Abstract

Groundwater is a major alternative water source used to cover the deficit of water supplied by Kathmandu Upatyaka Khanepani Limited (KUKL), the authority responsible for water supply inside Kathmandu Valley. The groundwater price relative to that of KUKL affects priority of usage, and hence, groundwater resources sustainability. Therefore, taxation or subsidies on water sources become necessary based on their implication on environment. In this study, we evaluate volumetric water price, including initial investment, operation and maintenance (O&M) cost for different water sources, and compare it with the water price of KUKL, Kathmandu. The results show that shallow groundwater is cheaper than KUKL’s water. For groundwater sustainability, taxation on shallow groundwater seems necessary. For the recent water use of 97 LPCD (liters per capita per day) the taxation requirement is Nepalese Rupee (NRs.) 320/month (0.35% of total expenditure) if the initial investment for well construction and O&M cost are considered, and NRs. 626 (0.7% of total expenditure) if only O&M cost is considered. On the other hand, rainwater harvesting and recharging, the measures to cope with groundwater exploitation, might need 40% to 50% subsidy for their initial investment.

1. Introduction

The Dublin Water Principles [1] claim water as an economic good and emphasize the importance of water pricing for the sustainability of water services. “Natural monopoly” of the market in water services has long been discussed, where the distribution is controlled by a single authority [2]. The environmental aspects of water market are seldom considered while calculating water price. Rogers et al. [3] emphasize that to ensure environmental sustainability, the cost of environmental externalities also needs to be included while calculating water price. However, water market functions differently when consumers have several choices including informal competitors such as groundwater and vendors. Pricing policies need to consider these informal competitors as well. Furthermore, Kilimani et al. [4] assert that the water pricing policy will be sustainable only if pricing and regulatory institutions function properly. Consumer behavior also plays an important role while addressing the pricing issues as affordability is one of the main parameters for fixing water price [5]. However, the measurement of environmental externality cost and the enforcement through taxation and subsidies to provide competitive advantage to utility and environment has not been adequately discussed in research literatures. The focus on consumer welfare while fixing the environmental externality cost is a critical issue; and hence, in urban areas, sustainable water pricing policy with proper pricing and regulatory institutions, and utilities with real time knowledge of consumer behavior can be used as tools for maintaining water resources sustainability.

This study focuses on the interrelationship between consumer behavior, pricing policies for groundwater externalities and institutions in Kathmandu Valley, Nepal, that are responsible for making those pricing policies. The Kathmandu Valley Water Supply Management Board (KVWSMB) acts as the owner of the assets of the water and wastewater systems inside Kathmandu Valley and the Kathmandu Upatyaka Khanepani Limited (KUKL) operates the assets. The Water Tariff Fixation Commission (WTFC) is responsible for tariff regulation and fixation [6]. Moreover, the Groundwater Resource Development Board (GRDB), the Ministry of Environment (MoE) and Water and Energy Commission Secretariat (WECS) are also involved in groundwater management of Kathmandu Valley [7]. KUKL, the agency responsible for supplying potable water, has not been able to meet the increasing demand since 2006. The total demand in KUKL service area in 2015 was estimated at 370 million liters a day (MLD), of which 95–154 MLD was supplied by KUKL [8]. The deficit is now met up through private wells, groundwater pumping, stone spouts (traditional public tap-stands made with stone), water tankers, jar water (water sold in 20 liter plastic containers from water vendors), etc. [9]. Several studies suggest that shallow and deep groundwater are already under stress [10,11,12]. Moreover, deep groundwater extraction volume is already a lot higher than groundwater recharge [12]. Pandey et al. [10] project groundwater extraction to reach 25.5 million cubic meters (MCM) where groundwater recharge is merely 9.6 MCM. Furthermore, Pandey et al. [13] warn that the whole groundwater storage will be sufficient to supply only 100 years demand if same water extraction rate continues. Shrestha et al. [14] predict deep groundwater extraction combined with Kathmandu’s hydrogeology may have higher vulnerability in terms of aquifer subsidence with two distinctive hotspots in northern Kathmandu exhibiting up to 28 mm of subsidence. The dependency on alternative sources could further increase due to population growth, climate change, and so forth. The first phase of the major project responsible for Kathmandu drinking water supply services, the Melamchi Water Supply Project (MWSP) expected to finish by 2018. The utility is planning to cover operation and maintenance cost and some additional cost to pay the lease fees for KVWSMB (as per the personnel communication with procurement officer of MWSP), and it will add additional 170 MLD to water supply [15,16].

