An Integrated Model to Explain How Corporate Social Responsibility Affects Corporate Financial Performance

Abstract

:1. Introduction

2. Literature Review

2.1. Corporate Social Responsibility (CSR)

2.2. Benefits of CSR on Performance

2.3. Negative Effects of CSR on Performance

2.4. Intellectual Capital

2.5. Industry Effect

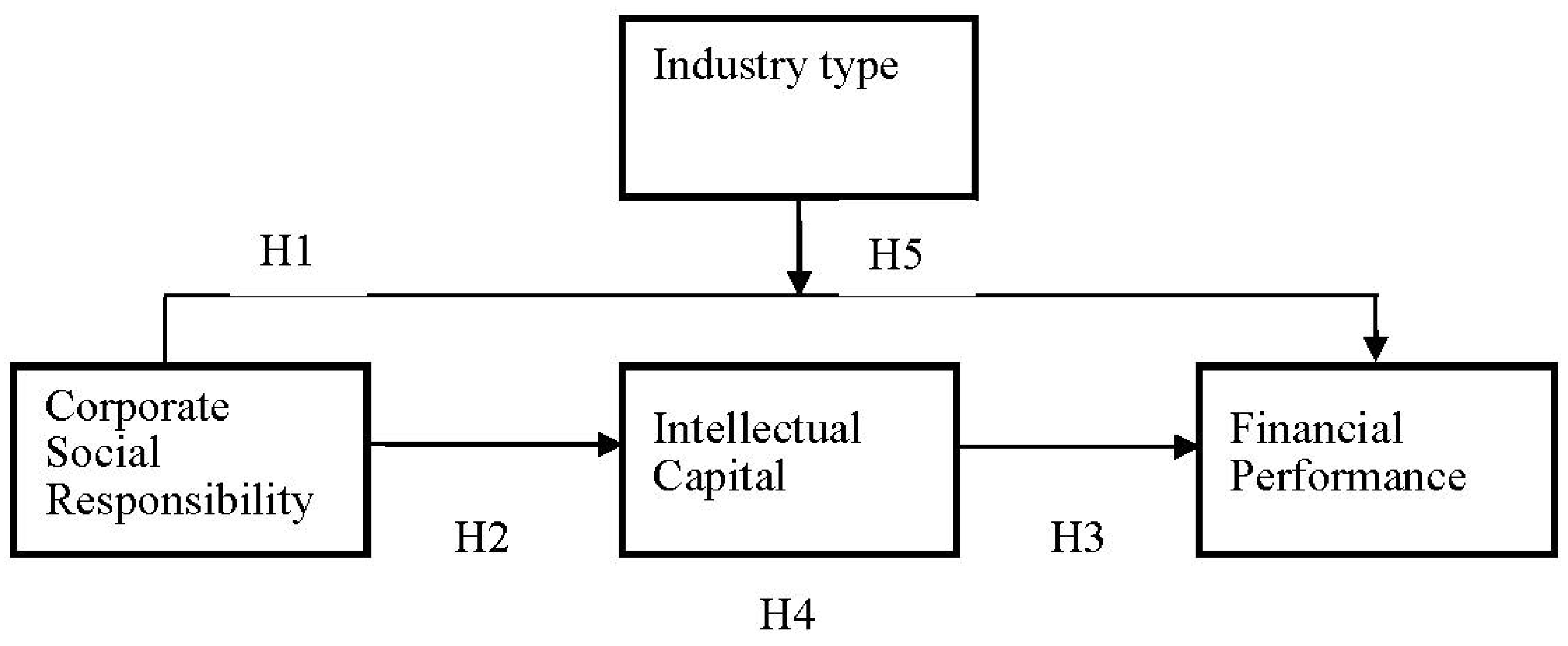

3. Conceptual Model and Hypotheses Development

3.1. Relationship between CSR and Firm Financial Performance

3.2. Relationship between CSR and Intellectual Capital

3.3. Relationship between Intellectual Capital and Firm Financial Performance

3.4. Moderating Role of Industry Type

4. Methodology

4.1. Sample and Data Collection

4.2. Corporate Social Responsibility

4.3. Intellectual Capital

4.4. Financial Performance

4.5. Industry Type

4.6. Control Variables

4.7. Analysis Methods

5. Empirical Results

5.1. Descriptive Statistics and Correlation Matrix

| Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | |

|---|---|---|---|---|---|---|---|---|

| 1. Firm Size | 1.327 | 0.016 | 1.000 | |||||

| 2. Capital Intensity | 1.273 | 0.027 | −0.293 ** | 1.000 | ||||

| 3. R&D Intensity | 0.299 | 0.018 | −0.036 | 0.208 ** | 1.000 | |||

| 4. Corporate Social Responsibility | 1.233 | 0.028 | 0.447 ** | −0.001 | −0.009 | 1.000 | ||

| 5. Intellectual Capital | 0.585 | 0.042 | 0.301 ** | 0.062 | 0.020 | 0.331 ** | 1.000 | |

| 6. ROA | 0.063 | 0.004 | 0.070 ** | −0.152 ** | −0.021 | −0.017 | 0.072 ** | 1.000 |

5.2. Hypotheses Testing

| Model 1 (ROA) | Model 2 (Intellectual Capital) | Model 3 (ROA) | |

|---|---|---|---|

| Constant | 0.11 *** | −19.9 *** | 0.12 *** |

| Control variables | |||

| Firm Size | −0.152 ** | 0.302 *** | −0.202 *** |

| Capital Intensity | −0.256 *** | 0.220 *** | −0.293 *** |

| R&D Intensity | 0.035 | 0.049 | 0.027 |

| Explanatory variables | |||

