Abstract

Examining the interrelationships among critical success factors (CSFs) for public private partnership (PPP) projects is of importance for improving PPP project performance and maintaining the sustainability of PPP project implementation. Previous studies mostly focused on the identification of the CSFs for PPP projects; limited studies investigated the interrelationships among CSFs. Hence, the research objectives are (a) to determine the interrelationships among CSFs of PPP projects taking into account the public and (b) to identify influence paths contributing to take advantage of CSFs in the process of PPP implementation. A literature review and expert interviews were adopted to construct the CSFs framework; nine hypotheses were constructed and tested by the structural equation modelling (SEM) based on the data collected from a questionnaire survey. This research reveals that the relationship between public and private partners is the leader-follower relationship, not the partnership relationship, in PPP projects, indicating that the responsibilities, power or resources existing among partners are very unequal. It also highlights that public involvement has a negative effect on the process of service provisions, and costs and risks exist in the process of public involvement in PPP projects. The determined interrelationships among CSFs will contribute to the sustainability and success of a PPP project.

1. Introduction

The pressure of increased inefficiency in public service provision, fiscal constraints and public demands have led to a growing number of associations between public and private sectors for service provision and maintaining the sustainability of infrastructure projects [1,2]. Public-private partnerships (PPP) have become the mechanism for governments to attract and leverage private investment to provide public services [3,4]. Although there have been many successes and some failures in PPP projects reported in the normative literature [5,6], the debate about their use has moved from ideological arguments about their strengths and weaknesses to a focus on how they can be constructed to achieve public policy goals [7]. Numerous studies on the advantage of PPP have been conducted over the decades, but the sustainability of a PPP is the most critical aspect [8,9]. The sustainability of a PPP involves social sustainability, financial sustainability, performance sustainability and partnership sustainability, which depend on the long-term willingness of all stakeholders, the project’s viability or the discounted cash flow analysis, performance-based evaluation and partners’ satisfaction assessment [4,9,10]. What is more, research on the success factors for affecting the application and implementation of PPP is important for public service provisions and achieving the sustainability of a PPP [3,8,11]. Therefore, the PPP success factors and their interrelationships are examined to provide some helpful evidence for PPP sustainability.

Various factors influence PPP project success to varying degrees; some factors and their interactions might cause the inefficiency and ineffectiveness of the projects and hinder efficient allocation of limited resources, whereas certain factors are more critical to a project’s success than others [12,13,14]. Certain factors are more critical to a project’s success and need to be highly valued for cooperation partners to integrate resources and qualities to create new benefits. The term “critical success factor” (CSF) was first introduced in information management [15], and Tiong et al. [16] then applied the term in the build-operate-transfer (BOT) projects for winning contracts. They defined CSFs as those characteristics that have a significant impact on project success. The last decades have witnessed a growing interest in PPP CSFs, and relevant studies developed in different areas, such as the conceptual framework or review [17,18], PPP CSFs’ identification [19], risk management [12,20,21,22], relationship management [23], organization management [24,25], separating CSFs for different phases of projects [8,26,27] or for projects of different types [28], have all been extensively explored by researchers worldwide. Since 1990, more and more researchers have employed different methodologies or statistical techniques to study the PPP projects’ CSFs from different countries or regions [26,29,30,31].

The current literature on PPP CSFs, although providing important insights into these issues, suffers from three main limitations. First, it is fragmented among several research streams, such as the conceptual framework, risk management, relationship management, financial viabilities and procurement; it lacks the attention given to the need for summarizing and analysing the key findings identified in previous studies irrespective of the phase of the PPP project and the project model adopted [17]. In addition, because of the limitation of many statistical techniques, the interrelationships among PPP CSFs are not easily identified [12], which makes it difficult for cooperation partners to take better advantage of the PPP CSFs. Second, existing studies on PPP tend to focus on its advantage or application in practice, while ignoring the difference in the characteristics of the partnership that are important to their success or failure. Although a partnership can enable both partners to achieve positive externalities, cost minimization and partnership synergy in PPP projects [7,32], different forms of partnerships have some differences in characteristics, and both partners will behave in different ways in different partnerships because of inherent tensions between private rent-driven objectives and public benefit [7,33,34], such as the unequal power or resource allocation among the public sector and private sector in a leader-follower partnership relationship [35]; for example, because of the frequently-changing attitudes of the local government, the Qingdao Veolia Wastewater Project in China took an extended time for contract negotiations that resulted in high transaction costs [6]; the powerful government assumed a leadership role in this case such that the private partner followed the decision-making of the government; and like the “Bird Nest” (2008 Olympiad Games Gymnasium), in which the Beijing municipal government took back the franchise because of excessive commercialism from the private sector in China [36], the profit-maximization aims of the private firm ruined the partnership so that the PPP project ended in failure. Therefore, identifying the form of partnership is very important for PPP success and maintaining a sustainable partnership in PPP projects. Finally, existing studies on CSFs in PPP tend to focus on cooperation partners, cooperative environment and the process of service provision, while ignoring the public or marginalization of the public [37], as well as the lack of study on the role and impact of public involvement in PPP projects [38]. Public involvement can play an active role in service delivery [39,40], and the attitudes, intentions or behaviours of the public toward the PPP projects, products or services are very important for project success or failure, such as 16 failed PPP projects in China [41] and six PPP projects in Finland [42]. Therefore, the public is an essential element for analysing the PPP CSFs, and public engagement also contribute to constructing a long-term partnership relationship and delivering a sustainable and resilient service.

Although there are many research topics in PPP that are worthy of analysis, the scope of our study is limited to three points, that is (a) to refine and construct the CSFs’ framework of PPP projects taking into account public involvement, (b) to identify and analyse the relationship between public and private sectors so as to understand the form of partnership and (c) to determine and verify the interrelationships among CSFs for PPP project implementation.

2. Critical Success Factors of PPP in Infrastructure Projects

In 2001, Qiao et al. summarized the CSFs in Chinese BOT projects and divided 27 identified factors into six categories from the project phase: the preliminary qualification evaluation phase, the tendering phase, the concession award phase, the construction phase, the operation phase and the transfer phase [43]. Jamali refined 14 key ingredients of effective collaboration in the PPP project [44]. Li et al. refined the research of CSFs in PPP/PFI (private finance initiative) projects in the United Kingdom, and 18 identified factors were classified into five groups: effective procurement, the implementability of a PPP project, government guarantee, favourable economic conditions and available financial markets [12]. Five categories were classified from 47 identified factors by Zhang, which respectively were economic viability, appropriate risk allocation via reliable contractual arrangements, sound financial package, favourable investment environment and a reliable concessionaire consortium with strong technical strength [13]. Jefferies developed a CSF framework and also identified 23 factors from relevant literature and a case study on the Sydney SuperDome project [45]. According to the interviewees’ comments on the importance level of PPP success factors, Jacobson and Choi identified 10 high-level factors: unifying specific vision, commitment, open communication and trust, willingness to compromise/collaborate, respect, community outreach, political support, expert advice and review, risk awareness and clear roles and responsibilities [46]. Considering the views from Chinese experts, Chan et al. applied the factor analysis technique to identify 18 CSFs, and then, these CSFs were divided into five groups: stable macroeconomic environment, shared responsibility between public and private sectors, transparent and efficient procurement process, stable political and social environment and judicious government control [29]. Based on four transfer-operate-transfer (TOT) case studies in the Chinese water supply industry, Meng et al. refined the eight most important factors for TOT projects, which included project profitability, asset quality, fair risk allocation, competitive tendering, internal coordination within government, employment of professional advisors, corporate governance and government supervision [47]. Babatunde et al. identified 17 CSFs, and the top three were availability of a suitable financier market, sound economic policy and good governance [30]. Ismail identified 18 CSFs of PPP implementation in Malaysia, and the top three were good governance, commitment of the public and private sectors and a favourable legal framework [48]. Kahwajian et al. identified 19 CSFs of PPP projects in Syria, and these CSFs were divided into four categories (i.e., public sector, private sector, administration environment and investment environment) in the Ishikawa Diagram [19]. Osei-Kyei and Chan reviewed and analysed the existing research on PPP CSFs from 1990 to 2013, and the findings showed that the top three CSFs were appropriate risk allocation and sharing, a strong private consortium and political support [17].

