas na eficiência de empresas de saneamento brasileiras. Econ. Apl. São Paulo 2007, 11, 369–386. [Google Scholar] [CrossRef][Green Version]

- Sato, J.M. Utilização da análise envoltória de dados (DEA) no estudo de eficiência do setor de saneamento. UCB, Brasília. Master’s Dissertation, Universidade Católica de Brasília, Brasília, Brazil, 2011. [Google Scholar]

- de Mello, M.F. Privatização do setor de saneamento no Brasil: Quatro experiências e muitas lições. Econ. Apl. 2005, 9, 495–517. [Google Scholar] [CrossRef][Green Version]

- Vining, A.R.; Boardman, A.E. Ownership versus competition: Efficiency in public enterprise. Public Choice 1992, 73, 205–239. [Google Scholar] [CrossRef]

- Barbosa, A. Análisis de la gestión económico-financiera y universalización de los servicios públicos de abastecimiento y saneamiento de agua: Una aplicación empírica para Brasil. Doctoral Dissertations, Universidad de Zaragoza, Zaragoza, Spain, 2011. [Google Scholar]

- Renzetti, S.; Dupont, D. Ownership and Performance of Water Utilities. Greener Manag. Int. 2003, 42, 9–19. [Google Scholar] [CrossRef]

- Borsani, H. Relações entre política e economia: Teoria da escolha pública. In Biderman y Paulo Arvate (coord.). Economia do setor público no Brasil; Elsevier: Rio de Janeiro, Brazil, 2004; pp. 103–125. [Google Scholar]

- Faraia, R.C.D.; Moreira, T.B.S.; Souza, G.S. Public versus private water utilities: Empirical evidence for Brazilian companies. Econ. Bull. 2005, 8, 1–7. [Google Scholar]

- Carvalho, A.E.C.; Sampaio, L.M.B. Paths to universalize water and sewage services in Brazil: The role of regulatory authorities in promoting efficient service. Util. Policy 2015, 34, 1–10. [Google Scholar]

- Carvalho, P.; Pedro, I.; Marques, R.C. The most efficient clusters of Brazilian water companies. Water Policy 2015, 17, 902–917. [Google Scholar] [CrossRef]

- Akerlof, G.A. The Market for ‘Lemons’: Quality Uncertainty and the Market for Lemons. Q. J. Econ. 1970, 84, 488–500. [Google Scholar] [CrossRef]

- Spence, M. Job Market Signaling. In Uncertainty in Economics; Academic Press: Cambridge, MA, USA, 1978; pp. 281–306. [Google Scholar]

- Morris, R.D. Signalling, agency theory and accounting policy choice. Account. Bus. Res. 1987, 18, 47–56. [Google Scholar] [CrossRef]

- Sato, I.D. Gestão Econômica em Serviços: Procedimento de Cobrança Para Recuperação de Receita em Núcleos de BAIXA renda. Master’s Thesis, Universidade Nove de Julho, São Paulo, Brazil, 2013. [Google Scholar]

- Wagenhofer, A. The role of revenue recognition in performance reporting. Account. Bus. Res. 2014, 44, 349–379. [Google Scholar] [CrossRef]

- Oghoghomeh, T.; Anthony, O. Entrepreneur‘s nightmare—Corporate failure: Consequences and probable solutions. Res. J. Financ. Account. 2013, 4, 45–53. [Google Scholar]

- Boyle, C.E. Adapting to change: Water utility financial practices in the early twenty-first century. Am. Water Work. Assoc. 2014, 106, E1–E9. [Google Scholar] [CrossRef]

- Zhu, J. Multi-factor performance measure model with an application to Fortune 500 companies. Eur. J. Oper. Res. 2000, 123, 105–124. [Google Scholar] [CrossRef]