Ojha et al. [5] showed that equitable and sustainable water supply would be possible when KUKL water price is raised by 30% and water consumption is kept at 80 LPCD after the completion of the MWSP. The major concern with the informal water market is environmental sustainability and equitable distribution of water resources inside Kathmandu Valley. Our interest in this study is how groundwater exploitation can be replaced by Melamchi water by introducing economic instruments to reduce over extraction of groundwater. Environmental taxation is one of the approaches to manage the demand for water [4,17]. Although rainwater harvesting is seen as a measure to cope with groundwater extraction not only in Kathmandu but also in other cities such as Dhaka [18,19], it has not yet been seen as a major contributor to water supply despite sufficient amount of rainfall inside Kathmandu Valley [18,20]. The purpose-wise water use inside Kathmandu valley is dependent upon the specific sources and it is imperative to analyze the water use pattern before formulating the policies [18].

From these perspectives, this study attempts to identify the available measures of taxation and subsidies that may be adopted inside Kathmandu Valley for water resources sustainability. The purpose of this study is to determine the possible groundwater taxation and rainwater subsidies while comparing water supply prices of competitors, considering the measures both with and without initial investment and possible interventions for adopting the taxation and subsidies for the sustainable management of surface and groundwater in Kathmandu Valley.

2. Methodology

Our purpose is to propose the possible method to select the water use scenarios, which is economically rational for residents and for the utility, based on various mechanisms such as water pricing, taxation, subsidies. As feasibility of these mechanisms in terms of institutional consideration is important, we tried to integrate the qualitative information on institutional challenges and possible solution of sustainable water supply and environmental measures etc., with quantitative evaluation of water cost by a rather simple calculation method.

Figure 1 presents the methodological framework for this research. The types of water sources for each purpose of water use identified inside Kathmandu Valley were drinking, cooking, cleaning, etc. Specific sources for specific water use were determined through the percentage of people using the source for that specific water use purpose, where 70% was used as the threshold value for that purpose. The volumetric cost analysis was performed to compare water prices from different water sources. The supply and demand deficit of KUKL was calculated based on projected population with varying water demands to know the effect of water use during deficit. Key informant interviews were conducted to understand the possible institutional mechanism required for efficient measures regarding water resources conservation, taxation, and subsidies. Based on the results of the analysis, possible taxation and subsidies were identified.

Figure 1.

Methodological framework.

2.1. Analysis of Household’s Water Use

The purpose-wise water use (volume per day per household) based on consumers’ water diary for five days and purpose of each type of water (piped water, well water, jar water, tanker water, etc.) were analyzed to clarify people’s consumption behavior and preference of water source for a particular purpose from the results of a questionnaire survey. The details of the survey followed in this study are described in Shrestha et al. [20].

2.2. Water Price Calculation

The monthly water price for each water source for different water consumption scenarios per capita (LPCD) was estimated assuming 10 people in a house. The pipe water price was calculated based on the present tariff system [8], which is an increasing block tariff with NRs. 100 for the first 10 cubic meters (CuM) and NRs. 32 per cubic meter after 10 CuM. For shallow groundwater, the volumetric water price (NRs./CuM) was calculated based on the cost of initial investment and operation and maintenance (O&M) as shown in Equation (1).

where, VWP is Total Volumetric water cost (NRs./CuM), which is the summation of VWPi and VWPo Where, VWPI is volumetric initial investment cost (NRs./CuM) and VWPo is volumetric O&M cost (NRs./CuM). I is the initial investment required for construction (NRs.); CRF is the capital recovery factor; V is the volumetric water consumption for 10 people per year (CuM); r is the inflation rate (%); n is the life of a well (years); and Pp is a pump’s price (NRs). Because the life of a pump and that of a well are different, their capital recovery factor are also different. Hence, CRFp is the capital recovery factor for pump; O is the operational power requirement (kW); Pe is the price of electricity (NRs 12/kWH) and T is the pumping period (hrs/CuM)

VWP = VWPI + VWPo

VWPI = I × CRF/V

CRF = r×(1 + r)n/[(1 + r(n−1)]

VWPo = (Pp × CRFp)/V + O × Pe × T

Table 1 summarizes the basic data used for calculation. After consulting with KVWSMB’s officials, we assumed that r is 10% and n is 20 years, then CRF becomes 0.12. The volumetric O&M cost was composed of the purchasing cost of pump and electricity cost required for pumping water. A pump’s portion of volumetric water price was calculated using the same method as that of a well’s portion, which is shown in Equation (4). CRFp is 0.16, as we assumed the life of a pump to be 10 years.

Table 1.

Data summary.

The data required for initial investment and O&M of shallow dug well and shallow tube well were obtained from KVWSMB’s officials. The initial investment cost required for construction was calculated using the depth (12.5 ft for a dug well and 40 ft for a tube well) and per running meter cost requirement during the construction (NRs 2800/ft for a dug well and NRs. 500/ft for a tube well). The cost of the pump was NRs 7500 for a dug well and NRs 18,000 for a tube well.

The initial investment cost for a deep tube well was obtained from KVWSMB’s officials. Initial investment includes NRs 1,536,000 for the construction of a well, and NRs 150,000 for a three- horsepower pump. The yearly O&M cost (NRs 378,051) and the yearly volume of water production (7722 CuM) was adopted from Yoden et al. [6].