Numerous studies have been conducted by previous researchers to determine and assess the success factors of the PPP project. Additionally, these existing factors are good references for studying the sustainable implementation of the PPP project. Among them, all of the CSFs mainly involved four types, i.e., the public sector-related factor [11,17,29], the private sector-related factor [12,13], the environment-related factor [26,29,30] and the factor of the process of services provision [11,16,45,47,49]; these findings are also good references for determining the CSFs and questionnaire design. However, all of the previous studies determined the critical success factor for the PPP project, but the interrelationships among CSFs were ignored; and the variable of the public in PPP is also not included in the CSF framework constructed in the previous research. Therefore, this research will try to identify and analyse the interrelationships among CSFs in the PPP project, taking into account the public.

Although the tentative factor list is identified from leading international journals or books, not all of them are fit for the Chinese context. Thus, seven professors from Beijing (Beijing Jiaotong University), Chongqing (Chongqing University), Jiangsu (Southeast University), Shanghai (Tongji University), Tianjin (Tianjin University), Zhejiang (Zhejiang University) and Liaoning (Dalian University of Technology) were invited to make comments on the tentative list. These respondents were invited not just because they have much knowledge of PPP nationwide, but also, they have a good relationship with practitioners, such as a teacher for PPP training or enterprise consultants. Their comments and suggestions help screen those unsuitable factors and add some factors that contribute to the research. Feedback from the professors was well analysed and discussed by the research group. If a factor were supported by four or more respondents, it would be retained or added; on the contrary, if a factor were rejected by four or more respondents, it would be deleted accordingly. As a result, twenty-nine factors are presented in Table 1.

Table 1.

Critical success factors for public private partnership (PPP) infrastructure projects.

As shown in Table 1, the CSFs, X7, X8, X10 and X27, were identified and refined based on the feedback of the professors or a few scattered pieces of information from previous studies; the others are from the literature review. The factor “strong private consortium” is the critical success factor for the PPP project that was supported by many scholars; we also support it. However, in order to further analyse the private sector’s characteristics, of seven professors that we invited, five professors suggested that specifying the characteristic of a strong private consortium is important to select the private partner in the bidding process; thus, X7, X8 and X10 are added to explain the strong private consortium, and the results of Cheung et al., Liu et al. and Li et al. also provided some similar evidence for the importance of the capabilities of fulfilling the contract, financial abilities and project experience in PPP projects [11,12,27]. In addition, reasonable services price (X27) was added to measure the project profitability or revenue based on the discussion of the professor that we invited; a project with good profitability or revenue will attract more private investors to ensure the sustainability of a PPP [12,47]. Additionally, the results of Jefferies et al. and Jamali provided some evidence for the importance of fees or price in future financial success; moreover, a reasonable service price contributed to the private sector to reduce the operation cost and also avoid the excess profits of private sectors [48].

First, Zhang developed a CSF package that contained five main categories, i.e., favourable investment environment, economic viability, reliable concessionaire consortium with strong technical strength, sound financial package and appropriate risk allocation via reliable contractual arrangements [13]. Moreover, the findings of Chan et al. showed that the 18 CSFs were grouped into five categories, i.e., stable macroeconomic environment, shared responsibility between public and private sectors, transparent and efficient procurement process, stable political and social environment and judicious government control [29]. According to Wibowo and Alfen, favourable investment environment, economic viability, sound financial package, stable macroeconomic environment, stable political and social environment and judicious government control pertain to the macro-environment [25]. Second, Ismail suggested that the rankings of importance for many factors were mostly significantly different between the public and private sectors, and the difference affects the success of PPP implementation in Malaysia [49]. Additionally, Tang et al. also suggested that stakeholder-related factors need to be considered to achieve the efficiency and effectiveness of relationships among stakeholders in PPP within the Australia context [14]. Finally, in order to determine the relationship between the public sector and private sector, the professor also suggests that stakeholder-related factors should be divided into three groups, i.e., the public sector-related factor, private sector-related factors and public-related factors. Furthermore, a workshop was conducted to discuss and refine the categories among 29 CSFs, of which the participants include professors, PPP project managers and local government officers. The discussion suggests that five groups should be divided into, i.e., government’s ability and characteristics, private sector’s characteristics, the public’s characteristics, cooperative environment and the PPP implementation process’s characteristics. Meanwhile, seven professors that we first invited for advice also obtained the results and agreed on these categories. Therefore, based on the experts’ comments and the typology of Zhang [13] and Chan et al. [29], the 29 CSFs were divided into five groups, as in Table 2.

Table 2.

Categorization of the critical success factors (CSFs).

3. Methodology

To examine the interrelationship among PPP CSFs, two main research methods were adopted: questionnaire survey and the structural equation model (SEM). Firstly, a literature review was conducted to formulate nine hypotheses. Secondly, a conceptual model was developed based on these hypotheses grounded on the SEM, for which the SEM was employed to explore and analyse the interrelationships among the CSFs for PPP projects.

3.1. Hypotheses

PPP is a cooperative arrangement between the public sector and private sector [5]. The partnership relationship is a distinctive element [35], which has some specific qualities owned by the public and private sectors to help them achieve positive externalities, resource complementarities and cost minimization [5,7]; and the critical interdependencies between public and private interests enhances and improves the partnership relationship between the public and private sector [33]. During the process of PPP implementation, government supervision is also essential to protect public interests, maintain social equity [47,63] and create such environments for helping the public be involved in the PPP project [38,57]. Hence, the constructed hypotheses are as follows:

H1:

The government’s ability and characteristic (Gov-Ch) has a positive influence on the process’s (Proc-Ch) in PPP projects.

H2:

Gov-Ch has a significant influence on the public’s (Pub)-Ch in PPP projects.

However, in China, governments have strong power on plenty of resources, which have an important influence on PPP success; the private sector needs to spend much time maintaining a good relationship with the public sector in order to gain special resources or to reduce the approval time [64]. The results of Ke et al. also provided some evidence that the current role of government in PPP is more of a regulator than that of a partner in China’s PPP projects; too much intervention required the private sector to spend much time and money on coping with relationships or Guanxi with the government [6]. Hence, the constructed hypothesis is as follows:

H3:

Gov-Ch has a significant influence on the private sector’s (Pri)-Ch in PPP projects.

The private sector is a key element in forming and maintaining the public-private partnership, whose abilities and experience contributed to the PPP project success. A strong private consortium is an important factor for PPP implementation or success, and a company who won the PFI contract was mainly large and well-established in the UK. [12]. Tiong et al. suggested that the private sector must consist of highly qualified professionals with the requisite financial engineering skills [16], sufficient operation experience or adequate investment funding [47]. Moreover, sufficient past experience will inform the parties as to what might or might not happen over a project’s life-cycle, and the firm can use its past experience to predict or assess risks so that an efficient risk allocation can be achieved by decreasing the complexity and simplifying the process in the current setting [65,66,67]. Furthermore, appropriate risk allocation will reduce the overall costs of the PPP project, achieve value for the money and ensure the sustainability of PPP [12,28,47]. Hence, the constructed hypothesis is as follows:

H4:

Pri-Ch has a positive influence on Proc-Ch in PPP projects.

The public is an important stakeholder for PPP projects; although they are not involved in any PPP contractual obligations, their opinions are very important for the PPP project’s success or failure [41,42]. Moreover, as the public is the end-user of a public service, their expectations or perceptions of service quality are critical for the operation of PPP projects and service performance improvement [56]. In order to further understand the importance of public involvement in PPP, Majamaa et al. proposed the public-private-people partnership (4P) model, which can be useful for decision-making or better service delivery [42], and public involvement will also improve public relations and reinforce relationships for achieving a more sustainable partnership and enhancing resilience [37,38,57]. Hence, the constructed hypotheses are as follows:

H5:

Pub-Ch has a significant influence on Pri-Ch in PPP projects.

