Hydrological Drought-Indexed Insurance for Irrigated Agriculture in a Highly Regulated System

Abstract

1. Introduction

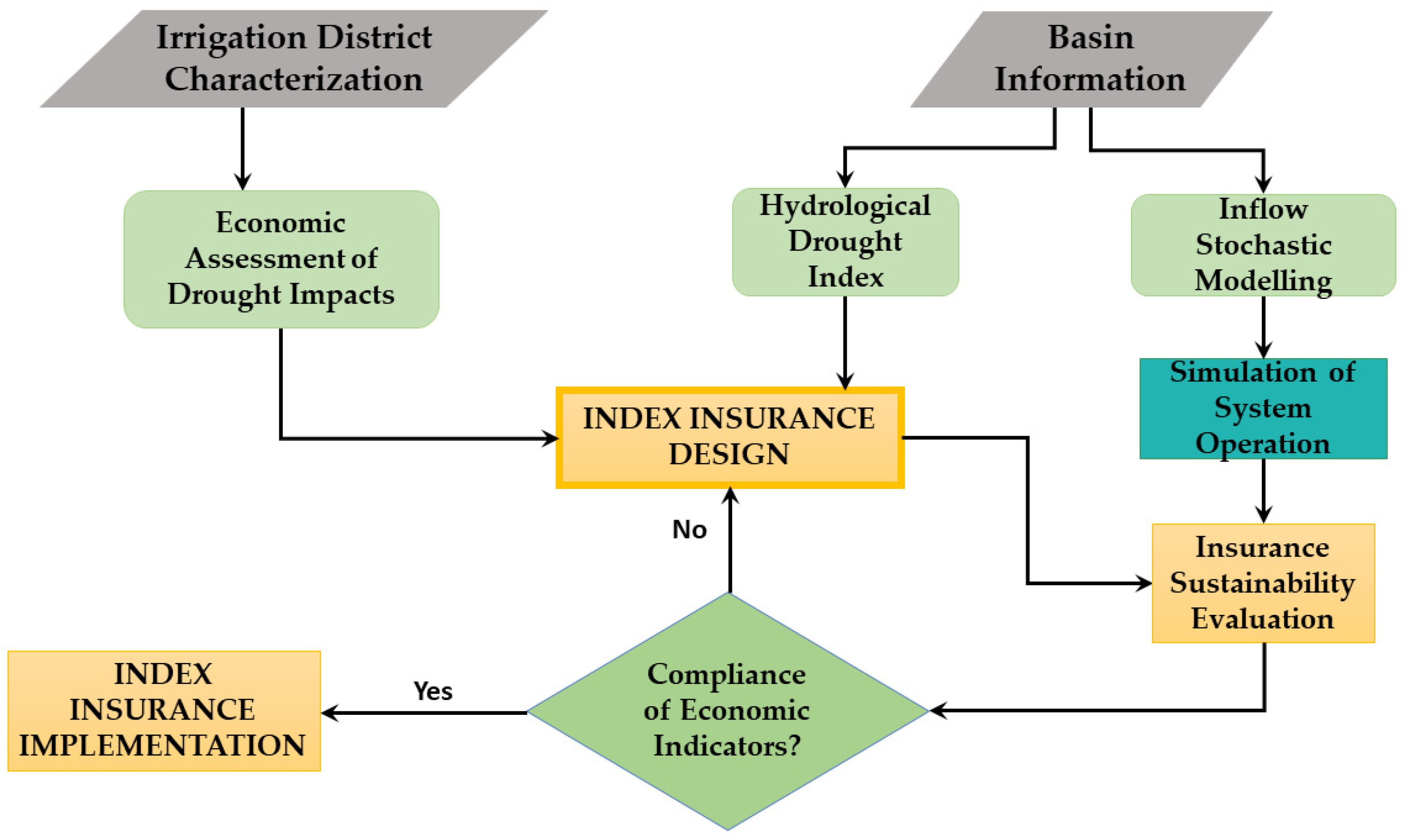

2. Materials and Methods

2.1. Economic Assessment of Drought Impacts

2.2. Design of the Insurance Scheme

2.3. Selection of the Most Appropriate Insurance Plan

