Abstract

We investigate experimentally whether players deliberately use irrelevant market cues to shape their evaluations of a traded item. We implement a repeated Vickrey median price selling auction of an unusual bad where players are informed on the market price and on the three lowest or highest asks. We elicited players’ consideration of market signals through a questionnaire at the end of the auction. We find that extreme information has a stronger influence on players’ evaluations than the market price. However, players’ consideration of the market signals explains their behavioral reactivity to the market price but not to the extremes. Hence, players deliberately use an unbiased estimator of the central tendency of the appraisals distribution, while extreme asks’ influence is consistent with a priming effect.

JEL Classification:

C91; C92; D44

1. Introduction

Experimental economics has provided robust evidence that players form their private evaluations by systematically following market cues that do not convey any relevant information for a rational economic behavior [1,2,3]. Nonetheless, no experimental study has investigated whether this anomalous behavior arises from a subjects’ deliberation—i.e., from the purposeful consideration of the irrelevant cues—or if market signals prime players’ evaluations without their explicit consideration. In this paper, we try to shed some light on this intriguing issue by investigating whether players follow purposefully irrelevant cues to guide their behavior in the market.

The main literature on this subject has isolated the price’s shaping effect—i.e., the correlation between players’ private evaluations, due to the observation of a public signal devoid of informative content—on players’ appraisals of an unfamiliar item with known properties in a repeated median price variant of the Vickrey auction [4]. This mechanism incentivizes to reveal truthfully one’s own willingness to accept (WTA hereafter) evaluation for the item on auction, independently of any information accruing from the market. Since players know at the outset the properties of the item on auction but they are uncertain about its monetary value, the setting neutralizes any incentive to value affiliation. Therefore, the observed adaptation of players’ asks to the prevailing market price is deemed genuine evidence of the influence of irrelevant cues on players’ appraisals [5,6,7,8,9].

This literature raises a key interpretation issue: as market prices in a median price auction not only disclose marginal appraisals, but also determine monetary payoffs, it seems legitimate to take them into account when an unfamiliar item is on auction and one’s appraisals are uncertain [10]. Then, the observed effect can result from a choice to take into account a market standard. Indeed, when facing an unfamiliar item, one may just have a vague idea of taste rankings and needs, needing others’ appraisals to reduce this uncertainty. Often, watching prices helps in inferring standard appraisals because markets aggregate and convey dispersed information via the price system: as such, prices not only drive choices, but also help people reduce uncertainty about their own appraisals.

At the same time, when uncertain about their own tastes, players may also be prone to be influenced by others’ private evaluations that, differently from the market price, convey no information on the market standard and do not determine monetary payoffs. Indeed, a large strand of literature shows that these uninformative cues exert a disproportionate pull on players’ monetary evaluations especially of unfamiliar items [11,12,13,14,15]. In a repeated median price auction, information on others’ private evaluations are likely to prime one’s own appraisals, though players do not have any reason to consider them intentionally.

To address the issue, we investigated experimentally the role of players’ consideration of seemingly irrelevant cues for their behavioural reactivity to market signals in a Vickrey’s median price repeated auction. We exploit the data of an experiment run at the Laboratory of Experimental Economics (LEE) of the University of Economics of Prague (VSE) in March 2014. While in a previous paper [16] we used these data to investigate how market prices and information about the three lowest/highest asks in a given market impact on chosen asks, here we study whether players’ explicit consideration of these market signals helps explain the sign and the size of parameters governing their behavioural response.

We implemented 18 independent markets with nine traders each, repeated for eleven rounds (the first one is played just for practice). In any round, players submit an ask expressing their minimum WTA for an unfamiliar bad on auction (i.e., a mixture of vinegar, salt, and Fanta). The market price corresponds to the median asks in any round. Players submitting an ask strictly lower than the market median price are required to drink the liquid and get paid the market price [5]. Since players placing a median ask do not trade, no chance of strategic manipulation of the market price exists: this feature approximates how large competitive markets work.

In the Control group, players only get information on the previous round’s market price. Then, we implement two treatments. In the Low Info group, players are informed on the previous round’s market price plus the three lowest asks. In the High Info treatment, instead, they get information on the previous round’s three highest asks, together with the market price. We clarify at the outset that these are information on the most extreme asks placed by real players in the same market. These information, as extracted from the actual appraisals’ distribution, have two attractive features: 1. do not inform about the central tendency of the distribution and therefore are irrelevant to players’ payoffs; 2. possibly exert stronger effects on players’ private evaluation than median values [17,18,19,20]. Thus, extreme asks, though not informative of any market standard, may become more salient than the median price.

After the auction’s end, players completed a questionnaire where they were asked to state if they either took into consideration the market signals—i.e., the market price and the three lowest (highest) asks—or completely ignored them. Appendix C reports the full questionnaire. The answers to these questions allow us investigating whether players deliberately considered market signals that are informative of the standard WTA (the market price) to form their private evaluations, or if their behaviour was unintentionally primed by uninformative but salient extreme information.

Our empirical estimation relies on a two stages procedure. In the first stage, we estimate the individual behavioral responsiveness to the market price and to the extreme asks. The challenge here is obtaining credible estimates at the individual level given ten observations per player, so we pick a quantile regression method to estimate median response. Moreover, we explore the relative size of the parameters estimated in the first stage. We look at the ratio of responsiveness to extreme asks on total behavioral response to median and extreme inputs, and again we estimate how this ratio responds to self-assessed consideration of potentially irrelevant cues.

In the second stage, we explain how the estimated responsiveness parameters depend on two dummies—representing self-assessed considerations of the market price and extreme asks—extracted from the above mentioned questionnaire. We perform this second stage using a Bayesian methodology to get a rich inferential approach based on extensive numerical simulations. In the Bayesian framework, estimated parameters are themselves random variables and can be explored more thoroughly compared to the standard frequentist approach. We make extensive use of random–walk Metropolis–Hastings simulations, distributional graphs, and odds ratios to draw our conclusions.

We replicate the findings of [16] by showing a stronger shaping effect of the market price on players’ private evaluation in the control than in the two treatment groups. Moreover, in the treatment groups we show that extreme information has a stronger force of attraction than the market price.

Measuring the relative effect size of players’ behavioral reactivity to the extreme information, we find that as players do take into consideration both market signals (i.e., the market price and the three lowest/highest asks), then the fraction of total sensitivity due to their behavioural reactivity to the extreme asks decreases. Overall, as explicit consideration of the market signals comes into play, players’ tend to follow more the market price than the extreme asks to shape their private evaluation.

Then we investigate the effect of players’ consideration of the market price and of the extreme asks on their behavioral reactivity to these signals. In all groups, we find that players’ consideration of the market price increases the sensitivity of their asking behaviour to this specific signal. We take this as evidence that players deliberately hook their private appraisals to the market price.

Conversely, we find that players’ consideration of the three lowest/highest asks does not play a relevant explanatory role for their behavioural reactivity to these extreme signals. Thus, the observed stronger influence of the extreme asks in the treatments cannot be explained by players’ deliberate use of the information on the tails of the asks distribution. As such, this anomalous behavior is largely consistent with a priming effect.

The rest of the paper is organized as follows. Section 2 illustrates the related literature and our specific contribution. Section 3 describes the experimental design. Section 4 provides the details of the Bayesian method of analysis. Section 5 reports our main results. Section 6 discusses a reasonable interpretation of findings. Section 7 concludes.

2. Related Literature

In standard rational choice theory, individuals’ decisions depend exclusively on tastes and constraints [21]. Therefore, context-dependent information irrelevant to tastes and constraints should play no role. However, recent experimental analyses have shown that individuals’ uncertainty about their own evaluations of a product may expand the set of useful information to apparently irrelevant information on the characteristics of the price distribution [10].

In this regard, several experiments have analyzed the influence on subjects’ private evaluations of seemingly irrelevant cues extracted from the prices distribution.

In the last decade, several experiments have isolated the shaping effect of the market price on subjects willingness-to-pay or willingness-to-accept evaluations in a modified version of the Vickrey auction with the median bid or ask standing as the market price. Since subjects’ reporting a median evaluation do not trade, this mechanism promotes truthful revelation of one’s own evaluation of the traded item as the weakly dominant strategy. However, when the item on auction has known properties but subjects are uncertain about their own evaluations, a convergence of subjects’ private appraisals towards the market price is consistently observed across studies. Indeed, the market price systematically affects players’ asks when unfamiliar items such as an annoying sound [12] or a disgusting liquid [7,16] is put on auction. Moreover, ref. [5,6] use lotteries as auctioned items to constrain players’ evaluations within the range of the highest and lowest outcome, showing that players’ asks converge towards the market price. Finally, ref. [4,9] document the robustness of the price shaping effect to market incentives and across studies.

However, a consistent strand of literature in economic and psychology have shown that the exposure to extreme, but plausible, values of a product exerts a stronger influence on individuals’ evaluations than the exposure to moderate (mean) values [17,19,20] especially in experiments eliciting individuals’ willingness-to-pay and willingness-to-accept evaluations or investment decisions [14,22]. Moreover, some experiments have provided evidence that the influence of uninformative cues on individuals’ evaluations is stronger when they are taken from the social context, that is, when subjects can directly observe others’ evaluations or investment decisions [15,23].

Our key contribution to this strand of literature refers to the cognitive mechanism behind the influence of irrelevant market cues. Our treatment is based on the simultaneous exposure to median (i.e., the market price) and extreme (i.e., the three lowest/highest asks) values. The qualitative difference between these two sources of information is likely to entail that a different underlying cognitive mechanism drives their influence on players’ asking behavior.

In our setting, as the market price is set equal to the median ask, then it is an unbiased estimator of the central tendency of the asks distribution. As such it determines players’ payoffs and can be deemed a reliable indicator of the standard evaluation of the auctioned item. Therefore, if subjects are uncertain about their own appraisals, then they are likely to deliberately adjust their asks towards the market standard. On the contrary, the three lowest/highest asks do not determine players’ payoffs and cannot be considered as an indicator of the market standard. Hence, subjects should not have any reason to deliberately use this information to shape their appraisals. As a result, the influence of the extreme asks on subjects’ appraisals may result from an automatic–reflexive–response to contextual cues.

3. Experimental Setting

A sample of 162 players took part in a trial run at the Laboratory of Experimental Economics (LEE) of the University of Economics of Prague (VSE) in March 2014. All participants were undergraduate and master students from Vysoka Skola Ekonomicka and the Charles University of Prague and they were not previously recruited for economic experiments. They were randomly recruited from the LEE database through the ORSEE system. This procedure guaranteed a sample with balanced gender and university background.

Consistently with a huge strand of experimental literature, we implemented a median price auction, a variant of the Vickrey’s [24] second price auction [5,6,7,8], which has proven to be easily understood by players and to induce a truthful revelation of their appraisals. Then, participants were assigned at random to three groups of 54 players each; then, in each group, they were randomly assigned to six independent markets with nine players. For each group, the trial was repeated for 11 rounds, with the first one played just for practice. In the control group players observed just the market price of the previous round. In the first treatment (the Low Info group), players could observe the previous round market price and also the three lowest asks. In the second treatment (the High Info group), they observed the thee highest asks and the market price of the previous round.

We elicited players’ willingness to accept a monetary amount for drinking an unpleasant but not toxic mixture of Fanta, vinegar, and salt. This selling auction of an unusual item allowed us to induce uncertainty in players’ evaluations and to prevent endowment effects. Notice that this unusual bad does not have any market substitute; thus players could not rely on their experience to form their monetary evaluations. Moreover, the auction rules required the consumption of the liquid on the spot without possibility of resale. This should induce players to reveal their true underlying valuation.

Before the start of the auction, players were given detailed information on the experiment (see Appendix B) and they were required to drink 30 mL of the liquid. Thus, they knew at the outset its organoleptic properties [21]. In each auction round, players placed an ask expressing the minimum price they required to drink the unpleasant liquid. In each round, the median ask represented the market price. Only players whose ask fell short of the median had to drink 60 mL of the liquid and got paid with the prevailing market price.

