Exploring Cruise Tourists’ Preferences and Satisfaction: The Case of Taiwan

Abstract

:1. Introduction

2. Materials and Methods

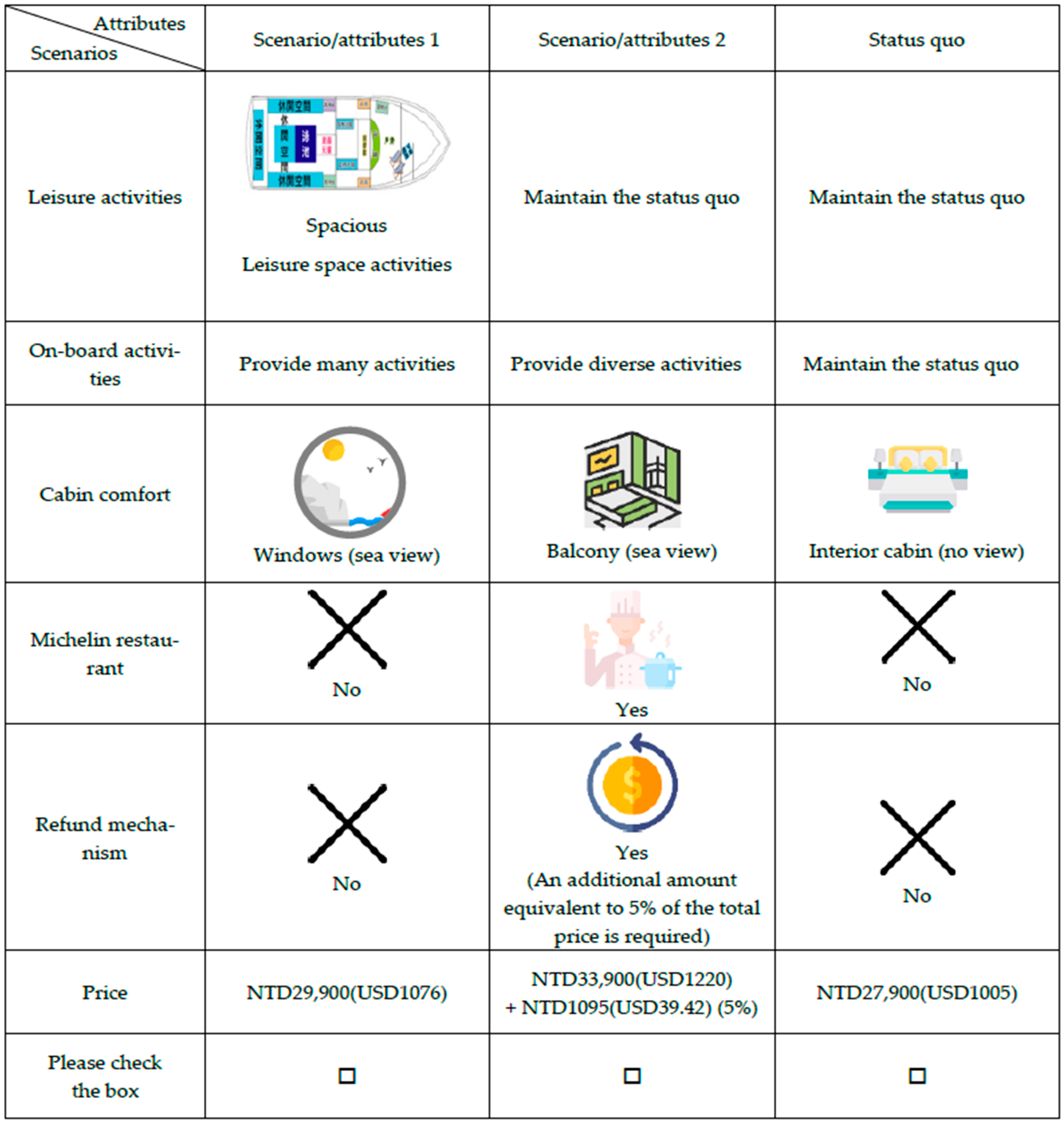

2.1. Choice Experiment Design

2.1.1. Leisure Space

2.1.2. On-Board Activities

2.1.3. Cabin Comfort

2.1.4. Michelin Restaurants

2.1.5. Refund Mechanism

2.2. Model Selection and Analysis

2.2.1. CL

2.2.2. RPL

2.2.3. Marginal Willingness to Pay (MWTP) for Attributes

2.2.4. Sample Size and Composition

3. Results

3.1. Importance Cruisers Attach to the Attributes and Travel Safety of Cruise Tours

3.2. Cruisers’ Preferred Travel Portfolio

3.3. Results of CL and RPL

3.4. The Effect of Respondents’ Socioeconomic Background on the Differences of MWTP for Cruise Tours

4. Discussion

5. Conclusions

5.1. Conclusions

5.2. Research Limitations and Future Research Directions

- This study only focused on five attributes of cruise tours (leisure space, on-board activities, cabin comfort, Michelin restaurant, and refund mechanism). There are also other attributes related to cruise tours to be explored: for example, the attractiveness of cruise routes or cruisers’ willingness to revisit, which can help to better understand consumers’ preferences for different cruise attributes or how to capture loyal customers’ preferences, thereby increasing the return rate of customers.

- The development of science and technology has begun to gradually influence the cruise industry. Foreign companies have promoted smart cabins, which can adjust the internal environment through the sensors in the cabin to create a more comfortable cabin space for cruisers. Princess Cruises in Taiwan has also promoted the “Ocean Medallion,” which is a wearable device that can strengthen the interaction between cruisers and service personnel and provide customized services. In the future, we can also explore if cruise ships can add technology-based services and ways to increase cruisers’ willingness to travel and their overall satisfaction by using the technology acceptance model.

