Tourist Satisfaction Enhancement Using Mobile QR Code Payment: An Empirical Investigation

Abstract

:1. Introduction

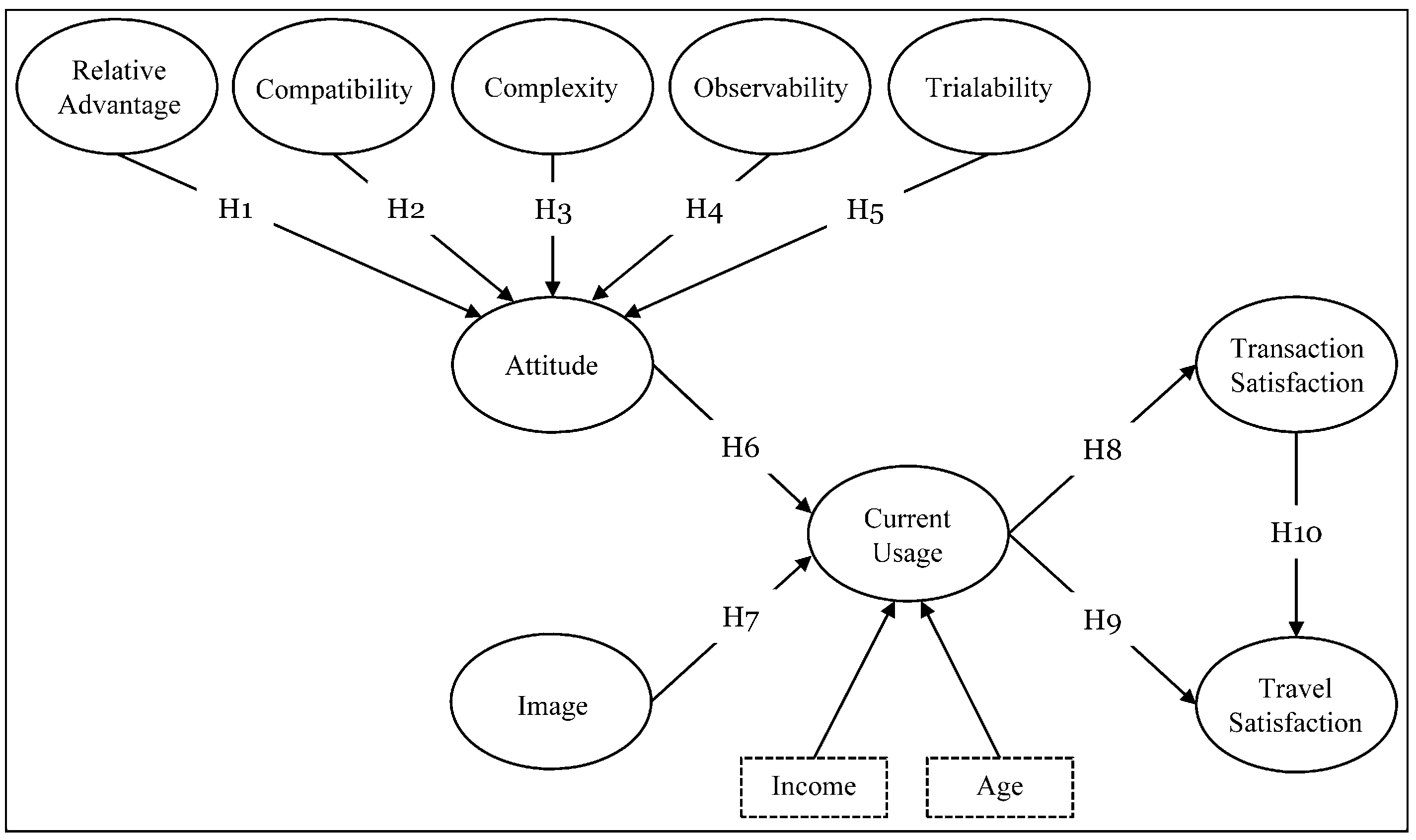

2. Theoretical Framework

2.1. Determinants of QR Code Payment Use

2.2. Outcomes of QR Code Payment Use

3. Methodology

3.1. Measurement

3.2. Data Collection

4. Results

4.1. Reliability and Validity

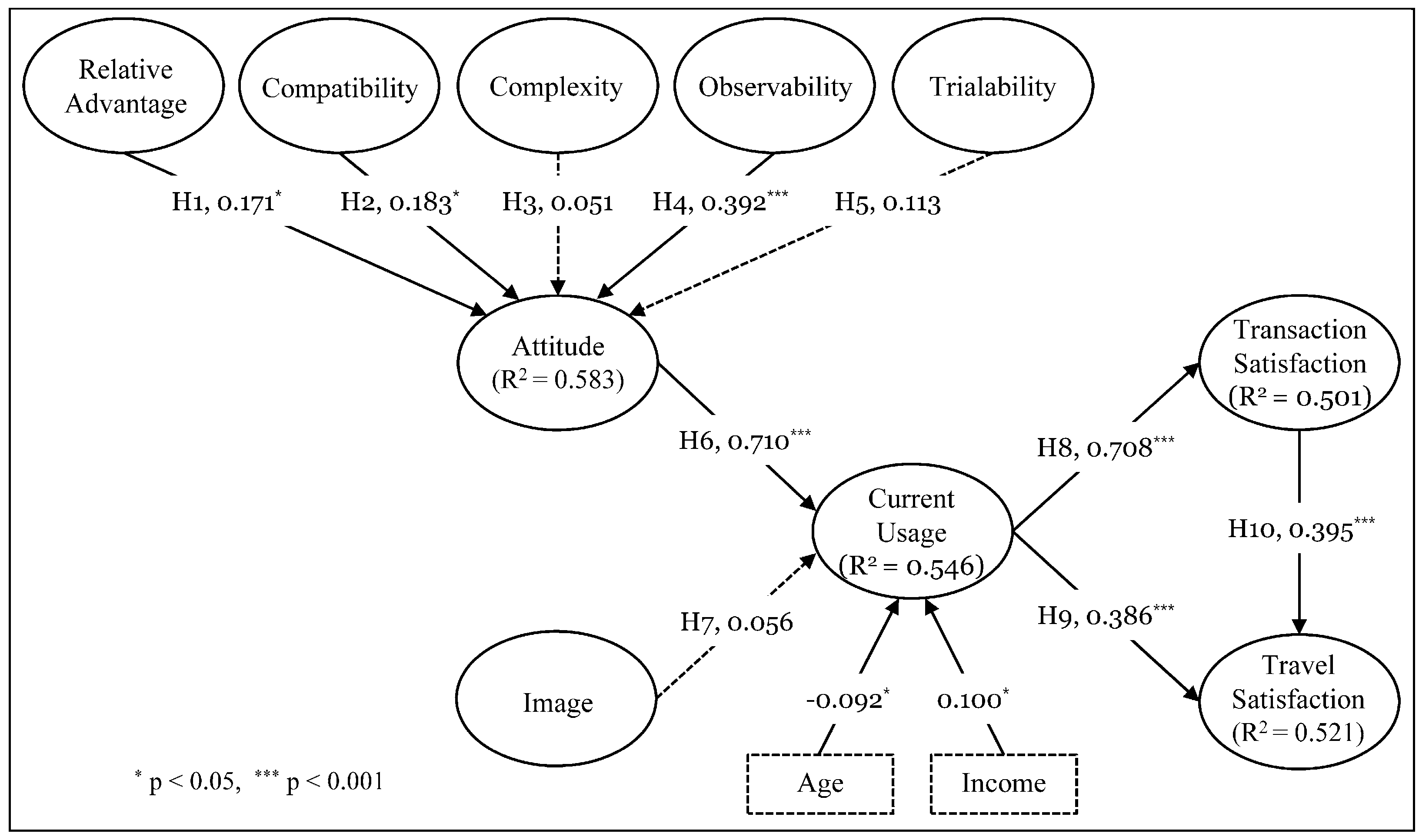

4.2. Hypotheses Test

5. Discussion

5.1. Implications for Research

5.2. Implications for Practice

5.3. Limitations and Future Research Directions

6. Conclusions

Author Contributions

Conflicts of Interest

Appendix A. Questionnaire Items

- Using a QR code payment enables me to accomplish payment more quickly.

- Using a QR code payment allows me to conduct payment more efficiently.

- Using a QR code payment makes it easier to conduct payment.

- Using a QR code payment is more useful for conducting payment.

- QR code payment is compatible with my lifestyle.

- Using QR code payments fits well with the way I like to conduct payments.

- Using a QR code payment to conduct payment fits into my consumption style.

- It is easy to get a QR code payment to accomplish payment.

- Overall, I think that a QR code payment is easy to use.

