Assessing the Early Impact of InvestEU on Romanian SME Financial Performance

Abstract

1. Introduction

2. Theoretical Framework

2.1. Driven Growth and Financial Strategies for Competitive SMEs

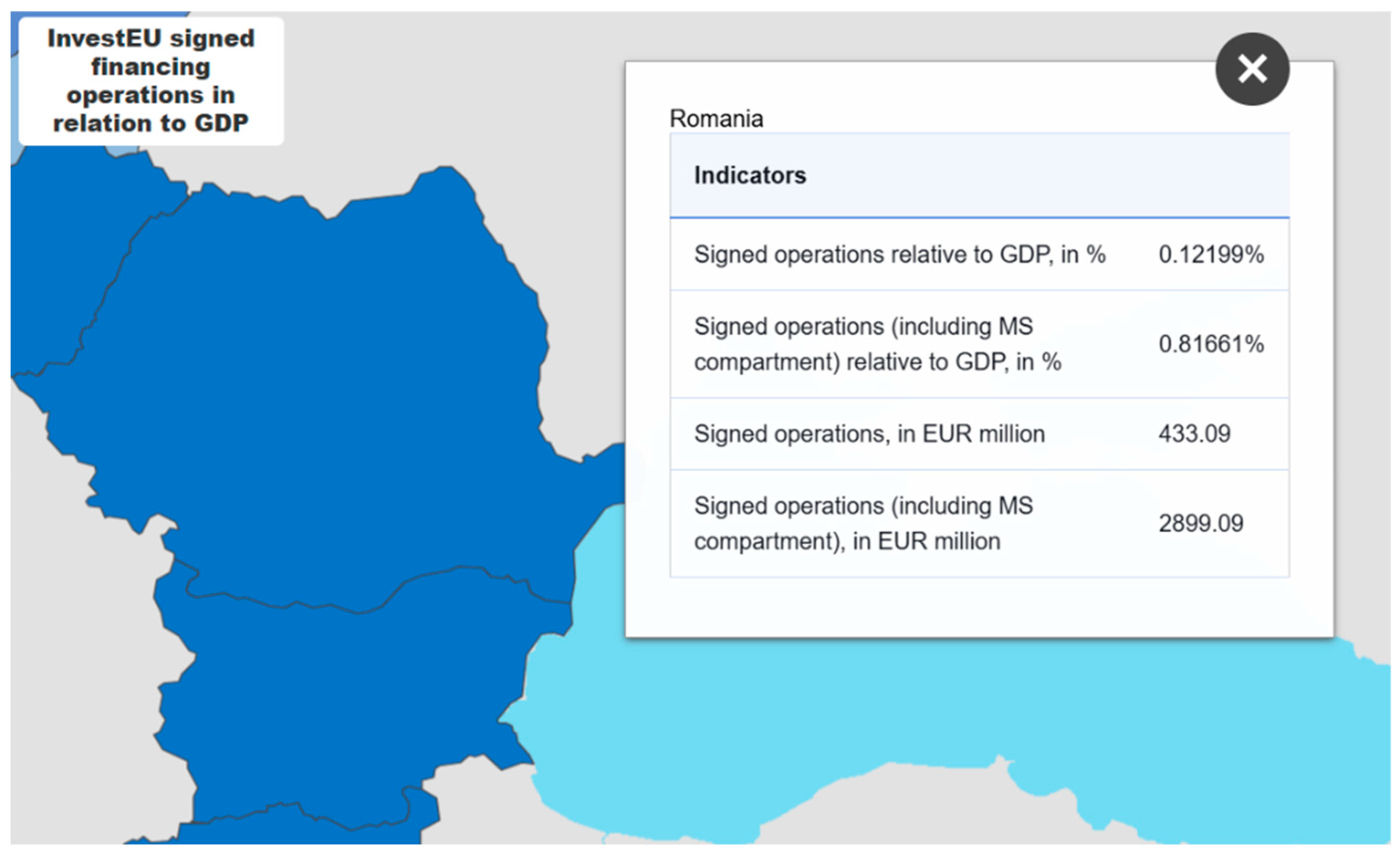

2.2. Supporting Romanian SMEs Through InvestEU Program

3. Data and Methods

- —Firm performance indicator (turnover, net profit or number of employees) for firm g in year t.

