Abstract

Coal-to-oil (CTL) combined with carbon capture, utilization and storage (CCUS) can significantly reduce the CO2 emissions generated in the production process to achieve clean coal utilization. Taking CTL enterprises as sources and deep saline aquifers and oil fields as sinks, this paper establishes a source–sink matching model, which is combined with a trinomial tree real-option model of carbon price fluctuation, and evaluates the investment decisions of CTL. The results show that 36 pipelines with an average transportation distance of 319.13 km and predominantly small diameters must be constructed for CO2 capture and storage combined with enhanced oil recovery (EOR). Under the current carbon price, 83.33% of enterprises can invest immediately when adopting EOR; when utilizing storage in a deep saline aquifer (DSF), even with a 50% subsidy and a decrease in costs due to the learning rate, enterprises still need to execute the deferred option investment. Government subsidies and technological advances can greatly increase the value of investment. The critical carbon price of CTL-CCUS projects is sensitive to government subsidies, technological advances, and CO2 transportation distances. Therefore, China should reasonably guide the development of the carbon market and give play to the role of the carbon market in emission reduction incentives. In addition, the Chinese government can provide direct financial support for the CTL-CCUS project to increase the enthusiasm of CTL enterprises for CCUS transformation and promote technological progress.

1. Introduction

China’s abundant coal resources and limited oil resources result in a heavy reliance on imported oil, posing significant energy security concerns []. CTL technology offers a practical solution to solve this problem by synthesizing oil energy from coal by liquefaction or gasification []. According to the statistics of the China National Coal Association, China had built a CTL production capacity of 9.31 Mt by the end of 2020, and the new generation of CTL technology has reached the international advanced level. However, the production process of CTL generates a large amount of CO2 emissions, which contradicts the goals of controlling temperature rise and achieving carbon neutrality as well as peak carbon emission targets []. As a key technology to achieve temperature control goals, CCUS technology provides a direction for the low-carbon transformation of the CTL industry. China has actively carried out CCUS demonstration projects and has made major breakthroughs in various aspects of technology, but there are still varying degrees of gaps with large-scale commercial applications []. Coal-to-liquid combined with carbon capture, utilization and storage (CTL-CCUS) technology can greatly reduce carbon emissions, achieve cleaner utilization of coal, and promote the development of CCUS technology []. However, the investment in CTL-CCUS involves numerous uncertainties, such as the instability of energy prices [], the impact of CCUS costs on storage methods and transportation distance [], the uncertainty of government subsidy support for the CCUS technology [], and the extent of cost reductions achieved by the CCUS technology []. Ignoring the impact of these uncertainties on investment decisions would deviate from reality and lead to decision failure.

Specifically, the CTL-CCUS project faces dual internal and external uncertainties:

- (1)

- Internal uncertainty is mainly the impact of technical factors on the CTL-CCUS project, which is reflected in two aspects: technology selection and technology maturity. For example, the technology choice of direct coal liquefaction (DCL) or indirect coal liquefaction (ICL), as well as the choice of CO2 transportation distance and storage method. Technology maturity determines the space for future technology cost reduction. Wei et al. [] obtained the cost of CCUS saline aquifer storage in the coal chemical industry by using a source–sink matching model, which is 14–17 USD/t CO2. Based on the trinomial tree real-option model, Li et al. [] assessed uncertainties such as the CO2 prices, capital subsidies, water resource fees, the residual lifetime of direct coal liquefaction plants, electricity prices, transport distance and the amount of certified emission reductions (CERs) of DCL-coupled carbon capture and storage combined with enhanced deep saline water recovery (CCUS-EWR). The results show that the critical CER price for CCS-EWR retrofits is 7.15 RMB/t higher than that (141.95 RMB/t) for CCS retrofits. The Ministry of Ecology and Environment together with other departments estimated the variations in the unit capture, transport, and storage costs of CCUS in China. They anticipate that the capture cost would be 100–480 RMB/t in 2025, 90–390 RMB/t in 2030, and 20–130 RMB/t in 2060 []. A number of studies on the cost changes of CCUS technology coupled with coal-fired power plants also predicted a shift in the trend of CCUS technology costs and concluded that future CCUS costs could gradually decrease through learning [,].

- (2)

- External environmental factors, such as government policy support and subsidies for the CTL-CCUS project, as well as the regulation of carbon taxes, carbon prices and energy prices, will have an impact on the investment value of the project. Zhao et al. [] established an evolutionary game model between government and enterprises from a micro perspective to study the issue of adopting CCUS technology and found that government policy support and active supervision for enterprises can help reduce the deployment cost of CCUS and promote the adoption of CCUS technology by enterprises. Mantripragada et al. [] established a plant-level techno-economic model and applied it to systematically evaluate the performance, carbon emissions, and costs of a wider range of CTL plant designs, and found that the economic feasibility of CCUS largely depends on CO2 price, taxes, and electricity sales price. Energy price factors primarily refer to the fluctuations in oil prices and coal prices. Zhou [] found that the life cycle breakeven crude oil price of the CTL process is above 96 USD/bbl. Zhou [] used Aspen Plus to simulate the production process of CTL-CCUS and analyze its economy. The study found that the cost of liquid fuel is between 4117–5627 RMB/t, which is economically feasible. Yao et al. [] established a real-option model assuming that oil, coal, and carbon prices are all geometric Brownian motions under the DCL project CCUS transformation value and found that it is not feasible under current market and policy conditions, but the value of delayed investment is substantial.