Simulation of the Insurance Design through a Water Resource System Model

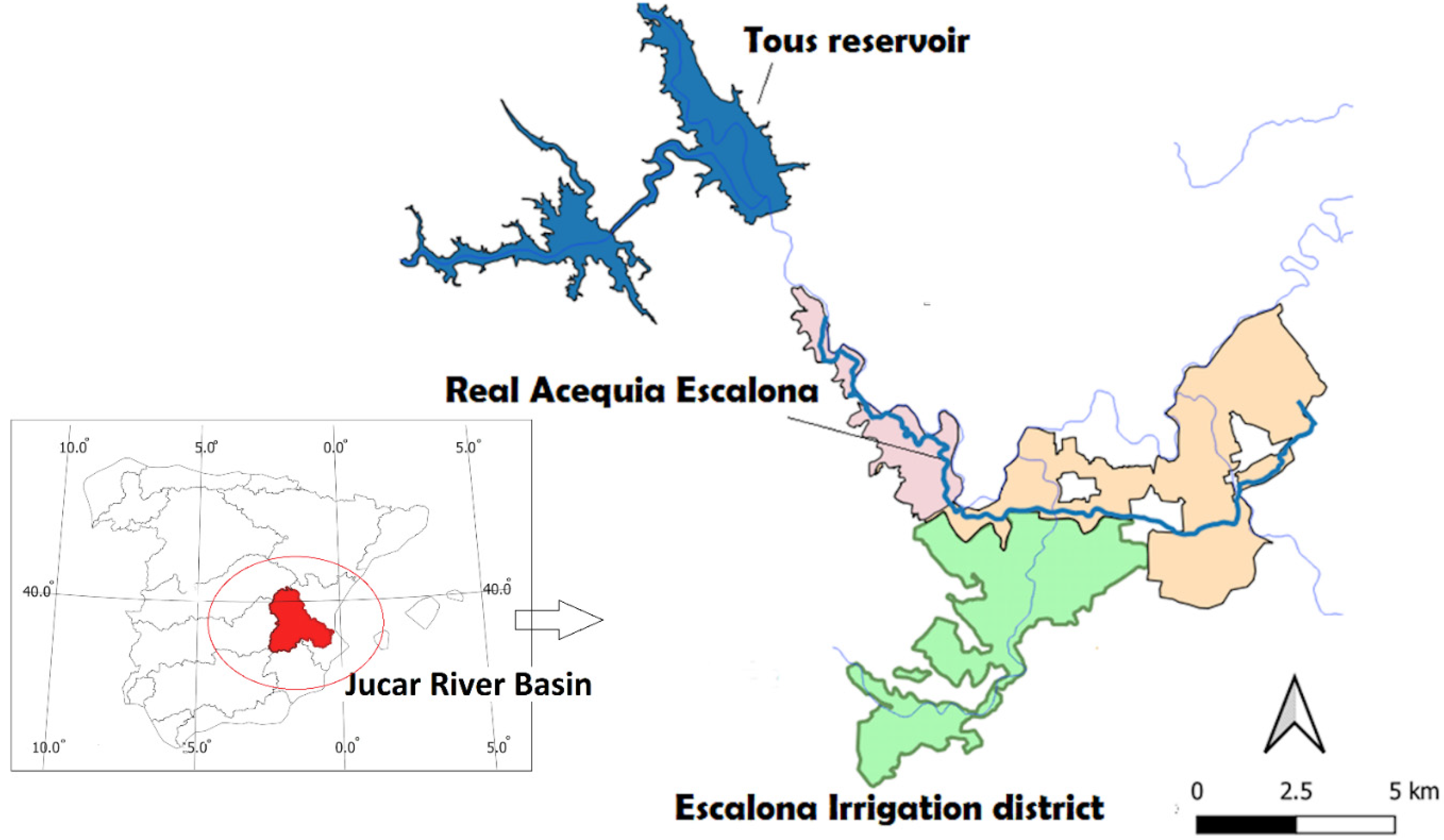

2.4. Case Study

2.4.1. Description

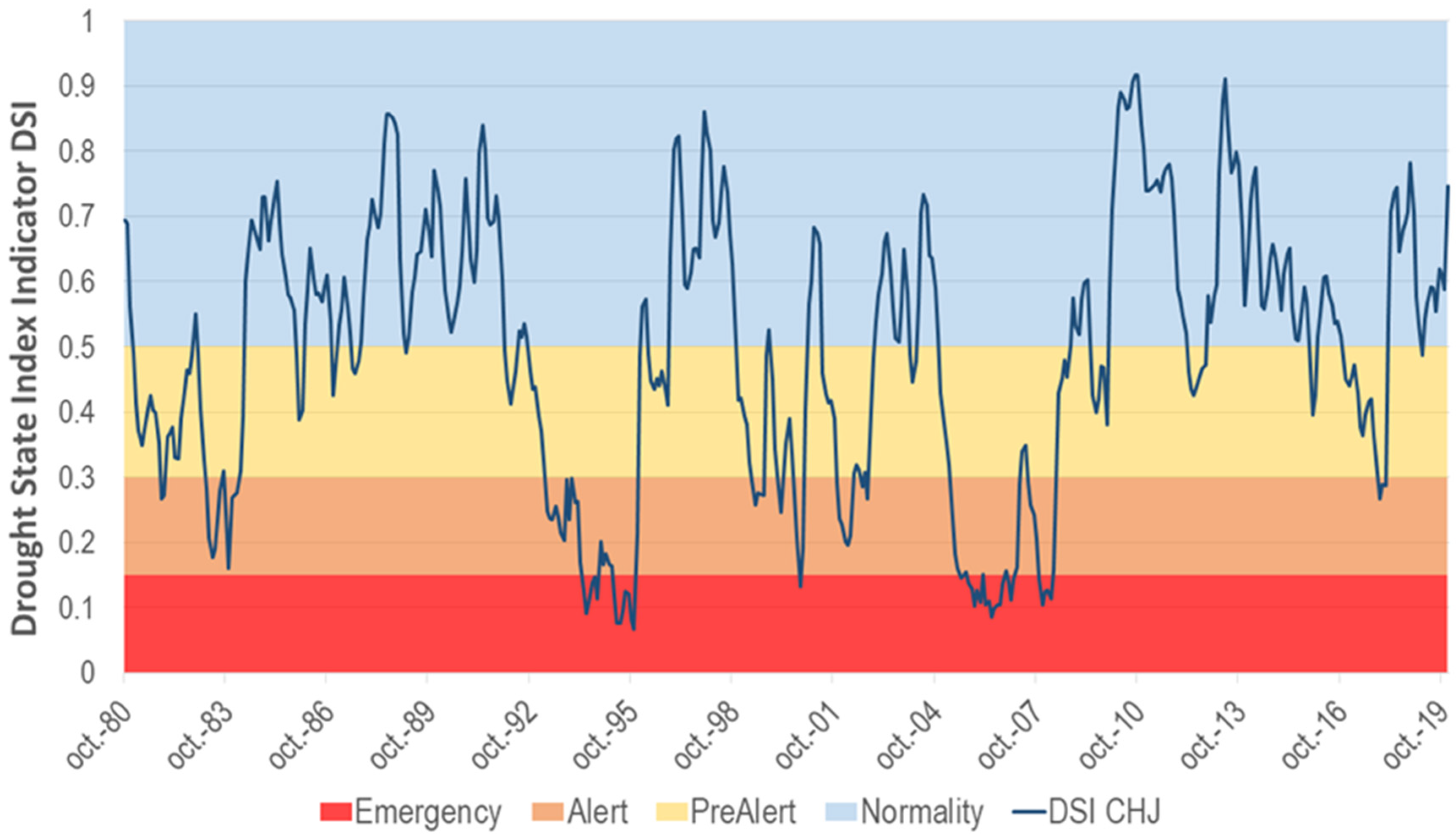

2.4.2. Drought State Index

2.4.3. Water Scarcity in the RAE

3. Results

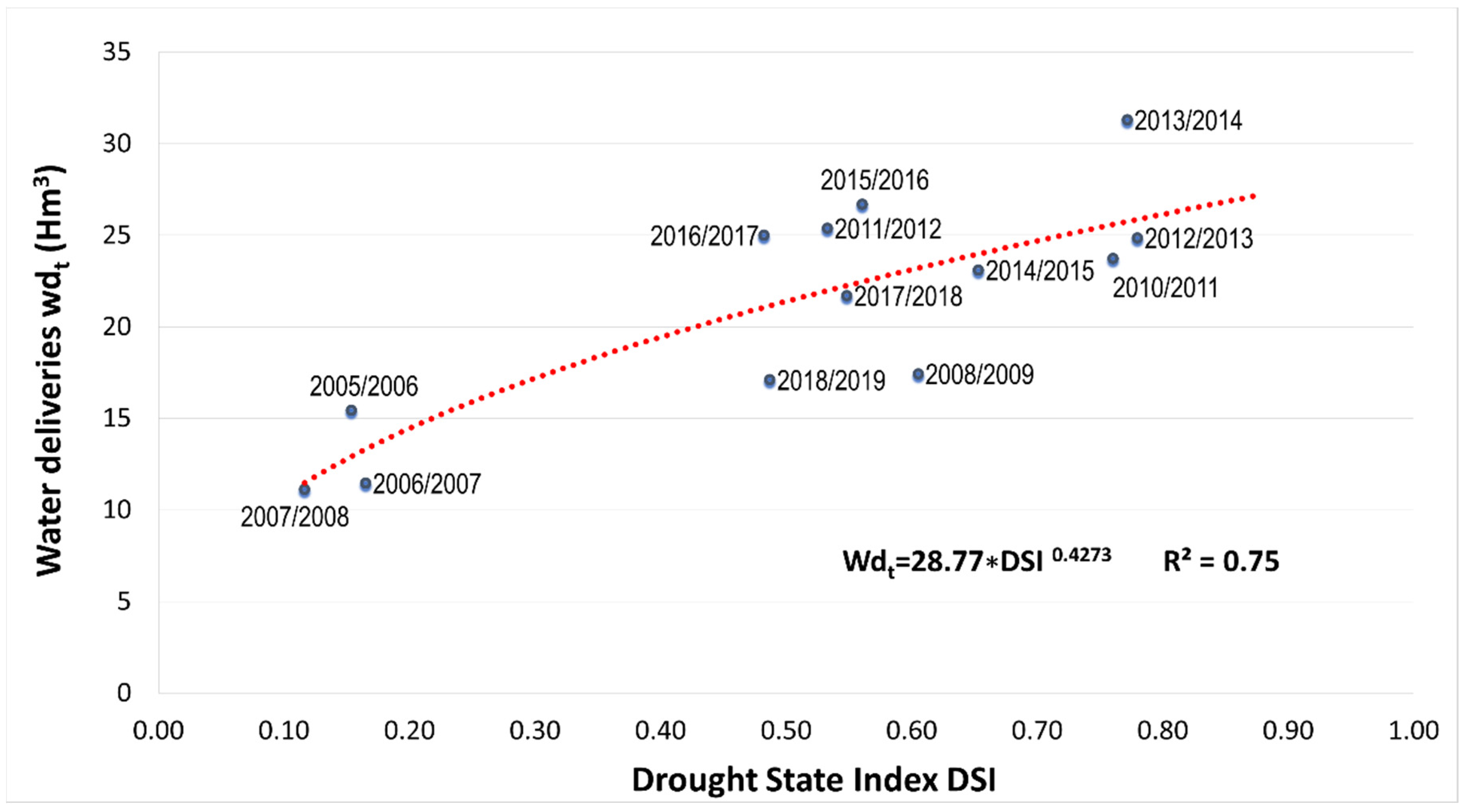

3.1. Correlation between Drought Index DSI and Water Deliveries

3.2. Measuring the Economic Impact of Hydrological Droughts

3.3. Hydrological Index Insurance Design

- Option 1: Variable premium and/or variable franchise based on the forecast of water availability for the insurance irrigation season.