To avoid strategic manipulation, players with an ask equal to the median did not trade. Moreover, given that players do not know the prevailing market price in each round, if they place an asks higher than their own true evaluation (i.e., over-asking) they are likely to incur a loss: they would fail to trade at a price compatible with their minimum WTA. Also, if players place an ask lower than their own true evaluation (i.e., under-asking), they could end up drinking the liquid and get paid with a market price lower than their minimum WTA evaluation. Therefore, the median price auction promotes sincere disclosure as the (weakly) dominant asking strategy. Printed instructions and public explanations emphasized this aspect.

The repeated median price auction was programmed with the ztree [25] and it was implemented according to the following scheme:

- 1.

- Market price. Starting from the second round onward, on the right hand side of the screen was displayed the market price of the previous round. This was the unique information provided to players in the control group.

- 2.

- Extreme info. Players in the Low and High Info treatment (i.e., the Low Info group and the High Info group) received information on the previous round three lowest and highest asks respectively, beyond the information on the market price. Players that placed the three lowest or highest asks in the treatments were informed only on the market price.

- 3.

- Frequency. In both treatments, at each round players were informed on the three lowest/highest asks of the previous round. This information was provided from the third round on wards.

- 4.

- Anonymity. Players knew that the extreme asks were extracted from the tails of the asks distribution, but they did not know who placed them. Indeed, on the left-hand side of the screen was displayed the caption “The lowest (highest) asks are...;”. The three lowest (highest) asks were presented in increasing (decreasing) order.

Once assigned to their slots, players were provided with the printed instructions of the experiment, some blank sheets with a pen, and two paper cups, one with 30 mL of the mixture of Fanta, vinegar, and salt, the other one with 60 ml. Participation to the experiment guaranteed a show-up fee of 100 CZK (€3.7), paid at the end of the session.

Participants could not talk during the trial to guarantee anonymity. Also, they were asked to read the instructions, that were also publicly illustrated by lab assistants. Participants had to answer three questions to test their understanding of the auction’s rules [26]. The experiment started once all players completed the survey.

Following the standard experimental protocol [4], players’ asks were elicited through the question: “Would you accept x CZK to drink the liquid?”, with x ranging from a minimum of 2 CZK (€0.072) to a maximum of 100 CZK (€3.7). Players could answer either yes or no. After a negative reply, the script proposed a new higher value. The elicitation procedure started with an x equal to 2 CZK and for the first 12 questions the script increased x by 2 CZK; then x was increased by 3 CZK (€0.11) until the 23rd question and finally by 6 CZK (€0.22) thereafter. On the opposite, after a positive answer, the script showed the lowest accepted price (the minimum price at which the player would be willing to drink the liquid) and the highest rejected price (the maximum price at which the player would not be willing drink the liquid) and then asked to confirm the choice. If the choice was confirmed, the recorded player’s ask was set equal to the highest rejected price. Otherwise, the procedure restarted.

For the sake of full comparability across markets, rounds 2, 6, and 9 were selected as payoffs relevant at the outset. At each round, players were informed whether the random mechanism required to drink the liquid or not.

At the end of the repeated auction, players completed a questionnaire where they had to answer two separate questions asking whether they took into consideration the market price and the three lowest (highest) asks or if they completely ignored them. This allows us to investigate whether players’ self-perceived and actual asking behaviour match in order to investigate whether subjects deliberately adapted their asks to market signals that are informative of the standard WTA of the unfamiliar bad in the market—i.e., the market price—or if their asking behaviour was primed by uninformative but salient extreme information that players did not take into account explicitly.

4. Empirical Analysis

Our estimation methodology goes through two main steps. In the first (Section 4.1), we assess sensitivity to market price and extreme asks using experimental data and study the relative weight of sensitivity to extremes on total sensitivity to market cues (Section 4.2). In the second (Section 4.3), we show how these sensitivities depend on players’ explicit consideration of the market price and the three lowest/highest asks.

4.1. Getting Individual Appraisals

In the first step, as each experimental session involved one initial warm-up stage and ten repetitions, we need a robust estimation method to get credible parameters at the player’s level. We faced the challenge by picking a quantile regression model to minimize outliers’ influence. Just like we did in the previous paper [16], we assumed a partial adjustment model for each i–th player and estimated its reduced form as

where is the natural log ask currently placed, is the previous round’s market log price, is the previous round’s average mean log signal: in the first treatment group (the Low Info), this signal equals the mean of the three lowest asks and in the second one (the High Info) it is the mean of the three highest asks; lastly, is a player-specific constant term and represents a random i.i.d. error term. We repeat this exercise for all the players involved in the experiment and obtain N triplets of parameters , where N is the total number of players in the experiment.

Next, we look at steady-state behavior by requesting dynamic stability, i.e., , , and . So, we obtain the stationary model

where is the steady-state constant and is an error term. With a slight abuse of notation, in what follows we will use the letters and to mean their steady-state values. The descriptive statistics for and can be found in Table 1 and Table 2.

Table 1.

Asks’ sensitivity to market price: The parameter across experimental groups.

Table 2.

Asks’ sensitivity to extreme values: The parameter across experimental groups.

We basically replicate, with a different empirical method, the results published in [16]. Specifically, we observe a shaping effect of prices on players’ asks, which is stronger in the control than in the treatment groups. Moreover, in the Low and High Info group the information on the three lowest/highest asks exert a stronger force of attraction on players’ asks than the market price, consistently with a huge experimental literature in economics and psychology documenting a stronger influence of extreme values than median ones on individuals private evaluations [17,18,19,20]. Also, we normalized the estimated parameters and obtained their z-values.

4.2. Measuring Relative Effect Size of

In this Section, we analyze how the absolute size of the coefficient absorbs of players’ total sensitivity to the market signals conditional on whether players take into account the market price and the extreme signals or not. To this aim, we introduce the following notation. The sum measures the asks’ total sensitivity to the market price and the extreme asks. The ratio

quantifies for each individual how much the absolute size of absorbs of players’ total sensitivity to the market signals.

On these grounds, we estimate a probit fractional response model with heteroskedastic errors conditional on markets. Our dependent variable is , estimated as a function of the dummies indicating players’ consideration of the market price and of the extreme information . Results are in Table 3.

Table 3.

Asks’ sensitivity to extreme values: The parameter across experimental groups.

Overall, Table 3 shows that when and are zero (i.e., players do not take into account the market price and the extreme info, respectively), the fraction of total sensitivity due to is sizable, especially in the Low Info group. However, as players do take into consideration both market signals (i.e., when both and take value zero), then the fraction of total sensitivity due to decreases. Specifically, considering the market price decreases the ratio by in the Low Info group and by in the High Info group. As for players’ consideration of the extremes, it decreases the ratio by in the Low Info group and by in the High Info group. Overall, as players’ consideration comes into play, the behavioral sensitivity to extremes reduces its contribution to players’ total sensitivity to the market signals.

4.3. Estimating the Effects of Considering the Market Price and Extreme Asks

In the second step, we adopted a Bayesian inferential approach to model how and respond to awareness. The Bayesian choice was motivated by the need of envisioning effects as random variables, whose spread, mean, and corresponding uncertainty are inherently worth investigating. The same approach proves especially helpful when data are noisy, as in our case: extensive simulations and plausible weak priors improve inference and provide a solid and richer exploration of results the frequentist approach cannot deliver.

In more detail, we encode the two variables from the questionnaire on players’ consideration of the provided information as follows:

We are now ready to regress each player’s parameters on and using the two following models:

Our analysis focuses on the and , namely the effect of considering the market price and the extreme asks, respectively. The models also include a constant and an error term . Since we have three experimental groups, we simulate our models separately for each group; for the control group, we employ a model without the variable as players only observe the market price.

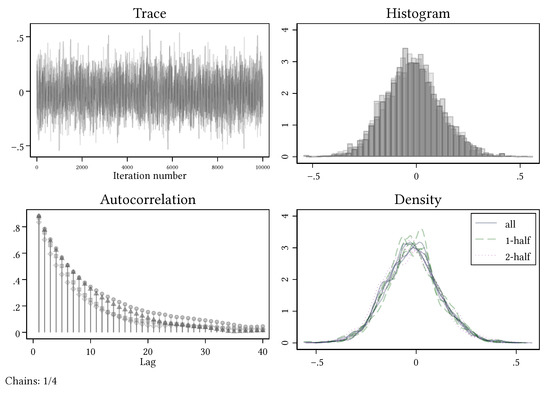

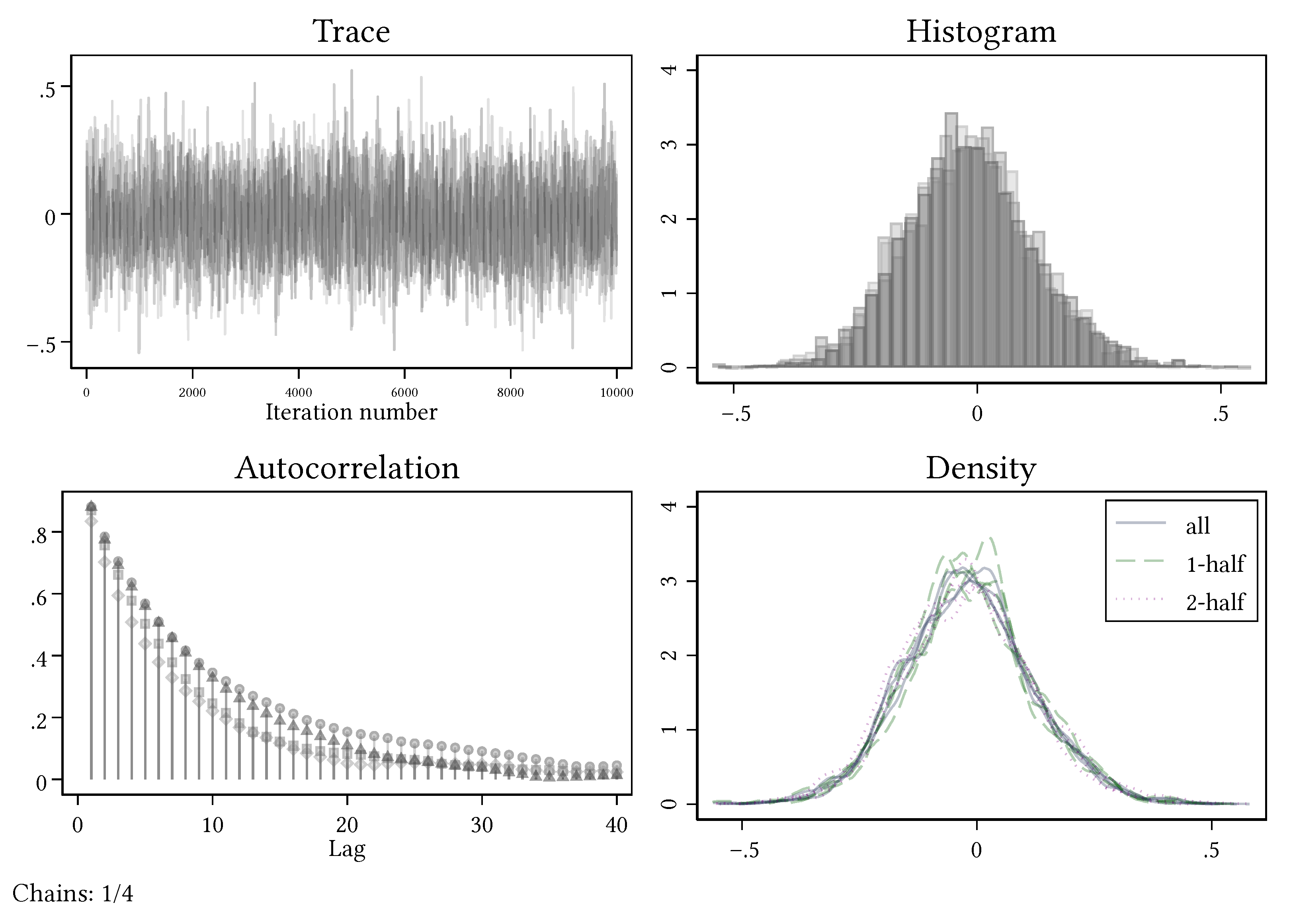

The priors’ choice reflects an objective Bayesian approach [27] mildly mitigated by the assumption of parameters’ normality, as extreme values in the behavioral parameters are unlikely and inconsistent with the limited range of possible asks. During the estimation phase we also modeled uncertainty by employing flat priors and results did not change significantly. The objective Bayesian approach drove us estimating the two equations of interest using a Jeffreys prior [28] for the whole regression’s variance and a weakly informative normal priors for the dependent variables with zero mean and variance equal to five: in this sense, we adopt a moderately agnostic approach since previous literature on this specific parameters is virtually non-existent. To simulate the models, we used the random–walk Metropolis–Hastings sampling with 12,500 iterations and 2500 samples for the burn-in phase: the whole sampling process included a total of four Markov chains, a standard choice for robust results. Convergence was reached for every simulated model, with the Gelman-Rubin statistic being always equal to one.