| Corporate social responsibility | 0.266 *** | 0.092 * | 0.141 ** |

| Intellectual capital | 0.167 *** | ||

| R2 | 0.380 | 0.667 | 0.441 |

| Adjusted R2 | 0.304 | 0.585 | 0.382 |

| F test | 8.220 *** | 22.451 *** | 9.213 *** |

| Model 1 (Sensitive Industry) | Model 2 (Non-Sensitive Industry) | |

|---|---|---|

| Constant | 0.114 *** | 0.064 *** |

| Control variables | ||

| Firm Size | −0.152 ** | 0.099 ** |

| Capital Intensity | −0.256 *** | −0.116 ** |

| R&D Intensity | 0.035 | 0.001 |

| Explanatory variable | ||

| Corporate social responsibility | 0.186 *** | −0.107 ** |

| R2 | 0.330 | 0.267 |

| Adjusted R2 | 0.274 | 0.206 |

| F test | 5.320 *** | 4.551 *** |

| Model 1 (ROA) | Model 2 (ROA) | |

|---|---|---|

| Constant | 0.079 *** | 0.079 *** |

| Control variables | ||

| Firm Size | 0.046 | 0.056 |

| Capital Intensity | −0.141 *** | −0.139 *** |

| R & D Intensity | 0.008 | 0.005 |

| Explanatory variable | ||

| Corporate social responsibility | −0.039 | 0.011 |

| Corporate social responsibility * Industry Type | −0.110 *** | |

| R2 | 0.160 | 0.267 |

| Adjusted R2 | 0.132 | 0.206 |

| F test | 6.220 *** | 4.551 *** |

6. Conclusions and Suggestions

Author Contributions

Conflicts of Interest

References

- Friedman, M. A friedman doctrine: The social responsibility of business is to increase its profits. The New York Times Magazine, 13 September 1970. [Google Scholar]

- Barnett, M. Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Acad. Manag. Rev. Arch. 2007, 32, 794–816. [Google Scholar] [CrossRef]

- Shen, C.H.; Chang, Y. Ambition versus conscience, does corporate social responsibility pay off? The application of matching methods. J. Bus. Ethics 2009, 88, 133–153. [Google Scholar] [CrossRef]

- Bitecktine, A.; Haack, P. The macro and micro of legitimacy: Toward a multilevel theory of the legitimacy process. Acad. Manag. Rev. 2015, 40, 49–75. [Google Scholar] [CrossRef]