Rainwater cost was calculated by conducting a survey questionnaire with 16 key respondents involved in rainwater harvesting projects inside Kathmandu Valley. The survey included questions about the initial cost of rainwater systems and the amount of water production, etc. This survey only included the system for direct consumption of rainwater and not for groundwater recharge. The average initial cost (NRs 90,625) and the amount of production per month (1.44 CuM) from all respondents were used for calculation. The O&M cost of rainwater harvesting system was calculated from the O&M cost of a shallow dug well. For a shallow dug well the cost of electricity depends on the building height and depth of the dug well, whereas the electricity cost for rainwater harvesting was calculated by assuming that the pumping height is only the building height (Equation (5)) and that rainwater is stored in a tank on the ground and pumped up to the roof for use.

where Bh is the average building height (30 ft) and D is the average depth of a shallow dug well (12.5 ft).

VWPo = Pp × CRFp/V + O × Pe × T × (Bh)/(Bh + D)

Tanker water price (NRs 264/CuM) was calculated from the KUKL’s proposal for water price to WTFC [21], whereas, jar water price was set as (NRs 5000/CuM), which was obtained during the interview with KVWSMB’s officials. The total expenditure was taken from the household questionnaire mentioned above.

2.3. Water Supply and Demand Analysis

The present and future water demand of KUKL and other water sources were calculated from the 2011 base population from the Central Bureau of Statistics (CBS), and the annual growth of different areas of Kathmandu was estimated based on the space availability for residence according to the method suggested by Thapa et al. [22]. Considering various demand scenarios, KUKL’s water deficit was calculated to assess the possible impact on groundwater environment.

2.4. Identifying the Water Pricing Challenges

A qualitative questionnaire survey including oral interviews was performed among 21 key informants from 12 key institutions such as KUKL, MWSP, Project Implementation Directorate (PID), Ministry of Water Supply and Sanitation (MoWSS), Water and Energy Commission Secretariat (WECS), and Lalitpur and Kathmandu metropolitan cities, to understand the current scenario of water resource inside Kathmandu Valley especially financial regulations. The key informants were selected based on “Tremblay’s characteristics of ideal key informant”, which suggests that the ideal key informant should have a role in the concerned community and should have knowledge, willingness, communicability, and impartiality toward the interviewed subject [23]. Thus, officials working on key managerial posts especially among the top three posts were selected to satisfy the characteristics and more attention was given to select the informants with greater diversity [23]. The interview has covered most of the institutions directly related with water resource inside Kathmandu Valley. The content was analyzed and synthesized for the analysis following Zhang and Wildermouth [24], where the oral interview was recorded and later written in text form. A single theme on a particular subject from a unique respondent was considered as the unit of coding. Themes were developed by inductive analysis of the information provided by the respondents. Of several themes such as the legal aspects of water resource, water quality standards, local governments’ impact on water resources, private sector participation, water tariff and regulation, equitable distribution of water resources, the responses to “water tariff and regulation” has been used for this study.

2.5. Estimation of Groundwater Taxation

Groundwater, if cheaper than KUKL’s piped supply, has the chance to be the first choice of consumers for most of the domestic purposes. However, it is not favorable from the viewpoint of utility as well as environment. To limit the use of groundwater, groundwater tax was estimated in a way that makes the groundwater cost equal to KUKL water for each water use scenario. It was assumed that people will consume KUKL’s first block of water, and thus the required tax was assigned as the difference between water price of KUKL’s second block and other water sources.

3. Results and Discussion

3.1. Future Water Deficit

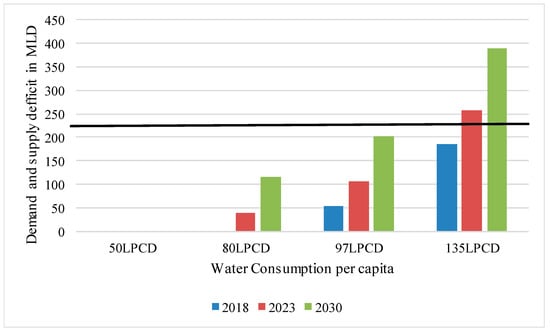

Future water deficit depends on water consumption pattern and population growth. The estimated population in 2018, 2023, and 2030 was found to be 3.44, 3.98, and 4.96 million respectively. The average water supplied by KUKL pre and post MWSP is approximately 109 MLD and 279 MLD, respectively. Figure 2 shows the possible water deficit after MWSP inside KUKL’s service area for some consumption scenarios. It shows that for water consumption scenario of 50 LPCD, there will not be any water deficit. The black straight line represents the present water deficit with 97 LPCD consumption. Note that 97 LPCD is the recent average consumption according to the survey mentioned in Section 2.1. Figure 2 projects that water deficit will be lesser than now if water consumption is 80 LPCD or 97 LPCD; however, it might exceed the current deficit by 2023 and 2030 if the water consumption increases post-MWSP to 135 LPCD, which is the designed water consumption for MWSP. The dependency on groundwater might increase in this scenario even after the completion of MWSP. As pointed out, the groundwater inside Kathmandu Valley is already under stress due to over extraction [13], and a possible solution to overcome the deficit with environmental sustainability is the demand management of household water use or alternative water options such as rainwater.