We numerically evaluated our results by looking at odds ratios. In our context, is the hypothesis that the estimated parameter of interest is positive, while represents the hypothesis of a negative parameter. Next, we consider the probability of these hypotheses as

and

where is the probability distribution function. Using the odds ratio , we contrasted the probability of hypothesis against the probability of hypothesis and employ the Table 4 from Kass and Raftery [29] to assess our confidence.

Table 4.

Evidence of effects.

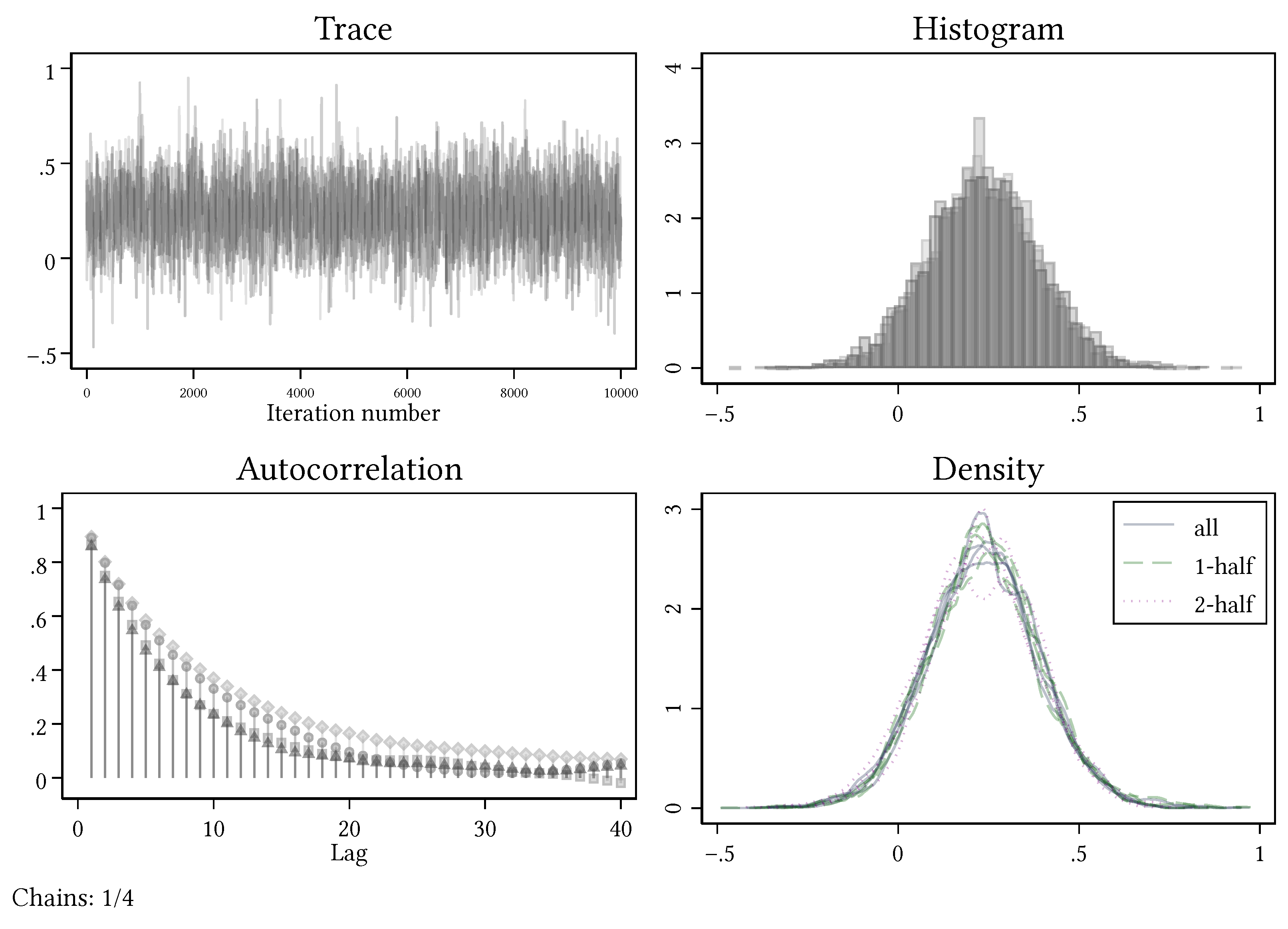

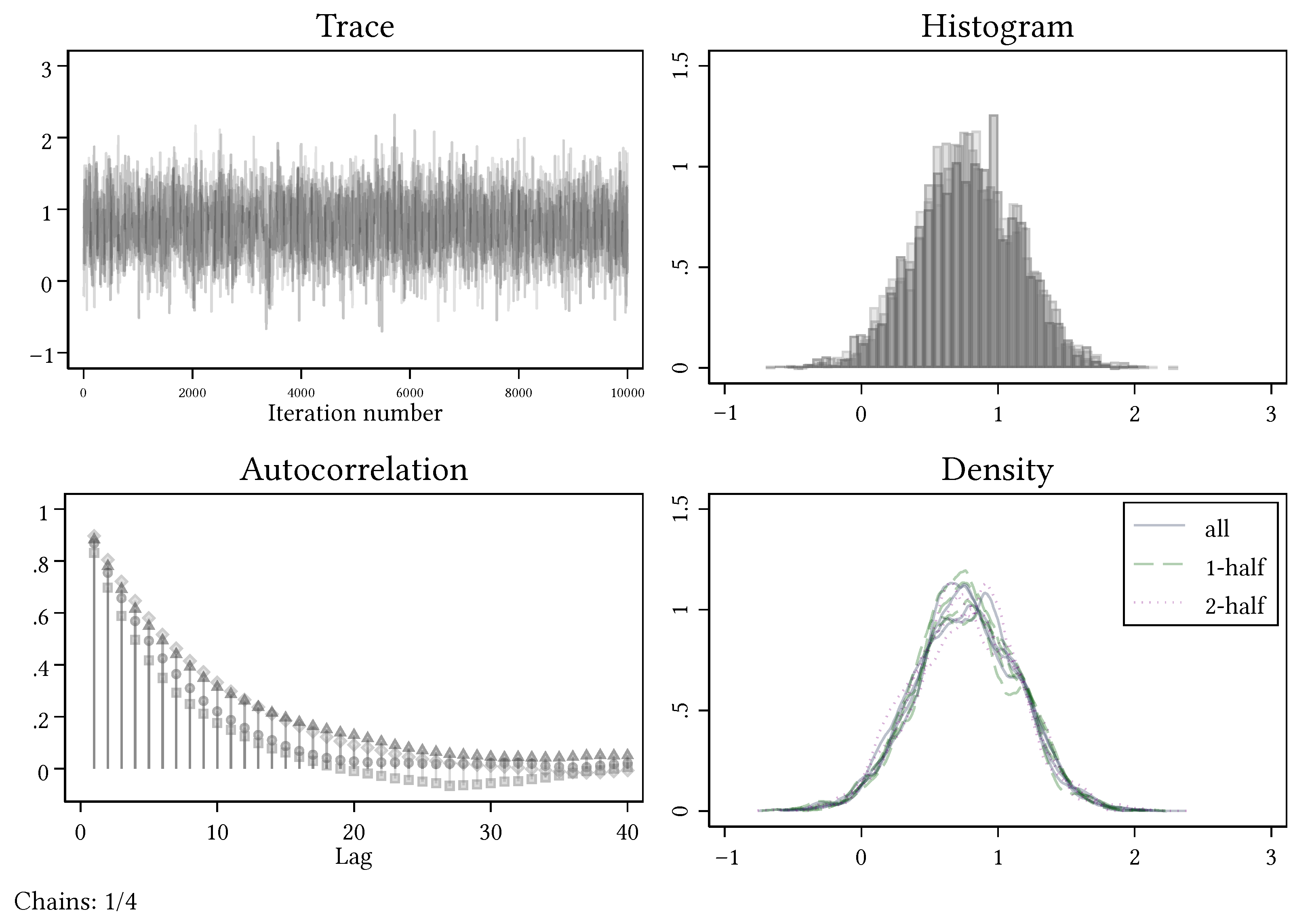

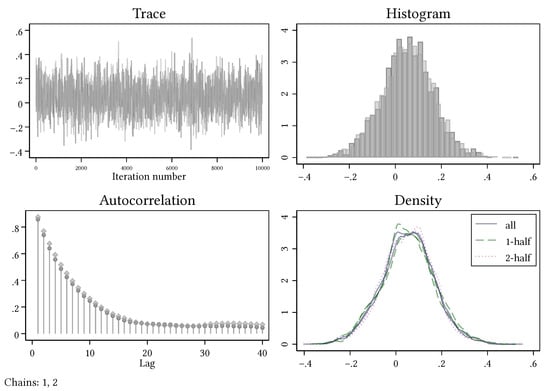

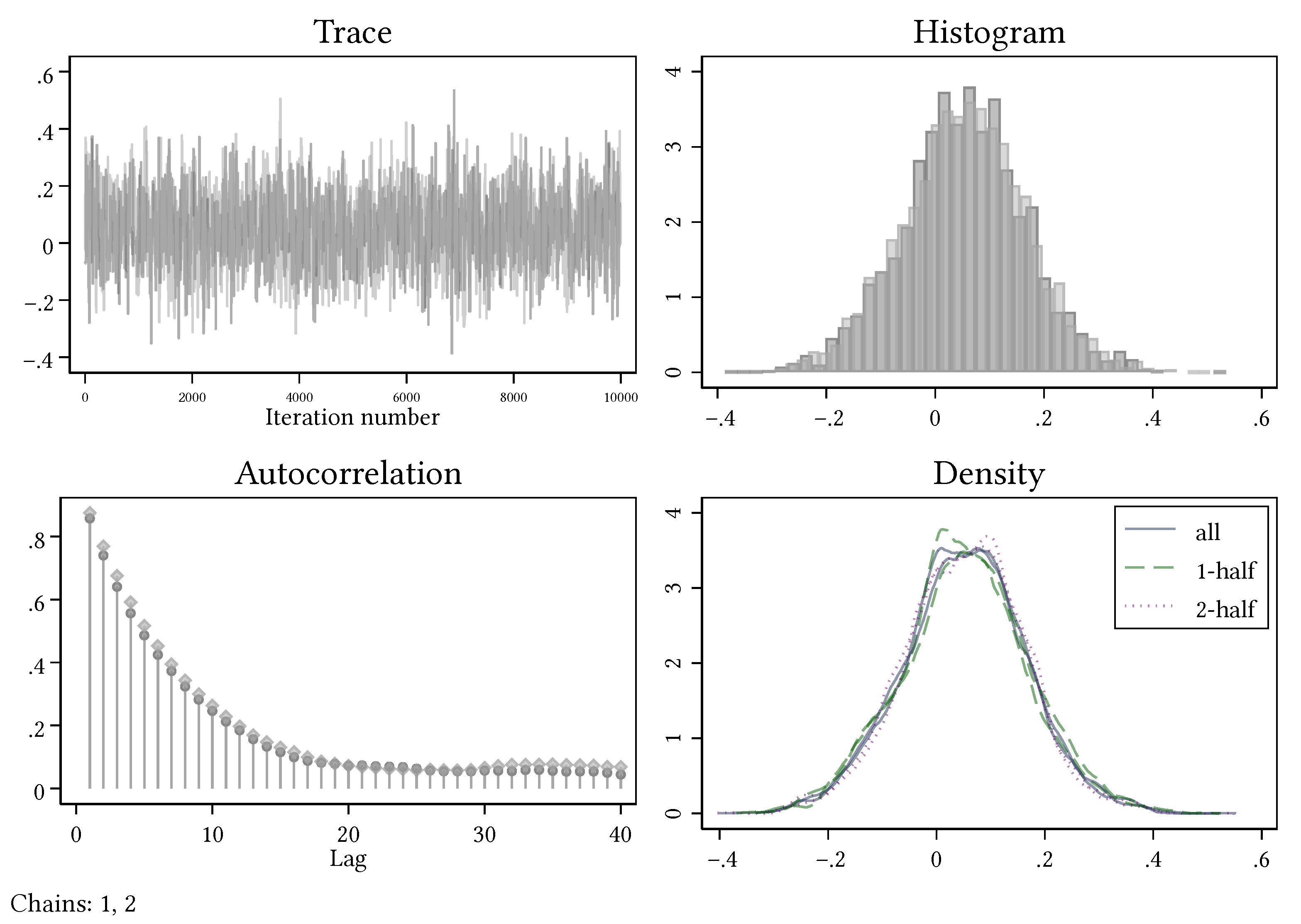

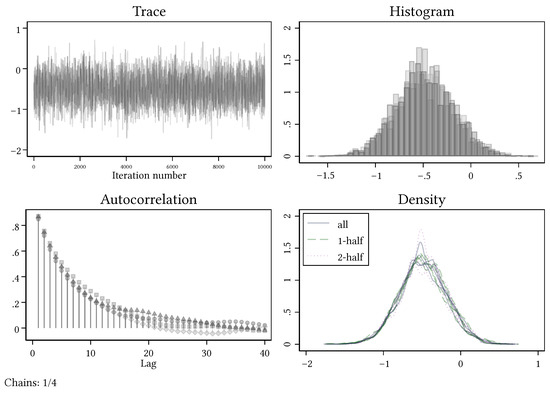

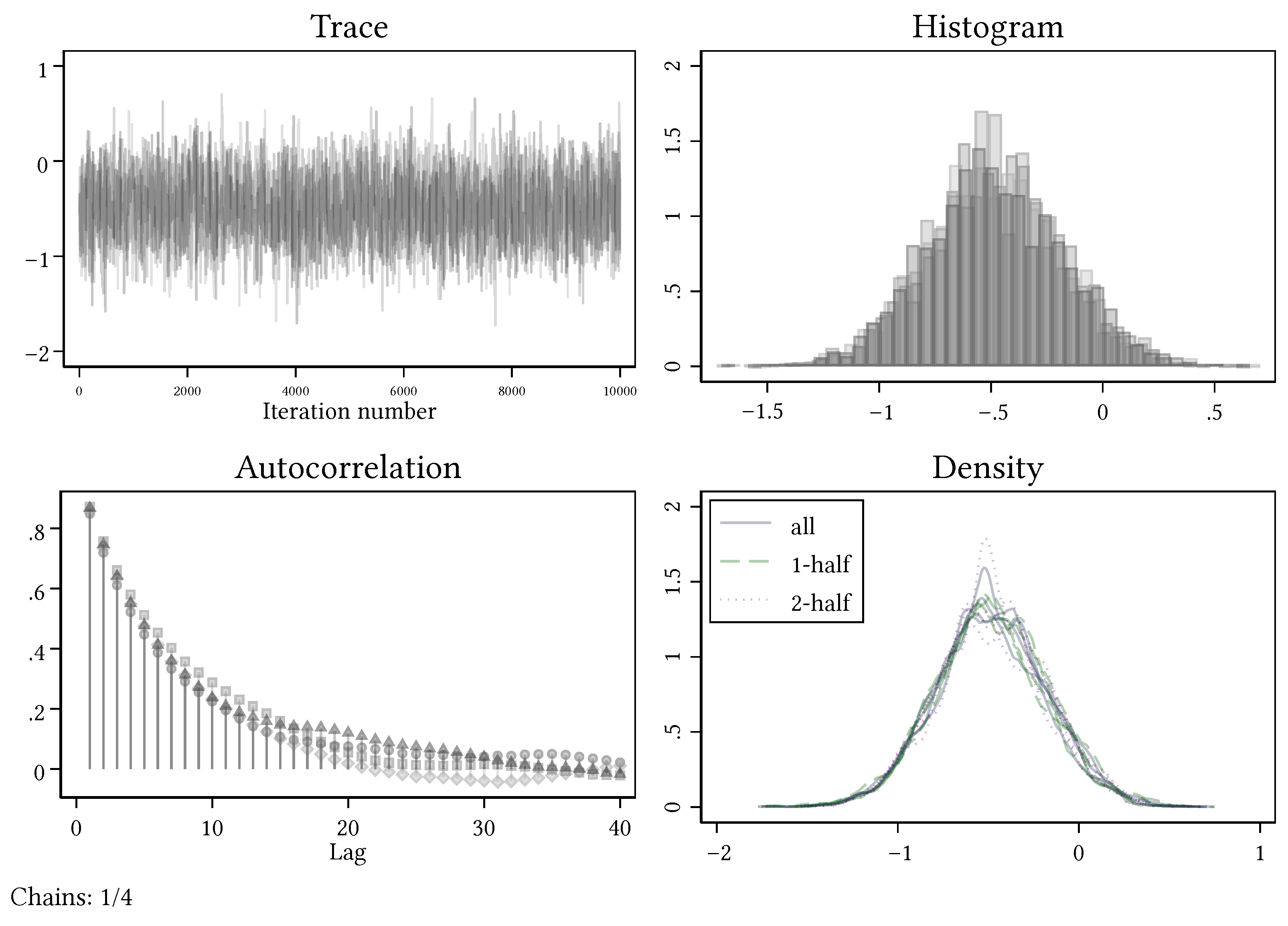

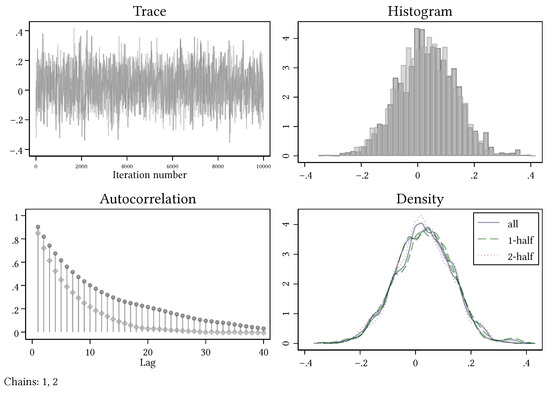

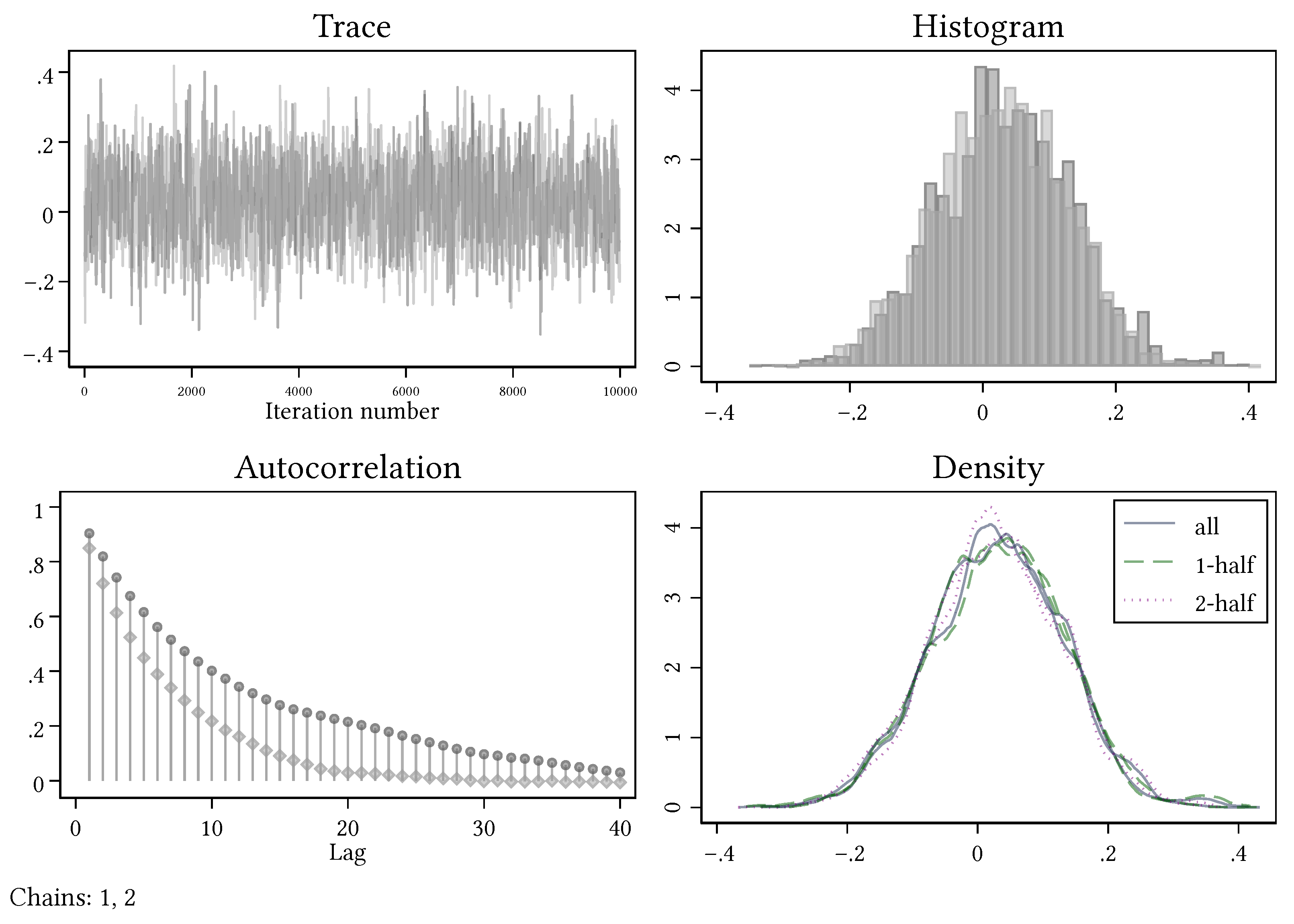

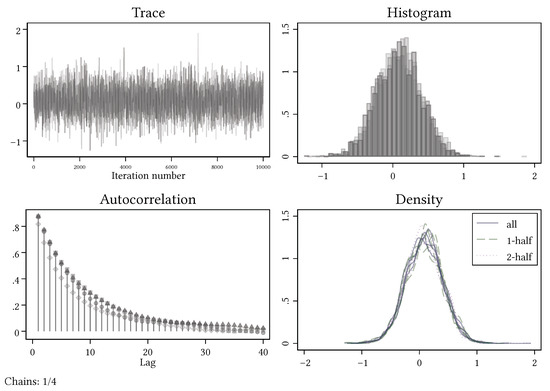

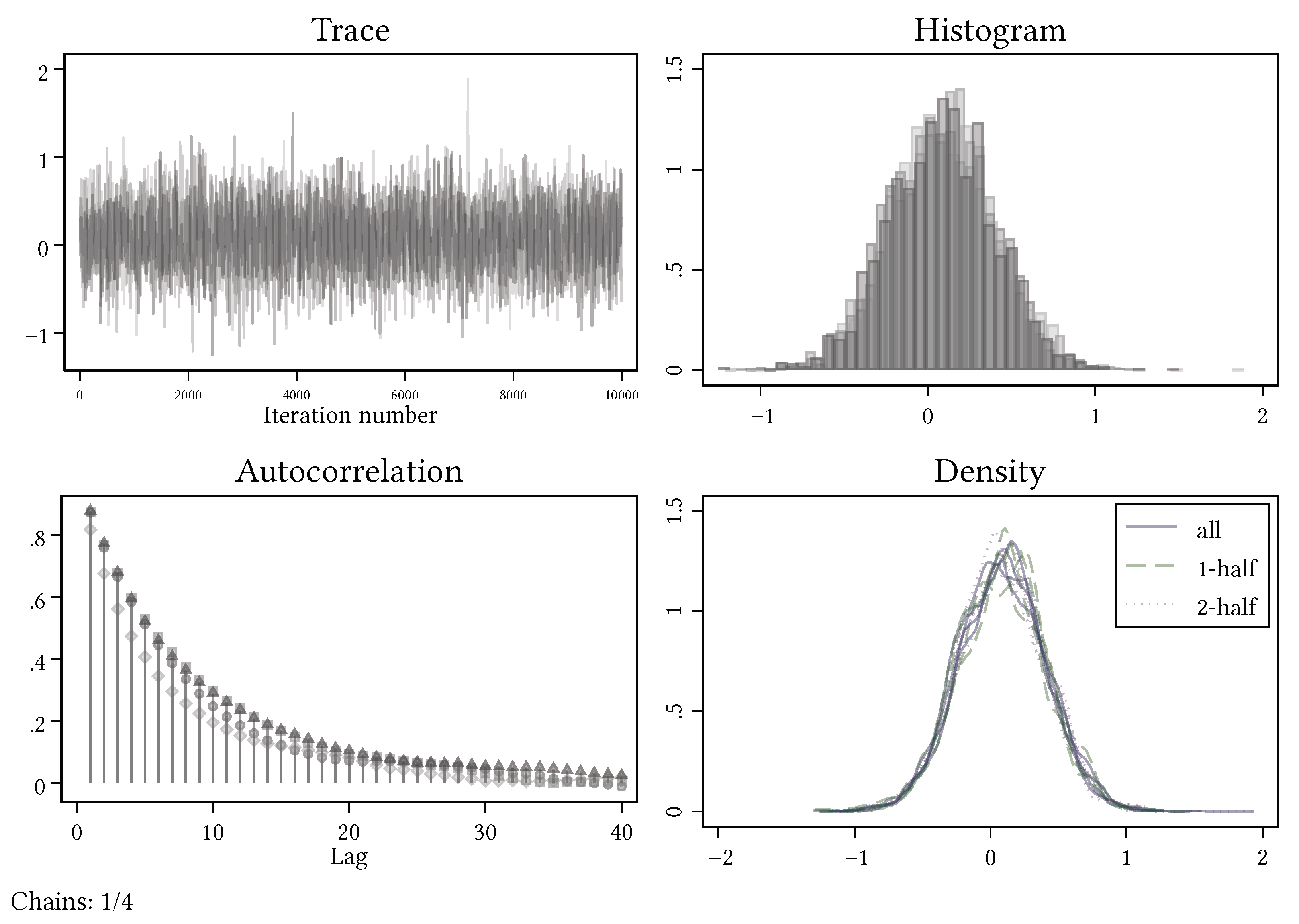

A full graphical depiction of diagnostics for each parameter is presented in Appendix A, while the density functions of each effect are reported in the following section along with an extended discussion of their features.

5. Bayesian Analysis Results

In this section, we analyze how players’ consideration of the market price and of the three lowest/highest asks directly influences players’ behavioural reactivity to these market signals (Section 5.1). Moreover, we investigate whether the consideration of the market price (three lowest/highest asks) have an indirect effect (Section 5.2) on players’ behavioural reactivity to the extreme asks (market price).

5.1. Direct Effects

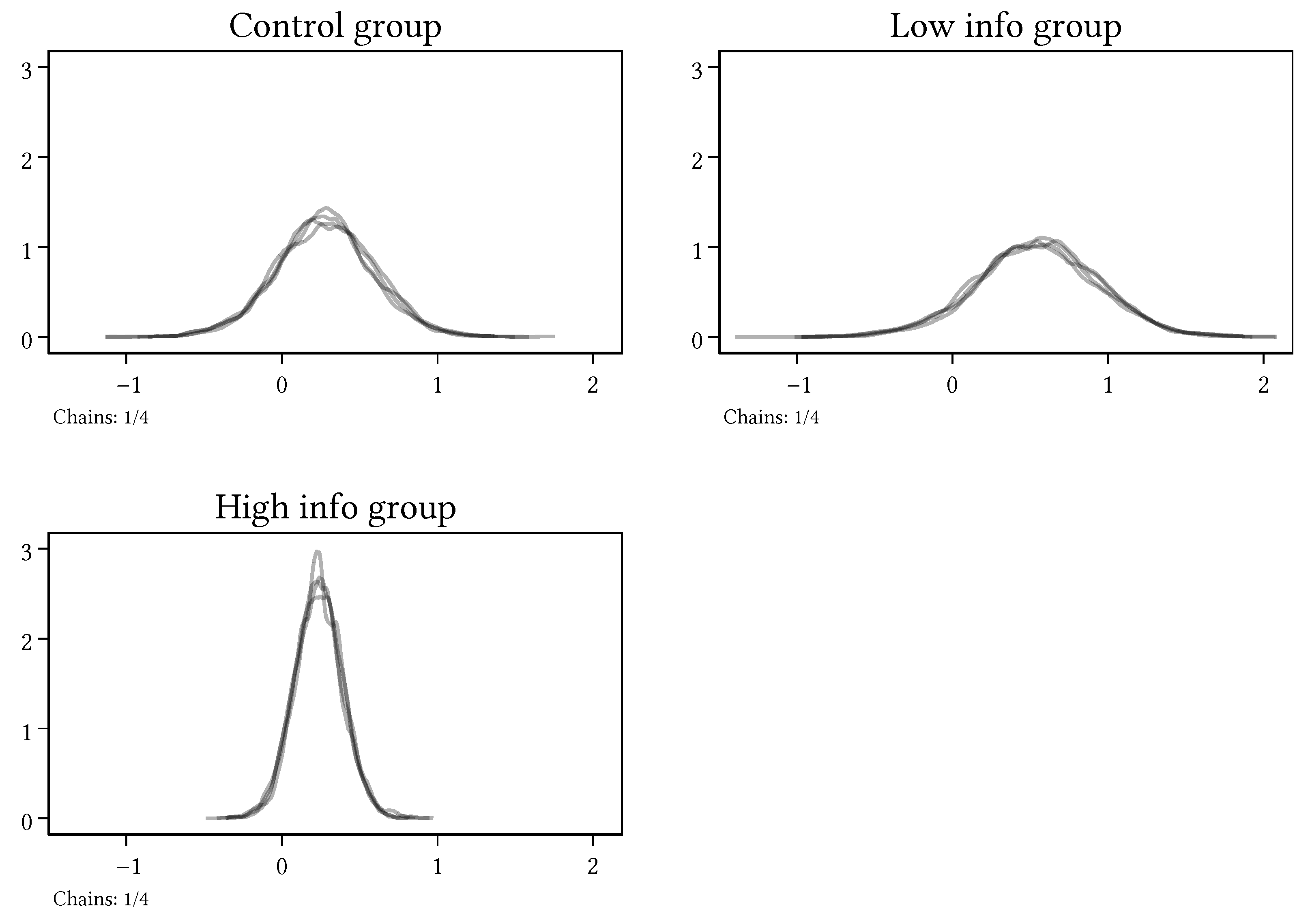

