Analysis of Aluminum Resource Supply Structure and Guarantee Degree in China Based on Sustainable Perspective

Abstract

:1. Introduction

2. Methods

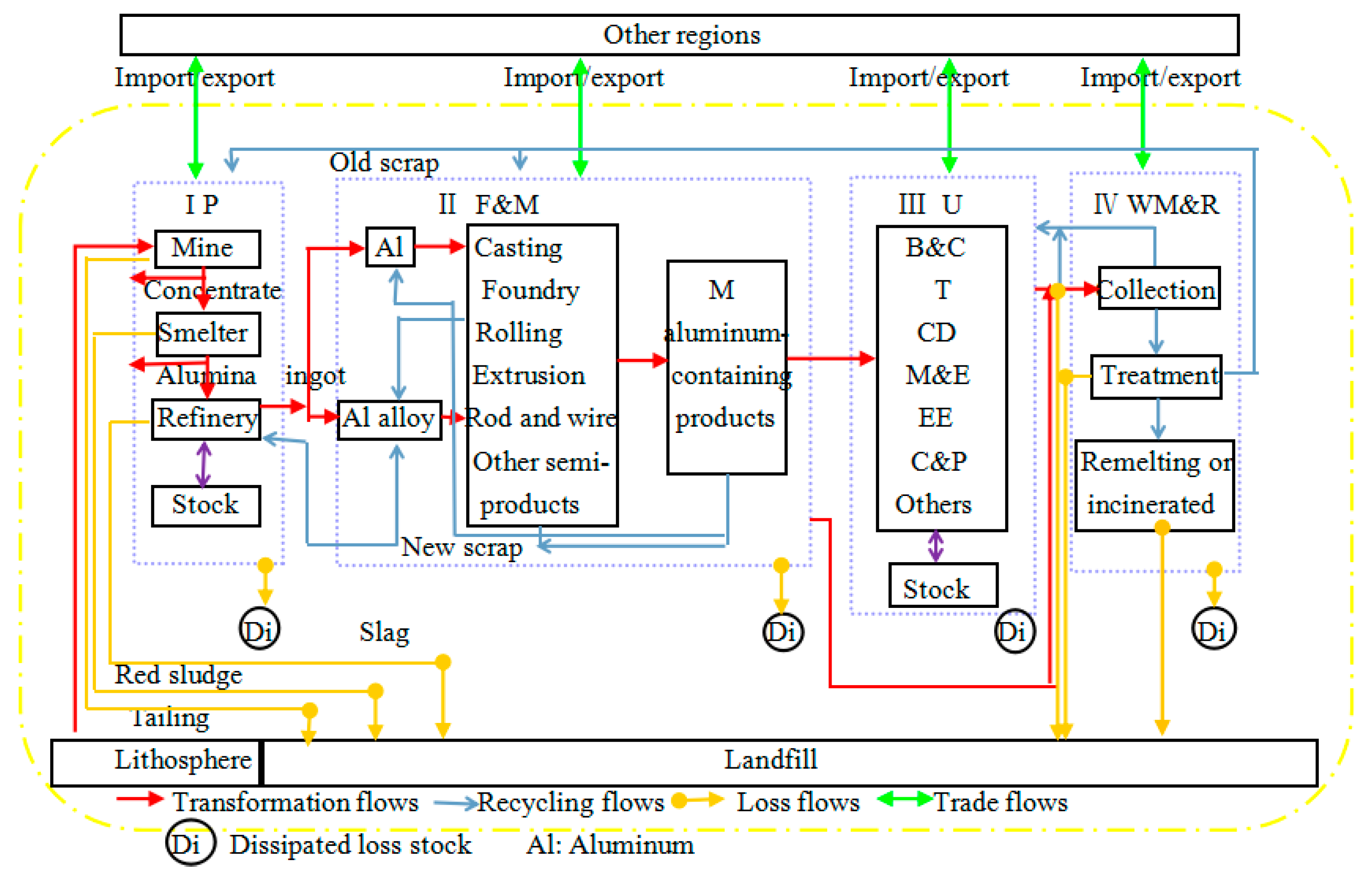

2.1. Substance Flow Analysis (SFA) and Brief Literature Review

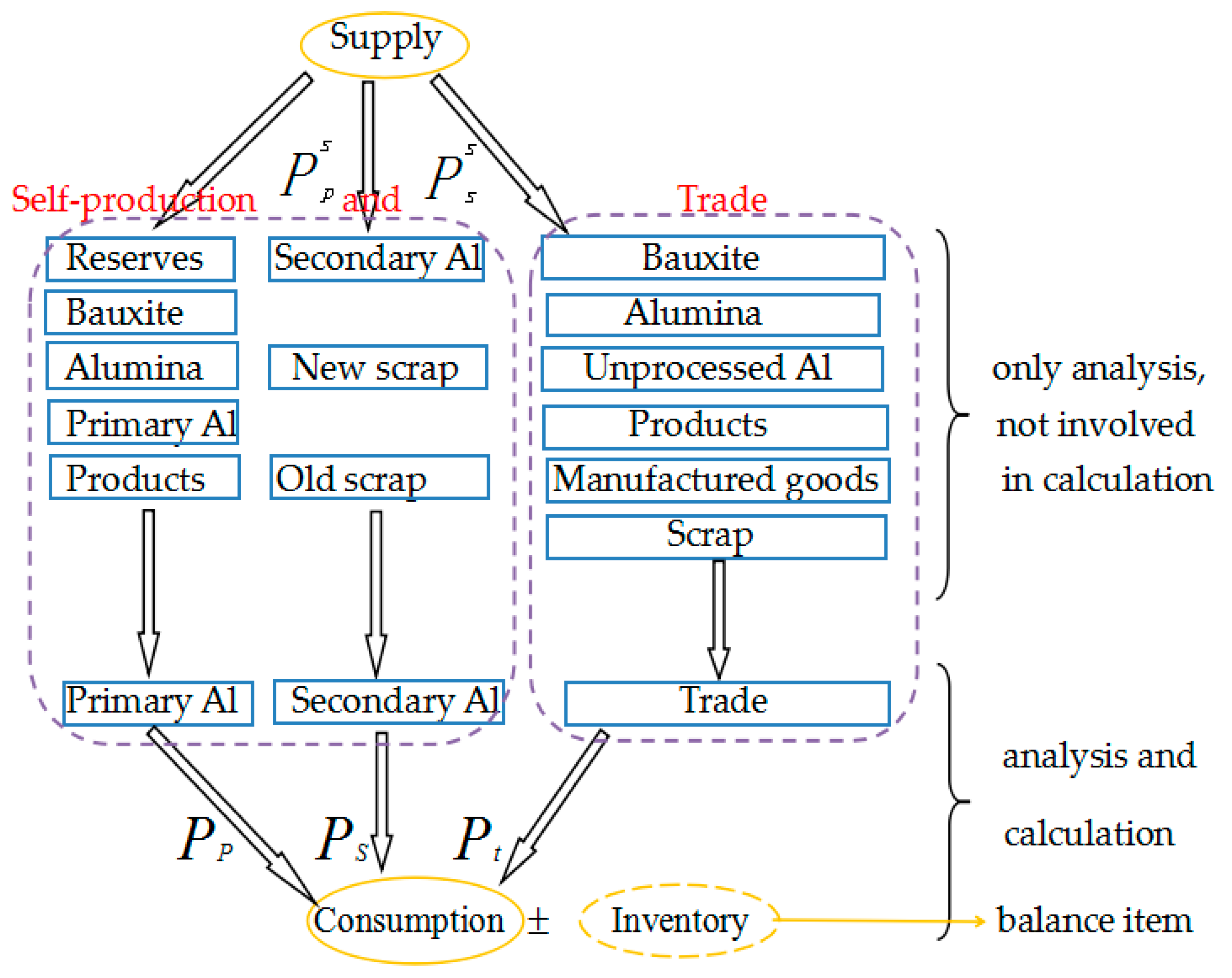

2.2. Supply Structure Model