The above studies analyzed the impact of one or several uncertainty factors on the cost or benefit of CTL-CCUS technology and have certain reference significance for the investment in CTL-CCUS technology. However, to analyze the investment decisions adequately, it is vital to evaluate the option value. There are also a few studies that pay attention to the impact of different factors on the option value of CTL-CCUS technology, but the research stays at the case level and cannot evaluate the current situation of the entire industry. China’s existing CTL projects have large differences in scale, remaining life, CO2 storage location, and transportation distance, and simple case studies cannot predict the industry’s critical carbon price and investment value. Additionally, in terms of uncertainty factor prediction, the impact of the external policy environment and internal technology changes on investment have not been taken into account, making it difficult to evaluate the investment of CTL-CCUS from a developmental perspective.

Therefore, this study has the following considerations and contributions:

- (1)

- Taking the existing CTL enterprises in China as sources and deep saline aquifers and oil fields as sinks, the source–sink matching model is established based on the principle of cost minimization, considering social, geographical and geological factors comprehensively.

- (2)

- The source–sink matching results are applied to the real-option model to evaluate the investment value and critical carbon price of CTL-CCUS projects under four scenarios. Compared to existing research, this article adopts CO2 transportation data that are more in line with reality and conducts research on all projects in the CTL industry, improving the accuracy and comprehensiveness of the evaluation results.

- (3)

- Exploring the effects of policy subsidies, technological progress and CO2 transport distance on the critical carbon price of CTL-CCUS projects, the investment environment and investment decision-making process of the CTL-CCUS project are described more scientifically, which provides reference opinions for the government to formulate the transformation policy of the CTL-CCUS project.

2. Methods and Data

2.1. Source–Sink Matching

This study includes 18 CTL projects that have been put into production and are under construction, and the specific information is shown in Table 1. The CO2 emission is calculated by using the actual process emission factor data of the plant [], while the capture rate is set at 90%. According to the actual production capacity of the operational projects and the design capacity of those under construction, the theoretical annual CO2 emission is 89.77 Mt, and the annual capture amount is 80.70 Mt.

Table 1.

China’s CTL projects information.

The CO2 geological storage basin data are derived from the research of the US Geological Survey [], with the main focus on land storage basins that include two types of geological storage sites: deep saline aquifers and oilfields. The actual construction of CCUS needs to be specific to the level of the prefecture-level administrative region, so we allocate the storage basin according to the area of the prefecture-level administrative region, and calculate its theoretical geological storage potential. Each allocated storage site is given a hub (as a distribution center within a certain area), and the hub is set at the centroid of the basin. A total of 88 hubs are obtained for EOR, with a total theoretical CO2 storage potential of 4.26 billion tons, and 171 hubs are obtained for DSF, with a total theoretical CO2 storage potential of 1989.57 billion tons.

The model takes into account factors such as rivers, lakes, seismic zones, nature reserves and ecological zones that have an impact on the construction of the pipeline. The overall pipeline layout model of CTL-CCUS is established with the goal of minimizing the cost of the entire life cycle, as shown in Equation (1):

The constraints of the model mainly include: (1) The annual capture capacity of any capture source does not exceed its annual emissions. (2) The total amount of storage during the planning period shall not be higher than its total storage potential. (3) The actual annual storage capacity is not higher than the annual injection capacity of the injection well. (4) The annual pipeline capacity is not higher than the transportation capacity of any pipeline. (5) The outflow of any source node is equal to the sum of its capture and inflow. (6) The outflow of any hub node is equal to the difference between its inflow and storage. (7) The sum of the storage amounts of all hubs is equal to the sum of all capture sources. (8) The capture and storage amount and the pipeline transportation amount are all non-negative. The equations are as follows:

The parameters in the pipeline network model are divided into variables and parameters. Table 2 lists the model parameters and decision variables [,].

Table 2.

Variables and parameters of the pipeline network model.

2.2. Uncertainties and Scenario Settings

2.2.1. Carbon Price and Subsidy

This study assumes that carbon prices follow the rule of geometric Brownian motion [,], as shown in Equation (13):

where is the carbon price at time , is the expected value of carbon price changes, is the volatility of carbon prices, and is the increment of the standard Wiener process. Based on the carbon prices of the eight national carbon emissions trading markets in 2020, the values of and are calculated as 0.0339 and 0.3431, respectively. The initial carbon price is taken to be the average value of 7.43 USD/t in 2020 (the exchange rate is based on the 2022 average exchange rate of 1:6.73).