- Dyson, R.; Allen, R.; Camanho, A.; Podinovski, V.; Sarrico, C.; Shale, E. Pitfalls and protocols in DEA. Eur. J. Oper. Res. 2001, 132, 245–259. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S. Intertemporal Production Frontiers: With Dynamic DEA, 1st ed.; Kluwer Academic Publishers: Boston, MA, USA, 1996; 202p. [Google Scholar]

- Nemoto, J.; Goto, M. Dynamic data envelopment analysis: Modeling intertemporal behavior of a firm in the presence of productive inefficiencies. Econ. Lett. 1999, 64, 51–56. [Google Scholar] [CrossRef]

- Nemoto, J.; Goto, M. Measurement of Dynamic Efficiency in Production: An Application of Data Envelopment Analysis to Japanese Electric Utilities. J. Product. Anal. 2003, 19, 191–210. [Google Scholar] [CrossRef]

- Sengupta, J.K. A dynamic efficiency model using data envelopment analysis. Int. J. Prod. Econ. 1999, 62, 209–218. [Google Scholar] [CrossRef]

- Sengupta, J.K. Nonparametric efficiency analysis under uncertainty using data envelopment analysis. Int. J. Prod. Econ. 2005, 95, 39–49. [Google Scholar] [CrossRef]

- Sengupta, J.K. Persistence of dynamic efficiency in Farrell models. Appl. Econ. 2010, 29, 665–671. [Google Scholar] [CrossRef]

- Wang, M.-H.; Huang, T.-H. A study on the persistence of Farrell’s efficiency measure under a dynamic framework. Eur. J. Oper. Res. 2007, 180, 1302–1316. [Google Scholar] [CrossRef]

- von Geymueller, P. Static versus dynamic DEA in electricity regulation: The case of US transmission system operators. Cent. Eur. J. Oper. Res. 2009, 17, 397–413. [Google Scholar] [CrossRef]

- Chen, C.-M.; van Dalen, J. Measuring dynamic efficiency: Theories and an integrated methodology. Eur. J. Oper. Res. 2010, 203, 749–760. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Dynamic DEA: Aslacks-based measure approach. Omega 2010, 38, 145–156. [Google Scholar] [CrossRef]

- Pointon, C.; Matthews, K. Dynamic Efficiency in the English and Welsh Water and Sewerage Industry. Omega 2015, 58, 86–96. [Google Scholar] [CrossRef]

- Addae, E.A.; Sun, D.; Abban, O.J. Evaluating the effect of urbanization and foreign direct investment on water use efficiency in West Africa: Application of the dynamic slacks-based model and the common correlated effects mean group estimator. Environ. Dev. Sustain. 2023, 25, 5867–5897. [Google Scholar] [CrossRef]

- Carvalho, A.E.C.; Sampaio, R.M.B.; Sampaio, L.M.B. The impact of regulation on the Brazilian water and sewerage companies’ efficiency. Socio-Econ. Plan. Sci. 2023, 87, 101537. [Google Scholar] [CrossRef]

- Pronunciamento Técnico CPC 48 Instrumentos Financeiros, Correlação às Normas Internacionais de Contabilidade—IFRS 9. (2016, 04 de novembro). Brasília, DF: Comitê de Pronunciamentos Contábeis. Available online: http://static.cpc.aatb.com.br/Documentos/530_CPC_48.pdf (accessed on 5 March 2024).

- Azhar, S.; Zeeshan, K. Receivables Management: A Study of Select State Owned Power Distribution Utilities in India. Financ. India 2021, 35, 1173. [Google Scholar]

- Murrar, A.; Batra, M.; Rodger, J. Service quality and customer satisfaction as antecedents of financial sustainability of the water service providers. TQM J. 2021, 33, 1867–1885. [Google Scholar] [CrossRef]

- World Bank. Performance Improvement Planning: Developing Effective Billing and Collection Practices (1 April 2008). World Bank Policy Research Working Paper No. 44119. Available online: https://ssrn.com/abstract=1149069 (accessed on 5 March 2024).