- Option 2: Pre-season index contract. Multi-year insurance contract

- Option 3: Early Contract

3.4. Assessment of Insurance Schemes Proposed in the RAE Irrigation District

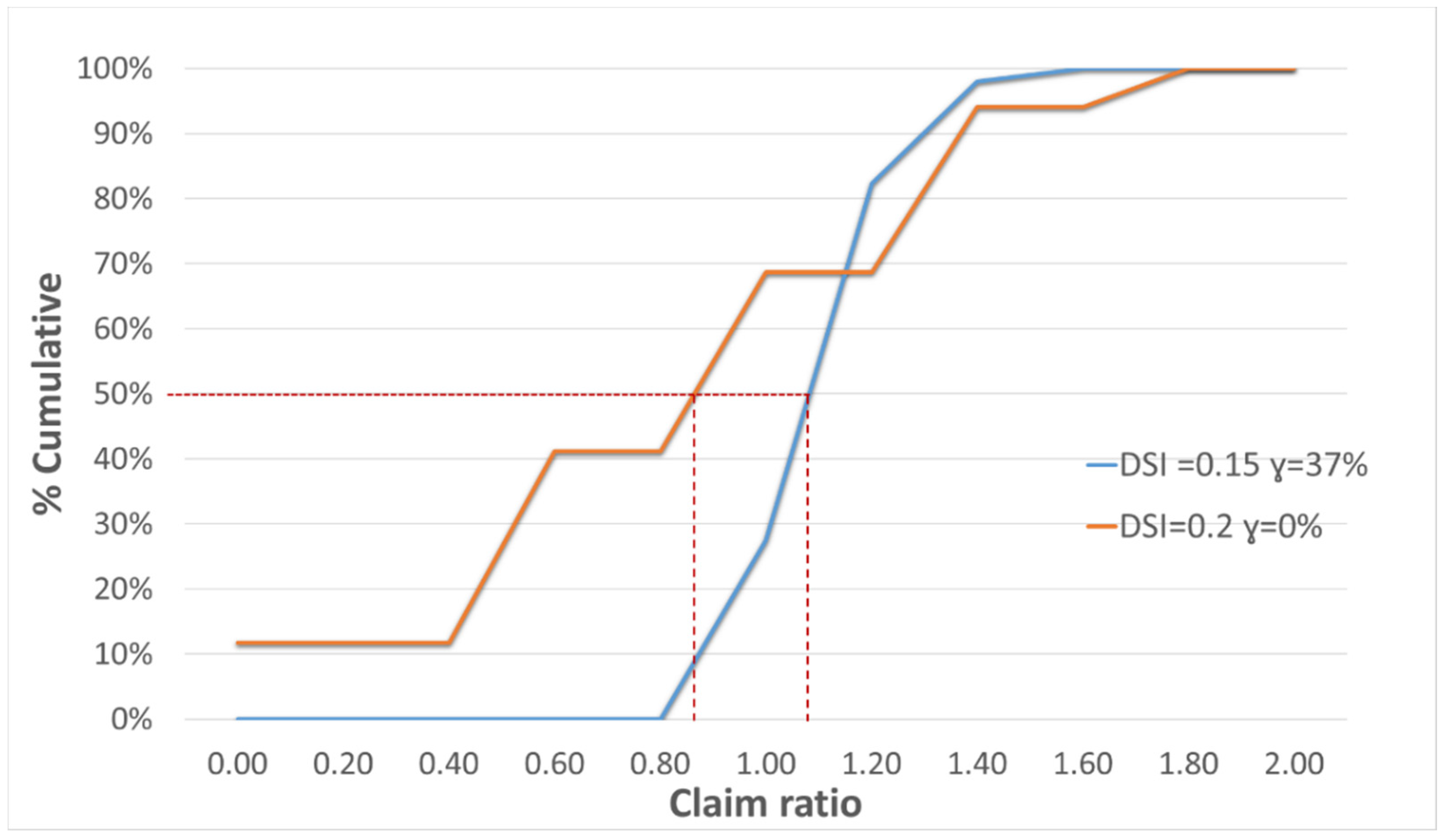

- Basis Risk

- Standard Deviation Gross Margin (€/ha), Minimum Gross Margin (€/ha), RMSL (€/ha)

| Insurance Scheme | Additional Loadings | Standard Deviation (€/ha) | Minimum Gross Margin (€/ha) | RMSL (€/ha) | Basis Risk (Loss) (%) | Basis Risk (Gain) (%) |