The low-carbon transformation of any industry necessitates certain government policy support. At present, the revenue from certified emission reductions through the carbon market is far from offsetting the high cost of CCUS equipment and operation investment. A direct and feasible means would be that the government provides a certain proportion of investment subsidies for the construction of CCUS infrastructure. This would alleviate the investment burden of enterprises in the early stage of transformation, enhance their cash flow, minimize the risk associated with the transformation process, and increase their willingness to pursue this transformation. Therefore, this paper assumes that enterprises are responsible for the construction of CCUS capture facilities, storage pipelines, and storage facilities, while the government provides a 50% subsidy for the construction of the above infrastructure projects.

2.2.2. Technological Advance

CCUS technology involves many aspects, and the associated technical costs consist of capture construction cost, capture operation cost, capture maintenance cost, pipeline construction cost, pipeline operation cost, pipeline maintenance cost, storage construction cost, storage operation cost, and storage maintenance cost.

Previous studies show that the construction cost of CCUS gradually decreases annually by approximately 2.02% []. Additionally, it has been demonstrated that the CO2 capture cost and O and M (operation and maintenance) cost of a million-ton ICL enterprise will decrease according to a certain learning rate after CCUS transformation [], as shown in the following equation:

where is the cost for the last unit, is the cost for the first unit, is the cumulative number of units, is the experience index, denotes the progress ratio, and is the learning rate.

The storage process of CCUS includes exploration, measurement, drilling, and infrastructure construction of the storage location, CO2 injection and equipment maintenance, as well as post-operation treatment. The learning rate of the storage process can be expressed as follows:

where and represent the initial storage amount and cumulative storage amount, and represent the storage costs of and . Studies have shown that projects that store 5 million tons of CO2 per year have a learning rate of 3.0% for storage maintenance costs after completion, 7.7% for storage operating costs in EOR, and 6.6% for storage operating costs in DSF []. This paper calculates the learning rate of operation and maintenance for each project by weighting the cost proportions of each part according to the scale of the CTL project.

2.2.3. Scenario Settings

According to the analysis of the storage type and the factors affecting the investment income of the CTL-CCUS project, this study sets the following 8 scenarios, as shown in Table 3.

Table 3.

Scenario settings.

2.3. Net Present Value

The cash inflows of the CTL-CCUS project encompass carbon reduction revenue, oil recovery revenue, and government subsidy. The cash outflows include the construction, operation, and maintenance costs of each link. Assuming that the CCUS project starts to invest in year , the retrofit construction period is 1 year, and the operation starts in year , the remaining life of the equipment is , then the net present value (NPV) of the CTL-CCUS project is shown in Equation (19):

where (t) is annual CO2 capture amount, (USD) is the carbon price in the carbon market, (USD/bbl) is the oil price, (bbl/t CO2) is the oil exchange rate, (USD) is the capture construction cost, (USD) is the capture operation cost, (USD) is the capture maintenance cost, (USD) is the pipeline construction cost, (USD) is the pipeline operation cost, (USD) is the pipeline maintenance cost, (USD) is the storage construction cost, (USD) is the storage operation cost, (USD) is the storage maintenance cost, is the learning rate of the initial investment cost, and is the learning rate of the operation and maintenance (O and M) cost.

If interest is compounded, replacing in the above equation with , then the cash flow can be expressed in Equation (20):

2.4. Trinomial Tree Real-Option Model

The real-option approach fully considers and quantifies the opportunity cost of project investment. In uncertain market conditions, investors can choose to wait to avoid potential market risks, thereby maximizing benefits []. The total investment value of the project according to the real-option approach is shown in equation (21):

where is the total investment value of the project, is the net present value of the project, and is the option value generated by delaying investment. The delayed investment option means that decision-makers do not have to invest immediately and can make timely adjustments according to market changes, wait for the most favorable time to make investment, and have great flexibility in choosing the time node of project investment [].

Assuming that the project life cycle is 30 years and the delay period is 10 years, the total investment value of the CTL-CCUS project at each node under the delayed option condition is shown in Equation (22):

where is the investment value at node , which can be expressed by equation (23), and is the net present value at node . , , , respectively, represent the probability that the carbon price will rise, fall, or remain unchanged. Assuming that the carbon price is independent of the order of movement, then there is . is the risk-free interest rate of 0.0443 [].

2.5. The Rules for Investment Decision Making

The decision rule based on the NPV method is relatively simple: invest when the NPV is positive and do not invest otherwise []. Based on the real-option approach, the net present value and the option value must both be considered. The specific investment decision rules are shown in Table 4.

Table 4.

Project investment decision rules under real options.