- —Treatment dummy; equals 1 if firm g received InvestEU funding (treated SME) and 0 if firm g belongs to the matched control group (non-funded SME).

- —Time dummy; equals 0 for the pre-intervention year 2023 and 1 for the post-intervention year 2024.

- —Interaction term between treatment status and time.

- —no of employees.

- —Intercept.

- —Regression coefficient associated with .

- —Regression coefficient associated with .

- —Regression coefficient associated with the interaction term .

- —Regression coefficient associated with employees.

- —Error term.

4. Results

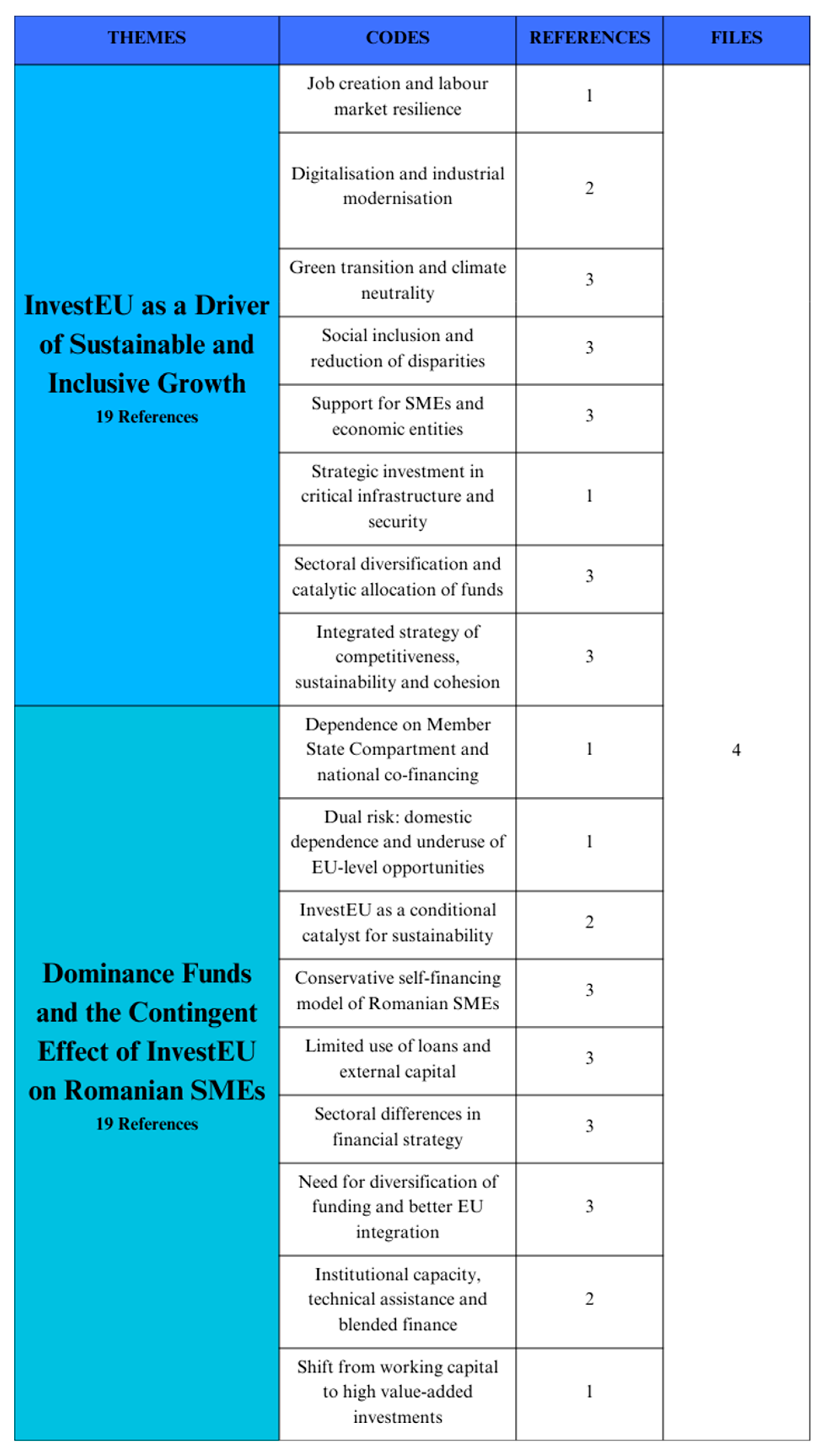

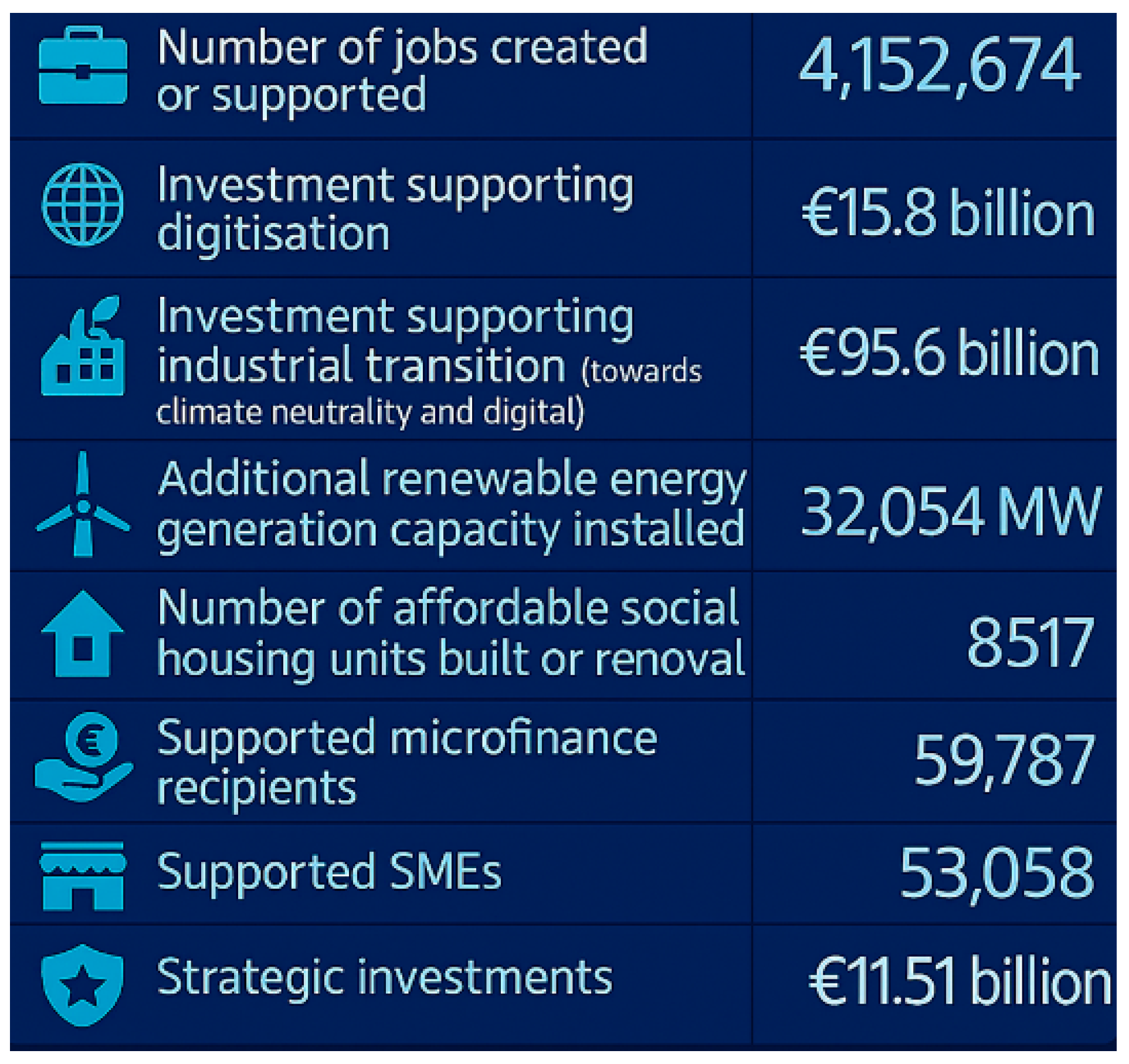

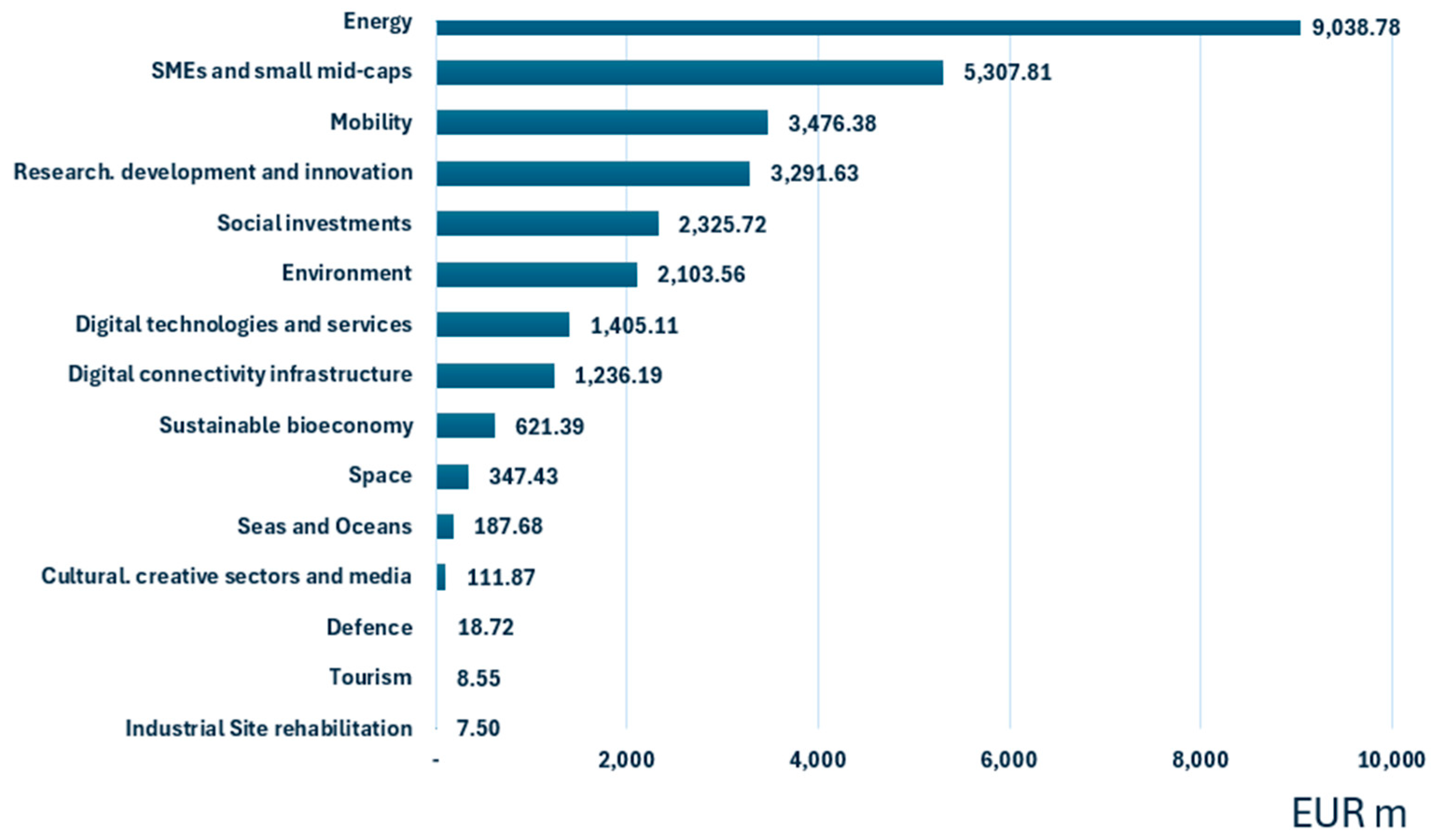

4.1. Analysis of InvestEU Potential for Strategic Growth

4.2. Funding Effect on Turnover with DiD

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| EU | European Union |

