Price Forecasting and Span Commercialization Opportunities for Mexican Agricultural Products

Abstract

1. Introduction

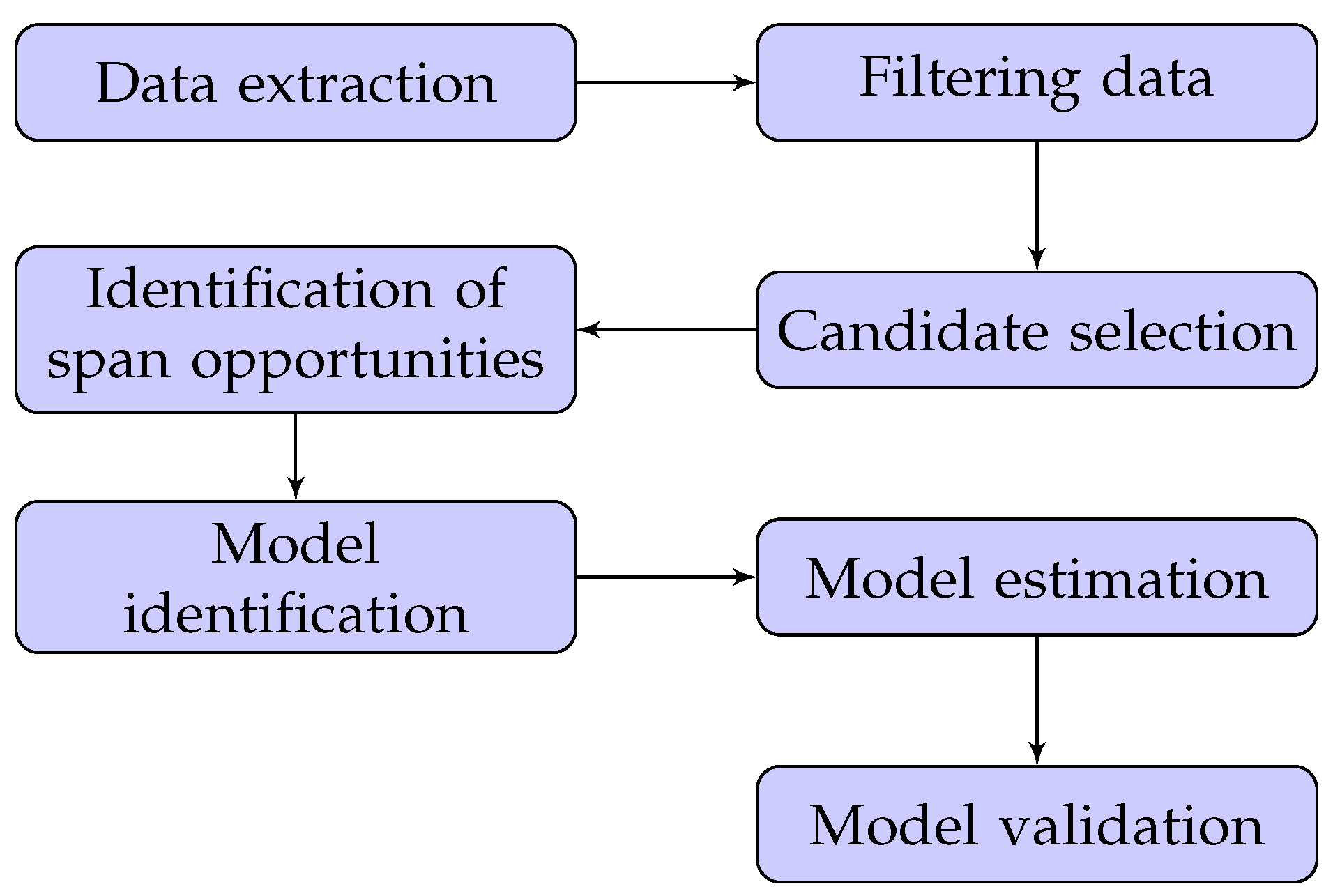

2. Methodology

2.1. Data Extraction

- Price. According to SNIIM, the products’ daily prices are only collected on work days (which in Mexico represents approximately 70% of the year).

- Packaging. It refers to the presentation of the product e.g., bunches or boxes.

- Origin. It refers to whether product is local or imported.

- Quality. There are two types: first quality and exportation quality.