3. Results and Analysis

3.1. Source–Sink Matching Results

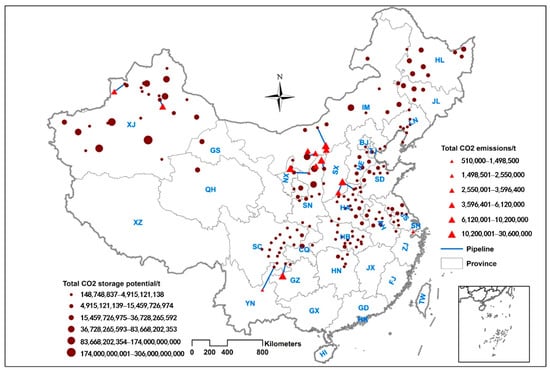

3.1.1. DSF Storage

The storage potential of deep saline aquifers is immense. Each project can be matched to a storage site, or multiple projects can be concentrated on one storage site. There are 12 matching pipelines, with a total pipeline construction length of 1418.67 km; the average transportation distance is 118.22 km, the shortest transportation distance is 12.63 km, the longest transportation distance is 290.06 km, and the pipe diameter is mainly 16 inches. The distribution of pipelines is shown in Figure 1, and the specific information on pipeline construction is shown in Table 5.

Figure 1.

Pipeline distribution under DSF storage.

Table 5.

DSF storage pipeline information.

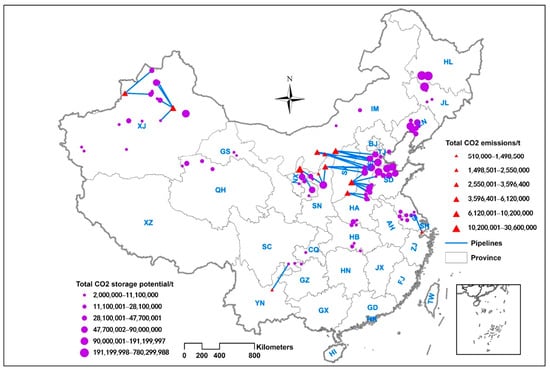

3.1.2. EOR Storage

Due to the limitation of storage potential, in the case of EOR storage, projects and storage sites cannot correspond one-to-one, and some projects are transported to more than one storage site for storage. A total of 36 pipelines need to be constructed, mainly of 8-, 12-, and 16-inch diameters, with a total length of 11,488.83 km, an average transportation distance of 319.13 km, a closest transportation distance of 39.75 km and a farthest transportation distance of 715.34 km. The distribution of pipelines is shown in Figure 2, and the specific information on pipeline construction is shown in Table 6.

Figure 2.

Pipeline distribution under EOR storage.

Table 6.

EOR storage pipeline information.

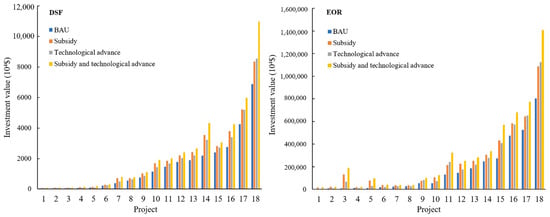

3.2. Investment Decision Results

By calculation, it can be obtained that utilizing DSF storage results in a TIV of 270 million US dollars for the CTL-CCUS project under the BAU scenario. In the subsidy scenario, the TIV is 352 million US dollars, while in the technological advancement scenario, the TIV is 331 million US dollars. In the subsidy and technological advancement scenario, the TIV is 416 million US dollars. At the time of the EOR storage, the TIV of the BAU scenario is 30.14 billion US dollars, the subsidy scenario is 43.09 billion US dollars, the technological advancement scenario is 40.27 billion US dollars, and the subsidy and technological advancement scenario is 53.22 billion US dollars.

According to the investment decision rules under the real-option approach, all scenarios need to execute delayed option investment when implementing DSF storage. At the time of the EOR storage, 15 CTL projects in the BAU scenario can choose to invest immediately; three enterprises executed deferred option investments. One CTL project in the technological advancement scenario needs to execute delayed option investment. Under the subsidy scenario and the subsidy and technological advancement scenario, all projects can execute immediate investment.

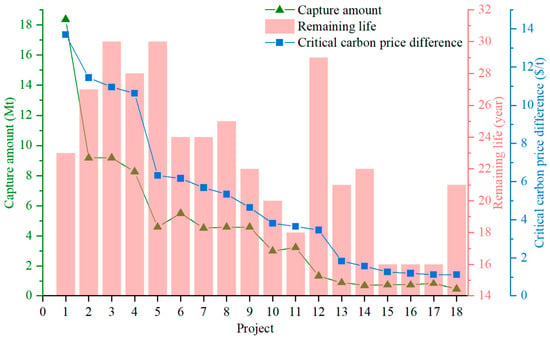

As shown in Figure 3, the investment value of the BAU scenario is the lowest. For most enterprises, the investment value of the subsidy scenario exceeds that of the technological advancement scenario, while for a few enterprises, the investment value of the technological advancement scenario is greater. Under identical conditions, the investment value of EOR storage is 26.21–483.55 times that of DSF storage. The investment value of the BAU scenario at the time of DSF storage is 45.64 × 104–688.25 × 104 US dollars, and the subsidy and technological advancement scenario is 82.57 × 104–10.97 × 107 US dollars. When EOR storage is used, the investment value of the BAU scenario is 18.37–8029.39 million US dollars, and the investment value of the subsidy and technological advancement scenario is 193.01–14,066.38 million US dollars. Subsidy and technological advance can significantly increase the value of investment.