| SMEs | Small and medium-sized enterprises |

| DiD | Difference-in-Differences |

| EIF | European Investment Fund |

| CSR | Corporate Social Responsibility |

| ESG | Environmental, Social, Governance |

References

- Schulze Brock, P.; Katsinis, A.; Lagüera González, J.; Di Bella, L.; Odenthal, L.; Hell, M.; Lozar, B.; Secades Casino, B. Annual Report on European SMEs 2024/2025; SME Performance Review; Publications Office of the European Union: Luxembourg, 2025. [Google Scholar] [CrossRef]

- Finnegan, M.; Kapoor, S. ECB unconventional monetary policy and SME access to finance. Small Bus. Econ. 2023, 61, 1253–1288. [Google Scholar] [CrossRef]

- Tyler, B.B.; Lahneman, B.; Cerrato, D.; Cruz, A.D.; Beukel, K.; Spielmann, N.; Minciullo, M. Environmental practice adoption in SMEs: The effects of firm proactive orientation and regulatory pressure. J. Small Bus. Manag. 2024, 62, 2211–2246. [Google Scholar] [CrossRef]

- Eggers, F. Masters of disasters? Challenges and opportunities for SMEs in times of crisis. J. Bus. Res. 2020, 116, 199–208. [Google Scholar] [CrossRef] [PubMed]

- Romanian National Bank. Financial Report. 2025. Volume 18, Issue 10. Available online: https://www.bnr.ro/uploads/2025-06raportasuprastabilit%C4%83%C8%9Biifinanciare-iunie2025_documentpdf_545_1751378181.pdf (accessed on 15 November 2025).

- Bianchini, M.; Lucas, M.; Cusmano, L.; Kauffmann, C. SME Digitalisation to Build Back Better Digital for SMEs Global Initiative; OECD: Paris, France, 2021; Available online: https://www.oecd.org (accessed on 15 November 2025).

- Sapsanguanboon, W.; Faijaidee, W.; Potasin, L. Strategic integration of sustainability for competitive advantage: A framework for balancing the triple bottom line. Corp. Gov. Sustain. Rev. 2025, 9, 110–119. [Google Scholar] [CrossRef]

- Hutsaliuk, O.; Yakusheva, O.; Miroshnychenko, I.; Taburets, I. Corporate Social Responsibility Management and Business Strategies in Sustainable Economic Development. Econ. Ecol. Socium 2025, 9, 97–108. [Google Scholar] [CrossRef]

- OECD. Financing SMEs and Entrepreneurs 2024: An OECD Scoreboard; OECD Publishing: Paris, France, 2024. [Google Scholar] [CrossRef]

- Becerra-Vicario, R.; Ruiz-Palomo, D.; León-Gómez, A.; Santos-Jaén, J.M. The Relationship between Innovation and the Performance of Small and Medium-Sized Businesses in the Industrial Sector: The Mediating Role of CSR. Economies 2023, 11, 92. [Google Scholar] [CrossRef]

- Kearney, C.; Hisrich, R.D.; Antoncic, B. The Mediating Role of Corporate Entrepreneurship for External Environment Effects on Performance. J. Bus. Econ. Manag. 2013, 14, S328–S357. [Google Scholar] [CrossRef]

