Are Consumers Willing to Pay More for a “Made in” Product? An Empirical Investigation on “Made in Italy”

Abstract

:1. Introduction

2. Literature Review

2.1. Country of Origin

2.2. Country Image

- -

- Factors related to the image of the product categories with certain provenances, such as shoes for Italy;

- -

- Influence of the “Made in” labels;

- -

- Image evoked by the origin of the product;

- -

- The product’s national image compared to the consumer’s overall judgment in respect to past experience;

- -

- Factors related to the image of domestic products over those that are imported.

2.3. Brand Image

2.4. Willingness to Pay

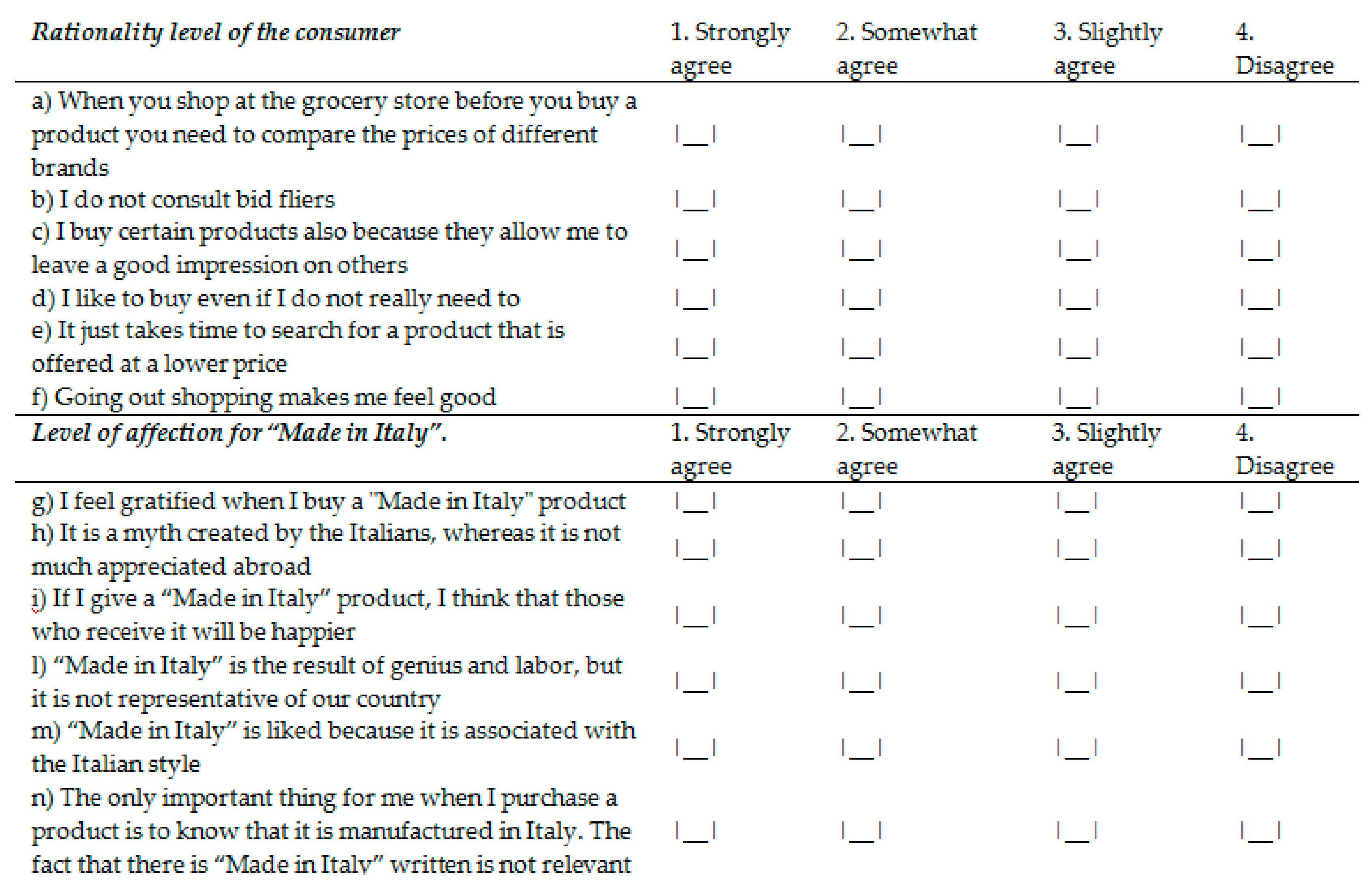

3. Materials and Methods

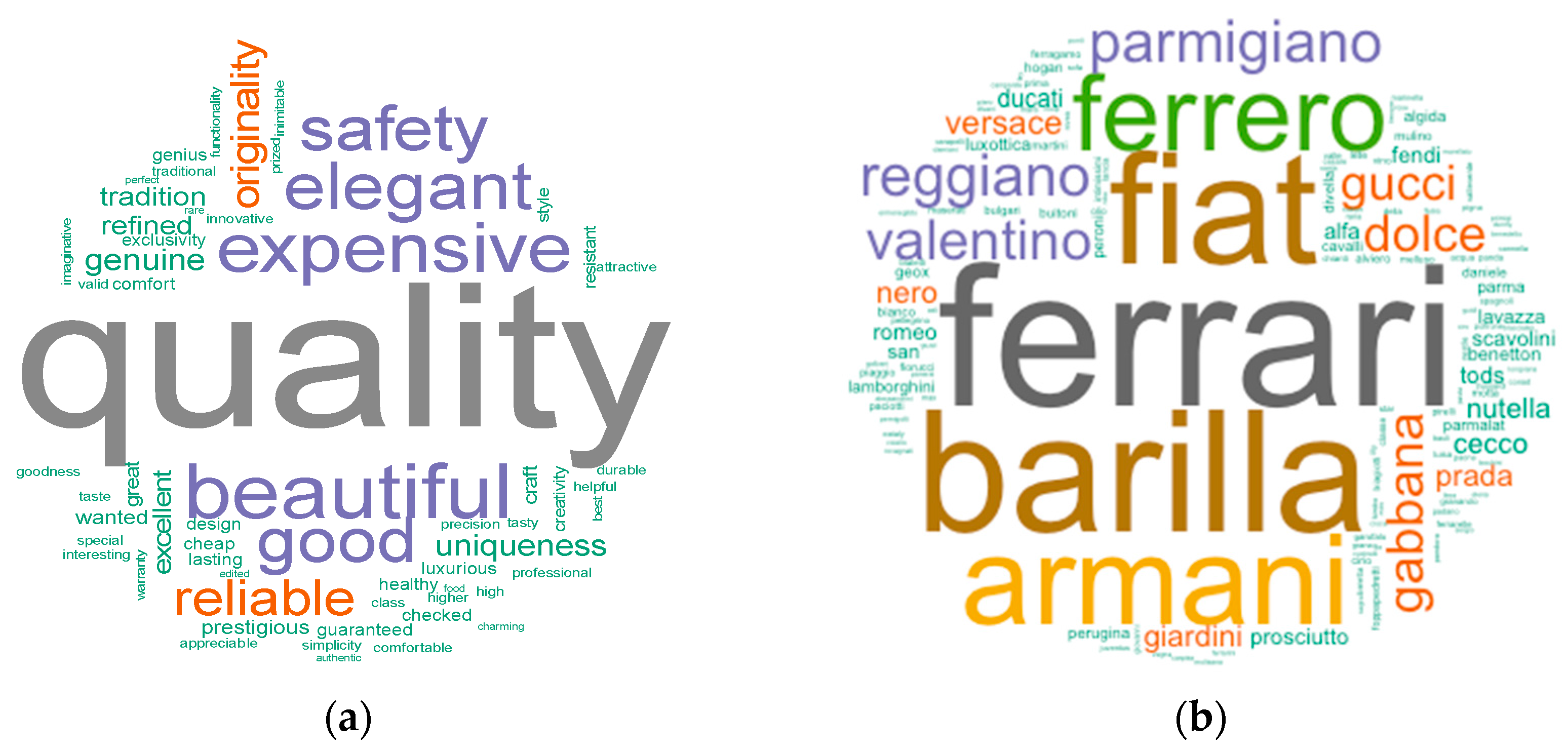

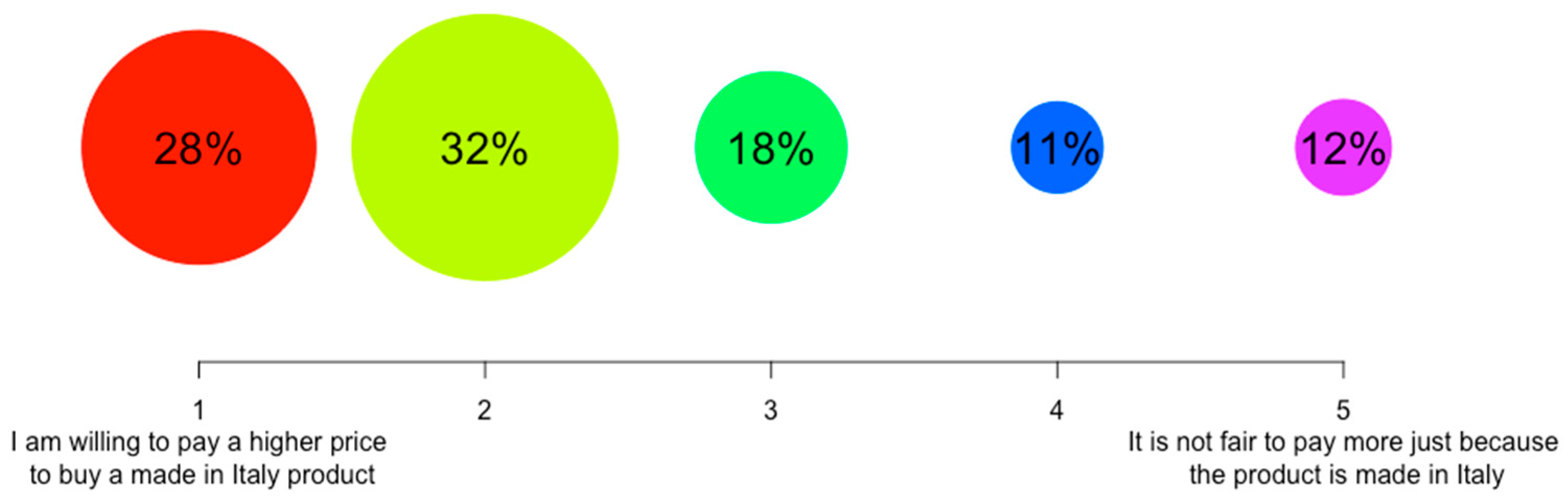

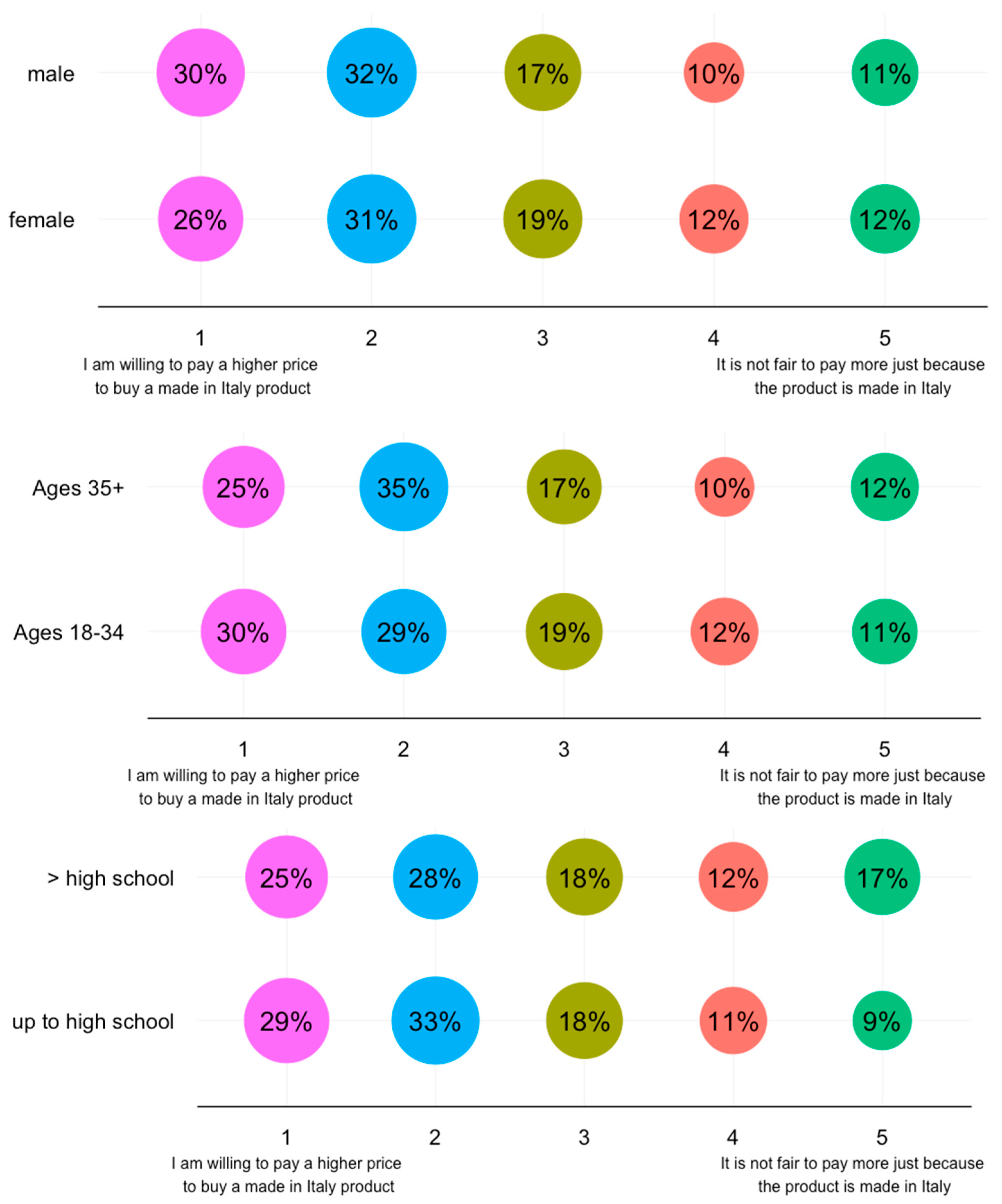

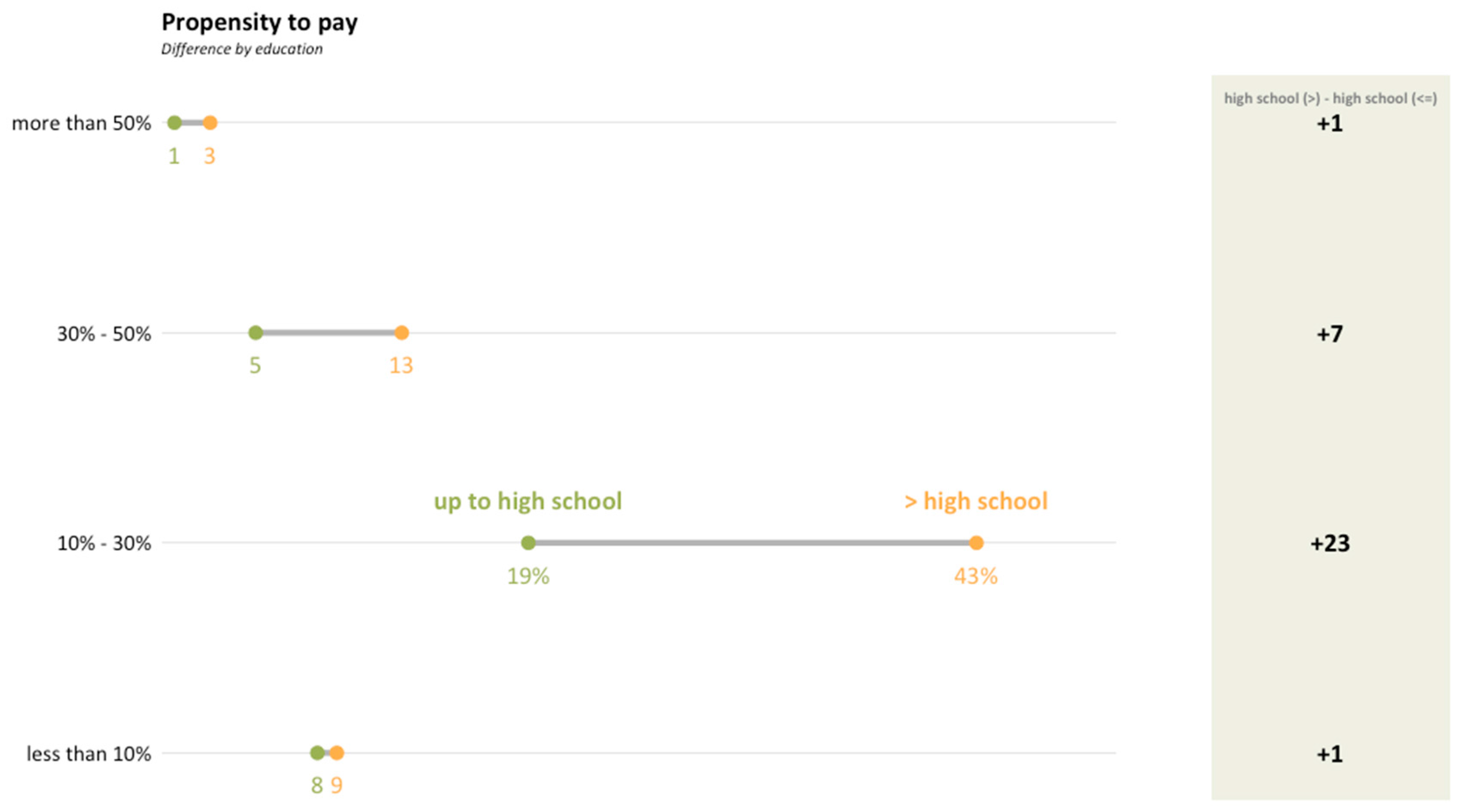

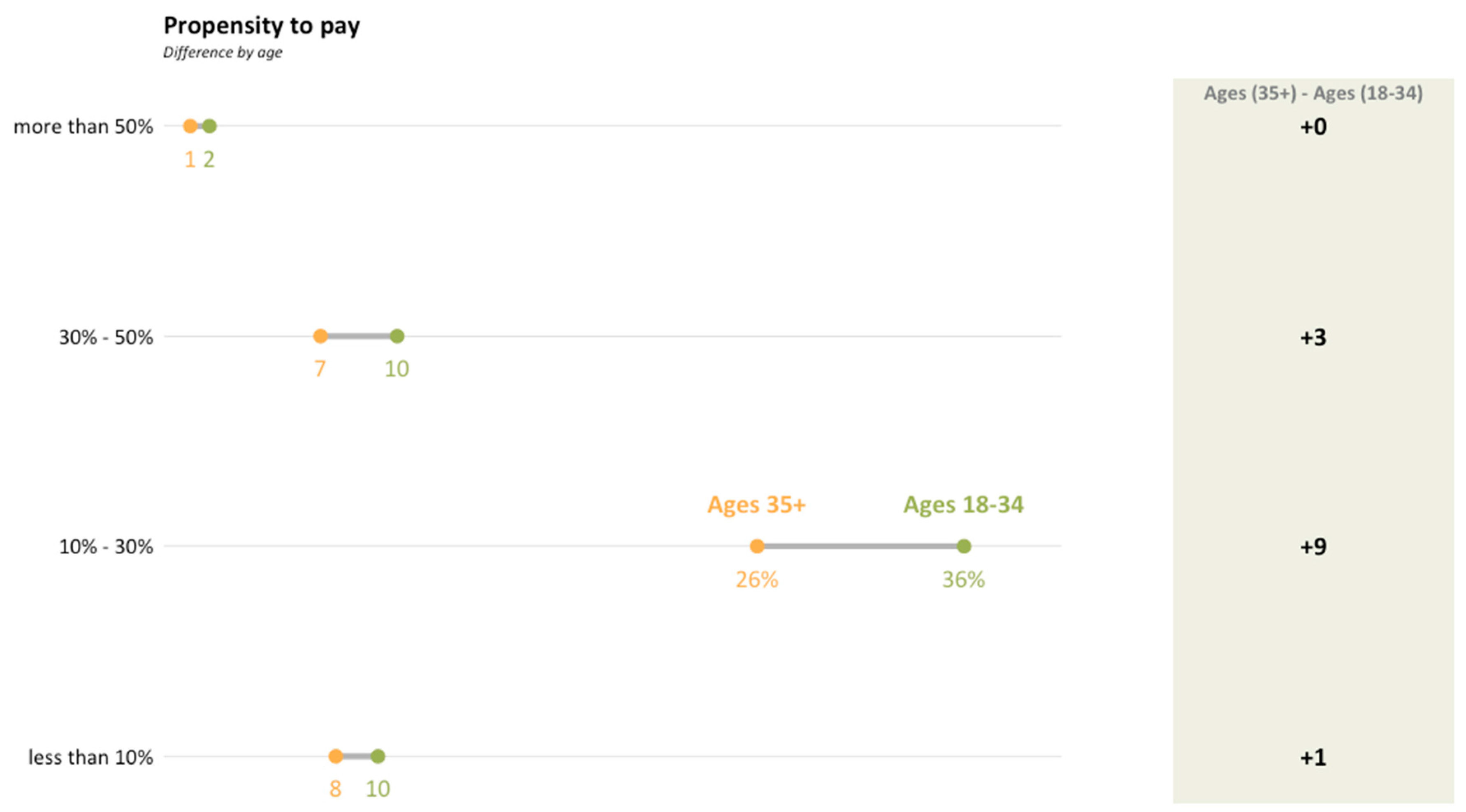

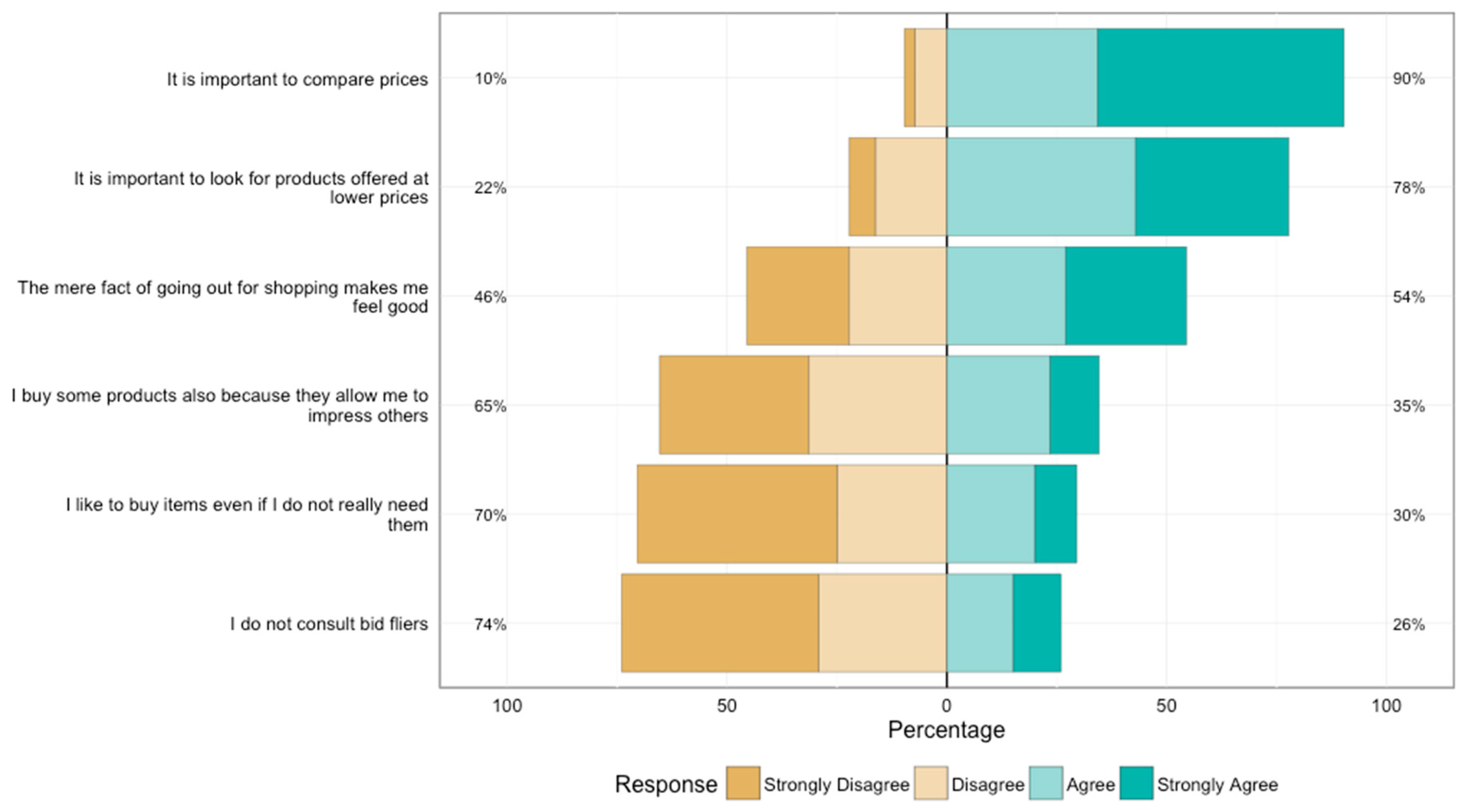