Figure 3.

CTL-CCUS Projects investment value.

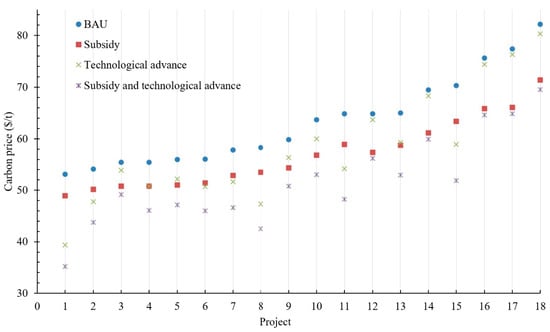

3.3. Critical Carbon Price

According to the investment decision rules under real options, the carbon price when the CTL-CCUS project can be invested immediately is called the critical carbon price. As shown in Figure 4, the critical carbon price of the BAU scenario is the highest during DSF storage, and the critical carbon price of the subsidy and technological advancement scenario is the lowest. The critical carbon price for the BAU scenario ranges from 53.07–82.12 USD/t, and for the subsidy scenario ranges from a low of 48.91USD/t to a high of 71 USD/t. The lowest critical carbon price under the technological advancement scenario is 39.38 USD/t, with a maximum of 80.27 USD/t. The critical carbon price for the subsidy and technological advancement scenario ranges from 35.20–69.60 USD/t. The current carbon price is far from covering the cost of the CCUS retrofit for DSF storage. If the three enterprises (accounting for 16.67%) that cannot invest immediately under the BAU scenario of EOR storage meet the investment conditions, the critical carbon prices are 9.77 USD/t, 17.16 USD/t and 18.05 USD/t, respectively. Under the technological advancement scenario, the critical carbon price of one enterprise that cannot invest immediately is 10.24 USD/t.

Figure 4.

Critical carbon price under DSF storage.

Based on the analysis presented above, it is apparent that the most important factor affecting the critical carbon price is the storage method. When EOR storage is used, 83.33% of the enterprises are able to invest immediately even without subsidies and cost reduction with the learning rate. When DSF storage is used, even with 50% infrastructure subsidies and cost reduction with the learning rate, they still cannot invest immediately. Therefore, in the following discussion of the influencing factors, the main focus is on the impact of various factors on the critical carbon price under DSF storage.

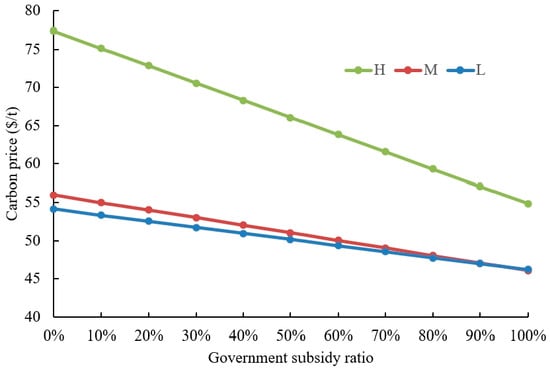

According to the calculation based on the existing CTL projects, a 50% government subsidy for fixed asset investment results in a reduction of the critical carbon price ranging from 7.37% to 14.64%. Under the same conditions, the extent of the decrease in the critical carbon price due to subsidies is related to the size of the enterprise. The smaller the enterprise, the greater the extent of the decrease in the critical carbon price. The changes in the critical carbon price under the BAU scenario for three enterprises with minimum (L), medium (M), and maximum (H) decreases are simulated, as shown in Figure 5.

Figure 5.

The impact of subsidy on the critical carbon price.

Scenario H is the most sensitive to government subsidies. From no subsidy to 100% subsidy, the critical carbon price decreases by 22.55 US dollars, a decrease of 29.14%. Scenario H captures 45.9 × 104 tons of CO2 per year and has a remaining life of 16 years. The common characteristics of this type of project are that the annual capture amount does not exceed one million tons and the remaining life does not exceed 20 years. The critical carbon price in the BAU scenario is high. Under the condition of a 50% government subsidy, the critical carbon price of this type of project decreases by more than 10%. Scenario L is the least sensitive to government subsidies. The critical carbon price dropped by 7.92 US dollars, a decrease of 14.64% from no subsidy to 100% subsidy. Scenario L captures 4.59 million tons of CO2 every year and has a remaining life of 30 years. The common characteristics of this type of project are that the capture amount is generally more than 4 million tons and the remaining life is longer than 25 years. The critical carbon price is low under the BAU scenario. With a 50% fixed asset subsidy, the critical carbon price decreases by about 7%. Scenario M captures 2.997 million tons of CO2 per year and has a remaining life of 20 years. This type of project has a capture amount between 1–4 million tons and a remaining life between 20–25 years, and the decrease in the critical carbon price is also in between.