Figure 2.

Demand and supply deficit of KUKL water for various water consumption scenarios. The black straight line represents the water supply-demand deficit Pre-MWSP for KUKL.

Because KUKL is unable to meet the full water demand, people are using multiple water sources, and the choice of water source has depended on the purpose of water use inside the valley. Table 2 shows the water source as per the purpose of water use based on the household questionnaire survey [20]. People’s preference on Jar water and Piped water for drinking among the sources may be because of the water quality concerns of other sources.

Table 2.

Water sources inside the valley and their use preferences.

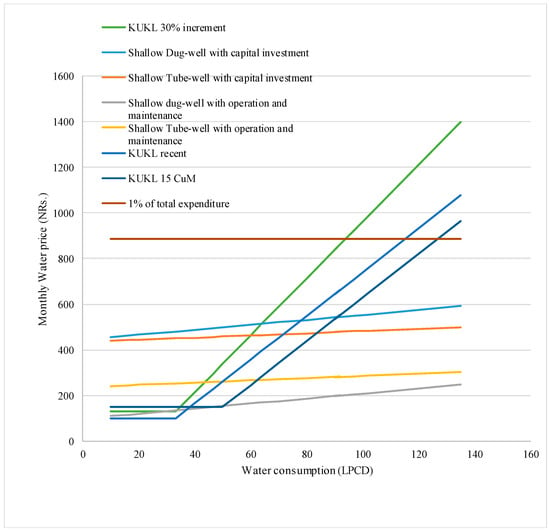

3.2. Monthly Water Price and Required Tax for Groundwater Use

Figure 3 shows the monthly cost for water against the water consumption of KUKL piped water and shallow dug well and tube well water. The costs were calculated for 10 people in each house, an average adopted from CBS’s report [25]. The brown line represents 1% of the total expenditure of the building with 10 people (NRs 883), derived from the household questionnaire survey and is used as maximum water expenditure, which can be allowed to maintain affordability [5]. The water price of deep tube well water, jar water, tanker water, and rainwater are not presented in Figure 3 because they are much higher compared to other options. The prices for tanker water and jar water were NRs 264/CuM, and NRs 5000/CuM, respectively, which correspond to NRs 792 and NRs 15,000 per month, respectively, for 10 LPCD scenario. The prices of rainwater harvesting and deep groundwater is NRs 701/CuM for the water use of 1.44 CuM/month, and NRs 71/CuM for the water use of 643 CuM/month, respectively. The price of rainwater harvesting cannot be compared with others because of its low production volume compared to other sources.

Figure 3.

Monthly water price of various sources per building depending on water consumption.

Regarding KUKL water cost, we assumed two types of increasing block tariffs (IBTs) in addition to the present system, depending on basic water requirement. There is a possibility of change in the first block of tariff system, depending on KUKL’s perception of basic water requirement. The present first block (10 CuM) corresponds to 33.33 LPCD for 10 people. Meanwhile, the amount of water corresponding to 50 LPCD, is the basic water requirement as per WHO guideline, which is 15 CuM. We assumed this value as water amount of the first block and with recent unit rate of first block of KUKL (NRs 100/ 10 CuM), the flat tariff that was proportional with the first block amount was equivalent to NRs 150. Ojha et al. [5] recommended an increase in water bill by 30% for utility sustainability post-MWSP. Hence, the scenario after increasing the price by 30% in recent block was also analyzed. When both initial investment as well as O&M costs are considered, KUKL’s water price is lower than that of shallow dug well for low consumption. For the volume of the first block (33.33 LPCD), the present KUKL’s water price is NRs 100 per month. Meanwhile, the water prices for shallow dug well and shallow tube well are NRs 480 per month and NRs 450 per month, respectively. However, the slope of the second block of KUKL’s tariff is steeper than that of the shallow dug well and tube well and the price is reversed after 80 LPCD. Furthermore, the O&M cost of a shallow dug well and a tube well is almost similar to KUKL’s first block tariff, and as the consumption increases the price gap between shallow dug well or tube well and KUKL increases. If the first block is increased to 50 LPCD (15 CuM) and NRs 150, people would receive basic water services at a cheaper price. However, KUKL will need to sell more water for sustainable operation in that scenario, and KUKL may not have enough amount of water to sell as can be seen in Figure 2.

