1. Introduction

In Europe, the built environment is responsible for approximately 40 per cent [

1] of the energy usage, and this has to be reduced drastically for the housing stock to be sustainable in the long term. In 2007, the European Council set an objective to increase energy efficiency by 20 per cent by 2020, and new European climate objectives are now being discussed to increase energy efficiency by 27 per cent by 2030 [

2].

As a result of the original and revised directive on the energy performance of buildings [

3,

4], there are since 2006 building regulations with requirements for energy efficiency for new buildings that have been gradually tighter. The requirement from the directive is that all new buildings shall be “nearly zero-energy” buildings by the end of 2018 for new buildings occupied and owned by public authorities and for all buildings by the end of 2020. Each member state sets their own definition of “nearly zero-energy” buildings and the National Board of Housing, Building and Planning have suggested a Swedish application that means that the requirements will be tightened further, but the regulations are still under consideration by the government [

5]. The directive also means clearer requirements for the public sector to take a lead and be at the forefront when it comes to constructing low-energy buildings. At the same time, there are clear regulations in Swedish law that the public housing sector should be run on the same commercial terms as the private sector with the normal returns on investments [

6,

7]. The housing companies will face big challenges over the coming years. While much of the existing housing stock needs to be renovated [

8], there are continued demands for increased construction of new buildings. In view of Statistics Sweden’s (SCB) new population forecast from April 2016, the National Board of Housing, Building and Planning has updated its latest forecast, which shows that 710,000 new flats are needed in Sweden by 2025 [

9]. This means that the rate of building needs to more than double [

10], which involves even greater challenges to continue placing high demands on energy efficiency, and environmental and climate adaptations.

Public housing companies are important stakeholders in meeting the directive’s requirement that the public sector should take the lead in constructing low-energy buildings. Furthermore, they are responsible for 29 per cent of the area with blocks of flats in Sweden [

11] and therefore have considerable influence on the potential of meeting the environmental objectives mentioned above. Low-energy buildings such as passive, zero-energy and plus-energy houses are already being constructed, but only to a limited share of the total new construction of multifamily houses. Some of the public housing companies have tried but only a few have taken the decision to build on a large scale in order to prepare for the coming requirements.

A recent study has been conducted to increase understanding of the way decisions are taken in Swedish housing companies [

12] and how the decision making process works. Another study has also been conducted on the strategies public housing companies have when deciding the level to which a flat should be renovated [

13]. These studies focus on renovation and how it can be made sustainable, with special consideration on social issues that arise for the tenants living in the building to be renovated. There is a lack of knowledge on how public housing companies reason when it comes to energy and the environment, social and economic aspects of new construction. For the construction of low-energy buildings to take off in earnest, greater understanding is needed of how the decision making process works and why public housing companies have taken the step to build better than the regulatory framework demands. What data have they had when making their decisions and what data will be relevant for them and other public housing companies to continue to increase the rate of constructing low-energy buildings?

An interview study of focus groups from twenty public housing companies has been conducted with the aim to identify obstacles and possibilities to be forerunners and build better than required by the building regulations. The study aims of answering the following questions:

How do housing companies make decisions? Identify the decision making process.

What data did they have?

What obstacles have they experienced?

What is needed for public housing companies to voluntarily continue to construct low-energy buildings?

The study shows that the twenty housing companies have no general decision making processes or practices when deciding to construct low-energy buildings. There is a need for extended, shared and comparable decision making support to meet the new pressure on the demand for increased house building.

2. Methods

The project has been implemented in a project group with different disciplines and representation from a firm of architects, a public housing company, a contractor, the trade organisation for public housing companies, an environmental economist, an adviser for sustainable building, engineers and universities. The work was carried out through interviews with focus groups from twenty public housing companies and a working seminar with some of the interviewees, other public housing companies, other contractors and the project group in which the results were presented and discussed. Interviews were chosen in front of inquires in order to have more elaborated discussions for all questions. Focus groups were selected since the aim was to clarify how the company in itself thinks and acts regarding construction of low-energy buildings.

2.1. Interview Method

A question template was prepared as a basis, or framework of themes to be explored, for the interviews, while the interviews themselves were semi-structured allowing new ideas to be brought up during the interview as a result of what the interviewee says. Interviews were then conducted in which at least two persons from the project group were involved. A few interviews were conducted with one individual from the public housing company, while the majority took place with several people as focus groups from the interviewed company at the same time.

The respondents had the following job titles: MD, property development manager, business development manager, business developer, building and project managers, environment manager, energy strategist, property analysts, technical manager, administration and operations managers. During the interviews, it was made clear that the results would be reported and the collected information anonymous but that there would be a list of interviewees.

Interviews took approximately two hours and were all conducted between April and September 2015. The question template was used as a basis for the interviews, or framework of themes to be explored, but the interviews were mainly led by the respondents’ experiences. The two interviewers then together summarised the results of the question template in writing. A person from the university then compiled the interview results in regular consultation with the other interviewers at a number of project meetings. Finally, the project group presented the results at a working seminar with some of the interviewees, other public housing companies and contractors. The results were discussed and analysed.

2.2. Overview of Constructed Low-Energy Buildings

When planning and conducting the interviews, an overview was first made of what houses had been constructed as low-energy buildings by the public housing sector. Data from several studies [

14,

15,

16] were analysed in order to compile the number of low-energy blocks of flats built by the public housing sector. From these sources, it could be established that 150 buildings had been constructed as low-energy buildings and 84 of them with the public housing sector or municipality as building owners. Most of the buildings are blocks of flats, but there is also housing for the elderly and assisted living. The buildings were constructed between 2000 and 2015, with 83 per cent built after 2010. Thirty-five of the buildings have an energy efficiency class of A and twenty-five of them were built with public owners, i.e., they were built to meet energy performance that is 50 per cent better than the legal requirements according to the National Board of Housing, Building and Planning’s regulations. The remainder (115) have an energy efficiency class of B, i.e., have been built to meet a performance level that is 25 per cent better than the legal requirements. Roughly half of them had public owners.