|---|---|---|---|---|---|---|

| No insurance | 567.9 | 1193.1 | 84.1 | |||

| γ = 37% DSI = 0.15 | 0% | 551.5 | 1156.6 | 96.1 | 3.85 | 12.55 |

| 10% | 551.5 | 1140.8 | 103.2 | |||

| 37% | 551.5 | 1098.1 | 122.7 | |||

| γ = 19% DSI = 0.3 | 0% | 550.8 | 1144.6 | 101.5 | 3.85 | 12.84 |

| 10% | 550.8 | 1127.6 | 109.2 | |||

| 37% | 550.8 | 1081.7 | 130.3 | |||

| γ = 0% DSI = 0.5 | 0% | 597.3 | 1021.6 | 158.3 | 2.71 | 25.96 |

| 10% | 597.3 | 992.3 | 172.4 | |||

| 37% | 597.3 | 913.2 | 211.9 | |||

| γ = 0% DSI = 0.3 | 0% | 550.8 | 1187.1 | 82.6 | 3.85 | 12.84 |

| 10% | 550.8 | 1174.3 | 88.2 | |||

| 37% | 550.8 | 1139.9 | 103.6 | |||

| γ = 0% DSI = 0.15 | 0% | 626.6 | 1163.1 | 99.2 | 9.13 | 3.85 |

| 10% | 626.6 | 1160.1 | 100.7 | |||

| 37% | 626.6 | 1152.0 | 104.9 | |||

| γ = 0% DSI = 0.2 | 0% | 550.8 | 1254.6 | 54.9 | 3.85 | 12.84 |

| 10% | 550.8 | 1248.6 | 57.2 | |||

| 37% | 550.8 | 1232.4 | 63.5 | |||

| γ = 31% DSI = 0.2 | 0% | 550.8 | 1143.6 | 102.0 | 3.85 | 12.84 |

| 10% | 550.8 | 1126.5 | 109.7 | |||

| 37% | 550.8 | 1080.3 | 130.9 |

3.5. Simulation of Insurance Design Based on the Implementation of a Management Model

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- FAO. Agua. Available online: https://www.fao.org/water/es/ (accessed on 1 February 2022).

- The World Bank. Water in Agriculture. Available online: https://www.bancomundial.org/es/topic/water-in-agriculture#1 (accessed on 1 February 2022).

- Berbel, J.; Espinosa Tasón, J. La gestión del regadío ante la escasez del agua: El caso de España. In Inundaciones y Sequías. Análisis Multidisciplinar Para Mitigar el Impacto de los Fenómenos Climáticos Extremos; Universitat d’Alacant: Joaquín Melgarejo, Ma Inmaculada López-Ortiz, Patricia Fernández-Aracil, 2021; pp. 411–416. Available online: http://hdl.handle.net/10317/10392 (accessed on 1 February 2022).

- Future Earth. Our Future on Earth. 2020. Available online: www.futureearth.org/publications/our-future-on-earth (accessed on 1 September 2022).

- Alamanos, A.; Mylopoulos, N.; Loukas, A.; Gaitanaros, D. An Integrated Multicriteria Analysis Tool for Evaluating Water Resource Management Strategies. Water 2018, 10, 1795. [Google Scholar] [CrossRef]

- MITECO. Tipos de Sequía. In Observatorio Nacional de la Sequía. Ministerio Para la Transición Ecológica y el Reto Demográfico; Madrid, Spain. 2018. Available online: https://www.miteco.gob.es/es/agua/temas/observatorio-nacional-de-la-sequia/ (accessed on 15 December 2021).

- Van Loon, A.F. Hydrological drought explained. WIREs Water 2015, 2, 359–392. [Google Scholar] [CrossRef]

- Tallaksen, L.M.; Van Lanen, H.A. Hydrological drought. Processes and estimation methods for streamflow and groundwater; Tallaksen, L., Van Lanen, H.A.J., Eds.; Elsevier: Amsterdam, The Netherlands, 2004. [Google Scholar]

- Gómez-Limón, J.A.; Guerrero-Baena, M.D. Diseño de un seguro indexado para la cobertura del riesgo de sequía hidrológica en la agricultura de regadío. Agua Territ. 2019, 3, 79–92. [Google Scholar] [CrossRef]

- Pulido-Velazquez, M.; Cabrera Marcet, E.; Garrido Colmenero, A. Economía del agua y gestión de recursos hídricos. Ing. Agua 2014, 18, 95. [Google Scholar] [CrossRef][Green Version]

- Expósito, A.; Beier, F.; Berbel, J. Hydro-Economic Modelling for Water-Policy Assessment Under Climate Change at a River Basin Scale: A Review. Water 2020, 12, 1559. [Google Scholar] [CrossRef]

- Comisión Europea. Informe Sobre la Revisión de la Política Europea de Lucha Contra la Escasez de Agua y la Sequía; Comisión Europea: Bruselas, Belgium, 2012; Available online: https://eur-lex.europa.eu/legal-content/ES/TXT/PDF/?uri=CELEX:52012DC0672&from=ES (accessed on 15 January 2020).

- Smith, R. Directive 2008/94/EC of the European Parliament and of the Council of 22 October 2008. In Core EU Legislation; Macmillan Education UK: London, UK, 2015; pp. 423–426. [Google Scholar] [CrossRef]

- Harou, J.J.; Pulido-Velazquez, M.; Rosenberg, D.E.; Medellín-Azuara, J.; Lund, J.R.; Howitt, R.E. Hydro-economic models: Concepts, design, applications, and future prospects. J. Hydrol. 2009, 375, 627–643. [Google Scholar] [CrossRef]

- López Nicolás, A.F.L. Métodos y Herramientas Para Diseño y Evaluación de Instrumentos Económicos para la Gestión a Escala de Cuenca. Ph.D. Thesis, Universitat Politècnica de València, Valencia, Spain, 2017. Available online: https://riunet.upv.es/handle/10251/91143 (accessed on 10 October 2019).

- Mechler, R.; Pulido-Velazquez, M.; Koehler, M.; Jenkins, K.; Surminski, S.; Williges, K.; Botzen, W.; Cremades, R.; Dransfeld, B.; Hudson, P.; et al. Economic instruments. In Novel Multi-Sector Partnerships in Disaster Risk Management; Aerts, J., Mysiak, J., Eds.; Enhance: Brussel, Belgium, 2017; pp. 70–97. [Google Scholar] [CrossRef]

- Rey, D.; Pérez-Blanco, C.D.; Escriva-Bou, A.; Girard, C.; Veldkamp, T.I.E. Role of economic instruments in water allocation reform: Lessons from Europe. Int. J. Water Resour. Dev. 2019, 35, 206–239. [Google Scholar] [CrossRef]

- FAO. Seguros Agricolas Para la Agricultura Familiar en America Latina y el Caribe-Lineamientos Para su Desarrollo e Implementación; Santiago, Chile. 2018. Available online: http://www.fao.org/publication/es (accessed on 15 June 2019).

