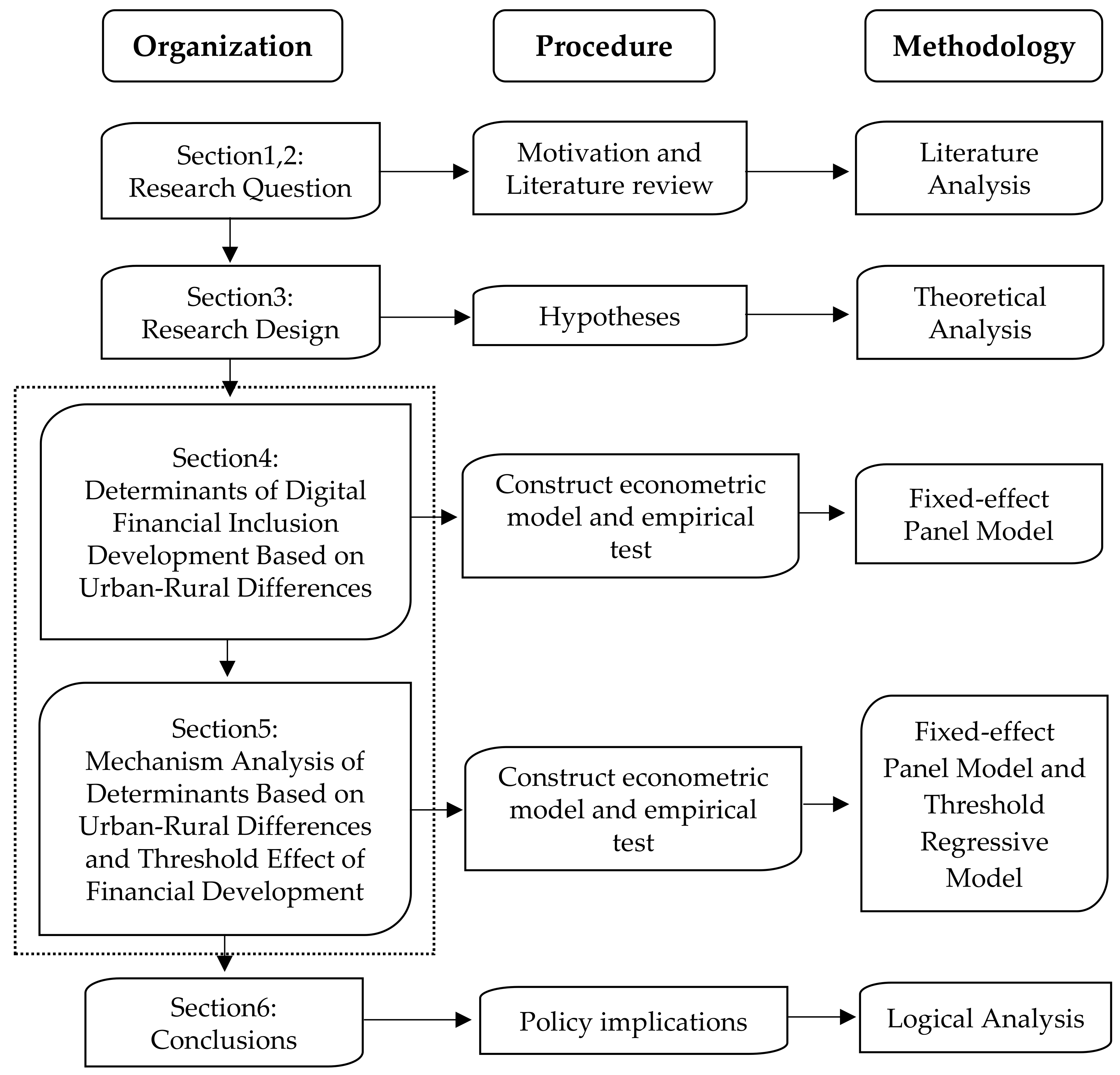

Determinants and Mechanisms of Digital Financial Inclusion Development: Based on Urban-Rural Differences