In the case of the second type of IBTs (increase in water bill by 30%), the gap between KUKL’s second block tariff and groundwater price becomes greater with the 30% increase, as shown in Figure 3. There are two methods to improve the scenario, improving the KUKL’s pricing by making it efficient and introducing tax on groundwater use. Regarding the first method, one of the respondents has highlighted the issue of KUKL’s pricing and efficiency as follows:

I think shallow groundwater has health related risks. KUKL’s water tariff should be as low as possible to keep it sustainable to compete with shallow groundwater. No one wants KUKL to make an excessive profit because it is a service-based institution. It has to work efficiently to keep the water tariff low. The cost of operation should be reduced. Although it is a private institution, KUKL is not operating like a private institution. There should be private culture to make things efficient.—Respondent from INGO sector

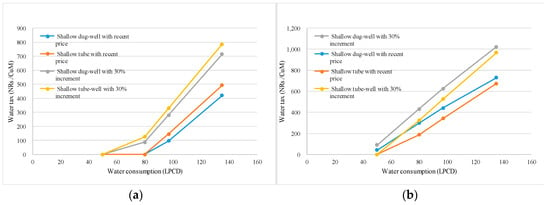

In contrast, Ojha et al. [5] showed that a 30% increase in water price is necessary to satisfy both utility sustainability and consumer affordability. Figure 3 suggests that taxation measures are needed for shallow groundwater to make KUKL’s water competitive as compared to shallow groundwater and to prevent excess groundwater use. Figure 4 shows required tax per month per house (10 people) for shallow well water use calculated based on the difference between the monthly cost of second block water price of KUKL’s water with two tariff systems (present and with 30% increase), and shallow groundwater cost in each water consumption scenarios. The required tax depended on the amount of water consumed and the volume of the lower block selected. This difference can be the basis for considering the future improvement of water pricing of KUKL water and alternative sources.

Figure 4.

Taxation requirements with different water consumption scenarios (NRs/month).

Figure 4a shows the amount of taxation required based on initial investment and O&M cost. However, in most of the areas inside the valley, alternative options are already adopted to cope with water scarcity; for example, households have invested in shallow dug wells or tube wells. In such a situation, it is suitable to compare KUKL’s water price with the O&M cost of alternative options, and required tax was higher as shown in Figure 4b. It shows that with 30% increment in KUKL’s price and 97 LPCD water consumption, the tax required for shallow dug wells and tube wells including initial investment is NRs 281/month and NRs 329/month, respectively. The higher value among the two, NRs 329/month, is approximately 0.35% of total expenditure of the building. However, if we consider O&M cost only, the taxation requirement for shallow dug wells and tube wells is Nrs 626/month and NRs 527/month, respectively. The higher value among the two, NRs 626/month, is 0.7% of total expenditure of the household. The tax requirements for higher demand are higher and for 135 LPCD (designed water demand of MWSP); it is 1.2% for shallow dug wells. If we take 1% ER as the affordable price as mentioned in Ojha et al. [5] it can be predicted that water use of 135 LPCD is not feasible from affordability point of view and proper taxation can be implemented in 97 LPCD scenario only.

3.3. Possible Measure and Challenges

Groundwater taxation might be a way to motivate people to use KUKL’s water if volumetric taxation of groundwater is possible depending on the amount of groundwater used in individual houses. However, volumetric taxation is difficult to implement because of difficulty in monitoring and measuring water volume. Some respondents have pointed out that this difficulty can be reduced if it is implemented with the help of local governing bodies. Moreover, the implementers should be aware of consumers’ water use and their affordability of taxation.

Although the use of shallow groundwater needs to be regulated, the monitoring of shallow groundwater is very difficult since it is located in each household. However, institutions are changing and local governments are becoming stronger. Local governments could be the regulator of shallow groundwater.—Respondent from the NGO sector

There is a threat that people will preferentially use well water than KUKL’s water to avoid paying both tax and KUKL’s tariff if volumetric taxation is not applied and tax is applied for the possession of a well. This problem might be tackled by introducing a mechanism of claiming tax rebate by confirming that KUKL’s water is used as a major water source in the house (e.g., by submitting KUKL’s water receipt). The co-ordination between KUKL, KVWSMB, and local governing bodies is critical to achieve proposed taxation or rebate.

As KUKL water cannot satisfy the future water demand even when water demand is managed to remain 80 LPCD as shown in Figure 2, people need to use groundwater to cover the deficit. Therefore, rainwater harvesting and recharging well water could be instrumental for groundwater sustainability. Although the initial investment of rainwater harvesting is expensive, as shown in Table 1, there would be several options to induce people to use rainwater such as tax rebates, subsidies for rainwater harvesting, or mandatory provisions for direct use of rainwater. Moreover, for buildings with rainwater recharge, groundwater tax rebate can be used as an incentive. It seems more feasible because its volume is larger compared to direct rainwater harvesting in buildings. Old well water users would be paying approximately NRs 800/month including tax (approximately NRs 600) mentioned in Figure 4b. While, the monthly cost of rainwater recharge is approximately NRs 1100 based on the initial investment (NRs 90,625 as shown in Table 1) with CRF of 0.12 (as shown in Section 2.2) and O&M (approximately NRs 200, which is same as shallow dug well). The monthly share of rainwater’s initial investment (NRs 900) if compared with that of a shallow dug well, is approximately 40–50% (NRs 36,000 to NRs 45,000) of the subsidy for initial investment in rainwater harvesting, which might motivate people to use rainwater harvesting and recharge systems.