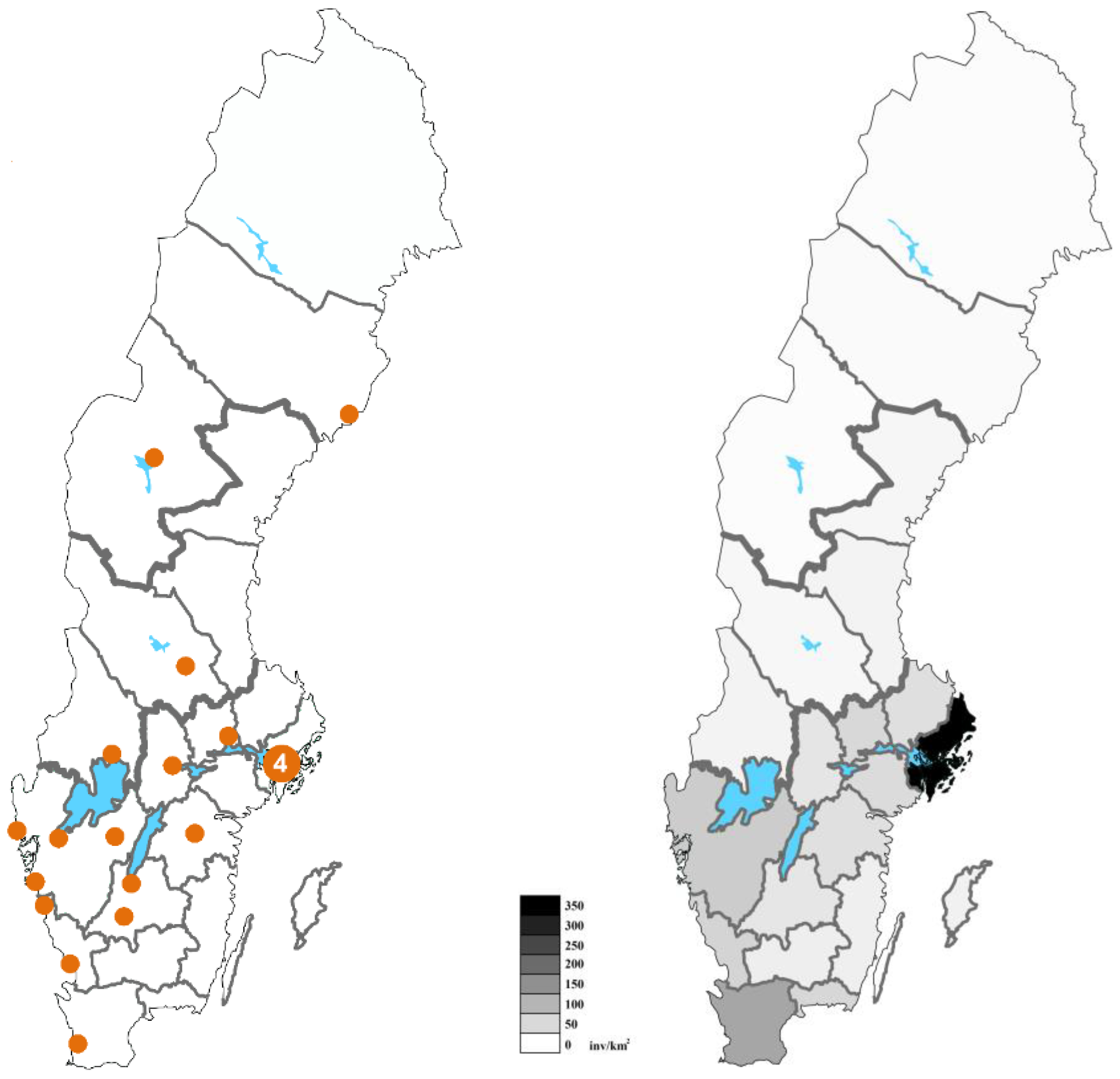

Figure 1 shows the low-energy buildings constructed in the public housing sector or by the municipality from north to south in Sweden. The larger concentration in south of Sweden is due to the denser population in the south as can be seen in

Figure 2. The share of low-energy buildings compared to total new construction of multifamily houses was seven per cent in 2014 [

14].

2.3. Selection of Companies for Interviews

When choosing which public housing companies to interview, the selection was based on a good spread throughout living areas in Sweden, with a distribution between big and small companies and some form of experience of low-energy building.

Figure 2 shows the spread of the interviewed companies in Sweden together with the spread of inhabitants per square kilometre in Sweden. A total of twenty public housing companies were interviewed, which is seven per cent of the public housing companies in Sweden [

17]. Furthermore, the selection of persons to interview was based on positions in the companies that could influence the decision making process and

Table 1 shows the job titles of the persons that were interviewed. The interviewed public housing companies vary in size from very small to very big. They manage from 1100 to 27,000 flats covering an area of 0.05 to 1.6 million m

2, have between 14 and 300 staff and turn over 80 to 1900 million SEK per year.

2.4. Definition of Low-Energy Buildings

The Swedish building regulations have one overall energy performance requirement, which is defined as so-called bought energy, i.e., annually supplied energy to a building for heating, comfort cooling, hot tap water and electricity to operate the property. Household electricity is not included. Energy from solar thermal or photovoltaic systems placed on the building site that can be assimilated within the building are not included in the energy performance requirements, while possibilities to export this energy from the building is included. The regulations do not set any requirements on carbon dioxide emission but distinguish between electrical and non-electrical heated buildings.