Abstract

:1. Introduction

2. Literature Review

3. Research Design

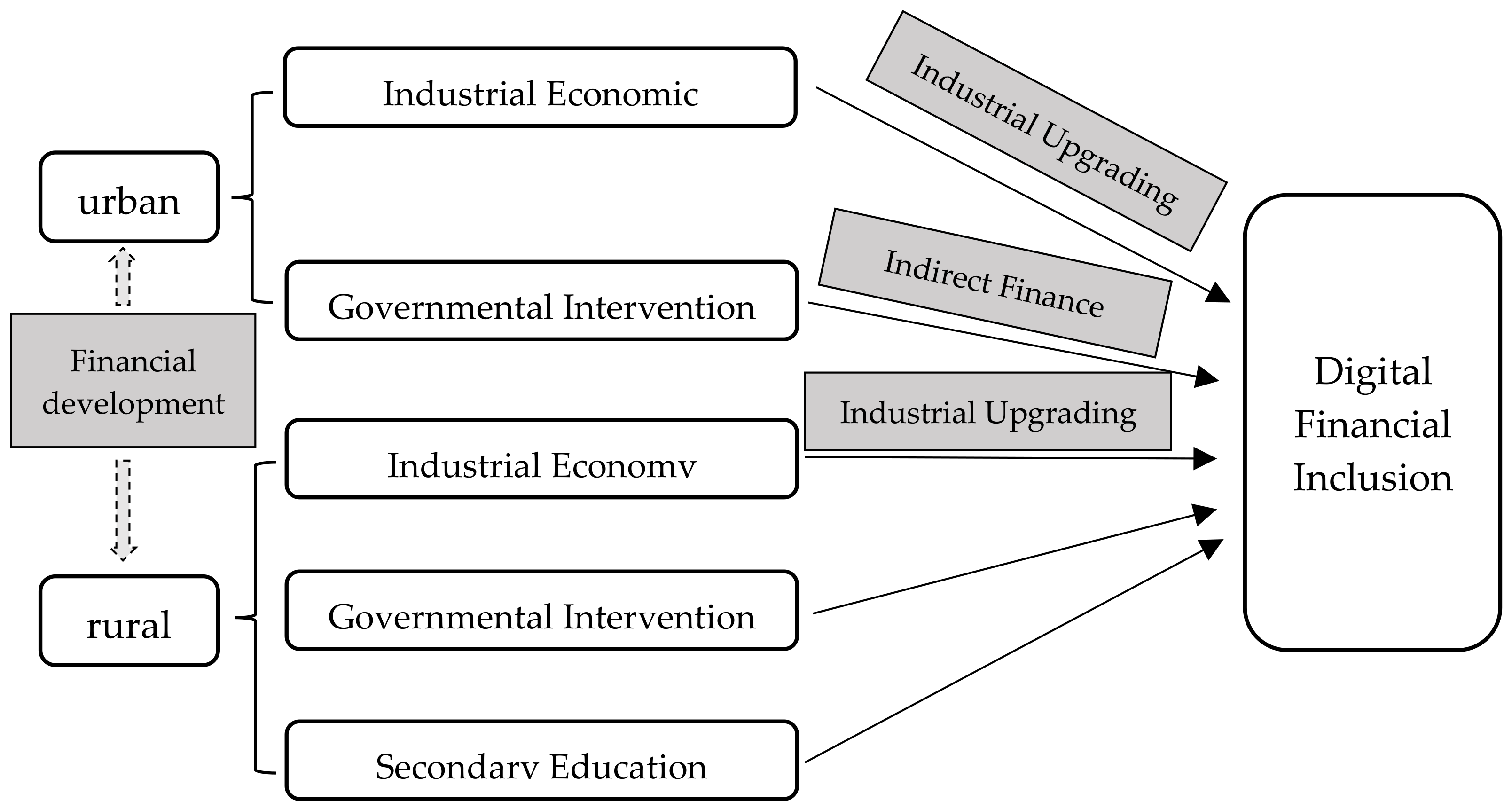

3.1. Theoretical Analysis and Research Hypothesis

3.2. Methods

3.3. Variable Description and Data Sources

4. Econometric Examination of Determinants of Digital Financial Inclusion Development of Urban-Rural Areas

4.1. Results of Parameter Estimation

4.2. Robustness Test

5. Further Discussion

5.1. Mechanisms Analysis of Determinants of Digital Financial Inclusion Development of Urban-Rural Areas

5.1.1. Mechanisms Analysis of the Industrial Economy

5.1.2. Mechanisms Analysis of Governmental Intervention

5.2. Threshold Effect of Financial Development

6. Conclusions and Implication

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Varghese, G.; Viswanathan, L. Normative perspectives on financial inclusion: Facts beyond statistics. J. Public Aff. 2018, 18, e1829. [Google Scholar] [CrossRef]

- Kusimba, S.; Yang, Y.; Chawla, N. Hearthholds of mobile money in western Kenya. Econ. Anthropol. 2016, 3, 266–279. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar]

- Goyal, K.; Kumar, S. Financial literacy: A systematic review and bibliometric analysis. Int. J. Consum. Stud. 2021, 45, 80–105. [Google Scholar] [CrossRef]

- Leong, C.; Tan, B.; Xiao, X.; Tan, F.T.C.; Sun, Y. Nurturing a FinTech ecosystem: The case of a youth microloan startup in China. Int. J. Inf. Manag. 2017, 37, 92–97. [Google Scholar] [CrossRef]

- Larios-Hernandez, G.J. Blockchain entrepreneurship opportunity in the practices of the unbanked. Bus. Horiz. 2017, 60, 865–874. [Google Scholar] [CrossRef]

- Mushtaq, R.; Bruneau, C. Microfinance, financial inclusion and ICT: Implications for poverty and inequality. Technol. Soc. 2019, 59, 101154. [Google Scholar] [CrossRef]