- This study surveyed passengers who have taken cruise tours and not passengers of different groups. The results of this study show that family trips account for the highest proportion for motivation for taking a cruise. Future research can explore the preference and popularity among family groups for cruise tours.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Chen, C.A. How can Taiwan create a niche in Asia’s cruise tourism industry. Tour. Manag. 2016, 55, 173–183. [Google Scholar] [CrossRef]

- Cruise Lines International Association. 2020 State of the Cruise Industry Outlook. Available online: https://cruising.org/en/news-and-research/press-room/2019/december/clia-releases-2020-state-of-the-cruise-industry-outlook-report (accessed on 23 January 2021).

- The Official Website of Cruise in Taiwan of Taiwan International Ports Corporation. 2020. Available online: https://cruise.twport.com.tw/ (accessed on 21 March 2020).

- Lueck, M.; Seeler, S.; Radic, A. Hitting the reset button for post-COVID-19 cruise tourism: The case of Akaroa, Aotearoa New Zealand. Acad. Lett. 2021, 2, I9. [Google Scholar] [CrossRef]

- Cruise Industry News. Here’s How Much Cash the Cruise Lines Are Burning Through. Available online: https://www.cruiseindustrynews.com/cruise-news/24746-here-are-the-cruise-lines-operating-right-now-2.html (accessed on 22 January 2021).

- Statista Research Department. Expected Passenger Cruise Capacity in Operation Worldwide from May 2020 to January 2021, by Month. Available online: https://www.statista.com/statistics/1119828/cruise-capacity-in-operation-forecast-monthly/ (accessed on 10 February 2021).

