1. Introduction

The EPC (Energy Performance Contracting) refers to a market-oriented mechanism for energy conservation. Since the “11th Five-Year Plan”, the EPC has been developing rapidly in China on account of the government vigorously promoting the market mechanism and economic means to achieve the targets of energy conservation and emissions reduction [

1]. In the mechanism, the ESCO (Energy Services Company) signs an energy-savings project contract with an EU (Energy Using Organization, such as enterprises, government office buildings, public facilities, and schools) and provides the necessary services according to the energy savings target, the services include energy-using status diagnosis, energy conservation project design, financing, renovation, and operation management, etc., the EU pays part of the energy-savings revenue regularly to cover the investment and reasonable profit [

2]. A project that operates with the EPC mode is called an EPCP (energy performance contracting project), and the types of EPCPs include industrial, construction, and infrastructure. The EPC originated in the United States when the oil crisis occurred in the 1970s, when the serious environmental damage and rising energy prices prompted its development. The first EPCP in China began in 1995, the rapid development of the EPC is the result of the national energy conservation policies during the “11th Five-Year Plan”. According to the speech of the director of the ESCO Committee of China Energy Conservation Association (EMCA) on 21 Januray 2016, the investment of the EPC had grown from 28.751 billion yuan in 2010 to 103.956 billion yuan in 2015, the average annual growth rate was 29.31%; the output of the energy services industry had reached 312.734 billion yuan in 2015 from 83.629 billion yuan in 2010, the average annual growth rate was 30.19%; and during the “12th Five-Year Plan”, the ESCOs had formatted the energy-saving capacity of 124 million tons of standard coal and had achieved 310 million tons of carbon dioxide emissions. Industry is China’s largest energy-consuming sector, which accounts for over 70% of the energy consumption of the whole country, so it is the largest client market of the energy services industry. The statistics of “the White Paper of the EPC market potential analysis of China and the United States [

3]” show that China’s EPCPs were mainly in industry and construction industry, in 2013 the two types of EPCPs accounted for the shares of 72% and 21% respectively, and the remaining 7% of EPCPs were in the transportation industry. According to the actual situation, the EU in this article refers to industrial product manufacture enterprise.

“Contract” (i.e., energy service contract) is the key to the successful implementation of the EPCP and the reasonable return obtainment of the ESCO, ways to improve the robustness of the energy service contract need to be found. The mainstream structures of the energy service contract are the shared savings contracts and the guaranteed savings contracts. The ESCO is responsible for whole project financing under a shared savings contract, whereas the EU is required to take part of financing risk in a guaranteed savings contract. In 2010, the shared savings contracts and the guaranteed savings contracts in China were 66% and 20% of the all energy service contracts in China respectively, and had changed to 45% and 42% in 2013 [

3]. Shared savings contracts are more appropriate in developing countries, where energy saving projects lack reliable and commercially viable tools of financing, and the industrial EUs with high energy intensity always pursue short-term economic interests and are reluctant to invest in energy efficiency projects [

4,

5,

6]. The energy service market is still in its infancy in China, shared savings contracts are widely used as the main structures of the energy service contract, and the government mainly supports it [

1]. We choose shared savings contracts to study in this paper. Based on the concept of the robustness of a commercial service contract provided by Chopra et al. [

7], Qian and Guo [

1] proposed the concept of the robustness of shared savings contract, which is exemplified by the situation in which, after the revenue sharing ratio and the contract period agreement are decided, the contract is smoothly implemented, even in the face of uncertainties in the contract period [

1]. So it is needed to industriously improve the robustness of shared savings contract without changing revenue sharing rules to increase the possibility of the smooth implementation of the EPCP.

Previous research on the robustness of shared savings contracts was very scarce. We start with the analysis of the influence factors of the shared savings contract robustness.

Uncertainty of project value is an important and influential factor on the robustness of energy performance contracts. In an industrial EPCP, for example, the project is the energy efficiency revenue carrier of the ESCO and EU, and the revenue comes from the product’s energy cost savings. Due to the impacts of energy prices, risk-adjusted discount rates, and accidents, there is a high degree of uncertainty around energy efficiency revenue [

8,

9,

10]. The signing of the shared savings contract is needed to negotiate the revenue share under the condition of uncertain project value, the above uncertain factors that may occur during project execution can contribute to the parties’ discontent about the negotiation result even constitute a default situation, and hence can influence the robustness of shared savings contract.

