Energy production in Poland relies predominantly on conventional energy sources, particularly coal. In fact, mining is one of Poland’s chief industries. After Poland acceded to the European Union in 2004, it had to comply with regulations which prevailed throughout the EU. One such instrument is Directive 2009/28/EC which envisions that the EU increase its share of renewables in ultimate energy consumption in individual member states to 20% by the year 2020 [

1]. To meet these requirements, Poland needs to reduce its coal combustion in coal-fired power plants so that 15% of its ultimate energy consumption comes from renewable sources by the year 2020. An arrangement considered and promoted to minimize carbon emissions from coal combustion in coal-fired plants, and one which Poland has committed to by signing the Kyoto Protocol, is to build a nuclear power station. This goes against the global trend of abandoning nuclear power, which has gained particular momentum since the Fukushima disaster in Japan of 2011. In its aftermath, Germany has committed to phase out its own nuclear power. All this puts a question mark over the growth of the nuclear sector in Poland. The idea is also facing strong public resistance and is viewed as highly controversial.

Crude oil reserves are predicted to run out by 2050 while the global deposits of gas and coal are expected to deplete rapidly. Not only the EU but also the rest of the world is convinced that it is time to invest in green energy. Foreign investors have come to Poland to launch engineering projects in which renewables such as wind, hydropower, biomass, geothermal heat and solar energy are used to produce power. Poland is slowly waking up to the fact that investing in renewable energy makes sense and brings tangible benefits. Regrettably, however, the Polish government seems to remain oblivious to such developments. Relevant legislation on the forms and levels of support for renewable energy is still to be adopted. Poland was obliged to comply with Directive [

1] by 2010. Having failed to do so, it now faces penalties to the tune of €133,000 for each day of delay. The case has been brought before the Court of Justice of the European Union in Strasbourg.

Poland’s geographical location prevents it from exploring some forms of energy on a large scale. The most promising of them seems to be biomass. Unlike other technologies which use biomass to produce energy, biogas plants go beyond mere energy production. They are ideally suited for utilizing environmentally harmful waste from agri-food processing and its post-fermentation products which form valuable natural fertilizer. Under the Polish law, rural biogas plants may produce agricultural biogas from such raw materials as organic agricultural products, liquid or solid animal manure, agri-food industry by-products or residues and forest biomass with the exception of biogas from wastewater treatment plants and landfills [

2]. No biogas plants in Poland produce biogas from biodegradable municipal waste currently composted or disposed of in municipal landfills. The reason for this is that Polish legislation fails to deem biogas produced from municipal organic waste as agricultural biogas. This in fact creates a number of administrative and economic challenges. Although plants fired by organic waste generated in food processing produce biogas which does enjoy this status, they are not sufficiently promoted.

Another serious difficulty faced by biogas plants relying on organic waste is strong public opposition which results mainly from the lack of reliable information about biogas. Although the method utilizes a biological process known since prehistory, the technology itself remains relatively new. The most common objections have to do with onerous smells, epidemiological risks and environmental pollution.

1.1. Situation in Poland

The potential of agricultural gas in Poland exceeds that of any other renewable energy available in the country. Nevertheless, its development remains hampered by the lack of relevant legislation. Poland’s potential to use biomass to produce biogas is comparable to that found in other EU member states where the adoption of laws supporting renewable contributed to rapid market saturation. While Poland is currently home to some 200 operating biogas plants, only 33 of them produce biogas. The majority make energy from energy crops, mainly maize silage, and animal waste,

i.e., manure. There is, however, a noticeable trend to move away from such practices in favor of agri-food waste such as spent wash or potato pulp whose disposal is problematic (see

Table 1). The remaining biogas facilities are located at wastewater treatment plants or landfills. These produce landfill biogas. In 2011, rural biogas plants have produced 73.43 GWh of electric and 88.8 GWh of thermal energy (see

Table 2). In 2012, the output of electric and thermal energy increased twofold in terms of value. In spite of an unfavorable political climate contributing to a steady decline in the value of certificates, last year saw the opening of 11 new biogas plants, each with a capacity of 0.5 MW. In view of the most recent developments in biogas production, such output has been on the rise. The trend, however, is relatively slow and far from satisfactory [

3].

Table 1.

Quantity of raw material used to produce agricultural biogas in 2011–2012 based on reports from Agricultural Market Agency [

4].

Table 1.