4. Results and Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Molteni, M.; Todisco, A. Responsabilità sociale d’impresa. In Come le PMI Possono Migliorare le Performance Aziendali Mediante Politiche di CSR; Logiche, Strumenti, Benefici: Milano, Italy, 2008. (In Italian) [Google Scholar]

- Bertoli, G.; Resciniti, R. International Marketing and the Country of Origin Effect: The Global Impact of “Made in Italy”; Edward Elgar: Cheltenham, UK, 2012. [Google Scholar]

- De Chiara, A. La competitività responsabile nelle PMI: Strategia vincente nei territori “nemici”. Piccola Impresa/Small Bus. 2012, 1, 29–52. (In Italian) [Google Scholar]

- Dichter, E. The world customer. Thunderbird Int. Bus. Rev. 1962, 40, 113–123. [Google Scholar] [CrossRef]

- Schooler, R.D. Product bias in the central American common market. J. Mark. Res. 1965, 2, 394–397. [Google Scholar] [CrossRef]

- Han, C.M. Country Image: Halo or summary construct? J. Mark. Res. 1989, 26, 222–229. [Google Scholar] [CrossRef]

- Heimbach, A.E.; Johansson, J.K.; Maclachlan, D.L. Product familiarity, information processing, and COO cues. Adv. J. Consum. Res. 1989, 16, 460–467. [Google Scholar]

- Baker, J.M.; Ballington, L. Country-of-origin as a source of competitive advantage. J. Strateg. Mark. 2002, 10, 157–168. [Google Scholar] [CrossRef]

- De Nisco, A. Country-of-origin e buyer behavior: Una meta-analisi della letteratura internazionale. Mercati e Competitività 2006, 4, 81–101. [Google Scholar]

- De Luca, P.; Pegan, G. La percezione del Made in Italy sui mercati internazionali: Primi risultati di una ricerca “netnografica” sulle comunità online di consumatori di caffè. In Proceedings of the Società Italiana Marketing, Benevento, Italy, 20–21 September 2012. [Google Scholar]

- Bursi, T.; Grappi, S.; Martinelli, E. Effetto “Country of Origin”. Un’analisi Comparata a Livello Internazionale Sul Comportamento d’acquisto Della Clientela, 1st ed.; Il Mulino: Bologna, Italy, 2012; pp. 1–204. [Google Scholar]