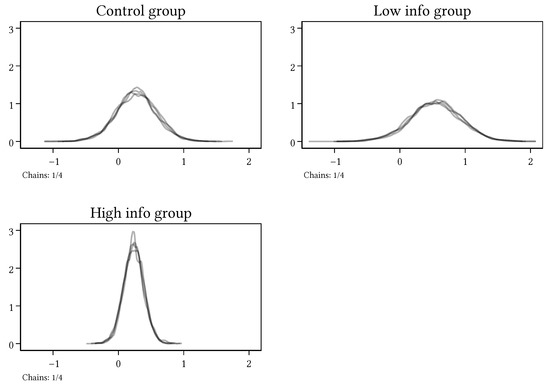

Figure 1 displays the density functions of the effect of players’ consideration of the market price on their behavioral reactivity to the market price itself (i.e., the parameter) in the control and in the two treatment groups. Table 5 provides the odds ratios of the probability of a positive () over a negative effect () for each of the three groups. Figure 1 shows that in the Control the density function is clearly positive, indicating that when players take into account the market price their sensitivity to this specific signal increases. The odds ratio of a positive effect over a negative effect is , which documents a favourable evidence that players use the market price to shape their private appraisals upon deliberation.

Figure 1.

How awareness of the price effect influences response to the median ask.

Table 5.

’s sensitivity to considering the market price.

We now turn to the analysis of the treatments to investigate whether additional information on the three lowest or highest asks weakens or strengthens the effect of players’ consideration of the market price on their behavioral reactivity to the price itself. Table 6 provides the relevant odds ratios. The other two graphs in Figure 1 show the results for the effect of players’ consideration of the market price in the Low and High Info group net of the indirect effect of the consideration of the three lowest/highest asks on players’ behavioral reactivity to the market price.

Table 6.

’s sensitivity to considering extreme asks.

