Beyond Platform Economy: A Comprehensive Model for Decentralized and Self-Organizing Markets on Internet-Scale

Abstract

1. Introduction

- works on the strategic and operational level,

- enables market exchange for complex products,

- and how its instances might unfold during different life stages.

2. Background and Approach

2.1. Distributed Market Spaces-Characteristics and Objectives

- to alleviate the adverse effects of rising platform-power, and

- lower transaction costs for complex products

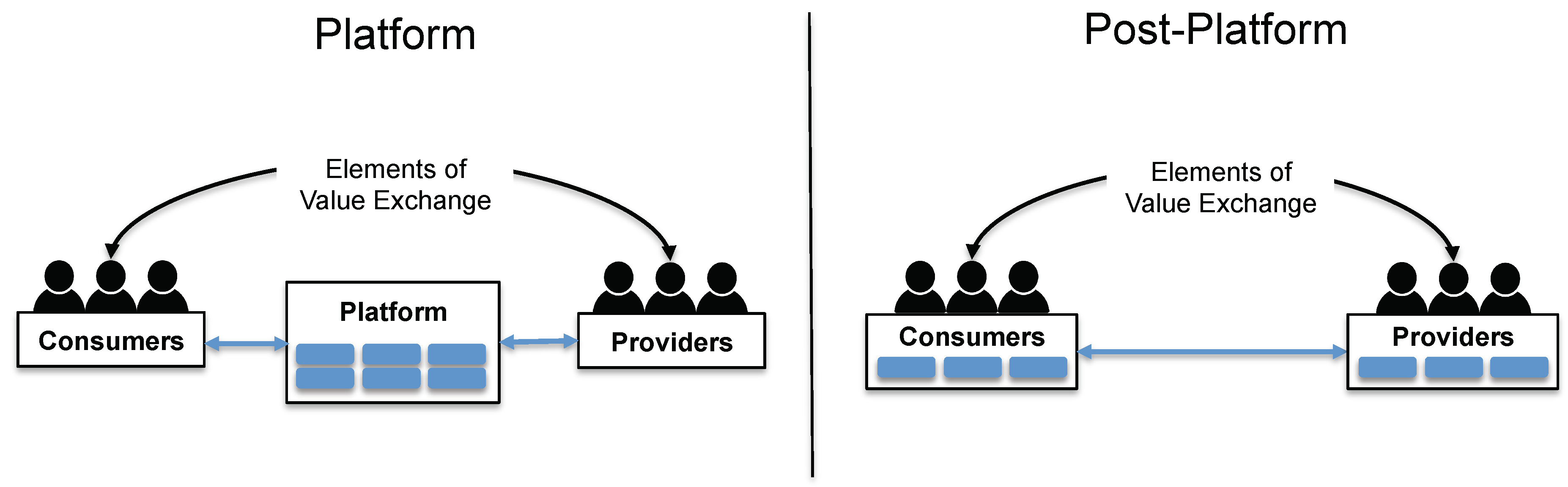

2.1.1. Decentralization as a driver

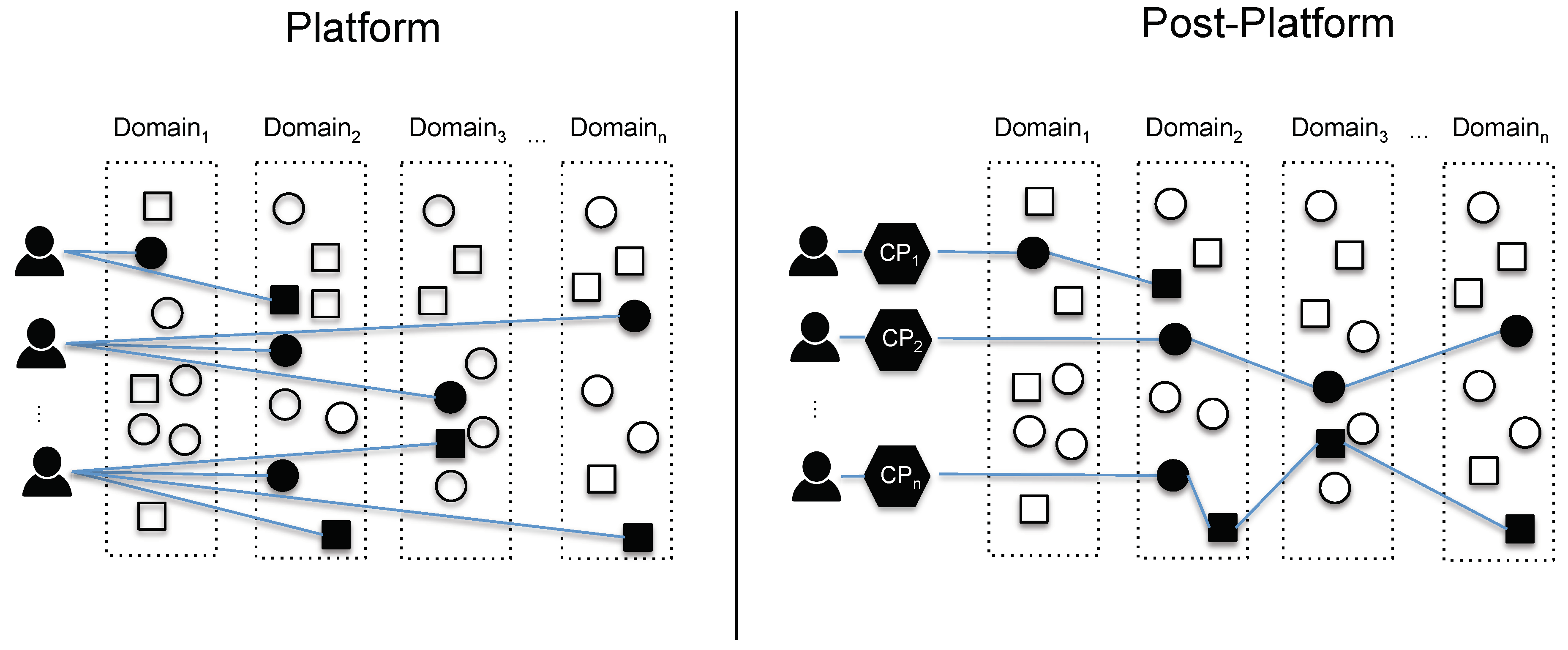

2.1.2. Complex Products as a Driver

- Objective 1—Facilitating decentralization and openness.

- Objective 2—Enabling market transactions of complex products directly and reliably.

- Objective 3—Supporting scalability and allowing the cross-domain market exchange.

2.2. Reference Modeling

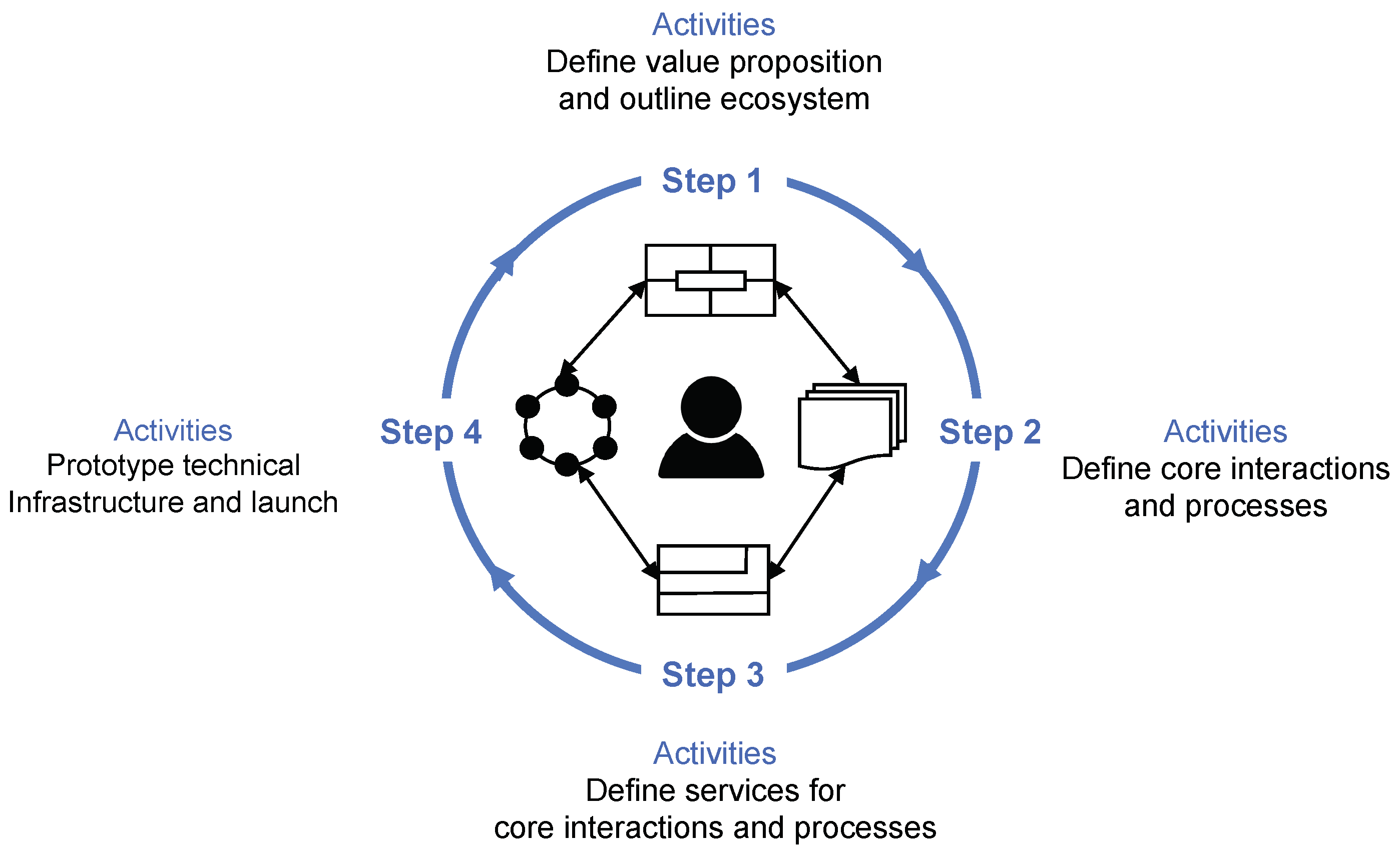

- Step 1—In Section 3, we reviewed the relevant reference models, with the focus on applicability, reusability, and adaptability for the modeling context of distributed market spaces.

- Step 2—In Section 4, we leveraged and adjusted the identified models and entities, adding additional entities and elements to meet the stated objectives of distributed market spaces.

- Step 3—In Section 5, we demonstrated the application of the proposed reference model in the context of a case study and evaluated its suitability of meeting the objectives it was designed for.

3. Related Work

- Practitioner Reference Models.

- Scientific Business Process Reference Models.

- Scientific Multi-View Reference Models.

- Applicability—to assess the extent to which they integrate concepts and models required for reference modeling of distributed market spaces.

- Reusability and adaptability–to assess how their elements can be reused and adapted to be of service for the distributed market spaces reference model.

3.1. Practitioner Reference Models

3.2. Scientific Business Process Reference Models

3.3. Scientific Multi-View Reference Models

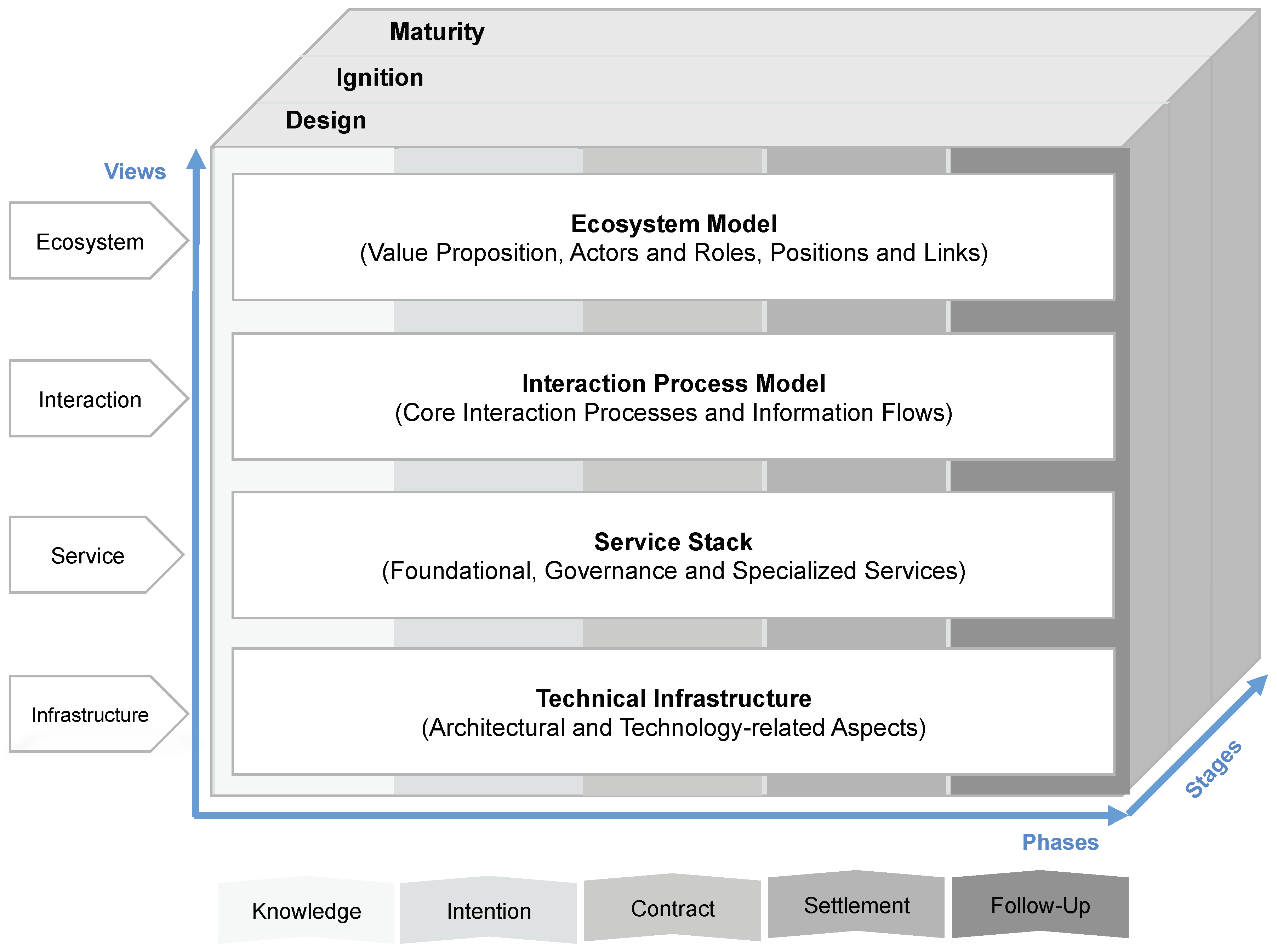

4. Proposed Reference Model for Distributed Market Spaces

- The vertical dimension (Views) was modified with an ecosystem view to integrate the ecosystem perspective of self-organized and governed structures. Further services are introduced to implementing the ecosystem view and related interaction processes;

- The horizontal dimension (Phases) was extended by a new phase to integrate additional activities necessary for the market transactions of complex products to realize;