- Xu, W.; Youn, H.-J.; Lee, C.-K. Role of Non-Pharmaceutical Interventions for COVID-19 in Cruise Tourists’ Decision-Making Process: An Extended Model of Goal-Directed Behavior. Sustainability 2021, 13, 5552. [Google Scholar] [CrossRef]

- Hung, K.; Petrick, J.F. Why do you cruise? Exploring the motivations for taking cruise holidays, and the construction of a cruising motivation scale. Tour. Manag. 2011, 32, 386–393. [Google Scholar] [CrossRef]

- Xie, H.; Kerstetter, D.L.; Mattila, A.S. The attributes of a cruise ship that influence the decision making of cruisers and potential cruisers. Int. J. Hosp. Manag. 2012, 31, 152–159. [Google Scholar] [CrossRef]

- Andriotis, K.; Agiomirgianakis, G. Cruise visitors’ experience in a Mediterranean port of call. Int. J. Tour. Res. 2010, 12, 390–404. [Google Scholar] [CrossRef]

- Wang, Y.; Jung, K.-A.; Yeo, G.-T.; Chou, C.-C. Selecting a cruise port of call location using the fuzzy-AHP method: A case study in East Asia. Tour. Manag. 2014, 42, 262–270. [Google Scholar] [CrossRef]

- Kwortnik, R.J. Shipscape influence on the leisure cruise experience. Int. J. Cult. Tour. Hosp. Res. 2008, 2, 289–311. [Google Scholar] [CrossRef] [Green Version]

- Qu, H.; Ping, E.W.Y. A service performance model of Hong Kong cruise travelers’ motivation factors and satisfaction. Tour. Manag. 1999, 20, 237–244. [Google Scholar] [CrossRef]

- Yi, S.; Jonathon, G.; Liping, A. Exploring Asian Cruise Travelers’ Travel Experience and Perceptions; Bepress: Berkeley, CA, USA, 2011. [Google Scholar]

- Price, L.L.; Marshall, A. Elements of Economics of Industry. Econ. J. 1892, 2, 316. [Google Scholar] [CrossRef] [Green Version]

- Govindasamy, R.; Italia, J. Predicting willingness-to-pay a premium for organically grown fresh produce. J. Food Distrib. Res. 1999, 30, 44–53. [Google Scholar]

- Wertenbroch, K.; Skiera, B. Measuring Consumers’ Willingness to Pay at the Point of Purchase. J. Mark. Res. 2002, 39, 228–241. [Google Scholar] [CrossRef]

- DE Pelsmacker, P.; Driesen, L.; Rayp, G. Do Consumers Care about Ethics? Willingness to Pay for Fair-Trade Coffee. J. Consum. Aff. 2005, 39, 363–385. [Google Scholar] [CrossRef]

- Casado-Díaz, A.B.; Sellers-Rubio, R.; Rodriguez-Sanchez, C.; Sancho-Esper, F. Predictors of willingness to pay a price premium for hotels’ water-saving initiatives. J. Travel Tour. Mark. 2020, 37, 773–784. [Google Scholar] [CrossRef]

- Ho, C.Q.; Hensher, D.A.; Mulley, C.; Wong, Y.Z. Potential uptake and willingness-to-pay for Mobility as a Service (MaaS): A stated choice study. Transp. Res. Part A Policy Pr. 2018, 117, 302–318. [Google Scholar] [CrossRef]

- Choi, A.; Ritchie, B.W.; Papandrea, F.; Bennett, J. Economic valuation of cultural heritage sites: A choice modeling approach. Tour. Manag. 2010, 31, 213–220. [Google Scholar] [CrossRef]

- Hoyos, D. The state of the art of environmental valuation with discrete choice experiments. Ecol. Econ. 2010, 69, 1595–1603. [Google Scholar] [CrossRef]

- Rudd, M.A. National values for regional aquatic species at risk in Canada. Endanger. Species Res. 2009, 6, 239–249. [Google Scholar] [CrossRef]

- Winter, K.; Cats, O.; Martens, K.; van Arem, B. A Stated-Choice Experiment on Mode Choice in an Era of Free-Floating Carsharing and Shared Autonomous Vehicles (No. 17-01321). In Proceedings of the Transportation Research Board 96th Annual Meeting, Washington, DC, USA, 8–12 January 2017. [Google Scholar]