- David-West, O.; Iheanachor, N.; Umukoro, I. Sustainable business models for the creation of mobile financial services in Nigeria. J. Innov. Knowl. 2020, 5, 105–116. [Google Scholar] [CrossRef]

- Malady, L. Consumer protection issues for digital financial services in emerging markets. Bank. Financ. Law Rev. 2016, 31, 389–401. [Google Scholar] [CrossRef] [Green Version]

- Kear, M. Governing Homo Subprimicus: Beyond Financial Citizenship, Exclusion, and Rights. Antipode 2013, 45, 926–946. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Scott, S.V.; Van Reenen, J.; Zachariadis, M. The long-term effect of digital innovation on bank performance: An empirical study of SWIFT adoption in financial services. Res. Policy 2017, 46, 984–1004. [Google Scholar] [CrossRef] [Green Version]

- Kemfert, C.; Schmalz, S. Sustainable finance: Political challenges of development and implementation of framework conditions. Green Financ. 2019, 1, 237–248. [Google Scholar] [CrossRef]

- Manyika, J.; Lund, S.; Singer, M.; White, O.; Berry, C. Digital finance for all: Powering inclusive growth in emerging economies. McKinsey Glob. Inst. 2016, 9, 1–15. [Google Scholar]

- Lai, J.N.T.; Yan, I.K.M.; Yi, X.J.; Zhang, H. Digital Financial Inclusion and Consumption Smoothing in China. China World Econ. 2020, 28, 64–93. [Google Scholar] [CrossRef]

- Kemal, A.A. Mobile banking in the government-to-person payment sector for financial inclusion in Pakistan*. Inf. Technol. Dev. 2019, 25, 475–502. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.H.; Huang, Z.H.; Dong, H. The Influential Factors on Outward Foreign Direct Investment: Evidence from the? The Belt and Road? Emerg. Mark. Financ. Trade 2019, 55, 3211–3226. [Google Scholar] [CrossRef]

- Qamruzzaman, M.; Wei, J.G. Do financial inclusion, stock market development attract foreign capital flows in developing economy: A panel data investigation. Quant. Financ. Econ. 2019, 3, 88–108. [Google Scholar] [CrossRef]