In both treatments, the positive effect of players’ consideration of the market price is much stronger than in the control, with odds ratios of 12 in the Low Info and 15 in the High Info group. Thus, the provision of further information on the three lowest/highest asks strengthens the positive relation between players’ consideration of the market price and their behavioural reactivity to the market price.

Overall, in all groups players systematically adjust their asks towards the market price upon deliberation, a tendency that is stronger when further information on the tails of the asks distribution is provided. To shed light on this result, we investigate the relationship between players’ consideration of the extreme asks and their behavioural reactivity to them in the Low and High Info groups.

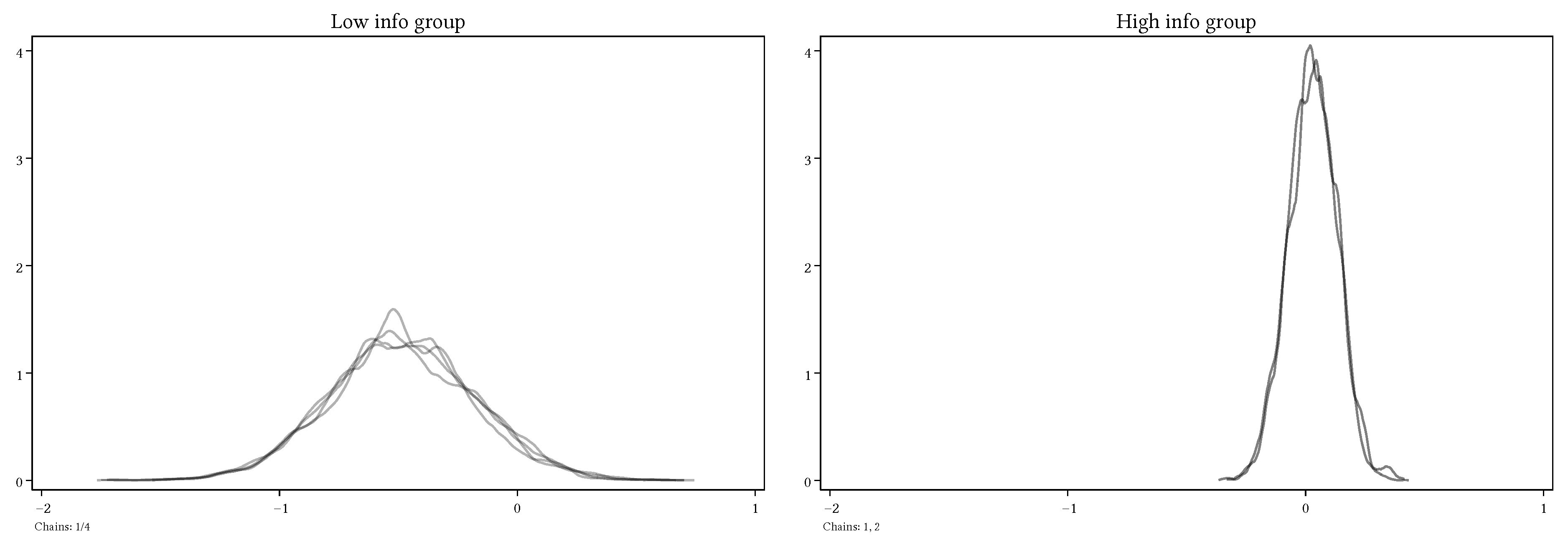

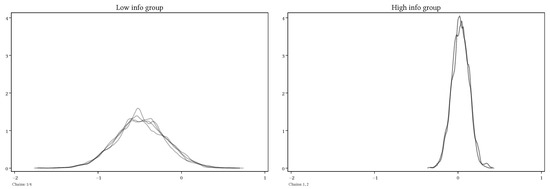

Figure 2 displays the density functions for the effect of players’ consideration of the extreme asks on their behavioural reactivity to the three lowest (Low Info Group) and highest (High Info Group) asks (i.e., the parameter). The figure documents a stark asymmetry between the two treatments. In the Low Info group, the density function is clearly negative, with an odds ratio of a negative () over a positive effect () of , providing a favorable evidence that as players consider the three lowest asks, they substantially reduce their behavioural reactivity to the extreme info. In other words, as players take into account the extreme signals, their asks diverge from the observed asks at the bottom of the distribution. Conversely, in the High Info group the density function is centered on zero—with an odds ratio of —indicating that players’ consideration of the three highest asks does not affect at all their behavioral reactivity to the extreme signal.