- Carteado-fatima, E.F. Vermersch-michel. Non-Revenue Water and Revenue Collection Ratio: Review, Assessment and Recommendations. 2016. Available online: https://mcast.edu.mt/wp-content/uploads/New-Appendix-6-Non-Revenue-Water-and-Revenue-Collection-Ratio-Review-Assessment-and-Recommendations.-Carteado.pdf (accessed on 5 March 2024).

- Alegre, H.; Baptista, J.M.; Cabrera, E., Jr.; Cubillo, F.; Duarte, P.; Hirner, W.; Merkel, W.; Parena, R. Performance Indicators for Water Supply Services; IWA Publishing: London, UK, 2010. [Google Scholar]

- Matos, R.; Cardoso, A.; Ashley, R.M.; Duarte, P.; Molinari, A.; Schulz, A. (Eds.) Performance Indicators for Wastewater Services; IWA Publishing: London, UK, 2003. [Google Scholar]

- Liang, K.-Y.; Zeger, S.L. Longitudinal data analysis using generalized linear models. Biometrika 1986, 73, 13–22. [Google Scholar] [CrossRef]

- Jalali, N.; Seyed, G.; Nouralizadeh, H.R. A two-stage DEA to analyze the effect of entrance deregulation on Iranian insurers: A robust approach. Math. Probl. Eng. 2012, 2012, 423524. [Google Scholar] [CrossRef]

- Dohmen, P.; van Ineveld, M.; Markus, A.; van der Hagen, L.; van de Klundert, J. Does competition improve hospital performance: A DEA based evaluation from the Netherlands. Eur. J. Health Econ. 2023, 24, 999–1017. [Google Scholar] [CrossRef] [PubMed]

- Hardin, J.; Hilbe, J. Generalized Linear Model and Extensions, 2nd ed.; Stata Press Publication: College Station, TX, USA, 2007. [Google Scholar]

- Mbuvi, D.; De Witte, K.; Perelman, S. Urban water sector performance in Africa: A step-wise bias-corrected efficiency and effectiveness analysis. Util. Policy 2012, 22, 31–40. [Google Scholar] [CrossRef]

- See, K.F. Exploring and analysing sources of technical efficiency in water supply services: Some evidence from Southeast Asian public water utilities. Water Resour. Econ. 2015, 9, 23–44. [Google Scholar] [CrossRef]

- Sabbioni, G. Econometric Measures of the Relative Efficiency of Water and Sewerage Utilities in Brazil; Guillermo Sabbioni Research; University of Florida: Gainesville, FL, USA, 2006; pp. 1–39. [Google Scholar]

- Gupta, S.; Kumar, S.; Sarangi, G.K. Measuring the performance of water service providers in urban India: Implications for managing water utilities. Water Policy 2012, 14, 391–408. [Google Scholar] [CrossRef]

- Ferro, G.; Romero, C.A.; Covelli, M.P. Regulation and performance: A production frontier estimate for the Latin American water and sanitation sector. Util. Policy 2011, 19, 211–217. [Google Scholar] [CrossRef]

- Marques, R.C. Measuring the total factor productivity of the Portuguese water and sewerage services. Econ. Apl. 2008, 12, 215–237. [Google Scholar] [CrossRef]

- Souza, G.d.S.e.; de Faria, R.C.; Moreira, T.B.S. Efficiency of Brazilian public and private water utilities. Estud. Econômicos 2008, 38, 905–917. [Google Scholar] [CrossRef]

- Nauges, C.; Berg, C.v.D. Economies of density, scale and scope in the water supply and sewerage sector: A study of four developing and transition economies. J. Regul. Econ. 2008, 34, 144–163. [Google Scholar] [CrossRef]

- Johns Hopkins University. COVID-19 dashboard. Center for Systems Science and Engineering (CSSE). 2020. Available online: https://coronavirus.jhu.edu/map.html (accessed on 5 March 2024).