2.3. Data Compilation and Assumptions

3. Results

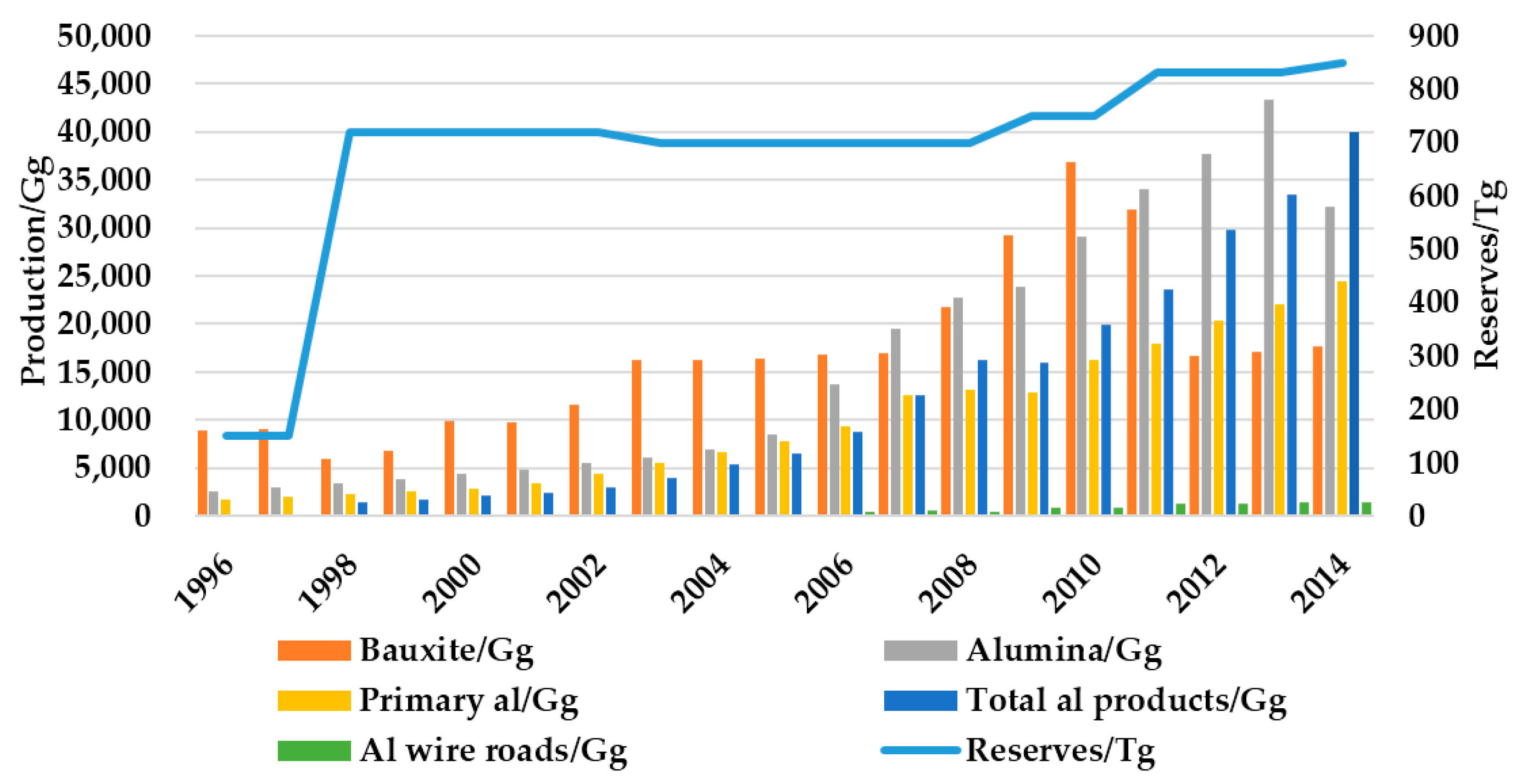

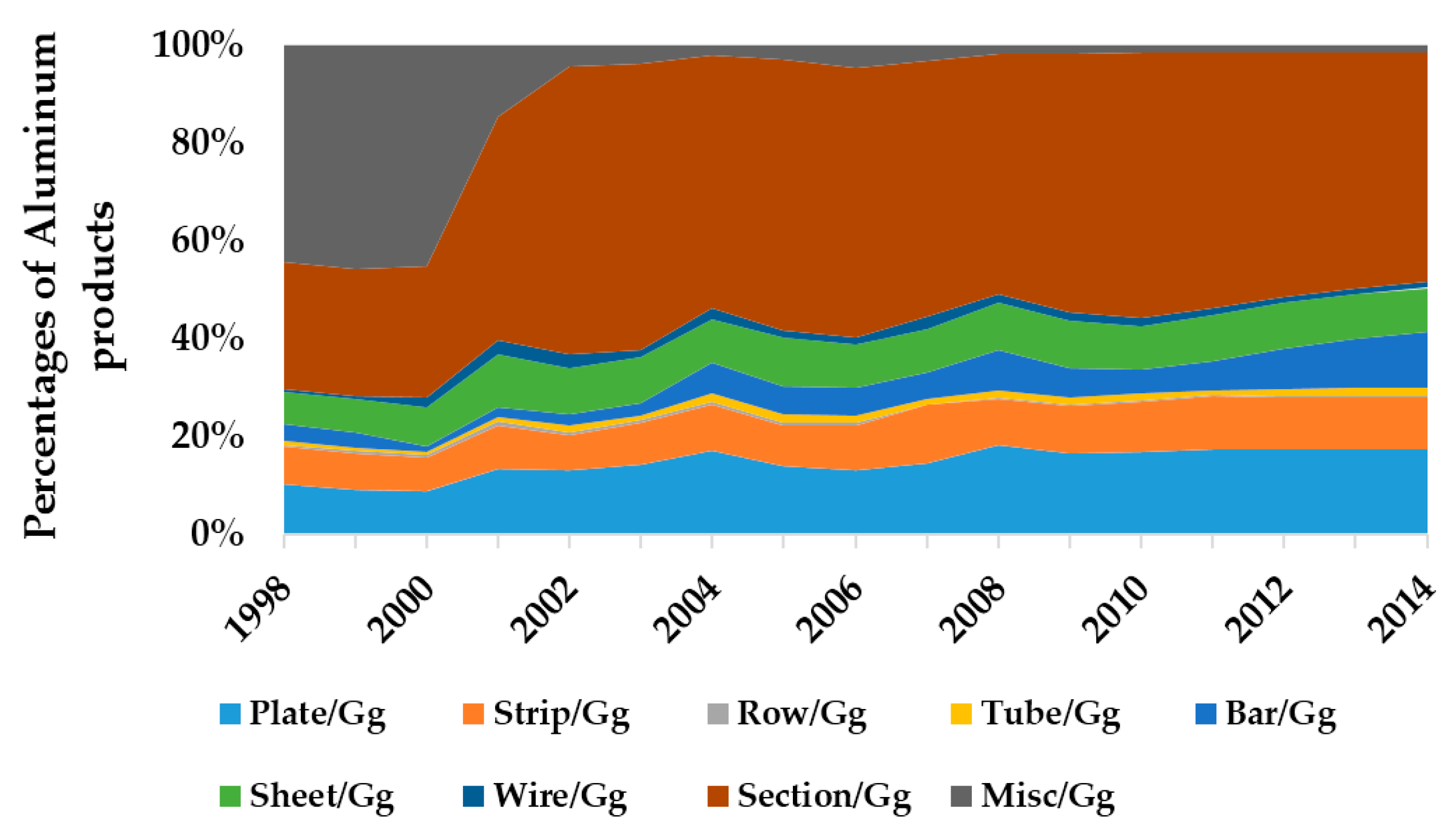

3.1. Domestic Aluminum Supply

3.1.1. Primary Aluminum Supply

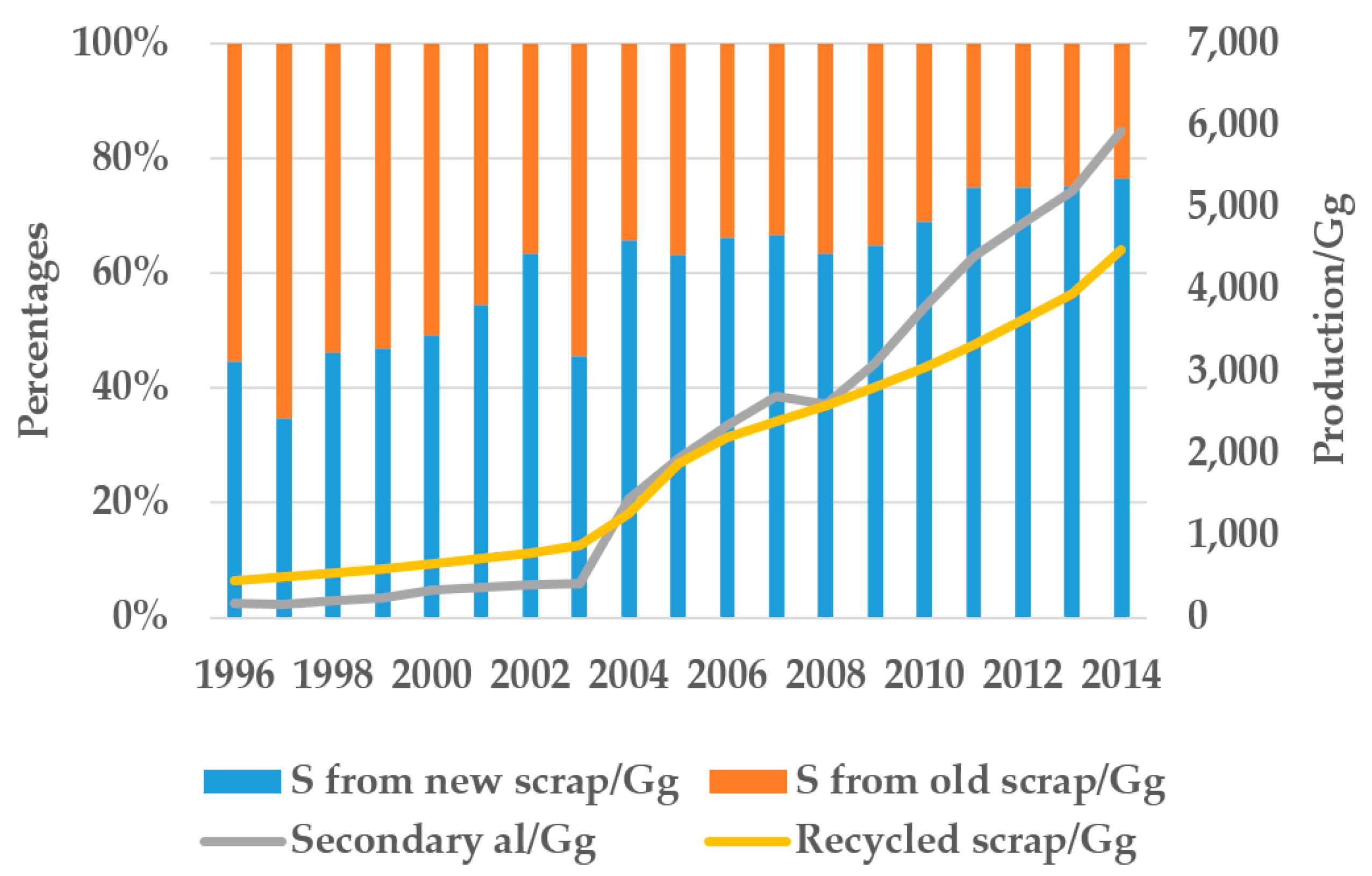

3.1.2. Secondary Aluminum Supply

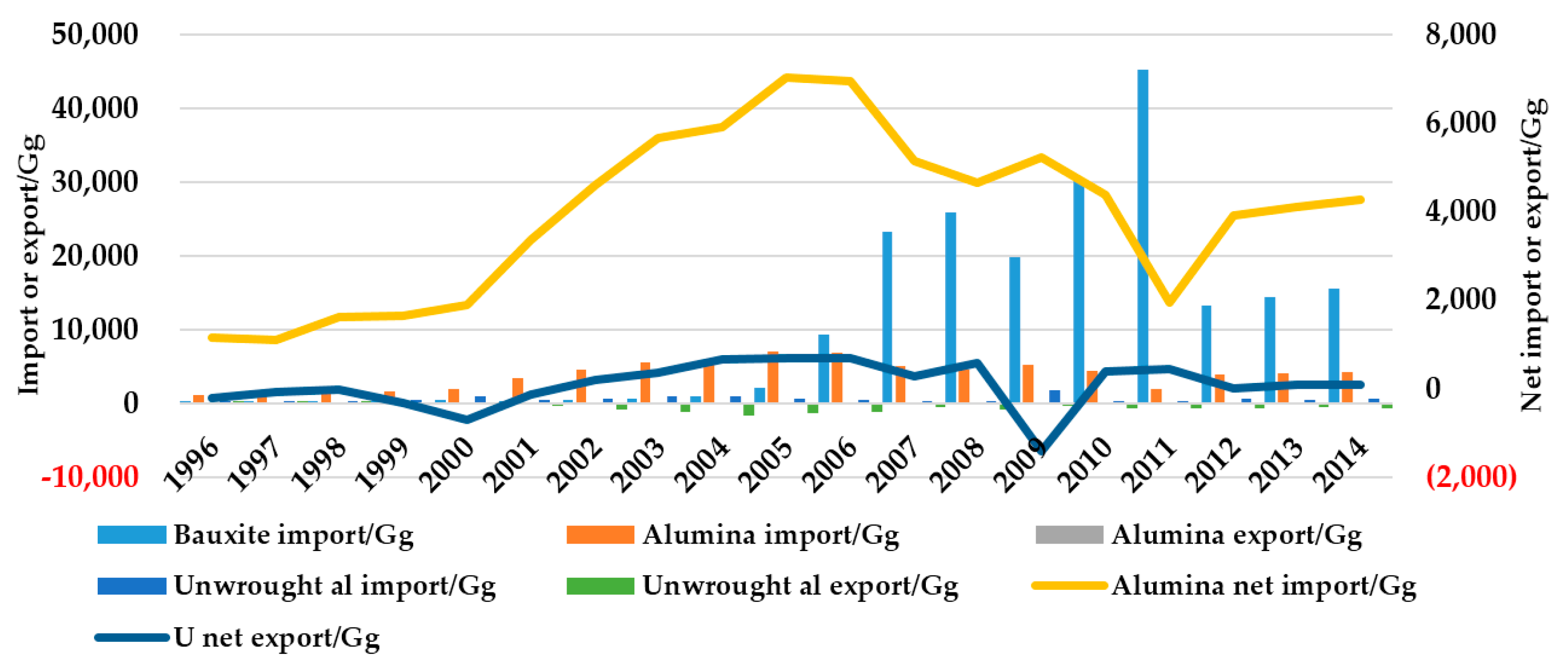