The learning rate reduces the critical carbon price by 1.46–25.80%. The learning rate is proportional to the scale and remaining life of the project. The larger the scale and the longer the remaining life, the more experience can be generated. With the accumulation of experience, the unit cost gradually decreases. As shown in Figure 6, the change rate of the difference between the critical carbon price of the BAU scenario and the technological advancement scenario is consistent with the scale change, and would fluctuate slightly due to the remaining life.

Figure 6.

The impact of learning rate on critical carbon price.

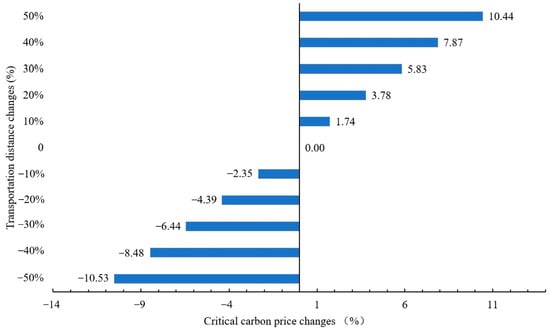

The impact of transportation distance on the critical carbon price incorporates two aspects. Firstly, the pipeline construction cost rises as the transportation distance increases. Secondly, transportation costs and pipeline O and M costs increase in correlation with the transportation distance. During EOR storage, there are three enterprises that cannot invest immediately in the BAU scenario because one project cannot be matched to the same storage site and multiple pipelines need to be built, which increases the cost. DSF storage has huge potential, and one storage site can meet the storage needs of one to several CTL projects, and the pipeline construction cost is vastly reduced compared to EOR storage. However, the transportation distance has a greater impact on the critical carbon price when DSF storage is used. The nearest transportation distance is 12.63 km and the longest transport distance is 290.06 km, with a pipeline construction capital of 5.48 USD/t and 185.12 USD/t, respectively. The critical carbon price under the BAU scenario is 48.91 USD/t and 66.05 USD/t, respectively. The average transportation distance of DSF storage is 118.22 km. Taking enterprise Y with a medium transportation distance (147.63 km) as an example, it captures 4.52 million tons of CO2 annually. The critical carbon price under the BAU scenario is 64.96 USD/t. The impact of increasing or decreasing the transportation distance by 50% on the critical carbon price under the BAU scenario for enterprise Y is simulated. As shown in Figure 7, the transportation distance decreased from 147.63 km to 73.82 (−50%) km and increased to 221.45 (+50%) km, and the critical carbon price decreased by 10.53% and increased by 10.44%, respectively. At present, the transportation distance of CCUS projects is controlled within 250 km, which makes it difficult to meet the emission reduction demand under the condition of insufficient incentive policies.

Figure 7.

The impact of transportation distance on critical carbon price.

Through analysis, it is found that 12 pipelines need to be built for EOR and 36 pipelines need to be built for DSF. The pipes of both storage methods are mainly of small diameter. Government subsidies and technological advances can significantly increase the investment value. Increasing the carbon price can effectively promote CTL projects to carry out the CCUS transformation. In the case of DSF storage, 50% and 77.78% of CTL-CCUS projects can be invested in immediately when the critical carbon price exceeds 60 USD/t and 70 USD/t, respectively, in the BAU scenario. The ratio is 83.33% and 100% under the subsidy and technological advancement scenario. CTL enterprises with an annual capture amount of more than 1.5 Mt CO2, a CO2 transportation distance of less than 100 km and a remaining life of more than 25 years should be given priority for CCUS retrofitting due to their lower critical carbon price.

4. Conclusions and Policy Implications

This study combines the source–sink matching model and the real-option model of existing CTL projects in China to analyze the investment decisions of CCUS retrofitting of CTL projects at the industry level. The main conclusions and policy implications are as follows:

- (1)

- For EOR storage, the CTL industry needs to construct 36 pipelines with an average transportation distance of 319.13 km. With DSF storage, the number of pipelines is 12, and the total length of construction is 1418.67 km. The pipelines for both types of storage are predominantly small-diameter pipelines. Enterprises can immediately invest in a CCUS retrofit if the CTL project can match the storage of oil fields and the ratio of pipeline construction cost to annual capture amount does not exceed 380 RMB/t.