- Tu, J.C.; Huang, H.S. Analysis on the relationship between green accounting and green design for enterprises. Sustainability 2015, 7, 6264–6277. [Google Scholar] [CrossRef]

- Russo, A.; Perrini, F. Investigating stakeholder theory and social capital: CSR in large firms and SMEs. J. Bus. Ethics 2010, 91, 207–221. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Ruf, B.M.; Muralidhar, K.; Brown, R.M.; Janney, J.J.; Paul, K. An empirical investigation of the relationship between change in corporate social performance and financial performance: A stakeholder theory perspective. J. Bus. Ethics 2001, 32, 143–156. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Brown, T.J.; Dacin, P.A. The company and the product: Corporate associations and consumer product responses. J. Mark. 1997, 61, 68–84. [Google Scholar] [CrossRef]

- Greening, D.W.; Turban, D.B. Corporate social performance as a competitive advantage in attracting a quality workforce. Bus. Soc. 2000, 39, 254–280. [Google Scholar] [CrossRef]

- Wang, Q.; Wong, T.J.; Xia, L. State ownership, the institutional environment, and auditor choice: Evidence from china. J. Account. Econ. 2008, 46, 112–134. [Google Scholar] [CrossRef]

- Bird, R.; Hall, A.; Momente, F.; Reggiani, F. What Corporate Responsibility Activities Are Valued By the Market? J. Bus. Ethics 2007, 76, 189–206. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. People and Profits? The Search for a Link Between a Company’s social and Financial Performance; Lawrence Erlbaum: London, UK, 2001. [Google Scholar]

- Mahon, J.F. Corporate reputation: A research agenda using strategy and stakeholder literature. Bus. Soc. 2002, 41, 415–445. [Google Scholar] [CrossRef]

- Surroca, J.; Tribo, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility and financial performance: Correlation or misspecification? Strateg. Manag. J. 2000, 21, 603–609. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar] [CrossRef]

- Schuler, D.A.; Cording, M. A corporate social performance-corporate financial performance behavioral model for consumers. Acad. Manag. Rev. 2006, 31, 540–558. [Google Scholar] [CrossRef]

- Halme, M.; Huse, M. The influence of corporate governance, industry and country factors on environmental reporting. Scand. J. Manag. 1997, 13, 137–157. [Google Scholar] [CrossRef]

- Jenkins, H.; Yakovleva, N. Corporate social responsibility in the mining industry: Exploring trends in social and environmental disclosure. J. Clean. Prod. 2006, 14, 271–284. [Google Scholar] [CrossRef]

- Line, M.; Hawley, H.; Krut, R. The development of global environmental and social reporting. Corpor. Environ. Strategy 2002, 9, 69–78. [Google Scholar] [CrossRef]

- Cheung, Y.L.; Jiang, K.; Mak, B.C.; Tan, W. Corporate social performance, firm evaluation, and industrial defference: Evidence from Hong Kong. J. Bus. Ethics 2013, 114, 625–631. [Google Scholar] [CrossRef]

- Chamberlain, N.W. The Limits of Corporate Responsibility; Basic Books: New York, NY, USA, 1973. [Google Scholar]

- Frederick, W.C. Corporate Social Responsibility in the Reagan Era and Beyond. Calif. Manag. Rev. 1983, 25, 145–157. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate social responsibility: Evolution fo a definitional construct. Bus. Soc. 1999, 38, 268–295. [Google Scholar] [CrossRef]

- Matten, D.; Moon, J. Corporate social responsibility education in Europe. J. Bus. Ethics 2005, 54, 323–337. [Google Scholar] [CrossRef]

- Orlitzky, M.; Siegel, D.S.; Waldman, D.A. Strategic corporate social responsibility and environmental sustainability. Bus. Soc. 2011, 50, 6–27. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar]

- Sharma, S.; Vredenburg, H. Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strateg. Manag. J. 1998, 19, 729–753. [Google Scholar] [CrossRef]