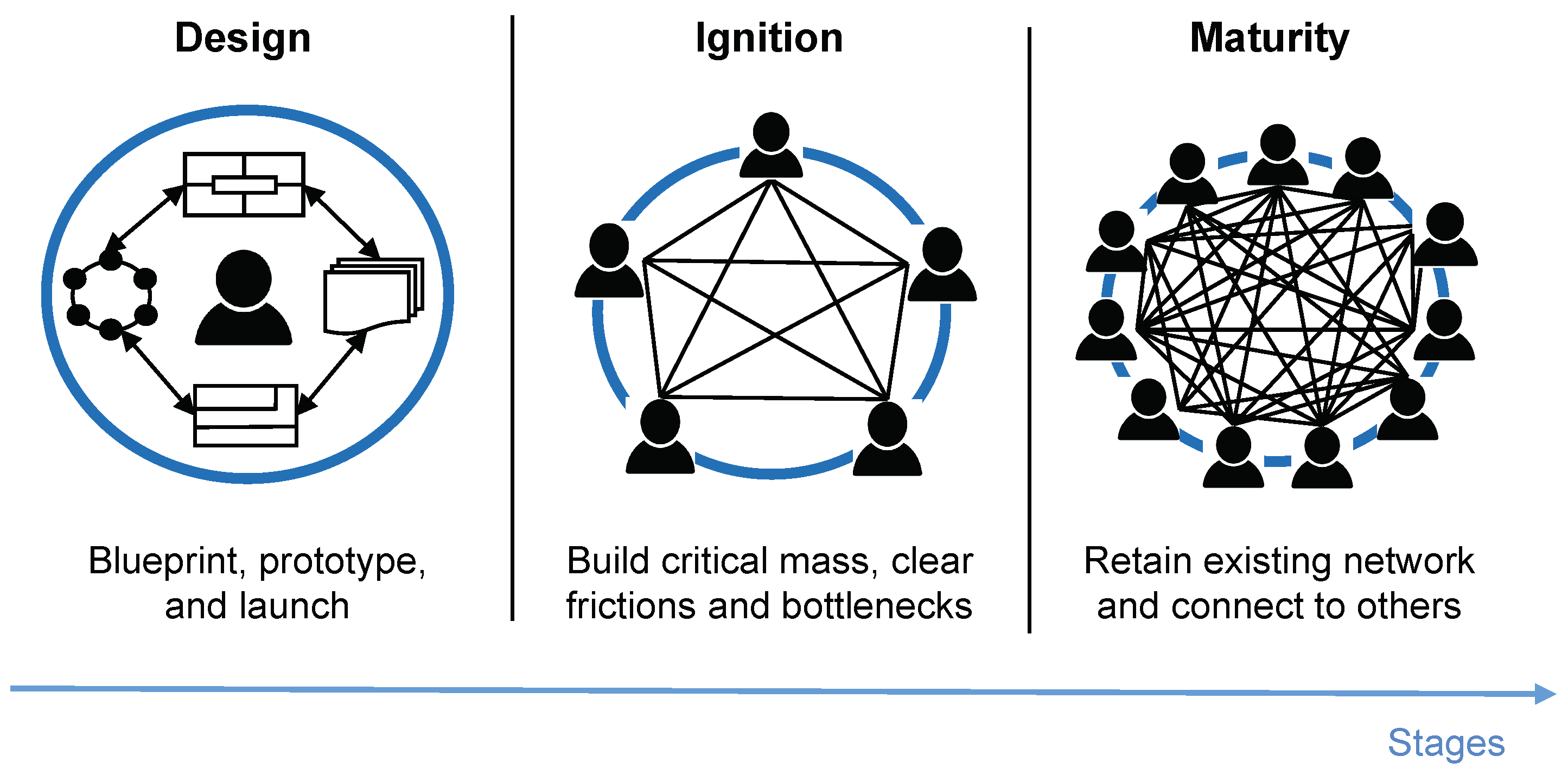

- A new dimension (Stages) was added to integrate different concerns in different life stages of distributed market spaces.

- The Ecosystem view maps the organizational structure of a reference DMS as an ecosystem. It proposes an ecosystem model that outlines actors, their roles, and primary activity flows and explicates how identified actors and activities need to link and align in order for the ecosystem’s value proposition to materialize.

- The Interaction view specifies the core interactions among identified actors taking different roles at the operational level of a reference DMS. It proposes an interaction process model that specifies the interaction processes, relevant activities, and resulting information flows required for market transactions of complex products through a reference DMS.

- The Service view defines services that a reference DMS must provide to its participants in order to facilitate the ecosystem and interaction view. It introduces a service stack that implements the ecosystem model and its core interaction processes specified by the interaction phase model.

- The Infrastructure view describes the technical infrastructure of a reference DMS for the implementation of the service view. It considers architectural and technology-related aspects and forms the basis for the implementation of the defined service stack.

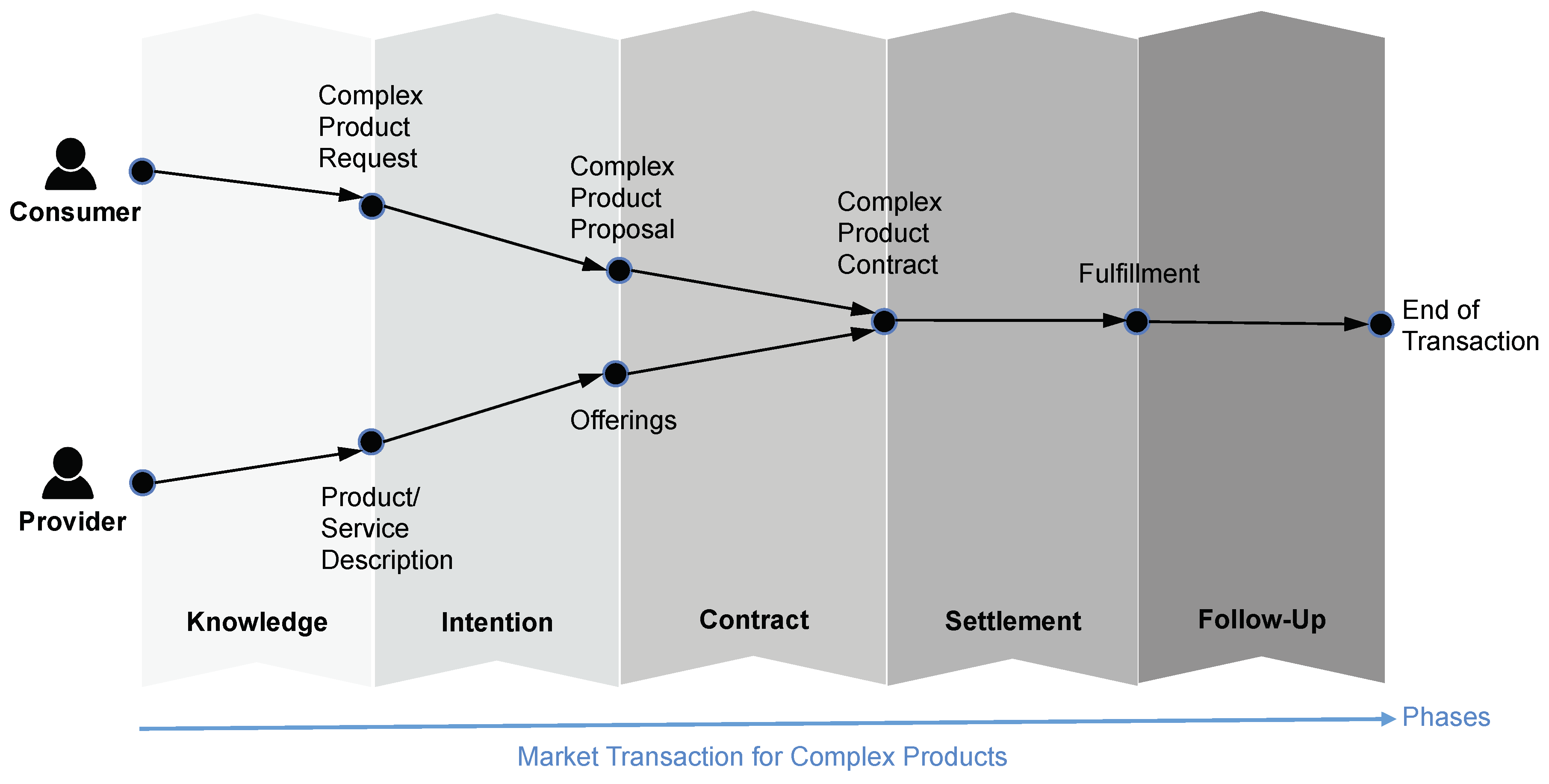

4.1. Phase Model of Market Transactions for Complex Products

- The integration of the ’Follow-Up’ phase, a new phase that integrates interaction processes among market participants that happen after the settlement.

- The integration of additional processes that address the specifics of complex products (cf. Section 2.1)