- Stoiber, T.; Schubert, I.; Hoerler, R.; Burger, P. Will consumers prefer shared and pooled-use autonomous vehicles? A stated choice experiment with Swiss households. Transp. Res. Part D Transp. Environ. 2019, 71, 265–282. [Google Scholar] [CrossRef]

- Yan, Q.; Feng, T.; Timmermans, H. Private Parking Space Owners’ Decision in Response to Shared Parking Schemes under Uncertainty: Results of a Stated Choice Experiment; Eindhoven University of Technology: Washington, DC, USA, 2021. [Google Scholar]

- Liu, Q.; Yan, Z.; Zhou, J. Consumer Choices and Motives for Eco-Labeled Products in China: An Empirical Analysis Based on the Choice Experiment. Sustainability 2017, 9, 331. [Google Scholar] [CrossRef] [Green Version]

- Boccia, F.; Manzo, R.M.; Covino, D. Consumer behavior and corporate social responsibility: An evaluation by a choice experiment. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 97–105. [Google Scholar] [CrossRef] [Green Version]

- Kim, H.-J.; Kim, J.-H.; Yoo, S.-H. Social acceptance of offshore wind energy development in South Korea: Results from a choice experiment survey. Renew. Sustain. Energy Rev. 2019, 113, 109253. [Google Scholar] [CrossRef]

- Azarova, V.; Cohen, J.; Friedl, C.; Reichl, J. Designing local renewable energy communities to increase social acceptance: Evidence from a choice experiment in Austria, Germany, Italy, and Switzerland. Energy Policy 2019, 132, 1176–1183. [Google Scholar] [CrossRef] [Green Version]

- Neumann, R.; Mehlkop, G. Framing electricity plan choices to enhance green energy usage: A choice experiment with panel data from Germany. Energy Res. Soc. Sci. 2020, 70, 101741. [Google Scholar] [CrossRef]

- Rewitzer, S.; Huber, R.; Grêt-Regamey, A.; Barkmann, J. Economic valuation of cultural ecosystem service changes to a landscape in the Swiss Alps. Ecosyst. Serv. 2017, 26, 197–208. [Google Scholar] [CrossRef]

- Chaikaew, P.; Hodges, A.W.; Grunwald, S. Estimating the value of ecosystem services in a mixed-use watershed: A choice experiment approach. Ecosyst. Serv. 2017, 23, 228–237. [Google Scholar] [CrossRef] [Green Version]

- Owuor, M.A.; Mulwa, R.; Otieno, P.; Icely, J.; Newton, A. Valuing mangrove biodiversity and ecosystem services: A deliberative choice experiment in Mida Creek, Kenya. Ecosyst. Serv. 2019, 40, 101040. [Google Scholar] [CrossRef]

- Nordén, A.; Coria, J.; Jönsson, A.M.; Lagergren, F.; Lehsten, V. Divergence in stakeholders’ preferences: Evidence from a choice experiment on forest landscapes preferences in Sweden. Ecol. Econ. 2017, 132, 179–195. [Google Scholar] [CrossRef] [Green Version]

- Tyrväinen, L.; Mäntymaa, E.; Juutinen, A.; Kurttila, M.; Ovaskainen, V. Private landowners’ preferences for trading forest landscape and recreational values: A choice experiment application in Kuusamo, Finland. Land Use Policy 2021, 107, 104478. [Google Scholar] [CrossRef]

- Castellani, M.; Pattitoni, P.; Vici, L. Pricing Visitor Preferences for Temporary Art Exhibitions. Tour. Econ. 2015, 21, 83–103. [Google Scholar] [CrossRef]

- Oppewal, H.; Huybers, T.; Crouch, G.I. Tourist destination and experience choice: A choice experimental analysis of decision sequence effects. Tour. Manag. 2015, 48, 467–476. [Google Scholar] [CrossRef]

- Vogel, M.; Papathanassis, A.; Wolber, B. The Business and Management of Ocean Cruises; Cabi: London, UK, 2012. [Google Scholar]