H6:

Pub-Ch has a significant impact on Proc-Ch in PPP projects.

Although the public-private-people cross-sector relationships can contribute to resilience and sustainability, the appropriate political support, legal framework and economic policy are essential to maintain the partnership relationship as sustainable and improve the quality of service provision [23,57]. Tang et al. suggest that a good project environment is useful for both public and private sectors to understand the stakeholders’ opinions [14].

The government can help to create and maintain such environments, which is the cornerstone of sustainable private participation in infrastructure projects [12], and eliminate fears of the private sector concerning various risks [13]. The government’s administrative capacities contributed to implementing policies, providing policy advice to decision-makers [53,54]. Additionally, the willingness of the private sector to invest in public infrastructure projects depends greatly on the project’s operation environment [12]. Meanwhile, the appropriate institutional environment contributes to prevent and control the government’s opportunistic behaviour [68], so as to avoid corruption risk and to minimize government’s intervention [6]. Hence, the constructed hypotheses are as follows:

H7:

The cooperative environment (Coop-En) has a positive correlation with Gov-Ch in PPP projects.

H8:

Coop-En has a positive influence on Pri-Ch in PPP projects.

In addition, in PPP projects, the public constitutes an immediate environment of equal importance to policies and regulations, and a favourable environment can help the public to understand all of the documentation used in PPP projects and to express their opinion reasonably [37,38]. Hence, the constructed hypothesis is as follows:

H9:

Coop-En has a positive influence on Pub-Ch in PPP projects.

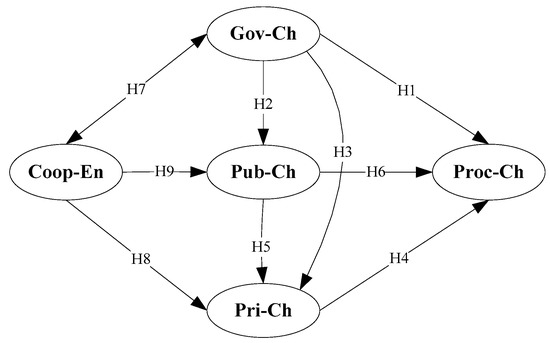

Based on the literature analysis, all hypotheses comprise the conceptual model shown in Figure 1.

Figure 1.

Hypothesized interrelationships from the structural equation modelling (SEM) perspective.

3.2. Structural Equation Model

The structural equation modelling (SEM), which is a multivariate statistical technique in studying multiple variables [69], has been widely applied in many disciplines. SEM is more appropriate for econometric methods, because it takes into account measurement errors that occur in a complicated multivariable system. Meanwhile, it allows measurement errors in observed and latent variables [69]. A researcher can directly measure observed variables according to the data collected, and latent variables are the most important variables needed by researchers to measure or estimate, although they are not directly observed [70]. Moreover, with complex relationships being identified visually and systematically, the SEM is more helpful in discovering the underlying interrelationships among CSFs [26,70].

There are two procedures included in the SEM: a measurement component and a structural component [69]. The measurement component incorporates a confirmatory factor analysis (CFA) that is concerned with how well latent variables are represented and measured by the observed variables. The latter establish the relationship between the variables through multiple regression analysis or path analysis [26,69]. In this article, the SEM approach was used to examine the relationship among cooperation partners, the public, the cooperative environment, PPP project implementation and to establish the structural relationships among the latent variables.

3.3. Data Collection

For this research, a questionnaire survey was conducted from May 2015 to February 2016 to collect stakeholders’ (including public sector, private sector and the public) opinions on the importance of each of the 29 variables in the PPP implementation in China, the questionnaire is shown in Supplementary Table S1. The reasons for the scope being narrowed in the Chinese context are as follows: firstly, the demand for PPP is increasing in China, and PPP are applied in a great number of projects in China, as shown in the findings of Ke [71]. Secondly, China is a developing country; the experience of applying PPP in infrastructure development will contribute to PPP implementation and improvement of PPP performance in other developing countries, and these findings are suggested by Shen et al. [10].

Public sector participants that have been engaged in PPP projects are target respondents for this survey; private sector participants that have been involved in PPP projects, such as construction enterprises, special purpose vehicles (SPV) and financial investors, were also target respondents; and the public that has been paying for the public service or using the public service comprised the target respondents for this survey. All of these respondents were asked to rate all PPP project success variables in terms of importance level according to a five-point Likert scale (where 5, extremely important, 4, important, 3, neutral, 2, unimportant, and 1, extremely unimportant). Moreover, to gain more responses for this questionnaire survey, the respondents were reminded to fill it in and send it back before the deadline approached. Especially, a face-to-face survey was conducted for the public, because these people were busy and expected the survey to be easy or convenient for them. Consequently, a total of 36 useful responses was received from the public.

Overall, 531 questionnaires were conducted either by post, face-to-face or e-mail, and a total of 257 useful responses was received, yielding a response rate of 24.4%. As shown in Table 3, the 257 collected questionnaires consisted of 72 responses from the public sector, 72 responses from the private sector, 23 responses from research institutions and 36 responses from the public involved in PPP.

Table 3.

Details of respondents.

4. Results

4.1. Reliability Test

To analyse the appropriateness of the measurement model, Cronbach’s reliability test was conducted to evaluate the reliability of the data [72]. Table 4 shows that five latent variables had a Cronbach’s alpha value higher than 0.7. This indicates that the data have sufficient internal consistency reliability [72].

Table 4.

Reliability test of the questionnaire responses.

4.2. Confirmatory Factor Analysis

The hypothesized structural model was analysed by using AMOS 21.0 (IBM, New York, NY, USA) to evaluate the initial model’s appropriateness. As discussed by Keline [69], the appropriateness was assessed based on the recommended goodness-of-fit (GOF) indices. If the overall fitness of the initial SEM does not meet the standard, it needs to be revised and refined [69]. Table 5 shows that some main GOF indices were not satisfied, such as X2/degree of freedom ratio (X2/df 2.410 > 2), Tucker–Lewis index (TLI 0.693 < 0.9), comparative fit index (CFI 0.707 < 0.9) and the root mean square error of approximation (RMSEA 0.082 > 0.05). Therefore, the hypothetical model needed to be refined to meet both the theoretical hypotheses and the GOF measures.

Table 5.

Results of goodness-of-fit (GOF) measures. TLI, Tucker–Lewis index; RMSEA, root mean square error of approximation.

Based on the rationale of the SEM, the suggestions of the GOF measures and the modification indices (MI) were used to simplify and refine the hypothetical model, adding the covariance error paths among the CSFs [69]. After the refinements, the SEM model performed well with the theoretical expectations and the goodness-of-fit (GOF) indices. It had also satisfied the recommended levels. For example, the X2/df is 1.839, indicating that the hypothetical model fits the sample. The index of GFI is 0.912, suggesting that the fit between the model and the sample data is absolutely accepted. The value of the index of RMSEA is less than 0.08, suggesting that the final model is supported with a high level of confidence. In addition, the values of the incremental fit indices of TLI and CFI are greater than 0.9, providing strong evidence for the acceptable fit between the hypothetical model and the data [69,70].