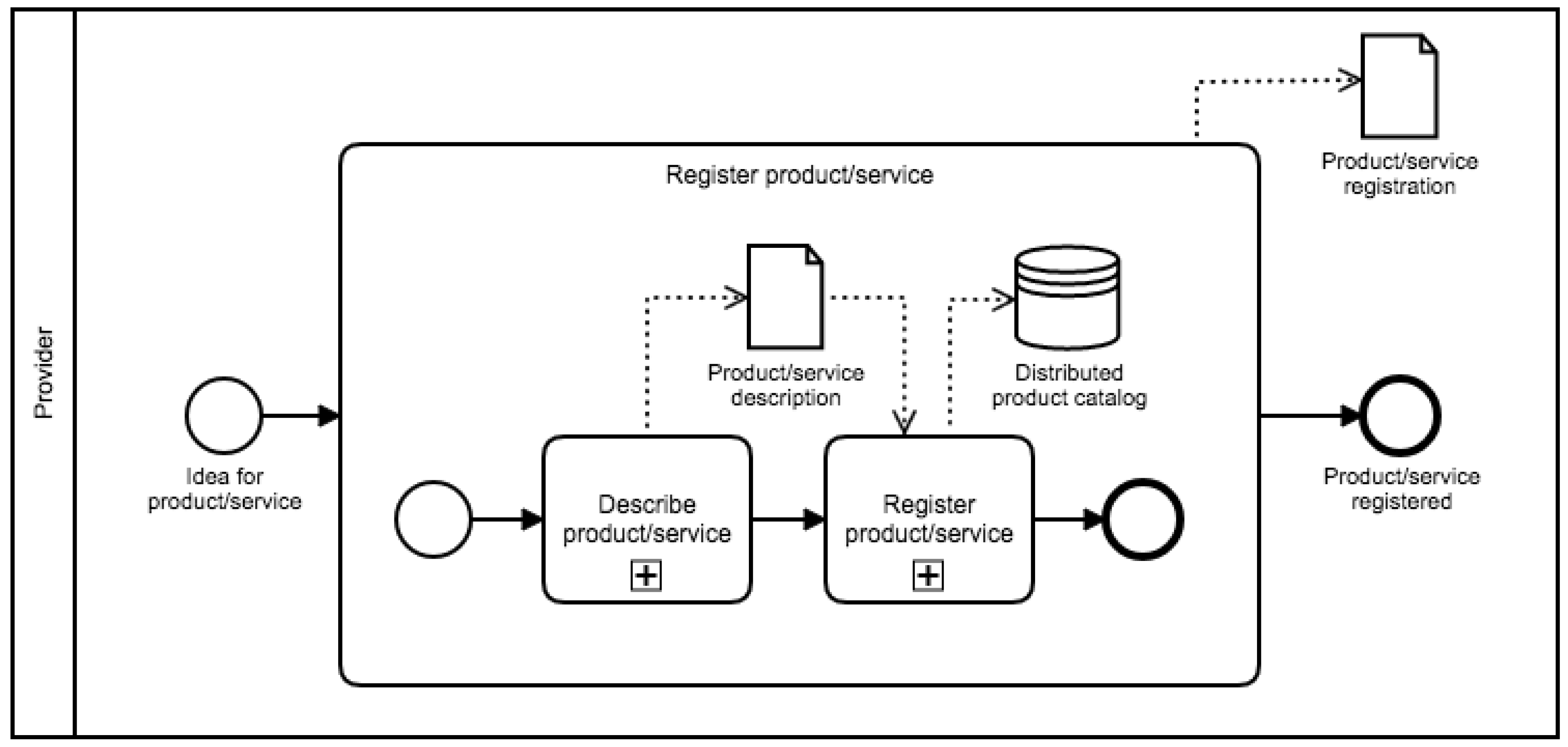

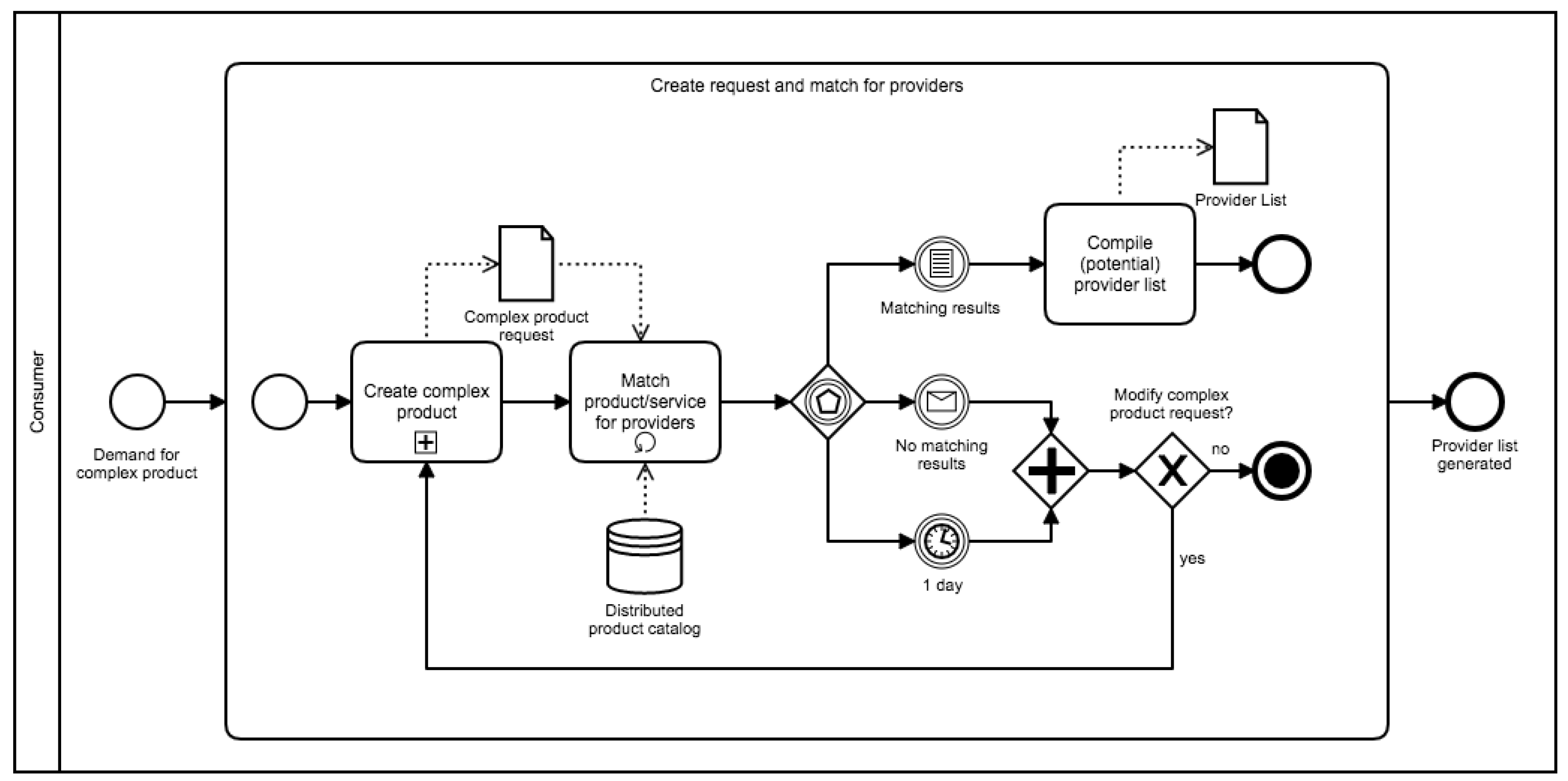

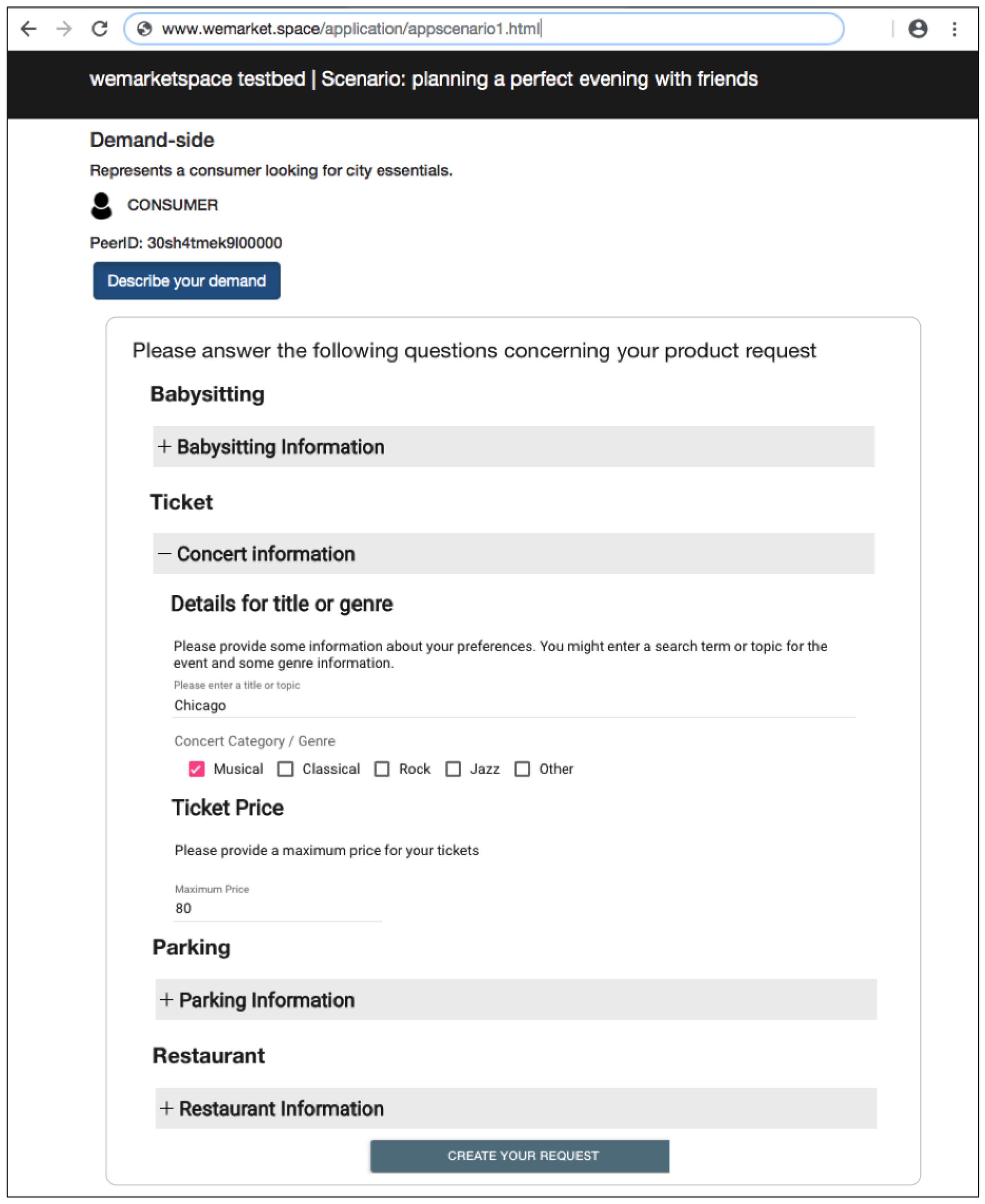

- In the Knowledge phase, market participants acquire an overview of the supply and demand in a distributed market space. Providers publish their offers by publishing descriptions of the products and services they offer. Consumers formulate their demands as complex product requests and, based on that search for potential providers that can provide parts of the required complex product. Consequently, the knowledge phase ends with a product/service description and a formulated complex product request accompanied by a list of possible transaction partners.

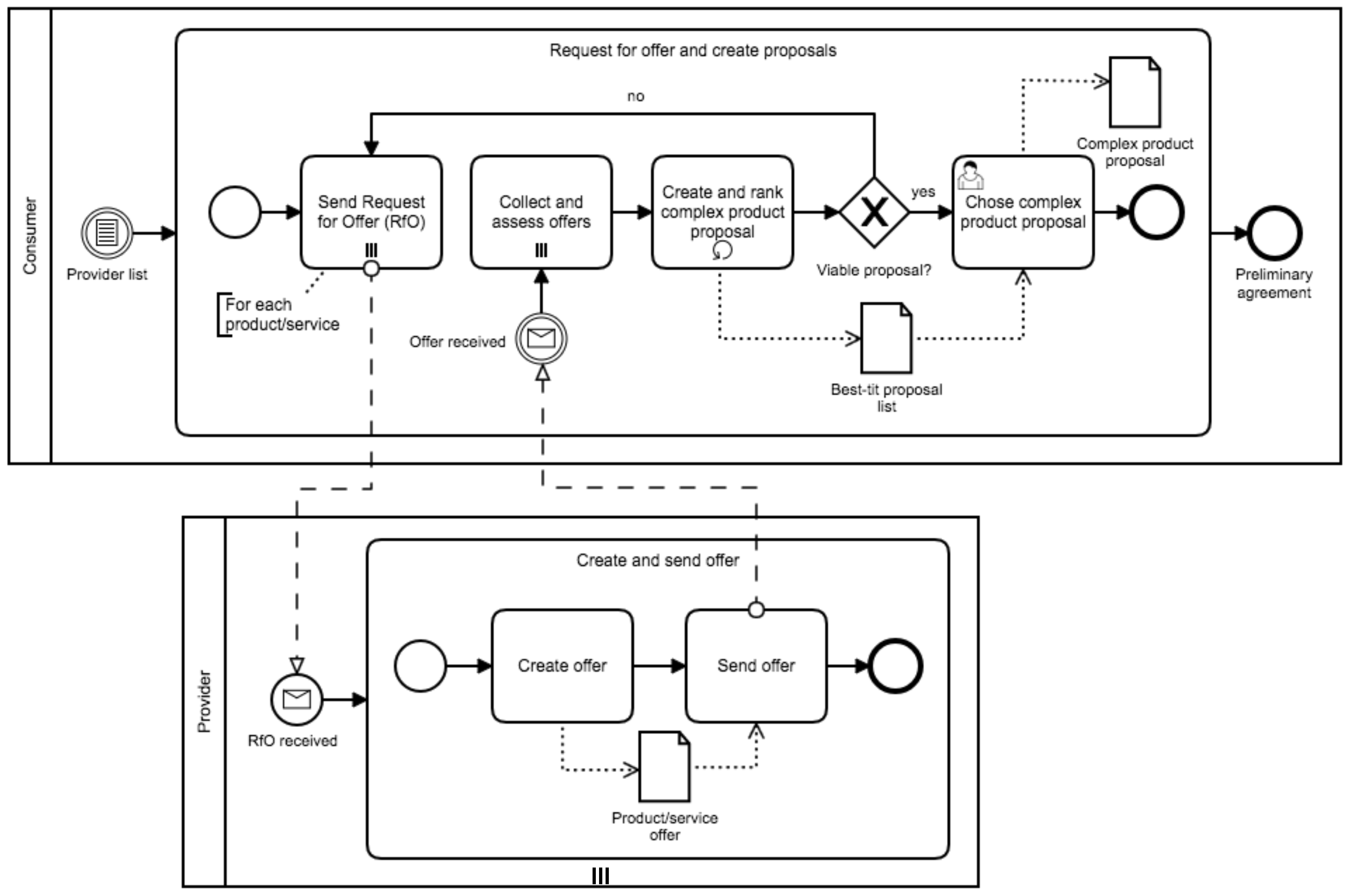

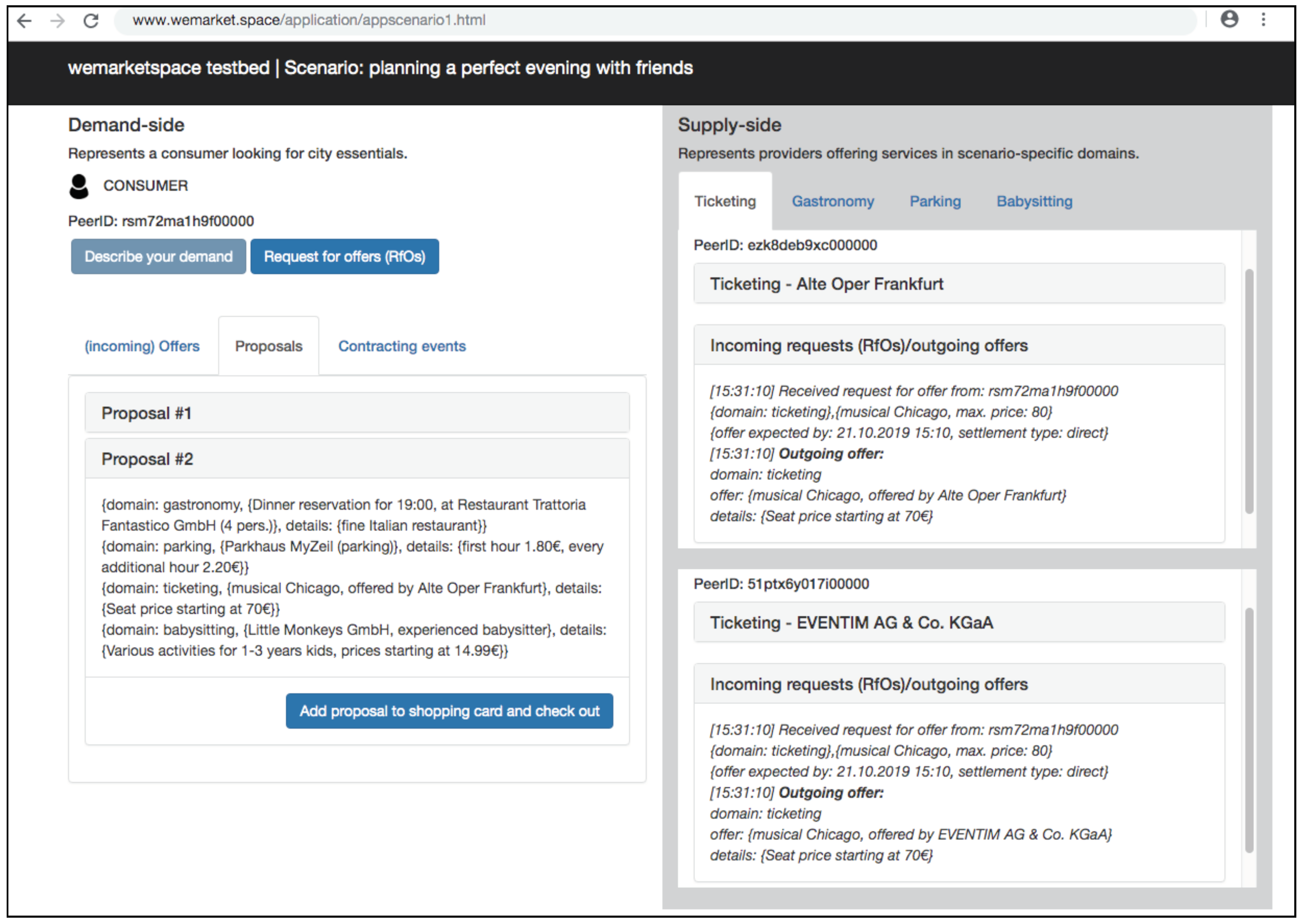

- In the Intention phase, market participants negotiate conditions for an agreement for the particular complex product. It covers the process of sending “Requests for Offer” (RfO) to the potential transaction partners (consumer), and providers send back particular offerings in a way including the price tag, payment mode, and delivery conditions. Consumers then aggregate all received offerings, and create complex product proposals, which they rank based on the defined requirements and constraints. Consumers might then select one complex product proposal, which best suits their demands. The chosen complex product proposal (consumer side) and offerings (provider side) represent the phase results. They are the starting point for the next phase and form the basis for the contractual agreement to be made.