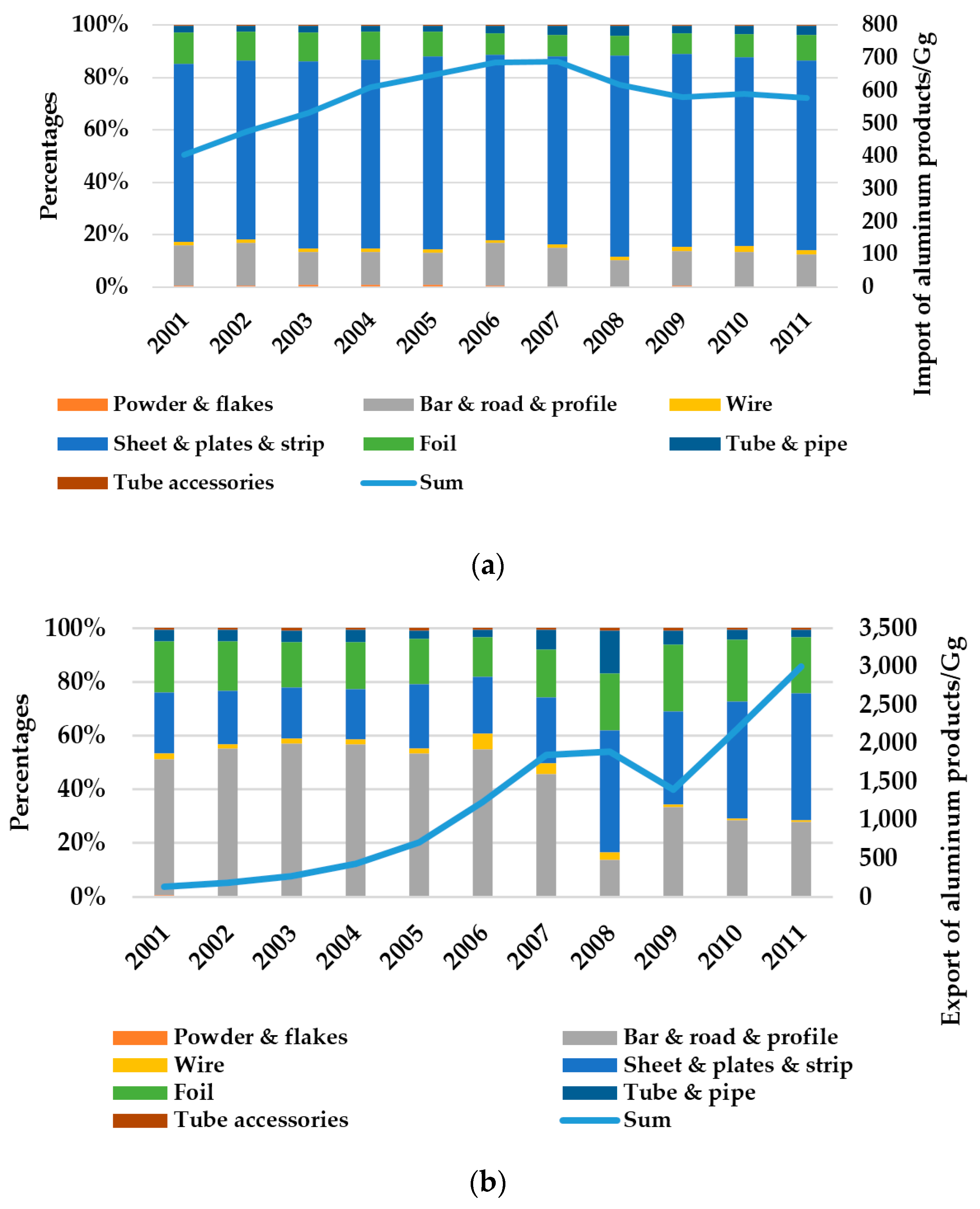

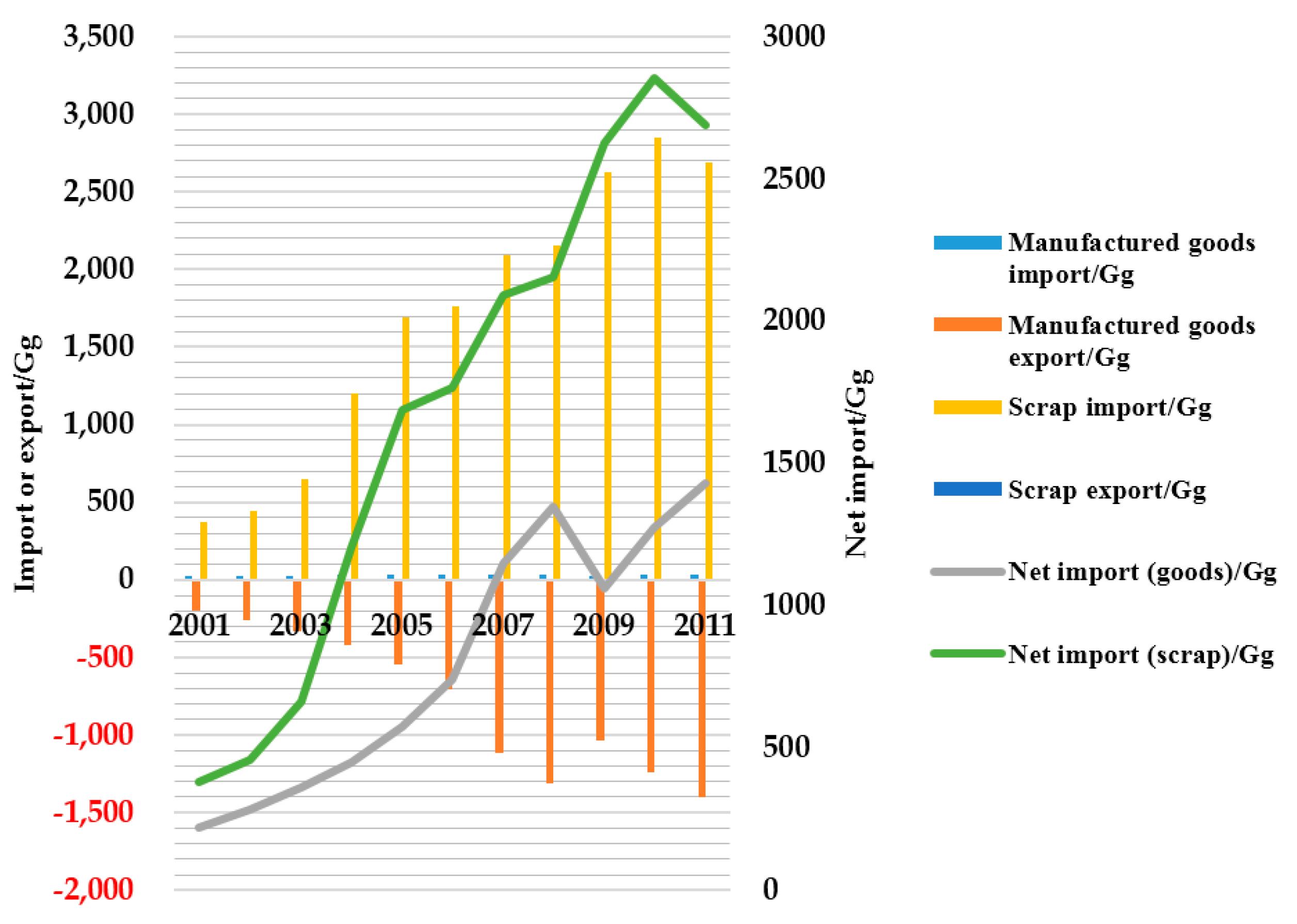

3.2. Trade

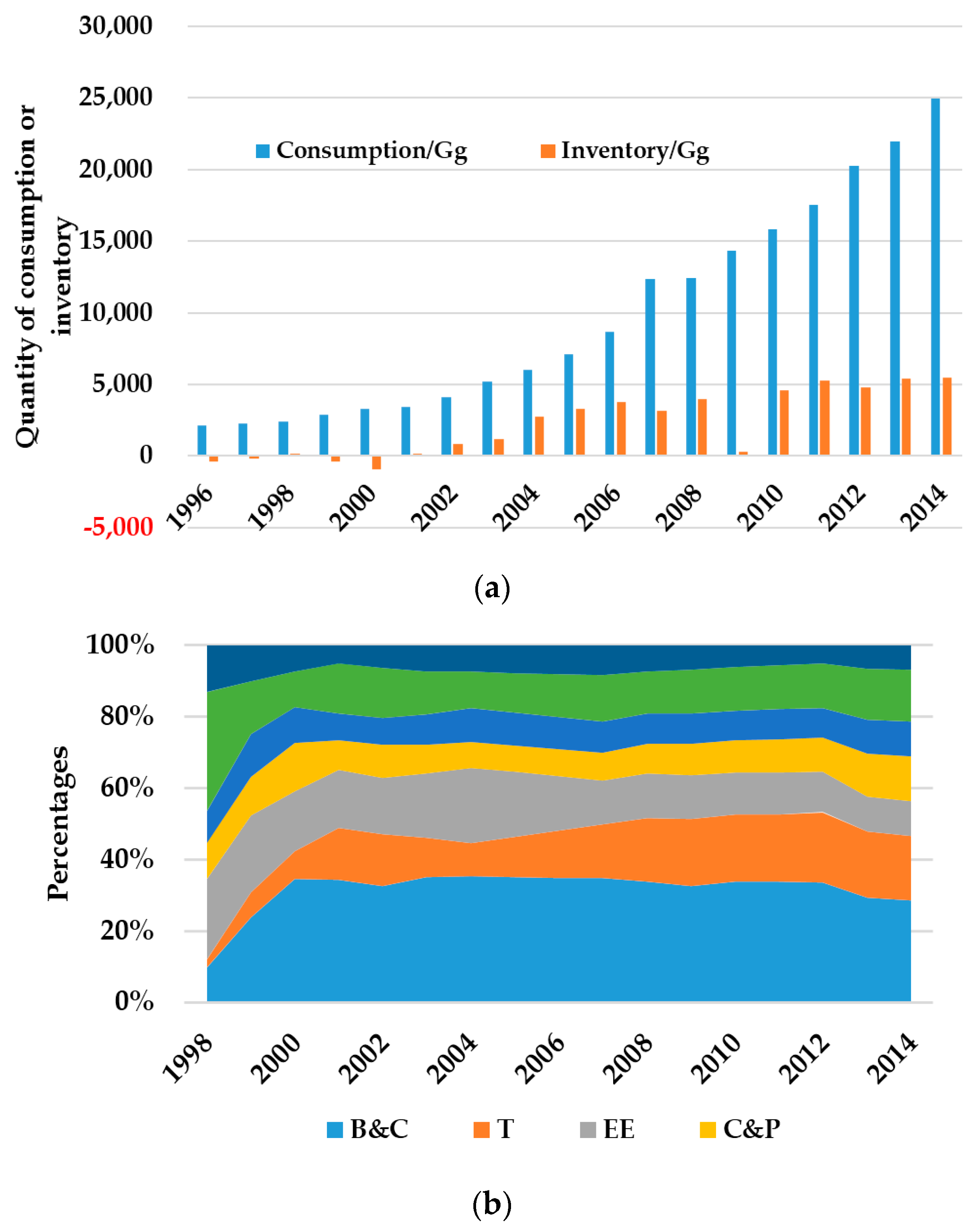

3.3. Domestic Consumption and Inventory

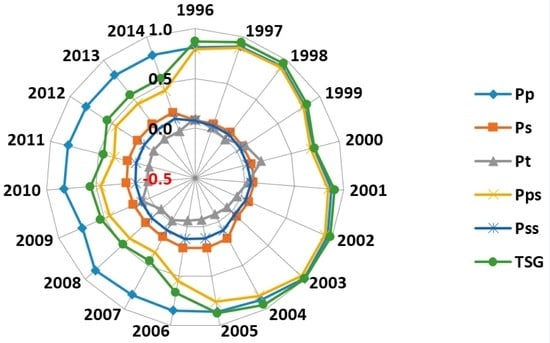

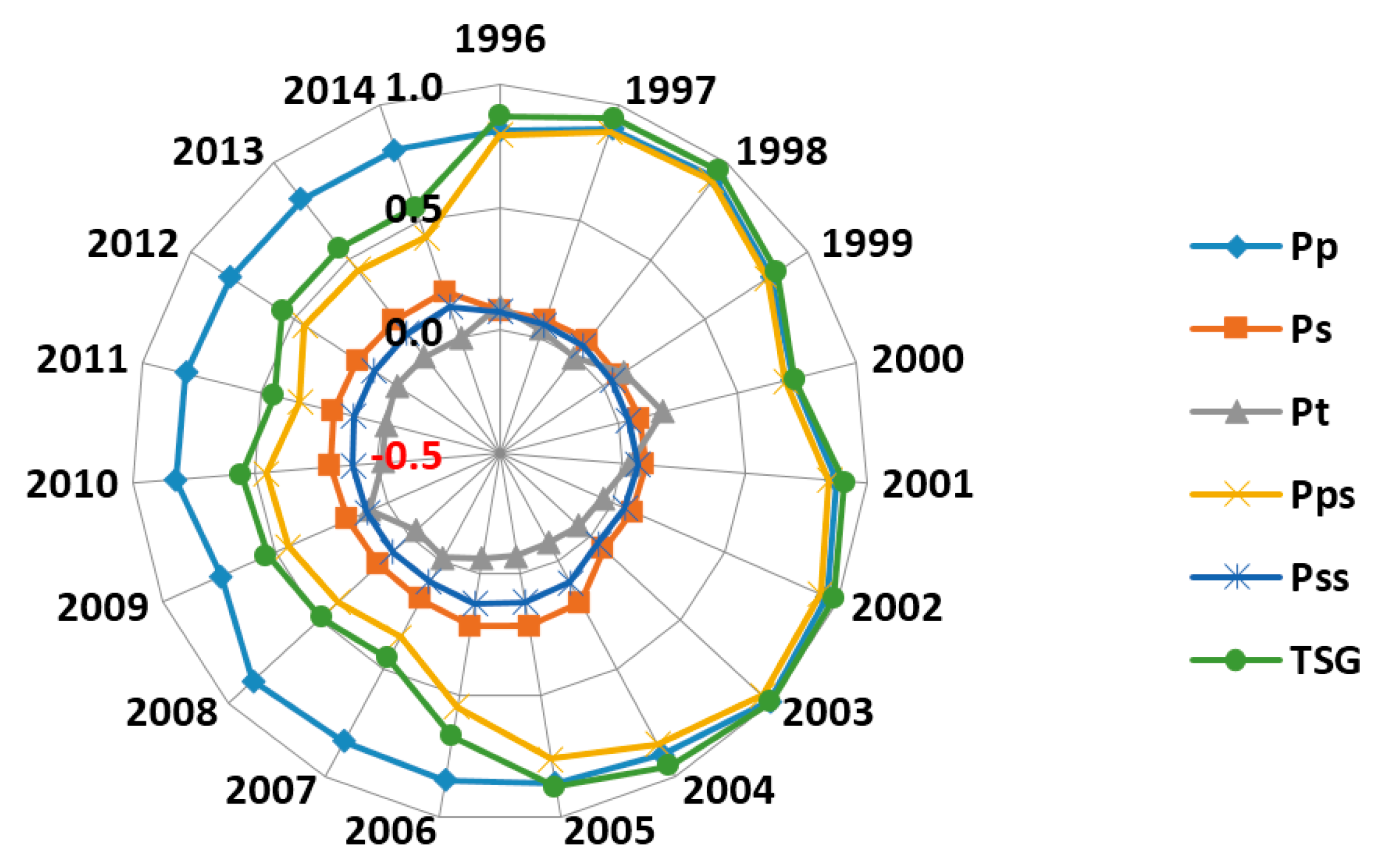

3.4. Supply Structure and Guarantee Degree

3.5. Main Results and Findings

4. Analysis and Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Malthus, T.R.; Chen, Z.Z.; Ou, Y.P.; Long, X.B.; Lv, R. Books Which Have Influenced the History of the World: An Essay on the Principle of Population (Translation in Chinese); Shanxi People’s Publishing House: Taiyuan, China, 2013. [Google Scholar]

- Ricardo, D.; Guo, D.L.; Wang, Y.N. On the Principles of Political Economy and Taxation; Beijing United Publishing Co., Ltd.: Beijing, China, 2013. [Google Scholar]

- Mill, J.S.; Jin, Z.; Jin, Y. Principles of Political Economics; Huaxia Publishing House: Beijing, China, 2013. [Google Scholar]

- Sverdlin, A. Introduction to aluminum. In Handbook of Aluminum; Totten, G.E., MacKenzie, D.S., Eds.; Marcel Dekker, Inc.: New York, NY, USA, 2003; Volume 1, pp. 1–31. [Google Scholar]

- U.S. Geological Survey: Aluminum Statistics and Information. 2016. Available online: http://minerals.usgs.gov/minerals/pubs/commodity/aluminum/ (accessed on 4 May 2016).