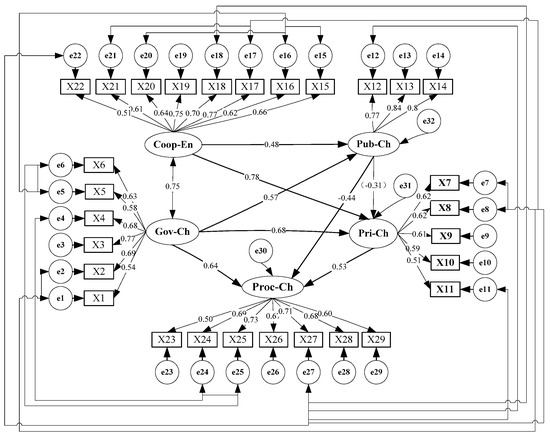

Although this study is modified based on the suggestions by the modification indices, the refinements are considered as theoretically and practically plausible. Because PPP implementation is a complex system, including various factors or variables and these factors will interact with each other, the correlation among the variables or factors can be constructed and analysed [5,12,17,26]. In a word, the GOF indices of the final model suggest a successful fit between the hypothesized model and the data. According to Kline [69], the detail of GOF indices of the refined model is shown as in Table 5. Subsequently, Figure 2 illustrates the final model.

Figure 2.

The final SEM model.

Table 6 illustrates the results of the measurement model estimates. All of the standardized path coefficients for regression weights are positive and significant at the 0.001 level, indicating that the relationship between each observed variable and its corresponding latent variable is significant. In addition, the variable of public satisfaction owns the highest factor loading of all observed variables, indicating that this variable has the most impact on the variable of the public’s characteristics (Pub-Ch).

Table 6.

Standardized regression weights.

In addition, government willingness, a clear cooperation department and the government’s capabilities of fulfilling the contract have the most influence on the government’s ability and characteristics (Gov-Ch); the firm’s capabilities of fulfilling the contract and the firm’s financial abilities have the most impact on the private sector’s characteristics (Pri-Ch) followed by the firm’s information disclosure being reasonably and timely combined. Sound economic policy and complete PPP guidelines show the most impact on cooperative environment (Coop-En), followed by clear project scope definition and documentation in a PPP project. Appropriate risk allocation shows higher influence in characterizing the process of service provision (Proc-Ch) followed by a reasonable service price.

Figure 2 and Table 7 illustrate the relationship paths among latent variables; these paths were determined, and their effects were also estimated by the regression analysis in the SEM model. All of the path coefficients are positive (except one) and significant at p < 0.05, and these findings also indicate that out of nine, eight hypotheses, i.e., H1, H2, H3, H4, H6, H7 and H8, are supported based on the data collected from the questionnaire survey. The indirect effects or mediation effects are determined though the method applied by Xiong et al. to identify the mediation effects among some latent variables in the SEM model [70]. Figure 2 shows the direct effects between latent variables in terms of the estimated path coefficients. Table 7 summarises the results for the four paths, and the four paths are positive and significant at p < 0.05 [70]. Meanwhile, the values of indirect effects are calculated in the corresponding column, such as Coop-En→Pri-Ch→Proc-Ch; its indirect effect is 0.41 (0.78 × 0.53).

Table 7.

Hypotheses and their results.

5. Findings and Discussion

Figure 2 shows the results that the hypotheses, H1, H2, H3, H4, H6, H7, H8 and H9, are supported by the data collected. In addition, some interrelationships were determined among the latent variables.

5.1. Interrelationships among the Latent Variables

5.1.1. Government’s Ability and Characteristics

Gov-Ch positively influences Proc-Ch (path coefficient is 0.64), and it supports the importance of the government’s ability and characteristics in PPP project, as well as demonstrates the positive relationship between the government’s ability and characteristics (Gov-Ch) and the process of service provision (Proc-Ch). It confirms Liu and Wilkinson’s finding that a well-organized public agency, government support and the commitment and responsibility of the public sector are the critical factors for PPP success [8]. The results of Li et al., Jacobson and Choi, as well as Aziz provided some similar evidence for the importance of the willingness to collaborate, the availability of implementation units and the standardization of procedures in the process of PPP implementation [12,46,50]. Moreover, Meng et al. also suggested that the proper supervision from the government contributed to ensuring the quality of public services, protecting public interests and improving social stability [47]. Furthermore, government willingness is identified, and the importance for Gov-Ch is among the top two (the path coefficient is 0.69); according to the findings of Brinkerhoff [4], good government willingness will improve the partners’ satisfaction and maintain partnership sustainability in PPP projects. In addition, Gov-Ch also has a positive influence on Pub-Ch (0.57) and Pri-Ch (the path coefficient is 0.68). For indirect effects, Gov-Ch influences Proc-Ch (−0.25 and 0.36) by the mediation effects of Pub-Ch and Pri-Ch.

5.1.2. Private Sector’s Characteristics

The private partner plays an important in operating the PPP project and delivering the public services. Pri-Ch has a direct and positive influence on Proc-Ch (the path coefficient is 0.53). This confirms Panayides et al.’s findings that the degree of private commitment, firm experience and leading private investors have a positive impact on PPP success [55], and the results of Zhao et al. and Jamali also provided some similar evidence for the significance of the expected profitability of the project and finance capacity of the contractor in the sustainability and success of a PPP project [29,44]. Furthermore, according to Meng et al., Levinthal and March, as well as Iossa and Martimort [47,65,66], sufficient project experience will contribute to the partners to predict or assess risks by decreasing the complexity and simplifying the PPP process in the current setting, so as to reduce the total cost and improve the financial or performance sustainability of a PPP project.

In addition, Pri-Ch is positively influenced by Gov-Ch (the path coefficient is 0.68), indicating that government plays an important role in the private sector’s decision-making in PPP projects. These effects exist in two aspects; one is that the government takes responsibility for the supervision of the quality of service provision to protect the public interest [47]; the other is misguided government intervention, which may increase the effects of risks in the PPP implementation [6,30]. Moreover, the firms’ capital and expertise invested in PPP will be locked in when the government engages in opportunistic behaviour or more risk shifts from the government to the private partner [68,73,74,75]. However, governments in China have strong power on plenty of resources, which have an important influence on PPP success [64]; the profit-driven private sector participating in PPP needs those special resources from the government to operate the PPP project for recovering its investments; inequality in power or resources exists among both partners in the PPP project and might increase opportunistic behaviour. As defined in the study of Schaeffer and Loveridge [35], a leader-follower relationship between the public sector and private sector would occur when participants are unequal in power or in resources; in that case, the relationship among both partners is not a partnership relationship, but a leader-follower relationship in China, and the determined relationship will contribute to helping both partners coordinate their actions toward mutual benefit.

5.1.3. The Public’s Characteristics

Pub-Ch has an important impact on Proc-Ch (the path coefficient is −0.44), but its influence on Pri-Ch is too weak to be significant. This supports Jamali’s findings that customer satisfaction contributed to achieving value for the money and enhanced the quality of service provisions [56]. Moreover, Boyer et al. suggested that public involvement could improve the project performance and benefit the administrative process within the context of PPP [38]. Additionally, the results of Kumaraswamy et al. and Ahmed et al. also provided some similar evidence for the importance of public recognition or opinions in the process of PPP project implementation [39,57]. Good public involvement in PPP will improve the organizational relationships between the public and both partners, and the public opinions or demand will be reflected in the service provision plan of the public sector and private sector, so as to reduce the opposition from the public and improve social sustainability. However, public involvement has a negative effect on Proc-Ch; costs and risks exist in the process of engaging the public; but Boyer et al. suggest that appropriate public involvement will have a positive influence on PPP in the long term [38], and this may reinforce relationships for resilience [57].

5.1.4. Cooperative Environment

Chan et al. suggested that a stable macroeconomic, political and social environments were the critical success factors to conduct PPP projects in China. The results of Li et al., Zhang and Ng et al. also provided some similar evidence for the significance of a stable macroeconomic condition, a favourable legal framework and a sound economic policy in the process of PPP implementation [12,13,26]. This model confirms these findings, indicating that a cooperative environment (Coop-En) can influence the process of public service provisions (Proc-Ch) (−0.21 and 0.41) by the mediation effects of Pub-Ch and Pri-Ch. In addition, Coop-En has a positive correlation with Gov-Ch (0.75); this supports the importance of laws, regulations, PPP guidance and policy in PPP implementation [17,18,25,55]; and Chen and Hubbard suggested that the institutional environment determines power relations between government, private investors and citizens in public private partnerships in China [74]. Furthermore, the government may express its opinion on the guidance or policy in a formal way to create a fair cooperative environment and improve financial transparency, while the cooperative environment also shapes and guides the behaviours of the government, the private sector and the public to reduce the probability of misguided government intervention, simplify the complexity of the approval systems and limit the opportunistic behaviour of the private sector; in that case, the social or partnership sustainability of a PPP will be improved successfully.