The overview of low-energy buildings in

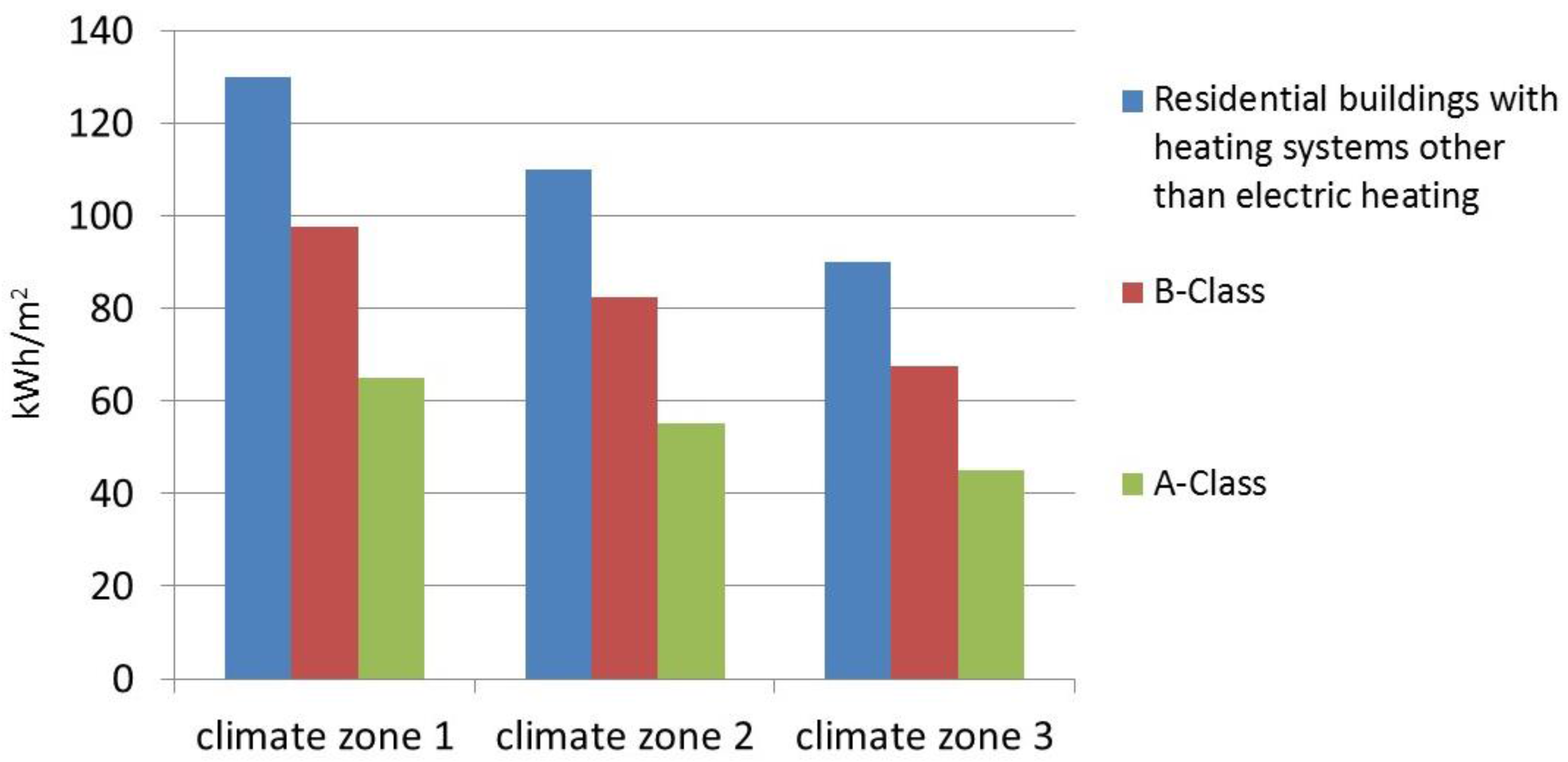

Figure 1 is based on the building regulations in force 2015. The required levels for blocks of flats not heated by electricity are 130, 110 and 90 kWh/m

2 for climate zones 1, 2 and 3, respectively [

18]. For blocks of flats with electric heating they are 95, 75 and 55 kWh/m

2 for climate zones 1, 2 and 3, respectively. Of the 84 low-energy buildings constructed by the public housing sector, only 5 have electric heating.

Figure 3 shows values for energy requirements according to the building regulations together with requirements for energy efficiency classes B and A. For passive houses, the requirements are roughly at the same level as for buildings of energy efficiency class A. For blocks of flats not heated by electricity, the Swedish passive house requirements are 58, 54 and 50 kWh/m

2 for climate zones 1, 2 and 3, respectively [

19].

The building regulation requirements have since been tightened and a further climate zone have been introduced. For buildings constructed in 2016, the levels 115, 100, 80 and 75 kWh/m

2 for climate zones 1, 2, 3 and 4, respectively, apply for blocks of flats not heated by electricity [

20].

3. Results

3.1. About the Public Housing Companies

All of the interviewed companies build from 40 to 500 flats annually. They have clear goals to continue building more than they do today, with most having a goal of doubling the rate of building. The goals vary from 100 to 1000 flats per year in the next few years.

The rent levels in the places where the companies operate are relatively similar, from 900 to 1000 SEK/m2 for old buildings and from 1350 to 1900 SEK/m2 for new housing areas. The exception is Stockholm, which has a much higher rent level in the city centre at 1600 to 2400 SEK/m2.

3.1.1. Previous Experiences

All of the interviewed companies have built better than the building regulations require in one or more projects. Roughly half have tried building with very low energy levels approaching class A buildings or passive house criteria. A few are trying to get down to plus-energy level. More than half construct all new buildings with better requirements than the building regulations demand. Several of the interviewed companies comply with Swedish environmental certification systems such as the Miljöbyggnad [

21], Svanen [

22] and Passive House Criteria [

19], and have certified one or more buildings.

3.1.2. Visions and Aims

The interviewed companies’ visions do not contain anything on the energy issue, though a few have laid down a vision with some emphasis on sustainability. Here are some examples:

To offer the best housing in the region–with long-term sustainability for people, the economy and the environment.

We are building the sustainable society for the future.

The company shall be at the forefront of sustainable housing.

Several companies refer to the municipalities’ visions, such as, for example:

Developing into an ecological, economic and socially sustainable municipality.

A healthy, sustainable municipality with space for everyone.

Most of the interviewed companies’ visions do not mention anything about energy or sustainability. Here are a few examples:

Well-known and popular choice of housing in the municipality.

A tenancy right of world class is achieved by offering homes, managing houses and creating a town.

Excellent accommodation–for a good life.

A home for you.

A few companies say they have expressed environmental aims/environmental policy. Here are a few examples:

The company shall contribute to a sustainable society and be a model on environmental issues.

The company’s activities shall be run in a green way and be compatible with long-term sustainable development.