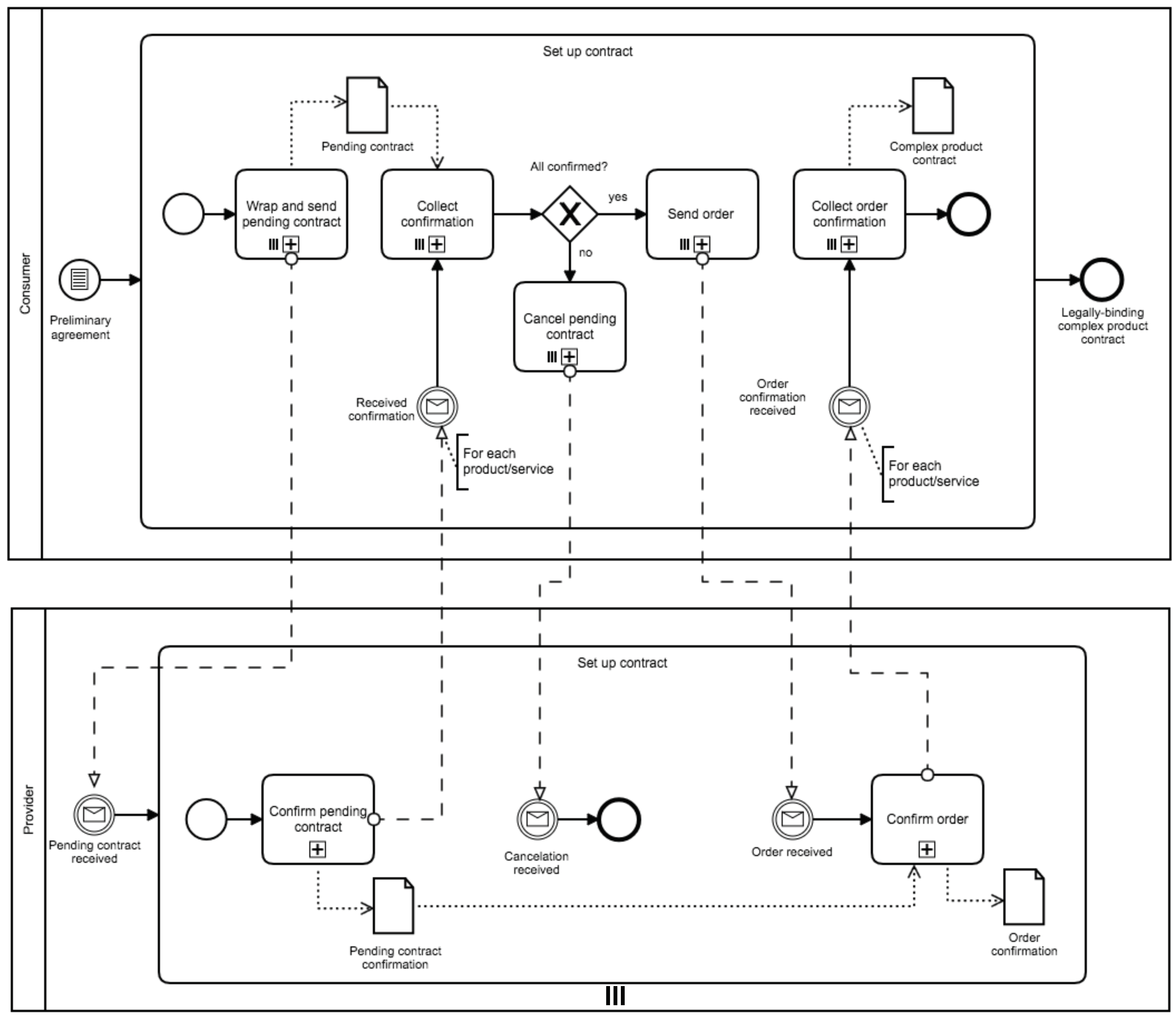

- In the Contract phase, consumers and provides substantiate the negotiated agreement represented by a legally binding contract. From the consumer side, a complex product contract is considered an umbrella contract since it incorporates different arrangements for different parts of the complex product. The umbrella contract represents a one-to-many contract situation and requires consumer’s involvement in several contractual processes (one for each product or service). On the provider side, the contracting process is regarded as a one-to-one contract situation with an additional activity regarding the confirmation of a pending contract. The phase ends with an agreed legally binding complex product contract, which is the starting point for the settlement phase.

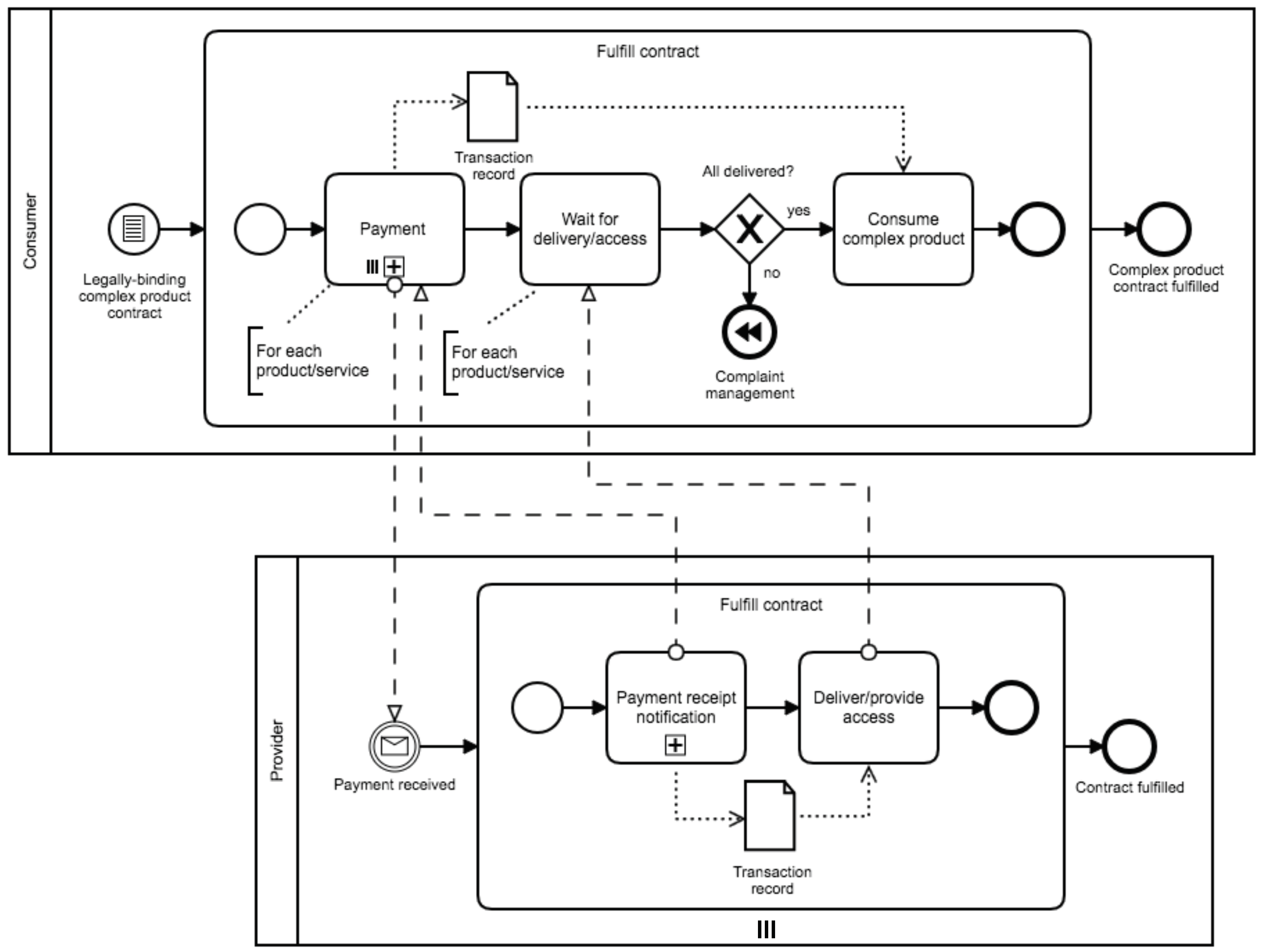

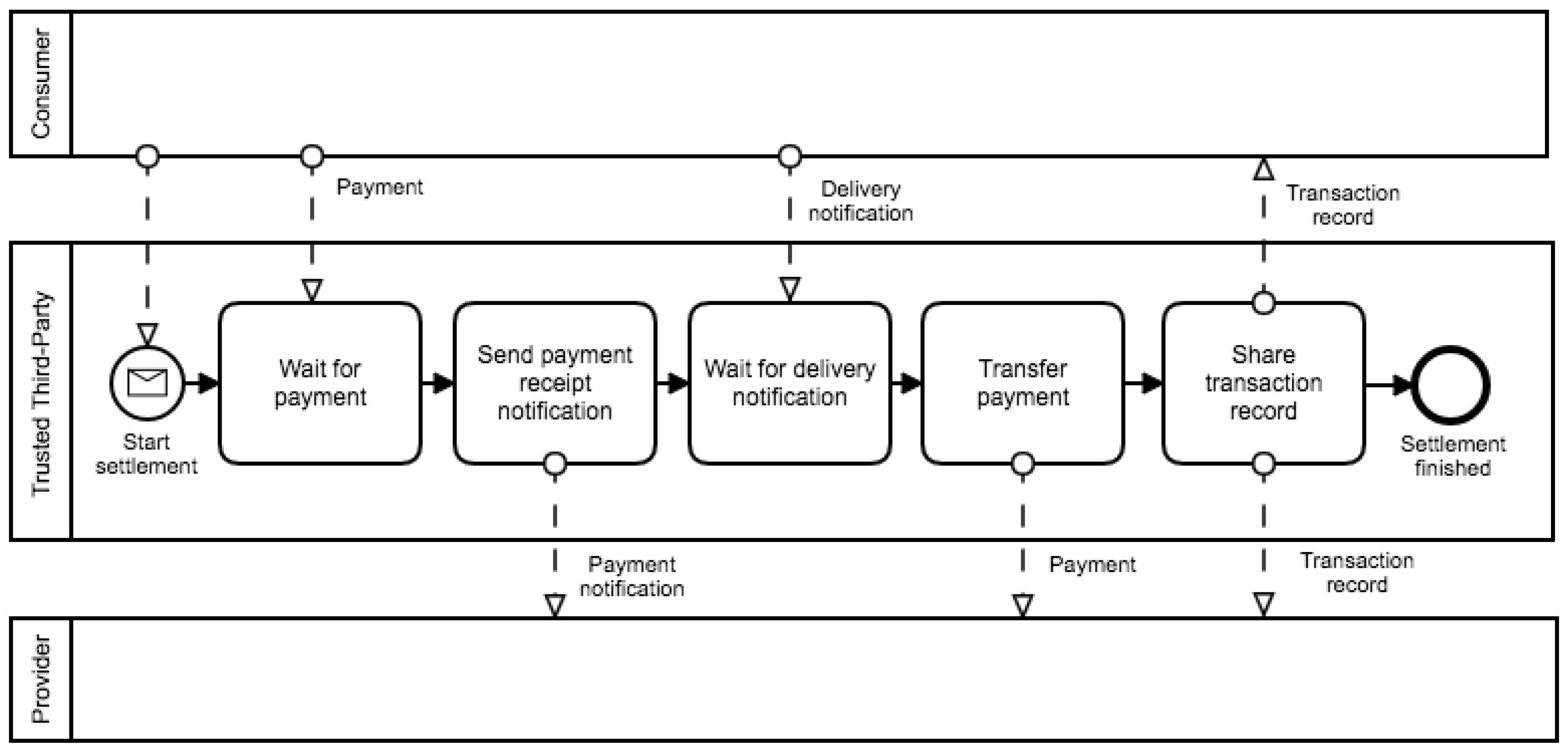

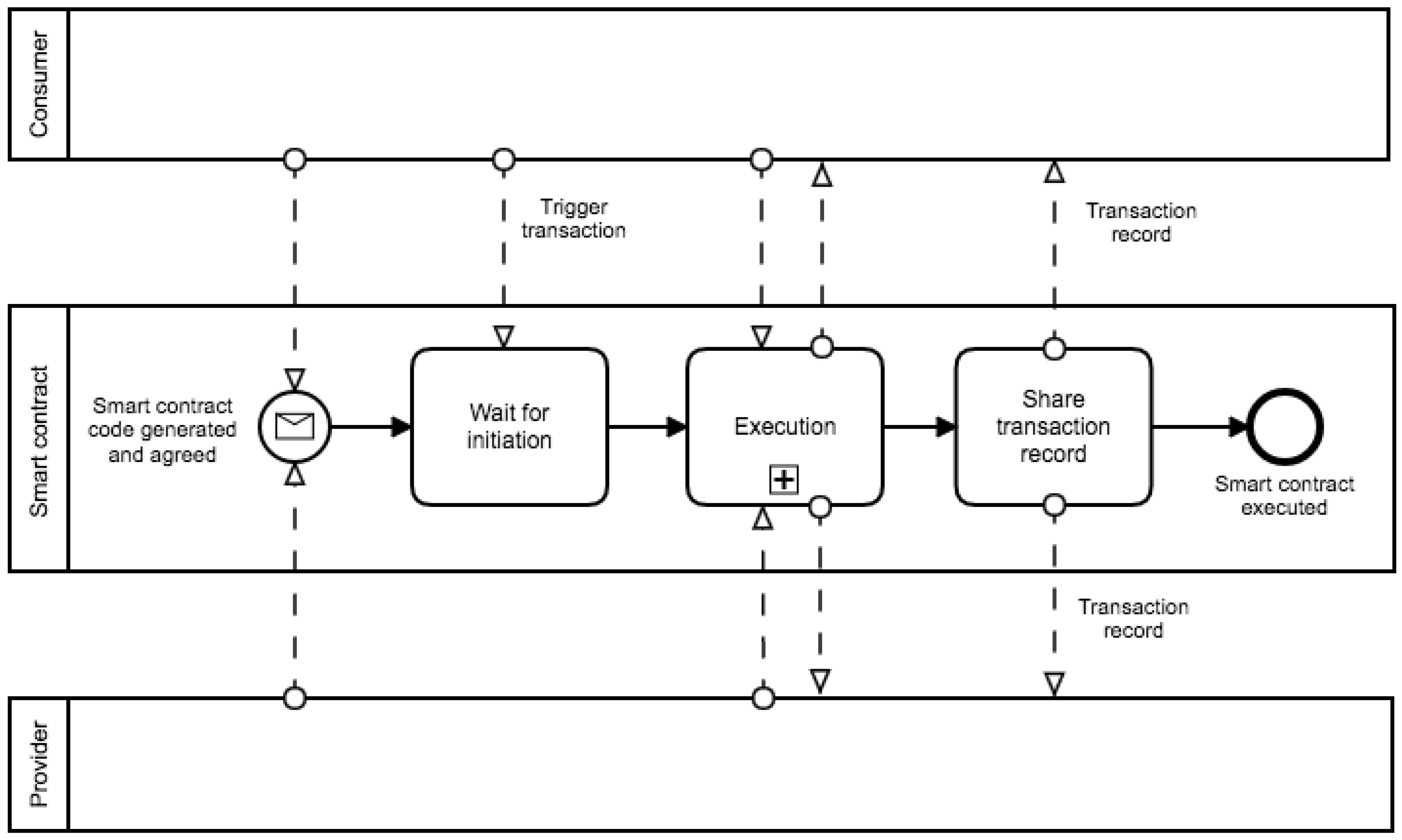

- The Settlement phase serves to fulfill the obligations resulting from the complex product contract agreed in the contract phase. Similarly to individual products and services, the settlement phase of complex products encompasses interaction processes related to delivery, payment, and logistics. Depending on the type of the exchanged product or service as well as the involved providers, the settlement phase might include additional sub-processes related to the type of settlement, which will be detailed in the following.