- Learning to operate a QR code payment is easy for me.

- I have no difficulty telling others about the results of using a QR code payment.

- I could communicate to others the consequences of using a QR code payment.

- The results of using a QR code payment are apparent to me.

- Before deciding on whether or not to adopt a QR code payment, I would be able to use it on a trial basis.

- Before deciding on whether or not to adopt a QR code payment, I would be able to properly try it out.

- I would be permitted to use a QR code payment on a trial basis long enough to see what it can do.

- extremely negative … extremely positive

- extremely bad … extremely good

- extremely harmful … extremely beneficial

- Using a QR code payment improves my image.

- Using a QR code payment gives me high status.

- Using a QR code payment makes me have more prestige than those who do not.

- Having a QR payment is a status symbol.

- I use QR code payments a lot during my trip.

- I use QR code payments whenever possible during my trip.

- I use QR code payments frequently during my trip.

- I use QR code payments whenever appropriate to conduct payment during my trip.

- I feel satisfied with consumption experiences when using QR code payments during my trip.

- I have good consumption experiences when using QR code payments during my trip.

- I am satisfied with my decision to use QR code payments to pay during my trip.

- My overall evaluation on this trip experience is positive.

- My overall evaluation on this trip experience is favorable.

- I am satisfied with this tourism experience.

- I am pleased with this tourism experience.

References

- Canadi, M.; Höpken, W.; Fuchs, M. Application of QR codes in online travel distribution. Inf. Commun. Technol. Tour. 2010, 137–148. [Google Scholar]

- Aktaş, C. The Evolution and Emergence of QR Codes; Cambridge Scholars Publishing: Newcastle, UK, 2017. [Google Scholar]

- eMarketer. China Boasts World’s Largest Proximity Mobile Payments Market. 7 June 2016. Available online: https://www.emarketer.com/article/china-boasts-worlds-largest-proximity-mobile-payments-market/1014053 (accessed on 1 May 2017).

- Wang, D.; Xiang, Z.; Fesenmaier, D.R. Adapting to the mobile world: A model of smartphone use. Ann. Tour. Res. 2014, 48, 11–26. [Google Scholar] [CrossRef]

- Gretzel, U.; Sigala, M.; Xiang, Z.; Koo, C. Smart tourism: Foundations and developments. Electron. Mark. 2015, 25, 179–188. [Google Scholar] [CrossRef]

- Neuhofer, B.; Buhalis, D.; Ladkin, A. Smart technologies for personalized experiences: A case study in the hospitality domain. Electron. Mark. 2015, 25, 243–254. [Google Scholar] [CrossRef]

- Chung, N.; Tyan, I.; Han, H. Enhancing the smart tourism experience through geotag. Inf. Syst. Front. 2016, 14, 1–12. [Google Scholar] [CrossRef]

- Zheng, W.; Huang, X.; Li, Y. Understanding the tourist mobility using GPS: Where is the next place? Tour. Manag. 2017, 59, 267–280. [Google Scholar] [CrossRef]

- Gretzel, U.; Werthner, H.; Koo, C.; Lamsfus, C. Conceptual foundations for understanding smart tourism ecosystems. Comput. Hum. Behav. 2015, 50, 558–563. [Google Scholar] [CrossRef]

- Hunter, W.C.; Chung, N.; Gretzel, U.; Koo, C. Constructivist research in smart tourism. Asia Pac. J. Inf. Syst. 2015, 25, 105–120. [Google Scholar]

- Quan, S.; Wang, N. Towards a structural model of the tourist experience: An illustration from food experiences in tourism. Tour. Manag. 2004, 25, 297–305. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations; The Free Press: New York, NY, USA, 1983. [Google Scholar]

- Agarwal, R.; Prasad, J. The role of innovation characteristics and perceived voluntariness in the acceptance of information technologies. Decis. Sci. 1997, 28, 557–582. [Google Scholar] [CrossRef]

- Karahanna, E.; Straub, D.W.; Chervany, N.L. Information technology adoption across time: A cross-sectional comparison of pre-adoption and post-adoption beliefs. MIS Q. 1999, 23, 183–213. [Google Scholar] [CrossRef]

- Mustonen-Ollila, E.; Lyytinen, K. Why organizations adopt information system process innovations: A longitudinal study using diffusion of innovation theory. Inf. Syst. J. 2003, 13, 275–297. [Google Scholar] [CrossRef]