Based on the discussion of revenue sharing bargaining issues of shared savings contracts under the expected energy savings, Qian and Guo [

1] introduced the forecast-commitment (FC) contract as the supplement of the shared savings contract. In the FC contract, the ESCO makes the forecast and the commitment to the product’s energy savings, and the EU makes the forecast and the commitment to the product yield in a single phase. During the project implementation, if the actual value of any party is less than his commitment, he must pay a penalty for the gap to the other party, and the revenue share ratio still submits to the shared savings contract. This approach can expand the range of revenue sharing to enhance the robustness of the shared savings contract.

The bidirectional moral hazard caused by asymmetric information during the project’s operation is the important factor of the robustness of the shared savings contract. The reasons are as follows:

The concept of the bidirectional moral hazard was first proposed in the land lease contract design [

11], and has since been studied as part of venture investment issues by many scholars [

12]. EPCPs have similar properties with venture investment projects, a bidirectional moral hazard also exists in the EPCP. After the shared savings contract signing, the EPCP subsidized by the production projects of the EU enters into the construction and operation period. Energy efficiency technology is the ESCO’s proprietary information, the presence of asymmetric information may lead to moral hazard problems of the ESCO (including opportunism, avoidance of responsibility, confliction of objectives, and incompetence). For instance, the ESCO may invest insufficient effort, conceal or gloss over their own business practices and ability to execute projects, or use immature and more risky energy-saving technologies which may bring greater individual returns for the purpose of building a reputation. All of these may lead to delay in building projects, cause the project to fail, or actively work against the designed energy-saving goals. Similarly, The EU owns the production information of energy-consuming products, they also have moral hazard problems, such as insufficient effort input and opportunism. Bertoldi et al. [

13] reviewed the development of the ESCOs in over 40 European countries to point out the main obstacle to the energy services industry was the EU’s lack of information, the effective recognition about energy services, and their suspicion of the ESCOs. Vine [

14] pointed out that information is an important factor influencing the development of China’s energy service industry, Gan [

15] and Ellis [

16] pointed out that China’s energy services industry is in the start-up stage, and they faced with high transaction cost barrier. Based on over 30 interviews of energy service providers, EMCA members and energy experts in Dalian, Beijing, and Baoding in 2011, Kostka and Shin [

17] indicated that the most important factor influencing the EPC’s development is in the high degree of uncertainty and the long-term risk if the ESCO and EU form the mutual trust relationship by the use of asymmetric information theory, transaction costs, and network embeddedness theory.

Houben [

18] noted that a bidirectional moral hazard makes the project value depend not only on their respective efforts but also on the level of cooperation between the two parties through the study of venture investment project success factors. Parker [

19] divided efforts of the two parties of start-ups into individual effects and complementary effects. After the signing of the energy service contract, the parties select efforts in accordance with the outcome of negotiations and cooperate with each other to complete the equipment installation, commissioning, and running, the efforts of the two parties in the construction and implementation of the EPCP are indispensable and cannot be replaced each other. Therefore, the bidirectional moral hazard caused by asymmetric information will affect the complementary effort choices of the parties, the complementary effects caused by the efforts directly affect the probability of the project’s success, and then the robustness of the shared savings contract.

Based on the above background of reality and theory, this paper explores the complementary effort selections of the ESCO and EU under asymmetric information conditions with the given revenue share rules in Qian and Guo [

1], and the effects of those selections on the robustness of the shared savings contract. Furthermore, we discuss how to stimulate the parties to choose the behaviors to improve the contract’s robustness.

This paper is arranged as follows:

Section 2 establishes basic assumptions;

Section 3 analyzes the complementary effect selection problem based on complementary efforts under symmetric and asymmetric information conditions;

Section 4 uses numerical analysis to study the relationship between the contractors’ effort selections and revenue sharing strategies;

Section 5 discusses the key findings and how to motivate contractors to put in more efforts to improve contract robustness;

Section 6 summarizes the study’s conclusions and potential limitations.