5.2. Interrelationships among the CSFs

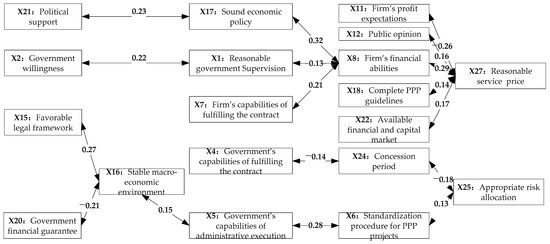

Figure 3 determines the seventeen paths among CSFs, while the SEM model fits the data collected. Of 29 CSFs, the links are found among nineteen observed variables in the model.

Figure 3.

Interrelationship links among the CSFs.

Figure 3 shows that appropriate risk allocation (X25) and service price (X27) are the critical connections between other observed variables and the latent variables. Both factors not only play an important role in the process of PPP implementation, but also provide some helpful evidence for the performance-based evaluation, the partners’ satisfaction assessment, the project’s viability or the discounted cash flow analysis of a PPP. First, appropriate risk allocation is ranked in the top two for the CSFs of PPP shown in the results of Chan et al. and Li et al. [12,30]. Meng et al. suggested that fair risk allocation was the important factor for TOT project success in China, and a lack of clear definition and fair allocation of risk will lead to more uncertainties about the project’s prospects and eventually raise conflicts between the partners [47]. Moreover, the results of Zhang, Osei-Kyei and Chan, as well as Ismail also provided some similar evidence for the importance of appropriate risk allocation in the process of PPP project implementation. Second, Zhang suggested that appropriate toll levels should be established based on the users’ affordability for a service; otherwise, public opposition may ruin the project [13]; Qiao et al. and Jefferies et al. suggested that an acceptable toll has a significant impact on PPP revenue and project success [43,45]. Moreover, the results of Hodge and Greve, Chen and Hubbard, as well as Voivontas et al. also provided some similar evidence for the importance of a reasonable service price in public satisfaction, service provision or social stability [5,74,75]. Finally, since risks may result in price fluctuation and revenue change, appropriate risk allocation and management contribute to sustainable partnership, public satisfaction and PPP resilience [3,57,74].

As for the service price-based casual chain, service price not only plays an important part in both partners’ decision-making, but also a reasonable service price contributes to increasing the probability of public acceptance or satisfaction for the quality of public service provisions. The firm’s profit expectations (X11) and its financial abilities (X8) play an important part in service price followed by the available financial and capital market combined. Zhao et al. suggested that the expected profits or revenues will affect the financial performance and project success [29], and the revenue stream of the project is the basis of PPP project financing [13]. Then, the service price or fee is the critical factor for project revenue, and this result was supported by Jamali, Jefferies et al. and Yuan et al. [44,45,48]. Moreover, if firms want to achieve higher profit expectations, enhancing the service price may be the first choice; similar results are supported by Yeo et al. and Niu et al. [60,76]. Auriol and Picard also suggested that appropriate price caps were essential for project implementation, which make contracts more valuable for governments and reduce the loss of consumer surplus during the concession period [73]. Furthermore, public opinion (X12) shows a positive influence on service price followed by complete PPP guidelines (X18) in the PPP projects. Zhang suggested that if toll levels exceed the users’ affordability for a service, public satisfaction will become poor, and the PPP project may be ruined by strong public opposition [13]. The results of Li et al., Ng et al. and Aziz also provided some similar evidence for the importance of an appropriate service price in achieving the sustainability of a PPP and maintaining social stability [12,40,49]. Therefore, a reasonable service price is very important to enhance the project revenue, improve public satisfaction and maintain a sustainable partnership.

For the indirect effects on the price-based casual chain, the mediation effect and influence mechanism are identified and constructed among some CSFs. As for the mediation effects, political support (X21) and government willingness (X2) influence service price by the mediation effects of sound economic policy (X17), reasonable government supervision (X1) and the firm’s financial abilities (X8); the firm’s capabilities of fulfilling the contract (X7) influence the service price by the mediation effect of the firm’s financial abilities. Reasonable government supervision and sound economic policy will maintain a good financial environment to help the private sector reduce some risks. Moreover, the firm’s capabilities of fulfilling the contract may increase the creditworthiness ranking in the bank system, so that the firm will gain more chances in the financial market [77]. In addition, these indirect effects also revealed the influence mechanism among these CSFs, making it easier to take greater control of the CSFs. For example, Figure 3 shows that “political support (X21)” positively influences “sound economic policy (X17),” whereas “sound economic policy (X17)” positively influences the “firm’s financial ability (X8)”; therefore, X21 can positively influence X8. If it is proven that X8 is a determinant for a reasonable service price in a PPP project, then enhancing political support would therefore be a critical control point for the service price management of a PPP project.

As regards the risk-based casual chain, risk allocation not only plays an important role in both partners’ strategy for the investment structure and service pricing in PPP, but also reasonable risk allocation contributes to lowering the probability of benefit conflicts or the partnership relationship breakdown and reduces the transaction costs on the frequent renegotiation between the public sector and the private sector. The concession period (X24) negatively influences appropriate risk allocation; this is confirmed by Jin and Zuo’s finding that the concession period has a significant impact on risk allocation, because a long concession period will subject service providers to the possibility of big changes in policy, demand, price and other economic condition. If an adverse impact results from any such changes, the actual PPP performance may become worse than estimates [20]; and a long concession period may hurt the social benefits of a PPP project [49]. The government’s capabilities of fulfilling the contract (X23) negatively influence the concession period, which indicates that the concession period will be cut down to a reasonable duration as the government’s capabilities of fulfilling the contract become better. For example, the government approval process complexity may increase project total costs and produce more uncertainties, especially the unreasonable prolonged approval time, which will increase the length of the payback period and even ruin the allocation strategy of a risk [20]. Furthermore, the standardization procedure for PPP projects (X6) has a positive correlation with appropriate risk allocation. It confirms Aziz’s finding that the standardization procedure for PPP projects contributed to achieving efficiencies and improving the performance of the PPP procurement processes, such as reducing the transaction time and costs of PPP projects, improving the risk allocation strategy and reducing the probability of risks [49].

Finally, as for the indirect effects on the risk-based casual chain, the mediation effect and risk influence mechanism are determined and constructed between government capabilities and the PPP-specific environment. As for the mediation effects, this study found that the government financial guarantee (X20) and a favourable legal framework (X15) influence risk allocation by the mediation effects of the government’s capabilities of administrative execution (X5), a stable macro-economic environment (X16) and a standardization procedure for PPP projects (X6). Li et al. suggested that the legal environment was the cornerstone of sustainable private participation in PPP project, and an appropriate risk framework should ensure the legal status for PPP implementation [12]. Moreover, Chan et al. also suggested that a fair and efficient legal framework is a critical success factor for PPP implementation and can make contracts bankable [30]. The results of Zhang and Chou et al. also provided some similar evidence for the importance of a favourable legal framework in risk allocation and PPP implementation [13,22]. In addition, the government’s administrative capacities can profoundly influence programmatic content, activities, outcomes and its performance [54]; Polidano also suggested that public sector capacity contributed to the government with respect to implementing policies, delivering public services and providing policy advice to decision-makers [53]. Therefore, considering government’s administrative capacities is necessary for a true understanding of public policy and achieving social benefit or public interest in PPP projects. As for the influence mechanism, these indirect effects also revealed the path of influence among these CSFs, making it easier to take greater control of the CSFs. For example, Figure 3 shows that “stable macro-economic environment (X16)” positively influences the “government’s capabilities of administrative execution (X5),” whereas X5 positively influences the “standardization procedure for PPP projects (X6)”; therefore, X16 can positively influence X6. If it is proven that X6 is a determinant for appropriate risk allocation in a PPP project, then improving the macro-economic environment would therefore be a key control point for the risk management of a PPP project. Such links can be found in Figure 3.