- Bilkey, W.J.; Nes, E. Country-of-origin effects on product evaluations. J. Int. Bus. Stud. 1982, 13, 89–100. [Google Scholar] [CrossRef]

- Bannister, J.; Saunders, J. UK consumers’ attitudes towards imports: The measurement of national stereotype image. Eur. J. Mark. 1978, 12, 562–570. [Google Scholar] [CrossRef]

- Gaedeke, R. Consumer attitudes toward products “Made in” developing countries. J. Retail. 1973, 49, 13–24. [Google Scholar]

- Hampton, G.M. Perceived risk in buying products made in abroad by American firms. Baylor Bus. Stud. 1977, 8, 53–64. [Google Scholar] [CrossRef]

- Schooler, R.D. Bias phenomena attendant to the marketing of foreign goods in the U.S. J. Int. Bus. Stud. 1971, 2, 71–80. [Google Scholar] [CrossRef]

- Schooler, R.D.; Sunoo, D.H. Consumer perceptions of international products. Soc. Sci. Q. 1969, 49, 886–890. [Google Scholar]

- Schooler, R.D.; Wildt, A.R. Elasticity of product bias. J. Mark. Res. 1968, 5, 78–81. [Google Scholar] [CrossRef]

- Kincaid, W.M. A Study of the Perception of Selected Brands on Products as Foreign and American Attitudes toward Such Brands. Ph.D. Thesis, University of Texas, Austin, TX, USA, 1970. [Google Scholar]

- Yaprak, A. Formulating a Multinational Marketing Strategy: A Deductive Cross-National Consumer Behavior Model. Ph.D. Thesis, Georgia State University, Atlanta, GA, USA, 1978. [Google Scholar]

- Baumgartner, G.; Jolibert, A.J. The perceptions of foreign products in France. Adv. Consum. Res. 1978, 5, 603–605. [Google Scholar]

- Roth, M.S.; Romeo, J.B. Matching product category and country image perceptions: A framework for managing country-of-origin effects. J. Int. Bus. Stud. 1992, 23, 477–497. [Google Scholar] [CrossRef]

- Johansson, J.K.; Douglas, S.P.; Nonanka, I. Assessing the impact of country of origin on product evaluation: A new methodological perspective. J. Mark. Res. 1985, 22, 388–396. [Google Scholar] [CrossRef]