2.2. Data Filtering

- Persistent. A product is called persistent when the missing data in the last four years do not exceed 30%.

- Seasonal. A product is called seasonal when the missing data in the last four years exceed 30%, but present periodical records during the same months year after year.

- Random. A product is called random when the missing data in the last four years exceed 30%, but do not present periodical records during the same months year after year.

- New A product is called new when it has been commercialized for less than four years and the missing data do not exceed 30 % since its commercialization began.

- Dead A product is called dead when there are no data available in the last two years.

- Ghostly. A product is called ghostly when there are fewer than 10 records.

- Pure Families that contain only one member.

- Mixed. Families that contain at least two members that do not overlap through time (product replacement).

- Multivalent. Families that contain at least two members that overlap through time.

2.3. Data Processing

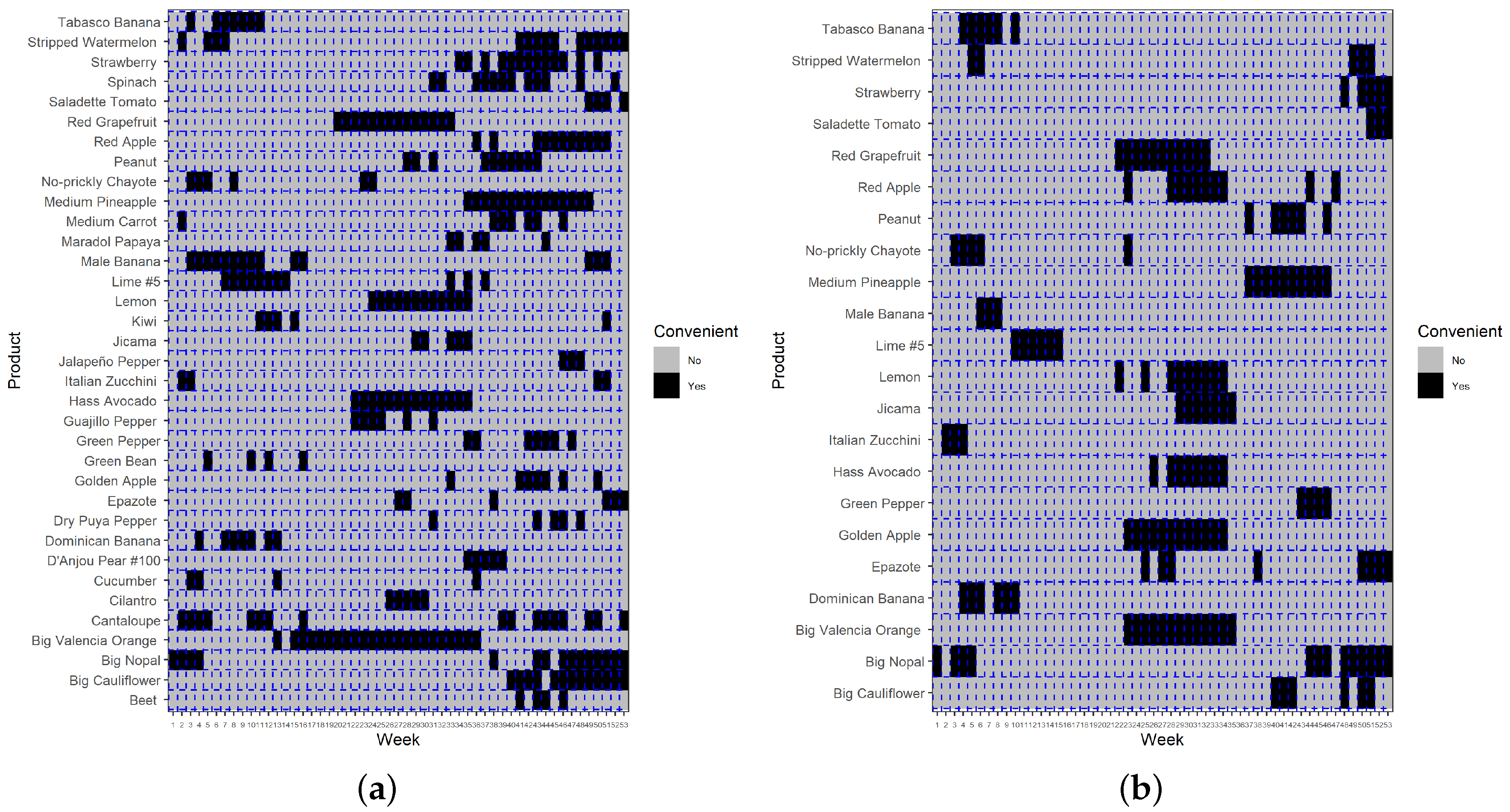

2.4. Span Commercialization Opportunities

2.5. Candidate Selection

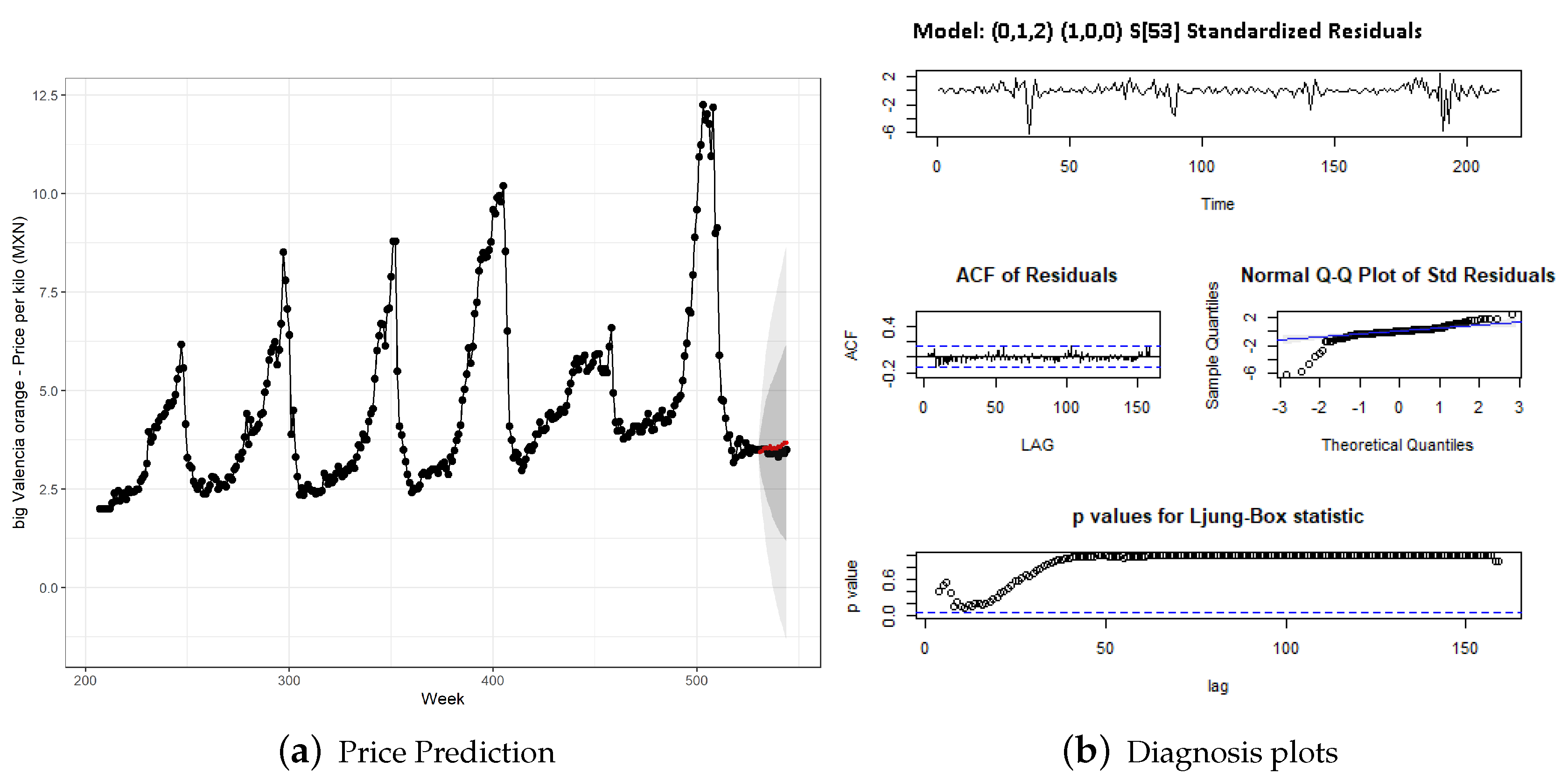

2.6. Mathematical Modeling for Price Understanding

3. Results

4. Discussion

4.1. Considerations Regarding Filtering

4.2. Modeling for Decision Making

5. Conclusions and Future Work

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Supplemental Tables

| Label | Products | |||

|---|---|---|---|---|

| Persistent | Alpha potato | Ancho pepper | Beet | Bell pepper |

| Big-sized cauliflower | Big-sized corn | Big-sized nopal | Big-sized Valencia orange | |