- Berger, E.; Nakata, C. Implementing Technologies for Financial Service Innovations in Base of the Pyramid Markets. J. Prod. Innov. Manag. 2013, 30, 1199–1211. [Google Scholar] [CrossRef]

- Blauw, S.; Franses, P.H. Off the Hook: Measuring the Impact of Mobile Telephone Use on Economic Development of Households in Uganda using Copulas. J. Dev. Stud. 2016, 52, 315–330. [Google Scholar] [CrossRef]

- Loureiro, Y.K.; Gonzalez, L. Competition against common sense Insights on peer-to-peer lending as a tool to allay financial exclusion. Int. J. Bank Mark. 2015, 33, 605–623. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Glavee-Geo, R.; Karjaluoto, H. Exploring the nexus between financial sector reforms and the emergence of digital banking culture-Evidences from a developing country. Res. Int. Bus. Financ. 2017, 42, 1030–1039. [Google Scholar] [CrossRef]

- Suri, T. Mobile Money. Annu. Rev. Econ. 2017, 9, 497–520. [Google Scholar] [CrossRef]

- Gabor, D.; Brooks, S. The digital revolution in financial inclusion: International development in the fintech era. New Polit. Econ. 2017, 22, 423–436. [Google Scholar] [CrossRef]

- Rogers, C.; Clarke, C. Mainstreaming social finance: The regulation of the peer-to-peer lending marketplace in the United Kingdom. Br. J. Polit. Int. Relat. 2016, 18, 930–945. [Google Scholar] [CrossRef] [Green Version]

- Ajide, F.M. Financial inclusion in Africa: Does it promote entrepreneurship? J. Financ. Econ. Policy 2020, 12, 687–706. [Google Scholar] [CrossRef]

- Mouna, A.; Jarboui, A. Understanding the link between government cashless policy, digital financial services and socio-demographic characteristics in the MENA countries. Int. J. Sociol. Soc. Policy 2021. [Google Scholar] [CrossRef]

- Liao, G.K.; Drakeford, B.M. An analysis of financial support, technological progress and energy efficiency: Evidence from China. Green Financ. 2019, 1, 174–187. [Google Scholar] [CrossRef]

- Aboal, D.; Tacsir, E. Innovation and productivity in services and manufacturing: The role of ICT. Ind. Corp. Chang. 2018, 27, 221–241. [Google Scholar] [CrossRef]

- Skiter, N.N.; Ketko, N.V.; Rogachev, A.F.; Gushchina, E.G.; Vitalyeva, E.M. Institutional poverty as one of the main threats to the digital economy. Int. J. Sociol. Soc. Policy 2021, 41, 15–23. [Google Scholar] [CrossRef]

- Yu, T.; Shen, W. Funds sharing regulation in the context of the sharing economy: Understanding the logic of China’s P2P lending regulation. Comput. Law Secur. Rev. 2019, 35, 42–58. [Google Scholar] [CrossRef]

- Tsai, C.H.; Peng, K.J. The FinTech Revolution and Financial Regulation: The Case of Online Supply-Chain Financing. Asian J. Law Soc. 2017, 4, 109–132. [Google Scholar] [CrossRef]

- Pal, A.; Herath, T.; De, R.; Rao, H.R. Contextual facilitators and barriers influencing the continued use of mobile payment services in a developing country: Insights from adopters in India. Inf. Technol. Dev. 2020, 26, 394–420. [Google Scholar] [CrossRef]

- Lyons, A.; Grable, J.; Zeng, T. Impacts of Financial Literacy on Loan Demand of Financially Excluded Households in China. SSRN 2017, 3075003. [Google Scholar] [CrossRef]

- Young, J.C. Rural digital geographies and new landscapes of social resilience. J. Rural Stud. 2019, 70, 66–74. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, J.J.; Wan, G.H.; Luo, Z. Fintech, Growth and Inequality: Evidence from China’s Household Survey Data. Singap. Econ. Rev. 2020, 65, 75–93. [Google Scholar] [CrossRef]