Quantity of raw material used to produce agricultural biogas in 2011–2012 based on reports from Agricultural Market Agency [4].

| Type of raw material used to produce agricultural biogas | Quantity of raw material used to produce agricultural biogas [in tons] |

|---|

| Total in 2011 | Total in 2012 |

|---|

| Energy crops including grass | 123,678.81 | 244,781.93 |

| Animal waste | 277,601.32 | 372,650.42 |

| Agri-food waste | 68,135.93 | 313,575.13 |

Table 2.

Production of biogas, electric and thermal energy in 2011 and 2012 in rural biogas plants based on quarterly reports from Agricultural Market Agency [

4].

Table 2.

Production of biogas, electric and thermal energy in 2011 and 2012 in rural biogas plants based on quarterly reports from Agricultural Market Agency [4].

| Year | Production of biogas [mln m3] | Production of electric energy from biogas [GWh] | Production of heat energy from biogas [GWh] |

|---|

| 2011 | 36.64 | 73.43 | 88.80 |

| 2012 | 73.14 | 141.79 | 158.64 |

Poland has not yet transposed Directive 2009/28/EC on the promotion of renewable sources of energy. The deadline for all member states to comply with the Directive, which aims at achieving a 20% share of energy from renewable sources in the overall energy mix by 2020, for all Member States was 5 December 2010. Thus far, Poland has not passed a law to at least regulate the amount of aid for renewable energy installations. Meanwhile, all energy certificates obtained for high-efficiency cogeneration have expired.

1.2. Biomass Potential

Given the enormous potential of biomass available for use in its biogas plants, Poland could well join the member states which lead in the production of biogas from rural feedstock. Poland has very robust agriculture and food industry [

5]. It boasts highly advanced pork and poultry production as well as expansive arable lands with good quality soils and a climate well-suited for growing a wide variety of energy crops. The Polish climate is moderate with the average total amount of rainfall ranging from 500 to 700 mm annually. The country’s predominant lowlands facilitate agricultural production. It is difficult, however, to measure the true potential of biomass and biogas in Poland as no credible sources of relevant data are available. According to the 2010 data provided by the Ministry of Economy, the potential for biogas production stands at 1.7 million cubic meters per annum [

6].

In the course of its public consultations on Directive 2009/28/EC, the European Commission firmly insisted that biogas production be based mainly on processing agricultural and agri-food industry waste [

3]. The fact that Poland significantly increased its use of agricultural waste substrates between 2011 and 2012 (see

Table 2) demonstrates that biogas plants are gradually venturing beyond mere energy production. Their additional advantage is that they utilize environmentally harmful agri-food waste which, incidentally, increases their profitability through the use of low-cost charges. In addition, the use of animal waste has not increased in proportion to that of other substrates. What has changed, however, is the location of biogas plants which are now being built closer to food processing operators rather than farms. As an example, a nearly fivefold increase has been reported in the use of distillers’ grain for the production of biogas. Its volume rose from ca. 30,000 tons in 2011 to ca. 130,000 tons in 2012 [

4]. This is primarily the result of difficulties with managing this type of waste and the legislative restrictions on its disposal imposed by the EU.

The most difficult part of designing a biogas plant is to estimate the availability of adequate quantities of substrates needed to run the plant at full capacity. A suitable plant site should offer the potential of securing sufficient amounts of substrate in its close proximity. This will not only cut costs but also turn the biogas plant into a diversified local source of energy. One can follow the German example and build biogas plants which rely solely on maize silage and manure. Another idea for Poland could be to place biogas plants close to agri-food companies with a view to reducing the cost of procuring raw materials. This could be achieved to a large extent by utilizing the large amounts of slaughterhouse waste which is available for biogas production, especially in the Wielkopolska Region [

3]. Studies on biogas plants show that the co-digestion of industrial waste and energy crops improves process performance and stability. It also eliminates the need for micronutrients required for crop digestion [

7].

1.3. Biogas Plants–State of Play

The failure of the renewable energy sector to achieve the expected growth can be attributed to a variety of economic, political and social factors. The biggest challenge seems to lie in the lack of legal regulations concerning renewable energy sources. The current support system fails to guarantee market stability, thus discouraging investors and impeding development.