The municipality wants to ensure a good future environment. The company shall maintain a clear energy and green profile and continue to build with strict requirements for energy and the environment.

3.1.3. Ownership Directive

A few of the interviewed companies have requirements in the ownership directive for new construction to be energy efficient or green. A few have a generally formulated ownership directive, for example:

To build with stringent energy and green requirements.

To build and develop our properties so they are energy efficient.

The company shall build in accordance with the environmental certification standards in force.

New construction shall have low energy consumption as far as technically possible and economically reasonable.

Some of the interviewed companies have direct requirements for new construction, for example:

New construction should be 20 or 30 per cent better than the National Board of Housing, Building and Planning’s regulations.

New construction should be max 60 kWh/m2.

Some of the companies have less strictly formulated requirements, such as, for example:

Eight of the twenty companies have some form of ownership directive for energy and the environment.

3.1.4. Strategic Decisions

Most of the interviewed companies have taken strategic decisions on the energy issue in other ways, for instance broken them down in a business plan or the company itself having set its own requirements, for example:

Reduce energy consumption by 1 per cent annually.

Reduce by 20 per cent between 2007 and 2020. (The interviewee pointed out that in practice this means that all new construction needs to be 55–60 kWh/m2 to meet this requirement.)

New construction shall be 25 per cent better than the building regulations in force. Linked to the company’s goals to reduce its share of bought energy by 25 per cent by 2025.

Newly built flats shall be planned as 55 kWh/m2 for normal dwellings and 65 kWh/m2 for category accommodation such as student or hotel homes (small flats).

The level of 65 kWh/m2 as long as the required return is met (5%).

New construction shall be built as 65 kWh/m2 as a general goal.

Strive for the Miljöbyggnad Silver grade and certify some strategic projects.

Investigate if solar energy (renewable) can form part of the projects.

Some companies have taken no such decisions. One of the interviewees points out that all decisions are taken with regard to sustainability, and another points out that they always think passive house level right from the start.

Two of the interviewed companies point out that decisions on an occasional plus-energy house or similar have no effect on the energy target and those decisions are made in other places and on other bases. They are considered learning projects, while it is the great majority that counts. One of the companies, however, points out that it is important that its new builds approach passive house level so it can meet its goal of reducing energy consumption by 20 per cent overall for all its housing stock by 2020.

3.2. Organisation and Data for the Decision Making Process

Decisions on new construction projects are taken at different organisational levels in the interviewed companies. For two companies, all decisions, project specific and strategic, are taken by the companies themselves. The boards are kept informed. At most of the companies, the boards have made strategic decisions on returns requirements and construction volumes, while decisions on specific projects and strategic decisions on energy and environmental issues are decided directly by the company management. The board is kept informed but if the investments are big or the development projects are expected to make a loss, the decisions are taken by the board. What constitutes a big amount varies between small and big companies. At many of the companies, all investment decisions are taken by the board.

The basic idea of constructing a low-energy building comes for the greater part from the staff of the interviewed companies. They drive the issue and collect experiences and knowledge. They also produce data for decisions that are then presented and approved by the MD. Several of those interviewed found it difficult to point out a specific person in their company as the driving force and instead emphasise the shared working climate that led the staff to drive the issue together. In some companies, the project manager or building manager was pointed out as driving the issue.

In some companies, it is the MD who drives the issue and makes direct decisions. Sometimes, especially at municipal election times, where the company board may be changed, decisions can be taken that the company should take a lead without extensive economic calculations. In some cases, there are overriding requirements from the board.

3.2.1. Data

There do not appear to be any rules or practices on what data are needed for a decision to be taken. Economic data are always needed. Even if the required data vary, they consist of some form of construction/investment calculations and value calculations/cash flow calculations. Long-term profitability is accepted by most companies.

Energy performance and environment are not asked for but often described as, for example, an aim. Many decisions appear to be taken with an assessment of experiences without any specified data. A gut feeling is mentioned.

The majority of the companies feel that their internal environmental goals are important in the decision making process. They may not be analysed in detail, however, when making decisions (more at the back of the mind) and for the odd company the goals are not clear enough.

3.2.2. Form of Contract

Turnkey contracts (where the contractor undertakes the responsibility from the company) seem to be the most common form of contract for low-energy construction. This contract form implies that the company should avoid specifying the technical solutions in detail since this may cause that the company overtakes control and responsibility. In the procurement, however, some take limited control by, for example, specifying technically of frames and heat recovery through functional and quality requirements. The companies believe that they have sufficient knowledge to order well and that they do not have the resources for other forms. More actively involved staff are needed in, for example, shared contract or partnership agreements/partnering.

Some companies have begun to use partnership agreements/partnering. This gives them more of a say when choosing technical solutions and freedom to solve things as they go, and it gets everyone actively involved in the process. The companies’ experiences are that everything is better and more focused when there are joint, tangible goals. Everyone does his or her best, which adds quality assurance throughout the process, for example even the wall is painted better. It also gets everyone involved, making work more fun. One company describes how it always pushes its subcontractors, turnkey contractors or partnering actors to do their utmost and not do what they always have done. This is demanding as they often put the brakes on in the beginning, but it is possible.

3.2.3. Acquiring the Right Competence

A few companies (especially in small locations) say that they have difficulties finding external competence when it comes to contractors and consultants. They have difficulties obtaining tenders. According to the interviewees, small contractors find it easier to meet the tougher energy requirements and to find solutions, but they do not have the resources to take on big projects. This is why the low-energy building projects are often small. One solution is to divide up a big project into several stages, but that involves additional work.

Another respondent says that it always receives many tenders for low-energy buildings from big and small contractors, so they do not think it is difficult to find the expertise to build buildings with low-energy use.

3.2.4. Cooperation with District Heating Companies

Several companies have the same owners as the district heating company, but the interviewees say that there are no strategic agreements to “always connect district heating” or similar. Nor are there any directives from the management. However, many companies choose district heating when possible due to group of companies thinking.

One company considers itself compulsorily connected, with the price model being a problem. Another has a requirement to always have district heating when it is nearby, but the installation costs are negotiated.