While conducting the qualitative questionnaire survey, two school of thoughts among the stakeholders were seen regarding rainwater harvesting. Some respondents think that rainwater harvesting should be conducted in large scales such as impounding reservoirs in Kathmandu Valley.

Rainwater harvesting should be conducted in mega scale such as impounding reservoir rather than providing household subsidies.—Respondent from PID

However, other respondents believe that household subsidies tied up with groundwater taxations and mandatory options in rainwater harvesting will also help conserve and restore groundwater.

Along with groundwater taxation and volumetric charge in deep tube well, rainwater and groundwater recharge should also be promoted. It can be achieved through subsidies and mandatory provisions for rainwater harvesting system installation in new buildings. Local government’s role is crucial in these provisions. Respondent from High Powered Committee for Integrated Development of the Bagmati civilization (HPCIDB).

It can be seen that almost all the solutions related with water pricing to maintain water resource sustainability inside Kathmandu Valley depends on the water use behavior of consumers and hence, monitoring of water use behavior is critical. The constitution of Nepal has a provision for local bodies to regulate and charge for the water resource inside its jurisdiction, which can support environmental taxation inside the Kathmandu Valley.

3.4. Water Use Pattern and Proposal for Changing Tariff System

There has been a huge debate on ‘water as an economic good’ when it comes to basic services. Some researchers have claimed that “the lifesaving block” should not be treated as an economic good and we should rather focus more on its accessibility [26]. However, it is not clear how much water should be treated as the lifesaving block. The second block can be the basic consumption block, which could not only provide the basic water services to the consumers but also ensure utility sustainability. Water pricing of the second block should take care of both consumers and utility. Meanwhile, the third block is appropriate in water scarce areas where the demand needs to be managed and, hence, the pricing can be high (Figure 5).

Figure 5.

Water quantity and blocks based upon economics of water use. Source: Adapted from Liu [26].

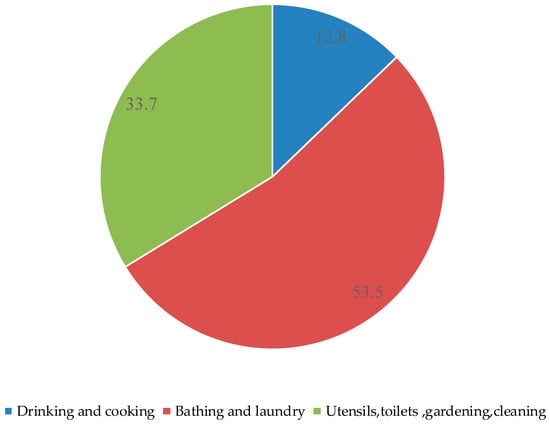

It may be possible to apply the concept of the block to the actual water consumption pattern to design the tariff system. Figure 6 shows the proportion of daily water consumption based on purpose. It shows that maximum water (53.5%) is used for bathing and laundry purposes in Kathmandu households. There is consumption of 33.7% for utensils, toilets, gardening, and cleaning, whereas water for drinking and cooking constitutes 12.8% of total consumption.

Figure 6.

Water use distribution inside the household in %.

Drinking and cooking can be termed as life-saving demands inside Kathmandu Valley and very few people are using groundwater and tanker water for those purposes (Table 2). Bathing and laundry are the second priority, and piped water is used, along with groundwater and tanker water for these purposes. For cleaning and other purposes, very little piped water is used compared to groundwater and tanker water, and these are considered as third priority. For lesser groundwater use, demand management of water used for cleaning and other purposes seems suitable. Despite using two-block pricing being in use now, the KVWSMB’s respondent reiterated similar thoughts during the qualitative survey.

There is a threat that water will not be accessible while implementing progressive two-blocks IBT inside the valley, and KVWSMB/KUKL should change it post MWSP. The first block volume should be reduced focusing on pro-poor. Even the per unit cost should be lower than the existing cost. The second block should be progressive but also affordable focusing on the basic consumption. The third block, however, should be highly progressive as it is focused on rich people.—KVWSMB’s official

Boland and Whittington [27] has pointed out that IBT should be able to create economic efficiency (create incentives that ensure largest benefit from water use), income redistribution (large users should bear high marginal cost and small users should be subsidized), and resource conservation. he third block mentioned by valley board respondent can be seen as a measure for resource conservation. Figure 6 shows that according to recent consumption of 97 LPCD, approximately 4 CuM is needed for drinking and cooking for one building, which is very less compared to the current first block (10 CuM) consumption. Similarly, after adding bathing and laundry, the requirement will be approximately 20 CuM, and after 20 CuM, the demand management can be enforced through pricing as a third block. However, in Kathmandu, resource conservation is not only meant for KUKL it is also for groundwater conservation. The taxation on groundwater and subsidy on rainwater thus can play a vital role in resource conservation.