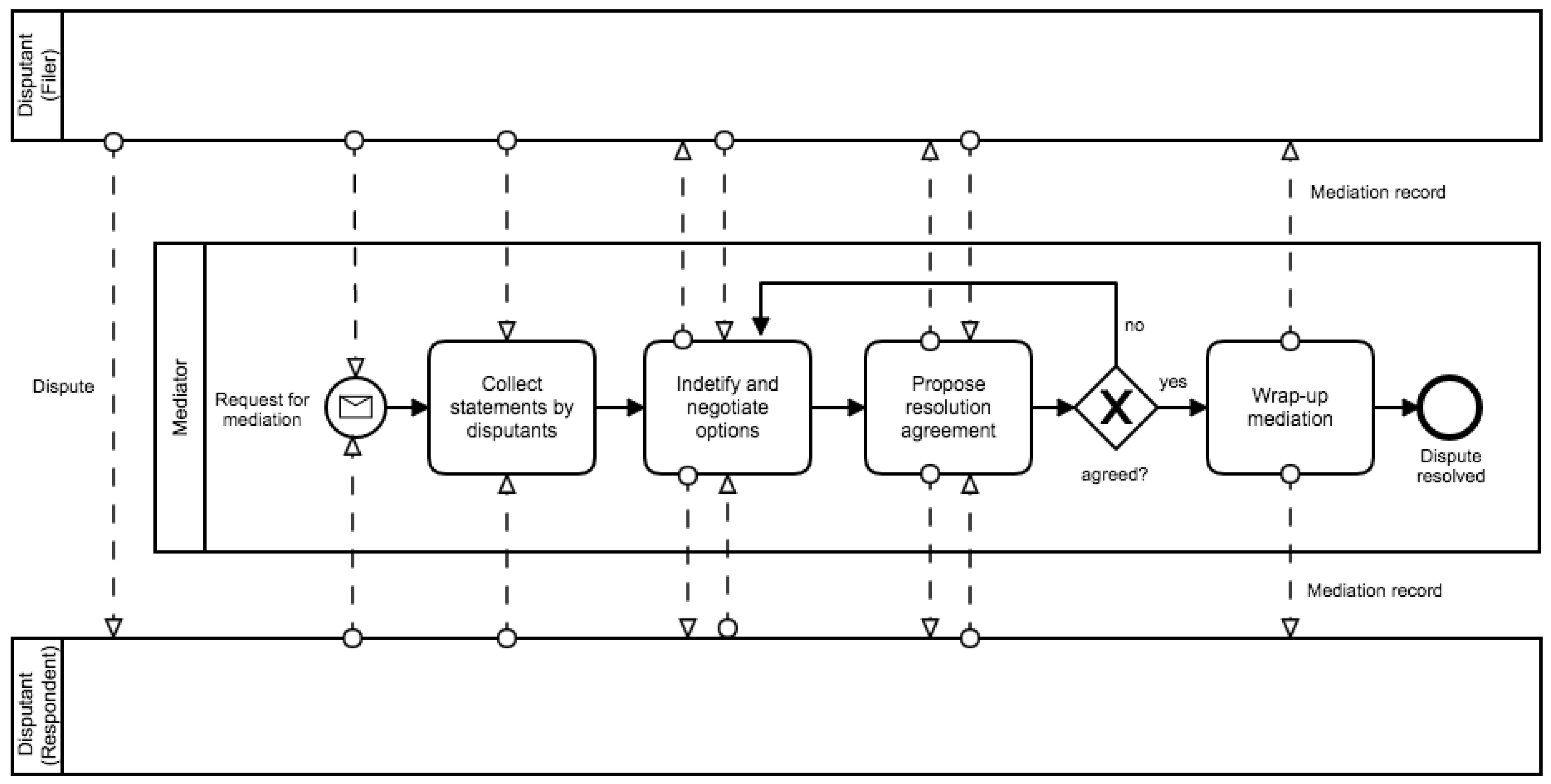

- The Follow-Up phase completes the market transaction for complex products. As the fifth phase, follow-up supports interactions between transaction partners that happen after the settlement. These are interactions and activities related to reviews of settled transactions, customer support, management of return and refund as well as management of disputes among transaction partners.

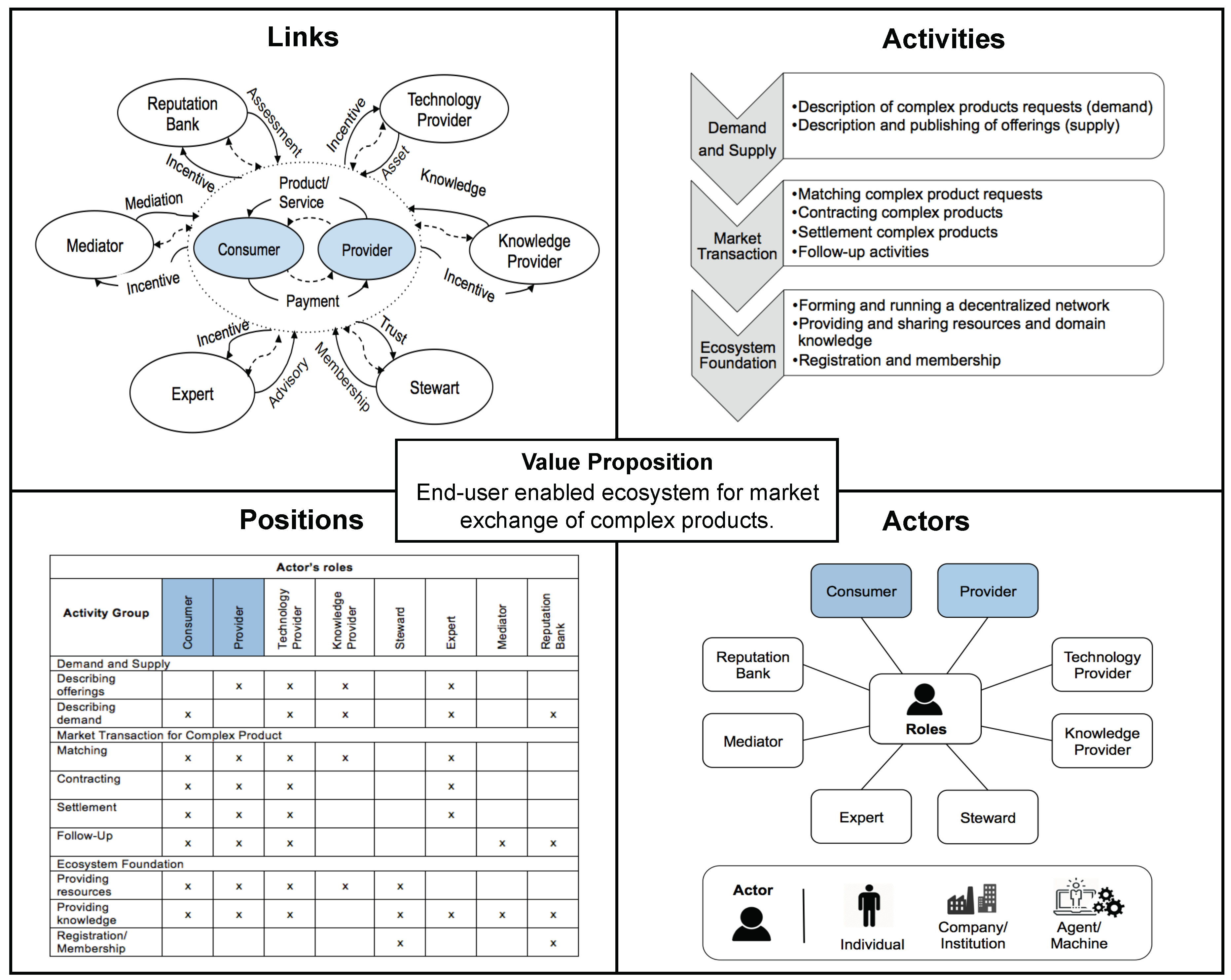

4.2. Ecosystem View

- Activities –defining the primary activity groups and discrete actions to be undertaken.

- Actors–specifying the entities that undertake these activities, taking different roles.

- Positions–specifying where in the flow of activities actors are located.

- Links–specifying how actors taking different roles need to interact and what value they need to exchange.

- Demand and Supply

- Market Transactions

- Ecosystem Foundation

- Consumer

- Provider

- Technology Provider

- Knowledge Provider

- Steward

- Expert

- Mediator

- Reputation Bank

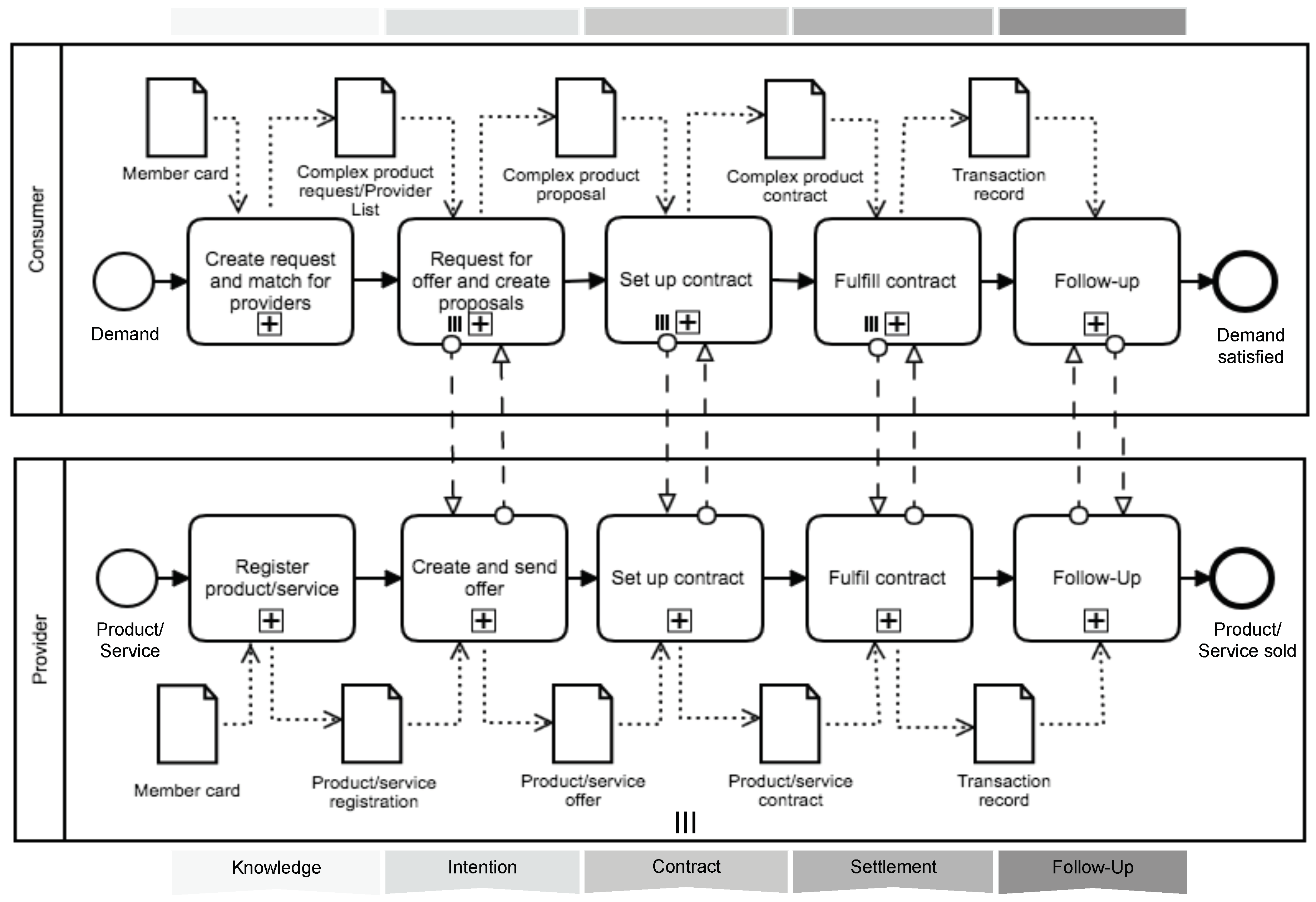

4.3. Interaction View

- The interaction processes in the intention phase are characterized by several iterations between consumers and potential providers required to negotiate a preliminary agreement. Consumers initiate the negotiation processes and run them as long as at least one proposal is created (Complex product proposal) fitted to satisfy the requested consumer’s demand.

- The interaction processes related to the contract phase, are defined by interactions necessary for creating and confirming a legally-binding contract (Complex product contract) based on the preliminary agreement. As with the intention phase, the interactions are initiated by consumers leading the process of creating an umbrella contract based on confirmations received from the involved providers and ordering.

- The interaction processes in the settlement phase are characterized by interactions required for the fulfillment of the legally-binding contract agreed in the previous phase. These fulfillment-related processes generate the transaction data, and together with data generated in previous phases, they build a transactional dataset (Transaction record). The generated transaction records serve as the basis for all subsequent processes that might occur during the follow-up phase. Moreover, these are records of the institutional history that are considered essential for building trust and reliability among the DMS as a self-organized exchange environment.