- Van Klyton, A.; Tavera-Mesias, J.F.; Castano-Munoz, W. Innovation resistance and mobile banking in rural Colombia. J. Rural Stud. 2021, 81, 269–280. [Google Scholar] [CrossRef]

- Agwu, M.E. Can technology bridge the gap between rural development and financial inclusions? Technol. Anal. Strateg. Manag. 2021, 33, 123–133. [Google Scholar] [CrossRef]

- Nan, W.X.; Markus, M.L. Is Inclusive Digital Innovation Inclusive? An Investigation of M-Shwari in Kenya. In Information and Communication Technologies for Development: Strengthening Southern-Driven Cooperation as a Catalyst for Ict4d, Pt I; Nielsen, P., Kimaro, H.C., Eds.; Springer: Cham, Switzerland, 2019; Volume 551, pp. 460–471. [Google Scholar]

- Salemink, K.; Strijker, D.; Bosworth, G. Rural development in the digital age: A systematic literature review on unequal ICT availability, adoption, and use in rural areas. J. Rural Stud. 2017, 54, 360–371. [Google Scholar] [CrossRef]

- Philip, L.; Williams, F. Remote rural home based businesses and digital inequalities: Understanding needs and expectations in a digitally underserved community. J. Rural Stud. 2019, 68, 306–318. [Google Scholar] [CrossRef]

- Bansal, S. Perspective of Technology in Achieving Financial Inclusion in Rural India. Procedia Econ. Financ. 2014, 11, 472–480. [Google Scholar] [CrossRef] [Green Version]

- Titus Freeman Ifeanyi, N. Relationship between Financial Inclusion and Economic Growth in Nigerian Rural Dwellers. Int. J. Small Bus. Entrep. Res. 2015, 3, 17–27. [Google Scholar]

- Danisman, G.O.; Tarazi, A. Financial inclusion and bank stability: Evidence from Europe. Eur. J. Financ. 2020, 26, 1842–1855. [Google Scholar] [CrossRef]

- Li, Y.H.; Westlund, H.; Liu, Y.S. Why some rural areas decline while some others not: An overview of rural evolution in the world. J. Rural Stud. 2019, 68, 135–143. [Google Scholar] [CrossRef]

- Allen, F.; Demirguc-Kunt, A.; Klapper, L.; Peria, M.S.M. The foundations of financial inclusion: Understanding ownership and use of formal accounts. J. Financ. Intermediation 2016, 27, 1–30. [Google Scholar] [CrossRef] [Green Version]

- Ovechkin, D.V.; Romashkina, G.F.; Davydenko, V.A. The Impact of Intellectual Capital on the Profitability of Russian Agricultural Firms. Agronomy 2021, 11, 286. [Google Scholar] [CrossRef]

- Naz, M.; Iftikhar, S.F.; Fatima, A. Does financial inclusiveness matter for the formal financial inflows? Evidence from Pakistan. Quant. Financ. Econ. 2020, 4, 19–35. [Google Scholar] [CrossRef]

- Li, G.D.; Fang, C.L. Analyzing the multi-mechanism of regional inequality in China. Ann. Reg. Sci. 2014, 52, 155–182. [Google Scholar] [CrossRef]

- Hao, Y.; Wang, L.O.; Zhu, L.Y.; Ye, M.J. The dynamic relationship between energy consumption, investment and economic growth in China’s rural area: New evidence based on provincial panel data. Energy 2018, 154, 374–382. [Google Scholar] [CrossRef]

- Li, T.; Li, X. Does structural deceleration happen in China? Evidence from the effect of industrial structure on economic growth quality. Natl. Account. Rev. 2020, 2, 155–173. [Google Scholar] [CrossRef]

- Zhu, F.; Zhang, F.; Ke, X. Rural industrial restructuring in China’s metropolitan suburbs: Evidence from the land use transition of rural enterprises in suburban Beijing. Land Use Policy 2018, 74, 121–129. [Google Scholar] [CrossRef]