| Broccoli | Cantaloupe | Celery | Cilantro | |

| Cucumber | D’ Anjou #100 pear | Dominican banana | Dry puya pepper | |

| Epazote | Golden delicious apple | Green bean | Green pepper | |

| Green tomato | Guajillo pepper | Guava | Hass avocado | |

| Italian zucchini | Jalapeno pepper | Jicama | Kiwi | |

| Lemon | Lime #5 | Male banana | Maradol papaya | |

| Medium-sized cabbage | Medium-sized carrot | Medium-sized pineapple | No-prickly chayote | |

| Pasilla pepper | Peanut | Poblano pepper | Radish | |

| Red delicious apple | Red grapefruit | Romaine big-sized lettuce | Saladette tomato | |

| Spinach | Strawberry | Stripped watermelon | Tabasco banana. | |

| Seasonal | Ataulfo mango | Castilla pumpkin | Mandarin orange | Manila mango |

| Sugarcane | White prickly pear fruit. | Random Balloon grape | Purple garlic | |

| Superior grape | Thompson grape. | |||

| New | Big ball onion | Green bean | Sweet potato | Yellow peach. |

| Dead | Ball onion | Cantaloupe #12 | Cantaloupe #27 | Chayote |

| Chilaca | Corn | Haden mango | Lime #3 | |

| Medium-sized cauliflower | Medium-sized red grapefruit | Medium-sized Valence orange | Nopal | |

| Powder carrot | Sangria watermelon | White garlic | Wood carrot. | |

| Ghostly | Big-sized cabbage | Chard | Cherry | Chiapas banana |

| Monica orange mandarin | Tamarind | Tejocote. | ||

| Label | Products | |||

|---|---|---|---|---|

| Pure Unique | Alpha potato | Beet | Broccoli | Celery |

| Cilantro | Cucumber | D’ Anjou #100 pear | Epazote | |

| Green bean | Green tomato | Guava | Hass avocado | |

| Italian zucchini | Jicama | Kiwi | Lemon | |

| Maradol papaya | Medium-sized pineapple | Peanut | Radish | |

| Romaine big-sized lettuce | Saladette tomato | Spinach | Strawberry | |

| Castilla pumpkin | Sugarcane | White prickly pear fruit | Green bean | |

| Sweet potato | Yellow peach | Chard | Cherry | |

| Tamarind | Tejocote. | |||

| Mixed | Ball onion | Big ball onion | Big-sized cauliflower | Big-sized corn |

| Big-sized nopal | Big-sized Valencia orange | Cantaloupe | Cantaloupe #12 | |

| Cantaloupe #27 | Chayote | Corn | Lime #3 | |

| Lime #5 | Medium-sized cauliflower | Medium-sized Valence orange | Nopal | |

| No-prickly chayote | Purple garlic | Sangria watermelon | Stripped watermelon | |

| White garlic | ||||

| Multivalent | Ancho pepper | Ataulfo mango | Balloon grape | Bell pepper |

| Big-sized cabbage | Chiapas banana | Chilaca | Dominican banana | |

| Dry puya pepper | Golden delicious apple | Green pepper | Guajillo pepper | |

| Haden mango | Jalapeno pepper | Mandarin orange | Male banana | |

| Manila mango | Medium-sized cabbage | Medium-sized carrot | Medium-sized red grapefruit | |

| Monica orange mandarin | Pasilla pepper | Poblano pepper | Powder carrot | |

| Red delicious apple | Red grapefruit | Superior grape | Tabasco banana | |

| Thompson grape | Wood carrot | |||

References

- Pittelkow, C.M.; Liang, X.; Linquist, B.A.; Van Groenigen, K.J.; Lee, J.; Lundy, M.E.; Van Gestel, N.; Six, J.; Venterea, R.T.; van Kessel, C. Productivity limits and potentials of the principles of conservation agriculture. Nature 2015, 517, 365. [Google Scholar] [CrossRef] [PubMed]