- Nnadi, F.N.; Chikaire, J.; Echetama, J.A.; Ihenacho, R.A.; Umunnakwe, P.C. Agricultural insurance: A strategic tool for climate change adaptation in the agricultural sector. Net J. Agric. Sci. 2013, 1, 1–9. [Google Scholar]

- Cole, S.A.; Xiong, W. Agricultural Insurance and Economic Development. Annu. Rev. Econ. 2017, 9, 235–262. [Google Scholar] [CrossRef]

- Hess, U.; Hazell, P.; Kuhn, S. Innovations and Emerging Trends in Agricultural Insurance: How can we transfer natural risks out of rural livelihoods to empower and protect people? Conference paper. Draft for Discussion Purposes. GPFI SME Finance SubGroup. In Proceedings of the G-20 Round Table on Innovations in Agricultural Finance, Antalya, Turkey, 9 September 2015. [Google Scholar]

- Barnett, B.J.; Barrett, C.B.; Skees, J.R. Poverty Traps and Index-Based Risk Transfer Products. World Dev. 2008, 36, 1766–1785. [Google Scholar] [CrossRef]

- Alderman, H.; Haque, T. Insurance Against Covariate Shocks: The Role of Index-Based Insurance in Social Protection in Low-Income Countries of Africa. In World Bank Working Papers; The World Bank: Columbia, DC, USA, 2007. [Google Scholar] [CrossRef]

- Hazell, P.; Skees, J. Insuring against Bad Weather Recent Thinking. January 2005. Available online: https://biotech.law.lsu.edu/blog/INSURING_AGAINST_BAD_WEATHER_RECENT_THINKING.pdf (accessed on 10 October 2021).

- Mahul, O.; Stutley, C.J. Government Support to Agricultural Insurance: Challenges and Options for Developing Countries; The World Bank: Washington, DC, USA, 2010. [Google Scholar] [CrossRef]

- Jensen, N.; Barrett, C. Agricultural Index Insurance for Development. Appl. Econ. Perspect. Policy 2017, 39, 199–219. [Google Scholar] [CrossRef]

- World Bank. 2005. Available online: https://openknowledge.worldbank.org/handle/10986/8797 (accessed on 1 September 2022).

- Roth, J.; McCord, M. Agricultural Microinsurance. Global Practices and Prospects, 1st ed.; Berold, R., Ed.; The MicroInsurance Centre, LLC: Appleton, WI, USA, 2008; Available online: https://www.findevgateway.org/sites/default/files/publications/files/mfg-en-paper-agricultural-microinsurance-global-practices-and-prospects-2008.pdf (accessed on 1 September 2022).

- Luna, A.; El Seguro Agrícola en Colombia. Reflexiones Comparadas Sobre su Desarrollo a Partir de Experiencias Internacionales. Fasecolda. 2013, 26. Available online: https://fdocuments.co/document/el-seguro-agrcola-en-colombia.html?page=1 (accessed on 25 July 2022).

- Boucher, S.; Moya, A. Recomendaciones para el Diseño e Implementación de un Seguro Indexado para Pequeños Productores Cafeteros. In Misión Estudios Competitividad Caficultura en Colombia; Universidad del Rosario: Bogota, Colombia, 2014; Available online: https://www.urosario.edu.co/Mision-Cafetera/Archivos/Gestion-de-Riesgo-Steve-Boucher-Andres-Moya.pdf (accessed on 12 January 2020).

- Maestro, T.; Bielza, M.; Garrido, A. Hydrological drought index insurance for irrigation districts in Spain. Span J. Agric. Res. 2016, 14, e0105. [Google Scholar] [CrossRef]

- Abdi, M.J.; Raffar, N.; Zulkafli, Z.; Nurulhuda, K.; Rehan, B.M.; Muharam, F.M.; Khosim, N.A.; Tangang, F. Index-based insurance and hydroclimatic risk management in agriculture: A systematic review of index selection and yield-index modelling methods. Int. J. Disaster Risk Reduct. 2022, 67, 102653. [Google Scholar] [CrossRef]

- Leiva, A.J.; Skees, J.R. Using Irrigation Insurance to Improve Water Usage of the Rio Mayo Irrigation System in Northwestern Mexico. World Dev. 2008, 36, 2663–2678. [Google Scholar] [CrossRef]

- Quiroga, S.; Garrote, L.; Fernandez-Haddad, Z.; Iglesias, A. Valuing drought information for irrigation farmers: Potential development of a hydrological risk insurance in Spain. Span J. Agric. Res. 2011, 9, 1059. [Google Scholar] [CrossRef]

- Pérez Blanco, C.D.; Gómez, C.M. Insuring water: A practical risk management option in water-scarce and drought-prone regions? Water Policy 2014, 16, 244–263. [Google Scholar] [CrossRef]

- Ruiz, J.; Bielza, M.; Garrido, A.; Iglesias, A. Dealing with drought in irrigated agriculture through insurance schemes: An application to an irrigation district in Southern Spain. Span J. Agric. Res. 2015, 13, e0106. [Google Scholar] [CrossRef]

- Gómez-Limón, J.A. Hydrological drought insurance for irrigated agriculture in southern Spain. Agric. Water Manag. 2020, 240, 106271. [Google Scholar] [CrossRef]

- Arandara, R.; Gunasekera, S.; Mookerjee, A. Index Insurance: A Viable Solution for Irrigated Farming? World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Generalitat Valenciana. Informe del Sector Agrario Valenciano 2020; Informes del Sector Agrario Valenciano; Generalitat Valenciana. Conselleria de Agricultura, Desarrollo Rural, Emergencia Climática y Transición Ecológica: Valencia, Spain, 2021; Available online: https://agroambient.gva.es/es/informes-del-sector-agrario-valenciano (accessed on 2 February 2022).