Most of the companies work with the district heating supplier to reduce demand peaks and increase the proportion of renewable energy. It is often difficult, however, to combine solar heating and exhaust air heat pumps with district heating in a green way. Other companies feel that the cooperation limps along and that the district heating return is too expensive. Some feel that district heating with a low carbon footprint is good but are dubious about, for example, importing waste for incineration. One company says that it has very good cooperation with the district heating company despite it not being municipally owned.

3.3. Comparisons/Cost Estimates and Calculation Bases for New Construction

There do not appear to be any general calculation tools. All the interviewed companies have created their own models for economic calculations when making investment decisions. Most of the companies use present value methods that show an effect on income (investment against return) expressed in terms of cash flow calculations. The calculations include investment costs, expected rental income and operating costs and can take energy price increases into consideration. However, operating costs, including changes in energy prices, generally seem to be treated as standard without consideration for low energy usage. The odd company starts out with what the building costs are allowed to be and then makes an analysis of the net operating cost.

3.3.1. Required Return and Depreciation Period

Most of the companies have different required returns depending on the location. The economic requirements are set based on the construction costs and the level of rent that is possible in the location. Required returns between three and nine per cent are given with the lower value being for town/city centres. Some have the same required returns regardless of location and instead make bigger depreciations in less attractive locations.

Many of the companies say that they can deviate from the required returns in the first few years. It is acceptable to make a loss in the first few years. A negative effect on the result can be accepted for 6–10 years if it is otherwise a good project, but then it has to turn around.

A few companies have required returns for the whole company rather than individual projects. Lower returns can thereby be compensated for by higher returns in another project. One company says that it cuts down on maintenance for existing housing stock to manage the requirements of returns in new construction.

The companies’ cost of capital/required returns are usually 3.5–5 per cent. In less attractive locations, up to nine per cent is mentioned. One company states that it does not want to make a loss so it has to depreciate and therefore often adds a small margin on the required return.

For depreciation periods, they state anything from 20 to 50 years, with 50 years predominating, i.e., depreciations of 1.5–3.5 per cent. Some follow the so-called K3 depreciation for renovation [

7] (frame 50 years, roof 40 years, ventilation 25 years, etc.). A few say that for new construction, 50 years applies to the envelope and 20 years to technical systems. Two companies have a policy of writing off losses over 10 per cent directly.

3.3.2. Aspects Regarding Operating Costs

Most of the companies are able to take energy price increases into consideration in their calculations, but only a few do so. However, some companies say that they set a 1–2 per cent price increase above inflation. Other companies say that they do not look at the energy price trend in individual projects but follow the trend as a whole. Two companies say that they work on two per cent inflation and two per cent rent increase.

Operating costs are included in the calculations but are a standard value, and there is usually no life-cycle cost analysis at building level. However, a few companies say that they use the life cycle costs (LCC) or simple payback period when choosing individual components. Most choices of solutions or components are based on knowledge and experience that they work well in the operating phase rather than cost analyses.

Most companies do not directly consider that reduced operating costs can lead to an increase in the property value. One respondent points out that the trade has not yet fully understood the meaning of that. Sales and purchases are carried out according to completely different premises, with the location being the most decisive factor: “A pile of stones in the right location can be worth more than a functional property in the wrong location”. Six of the companies believe that reduced operating costs can lead to an increased property value and that this is taken into account in the decisions. One company points out that it has verified that lower operating costs increase the property value, especially of the existing housing stock. Lower operating costs lead to better net operating costs and thereby also property value. The need for depreciation is also reduced with lower operating costs. Another respondent mentions that the required returns can be changed a little.

3.3.3. Solvency and Liquidity

The companies have good finances and no problem with cash flow or borrowing money. Only one company had to sell some of its building stock to achieve solvency.

When project planning, the budget can be increased by extra investments if it is within the required profitability. The companies’ views are split on whether the budget should be increased after the start of the project if more profitable solutions are identified. One respondent says that in one project it was difficult to meet the requirement for 55 kWh/m2 with the rent level at 1800 SEK/m2. It then had an option during the procurement so that if anyone had a good idea later on, it should be possible to introduce it.

3.3.4. Rent Levels in Different Areas

The rent level has a strong effect on the budget. In town/city centres, higher rents are possible and thereby lower required returns. One respondent points out that the company does not worry about depreciations in central locations as these still become profitable over time. However, it prefers not to take depreciations in peripheral areas. Several companies point out that they have profile buildings in town/city centres and “normal” houses in fringe areas but that this does not apply primarily to energy issues but rather to fittings and equipment.

One respondent points out that the total income is directly in proportion with how much space that can be let out. Building law controls the outer area, which means that the higher the energy efficiency (thicker walls), the smaller the rental area. The fact that the lost rental income is higher than the savings in operating costs has a negative effect on the calculations. Another respondent points out that an investment in fringe areas can be profitable but that the same investment in town/city centres can be too costly, as the lost income for rentable area is too high.

3.3.5. Non-Financial Factors

The companies do not consider non-financial factors directly in their calculations though several stress that these values are intuitively part of the decisions: everything from the valuation of, for example, a better indoor environment to decisions that some systems are better than others. There are no predefined templates for the way evaluations are done, however, and one respondent points out that emotions are also part of the decisions.

Some companies mention projects in which strategies for increased goodwill, development or building with wood have influenced decisions. One respondent took into consideration that the market value of the whole area could be increased (e.g., by mixing housing with office premises in an area).

Some companies point out that today there is a “hygiene factor” to work with energy, environment and social responsibility. Many work with jobcentres on integration and employment projects, etc. and these social issues are considered in the decisions. Many measures that are taken are not profitable in themselves.

One respondent tells of a decision to build in an area where it was not possible to charge the required rent but as the company had the money it was built anyway. The company in question does see a demand from a longer perspective. “Politicians have said that we should build but when it comes down to it, it’s not profitable and then it’s difficult to make a decision.”

3.4. Comparison of Options in Decisions

The interviewed companies do not make any economic calculations comparing the costs of different options with regard to energy performance, i.e., the planned low-energy building with a standard house with energy performance according to the building regulations in force. A few companies say that they decide and put it out to tender. If the return is too low, they do not build, but different criteria are not compared. A few companies explain that they comply with the ownership directives they have and try to meet these within the given economic framework. One company made a calculation in cooperation with a contractor of the additional costs of going from the building regulations in force to a passive house for which the extra investment was calculated at five per cent.