- Mahadevan, R.; Chang, S. Valuing shipscape influence to maximise cruise experience using a choice experiment. Int. J. Hosp. Manag. 2017, 67, 53–61. [Google Scholar] [CrossRef]

- Lee, C.K.; Mjelde, J.W.; Kim, T.K.; Lee, E.; Choi, Y. Willingness-to-pay for whale tour attributes using a choice experiment. Asia Pac. J. Tour. Res. 2019, 24, 606–617. [Google Scholar] [CrossRef]

- Hwang, J.; Lyu, S.O.; Cho, S.-B. In-Flight Casinos, Is It Really a Nonsensical Idea? An Exploratory Approach Using Different Choice Experiments. Sustainability 2019, 11, 3038. [Google Scholar] [CrossRef] [Green Version]

- Wakefield, K.L.; Blodgett, J.G. The Importance of Servicescapes in Leisure Service Settings. J. Serv. Mark. 1994, 8, 66–76. [Google Scholar] [CrossRef]

- Eroglu, S.A.; Machleit, K.A. An empirical study of retail crowding: Antecedents and consequences. J. Retail. 1990, 66, 201. [Google Scholar]

- Xie, H. Examining the Role of Onboard Attributes and Temporal Distance in Individuals’ Pre-Purchase Evaluation of a Cruise (Doctoral Dissertation). 2011. Available online: https://etda.libraries.psu.edu/catalog/12046 (accessed on 13 March 2021).

- Gibson, P.; Parkman, R. Cruise Operations Management: Hospitality Perspectives; Routledge: London, UK, 2018. [Google Scholar]

- Pullman, M.; Gross, M.A. Ability of Experience Design Elements to Elicit Emotions and Loyalty Behaviors. Decis. Sci. 2004, 35, 551–578. [Google Scholar] [CrossRef]

- Surlemont, B.; Johnson, C. The role of guides in artistic industries: The special case of the “star system” in the haute-cuisine sector. Manag. Serv. Qual. 2005, 15, 577–590. [Google Scholar] [CrossRef]

- Kiatkawsin, K.; Han, H. What drives customers’ willingness to pay price premiums for luxury gastronomic experiences at michelin-starred restaurants? Int. J. Hosp. Manag. 2019, 82, 209–219. [Google Scholar] [CrossRef]

- Becker, N. A Comparative Analysis of the Pricing Systems of Nature Reserves. Tour. Econ. 2009, 15, 193–213. [Google Scholar] [CrossRef]

- Jiang, F.; Deng, L.; Zhang, L.; Cai, Y.; Cheung, C.W.; Xia, Z. Review of the Clinical Characteristics of Coronavirus Disease 2019 (COVID-19). J. Gen. Intern. Med. 2020, 35, 1545–1549. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Talluri, K.T.; Van Ryzin, G.J. The Theory and Practice of Revenue Management; Springer Science and Business Media LLC: Berlin/Heidelberg, Germany, 2004; Volume 68. [Google Scholar]

- Xie, J.; Gerstner, E. Service Escape: Profiting from Customer Cancellations. Mark. Sci. 2007, 26, 18–30. [Google Scholar] [CrossRef]

- Train, K.E. Discrete Choice Methods with Simulation; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Baskaran, R.; Cullen, R.; Colombo, S. Estimating values of environmental impacts of dairy farming in New Zealand. N. Z. J. Agric. Res. 2009, 52, 377–389. [Google Scholar] [CrossRef] [Green Version]

- Revelt, D.; Train, K. Mixed Logit with Repeated Choices: Households’ Choices of Appliance Efficiency Level. Rev. Econ. Stat. 1998, 80, 647–657. [Google Scholar] [CrossRef]

- Petrin, A.; Train, K. Omitted Product Attributes in Discrete Choice Models; National Bureau of Economic Research: Cambridge, MA, USA, 2003. [Google Scholar]