6. Conclusions

The interrelationships among CSFs and public involvement play an important part in maintaining the social and partnership sustainability of a PPP and improving the quality of public service. The determined factors for the PPP implementation process’s characteristics are provided for financial sustainability or performance sustainability. Based on the extensive literature review and a questionnaire survey, the CSFs of PPP implementation are identified, and their interrelationships are tested by the structural equation model. By examining the interrelationships among CSFs from a comparative perspective, the research finds that appropriate risk allocation and service price are the critical connections between other observed variables and the latent variables. Especially for service price, it was not directly determined by previous studies, but they provided some similar or indirect information for supporting the importance of a reasonable service price in the performance or partnership sustainability of a PPP project.

This research reveals the leader-follower relationship between the public and private partners in PPP projects; the path coefficient is 0.68, as shown in Figure 2, indicating that government plays an important role in the decision-making of private involvement in PPP, and it also influences the strategy of PPP project operation made by the private sector. The results of Ke et al. provided some evidence that the current role of government in PPP is more of a regulator than that of a partner in China’s PPP projects; too much intervention required the private sector to spend much time and money on coping with relationships or Guanxi with the government [6]. Moreover, Schaeffer and Loveridge suggested that the leader-follower relationship is a widely-used form; it is very unequal in the power or resources among partners [35]; the relationship determined in this research will contribute to help both partners check their aims and then coordinate their actions for mutual benefit and to ensure the partnership sustainability.

The mediation effects and influence mechanisms are revealed and analysed among these CSFs, making it easier to take greater control of the CSFs in PPP projects. For example, Figure 3 shows that “stable macro-economic environment (X16)” positively influences the “government’s capabilities of administrative execution (X5)”, whereas X5 positively influences the “standardization procedure for PPP projects (X6)”; therefore, X16 can positively influence X6. If it is proven that X6 is a determinant for appropriate risk allocation in a PPP project, then improving the macro-economic environment would therefore be a key control point for the risk management of a PPP project; other links can be found in Figure 3. That is, both partners should pay more attention to how to manage the critical control point; in that case, it can save more time or costs with respect to searching for the critical control point and improving the efficiency and effectiveness.

Finally, the effects of the public are determined and analysed as a latent variable in the SEM model. Public involvement has a negative effect on the process of service provisions (Proc-Ch); costs and risks exist in the process of public involvement in PPP projects; but Boyer et al. suggested that public involvement will have a positive influence on PPP in the long run [38], and it may reinforce relationships for resilience [57] and eventually improve the social sustainability. Besides the graphical method, the relationship can also be expressed in a regression equation according to the developed SEM model, and many such cases can be found in Keline [69]. Based on direct effects in Figure 2 and indirect significant effects shown in Table 7, the equation is constructed as follows to calculate the changes of Proc-Ch with other variables’ changes:

∆Proc-Ch = 0.64 × ∆Gov-Ch + 0.53 × ∆Pri-Ch − 0.44 × ∆Pub-Ch + (0.41 + 0.36) × ∆Pri-Ch − (0.21 + 0.25) × ∆Pub-Ch

In Equation (1), the first three components refer to direct effects from cooperative partner-related factors, and the last two components refer to the indirect effects from other variables. With the equation, the public sector can effectively identify and supervise the private partner in PPP projects by evaluating and focusing on significant factors. Similarly, the developed model provides the opportunity for private partners to estimate potential project performance and choose a reasonable strategy to deal with and coordinate these complex partnership relationships in order to reinforce relationships for resilience with a higher likely level of public satisfaction, especially in circumstances where the public does not accept the service price or quality of service. Further, as it is reasonable to speculate that both the public and private sector will have new insight for public involvement, it would then motivate partners to adjust the strategy in a timely manner and reasonably by improving the corresponding relationships, such as Gov-Ch, Pri-Ch, Pub-Ch and Coop-En.

A comparative study on previous studies of Hodge and Greve [5], Verhoest et al. [51], Farrell and Vanelslander [61], Voivontas et al. [75], Li et al. [12], Boyer et al. [38], Jamali [44,49], Osei-Kyei and Chan [17], Schaeffer and Loveridge [35] and Jefferies et al. [45] indicated that in addition to the Chinese setting and culture, government support, service price, institutions’ environment and appropriate risk allocation are important for PPP project success and the improvement of project performance in 20 European countries [51]; moreover, institutional factors, competitive environment, operational skills and experience will help the private sector to gain more PPP market opportunities and resources in low-and-middle-income countries [61]. In addition, Boyer et al. suggested that public involvement will improve public relations and reinforce relationships for achieving a more sustainable partnership and enhancing resilience; the results of Voivontas et al. also provided some similar evidence for the importance of a reasonable service price in public satisfaction, service provision or social stability in Greece [75]. Thus, we can conclude that the interrelationships among these CSFs are important for successful PPP implementation and improvement of PPP performance whether or not it refers to China or low-and-middle-income countries. According to the PPP maturity model provided by Deloitte’s research titled “Closing the Infrastructure Gap” in 2006, many governments in low- and middle-income countries are still at the first stage of PPP development; developing a deep understanding of the challenges and potential solutions is important for them to move up on the maturity curve. Therefore, according to the previous statement, our research may contribute to the low- and middle-income countries or some countries at the first stage of PPP development for improving the PPP implementation successfully.

However, although the interrelationships among CSFs are determined and analysed in PPP projects, this study is not without limitations. First, some caution is necessary in generalizing these findings, as the data come from one country within the special institutional context, which may limit its generalizability. Second, as some variables are tested by the questionnaire, the validity of the data collected may be influenced by the possible difficulty in the respondents’ understanding of the questions and their willingness to respond to those questions honestly. However, in order to reduce the effect of these limitations on the research, we enhance the comparison between previous studies and our findings, as well as deepen the interpretation and description to reduce the difficulty in the respondents’ understanding of the questions. Future research may build more accurate models for measuring the relationship between the private sector’s characteristics (Pri-Ch) and the cooperative environment (Coop-En) and in PPP projects by increasing the reciprocal relation on both variables.

Supplementary Materials

The following are available online at www.mdpi.com/2071-1050/8/12/1313/s1, Table S1: Sample Questionnaire.

Author Contributions

All of the authors have contributed equally to the design of theoretical model, to analysing and discussing the data and to writing the paper. All of the authors read and approved this manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Savas, E.S. Privatization and Public-Private Partnerships; Seven Bridges Press: New York, NY, USA, 2000; pp. 20–39. [Google Scholar]

- Ke, Y.; Wang, S.; Chan, P.C.; Cheung, E. Research Trend of Public-Private Partnership in Construction Journals. J. Constr. Eng. Manag. 2009, 135, 1076–1086. [Google Scholar] [CrossRef]

- Maskin, E.; Tirole, J. Public-private partnerships and government spending limits. Int. J. Ind. Organ. 2008, 26, 412–420. [Google Scholar] [CrossRef]

- Bennett, A. Sustainable public/private partnerships for public service delivery. Nat. Resour. Forum 1998, 22, 193–199. [Google Scholar] [CrossRef]

- Hodge, G.A.; Greve, C. Public-Private Partnerships: An International Performance Review. Public Adm. Rev. 2007, 67, 545–558. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, P.C. Risk Misallocation in Public-Private Partnership Projects in China. Int. Public Manag. J. 2013, 16, 438–460. [Google Scholar] [CrossRef]

- Kivleniece, I.; Quelin, B.V. Creating and capturing value in public-private ties: A private actor’s perspective. Acad. Manag. Rev. 2012, 37, 272–299. [Google Scholar] [CrossRef]