2. Basic Assumptions

We follow the concept of robustness of the shared savings contract in Qian and Guo [

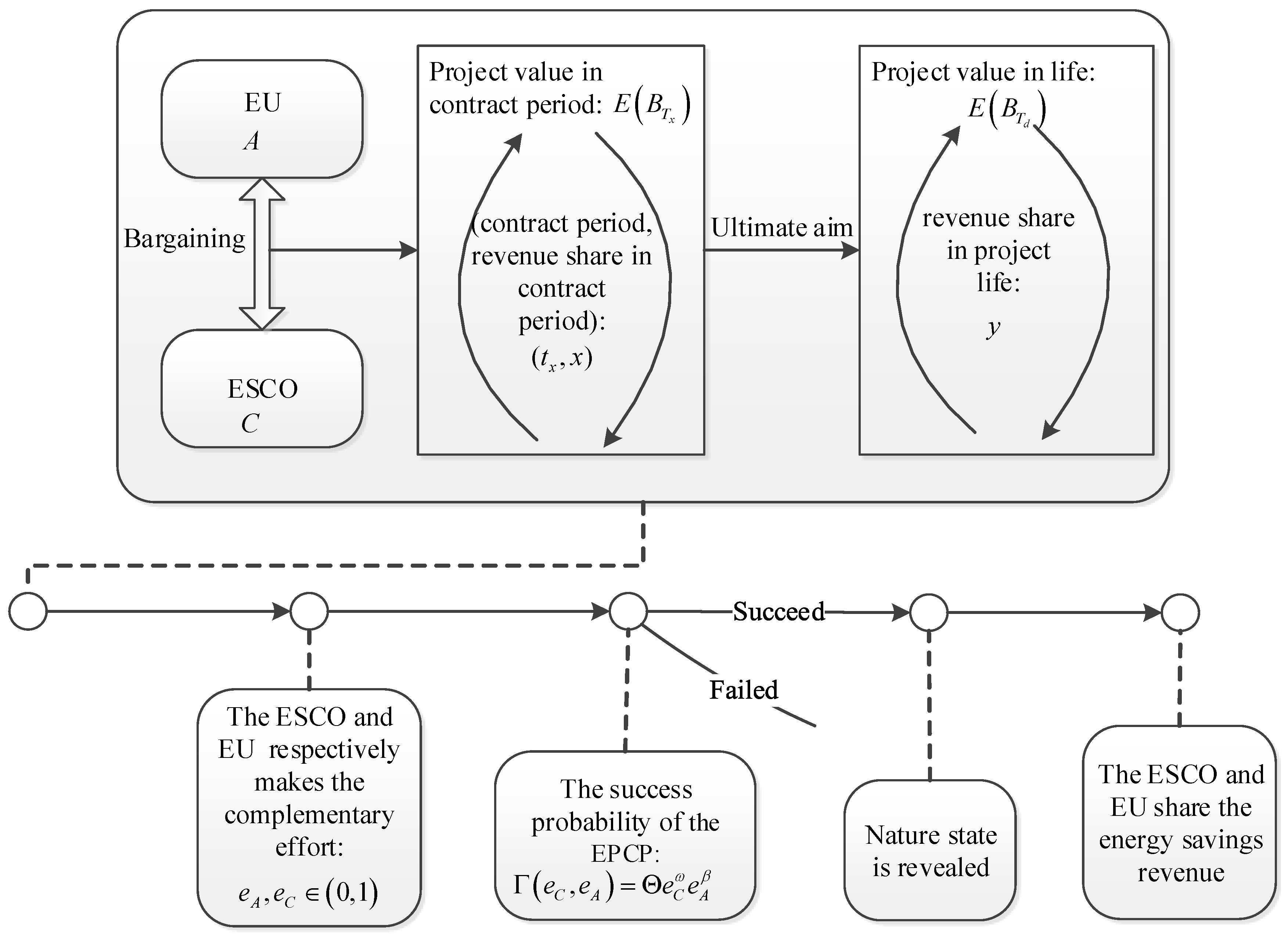

1]. This paper assumes that the negotiating parties share the future energy savings revenue forecast information of the EPCP, and the complementary efforts play the decisive role in the probability of the project’s success (i.e., the probability of the mean of the energy savings’ distribution function during the project operation is the predicted energy savings). This article uses probability to measure the degree of robustness of the shared savings contract. Because in this paper, the committed energy savings is in the distribution function, it can be regarded as a successful project when the project energy savings achieve committed energy savings and the mean of the energy savings’ distribution function is the predicted energy savings. The ESCO bears the cost of the EPCP and bargains with the EU over the contract period and the energy savings revenue-share ratio under the project uncertainty. Ultimately, the parties reach an agreement and then choose the optimal complementary efforts to determine whether the project runs successfully (the execution timing of the contract is shown in