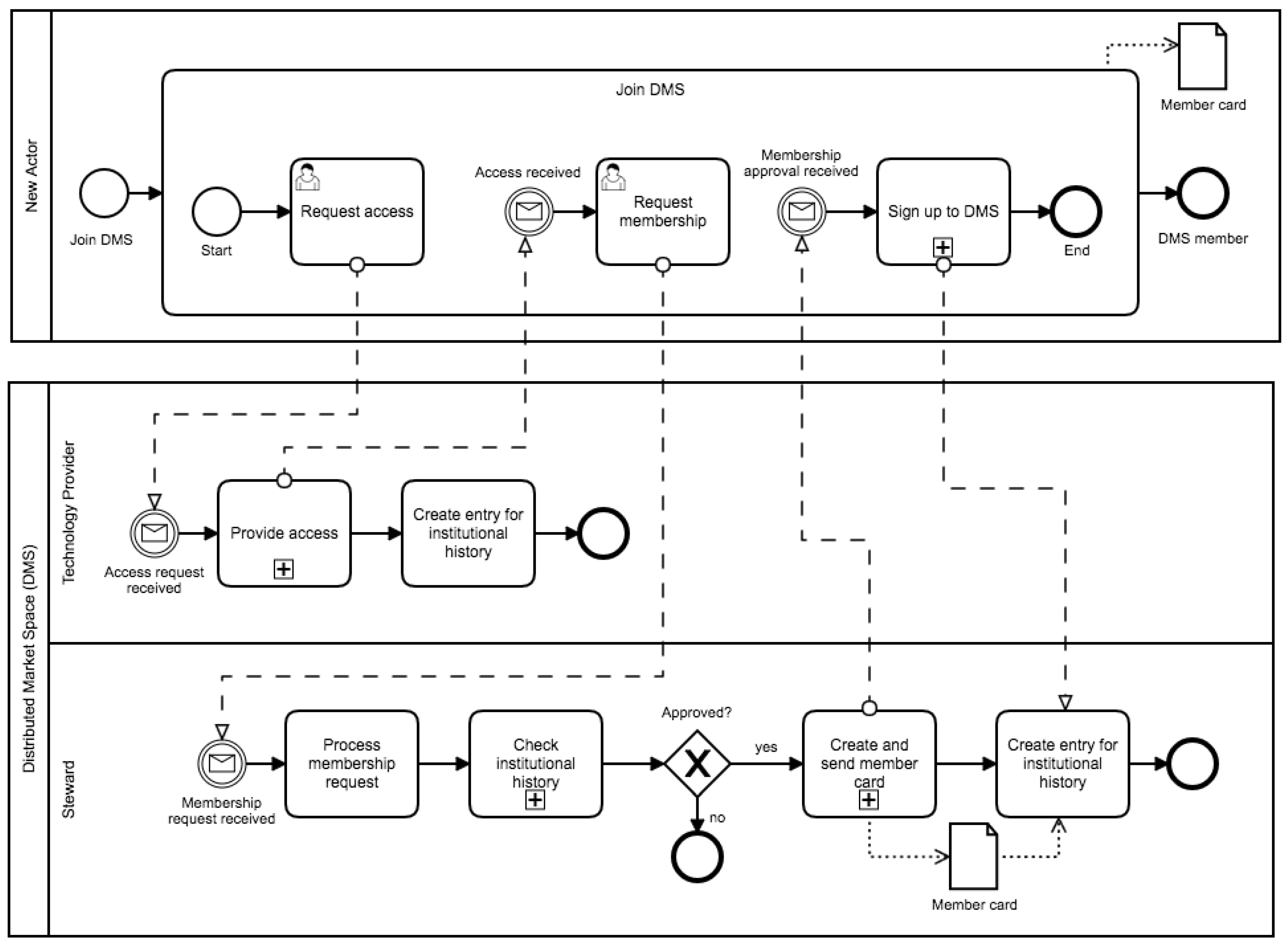

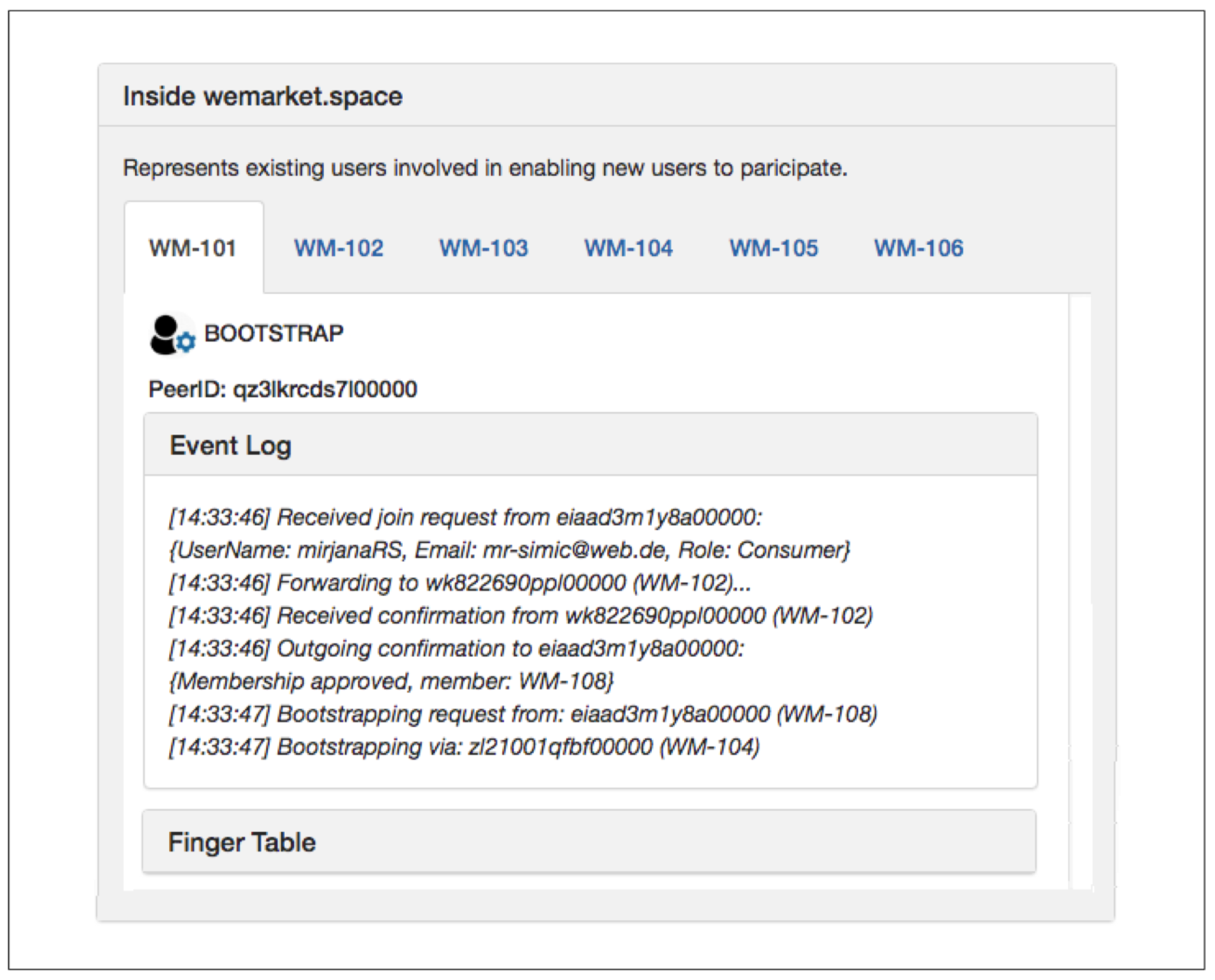

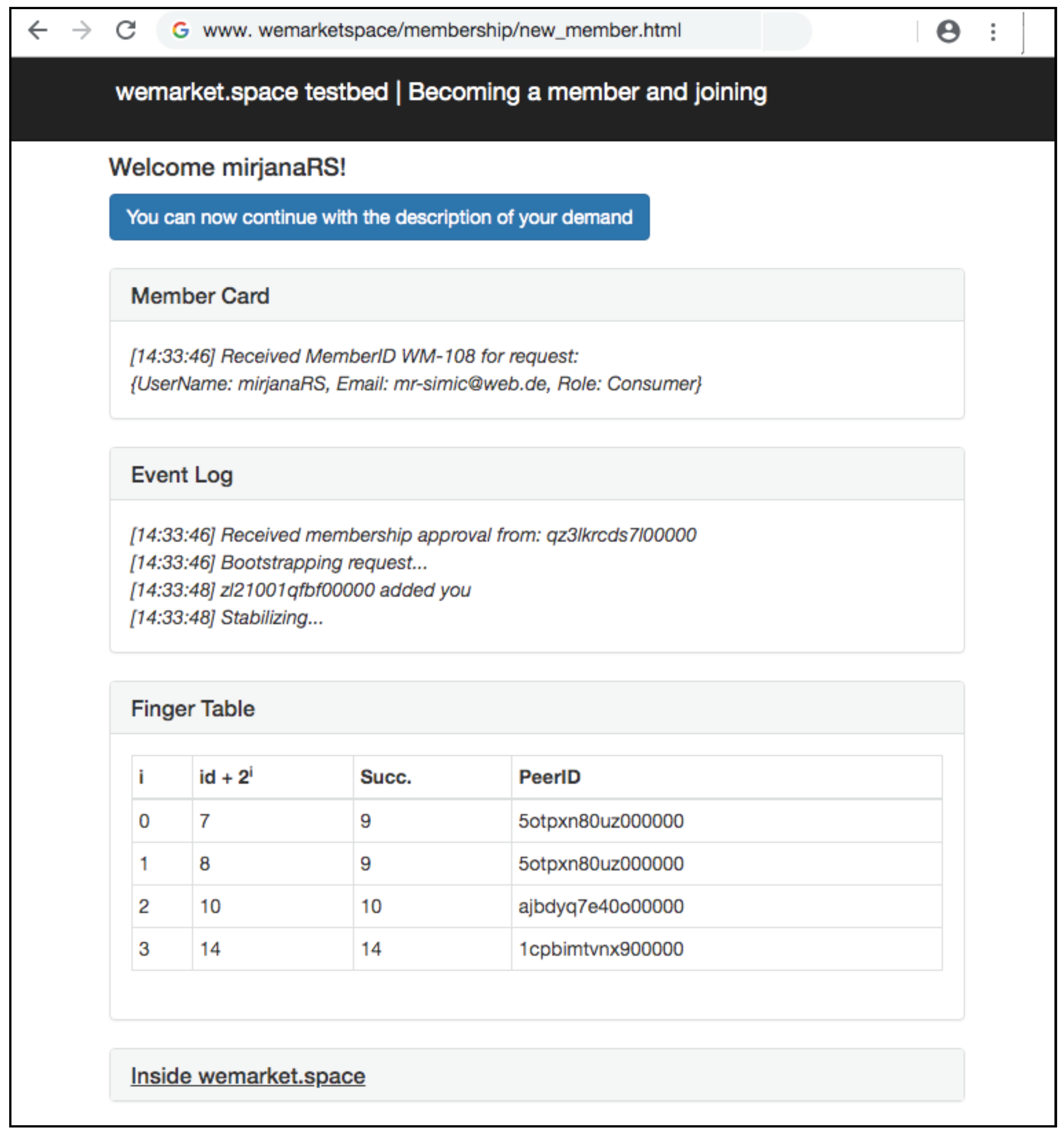

4.3.1. Knowledge Phase

- Becoming a member and joining the DMS ecosystem (all roles)

- Describing and registering offerings (provider role)

- Formulating complex product requests and matching with potential providers (consumer role)

4.3.2. Intention Phase

4.3.3. Contract Phase

4.3.4. Settlement Phase

- Trusted settlement

- Trusted third-party settlement

- Trustless settlement

4.3.5. Follow-Up Phase

- After-sales processes

- Dispute resolution

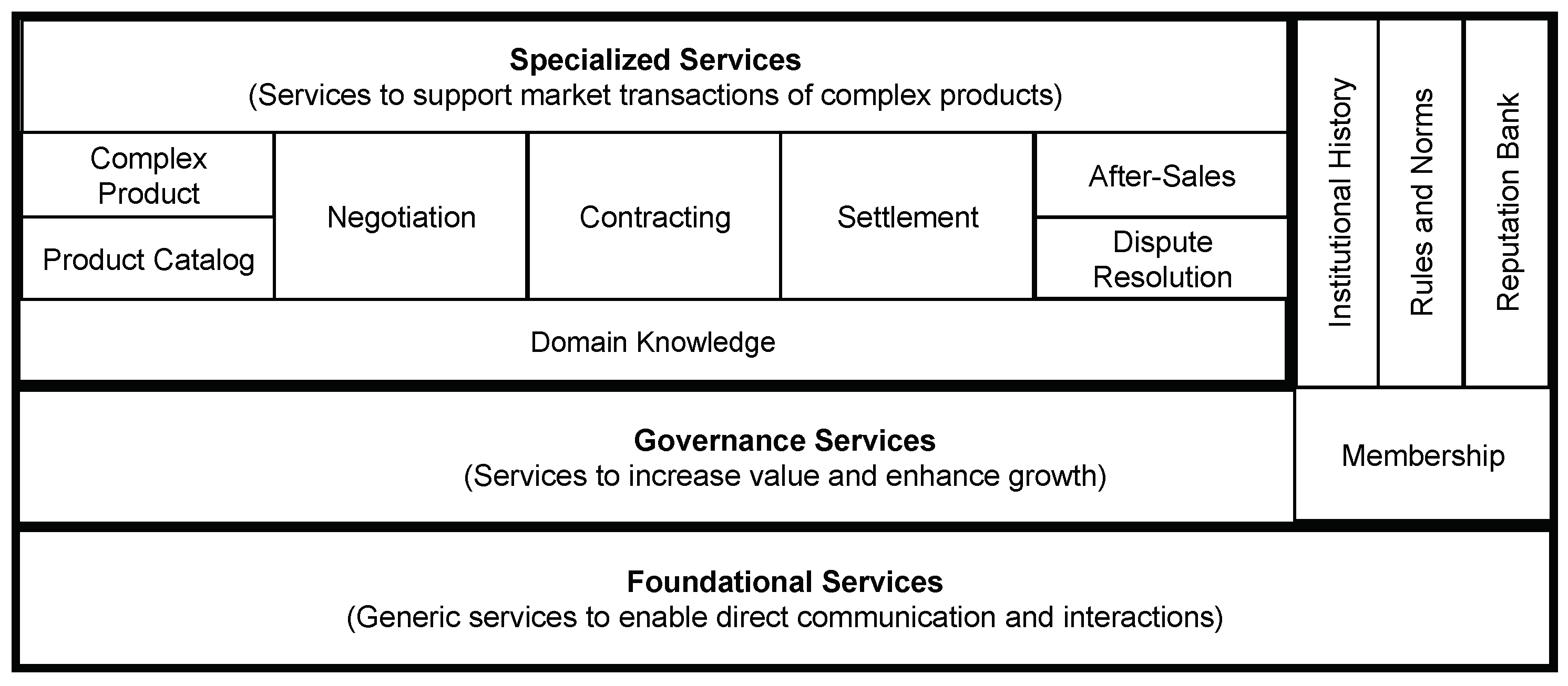

4.4. Service View

- Foundational Services

- Governance Services

- Specialized Services

4.4.1. Foundational Services

- to enable discovery, locating, routing and messaging among the ecosystem’s participants, and

- to assure the security and reliability of the ecosystem’s communication infrastructure.