One respondent explains that it has a system view in which it sets goals that are reasonable in relation to the whole but without making the comparison with regard to the building regulations in force. A thicker wall has a lower power requirement, which in turn means a smaller heating system and simpler culvert system. Concentrating on the extra cost of the wall at the exclusion of everything else does not work; the investment has to be seen from a system perspective. In one residential area, low-energy buildings have such a low power requirement that the heating plant was automated. A greater power requirement would have needed a bigger heating plant, which would have required staff.

3.4.1. Comparison of Tenders

One respondent explains that when a decision was taken to build a passive house, it was difficult to convince everyone. It ended with a request for two quotations in the tender: one for energy performance according to the level of the building regulations in force and one for passive house level. It turned out that the best tender was for the passive house level.

Another company asked for both a price and energy performance level in the tender. The evaluation of the tenders was done by calculating the value based on the difference in energy performance between the tender and a reference value, energy price and economic weighting factor. The value was then deducted from the tender price when comparing the tenders.

A third company issued a call for tenders with the tenders being evaluated with a weighting for price of 65 per cent and energy 35 per cent. It received two tenders with low energy usage. In a subsequent project, the company set stricter goals for energy and had a weighting of 70 per cent for energy and 30 per cent for price. The company then received several tenders with different energy levels (73–38 kWh/m2) and accepted the tender with 57 kWh/m2 as this had the right relationship between price and energy performance. In its most recent offered project, the company has removed all evaluation criteria for organisation and competence, as they all get full marks anyway and it only has a requirement for 50 kWh/m2 and evaluation of price. In its most recent procurement, the company only received two tenders, though this cannot just be related to the energy requirement but is more about the current construction market in which residential building is less profitable than other projects.

One company considers it difficult to evaluate and compare costings as they often differ too much between consultants.

3.4.2. Other Aspects and Strategically Important Areas

Architectural design, environmental impact, certification, indoor environment and brand are mentioned as important factors when comparing different options. Some companies point out that architectonic values have been very important. Design has driven the cost, which has meant that other functions have had to be removed.

Ownership directives, environmental programmes, environmental profile (brand building), requirements from the town/city and tighter future requirements from EU directives and building regulations are stated as being decisive to big investments to build better than the building regulations in force. In the long term, it is seen as unavoidable to learn to build in a more environmentally friendly and sustainable way. A significant increase in the energy price is also given as one of the reasons. Two of the respondents believe that it does not cost more to build better.

Most of the interviewed companies believe it is good business to build better than the building regulations in force, but where the energy line is drawn not to be good business is difficult to say and differs depending on the conditions of the individual projects. However, one respondent points out that with the current housing queue, letting out flats is not really a problem and it is therefore only good business in some locations to build passive houses.

Strategically important areas are being at the forefront and developing both the quality and the environment.

Many companies, however, stress that speed and feasibility have the highest priority so they can achieve the new goals for the number of newly built flats.

3.5. Obstacles that the Housing Companies Have Experienced

There are many obstacles to constructing low-energy buildings, of which the companies stress the following:

One company does not have any self-interest in investing further in the environment or energy. It believes that it costs too much to reduce the extra kilowatt-hours from their current level (60 kWh/m2).

Two companies have access to district heating with low carbon dioxide emissions that reduce the driving force to build more energy efficiently than energy class B.

The detailed plan is drawn up so that the outer area of the building cannot be increased, which means that thicker insulation reduces the area that can be let.

A few companies have strong focus on improving energy efficiency of existing stock, which means that there are few resources and little time for new building.

The calculation does not allow for reductions in kWh or increases in property values.

Follow-up and feedback of experiences are scant. It is difficult to meet the energy objectives (regardless of level). This makes it difficult to evaluate the outcome or improve routines ahead of decisions on the next low-energy building project.

Difficult to inform users and it can be hard to achieve a satisfactory indoor climate.

It is considered expensive to construct low-energy buildings.

Commissioning and handover are a big problem to manage.

3.6. Experiences from Implemented Projects

Experiences from the low-energy building projects show that most of the companies took the decision to implement the project because they wanted to be at the forefront and to see if they could meet the levels and certifications. There have been initiatives from the staff themselves, the trade organisation and direct from ownership directives. Other reasons mentioned were that they wanted something extra for a housing show or to show that they were at the forefront for an upcoming municipal election. Decisions on the project’s energy performance level have in many cases been based on available knowledge and experience of what is a reasonable level or a gut feeling, rather than economic comparisons of different options.

3.6.1. Energy Performance

Several of the companies have good experiences of achieving the technical performance, and measurements show that the energy targets can be met in principle. Internally, there has been awareness that the performance is a calculated level and that there are many operational factors that affect the actual outcome, especially with regard to how users/tenants are informed and influenced, which is seen as challenging to have the desired effect. One company describes a low-energy area that was built to passive house standards but for which the energy usage ended up much lower at approximately 40–45 kWh/m2. Yet another believes it is possible to meet the planned energy values after removing insolation from the simulations/calculations of energy performance.

Other companies have experience of it being difficult to meet the energy targets even if their requirements are a long way over the passive house level. One company learnt that incentives are often better than penalties to achieve good procurement. Otherwise costs are just added for higher risk.

3.6.2. Follow-Up

Experience shows that there is often something that needs to be corrected in the end and follow-up is therefore important for a successful result. Follow-up of the goals is also emphasised as very important by many companies. Here, cooperation with universities can be beneficial. One company mentions that it has created a new position of energy expert to follow the energy issue for the whole company, long before as well as after the actual construction projects. There is an energy coordinator earlier in the projects.

Another company says that it starts measuring and making forecasts of energy usage three months after the moving in date. Carelessness is common when setting up the ventilation, with the flows being set too high, making the energy performance incorrect.

One company starts off by formulating requirements for the supply of an energy balance calculation that can be examined against the energy requirements that have been set. The measured energy performance is followed up twice a year for two years, but there are no penalties or incentives for the results. There is a weakness here of who is responsible, but the follow-up has led to high energy usage being detected and action being taken.