- Mina, A.; Minin, A.D.; Martelli, I.; Testa, G.; Santoleri, P. Public funding of innovation: Exploring applications and allocations of the European SME Instrument. Res. Policy 2021, 50, 104131. [Google Scholar] [CrossRef]

- AnnSpoz, A. Significance of the EU Funds in Investments of Small and Medium-Sized Enterprises. Oeconomia Copernic. 2014, 5, 61–74. [Google Scholar] [CrossRef]

- Aliano, M.; Cestari, G.; Madonna, S. Financial Instruments for Green Finance Tailored to SMEs. In Sustainable Finance for SMEs; Sustainable Finance; Springer: Cham, Switzerland, 2024. [Google Scholar] [CrossRef]

- Sileniece, L. A Review of Green Business Negotiations and the Development of Sustainable Business Transitions. Econ. Ecol. Socium 2024, 8, 14–24. [Google Scholar] [CrossRef]

- Cuckovic, N.; Vuckovic, V. The effects of EU R&I funding on SME innovation and business performance in new EU member states: Firm-level evidence. Econ. Ann. 2021, 66, 7–41. [Google Scholar] [CrossRef]

- OECD. Financing SMEs for sustainability: Drivers, Constraints and Policies. In OECD SME and Entrepreneurship Papers; No. 35; OECD Publishing: Paris, France, 2022. [Google Scholar] [CrossRef]

- Pop, G.; Iootty, M.; Bruhn, M.; Ortega, C.R. Design for Impact: A State Aid Evaluation for Romani; The World Bank: Washington, DC, USA, 2021. [Google Scholar] [CrossRef]

- Rekkas, T. EU Funding Instruments for SMEs; Palgrave Macmillan: Cham, Switzerland, 2024; pp. 323–338. [Google Scholar] [CrossRef]

- Rekkas, T. Financial Instruments as a Public Policy Mechanism. Acad. Lett. 2021, 2, 4. [Google Scholar] [CrossRef]

- Boschmans, K.; Pissareva, L. Fostering Markets for SME Finance; OECD Publishing: Paris, France, 2018. [Google Scholar] [CrossRef]

- Ismail, A.M.; Adnan, Z.H.M.; Fahmi, F.M.; Darus, F.; Clark, C. Board Capabilities and the Mediating Roles of Absorptive Capacity on Environmental Social and Governance (ESG) Practices. Int. J. Financ. Res. 2019, 10, 11. [Google Scholar] [CrossRef]

- Radas, S.; Mervar, A.; Škrinjarić, B. Regional Perspective on R&D Policies for SMEs: Does Success Breed Success? Sustainability 2020, 12, 3846. [Google Scholar] [CrossRef]

- Brown, R.; Mason, C.; Mawson, S. Increasing “The Vital 6 Percent”: Designing Effective Public Policy to Support High Growth Firms; National Endowment for Science Technology and Arts: London, UK, 2014; Available online: https://www.researchgate.net/publication/259946280_Increasing_the_‘vital_6_per_cent’_designing_effective_public_policy_to_support_high_growth_firms (accessed on 15 November 2025).

- Stoyanov, P. Corporate Social Responsibility and Strategic Management of Business Development in Small and Medium-Sized Enterprises. Econ. Ecol. Socium 2025, 9, 1–15. [Google Scholar] [CrossRef]

- Nicoleta Vâlcu, E. “EU INVEST PROGRAM”—Financing Union Mechanism of Member States for Post-Pandemic Economic Recovery. 2025. Available online: https://www.ceeol.com/search/article-detail?id=1103102 (accessed on 15 November 2025).

- Militaru, I.-N.; Moțatu, A. EUROPEAN INVESTMENT BANK. Valahia Univ. Law Study 2024, 43, 69–79. [Google Scholar] [CrossRef]

- EPRS; Alfonso, A.D. BRIEFING EU Legislation in Progress. European Parliamentary Research Service: Brussels, Belgium, 2021; Available online: https://fondazionecerm.it/wp-content/uploads/2021/02/Europarl-EPRS_BRI2020659364_EN.pdf (accessed on 15 November 2025).