- Liu, T.; Wilkinson, S. Critical Factors Affecting the Viability of Using Public-Private Partnerships for Prison Development. J. Manag. Eng. 2015. [Google Scholar] [CrossRef]

- Brinkerhoff, J.M. Assessing and improving partnership relationships and outcomes: A proposed framework. Eval. Program Plan. 2002, 25, 215–231. [Google Scholar] [CrossRef]

- Shen, L.Y.; Tam, V.; Gan, L.; Ye, K.; Zhao, Z. Improving Sustainability Performance for Public-Private-Partnership (PPP) Projects. Sustainability 2016, 8, 289–303. [Google Scholar] [CrossRef]

- Liu, J.; Love, P.; Smith, J.; Regan, M.; Davis, P. Life Cycle Critical Success Factors for Public-Private Partnership Infrastructure Projects. J. Manag. Eng. 2015, 31. [Google Scholar] [CrossRef]

- Li, B.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. Critical success factors for PPP/PFI projects in the UK construction industry. Constr. Manag. Econ. 2005, 23, 459–471. [Google Scholar] [CrossRef]

- Zhang, X. Critical Success Factors for Public-Private Partnerships in Infrastructure Development. J. Constr. Eng. Manag. 2005, 131, 3–14. [Google Scholar] [CrossRef]

- Tang, L.; Shen, Q.; Skitmore, M.; Eddie, W.L.C. Ranked Critical Factors in PPP Briefings. J. Manag. Eng. 2013, 29, 164–171. [Google Scholar] [CrossRef]

- Rockart, J.F. Chief executives define their own data needs. Harv. Bus. Rev. 1979, 57, 81–93. [Google Scholar] [PubMed]

- Tiong, R.L.K.; Yeo, K.T.; McCarthy, S.C. Critical success factors in winning BOT contracts. J. Constr. Eng. Manag. 1992, 118, 217–228. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P. Review of studies on the Critical Success Factors for Public-Private Partnership (PPP) projects from 1990 to 2013. Int. J. Proj. Manag. 2015, 33, 1335–1346. [Google Scholar] [CrossRef]

- Zhang, S.; Chan, P.C.; Feng, Y.; Duan, H.; Ke, Y. Critical review on PPP Research-A search from the Chinese and International Journals. Int. J. Proj. Manag. 2016, 34, 597–612. [Google Scholar] [CrossRef]

- Kahwajian, A.; Baba, S.; Amudi, O.; Wanos, M. Identification of Critical Success Factors (CSFs) for Public Private Partnership (PPP) Construction Projects in Syria. Jordan J. Civ. Eng. 2014, 8, 393–405. [Google Scholar]

- Jin, X.; Zuo, J. Critical Uncertainty Factors for Efficient Risk Allocation in Privately Financed Public Infrastructure Projects in Australia. Int. J. Constr. Manag. 2011, 11, 19–34. [Google Scholar]

- Hwang, B.G.; Zhao, X.; Gay, M.J.S. Public private partnership projects in Singapore: Factors, critical risks and preferred risk allocation from the perspective of contractors. Int. J. Proj. Manag. 2013, 31, 424–433. [Google Scholar] [CrossRef]

- Chou, J.; Pramudawardhani, D. Cross-country comparisons of key drivers, critical success factors and risk allocation for public-private partnership projects. Int. J. Proj. Manag. 2015, 33, 1136–1150. [Google Scholar] [CrossRef]

- Zou, W.; Kumaraswamy, M.; Chung, J.; Wong, J. Identifying the critical success factors for relationship management in PPP projects. Int. J. Proj. Manag. 2014, 32, 265–274. [Google Scholar] [CrossRef]

- Yun, S.; Jung, W.; Han, S.H.; Heedae, P. Critical organizational success factors for public private partnership projects-a comparison of solicited and unsolicited proposals. J. Civ. Eng. Manag. 2015, 21, 131–143. [Google Scholar] [CrossRef]

- Wibowo, A.; Alfen, W. Identifying macro-environmental critical success factors and key areas for improvement to promote public-private partnerships in infrastructure. Eng. Constr. Archit. Manag. 2014, 21, 383–402. [Google Scholar] [CrossRef]

- Ng, S.T.; Wong, Y.W.; Wong, J.M. A structural equation model of feasibility evaluation and project success for public private partnerships in Hong Kong. IEEE Trans. Eng. Manag. 2010, 57, 310–322. [Google Scholar] [CrossRef]

- Cheung, E.; Chan, A.P.C.; Lam, P.T.I.; Chan, D.W.M.; Ke, Y. A comparative study of critical success factors for public private partnerships (PPP) between Mainland China and the Hong Kong Special Administrative Region. Facilities 2012, 30, 647–666. [Google Scholar] [CrossRef]

- Zhao, Z.; Zuo, J.; Zillante, G.; Wang, X. Critical success factors for BOT electric power projects in China: Thermal power versus wind power. Renew. Energy 2010, 35, 1283–1291. [Google Scholar] [CrossRef]

- Chan, P.C.; Lam, P.T.I.; Chan, D.W.M.; Cheung, E.; Ke, Y. Critical success factors for PPPs in infrastructure developments: Chinese perspective. J. Constr. Eng. Manag. 2010, 136, 484–495. [Google Scholar] [CrossRef]

- Babatunde, S.O.; Opawole, A.; Akinsiku, O.E. Critical success factors in public-private partnership (PPP) on infrastructure delivery in Nigeria. J. Facil. Manag. 2012, 10, 212–225. [Google Scholar] [CrossRef]

- Aerts, G.; Grage, T.; Dooms, M.; Haezendonck, E. Public-Private Partnerships for the Provision of Port Infrastructure: An Explorative Multi-Actor Perspective on Critical Success Factors. Asian J. Shipp. Logist. 2014, 30, 273–298. [Google Scholar] [CrossRef]

- Lasker, R.; Weiss, E.; Miller, R. Partnership Synergy: A Practical Framework for Studying and Strengthening the Collaborative Advantage. Milbank Q. 2001, 79, 179–205. [Google Scholar] [CrossRef] [PubMed]

- Mahoney, J.T.; McGahan, A.M.; Pitelis, C.N. The interdependence of private and public interests. Organ. Sci. 2009, 20, 1034–1052. [Google Scholar] [CrossRef]

- Brinkerhoff, J. Government-nonprofit partnership: A defining framework. Public Adm. Dev. 2002, 22, 19–30. [Google Scholar] [CrossRef]

- Schaeffer, P.; Loveridge, S. Toward an Understanding of Types of Public-Private Cooperation. Public Perform. Manag. Rev. 2002, 26, 169–189. [Google Scholar] [CrossRef]

- Zheng, Z.; Tao, C.; Leng, Y. Analysis on Construction of Major Sports Facilities: Based on PPP Mode through Cooperative Game. China Sport Sci. 2011, 31, 27–32. [Google Scholar]

- Rwelamila, P.; Fewings, P.; Henjewele, C. Addressing the missing link in PPP projects: What constitutes the public? J. Manag. Eng. 2015. [Google Scholar] [CrossRef]

- Boyer, E.J.; Slyke, D.M.V.; Rogers, J.D. An Empirical Examination of Public Involvement in Public-Private Partnerships: Qualifying the Benefits of Public Involvement in PPPs. J. Public Adm. Res. Theory 2016, 26, 45–61. [Google Scholar] [CrossRef]

- Ahmed, S.A.; Ali, M. People as partners: Facilitating people’s participation in public-private partnerships for solid waste management. Habitat Int. 2006, 30, 781–796. [Google Scholar] [CrossRef]

- Ng, S.T.; Wong, J.M.W.; Wong, K.K.W. A public private people partnerships (P4) process framework for infrastructure development in Hong Kong. Cities 2013, 31, 370–381. [Google Scholar] [CrossRef]