- WBG. Agricultura, Valor Agregado (% del PIB); Technical Report; WBG: Washington, DC, USA, 2019. [Google Scholar]

- SIAP. Estadística de Producción Agrícola de 2017; Technical Report; Secretaría de Economía: Mexico City, Mexico, 2019. [Google Scholar]

- SADER. Análisis de la Balanza Comercial Agroalimentaria de México, Diciembre 2018; Technical Report; Secretaría de Agricultura y Desarrollo Rural: Mexico City, Mexico, 2019. [Google Scholar]

- Li, G.Q.; Xu, S.W.; Li, Z.M. Short-term price forecasting for agro-products using artificial neural networks. Agric. Agric. Sci. Procedia 2010, 1, 278–287. [Google Scholar] [CrossRef]

- Marroquín Martínez, G.; Chalita Tovar, L.E. Aplicación de la metodología Box-Jenkins para pronóstico de precios en jitomate. Rev. Mex. Cienc. AgrÍcolas 2011, 2, 573–577. [Google Scholar] [CrossRef][Green Version]

- Drachal, K. Analysis of Agricultural Commodities Prices with New Bayesian Model Combination Schemes. Sustainability 2019, 11, 5305. [Google Scholar] [CrossRef]

- Xie, H.; Wang, B. An Empirical Analysis of the Impact of Agricultural Product Price Fluctuations on China’s Grain Yield. Sustainability 2017, 9, 906. [Google Scholar] [CrossRef]

- Shukla, M.; Jharkharia, S. Applicability of ARIMA models in wholesale vegetable market: An investigation. Int. J. Inf. Syst. Supply Chain. Manag. 2013, 6, 105–119. [Google Scholar] [CrossRef]

- Xiong, T.; Li, C.; Bao, Y. Seasonal forecasting of agricultural commodity price using a hybrid STL and ELM method: Evidence from the vegetable market in China. Neurocomputing 2018, 275, 2831–2844. [Google Scholar] [CrossRef]

- Nhita, F.; Saepudin, D.; Wisesty, U.N. Planting Date Recommendation for Chili and Tomato Based on Economic Value Prediction of Agricultural Commodities. Open Agric. J. 2018, 12, 156–163. [Google Scholar] [CrossRef]

- Yu, S.; Ou, J. Forecasting model of agricultural products prices in wholesale markets based on combined BP neural network-time series model. In Proceedings of the IEEE 2009 International Conference on Information Management, Innovation Management and Industrial Engineering, Xi’an, China, 26–27 December 2009; Volume 1, pp. 558–561. [Google Scholar]

- Nasira, G.; Hemageetha, N. Vegetable price prediction using data mining classification technique. In Proceedings of the IEEE International Conference on Pattern Recognition, Informatics and Medical Engineering (PRIME-2012), Salem, India, 21–23 March 2012; pp. 99–102. [Google Scholar]

- Hemageetha, N.; Nasira, G. Radial basis function model for vegetable price prediction. In Proceedings of the IEEE International Conference on Pattern Recognition, Informatics and Mobile Engineering, Salem, India, 21–22 February 2013; pp. 424–428. [Google Scholar]

- McKinney, W. Python for Data Analysis: Data Wrangling with Pandas, NumPy, and IPython; O’Reilly Media, Inc.: Sebastopol, CA, USA, 2012. [Google Scholar]

- Hair, J.F.; Celsi, M.; Ortinau, D.J.; Bush, R.P. Essentials of Marketing Research; McGraw-Hill/Higher Education: New York, NY, USA, 2008. [Google Scholar]

- Banxico. Estadísticas del Banco de México. 2019. Available online: http://www.anterior.banxico.org.mx/portal-inflacion/inflacion.html (accessed on 15 March 2019).