- Lin, H.-F. An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. Int. J. Inf. Manag. 2011, 31, 252–260. [Google Scholar] [CrossRef]

- Neuhofer, B.; Buhalis, D.; Ladkin, A. A typology of technology-enhanced tourism experiences. Int. J. Tour. Res. 2014, 16, 340–350. [Google Scholar] [CrossRef]

- Buhalis, D.; Law, R. Progress in information technology and tourism management: 20 years on and 10 years after the internet—The state of etourism research. Tour. Manag. 2008, 29, 609–623. [Google Scholar] [CrossRef]

- Moore, G.C.; Benbasat, I. Development of an instrument to measure the perceptions of adopting an information technology innovation. Inf. Syst. Res. 1991, 2, 192–222. [Google Scholar] [CrossRef]

- Ajzen, I.; Fishbein, M. Understanding Attitudes and Predicting Social Behaviour; Prentice-Hall: Englewood Cliffs, NJ, USA, 1980. [Google Scholar]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Ryu, J.S.; Murdock, K. Consumer acceptance of mobile marketing communications using the QR code. J. Direct Data Digit. Mark. Pract. 2013, 15, 111–124. [Google Scholar]

- Liébana-Cabanillas, F.; Ramos de Luna, I.; Montoro-Ríos, F.J. User behaviour in QR mobile payment system: The QR payment acceptance model. Technol. Anal. Strateg. Manag. 2015, 27, 1031–1049. [Google Scholar] [CrossRef]

- Beatty, S.E.; Kahle, L.R. Alternative hierarchies of the attitude-behavior relationship: The impact of brand commitment and habit. J. Acad. Mark. Sci. 1988, 16, 1–10. [Google Scholar] [CrossRef]

- Bhattacherjee, A.; Sanford, C. Influence processes for information technology acceptance: An elaboration likelihood model. MIS Q. 2006, 30, 805–825. [Google Scholar]

- Tornatzky, L.G.; Klein, K.J. Innovation characteristics and innovation adoption-implementation: A meta-analysis of findings. IEEE Trans. Eng. Manag. 1982, 29, 28–45. [Google Scholar] [CrossRef]

- Carter, L.; Bélanger, F. The utilization of e-government services: Citizen trust, innovation and acceptance factors. Inf. Syst. J. 2005, 15, 5–25. [Google Scholar] [CrossRef]

- No, E.; Kim, J.K. Determinants of the adoption for travel information on smartphone. Int. J. Tour. Res. 2014, 16, 534–545. [Google Scholar] [CrossRef]

- Meyer, C.; Schwager, A. Understanding customer experience. Harv. Bus. Rev. 2007, 85, 116–126. [Google Scholar] [PubMed]

- Holbrook, M.B.; Hirschman, E.C. The experiential aspects of consumption: Consumer fantasies, feelings, and fun. J. Consum. Res. 1982, 9, 132–140. [Google Scholar] [CrossRef]

- Orel, F.D.; Kara, A. Supermarket self-checkout service quality, customer satisfaction, and loyalty: Empirical evidence from an emerging market. J. Retail. Consum. Serv. 2014, 21, 118–129. [Google Scholar] [CrossRef]

- Chi, C.G.-Q.; Qu, H. Examining the structural relationships of destination image, tourist satisfaction and destination loyalty: An integrated approach. Tour. Manag. 2008, 29, 624–636. [Google Scholar] [CrossRef]

- Gao, B.W.; Lai, I.K.W. The effects of transaction-specific satisfactions and integrated satisfaction on customer loyalty. Int. J. Hosp. Manag. 2015, 44, 38–47. [Google Scholar]

- Olsen, L.L.; Johnson, M.D. Service equity, satisfaction, and loyalty: From transaction-specific to cumulative evaluations. J. Serv. Res. 2003, 5, 184–195. [Google Scholar] [CrossRef]

- Jones, M.A.; Suh, J. Transaction-specific satisfaction and overall satisfaction: An empirical analysis. J. Serv. Mark. 2000, 14, 147–159. [Google Scholar] [CrossRef]

- Kohli, R.; Devaraj, S.; Mahmood, M.A. Understanding determinants of online consumer satisfaction: A decision process perspective. J. Manag. Inf. Syst. 2004, 21, 115–136. [Google Scholar] [CrossRef]

- Sharda, R.; Barr, S.H.; McDonnell, J.C. Decision support system effectiveness: A review and an empirical test. Manag. Sci. 1988, 34, 139–159. [Google Scholar] [CrossRef]