- Berning, A.; Venter, C. Sustainable supply chain engagement in a retail environment. Sustainability 2015, 7, 6246–6263. [Google Scholar] [CrossRef] [Green Version]

- King, A.; Lenox, M. Exploring the locus of profitable pollution reduction. Manag. Sci. 2002, 48, 289–299. [Google Scholar] [CrossRef]

- Christmann, P. Effects of “best practices” of environmental management on cost advantage: The role of complementary assets. Acad. Manag. J. 2000, 43, 663–680. [Google Scholar] [CrossRef]

- Albinger, H.S.; Freeman, S.J. Corporate social performance and attractiveness as an employer to different job seeking populations. J. Bus. Ethics 2000, 28, 243–253. [Google Scholar] [CrossRef]

- Brown, J.A.; Forster, W.R. CSR and stakeholder theory: A tale of Adam Smith. J. Bus. Ethics 2013, 112, 301–312. [Google Scholar] [CrossRef]

- Parmar, B.L.; Freeman, R.E.; Harrison, J.S.; Wicks, A.C.; Purnell, L.; Colle, S.D. State holder theory: State of the arts. Acad. Manag. Ann. 2010, 4, 403–445. [Google Scholar] [CrossRef]

- Fombrun, C.; Gardberg, N.; Barnett, M. Opportunity platforms and safety nets: Corporate citizenship and reputational risk. Bus. Soc. Rev. 2000, 105, 85–106. [Google Scholar] [CrossRef]

- Berens, G.; Riel, C.B.M.V.; Rekom, J.V. The CSR-quality trade-off: When can corporate social responsibility and corporate ability compensate each other? J. Bus. Ethics 2007, 74, 233–252. [Google Scholar] [CrossRef]

- Jensen, M.C. Value maximization, stakeholder theory, and the corporate objective function. Bus. Ethics Q. 2002, 12, 235–256. [Google Scholar] [CrossRef]

- Cai, Y.; Jo, H.; Pan, C. Doing well while doing bad? CSR in controversial industry sectors. J. Bus. Ethics 2012, 108, 467–480. [Google Scholar] [CrossRef]

- Wagner, T.; Lutz, R.J.; Weitz, B.A. Corporate hypocrisy: Overcoming the threat of incosistent corporate social responsibility perceptions. J. Mark. 2009, 73, 77–91. [Google Scholar] [CrossRef]

- Preston, L.E.; O’Bannon, D.P. The corporate social-financial performance relationship. Bus. Soc. 1997, 36, 419–429. [Google Scholar] [CrossRef]

- Groza, M.D.; Pronschinske, M.R.; Walker, M. Perceived organizational motives and consumer responses to proactive and reactive CSR. J. Bus. Ethics 2011, 102, 639–652. [Google Scholar] [CrossRef]

- Ethiraj, S.K.; Kale, P.; Krishnan, M.S.; Singh, J.V. Where do capabilities come from and how do they matter? A study in the software services industry. Strateg. Manag. J. 2005, 26, 25–45. [Google Scholar] [CrossRef]

- Haas, M.R.; Hansen, M.T. When using knowledge can hurt performance: The value of organizational capabilities in a management consulting company. Strateg. Manag. J. 2005, 26, 1–24. [Google Scholar] [CrossRef]

- Brooking, A. Intellectual Capital; International Thompson Business Press: London, UK, 1996. [Google Scholar]

- Stewart, T. Intellectual Capital: The New Wealth of Organizations; Nicholas Brealey Publishing, Business Digest: New York, NY, USA, 1997. [Google Scholar]

- Edvinsson, L.; Malone, M.S. Intellectual Capital: Realizing Your Company’s True Value by Finding Its Hidden Brainpower; Collins: New York, NY, USA, 1997. [Google Scholar]

- Zeghal, D.; Maaloul, A. Analyzing value added as an indicator of intellectual capital and its consequences on company performance. J. Intell. Cap. 2010, 11, 39–60. [Google Scholar] [CrossRef]