- Halvor, K. The aluminum smelting process. J. Occup. Environ. Med. 2014, 56, S2–S4. [Google Scholar]

- Luca, C.; Chen, W.Q.; Fabrizio, P. Historical evolution of anthropogenic aluminum stocks and flows in Italy. Resour. Conserv. Recycl. 2013, 72, 1–8. [Google Scholar]

- Chen, W.Q.; Shi, L.; Chang, X.Y.; Qian, Y. Substance flow analysis of aluminum in China for 1991–2007 (Ι): Trade of aluminum from a perspective of life cycle and its policy implications. Resour. Sci. 2009, 31, 1887–1897. [Google Scholar]

- Chen, W.Q.; Shi, L.; Qian, Y. Substance flow analysis of aluminum in mainland China for 2001, 2004 and 2007: Exploring its initial sources, eventual sinks and the pathways linking them. Resour. Conserv. Recycl. 2010, 54, 557–570. [Google Scholar] [CrossRef]

- Chen, W.Q.; Shi, L. Analysis of aluminum stocks and flows in mainland China from 1950 to 2009: Exploring the dynamics driving the rapid increase in China’s aluminum production. Resour. Conserv. Recycl. 2012, 65, 18–28. [Google Scholar] [CrossRef]

- Gu, S.Q.; Zhu, J.Y.; Yin, Z.L. Study on strategy of China’s aluminum resources sustainable development. In Research Group of China’s Sustainable Development Strategy of Mineral Resources. Study on China’s Sustainable Development Strategy of Mineral Resources: Nonferrous Metals Volume; Science Press: Beijing, China, 2006. [Google Scholar]

- Chen, W.Q.; Shi, L.; Qian, Y. Description of anthropogenic aluminum cycles. Resour. Sci. 2008, 30, 1004–1012. [Google Scholar]

- Liu, G.; Bangs, C.E.; Müller, D.B. Unearthing potentials for decarbonizing the US aluminum cycle. Environ. Sci. Technol. 2011, 45, 9515–9522. [Google Scholar] [CrossRef] [PubMed]

- Liu, G.; Müller, D.B. Addressing sustainability in the aluminum industry: A critical review of life cycle assessments. J. Clean. Prod. 2012, 35, 108–117. [Google Scholar] [CrossRef]

- Chen, W.Q.; Wan, H.Y.; Wu, J.N.; Shi, L. Life cycle assessment of aluminum and the environmental impacts of aluminum industry. Light Met. 2009, 5, 3–10. [Google Scholar]

- Tilton, J.E.; Lagos, G. Assessing the long-term availability of copper. Resour. Policy 2007, 32, 19–23. [Google Scholar] [CrossRef]

- Lu, A.L.; Sun, Z.W.; Zhang, H. Availability analysis of copper resource in China. Resour. Ind. 2010, 12, 12–16. [Google Scholar]

- Yang, B. Analysis and discussion on dependency of overseas market and supply of China non-ferrous metals resources. Miner. Explor. 2013, 4, 8–11. [Google Scholar]

- Rosenau-Tornow, D.; Buchholz, P.; Riemann, A.; Wagner, M. Assessing the long-term supply risks for mineral raw materials—A combined evaluation of past and future trends. Resour. Policy 2009, 34, 161–175. [Google Scholar] [CrossRef]

- Achzet, B.; Helbig, C. How to evaluate raw material supply risks—An overview. Resour. Policy 2013, 38, 435–447. [Google Scholar] [CrossRef]

- Wang, X.B.; Lei, Y.L.; Ge, J.P.; Wu, S.M. Production forecast of China’s rare earths based on the Generalized Weng model and policy recommendations. Resour. Policy 2015, 43, 11–18. [Google Scholar] [CrossRef]

- Wang, G.S.; Han, M. The prediction of the demand on important mineral resources in China. Acta Geosci. Sin. 2002, 23, 483–490. [Google Scholar]

- Xue, Y.Z. Forecast of aluminum consumption based on GM (1, n) model. Met. Mine 2012, 11, 14–18. [Google Scholar]

- Brunner, P.H.; Rechberger, H. Practical Handbook of Material Flow Analysis; Lewis Publishers: Boca Raton, FL, USA, 2004. [Google Scholar]

- Baccini, P.; Brunner, P.H. Metabolism of the Antroposphere; Spinger: Berlin, Germany, 1991. [Google Scholar]

- Wang, T.; Müller, D.B.; Graedel, T.E. Forging the anthropogenic iron cycle. Environ. Sci. Technol. 2007, 41, 5120–5129. [Google Scholar] [CrossRef] [PubMed]

- Zhao, H.C.; Zhang, L.N. Material flow analysis about China aluminum production: Based on data from China’s aluminum industry in 2010. J. North Chin. Univ. Technol. 2014, 26, 1–8. [Google Scholar]

- Chen, W.Q.; Shi, L.; Qian, Y. Aluminum substance flow analysis for mainland China in 2005. Resour. Sci. 2008, 30, 1320–1326. [Google Scholar]

- Chen, W.Q.; Graedel, T.E. Dynamic analysis of aluminum stocks and flows in the United States: 1900–2009. Ecol. Econ. 2012, 81, 92–102. [Google Scholar] [CrossRef]

- Buchner, H.; Laner, D.; Rechberger, H.; Fellner, J. In-depth analysis of aluminum flows in Austria as a basis to increase resource efficiency. Resour. Conserv. Recycl. 2014, 93, 112–123. [Google Scholar] [CrossRef]

- Melo, M.T. Statistical analysis of metal scrap generation: The case of aluminum in Germany. Resour. Conserv. Recycl. 1999, 26, 91–113. [Google Scholar] [CrossRef]

- Boin, U.M.J.; Bertram, M. Melting standardized aluminum scrap: A mass balance model for Europe. J. Metals 2005, 57, 26–33. [Google Scholar] [CrossRef]

- Hatayama, H.; Yamada, H.; Daigo, I.; Matsuno, Y.; Adachi, Y. Dynamic substance flow analysis of aluminum and its alloying elements. Mater. Trans. 2007, 48, 2518–2524. [Google Scholar] [CrossRef]

- Dhalström, K.; Ekins, P. Combining economic and environmental dimensions: Value chain analysis of UK aluminum flows. Resour. Conserv. Recycl. 2007, 51, 541–560. [Google Scholar] [CrossRef]

- Graedel, T.E.; Bertram, M.; Fuse, K.; Gordon, R.B.; Lifset, R.; Rechberger, H.; Spatari, S. The contemporary European copper cycle: The characterization of technological copper cycles. Ecol. Econ. 2002, 42, 9–26. [Google Scholar] [CrossRef]

- Spatari, S.; Bertram, M.; Fuse, K.; Graedel, T.E.; Rechberger, H. The contemporary European copper cycle: 1 year stocks and flows. Ecol. Econ. 2002, 42, 27–42. [Google Scholar] [CrossRef]

- Bertram, M.; Graedel, T.E.; Rechberger, H.; Spatari, S. The contemporary European copper cycle: Waste management subsystem. Ecol. Econ. 2002, 42, 43–57. [Google Scholar] [CrossRef]

- Rechberger, H.; Graedel, T.E. The contemporary European copper cycle: Statistical entropy analysis. Ecol. Econ. 2002, 42, 59–72. [Google Scholar] [CrossRef]