- Peterson, R.A.; Jolibert, A.J.P. A meta-analysis of country-of-origin business studies. J. Int. Bus. Stud. 1995, 26, 883–900. [Google Scholar] [CrossRef]

- Krishnakumar, P. An Exploratory Study of Influence of Country of Origin on the Product Images of Persons from Selected Countries. Ph.D. Thesis, University of Florida, Gainesville, FL, USA, 1974. [Google Scholar]

- Wang, C. The Effects of Foreign Economics, Political and Cultural Environment on Consumer’s Willingness to Buy Foreign Products. Ph.D. Thesis, Texas A&M University, College Station, TX, USA, 1978. [Google Scholar]

- Manrai, L.A.; Lascu, D.N.; Manrai, A.K. Interactive effects of country of origin and product category on product evaluations. Int. Bus. Rev. 1998, 7, 591–615. [Google Scholar] [CrossRef]

- Thanasuta, K.; Patoomsuwan, T.; Chaimahawong, V.; Chiaravutthi, Y. Brand and country of origin valuations of automobiles. Asia Pac. J. Mark. Logist. 2009, 21, 355–375. [Google Scholar] [CrossRef]

- Dornoff, R.J.; Tankersley, C.B.; White, G.P. Consumer’s perception of imports. Akron Bus. Econ. Rev. 1974, 5, 26–29. [Google Scholar]

- Tongberg, R.C. An Empirical Study of Relationship between Dogmatism and Consumer Attitudes toward Foreign Products. Ph.D. Thesis, Penn State Universtity, State College, PA, USA, 1972. [Google Scholar]

- Brodowsky, G.H. The effects of country of design and country of assembly on evaluative beliefs about automobiles and attitudes toward buying them: A comparison between high and low ethnocentric consumers. J. Int. Consum. Mark. 1998, 10, 85–103. [Google Scholar] [CrossRef]

- Balbanis, G.; Diamantopoulos, A. Domestic country bias, country-of-origin effects, and consumer ethnocentrism: A multidimensional unfolding approach. J. Acad. Mark. Sci. 2004, 32, 80–95. [Google Scholar] [CrossRef]

- Batra, R.; Ramaswamy, V.; Alden, D.L.; Steenkamp, J.-B.E.M. Effects of brand local and non-local origin on consumer attitudes in developing countries. J. Consum. Psychol. 2000, 9, 83–95. [Google Scholar] [CrossRef]

- Dakin, J.A.; Carter, S. Negative image: Developing countries and country of origin—An example from Zimbabwe. Int. J. Econ. Bus. Res. 2010, 2, 166–186. [Google Scholar] [CrossRef]

- Lumpkin, J.R.; Crawford, J.C.; Kim, G. Perceived risk as a factor in buying foreign clothes. Int. J. Advert. 1985, 4, 157–161. [Google Scholar] [CrossRef]

- Watson, J.; Wright, K. Consumer ethnocentrism and attitudes toward domestic and foreign products. Eur. J. Mark. 2000, 34, 1149–1166. [Google Scholar] [CrossRef]

- Ger, G.; Askegaard, S.; Christiensen, A. Experiential nature of product-place images: Image as a narrative. Adv. Consum. Res. 1999, 26, 165–169. [Google Scholar]

- Anderson, W.T.; Cunningham, W.H. The socially conscious consumer. J. Mark. 1972, 36, 23–31. [Google Scholar] [CrossRef]

- Shimp, T.A.; Sharma, S. Consumer ethnocentrism: Construction and validation of the CETSCALE. J. Mark. Res. 1987, 26, 280–289. [Google Scholar] [CrossRef]

- Bailey, W.; Pineres, S. Country of origin attitudes in Mexico: The malinchismo effect. J. Int. Consum. Mark. 1997, 9, 25–41. [Google Scholar] [CrossRef]

- Ahmed, S.A.; D’Astous, A. Perceptions of countries as producers of consumer goods. A t-shirt study in China. J. Fash. Mark. Manag. 2004, 8, 187–200. [Google Scholar] [CrossRef]

- Obermiller, C.; Spangenberg, E. Exploring the effects of country of origin labels: An Information processing framework. Adv. Consum. Res. 1989, 16, 454–459. [Google Scholar]

- Verlegh, P.W.J.; Steenkamp, J.-B.E.M.; Meulenberg, M.T.G. Country-of-origin effects in consumer processing of advertising claims. Int. J. Res. Mark. 2005, 22, 127–139. [Google Scholar] [CrossRef]

- Dmitrovic, T.; Vida, I. Consumer behavior induced by product nationality: The evolution of the field and its theoretical antecedents. Transform. Bus. Econ. 2010, 9, 145–165. [Google Scholar]

- Andehn, M.; Berg, P.O. Place-of-Origin Effects: A Conceptual Framework Based on a Literature Review; Stockholm University School of Business: Stockholm, Sweden, 2011. [Google Scholar]

- Li, W.-K.; Monroe, K.B.; Chan, D.K.S. The effects of country of origin, brand, and price information: A cognitive-affective model of buying intentions. Adv. Consum. Res. 1994, 21, 449–457. [Google Scholar]

- Alba, J.W.; Hutchinson, J.W. Dimensions of consumer expertise. J. Consum. Res. 1987, 13, 411–454. [Google Scholar] [CrossRef]

- Schaefer, A. Consumer knowledge and country-of-origin effects. Eur. J. Mark. 1997, 31, 56–72. [Google Scholar] [CrossRef]

- Papadopoulos, N.; Heslop, L.A. Product and Country Images: Research and Strategy; The Haworth Press: New York, NY, USA, 1993; pp. 1–504. [Google Scholar]

- Liefeld, J.P. Consumer knowledge and use of country-of-origin information at the point of purchase. J. Consum. Behav. 2004, 4, 85–96. [Google Scholar] [CrossRef]

- Usunier, J.C.; Cestre, G. Product ethnicity: Revisiting the match between products and countries. J. Int. Mark. 2007, 15, 32–72. [Google Scholar] [CrossRef]