- Dzinkowski, R. The measurement and management of intellectual capital: An introduction. Manag. Account. (Br.) 2000, 78, 32–36. [Google Scholar]

- Bontis, N. Assessing knowledge assets: A review of the models used to measure intellectual capital. Int. J. Manag. Rev. 2001, 3, 41–60. [Google Scholar] [CrossRef]

- King, A.W.; Zeithaml, C.P. Measuring organizational knowledge: A conceptual and methodological framework. Strateg. Manag. J. 2003, 24, 763–772. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M. Environmental reporting management: A continental european perspective. J. Account. Public Policy 2003, 22, 43–62. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M.; van Velthoven, B. Environmental disclosure quality: Do firms respond to economic incentives, public pressures or institutional conditions. Eur. Account. Rev. 2005, 14, 1–37. [Google Scholar] [CrossRef]

- Harte, G.; Owen, D. Environmental disclosure in the annual reports of british companies: A research note. Account. Audit. Account. J. 1991, 4, 51–61. [Google Scholar] [CrossRef]

- Bowen, F.E. Environmental visibility: A trigger of green organizational response? Bus. Strategy Environ. 2000, 9, 92–107. [Google Scholar] [CrossRef]

- Hoffman, A.J. Institutional evolution and change: Environmentalism and the US chemical industry. Acad. Manag. J. 1999, 42, 351–371. [Google Scholar] [CrossRef]

- Saiia, D.H.; Carroll, A.B.; Buchholtz, A.K. Philanthropy as strategy when corporate charity “begins at home”. Bus. Soc. 2003, 42, 169–201. [Google Scholar] [CrossRef]

- Chen, M.C.; Cheng, S.J.; Hwang, Y. An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. J. Intell. Cap. 2005, 6, 159–176. [Google Scholar]

- Firer, S.; Williams, S.M. Intellectual capital and traditional measures of corporate performance. J. Intell. Cap. 2003, 4, 348–360. [Google Scholar] [CrossRef]

- Tan, H.P.; Plowman, D.; Hancock, P. Intellectual capital and financial returns of companies. J. Intell. Cap. 2007, 8, 76–95. [Google Scholar] [CrossRef]

- Chen, J.; Zhu, Z.; Xie, H.Y. Measuring intellectual capital: A new model and empirical study. J. Intell. Cap. 2004, 5, 195–212. [Google Scholar] [CrossRef]

- Hitt, M.A.; Ireland, R.D.; Hoskisson, R.E. Strategic Management: Competitiveness and Globalization; South-Western Pubishing Company: Cincinnati, OH, USA, 2001. [Google Scholar]

- Carmeli, A.; Tishler, A. The relationships between intangible organizational elements and organizational performance. Strateg. Manag. J. 2004, 25, 1257–1278. [Google Scholar] [CrossRef]

- Sen, S.; Bhattacharya, C.B. Does doing good always lead to doing better? Consumer reactions to corporate social responsibility. J. Mark. Res. 2001, 38, 225–243. [Google Scholar] [CrossRef]

- Bertels, S.; Peloza, J. Running just to stand still? Managing CSR reputation in an era of ratcheting expectations. Corpor. Reput. Rev. 2008, 11, 56–72. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relationship between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Plumlee, M.; Brown, D.; Marshall, R. Voluntary Environmental Disclosure Quality and Firm Value: Roles of Venue and Industry Type. J. Account. Public Policy 2010, 12, 1–43. [Google Scholar]

- Berman, S.L.; Wicks, A.C.; Kotha, S.; Jones, T.M. Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Acad. Manag. J. 1999, 42, 488–506. [Google Scholar] [CrossRef]

- Harrison, J.S.; Freeman, R.E. Stakeholders, social responsibility, and performance: Empirical evidence and theoretical perspectives. Acad. Manag. J. 1999, 42, 479–485. [Google Scholar] [CrossRef]

- Stanwick, P.A.; Stanwick, S.D. The relationship between corporate social performance, and organizational size, financial performance, and environmental performance: An empirical examination. J. Bus. Ethics 1998, 17, 195–204. [Google Scholar] [CrossRef]