Figure 1, and the parameters and equations are explained in

Section 2.1,

Section 2.2 and

Section 2.3). Based on the above situations, the research contents of this paper are: based on the complementary effects, focus on analyzing the effects of bidirectional moral hazards caused by asymmetric information on the efforts selection of the contractors, and the effect of the complementary effort selection on the success probability of the project. Moreover, the paper explores the incentive strategies to improve the robustness of the shared savings contract under asymmetric information.

2.1. Assumptions of the Project Value

The basic assumptions of the project value are the same as Qian and Guo [

1]. They can be described as follows.

The initial investment cost of the EPCP is , is the initial revenue stream; the investment time is , the building and acceptance period is 0, the contract period ends at time , is the end of the whole life of the project where , we denote , .

It is assumed at time

that the instantaneous cash flow is

,

, and

follows geometric Brownian motion with Poisson Jump:

. where

is the expected growth rate of

;

measures the volatility in

;

follows a Weiner Process

; and

is the increment of a Poisson Process with a constant mean arrival rate

that is independent of

. Thus,

and

is constant and represents the percentage change in

when the incident happens. Then the expected project value in the contract period is [

20]:

, where

is the initial revenue stream and

. The Poisson Jump is implicitly concluded in

and

.

is the risk-adjusted discount rate of return.

is the minimum retention revenue share of

in the project lifetime, where

and

. According to Qian and Guo [

1], there is

.

is the revenue share between the EU (

) and ESCO (

) of the project’s whole lifetime,

is given by the equation

, where

is the number of negotiation rounds,

is the round discount factor to the expected future revenue of

and

. This research builds on the precondition that

is given, we will not introduce the derivation process of

, the detailed derivation process can be seen in Qian and Guo [

1].

is the revenue share in the contract period. the payment function of the ESCO is: , thus, , where , , .

2.2. Assumptions of Project Success Probability

refers to the project value across its whole life when the EPCP runs successfully, but it is 0 if the project fails. The ESCO and EU are the agent and principal, respectively, and both are risk neutral. The probability of the project’s success is denoted by

and depends on the complementary efforts of the parties. The complementary effort degree of the EU is

, the degree of the ESCO is

, and

. Lai and Wang [

21] studied the revenue sharing contracts of new product development, and stated that the Cobb-Douglas function can reflect the complementary relationship between the efforts. Chen et al. [

22] assumed that the complementary effects of entrepreneurs and investors fit the Cobb-Douglas function in their research on venture financing contracts. Thus, this paper uses the Cobb-Douglas functional form to represent the success probability of the project, namely:

where the constant

represents the level of integrated technology (including energy-saving technology, production technology, and management level),

and

represent the marginal contribution rate of the efforts of the EU and ESCO, respectively, and the increase of the probability of success has constant returns to scale from the two efforts. Therefore,

, and without loss of generality, we assume

, meaning that the two sides have the same marginal contributions. It is easy to understand that

, and

, as it shows that when one of the efforts is 0, the project will be a complete failure. It also indicates that the parties cannot completely replace the work of one another, which is in line with the features of complementary efforts. The project success probability function is concave and increases with both efforts and twice differentiable, as described by these functions:

The second-order conditions described above indicate that the marginal efficiency increase of one party’s efforts will cause the other’s to increase, which shows that this probability function can reflect the complementary relationship between the efforts of the EU and ESCO.

2.3. Assumptions of Efforts Costs

Research on the principal-agent problem of venture investment projects usually assume that the cost of efforts from entrepreneurs and investors

can be equivalent to monetary costs, which satisfy

, and

. Rhey set the cost of the effort to

, where

represents a cost coefficient, and its reciprocal is the efficiency coefficient of efforts’ cost [

23]. Because the energy service industry in China is an emerging high-tech and high-risk industry, and ESCOs are mostly small and medium enterprises, EPCPs have strong similarities to general venture investment projects on the project uncertainty. This paper draws on these assumptions and sets the complementary efforts of the ESCO and EU to be

and

, respectively, where both known constants

and

are their cost coefficients. The coefficients reflect their ability to control costs, and the greater the cost coefficient, the higher the cost of effort.