- Brazil. The Ministry of Regional Development. National Sanitation Information System. Diagnóstico Temático Serviços de Água e Esgoto: Visão Geral, ano de referência 2020 [Thematic Diagnosis Water and Sewage Services: Overview, Reference Year 2020]. Available online: https://www.gov.br/cidades/pt-br/acesso-a-informacao/acoes-e-programas/saneamento/snis/produtos-do-snis/diagnosticos/DIAGNOSTICO_TEMATICO_VISAO_GERAL_AE_SNIS_2021.pdf (accessed on 5 March 2024).

- SIWI, UNICEF Brazil, The World Bank Policy Brief—August 2020: The key role of Water, Sanitation and Hygiene Promotion in the response to Covid-19 in Brazil. 2020. Available online: https://www.unicef.org/brazil/media/9746/file/policy-brief-wash-in-response-to-covid-19.pdf (accessed on 5 March 2024).

- Companhia de Água e Esgotos do Rio Grande do Norte (CAERN). 2023 Relatório Integrado de Gestão. Available online: https://arquivos-transparencia.caern.com.br/s/OUb6QbzywOcNeAe (accessed on 5 March 2024).

- Brazil. Lei n°. 13.982, de 2 de abril de 2020. Diário Oficial da União, Brasília, DF. 2 abr. 2020. Available online: https://www.planalto.gov.br/ccivil_03/_ato2019-2022/2020/lei/l13982.htm (accessed on 5 March 2024).

| Variable | Description | DSBM Specification | |

|---|---|---|---|

| Accumulated gross balance of the accounts receivable from utility j in year t, considering the last day of the reference year, as a result of billing for direct and indirect water and wastewater services (FN008 of the SNIS), and adjusted using the Brazilian price index IPCA/IBGE (measured in BRL). | |||

| Value effectively collected from all the operating revenues of utility j in year t (FN006 of the SNIS), adjusted using the Brazilian price index IPCA/IBGE (measured in BRL). | |||

| Value of the revenue from the direct and indirect provision of water and wastewater services proportional to the delay in the accounts receivable of utility j in year t. Adjusted using the Brazilian price index IPCA/IBGE (measured in BRL). | |||

| Variable | Obs. | Mean | Std. Dev. | Min. | Max. | |

|---|---|---|---|---|---|---|

| RECEIVABLE (Input) | 2018 | 127 | 165.869.467,21 | 657.283.064,94 | 74.646,46 | 6.897.348.366,50 |

| 2019 | 167.374.566,76 | 561.457.858,19 | 30.585,57 | 5.530.197.982,14 | ||

| 2020 | 158.014.639,85 | 491.273.835,81 | 79.843,79 | 4.591.003.333,72 | ||

| 2021 | 157.639.908,21 | 504.144.089,44 | 124.037,10 | 4.810.883.363,14 | ||

| 2022 | 163.443.068,09 | 533.186.618,26 | 15.745,76 | 5.071.957.155,28 | ||

| COLLECTION (Output) | 2018 | 127 | 471.691.116,07 | 1.749.687.069,82 | 692.011,06 | 17.226.245.956,49 |

| 2019 | 492.783.587,21 | 1.806.613.058,97 | 731.916,37 | 17.697.395.904,04 | ||

| 2020 | 488.928.181,88 | 1.777.387.685,86 | 781.831,46 | 17.223.734.191,47 | ||

| 2021 | 471.055.305,68 | 1.692.515.241,82 | 738.760,91 | 16.353.129.233,29 | ||

| 2022 | 496.094.613,70 | 1.810.782.140,01 | 984.241,22 | 17.821.953.434,74 | ||

| REVENUE (Good carry-over) | 2018 | 127 | 502.398.538,08 | 1.835.741.403,66 | 686.753,62 | 18.093.571.779,99 |