- Prior, D.; Surroca, J.; Tribó, J.A. Are socially responsible managers really ethical? Exploring the relationship between earnings management and corporate social responsibility. Corpor. Gov. 2008, 16, 160–177. [Google Scholar] [CrossRef]

- Pulic, A. Intellectual capital–does it create or destroy value? Measur. Bus. Excell. 2004, 8, 62–68. [Google Scholar] [CrossRef]

- Wang, W.Y.; Chang, C. Intellectual capital and performance in causal models: Evidence from the information technology industry in taiwan. J. Intell. Cap. 2005, 6, 222–236. [Google Scholar]

- Nazari, J.A.; Herremans, I.M. Extended VAIC model: Measuring intellectual capital components. J. Intell. Cap. 2007, 8, 595–609. [Google Scholar]

- Williams, S.M. Is intellectual capital performance and disclosure practices related? J. Intell. Cap. 2001, 2, 192–203. [Google Scholar] [CrossRef]

- Moore, G. Corporate social and financial performance: An investigation in the UK supermarket industry. J. Bus. Ethics 2001, 34, 299–315. [Google Scholar] [CrossRef]

- Bansal, P.; Clelland, I. Talking trash: Legitimacy, impression management, and unsystematic risk in the context of the natural environment. Acad. Manag. J. 2004, 47, 93–103. [Google Scholar] [CrossRef]

- Sealy, I.; Wehrmeyer, W.; France, C.; Leach, M. Sustainable development management systems in global business organizations. Manag. Res. Rev. 2010, 33, 1083–1096. [Google Scholar]

- Polosky, M.; Zeffane, R. Corporate environmental commitment in Australia: A sectorial comparison. Bus. Strategy Environ. 1992, 2, 25–39. [Google Scholar] [CrossRef]

- World Commission on Environmental and Development (WCED). Our Common Future; Oxford Univerity Press: Oxford, UK, 1987. [Google Scholar]

- Willums, J.O.; Goluke, U. From Ideas to Action: Business and Sustainable Development; Ad Notam Gyldendal: Oslo, Norway, 1992. [Google Scholar]

- Acquaah, M.; Chi, T. A longitudinal analysis of the impact of firm resources and industry characteristics on firm-specific profitability. J. Manag. Gove. 2007, 11, 179–213. [Google Scholar] [CrossRef]

- Silverman, B.S. Technological resources and the direction of corporate diversification: Toward an integration of the resource-based view and transaction cost economics. Manag. Sci. 1999, 45, 1109–1124. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Kutner, M.H.; Nachtsheim, C.J.; Neter, J. Applied Linear Regression Models, 4th ed.; Mc Graw Hill: New York, NY, USA, 2008. [Google Scholar]

- Venkatraman, N. The concept of fit in strategy research: Toward verbal and statistical correspondence. Acad. Manag. Rev. 1989, 14, 423–444. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, C.-S.; Chang, R.-Y.; Dang, V.T. An Integrated Model to Explain How Corporate Social Responsibility Affects Corporate Financial Performance. Sustainability 2015, 7, 8292-8311. https://doi.org/10.3390/su7078292

Lin C-S, Chang R-Y, Dang VT. An Integrated Model to Explain How Corporate Social Responsibility Affects Corporate Financial Performance. Sustainability. 2015; 7(7):8292-8311. https://doi.org/10.3390/su7078292

Chicago/Turabian StyleLin, Chin-Shien, Ruei-Yuan Chang, and Van Thac Dang. 2015. "An Integrated Model to Explain How Corporate Social Responsibility Affects Corporate Financial Performance" Sustainability 7, no. 7: 8292-8311. https://doi.org/10.3390/su7078292

APA StyleLin, C.-S., Chang, R.-Y., & Dang, V. T. (2015). An Integrated Model to Explain How Corporate Social Responsibility Affects Corporate Financial Performance. Sustainability, 7(7), 8292-8311. https://doi.org/10.3390/su7078292