3. Complementary Efforts Selection Model Based on the Contract Robustness

3.1. Utility Functions of the Parties Based on Complementary Effect

According to the basic assumptions, when considering the complementary efforts’ costs of the two sides and

is given, the expected utility functions

and

of the ESCO EU are

The ESCO bears the project cost, so the contract period must be longer than the extreme case: the ESCO gets 100% of the energy savings revenue in the contract period and the revenue is fitly equal to the cost. Combining with the assumptions in

Section 2.1, we can obtain the conditions that

needs to meet:

As observed, the floor of the contract period when considering the effort cost () is higher than that without considering it. Therefore, it will not be feasible to consider revenue sharing strategies without considering the effort cost.

The conditions that the parties’ expected returns need to meet are

According to Equations (5) and (6), which are approximately the ceiling and floor of the revenue share in contract period, there exists

As observed, after considering the efforts’ costs, the negotiation range of the revenue share in the contract period is narrowed. The ceiling of decreases with the rise of the effort and the effort’s cost of the ESCO, while the floor of increases with the rise of the effort and the effort’s cost of the EU.

3.2. Behavior Choices of the Parties under Symmetric Information

In the case of symmetric information, the ESCO and EU can observe mutual behavior choices, and there is no moral hazard. The optimal complementarity efforts of the two sides are the cooperative solutions to the total utility maximization, that is,

According to the first-order condition, the optimal complementarity efforts of the ESCO and EU,

, satisfy the conditions:

By putting Equations (9) and (10) together, the solution is

Expected project revenue and the efforts’ cost coefficients form the forced contracting for the choices of complementary efforts. Under symmetric information, is independent with the revenue share, so the ESCO generates a revenue sharing bargaining strategy without considering the cost of paying complementary efforts. In addition, the degree of complementary efforts both increases with the rise of the expected project revenue, and decreases alongside the increases of the efforts’ cost coefficients, which reflects the complementarity between the two efforts.

The success probability of the project is:

It can be observed that the success probability of the project increases with the rise of the project’s expected revenue and decreases with the rise of the complementary efforts’ cost coefficients of the two parties. Putting Equations (11) and (12) into Equation (7), and combining it with condition (4), we can obtain the ceilings and floors of the revenue shares in different contract periods under optimal efforts and symmetric information.

3.3. Behavior Choices of the Parties under Asymmetric Information

Under asymmetric information conditions, the ESCO and EU are unable to observe the behavior choices of one another, and cannot form the forced contracting for the choices of complementary efforts. In this case, the parties aim to maximize their own utility when choosing their optimal complementarity efforts.

When the revenue share is given, the first order conditions are set by maximizing Formulaes (2) and (3):

By putting the above equations together, we obtain the optimal complementarity efforts

:

From Equation (15), we can see that the bidirectional moral hazard exists under asymmetric information, and the revenue share has impact on the complementary effort choices of the ESCO and EU. Comparing Equations (15) and (11), it can be observed that the optimal efforts under asymmetric information are worse than those under symmetric information. It is easy to see that the degree of their own efforts increases with the increase of their own revenue share, and decreases with the increase of one another’s effort. Both the degree of complementary efforts increase with the rise of the expected project revenue, and decrease with the increases of the efforts’ cost coefficients, which reflects the complementarity between the two efforts.

The probability of the project’s success is

Comparing Equations (12) and (16), we can see that the probability of the project’s success under asymmetric information conditions is worse than that under symmetric information conditions, as there is a two-way moral hazard that erodes the value of the project. It is not difficult to calculate the success probability of the project under asymmetric information: it rises at first and then decreases with the increase of , obtaining a maximum of .

Putting Equations (15) and (16) into Equation (7), and combining contract constraint condition (4), we can obtain the ceilings and floors of the revenue shares in different contract periods under optimal efforts and asymmetric information. Because the efforts of both sides are reduced by comparing with asymmetric information conditions, the floor of the revenue share during contract period decreases and the ceiling increases. Therefore, the revenue share negotiation interval under asymmetric information conditions is larger than it is under symmetric information conditions.