- (2)

- A total of 83.33% of CTL enterprises can immediately invest in EOR storage under existing conditions, with a maximum critical carbon price of 18.05 USD/t. The current carbon market revenue is not enough to cover the high cost of DSF storage, so all CTL-CCUS projects still need to implement deferred-option investment. Therefore, the government should reasonably guide the development of the carbon market according to the demand for crude oil and the demand for emission reduction, and give play to the role of the carbon market in emission reduction incentives.

- (3)

- The incentive policy can greatly improve the investment value of the CTL-CCUS project. Government subsidies have a notable impact on reducing the critical carbon price for small-scale CTL enterprises with a short remaining life, while the learning rate has a greater advantage for large-scale enterprises with a long remaining life. Moreover, changes in transportation distance also have a significant impact on the critical carbon price. The Chinese government can allocate funds to provide direct financial support for CTL-CCUS projects to promote the development of CCUS technology and improve the learning rate. In addition, to meet the requirements for clean utilization of coal in the future, clustered large-scale projects should be established when building new CTL projects. At the same time, coal transportation distance and CO2 transportation distance should be comprehensively considered when selecting sites.

Author Contributions

Conceptualization, M.D.; methodology, M.D.; software, M.D. and J.X.; validation, M.D., J.X., X.L. and X.G.; formal analysis, M.D.; investigation, M.D. and J.X.; resources, X.G.; data curation, M.D.; writing—original draft preparation, M.D.; writing—review and editing, M.D. and J.X.; visualization, X.L.; supervision, X.G.; project administration, M.D.; funding acquisition, M.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Yang, C.J. Coal chemicals: China’s high-carbon clean coal programme? Clim. Policy 2017, 17, 470–475. [Google Scholar] [CrossRef]

- Gao, D.; Ye, C.; Ren, X.; Zhang, Y. Life cycle analysis of direct and indirect coal liquefaction for vehicle power in China. Fuel Process. Technol. 2018, 169, 42–49. [Google Scholar] [CrossRef]

- Huang, Y.; Yi, Q.; Kang, J.X.; Zhang, Y.G.; Li, W.Y.; Feng, J.; Xie, K.C. Investigation and optimization analysis on deployment of China coal chemical industry under carbon emission constraints. Appl. Energy 2019, 254, 113684. [Google Scholar] [CrossRef]

- Cai, B.; Li, Q.; Zhang, X. China Status of CO2 Capture, Utilization and Storage (CCUS) 2021—China’s CCUS Pathways; MEEPRC: Beijing, China, 2021. [Google Scholar]

- Meng, K.C.; Williams, R.H.; Celia, M.A. Opportunities for low-cost CO2 storage demonstration projects in China. Energy Policy 2007, 35, 2368–2378. [Google Scholar] [CrossRef]

- Yao, X.; Fan, Y.; Xu, Y.; Zhang, X.; Zhu, L.; Feng, L. Is it worth to invest?—An evaluation of CTL-CCS project in China based on real options. Energy 2019, 182, 920–931. [Google Scholar] [CrossRef]

- Budinis, S.; Krevor, S.; Mac Dowell, N.; Brandon, N.; Hawkes, A. An assessment of CCS costs, barriers and potential. Energy Strategy Rev. 2018, 22, 61–81. [Google Scholar] [CrossRef]

- Zhao, T.; Liu, Z. A novel analysis of carbon capture and storage (CCS) technology adoption: An evolutionary game model between stakeholders. Energy 2019, 189, 116352. [Google Scholar] [CrossRef]

- Singh, S.; Lu, H.; Cui, Q.; Li, C.; Zhao, X.; Xu, W.; Ku, A.Y. China baseline coal-fired power plant with post-combustion CO2 capture:2. Techno-economics. Int. J. Greenh. Gas Control 2018, 78, 429–436. [Google Scholar] [CrossRef]

- Wei, N.; Li, X.; Liu, S.; Dahowski, R.T.; Davidson, C.L. Early opportunities of CO2 geological storage deployment in coal chemical industry in China. Energy Procedia 2014, 63, 7307–7314. [Google Scholar] [CrossRef]

- Li, J.Q.; Yu, B.Y.; Tang, B.J.; Hou, Y.; Mi, Z.; Shu, Y.; Wei, Y.M. Investment in carbon dioxide capture and storage combined with enhanced water recovery. Int. J. Greenh. Gas Control 2020, 94, 102848. [Google Scholar] [CrossRef]

- Lohwasser, R.; Madlener, R. Relating R&D and investment policies to CCS market diffusion through two-factor learning. Energy Policy 2013, 52, 439–452. [Google Scholar]

- Wu, X.D.; Yang, Q.; Chen, G.Q.; Hayat, T.; Alsaedi, A. Progress and prospect of CCS in China: Using learning curve to assess the cost-viability of a 2×600 MW retrofitted oxyfuel power plant as a case study. Renew. Sustain. Energy Rev. 2016, 60, 1274–1285. [Google Scholar] [CrossRef]