- Nagashima, A. A comparison of Japanese and US attitudes toward foreign products. J. Mark. 1970, 34, 68–74. [Google Scholar] [CrossRef]

- Nagashima, A. Comparative “Made in” product image survey among Japanese businessmen. J. Mark. 1977, 41, 95–100. [Google Scholar] [CrossRef]

- Nebenzahl, I.D.; Jaffé, E.D. Measuring the joint effect of brand and country of image in consumer evaluation of global products. Int. Mark. Rev. 1996, 13, 5–22. [Google Scholar] [CrossRef]

- Zeugner-Roth, K.P.; Diamantopoulos, A. Advancing the country image construct: Reply to Samiee’s (2009) commentary. J. Bus. Res. 2010, 63, 446–449. [Google Scholar] [CrossRef]

- Kotler, P.; Haider, D.H.; Rein, I. Marketing Places; Free Press: New York, NY, USA, 1993. [Google Scholar]

- Aiello, G.; Donvito, R. L’immagine paese e l’immagine di marca: Gli esiti di una ricerca empirica sul Made in Italy. In Proceedings of the 10th International Congress Marketing Trends Conference, Paris, France, 20–22 January 2011. (In Italian). [Google Scholar]

- Esposito, G.E. Elogio Della Diversità: Made in Italy; Hoepli: Milano, Italy, 2006; p. 49. [Google Scholar]

- Varaldo, R. Il Marketing del Made in Italy: Quadro d’insieme, in Carlo Alberto Pratesi, (a cura di) Il Marketing del Made in Italy; Nuovi Scenari e Competitività Franco Angeli: Milano, Italy, 2001. (In Italian) [Google Scholar]

- Becattini, G. “Dal “Miracolo Economico al Made in Italy”, in Becattini G. (2000), Dal Distretto Industriale allo Sviluppo Locale; Bollati Boringhieri: Torino, Italy, 2000. (In Italian) [Google Scholar]

- Micelli, S.; Di Maria, E. Distretti Industriali e Tecnologie di rete: Progettare la Convergenza; FrancoAngeli: Milano, Italy, 2000. (In Italian) [Google Scholar]

- Chiarvesio, M.; Di Maria, E. Internationalization of supply networks inside and outside clusters. Int. J. Oper. Prod. Manag. 2009, 29, 1186–1207. [Google Scholar] [CrossRef]

- Fortis, M. Il Made in Italy tra Commercio Leale e Innovazione Industriale. In Proceedings of the II Conferenza Nazionale sul Commercio con l’Estero, Roma, Italy, February 2005. (In Italian). [Google Scholar]

- Fortis, M.; Realacci, E. ITALIA: Geografie del Nuovo Made in Italy; Symbola e Fondazione Edison: Milano, Italy, 2009. (In Italian) [Google Scholar]

- Aaker, D.A. Managing Brand Equity; The Free Press: New York, NY, USA, 1991. [Google Scholar]

- Keller, K.L. Conceptualizing, Measuring, and Managing Customer-Based Brand Equity. J. Mark. Res. 1993, 29, 1–22. [Google Scholar] [CrossRef]

- Thakor, M.V.; Kohli, C.S. Brand origin: Conceptualization and review. J. Consum. Mark. 1996, 13, 27–42. [Google Scholar] [CrossRef]

- Samiee, S. Consumer evaluation of products in a global market. Int. Bus. Stud. 1994, 25, 579–604. [Google Scholar] [CrossRef]

- Samiee, S. Advancing the country image construct—A commentary essay. J. Bus. Res. 2010, 63, 442–445. [Google Scholar] [CrossRef]

- Temperini, V.; Gregori, G.L.; Palanga, P. The Brand Made in Italy. A critical Analysis. Manag. Stud. 2016, 4, 93–103. [Google Scholar] [CrossRef]

- Prometeia, C. Esportare la Dolce Vita; SIPI Spa: Roma, Italy, 2015. (In Italian) [Google Scholar]

- Kotler, P.; Pfoertsch, W. Being known or being one of many: The need for brand management for business to business (B2B) companies. J. Bus. Ind. Mark. 2007, 22, 357–362. [Google Scholar] [CrossRef]

- Delgado-Bellester, E.; Munuera-Alemán, J.L. Brand trust in the context of consumer loyalty. Eur. J. Mark. 2001, 35, 1238–1258. [Google Scholar] [CrossRef]

- Oberecker, E.M.; Diamantopoulos, A. Consumers’ emotional bonds with foreign countries: Does consumer affinity affect behavioral intentions? J. Int. Mark. 2011, 19, 45–72. [Google Scholar] [CrossRef]

- Bernard, Y.; Zarrouk-Karoui, S. Reinforcing willingness to buy and to pay due to consumer affinity towards a foreign country. Int. Manag. Rev. 2014, 10, 57–67. [Google Scholar]

- Homburg, C.; Koschate-Fischer, N.; Hoyer, W.D. Do satisfied customers really pay more? A study of the relationship between customer satisfaction and willingness to pay. J. Mark. 2005, 69, 84–96. [Google Scholar] [CrossRef]

- Cappelli, L.; D’Ascenzo, F.; Natale, L.; Rossetti, F.; Ruggieri, R.; Vistocco, D. Is the “Made in Italy” a key to success? An empirical investigation. In Proceedings of the Congresso di Scienze Merceolgiche, Viterbo, Italy, 2–4 March 2016. [Google Scholar]

- Koschate-Fischer, N.; Diamantopoulos, A.; Oldenkotte, K. Are consumers really willing to pay more for a favorable country image? A study of country-of-origin effects on willingness to pay. J. Int. Mark. 2012, 20, 19–41. [Google Scholar] [CrossRef]

- Steenkamp, J.-B.E.M.; Batra, R.; Alden, D.L. How perceived brand globalness creates brand value. J. Int. Bus. Stud. 2002, 34, 53–65. [Google Scholar] [CrossRef]

- Team, R.C. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2016. [Google Scholar]

- Wickham, H. ggplot2: Elegant Graphics for Data Analysis; Springer: New York, NY, USA, 2009. [Google Scholar]

- Bryer, J.; Speerschneider, K. Likert: Analysis and Visualization Likert Items; R Package Version 1.3.5.; GitHub: Vienna, Austria, 2016. [Google Scholar]