Given the lifetime revenue sharing ratio, the optimal complementary efforts of the ESCO and EU under symmetrical and asymmetrical information conditions can be obtained. According to the observability of the efforts’ cost coefficients, we can reverse-estimate the negotiations interval of the revenue share in different contract periods, which can help to improve the revenue sharing bargaining strategy of the ESCO.

4. Numerical Analysis

In order to demonstrate the impact of the revenue-sharing ratio on the degree of complementarity efforts of the ESCO and EU and the impact of those efforts on the negotiation range of the revenue share more clearly, we use numerical simulation analysis.

The numerical analysis in Qian and Guo [

1] did not consider the costs of complementarity efforts, in order to compare with that, we use the same values of the parameters. So we assume an electricity saving service project with a life expectancy is

; the investment cost is

Yuan, all financed by the ESCO. The hurdle rate of the EU (the bottom line of the revenue share across the project’s entire life) is given by

; the initial revenue stream is

Yuan. The analysis ranges of the remaining parameters are shown in

Table 1. According to the assumptions in

Section 2.1, we can obtain

. Considering the ESCO is the primary participant in the EPCP, we set the efforts’ cost coefficients at

and

; and the level of integrated technology is

because the EPC in China is still at an initial stage.

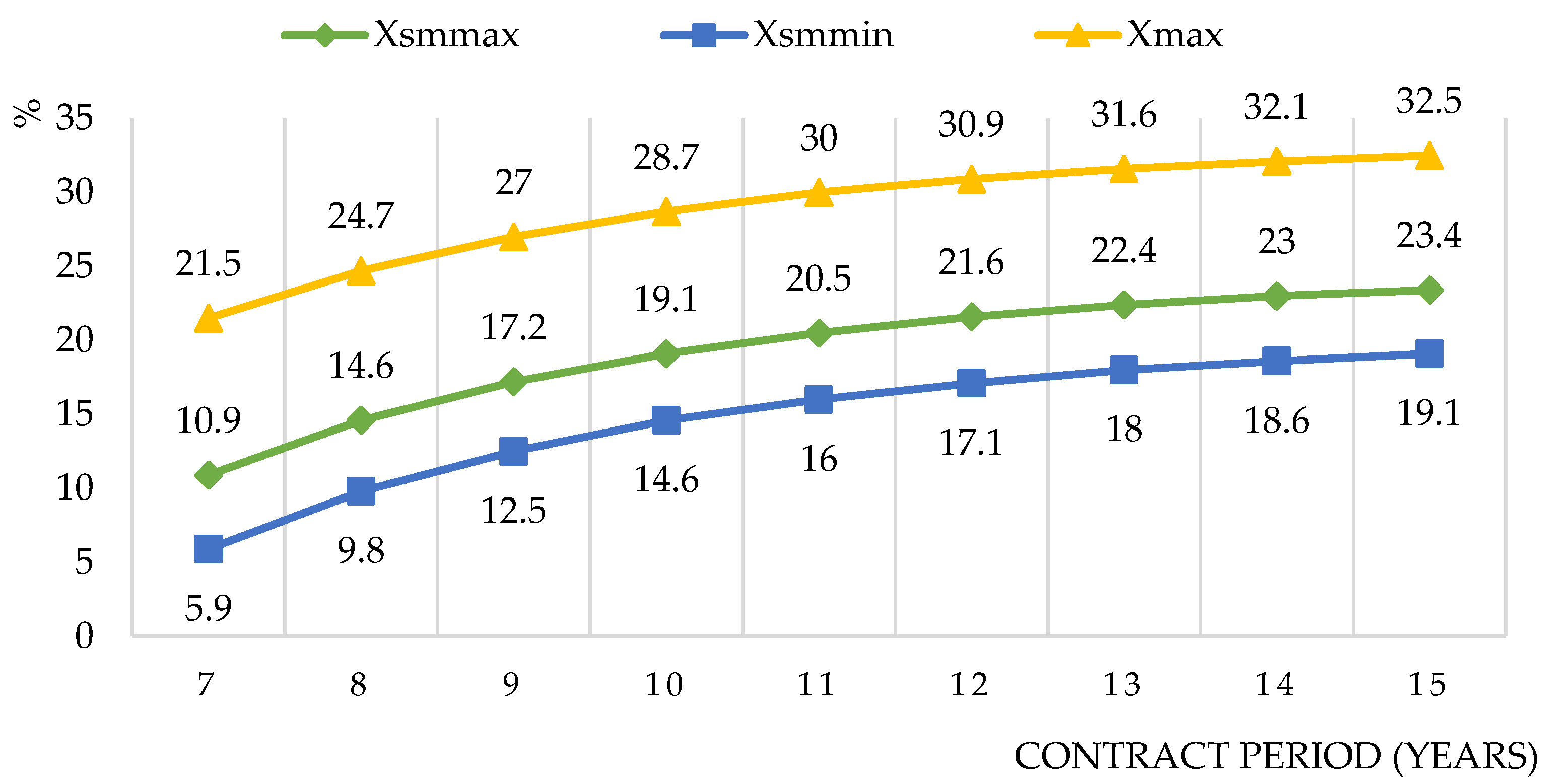

We analyze the behavior selection under symmetric information conditions. We can calculate the optimal degree of complementary efforts of the ESCO and EU by Equation (11), which results in

, and the project’s success probability as calculated by Equation (12) is

. We also calculate the scope of the contract period to be

by condition (4), and compared with Qian and Guo [

1], the floor of the contract period increases from 6 to 7 after considering the complementary efforts. The ceiling and floor of the revenue share during the contract period are

and

respectively according to Equation (7), and we can compare them with the ceiling of the revenue share without considering complementary efforts

[

1], as shown on

Figure 2.

As seen from

Figure 2, the feasible contract period and the revenue share are narrowed when the expected return remains unchanged.

We then analyze the behavior selection under asymmetric information conditions. We can calculate the optimal degree of complementary efforts of the ESCO and EU by Equation (15), which results in

, and the project’s success probability as calculated by Equation (16) is

. We also calculate the scope of the contract period to be

by condition (4), and the floor of the contract period decreases from 7 to 6. The ceiling and the floor of the revenue share during the contract period are