- Forgionne, G.A.; Kohli, R. HMSS: A management support system for concurrent hospital decision making. Decis. Support Syst. 1996, 16, 209–229. [Google Scholar] [CrossRef]

- Engel, J.; Kollat, D.T.; Blackwell, R.D. Consumer Behavior; Dryden Press: New York, NY, USA, 1978. [Google Scholar]

- Zhao, L.; Lu, Y.; Zhang, L.; Chau, P.Y.K. Assessing the effects of service quality and justice on customer satisfaction and the continuance intention of mobile value-added services: An empirical test of a multidimensional model. Decis. Support Syst. 2012, 52, 645–656. [Google Scholar] [CrossRef]

- Shankar, V.; Balasubramanian, S. Mobile marketing: A synthesis and prognosis. J. Interact. Mark. 2009, 23, 118–129. [Google Scholar] [CrossRef]

- Chin, W.W.; Peterson, R.A.; Brown, S.P. Structural equation modeling in marketing: Some practical reminders. J. Market. Theory Pract. 2008, 16, 287–298. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Gefen, D.; Straub, D.; Boudreau, M.-C. Structural equation modeling and regression: Guidelines for research practice. Commun. AIS 2000, 4, 2–76. [Google Scholar]

- Tabachnick, B.G.; Fidell, L.S. Using Multivariate Statistics; Harper Collins: New York, NY, USA, 1996. [Google Scholar]

- Gretzel, U. Intelligent systems in tourism: A social science perspective. Ann. Tour. Res. 2011, 38, 757–779. [Google Scholar] [CrossRef]

- Garau, C. Smart paths for advanced management of cultural heritage. Reg. Stud. Reg. Sci. 2014, 1, 286–293. [Google Scholar] [CrossRef]

- Choy, M.; Park, G. Sustaining innovative success: A case study on consumer-centric innovation in the ict industry. Sustainability 2016, 8, 986. [Google Scholar] [CrossRef]

- Claudy, M.C.; Garcia, R.; O’Driscoll, A. consumer resistance to innovation—a behavioral reasoning perspective. J. Acad. Mark. Sci. 2015, 43, 528–544. [Google Scholar] [CrossRef]

- DeLone, W.H.; McLean, E.R. Information systems success: The quest for the dependent variable. Inf. Syst. Res. 1992, 3, 60–95. [Google Scholar] [CrossRef]

- Koo, C.; Yoo, K.-H.; Lee, J.-N.; Zanker, M. Special section on generative smart tourism systems and management: Man–machine interaction. Int. J. Inf. Manag. 2016, 6, 1301–1305. [Google Scholar] [CrossRef]

- Kim, H.; Woo, E.; Uysal, M. Tourism experience and quality of life among elderly tourists. Tour. Manag. 2015, 46, 465–476. [Google Scholar] [CrossRef]

| Attributes | Definitions |

|---|---|

| Relative advantage | The degree to which an innovation is perceived as being better than the idea it supersedes. |

| Compatibility | The degree to which an innovation is perceived as being consistent with existing values, past experiences, and needs of potential adopters. |

| Complexity a | The degree to which an innovation is perceived as being difficult to understand and use. |

| Observability | The degree to which the results of using an innovation are observable and communicable to others. |

| Trialability | The degree to which an innovation may be experimented with on a limited basis before adoption. |