- Shumway, R.H.; Stoffer, D.S. Time Series Analysis and Its Applications: With R Examples; Springer: Berlin, Germany, 2017. [Google Scholar]

- Croushore, D.; Stark, T. A real-time data set for macroeconomists. J. Econ. 2001, 105, 111–130. [Google Scholar] [CrossRef]

- SAGARPA. PC-024-2005 Pliego de Condiciones Para el uso de la Marca Oficial México: Calidad Suprema en el Limón Mexicano; Technical Report; SAGARPA: Mexico City, Mexico, 2005. [Google Scholar]

- Secretaria de Economia (SE). NMX-FF-087-SCFI-2001 Productos Alimenticios no Industrializados para uso Humano—Fruta Fresca—Limón Mexicano (Citrus Aurantifolia Swingle)—Especificaciones (Cancela a la NMX-FF-087-1995-SCFI); Technical Report; SE: Mexico City, Mexico, 2001. [Google Scholar]

- Ahumada, O.; Villalobos, J.R. Application of planning models in the agri-food supply chain: A review. Eur. J. Oper. Res. 2009, 196, 1–20. [Google Scholar] [CrossRef]

- Secretaria de Economia (SE). Monografía del Sector Aguacate en México: Situación Actual y Oportunidades de Mercado; Technical Report; SE: Mexico City, Mexico, 2012. [Google Scholar]

- Salazar-García, S.; González-Durán, I.J.L.; Tapia-Vargas, L.M. Influencia del clima, humedad del suelo y época de floración sobre la biomasa y composición nutrimental de frutos de aguacate Hass en Michoacán, México. Rev. Chapingo. Ser. Hortic. 2011, 17, 183–194. [Google Scholar] [CrossRef]

- Rocha-Arroyo, J.L.; Salazar-García, S.; Bárcenas-Ortega, A.E. Determinación irreversible a la floración del aguacate Hass en Michoacán. Rev. Mex. Cienc. AgrÍcolas 2010, 1, 469–478. [Google Scholar]

- Diario Oficial de la Federacion (DOF). Acuerdo por el que se dan a Conocer los Lineamientos de Operacion del Programa de Desarrollo Rural de la Secretaria de Agricultura y Desarrollo Rural para el Ejercicio Fiscal 2019; Technical Report; DOF: Mexico City, Mexico, 2019. [Google Scholar]

- Sexton, R.J. Market Power, Misconceptions, and Modern Agricultural Markets. Am. J. Agric. Econ. 2012, 95, 209–219. [Google Scholar] [CrossRef]

| Product | Model Type | Relative Error |

|---|---|---|

| Big Cauliflower | IMA | 9.47% |

| Big Nopal | IMA | 34.41% |

| Big Valencia Orange | SARIMA | 3.89% |

| Epazote | IMA | 6.51% |

| Green Pepper | IMA | 36.61% |

| Hass Avocado | IMA | 7.01% |

| Italian Zucchini | IMA | 15.91% |

| Jicama | SARIMA | 9.33 % |

| Kiwi | SARIMA | 8.24 % |

| Lemon | SARIMA | 10.07% |

| Lime #5 | SARIMA | 6.11% |

| Male Banana | IMA | 4.51% |

| Medium-sized Pineapple | IMA | 4.32% |

| Non-prickly chayote | IMA | 41.39% |

| Peanut | IMA | 3.89% |

| Red Grapefruit | IMA | 3.15% |

| Saladette Tomato | IMA | 8.09% |

| Tabasco Banana | IMA | 23.15% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Paredes-Garcia, W.J.; Ocampo-Velázquez, R.V.; Torres-Pacheco, I.; Cedillo-Jiménez, C.A. Price Forecasting and Span Commercialization Opportunities for Mexican Agricultural Products. Agronomy 2019, 9, 826. https://doi.org/10.3390/agronomy9120826

Paredes-Garcia WJ, Ocampo-Velázquez RV, Torres-Pacheco I, Cedillo-Jiménez CA. Price Forecasting and Span Commercialization Opportunities for Mexican Agricultural Products. Agronomy. 2019; 9(12):826. https://doi.org/10.3390/agronomy9120826

Chicago/Turabian StyleParedes-Garcia, Wilfrido Jacobo, Rosalia Virginia Ocampo-Velázquez, Irineo Torres-Pacheco, and Christopher Alexis Cedillo-Jiménez. 2019. "Price Forecasting and Span Commercialization Opportunities for Mexican Agricultural Products" Agronomy 9, no. 12: 826. https://doi.org/10.3390/agronomy9120826

APA StyleParedes-Garcia, W. J., Ocampo-Velázquez, R. V., Torres-Pacheco, I., & Cedillo-Jiménez, C. A. (2019). Price Forecasting and Span Commercialization Opportunities for Mexican Agricultural Products. Agronomy, 9(12), 826. https://doi.org/10.3390/agronomy9120826