3.6.3. Architectonic Design

Experience of architectonic design shows that it is easier to meet the energy requirements for tower blocks than for blocks of flats. That is the thinking of experienced architects, so it is important to choose the right one. There are uncertainties as to what the town/city building offices will approve, however, and there can be problems with town/city building offices that do not have an understanding of bay windows, etc., making it more difficult to meet the energy requirements.

3.6.4. Indoor Climate

Most of the companies’ experiences are that the users are satisfied with the indoor climate but that it is important to inform them of how the technology works. One company has worse experiences of the indoor climate and states that it had to install electric radiators afterwards. One company found out that it was too warm if sun protection was forgotten.

3.6.5. Economy

The economic experiences of most of the companies are that the investments are good. The additional costs are given as 0.5–5 per cent. The operating costs have reduced significantly leading to profitability and sustainability. As one respondent points out: “why build expensively and badly when you can build cheaply and well”. Other companies find it difficult to achieve profitability at very low levels. Experience shows that a level around energy efficiency class B (approximately 25 per cent better than the building regulations in force) is possible with profitability but to achieve passive house level (approximately 50 per cent better than the building regulations in force) is too expensive. Experiences show that it is difficult to meet 55 kWh/m2 when the level of rent goes down towards 1600–1700 SEK. Where the energy line is for profitability varies according to the individual project conditions.

According to one company, the building costs are increasing sharply. The building price index has increased above CPI in the past 15 years and even more in the last year, though the quality of the buildings has also increased. In addition, land prices have increased, with the town/city being seen as aggressive in its pricing while energy prices are static, making it difficult to make it pay. At the same time, there is political pressure to keep the rents low and on requirements for increased quality. “It is difficult to prioritise to get the budget to add up.”

3.6.6. Organisation

The experiences of organisation are that managing the running in and handover have been very problematic, and it has been difficult to know who has had control and responsibility for the whole concept. Installation coordinators help to an extent but not fully. Often, much running in is needed for a long time after commissioning and this is expensive. The tighter the energy requirements, the better the operational staff needed. Other experiences are that a gap easily arises between the construction and management units. There is development potential here in the handover as well as at the management stage. Other experiences show that a signed agreement is needed regarding the consequences for the contractor when the energy goals that have been set are not met, but there is no established practice for this.

3.7. What Others Have Done and Feedback of Experiences

The interest in drawing on the experience of others appears negligible. A few companies have conducted study visits with other companies that have constructed low-energy buildings but they do not appear to have been influenced much by them. Several interviewees feel that they can show good examples, but few believe there are other good examples to look at.

Many companies have exchanged experiences and a few mention that they get much out of the trade organisation’s energy group in which experiences are broken down further in a discussion forum.

One company has carried out a comprehensive analysis of the costs of low-energy buildings and why they differ so much between companies. They turned out to be quite similar when all the conditions had been considered however. It is easy to compare “apples” and “pears”.

When it comes to follow-up, all of the companies have long had or now have strong focus on following up energy usage. When it comes to making use of and feeding back experiences within the companies, this varies. A few have energy meetings within the company and the projects.

The indoor environment is followed up, but it is seen as difficult to interpret the result and give feedback on experiences. One problematic aspect of questionnaires on the indoor environment is that they are not done for standard houses, so what should questionnaires from, for example, passive houses be compared with? There is some follow-up but only for complaints handling. One company states that it conducts customer surveys six months after moving in and then every three years on the questions on indoor climate. The company has also employed an environment coordinator with leading-edge competence in the indoor environment to handle these issues. In surveys, tenants have become more positive to the indoor environment after the introduction of recovery and balanced ventilation.

Five companies have followed up brand building, but it is pointed out that it is a perishable product.

The operation has been followed up in a few cases as it is new technology. One company states that it adds extra requirements for the control side and operation already in the procurement to make follow-up easier. Another company states that it makes more frequent rounds and that it has been possible to adjust the ventilation flow down gradually. One company conducted training with the help of a consultant when running it in, but when the consultant’s assignment ended, the focus on the issue fizzled out.

The organisational and practical process of constructing the building was only followed up by one company, even if several noted organisational changes. A few companies conduct follow-ups to increase competence on environmental certification issues within the organisation.

A few companies have created new roles. One company, for example, has created an expert group unit/staff group for support, follow-up, monitoring of trends and feedback on experiences. Some have started using a consultant (third party) who does the follow-up.

A few companies have simple/overall project “planning requirement documents” that are continually improved.

3.8. Experiences of Negative Decisions

The interviewed companies have little experience of discussing the construction of low-energy buildings and have ended up building according to the building regulations in force. Once they have decided to build low-energy buildings they do so.

There are no instances of projects being stopped due to energy usage. However, one company found that it could not build low-energy buildings as it was too far along in the process and thereby had limitations when the idea arose. It was primarily due to the geometry of the building, which was fixed and the plot too small. There are several instances of the brakes being applied to conversions however.

One company says that it relaxed the tighter energy requirements from the start that it usually has for a small project in a fringe area. Furthermore, the form factor was wrong as it “only” built one three-storey house. “It’s much easier to get returns on eight-story buildings.”

There are some instances of certification having been stopped some way into the planning, however, as it turned out that the daylight requirements could not be met or that the district heating was not green enough. The work continued on other objectives, however.

3.9. Plans for Continued Construction

Table 2 summarise short answers on the question: If the company has built better than the building regulations demand before and if they can consider to do that again? All the respondents have built better than the building regulations demand and most have built low-energy buildings (energy efficiency class A or B). Sixteen of the housing companies had experiences that were good enough to construct low-energy buildings again. Three are satisfied with building better than the building regulations require, i.e., around 60 to 65 kWh/m

2. Two say that their district heating is so good that the extra costs to save a few kilowatt-hours has little impact on reducing carbon dioxide emissions and cannot be motivated from an energy system perspective with combined heat and power. One small company is doubtful about constructing low-energy buildings again.

3.10. Other

One company believes that reimbursement models/subsidies that can be awarded by authorities have a big impact on the types of buildings/projects constructed. It is important that the company reviews its business models and introduces more long-term thinking. The goal is that what the company does well today should continue to make rents more reasonable.