- InvestEU. Contribution to the Green Deal and the Just Transition Scheme. EU: Brussels, Belgium. Available online: https://Investeu.Europa.Eu/Contribution-Green-Deal-and-Just-Transition-Scheme_en (accessed on 15 November 2025).

- Ministry of Investments European Projects. Over 600 Million Euros Have Reached SMEs Through the InvestEUGuarantee Financed via the, PNRR; Ministerul Investițiilor și Proiectelor Europene: București, Romania, 2025; Available online: https://Mfe.Gov.Ro/Peste-600-Milioane-Euro-Au-Ajuns-La-Imm-Uri-Prin-Garantia-Investeu-Finantata-Prin-Pnrr/ (accessed on 22 July 2025).

- European Investment Fund. Romanian Banks to Get An Additional €500 Million in Financing Under New EIF Guarantee Agreements; European Investment Fund: Luxembourg, 2024; Available online: https://business-review.eu/money/finance/romanian-banks-to-get-an-additional-e500-million-in-financing-under-new-eif-guarantee-agreements-272597 (accessed on 10 November 2025).

- Babu, S.C.; Gajanan, S.N.; Hallam, J.A. Methods of Program Evaluation. In Nutrition Economics; Elsevier: Amsterdam, The Netherlands, 2017; pp. 205–230. [Google Scholar] [CrossRef]

- Dunbar, K.; Treku, D.; Sarnie, R.; Hoover, J. What does ESG risk premia tell us about mutual fund sustainability levels: A difference-in-differences analysis. Financ. Res. Lett. 2023, 57, 104262. [Google Scholar] [CrossRef]

- Polsky, D.; Baiocchi, M. Observational Studies in Economic Evaluation. In Encyclopedia of Health Economics; Elsevier: Amsterdam, The Netherlands, 2014; pp. 399–408. [Google Scholar] [CrossRef]

- Lechner, M. The Estimation of Causal Effects by Difference-in-Difference MethodsEstimation of Spatial Panels. Found. Trends® Econom. 2010, 4, 165–224. [Google Scholar] [CrossRef]

- Daw, J.R.; Hatfield, L.A. Matching and Regression to the Mean in Difference-in-Differences Analysis. Health Serv. Res. 2018, 53, 4138–4156. [Google Scholar] [CrossRef] [PubMed]

- Li, H.; Graham, D.J.; Majumdar, A. The effects of congestion charging on road traffic casualties: A causal analysis using difference-in-difference estimation. Accid. Anal. Prev. 2012, 49, 366–377. [Google Scholar] [CrossRef] [PubMed]

- Greene, W.H.; Liu, M. Review of Difference-in-Difference Analyses in Social Sciences: Application in Policy Test Research. In Handbook of Financial Econometrics, Mathematics, Statistics, and Machine Learning; World Scientific: Singapore, 2020; pp. 4255–4280. [Google Scholar] [CrossRef]

- Stuart, B.; Loh, F.E.; Roberto, P.; Miller, L. Incident User Cohorts for Assessing Medication Cost-Offsets. Health Serv. Res. 2014, 49, 1364–1386. [Google Scholar] [CrossRef] [PubMed]

- Lochmiller, C. Conducting Thematic Analysis with Qualitative Data. Qual. Rep. 2021, 26, 2029–2044. [Google Scholar] [CrossRef]

- Dhakal, K. NVivo. J. Med. Libr. Assoc. 2022, 110, 270–272. [Google Scholar] [CrossRef] [PubMed]

- Campbell, S.; Greenwood, M.; Prior, S.; Shearer, T.; Walkem, K.; Young, S.; Bywaters, D.; Walker, K. Purposive sampling: Complex or simple? Research case examples. J. Res. Nurs. 2020, 25, 652–661. [Google Scholar] [CrossRef]

- Braun, V.; Clarke, V. Using thematic analysis in psychology. Qual. Res. Psychol. 2006, 3, 77–101. [Google Scholar] [CrossRef]

- European Commission. Available online: https://investeu.europa.eu/investeu-programme/investeu-fund/investeu-indicators_en (accessed on 10 November 2025).