Figure 2.

How awareness of the extremes affects the responses to the lowest/highest asks in the treatment groups.

Overall, these results indicate that players deliberately choose to follow unbiased indicators of the central tendency of the asks distribution—i.e., the market price—rather than extreme and biased information. Moreover, since in the treatments we do observe a stronger adjustment of players’ asking behaviour to the extreme info than to the market price, the results in Figure 2 suggest that players’ consideration of the extreme signals does not play a significant explanatory role for their behavioral response to the three lowest or highest asks. Thus, the strong adjustment towards the extremes observed in the treatment groups is largely compatible with the hypothesis of a priming effect, i.e., the influence of uninformative but salient extreme asks on players’ evaluations that is not mediated by their explicit consideration of these market signals.

5.2. Indirect Effects

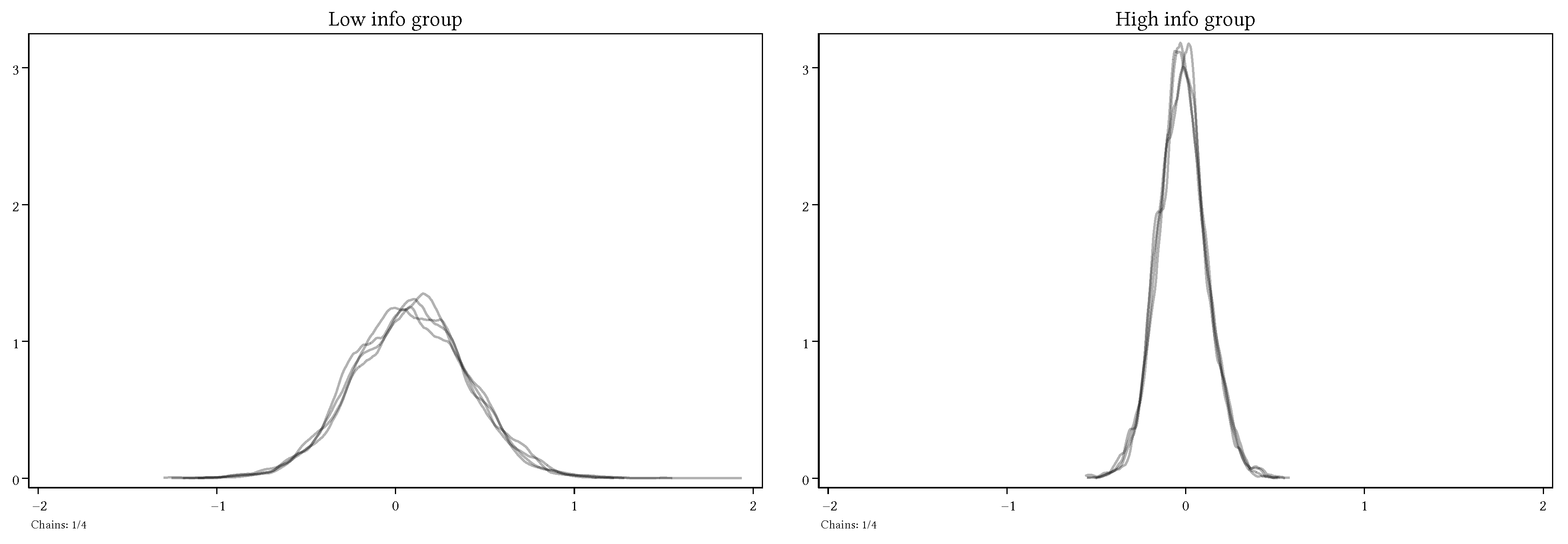

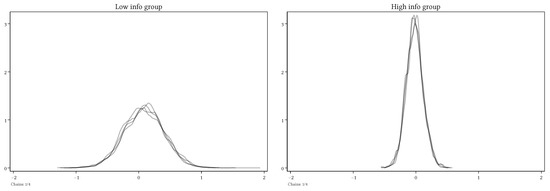

In Figure 3, we analyse the indirect effect of players’ consideration of the extreme asks on their behavioural reactivity to the market price. Table 7 provides the relevant odds ratios. Both graphs display two density functions centered on zero (with odds ratios of and , respectively), which document that players’ consideration of the extreme information does not have any effect on their behavioral reactivity to the market price in both treatment groups.

Figure 3.

How awareness of the extreme asks influences response to the market price.

Table 7.

’s sensitivity to considering extreme asks.

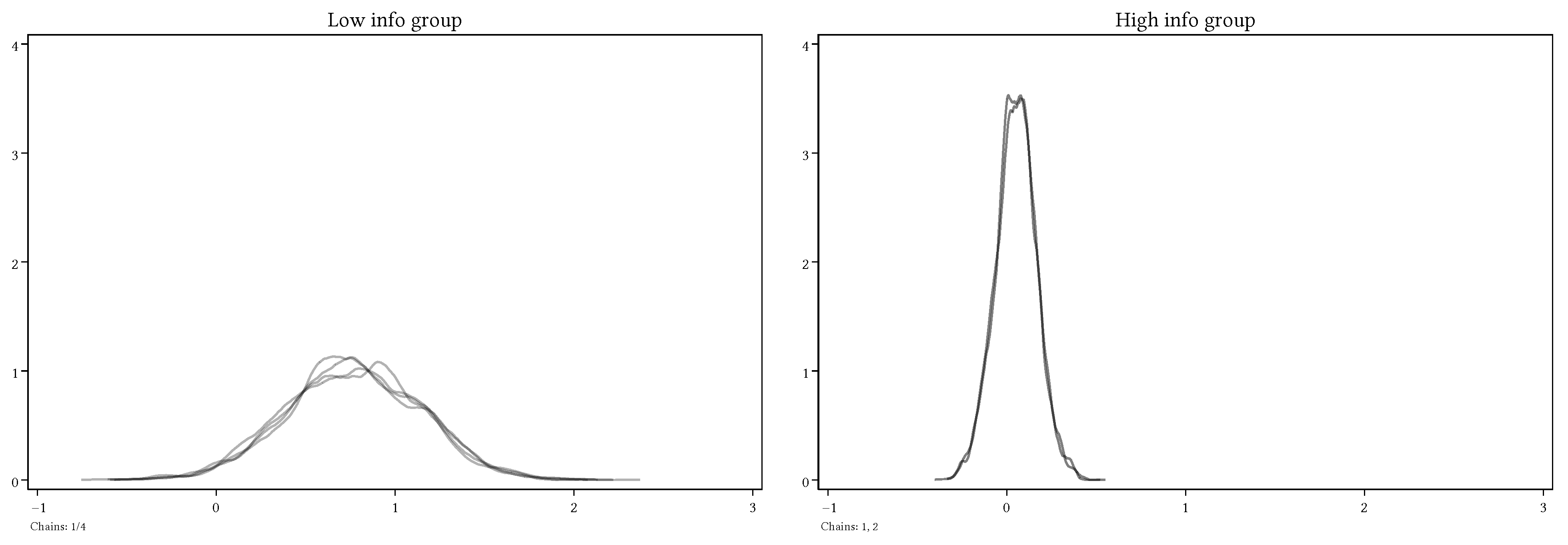

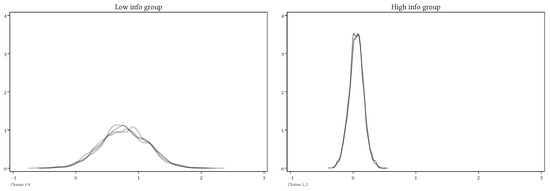

Interesting results are found when we analyse the indirect effect of players’ consideration of the market price on their behavioural reactivity to the extreme (see Figure 4 and Table 8). Figure 4 shows that in the Low Info group the density function is clearly positive with an odds ratio of . Thus, there is strong evidence that the consideration of the market price induces players to be more responsive to the three lowest asks in their evaluations. Conversely, in the High Info group the density function is roughly centered on zero—with an odds ratio of —indicating that players’ consideration of the market price does not have any effect on their sensitivity to the three highest asks.

Figure 4.

How awareness of the market price influences response to the extremes.

Table 8.

’s sensitivity to considering the market price.

Overall, our evidence suggests that players deliberately take into account the market price to shape their private appraisals. As for the information on the extreme asks, our evidence documents an interesting asymmetry between the Low and High Info group. Indeed, only in the Low Info group the extreme asks are deliberately taken into account through the consideration of the market price (see Figure 4). This points to a qualitative difference between the information on the extreme low and extreme high asks in a median price auction when players’ appraisals of an unfamiliar bad are uncertain. Indeed, the three lowest asks are representative of the willingness to accept of players’ that trade at the prevailing market price. Hence, players seem to integrate the information on the three lowest asks with the information on the market price to infer the characteristics of the asks distribution and to shape their appraisals accordingly. By contrast, the three highest asks do not convey information on players willing to trade at the prevailing market price, therefore they are likely to be perceived as randomly generated numbers, priming players’ private appraisals.

6. Discussion

The main findings of our experiment significantly contribute to the experimental literature on the behavioural anomalies in individual decision-making as they identify a novel link between observed behavior and self-awareness, helping to disentangle deliberate from reflexive (automatic) behavior.

As widely accepted, intentional actions require self-awareness, so that whenever subjects declare explicit consideration of market signals, then their behavior must be consistent with some form of deliberate learning. In our experiment, this occurs when subjects behavioural reactivity to the market price is mainly explained by their explicit consideration of this information. On the contrary, when behavior is misaligned to declared awareness, then unintentional acting is at work: this is exactly the case of extreme signals that subjects follow when placing their asks, without explicit consideration. This result helps embedding the analysis of behavioral anomalies within the larger literature—both psychological and related to the philosophy of action—on the link between intentions and choices [30,31,32,33].

Within this literature, a standard perspective defines intentional actions in terms of the ability to choose what one ultimately prefers. In this sense, if an individual does not pick up from the choice set the element she prefers most—or otherwise not strictly preferred by any other element in the same set—her choice counts as unintentional.

This conceptual framework can be adapted to interpret our results. Clearly, in the setting we analyze, preferences emerge from the market process as subjects do not have a clear idea at the outset of their own evaluation of the bad on auction. So, there is no such thing as true preferences revealed in choices that for this very reason might be said intentional. However, this does not rule out the possibility that intentions play a role in players’ choices, otherwise we should admit that individuals are simply automata mechanically responding to irrelevant cues.

Speculatively, we can hypothesize that, in the context at hand, players exert their intentions by deliberately choosing the information sources they prefer most. In other words, they might be thought as if they chose according to preferences defined over the informational sources available to shape their appraisals of the auctioned bad. In this sense, the pure shaping effect produced by the median, might be thought as intentionally accepted by players, for this is a deliberate consequence of their desire of shaping their asks by following an unbiased estimator of the central tendency of the asks distribution. On the opposite, the fact that subjects themselves assess extreme signals as irrelevant for choice, suggests that the conditioning they produce on asking behaviour is something that cannot go through deliberation. Hence, the observed effects of extreme information on individuals’ asking behaviour is likely to go through some form of reflexive (automatic) response to contextual cues. The kind of behaviour that Daniel Kahneman would label, in homage to dual process theory, as dependent on system 1 [34].

7. Conclusions

In this paper, we tried to shed some light on the cognitive mechanism at the roots of players’ systematic tendency to shape their private evaluation by following irrelevant market cues. Specifically, within the contexts of a repeated Vickrey median price selling auction, we investigate whether players deliberately use information on the market price and on the three lowest/highest asks to shape their private evaluations of an unusual bad (i.e., a mixture of Fanta, vinegar, and salt).