4.4.2. Governance Services

- Membership

- Monitoring

- Institutional History

- Reputation Bank

4.4.3. Specialized Services

- Complex Product

- Catalog

- Negotiation

- Contracting

- Settlement

- After-Sales

- Dispute Resolution

- Domain Knowledge

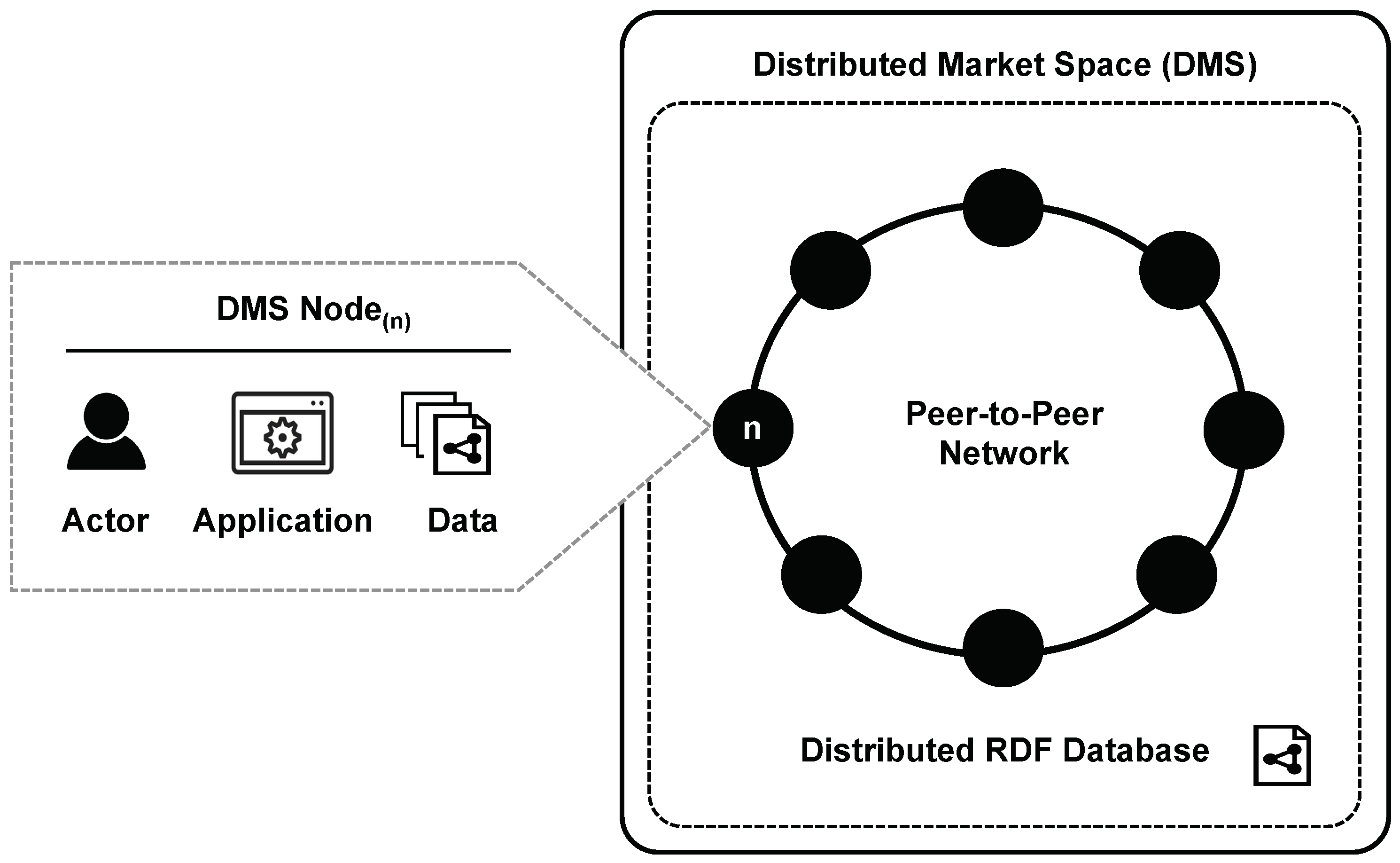

4.5. Infrastructure View

4.6. Life Stages of Distributed Market Spaces

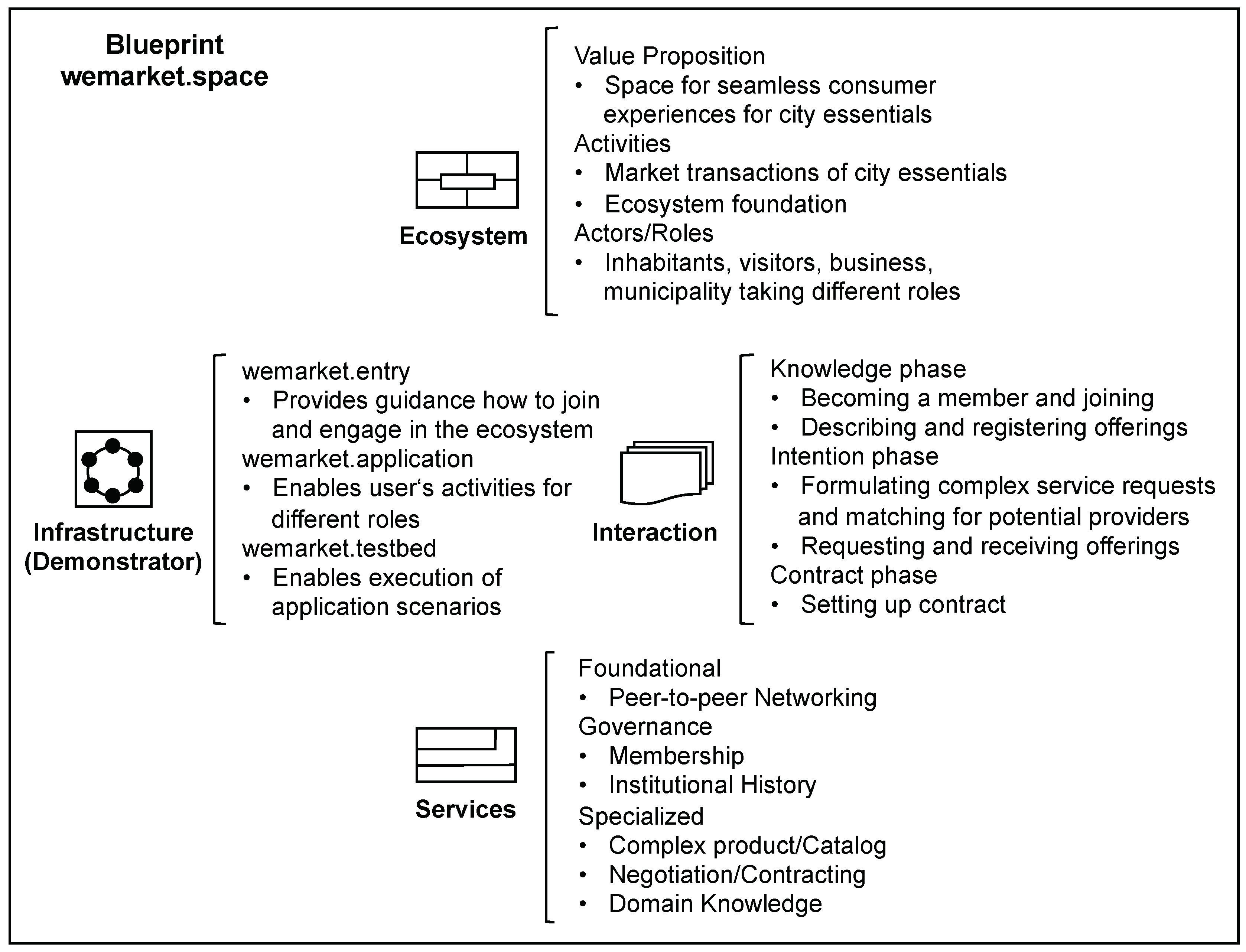

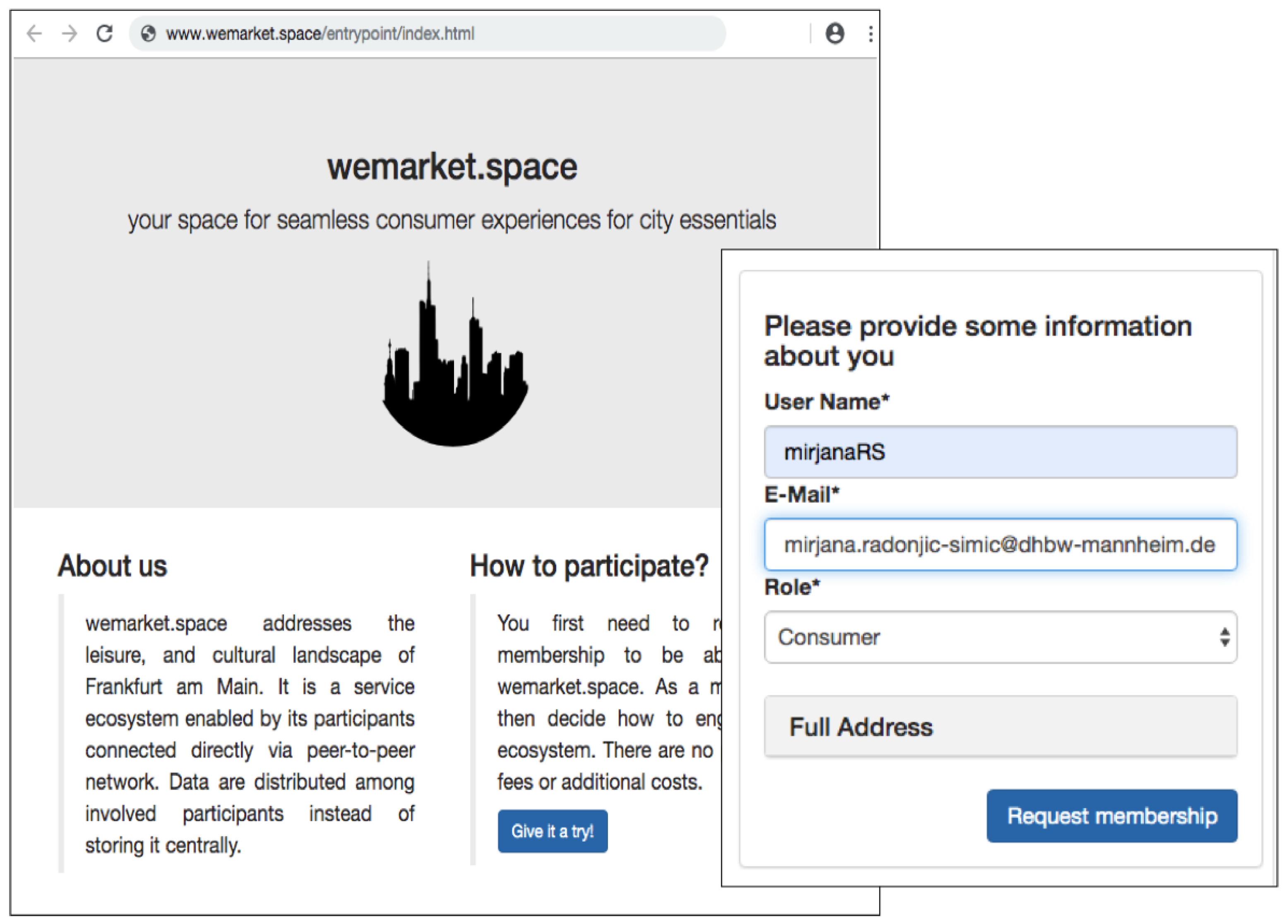

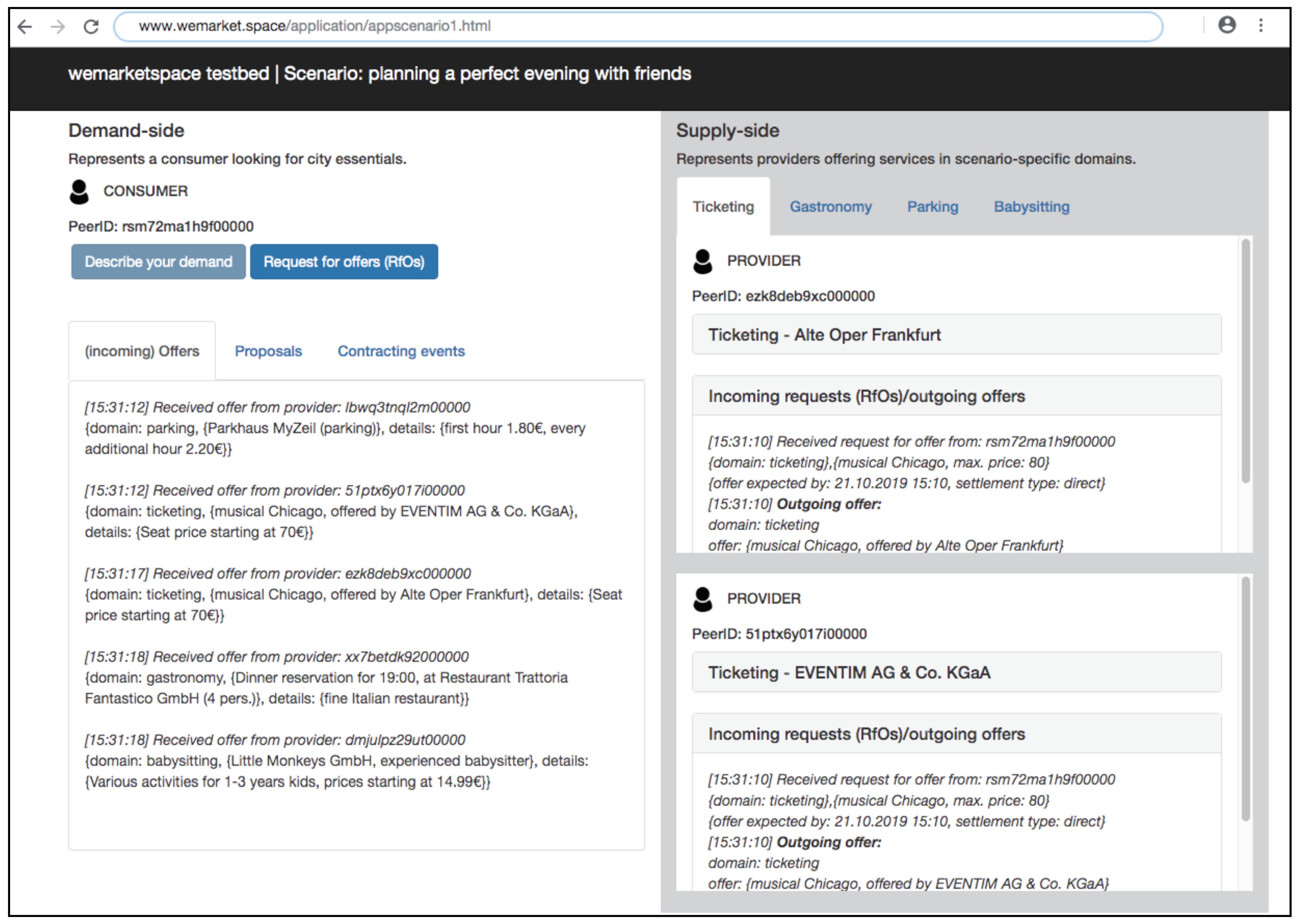

5. Case Study: Application in the Smart City Context

- The wemarket project addresses the leisure and cultural landscapes of a city and is aimed at supporting seamless consumer experiences for so-called city essentials. City essentials combine services such as leisure, transportation, and cultural events that are usually offered in a city. However, in their nature, they are highly personalized by consumers and their contextual requirements and thus regarded as complex services (i.e., complex products).

- The wemarket project is based in Frankfurt am Main, Germany as an exemplary city. This city was chosen to demonstrate aspects relevant to the contextual requirements and constraints of city essentials (e.g., location and other contextual data).

- The wemarket project was realized by a core team. It was trained and skilled to use the proposed reference model adequately and efficiently.

5.1. Approach and Outcomes

5.2. Demonstration

6. Discussion

7. Conclusions and Future Work

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Haydn, S. Shift: A Leader’s Guide to the Platform Economy; Tru Publishing: Boise, ID, USA, 2015. [Google Scholar]

- Cusumano, M.A.; Yoffie, D.B.; Gawer, A. The Business of Platforms: Strategy in the Age of Digital Competition, Innovation, and Power; HarperCollins Publishers: New York, NY, USA, 2019. [Google Scholar]

- Parker, G.G.; Van Alstyne, M.W.; Choudary, S.P. Platform Revolution: How Networked Markets Are Transforming the Economyand How to Make Them Work for You; WW Norton & Company: New York, NY, USA, 2016. [Google Scholar]

- Kenney, M.; Zysman, J. The rise of the platform economy. Issues Sci. Technol. 2016, 32, 61. [Google Scholar]

- Moazed, A.; Johnson, N.L. Modern Monopolies: What It Takes to Dominate the 21st Century Economy; St. Martin’s Press: New York, NY, USA, 2016. [Google Scholar]

- Reillier, L.C.; Reillier, B. Platform Strategy: How to Unlock the Power of Communities and Networks to Grow Your Business; Routledge: Abingdon-on-Thames, UK, 2017. [Google Scholar]

- Open Bazaar. 2016. Available online: https://openbazaar.org/ (accessed on 8 December 2019).

- Mirjana Radonjic-Simic, D.P. A Decentralized Business Ecosystem for Complex Products. In Digital Business: Business Algorithms, Cloud Computing and Data Engineering; Springer International Publishing: New York, NY, USA, 2019. [Google Scholar]

- Mirjana Radonjic-Simic, D.P. Reference Model and Architecture for the Post-Platform Economy. In Economics of Digital Transformation; University of Rijeka, Faculty of Economics and Business: Rijeka, Croatia, 2019; p. 465. [Google Scholar]

- Schmid, B. The Concept of Media. 1997. Available online: https://www.alexandria.unisg.ch/9574/1/The%20Concept%20of%20Media.pdf (accessed on 8 December 2019).