| 2019 | 532.450.227,00 | 1.983.504.112,52 | 726.061,35 | 19.634.345.685,23 | ||

| 2020 | 513.724.131,31 | 1.829.264.675,43 | 775.733,16 | 17.648.578.345,92 | ||

| 2021 | 499.887.041,02 | 1.779.251.733,57 | 754.463,03 | 17.248.220.283,74 | ||

| 2022 | 529.384.479,57 | 1.912.209.670,65 | 1.013.075,30 | 18.837.156.721,07 | ||

| Variable | REVENUE (Good Carry-over) | COLLECTION (Output) | |

|---|---|---|---|

| RECEIVABLE (Input) | 2018 | 0.845 (***) | 0.827 (***) |

| 2019 | 0.836 (***) | 0.815 (***) | |

| 2020 | 0.847 (***) | 0.830 (***) | |

| 2021 | 0.851 (***) | 0.827 (***) | |

| 2022 | 0.837 (***) | 0.821 (***) | |

| COLLECTION (Output) | 2018 | 0.973 (***) | |

| 2019 | 0.964 (***) | ||

| 2020 | 0.971 (***) | ||

| 2021 | 0.964 (***) | ||

| 2022 | 0.977 (***) | ||

| Variable | Obs. | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|

| EFF | 635 | 0.5057 | 0.2686 | 0.0115 | 1.0000 |

| Mann–Whitney tests | |||||

| Utilities on the stock market | 71 | 0.4767 | 0.2545 | Prob > |z| = 0.0000 | |

| Other utilities | 564 | 0.7361 | 0.2562 | ||

| Privately owned utilities | 475 | 0.4761 | 0.2439 | Prob > |z| = 0.0000 | |

| Publicly owned utilities | 160 | 0.5934 | 0.3162 | ||

| Water and sewage utilities | 487 | 0.5224 | 0.2554 | Prob > |z| = 0.0003 | |

| Utilities water or wastewater | 148 | 0.4505 | 0.3024 | ||

| Pre-COVID-19 period | 254 | 0.4741 | 0.2715 | Prob > |z| = 0.0072 | |

| COVID-19 period | 381 | 0.5267 | 0.2649 | ||

| CORP | 635 | 0.1118 | 0.3154 | 0.0000 | 1.0000 |

| OWN | 635 | 0.7480 | 0.4345 | 0.0000 | 1.0000 |

| REPCUST | 635 | 0.9166 | 0.0436 | 0.6025 | 1.0000 |

| DENSITY | 635 | 245.6764 | 112.1077 | 53.1081 | 728.0620 |

| SIZECUST | 635 | 10,117.78 | 109,895.70 | 0.0017 | 1,647,134.00 |

| URB | 635 | 2.5378 | 0.6100 | 0.5278 | 5.3328 |

| AFFOR | 635 | 0.1944 | 0.1415 | 0.0021 | 1.9383 |

| JOINT | 635 | 0.7669 | 0.4231 | 0.0000 | 1.0000 |

| COVID-19 | 635 | 0.6000 | 0.4903 | 0.0000 | 1.0000 |

| Model 1—Exchangeable | Model 2—Independent | Model 2—AR (1) | ||||

|---|---|---|---|---|---|---|

| Binomial Logit | Binomial Identity | Binomial Logit | Binomial Identity | Binomial Logit | Binomial Identity | |

| OWN | −0.061651900 | −0.050723000 | −0.111411700 | −0.111236400 | −0.087367800 | −0.081416900 |

| −0.97 (0.332) | −0.84 (0.404) | −1.82 (0.069) * | −1.98 (0.047) ** | −1.45 (0.147) | −1.37 (0.171) | |

| CORP | 0.130064000 | 0.108718100 | 0.207300200 | 0.188442800 | 0.095203100 | 0.074438700 |

| 1.74 (0.082) * | 1.68 (0.093) * | 2.52 (0.012) ** | 2.49 (0.013) ** | 1.66 (0.097) * | 1.7 (0.089) * | |