To obtain our empirical results, we first estimated individual players’ responsiveness parameters to the market price and extreme asks, then we checked how these parameters change in response to self-assessed consideration of potentially irrelevant market cues using a Bayesian approach.

At the behavioural level, we found a stronger shaping effect of the market price on players’ private evaluations in the control than in the two treatment groups. Moreover, in the treatment groups we showed that extreme information has a stronger attraction force than the market price.

As for the underlying cognitive mechanism, we found that players deliberately use the market price to shape their private evaluations of the auctioned bad. Conversely, players’ consideration of the extreme signals did not have a relevant role in explaining the players’ behavioural reactivity to the three lowest/highest asks. Overall, our evidence indicated that players deliberately rely on unbiased estimators of the asks distribution—i.e., the market (median) price—to shape their private evaluations, while the influence of the information on the tails of the asks distribution is largely consistent with a priming effect: i.e., the influence of uninformative but salient extreme asks on players’ evaluations that is not mediated by their explicit consideration of the these specific market signals.

Author Contributions

Conceptualization, S.C., S.B., V.F. and M.S.; Investigation, V.F. and M.S.; data curation, V.F.; writing—original draft preparation, S.C., S.B., V.F. and M.S.; writing— S.C., S.B., V.F. and M.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the project Reti, Politiche Pubbliche e Sviluppo (REPOS), research unit of the Department of Economics and Statistics of the University of Naples Federico II.

Institutional Review Board Statement

The study was conducted according to the guidelines of the Declaration of Helsinki.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data are available upon request.

Acknowledgments

The authors wish to thank Kent Osband at ISMed for suggestions and remarks on Bayesian modelling.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Diagnostic Plots

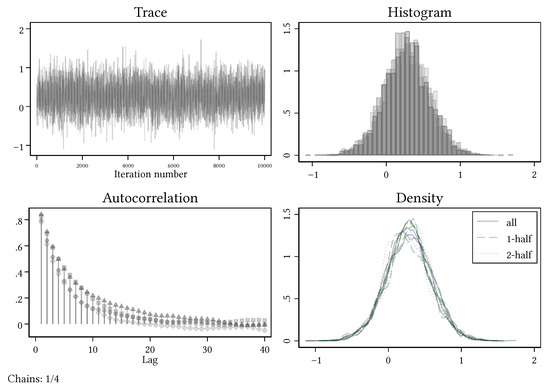

Figure A1.

How awareness of the price effect influences the response to the market price. The control group.

Figure A1.

How awareness of the price effect influences the response to the market price. The control group.

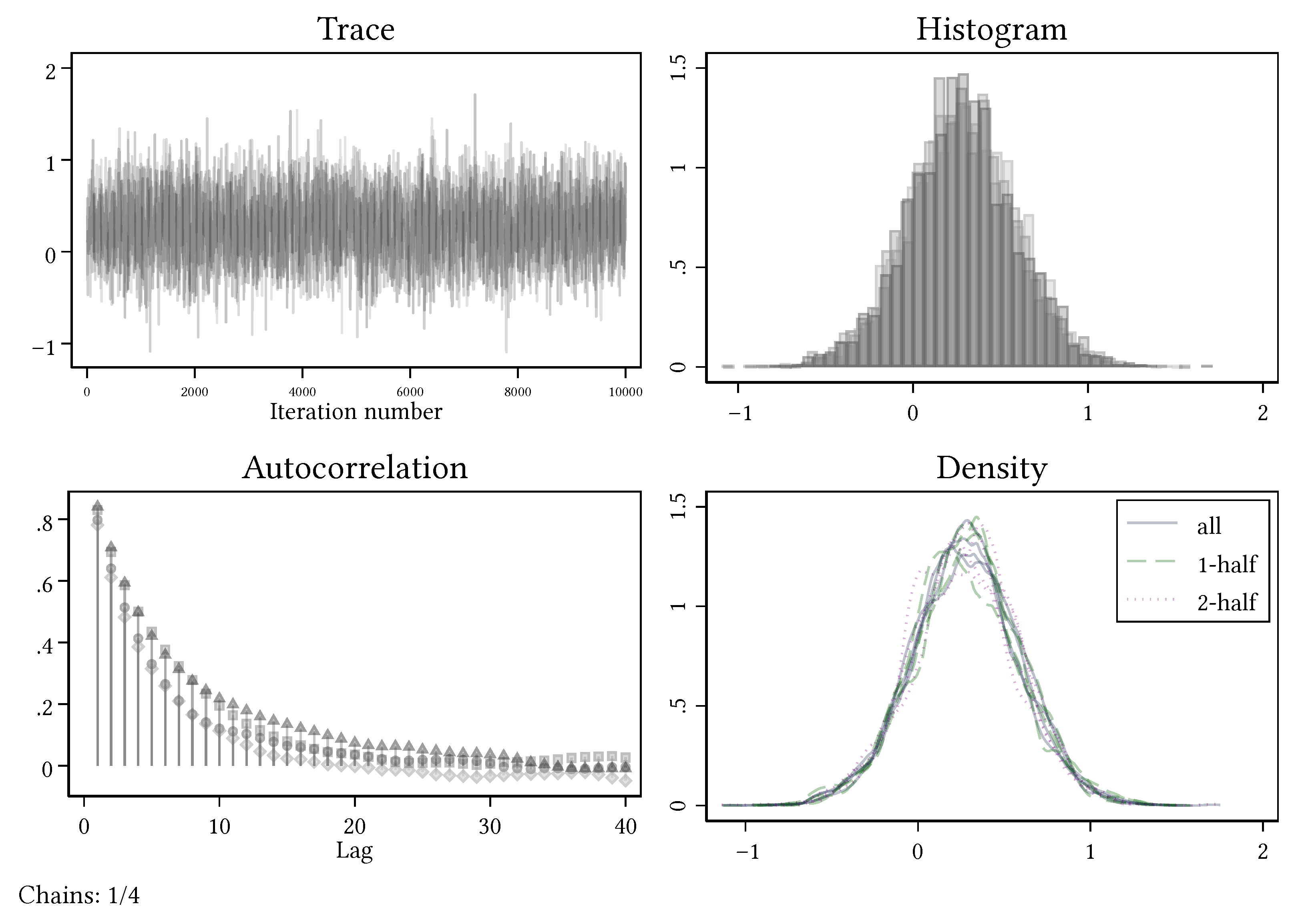

Figure A2.

How awareness of the price effect influences the response to the market price. The Low Info group.

Figure A2.

How awareness of the price effect influences the response to the market price. The Low Info group.

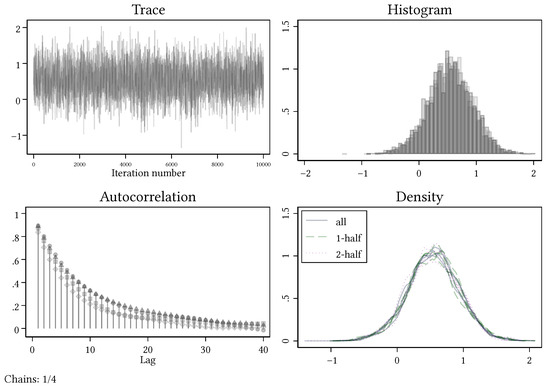

Figure A3.

How awareness of the price effect influences the response to the market price. The High Info group.

Figure A3.

How awareness of the price effect influences the response to the market price. The High Info group.

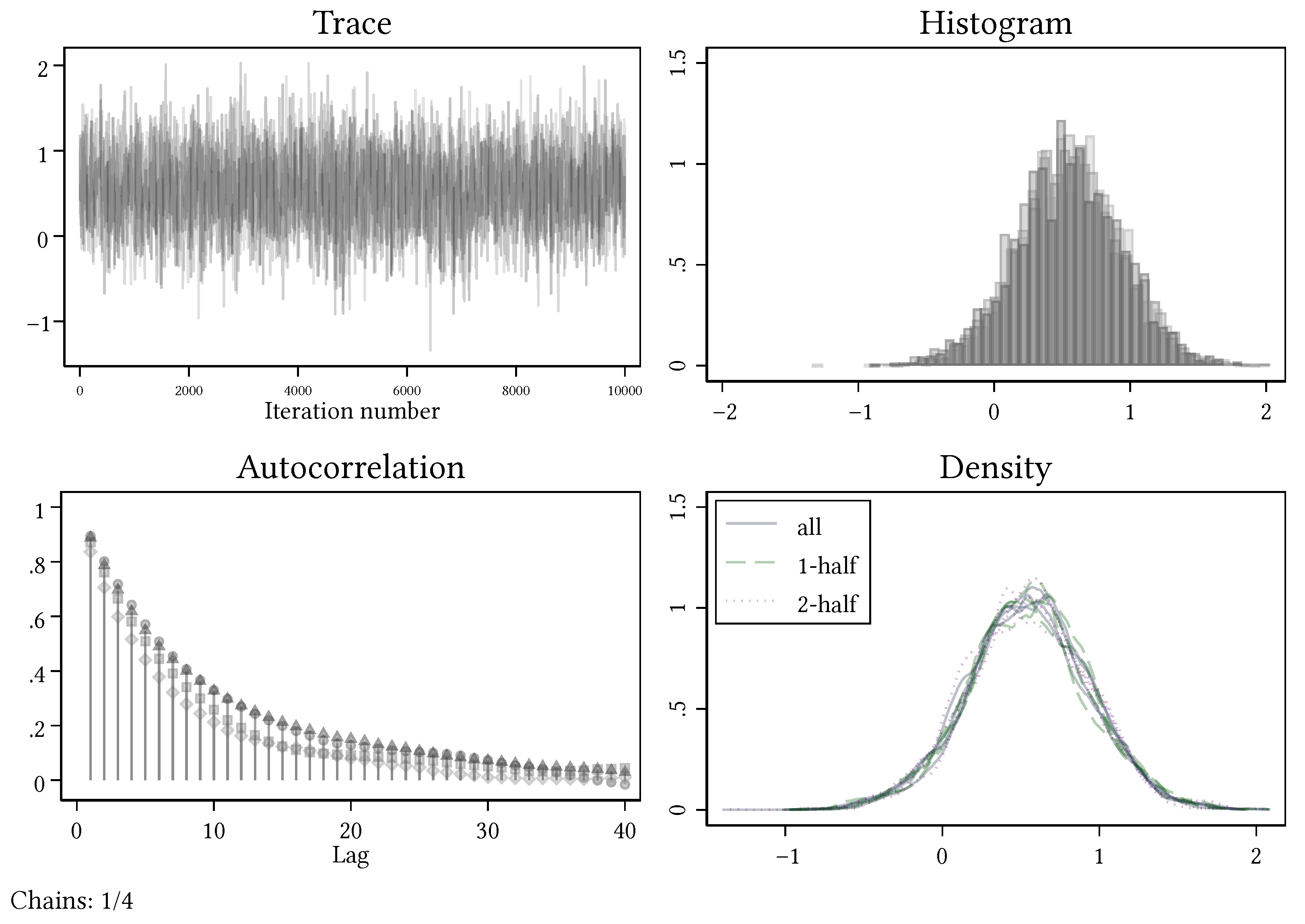

Figure A4.

How awareness of the price effect influences the response to extreme asks. The Low Info group.

Figure A4.

How awareness of the price effect influences the response to extreme asks. The Low Info group.

Figure A5.

How awareness of the price effect influences response to extreme ask. The High Info group.

Figure A5.

How awareness of the price effect influences response to extreme ask. The High Info group.

Figure A6.

How awareness of the lowest asks influences the response to extreme asks. The Low Info group.

Figure A6.

How awareness of the lowest asks influences the response to extreme asks. The Low Info group.

Figure A7.

How awareness of the highest asks influences the response to extreme ask. The High Info group.

Figure A7.

How awareness of the highest asks influences the response to extreme ask. The High Info group.

Figure A8.

How awareness of the lowest asks influences the response to the market price. The Low Info group.

Figure A8.

How awareness of the lowest asks influences the response to the market price. The Low Info group.

Figure A9.

How awareness of the highest asks influences the response to the market price. The High Info group.