- Reck, B.R.; Bertram, M.; Müller, D.B.; Graedel, T.E. Multilevel anthropogenic cycles of copper and zinc: A comparative statistical analysis. J. Ind. Ecol. 2006, 10, 89–110. [Google Scholar] [CrossRef]

- Daigo, I.; Hashimoto, S.; Matsuno, Y.; Adachi, Y. Material stocks and flows accounting for copper and copper-based alloys in Japan. Resour. Conserv. Recycl. 2009, 53, 208–217. [Google Scholar] [CrossRef]

- Reck, B.R.; Müller, D.B.; Rostkowski, K.; Graedel, T.E. Anthropogenic nickel cycle: Insights into use, trade, and recycling. Environ. Sci. Technol. 2008, 42, 3394–3400. [Google Scholar] [CrossRef] [PubMed]

- Graedel, T.E.; van Beers, D.; Bertram, M.; Fuse, K.; Gordon, R.B. The multilevel cycle of anthropogenic zinc. J. Ind. Ecol. 2005, 9, 67–90. [Google Scholar] [CrossRef]

- Guo, X.Y.; Zhong, J.Y.; Song, Y.; Tian, Q.H. Substance flow analysis of zinc in China. Resour. Conserv. Recycl. 2010, 54, 171–177. [Google Scholar] [CrossRef]

- Mao, J.S.; Dong, J.; Graedel, T.E. The multilevel cycle of anthropogenic lead I. Methodology. Resour. Conserv. Recycl. 2008, 52, 1058–1064. [Google Scholar] [CrossRef]

- Mao, J.S.; Dong, J.; Graedel, T.E. The multilevel cycle of anthropogenic lead II. Recults and Discussion. Resour. Conserv. Recycl. 2008, 52, 1050–1057. [Google Scholar] [CrossRef]

- Johason, J.; Jirikowic, J.; Bertram, M.; van Beers, D.; Gordon, R.B. Contemporary anthropogenic silver cycle: A multilevel analysis. Environ. Sci. Technol. 2005, 39, 4655–4665. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, J.N. Substance flow analysis of phosphorus cycle system in China. Chin. Environ. Sci. 2006, 26, 238–242. [Google Scholar]

- Liu, Y.; Chen, J.N. Substance flow analysis on phosphorus cycle in Dianchi basin, China. Environ. Sci. 2006, 27, 1549–1553. [Google Scholar]

- Hoyle, G. Recycling opportunities in the UK for aluminum-bodied motor cars. Resour. Conserv. Recycl. 1995, 15, 181–191. [Google Scholar] [CrossRef]

- Gesing, A.; Wolanski, R. Recycling light metals from end-of-life vehicle. JOM 2001, 53, 21–23. [Google Scholar] [CrossRef]

- Müller, D.B. Stock dynamics for forecasting material flows-case study for housing in the Netherland. Ecol. Econ. 2006, 59, 142–156. [Google Scholar] [CrossRef]

- Modaresi, R.; Müller, D.B. The role of automobiles for the future of aluminum recycling. Environ. Sci. Technol. 2012, 46, 8587–8594. [Google Scholar] [CrossRef] [PubMed]

- Gu, Y.F.; Wu, Y.F.; Xu, M.; Mu, X.Z.; Zuo, T.Y. Waste electrical and electronic equipment (WEEE) recycling for a sustainable resource supply in the electronics industry in China. J. Clean. Prod. 2016, 127, 331–338. [Google Scholar] [CrossRef]

- Gu, Y.F.; Wu, Y.F.; Xu, M.; Wang, H.D.; Zuo, T.Y. The stability and profitability of the informal WEEE collector in developing countries: A case study of China. Resour. Conserv. Recycl. 2016, 107, 18–26. [Google Scholar] [CrossRef]

- Cheng, C.Y. Study on the Development Strategies of China’s Aluminum Industry from the Background of Economic Transition. Master’s Thesis, China University of Geosciences, Beijing, China, 28 May 2013. [Google Scholar]

- World Bureau of Metal Statistics: World Bureau Metals Database. Available online: http://www.world-bureau.co.uk/index.html (accessed on 7 December 2016).

- China Nonferrous Metals Industry Association. China Nonferrous Metals Industry Yearbook 1997–2015; China Nonferrous Metals Industry Yearbook Press: Beijing, China.

- Quinkertz, R.; Rombach, G.; Liebig, D. A scenario to optimise the energy demand of aluminum production depending on the recycling quota. Resour. Conserv. Recycl. 2001, 33, 217–234. [Google Scholar] [CrossRef]

- Qiu, Z.S. The Chinese Primary Aluminum Consumption Analysis and Future Consumption Demand Forecasting. Master’s Thesis, Yunnan University, Kunming, China, 19 November 2010. [Google Scholar]

- Chen, W.Q.; Graedel, T.E. Improved alternatives for estimating in-use material stocks. Environ. Sci. Technol. 2015, 49, 3048–3055. [Google Scholar] [CrossRef] [PubMed]

- Rauch, J.N. Global mapping of Al, Cu, Fe, and Zn in-use stocks and in-ground resources. Proc. Natl. Acad. Sci. USA 2009, 106, 18920–18925. [Google Scholar] [CrossRef] [PubMed]

- Takahashi, K.I.; Terakado, R.; Nakamura, J.; Adachi, Y.; Elvidge, C.D.; Matsuno, Y. In-use stock analysis using satellite nighttime light observation data. Resour. Conserv. Recycl. 2010, 55, 196–200. [Google Scholar] [CrossRef]

- Hattori, R.; Horie, S.; Hsu, F.C.; Elvidge, C.D.; Matsuno, Y. Estimation of in-use steel stock for civil engineering and building using nighttime light images. Resour. Conserv. Recycl. 2013. [Google Scholar] [CrossRef]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, S.; Li, X.; Wang, M. Analysis of Aluminum Resource Supply Structure and Guarantee Degree in China Based on Sustainable Perspective. Sustainability 2016, 8, 1335. https://doi.org/10.3390/su8121335

Liu S, Li X, Wang M. Analysis of Aluminum Resource Supply Structure and Guarantee Degree in China Based on Sustainable Perspective. Sustainability. 2016; 8(12):1335. https://doi.org/10.3390/su8121335

Chicago/Turabian StyleLiu, Shaoli, Xin Li, and Minxi Wang. 2016. "Analysis of Aluminum Resource Supply Structure and Guarantee Degree in China Based on Sustainable Perspective" Sustainability 8, no. 12: 1335. https://doi.org/10.3390/su8121335

APA StyleLiu, S., Li, X., & Wang, M. (2016). Analysis of Aluminum Resource Supply Structure and Guarantee Degree in China Based on Sustainable Perspective. Sustainability, 8(12), 1335. https://doi.org/10.3390/su8121335