- Schmid, B.F.; Lindemann, M.A. Elements of a reference model for electronic markets. In Proceedings of the Thirty-First Hawaii International Conference on System Sciences, Kohala Coast, HI, USA, 9 January 1998; Volume 4, pp. 193–201. [Google Scholar]

- Evans, D.S.; Schmalensee, R. Matchmakers: The New Economics of Multisided Platforms; Harvard Business Review Press: Brighton, MA, USA, 2016. [Google Scholar]

- Tiwana, A. Platform Ecosystems: Aligning Architecture, Governance, and Strategy; Morgan Kaufmann: Waltham, MA, USA, 2013. [Google Scholar]

- Coase, R.H. The nature of the firm. Economica 1937, 4, 386–405. [Google Scholar] [CrossRef]

- Fettke, P.; Loos, P. Perspectives on reference modeling. In Reference Modeling for Business Systems Analysis; IGI Global: Hershey, PA, USA, 2007; pp. 1–21. [Google Scholar]

- Frank, U. Conceptual modelling as the core of the information systems discipline-perspectives and epistemological challenges. In Proceedings of the AMCIS 1999, Milwaukee, WI, USA, 13–15 August 1999; p. 240. [Google Scholar]

- Rosemann, M. Application reference models and building blocks for management and control. In Handbook on Enterprise Architecture; Springer: New York, NY, USA, 2003; pp. 595–615. [Google Scholar]

- Braun, R.; Esswein, W. Classification of reference models. In Advances in Data Analysis; Springer: New York, NY, USA, 2007; pp. 401–408. [Google Scholar]

- Walter, M.; Lohse, M.; Guzman, S. Platform Innovation Kit 3.0. Available online: http://www.platforminnovationkit.com/ (accessed on 8 December 2019).

- Schneider, N.; Scholz, T. The Internet needs a new economy. Explore 2015, 8, 2015. [Google Scholar]

- Scholz, T. Platform cooperativism. In Challenging the Corporate Sharing Economy; Rosa Luxemburg Foundation: New York, NY, USA, 2016. [Google Scholar]

- Stokes, K.; Clarence, E.; Anderson, L.; Rinne, A. Making Sense of the UK Collaborative Economy; Nesta: London, UK, 2014. [Google Scholar]

- Bauwens, M. Open Cooperativism for the P2P Age. 2014. Available online: https://blog.p2pfoundation.net/open-cooperativism-for-the-p2p-age/2014/06/16 (accessed on 8 December 2019).

- Becker, J.; Schutte, R. A Reference Model for Retail Enterprise. In Reference Modeling for Business Systems Analysis; IGI Global: Hershey, PA, USA, 2007; pp. 182–205. [Google Scholar]

- Frank, U. E-MEMO: Referenzmodelle zur ökonomischen realisierung leistungsfähiger Infrastrukturen für electronic commerce. Wirtschaftsinformatik 2004, 46, 373–381. [Google Scholar] [CrossRef]

- Kollmann, T. E-Business: Grundlagen Elektronischer Geschäftsprozesse in der Net Economy. 3; Gabler: Wiesbaden, Germany, 2013. [Google Scholar]

- Aulkemeier, F.; Schramm, M.; Iacob, M.E.; Van Hillegersberg, J. A service-oriented e-commerce reference architecture. J. Theor. Appl. Electron. Commer. Res. 2016, 11, 26–45. [Google Scholar] [CrossRef]

- Menasce, D.A. Scaling for e-business. In Proceedings of the 8th International Symposium on Modeling, Analysis and Simulation of Computer and Telecommunication Systems, San Francisco, CA, USA, 29 August–1 September 2000; pp. 511–513. [Google Scholar]

- Camarinha-Matos, L.M.; Afsarmanesh, H. A comprehensive modeling framework for collaborative networked organizations. J. Intell. Manuf. 2007, 18, 529–542. [Google Scholar] [CrossRef]

- Stanoevska-Slabeva, K. Towards a reference model for m-commerce applications. In Proceedings of the ECIS 2002, Gdansk, Poland, 2003; p. 159. [Google Scholar]

- Schmid, B.; Schroth, C. Organizing as programming: A reference model for cross-organizational collaboration. In Proceedings of the 9th International Business Information Management Association Conference IBIMA, Marrakech, Morocco, 4–6 January 2008. [Google Scholar]

- Janner, T.; Schroth, C.; Schmid, B. Modelling service systems for collaborative innovation in the enterprise software industry-the st. gallen media reference model applied. In Proceedings of the IEEE International Conference on Services Computing (SCC’08), Honolulu, HI, USA, 2008; Volume 2, pp. 145–152. [Google Scholar]

- Hoyer, V.; Stanoevska-Slabeva, K. Towards a reference model for grassroots enterprise mashup environments. In Proceedings of the 17th European Conference on Information Systems (ECIS) 2009, Verona, Italy, 8–10 June 2009. [Google Scholar]

- Giovanoli, C.; Pulikal, P.; Grivas, S.G. E-marketplace for cloud services. In Proceedings of the Fifth International Conference on Cloud Computing, GRIDs, and Virtualization—CLOUD COMPUTING 2014, Venice, Italy, 25–29 May 2014; pp. 76–83. [Google Scholar]

- Moore, J. Predators and Prey: A New Ecology of Competition. Harv. Bus. Rev. 1993, 71, 75–86. [Google Scholar] [PubMed]

- Teece, D.J. Business Ecosystem. In The Palgrave Encyclopedia of Strategic Management; Augier, M., Teece, J.D., Eds.; Palgrave Macmillan: London, UK, 2016; pp. 1–4. [Google Scholar]

- Iansiti, M.; Levien, R. The Keystone Advantage: What the New Dynamics of Business Ecosystems Mean for Strategy, Innovation, and Sustainability; Harvard Business Press: Brighton, MA, USA, 2004. [Google Scholar]

- Tian, C.; Ray, B.K.; Lee, J.; Cao, R.; Ding, W. BEAM: A framework for business ecosystem analysis and modeling. IBM Syst. J. 2008, 47, 101–114. [Google Scholar] [CrossRef]

- Rong, K.; Hu, G.; Lin, Y.; Shi, Y.; Guo, L. Understanding business ecosystem using a 6C framework in Internet-of-Things-based sectors. Int. J. Prod. Econ. 2015, 159, 41–55. [Google Scholar] [CrossRef]

- El Sawy, O.A.; Pereira, F. Business Modelling in the Dynamic Digital Space: An Ecosystem Approach; Springer: New York, NY, USA, 2013. [Google Scholar]

- Battistella, C.; Colucci, K.; De Toni, A.F.; Nonino, F. Methodology of business ecosystems network analysis: A case study in Telecom Italia Future Centre. Technol. Forecast. Soc. Chang. 2013, 80, 1194–1210. [Google Scholar] [CrossRef]

- Westerlund, M.; Leminen, S.; Rajahonka, M. Designing business models for the internet of things. Technol. Innov. Manag. Rev. 2014, 4, 5. [Google Scholar] [CrossRef]

- Adner, R. Ecosystem as structure: An actionable construct for strategy. J. Manag. 2017, 43, 39–58. [Google Scholar] [CrossRef]

- OMG. Business Process Model and Notation Version 2.0. 2015. Available online: http://www.omg.org/spec/BPMN/2.0/ (accessed on 8 December 2019).

- Picot, A.; Reichwald, R.; Wigand, R.T. Die Grenzenlose Unternehmung: Information, Organisation und Management; Springer: New York, NY, USA, 2003. [Google Scholar]

- Selz, D.; Schubert, P. Web assessment—A model for the evaluation and the assessment of successful electronic commerce applications. In Proceedings of the Thirty-First Hawaii International Conference on System Sciences, Kohala Coast, HI, USA, 9 January 1998; Volume 4, pp. 222–231. [Google Scholar]

- Foundation, E. Ethereum Blockchain App Platform. 2014. Available online: https://ethereum.org/ (accessed on 8 December 2019).

- Fabric, H. Hyperledger Fabric. 2016. Available online: https://www.hyperledger.org/projects/fabric (accessed on 8 December 2019).

- Szabo, N. Formalizing and securing relationships on public networks. First Monday. 1997. Available online: https://firstmonday.org/ojs/index.php/fm/article/view/548/469 (accessed on 8 December 2019). [CrossRef]

- Luu, L.; Chu, D.H.; Olickel, H.; Saxena, P.; Hobor, A. Making smart contracts smarter. In Proceedings of the 2016 ACM SIGSAC Conference on Computer and Communications Security, Vienna, Austria, 24–28 October 2016; pp. 254–269. [Google Scholar]

- Antonopoulos, A.M.; Wood, G. Mastering Ethereum: Building Smart Contracts and Dapps; O’Reilly Media: Sebastopol, CA, USA, 2018. [Google Scholar]

- Felstiner, W.L.; Abel, R.L.; Sarat, A. The Emergence and Transformation of Disputes: Naming, Blaming, Claiming. Law Soc. Rev. 1980, 15, 631–654. [Google Scholar] [CrossRef]

- Katsh, E.E.; Katsh, M.E.; Rifkin, J. Online Dispute Resolution: Resolving Conflicts in Cyberspace; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2001. [Google Scholar]

- Stoica, I.; Morris, R.; Karger, D.; Kaashoek, M.F.; Balakrishnan, H. Chord: A scalable peer-to-peer lookup service for internet applications. ACM SIGCOMM Comput. Commun. Rev. 2001, 31, 149–160. [Google Scholar] [CrossRef]

- Ostrom, E. Governing the Commons; Cambridge University Press: Cambridge, UK, 2015. [Google Scholar]

- Benkler, Y. The Wealth of Networks: How Social Production Transforms Markets and Freedom; Yale University Press: New Haven, CT, USA, 2006. [Google Scholar]

- McCleary, T. Got Influence? What’s Social Currency Got to Do with It? 2014. Available online: https://fowmedia.com/influence-social-currency/ (accessed on 8 December 2019).

- Manola, F.; Miller, E.; McBride, B. RDF primer. W3C Recomm. 2004, 10, 6. [Google Scholar]

- Iansiti, M.; Levien, R. Strategy as ecology. Harv. Bus. Rev. 2004, 82, 68–81. [Google Scholar] [PubMed]

- Eisenmann, T.; Parker, G.; Van Alstyne, M. Platform envelopment. Strateg. Manag. J. 2011, 32, 1270–1285. [Google Scholar] [CrossRef]

- den Hartigh, E.; Tol, M.; Visscher, W. The health measurement of a business ecosystem. In Proceedings of the European Network on Chaos and Complexity Research and Management Practice Meeting, Bergen aan Zee, The Netherlands, 20–21 October 2006; pp. 1–39. [Google Scholar]

- Caragliu, A.; Del Bo, C.; Nijkamp, P. Smart Cities in Europe. In Proceedings of the 3rd International Conference on Regional Science (CERS), Kosice, Slovakia, 7–9 October 2009. [Google Scholar]

- Komninos, N.; Pallot, M.; Schaffers, H. Special Issue on Smart Cities and the Future Internet in Europe. J. Knowl. Econ. 2013, 4, 119–134. [Google Scholar] [CrossRef]

- Anthopolous, L.; Fitsilis, P. Exploring Architectural and Organizational Features in Smart Cities. In Proceedings of the 16th Internatinal Conference on Advanced Communication Technology, Pyeongchang, Korea, 16–19 February 2014. [Google Scholar] [CrossRef]

- Novak, T.P.; Hoffman, D.L.; Yung, Y.F. Measuring the customer experience in online environments: A structural modeling approach. Mark. Sci. 2000, 19, 22–42. [Google Scholar] [CrossRef]

- Meyer, C.; Schwager, A. Understanding customer experience. Harv. Bus. Rev. 2007, 85, 116. [Google Scholar] [PubMed]

- Commission, E. The European Single Market. 2015. Available online: https://ec.europa.eu/growth/single-market_en (accessed on 8 December 2019).

- Lee, S.; Sherwood, R.; Bhattacharjee, B. Cooperative peer groups in NICE. In Proceedings of the IEEE INFOCOM 2003. Twenty-Second Annual Joint Conference of the IEEE Computer and Communications Societies (IEEE Cat. No. 03CH37428), San Francisco, CA, USA, 30 March–3 April 2003; Volume 2, pp. 1272–1282. [Google Scholar]

- Berners-Lee, T. The Solid Project. 2017. Available online: https://solid.mit.edu/ (accessed on 8 December 2019).

| Role | Description | Motivation/Expected Value |

|---|---|---|

| Consumer | Looking for a complex product. | To satisfy personalized needs defined through market transactions of complex products directly and reliably. |

| Provider | Offering products or services in one particular domain or many domains. | To earn revenue per product/service sold (payment). To increase the visibility of offerings. To increase the level of customization based on contextual information provided by consumers. |

| Technology Provider | Providing technology assets (resource/tool/service) to support market transactions of complex products. | To contribute to the ecosystem foundation. To earn revenue by guaranteeing availability only to paying users (incentive). To leverage usage-data for improvement and developing new assets. |

| Knowledge Provider | Providing domain knowledge. | To contribute to the shared knowledge base. To earn revenue by providing paid knowledge-based services (incentive). |

| Steward | Registering the ecosystem’s members after being granted access. | To contribute to the self-governance capability of the ecosystem. To ensure congruence between members, rules, and norms. |

| Expert | Offering expertise and advice to inform decision making. | To earn revenue through advisory and user’s feedback (incentive). |

| Mediator | Offering mediation to support resolving disputes and conflicts. | To earn revenue through mediation and user’s feedback (incentive). |

| Reputation Bank | Assessing ecosystem’s members regarding their reliability, solvency, and worthiness. | To capture two-sided reviews about conducted transactions needed for a qualified assessment of members (assessments). To promote an adequate level of trust among the ecosystem’s members. |

| Design Stage | Ignition Stage | Maturity Stage | |

|---|---|---|---|

| Concern | Blueprint, prototype, and launch. | Build critical mass, clear frictions, and bottlenecks. | Retain existing network and connect to others. |

| Ecosystem View | Define value proposition and outline ecosystem structure. | Review participants’ experiences, eliminate frictions. | Alter and extend ecosystem structure. |

| Interaction View | Define core interactions and related processes. | Improve core interactions and clear bottlenecks. | Review existing and propose new core interactions. |

| Service View | Define services to implement core interactions. | Improve and enhance existing services. | Optimize by adding new functionalities and introduce new services. |

| Infrastructure View | Prototype technical infrastructure and launch. | Remedy deficiencies, improve, and scale-up. | Keep infrastructure up-to-date, expand for more service. |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Radonjic-Simic, M.; Pfisterer, D. Beyond Platform Economy: A Comprehensive Model for Decentralized and Self-Organizing Markets on Internet-Scale. Computers 2019, 8, 90. https://doi.org/10.3390/computers8040090

Radonjic-Simic M, Pfisterer D. Beyond Platform Economy: A Comprehensive Model for Decentralized and Self-Organizing Markets on Internet-Scale. Computers. 2019; 8(4):90. https://doi.org/10.3390/computers8040090

Chicago/Turabian StyleRadonjic-Simic, Mirjana, and Dennis Pfisterer. 2019. "Beyond Platform Economy: A Comprehensive Model for Decentralized and Self-Organizing Markets on Internet-Scale" Computers 8, no. 4: 90. https://doi.org/10.3390/computers8040090

APA StyleRadonjic-Simic, M., & Pfisterer, D. (2019). Beyond Platform Economy: A Comprehensive Model for Decentralized and Self-Organizing Markets on Internet-Scale. Computers, 8(4), 90. https://doi.org/10.3390/computers8040090