- Cornett, M.M.; Guo, L.; Khaksari, S.; Tehranian, H. The impact of state ownership on performance differences in privately-owned versus state-owned banks: An international comparison. J. Financ. Intermed. 2010, 19, 74–94. [Google Scholar] [CrossRef]

- Marr, A. Effectiveness of Rural Microfinance: What We Know and What We Need to Know. J. Agrar. Chang. 2012, 12, 555–563. [Google Scholar] [CrossRef]

- Hosen, M.; Broni, M.Y.; Uddin, M.N. What bank specific and macroeconomic elements influence non-performing loans in Bangladesh? Evidence from conventional and Islamic banks. Green Financ. 2020, 2, 212–226. [Google Scholar] [CrossRef]

- Liu, F.C.; Simon, D.F.; Sun, Y.T.; Cao, C. China’s innovation policies: Evolution, institutional structure, and trajectory. Res. Policy 2011, 40, 917–931. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Yang, C.; Li, T.; Albitar, K. Does Energy Efficiency Affect Ambient PM2.5? The Moderating Role of Energy Investment. Front. Environ. Sci. 2021, 9. [Google Scholar] [CrossRef]

- Hansen, B.E. Sample splitting and threshold estimation. Econometrica 2000, 68, 575–603. [Google Scholar] [CrossRef] [Green Version]

- Law, S.H.; Singh, N. Does too much finance harm economic growth? J. Bank. Financ. 2014, 41, 36–44. [Google Scholar] [CrossRef] [Green Version]

- Li, F.; Yang, C.; Li, Z.; Failler, P. Does Geopolitics Have an Impact on Energy Trade? Empirical Research on Emerging Countries. Sustainability 2021, 13, 5199. [Google Scholar] [CrossRef]

- Li, Y.H.; Chen, C.; Wang, Y.F.; Liu, Y.S. Urban-rural transformation and farmland conversion in China: The application of the environmental Kuznets Curve. J. Rural Stud. 2014, 36, 311–317. [Google Scholar] [CrossRef]

- Itskhoki, O.; Moll, B. Optimal Development Policies with Financial Frictions. Econometrica 2019, 87, 139–173. [Google Scholar] [CrossRef]

| Variable | Abbr. | Source |

|---|---|---|

| Digital Financial Inclusion | DFI | Digital Financial Inclusion Index of China |