- Burton, M.; Rigby, D.; Young, T.; James, S. Consumer attitudes to genetically modified organisms in food in the UK. Eur. Rev. Agric. Econ. 2001, 28, 479–498. [Google Scholar] [CrossRef] [Green Version]

- Birol, E.; Koundouri, P. (Eds.) Choice Experiments Informing Environmental Policy: A European Perspective; Edward Elgar Publishing: Cheltenham, UK, 2008. [Google Scholar]

- Train, K.; Weeks, M. Discrete choice models in preference space and willingness-to-pay space. In Applications of Simulation Methods in Environmental and Resource Economics; Springer: Dordrecht, The Netherlands, 2005; Volume 6, pp. 1–16. [Google Scholar]

- Masiero, L.; Viglia, G.; Nieto-Garcia, M. Strategic consumer behavior in online hotel booking. Ann. Tour. Res. 2020, 83, 102947. [Google Scholar] [CrossRef]

- Chen, J.M.; Zhang, J.; Nijkamp, P. A regional analysis of willingness-to-pay in Asian cruise markets. Tour. Econ. 2016, 22, 809–824. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Z.; Ye, Q.; Song, H.; Liu, T. The structure of customer satisfaction with cruise-line services: An empirical investigation based on online word of mouth. Curr. Issues Tour. 2015, 18, 450–464. [Google Scholar] [CrossRef]

- Duman, T.; Mattila, A.S. The role of affective factors on perceived cruise vacation value. Tour. Manag. 2005, 26, 311–323. [Google Scholar] [CrossRef]

- Harrington, R.J.; Ottenbacher, M.C.; Way, K.A. QSR Choice: Key Restaurant Attributes and the Roles of Gender, Age and Dining Frequency. J. Qual. Assur. Hosp. Tour. 2013, 14, 81–100. [Google Scholar] [CrossRef]

- Harrington, R.J.; Fauser, S.G.; Ottenbacher, M.C.; Kruse, A. Key Information Sources Impacting Michelin Restaurant Choice. J. Foodserv. Bus. Res. 2013, 16, 219–234. [Google Scholar] [CrossRef] [Green Version]

- William, H., Jr. The Fabulous Interiors of the Great Ocean Liners in Historic Photographs; Dover Publications: New York, NY, USA, 2013. [Google Scholar]

- Lee, M.-K.; Yoo, S.-H. Using a Choice Experiment (CE) to Value the Attributes of Cruise Tourism. J. Travel Tour. Mark. 2014, 32, 416–427. [Google Scholar] [CrossRef]

- Guo, J.; Jiang, F. A novel electric vehicle thermal management system based on cooling and heating of batteries by refrigerant. Energy Convers. Manag. 2021, 237, 114145. [Google Scholar] [CrossRef]

| Attributes | Description of Attributes | Levels |

|---|---|---|

| Leisure space | To reduce cruisers’ negative emotions caused by crowded space, few decorations and designs are used on the deck of the cruise ship to make them feel more spacious. | (1) Maintain the status quo (2) Comfortable pool space (3) Spacious leisure space |

| On-board activities | There are usually a variety of activities on board, such as social events (e.g., wine tasting, Bingo.) and performances (e.g., nightclub shows, dance troupes). | (1) Maintain the status quo (2) Provide many activities (3) Provide diverse activities |

| Cabin comfort | The cabins are differentiated by the presence or absence of windows, and those with windows are further differentiated in price according to the size of the space. | (1) No sea view (interior cabin) (2) Sea view (window) (3) Sea view (balcony) |

| Michelin restaurant | In recent years, some cruise lines have started to add premium restaurants featuring Michelin star chefs to their ships for passengers to choose from. | (1) No (2) Yes |