and

respectively, according to Equation (7). The results are as shown on

Figure 3.

As seen from

Figure 3, the revenue sharing interval under asymmetric information conditions is greater than it is under symmetric information conditions, which illustrates that the revenue sharing negotiation risk of the ESCO is also greater under asymmetric information conditions. The probability of the project’s success is revealed to decrease greatly, so in practice the parties should try to reduce information asymmetry.

6. Conclusions

This paper establishes a bidirectional moral hazard model under asymmetric information conditions to analyze the complementary efforts’ selection of the two parties (the ESCO and EU) of the shared savings contract with the given revenue share. In the model, the efforts of the ESCO and EU are not interchangeable, and the success probability of the EPCP is the incrementally concave function of the complementary efforts of the ESCO and EU. Moreover, we use a numerial simulation to discover the differences of the complementary efforts under symmetric and asymmetric information conditions and the impacts of the efforts on the shared savings contract’s robustness. The results show that comparing with symmetric information conditions, the bidirectional moral hazard will erode the project’s value under asymmetric information conditions, the project’s success probability and the level of the parties’ efforts will decrease, which reveals the negative impact of asymmetric information on the robustness of the shared savings contract and the importance of eliminating information asymmetry effectively and incentivizing the parties to increase their degree of complementary efforts to enhance the probability of the project’s success. Finally, we discuss how to motivate contractors to put in more effort to improve contract robustness, and provide policy recommendations regarding the introduction of incomplete contracts, promoting guaranteed savings contracts and improving energy savings audits. The research and the conclusions will be helpful to improve the theoretical research on the contract’s robustness, perfect the design of the energy service contract, and formulate the related support policies.

This paper also has some limitations. First, we do not consider the relationship between the forecast-commitment contract and the effort selections of the parties, this issue can be analyzed in-depth going forward. Second, the complementary efforts analysis of the parties is based on the equal marginal contribution rate, the research in the future can consider the unequal case. Third, the improvement strategy of the contract robustness, which was raised by

Section 5.2, can be studied more systematically.