- Bozintan, I.-C.; Crespai, M.; Bădulescu, D. Access to finance in the Romanian entrepreneurial ecosystem: Insights from financial professionals. MEST J. 2025, 14, 72–80. [Google Scholar] [CrossRef]

- OECD. Strengthening FDI and SME Linkages in Poland; OECD Publishing: Paris, France, 2025. [Google Scholar] [CrossRef]

- European Investment Bank and Ipsos Public Affairs. EIB Investment Survey 2024: Hungary Overview; Publications Office of the European Union: Luxembourg, 2025. [Google Scholar] [CrossRef]

| Sector | Year | Own Funds | Loans | Budget Subsidies | Foreign Capital |

|---|---|---|---|---|---|

| Industry | 2021 | 89.19% | 9.65% | 0.22% | 0.08% |

| 2022 | 89.18% | 9.08% | 0.43% | 0.36% | |

| 2023 | 88.26% | 10.06% | 0.21% | 0.43% | |

| Construction | 2021 | 94.61% | 4.16% | 0.06% | 0.06% |

| 2022 | 94.31% | 4.40% | 0.01% | 0.15% | |

| 2023 | 94.93% | 4.28% | 0.01% | 0.09% | |

| Commerce | 2021 | 92.55% | 6.27% | 0.01% | 0.12% |

| 2022 | 90.93% | 7.71% | 0.03% | 0.04% | |

| 2023 | 91.99% | 6.98% | 0.04% | 0.06% | |

| Services | 2021 | 94.42% | 4.46% | 0.11% | 0.20% |

| 2022 | 93.72% | 5.32% | 0.07% | 0.02% | |

| 2023 | 93.31% | 5.10% | 0.23% | 0.31% |

| ANOVA | |||||

| Coefficients | Standard Error | p-Value | Lower 95% | Upper 95% | |

| Intercept | 4,943,217.43 | 5,729,462.98 | 0.39 | 16,356,892.97 | 6,470,458.11 |

| Treatment | 5,726,915.11 | 7,677,396.85 | 0.46 | 9,567,243.68 | 21,021,073.91 |

| Time | 1,328,476.80 | 7,639,869.23 | 0.86 | 16,547,876.76 | 13,890,923.15 |

| Interaction | 6,650,178.98 | 10,804,006.26 | 0.54 | 14,872,505.16 | 28,172,863.12 |

| Employees | 765,893.10 | 63,961.16 | 0.00 | 638,475.93 | 893,310.27 |

| REGRESSION STATISTICS | |||||

| R Square | 0.674127755 | ||||

| Adjusted R Square | 0.656747902 | ||||

| Observations | 80 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.

Share and Cite

Ciobanu, E.; Torjescu, A.-M.; Polec, I.; Păunescu, C. Assessing the Early Impact of InvestEU on Romanian SME Financial Performance. Sustainability 2026, 18, 982. https://doi.org/10.3390/su18020982

Ciobanu E, Torjescu A-M, Polec I, Păunescu C. Assessing the Early Impact of InvestEU on Romanian SME Financial Performance. Sustainability. 2026; 18(2):982. https://doi.org/10.3390/su18020982

Chicago/Turabian StyleCiobanu, Emanuel, Ana-Maria Torjescu, Ioana Polec, and Carmen Păunescu. 2026. "Assessing the Early Impact of InvestEU on Romanian SME Financial Performance" Sustainability 18, no. 2: 982. https://doi.org/10.3390/su18020982

APA StyleCiobanu, E., Torjescu, A.-M., Polec, I., & Păunescu, C. (2026). Assessing the Early Impact of InvestEU on Romanian SME Financial Performance. Sustainability, 18(2), 982. https://doi.org/10.3390/su18020982