- Carmona, M.; Máñez Costa, M.; Andreu, J.; Pulido-Velazquez, M.; Haro-Monteagudo, D.; Lopez-Nicolas, A.; Cremades, R. Assessing the effectiveness of Multi-Sector Partnerships to manage droughts: The case of the Jucar river basin: Assessing Governance Performance. Earth’s Future 2017, 5, 750–770. [Google Scholar] [CrossRef]

- Ortega-Gómez, T.; Pérez-Martín, M.A.; Estrela, T. Improvement of the drought indicators system in the Júcar River Basin, Spain. Sci. Total Environ. 2018, 610–611, 276–290. [Google Scholar] [CrossRef]

- Zaniolo, M.; Giuliani, M.; Castelletti, A.F.; Pulido-Velazquez, M. Automatic design of basin-specific drought indexes for highly regulated water systems. Hydrol. Earth Syst. Sci. 2018, 22, 2409–2424. [Google Scholar] [CrossRef]

- Barnett, B. Agricultural Index Insurance Products: Strengths and Limitations; No 32971, Agricultural Outlook Forum 2004; United States Department of Agriculture: 2004. Available online: https://EconPapers.repec.org/RePEc:ags:usaofo:32971 (accessed on 12 January 2020).

- Zhang, J.; Tan, K.S.; Weng, C. Index Insurance Design. ASTIN Bull. 2019, 49, 491–523. [Google Scholar] [CrossRef]

- Carpenter, R. Index Insurance. Status and Regulatory Challenges; International Association of Insurance Supervisors (IAIS): Basel, Germany, 2018; Available online: https://a2ii.org/en/home (accessed on 16 February 2022).

- Suchato, P.; Mieno, T.; Schoengold, K.; Foster, T. The potential for moral hazard behavior in irrigation decisions under crop insurance. Agric. Econ. 2022, 53, 257–273. [Google Scholar] [CrossRef]

- Carter, M.; Elabed, G.; Serfilippi, E. Behavioral economic insights on index insurance design. Agric. Financ. Rev. 2015, 75, 8–18. [Google Scholar] [CrossRef]

- Lopez-Nicolas, A.; Pulido-Velazquez, M.; Macian-Sorribes, H. Economic risk assessment of drought impacts on irrigated agriculture. J. Hydrol. 2017, 550, 580–589. [Google Scholar] [CrossRef]

- International Risk Management Institute, Inc. (IRMI). Glossary of Insurance & Risk Management Terms. Available online: http://www.irmi.com/online/insurance-glossary/default.aspx (accessed on 20 January 2019).

- Maestro Villarroya, T. Hydrological Drought Index Insurance for Irrigated Agriculture. Ph.D. Thesis, Universidad Politécnica de Madrid, Madrid, Spain, 2016. [Google Scholar] [CrossRef]

- Maestro, T.; Barnett, B.J.; Coble, K.H.; Garrido, A.; Bielza, M. Drought Index Insurance for the Central Valley Project in California. Appl. Econ. Perspect. Policy 2016, 38, 521–545. [Google Scholar] [CrossRef]

- Vedenov, D.; Barnett, B.J. Efficiency of Weather Derivatives as Primary Crop Insurance Instruments. J. Agric. Resour. Econ. 2004, 29, 387–403. [Google Scholar]

- Adeyinka, A.A.; Krishnamurt, C.; Maraseni, T.; Chantarat, S. Viability of Weather Index Insurance in Managing Drought Risk in Australia. In Proceedings of the Actuaries Summit 2013, Sydney, Australia, 20–21 May 2013; Available online: http://eprints.usq.edu.au/id/eprint/23781 (accessed on 16 February 2022).

- Kellner, U.; Musshoff, O. Precipitation or water capacity indices? An analysis of the benefits of alternative underlyings for index insurance. Agric. Syst. 2011, 104, 645–653. [Google Scholar] [CrossRef]

- World Bank Group. Seguro Agropecuario Catastrófico en Colombia. Anexo “As If”; World Bank Group: Bogotá, DC, USA, 2018; p. 12. [Google Scholar]

- Andreu, J.; Ferrer-Polo, J.; Pérez, M.A.; Solera, A.; Paredes-Arquiola, J. Drought Planning and Management in the Júcar River Basin, Spain. In Drought in Arid and Semi-Arid Regions; Schwabe, K., Albiac, J., Connor, J.D., Hassan, R.M., Meza González, L., Eds.; Springer: Dordrecht, The Netherlands, 2013; pp. 237–249. [Google Scholar] [CrossRef]

- Rubio-Martin, A.; Pulido-Velazquez, M.; Macian-Sorribes, H.; Garcia-Prats, A. System Dynamics Modeling for Supporting Drought-Oriented Management of the Jucar River System, Spain. Water 2020, 12, 1407. [Google Scholar] [CrossRef]

- Sechi, G.M.; Sulis, A. Drought mitigation using operative indicators in complex water systems. Phys. Chem. Earth Parts A/B/C 2010, 35, 195–203. [Google Scholar] [CrossRef]

- CHJ. Plan Especial De Sequía. Demarcación Hidrográfica Del Júcar. Confederación Hidrográfica del Júcar; Valencia, Spain. 2018. Available online: https://www.chj.es/es-es/medioambiente/gestionsequia/Paginas/PlanEspecialdeAlertayEventualSequia.aspx (accessed on 10 December 2018).