4. Conclusion and Recommendations

The study has emphasized the pricing of environmental externalities and challenges in adopting the pricing system particularly in urban areas with multiple water use options. Water pricing should be the instrument to support environmental sustainability, consumer’s affordability, and utility sustainability. In case of Kathmandu Valley, groundwater sustainability should be one of the criteria to be considered while fixing the water price henceforward. It is imperative for KUKL to consider its competitors before changing the water price and for KVWSMB to consider environmental taxation on shallow groundwater with subsidies on water recharge to ensure the sustainability. Local governments seem to be the suitable institutions for monitoring and regulating shallow dug wells and adopting rainwater recharge mechanisms. Furthermore, a close look at water consumption behavior seems necessary because of the relationship between water consumption and water taxation requirements. This study has discussed the ways of taxation and subsidies based on consumers’ water use behavior where multiple water sources are used.

The institutional co-ordination seems critical as WTFC decides KUKL’s water tariff, whereas KVWSMB decides the taxation on groundwater. On the other hand, subsidy and mandatory policies on rainwater harvesting and recharge can only be adopted by the support of local governments, and recent improvement in distribution lines is from MWSP. Thus, the co-ordination between these entities seems necessary for the sustainability of both surface and groundwater resources in Kathmandu Valley.

The coping cost has not been calculated in this study and it can be predicted that it will be expensive to provide water with Nepal Drinking Water Quality Standard in case of sources other than KUKL. The adaptation of constant inflation rate is also one of the limitations of these calculations. However, this study recommends that awareness regarding the quality of water and the sustainability of water resources, along with taxation and subsidies for the sustainable extraction of groundwater will be important for Kathmandu Valley’s sustainable water management.

Author Contributions

This research was conceptualized by R.O. and F.K. F.K., J.S. and H.I. has supervised this study. R.O., B.R.T. and S.S. were involved in data preparation and analysis during this study.

Funding

This research has been supported by project from Science and Technology Research Partnership for Sustainable Development (SATREPS) on “Hydro-microbiological Approach for Water Security in Kathmandu Valley, Nepal”, co-funded by Japanese International Co-operation Agency (JICA) and Japan Science and Technology Agency (JST)

Acknowledgments

The authors would like to thank all the respondents for their valuable support. The authors are grateful to Science and Technology Research Partnership for Sustainable Development (SATREPS), co-funded by Japanese International Co-operation Agency (JICA), Japan Science and Technology Agency (JST), and University of Yamanashi for providing the platform for this research.

Conflicts of Interest

The author declares no conflict of interest in this study. The funding sponsors had no role in the design of the study, in the collection, analyses or interpretation of data, in the writing of the manuscript, and in the decision to publish the results.

References

- Rogers, P.; Bhatia, R.; Huber, A. Water as a social and economic Good: How to put the principle into practice, 1998. Available online: http://hdl.handle.net/10535/4989 (accessed on 28 August 2018).

- Rees, J.A. Regulation and private participation in the water and sanitation sector. Nat. Resour. Forum 1998, 22, 95–105. [Google Scholar] [CrossRef]

- Rogers, P.; De Silva, R.; Bhatia, R. Water is an economic good: How to use prices to promote equity, efficiency, and sustainability. Water Policy 2002, 4, 1–17. [Google Scholar] [CrossRef]

- Kilimani, N.; van Heerden, J.; Bohlmann, H. Water taxation and the double dividend hypothesis. Water Resour. Econ. 2015, 10, 68–91. [Google Scholar] [CrossRef]

- Ojha, R.; Thapa, B.; Shrestha, S.; Shindo, J.; Ishidaira, H.; Kazama, F. Water price optimization after the Melamchi Water Supply Project: Ensuring affordability and equitability for consumer’s water use and sustainability for utilities. Water 2018, 10, 249. [Google Scholar] [CrossRef]

- Yoden, K.; Chhetry, L.K. Kathmandu Valley Water Distribution, Sewerage and Urban Development Project, PPIAF Baseline Survey Part-1; Asian Development Bank: Manila, Phillipines, 2010. [Google Scholar]

- Pandey, V.P.; Shrestha, S.; Chapagain, S.K.; Kazama, F.A. framework for measuring groundwater sustainability. Environ. Sci. Policy 2011, 14, 396–407. [Google Scholar] [CrossRef]

- Kathmandu Upatyaka Khanepani Limited. Annual report of Kathmandu Upatyaka Khanepani Limited; Kathmandu Upatyaka Khanepani Limited: Kathmandu, Nepal, 2015. [Google Scholar]

- Thapa, B.R.; Ishidaira, H.; Pandey, V.P.; Shakya, N.M. Impact assessment of Gorkha earthquake 2015 on potable water supply inside Kathmandu Valley: Preliminary analysis. Annu. J. Hydraul. Eng. JSCE 2016, 72, 61–66. [Google Scholar]