- Shan, X.; Hou, W.; Ye, X.; Wu, C. Decision-making criteria of PPP projects: Stakeholder theoretic perspective. World Acad. Sci. Eng. Technol. 2011, 5, 631–635. [Google Scholar]

- Majamaa, W.; Junnila, S.; Doloi, H.; Niemistö, E. End-user oriented public-private partnerships in real estate industry. Int. J. Strat. Prop. Manag. 2008, 12, 1–17. [Google Scholar] [CrossRef]

- Qiao, L.; Wang, S.Q.; Tiong, R.L.K.; Chan, T.S. Framework for Critical Success Factors of BOT Projects in China. J. Struct. Financ. 2001, 7, 53–61. [Google Scholar] [CrossRef]

- Jamali, D. Success and failure mechanisms of public private partnerships (PPPs) in developing countries: Insights from the Lebanese context. Int. J. Public Sect. Manag. 2004, 17, 414–430. [Google Scholar] [CrossRef]

- Jefferies, M.; Gameson, R.; Rowlinson, S. Critical Success Factors of the BOOT Procurement System: Reflections from the Stadium Australia Case Study. Eng. Constr. Archit. Manag. 2002, 9, 352–361. [Google Scholar] [CrossRef]

- Jacobson, C.; Choi, S.O. Success factors: Public works and public-private partnerships. Int. J. Public Sect. Manag. 2008, 21, 637–657. [Google Scholar] [CrossRef]

- Meng, X.; Zhao, Q.; Shen, Q. Critical Success Factors for Transfer-Operate-Transfer Urban Water Supply Projects in China. J. Manag. Eng. 2011, 27, 243–251. [Google Scholar] [CrossRef]

- Ismail, S. Factors Attracting the Use of Public Private Partnership in Malaysia. J. Constr. Dev. C 2013, 18, 95–108. [Google Scholar]

- Yuan, J.; Skibniewski, M.; Li, Q.; Shan, J. The driving factors of China’s public-private partnership projects in Metropolitian transportation systems: Public sector's viewpoint. J. Civ. Eng. Manag. 2010, 16, 5–18. [Google Scholar] [CrossRef]

- Abdel Aziz, A.M. Successful Delivery of Public-Private Partnerships for Infrastructure Development. J. Constr. Eng. Manag. 2007, 133, 918–931. [Google Scholar] [CrossRef]

- Verhoest, K.; Petersen, O.; Scherrer, W.; Soecipto, R.M. How Do Governments Support the Development of Public Private Partnerships? Measuring and Comparing PPP Governmental Support in 20 European Countries. Transp. Rev. 2015, 35, 118–139. [Google Scholar] [CrossRef]

- Post, J.; Obirih-Opareh, N. Partnerships and the Public Interest: Assessing the Performance of Public-Private Collaboration in Solid Waste Collection in Accra. Space Polity 2003, 7, 45–63. [Google Scholar] [CrossRef]

- Polidano, C. Measuring Public Sector Capacity. World Dev. 2000, 28, 805–822. [Google Scholar] [CrossRef]

- Coggburn, J.; Schneider, S. The Quality of Management and Government Performance: An Empirical Analysis of the American States. Public Adm. Rev. 2003, 63, 206–213. [Google Scholar] [CrossRef]

- Panayides, P.M.; Parola, F.; Lam, J. The effect of institutional factors on public-private partnership success in ports. Transp. Res. Part A Policy Pract. 2015, 71, 110–127. [Google Scholar] [CrossRef]

- Jamali, D. A study of customer satisfaction in the context of a public private partnership. Int. J. Qual. Reliab. Manag. 2007, 24, 370–385. [Google Scholar] [CrossRef]

- Kumaraswamy, M.; Zou, W.; Zhang, J. Reinforcing relationships for resilience-by embedding end-user ‘people’ in public-private partnerships. Civ. Eng. Environ. Syst. 2015, 32, 119–129. [Google Scholar] [CrossRef]

- Zhao, Z.; Zuo, J.; Zillante, G. Factors influencing the success of BOT power plant projects in China: A review. Renew. Sust. Energy Rev. 2013, 22, 446–453. [Google Scholar] [CrossRef]

- Carbonara, N.; Costantino, N.; Pellegrino, R. A transaction costs-based model to choose PPP procurement procedures. Eng. Constr. Archit. Manag. 2016, 23, 491–510. [Google Scholar] [CrossRef]

- Niu, B.; Zhang, J. Price, capacity and concession period decisions of Pareto-efficient BOT contracts with demand uncertainty. Transp. Res. Part E Logist. Transp. Rev. 2013, 53, 1–14. [Google Scholar] [CrossRef]

- Farrell, S.; Vanelslander, T. Comparison of Public-Private Partnerships in Airports and Seaports in Low- and Middle-Income Countries. Transp. Rev. 2015, 35, 329–351. [Google Scholar] [CrossRef]

- Ng, S.T.; Wong, Y.M.; Wong, J.M. Factors influencing the success of PPP at feasibility stage—A tripartite comparison study in Hong Kong. Habitat Int. 2012, 36, 423–432. [Google Scholar] [CrossRef]

- McCann, S.; Aranda-Mena, G.; Edwards, P.J. Public private partnership projects in the operating phase: Three Australian case studies. J. Strateg. Contract. Negot. 2015, 1, 268–287. [Google Scholar] [CrossRef]

- Zhang, Y. From State to Market: Private Participation in China’s Urban Infrastructure Sectors, 1992–2008. World Dev. 2014, 64, 473–486. [Google Scholar] [CrossRef]

- Iossa, E.; Martimort, D. Risk allocation and the costs and benefits of public-private partnerships. RAND J. Econ. 2012, 43, 442–474. [Google Scholar] [CrossRef]

- Levinthal, D.; March, J. The myopia of learning. Strateg. Manag. J. 1993, 14, 95–112. [Google Scholar] [CrossRef]

- Mouraviev, N.; Kakabadse, N.K. Public-Private Partnership’s Procurement Criteria: The case of managing stakeholders’ value creation in Kazakhstan. Public Manag. Rev. 2015, 17, 769–790. [Google Scholar] [CrossRef]

- Valero, V. Government Opportunism in public-private partnerships. J. Public Econ. Theory 2015, 17, 111–135. [Google Scholar] [CrossRef]

- Keline, R.B. Principles and Practice of Structural Equation Modeling, 4th ed.; The Guilford Press Inc.: New York, NY, USA, 2016. [Google Scholar]

- Xiong, B.; Skitmore, M.; Xia, B. A critical review of structural equation modeling applications in construction research. Autom. Constr. 2015, 49, 59–70. [Google Scholar] [CrossRef]

- Ke, Y. Is public-private partnership a panacea for infrastructure development? The case of Beijing National Stadium. Int. J. Constr. Manag. 2014, 14, 90–100. [Google Scholar] [CrossRef]

- Sharma, S. Applied Multivariate Techniques; Wiley: New York, NY, USA, 1996. [Google Scholar]

- Auriola, E.; Picard, P.M. A theory of BOT concession contracts. J. Econ. Behav. Organ. 2013, 89, 187–209. [Google Scholar] [CrossRef]

- Chen, C.; Hubbard, M. Power relations and risk allocation in the governance of public private partnerships: A case study from China. Policy Soc. 2012, 31, 39–49. [Google Scholar] [CrossRef]

- Voivontas, D.; Xenos, D.; Xanthakis, A.; Pisias, E.; Assimacopoulos, D. Public-Private Partnerships in the Water Sector: A Case Study in the Cyclades Islands, Greece. Water Int. 2002, 27, 330–342. [Google Scholar] [CrossRef]

- Yeo, K.T.; Tiong, R.L.K. Positive management of differences for risk reduction in BOT projects. Int. J. Proj. Manag. 2000, 18, 257–265. [Google Scholar] [CrossRef]

- Bodie, Z.; Kane, A.; Marcus, A. Investments, 10th ed.; McGraw-Hill Education: New York, NY, USA, 2014. [Google Scholar]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).