Although much has been said in recent years on changes which would fuel the rise of renewables, no tangible progress seems to have followed. In 2007, in its Communication to the Council and the European Parliament, the European Commission noted that considering the low price of green certificates in Poland, the country is expected to rapidly increase its share of electricity generated from renewable energy sources, especially in view of its high obligations with that respect [

8]. Little has actually changed since that time. The support system is still weak and the uncertainty associated with the lack of legal regulations slows down investor activity. As the green certificate market collapsed in 2012 due to an oversupply on the Polish Energy Exchange, certificate prices fell to PLN 130. In addition, the previous plan to support electric and thermal energy production with efficient co-generation was abandoned in March 2013. This put a stop to the development of biogas in Poland seriously jeopardizing the achievement of renewable energy targets for 2020 (a 15% share of renewable energy in ultimate energy consumption in all sectors, including 19% for the electric power sector) [

9]. To ensure that biogas plants operate at a profit, their construction needs to be subsidized. For technological reasons, less profitable biogas plants run only on maize silage and are ill-suited to take advantage of other feedstocks. The approximate cost of 1 ton of silage at gate is PLN 130. In Germany, where biogas plants have grown rapidly, investors focus primarily on maize silage rather than limiting themselves to manure. Meanwhile, Poland’s high prices of fresh maize effectively deter investors [

10].

Investors are also discouraged by the administrative burden of mandatory procedures involved in obtaining the required permits. The first requirement they face is to obtain an environmental permit based on environmental impact assessments. Such assessments are a key instrument of the EU’s environmental protection policy, their intention being to protect natural sites potentially endangered by new development. Impact assessments are prerequisite to obtaining EU funds for the construction of road infrastructure [

11]. They require lengthy public consultations. This in itself would not be difficult were it not for massive public resistance to projects which stem from a number of concerns rooted mainly in public ignorance. Of about 350 biogas plants seeking permits, 130 have encountered overt social resistance [

12]. Some of the most notable among the many reasons for such protests are:

the fear of change;

the lack of reliable information on biogas and its production;

the NIMBY (Not In My Back Yard) effect;

the work of proactive opponents relying on manipulated data (and frequently acting on personal grounds).

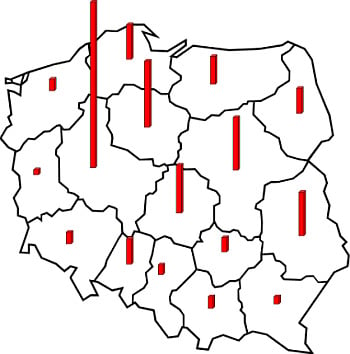

Political support for biogas installations is another problem. While many politicians staunchly support large-scale development of renewable energy sources, they are also in favor of building nuclear power plants. A strategic document published by the Ministry of Economy presents an ambitious plan to construct two thousand biogas plants by the year 2020 to place “a biogas plant in each municipality” [

6]. This would result in the construction of an estimated 3000 facilities, each with an average capacity of 1 MW. Their total combined output would be comparable to that of a single nuclear power plant. Such a huge number of biogas plants would require not only the involvement of private capital but also the support of the Polish government [

8]. Moreover, as no large-scale activities (such as information campaigns) exist to promote renewable energy sources unreliable information tends to be exaggerated fueling public resistance.

About 90 percent of the electricity produced in Poland is generated from coal. This makes the energy sector a major polluter. As most of the mining industry is state rather than privately owned, the state, which supports the development of RES in view of its commitments towards the EU, is also very reluctant to allow renewable energy to dominate the Polish energy sector as this is not in its interest.

The Polish energy sector is torn by huge technical disparities as its technical infrastructure is ill-adapted to fulfill the functional needs and requirements of its customers. This is true for capacities, their distribution and power grids. For instance, 39% of power facilities will be more than 40 years old by 2010 [

13]. A major problem faced by for investors is that they are not allowed to connect their plants to the grid. Obviously, energy operators cannot keep energy from renewable sources from being connected and fed into the grid. They may however declare such connections impossible due to the lack of spare capacities or inadequate grid infrastructure at energy source. The preferred suppliers of energy companies are biogas plants as the electricity produced from biogas is more stable and steady compared to other renewable.

Installation projects are also hampered by the lack of appropriate laws to govern residues. Residues in Poland continue to be treated as waste and are expected to be used in agriculture as fertilizer. However, to fulfill the requirement, biogas plant owners would need to have sufficient land of their own on which to spread their residues. Before slaughterhouse waste or other animal waste can be applied in the fermentation process, regular soil tests for the presence of heavy metals must be conducted. Under such circumstances, it is considerably more convenient to build a biogas plant at the farm where the feedstock of manure and maize corn is available for use than to opt for biogas plants which run on organic waste from the agri-food industry. The fact that residues are classified as waste creates additional legal problems related to waste management. What deters investors is that they are kept from selling residues as fertilizer for additional income. Therefore, a pressing need exists to adopt appropriate laws on renewable energy, particularly in the context of the treatment of fermentation residues.