| Refund mechanism | At the time of ordering a cruise, cruisers can only be offered a refund based on the cruise line’s assessments of weather conditions and so on. It is impossible for them to decide whether to cancel the voyage based on their own feelings or perceptions. *** The refund method designed for this study is 5% of the total price and will be charged as the refund fee, i.e., in case of refund, 5% of the total price will be deducted as the processing fee, and the rest will be refunded in full. | (1) No (2) 2.5% |

| Variables | Description | Sample Size | Percentage | Variables | Description | Sample Size | Percentage |

|---|---|---|---|---|---|---|---|

| Gender | Male | 208 | 47.4% | Average monthly personal salary | Less than NTD20,000 (USD720) (inclusive) | 34 | 7.8% |

| Female | 231 | 52.6% | NTD20,001–40,000 (USD720–1440) | 29 | 6.6% | ||

| Age | 20 years old (inclusive) or less | 25 | 5.7% | NTD40,001–60,000 (USD1440–2160) | 94 | 21.4% | |

| 21–30 years old | 43 | 9.8% | NTD60,001–80,000 (USD2160–2880) | 141 | 32.1% | ||

| 31–40 years old | 79 | 18.0% | NTD80,001–100,000 (USD2880–3600) | 108 | 24.6% | ||

| 41–50 years old | 142 | 32.3% | NTD100,001 (USD3600) or more | 33 | 7.5% | ||

| 51–60 years old | 115 | 26.2% | Number of cruises trips taken | 1 time | 264 | 60.1% | |

| 61 years old or above | 36 | 8.2% | 2~3 times | 128 | 29.2% | ||

| Occupation | Student | 47 | 10.7% | 4~5 times | 40 | 9.1% | |

| Agriculture, forestry, fishery, and animal husbandry | 23 | 5.2% | More than 6 times | 7 | 1.6% | ||

| Army, civil service, and education | 87 | 19.8% | Motivation for cruise tour | Honeymoon trip | 41 | 9.3% | |

| Service industry | 132 | 30.1% | Family travel | 311 | 70.8% | ||

| Self-employed | 89 | 20.3% | Employee travel | 43 | 9.8% | ||

| Retirees | 8 | 1.8% | Peer-to-peer travel | 44 | 10.1% | ||

| Other | 53 | 12.1% | |||||

| Education level | Junior high school (or below) | 15 | 3.4% | ||||

| High school | 150 | 34.2% | |||||

| College or university | 182 | 41.5% | |||||

| Master’s | 69 | 15.7% | |||||

| Doctorate | 23 | 5.2% | |||||

| Attributes and Levels | CL | RPL | ||||||

|---|---|---|---|---|---|---|---|---|

| Coefficient | t-value | MWTP | Coefficient | t-value | Standard deviation of coefficient | t-value | MWTP | |

| Leisure space (LSA1) | −0.950 | −5.10 *** | NTD475 (USD17.10) | −1.153 | −6.29 *** | 1.032 | 5.88 | NTD577 (USD20.77) |

| Leisure space (LSA2) | 0.487 | 2.53 * | NTD244 (USD8.78) | −0.372 | 1.71 ** | 0.408 | 2.12 *** | NTD186 (USD6.70) |

| On-board activities (OA1) | −0.992 | −6.64 *** | NTD496 (USD17.86) | −1.244 | −8.26 *** | 1.107 | 5.61 | NTD622 (USD22.39) |

| On-board activities (OA2) | 0.466 | 2.43 * | NTD233 (USD8.39) | 0.561 | 1.49 * | 0.499 | 1.27 | NTD281 (USD10.12) |

| Cabin comfort (CC1) | 1.258 | 2.66 ** | NTD629 (USD22.64) | 1.934 | 0.86 *** | 1.722 | 1.76 | NTD967 (USD34.81) |

| Cabin comfort (CC2) | 1.834 | 3.74 *** | NTD917 (USD33.01) | 2.433 | 2.27 *** | 2.245 | 2.84 | NTD1,216 (USD43.78) |

| Michelin restaurant (RM) | 0.941 | 4.46 *** | NTD824 (USD29.66) | 1.311 | 1.99 *** | 1.129 | 0.49 *** | NTD856 (USD30.82) |