- Mantripragada, H.C.; Rubin, E.S. CO2 implications of coal-to-liquids (CTL) plants. Int. J. Greenh. Gas Control 2013, 16, 50–60. [Google Scholar] [CrossRef]

- Zhou, H.; Qian, Y.; Kraslawski, A.; Yang, Q.; Yang, S. Life-cycle assessment of alternative liquid fuels production in China. Energy 2017, 139, 507–522. [Google Scholar] [CrossRef]

- Zhou, L.; Duan, M.; Yu, Y. Exergy and economic analyses of indirect coal-to-liquid technology coupling carbon capture and storage. J. Clean. Prod. 2018, 174, 87–95. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, Y.; Tian, Y. Comparative studies on carbon dioxide emissions of typical modern coal chemical processes. Chem. Ind. Eng. Prog. 2016, 35, 4060–4064. [Google Scholar]

- National Energy Technology Laboratory. FE/NETL CO2 Saline Storage Cost Model: Model Description and Baseline Results; National Energy Technology Laboratory (NETL): Pittsburgh, PA, USA, 2014. [Google Scholar]

- Xie, J.; Li, X.; Gao, X. Pipeline Network Options of CCUS in Coal Chemical Industry. Atmosphere 2022, 13, 1864. [Google Scholar] [CrossRef]

- Wei, Y.M.; Li, X.Y.; Liu, L.C.; Kang, J.N.; Yu, B.Y. A cost-effective and reliable pipelines layout of carbon capture and storage for achieving China’s carbon neutrality target. J. Clean. Prod. 2022, 379, 134651. [Google Scholar] [CrossRef]

- Middleton, R.S.; Bielicki, J.M. A scalable infrastructure model for carbon capture and storage: SimCCS. Energy Policy 2009, 37, 1052–1060. [Google Scholar] [CrossRef]

- Wei, Y.M.; Li, X.Y.; Liu, L.C.; Kang, J.N.; Yu, B.Y. Economic Evaluation of CO2 Storage and Sink Enhancement Options; Tennessee Valley Authority: Knoxville, TN, USA, 2003. [Google Scholar]

- Ramírez, A.; Hagedoorn, S.; Kramers, L.; Wildenborg, T.; Hendriks, C. Screening CO2 storage options in the Netherlands. Int. J. Greenh. Gas Control 2010, 4, 367–380. [Google Scholar] [CrossRef]

- Zhong, L.F.; Lin, Q.G.; Wang, X.Z.; Wang, H.; Zhai, M.Y. Economic evaluation of carbon capture and storage enhanced oil recovery technology. Mod. Chem. Ind. 2016, 36, 7–10. [Google Scholar]

- Fan, J.H.; Todorova, N. Dynamics of China’s carbon prices in the pilot trading phase. Appl. Energy 2017, 208, 1452–1467. [Google Scholar] [CrossRef]

- Fan, J.L.; Xu, M.; Yang, L.; Zhang, X. Benefit evaluation of investment in CCS retrofitting of coal-fired power plants and PV power plants in China based on real options. Renew. Sustain. Energy Rev. 2019, 115, 109350. [Google Scholar] [CrossRef]

- Zhang, Z.; Liang, D. Study of industrial path to reduce the energy density based on divisia decomposition. In Proceedings of the 2009 International Conference on Management Science and Engineering, Moscow, Russia, 14–16 September 2009; IEEE: Piscataway, NJ, USA, 2009; pp. 1650–1655. [Google Scholar]

- Zhou, L.; Duan, M.; Yu, Y.; Zhang, X. Learning rates and cost reduction potential of indirect coal-to-liquid technology coupled with CO2 capture. Energy 2018, 165, 21–32. [Google Scholar] [CrossRef]

- Upstill, G.; Hall, P. Estimating the learning rate of a technology with multiple variants: The case of carbon storage. Energy Policy 2018, 121, 498–505. [Google Scholar] [CrossRef]

- Nadarajah, S.; Secomandi, N. A review of the operations literature on real options in energy. Eur. J. Oper. Res. 2023, 309, 469–487. [Google Scholar] [CrossRef]

- Ho, T.; Kim, K.; Li, Y.; Xu, F. Can Real Options Explain the Skewness of Stock Returns? J. Bank. Finance 2023, 148, 106751. [Google Scholar] [CrossRef]

- Fan, J.L.; Xu, M.; Yang, L.; Zhang, X.; Li, F. How can carbon capture utilization and storage be incentivized in China? A perspective based on the 45Q tax credit provisions. Energy Policy 2019, 132, 1229–1240. [Google Scholar] [CrossRef]

- Li, J.; Wei, Y.M.; Dai, M. Investment in CO2 capture and storage combined with enhanced oil recovery in China: A case study of China's first megaton-scale project. J. Clean. Prod. 2022, 373, 133724. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).