| REPCUST | 0.001722000 | −0.009210100 | −0.272000200 | −0.313330100 | 0.110811400 | 0.094847600 |

| 0.01 (0.993) | −0.04 (0.964) | −0.67 (0.504) | −0.78 (0.434) | 0.48 (0.628) | 0.43 (0.668) | |

| DENSITY | 0.000220000 | 0.000215300 | −0.000016300 | −0.000045500 | 0.000219000 | 0.000219400 |

| 1.43 (0.152) | 1.5 (0.133) | −0.07 (0.944) | −0.22 (0.825) | 0.94 (0.350) | 0.98 (0.329) | |

| SIZECUST | −0.000000065 | −0.000000038 | 0.000000009 | 0.000000041 | −0.000000011 | −0.000000004 |

| −3.72 (0.000) *** | −2.07 (0.038) ** | 0.11 (0.914) | 0.65 (0.517) | −1.12 (0.261) | −0.3 (0.763) | |

| URB | −0.016778700 | −0.014840200 | −0.168176000 | −0.153196900 | −0.021120200 | −0.018322600 |

| −0.81 (0.418) | −0.74 (0.461) | −3.87 (0.000) *** | −4.48 (0.000) *** | −0.94 (0.348) | −0.83 (0.406) | |

| AFFOR | 0.067605200 | 0.065856700 | −0.419747600 | −0.377515900 | 0.089764100 | 0.088255400 |

| 0.83 (0.404) | 0.89 (0.373) | −2.5 (0.012) ** | −3.85 (0.000) *** | 0.86 (0.388) | 0.94 (0.348) | |

| JOINT | 0.069453100 | 0.074361500 | 0.037114700 | 0.036536300 | 0.060850500 | 0.063340200 |

| 3.3 (0.001) *** | 3.88 (0.000) *** | 0.68 (0.497) | 0.74 (0.459) | 4.74 (0.000) *** | 5.58 (0.000) *** | |

| COVID19 | 0.053706100 | 0.052483800 | 0.031000500 | 0.029180300 | 0.042980300 | 0.041824700 |

| 6.31 (0.000) *** | 6.21 (0.000) *** | 2.63 (0.008) *** | 2.86 (0.004) *** | 7.39 (0.000) *** | 7.36 (0.000) *** | |

| Robustness analysis | ||||||

| Wald chi2(9) | 196.91 | 260.77 | 421.87 | 414.02 | 201.38 | 242.71 |

| Prob > chi2 | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| QIC | 875.447 | 878.636 | 851.644 | 849.911 | 877.857 | 884.791 |

| QICu | 884.913 | 886.591 | 853.405 | 853.37 | 887.421 | 892.179 |

| Number of observations: 635 | ||||||

| Number of groups: 127 | ||||||

| Variance inflation factor (mean): 1.2 | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Barbosa, A.; Medeiros, F.A.S.d.; Simões, P. Governance and Efficiency in Brazilian Water Utilities: An Analysis Based on Revenue Collection Efficiency. Water 2024, 16, 2483. https://doi.org/10.3390/w16172483

Barbosa A, Medeiros FASd, Simões P. Governance and Efficiency in Brazilian Water Utilities: An Analysis Based on Revenue Collection Efficiency. Water. 2024; 16(17):2483. https://doi.org/10.3390/w16172483

Chicago/Turabian StyleBarbosa, Alexandro, Felipe Anderson Smith de Medeiros, and Pedro Simões. 2024. "Governance and Efficiency in Brazilian Water Utilities: An Analysis Based on Revenue Collection Efficiency" Water 16, no. 17: 2483. https://doi.org/10.3390/w16172483

APA StyleBarbosa, A., Medeiros, F. A. S. d., & Simões, P. (2024). Governance and Efficiency in Brazilian Water Utilities: An Analysis Based on Revenue Collection Efficiency. Water, 16(17), 2483. https://doi.org/10.3390/w16172483