| Industrial Economy | Ind | China Statistical Yearbook (County Level) |

| Governmental Intervention | Gov | China Statistical Yearbook (County Level) |

| Secondary Education | Edu | China Statistical Yearbook (County Level) |

| Economic Development | Eco | China Statistical Yearbook (County Level) |

| Informatization Level | Inf | China Statistical Yearbook (County Level) |

| Medical Construction | Med | China Statistical Yearbook (County Level) |

| Industrial Upgrading | Iup | China Statistical Yearbook (County Level) |

| Indirect Finance | Inf | China Statistical Yearbook (County Level) |

| Financial Development | Fin | China Statistical Yearbook (County Level) |

| Unit | Items | Urban | Rural | |

|---|---|---|---|---|

| N | - | 2214 | 7428 | |

| DFI | - | Mean | 89.08 | 84.4271 |

| Std | 23.21 | 24.61741 | ||

| Ind | ratio | Mean | 13.93 | 12.76742 |

| Std | 0.92 | 1.127755 | ||

| Gov | ratio | Mean | 16.93 | 32.85194 |

| Std | 9.43 | 23.80552 | ||

| Edu | ln(person) | Mean | 10.37 | 9.558112 |

| Std | 0.65 | 0.817146 | ||

| Eco | ln(RMB/person) | Mean | 4.55 | 3.675358 |

| Std | 4.34 | 3.38737 | ||

| Inf | ratio | Mean | 983.87 | 939.2462 |

| Std | 911.15 | 874.7456 | ||

| Med | bed/person | Mean | 39.68 | 41.81459 |

| Std | 15.61 | 17.88123 | ||

| Iup | ratio | Mean | 85.05 | 79.17214 |

| Std | 8.52 | 10.76238 | ||

| Inf | RMB/person | Mean | 9.89 | 9.866019 |

| Std | 0.90 | 0.681127 | ||

| Fin | ratio | Mean | 64.40 | 74.82114 |

| Std | 39.89 | 46.36051 |

| (1) | (2) | |

|---|---|---|

| Urban | Rural | |

| Ind | 9.118 *** 1 | 2.730 *** |

| (11.038) | (8.287) | |

| Gov | 0.082 * | 0.041 *** |

| (1.883) | (3.840) | |

| Edu | −0.190 | 1.704 *** |

| (−0.213) | (3.218) | |

| Eco | −3.955 *** | −0.999 *** |

| (−18.043) | (−9.446) | |

| Inf | 0.001 *** | 0.001 *** |

| (2.682) | (6.688) | |

| Med | −0.003 | 0.025 ** |

| (−0.126) | (2.381) | |

| Individual control | Yes | Yes |

| Time control | Yes | Yes |

| _cons | −58.518 *** | −6.133 |

| (−4.120) | (−0.937) | |

| N | 2214 | 7428 |

| R2 | 0.946 | 0.946 |

| F | 2907.579 | 9922.239 |

| Item | Winsorize | Lag One-Phase | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Urban | Rural | Urban | Rural | |

| Ind | 9.106 *** 1 | 3.473 *** | 5.312 *** | 3.126 *** |

| (10.596) | (10.015) | (5.013) | (8.281) | |

| Gov | 0.124 ** | 0.025 ** | 0.116 * | 0.056 *** |

| (2.470) | (2.036) | (1.881) | (4.745) | |

| Edu | −0.453 | 1.447 *** | −0.312 | 1.844 *** |

| (−0.493) | (2.724) | (−0.315) | (3.250) | |

| Eco | −3.893 *** | −1.725 *** | −2.414 *** | −0.708 *** |

| (−16.510) | (−13.426) | (−11.596) | (−7.359) | |

| Inf | 0.001 *** | 0.002 *** | 0.002 *** | 0.001 *** |

| (4.190) | (8.808) | (4.189) | (3.107) | |

| Med | 0.002 | 0.052 *** | −0.018 | 0.020 * |

| (0.061) | (4.298) | (−0.686) | (1.817) | |

| Individual control | Yes | Yes | Yes | Yes |

| Time control | Yes | Yes | Yes | Yes |

| _cons | −57.762 *** | −12.266 * | 9.925 | 7.173 |

| (−3.897) | (−1.846) | (0.567) | (1.001) | |

| N | 2214 | 7428 | 1845 | 6190 |

| R2 | 0.944 | 0.949 | 0.894 | 0.910 |

| F | 2787.466 | 1.0 × 104 | 1239.910 | 4970.213 |

| (1) | (2) | |

|---|---|---|

| Urban | Rural | |

| Ind | 11.986 *** 1 | 8.526 *** |

| (4.630) | (7.999) | |

| Gov | 0.209 * | 0.222 *** |

| (1.413) | (3.976) | |

| Edu | −1.552 | 6.208 *** |

| (−0.357) | (3.147) | |

| Eco | −4.089 *** | −1.504 *** |

| (−9.545) | (−8.232) | |

| Inf | 0.002 *** | 0.001 *** |

| (3.446) | (4.216) | |

| Med | −0.024 | 0.020 * |

| (−0.876) | (1.691) | |

| Individual control | Yes | Yes |

| Time control | Yes | Yes |

| _cons | −64.250 | −106.177 *** |

| (−1.166) | (−4.502) | |

| N | 1845 | 6190 |

| Wald | 634,739.65 | 1.73 × 106 |

| Item | Urban | Rural | ||||

|---|---|---|---|---|---|---|

| DFI | Iup | DFI | DFI | Iup | DFI | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Ind | 9.118 *** 1 | 7.936 *** | 4.528 *** | 2.730 *** | 7.521 *** | 2.129 *** |