Another company explains that the only thing that would have a direct influence on the company rethinking and constructing more low-energy buildings is a significant increase in the energy price. The respondent believes that Sweden already builds very expensive housing compared with other countries and that this is one of the fundamental reasons it does not want to build higher quality at even higher cost.

Overall problems with construction costs are given as: lack of competition, the wholesalers making a large amount of money, poor productivity trend, high technological installation costs and tax relief on interest, as well as the fact that when builders build on their own account, competition decreases as the resources are linked to them instead of building tenancy rights.

A third company believes there should be state subsidies. If it can become standard to build energy-efficiently, the market should become cheaper. This respondent also points out that if the energy price should increase there would be greater incentives to save energy. It must always be a business.

A fourth company currently often builds more expensively than the rent it can achieve. It thinks it is difficult to make calculation models that take into consideration the value of construction projects that lead to more satisfied users, fewer operating errors and so on.

4. Discussion

An interview study with focus groups from twenty public housing companies has been conducted. Obstacles and possibilities for the companies to build better than required by the building regulations have been identified. The interviewed companies have previous experiences of building better than the building regulations, are representing a good spread of big and small companies throughout Sweden and represents seven per cent of the total public housing companies. Considering these factors and that the companies have been forerunners, and are likely to continue to be so, the answers from the twenty interviews can show the positive side of an on-the-spot account for the sector.

4.1. The Decision Making Process

The study shows that there are no general decision making processes or practices between the public housing companies. The twenty housing companies have followed their own ordinary models for economic calculations when making investment decisions, and the decisions to build low-energy buildings were taken for other reasons than economic. For example, that the company wanting to try to be at the forefront, to try a certification or to have something extra ahead of a housing show or an upcoming municipal election. The fact that the decisions were taken was in many cases because individuals or groups of individuals from the staff pushed them through and in a few cases ownership directives. The background to the decisions is green programmes, long-term green requirements and legislation, trade challenges and, in one case, a significant increase in the energy price. The companies have not defined any specific support information needed when taking decisions about construction of low-energy buildings.

Regardless of whether there was an ownership directive, it can be confirmed that the companies themselves have great influence over the decisions. As long as the required returns are met, decisions on strategic energy and green issues are taken by most of the companies themselves. For some, mainly small, companies, all decisions are taken by the board.

4.2. Data Used when Conduting the Decision

The economic decision data are scarce among the companies when it comes to the energy issue. There do not appear to be any practices or templates for evaluating the energy issue in the decision. Economic data are always required by all the companies though not in any particular format. Models for the economic data are produced by the companies themselves. Energy performance and environment are not formally requested but often described anyway. Long-term profitability appears to be accepted by most of the companies. Internal environmental goals are important, but they are not always analysed in detail when making decisions, and the goals are not clear to everyone. The life cycle cost of the whole project is not considered to any great extent, even though such analysis can show that a higher investment cost in the construction phase can lead to lower running costs and a lower life cycle cost compared to a building constructed to the maximum energy level according to the building regulations. If the operating costs are part of the calculations, they are often added as standard. The companies decide on energy performance and then invest in that. Thereby, comparisons are seldom made with the costings of what it would have cost if the building had been constructed to the maximum level according to the building regulations. Such analyses are simply not demanded and are also too time-consuming and costly. Many decisions appear to be taken by evaluating experiences but without specified data, for example it is mentioned that decisions are taken by gut feeling.

4.3. Obtsacles Experinceed During the Decision

There are many obstacles to the decision to construct low-energy buildings, such as the economic calculation not allowing for reductions in energy costs or increases in property values, making the decision more difficult. Follow-up and feedback of experiences are often not structured or documented, which limits the companies’ opportunities to evaluate the outcome or improve the routines ahead of decisions on the next low-energy building project. Experience exchange between the companies could also be improved. In general, the interviewees seem to prefer to show good examples than to look at those of others. It is difficult to inform the users about the functions of the building, and it can be difficult to achieve a satisfactory indoor climate, which demands extra resources during running in and handover. Some companies have good experiences of meeting the designed energy performance, at follow up of measured energy use after two years of operation, while others think it is hard to meet the designed energy performance regardless of the energy level, i.e., even for buildings constructed to the maximum energy level of the building regulations. This is an accordance with a previous study there 88 buildings have compared designed and verified energy performance [

14]. In 38 per cent of the buildings, the designed energy performance is not in accordance with the verified. It was equally many that overestimated as underestimated the energy performance. A few companies think it is expensive to invest in the environment and energy—it is costly to reduce the last kilowatt-hours.

5. Conclusions

The public housing companies face demands to be at the forefront when it comes to constructing low-energy buildings, and passive, zero-energy and plus-energy houses are already being built today to small extent. All twenty public housing companies have built better than the requirements of the current building regulations in one or a few cases. About half of them have constructed buildings with very low energy use (class A) and about half of them are doing all their new construction with better energy performance than required by the building regulation. All except one have intentions to continue to build better than required by the building regulation.

The driving force is to be at the forefront and to build green. Construction of low-energy buildings is particularly suitable in central locations where land is attractive and the required returns are lower. The required returns are decisive to the decisions while the energy requirements have limited influence.

It is characteristic of all the interviewed housing companies to have goals to double the rate of constructing new buildings in the next few years (between 100 and 1000 flats per year for the different companies) to meet the urgent need for more flats. There is thereby great focus on increasing the rate of construction, which probably leaves less scope for environmental and energy issues. Even if the routines for the decision making process, follow-up and feedback of experiences need to improve, it is clear that the housing companies have built up knowledge on constructing low-energy buildings that previously did not exist and that this knowledge is spread among most of the companies.

To reduce the risk of this knowledge not being used and energy and quality issues being given a lower priority, there is a need to develop the decision making process and produce increased, shared and comparable decision making support. The support may be cost estimates and value increase models, better templates for procurements and evaluation of bids, better follow-up and evaluation tools, and better procedures for experience return. This would allow the housing companies to continue to construct low-energy buildings of good quality and other companies to copy them and do the same, despite the pressure for increased house building.