- Fellows, I. Wordcloud: Word Clouds. R Package Version 2014, 2, 109. [Google Scholar]

- Hui, M.K.; Zhou, L. Country of manufacture effects for know brands. Eur. J. Mark. 2003, 37, 133–153. [Google Scholar] [CrossRef]

- Casacchia, O.; Natale, L. Pregiudizio e Discriminazione Verso Gli Stranieri, Polis, 3; Il Mulino Bologna: Bologna, Italy, 1994. [Google Scholar]

- De Santis, G.; Breschi, M. Fecondità Costrizioni Economiche ed Interventi Pubblici in M. Breschi, M.Livi Bacci, (a cura di) La bassa Fecondità Italiana tra Costrizioni Economiche e Cambio di Valori; Forum Editrice: Udine, Italy, 2003. [Google Scholar]

- Cacciola, S.; Marradi, A. Costruire il dato. Sulle Tecniche di Raccolta Delle Informazioni Nelle Scienze Sociali, 1st ed.; Franco Angeli Editore: Milano, Italy, 1988; pp. 63–105. [Google Scholar]

| Statement | First Principal Component | Second Principal Component |

|---|---|---|

| COMPARE_PRICES | 0.07 | 0.44 |

| FLYER | 0.36 | 0.41 |

| STATUS_SYMBOL | −0.17 | 0.45 |

| USELESSNESS | 0.08 | 0.61 |

| RESEARCH_BEST_PRICE | 0.26 | 0.46 |

| PLEASURE_OF_SHOPPING | 0.01 | 0.57 |

| GRATIFICATION | 0.71 | −0.27 |

| INTERNATIONAL | 0.52 | 0.18 |

| GIFT | 0.73 | −0.18 |

| GENIUS | 0.48 | 0.08 |

| LIFESTYLE | 0.16 | −0.33 |

| ITALIAN_ORIGIN | −0.01 | 0.13 |

| ≤1963 | 1964–1977 | 1978–1990 | 1990≥ | Tot. | |

|---|---|---|---|---|---|

| Lower | 19.3% | 15.8% | 21.8% | 22.8% | 20.0% |

| Lower-middle | 17.4% | 18.0% | 21.1% | 24.2% | 20.1% |

| Medium | 24.8% | 23.7% | 17.7% | 12.8% | 19.8% |

| Medium-high | 18.0% | 15.8% | 19.7% | 26.2% | 20.0% |

| High | 20.5% | 26.6% | 19.7% | 14.1% | 20.1% |

| Tot. | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| % ≥ medium-high | 38.5% | 42.4% | 39.5% | 40.3% | 40.1% |

| ≤1963 | 1964–1977 | 1978–1990 | 1990≥ | Tot. | |

|---|---|---|---|---|---|

| Lower | 23.6% | 15.8% | 17.7% | 21.5% | 19.8% |

| Lower-middle | 17.4% | 20.1% | 19.7% | 24.2% | 20.3% |

| Medium | 17.4% | 21.6% | 21.8% | 19.5% | 20.0% |

| Medium-high | 23.0% | 18.7% | 17.0% | 20.8% | 20.0% |

| High | 18.6% | 23.7% | 23.8% | 14.1% | 20.0% |

| Tot. | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| % ≥ medium-high | 41.6% | 42.4% | 40.8% | 34.9% | 39.9% |

| Add a Premium in the Order of | |||||

|---|---|---|---|---|---|

| From 10% to 30% | From 30% to 50% | ≤10% | ≥50% | Tot. | |

| Lower | 65.5% | 17.6% | 12.6% | 3.4% | 100.0% |

| Lower-middle | 66.9% | 9.9% | 19.0% | 4.1% | 100.0% |

| Medium | 62.2% | 21.0% | 15.1% | 1.7% | 100.0% |

| Medium-high | 58.0% | 18.5% | 21.0% | 2.5% | 100.0% |

| High | 57.5% | 20.0% | 18.3% | 4.2% | 100.0% |

| Tot. | 62.0% | 17.4% | 17.2% | 3.2% | 100.0% |

| Add a Premium in the Order of | |||||

|---|---|---|---|---|---|

| From 10% to 30% | From 30% to 50% | ≤10% | ≥50% | Tot. | |

| Lower | 65.0% | 16.7% | 17.5% | 0.8% | 100.0% |

| Lower-middle | 63.6% | 14.0% | 19.0% | 3.3% | 100.0% |

| Medium | 64.4% | 19.5% | 15.3% | 0.8% | 100.0% |

| Medium-high | 59.7% | 21.0% | 16.0% | 2.5% | 100.0% |

| High | 57.5% | 15.8% | 18.3% | 8.3% | 100.0% |

| Tot. | 62.0% | 17.4% | 17.2% | 3.2% | 100.0% |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cappelli, L.; D’Ascenzo, F.; Natale, L.; Rossetti, F.; Ruggieri, R.; Vistocco, D. Are Consumers Willing to Pay More for a “Made in” Product? An Empirical Investigation on “Made in Italy”. Sustainability 2017, 9, 556. https://doi.org/10.3390/su9040556

Cappelli L, D’Ascenzo F, Natale L, Rossetti F, Ruggieri R, Vistocco D. Are Consumers Willing to Pay More for a “Made in” Product? An Empirical Investigation on “Made in Italy”. Sustainability. 2017; 9(4):556. https://doi.org/10.3390/su9040556

Chicago/Turabian StyleCappelli, Lucio, Fabrizio D’Ascenzo, Luisa Natale, Francesca Rossetti, Roberto Ruggieri, and Domenico Vistocco. 2017. "Are Consumers Willing to Pay More for a “Made in” Product? An Empirical Investigation on “Made in Italy”" Sustainability 9, no. 4: 556. https://doi.org/10.3390/su9040556

APA StyleCappelli, L., D’Ascenzo, F., Natale, L., Rossetti, F., Ruggieri, R., & Vistocco, D. (2017). Are Consumers Willing to Pay More for a “Made in” Product? An Empirical Investigation on “Made in Italy”. Sustainability, 9(4), 556. https://doi.org/10.3390/su9040556