Figure A9.

How awareness of the highest asks influences the response to the market price. The High Info group.

Appendix B. Instructions Given to Players

- 1.

- This is an experiment in the economics of market decision making. The instructions are simple, and if you follow them carefully you might earn a considerable amount of money which will be paid to you in cash after the experiment. You will be given opportunities to earn money by drinking small amounts of an unpleasant tasting but harmless liquid composed of equal parts of vinegar and Gatorade. At the start of the experiment you will be asked to taste a 30 mL sample of this drink. You will not be required to drink any more than this sample. If you drink any more it will only be because you have chosen to do so, and you will be paid for this.

- 2.

- We are interested in your choices as individuals. Therefore, there must be no talking during the experiment unless you want to ask us a question—in which case, simply raise your hand—and you must not look at what other people are doing. When we ask you to enter information in the form that will be displayed on the screen of your computer, do only what we have asked then wait for instructions from us. This is very important so please wait for us to prompt you, do not try to look ahead, and do not worry about being left behind. Please keep to these simple rules because anyone breaking them may be asked to leave the experiment without any reward.

- 3.

- The computer will ask you a sequence of questions of the form “Would you be willing to accept £x to drink the liquid?” The values of x range from a minimum of 2.00 CZK to a maximum of 100 CZK. To any question of such sequence you either answer yes or no. At the end of the sequence the computer will ask you to confirm the values of your highest rejected price—i.e., the maximum price at which you are not willing to drink the liquid—and your minimum accepted price—i.e., the minimum price at which you are willing to drink the liquid.

- 4.

- The auction will be repeated for 11 rounds.

- 5.

- Now we’ll explain how the market price will be set. After your confirmation, the computer will register the maximum price at which any of the participants at the experiment is not willing to drink the liquid. It will rank them in order, from the lowest to the highest, and then it selects the median value. This will be the market price. Now, please look at the Table. This is an example of a market with hypothetical values, just to help you understand how the process works.

- 6.

- Think about a market in which five people declare their willingness to accept money for drinking an unpleasant-tasting liquid; suppose that person 1 says she would be willing to accept 24 CZK but not 22 CZK; person 2 says she would be willing to accept 26 CZK but not 24 CZK; and so on (see the table below). The ‘Reject’ column here shows the highest price at which each person would not be willing to trade. So, person 1 would not want to drink if the price were 22 CZK and so on. The market rule is to take the value in the middle of these “Rejects” and set this as the market price. So, in this case, the market price would be 34 CZK: persons 1 and 2 will trade, because they are willing to accept this payment in exchange for the unpleasant liquid; on the contrary, persons 3, 4 and 5 will not trade because the market price is less than what any of them would be willing to accept.

Person Lowest Accepted Price Highest Accepted Price Trade 1 24 CZK 22 CZK Yes 2 26 CZK 24 CZK Yes 3 37 CZK 34 CZK No 4 46 CZK 43 CZK No 5 52 CZK 49 CZK No - 7.

- This rule is an attempt to simulate the way prices get determined in real markets. In this experiment the price approximately reflects the valuation of the average participant. Another feature of this rule is that no one can manipulate the price to their own advantage. To illustrate this, look again at the table. Only persons 1 and 2 are trading at the market price. Now it might occur to one of them that it would be better for them if the market price were higher so that they could receive more for drinking. However, the only way that they could affect the price is by stating a valuation higher than the current market price: but then, they would end up being one of the participants who did not trade, so if they succeeded in increasing the price, they would not benefit from it because they would no longer trade! Now that probably sounds horribly complicated! But don’t worry about it. We suggest that your best policy is just to think about this like an ordinary price. You can’t manipulate the price to your advantage, so we ask you to take our word for it that the best thing to do is to just respond honestly to the questions posed to you.

Appendix C. Final Questionnaire

| Variable | Question |

| gender | 0 = male, 1 = female |

| age | age |

| country | Country of origin, 1 = “Czech Republic”; 2 = “Slovakia”; 3 = “Russia”; 4 = “Ukraine”; 5 = “Poland”; 6 = “Other” |

| siblings | Number of siblings |

| field | field of study, 1 = “Mathematics/Statistics”; 2 = “Science/Engineering/Medicine”; 3 = “Economics/Business”; 4 = “Other Social Sciences”; 5 = “Humanities and Other” |

| degree | Your highest earned academic degree so far, 1 = “none”; 2 = “Bachelor”; 3 = “Master”; 4 = “Doctoral degree” |

| job | Do you have a job? (1 for Yes, 2 for No) |

| earnings | If yes, how much is the yearly earning (in CZK)? |

| need | What is the average amount of money you need weekly? |

| priceeffect | When you observed the market price, 0 = “you completely ignored it”; 1 = “you took it into account” |

| observeeffect | If you had the opportunity to observe the choices of some of your colleagues, did this affect your choices (0 for No, 1 for Yes) |

References

- Barberis, N.; Huang, M.; Thaler, R.H. Individual preferences, monetary gambles, and stock market participation: A case for narrow framing. Am. Econ. Rev. 2006, 96, 1069–1090. [Google Scholar] [CrossRef] [Green Version]

- Kahneman, D.; Knetsch, J.L.; Thaler, R.H. Anomalies: The Endowment Effect, Loss Aversion, and Status Quo Bias. J. Econ. Perspect. 1991, 5, 193–206. [Google Scholar] [CrossRef] [Green Version]

- Tversky, A.; Kahneman, D. The framing of decisions and the psychology of choice. Science 1981, 211, 453–458. [Google Scholar] [CrossRef] [Green Version]

- Isoni, A.; Brooks, P.; Loomes, G.; Sugden, R. Do markets reveal preferences or shape them? J. Econ. Behav. Organ. 2016, 122, 1–16. [Google Scholar] [CrossRef]

- Loomes, G.; Starmer, C.; Sugden, R. Do anomalies disappear in repeated markets? Econ. J. 2003, 113, C153–C166. [Google Scholar] [CrossRef]

- Loomes, G.; Starmer, C.; Sugden, R. Preference reversals and disparities between willingness to pay and willingness to accept in repeated markets. J. Econ. Psychol. 2010, 31, 374–387. [Google Scholar] [CrossRef] [Green Version]

- Tufano, F. Are ‘true’ preferences revealed in repeated markets? An experimental demonstration of context-dependent valuations. Exp. Econ. 2010, 13, 1–13. [Google Scholar] [CrossRef]

- Maniadis, Z.; Tufano, F.; List, J.A. One swallow doesn’t make a summer: New evidence on anchoring effects. Am. Econ. Rev. 2014, 104, 277–290. [Google Scholar] [CrossRef]

- Li, L.; Maniadis, Z.; Sedikides, C. Anchoring in Economics: A Meta-Analysis of Studies on Willingness-to-Pay and Willingness-to-Accept. J. Behav. Exp. Econ. 2021, 90, 101629. [Google Scholar] [CrossRef]

- Mazar, N.; Koszegi, B.; Ariely, D. True Context-dependent Preferences? The Causes of Market-dependent Valuations. J. Behav. Decis. Mak. 2014, 27, 200–208. [Google Scholar] [CrossRef]

- Furnham, A.; Boo, H.C. A literature review of the anchoring effect. J. Socio-Econ. 2011, 40, 35–42. [Google Scholar] [CrossRef]

- Ariely, D.; Loewenstein, G.; Prelec, D. “Coherent arbitrariness”: Stable demand curves without stable preferences. Q. J. Econ. 2003, 118, 73–106. [Google Scholar] [CrossRef] [Green Version]

- Sugden, R.; Zheng, J.; Zizzo, D.J. Not All Anchors Are Created Equal. J. Econ. Psychol. 2013, 39, 21–31. [Google Scholar] [CrossRef]

- Ioannidis, K.; Offerman, T.; Sloof, R. On the effect of anchoring on valuations when the anchor is transparently uninformative. J. Econ. Sci. Assoc. 2020, 6, 77–94. [Google Scholar] [CrossRef]

- Karakostas, A.; Morgan, G.; Zizzo, D.J. Socially Interdependent Investment; Elsevier: Amsterdam, The Netherlands, SSRN 3799854; 2021. [Google Scholar]

- Beraldo, S.; Filoso, V.; Stimolo, M. Much Ado About Extremes: An Experimental Test of the Shaping Effect of Prices on Preferences. Metroeconomica 2019, 70, 119–143. [Google Scholar] [CrossRef] [Green Version]

- Wegener, D.T.; Petty, R.E.; Blankenship, K.L.; Detweiler-Bedell, B. Elaboration and Numerical Anchoring: Implications of Attitude Theories for Consumer Judgment and Decision Making. J. Consum. Psychol. 2010, 20, 5–16. [Google Scholar] [CrossRef]

- Wegener, D.T.; Petty, R.E.; Detweiler-Bedell, B.T.; Jarvis, W.B.G. Implications of attitude change theories for numerical anchoring: Anchor plausibility and the limits of anchor effectiveness. J. Exp. Soc. Psychol. 2001, 37, 62–69. [Google Scholar] [CrossRef] [Green Version]

- Chapman, G.B.; Johnson, E.J. Anchoring, activation, and the construction of values. Organ. Behav. Hum. Decis. Process. 1999, 79, 115–153. [Google Scholar] [CrossRef] [Green Version]

- Palmeri, T.J.; Nosofsky, R.M. Central tendencies, extreme points, and prototype enhancement effects in ill-defined perceptual categorization. Q. J. Exp. Psychol. Sect. A 2001, 54, 197–235. [Google Scholar] [CrossRef]

- Plott, C.R. Rational Individual Behaviour in Markets and Social Choice Processes. In The Rational Foundations of Economic Behaviour: Proceedings of the IEA Conference Held in Turin, Italy; Arrow, K.J., Colombatto, E., Perlman, M., Schmidt, C., Eds.; Macmillan: London, UK, 1996. [Google Scholar]

- O’Donnell, M.; Evers, E.R. Preference Reversals in Willingness to Pay and Choice. J. Consum. Res. 2019, 45, 1315–1330. [Google Scholar] [CrossRef]

- Drouvelis, M.; Sonnemans, J. The Endowment Effect in Games. Eur. Econ. Rev. 2017, 94, 240–262. [Google Scholar] [CrossRef] [Green Version]

- Vickrey, W. Counterspeculation, auctions, and competitive sealed tenders. J. Financ. 1961, 16, 8–37. [Google Scholar] [CrossRef]

- Fischbacher, U. z-Tree: Zurich Toolbox for Ready-made Economic Experiments. Exp. Econ. 2007, 10, 171–178. [Google Scholar] [CrossRef] [Green Version]

- Lusk, J.L.; Shogren, J.F. Experimental Auctions: Methods and Applications in Economic and Marketing Research; Cambridge University Press: Cambridge, MA, USA, 2007. [Google Scholar]

- Gelman, A.; Carlin, J.B.; Stern, H.S.; Dunson, D.B.; Vehtari, A.; Rubin, D.B. Bayesian Data Analysis, 3rd ed.; CRC Press: Boca Raton, FL, USA, 2014. [Google Scholar]

- Jeffreys, H. An invariant form for the prior probability in estimation problems. Proc. R. Soc. Lond. Ser. A Math. Phys. Sci. 1946, 186, 453–461. [Google Scholar]

- Kass, R.E.; Raftery, A.E. Bayes Factors. J. Am. Stat. Assoc. 1995, 90, 773–795. [Google Scholar] [CrossRef]

- Mele, A.R.; Moser, P.K. Intentional Action. Nous 1994, 28, 39–68. [Google Scholar] [CrossRef]

- Moors, A.; De Houwer, J. Automaticity: A theoretical and conceptual analysis. Psychol. Bull. 2006, 132, 297–326. [Google Scholar] [CrossRef] [Green Version]

- Baldwin, D.A.; Baird, J.A. Discerning Intentions in Dynamic Human Action. Trends Cogn. Sci. 2001, 5, 171–178. [Google Scholar] [CrossRef]

- Fiske, S.T.; Taylor, S.E. Social Cognition: From Brains to Culture; Sage: Thousand Oaks, CA, USA, 2013. [Google Scholar]

- Kahneman, D. Thinking, Fast and Slow; Macmillan: New York, NY, USA, 2011. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).