| Iup | - | - | 0.578 *** | - | - | 0.080 ** |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | −78.863 *** | −37.338 *** | −28.308 ** | 42.498 *** | −6.808 ** | 43.042 *** |

| N | 2214 | 2214 | 2214 | 7428 | 7428 | 7428 |

| R2 | 0.9546 | 0.9657 | 0.9559 | 0.9532 | 0.9616 | 0.9533 |

| Item | Urban | Rural | ||||

|---|---|---|---|---|---|---|

| DFI | Inf | DFI | DFI | Inf | DFI | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Gov | 0.082 * 1 | 0.002 ** | 3.938 *** | 0.041 *** | 0.000 | 4.330 *** |

| Inf | - | - | 0.072 * | - | - | 0.041 ** |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| _cons | −78.863 *** | 4.952 *** | −90.787 *** | 42.498 *** | 9.938 *** | −0.530 |

| N | 2214 | 2214 | 2214 | 7428 | 7428 | 7428 |

| R2 | 0.9546 | 0.9761 | 0.9552 | 0.9532 | 0.9404 | 0.9541 |

| Threshold Variables | Number of Thresholds | F | P | Conclusion | Threshold Estimation | 95% Confidence Interval |

|---|---|---|---|---|---|---|

| Urban financial development | One | 313.84 | 0.0000 | Reject the null hypothesis | 54.6697 | (54.2477, 54.7200) |

| Two | 134.08 | 0.0000 | Reject the null hypothesis | 56.8872 | (56.7134, 57.1059) | |

| 41.5935 | (29.1103, 41.9348) | |||||

| Three | 104.14 | 1.0000 | Accept the null hypothesis | - | - | |

| Rural financial development | One | 731.33 | 0.0000 | Reject the null hypothesis | 68.9634 | (68.6887, 69.0998) |

| Two | 502.63 | 0.0000 | Reject the null hypothesis | 70.3303 | (70.1397, 70.4942) | |

| 50.7740 | (50.1943, 50.9848) | |||||

| Three | 298.56 | 1.0000 | Accept the null hypothesis | - | - |

| Item | (1) | (2) |

|---|---|---|

| Urban | Rural | |

| Ind_1 | 22.105 *** 1 | 1.806 * |

| (9.56) | (1.70) | |

| Ind_2 | 24.138 *** | 3.585 *** |

| (10.27) | (3.34) | |

| Ind_3 | 25.878 *** | 4.958 *** |

| (10.85) | (4.56) | |

| Gov_1 | 2.315 *** | 0.666 *** |

| (9.96) | (12.68) | |

| Gov_2 | 1.532 *** | 0.502 *** |

| (8.33) | (11.58) | |

| Gov_3 | 1.208 *** | 0.505 *** |

| (9.98) | (14.36) | |

| Control variables | Yes | Yes |

| _cons | −360.430 | −38.055 * |

| (−8.98) | (−1.78) | |

| N | 2214 | 7428 |

| R2 | 0.5688 | 0.4343 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, G.; Huang, Y.; Huang, Z. Determinants and Mechanisms of Digital Financial Inclusion Development: Based on Urban-Rural Differences. Agronomy 2021, 11, 1833. https://doi.org/10.3390/agronomy11091833

Liu G, Huang Y, Huang Z. Determinants and Mechanisms of Digital Financial Inclusion Development: Based on Urban-Rural Differences. Agronomy. 2021; 11(9):1833. https://doi.org/10.3390/agronomy11091833

Chicago/Turabian StyleLiu, Guang, Yunying Huang, and Zhehao Huang. 2021. "Determinants and Mechanisms of Digital Financial Inclusion Development: Based on Urban-Rural Differences" Agronomy 11, no. 9: 1833. https://doi.org/10.3390/agronomy11091833

APA StyleLiu, G., Huang, Y., & Huang, Z. (2021). Determinants and Mechanisms of Digital Financial Inclusion Development: Based on Urban-Rural Differences. Agronomy, 11(9), 1833. https://doi.org/10.3390/agronomy11091833