- Alvarez, J.A.; Solera, A.S.; Romá, J.C.; Polo, J.F. SIMGES Simulation Model of Water Resource Management including Conjunctive Use. Version 3.02 User Manual; Valencia Polytechnic University: Valencia, Spain, 2007; p. 106. [Google Scholar]

- Confederación Hidrográfica del Júcar. Plan Hidrográfico de la Demarcación Hidrográfica del JÚCAR. Ciclo de Planificación Hidrológica 2015–2021. Anejo VI. Sistemas de Explotación y Balances; Confederación Hidrográfica del Júcar: Valencia, Spain, 2015; p. 582. Available online: https://www.chj.es/Descargas/ProyectosOPH/Consulta%20publica/PHC-2015-2021/PHJ1521_Anejo06_SE-Balances_151126.pdf (accessed on 15 December 2019).

| Option | Characteristics |

|---|---|

| Option 1: Variable premium and/or variable franchise based on the forecast of water availability for the secured irrigation season. | Farmers may purchase insurance based on the conditions of scarcity presented before the start of the irrigation season (1 April). The value of the premium would depend on two franchises (state of alert and emergency scarcity) [31]. |

| Option 2: Pre-season index contract. Multi-year insurance contract | Farmers may purchase insurance that uses certain indexes to adapt the value of its premium to the real risk at the time of the purchase. This can either be a one-year or a multi-year policy. The period of the policy would be set in October, i.e., the beginning of the harvest season. That is, the value of the premium is estimated with the DSI measured in October t and the compensation is calculated with the DSI in 1 April t + 1 [50]. |

| Option 3: Early Contract with a Constant Premium (Early Bird) | Farmers may purchase insurance at a constant premium. However, they would have to buy it early, before the drought can be predicted [51]. |

| Indicator | Description |

|---|---|

| % Basis Risk | Expected difference between the compensation received by the farmer with the insurance (indt) and the current losses calculated based on the historical water deliveries. The base risk can be broken down into base loss (probable farmer losses due to index insurance) and base gain (probable farmer gains due to index insurance) [31]. |

| RMSL (Gross margin) | It is a simple function of the semivariance (i.e., losses) with respect to the trend of the gross margin without Insurance [31,52,53]. |

| Minimum Gross Margin | Minimum gross margin in productive systems, with and without insurance (revenue—direct costs), in historical time series [31,54]. |

| Claim ratio | The most commonly used indicator for assessing the performance of an insurance or reinsurance undertaking is the claim rate [18]. This index makes it possible to determine whether the price fixed for a given insurance scheme is correct; that is, whether it actually allows for the settlement of claims arising in a given period. Claim Ratio = claim incurred/premium collected |

| DSICHJ Trigger Deductible Franchise | 0.5 γ = 0% | 0.3 γ = 19% | 0.2 γ = 31% | 0.15 γ = 37% | 0.3 γ = 0% | 0.2 γ = 0% | 0.15 γ = 0% |

|---|---|---|---|---|---|---|---|

| Premium rate (€/ha) | 293.00 | 170.00 | 171.00 | 158.00 | 127.00 | 60.00 | 30.00 |

| % liability | 41.80 | 24.25 | 24.39 | 22.54 | 18.19 | 8.56 | 4.28 |

| Pre-Season Index Contracts DSICHJ | Premium 1 Year-Contract | Premium 2 Year-Contract | Premium 3 Year-Contract | |||

|---|---|---|---|---|---|---|

| €/ha/year | % Liability | €/ha/year | % Liability | €/ha/year | % Liability | |

| Normality | 292.00 | 41.65 | 243.00 | 34.66 | 268.00 | 38.23 |

| Pre alert—Alert | 542.00 | 77.32 | 451.00 | 77.32 | 498.00 | 71.04 |

| Emergency | 947.00 | 135.09 | 788.00 | 112.41 | 871.00 | 124.25 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Valenzuela-Mahecha, M.A.; Pulido-Velazquez, M.; Macian-Sorribes, H. Hydrological Drought-Indexed Insurance for Irrigated Agriculture in a Highly Regulated System. Agronomy 2022, 12, 2170. https://doi.org/10.3390/agronomy12092170

Valenzuela-Mahecha MA, Pulido-Velazquez M, Macian-Sorribes H. Hydrological Drought-Indexed Insurance for Irrigated Agriculture in a Highly Regulated System. Agronomy. 2022; 12(9):2170. https://doi.org/10.3390/agronomy12092170

Chicago/Turabian StyleValenzuela-Mahecha, Miguel Angel, Manuel Pulido-Velazquez, and Hector Macian-Sorribes. 2022. "Hydrological Drought-Indexed Insurance for Irrigated Agriculture in a Highly Regulated System" Agronomy 12, no. 9: 2170. https://doi.org/10.3390/agronomy12092170

APA StyleValenzuela-Mahecha, M. A., Pulido-Velazquez, M., & Macian-Sorribes, H. (2022). Hydrological Drought-Indexed Insurance for Irrigated Agriculture in a Highly Regulated System. Agronomy, 12(9), 2170. https://doi.org/10.3390/agronomy12092170