| Category | Item | Frequency | Percentage |

|---|---|---|---|

| Gender | Male | 120 | 48.6 |

| Female | 127 | 51.4 | |

| Age | <20 | 8 | 3.2 |

| 20–29 | 137 | 55.5 | |

| 30–39 | 94 | 38.1 | |

| >39 | 8 | 3.2 | |

| Education | <Undergraduate | 11 | 4.5 |

| Undergraduate | 146 | 59.1 | |

| Postgraduate or higher | 90 | 36.4 | |

| Income per month | <5000 CNY b | 115 | 46.6 |

| 5000–10,000 CNY | 99 | 40.1 | |

| 10,001–15,000 CNY | 11 | 4.5 | |

| 15,001–20,000 CNY | 10 | 4.0 | |

| >20,000 CNY | 12 | 4.9 | |

| Total | - | 247 | 100 |

| Construct | Indicator | Standardized Loading | CR | AVE | Cronbach’s Alpha |

|---|---|---|---|---|---|

| Relative Advantage | RA1 | 0.958 | 0.975 | 0.906 | 0.965 |

| RA2 | 0.948 | ||||

| RA3 | 0.941 | ||||

| RA4 | 0.960 | ||||

| Compatibility | Compa1 | 0.872 | 0.936 | 0.830 | 0.897 |

| Compa2 | 0.947 | ||||

| Compa3 | 0.912 | ||||

| Complexity | Compl1 | 0.945 | 0.959 | 0.885 | 0.935 |

| Compl2 | 0.958 | ||||

| Compl3 | 0.920 | ||||

| Observability | Ob1 | 0.947 | 0.953 | 0.870 | 0.925 |

| Ob2 | 0.951 | ||||

| Ob3 | 0.899 | ||||

| Trialability | Tr1 | 0.907 | 0.939 | 0.837 | 0.903 |

| Tr2 | 0.893 | ||||

| Tr3 | 0.944 | ||||

| Attitude | At1 | 0.939 | 0.960 | 0.890 | 0.938 |

| At2 | 0.959 | ||||

| At3 | 0.932 | ||||

| Image | Im1 | 0.943 | 0.976 | 0.910 | 0.967 |

| Im2 | 0.960 | ||||

| Im3 | 0.971 | ||||

| Im4 | 0.941 | ||||

| Current Usage | CU1 | 0.934 | 0.963 | 0.868 | 0.949 |

| CU2 | 0.923 | ||||

| CU3 | 0.954 | ||||

| CU4 | 0.915 | ||||

| Transaction Satisfaction | TranS1 | 0.960 | 0.966 | 0.906 | 0.948 |

| TranS2 | 0.963 | ||||

| TranS3 | 0.931 | ||||

| Travel Satisfaction | TravS1 | 0.960 | 0.982 | 0.930 | 0.975 |

| TravS2 | 0.975 | ||||

| TravS3 | 0.949 | ||||

| TravS4 | 0.973 |

| Construct | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. RA | 0.952 | |||||||||||

| 2. Compa | 0.756 | 0.911 | ||||||||||

| 3. Compl | 0.704 | 0.669 | 0.941 | |||||||||

| 4. Ob | 0.581 | 0.580 | 0.633 | 0.933 | ||||||||

| 5. Tr | 0.479 | 0.518 | 0.388 | 0.547 | 0.915 | |||||||

| 6. At | 0.627 | 0.632 | 0.585 | 0.691 | 0.524 | 0.943 | ||||||

| 7. Im | 0.168 | 0.251 | 0.174 | 0.283 | 0.524 | 0.373 | 0.954 | |||||

| 8. CU | 0.665 | 0.704 | 0.576 | 0.611 | 0.535 | 0.728 | 0.317 | 0.931 | ||||

| 9. TranS | 0.563 | 0.537 | 0.463 | 0.550 | 0.524 | 0.742 | 0.436 | 0.708 | 0.952 | |||

| 10. TravS | 0.635 | 0.587 | 0.555 | 0.561 | 0.490 | 0.738 | 0.292 | 0.666 | 0.668 | 0.964 | ||

| 11. Age | 0.086 | −0.038 | 0.029 | 0.096 | −0.078 | 0.172 | −0.073 | 0.053 | 0.155 | 0.082 | - | |

| 12.Income | 0.147 | 0.141 | 0.103 | 0.142 | 0.029 | 0.136 | −0.104 | 0.164 | 0.056 | 0.078 | 0.279 | - |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lou, L.; Tian, Z.; Koh, J. Tourist Satisfaction Enhancement Using Mobile QR Code Payment: An Empirical Investigation. Sustainability 2017, 9, 1186. https://doi.org/10.3390/su9071186

Lou L, Tian Z, Koh J. Tourist Satisfaction Enhancement Using Mobile QR Code Payment: An Empirical Investigation. Sustainability. 2017; 9(7):1186. https://doi.org/10.3390/su9071186

Chicago/Turabian StyleLou, Liguo, Zilu Tian, and Joon Koh. 2017. "Tourist Satisfaction Enhancement Using Mobile QR Code Payment: An Empirical Investigation" Sustainability 9, no. 7: 1186. https://doi.org/10.3390/su9071186

APA StyleLou, L., Tian, Z., & Koh, J. (2017). Tourist Satisfaction Enhancement Using Mobile QR Code Payment: An Empirical Investigation. Sustainability, 9(7), 1186. https://doi.org/10.3390/su9071186