- Pandey, V.P.; Shrestha, S.; Kazama, F. Groundwater in the Kathmandu Valley: Development dynamics, consequences and prospects for sustainable management. Eur. Water 2012, 37, 3–14. [Google Scholar]

- Khatiwada, N.R.; Takizawa, S.; Tran, T.V.N.; Inoue, M. Groundwater contamination assessment for sustainable water supply in Kathmandu Valley, Nepal. Water Sci. Technol., 2002, 46, 147–156. [Google Scholar] [CrossRef]

- Pandey, V.P.; Chapagain, S.K.; Kazama, F. Evaluation of groundwater environment of Kathmandu valley. Environ. Earth Sci. 2010, 60, 1329–1342. [Google Scholar] [CrossRef]

- Pandey, V.P.; Kazama, F. Groundwater Storage Potential in the Kathmandu Valley’s Shallow and Deep Aquifers. In Kathmandu Valley Groundwater Outlook; Shrestha, S., Pradhananga, D., Eds.; Asian Institute of Technology (AIT): Pathumthani, Thailand; The Small Earth Nepal (SEN): Kathmandu, Nepal; Center of Research for Environment Energy and Water (CREEW): Kathmandu, Nepal; International Research Center for River Basin Environment-University of Yamanashi (ICRE-UY): Yamanashi, Japan, 2012; pp. 31–38. [Google Scholar]

- Shrestha, P.K.; Shakya, N.M.; Pandey, V.P.; Birkinshaw, S.J.; Shrestha, S. Model-based estimation of land subsidence in Kathmandu Valley, Nepal. Geomatics Nat. Hazards Risk 2017, 8, 974–996. [Google Scholar] [CrossRef]

- Shrestha, S.; Shrestha, M.; Babel, M.S. Assessment of climate change impact on water diversion strategies of Melamchi Water Supply Project in Nepal. Theor. Appl. Climatol. 2015, 128, 311–323. [Google Scholar] [CrossRef]

- Jha, P.K. Climate change: Impact, adaptation and vulnerability in water supply of Kathmandu Valley. WIT Trans. Ecol. Environ. 2012, 155, 563–574. [Google Scholar] [CrossRef]

- Pezzey, J.C.V.; Park, A. Reflections on the double dividend debate: The importance of interest groups and information costs. Environ. Resour. Econ. 1998, 11, 3–4. [Google Scholar] [CrossRef]

- Shrestha, S. Evaluating Role of Rain Water Harvesting in Water Insecure Areas: A Case of Kathmandu Valley, Nepal. Ph.D. Thesis, University of Yamanashi, Yamanashi, Japan, 2013. [Google Scholar]

- Karim, M.R.; Bashar, M.Z.I.; Imteaz, M.A. Reliability and economic analysis of urban rainwater harvesting in a megacity in Bangladesh. Resour. Conserv. Recycl. 2015, 104, 61–67. [Google Scholar] [CrossRef]

- Shrestha, S.; Aihara, Y.; Kondo, N.; Rajbhandari, S.; Bhattarai, A.P.; Bista, N.; Kazama, F.; Nishida, K.; Timilsina, H.P.; Shindo, J. Household Water Use in the Kathmandu Valley: A Dry Season Survey, Interdisciplinary Center for River Basin Environment. Interdisciplinary Center for River Basin Environment: Kofu Yamanashi, Japan, 2016; Available online: http://www.icre.yamanashi.ac.jp/file/WASH-MIA_Rapid_Report.pdf (accessed on 28 August 2018).

- KUKL. Proposal for Water Tarriff Rate Adjustment in Kathmandu Valley, Kathmandu, Nepal, 2013.

- Thapa, B.R.; Ishidaira, H.; Pandey, V.P.; Bhandari, T.M. Evaluation of water security in Kathmandu Valley before and after water transfer from another basin. Water 2018, 10, 224. [Google Scholar] [CrossRef]

- Marshall, M. The key informant technique. Fam. Pract. 1996, 13, 92–97. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.; Wildemuth, B.M. Qualitative analysis of content. In Applications of Social Research Methods to Questions in Information and Library Science; Libraries Unlimited: Santa Barbara, CA, USA, 2016. [Google Scholar]

- Central Bureau of Statistics. National Population and Housing Census 2011 (National Report); Central Bureau of Statistics, National Planning Commission, Government of Nepal: Kathmandu, Nepal, 2012.

- Liu, J.; Savenije, H.H.G.; Xu, J. Water as an economic good and water tariff design: Comparison between IBT-con and IRT-cap. Phys. Chem. Earth 2003, 28, 209–217. [Google Scholar] [CrossRef]

- Boland, J.J.; Whittington, D. Water Tariff Design in Developing Countries: Disadvantages of Increasing Block Tariffs (IBTs) and Advantages of Uniform Price with Rebate (UPR) Designs; World Bank Water and Sanitation Program: Washington, DC, USA, 2000. [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).