| Refund mechanism (RF) | 0.291 | 2.01 * | NTD146 (USD5.26) | 0.527 | 0.48 ** | 0.331 | 0.93 | NTD264 (USD9.50) |

| Tour price (FUND) | −0.002 | −0.35 | −0.002 | −1.67 * | ||||

| Number of choice sets | 878 | 878 | ||||||

| Log-likelihood ratio | −745.651 | −589.744 | ||||||

| Socioeconomic Background | Sample Size | ASC | LSA2 | RM | ||||

|---|---|---|---|---|---|---|---|---|

| Mean | t-Value | Mean | t-Value | Mean | t-Value | |||

| Gender | Male | 208 | −22,453 | −2.37 | 205 | 1.82 | 901 | 1.39 |

| Female | 231 | −21,862 | 212 | 856 | ||||

| Age | 20 years (inclusive) or less | 25 | −17,623 | −3.61 ** | 134 | 1.67 * | 657 | 2.49 ** |

| 21–30 years | 43 | −19,570 | 156 | 723 | ||||

| 31–40 years | 79 | −25,237 | 190 | 861 | ||||

| 41–50 years | 142 | −26,433 | 225 | 880 | ||||

| 51–60 years | 115 | −27,091 | 241 | 921 | ||||

| 61 years or above | 36 | −25,746 | 237 | 904 | ||||

| Education level | Junior high school (or below) | 15 | −19,862 | 1.28 | 156 | 0.86 | 635 | 2.14 * |

| High school | 150 | −22,395 | 206 | 749 | ||||

| College or university | 182 | −23,412 | 219 | 837 | ||||

| Master’s | 69 | −23,561 | 220 | 841 | ||||

| Doctorate | 23 | −23,652 | 223 | 863 | ||||

| Average personal monthly salary | Less than NTD20,000(USD720) (inclusive) | 34 | −16,522 | −4.72 *** | 127 | 2.45 * | 598 | 2.47 * |

| NTD20,001–40,000 (USD720–1440) | 29 | −19,658 | 156 | 654 | ||||

| NTD40,001–60,000 (USD1440–2160) | 94 | −21,036 | 184 | 763 | ||||

| NTD60,001–80,000 (USD2160–2880) | 141 | −24,528 | 198 | 839 | ||||

| NTD80,001–100,000 (USD2880–3660) | 108 | −25,563 | 217 | 877 | ||||

| NTD100,001(USD3660) or more | 33 | −25,980 | 223 | 920 | ||||

| Number of cruise trips taken | 1 time | 264 | −21,803 | 0.75 | 186 | 1.02 | 747 | 1.88 |

| 2~3 times | 128 | −24,367 | 197 | 867 | ||||

| 4~5 times | 40 | −24,766 | 209 | 879 | ||||

| More than 6 times | 7 | −25,381 | 199 | 891 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chang, M.-Y.; Wang, C.-H.; Chen, H.-S. Exploring Cruise Tourists’ Preferences and Satisfaction: The Case of Taiwan. Water 2021, 13, 3183. https://doi.org/10.3390/w13223183

Chang M-Y, Wang C-H, Chen H-S. Exploring Cruise Tourists’ Preferences and Satisfaction: The Case of Taiwan. Water. 2021; 13(22):3183. https://doi.org/10.3390/w13223183

Chicago/Turabian StyleChang, Min-Yen, Chen-Hao Wang, and Han-Shen Chen. 2021. "Exploring Cruise Tourists’ Preferences and Satisfaction: The Case of Taiwan" Water 13, no. 22: 3183. https://doi.org/10.3390/w13223183

APA StyleChang, M.-Y., Wang, C.-H., & Chen, H.-S. (2021). Exploring Cruise Tourists’ Preferences and Satisfaction: The Case of Taiwan. Water, 13(22), 3183. https://doi.org/10.3390/w13223183